Annual Report for the year ended December 31, 2024

Calpine Corporation

(A Delaware Corporation)

I.R.S. Employer Identification No. 77-0212977 717

Texas Avenue, Suite 1000, Houston, Texas 77002

Telephone: (713) 830-2000

CALPINE CORPORATION AND SUBSIDIARIES

ANNUAL REPORT

For the Year Ended December 31, 2024

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 24 |

| Item 1B. | Unresolved Staff Comments | 39 |

| Item 2. | Properties | 39 |

| Item 3. | Legal Proceedings | 39 |

| Item 4. | Mine Safety Disclosures | 39 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 40 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 41 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 60 |

| Item 8. | Financial Statements and Supplementary Data | 62 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 62 |

| Item 9B. | Other Information | 62 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 63 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 66 |

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 67 |

| Item 14. | Principal Accounting Fees and Services | 68 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedule | 69 |

| Item 16. | Form 10-K Summary | 73 |

| Signatures | 74 | |

| Index to Consolidated Financial Statements | 75 | |

| i |

DEFINITIONS

As used in this report for the year ended December 31, 2024 (this “Report”), the following abbreviations and terms have the meanings as listed below. Additionally, the terms “Calpine,” “we,” “us,” “our,” and "the Company" refer to Calpine Corporation and its consolidated subsidiaries unless the context clearly indicates otherwise. The term “Calpine Corporation” refers only to Calpine Corporation and not to any of its subsidiaries. Unless and as otherwise stated, any references in this Report to any agreement means such agreement and all schedules, exhibits and attachments in each case as amended, restated, supplemented or otherwise modified to the date of the issuance of this Report.

| ABBREVIATION | DEFINITION | |

| 2026 First Lien Notes | Collectively, the $625 million initial aggregate principal amount of 5.25% Senior Secured Notes due 2026, issued May 31, 2016, and the $560 million initial aggregate principal amount of 5.25% Senior Secured Notes due 2026, issued December 15, 2017. | |

| 2026 First Lien Term Loans | Collectively, the $950 million first lien senior secured term loan, issued April 5, 2019, and the $750 million first lien senior secured term loan, issued August 12, 2019. | |

| 2027 First Lien Term Loan | The $1.0 billion first lien senior secured term loan, issued December 16, 2020. In January 2024, we amended our 2027 First Lien Term Loan to reduce the applicable margin. | |

| 2028 First Lien Notes | The $1.25 billion initial aggregate and current outstanding principal amount of 4.50% senior secured notes due 2028, issued December 20, 2019. | |

| 2028 Senior Unsecured Notes | The $1.4 billion initial aggregate and current outstanding principal amount of 5.125% senior unsecured notes due 2028, issued December 27, 2019. | |

| 2029 Senior Unsecured Notes | The $650 million initial aggregate and current outstanding principal amount of 4.625% senior unsecured notes due 2029, issued August 10, 2020. | |

| 2031 First Lien Term Loans | The $1.7 billion first lien senior secured term loan are our legacy 2026 First Lien Term Loans as refinanced in January 2024, and repriced and consolidated in December 2024 extending the maturity. | |

| 2031 First Lien Notes | The $900 million initial aggregate and current outstanding principal amount of 3.75% senior secured notes due 2031, issued December 16, 2020. | |

| 2031 Senior Unsecured Notes | The $850 million initial aggregate and current outstanding principal amount of 5.00% senior unsecured notes due 2031, issued August 10, 2020. | |

| 2032 First Lien Term Loan | The $1.0 billion first lien senior secured term loan are our legacy 2027 First Lien Term Loans as refinanced in December 2024 extending the maturity. | |

| AB | Assembly Bill | |

| AB 32 | California Assembly Bill 32 | |

| Accounts Receivable Sales Program | The receivables purchase agreement between Calpine Solutions and Calpine Receivables and the purchase and sale agreement between Calpine Receivables and an unaffiliated financial institution, which together, allows for the revolving sale of up to $500 million in certain trade accounts receivables to third parties. | |

| AOCI | Accumulated Other Comprehensive Income | |

| ASC | Accounting Standards Codification | |

| ASU | Accounting Standards Update | |

| Average Availability | Represents the total hours during the period that our plants were in-service or available for service as a percentage of the total hours in the period. |

| ii |

| ABBREVIATION | DEFINITION | |

| Average Capacity Factor, excluding Peakers | A measure of total actual power generation as a percent of total potential power generation. It is calculated by dividing (1) the total MWh generated by our power plants, excluding peakers, by (2) the product of multiplying (a) the average total MW in operation, excluding peakers, during the period by (b) the total hours in the period. | |

| BART | Best Achievable Retrofit Technology | |

| Board of Directors | Calpine Corporation Board of Directors | |

| Btu | British thermal unit(s), a measure of heat content | |

| CAA | Federal Clean Air Act, U.S. Code Title 42, Chapter 85 | |

| CAISO | California Independent System Operator is an entity that manages the power grid and operates the competitive power market in California. | |

| CAMT | Corporate Alternative Minimum Tax | |

| CARB | California Air Resources Board | |

| Calpine Receivables | Calpine Receivables, LLC, an indirect, wholly-owned subsidiary of Calpine, was established as a bankruptcy-remote, special-purpose subsidiary and is responsible for administering the Accounts Receivable Sales Program. | |

| Calpine Solutions | Calpine Energy Solutions, LLC, an indirect, wholly-owned subsidiary of Calpine, is a supplier of power to commercial and industrial retail customers in the United States with customers in 18 states, including presence in California, Texas, the Mid-Atlantic and the Northeast. | |

| Cap-and-Trade | A government-imposed emissions reduction program that would place a cap on the amount of emissions that can be emitted from certain sources, such as power plants. In its simplest form, the cap amount is set as a reduction from the total emissions during a base year, and for each year over a period of years, the cap amount would be reduced to achieve the targeted overall reduction by the end of the period. Allowances or credits for emissions equal to the cap would be issued or auctioned to companies with facilities, permitting them emissions up to a specified cap during each applicable period. After allowances have been distributed or auctioned, they can be transferred or traded. | |

| CCA | Community Choice Aggregators (CCA) are local governments that procure power on behalf of their residents, businesses and municipal accounts from an alternative supplier while still receiving transmission and distribution services from their existing utility. | |

| CCFC | Calpine Construction Finance Company, L.P. (CCFC), is an indirect, wholly-owned subsidiary of Calpine. | |

| CCFC Term Loan | The $1.9 billion first lien senior secured term loan dated December 15, 2017, as amended on June 6, 2024, and September 16, 2024, issued by CCFC and due July 31, 2030. | |

| CCUS | Carbon capture, utilization and storage. | |

| CDHI | Calpine Development Holdings, LLC (CDHI) is an indirect, wholly-owned subsidiary of Calpine. | |

| CDHI Credit Agreement | The approximately $1.2 billion aggregate amount letter of credit, reimbursement, and revolving credit agreement dated March 29, 2023, as amended and restated, issued by CDHI Intermediate Holdco, LLC and Calpine York Holdings, LLC. | |

| CERCLA | Comprehensive Environmental Response, Compensation and Liability Act | |

| CFTC | Commodities Futures Trading Commission (CFTC) | |

| Chapter 11 | Chapter 11 of the U.S. Bankruptcy Code |

| iii |

| ABBREVIATION | DEFINITION | |

| Class A Common Shares | The common stock class of the Company held by CPN Management, L.P. and comprising 95.14% of all common stock outstanding of Calpine. Class A common shares retain all voting rights in relation to Calpine as well as the rights and obligations as specified under the Stockholders Agreement and the Fifth Amended and Restated Certificate of Incorporation of Calpine. | |

| Class B Common Shares | Class of common stock of the Company comprising 4.86% of all common stock outstanding. Class B common shares have no voting rights in relation to Calpine. The rights and obligations of this class of common shares are specified under the Stockholders Agreement and the Fifth Amended and Restated Certificate of Incorporation of Calpine. | |

| CO2 | Carbon dioxide | |

| Cogeneration | The use of all or portion of the steam generated in the power generating process to supply a customer with the steam for use in the customer's operations. | |

| Commodity Expense | The sum of our expenses from fuel and purchased energy expense, commodity transmission and transportation expense, environmental compliance expense, ancillary retail expense and realized settlements from our marketing, hedging and optimization activities, including natural gas and fuel oil transactions hedging future power sales. | |

