Investor Presentation Fourth Quarter and Full Year 2025 Results

Forward-Looking Statements and Other Matters This presentation includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, liquidity and capital ratios, and other non-historical statements, including statements in the “2026 Strategic Priorities and Outlook” section of this presentation. Words or phrases such as “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “est imate,” “project,” “plans,” “strategy,” or similar expressions are intended to identify these forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements are necessarily subject to risk and uncertainty and actual results could differ materially from those anticipated due to various factors, including those set forth from time to time in the documents filed or furnished by Banc of California, Inc. (the “Company”) with the Securities and Exchange Commission (“SEC”). The Company undertakes no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made, except as required by law. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not l imited to: (i) changes in general economic conditions, either nationally or in our market areas, including the impact of tariffs, supply chain disruptions, and the risk of recession or an economic downturn; (ii) changes in the interest rate environment, including the recent and potential future changes in the FRB benchmark rate, which could adversely affect our revenue and expenses, the value of assets and obligations, the realization of deferred tax assets, the availability and cost of capital and liquidity, and the impacts of continuing or renewed inflation; (iii) the credit risks of lending activities, which may be affected by deterioration in real estate markets and the financial condition of borrowers, and the operational risk of lending activities, including the effectiveness of our underwriting practices and the risk of fraud, any of which may lead to increased loan delinquencies, losses, and non-performing assets, and may result in our allowance for credit losses not being adequate; (iv) fluctuations in the demand for loans, and fluctuations in commercial and residential real estate values in our market area; (v) the quality and composition of our securities portfolio; (vi) our ability to develop and maintain a strong core deposit base, including among our venture banking clients, or other low cost funding sources necessary to fund our activities particularly in a rising or high interest rate environment; (vii) the rapid withdrawal of a significant amount of demand deposits over a short period of time; (viii) the costs and effects of litigation; (ix) risks related to the Company’s acquisitions, including disruption to current plans and operations; difficulties in customer and employee retention; fees, expenses and charges related to these transactions being significantly higher than anticipated; and our inability to achieve expected revenues, cost savings, synergies, and other benefits; (x) results of examinations by regulatory authorities of the Company and the possibility that any such regulatory authority may, among other things, limit our business activities, restrict our ability to invest in certain assets, refrain from issuing an approval or non-objection to certain capital or other actions, increase our allowance for credit losses, result in write-downs of asset values, restrict our ability or that of our bank subsidiary to pay dividends, or impose fines, penalties or sanctions; (xi) legislative or regulatory changes that adversely affect our business, including changes in tax laws and policies, accounting policies and practices, privacy laws, and regulatory capital or other rules; (xii) the risk that our enterprise risk management framework may not be effective in mitigating risk and reducing the potential for losses; (xiii) errors in estimates of the fair values of certain of our assets and liabilities, as well as the value of collateral supporting our loans, which may result in significant changes in valuation or recoveries; (xiv) failures or security breaches with respect to the network, applications, vendors and computer systems on which we depend, including due to cybersecurity threats; (xv) our ability to attract and retain key members of our senior management team; (xvi) the effects of climate change, severe weather events, natural disasters such as earthquakes and wildfires, pandemics, epidemics and other public health crises, acts of war or terrorism, and other external events on our business; (xvii) the impact of bank failures or other adverse developments at other banks on general depositor and investor sentiment regarding the stability and liquidity of banks; (xviii) the possibility that our recorded goodwill could become impaired, which may have an adverse impact on our earnings and capital; (xix) our existing indebtedness, together with any future incurrence of additional indebtedness, could adversely affect our ability to raise additional capital and to meet our debt obligations; (xx) the risk that we may incur significant losses on future asset sales or may not be able to execute anticipated asset sales; and (xxi) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services and the other risks described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and from time to time in other documents that we file with or furnish to the SEC. Included in this presentation are certain non-GAAP financial measures, such as tangible assets, tangible common equity ratio, tangible book value per common share, adjusted net earnings, adjusted earnings per share, return on average tangible common equity, adjusted return on average tangible common equity, pre-tax pre-provision income, adjusted noninterest expense, adjusted noninterest expense to average assets, efficiency ratio, adjusted efficiency ratio, core deposits, core loans, economic coverage ratio, and adjusted ACL ratio, designed to complement the financial information presented in accordance with U.S. GAAP because management believes such measures are useful to investors. These non-GAAP financial measures should be considered only as supplemental to, and not superior to, financial measures provided in accordance with GAAP. Please refer to the “Non-GAAP Financial Information” and “Non-GAAP Reconciliation” sections of the appendix of this presentation for additional detail including reconciliations of non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP financial measures, including ROTCE future state targets. For the same reasons, we are unable to address the probable significance of the unavailable information, which could be material to future results. Fourth Quarter 2025 Earnings | 2

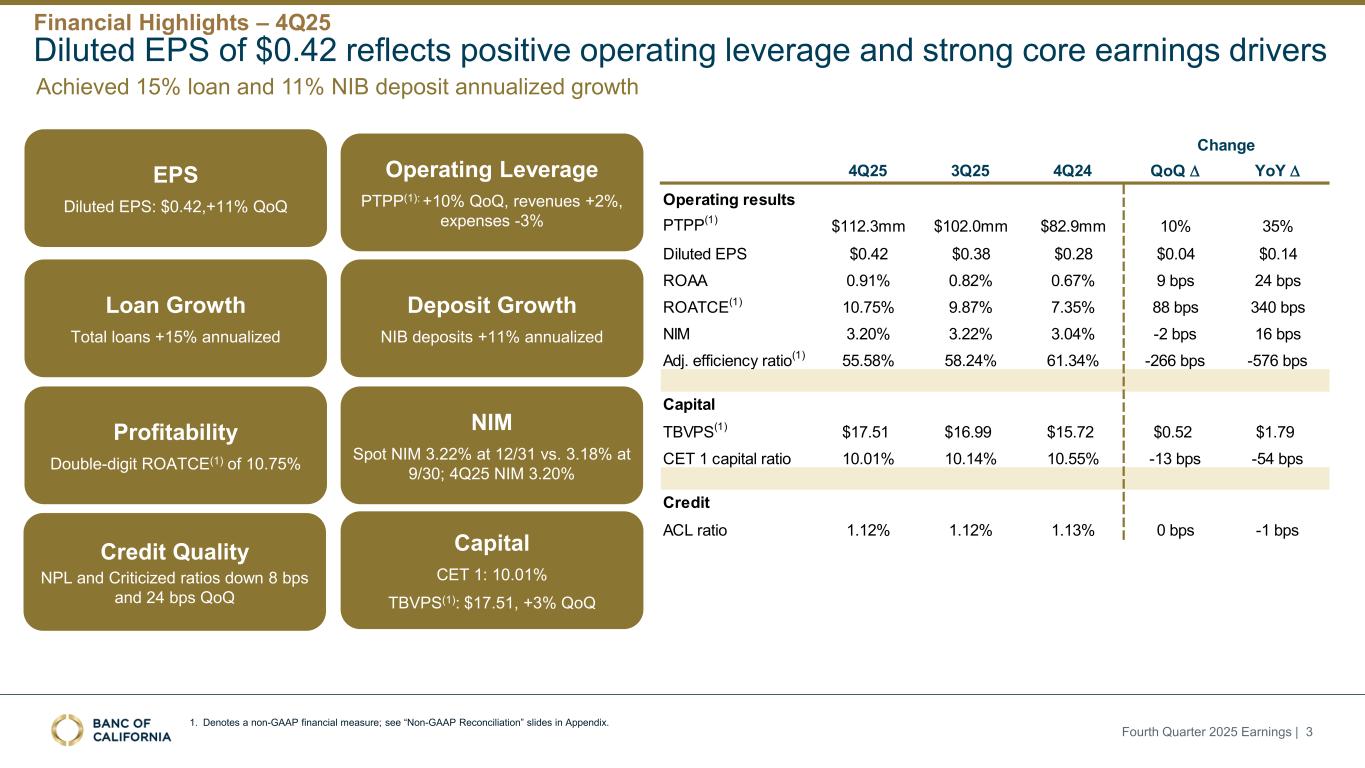

1. Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides in Appendix. Diluted EPS of $0.42 reflects positive operating leverage and strong core earnings drivers EPS Diluted EPS: $0.42,+11% QoQ Operating Leverage PTPP(1): +10% QoQ, revenues +2%, expenses -3% Profitability Double-digit ROATCE(1) of 10.75% Credit Quality NPL and Criticized ratios down 8 bps and 24 bps QoQ Loan Growth Total loans +15% annualized Deposit Growth NIB deposits +11% annualized NIM Spot NIM 3.22% at 12/31 vs. 3.18% at 9/30; 4Q25 NIM 3.20% Capital CET 1: 10.01% TBVPS(1): $17.51, +3% QoQ Fourth Quarter 2025 Earnings | 3 Financial Highlights – 4Q25 Change 4Q25 3Q25 4Q24 QoQ D YoY D Operating results PTPP(1) $112.3mm $102.0mm $82.9mm 10% 35% Diluted EPS $0.42 $0.38 $0.28 $0.04 $0.14 ROAA 0.91% 0.82% 0.67% 9 bps 24 bps ROATCE(1) 10.75% 9.87% 7.35% 88 bps 340 bps NIM 3.20% 3.22% 3.04% -2 bps 16 bps Adj. efficiency ratio(1) 55.58% 58.24% 61.34% -266 bps -576 bps Capital TBVPS(1) $17.51 $16.99 $15.72 $0.52 $1.79 CET 1 capital ratio 10.01% 10.14% 10.55% -13 bps -54 bps Credit ACL ratio 1.12% 1.12% 1.13% 0 bps -1 bps Achieved 15% loan and 11% NIB deposit annualized growth

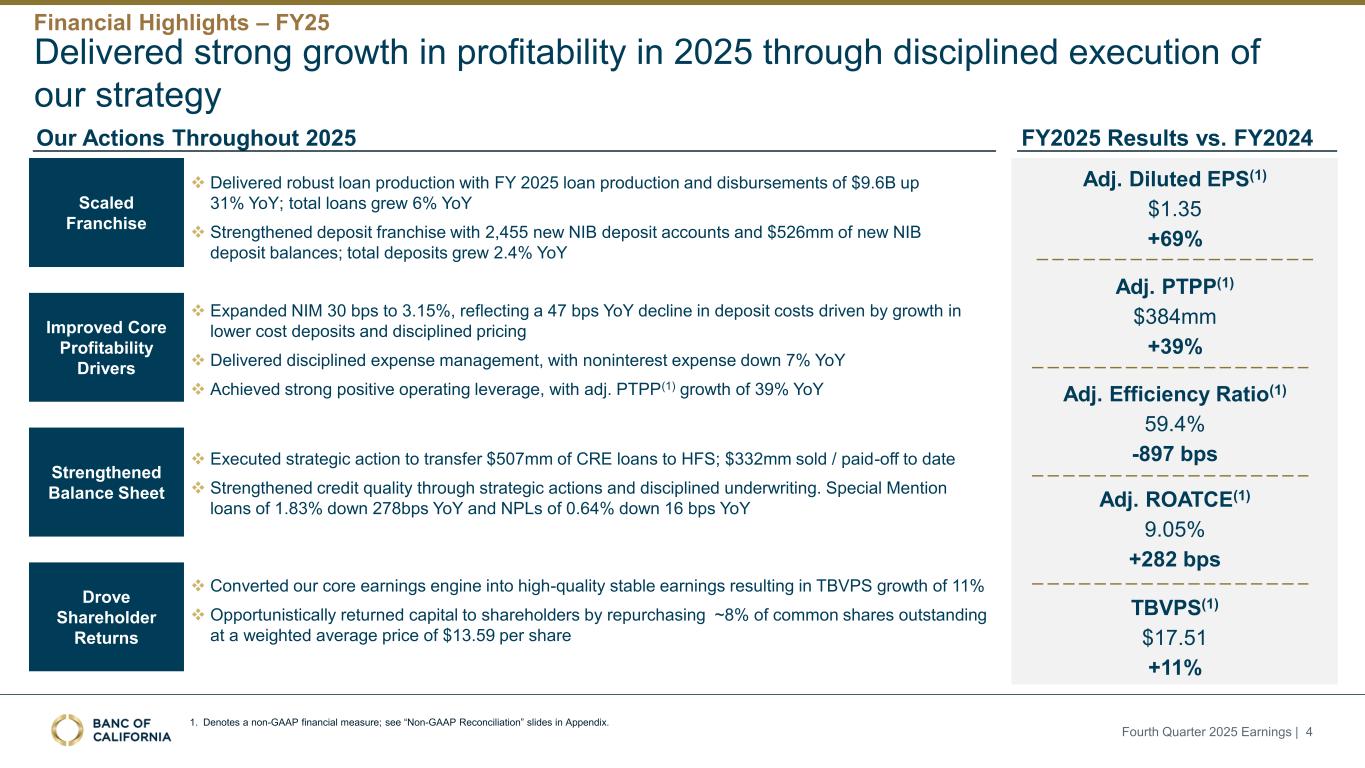

1. Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides in Appendix. Fourth Quarter 2025 Earnings | 4 Financial Highlights – FY25 Delivered strong growth in profitability in 2025 through disciplined execution of our strategy Adj. Diluted EPS(1) $1.35 +69% Adj. Efficiency Ratio(1) 59.4% -897 bps Adj. ROATCE(1) 9.05% +282 bps TBVPS(1) $17.51 +11% ❖ Delivered robust loan production with FY 2025 loan production and disbursements of $9.6B up 31% YoY; total loans grew 6% YoY ❖ Strengthened deposit franchise with 2,455 new NIB deposit accounts and $526mm of new NIB deposit balances; total deposits grew 2.4% YoY Adj. PTPP(1) $384mm +39% FY2025 Results vs. FY2024Our Actions Throughout 2025 Scaled Franchise ❖ Expanded NIM 30 bps to 3.15%, reflecting a 47 bps YoY decline in deposit costs driven by growth in lower cost deposits and disciplined pricing ❖ Delivered disciplined expense management, with noninterest expense down 7% YoY ❖ Achieved strong positive operating leverage, with adj. PTPP(1) growth of 39% YoY Improved Core Profitability Drivers ❖ Executed strategic action to transfer $507mm of CRE loans to HFS; $332mm sold / paid-off to date ❖ Strengthened credit quality through strategic actions and disciplined underwriting. Special Mention loans of 1.83% down 278bps YoY and NPLs of 0.64% down 16 bps YoY Strengthened Balance Sheet ❖ Converted our core earnings engine into high-quality stable earnings resulting in TBVPS growth of 11% ❖ Opportunistically returned capital to shareholders by repurchasing ~8% of common shares outstanding at a weighted average price of $13.59 per share Drove Shareholder Returns

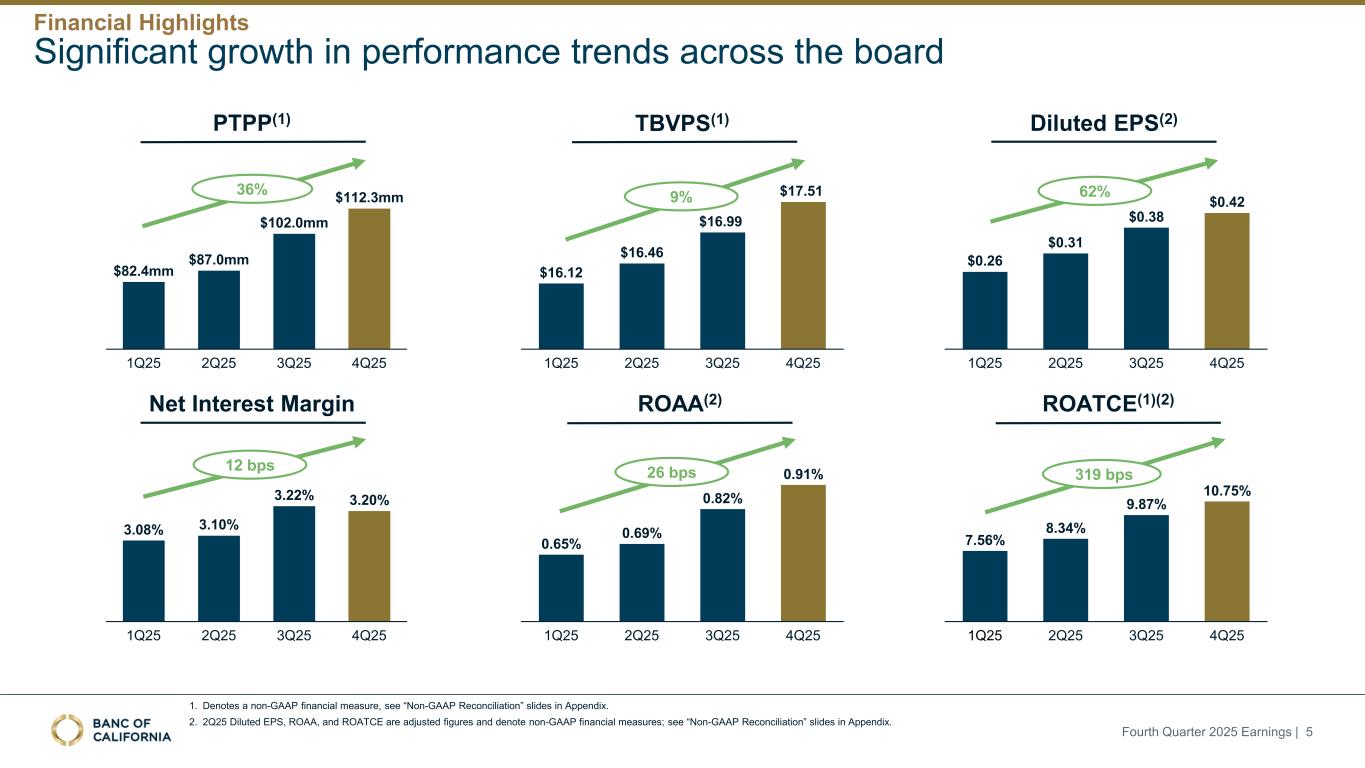

ROAA(2) Diluted EPS(2)PTPP(1) Significant growth in performance trends across the board ROATCE(1)(2) 1. Denotes a non-GAAP financial measure, see “Non-GAAP Reconciliation” slides in Appendix. 2. 2Q25 Diluted EPS, ROAA, and ROATCE are adjusted figures and denote non-GAAP financial measures; see “Non-GAAP Reconciliation” slides in Appendix. TBVPS(1) Net Interest Margin $0.26 $0.31 $0.38 $0.42 1Q25 2Q25 3Q25 4Q25 $82.4mm $87.0mm $102.0mm $112.3mm 1Q25 2Q25 3Q25 4Q25 1Q25 2Q25 3Q25 4Q25 0.65% 0.69% 0.82% 0.91% 1Q25 2Q25 3Q25 4Q25 7.56% 8.34% 9.87% 10.75% $16.12 $16.46 $16.99 $17.51 1Q25 2Q25 3Q25 4Q25 Fourth Quarter 2025 Earnings | 5 3.08% 3.10% 3.22% 3.20% 1Q25 2Q25 3Q25 4Q25 36% 62%9% 12 bps 26 bps 319 bps Financial Highlights

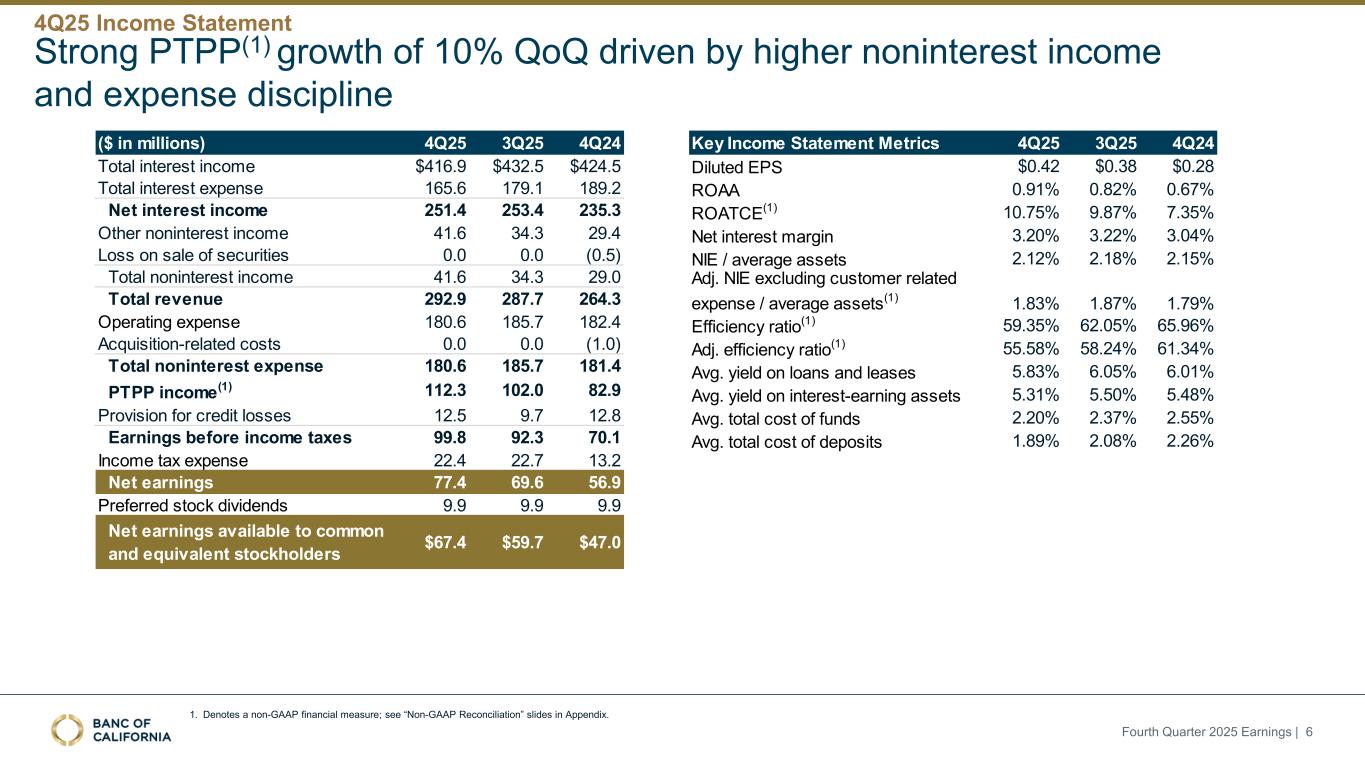

1. Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides in Appendix. Strong PTPP(1) growth of 10% QoQ driven by higher noninterest income and expense discipline Fourth Quarter 2025 Earnings | 6 4Q25 Income Statement ($ in millions) 4Q25 3Q25 4Q24 Total interest income $416.9 $432.5 $424.5 Total interest expense 165.6 179.1 189.2 Net interest income 251.4 253.4 235.3 Other noninterest income 41.6 34.3 29.4 Loss on sale of securities 0.0 0.0 (0.5) Total noninterest income 41.6 34.3 29.0 Total revenue 292.9 287.7 264.3 Operating expense 180.6 185.7 182.4 Acquisition-related costs 0.0 0.0 (1.0) Total noninterest expense 180.6 185.7 181.4 PTPP income(1) 112.3 102.0 82.9 Provision for credit losses 12.5 9.7 12.8 Earnings before income taxes 99.8 92.3 70.1 Income tax expense 22.4 22.7 13.2 Net earnings 77.4 69.6 56.9 Preferred stock dividends 9.9 9.9 9.9 Net earnings available to common and equivalent stockholders $67.4 $59.7 $47.0 Key Income Statement Metrics 4Q25 3Q25 4Q24 Diluted EPS $0.42 $0.38 $0.28 ROAA 0.91% 0.82% 0.67% ROATCE(1) 10.75% 9.87% 7.35% Net interest margin 3.20% 3.22% 3.04% NIE / average assets 2.12% 2.18% 2.15% Adj. NIE excluding customer related expense / average assets(1) 1.83% 1.87% 1.79% Efficiency ratio(1) 59.35% 62.05% 65.96% Adj. efficiency ratio(1) 55.58% 58.24% 61.34% Avg. yield on loans and leases 5.83% 6.05% 6.01% Avg. yield on interest-earning assets 5.31% 5.50% 5.48% Avg. total cost of funds 2.20% 2.37% 2.55% Avg. total cost of deposits 1.89% 2.08% 2.26%