| Commodity-linked Revolver | The $1.8 billion commodity-linked revolving credit facility between Calpine Corporation, as a borrower, the lender's parties thereto, MUFG Bank, Ltd., as administrative agent, and MUFG Union Bank, N.A., as collateral agent, dated July 21, 2022, as amended. In July 2024, the facility was extended for a term through July 18, 2025. | |

| Commodity Margin | Commodity Margin is a non-GAAP measure of segment profit or loss under FASB ASC 280, which is used by our chief operating decision maker to assess segment performance and make decisions about allocating resources to specific segments. Commodity Margin is calculated as Commodity revenue less Commodity expense, adjusted to exclude one-time and non-cash GAAP-related items including, but not limited to, levelization adjustments to revenues required on long-term PPA contracts and non-cash amortization of intangible assets/liabilities associated with contracts recorded at fair value. | |

| Commodity Revenue | Revenues recognized on our wholesale and retail power sales activity, electric capacity sales, REC sales, steam sales and realized settlements from our marketing, hedging, optimization and trading activities, excluding natural gas and fuel oil transactions, which are reflected in Commodity expense. | |

| Company | Calpine Corporation, a Delaware corporation and its subsidiaries | |

| Corporate Revolving Facility | The approximately $2.5 billion aggregate amount revolving credit facility agreement, dated December 10, 2010, as amended. | |

| CPN Management | CPN Management, L.P., which owns all of the Class A common shares of Calpine Corporation as of December 31, 2024. | |

| CPUC | California Public Utilities Commission | |

| CSAPR | Cross-State Air Pollution Rule | |

| DOJ | Department of Justice | |

| EBITDA | Earnings (Net Income) Before Interest, Taxes, Depreciation and Amortization | |

| EGU | Electric Generating Units | |

| EIA | Energy Information Administration of the U.S. Department of Energy | |

| EPA | U.S. Environmental Protection Agency |

| iv |

| ABBREVIATION | DEFINITION | |

| ERCOT | Electric Reliability Council of Texas, which is an entity that manages the flow of electric power to Texas customers representing approximately 90% of the state’s electric load. | |

| FASB | Financial Accounting Standards Board | |

| FDIC | U.S. Federal Deposit Insurance Corporation | |

| FERC | U.S. Federal Energy Regulatory Commission | |

| First Lien Notes | Collectively, the 2026 First Lien Notes, the 2028 First Lien Notes and the 2031 First Lien Notes | |

| First Lien Term Loans | Collectively, the 2032 First Lien Term Loan and the 2031 First Lien Term Loans | |

| Geysers Assets | Our geothermal power plant assets, including our steam extraction and gathering assets, located in northern California consisting of 13 operating power plants. | |

| GHGs | Greenhouse gas(es), primarily carbon dioxide (CO2), including methane (CH4), nitrous oxide (N2O), sulfur hexafluoride (SF6), hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs) | |

| GPC | Geysers Power Company, LLC, an indirect, wholly-owned subsidiary of Calpine | |

| GPC Term Loan | The $1.8 billion first lien senior secured term loan and $250 million letter of credit facility issued by GPC on June 9, 2020, and subsequently amended on November 9, 2021, and May 31, 2022. | |

| Greenfield LP | Effective September 5, 2023, Greenfield Energy Centre LP, became an indirect, wholly-owned subsidiary of Calpine, after our purchase of the partnership’s outstanding 50% ownership interest from a third party. Prior to September 5, 2023, we owned 50% of the ownership interest of Greenfield LP. | |

| Greenfield Term Loan Facility | The loan agreement issued by Greenfield LP in 2008, as amended, comprised of a Term Facility of $500 million CAD, a revolving working capital facility of $48 million CAD, and two other letter of credit facilities. | |

| Gregory Power Holdings, LLC | Gregory Power Holdings, LLC owns and operates a 385 MW combined cycle generation facility located in Corpus Christi, Texas. Effective December 29, 2023, Calpine Corporation, through a wholly-owned subsidiary, purchased an investment in Gregory Power Holdings, LLC, with the remaining ownership interest in the entity held by a third party, Gregory Power Investments, LLC. | |

| Heat Rate(s) | A measure of the amount of fuel required to produce a unit of power. | |

| ICE | Intercontinental Exchange | |

| IESO | Independent Electricity System Operator, which operates the electricity market in the province of Ontario, Canada. | |

| IRA | Inflation Reduction Act of 2022, signed into law on August 16, 2022, created a new corporate alternative minimum tax effective for periods beginning after December 31, 2022, and includes provisions intended to mitigate climate change by, among others, providing tax credit incentives for reductions in greenhouse gas emissions. | |

| IRS | U.S. Internal Revenue Service | |

| ISO(s) | Independent System Operator(s), which is an entity that coordinates, controls and monitors the operation of an electric power system. | |

| ISO-NE | ISO New England Inc., is an independent nonprofit RTO serving states in the New England area, including Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont. |

| v |

| ABBREVIATION | DEFINITION | |

| ITC | Investment Tax Credit | |

| KWh | Kilowatt hour(s), a measure of power produced, purchased, or sold. | |

| LIBOR | London Inter-Bank Offered Rate, effective July 1, 2023, all outstanding debt agreements and interest rate instruments priced against LIBOR were converted from LIBOR to SOFR. | |

| LTSA(s) | Long-Term Service Agreement(s) | |

| Lyondell | LyondellBasell Industries N.V. | |

| Market Heat Rate(s) | The regional power price divided by the corresponding regional natural gas price. | |

| MATS | Mercury and Air Toxics Standards | |

| Merger | Merger of Volt Merger Sub, Inc. with and into Calpine under the terms of the Merger Agreement, which was consummated on March 8, 2018. | |

| MMBtu | Million Btu | |

| MW | Megawatt(s), a measure of plant capacity | |

| MWh | Megawatt hour(s), a measure of power produced, purchased, or sold | |

| NAAQS | National Ambient Air Quality Standards | |

| NERC | North American Electric Reliability Council | |

| NOL(s) | Net operating loss(es) | |

| Nova Power, LLC | An indirect, wholly-owned subsidiary of Calpine that is constructing the Nova Power Battery Storage Facilities. | |

| Nova Credit Agreement | A credit agreement issued by Nova Power, LLC on December 21, 2023, comprising of certain credit facilities totaling more than $1 billion, including (a) a construction facility in an aggregate principal amount of $655 million, (b) a bridge facility in an aggregate principal amount of $256 million, available until the facility’s investment tax credits are received and (c) letter of credit facilities available to support various obligations with $94 million of total available capacity. The bridge facility was fully repaid in September 2024. The credit agreement was converted to a first lien term loan on October 31, 2024. | |

| NOx | Nitrogen oxides | |

| NPCC | Northeast Power Coordinating Council | |

| NPNS | Normal purchase-normal sale | |

| NYISO | New York ISO which operates competitive wholesale markets to manage the flow of electricity across New York. | |

| NYMEX | New York Mercantile Exchange | |

| OCI | Other Comprehensive Income | |

| OTC | Over-the-Counter |

| vi |

| ABBREVIATION | DEFINITION | |

| PJM | PJM Interconnection is an RTO that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. | |

| PPAs | Any term power purchase agreement or other contract for a physically settled sale (as distinguished from a financially settled future, option, or swap) of any power product, including power, capacity and/or ancillary services, in the form of a bilateral agreement or a written or oral confirmation of a transaction between two parties to a master agreement, including sales related to a tolling transaction in which the purchaser provides the fuel required by us to generate such power and we receive a variable payment to convert the fuel into power and steam. | |

| PUCT | Public Utility Commission of Texas | |

| QFs | Qualifying facilities are cogeneration facilities and certain small power production facilities eligible to be “qualifying facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. QF status provides an exemption from the books and records requirement of PUHCA 2005 and grants certain other benefits to the QF. | |

| RECs | Renewable energy credit(s) | |

| Report | This Annual Report for the year ended December 31, 2024, posted to our website on February 18, 2025. | |

| RFC | Reliability First Corporation | |

| RGGI | Regional Greenhouse Gas Initiative | |

| Risk Management Policy | Calpine’s policy applicable to all employees, contractors, representatives and agents, which defines the risk management framework and corporate governance structure for commodity risk, interest rate risk, currency risk and other risks. | |

| RMR Contract(s) | Reliability Must Run contract(s) | |

| RPS | Renewable Portfolio Standard | |

| RTO(s) | Regional Transmission Organization(s) are entities that coordinate, control and monitor the operation of an electric power system and administrate the transmission grid on a regional basis. | |

| SEC | U.S. Securities and Exchange Commission | |

| Senior Unsecured Notes | Collectively, the 2028 Senior Unsecured Notes, the 2029 Senior Unsecured Notes and the 2031 Senior Unsecured Notes. | |

| SERC | Southeastern Electric Reliability Council | |

| SIP | State Implementation Plans | |

| SO2 | Sulfur dioxide | |

| SOx | Sulfur oxides | |

| SOFR | A rate equal to the secured overnight financing rate as administered by the Federal Reserve Bank of New York. | |

| Spark Spread(s) | The difference between the sales price of power per MWh and the cost of natural gas to produce it. |

| vii |

| ABBREVIATION | DEFINITION | |

| Steam Adjusted Heat Rate | The adjusted Heat Rate for our natural gas-fired power plants, excluding peakers. It is calculated by dividing (a) the fuel consumed in Btu, reduced by the net equivalent Btu in steam exported to a third party by (b) the KWh generated. Steam Adjusted Heat Rate is a measure of fuel efficiency, so the lower our Steam Adjusted Heat Rate, the lower our cost of generation. | |

| Stockholders Agreement | Collectively, the Stockholders Agreement of Calpine Corporation, dated March 8, 2018, and the First Amended and Restated Stockholders Agreement of Calpine Corporation, dated June 13, 2022, by and between Calpine Corporation and CPN Management, L.P., and such other stockholders who become parties thereto from time to time. | |

| TRE | Texas Reliability Entity, Inc. | |

| U.S. GAAP | Generally accepted accounting principles in the U.S. | |

| VAR | Value-at-risk | |

| VIE(s) | Variable interest entity(ies) | |

| WECC | Western Electricity Coordinating Council | |

| Winter Storm Uri | A winter weather event in Texas during February 2021 that resulted in temperatures well below freezing for more than five days and ERCOT declaring a system emergency and initiating firm load shedding, or blackouts, from February 15, 2021, through February 19, 2021. |

| viii |

FORWARD-LOOKING STATEMENTS

This Report includes forward-looking statements that reflect our current views with respect to, among other things, our operations and financial performance. Forward-looking statements include all statements that are not historical facts. These forward-looking statements are included throughout this Report, including, without limitation, the “Management’s Discussion and Analysis” section. We have used the words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable,” “should,” the negative version of these words or similar terms and phrases to identify forward-looking statements.

The forward-looking statements contained in this Report are based on management’s current expectations and are not guarantees of future performance. The forward-looking statements are subject to various risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. Actual results may differ materially from these expectations due to changes in global, regional, or local economic, business, competitive, market, regulatory and other factors, many of which are beyond our control. We believe that these factors include but are not limited to those described under the “Management’s Discussion and Analysis” section.

The statements we make regarding the following matters are forward-looking by their nature:

| · | Financial results that may be volatile and may not reflect historical trends due to, among other things, seasonality and other changes in demand, fluctuations in prices for commodities such as natural gas and power, changes in U.S. macroeconomic conditions, fluctuations in liquidity and volatility in the energy commodities markets and our ability and the extent to which we hedge risks; |

| · | Laws, regulations and market rules in the wholesale and retail markets in which we participate and our ability to effectively respond to changes in laws, regulations, or market rules or the interpretation thereof, including those related to the environment, derivative transactions and market design in the regions in which we operate; |

| · | Our ability to manage interest rate risk, our liquidity needs, including collateral requirements, access the capital markets when necessary and comply with covenants under our Senior Unsecured Notes, First Lien Term Loans, First Lien Notes, Corporate Revolving Facility, Calpine Development Holdings, LLC Credit Agreement (“CDHI Credit Agreement”), Calpine Construction Finance Company, L.P. Term Loan (“CCFC Term Loan”), Geysers Power Company Term Loan (“GPC Term Loan”) and other existing financing obligations; |

| · | Risks associated with the operation, construction and development of power plants, battery storage facilities and carbon capture facilities, including unscheduled outages or delays and plant efficiencies; |

| · | Risks related to our geothermal resources, including the adequacy of our steam reserves, unusual or unexpected steam field well and pipeline maintenance requirements, variables associated with the injection of water to the steam reservoir, and potential regulations or other requirements related to seismicity concerns that may delay or increase the cost of developing or operating geothermal resources; |

| · | Extensive competition in our wholesale and retail businesses, including challenges from renewable sources of power, interference by states in competitive power markets through subsidies or similar support for new or existing power plants, new and existing federal subsidies, lower prices and other incentives offered by retail competitors and other risks associated with marketing and selling power in the evolving energy markets; |

| · | Structural changes in the supply and demand of power, resulting from the development of new fuels or technologies and continued development of demand-side management tools (such as power storage, distributed generation and other technologies); |

| · | The expiration or early termination of our power purchase agreements (“PPAs”) and the related results on revenues; |

| · | Future capacity revenue may not occur at expected levels; |

| · | Natural disasters, such as hurricanes, earthquakes, droughts, floods, extreme winter weather and wildfires, acts of terrorism or cyber-attacks that may affect our power plants and battery storage facilities or the markets our power plants, battery storage facilities, or retail operations serve and our corporate offices as well as pandemics, such as COVID-19, and the impact on our business, suppliers, customers, employees and supply chains; |

| · | Disruptions in or limitations on the transportation of natural gas or fuel oil and the transmission of power; |

1

| · | Our ability to manage our counterparty and customer exposure and credit risk, including our commodity positions or if a significant customer were to seek bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code; |

| · | Our ability to attract, motivate and retain key employees; |

| · | The impact of changes to federal and state legislative and tax regulations, including, but not limited, to the Inflation Reduction Act (“IRA”) and all corresponding rules and regulations on our financial condition, results of operations or cash flows; |

| · | Present and possible future claims and litigation, including litigation arising out of Winter Storm Uri and enforcement actions that may arise from noncompliance with market rules promulgated by the U.S. Securities and Exchange Commission (“SEC”), Commodities Futures Trading Commission (“CFTC”), U.S. Federal Energy Regulatory Commission (“FERC”) and other regulatory bodies; and |

| · | Other risks identified in this Report. |

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Many of these factors are beyond our ability to control or predict. Our forward-looking statements speak only as of the date of this Report. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. We undertake no obligation to publicly update or review any forward-looking statement, whether because of new information, future developments, or otherwise, except as may be required by any applicable securities laws.

Where You Can Find Other Information

Our website is www.calpine.com. Information contained on our website is not part of this Report. Our historical SEC filings made prior to August 21, 2020, including exhibits filed therewith, are available directly on the SEC’s website at www.sec.gov. As of August 21, 2020, we ceased filing all reports with the SEC. All future financial reports will be posted on our website. In November 2024, we issued our 2023 sustainability report, which is posted on our website and highlights Calpine’s (“Calpine Corporation," "the Company” or “CALPINE CORP”) performance through an environmental, social and governance (“ESG”) perspective. The report content and disclosures were developed with consideration from the Global Reporting Initiative Standards and Sustainability Accounting Standards Board Standard for Electric Utilities and Power Generators.

2

PART I

Item 1. BUSINESS

Business and Strategy

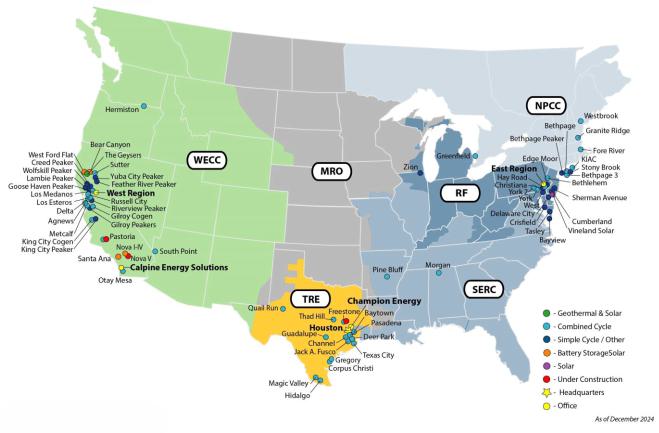

Calpine is America’s largest generator of electricity from natural gas and geothermal resources, according to S&P Global Market Intelligence. We sell electricity and other related energy products to load-serving entities such as utilities and public power customers, end users such as commercial, industrial and residential customers and to state and regional wholesale market operators. We have a significant presence in the major competitive wholesale and retail power markets in California, Texas and the Northeast and Mid-Atlantic regions of the United States. We own and operate approximately 28 Gigawatts (“GW”) of power facilities, enough to power approximately 27 million homes, consisting of natural gas, geothermal, solar and battery storage assets.