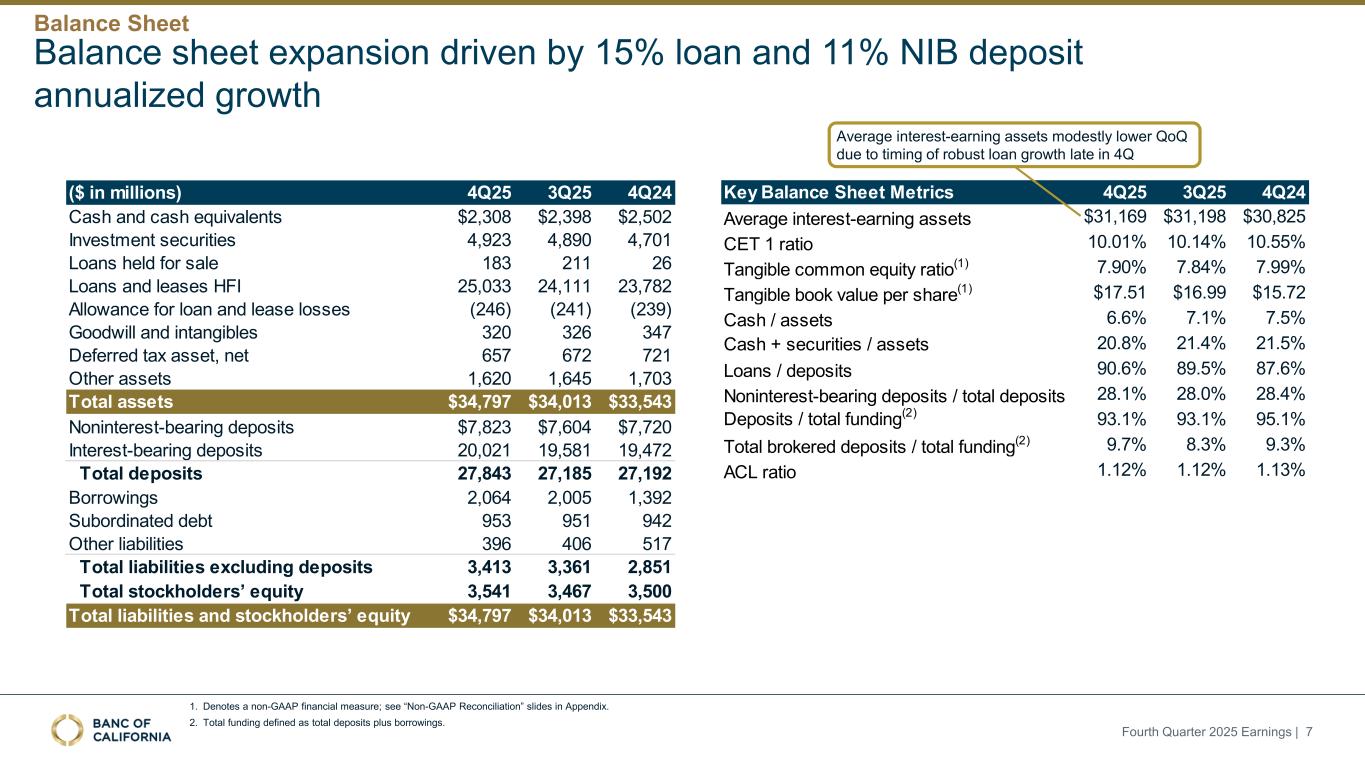

Balance sheet expansion driven by 15% loan and 11% NIB deposit annualized growth 1. Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides in Appendix. 2. Total funding defined as total deposits plus borrowings. Fourth Quarter 2025 Earnings | 7 Balance Sheet ($ in millions) 4Q25 3Q25 4Q24 Cash and cash equivalents $2,308 $2,398 $2,502 Investment securities 4,923 4,890 4,701 Loans held for sale 183 211 26 Loans and leases HFI 25,033 24,111 23,782 Allowance for loan and lease losses (246) (241) (239) Goodwill and intangibles 320 326 347 Deferred tax asset, net 657 672 721 Other assets 1,620 1,645 1,703 Total assets $34,797 $34,013 $33,543 Noninterest-bearing deposits $7,823 $7,604 $7,720 Interest-bearing deposits 20,021 19,581 19,472 Total deposits 27,843 27,185 27,192 Borrowings 2,064 2,005 1,392 Subordinated debt 953 951 942 Other liabilities 396 406 517 Total liabilities excluding deposits 3,413 3,361 2,851 Total stockholders’ equity 3,541 3,467 3,500 Total liabilities and stockholders’ equity $34,797 $34,013 $33,543 Key Balance Sheet Metrics 4Q25 3Q25 4Q24 Average interest-earning assets $31,169 $31,198 $30,825 CET 1 ratio 10.01% 10.14% 10.55% Tangible common equity ratio(1) 7.90% 7.84% 7.99% Tangible book value per share(1) $17.51 $16.99 $15.72 Cash / assets 6.6% 7.1% 7.5% Cash + securities / assets 20.8% 21.4% 21.5% Loans / deposits 90.6% 89.5% 87.6% Noninterest-bearing deposits / total deposits 28.1% 28.0% 28.4% Deposits / total funding(2) 93.1% 93.1% 95.1% Total brokered deposits / total funding(2) 9.7% 8.3% 9.3% ACL ratio 1.12% 1.12% 1.13% Average interest-earning assets modestly lower QoQ due to timing of robust loan growth late in 4Q

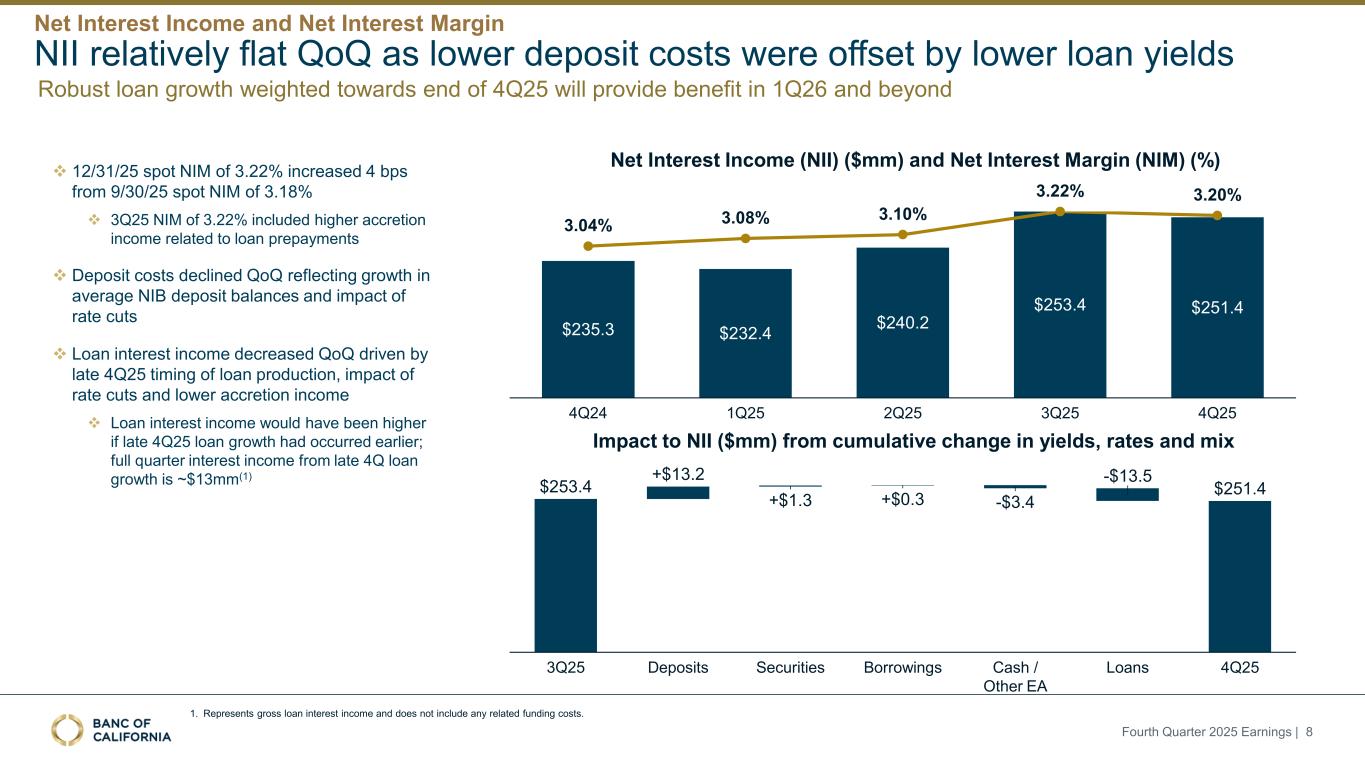

Net Interest Income (NII) ($mm) and Net Interest Margin (NIM) (%) Impact to NII ($mm) from cumulative change in yields, rates and mix 3Q25 Deposits +$1.3 Securities +$0.3 Borrowings -$3.4 Cash / Other EA -$13.5 Loans 4Q25 $253.4 +$13.2 $251.4 $235.3 $232.4 $240.2 $253.4 $251.4 3.04% 4Q24 3.08% 1Q25 3.10% 2Q25 3.22% 3Q25 3.20% 4Q25 NII relatively flat QoQ as lower deposit costs were offset by lower loan yields Fourth Quarter 2025 Earnings | 8 Net Interest Income and Net Interest Margin ❖ 12/31/25 spot NIM of 3.22% increased 4 bps from 9/30/25 spot NIM of 3.18% ❖ 3Q25 NIM of 3.22% included higher accretion income related to loan prepayments ❖ Deposit costs declined QoQ reflecting growth in average NIB deposit balances and impact of rate cuts ❖ Loan interest income decreased QoQ driven by late 4Q25 timing of loan production, impact of rate cuts and lower accretion income ❖ Loan interest income would have been higher if late 4Q25 loan growth had occurred earlier; full quarter interest income from late 4Q loan growth is ~$13mm(1) Robust loan growth weighted towards end of 4Q25 will provide benefit in 1Q26 and beyond 1. Represents gross loan interest income and does not include any related funding costs.

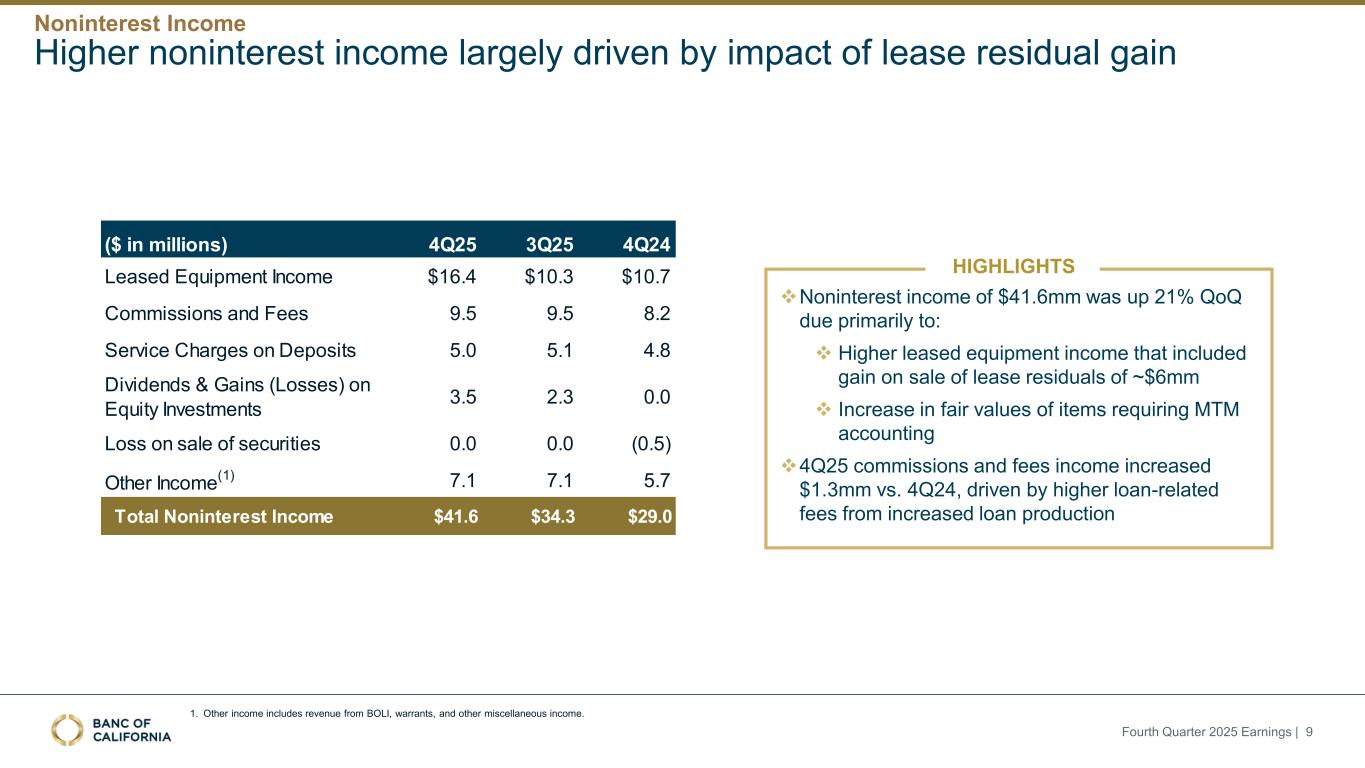

1. Other income includes revenue from BOLI, warrants, and other miscellaneous income. Higher noninterest income largely driven by impact of lease residual gain Fourth Quarter 2025 Earnings | 9 HIGHLIGHTS ❖Noninterest income of $41.6mm was up 21% QoQ due primarily to: ❖ Higher leased equipment income that included gain on sale of lease residuals of ~$6mm ❖ Increase in fair values of items requiring MTM accounting ❖4Q25 commissions and fees income increased $1.3mm vs. 4Q24, driven by higher loan-related fees from increased loan production ($ in millions) 4Q25 3Q25 4Q24 Leased Equipment Income $16.4 $10.3 $10.7 Commissions and Fees 9.5 9.5 8.2 Service Charges on Deposits 5.0 5.1 4.8 Dividends & Gains (Losses) on Equity Investments 3.5 2.3 0.0 Loss on sale of securities 0.0 0.0 (0.5) Other Income (1) 7.1 7.1 5.7 Total Noninterest Income $41.6 $34.3 $29.0 Noninterest Income

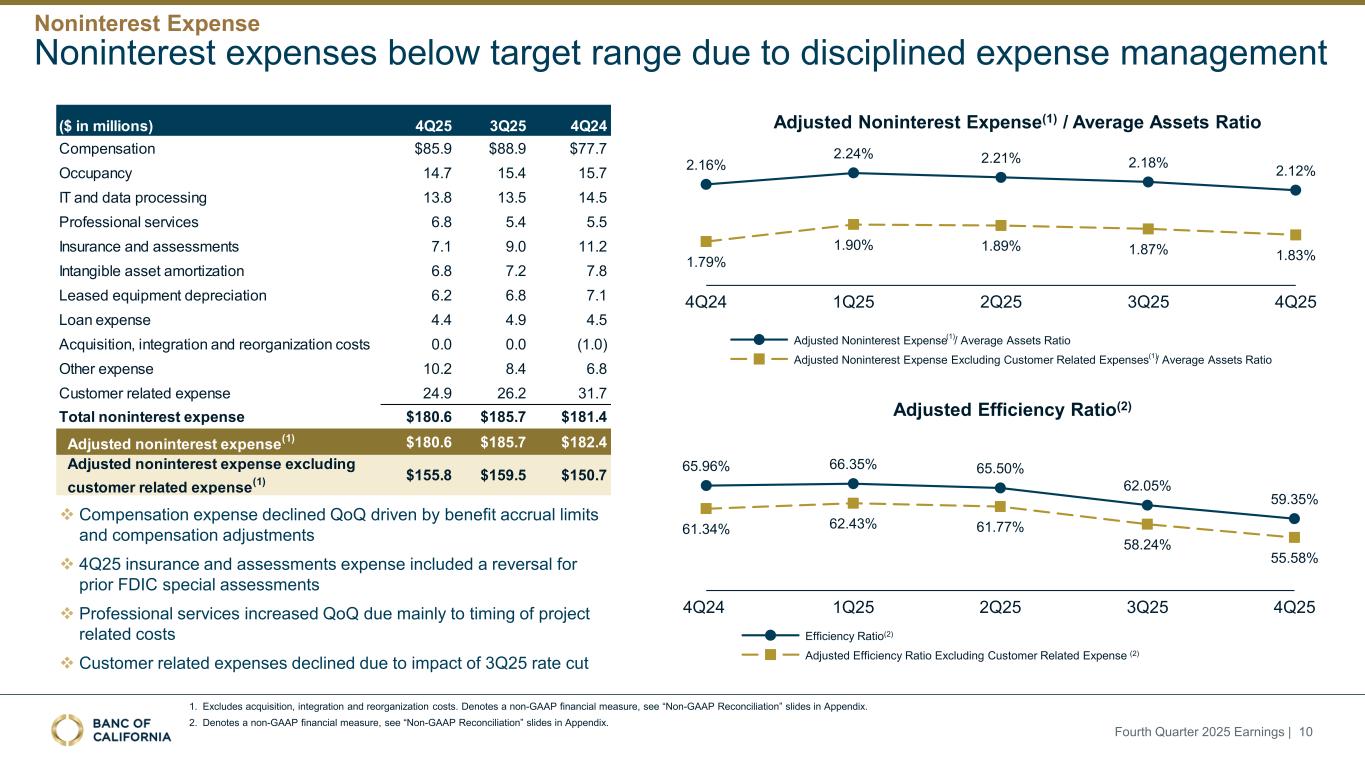

❖ Compensation expense declined QoQ driven by benefit accrual limits and compensation adjustments ❖ 4Q25 insurance and assessments expense included a reversal for prior FDIC special assessments ❖ Professional services increased QoQ due mainly to timing of project related costs ❖ Customer related expenses declined due to impact of 3Q25 rate cut Adjusted Noninterest Expense(1) / Average Assets Ratio 1. Excludes acquisition, integration and reorganization costs. Denotes a non-GAAP financial measure, see “Non-GAAP Reconciliation” slides in Appendix. 2. Denotes a non-GAAP financial measure, see “Non-GAAP Reconciliation” slides in Appendix. Noninterest expenses below target range due to disciplined expense management 65.96% 66.35% 65.50% 62.05% 59.35% 61.34% 62.43% 61.77% 58.24% 55.58% 4Q24 1Q25 2Q25 3Q25 4Q25 Efficiency Ratio(2) Adjusted Efficiency Ratio Excluding Customer Related Expense (2) Adjusted Efficiency Ratio(2) Fourth Quarter 2025 Earnings | 10 ($ in millions) 4Q25 3Q25 4Q24 Compensation $85.9 $88.9 $77.7 Occupancy 14.7 15.4 15.7 IT and data processing 13.8 13.5 14.5 Professional services 6.8 5.4 5.5 Insurance and assessments 7.1 9.0 11.2 Intangible asset amortization 6.8 7.2 7.8 Leased equipment depreciation 6.2 6.8 7.1 Loan expense 4.4 4.9 4.5 Acquisition, integration and reorganization costs 0.0 0.0 (1.0) Other expense 10.2 8.4 6.8 Customer related expense 24.9 26.2 31.7 Total noninterest expense $180.6 $185.7 $181.4 Adjusted noninterest expense (1) $180.6 $185.7 $182.4 Adjusted noninterest expense excluding customer related expense (1) $155.8 $159.5 $150.7 2.16% 1.79% 4Q24 2.24% 1.90% 1Q25 2.21% 1.89% 2Q25 2.18% 1.87% 3Q25 2.12% 1.83% 4Q25 Adjusted Noninterest Expense / Average Assets Ratio Adjusted Noninterest Expense Excluding Customer Related Expenses / Average Assets Ratio Noninterest Expense (1) (1)

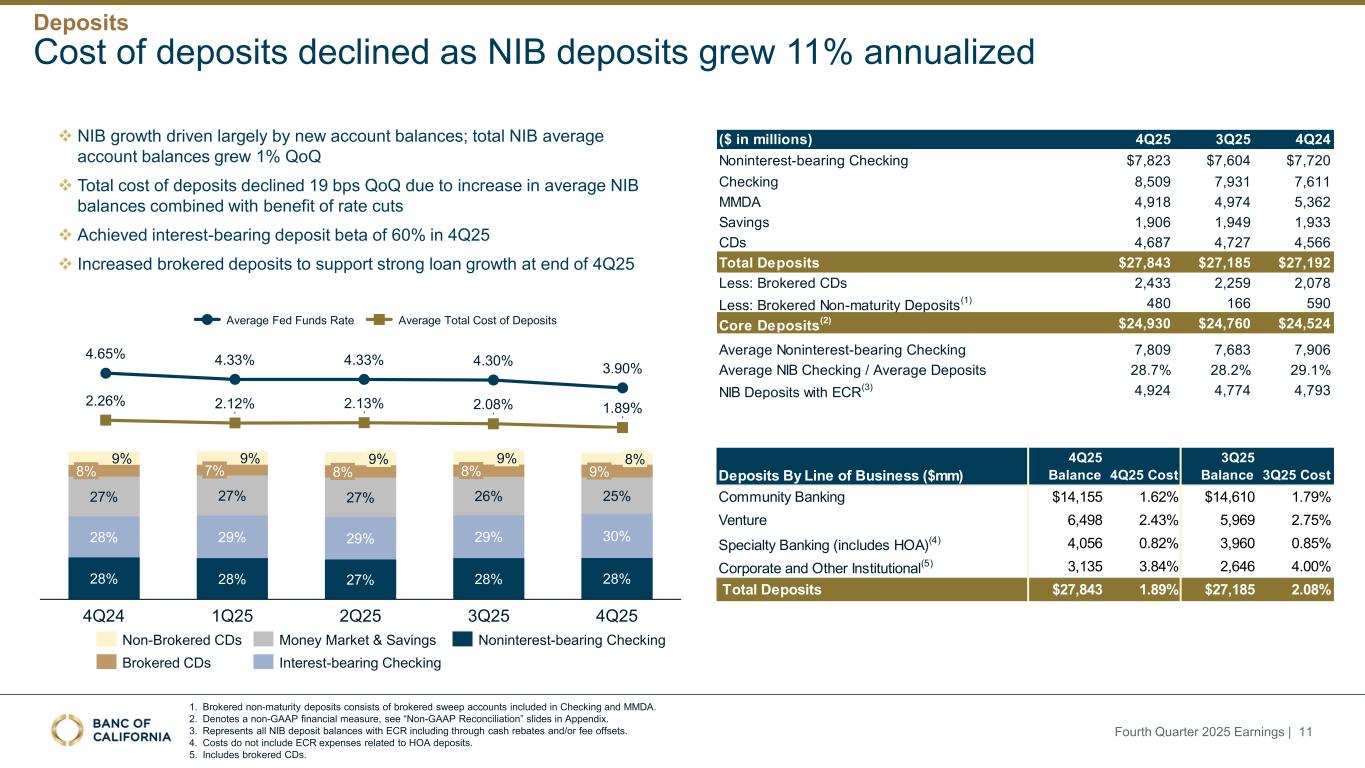

Cost of deposits declined as NIB deposits grew 11% annualized 4.65% 4.33% 4.33% 4.30% 3.90% 2.26% 2.12% 2.13% 2.08% 1.89% Average Fed Funds Rate Average Total Cost of Deposits 28% 28% 27% 28% 28% 28% 29% 29% 29% 30% 27% 27% 27% 26% 25% 9% 9% 8% 4Q24 7% 1Q25 8% 9% 2Q25 8% 9% 3Q25 9% 8% 4Q25 Non-Brokered CDs Brokered CDs Money Market & Savings Interest-bearing Checking Noninterest-bearing Checking 1. Brokered non-maturity deposits consists of brokered sweep accounts included in Checking and MMDA. 2. Denotes a non-GAAP financial measure, see “Non-GAAP Reconciliation” slides in Appendix. 3. Represents all NIB deposit balances with ECR including through cash rebates and/or fee offsets. 4. Costs do not include ECR expenses related to HOA deposits. 5. Includes brokered CDs. Fourth Quarter 2025 Earnings | 11 Deposits By Line of Business ($mm) 4Q25 Balance 4Q25 Cost 3Q25 Balance 3Q25 Cost Community Banking $14,155 1.62% $14,610 1.79% Venture 6,498 2.43% 5,969 2.75% Specialty Banking (includes HOA)(4) 4,056 0.82% 3,960 0.85% Corporate and Other Institutional(5) 3,135 3.84% 2,646 4.00% Total Deposits $27,843 1.89% $27,185 2.08% ❖ NIB growth driven largely by new account balances; total NIB average account balances grew 1% QoQ ❖ Total cost of deposits declined 19 bps QoQ due to increase in average NIB balances combined with benefit of rate cuts ❖ Achieved interest-bearing deposit beta of 60% in 4Q25 ❖ Increased brokered deposits to support strong loan growth at end of 4Q25 Deposits ($ in millions) 4Q25 3Q25 4Q24 Noninterest-bearing Checking $7,823 $7,604 $7,720 Checking 8,509 7,931 7,611 MMDA 4,918 4,974 5,362 Savings 1,906 1,949 1,933 CDs 4,687 4,727 4,566 Total Deposits $27,843 $27,185 $27,192 Less: Brokered CDs 2,433 2,259 2,078 Less: Brokered Non-maturity Deposits (1) 480 166 590 Core Deposits (2) $24,930 $24,760 $24,524 Average Noninterest-bearing Checking 7,809 7,683 7,906 Average NIB Checking / Average Deposits 28.7% 28.2% 29.1% NIB Deposits with ECR (3) 4,924 4,774 4,793