Our business strategy is to deliver long-term value to our stockholders and customers by focusing on operational excellence and a disciplined capital allocation strategy.

Since our inception in 1984, we have led the way in helping America move towards cleaner electricity. We believe our continued investment in sustainable power generation technologies has positioned us as a leader in developing, constructing, owning and operating an environmentally responsible portfolio of flexible and reliable power plants. Data gathered by the EIA show that our Geysers Assets (“Geysers,” or “The Geysers”), located in northern California, represent the largest geothermal power generation portfolio in the United States (“U.S.”), as well as the largest single renewable energy asset in California. Our modern natural gas fleet serves as a key part of the backbone of the U.S. electrical grid, enabling the transition away from coal-fired generation and the growth of intermittent renewable resources while maintaining reliability. We have championed environmental progress in the power sector through our own investments and by supporting government rules and regulations related to air emissions and water use. We have remained committed to these founding principles while expanding our portfolio geographically across the United States and into new, low-emission generation technologies. With one of the largest gas-fired generation fleets in California, Texas, the Mid-Atlantic and New England, we have a significant presence in these markets, which provides us with operational and strategic benefits.

We are pursuing an “inside-out” growth strategy, starting with our people, our capabilities, our sites and our power plants. This strategy includes a major effort to organically grow our retail businesses, a modest expansion of our geothermal footprint at The Geysers, our large-scale energy storage development effort — initially in the West and with expectations to expand in the East and potentially most significantly an industry-leading effort to attempt to develop profitable CCS facilities at natural gas plants.

Our wholesale customers include utilities, municipalities, cooperatives, retail power providers, large industrial companies, power marketers and governmental entities. We manage our portfolio through a combination of long-term customer contracts, forward hedging transactions and spot market participation. Our customer focus and relationships enable mutually beneficial opportunities through customized contract structures. For example, we operate the largest cogeneration fleet in the United States. Our cogeneration fleet is composed of plants that offer not only power but also steam products to our customers. By offering both steam and power, we provide efficient and reliable thermal and power products that are highly customized for our wholesale industrial customers.

Proposed Merger

On January 10, 2025, the Company announced that it entered into an Agreement and Plan of Merger (the "Plan of Merger Agreement") with Constellation Energy Corporation ("Constellation") under which Constellation will acquire Calpine in a cash and stock transaction. See Part II, Item 7. Management Discussion and Analysis and Note 19 to the Consolidated Financial Statements for additional details relating to the Plan of Merger Agreement and 1A. Risk Factors for a discussion of the risks related to the Plan of Merger Agreement.

Reportable Segments

We operate four reportable segments based primarily on region. We assess our business on a regional basis due to the effects that the differing characteristics of these regions have on our financial performance, particularly concerning competition, regulation and other factors affecting supply and demand. Our four reportable segments are:

| · | West: Includes our power plants and battery storage facilities located in California in the CAISO region, as well as our power plants in Arizona and Oregon; |

3

| · | Texas: Includes our power plants located in the ERCOT region; |

| · | East: Includes our power plants located in PJM, ISO-NE, NYISO, MISO, SERC and the Canadian IESO; and |

| · | Retail: Includes our retail operations throughout the country. |

See Note 18, Segment and Significant Customer Information of the Consolidated Financial Statements, for a discussion of financial information by reportable segment and geographic area and significant customer information for the years ended December 31, 2024, 2023 and 2022.

Our Core Business Functions

We manage our platform through five core business functions: 1) power plant operational excellence; 2) wholesale hedging and optimization and a customer-focused origination effort; 3) new asset development efforts, including power plants, energy storage, and potential carbon capture for sequestration; 4) retail businesses that provide products directly to end customers; and 5) active external engagement with our communities, regulators and governments, including on behalf of our customers. Our business functions leverage relationships and knowledge from each business, employ skilled, cross-functional teams and benefit from our scale to drive development opportunities and make informed commercial decisions. Our ability to leverage the entire Calpine platform allows us to provide innovative and cross-functional solutions to customers. Calpine’s core competencies are complementary, providing the business with a value greater than the sum of each of its individual parts. Our scale and operational expertise across these five functions allow us to proactively pursue growth opportunities, placing us at a competitive advantage over companies only involved in a subset of these five functions.

Our Markets

Calpine operates across eight wholesale power markets in the United States and Canada. Approximately 87% of Calpine’s electrical generation, as measured by our capacity, is concentrated within CAISO, ERCOT, PJM and ISO-NE.

CAISO

CAISO covers customers primarily in California, managing the dispatch of installed capacity to 32 million customers. Approximately 7.2 GW, or 26% of our generation fleet as measured by net interest with peaking operates within CAISO as of December 31, 2024. Our portfolio within CAISO is 11% geothermal, 88% natural gas-fired, and 1% storage. Operating as a fully functioning ISO since 1998, CAISO is a competitive wholesale electricity market with day-ahead and real-time energy markets, ancillary services and congestion revenue rights. The CAISO also operates a real-time imbalance market across much of the West. Although CAISO does not operate a centralized capacity market, it does use mandatory resource requirements supported through bilateral contracts in its Resource Adequacy (“RA”) program.

California is pursuing ambitious climate and energy policies with the goal of transitioning away from carbon-emitting fuels and toward cleaner energy sources. These cleaner energy sources include solar, wind and geothermal. In 2022, Governor Gavin Newsom set benchmarks for the state to reach 90% carbon-free electricity, inclusive of post-combustion carbon capture gas units, by 2035 to keep pace with the state’s previously stated goal of reaching 100% by 2045. To grow the state’s renewable energy portfolio, the RPS required California utilities procure 33% of retail sales from renewable resources by 2020 and will require 60% come from renewable sources by 2030. The state’s aggressive energy transition agenda has come alongside operational challenges as it works through its transition. Rolling blackouts throughout the state forced California officials to delay the retirement of three gas-fired power plants in 2023, extending their lives through 2026. These delays allowed the state to retain essential gas-fired power to maintain grid reliability during extreme weather events like wildfires and heat waves.

ERCOT

ERCOT coordinates the movement of electricity to 27 million customers in Texas. Approximately 9.7 GW, or 35% of our generation fleet, as measured by net interest with peaking, operates within ERCOT as of December 31, 2024. Our portfolio in ERCOT is comprised entirely of natural gas generation. ERCOT is a competitive electricity market that manages approximately 90% of Texas’ load and an electric grid covering approximately 75% of the state. ERCOT oversees transactions associated with Texas’ competitive wholesale and retail power markets and does not operate a capacity market.

ERCOT has seen weather-related disruptions, including extreme cold weather of winter storms Uri in 2021. With electric demand and load forecasted to grow substantially in the coming years, ERCOT President and CEO Pablo Vegas unveiled a comprehensive strategy in April 2024, called the New Era of Planning, designed to ensure all areas of system planning, including generation, load interconnections and transmission development, can meet the state’s growing energy needs. In July 2024, State representatives announced their intent to double the Texas Energy Fund from $5 billion to $10 billion to incentivize the construction of new gas-fired power plants.

4

PJM

PJM serves a population of 65 million in all or parts of 13 states and the District of Columbia. Approximately 5.3 GW, or 19% of our generation fleet, as measured by net interest with peaking, operates within PJM as of December 31, 2024. Our portfolio within PJM is 86% gas-fired generation and 14% steam as of December 31, 2024. All of our gas-fired generation facilities in PJM are dual-fuel systems that can also run on oil. This enables our fleet to continue operating during periods when gas may be constrained, such as recent winter storms. PJM is a competitive wholesale electricity market that consists of a locationally based energy market, a forward capacity market and ancillary service markets.

PJM is the largest and one of the most advanced power markets in the United States, with a capacity market, intended to ensure the future availability of power supplies three years in advance.

PJM may see a significant retirement of coal in the future due to issues arising from aging assets, competitive gas-fired generation and environmental targets. To offset these retirements and prepare for growing electric demand in the region, the ISO is scheduled to increase renewables. However, a recent report from independent developers in PJM suggested that most new generation is unlikely to come online before 2030 due to barriers in the grid interconnection and transmission planning processes. Additionally, PJM has implemented winter readiness measures to bolster system reliability in reaction to recent extreme weather events like Winter Storm Elliott, which resulted in the temporary shutdown of more than 25% of PJM’s generation fleet and led to load shedding in four nearby states in territories outside of PJM’s footprint.

ISO-NE

ISO-NE manages installed capacity across six states — Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont. Approximately 2.0 GW, or 7% of our generation fleet, as measured by net interest with peaking, operates within ISO-NE as of December 31, 2024. ISO-NE is a competitive wholesale electricity market with broad authority over the day-day operation of the transmission system. ISO-NE operates a day-ahead and real-time wholesale energy market, a forward capacity market and an ancillary services market.

ISO-NE stated in March 2024 that the region’s grid would need up to $1 billion in annual transmission investments until 2050 to support the clean energy transition. Though NERC has forecasted the ISO’s reserve margin level to be approximately 13%, access to fuel can be uncertain during winter when the region’s pipelines run at or near capacity, according to ISO-NE.

Other Markets

Our other markets include SERC, WECC, IESO, MISO and NYISO. As measured by net interest with peaking, Approximately 13% of our generation fleet operates in these markets, with 4% in WECC, 4% in IESO, 3% in SERC, 1% in MISO and 1% in NYISO.

Power Plant Operational Excellence

As of December 31, 2024, our generation fleet had a generating capacity of 27,802 MW and produced 121 Terawatt-hours (“TWh”) of electricity in 2024. As of December 31, 2024, our fleet included 79 operational power plants and facilities, including the newly acquired Quail Run Energy Center. Additionally, our fleet includes four battery storage facilities in operation, where one battery storage facility has four of five phases operational, with the final phase scheduled for commercial operations during the first half of 2025. Our fleet provides dispatchable, intermittent and peak power generation. As of December 31, 2024, our leading generation and battery storage fleet operated in 18 states and Canada, with most of our generating capacity located in the ERCOT, CAISO and PJM. Further details on our generation and battery storage fleet are included below in the section titled “Item 1. Business — Description of our Operations — Table of Operating Power Plants and Projects Under Construction.”

Since Calpine’s inception in 1984, we have focused on excellence in operations, continuously working to meet or exceed our goals. Our employees’ expertise allows us to optimize the value and profitability of our electric facilities, enhance our retail brands, and prudently manage the risks inherent in our business. We consider the proactive management and continuous improvement of safety and health risks crucial to our long-term business success. As a result, Calpine’s world-class safety performance routinely ranks among the best in the industry based on lost-time incidents and total recordable incident rates, the primary indicators of industrial safety performance. Reinforcing our stringent safety principles, several of our power plants have earned Star worksite certification through the Voluntary Protection Programs administered by the U.S. Department of Labor’s Occupational Safety and Health Administration, and others are working toward earning this distinction.

5

Description of Our Operations

Natural Gas Fleet

Our natural gas-fired power plants primarily use four types of designs: 1,500 MW of simple cycle combustion turbines, or peakers, 17,632 MW of combined cycle combustion turbines, 5,697 MW of cogeneration power plants and a small portion from conventional natural gas/oil-fired boilers with steam turbines. As of December 31, 2024, we own and operate 60 natural gas-fired power plants, making us the owner of the largest natural gas fleet in the United States. Our natural gas portfolio has an average capacity-weighted age of approximately 20 years. The efficiency of natural gas-fired power plants is demonstrated by our 2024 Steam Adjusted Heat Rate of 7,411 Btu/KW, which results in a power conversion efficiency of approximately 46%. Simple cycle combustion turbines burn natural gas or fuel oil to spin an electric generator to produce power. A combined cycle unit combusts fuel like a simple cycle combustion turbine, and boiler, which captures the exhaust heat to create steam, which can then spin a steam turbine. Each of our power plants currently in operation can produce power for sale to a utility, another third-party end user, our retail customers, or an intermediary such as a marketing company. At 13 of our power plants, we also produce thermal energy (primarily steam and chilled water), which can be sold to industrial and commercial users. These cogeneration power plants are also called combined heat and power facilities or cogens.

Geothermal Fleet

At The Geysers, located in the Mayacamas Mountains in northern California, we use a natural, clean energy source, geothermal energy, which is heat from the Earth’s interior, to produce electricity. Calpine’s wholly owned subsidiary, GPC owns and operates our Geysers Assets. Our Geysers Assets include a 725 MW fleet of 13 operating power plants, including steam extraction and gathering assets in northern California. This facility is the world’s largest geothermal power plant complex, and in 2024, our Geysers Assets were responsible for approximately 31% of the country’s total generation of electricity from geothermal sources in the United States. Geothermal energy is classified as clean and renewable as it does not require burning fossil fuel to create electricity. Steam is produced below the Earth’s surface from reservoirs of hot water, both naturally occurring and injected. The steam is piped directly from the underground production wells to the power plants and used to spin turbines to generate power.

6

We inject water back into the steam reservoir, which extends the useful life of the resource and helps to maintain the output of our Geysers Assets. The water we inject primarily comes from water purchase agreements for reclaimed water and the condensate associated with the steam extracted to generate power. As a result of these recharge projects, MWh production has been relatively constant. We expect that, as a result of the water injection program, the reservoir at our Geysers Assets will be able to supply economic quantities of steam for the foreseeable future.

We lease the geothermal steam fields from which we extract steam for our Geysers Assets. We have leasehold mineral interests in 105 leases comprising approximately 29,000 acres of federal, state and private geothermal resource lands in The Geysers region of northern California. Our leases cover one contiguous area of property that comprises approximately 45 square miles in Sonoma and Lake County. The approximate breakout by volume of steam removed under the above leases for the year ended December 31, 2024, is as follows:

| · | 25% related to leases with the Federal Government via the Bureau of Land Management; |

| · | 23% related to leases with the California State Lands Commission; and |

| · | 53% related to leases with private landowners/leaseholders. |

In general, our geothermal leases grant us the exclusive right to drill for, produce and sell geothermal resources from these properties and the right to use the surface for related purposes. Each lease requires the payment of annual rent and royalty payments. In general, lease royalty calculations are based upon its percentage of revenue as calculated by its steam generated relative to the total steam generated by our Geysers Assets as a whole.

Our geothermal leases are generally for initial terms varying from five to 20 years and for so long thereafter as geothermal resources are produced and sold. Most of our geothermal leases were signed more than 30 years ago and continue uninterrupted. Our federal leases typically span an initial ten-year period with renewal clauses for an additional 40 years for a maximum of 50 years. In 2024, four of our federal leases were renewed through 2064. Most of our other leases run through the economic life of our Geysers Assets and provide for renewals so long as geothermal resources are being produced or used, or are capable of being produced or used, in commercial quantities from the leased land or from land unitized with the leased land. Although we believe that we will be able to renew our leases through the economic life of our Geysers Assets on terms that are acceptable to us, it is possible that certain of our leases may not be renewed or may be renewed on less favorable terms.

Unlike other renewable resources, such as wind or solar, which depend on intermittent sources to generate power, geothermal power provides a consistent source of energy, as evidenced by our Geysers Assets’ availability of approximately 91% in 2024. Additionally, many growth projects and new capital expenditures at The Geysers may be eligible for investment tax credits, as provided within the IRA.

Other Technologies

We also have four MW of capacity from solar power generation technology at our Vineland Solar Energy Center in New Jersey and 105 MW of solar power generation under construction at our Pastoria Solar Energy Center. As of December 31, 2024, we have four battery storage projects in California that are fully operational representing 738 MW of capacity, and one facility in California (Pastoria) that is under construction, representing approximately 80 MW of capacity. Among the world's largest battery storage projects is our 680 MW Nova asset. The development is financed and fully contracted. The first four phases of the Nova power battery storage facility came online during the summer of 2024, with phase five expected to be operational in the first half of 2025. We also have 725 MW of conventional steam turbine technology at our Edge Moor Energy Center.

7

Table of Operating Power Plants, Battery Storage Facilities and Projects Under Construction

Set forth below is certain information regarding our operating power plants, battery storage facilities and projects under construction as of December 31, 2024.

| SEGMENT/Power Plant | NERC

Region | U.S.