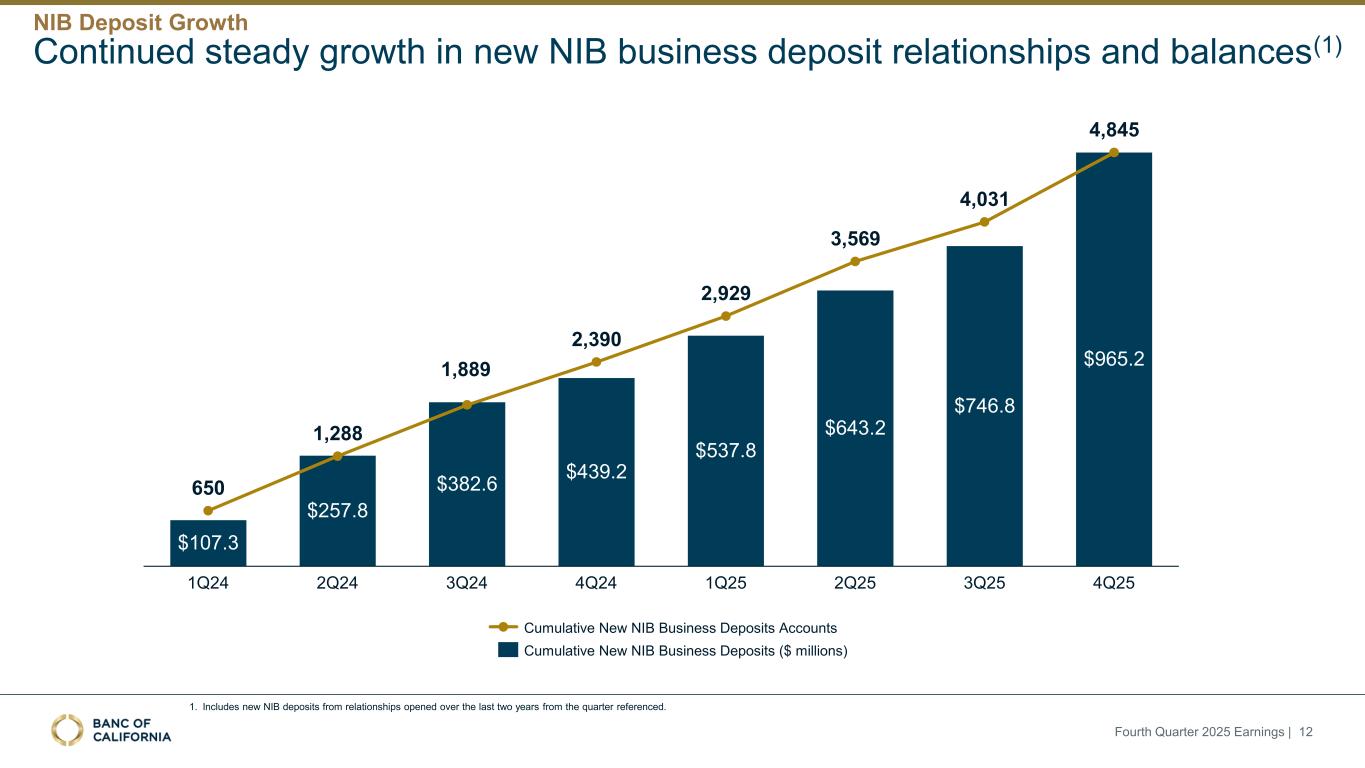

650 1,288 1,889 2,390 2,929 3,569 4,031 4,845 $107.3 1Q24 $257.8 2Q24 $382.6 3Q24 $439.2 4Q24 $537.8 1Q25 $643.2 2Q25 $746.8 3Q25 $965.2 4Q25 Cumulative New NIB Business Deposits Accounts Cumulative New NIB Business Deposits ($ millions) Continued steady growth in new NIB business deposit relationships and balances(1) 1. Includes new NIB deposits from relationships opened over the last two years from the quarter referenced. Fourth Quarter 2025 Earnings | 12 NIB Deposit Growth

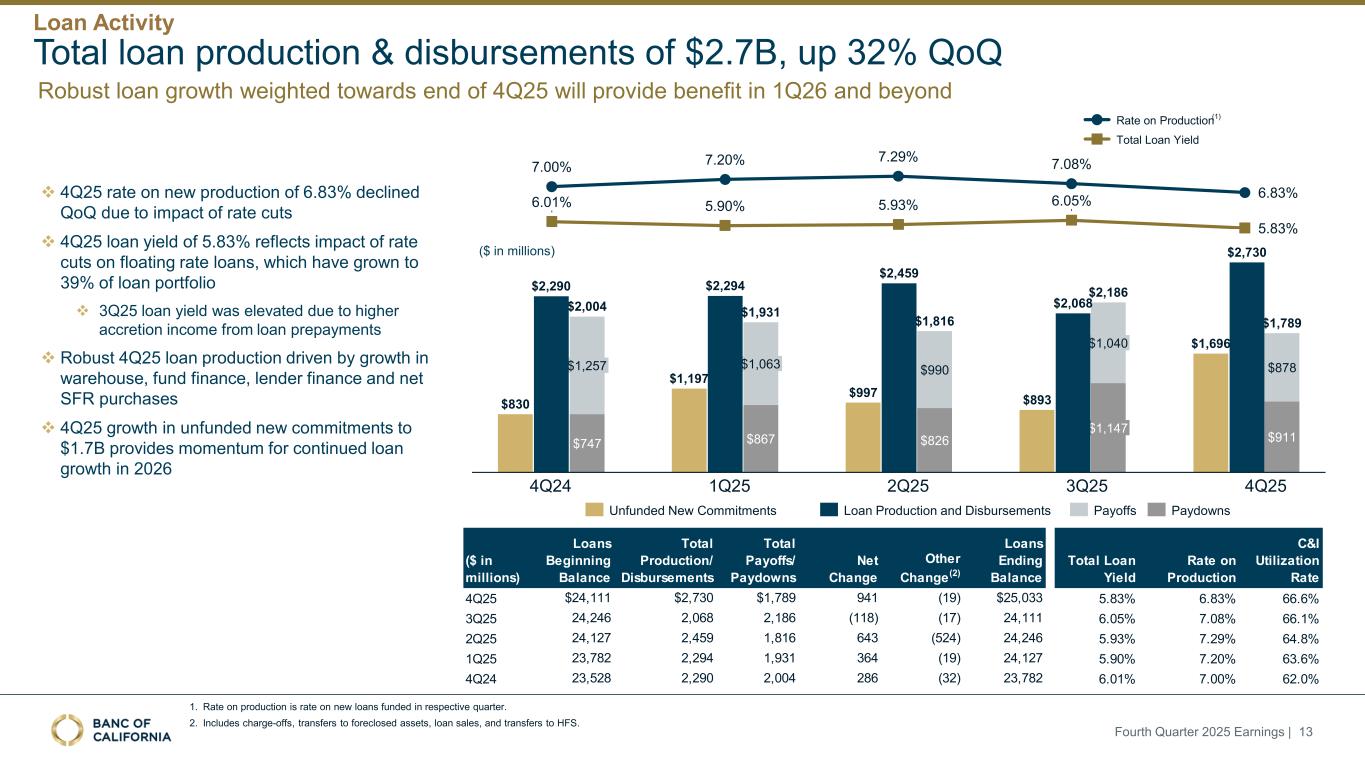

$1,257 $747 $1,063 $867 $990 $826 $1,040 $1,147 $878 $911 $2,004 $1,931 $1,816 $2,186 $1,789 7.00% 7.20% 7.29% 7.08% 6.83% 6.01% 5.90% 5.93% 6.05% 5.83% Rate on Production Total Loan Yield ($ in millions) 1. Rate on production is rate on new loans funded in respective quarter. 2. Includes charge-offs, transfers to foreclosed assets, loan sales, and transfers to HFS. Total loan production & disbursements of $2.7B, up 32% QoQ Fourth Quarter 2025 Earnings | 13 $830 $1,197 $997 $893 $1,696 Payoffs PaydownsUnfunded New Commitments 4Q24 1Q25 2Q25 3Q25 4Q25 $2,290 $2,294 $2,459 $2,068 $2,730 Loan Production and Disbursements ($ in millions) Loans Beginning Balance Total Production/ Disbursements Total Payoffs/ Paydowns Net Change Other Change(2) Loans Ending Balance Total Loan Yield Rate on Production C&I Utilization Rate 4Q25 $24,111 $2,730 $1,789 941 (19) $25,033 5.83% 6.83% 66.6% 3Q25 24,246 2,068 2,186 (118) (17) 24,111 6.05% 7.08% 66.1% 2Q25 24,127 2,459 1,816 643 (524) 24,246 5.93% 7.29% 64.8% 1Q25 23,782 2,294 1,931 364 (19) 24,127 5.90% 7.20% 63.6% 4Q24 23,528 2,290 2,004 286 (32) 23,782 6.01% 7.00% 62.0% Loan Activity (1) ❖ 4Q25 rate on new production of 6.83% declined QoQ due to impact of rate cuts ❖ 4Q25 loan yield of 5.83% reflects impact of rate cuts on floating rate loans, which have grown to 39% of loan portfolio ❖ 3Q25 loan yield was elevated due to higher accretion income from loan prepayments ❖ Robust 4Q25 loan production driven by growth in warehouse, fund finance, lender finance and net SFR purchases ❖ 4Q25 growth in unfunded new commitments to $1.7B provides momentum for continued loan growth in 2026 Robust loan growth weighted towards end of 4Q25 will provide benefit in 1Q26 and beyond

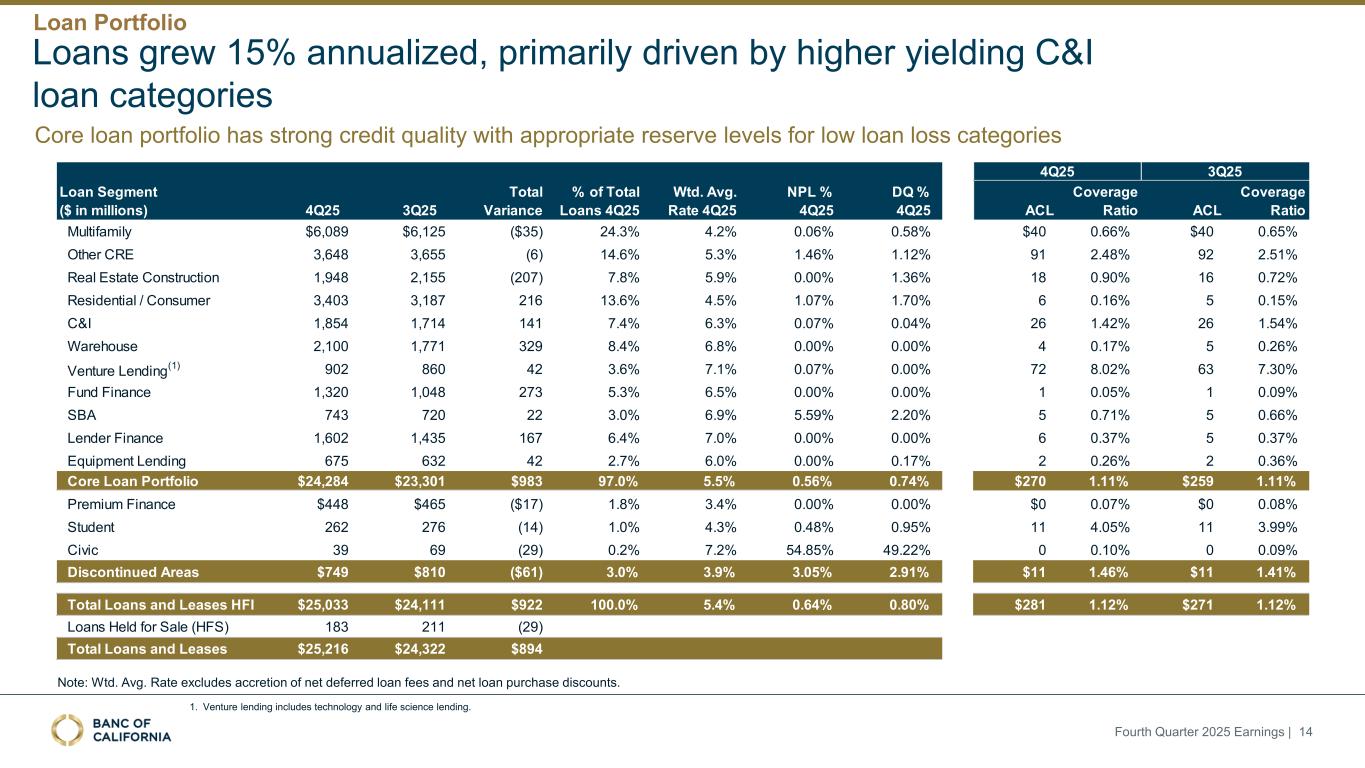

Loans grew 15% annualized, primarily driven by higher yielding C&I loan categories Note: Wtd. Avg. Rate excludes accretion of net deferred loan fees and net loan purchase discounts. 1. Venture lending includes technology and life science lending. Fourth Quarter 2025 Earnings | 14 Core loan portfolio has strong credit quality with appropriate reserve levels for low loan loss categories Loan Portfolio 4Q25 3Q25 4Q25 3Q25 Total Variance % of Total Loans 4Q25 Wtd. Avg. Rate 4Q25 NPL % 4Q25 DQ % 4Q25 ACL Coverage Ratio ACL Coverage Ratio Multifamily $6,089 $6,125 ($35) 24.3% 4.2% 0.06% 0.58% $40 0.66% $40 0.65% Other CRE 3,648 3,655 (6) 14.6% 5.3% 1.46% 1.12% 91 2.48% 92 2.51% Real Estate Construction 1,948 2,155 (207) 7.8% 5.9% 0.00% 1.36% 18 0.90% 16 0.72% Residential / Consumer 3,403 3,187 216 13.6% 4.5% 1.07% 1.70% 6 0.16% 5 0.15% C&I 1,854 1,714 141 7.4% 6.3% 0.07% 0.04% 26 1.42% 26 1.54% Warehouse 2,100 1,771 329 8.4% 6.8% 0.00% 0.00% 4 0.17% 5 0.26% Venture Lending (1) 902 860 42 3.6% 7.1% 0.07% 0.00% 72 8.02% 63 7.30% Fund Finance 1,320 1,048 273 5.3% 6.5% 0.00% 0.00% 1 0.05% 1 0.09% SBA 743 720 22 3.0% 6.9% 5.59% 2.20% 5 0.71% 5 0.66% Lender Finance 1,602 1,435 167 6.4% 7.0% 0.00% 0.00% 6 0.37% 5 0.37% Equipment Lending 675 632 42 2.7% 6.0% 0.00% 0.17% 2 0.26% 2 0.36% Core Loan Portfolio $24,284 $23,301 $983 97.0% 5.5% 0.56% 0.74% $270 1.11% $259 1.11%0 0 #DIV/0! Premium Finance $448 $465 ($17) 1.8% 3.4% 0.00% 0.00% $0 0.07% $0 0.08% Student 262 276 (14) 1.0% 4.3% 0.48% 0.95% 11 4.05% 11 3.99% Civic 39 69 (29) 0.2% 7.2% 54.85% 49.22% 0 0.10% 0 0.09% Discontinued Areas $749 $810 ($61) 3.0% 3.9% 3.05% 2.91% $11 1.46% $11 1.41% Total Loans and Leases HFI $25,033 $24,111 $922 100.0% 5.4% 0.64% 0.80% $281 1.12% $271 1.12% Loans Held for Sale (HFS) 183 211 (29) Total Loans and Leases $25,216 $24,322 $894 Loan Segment ($ in millions)

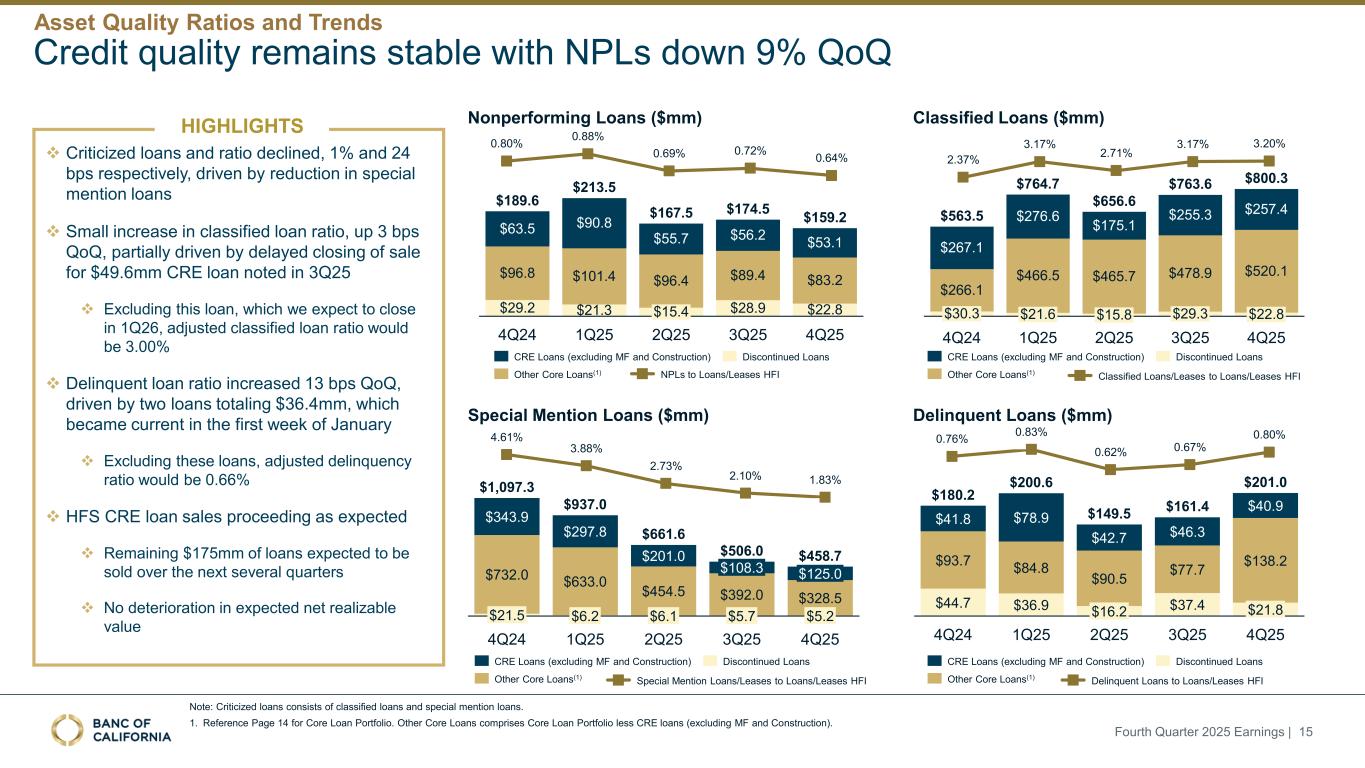

Credit quality remains stable with NPLs down 9% QoQ ❖ Criticized loans and ratio declined, 1% and 24 bps respectively, driven by reduction in special mention loans ❖ Small increase in classified loan ratio, up 3 bps QoQ, partially driven by delayed closing of sale for $49.6mm CRE loan noted in 3Q25 ❖ Excluding this loan, which we expect to close in 1Q26, adjusted classified loan ratio would be 3.00% ❖ Delinquent loan ratio increased 13 bps QoQ, driven by two loans totaling $36.4mm, which became current in the first week of January ❖ Excluding these loans, adjusted delinquency ratio would be 0.66% ❖ HFS CRE loan sales proceeding as expected ❖ Remaining $175mm of loans expected to be sold over the next several quarters ❖ No deterioration in expected net realizable value Special Mention Loans ($mm) Delinquent Loans ($mm) Classified Loans ($mm) $311.3 $320.1 $275.3 $281.9 $267.1 $266.1 $30.3 4Q24 $276.6 $466.5 $21.6 1Q25 $175.1 $465.7 $15.8 2Q25 $255.3 $478.9 $29.3 3Q25 $257.4 $520.1 $22.8 4Q25 $563.5 $764.7 $656.6 $763.6 $800.3 2.37% 3.17% 2.71% 3.17% 3.20% Classified Loans/Leases to Loans/Leases HFI CRE Loans (excluding MF and Construction) Other Core Loans(1) Discontinued Loans 0.76% 0.83% 0.62% 0.67% 0.80% Delinquent Loans to Loans/Leases HFI Note: Criticized loans consists of classified loans and special mention loans. 1. Reference Page 14 for Core Loan Portfolio. Other Core Loans comprises Core Loan Portfolio less CRE loans (excluding MF and Construction). HIGHLIGHTS Fourth Quarter 2025 Earnings | 15 Nonperforming Loans ($mm) $63.5 $96.8 $29.2 4Q24 $90.8 $101.4 $21.3 1Q25 $55.7 $96.4 $15.4 2Q25 $56.2 $89.4 $28.9 3Q25 $53.1 $83.2 $22.8 4Q25 $189.6 $213.5 $167.5 $174.5 $159.2 CRE Loans (excluding MF and Construction) Other Core Loans(1) Discontinued Loans 0.80% 0.88% 0.69% 0.72% 0.64% $343.9 $732.0 $21.5 4Q24 $297.8 $633.0 $6.2 1Q25 $201.0 $454.5 $6.1 2Q25 $108.3 $392.0 $5.7 3Q25 $125.0 $328.5 $5.2 4Q25 $1,097.3 $937.0 $661.6 $506.0 $458.7 CRE Loans (excluding MF and Construction) Other Core Loans(1) Discontinued Loans 4.61% 3.88% 2.73% 2.10% 1.83% Special Mention Loans/Leases to Loans/Leases HFI NPLs to Loans/Leases HFI $41.8 $93.7 $44.7 4Q24 $78.9 $84.8 $36.9 1Q25 $42.7 $90.5 $16.2 2Q25 $46.3 $77.7 $37.4 3Q25 $40.9 $138.2 $21.8 4Q25 $180.2 $200.6 $149.5 $161.4 $201.0 CRE Loans (excluding MF and Construction) Other Core Loans(1) Discontinued Loans Asset Quality Ratios and Trends