State or Canadian Province | Technology | Calpine

Interest Percentage | Calpine

Net Interest Baseload (MW)(1)(3) | Calpine Net Interest With Peaking (MW)(2)(3) | 2024 Total MWh Generated(4) | |||||||||||||||

| WEST | ||||||||||||||||||||||

| Geothermal | ||||||||||||||||||||||

| McCabe #5 & #6 | WECC | CA | Renewable | 100 | % | 84 | 84 | 483,907 | ||||||||||||||

| Ridge Line #7 & #8 | WECC | CA | Renewable | 100 | % | 76 | 76 | 617,457 | ||||||||||||||

| Calistoga | WECC | CA | Renewable | 100 | % | 69 | 69 | 468,760 | ||||||||||||||

| Eagle Rock | WECC | CA | Renewable | 100 | % | 68 | 68 | 518,774 | ||||||||||||||

| Big Geysers | WECC | CA | Renewable | 100 | % | 61 | 61 | 398,742 | ||||||||||||||

| Lake View | WECC | CA | Renewable | 100 | % | 54 | 54 | 495,151 | ||||||||||||||

| Quicksilver | WECC | CA | Renewable | 100 | % | 53 | 53 | 403,220 | ||||||||||||||

| Sonoma | WECC | CA | Renewable | 100 | % | 53 | 53 | 447,631 | ||||||||||||||

| Cobb Creek | WECC | CA | Renewable | 100 | % | 51 | 51 | 362,971 | ||||||||||||||

| Socrates | WECC | CA | Renewable | 100 | % | 50 | 50 | 362,705 | ||||||||||||||

| Sulphur Springs | WECC | CA | Renewable | 100 | % | 47 | 47 | 441,958 | ||||||||||||||

| Grant | WECC | CA | Renewable | 100 | % | 41 | 41 | 282,313 | ||||||||||||||

| Aidlin | WECC | CA | Renewable | 100 | % | 18 | 18 | 81,308 | ||||||||||||||

| Natural Gas-Fired | ||||||||||||||||||||||

| Delta Energy Center | WECC | CA | Combined Cycle | 100 | % | 860 | 882 | 1,860,563 | ||||||||||||||

| Pastoria Energy Center | WECC | CA | Combined Cycle | 100 | % | 780 | 759 | 2,630,642 | ||||||||||||||

| Hermiston Power Project | WECC | OR | Combined Cycle | 100 | % | 566 | 635 | 3,519,891 | ||||||||||||||

| Russell City Energy Center | WECC | CA | Combined Cycle | 100 | % | 572 | 619 | 745,909 | ||||||||||||||

| Otay Mesa Energy Center | WECC | CA | Combined Cycle | 100 | % | 513 | 608 | 1,792,894 | ||||||||||||||

| Metcalf Energy Center | WECC | CA | Combined Cycle | 100 | % | 584 | 625 | 1,550,422 | ||||||||||||||

| Sutter Energy Center | WECC | CA | Combined Cycle | 100 | % | 542 | 578 | 1,214,035 | ||||||||||||||

| Los Medanos Energy Center | WECC | CA | Cogen | 100 | % | 518 | 572 | 2,567,898 | ||||||||||||||

| South Point Energy Center | WECC | AZ | Combined Cycle | 100 | % | 520 | 530 | 2,583,896 | ||||||||||||||

| Los Esteros Critical Energy Facility | WECC | CA | Combined Cycle | 100 | % | 243 | 309 | 207,010 | ||||||||||||||

| Gilroy Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 141 | 16,231 | ||||||||||||||

| Gilroy Cogeneration Plant | WECC | CA | Combined Cycle | 100 | % | 109 | 130 | 23,752 | ||||||||||||||

| King City Cogeneration Plant | WECC | CA | Combined Cycle | 100 | % | 120 | 120 | 14,732 | ||||||||||||||

| Wolfskill Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 48 | 1,536 | ||||||||||||||

| Yuba City Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 41,512 | ||||||||||||||

| Feather River Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 39,036 | ||||||||||||||

| Creed Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 4,138 | ||||||||||||||

| Lambie Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 6,609 | ||||||||||||||

| Goose Haven Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 7,522 | ||||||||||||||

| Riverview Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 47 | 20,944 | ||||||||||||||

| King City Peaking Energy Center | WECC | CA | Simple Cycle | 100 | % | — | 44 | 3,282 | ||||||||||||||

| Agnews Power Plant | WECC | CA | Combined Cycle | 100 | % | 28 | 28 | 5,261 | ||||||||||||||

| Battery Storage Facilities | ||||||||||||||||||||||

| Santa Ana I - III(5) | WECC | CA | Battery Storage | 100 | % | 80 | 80 | 97,729 | ||||||||||||||

| Nova Battery Power Bank(9) | WECC | CA | Battery Storage | 100 | % | 620 | 620 | 691,219 | ||||||||||||||

| Bear Canyon battery storage project(10) | WECC | CA | Battery Storage | 100 | % | 13 | 13 | 5,477 | ||||||||||||||

| West Ford Flat battery storage project(10) | WECC | CA | Battery Storage | 100 | % | 25 | 25 | 8,301 | ||||||||||||||

| Subtotal | 7,418 | 8,373 | 25,025,338 | |||||||||||||||||||

8

| SEGMENT/Power Plant | NERC

Region | U.S.

State or Canadian Province | Technology | Calpine

Interest Percentage | Calpine

Net Interest Baseload (MW)(1)(3) | Calpine Net Interest With Peaking (MW)(2)(3) | 2024 Total MWh Generated(4) | |||||||||||||||

| TEXAS | ||||||||||||||||||||||

| Deer Park Energy Center | TRE | TX | Cogen | 100 | % | 1,116 | 1,217 | 7,936,876 | ||||||||||||||

| Guadalupe Energy Center | TRE | TX | Combined Cycle | 100 | % | 1,049 | 1,040 | 6,860,790 | ||||||||||||||

| Baytown Energy Center | TRE | TX | Cogen | 100 | % | 810 | 896 | 4,768,009 | ||||||||||||||

| Channel Energy Center | TRE | TX | Cogen | 100 | % | 760 | 845 | 4,945,918 | ||||||||||||||

| Pasadena Power Plant(6) | TRE | TX | Cogen/Combined Cycle | 100 | % | 763 | 781 | 4,976,217 | ||||||||||||||

| Thad Hill Energy Center | TRE | TX | Combined Cycle | 100 | % | 770 | 792 | 2,814,268 | ||||||||||||||

| Freestone Energy Center | TRE | TX | Combined Cycle | 75 | % | 809 | 776 | 5,042,951 | ||||||||||||||

| Magic Valley Generating Station | TRE | TX | Combined Cycle | 100 | % | 682 | 712 | 1,670,580 | ||||||||||||||

| Jack A. Fusco Energy Center | TRE | TX | Combined Cycle | 100 | % | 523 | 609 | 3,738,906 | ||||||||||||||

| Corpus Christi Energy Center | TRE | TX | Cogen | 100 | % | 446 | 520 | 2,541,226 | ||||||||||||||

| Texas City Power Plant | TRE | TX | Cogen | 100 | % | 400 | 453 | 2,003,732 | ||||||||||||||

| Hidalgo Energy Center | TRE | TX | Combined Cycle | 78.5 | % | 413 | 395 | 440,000 | ||||||||||||||

| Quail Run Energy Center | TRE | TX | Combined Cycle | 100 | % | 550 | 550 | 915,317 | ||||||||||||||

| Gregory Energy Center(13) | TRE | TX | Combined Cycle | 28.5 | % | 110 | 110 | 238,111 | ||||||||||||||

| Subtotal | 9,201 | 9,696 | 48,892,901 | |||||||||||||||||||

| EAST | ||||||||||||||||||||||

| Bethlehem Energy Center(7) | RFC | PA | Combined Cycle | 100 | % | 960 | 1,130 | 5,980,570 | ||||||||||||||

| Hay Road Energy Center(7) | RFC | DE | Combined Cycle | 100 | % | 931 | 1,130 | 1,706,133 | ||||||||||||||

| York 2 Energy Center(7) | RFC | PA | Combined Cycle | 100 | % | 668 | 828 | 5,533,730 | ||||||||||||||

| Morgan Energy Center | SERC | AL | Cogen | 100 | % | 720 | 807 | 4,094,869 | ||||||||||||||

| Fore River Energy Center(7) | NPCC | MA | Combined Cycle | 100 | % | 750 | 731 | 2,950,781 | ||||||||||||||

| Edge Moor Energy Center(7) | RFC | DE | Steam Cycle | 100 | % | — | 725 | 344,014 | ||||||||||||||

| Granite Ridge Energy Center | NPCC | NH | Combined Cycle | 100 | % | 745 | 695 | 3,447,295 | ||||||||||||||

| York Energy Center(7) | RFC | PA | Combined Cycle | 100 | % | 464 | 565 | 2,905,911 | ||||||||||||||

| Westbrook Energy Center | NPCC | ME | Combined Cycle | 100 | % | 552 | 552 | 2,864,339 | ||||||||||||||

| Greenfield Energy Center(8) | NPCC | ON | Combined Cycle | 100 | % | 863 | 1,058 | 3,958,183 | ||||||||||||||

| Zion Energy Center(7) | RFC | IL | Simple Cycle | 100 | % | — | 503 | 387,686 | ||||||||||||||

| Pine Bluff Energy Center | SERC | AR | Cogen | 100 | % | 184 | 215 | 1,221,233 | ||||||||||||||

| Cumberland Energy Center(7) | RFC | NJ | Simple Cycle | 100 | % | — | 191 | 72,093 | ||||||||||||||

| Kennedy International Airport Power Plant(7) | NPCC | NY | Cogen | N/A | 110 | 125 | 350,835 | |||||||||||||||

| Sherman Avenue Energy Center(7) | RFC | NJ | Simple Cycle | 100 | % | — | 92 | 25,736 | ||||||||||||||

| Bethpage Energy Center 3 | NPCC | NY | Combined Cycle | 100 | % | 60 | 80 | 180,514 | ||||||||||||||

| Bethpage Power Plant | NPCC | NY | Combined Cycle | 100 | % | 55 | 56 | 197,281 | ||||||||||||||

| Christiana Energy Center | RFC | DE | Simple Cycle | 100 | % | — | 53 | 172 | ||||||||||||||

| Bethpage Peaker | NPCC | NY | Simple Cycle | 100 | % | — | 48 | 66,095 | ||||||||||||||

| Stony Brook Power Plant(7) | NPCC | NY | Cogen | 100 | % | 45 | 47 | 277,240 | ||||||||||||||

| Tasley Energy Center | RFC | VA | Simple Cycle | 100 | % | — | 33 | 693 | ||||||||||||||

| Delaware City Energy Center | RFC | DE | Simple Cycle | 100 | % | — | 23 | 4,327 | ||||||||||||||

| West Energy Center | RFC | DE | Simple Cycle | 100 | % | — | 20 | 4,105 | ||||||||||||||

| Bayview Energy Center | RFC | VA | Simple Cycle | 100 | % | — | 12 | 886 | ||||||||||||||

| Crisfield Energy Center | RFC | MD | Simple Cycle | 100 | % | — | 10 | 682 | ||||||||||||||

| Vineland Solar Energy Center | RFC | NJ | Renewable | 100 | % | — | 4 | 5,779 | ||||||||||||||

| Subtotal | 7,107 | 9,733 | 36,581,182 | |||||||||||||||||||

| Total operating power plants and battery storage facilities | 79 | 23,726 | 27,802 | 110,499,421 | ||||||||||||||||||

9

| SEGMENT/Power Plant | NERC

Region | U.S.

State or Canadian Province | Technology | Calpine

Interest Percentage | Calpine

Net Interest Baseload (MW)(1)(3) | Calpine Net Interest With Peaking (MW)(2)(3) | 2024 Total MWh Generated(4) | |||||||||||||||

| Projects under construction | ||||||||||||||||||||||

| Nova Power Storage Project - Phase V(9) | WECC | CA | Battery Storage | 100 | % | 60 | 60 | n/a | ||||||||||||||

| North Geysers Development(11) | WECC | CA | Renewable | 100 | % | 25 | 25 | n/a | ||||||||||||||

| Pin Oak Creek Energy Center, LLC(12) | TRE | TX | Combined Cycle | 100 | % | — | 425 | n/a | ||||||||||||||

| Pastoria Solar Project | WECC | CA | Renewable | 100 | % | 105 | 105 | n/a | ||||||||||||||

| Total operating power plants, battery storage facilities and projects under construction | 23,916 | 28,417 | ||||||||||||||||||||

| (1) | Natural gas-fired fleet capacities are generally derived on as-built as-designed outputs, including upgrades, based on site specific annual average temperatures and average process steam flows for cogeneration. |

| (2) | Natural gas-fired fleet peaking capacities are primarily derived on as-built-as-designed peaking outputs based on site-specific average summer temperatures and include power enhancement features such as heat recovery steam generator duct-firing, gas turbine power augmentation and/or other power augmentation features. For certain power plants with definitive contracts, capacities at contract conditions have been included. Oil-fired capacities reflect capacity test results. Battery storage capacity is based on installed MW. |

| (3) | These outputs do not factor in the typical MW loss and recovery profiles over time, which natural gas-fired turbine power plants display associated with their planned major maintenance schedules. |

| (4) | MWh generation for our power generation facilities and capacity for our battery storage facilities is shown here as our net operating interest. |

| (5) | The Santa Ana battery storage facility is a four-hour duration battery installation comprised of three phases with a total capacity of 80 MW - phase I for 20 MW/80 MWh, phase II for 20 MW/80 MWh and phase III for 40 MW/160 MWh. |

| (6) | Pasadena comprises 260 MW of CoGen technology and 521 MW of combined cycle (non-CoGen) technology. |

| (7) | These power plants have dual-fuel capability. |

| (8) | Prior to September 5, 2023, Calpine held a 50% partnership interest in Greenfield L.P. (“Greenfield Energy Centre L.P.”, “Greenfield Energy Centre”) through its subsidiaries. On September 5, 2023, we acquired the remaining 50% partner's interest. The facility continues to be operated by a third party. |

| (9) | The Nova Battery Power Bank is a four-hour duration battery installation comprised of five phases. Phases I-IV are currently operational (620 MW/2,480 MWh) and Phase V is currently under construction (60 MW/240 MWh). |

| (10) | The Bear Canyon battery storage facility is a four-hour duration battery installation (13 MW/52 MWh), and West Ford Flat battery storage facility is a four-hour duration battery installation (25 MW/100 MWh). |

| (11) | North Geysers development represents a drilling expansion project expected to increase capacity at our Geysers Assets by 25 MW. |

| (12) | Pin Oak Creek Energy Center, LLC is a new 425 MW peaking facility that will be adjacent to our Freestone Energy Center and is currently under construction. |

| (13) | As of December 31, 2024, we own a 33% non-economic interest and a 28.5% economic interest in Gregory Power Holdings, LLC, an entity that owns a 385 MW combined cycle generation facility in Texas. We have entered into an LLC agreement with a third party, who currently owns the remaining 71.5% economic interest in the entity, and we have agreed to contribute up to a 45% economic interest in Gregory Power Holdings, LLC over time. |

Substantially, all the power plants and battery storage facilities in which we have an interest are located on sites we either own or lease long-term.

10

Wholesale Hedging, Optimization and Origination Efforts

Our commercial approach and platform allow us to enhance the value of individual power plants and our fleet as a whole. Our hedging program’s goal is to enhance profitability by making informed risk-adjusted decisions around power sales and fuel procurement. We have standing agreements in place that enable us to transact with an extensive number of customers and trading counterparties. This allows efficient access to markets and bilateral commercial opportunities. We also hold extensive natural gas transportation and storage agreements that allow us to source reliable and cost-effective fuel for our facilities and to benefit from fuel price variations across the United States. This participation in the markets yields market knowledge and perspectives that inform our hedging decisions. Starting and replicating a commercial platform of this scale and diversity would be a difficult and costly multi-year effort, if possible.

At any point, the relative quantity of our products hedged or sold under longer-term contracts is determined by the availability of forward product sales opportunities and our view of the attractiveness of the pricing available for forward sales. We have economically hedged a portion of our expected generation and natural gas portfolio as well as retail load supply obligations, where appropriate, primarily through power and natural gas forward physical and financial transactions, including retail power sales; however, we currently remain susceptible to significant price movements for 2025 and beyond. When we elect to enter into these transactions, we are able to economically hedge a portion of our Spark Spread at predetermined generation and price levels.

We have also historically used interest rate derivative instruments to adjust the mix between our fixed and variable rate debt. To the extent eligible, our interest rate derivative instruments have been designated as cash flow hedges. Changes in fair value are recorded in OCI, with gains and losses reclassified into earnings in the same period during which the hedged forecasted transaction affects earnings.

New Asset Development Efforts

We are pursuing a growth strategy that leverages our specific expertise and complements our existing operations. We expect our growth to stem from three broad channels: growth from our existing assets, development of new assets and inorganic growth. Since 1998, Calpine has developed approximately 28 GW of generation across the United States, enough electricity to power approximately 27 million homes. We have successfully developed natural gas, geothermal, battery storage and solar assets, and our experienced development team continually seeks out and evaluates opportunities to grow our businesses organically. We have expertise in all areas of the project development process, from state and federal permitting to interconnection evaluation, equipment procurement, thermal design, project financing and construction management. We have multiple battery storage, geothermal and natural gas assets under development. In addition to new generation facilities, we are working towards potential retrofits of existing natural gas facilities to capture carbon dioxide (“CO2”) from the flue gas for permanent storage in geologic formations.