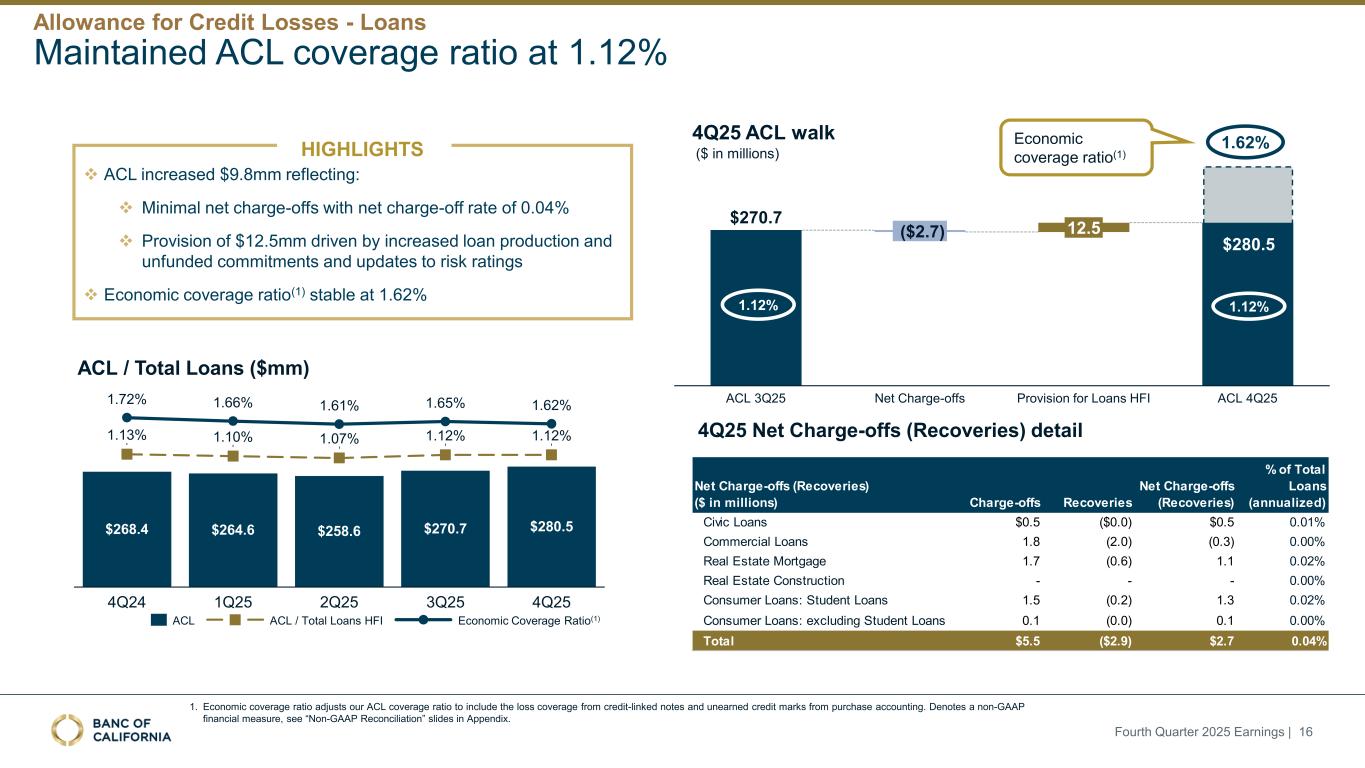

❖ ACL increased $9.8mm reflecting: ❖ Minimal net charge-offs with net charge-off rate of 0.04% ❖ Provision of $12.5mm driven by increased loan production and unfunded commitments and updates to risk ratings ❖ Economic coverage ratio(1) stable at 1.62% ($ in millions) 4Q25 Net Charge-offs (Recoveries) detail ACL 3Q25 ($2.7) Net Charge-offs 12.5 Provision for Loans HFI ACL 4Q25 $270.7 Maintained ACL coverage ratio at 1.12% HIGHLIGHTS 1. Economic coverage ratio adjusts our ACL coverage ratio to include the loss coverage from credit-linked notes and unearned credit marks from purchase accounting. Denotes a non-GAAP financial measure, see “Non-GAAP Reconciliation” slides in Appendix. 1.62% Economic coverage ratio(1) $280.5 Fourth Quarter 2025 Earnings | 16 $268.4 1.13% 1.72% 4Q24 $264.6 1.10% 1.66% 1Q25 $258.6 1.07% 1.61% 2Q25 $270.7 1.12% 1.65% 3Q25 $280.5 1.12% 1.62% 4Q25 ACL ACL / Total Loans HFI Economic Coverage Ratio(1) ACL / Total Loans ($mm) 4Q25 ACL walk 1.12% 1.12% Net Charge-offs (Recoveries) ($ in millions) Charge-offs Recoveries Net Charge-offs (Recoveries) % of Total Loans (annualized) Civic Loans $0.5 ($0.0) $0.5 0.01% Commercial Loans 1.8 (2.0) (0.3) 0.00% Real Estate Mortgage 1.7 (0.6) 1.1 0.02% Real Estate Construction - - - 0.00% Consumer Loans: Student Loans 1.5 (0.2) 1.3 0.02% Consumer Loans: excluding Student Loans 0.1 (0.0) 0.1 0.00% Total $5.5 ($2.9) $2.7 0.04% Allowance for Credit Losses - Loans

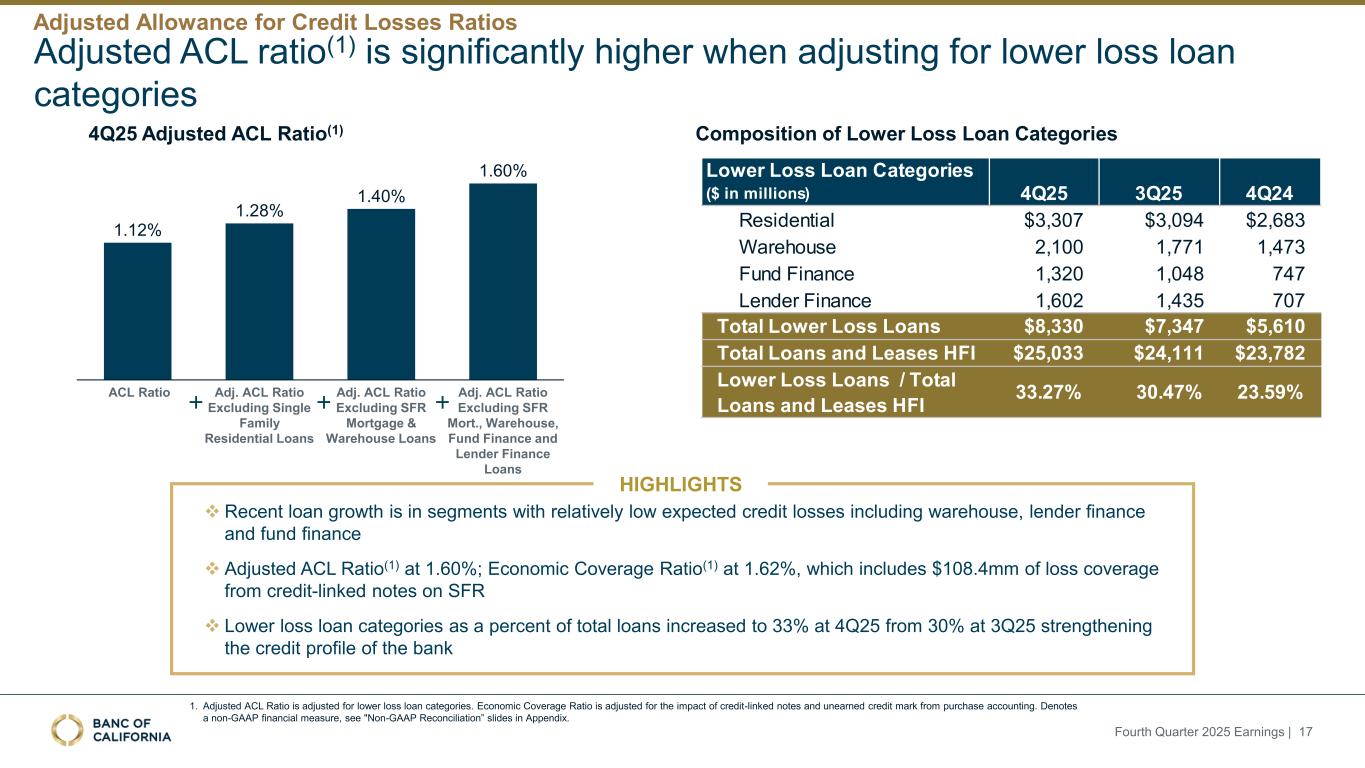

Adjusted ACL ratio(1) is significantly higher when adjusting for lower loss loan categories 4Q25 Adjusted ACL Ratio(1) Composition of Lower Loss Loan Categories ❖ Recent loan growth is in segments with relatively low expected credit losses including warehouse, lender finance and fund finance ❖ Adjusted ACL Ratio(1) at 1.60%; Economic Coverage Ratio(1) at 1.62%, which includes $108.4mm of loss coverage from credit-linked notes on SFR ❖ Lower loss loan categories as a percent of total loans increased to 33% at 4Q25 from 30% at 3Q25 strengthening the credit profile of the bank 1.12% 1.28% 1.40% 1.60% ACL Ratio Adj. ACL Ratio Excluding Single Family Residential Loans Adj. ACL Ratio Excluding SFR Mortgage & Warehouse Loans Adj. ACL Ratio Excluding SFR Mort., Warehouse, Fund Finance and Lender Finance Loans HIGHLIGHTS 1. Adjusted ACL Ratio is adjusted for lower loss loan categories. Economic Coverage Ratio is adjusted for the impact of credit-linked notes and unearned credit mark from purchase accounting. Denotes a non-GAAP financial measure, see "Non-GAAP Reconciliation” slides in Appendix. Fourth Quarter 2025 Earnings | 17 Adjusted Allowance for Credit Losses Ratios Lower Loss Loan Categories ($ in millions) 4Q25 3Q25 4Q24 Residential $3,307 $3,094 $2,683 Warehouse 2,100 1,771 1,473 Fund Finance 1,320 1,048 747 Lender Finance 1,602 1,435 707 Total Lower Loss Loans $8,330 $7,347 $5,610 Total Loans and Leases HFI $25,033 $24,111 $23,782 Lower Loss Loans / Total Loans and Leases HFI 33.27% 30.47% 23.59%

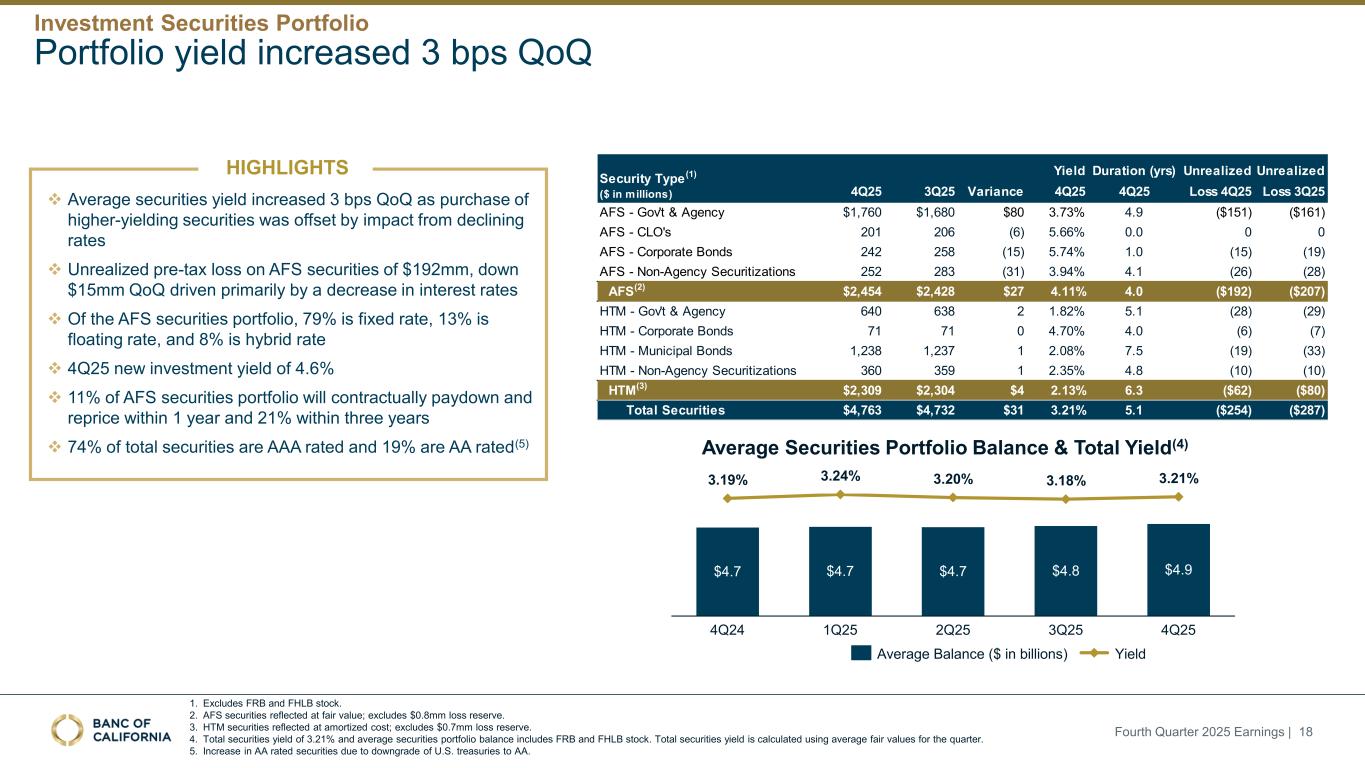

Average Securities Portfolio Balance & Total Yield(4) 1. Excludes FRB and FHLB stock. 2. AFS securities reflected at fair value; excludes $0.8mm loss reserve. 3. HTM securities reflected at amortized cost; excludes $0.7mm loss reserve. 4. Total securities yield of 3.21% and average securities portfolio balance includes FRB and FHLB stock. Total securities yield is calculated using average fair values for the quarter. 5. Increase in AA rated securities due to downgrade of U.S. treasuries to AA. Portfolio yield increased 3 bps QoQ ❖ Average securities yield increased 3 bps QoQ as purchase of higher-yielding securities was offset by impact from declining rates ❖ Unrealized pre-tax loss on AFS securities of $192mm, down $15mm QoQ driven primarily by a decrease in interest rates ❖ Of the AFS securities portfolio, 79% is fixed rate, 13% is floating rate, and 8% is hybrid rate ❖ 4Q25 new investment yield of 4.6% ❖ 11% of AFS securities portfolio will contractually paydown and reprice within 1 year and 21% within three years ❖ 74% of total securities are AAA rated and 19% are AA rated(5) HIGHLIGHTS $4.7 3.19% 4Q24 $4.7 3.24% 1Q25 $4.7 3.20% 2Q25 $4.8 3.18% 3Q25 $4.9 3.21% 4Q25 Average Balance ($ in billions) Yield Fourth Quarter 2025 Earnings | 18 Investment Securities Portfolio (4) Yield Duration (yrs) Unrealized Unrealized 4Q25 3Q25 Variance 4Q25 4Q25 Loss 4Q25 Loss 3Q25 AFS - Gov't & Agency $1,760 $1,680 $80 3.73% 4.9 ($151) ($161) AFS - CLO's 201 206 (6) 5.66% 0.0 0 0 AFS - Corporate Bonds 242 258 (15) 5.74% 1.0 (15) (19) AFS - Non-Agency Securitizations 252 283 (31) 3.94% 4.1 (26) (28) AFS(2) $2,454 $2,428 $27 4.11% 4.0 ($192) ($207) HTM - Gov't & Agency 640 638 2 1.82% 5.1 (28) (29) HTM - Corporate Bonds 71 71 0 4.70% 4.0 (6) (7) HTM - Municipal Bonds 1,238 1,237 1 2.08% 7.5 (19) (33) HTM - Non-Agency Securitizations 360 359 1 2.35% 4.8 (10) (10) HTM(3) $2,309 $2,304 $4 2.13% 6.3 ($62) ($80) Total Securities $4,763 $4,732 $31 3.21% 5.1 ($254) ($287) Security Type (1) ($ in millions)

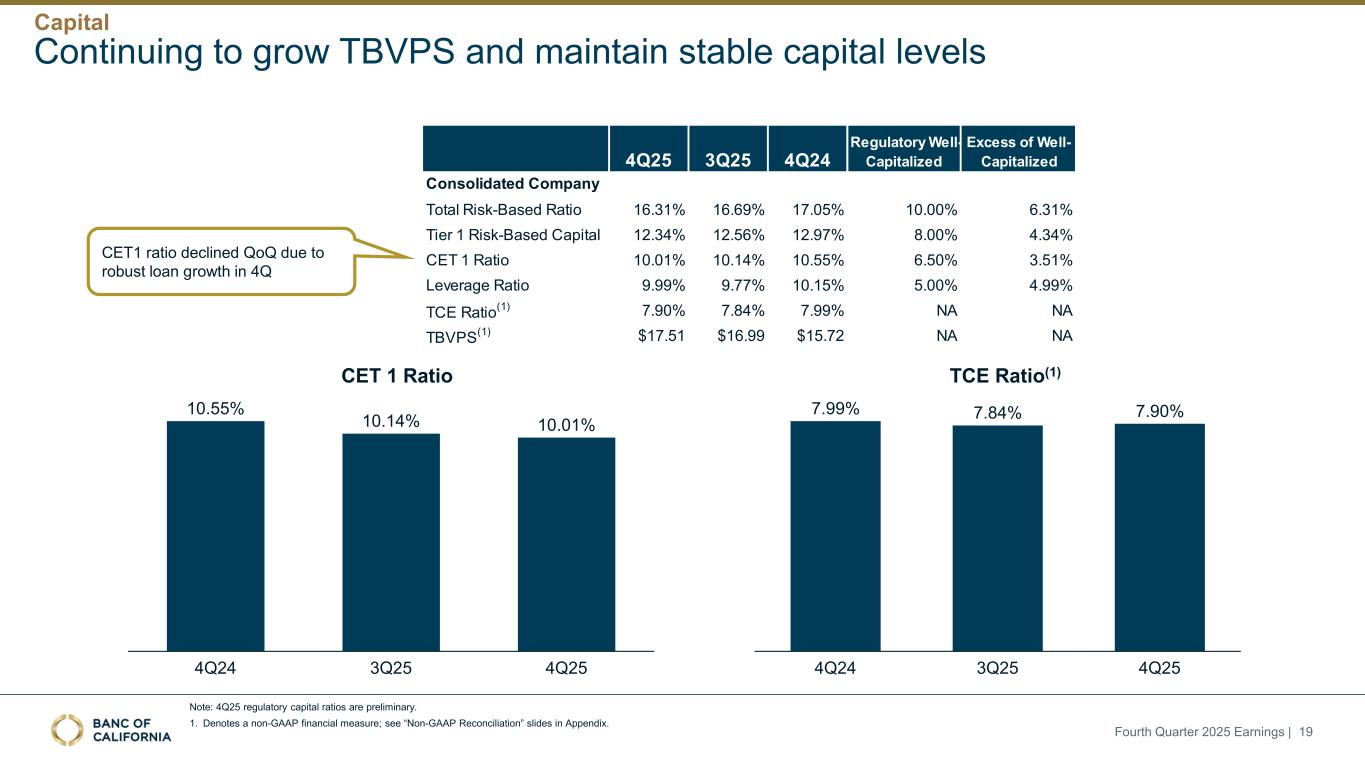

10.55% 10.14% 10.01% 4Q24 3Q25 4Q25 7.99% 7.84% 7.90% 4Q24 3Q25 4Q25 CET 1 Ratio TCE Ratio(1) Note: 4Q25 regulatory capital ratios are preliminary. 1. Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides in Appendix. Continuing to grow TBVPS and maintain stable capital levels CET1 ratio declined QoQ due to robust loan growth in 4Q Fourth Quarter 2025 Earnings | 19 4Q25 3Q25 4Q24 Regulatory Well- Capitalized Excess of Well- Capitalized Consolidated Company Total Risk-Based Ratio 16.31% 16.69% 17.05% 10.00% 6.31% Tier 1 Risk-Based Capital 12.34% 12.56% 12.97% 8.00% 4.34% CET 1 Ratio 10.01% 10.14% 10.55% 6.50% 3.51% Leverage Ratio 9.99% 9.77% 10.15% 5.00% 4.99% TCE Ratio (1) 7.90% 7.84% 7.99% NA NA TBVPS (1) $17.51 $16.99 $15.72 NA NA Capital

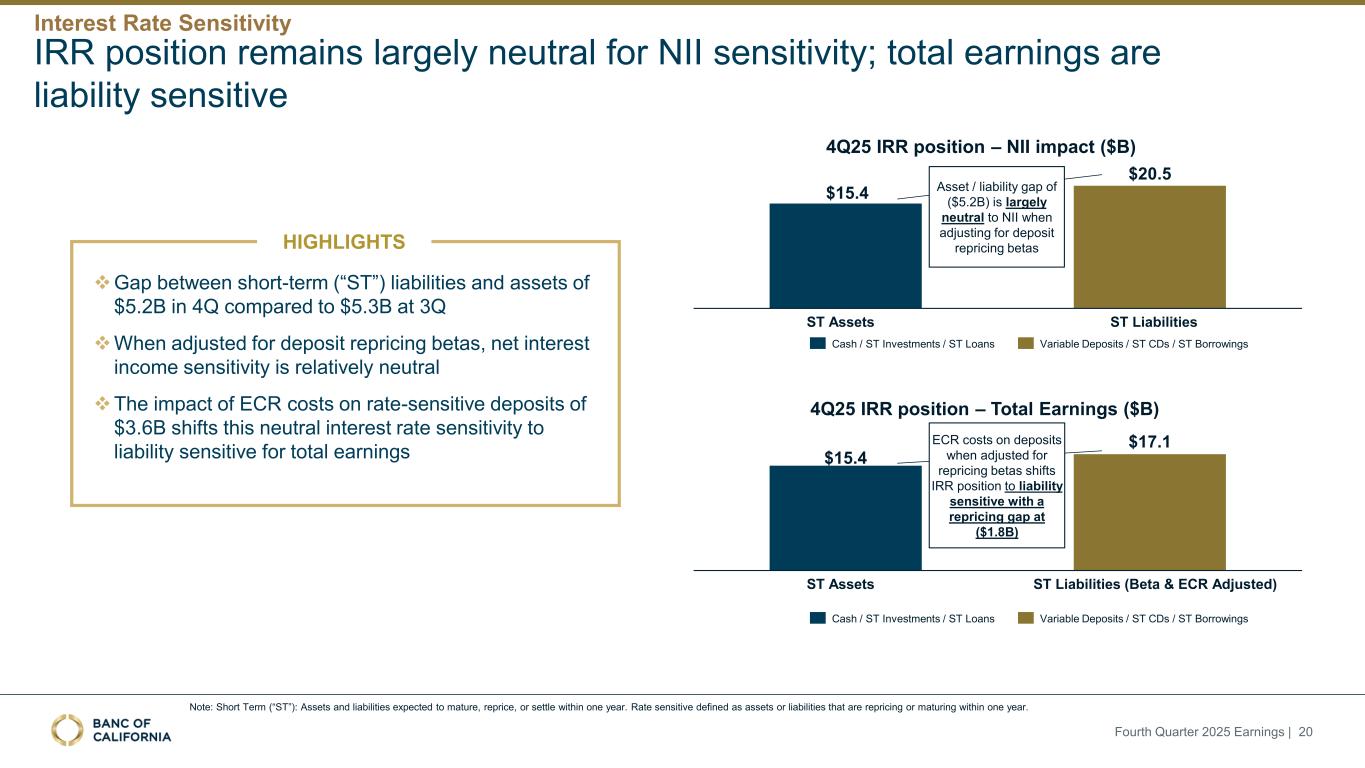

IRR position remains largely neutral for NII sensitivity; total earnings are liability sensitive 4Q25 IRR position – NII impact ($B) ❖Gap between short-term (“ST”) liabilities and assets of $5.2B in 4Q compared to $5.3B at 3Q ❖When adjusted for deposit repricing betas, net interest income sensitivity is relatively neutral ❖The impact of ECR costs on rate-sensitive deposits of $3.6B shifts this neutral interest rate sensitivity to liability sensitive for total earnings HIGHLIGHTS $15.4 $20.5 ST Assets ST Liabilities Asset / liability gap of ($5.2B) is largely neutral to NII when adjusting for deposit repricing betas 4Q25 IRR position – Total Earnings ($B) $15.4 $17.1 ST Assets ST Liabilities (Beta & ECR Adjusted) ECR costs on deposits when adjusted for repricing betas shifts IRR position to liability sensitive with a repricing gap at ($1.8B) Cash / ST Investments / ST Loans Cash / ST Investments / ST Loans Variable Deposits / ST CDs / ST Borrowings Variable Deposits / ST CDs / ST Borrowings Interest Rate Sensitivity Note: Short Term (“ST”): Assets and liabilities expected to mature, reprice, or settle within one year. Rate sensitive defined as assets or liabilities that are repricing or maturing within one year. Fourth Quarter 2025 Earnings | 20

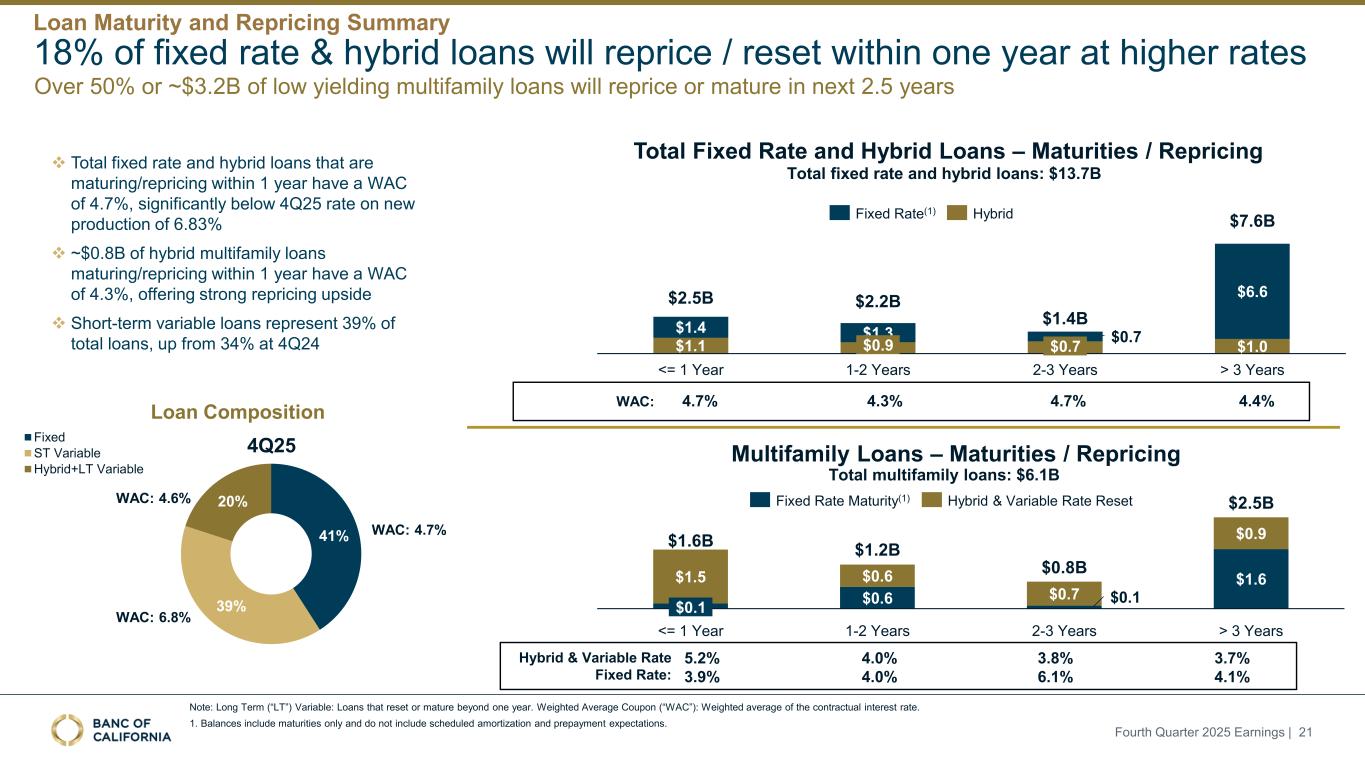

18% of fixed rate & hybrid loans will reprice / reset within one year at higher rates 4.0% 4.0% 3.8% 6.1% 3.7% 4.1% 5.2% 3.9% Multifamily Loans – Maturities / Repricing Hybrid & Variable Rate Fixed Rate: Total Fixed Rate and Hybrid Loans – Maturities / Repricing Total fixed rate and hybrid loans: $13.7B Total multifamily loans: $6.1B 41% 39% 20% 4Q25 Fixed ST Variable Hybrid+LT Variable Loan Composition WAC: 4.7% WAC: 6.8% WAC: 4.6% 4.3% 4.7% 4.4%4.7%WAC: $0.6 $0.1 $1.6 $1.5 $0.6 $0.7 $0.9 $0.1 <= 1 Year 1-2 Years 2-3 Years > 3 Years $1.6B $1.2B $0.8B $2.5BFixed Rate Maturity(1) Hybrid & Variable Rate Reset $1.1 $1.0 $1.4 $1.3 $0.7 $6.6 <= 1 Year $0.9 1-2 Years $0.7 2-3 Years > 3 Years $2.5B $2.2B $1.4B $7.6B Fixed Rate(1) Hybrid Over 50% or ~$3.2B of low yielding multifamily loans will reprice or mature in next 2.5 years Note: Long Term (“LT”) Variable: Loans that reset or mature beyond one year. Weighted Average Coupon (“WAC”): Weighted average of the contractual interest rate. 1. Balances include maturities only and do not include scheduled amortization and prepayment expectations. Loan Maturity and Repricing Summary Fourth Quarter 2025 Earnings | 21 ❖ Total fixed rate and hybrid loans that are maturing/repricing within 1 year have a WAC of 4.7%, significantly below 4Q25 rate on new production of 6.83% ❖ ~$0.8B of hybrid multifamily loans maturing/repricing within 1 year have a WAC of 4.3%, offering strong repricing upside ❖ Short-term variable loans represent 39% of total loans, up from 34% at 4Q24

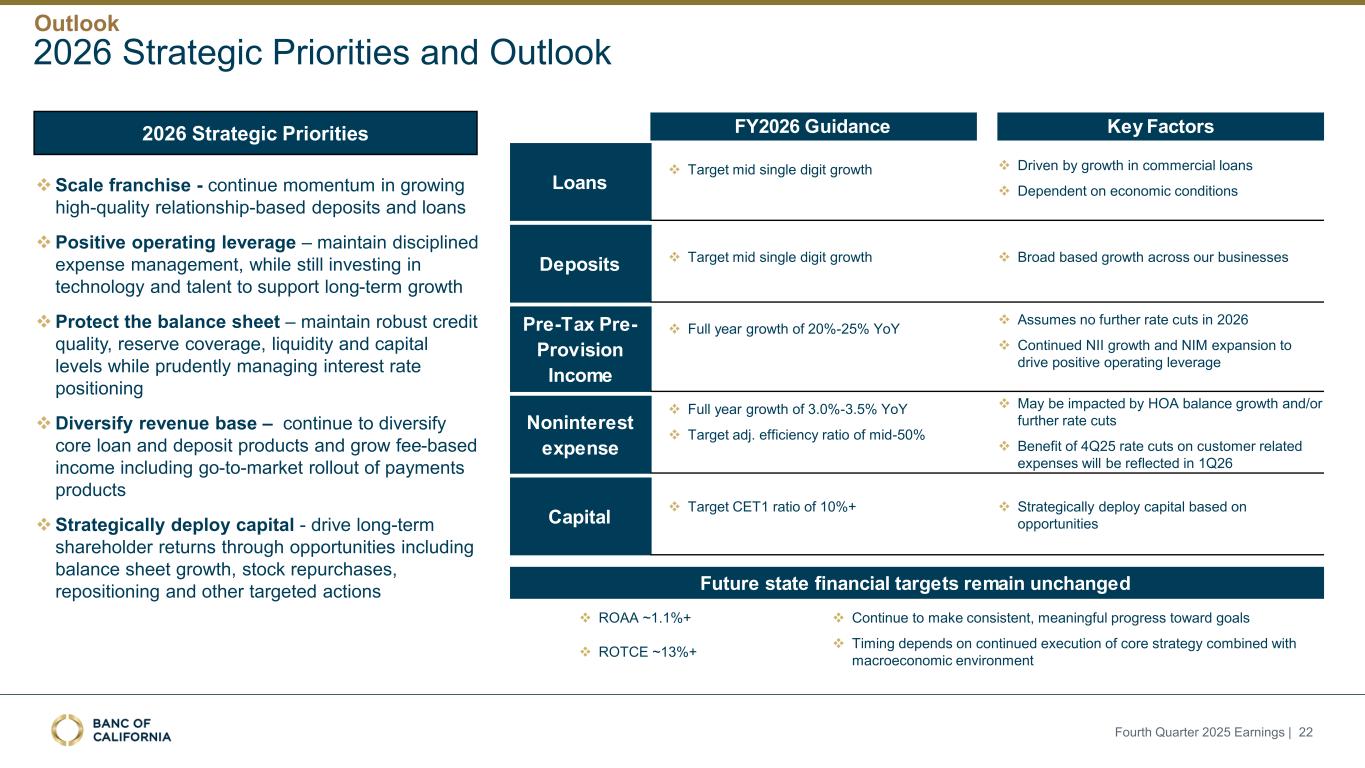

FY2026 Guidance Key Factors Loans Deposits Pre-Tax Pre- Provision Income Noninterest expense Capital Future state financial targets remain unchanged ❖ Full year growth of 20%-25% YoY ❖ Assumes no further rate cuts in 2026 ❖ Continued NII growth and NIM expansion to drive positive operating leverage ❖ Full year growth of 3.0%-3.5% YoY ❖ Target adj. efficiency ratio of mid-50% ❖ May be impacted by HOA balance growth and/or further rate cuts ❖ Benefit of 4Q25 rate cuts on customer related expenses will be reflected in 1Q26 ❖ ROAA ~1.1%+ ❖ ROTCE ~13%+ ❖ Target mid single digit growth ❖ Driven by growth in commercial loans ❖ Dependent on economic conditions ❖ Target mid single digit growth ❖ Broad based growth across our businesses 2026 Strategic Priorities and Outlook Outlook Fourth Quarter 2025 Earnings | 22 ❖Scale franchise - continue momentum in growing high-quality relationship-based deposits and loans ❖Positive operating leverage – maintain disciplined expense management, while still investing in technology and talent to support long-term growth ❖Protect the balance sheet – maintain robust credit quality, reserve coverage, liquidity and capital levels while prudently managing interest rate positioning ❖Diversify revenue base – continue to diversify core loan and deposit products and grow fee-based income including go-to-market rollout of payments products ❖Strategically deploy capital - drive long-term shareholder returns through opportunities including balance sheet growth, stock repurchases, repositioning and other targeted actions ❖ Continue to make consistent, meaningful progress toward goals ❖ Timing depends on continued execution of core strategy combined with macroeconomic environment 2026 Strategic Priorities ❖ Target CET1 ratio of 10%+ ❖ Strategically deploy capital based on opportunities

Supplemental Information

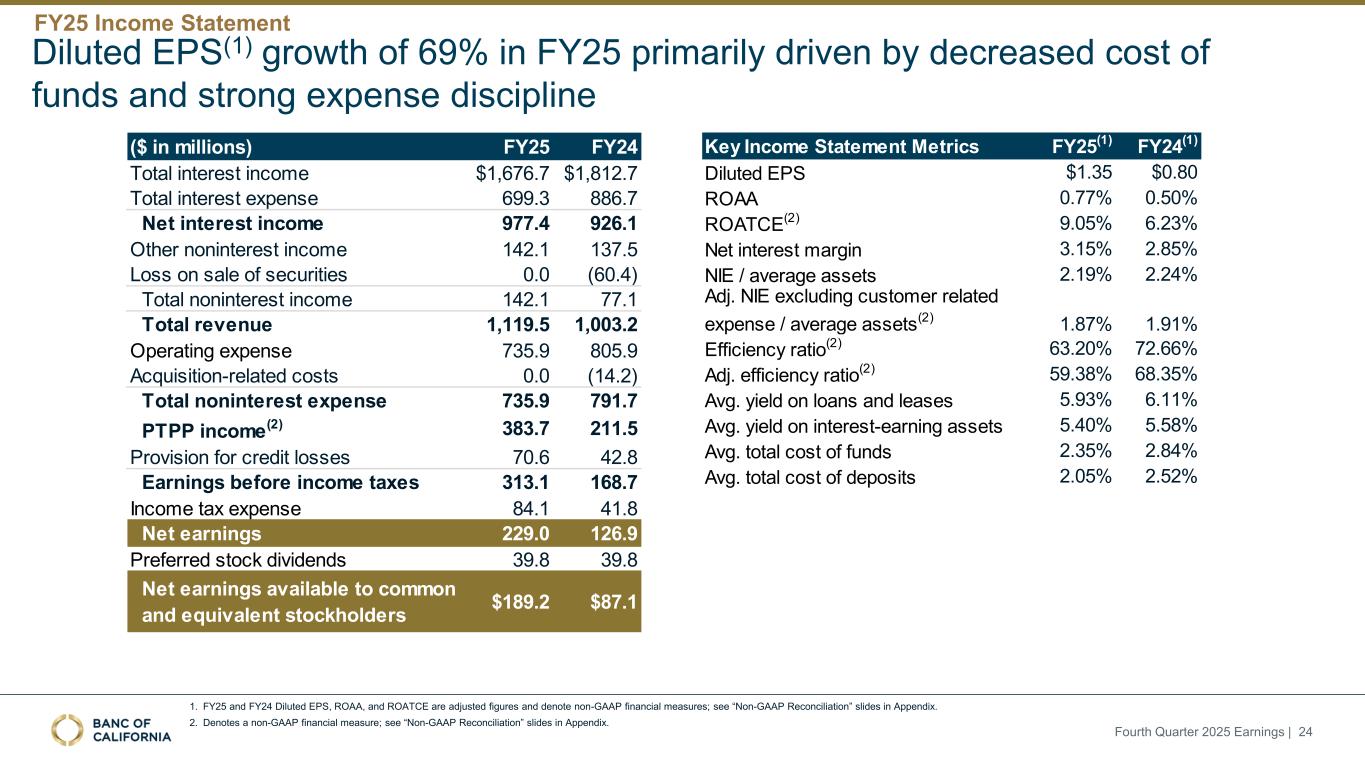

1. FY25 and FY24 Diluted EPS, ROAA, and ROATCE are adjusted figures and denote non-GAAP financial measures; see “Non-GAAP Reconciliation” slides in Appendix. 2. Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides in Appendix. Diluted EPS(1) growth of 69% in FY25 primarily driven by decreased cost of funds and strong expense discipline Fourth Quarter 2025 Earnings | 24 FY25 Income Statement ($ in millions) FY25 FY24 Total interest income $1,676.7 $1,812.7 Total interest expense 699.3 886.7 Net interest income 977.4 926.1 Other noninterest income 142.1 137.5 Loss on sale of securities 0.0 (60.4) Total noninterest income 142.1 77.1 Total revenue 1,119.5 1,003.2 Operating expense 735.9 805.9 Acquisition-related costs 0.0 (14.2) Total noninterest expense 735.9 791.7 PTPP income(2) 383.7 211.5 Provision for credit losses 70.6 42.8 Earnings before income taxes 313.1 168.7 Income tax expense 84.1 41.8 Net earnings 229.0 126.9 Preferred stock dividends 39.8 39.8 Net earnings available to common and equivalent stockholders $189.2 $87.1 Key Income Statement Metrics FY25(1) FY24(1) Diluted EPS $1.35 $0.80 ROAA 0.77% 0.50% ROATCE(2) 9.05% 6.23% Net interest margin 3.15% 2.85% NIE / average assets 2.19% 2.24% Adj. NIE excluding customer related expense / average assets(2) 1.87% 1.91% Efficiency ratio(2) 63.20% 72.66% Adj. efficiency ratio(2) 59.38% 68.35% Avg. yield on loans and leases 5.93% 6.11% Avg. yield on interest-earning assets 5.40% 5.58% Avg. total cost of funds 2.35% 2.84% Avg. total cost of deposits 2.05% 2.52%

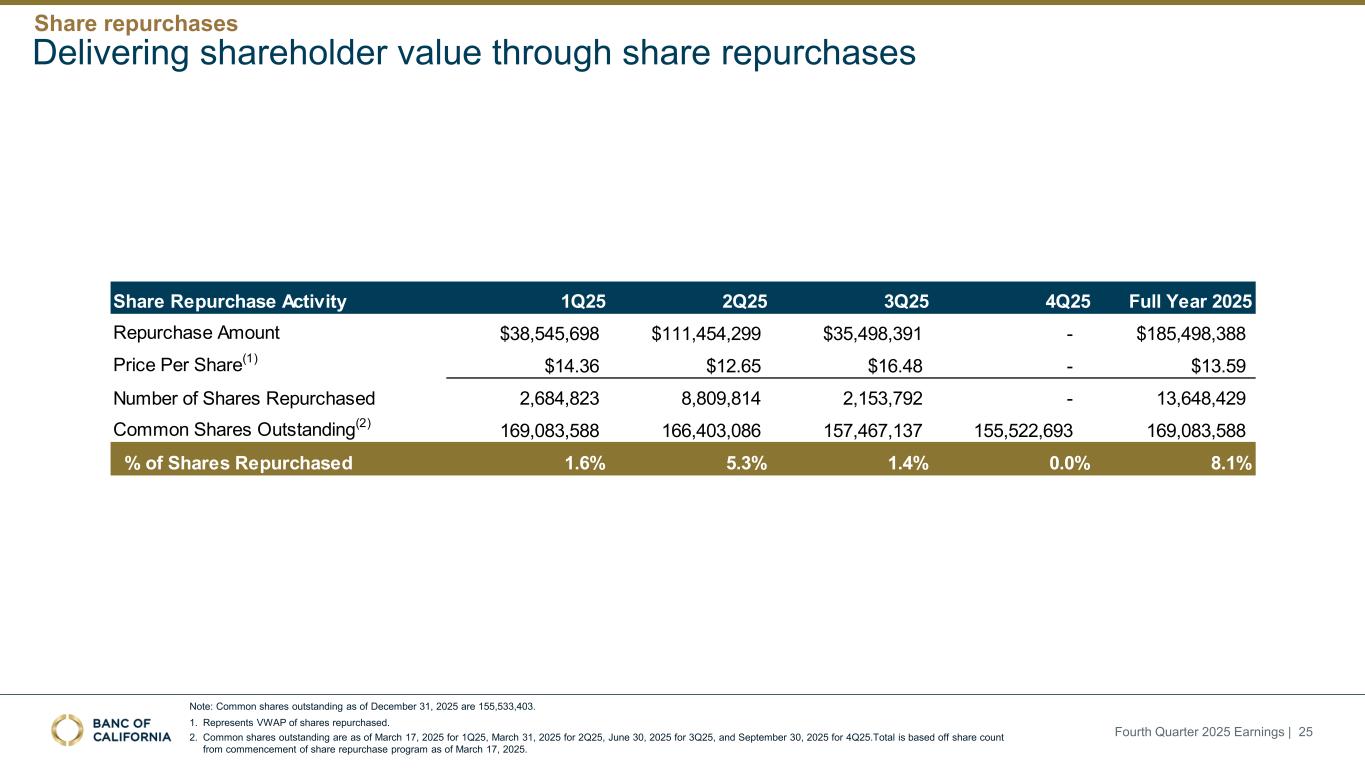

Note: Common shares outstanding as of December 31, 2025 are 155,533,403. 1. Represents VWAP of shares repurchased. 2. Common shares outstanding are as of March 17, 2025 for 1Q25, March 31, 2025 for 2Q25, June 30, 2025 for 3Q25, and September 30, 2025 for 4Q25.Total is based off share count from commencement of share repurchase program as of March 17, 2025. Delivering shareholder value through share repurchases Fourth Quarter 2025 Earnings | 25 Share repurchases Share Repurchase Activity 1Q25 2Q25 3Q25 4Q25 Full Year 2025 Repurchase Amount $38,545,698 $111,454,299 $35,498,391 - $185,498,388 Price Per Share(1) $14.36 $12.65 $16.48 - $13.59 Number of Shares Repurchased 2,684,823 8,809,814 2,153,792 - 13,648,429 Common Shares Outstanding(2) 169,083,588 166,403,086 157,467,137 155,522,693 169,083,588 % of Shares Repurchased 1.6% 5.3% 1.4% 0.0% 8.1%

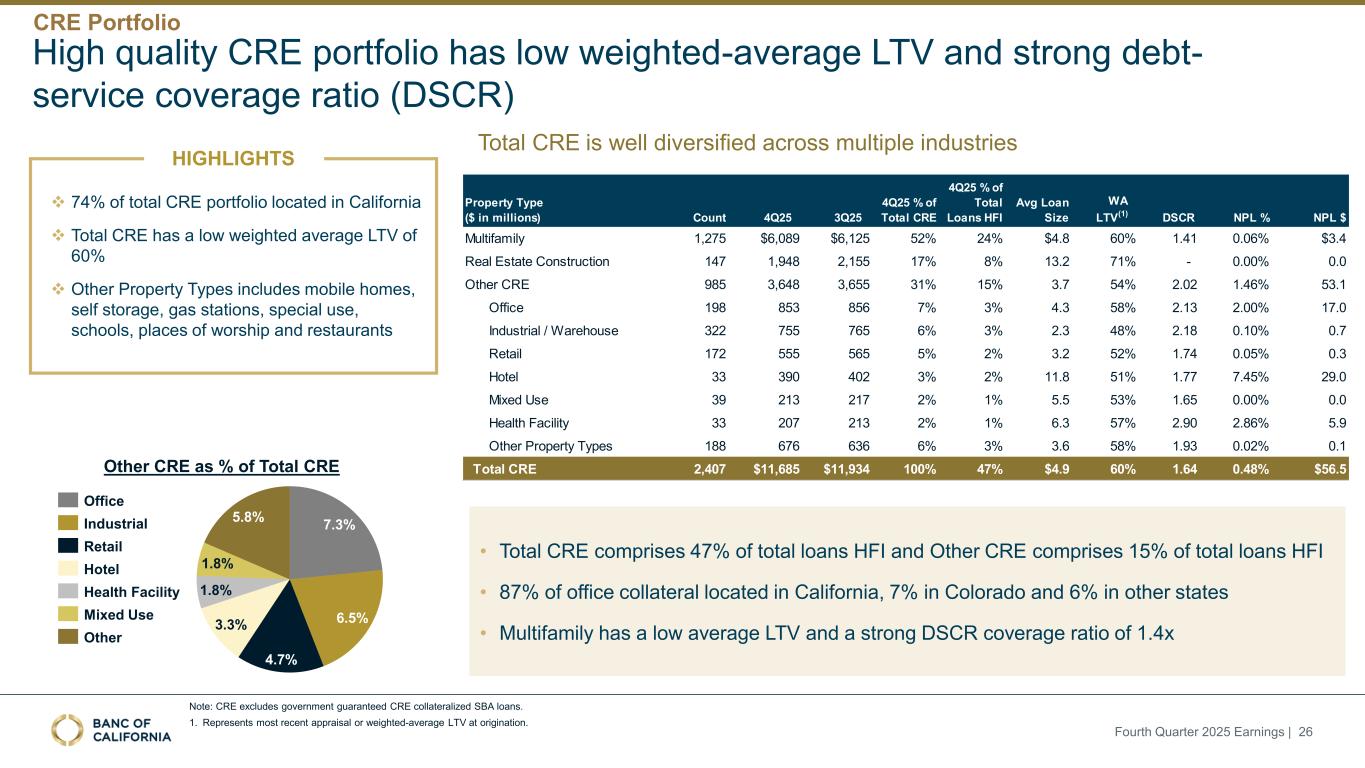

❖ 74% of total CRE portfolio located in California ❖ Total CRE has a low weighted average LTV of 60% ❖ Other Property Types includes mobile homes, self storage, gas stations, special use, schools, places of worship and restaurants 7.3% 6.5% 4.7% 3.3% 1.8% 1.8% 5.8% Office Industrial Retail Hotel Health Facility Mixed Use Other Other CRE as % of Total CRE Total CRE is well diversified across multiple industries • Total CRE comprises 47% of total loans HFI and Other CRE comprises 15% of total loans HFI • 87% of office collateral located in California, 7% in Colorado and 6% in other states • Multifamily has a low average LTV and a strong DSCR coverage ratio of 1.4x Note: CRE excludes government guaranteed CRE collateralized SBA loans. 1. Represents most recent appraisal or weighted-average LTV at origination. High quality CRE portfolio has low weighted-average LTV and strong debt- service coverage ratio (DSCR) HIGHLIGHTS Fourth Quarter 2025 Earnings | 26 Property Type ($ in millions) Count 4Q25 3Q25 4Q25 % of Total CRE 4Q25 % of Total Loans HFI Avg Loan Size WA LTV(1) DSCR NPL % NPL $ Multifamily 1,275 $6,089 $6,125 52% 24% $4.8 60% 1.41 0.06% $3.4 Real Estate Construction 147 1,948 2,155 17% 8% 13.2 71% - 0.00% 0.0 Other CRE 985 3,648 3,655 31% 15% 3.7 54% 2.02 1.46% 53.1 Office 198 853 856 7% 3% 4.3 58% 2.13 2.00% 17.0 Industrial / Warehouse 322 755 765 6% 3% 2.3 48% 2.18 0.10% 0.7 Retail 172 555 565 5% 2% 3.2 52% 1.74 0.05% 0.3 Hotel 33 390 402 3% 2% 11.8 51% 1.77 7.45% 29.0 Mixed Use 39 213 217 2% 1% 5.5 53% 1.65 0.00% 0.0 Health Facility 33 207 213 2% 1% 6.3 57% 2.90 2.86% 5.9 Other Property Types 188 676 636 6% 3% 3.6 58% 1.93 0.02% 0.1 Total CRE 2,407 $11,685 $11,934 100% 47% $4.9 60% 1.64 0.48% $56.5 CRE Portfolio

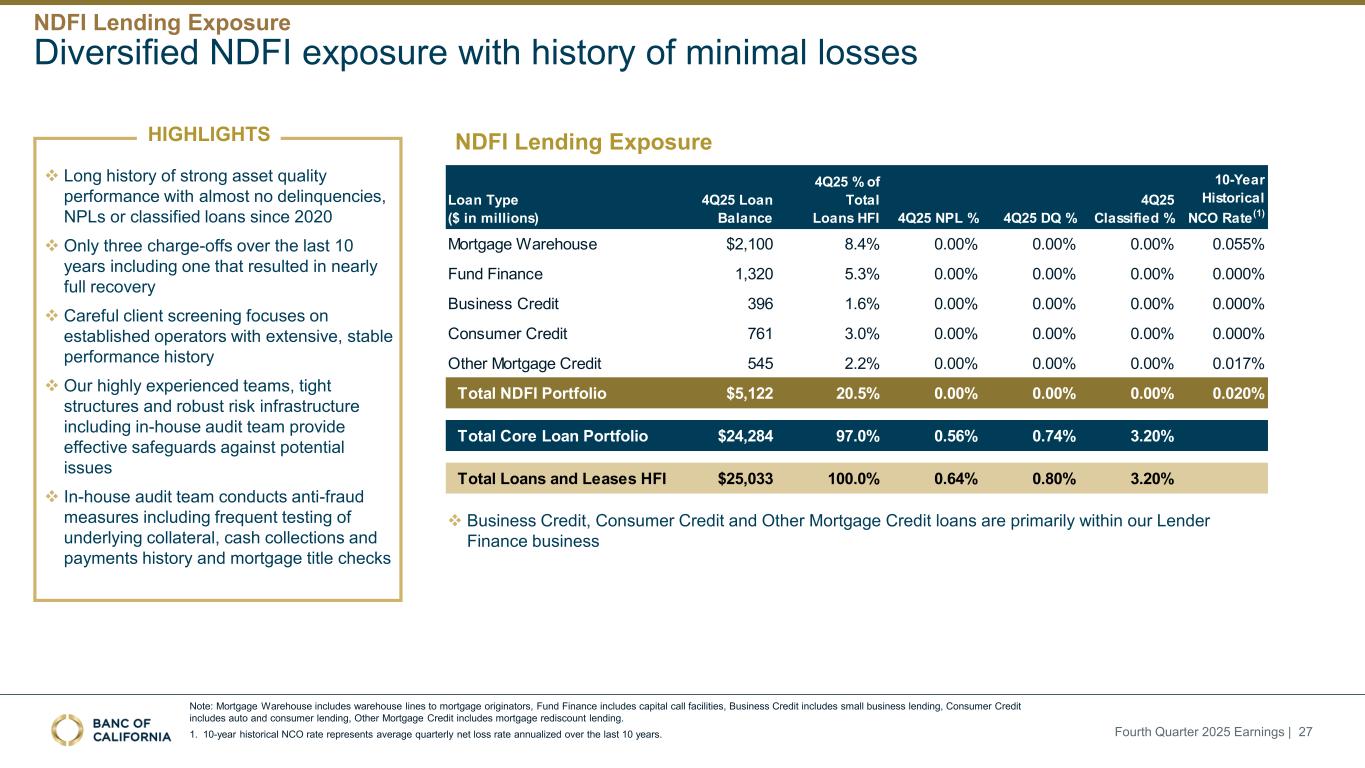

Diversified NDFI exposure with history of minimal losses Fourth Quarter 2025 Earnings | 27 NDFI Lending Exposure Note: Mortgage Warehouse includes warehouse lines to mortgage originators, Fund Finance includes capital call facilities, Business Credit includes small business lending, Consumer Credit includes auto and consumer lending, Other Mortgage Credit includes mortgage rediscount lending. 1. 10-year historical NCO rate represents average quarterly net loss rate annualized over the last 10 years. HIGHLIGHTS ❖ Long history of strong asset quality performance with almost no delinquencies, NPLs or classified loans since 2020 ❖ Only three charge-offs over the last 10 years including one that resulted in nearly full recovery ❖ Careful client screening focuses on established operators with extensive, stable performance history ❖ Our highly experienced teams, tight structures and robust risk infrastructure including in-house audit team provide effective safeguards against potential issues ❖ In-house audit team conducts anti-fraud measures including frequent testing of underlying collateral, cash collections and payments history and mortgage title checks NDFI Lending Exposure Loan Type ($ in millions) 4Q25 Loan Balance 4Q25 % of Total Loans HFI 4Q25 NPL % 4Q25 DQ % 4Q25 Classified % 10-Year Historical NCO Rate(1) Mortgage Warehouse $2,100 8.4% 0.00% 0.00% 0.00% 0.055% Fund Finance 1,320 5.3% 0.00% 0.00% 0.00% 0.000% Business Credit 396 1.6% 0.00% 0.00% 0.00% 0.000% Consumer Credit 761 3.0% 0.00% 0.00% 0.00% 0.000% Other Mortgage Credit 545 2.2% 0.00% 0.00% 0.00% 0.017% Total NDFI Portfolio $5,122 20.5% 0.00% 0.00% 0.00% 0.020% Total Core Loan Portfolio $24,284 97.0% 0.56% 0.74% 3.20% Total Loans and Leases HFI $25,033 100.0% 0.64% 0.80% 3.20% ❖ Business Credit, Consumer Credit and Other Mortgage Credit loans are primarily within our Lender Finance business

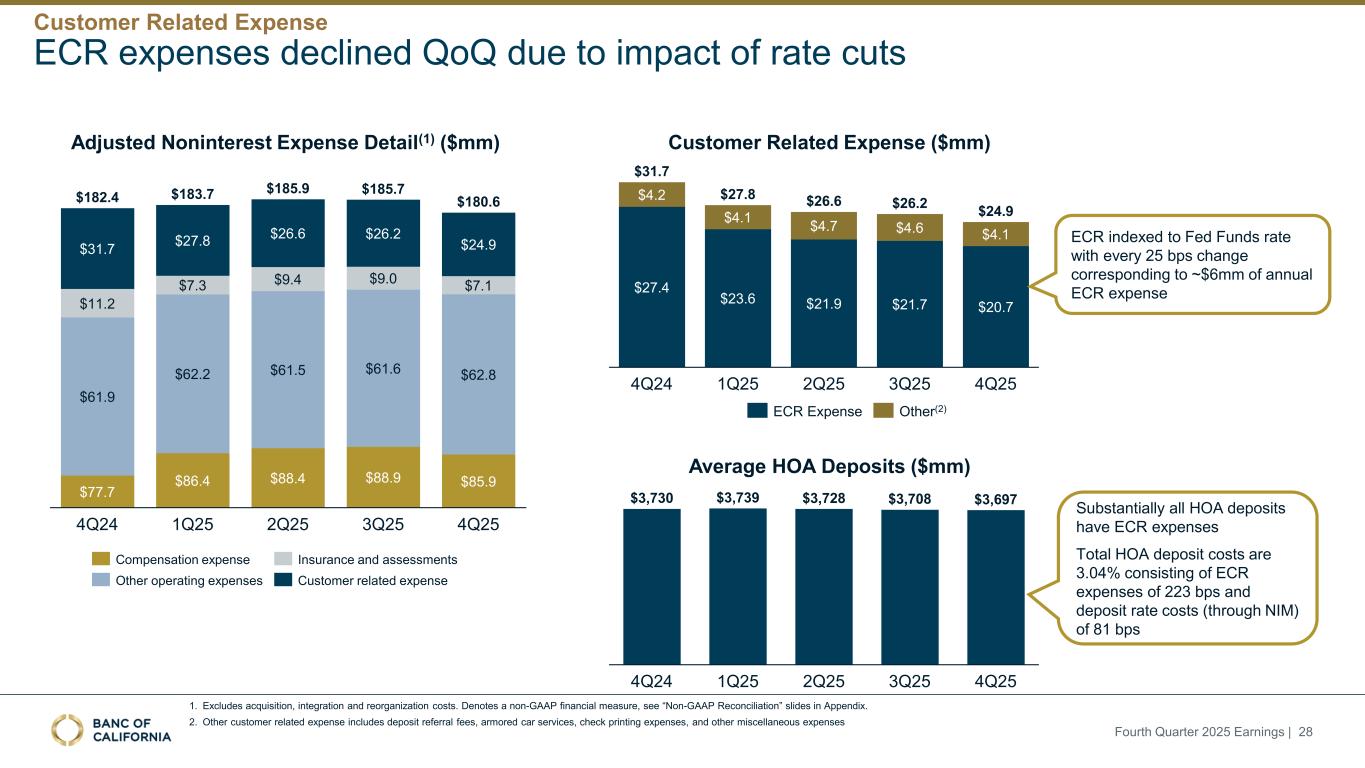

Adjusted Noninterest Expense Detail(1) ($mm) $31.7 $11.2 $61.9 $77.7 4Q24 $27.8 $7.3 $62.2 $86.4 1Q25 $26.6 $9.4 $61.5 $88.4 2Q25 $26.2 $9.0 $61.6 $88.9 3Q25 $24.9 $7.1 $62.8 $85.9 4Q25 $182.4 $183.7 $185.9 $185.7 $180.6 Compensation expense Other operating expenses Insurance and assessments Customer related expense Customer Related Expense ($mm) $27.4 $4.2 4Q24 $23.6 $4.1 1Q25 $21.9 $4.7 2Q25 $21.7 $4.6 3Q25 $20.7 $4.1 4Q25 $31.7 $27.8 $26.6 $26.2 $24.9 ECR Expense Other(2) 1. Excludes acquisition, integration and reorganization costs. Denotes a non-GAAP financial measure, see “Non-GAAP Reconciliation” slides in Appendix. 2. Other customer related expense includes deposit referral fees, armored car services, check printing expenses, and other miscellaneous expenses ECR expenses declined QoQ due to impact of rate cuts 4Q24 1Q25 2Q25 3Q25 4Q25 $3,730 $3,739 $3,728 $3,708 $3,697 Average HOA Deposits ($mm) ECR indexed to Fed Funds rate with every 25 bps change corresponding to ~$6mm of annual ECR expense Substantially all HOA deposits have ECR expenses Total HOA deposit costs are 3.04% consisting of ECR expenses of 223 bps and deposit rate costs (through NIM) of 81 bps Fourth Quarter 2025 Earnings | 28 Customer Related Expense

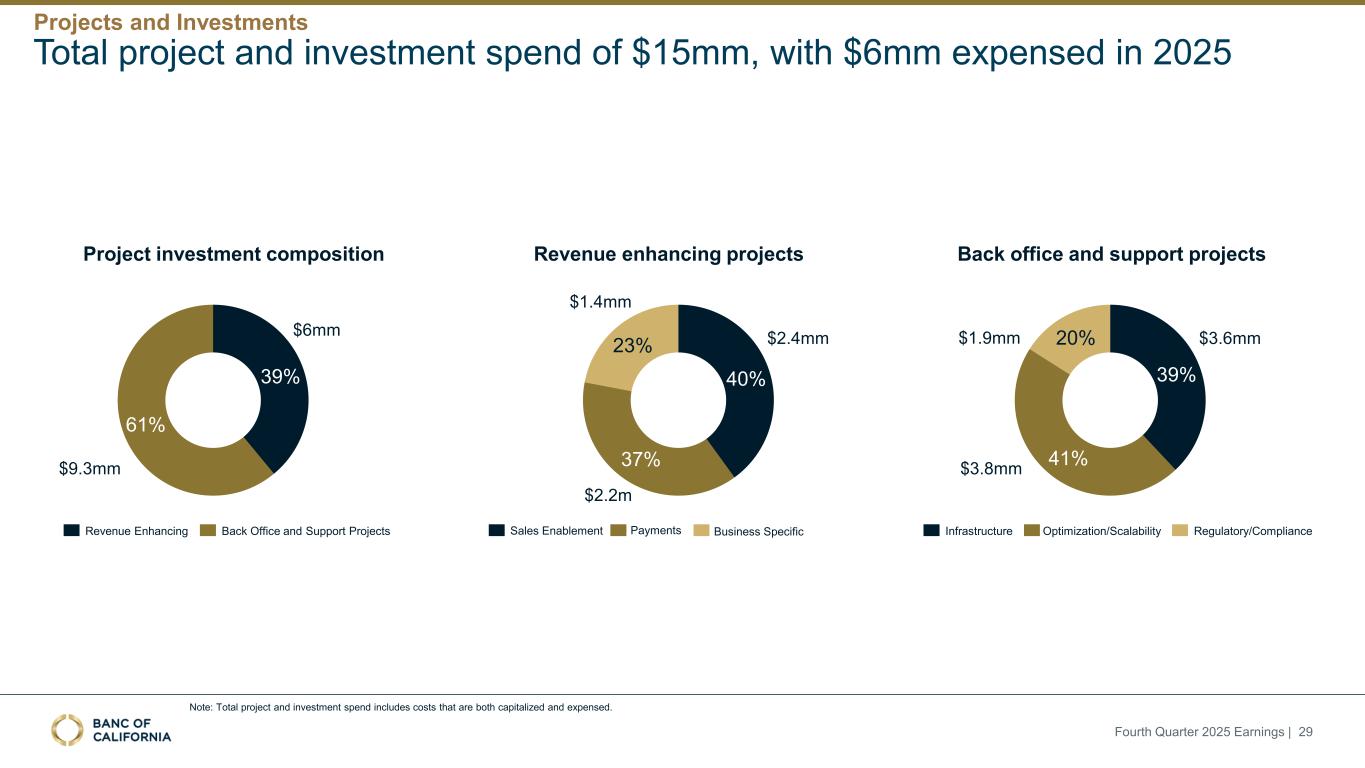

Total project and investment spend of $15mm, with $6mm expensed in 2025 Project investment composition Revenue enhancing projects Back office and support projects Fourth Quarter 2025 Earnings | 29 Projects and Investments 39% 61% Revenue Enhancing Back Office and Support Projects $6mm $9.3mm 39% 41% 20% Infrastructure Optimization/Scalability Regulatory/Compliance $3.8mm $1.9mm $3.6mm 40% 37% 23% Sales Enablement Payments Business Specific $2.2m $1.4mm $2.4mm Note: Total project and investment spend includes costs that are both capitalized and expensed.

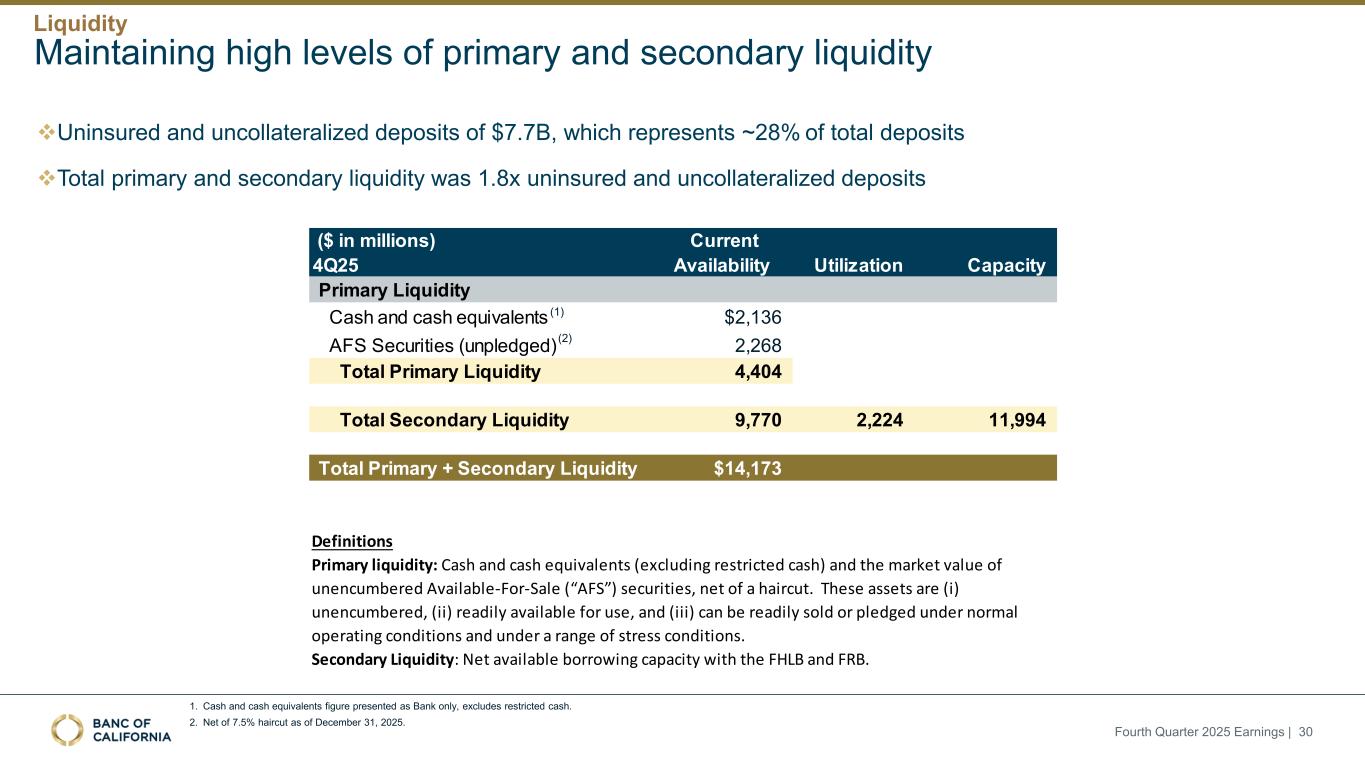

❖Uninsured and uncollateralized deposits of $7.7B, which represents ~28% of total deposits ❖Total primary and secondary liquidity was 1.8x uninsured and uncollateralized deposits Maintaining high levels of primary and secondary liquidity 1. Cash and cash equivalents figure presented as Bank only, excludes restricted cash. 2. Net of 7.5% haircut as of December 31, 2025. ($ in millions) 4Q25 Current Availability Utilization Capacity Primary Liquidity Cash and cash equivalents $2,136 AFS Securities (unpledged) 2,268 Total Primary Liquidity 4,404 Total Secondary Liquidity 9,770 2,224 11,994 Total Primary + Secondary Liquidity $14,173 Definitions Secondary Liquidity: Net available borrowing capacity with the FHLB and FRB. Primary liquidity: Cash and cash equivalents (excluding restricted cash) and the market value of unencumbered Available-For-Sale (“AFS”) securities, net of a haircut. These assets are (i) unencumbered, (ii) readily available for use, and (iii) can be readily sold or pledged under normal operating conditions and under a range of stress conditions. Fourth Quarter 2025 Earnings | 30 (1) (2) Liquidity

Experienced Management Team with Track Record of Success at Leading Institutions Chris Blake Vice Chairman of the Bank 40+ years of banking experience, previously served as President & CEO, Community Bank Division, for PacWest Bancorp Scott Ladd Chief Credit Officer for Specialty Banking and Credit Operations 25+ years banking and consulting experience, previously served as EVP, Group Head, Portfolio Management at PacWest Bancorp Hamid Hussain President of the Bank 30+ years of banking experience, previously served as EVP, Real Estate Market Executive for Wells Fargo Bryan Corsini Chief Credit Officer 35+ years of banking experience, previously served as CCO of PacWest Bancorp and Director of Pacific Western Bank Ido Dotan General Counsel and Chief Administrative Officer 20+ years experience in corporate securities, M&A, and structured finance. Previously served as EVP of Carrington Mortgage Holdings Olivia Lindsay Chief Risk Officer 20+ years of experience in regulatory processes and controls, previously spent 15 years at MUFG Union Bank Steve Schwimmer Chief Information Officer 30+ years of experience in banking technology, previously served as the EVP, Chief Innovation Officer at PacWest Bancorp Stan Ivie Head of Government and Regulatory Affairs Previously served as the Chief Risk Officer of PacWest Bancorp & the regional director for the FDIC’s San Francisco and Dallas Regions Michael Pierron Head of Payments 25+ years of technology, product and operations, previously served as Head of Operations at Flagstar Bank Sean Lynden President, Venture Banking Group 30+ years of banking and related experience. Previously served as President of Venture Banking Group for Pacific Western Bank Chris Baron President, Community Banking 30+ years of banking experience. Previously served as President of Los Angeles Region for Pacific Western Bank Karen Hon Chief Accounting Officer 20+ years of finance & accounting experience, previously served as Chief Accounting Officer at Silicon Valley Bank Jared Wolff Chairman and Chief Executive Officer 30+ years of banking and law. Previously held senior executive positions with City National Bank (RBC) and PacWest Bancorp Joe Kauder Chief Financial Officer 30+ years of banking experience, previously served as EVP, CFO Wells Fargo Wholesale Banking Bill Rhodes Chief Internal Audit Officer 25+ years of banking and internal audit experience, previously served as CAE of Coastal Community Bank and Deputy CAE of Silicon Valley Bank Fourth Quarter 2025 Earnings | 31

Appendix

Non-GAAP Financial Information Tangible assets, tangible common equity, tangible common equity ratio, tangible book value per common share, adjusted net earnings, adjusted return on average assets (“ROAA”), return on average tangible common equity, adjusted return on average tangible common equity, pre-tax pre-provision (“PTPP”) income, adjusted noninterest expense, efficiency ratio, adjusted efficiency ratio, adjusted ACL ratio, and economic coverage ratio constitute supplemental financial information determined by methods other than in accordance with GAAP. These non-GAAP measures are used by management in its analysis of the Company's performance. Tangible assets is calculated by subtracting goodwill and other intangible assets from total assets. Tangible common equity is calculated by subtracting preferred stock and goodwill and other intangible assets, as applicable, from stockholders’ equity. Return on average tangible common equity is calculated by dividing net earnings available to common stockholders, after adjustment for amortization of intangible assets and goodwill impairment, by average tangible common equity. Adjusted return on average tangible common equity is calculated by dividing adjusted net earnings available to common stockholders, after adjustment for amortization of intangible assets and goodwill impairment, by average tangible common equity. Banking regulators also exclude goodwill and other intangible assets from stockholders' equity when assessing the capital adequacy of a financial institution. Adjusted net earnings is calculated by adjusting net earnings by unusual, one-time items. ROAA is calculated by dividing annualized net earnings by average assets. Adjusted ROAA is calculated by dividing annualized adjusted net earnings by average assets. PTPP income is calculated by adding net interest income and noninterest income (total revenue) and subtracting noninterest expense. Adjusted PTPP income is calculated by adding net interest income and adjusted noninterest income (adjusted total revenue) and subtracting adjusted noninterest expense. Adjusted noninterest expense is calculated by subtracting acquisition, integration and reorganization costs from total noninterest expense. Adjusted noninterest expense excluding customer related expenses is calculated by subtracting customer related expenses from adjusted noninterest expense. Efficiency ratio is calculated by dividing noninterest expense (less intangible asset amortization and acquisition, integration and reorganization costs) by total revenue (the sum of net interest income and noninterest income, less gain (loss) on sale of securities). Adjusted efficiency ratio is calculated by dividing adjusted noninterest expense (less intangible asset amortization and acquisition, integration and reorganization costs, customer related expenses and any unusual one-item items) by adjusted total revenue (the sum of net interest income and noninterest income, less gain (loss) on sale of securities and customer related expense). Economic coverage ratio is calculated by dividing the allowance for credit losses adjusted for the impact of the credit- linked notes and unearned credit mark from purchase accounting by loans and leases held for investment. Core deposits is calculated as total deposits less brokered CDs and brokered non-maturity deposits. Core loan portfolio is calculated as total loans held for investment less premium finance loans, student loans, and Civic loans. Adjusted ACL ratio is calculated by dividing adjusted ACL for lower loss loan categories by adjusted loans and leases held for investment. Management believes the presentation of these financial measures adjusting the impact of these items provides useful supplemental information that is essential to a proper understanding of the financial results and operating performance of the Company. This disclosure should not be viewed as a substitute for results determined in accordance with GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies. The following tables on pages 34-43 provide reconciliations of the non-GAAP measures to financial measures defined by GAAP. Fourth Quarter 2025 Earnings | 33

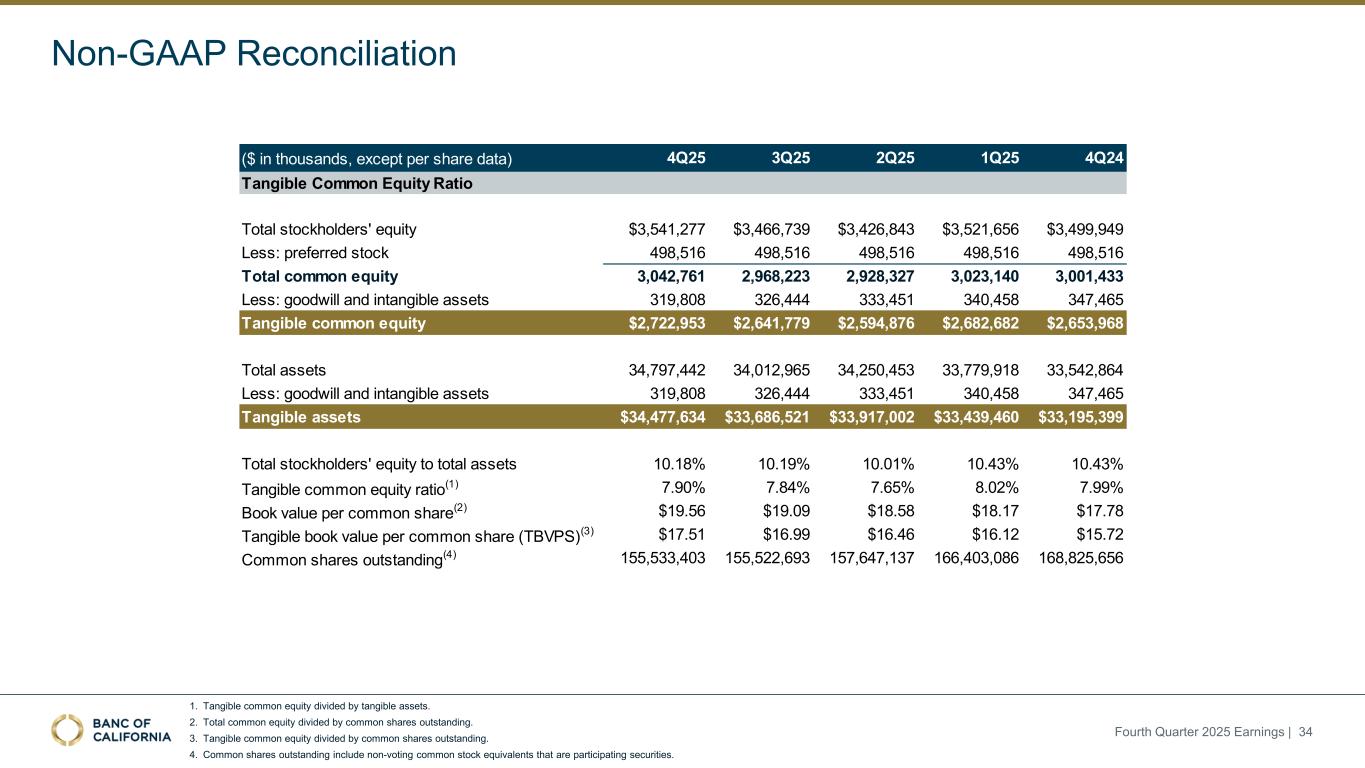

Non-GAAP Reconciliation 1. Tangible common equity divided by tangible assets. 2. Total common equity divided by common shares outstanding. 3. Tangible common equity divided by common shares outstanding. 4. Common shares outstanding include non-voting common stock equivalents that are participating securities. ($ in thousands, except per share data) 4Q25 3Q25 2Q25 1Q25 4Q24 Tangible Common Equity Ratio Total stockholders' equity $3,541,277 $3,466,739 $3,426,843 $3,521,656 $3,499,949 Less: preferred stock 498,516 498,516 498,516 498,516 498,516 Total common equity 3,042,761 2,968,223 2,928,327 3,023,140 3,001,433 Less: goodwill and intangible assets 319,808 326,444 333,451 340,458 347,465 Tangible common equity $2,722,953 $2,641,779 $2,594,876 $2,682,682 $2,653,968 Total assets 34,797,442 34,012,965 34,250,453 33,779,918 33,542,864 Less: goodwill and intangible assets 319,808 326,444 333,451 340,458 347,465 Tangible assets $34,477,634 $33,686,521 $33,917,002 $33,439,460 $33,195,399 Total stockholders' equity to total assets 10.18% 10.19% 10.01% 10.43% 10.43% Tangible common equity ratio(1) 7.90% 7.84% 7.65% 8.02% 7.99% Book value per common share(2) $19.56 $19.09 $18.58 $18.17 $17.78 Tangible book value per common share (TBVPS)(3) $17.51 $16.99 $16.46 $16.12 $15.72 Common shares outstanding(4) 155,533,403 155,522,693 157,647,137 166,403,086 168,825,656 Fourth Quarter 2025 Earnings | 34

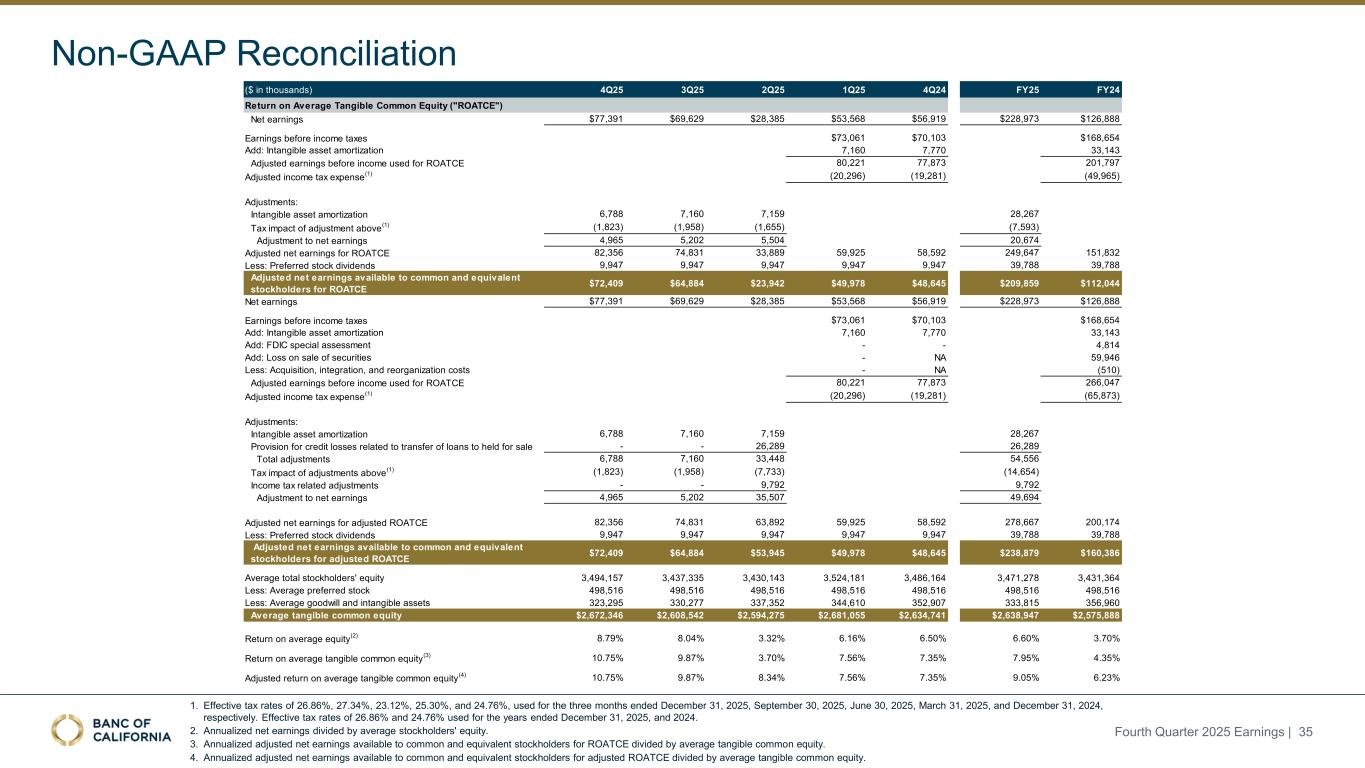

1. Effective tax rates of 26.86%, 27.34%, 23.12%, 25.30%, and 24.76%, used for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025, and December 31, 2024, respectively. Effective tax rates of 26.86% and 24.76% used for the years ended December 31, 2025, and 2024. 2. Annualized net earnings divided by average stockholders' equity. 3. Annualized adjusted net earnings available to common and equivalent stockholders for ROATCE divided by average tangible common equity. 4. Annualized adjusted net earnings available to common and equivalent stockholders for adjusted ROATCE divided by average tangible common equity. Fourth Quarter 2025 Earnings | 35 Non-GAAP Reconciliation ($ in thousands) 4Q25 3Q25 2Q25 1Q25 4Q24 FY25 FY24 Return on Average Tangible Common Equity ("ROATCE") Net earnings $77,391 $69,629 $28,385 $53,568 $56,919 $228,973 $126,888 Earnings before income taxes $73,061 $70,103 $168,654 Add: Intangible asset amortization 7,160 7,770 33,143 Adjusted earnings before income used for ROATCE 80,221 77,873 201,797 Adjusted income tax expense (1) (20,296) (19,281) (49,965) Adjustments: Intangible asset amortization 6,788 7,160 7,159 28,267 Tax impact of adjustment above (1) (1,823) (1,958) (1,655) (7,593) Adjustment to net earnings 4,965 5,202 5,504 20,674 Adjusted net earnings for ROATCE 82,356 74,831 33,889 59,925 58,592 249,647 151,832 Less: Preferred stock dividends 9,947 9,947 9,947 9,947 9,947 39,788 39,788 Adjusted net earnings available to common and equivalent stockholders for ROATCE $72,409 $64,884 $23,942 $49,978 $48,645 $209,859 $112,044 Net earnings $77,391 $69,629 $28,385 $53,568 $56,919 $228,973 $126,888 Earnings before income taxes $73,061 $70,103 $168,654 Add: Intangible asset amortization 7,160 7,770 33,143 Add: FDIC special assessment - - 4,814 Add: Loss on sale of securities - NA 59,946 Less: Acquisition, integration, and reorganization costs - NA (510) Adjusted earnings before income used for ROATCE 80,221 77,873 266,047 Adjusted income tax expense (1) (20,296) (19,281) (65,873) Adjustments: Intangible asset amortization 6,788 7,160 7,159 28,267 Provision for credit losses related to transfer of loans to held for sale - - 26,289 26,289 Total adjustments 6,788 7,160 33,448 54,556 Tax impact of adjustments above (1) (1,823) (1,958) (7,733) (14,654) Income tax related adjustments - - 9,792 9,792 Adjustment to net earnings 4,965 5,202 35,507 49,694 Adjusted net earnings for adjusted ROATCE 82,356 74,831 63,892 59,925 58,592 278,667 200,174 Less: Preferred stock dividends 9,947 9,947 9,947 9,947 9,947 39,788 39,788 Adjusted net earnings available to common and equivalent stockholders for adjusted ROATCE $72,409 $64,884 $53,945 $49,978 $48,645 $238,879 $160,386 Average total stockholders' equity 3,494,157 3,437,335 3,430,143 3,524,181 3,486,164 3,471,278 3,431,364 Less: Average preferred stock 498,516 498,516 498,516 498,516 498,516 498,516 498,516 Less: Average goodwill and intangible assets 323,295 330,277 337,352 344,610 352,907 333,815 356,960 Average tangible common equity $2,672,346 $2,608,542 $2,594,275 $2,681,055 $2,634,741 $2,638,947 $2,575,888 Return on average equity (2) 8.79% 8.04% 3.32% 6.16% 6.50% 6.60% 3.70% Return on average tangible common equity (3) 10.75% 9.87% 3.70% 7.56% 7.35% 7.95% 4.35% Adjusted return on average tangible common equity (4) 10.75% 9.87% 8.34% 7.56% 7.35% 9.05% 6.23%

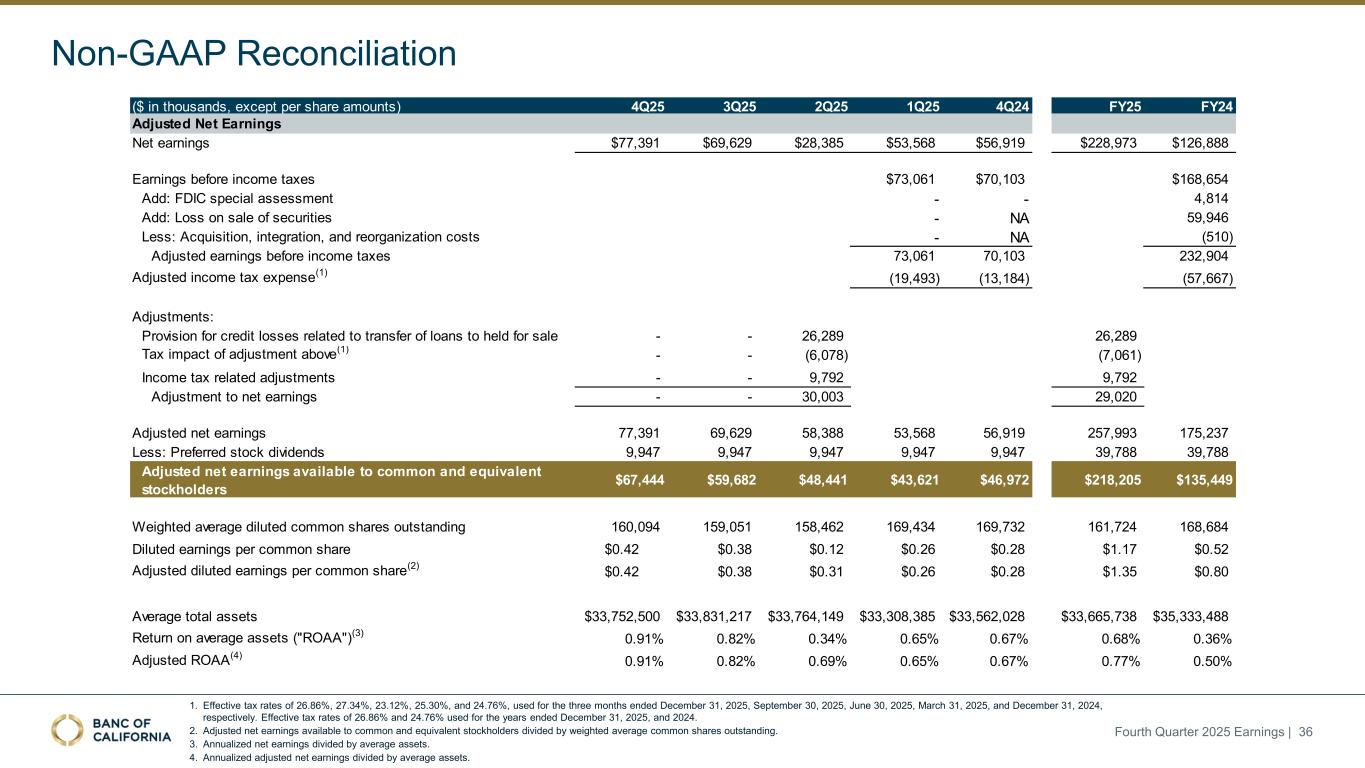

1. Effective tax rates of 26.86%, 27.34%, 23.12%, 25.30%, and 24.76%, used for the three months ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025, and December 31, 2024, respectively. Effective tax rates of 26.86% and 24.76% used for the years ended December 31, 2025, and 2024. 2. Adjusted net earnings available to common and equivalent stockholders divided by weighted average common shares outstanding. 3. Annualized net earnings divided by average assets. 4. Annualized adjusted net earnings divided by average assets. Fourth Quarter 2025 Earnings | 36 Non-GAAP Reconciliation ($ in thousands, except per share amounts) 4Q25 3Q25 2Q25 1Q25 4Q24 FY25 FY24 Net earnings $77,391 $69,629 $28,385 $53,568 $56,919 $228,973 $126,888 Earnings before income taxes $73,061 $70,103 $168,654 Add: FDIC special assessment - - 4,814 Add: Loss on sale of securities - NA 59,946 Less: Acquisition, integration, and reorganization costs - NA (510) Adjusted earnings before income taxes 73,061 70,103 232,904 Adjusted income tax expense(1) (19,493) (13,184) (57,667) Adjustments: Provision for credit losses related to transfer of loans to held for sale - - 26,289 26,289 Tax impact of adjustment above(1) - - (6,078) (7,061) Income tax related adjustments - - 9,792 9,792 Adjustment to net earnings - - 30,003 29,020 Adjusted net earnings 77,391 69,629 58,388 53,568 56,919 257,993 175,237 Less: Preferred stock dividends 9,947 9,947 9,947 9,947 9,947 39,788 39,788 Adjusted net earnings available to common and equivalent stockholders $67,444 $59,682 $48,441 $43,621 $46,972 $218,205 $135,449 Weighted average diluted common shares outstanding 160,094 159,051 158,462 169,434 169,732 161,724 168,684 Diluted earnings per common share $0.42 $0.38 $0.12 $0.26 $0.28 $1.17 $0.52 Adjusted diluted earnings per common share(2) $0.42 $0.38 $0.31 $0.26 $0.28 $1.35 $0.80 Average total assets $33,752,500 $33,831,217 $33,764,149 $33,308,385 $33,562,028 $33,665,738 $35,333,488 Return on average assets ("ROAA")(3) 0.91% 0.82% 0.34% 0.65% 0.67% 0.68% 0.36% Adjusted ROAA(4) 0.91% 0.82% 0.69% 0.65% 0.67% 0.77% 0.50% Adjusted Net Earnings

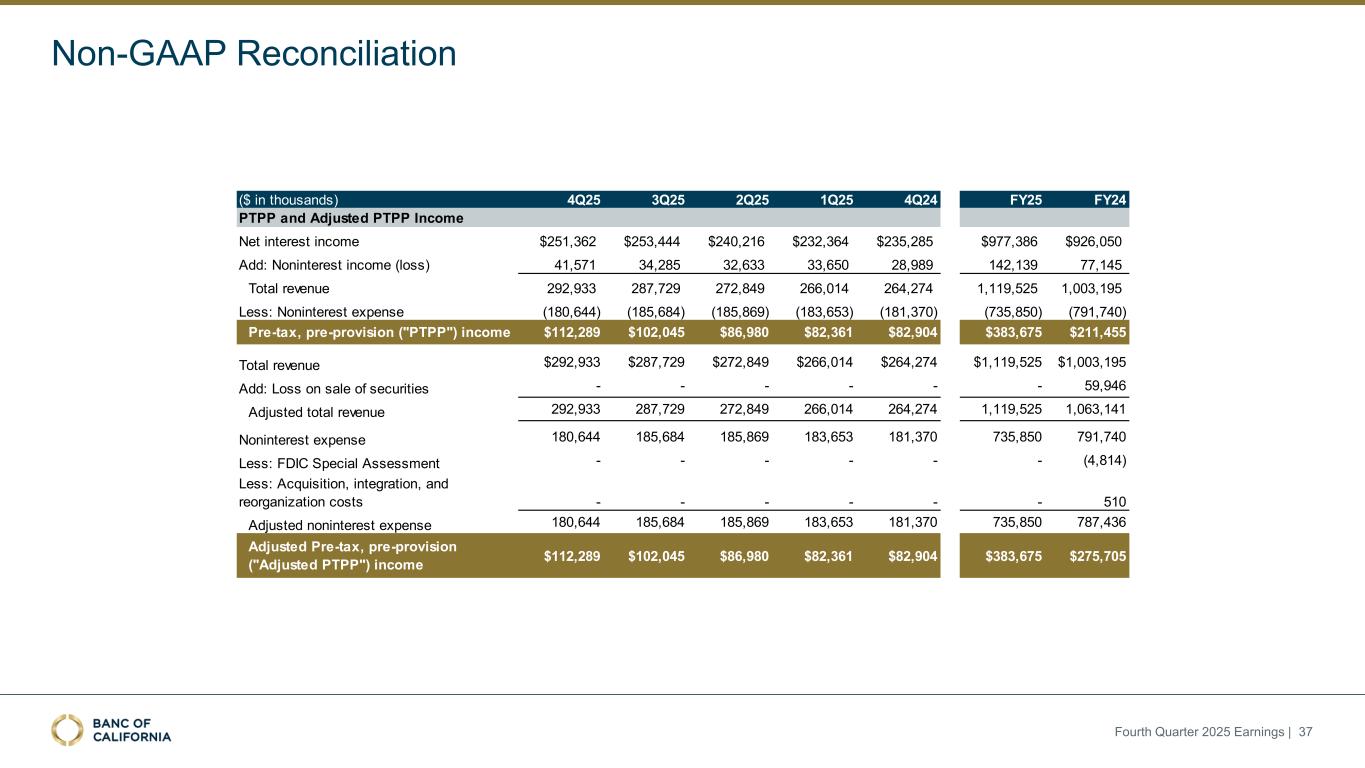

Fourth Quarter 2025 Earnings | 37 Non-GAAP Reconciliation ($ in thousands) 4Q25 3Q25 2Q25 1Q25 4Q24 FY25 FY24 PTPP and Adjusted PTPP Income Net interest income $251,362 $253,444 $240,216 $232,364 $235,285 $977,386 $926,050 Add: Noninterest income (loss) 41,571 34,285 32,633 33,650 28,989 142,139 77,145 Total revenue 292,933 287,729 272,849 266,014 264,274 1,119,525 1,003,195 Less: Noninterest expense (180,644) (185,684) (185,869) (183,653) (181,370) (735,850) (791,740) Pre-tax, pre-provision ("PTPP") income $112,289 $102,045 $86,980 $82,361 $82,904 $383,675 $211,455 Total revenue $292,933 $287,729 $272,849 $266,014 $264,274 $1,119,525 $1,003,195 Add: Loss on sale of securities - - - - - - 59,946 Adjusted total revenue 292,933 287,729 272,849 266,014 264,274 1,119,525 1,063,141 Noninterest expense 180,644 185,684 185,869 183,653 181,370 735,850 791,740 Less: FDIC Special Assessment - - - - - - (4,814) Less: Acquisition, integration, and reorganization costs - - - - - - 510 Adjusted noninterest expense 180,644 185,684 185,869 183,653 181,370 735,850 787,436 Adjusted Pre-tax, pre-provision ("Adjusted PTPP") income $112,289 $102,045 $86,980 $82,361 $82,904 $383,675 $275,705

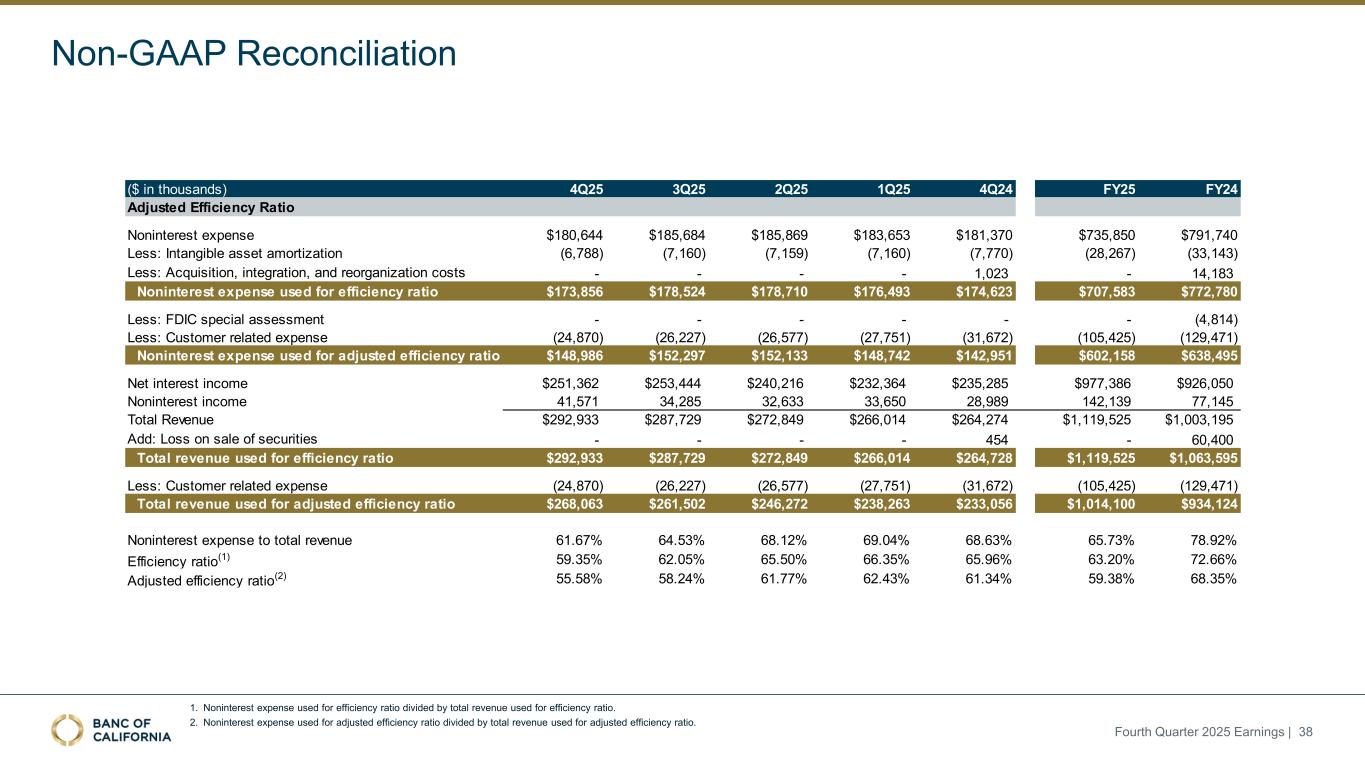

1. Noninterest expense used for efficiency ratio divided by total revenue used for efficiency ratio. 2. Noninterest expense used for adjusted efficiency ratio divided by total revenue used for adjusted efficiency ratio. Fourth Quarter 2025 Earnings | 38 Non-GAAP Reconciliation ($ in thousands) 4Q25 3Q25 2Q25 1Q25 4Q24 FY25 FY24 Adjusted Efficiency Ratio Noninterest expense $180,644 $185,684 $185,869 $183,653 $181,370 $735,850 $791,740 Less: Intangible asset amortization (6,788) (7,160) (7,159) (7,160) (7,770) (28,267) (33,143) Less: Acquisition, integration, and reorganization costs - - - - 1,023 - 14,183 Noninterest expense used for efficiency ratio $173,856 $178,524 $178,710 $176,493 $174,623 $707,583 $772,780 Less: FDIC special assessment - - - - - - (4,814) Less: Customer related expense (24,870) (26,227) (26,577) (27,751) (31,672) (105,425) (129,471) Noninterest expense used for adjusted efficiency ratio $148,986 $152,297 $152,133 $148,742 $142,951 $602,158 $638,495 Net interest income $251,362 $253,444 $240,216 $232,364 $235,285 $977,386 $926,050 Noninterest income 41,571 34,285 32,633 33,650 28,989 142,139 77,145 Total Revenue $292,933 $287,729 $272,849 $266,014 $264,274 $1,119,525 $1,003,195 Add: Loss on sale of securities - - - - 454 - 60,400 Total revenue used for efficiency ratio $292,933 $287,729 $272,849 $266,014 $264,728 $1,119,525 $1,063,595 Less: Customer related expense (24,870) (26,227) (26,577) (27,751) (31,672) (105,425) (129,471) Total revenue used for adjusted efficiency ratio $268,063 $261,502 $246,272 $238,263 $233,056 $1,014,100 $934,124 Noninterest expense to total revenue 61.67% 64.53% 68.12% 69.04% 68.63% 65.73% 78.92% Efficiency ratio(1) 59.35% 62.05% 65.50% 66.35% 65.96% 63.20% 72.66% Adjusted efficiency ratio(2) 55.58% 58.24% 61.77% 62.43% 61.34% 59.38% 68.35%

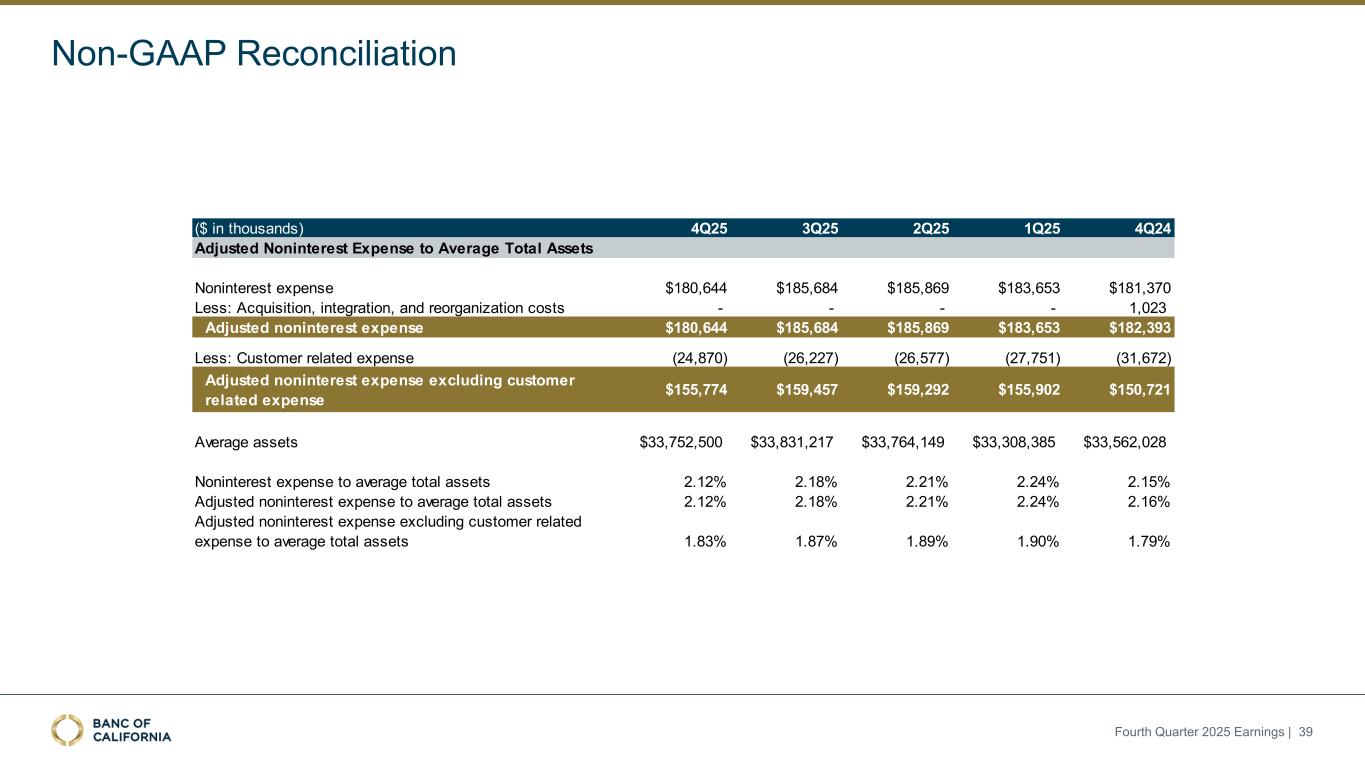

($ in thousands) 4Q25 3Q25 2Q25 1Q25 4Q24 Noninterest expense $180,644 $185,684 $185,869 $183,653 $181,370 Less: Acquisition, integration, and reorganization costs - - - - 1,023 Adjusted noninterest expense $180,644 $185,684 $185,869 $183,653 $182,393 Less: Customer related expense (24,870) (26,227) (26,577) (27,751) (31,672) Adjusted noninterest expense excluding customer related expense $155,774 $159,457 $159,292 $155,902 $150,721 Average assets $33,752,500 $33,831,217 $33,764,149 $33,308,385 $33,562,028 Noninterest expense to average total assets 2.12% 2.18% 2.21% 2.24% 2.15% Adjusted noninterest expense to average total assets 2.12% 2.18% 2.21% 2.24% 2.16% Adjusted noninterest expense excluding customer related expense to average total assets 1.83% 1.87% 1.89% 1.90% 1.79% Adjusted Noninterest Expense to Average Total Assets Fourth Quarter 2025 Earnings | 39 Non-GAAP Reconciliation

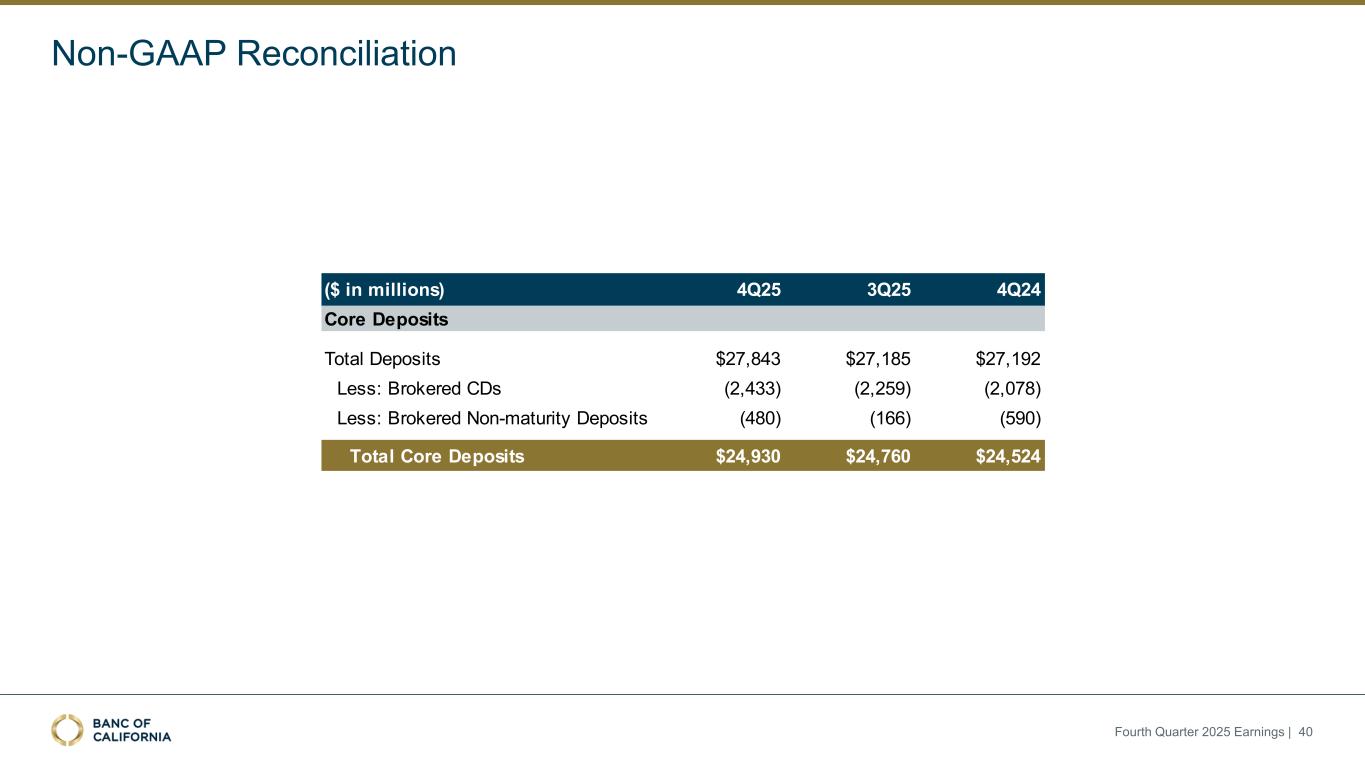

Fourth Quarter 2025 Earnings | 40 ($ in millions) 4Q25 3Q25 4Q24 Total Deposits $27,843 $27,185 $27,192 Less: Brokered CDs (2,433) (2,259) (2,078) Less: Brokered Non-maturity Deposits (480) (166) (590) Total Core Deposits $24,930 $24,760 $24,524 Core Deposits Non-GAAP Reconciliation

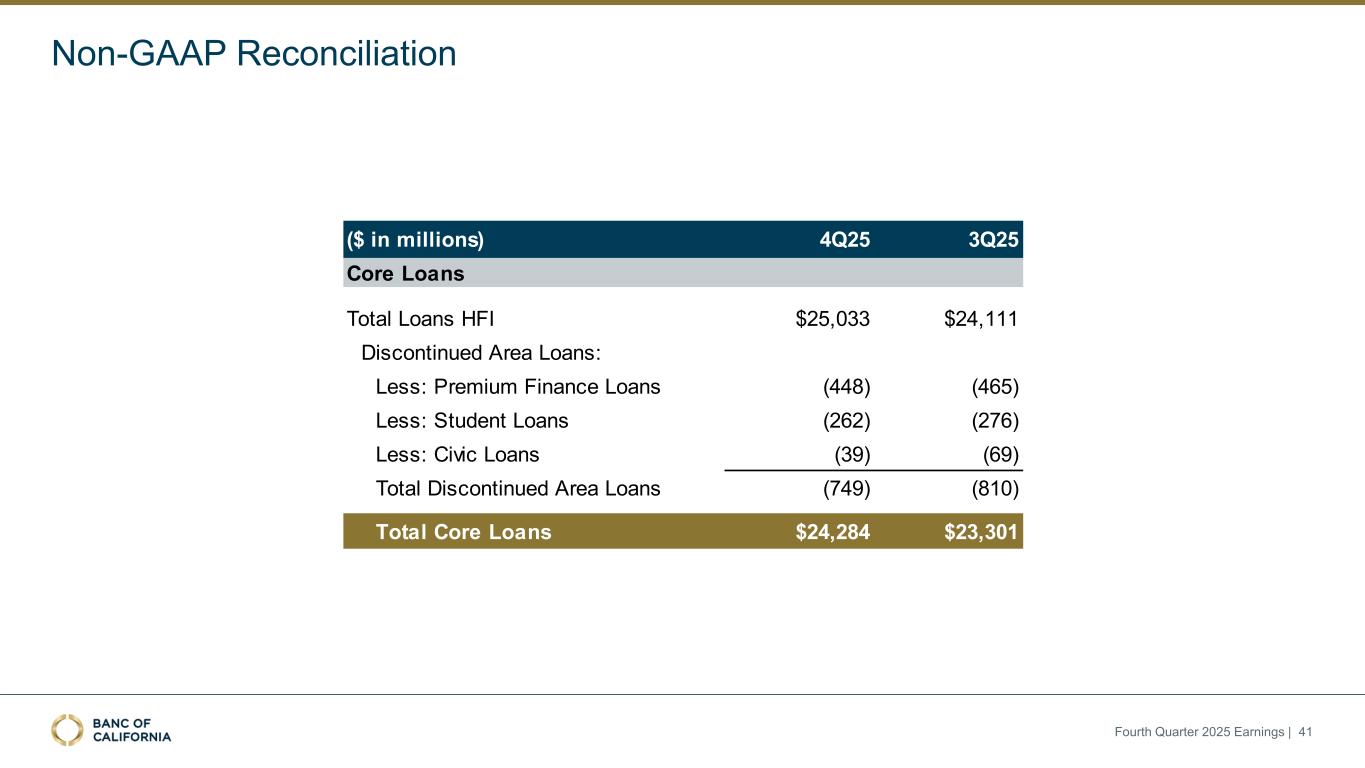

Non-GAAP Reconciliation Fourth Quarter 2025 Earnings | 41 ($ in millions) 4Q25 3Q25 Total Loans HFI $25,033 $24,111 Discontinued Area Loans: Less: Premium Finance Loans (448) (465) Less: Student Loans (262) (276) Less: Civic Loans (39) (69) Total Discontinued Area Loans (749) (810) Total Core Loans $24,284 $23,301 Core Loans

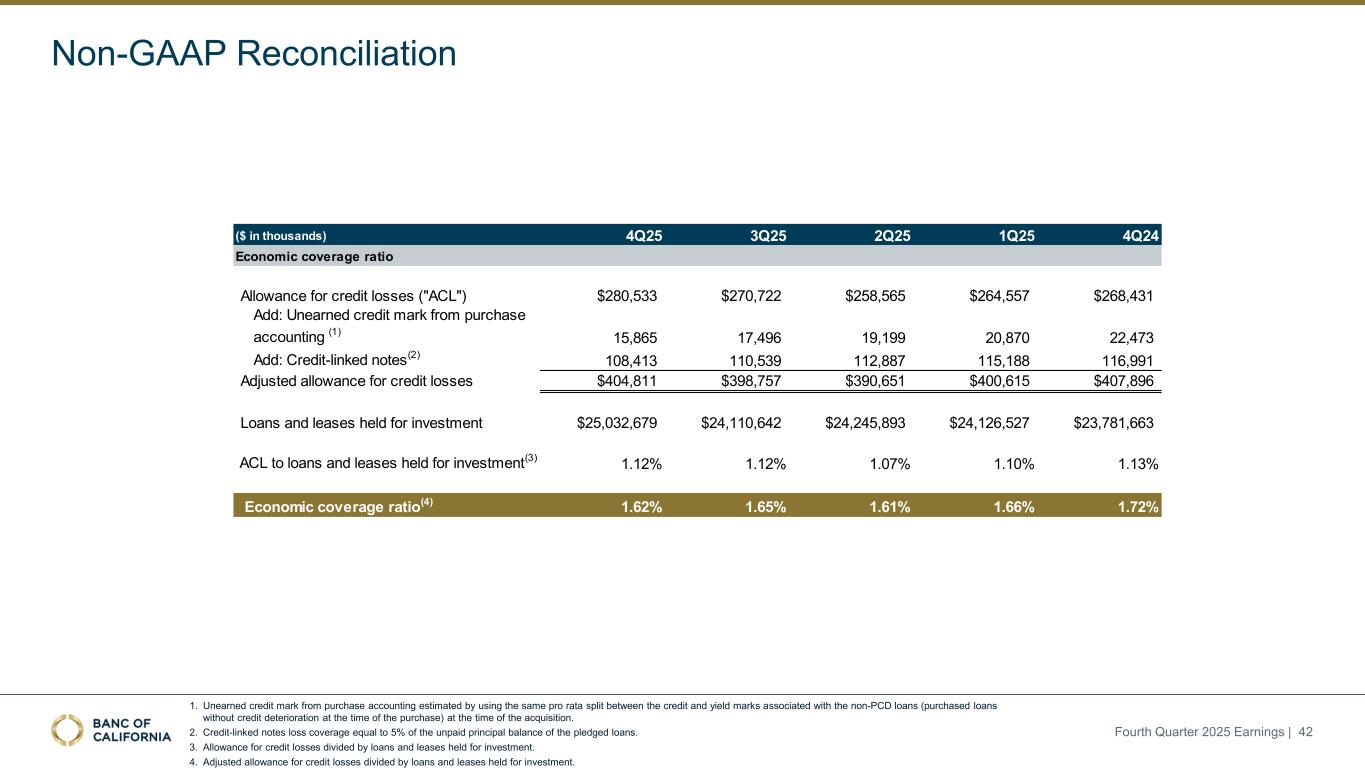

Non-GAAP Reconciliation 1. Unearned credit mark from purchase accounting estimated by using the same pro rata split between the credit and yield marks associated with the non-PCD loans (purchased loans without credit deterioration at the time of the purchase) at the time of the acquisition. 2. Credit-linked notes loss coverage equal to 5% of the unpaid principal balance of the pledged loans. 3. Allowance for credit losses divided by loans and leases held for investment. 4. Adjusted allowance for credit losses divided by loans and leases held for investment. Fourth Quarter 2025 Earnings | 42 ($ in thousands) 4Q25 3Q25 2Q25 1Q25 4Q24 Allowance for credit losses ("ACL") $280,533 $270,722 $258,565 $264,557 $268,431 Add: Unearned credit mark from purchase accounting (1) 15,865 17,496 19,199 20,870 22,473 Add: Credit-linked notes(2) 108,413 110,539 112,887 115,188 116,991 Adjusted allowance for credit losses $404,811 $398,757 $390,651 $400,615 $407,896 Loans and leases held for investment $25,032,679 $24,110,642 $24,245,893 $24,126,527 $23,781,663 ACL to loans and leases held for investment(3) 1.12% 1.12% 1.07% 1.10% 1.13% Economic coverage ratio(4) 1.62% 1.65% 1.61% 1.66% 1.72% Economic coverage ratio

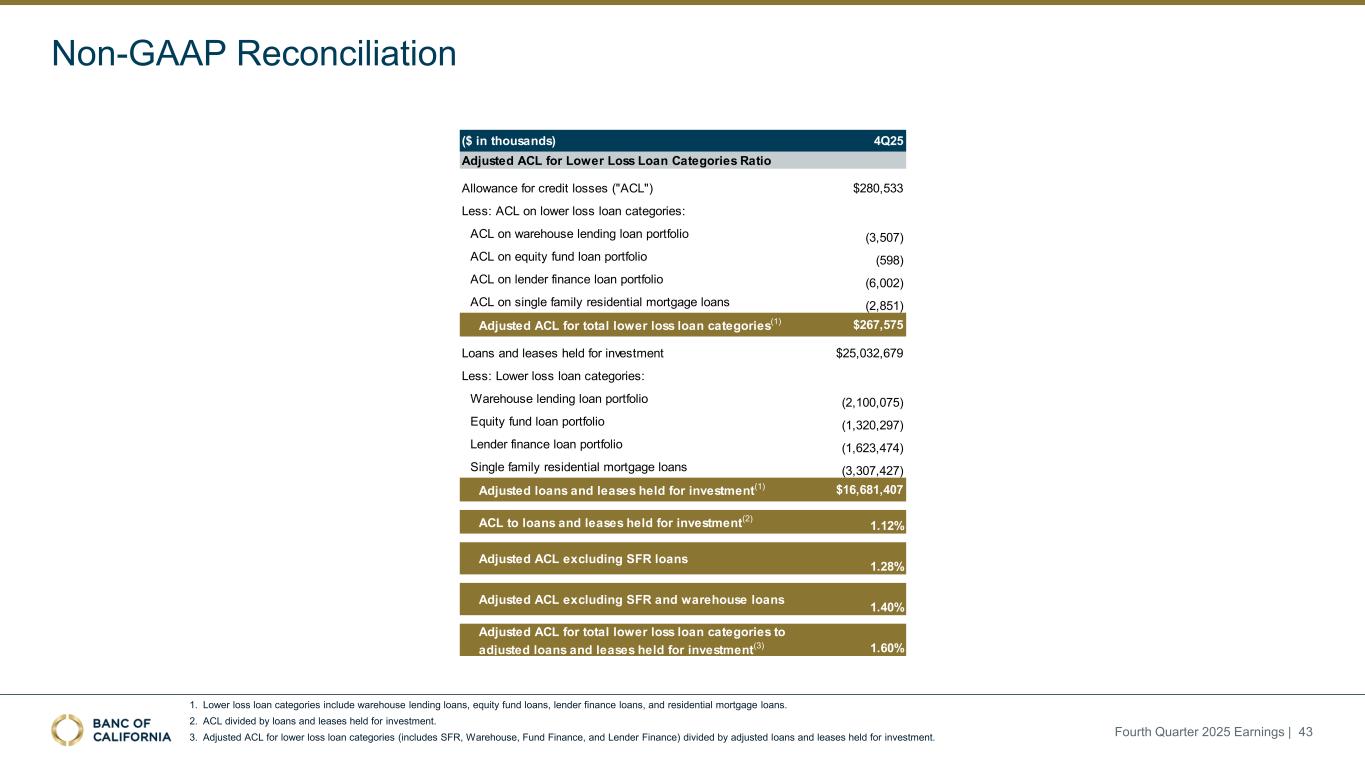

Non-GAAP Reconciliation 1. Lower loss loan categories include warehouse lending loans, equity fund loans, lender finance loans, and residential mortgage loans. 2. ACL divided by loans and leases held for investment. 3. Adjusted ACL for lower loss loan categories (includes SFR, Warehouse, Fund Finance, and Lender Finance) divided by adjusted loans and leases held for investment. Fourth Quarter 2025 Earnings | 43 ($ in thousands) 4Q25 Allowance for credit losses ("ACL") $280,533 Less: ACL on lower loss loan categories: ACL on warehouse lending loan portfolio (3,507) ACL on equity fund loan portfolio (598) ACL on lender finance loan portfolio (6,002) ACL on single family residential mortgage loans (2,851) Adjusted ACL for total lower loss loan categories(1) $267,575 Loans and leases held for investment $25,032,679 Less: Lower loss loan categories: Warehouse lending loan portfolio (2,100,075) Equity fund loan portfolio (1,320,297) Lender finance loan portfolio (1,623,474) Single family residential mortgage loans (3,307,427) Adjusted loans and leases held for investment(1) $16,681,407 ACL to loans and leases held for investment(2) 1.12% Adjusted ACL excluding SFR loans 1.28% Adjusted ACL excluding SFR and warehouse loans 1.40% Adjusted ACL for total lower loss loan categories to adjusted loans and leases held for investment(3) 1.60% Adjusted ACL for Lower Loss Loan Categories Ratio