Battery Storage

We are currently operational on Phases I – IV (out of five total phases) of one of the world’s largest battery storage projects, the 680 MW Nova Power Battery Storage Facilities in Menifee, California, and we have several other battery storage projects under construction or in development. Our pipeline of identified projects is primarily comprised of sites where we have existing land, infrastructure and/or transmission rights, which greatly facilitate the development of new battery storage.

Geothermal

As the owners of the world’s largest geothermal power plant complex, The Geysers, we look for opportunities to both increase the efficiency of our existing fleet and to expand and build new generating assets. We currently have an expansion underway at The Geysers that is expected to increase capacity by 25 MW via additional steam production wells in the northern part of the field. We continue to pursue opportunities to increase the output of our Geysers project as we look to increase the supply of low-carbon, dispatchable power that we are able to provide from our geothermal fleet.

Natural Gas

We believe that natural gas-fired generation will play a critical role in the U.S., given its low air emissions, high reliability and potential for future carbon abatement opportunities. In Texas, we are under construction for the 425 MW Pin Oak Creek Energy Center, LLC project adjacent our existing Freestone facility, and we are advancing the development of a natural gas combined cycle gas turbine (“CCGT”) expansion at the Gregory Facility in Corpus Christi in partnership with an industrial customer. We also have additional gas developments underway in cooperation with our customers. Our development team has significant expertise in developing gas projects, which allows us to successfully develop new gas projects in an environment where others may be challenged.

11

Carbon Capture

Our fleet includes multiple facilities located proximate to favorable carbon dioxide sequestration geology, and we have identified an initial pipeline of facilities that we believe might be good candidates for the application of post-combustion carbon capture technology. As part of our effort to advance these potential projects, we have completed or commenced front-end engineering design studies at five facilities partially funded by the Department of Energy (“DOE”), have executed the first phase with DOE’s Office of Clean Energy Demonstrations for cost-sharing awards of up to $270 million each for two full-scale demonstration projects — at our Baytown Energy Center east of Houston in Texas and our Sutter Energy Center near Sacramento in California. We are currently operating with a partner, Ion Energy, a DOE-funded pilot-scale carbon capture facility at our Los Medanos facility in California, the only pilot attached to an operating natural gas combined cycle facility in the world. The Baytown and Sutter projects have the potential to sequester up to 3.75 million metric tons of CO2 annually. Decisions to move construction forward on both projects are contingent on successfully completing several remaining milestones, including achieving sufficient returns after executing long-term customer contracts for decarbonized generation facility output.

Our Retail Businesses

Calpine is one of the nation’s largest retail energy providers, supplying electricity, gas and energy solutions to a diverse mix of customers across the United States. Calpine Retail, comprised of Calpine Energy Solutions, LLC and Champion Energy Marketing, LLC (“Champion,” “Champion Energy Services” or “Champion Energy”), engages our retail customers in a consultative sales approach to create innovative, tailored energy management products and services. We offer a wide range of retail power and gas products, both fixed price and index, with tenors varying based on the needs of each customer segment. By design, our retail operations overlap with our generation business, as this facilitates our ability to provide customers with access to clean, flexible and reliable electricity. Our leading retail business has a presence across all competitive retail markets in America, with our service area of 21 states.

Calpine Energy Solutions

Solutions, one of the largest energy suppliers in North America, is a licensed retail energy provider in every deregulated state. Solutions’ customers are mostly large commercial, industrial or institutional entities whose energy needs represent a significant part of their businesses, with a peak load of approximately 6,600 MW. Solutions employs a direct, consultative sales approach, offers bespoke products and leverages a proprietary framework to help customers manage their energy cost, risk and carbon exposure. In 2024, Solutions was re-accredited as a silver renewable energy partner by the Carbon Disclosure Project (“CDP”), which runs the world’s leading disclosure system for environmental impact.

Champion Energy Services

Champion is widely known for its customer service and straightforward and innovative pricing plans in Texas. Its peak load is approximately 1,700 MW and comprises residential, commercial and industrial customers, with coverage in most of the broadly deregulated states, largely Texas for residential customers.

Active External Engagement

Calpine’s business is at the intersection of heavy capital deployment, complex microeconomics and high-profile public policy. Through active external engagement with key stakeholders on behalf of our business and customers, we believe we can support the effective design and operation of the electric markets. As America’s largest generator of electricity from natural gas and geothermal resources, according to S&P Global Market Intelligence, and the owner of one of the nation’s largest retail energy providers, we bring an informed perspective to public policy discussions at the state, regional and national levels. Our Government and Regulatory Affairs personnel have become trusted experts on important issues affecting electric reliability and economics, earning us a seat at the table when key issues are being debated.

12

Emissions and Our Environmental Profile

The environmental profile of our power plants reflects our commitment to environmental stewardship. We believe we have invested the capital necessary to develop a power generation portfolio with substantially lower air emissions than our major competitors’ power plants that use other fossil fuels, such as coal. In addition, we strive to preserve our nation’s valuable water and land resources. With efficient technology and use of cleaner fuel, our plants have a smaller footprint and less hazardous waste generation compared to coal. In 2023, our GHG emissions from natural gas combustion amounted to approximately 48.9 million metric tons with a net electric generation of approximately 119 million megawatts-hour. In addition, we aim to further reduce our environmental footprint in the future by implementing carbon capture technology at many of our facilities and further developing and using battery storage facilities, which is expected to lower our emissions intensity per kilowatt-hour provided, as the battery storage facilities are expected to primarily be charged by renewable power.

Natural Gas-Fired Generation

Our fleet consumes significantly less fuel to generate power than conventional boiler/steam turbine power plants. It emits fewer air pollutants per MWh of power produced as compared to coal-fired or oil-fired power plants. Our power plants all have air emissions controls, which seek to reduce emissions such as Nitrogen Oxides (“NOx”), a precursor of atmospheric ozone and acid rain. The table below summarizes approximate air pollutant emission rates from our power plants compared to the average emission rates from U.S. coal, oil and natural gas-fired power plants as a group, based on the most recent statistics available.

| Air Pollutant Emission Rates - Pounds of Pollutant Emitted Lbs/MWh of Power Generated | ||||||||||||

| Air Pollutants | Average

U.S. Coal, Oil and Natural Gas-Fired Power Plant(1) | Calpine Power Plants (2) | Advantage Compared to Average U.S. Coal, Oil and Natural Gas- Fired Power Plant | |||||||||

| Nitrogen Oxides, NOx | 0.98 | 0.13 | 87.2 | % | ||||||||

| Acid rain, smog and fine particulate formation | ||||||||||||

| Sulfur Dioxide, SO2 | 0.7450 | 0.0046 | 99.4 | % | ||||||||

| Acid rain and fine particulate formation | ||||||||||||

| Mercury Compounds(3) | 0.000002400 | 0.000000029 | 98.8 | % | ||||||||

| Neurotoxin | ||||||||||||

| Carbon Dioxide, CO2 | 1,345 | 906 | 32.7 | % | ||||||||

| Principal GHG - contributor to climate change | ||||||||||||

| (1) | The average U.S. coal, oil and natural gas-fired power plants’ emission rates were obtained from the U.S. Department of Energy’s Electric Power Annual Report for 2023. Emission rates are based on 2023 emissions and net generation. The U.S. Department of Energy has not yet released 2024 information. | |

| (2) | Our natural gas-fired, combined cycle power plant estimated emission rates are based on our 2023 emissions and power generation data from our natural gas-fired, combined power plants (excluding combined heat power plants) as measured under the Environmental Protection Agency (“EPA”) reporting requirements. | |

| (3) | The U.S. coal, oil and natural gas-fired power plant air emissions of mercury compounds were obtained from the EPA Toxics Release Inventory for 2024. Emission rates are based on 2023 emissions and net generation from the U.S. Department of Energy’s Electric Power Annual Report for 2023. |

Geothermal Generation

As a renewable energy source, our Geysers Assets do not burn fossil fuel and produce power with only negligible emissions of naturally emitted CO2, NOx and SO2 from the steam. Our Geysers Assets, which produce 8% of the renewable energy and 49% of the geothermal power in California, are helping to meet the state’s clean energy goals.

Water Conservation and Reclamation

We have also invested substantially in technologies and systems that reduce the effect of our operations on water as a natural resource: