Statement by Mike Fraser, CEO Gold Fields delivered strong results in 2025, with a significant improvement in our safety, operational and financial performance, compared to 2024. Most importantly, the benefits of our Safety Improvement Plan, which commenced in 2024 resulted in no fatalities at any of our operations in 2025. There were seven serious injuries recorded during the year and this reminds us of the ongoing focus required to achieve our goal of ensuring all our people return home safe and well every day. We continued to embed our functional operating model and improve our systems and processes, providing the platform for reliable delivery of our strategy and long-term aspirations. We also identified asset optimisation initiatives across our portfolio which were communicated to the market with our H1 2025 results in August 2025 and again at our Capital Markets Day in November 2025. These initiatives are aimed at enhancing the value and life of our mines by improving efficiencies, reducing operating costs, extending the lives of our mines, and in some cases, increasing production. At our inaugural Capital Markets Day, we provided a five-year outlook for the Group, together with five-year profiles for individual assets. This outlook demonstrates the significant opportunities within our portfolio and the levers to deliver increased value. We also presented our enhanced capital allocation framework which included a change to our dividend policy. The new policy, which will take effect with the final FY 2025 dividend declaration, targets a base dividend of 35% of free cash flow before discretionary growth investments, with a minimum annual dividend of US$0.50 per share1. In addition, we communicated our intention to provide additional returns to shareholders of up to US$500m2 over the next 24 months based on current cash flow projections, in the form of special dividends and/or share buybacks3,4. Operationally, we delivered a more predictable performance in 2025, keeping guidance unchanged throughout the year, delivering production at the upper end of guidance and costs within the guided range. Group attributable gold-equivalent production increased 18% to 2,438koz in 2025, underpinned by strong performances across the portfolio. Salares Norte delivered a particularly strong second half performance, reaching commercial production in Q3 2025 and steady state by year-end, with the mine delivering above the upper end of its guidance. The improved operational performance, coupled with the higher gold price, resulted in a strong financial performance in 2025. The Group generated adjusted free cash flow of US$2,970 million compared to US$605 million in 2024 and headline earnings of US$2,576 million compared to US$1,188 million in 2024. In line with our updated dividend policy, we have declared a final dividend of R18.50 per share, which is 164% higher than the final dividend paid last year. When combined with the interim dividend of R7.00 per share, the total dividend of R25.50 per share (US$1.60 per share) equates to 35% of free cash flow before discretionary investments, in line with our targeted 35%. In addition to the base dividend, Gold Fields will distribute US$353 million in additional returns. This will comprise US$253 million in special dividends and US$100 million in share buy-backs, broadly aligned with the preferences and composition of our shareholder register. Combined with the base dividend, this results in a total distribution to shareholders of US$1.7 billion which equates to 54% of adjusted free cash flow. Attributable gold-equivalent production 2.438Moz All-in sustaining costs US$1,645/oz All-in costs US$1,927/oz Normalised profit* US$2,684m Adjusted free cash flow from operations US$3,171m Adjusted free cash flow** US$2,970m Final dividend per share 1850 SA cents and special dividend per share 450 SA cents * Profit excluding gains and losses on foreign exchange, financial instruments, non- recurring NRV adjustments to stockpiles and non-recurring items after taxation and non-controlling interest effect ** Cash flow from operating activities less net capital expenditure, contributions to environmental trust funds and payments of lease liabilities JOHANNESBURG, 19 February 2026: Gold Fields Limited (NYSE & JSE: GFI) today announced profit attributable to owners of the parent for the year ended 31 December 2025 of US$3,567.4 million (US$3.99 per share). This compares with profit of US$1,245.0 million (US$1.39 per share) for the year ended 31 December 2024. A gross final dividend of 1850 South African cents per share and special dividend of 450 SA cents are payable on 16 March 2026. 1 Paid semi-annually at US$0.25 per share 2 Subject to applicable legal, regulatory and shareholder approval requirements 3 Subject to maintaining an adjusted net debt to adjusted EBITDA ratio of below 1.0 times 4 All payouts are subject to all applicable legal, regulatory and shareholder approval requirements Reviewed results for year ended 31 December 2025 Gold Fields Limited Reg. No. 1968/004880/06 Incorporated in the Republic of South Africa JSE, NYSE, DIFX Share Code: GFI ISIN Code:ZAE000018123 l i l i i . . I i li i , , I : I ISIN Code:

Looking ahead, our priorities for 2026 include advancing our Safety Improvement Plan, and optimising our operating model, systems and processes which provide the platform for safe, reliable and cost-effective production delivery. Strategically, we are focused on advancing the renewal of the Tarkwa mining leases, while ensuring the smooth transition of the Damang mine to the Government of Ghana. At the Windfall Project in Canada, we are progressing permitting approvals, the Impact Benefit Agreement and advancing project studies to Final Investment Decision (FID). Finally, we intend to progress the value-enhancing organic opportunities presented to the market in November, including: • Integration of the Yamarna and Golden Highway land tenements at Gruyere; • Gruyere open pit and underground studies; • St Ives and Granny Smith material handling system studies; • Preparation for the pre-stripping activities at Aqua Amarga; • Santa Ana and Invincible underground life-extension study at St Ives; and • South of Wrench feasibility study at South Deep Delivering on our strategy During 2025, we continued to execute our three-pillar strategy to: • Operate in a safe, reliable and cost-effective way • Have a positive impact on our communities and the environment, and • Grow the quality of our portfolio We believe that the consistent delivery of this strategy will drive improved margins and free cash flow per share, strengthen our position relative to peers and enhance returns for our shareholders. Operate in a safe, reliable and cost-effective way Safety and wellbeing We remain steadfast in our belief in fatality- and serious injury-free mining and are committed to eliminating fatalities, serious injuries and occupational diseases. Safety performance improved materially during 2025, with the achievement of zero fatalities and six consecutive fatality-free quarters, an important milestone in Gold Fields’ history. However, seven serious injuries occurred during the year, reinforcing that further progress is required. The disciplined delivery of our Safety Improvement Plan, together with the continued maturation of our culture and operating systems, remains critical to eliminating serious injuries. We continue to reinforce our cultural and operational levers through improving leadership behaviours and mindsets, robust risk management and strengthened health and safety systems and practices. In 2025, we implemented an Occupational Health Framework to prevent workplace exposures and illnesses and to further strengthen workforce wellbeing. Reliable and cost-effective operations Our operational delivery was more predictable in 2025, enabling us to track our operating plans and achieve our guidance for the year. Group attributable gold-equivalent production for FY 2025 was 18% higher year- on-year (YoY) at 2,438koz (FY 2024: 2,071koz). Costs remained elevated in FY 2025 driven by general industry inflation, higher royalties owing to increased realised gold prices, stronger producer currencies and higher capital expenditure. All-In Cost (AIC) increased by 3% YoY to US$1,927/oz (FY 2024: US$1,873/oz) and All-in Sustaining Cost (AISC) increased by 1% YoY to US$1,645/oz (FY 2024: US$1,629/oz), as higher royalties and capital expenditure offset the impact of increased gold sold. Through our asset optimisation programme, we identified a number of improvement opportunities at key assets which are expected to mitigate inflationary impacts going forward. Gruyere had a difficult Q4 2025, with ground instability and rock fall incidents resulting in the resequencing of mining activities to lower- grade areas of the Gruyere pit. Head grade was further impacted as lower-grade stockpiles were processed to supplement ore feed. The mine also experienced increased workforce turnover during H2 2025, resulting in unplanned downtime of production equipment and a decrease in tonnes mined for the period. While these challenges are expected to continue impacting operations at Gruyere in Q1 2026, the team has identified action plans to improve mining performance. These include improving mining fleet equipment availability, implementing optimisation initiatives to unlock mining efficiencies, and engaging with our business partners to strengthen retention and recruitment strategies. Despite the current challenges, we forecast an increase in Gruyere’s production in FY 2026 compared with FY 2025, with production weighted to H2 2026. Tarkwa’s waste stripping campaign continued during 2025. As a result, production decreased by 12% as lower-grade stockpiles were used to supplement the ore feed. AIC increased by 26% YoY driven by lower volumes of gold sold, general mining inflation, a 31% increase in royalties paid and increased capital expenditure. A key focus in the near to medium term is to optimise Tarkwa’s mining costs by improving mining efficiencies, reconfiguring the mining fleet and optimising the mine design. South Deep delivered a strong performance in 2025, with production of 309koz up 16% YoY (FY 2024: 267koz) and achieving the top end of its guidance range. As a highly mechanised, long-life orebody, South Deep remains a cornerstone asset, with the team focused on improving stope turnaround times and driving incremental performance gains. Salares Norte had a successful ramp-up in 2025 with a particularly strong second half. The mine achieved commercial production in Q3 2025 and reached steady state operations in Q4 2025, resulting in production of 397koz eq for FY 2025, which is above the guidance range (325koz eq – 375koz eq). Encouragingly, the plant continued to operate uninterrupted through the winter months, despite still being in the ramp-up phase and experiencing weather events similar to 2024. AISC was US$1,144/oz eq, within the guidance range provided in February 2025. Salares Norte delivered US$808m in free cash flow for the year which was the highest in the Group. Financial performance and capital allocation Gold Fields continued to deliver on its capital allocation priorities during FY 2025. The Group spent US$1,029 million (US$427/oz) in sustaining capital to maintain the integrity of our asset base and declared a total dividend of R25.50/share (interim dividend of R7/share and final of R18.50/share). This represents 35% of free cash flow before discretionary investments, and is in line with our targeted dividend policy of 35%. We also maintained a healthy debt position. Normalised profit increased by 119% YoY to US$2,684 million, or US$3.00 per share in FY 2025 (FY 2024: US$1,227m, or US$1.37 per share), driven by higher gold sales volumes and higher realised gold prices during the period. During FY 2025, the Group generated adjusted free cash flow of US$2,970 million (after considering all costs and project capital expenditure), compared with US$605 million in FY 2024. The mines generated adjusted free cash flow from operations of US$3,171 million in FY 2025 compared with US$1,986 million in FY 2024. Net debt decreased by US$644 million during 2025, despite the US$1.45 billion payment, net of the Northern Star share sale, for the acquisition of Gold Road Resources in October. Gold Fields ended 2025 with a robust balance sheet, with net debt of US$1,442 million (end- December 2024: US$2,086m) and a net debt to adjusted EBITDA ratio of 0.26x (end-December 2024: 0.73x). Excluding lease liabilities, net debt was US$959 million at the end of FY 2025. In May 2025, Gold Fields issued US$750 million seven-year notes with a 5.854% coupon. The proceeds were used to repay amounts outstanding under the US$750 million bridge facilities utilised to fund the acquisition of Osisko Mining in 2024. In October 2025, we utilised a bridge facility to fund the acquisition of Gold Road Resources, which was subsequently partially repaid using the proceeds of an A$1,250m multi-currency term loan arranged in December 2025. At the end of December 2025, the Group’s capital structure consisted of a US$1.2 billion sustainability-linked revolving credit facility (US$637 million undrawn), a US$500 million bond maturing in 2029, the US$750 million notes maturing in 2032, the A$1,250 million multi-currency term loan terminating in December 2030, several smaller in-country facilities and US$1,779 million in cash. Have a positive impact on our communities and the environment Our people are our most important stakeholders. We continue to strengthen our culture by investing in leadership development and enhancing our workplaces. We have implemented all the Elizabeth Broderick & Co. recommendations and successfully achieved our 2025 target of 26% female representation. 2 Gold Fields Reviewed Results 2025

Stakeholder value creation – Since 2020, Gold Fields has delivered substantial national value through employment, procurement and socio-economic development, strengthening trust and social licence to operate. Total value distributed in FY 2025 was US$5.778 billion (FY 2024: US$4.21 billion). Procurement from in-country suppliers was US$1.69 billion, representing 97% of total procurement (FY 2024: US$1.28bn; 97%). Carbon emission reduction – Gold Fields has achieved meaningful improvements in Scope 1 and 2 emissions intensity, improving energy security, reliability and cost resilience. Renewables accounted for 18% of Group electricity consumption in FY 2025 (FY 2024: 18%). Construction of the St Ives hybrid renewable project, comprising a 42MW wind farm and a 35MW solar plant, is approximately 80% complete, with commissioning planned for mid-2026. Environment - We reported zero significant environmental incidents during the period. Freshwater recycled and reused reached 74%, above our 73% target for the year (FY 2024: 74%). Total freshwater withdrawal for FY 2025 was 9.72 GL, an improvement against both FY 2024 (11.09 GL) and our 2025 target of 12.06 GL. Responsible tailings management – Meaningful conformance with the Global Industry Standard on Tailings Management (GISTM) has been achieved, in line with our International Council on Mining and Metals (ICMM) commitment and a comprehensive, multi-year programme, which was planned to meet the requirements of the GISTM across our global assets. Collectively, our progress demonstrates that sustainability is embedded in how Gold Fields operates, driving greater reliability and predictability and strengthening our ability to deliver. Mid-point review – In 2021, Gold Fields established six Environmental, Social and Governance (ESG) targets for 2030. In 2025, at the mid-point to 2030, we undertook a comprehensive review to assess progress, continued relevance and alignment with our longer-term strategy and 2035 aspirations. The review confirmed that: • We have made meaningful progress against our 2030 targets • Changes in external context and portfolio growth require selective refinement of targets to ensure they remain credible and outcome-focused, and • The 2035 aspirations are integral to our strategy and critical to sustaining access to resources and supporting growth The outcome of the review is a refined and extended set of strategic sustainability commitments and targets through to 2035 and beyond from our 2030 trajectory. Net Zero by 2050 remains an objective; however, business growth and portfolio evolution, together with the slower pace of sector-wide technological development and deployment, have reduced the appropriateness of an absolute emissions target. Shifting to a 30% emissions intensity reduction target, by 2035, strengthens our commitment to efficiency and real-world impact, while better reflecting the relationship between production and emissions during growth phases. Our freshwater reuse and recycling performance remains best practice within our peer group. We plan to refine water targets by retaining water, reuse and recycling targets in freshwater catchments, while shifting to more relevant, context-based, asset-specific water targets in saline and hypersaline environments. Nature risk management continues to mature across the portfolio, and we will expand our commitments to measure and disclose nature-related impacts and risks, while implementing projects to enhance habitats affected by our operations. Sustainability is intrinsic to Gold Fields’ purpose, strategy and long-term success. It underpins how we operate today and how we secure access to resources, enable growth opportunities and create value over time. Advancing shared value and empowerment During FY 2025, Gold Fields marked the vesting of the Thusano Trust, our employee share ownership initiative established in 2010 in line with South African Mining Charter requirements applicable at the time. The vesting concluded a 15-year shared value model, enabling qualifying past and current employees to participate in long-term value creation. The Trust benefits 46,007 beneficiaries and was valued at R11.1 billion at vesting date. The share trade process was completed on 15 January 2026. This milestone reflects Gold Fields’ commitment to responsible empowerment and sustainable value creation. Growing the quality of our portfolio Gold Fields’ strategy aims to continually improve the quality of our production base, either through acquiring assets that will enhance the quality of the portfolio or disposing of assets which no longer fit the longer-term vision for the business. In this regard, we disposed of our 19.5% stake in Galiano Gold in September 2025 for a total consideration of C$151 million. We have also entered into definitive agreements to sell a portfolio of royalties and related instruments for US$167 million in cash. This comprises US$115 million from the sale of a royalty portfolio, including a 1.5% NSR on Buenaventura’s San Gabriel gold silver mine, a capped 1.0% NSR on Galiano’s Nkran deposit pit, and NSR and NPI interests over Amarc’s JOY Project, together with several smaller royalties. The remaining US$52 million relates to the sale of our rights to deferred and contingent payments from Galiano Gold associated with the 2023 Asanko transaction. During 2025, we worked closely with the Government of Ghana to develop a transition plan for the Damang mine. In April 2026, the 12-month lease extension comes to an end, at which point Gold Fields will transfer ownership of the mine to the Government of Ghana. 2025 was the final year of mining at Cerro Corona, with the operation expected to process stockpiles from 2026 onwards. While we expect that the mine will continue to produce gold and copper and generate cash flow until 2031, we have begun assessing pathways to realise Cerro Corona’s full value, including potential life-extension opportunities. Gold Road acquisition In October 2025, Gold Fields completed the acquisition of Gold Road Resources and paid US$1.42 billion (A$2.19 billion), net of cash received, the special dividend paid by Gold Road upon transaction close and the disposal of the Northern Star Resources shares that were acquired as part of the transaction. Full ownership of Gruyere, together with the surrounding land package, enables Gold Fields to optimise the life-of-mine plan for the asset. The incremental expansion of the processing facility, together with consolidation of Gruyere, Golden Highway and the Yamarna land packages is expected to allow the asset to produce c.400koz on a sustainable basis over an extended period. During 2026, we will advance studies to optimise the value of the Gruyere deposit, including an open-pit cutback versus underground trade-off study. We also plan to accelerate access to the higher-grade material from Golden Highway and the Gilmour deposit to supplement ore feed from the Gruyere pit. Finally, we will increase our exploration efforts across the under-explored 2,000km2 Yamarna land package during 2026. Windfall Project update Gold Fields provided an update on the Windfall Project at our Capital Markets Day in November 2025. The focus remains on advancing the Environmental Impact Assessment (EIA) and secondary permits, signing the Impact Benefit Agreement (IBA) and updating the feasibility study in preparation for the FID. Good progress has been made in finalising the IBA with the Cree First Nation of Waswanipi. During 2026, we plan to advance our multi-year exploration programme across our 2,500km2 land position which covers the Urban Barry and Quévillon belts. The Phoenix JV earn-in with Bonterra Resources is also expected to be completed in H1 2026. Tarkwa life-of-mine extension Tarkwa remains one of the cornerstone assets of the Gold Fields portfolio. Through proactive engagements with the Government of Ghana, we have initiated the process to renew the Tarkwa mining lease, which is due to expire in April 2027. We submitted a comprehensive application for the renewal of the Tarkwa mining leases in November 2025, and have commenced discussions with the Government of Ghana on the terms of the renewal. Ghana has proposed mining policy reforms aimed at increasing local participation and state revenues from the industry, which are expected to influence the outcome of these lease renewal discussions. A key component of this process has been updating Tarkwa’s life-of-mine plan and the mine’s declared Mineral Resources and Mineral Reserves. In November 2025, Gold Fields published an out-of-cycle Mineral Resources and Mineral Reserves declaration for Tarkwa. Gold Fields Reviewed Results 2025 3

In the 2025 declaration, managed Mineral Reserves increased to 7.4 million ounces from 4.3 million ounces in the 2024 declaration, and managed Mineral Resources (inclusive of Reserves) increased to 11.2 million ounces, from 8.9 million ounces. Gold Fields’ attributable share, after allowing for the Government of Ghana’s 10% free-carry interest, represents 6.6 million ounces of Reserves (up from 3.8 million ounces) and 10.0 million ounces of Resources (inclusive of Reserves). The approximately 70% increase in attributable Reserves was driven by a higher Reserve gold price of known Mineral Resources (as discussed in the Mineral Resource and Reserve update below), together with the removal of key operational constraints, including a reduced Akontansi open pit stand-off distance from infrastructure. A key focus for the team in the near to medium term is to optimise Tarkwa’s operating costs to enhance margins and cash generation and to further increase mineable inventory. Exploration update We continued to advance our greenfields exploration strategy during 2025, building a pipeline of early-stage opportunities to underpin production beyond 2035. During 2025, Gold Fields made a strategic equity investment of C$50 million in Founders Metals, acquiring a 10.5% ownership interest and gaining exposure to the district-scale Antino gold project in Suriname. In Chile, work at Santa Cecilia progressed following Phase 1 drilling, which demonstrated broad zones of low-grade gold–copper mineralisation adjacent to the Norte Abierto development. With Torq Resources as operator, activities focused on technical review and target refinement in preparation for the Phase 2 drilling programme for 2026. In Peru, exploration remained focused on advancing the early-stage portfolio, with land access, permitting and technical programmes progressing across several 100%-owned projects. In Australia, drilling commenced at Brandy in the East Lachlan Belt, targeting a large blind porphyry gold-copper system located proximal to Cadia Valley Operations (Newmont). Drilling and surface programmes were also completed at the Edinburgh Park project in North Queensland, while regional soil sampling and airborne electromagnetic surveys across the West Tanami supported target prioritisation ahead of drilling. The integration of the Gold Road exploration portfolio was completed during H2 2025 following the acquisition, materially expanding our Australian greenfields footprint. Canada remains a core focus, with a drilling programme completed across the Windfall district during H2 2025. Preparations are underway for a drilling programme at the Phoenix joint venture with Bonterra Resources, scheduled to commence in H1 2026. Our equity partner, Onyx Gold, continued to deliver high-grade results at the Munro-Croesus project, supporting the ongoing assessment of its discovery potential. Mineral Resources and Mineral Reserves update Gold Fields’ Mineral Resources and Mineral Reserves are reported as at 31 December 2025 on an attributable basis, with Resources stated exclusive of Reserves. Group gold Reserves increased by 4.0Moz or 9% to 48.3 Moz (2024: 44.3 Moz). Gold Measured and Indicated Resources increased by 13% to 34.2 Moz (2024: 30.4 Moz), while Inferred gold Resources increased by 10% to 12.8 Moz (2024: 11.6 Moz). The increase in Reserves stems from revised gold price assumptions and improving underlying asset quality across the Group. Higher gold prices enabled the economic inclusion of Reserves where substantial, well-defined Resources already existed. Portfolio-specific drivers included the acquisition of Gold Road Resources, increasing Gold Fields’ ownership in the Gruyere mine to 100%, growth at Tarkwa due to revised prices and an updated mine design, and growth at St Ives and Granny Smith driven by successful brownfields exploration. In 2025, the gold price assumptions applied to Mineral Resources and Mineral Reserves were increased to US$2,000/oz (2024: US$1,500/oz) and US$2,300/oz (2024: US$1,725/oz) respectively, reflecting prevailing market conditions. Mineral Resources and Mineral Reserves for the Windfall Project will be included in the Group’s reporting upon completion of the feasibility study and receipt of environmental approvals, expected in 2026. The Mineral Resources and Mineral Reserves Supplement will be published concurrently with the Integrated Annual Report in late March 2026. Attributable Mineral Reserves 2025 2024 YoY Gold Proved and Probable (Moz) 48.3 44.3 9 % Copper Proved and Probable (Mlb) 193.0 271.0 (29) % Silver Proved and Probable (Moz) 43.2 46.0 (6) % Attributable Exclusive Mineral Resources 2025 2024 YoY Gold Measured and Indicated (Moz) 34.2 30.4 13 % Gold Inferred (Moz) 12.8 11.6 10 % Copper Measured and Indicated (Mlb) 0.0 0.0 — % Copper Inferred (Mlb) 0.0 0.0 — % Silver Measured and Indicated (Moz) 4.6 2.8 61 % Silver Inferred (Moz) 0.0 0.1 (24) % The Company’s Mineral Resources and Mineral Reserves have been estimated and prepared in accordance with the SAMREC Code and Securities and Exchange Commission (SEC) requirements. The estimates were compiled under the supervision and review of the Group Competent Person, Alex Trueman (FAusIMM(CP), P.Geo.), Vice President: Geology, and a member of Gold Fields’ Group Technical team. Mr Trueman consents to the inclusion of these Mineral Resource and Mineral Reserve statements in the form and context in which they appear. FY 2026 guidance Our primary focus for 2026 remains ensuring safe, reliable and cost- effective delivery against our production plans and guidance for the year, which will provide the platform for continued progress of our strategic priorities. Attributable gold-equivalent production for 2026 is expected to be between 2.400Moz – 2.600Moz (compared to 2.438Moz delivered in 2025). AISC is expected to be between US$1,800/oz – US$2,000/oz, and AIC is expected to be between US$2,075/oz – US$2,300/oz. The exchange rates used for our 2026 guidance are: R/US$16.00, US$/A$0.70 and C$/US$0.73. The metal price assumptions for the calculation of royalties and copper and silver by-products are: gold price US$5,000/oz (A$7,100/oz, R2,450,000kg); copper price US$9,000/t and silver price US$65/oz. 2026 is another year in which capital expenditure levels will remain elevated, given the capital planned budgeted for Windfall, as well as sustaining capital expenditure across the portfolio required to maintain the production base of the Group. Total capital expenditure for the Group for the year is expected to be US$1,900 million – US$2,100 million in 2026. Sustaining capital expenditure is expected to be US$1,300 million – US$1,400 million, while non-sustaining capital expenditure is expected to be US$240 million – US$340 million, with the largest component of this being the Windfall Project capital of C$495 million. Guidance for 2026 remains unchanged from that provided at our Capital Markets Day in November 2025 for production. However, we have seen increases in AISC and AIC, driven primarily by the strengthening of exchange rates in Australia and South Africa as well as the impact of higher gold price on royalty payments. In comparison to the rates disclosed above, the exchange rates used at our Capital Markets Day were R/US$18.50, US$/A$0.67 and C$/US$0.71. The metal price assumptions for the Capital Markets Day were: gold price US$3,872/oz and silver price US$44/oz. The Capital Markets Day also excluded non-core assets (Cerro Corona and Damang). The above is subject to the forward-looking statement on page 63. Mike Fraser Chief Executive Officer 19 February 2026 4 Gold Fields Reviewed Results 2025

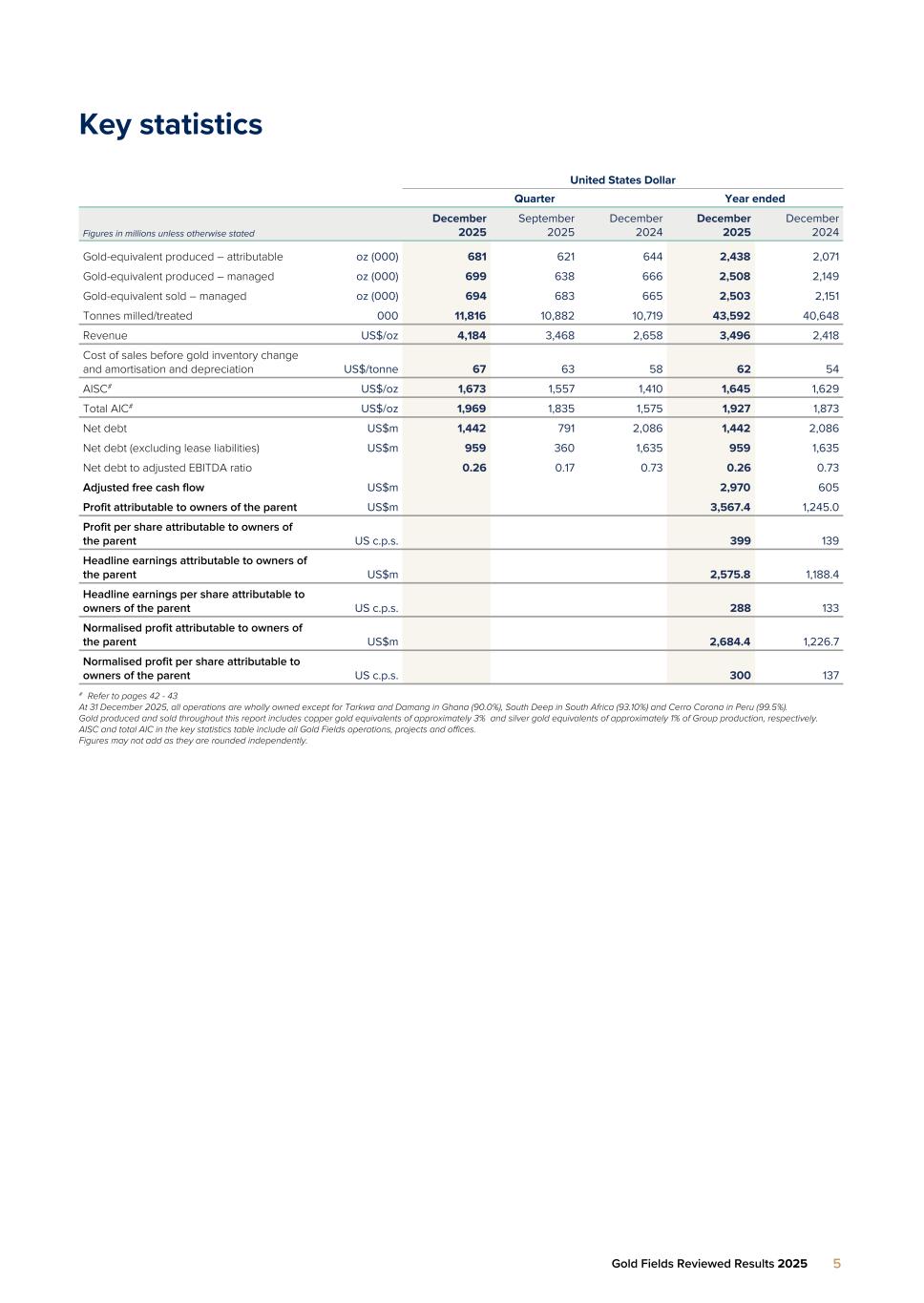

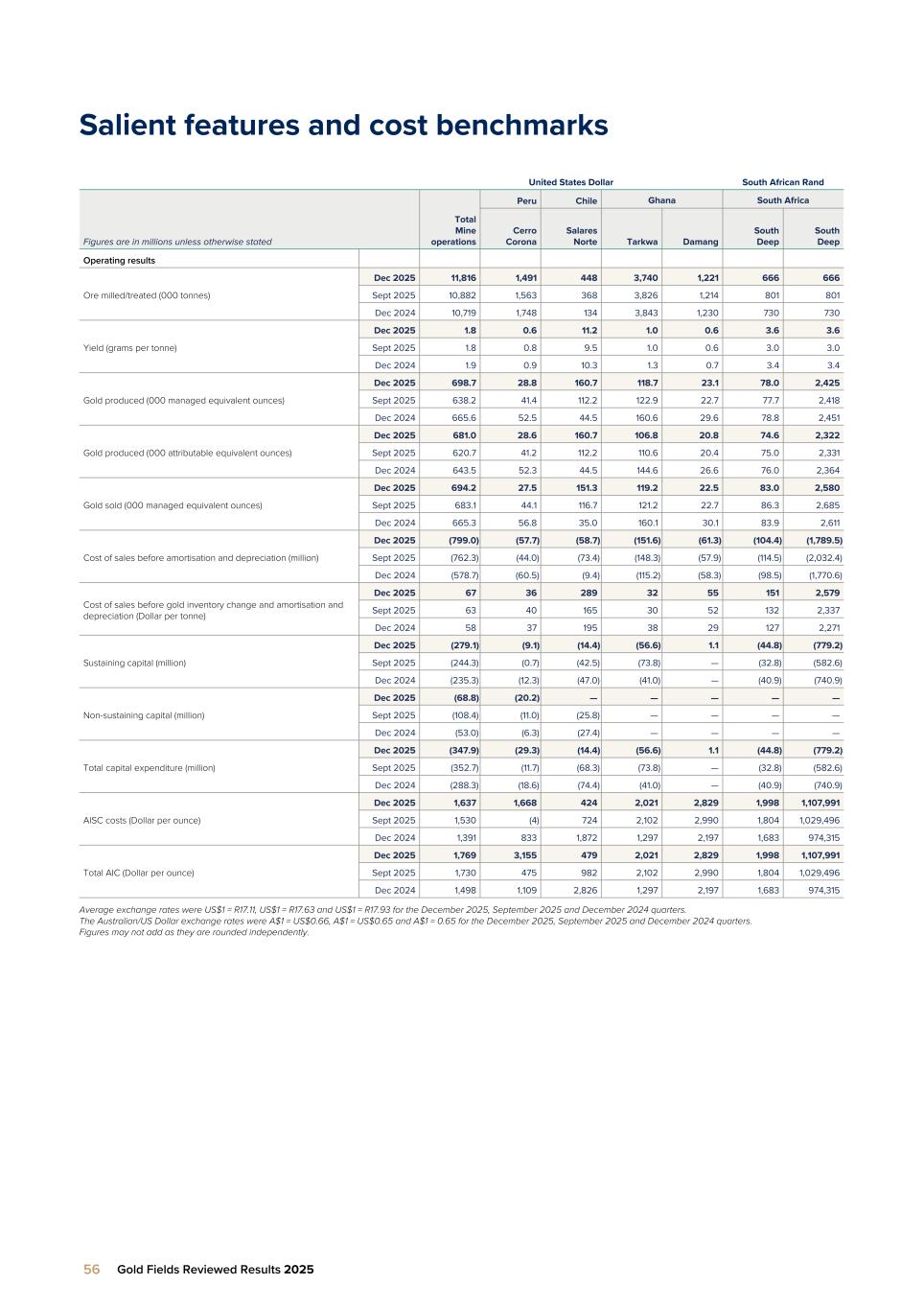

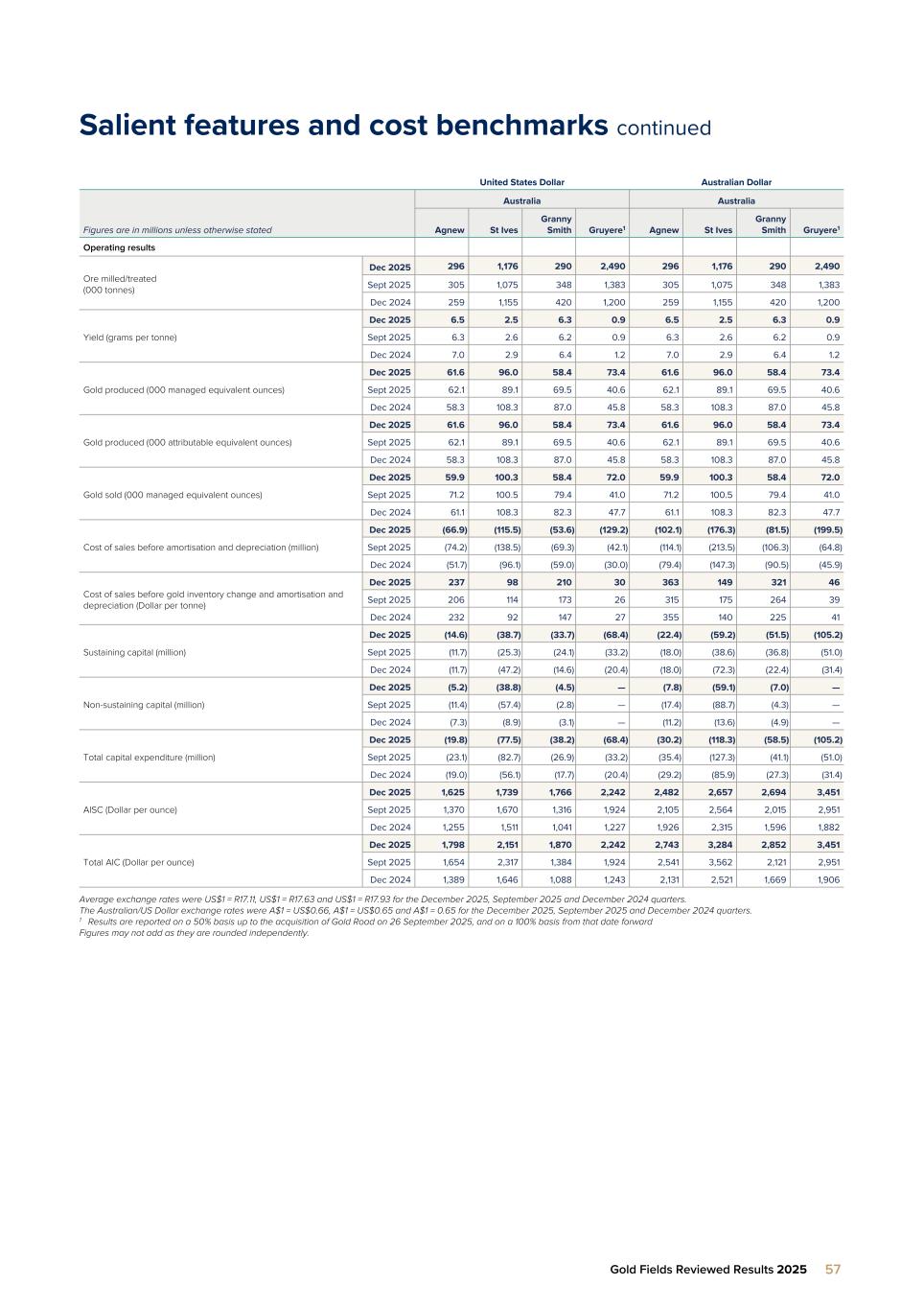

Key statistics United States Dollar Quarter Year ended Figures in millions unless otherwise stated December 2025 September 2025 December 2024 December 2025 December 2024 Gold-equivalent produced – attributable oz (000) 681 621 644 2,438 2,071 Gold-equivalent produced – managed oz (000) 699 638 666 2,508 2,149 Gold-equivalent sold – managed oz (000) 694 683 665 2,503 2,151 Tonnes milled/treated 000 11,816 10,882 10,719 43,592 40,648 Revenue US$/oz 4,184 3,468 2,658 3,496 2,418 Cost of sales before gold inventory change and amortisation and depreciation US$/tonne 67 63 58 62 54 AISC# US$/oz 1,673 1,557 1,410 1,645 1,629 Total AIC# US$/oz 1,969 1,835 1,575 1,927 1,873 Net debt US$m 1,442 791 2,086 1,442 2,086 Net debt (excluding lease liabilities) US$m 959 360 1,635 959 1,635 Net debt to adjusted EBITDA ratio 0.26 0.17 0.73 0.26 0.73 Adjusted free cash flow US$m 2,970 605 Profit attributable to owners of the parent US$m 3,567.4 1,245.0 Profit per share attributable to owners of the parent US c.p.s. 399 139 Headline earnings attributable to owners of the parent US$m 2,575.8 1,188.4 Headline earnings per share attributable to owners of the parent US c.p.s. 288 133 Normalised profit attributable to owners of the parent US$m 2,684.4 1,226.7 Normalised profit per share attributable to owners of the parent US c.p.s. 300 137 # Refer to pages 42 - 43 At 31 December 2025, all operations are wholly owned except for Tarkwa and Damang in Ghana (90.0%), South Deep in South Africa (93.10%) and Cerro Corona in Peru (99.5%). Gold produced and sold throughout this report includes copper gold equivalents of approximately 3% and silver gold equivalents of approximately 1% of Group production, respectively. AISC and total AIC in the key statistics table include all Gold Fields operations, projects and offices. Figures may not add as they are rounded independently. Gold Fields Reviewed Results 2025 5

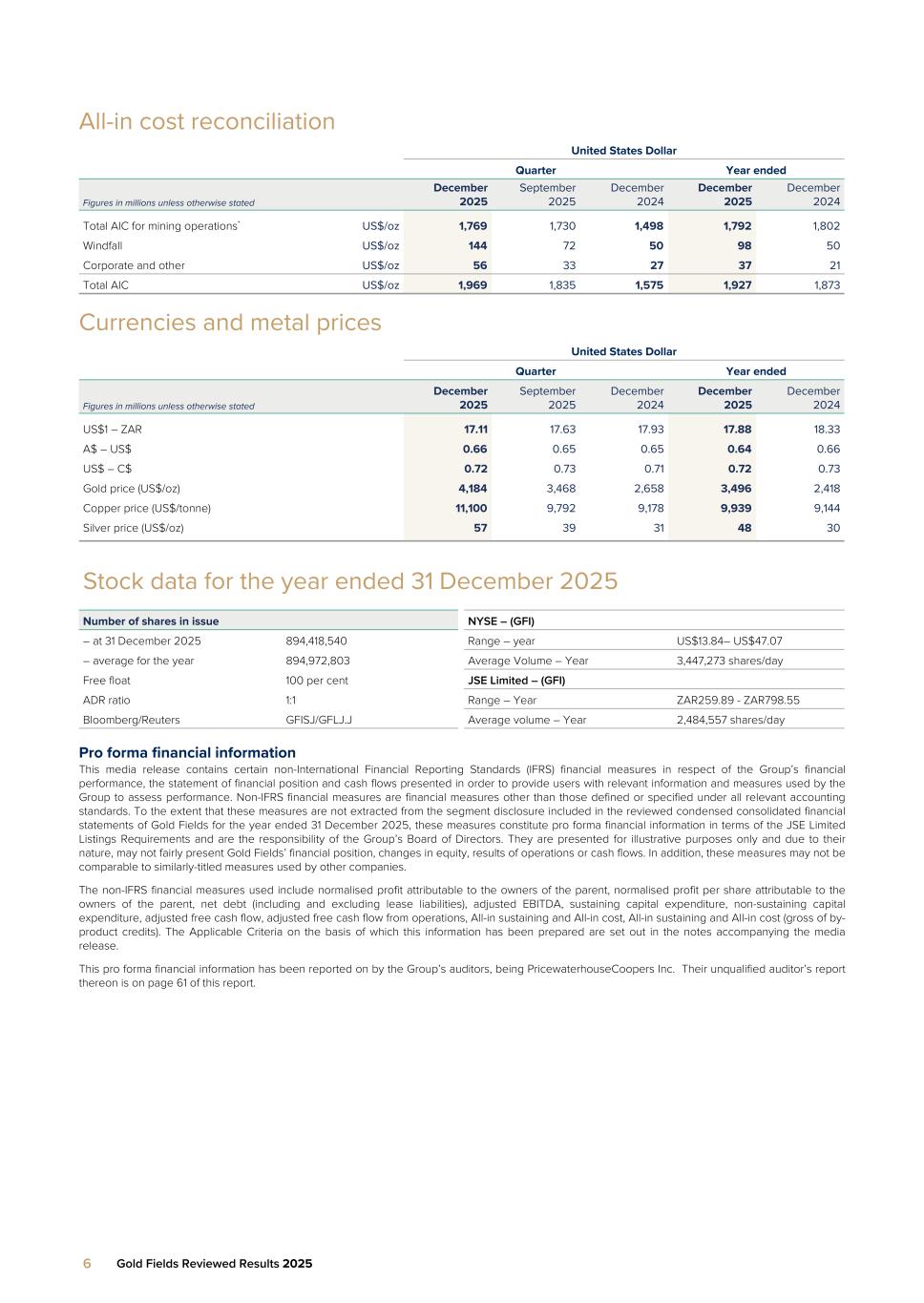

All-in cost reconciliation United States Dollar Quarter Year ended Figures in millions unless otherwise stated December 2025 September 2025 December 2024 December 2025 December 2024 Total AIC for mining operations* US$/oz 1,769 1,730 1,498 1,792 1,802 Windfall US$/oz 144 72 50 98 50 Corporate and other US$/oz 56 33 27 37 21 Total AIC US$/oz 1,969 1,835 1,575 1,927 1,873 Currencies and metal prices United States Dollar Quarter Year ended Figures in millions unless otherwise stated December 2025 September 2025 December 2024 December 2025 December 2024 US$1 – ZAR 17.11 17.63 17.93 17.88 18.33 A$ – US$ 0.66 0.65 0.65 0.64 0.66 US$ – C$ 0.72 0.73 0.71 0.72 0.73 Gold price (US$/oz) 4,184 3,468 2,658 3,496 2,418 Copper price (US$/tonne) 11,100 9,792 9,178 9,939 9,144 Silver price (US$/oz) 57 39 31 48 30 Stock data for the year ended 31 December 2025 Number of shares in issue NYSE – (GFI) – at 31 December 2025 894,418,540 Range – year US$13.84– US$47.07 – average for the year 894,972,803 Average Volume – Year 3,447,273 shares/day Free float 100 per cent JSE Limited – (GFI) ADR ratio 1:1 Range – Year ZAR259.89 - ZAR798.55 Bloomberg/Reuters GFISJ/GFLJ.J Average volume – Year 2,484,557 shares/day Pro forma financial information This media release contains certain non-International Financial Reporting Standards (IFRS) financial measures in respect of the Group’s financial performance, the statement of financial position and cash flows presented in order to provide users with relevant information and measures used by the Group to assess performance. Non-IFRS financial measures are financial measures other than those defined or specified under all relevant accounting standards. To the extent that these measures are not extracted from the segment disclosure included in the reviewed condensed consolidated financial statements of Gold Fields for the year ended 31 December 2025, these measures constitute pro forma financial information in terms of the JSE Limited Listings Requirements and are the responsibility of the Group’s Board of Directors. They are presented for illustrative purposes only and due to their nature, may not fairly present Gold Fields’ financial position, changes in equity, results of operations or cash flows. In addition, these measures may not be comparable to similarly-titled measures used by other companies. The non-IFRS financial measures used include normalised profit attributable to the owners of the parent, normalised profit per share attributable to the owners of the parent, net debt (including and excluding lease liabilities), adjusted EBITDA, sustaining capital expenditure, non-sustaining capital expenditure, adjusted free cash flow, adjusted free cash flow from operations, All-in sustaining and All-in cost, All-in sustaining and All-in cost (gross of by- product credits). The Applicable Criteria on the basis of which this information has been prepared are set out in the notes accompanying the media release. This pro forma financial information has been reported on by the Group’s auditors, being PricewaterhouseCoopers Inc. Their unqualified auditor’s report thereon is on page 61 of this report. 6 Gold Fields Reviewed Results 2025

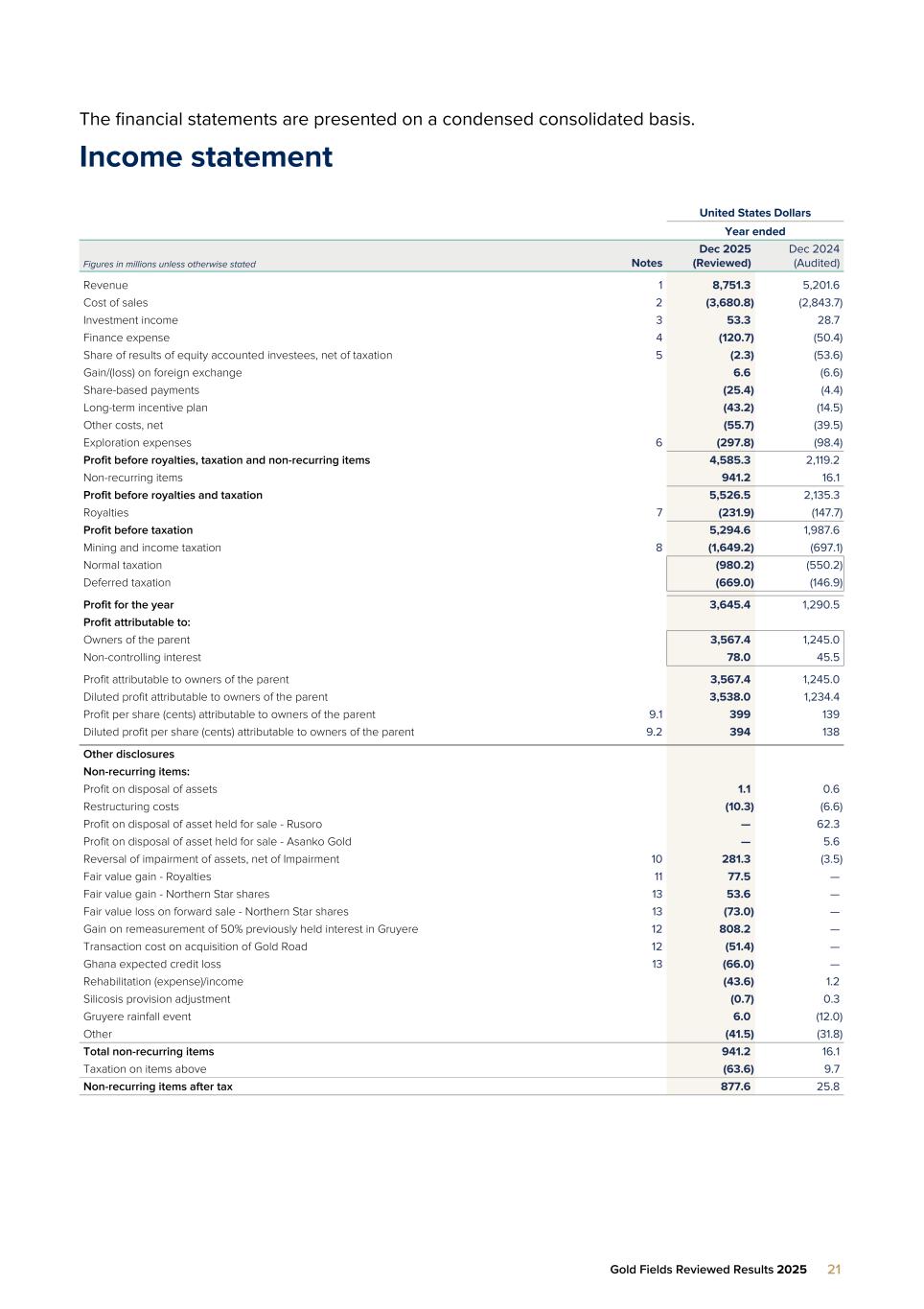

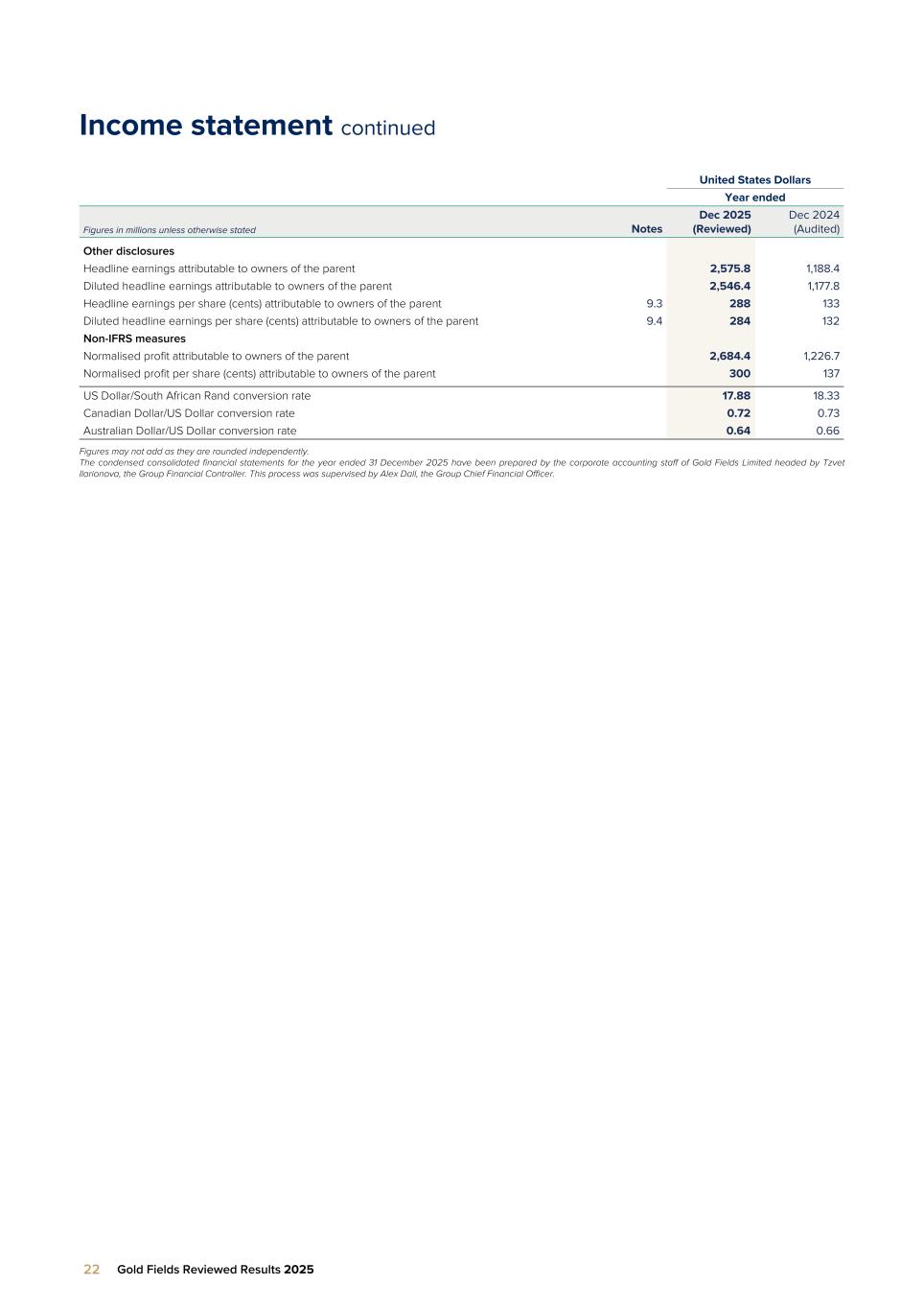

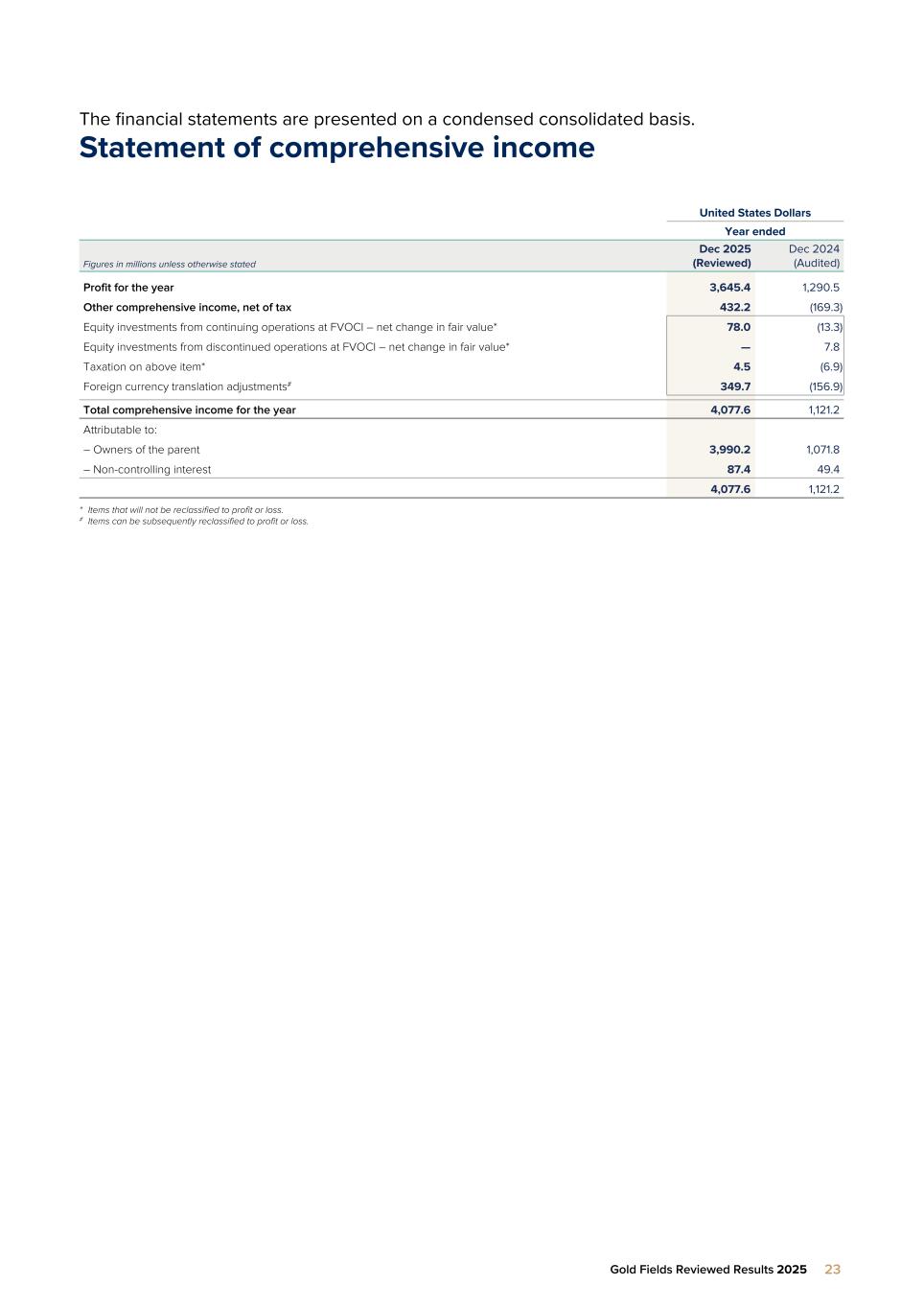

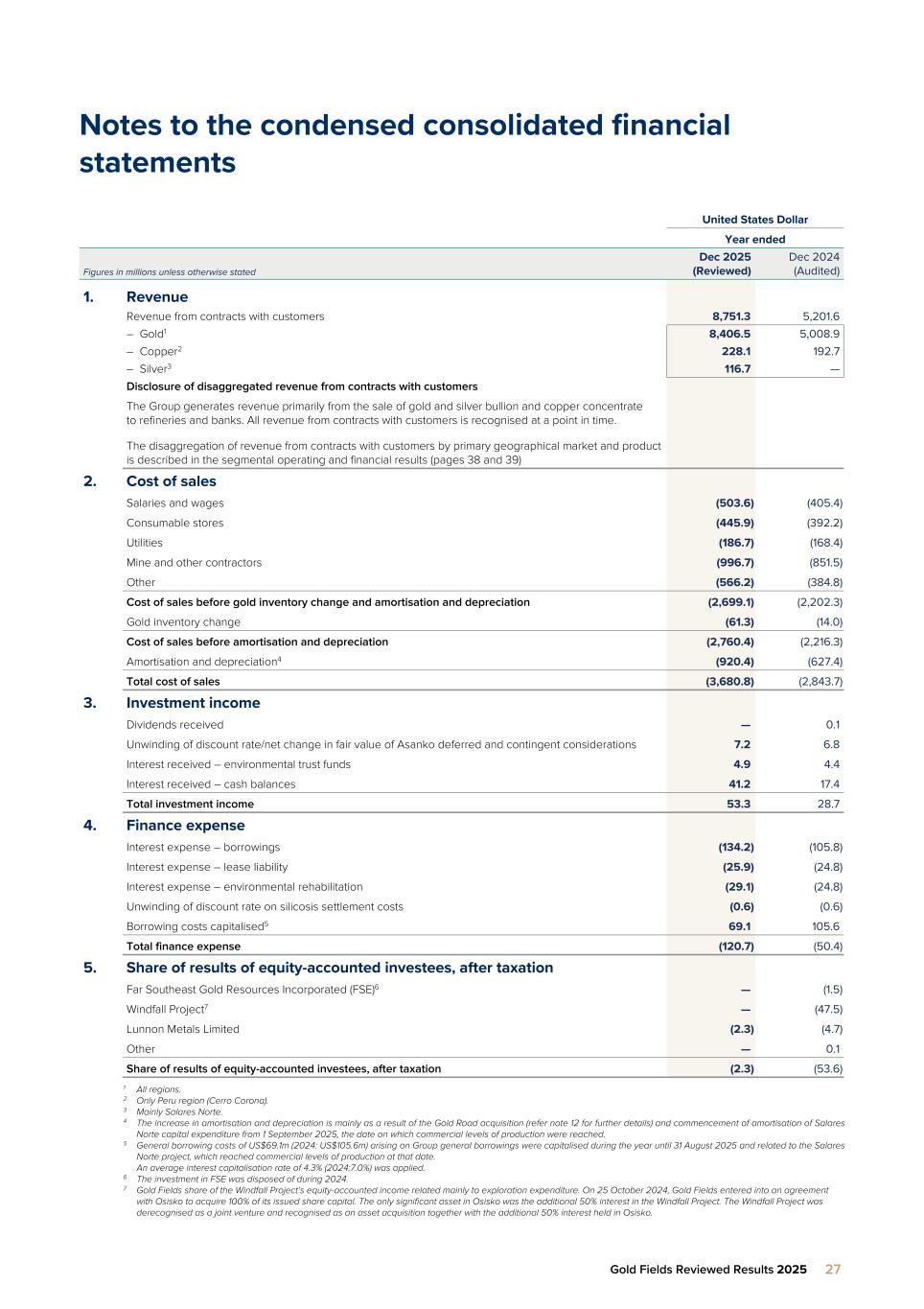

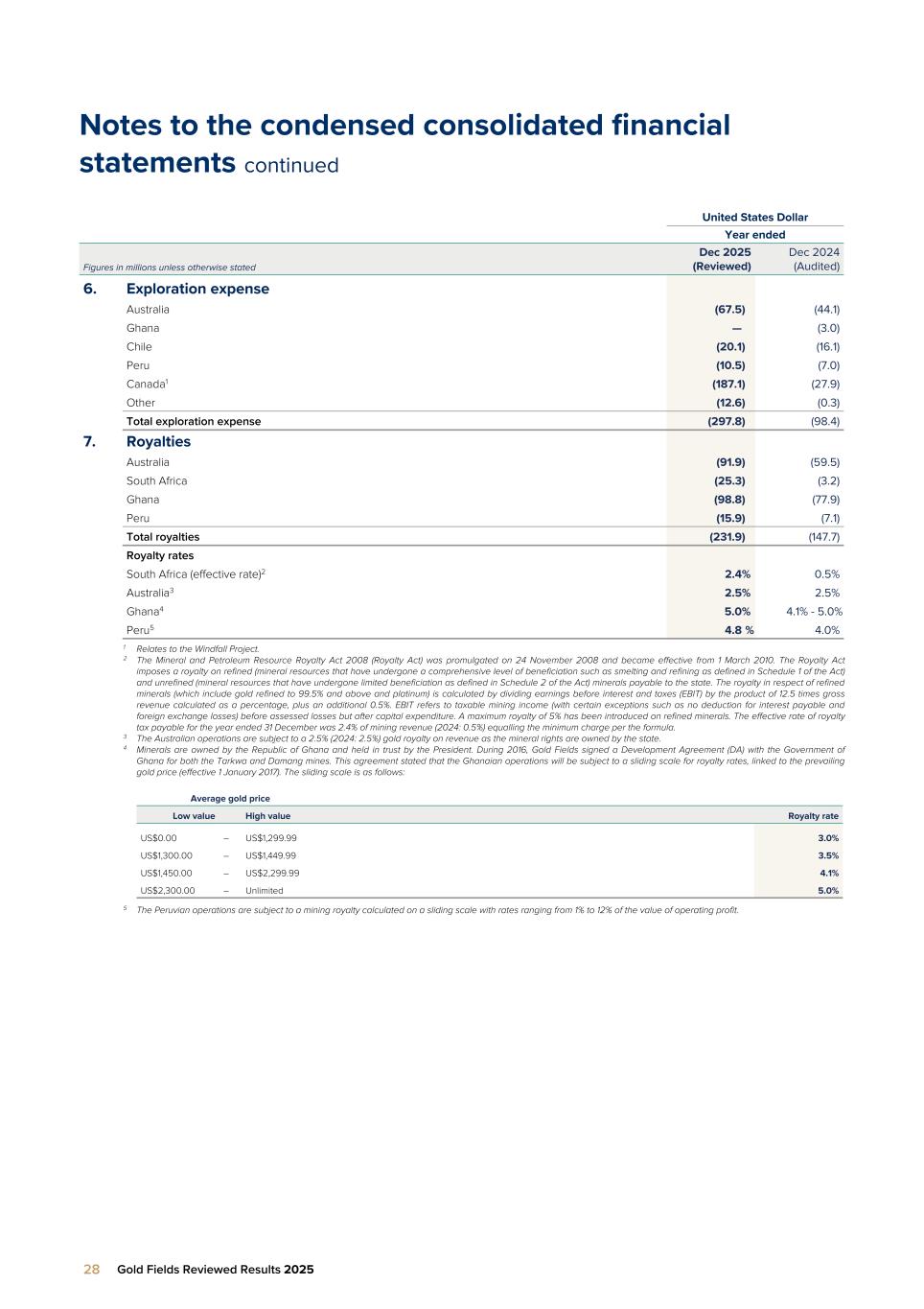

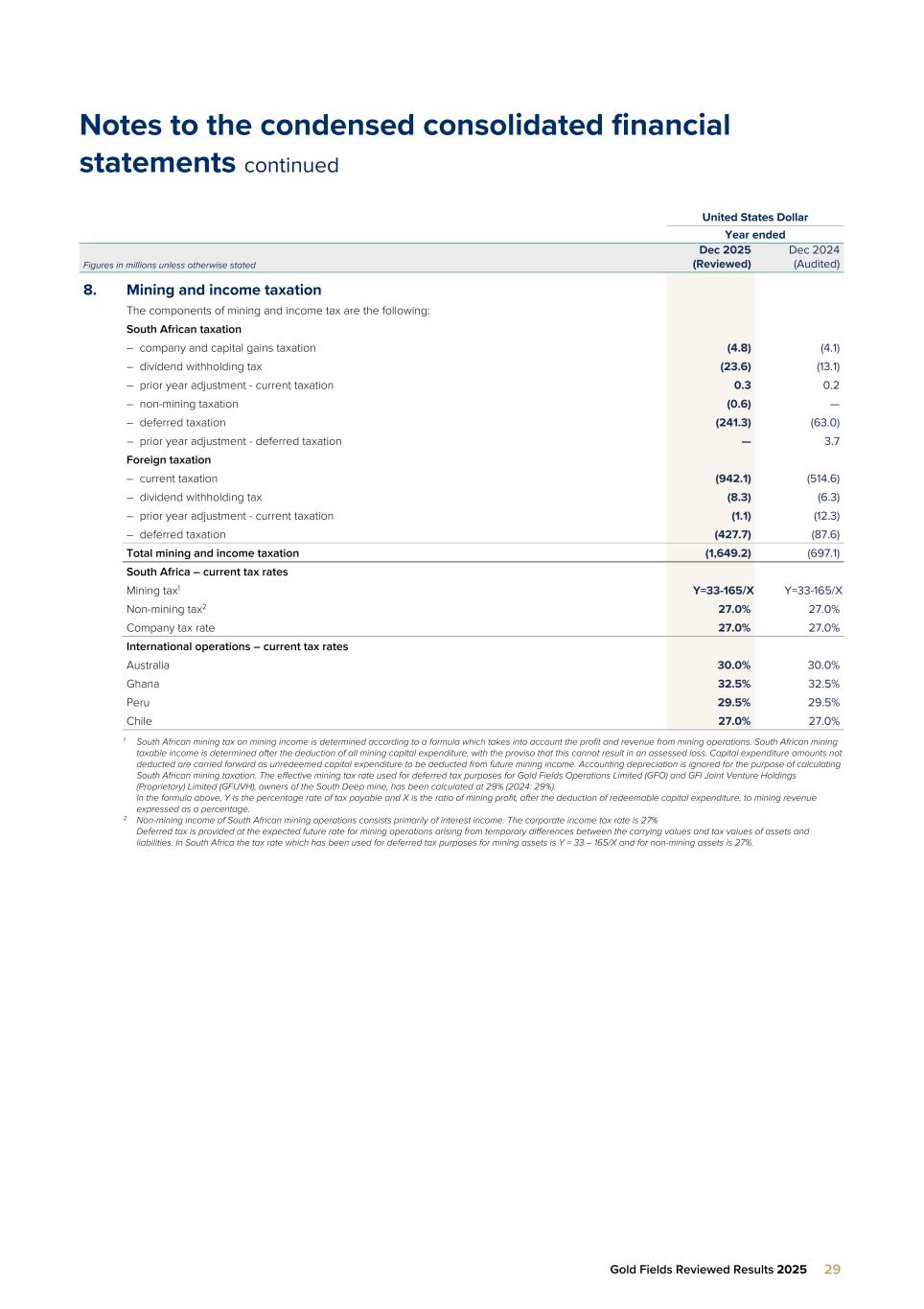

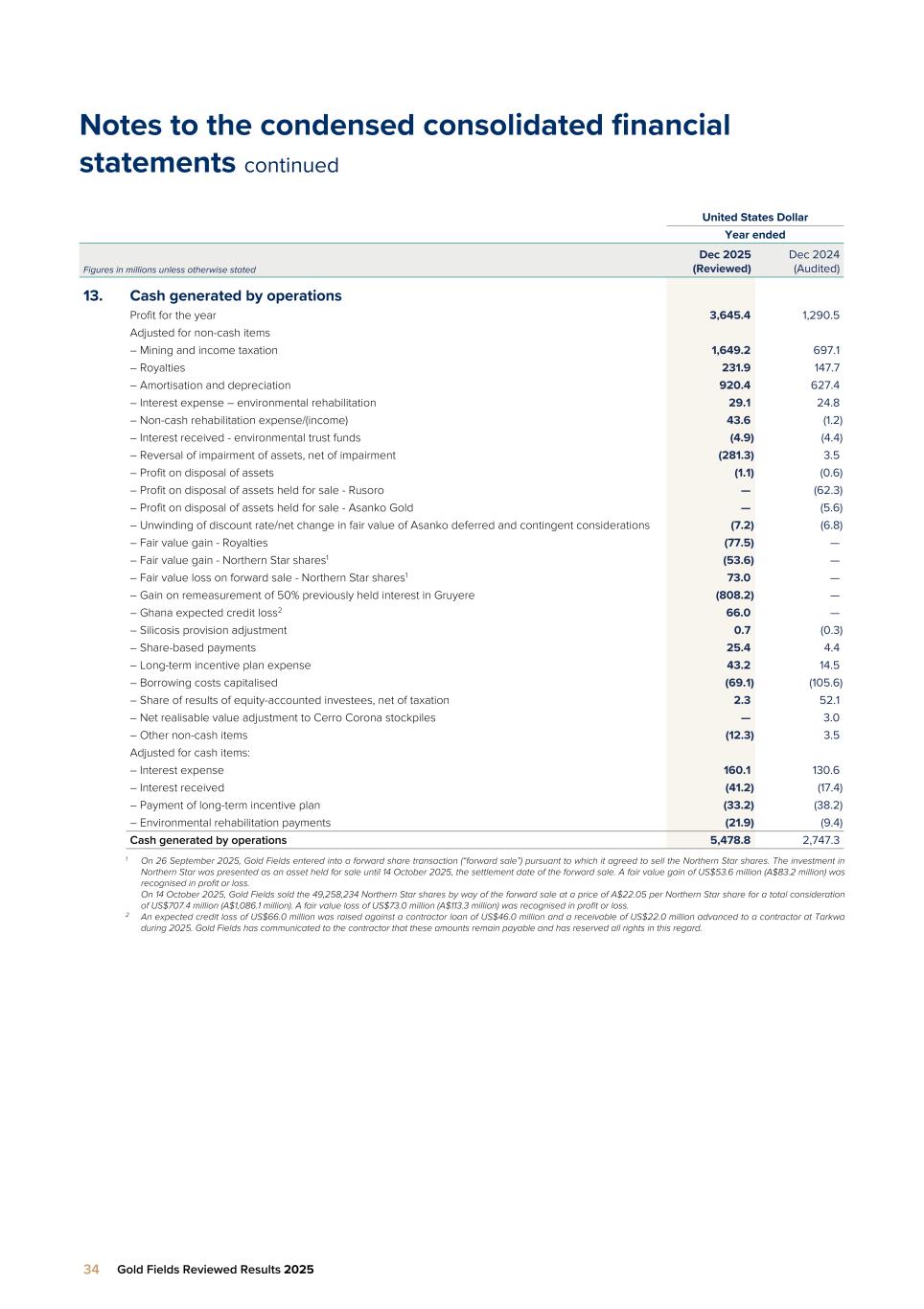

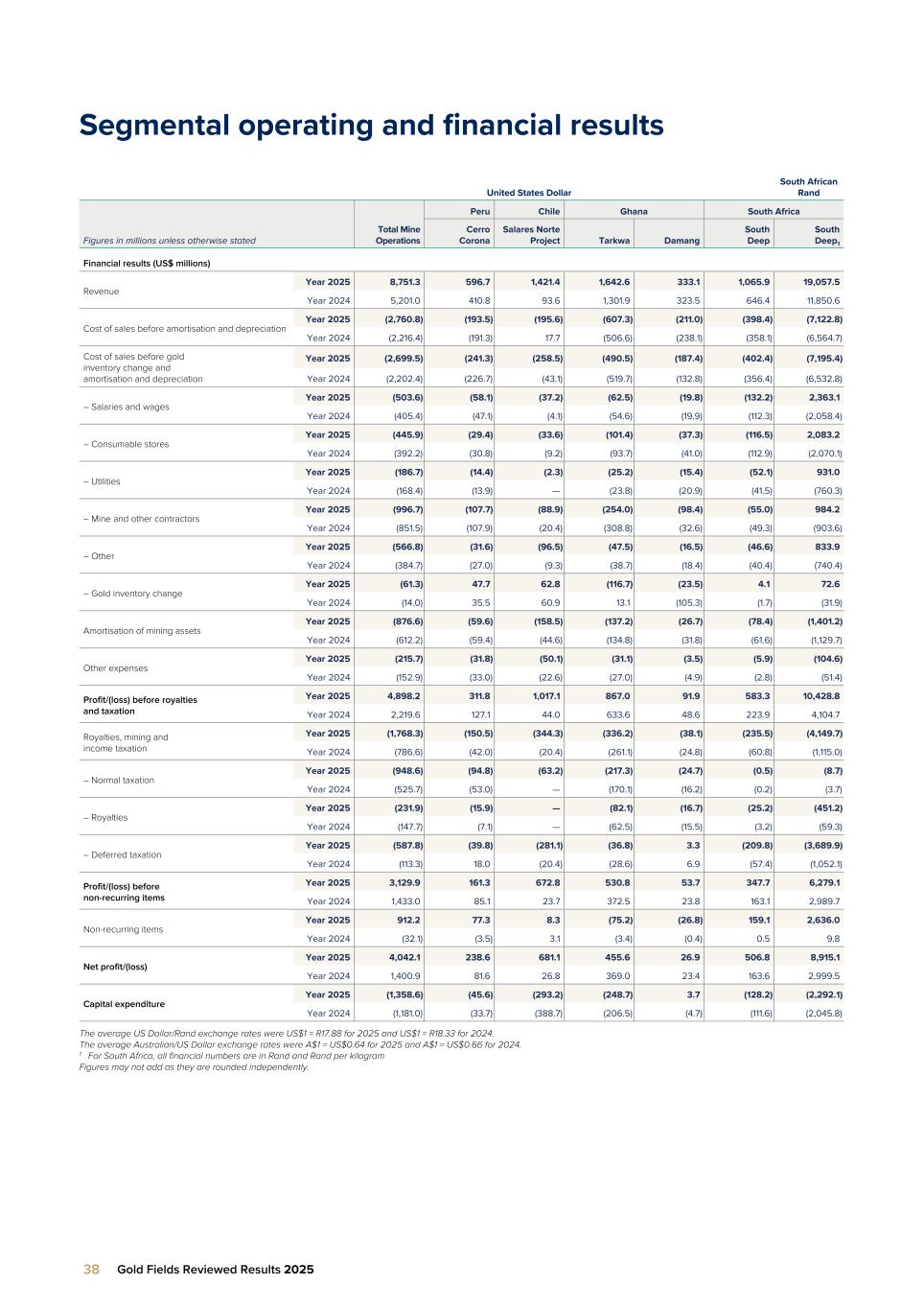

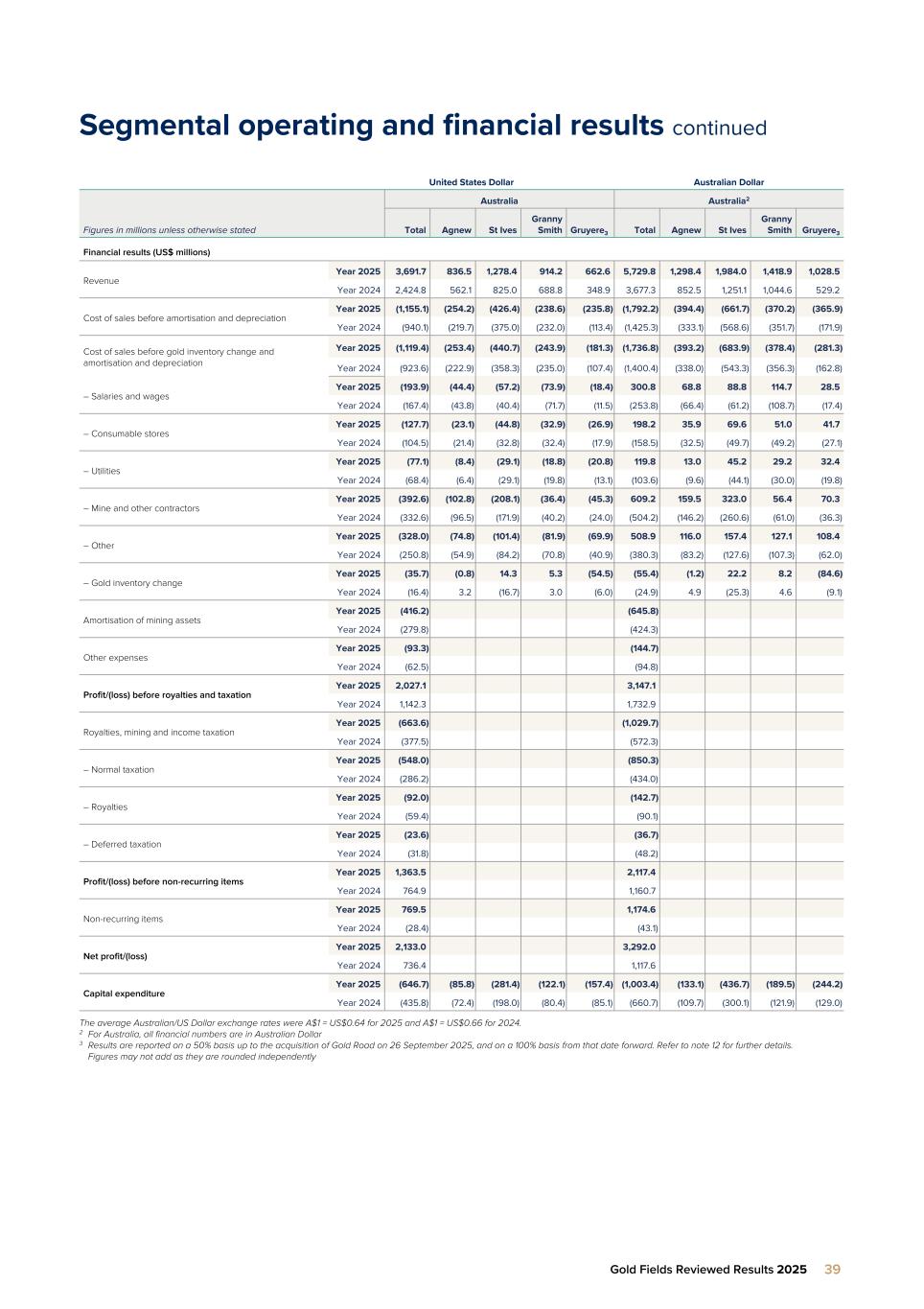

Results for the Group Income statement Revenue Revenue increased by 68% from US$5,202m in 2024 to US$8,751m in 2025 due to a 45% higher gold price and 16% higher gold-equivalent ounces sold. Gold-equivalent ounces sold increased by 16% from 2.151Moz to 2.503Moz. Refer Review of Operations for breakdown per asset. The average US Dollar gold price achieved by the Group increased by 45% from US$2,418/eq oz in 2024 to US$3,496/eq oz in 2025. The average Australian/US Dollar exchange rate strengthened by 3% from 0.66 to A$1.00 = US$0.64 in 2025. The average US Dollar/Rand exchange rate strengthened by 2% from R18.33 in 2024 to R17.88 in 2025. The average Canadian/US Dollar exchange rate strengthened by 1% from C$1.00 = US$0.73 to C$1.00 = US$0.72. Cost of sales before amortisation and depreciation Cost of sales before amortisation and depreciation increased by 25% from US$2,216m in 2024 to US$2,760m in 2025 mainly due to the increase in production as well as inflationary increases affecting all the regions and a US$14m gold inventory debit to cost in 2024 compared to US$61m in 2025. Amortisation and depreciation Amortisation and depreciation for the Group increased by 47% from US$627m in 2024 to US$920m in 2025 mainly due to the higher production. Investment income Investment income increased by 83% from US$29m in 2024 to US$53m in 2025 due to higher interest received as a result of higher average cash and cash equivalents during 2025. Finance expense Finance expense for the Group increased by 142% from US$50m in 2024 to US$121m in 2025 due to lower interest capitalised and higher borrowings in 2025. Interest expense on borrowings of US$134m, lease interest of US$26m, rehabilitation interest of US$29m and silicosis liability unwinding of US$1m, partially offset by interest capitalised of US$69m in 2025 compared to interest expense on borrowings of US$106m, lease interest of US$25m, rehabilitation interest of US$25m and silicosis liability unwinding of US$1m, partially offset by interest capitalised of US$106m. The decrease in interest capitalised relates to the cessation of interest capitalisation at Salares Norte from Q3 2025 due to the mine having reached commercial levels of production Share of results of equity-accounted investees after taxation The share of losses of equity-accounted investees after taxation decreased by 96% from US$54m in 2024 to US$2m in 2025. The loss of US$2m in 2025 comprised share of loss of US$2m of Lunnon. The loss of US$54m in 2024 comprised a share of loss of US$48m of Windfall up to acquisition of remaining 50%, a share of loss of US$5m of Lunnon and expenditure of US$2m incurred at FSE. Gain/(loss) on foreign exchange The loss on foreign exchange of US$7m in 2024 compared to a gain of US$7m in 2025 and related to the conversion of offshore cash holdings into their functional currencies. Share-based payments Share-based payments for the Group increased from US$4m in 2024 to US$25m due to higher vesting percentages of share-based payments as well as a higher number of awards granted in 2025 as a result of a change in the employee share scheme with shares granted to a broader group of employees and not only executives and certain officers. Long-term incentive plan The long-term incentive plan increased by 187% from US$15m in 2024 to US$43m in 2025 mainly due to the current marked-to-market valuation of the plan reflecting improved forecast performance. Other costs, net Other costs for the Group increased by 40% from US$40m in 2024 to US$56m in 2025 mainly due to higher corporate and community costs. Exploration expense Exploration expense increased by 204% from US$98m in 2024 to US$298m in 2025 mainly due to higher spend on exploration in Canada. Non-recurring items Non-recurring income of US$941m in 2025 compared to income of US$16m in 2024. The non-recurring income of US$941m comprises mainly: • US$808m profit on previously held interest in Gruyere; • Reversal of impairment of US$281m made up of reversal of impairment of the South Deep cash-generating unit of US$285m partially offset by an impairment of various redundant assets at Salares Norte of US$4m; • Fair value adjustment of held for sale assets – royalties of US$78m, partially offset by; • Expected credit loss on loan advanced to contractor in Ghana of US$66m; • Rehabilitation adjustments of US$44m and • Transaction costs related to the Gold Road acquisition of US$51m. Royalties Government royalties for the Group increased by 57% from US$148m in 2024 to US$232m in 2025 in line with the higher revenue. Mining and income taxation The taxation charge for the Group increased by 138% from US$697m in 2024 to US$1,649m in 2025 in line with the increase in profit before taxation. Normal taxation increased by 78% from US$550m in 2024 to US$980m in 2025. The deferred tax increased from US$147m in 2024 to US$669m in 2025. Profit for the period Profit for the year increased by 182% from US$1,291m in 2024 to US$3,645m in 2025. Normalised profit Normalised profit reconciliation for the Group is calculated as follows: Year ended US$’m 2025 2024 Profit for the period attributable to owners of the parent 3,567.4 1,245.0 Non-recurring items (941.2) (16.1) Tax effect of non-recurring items* 63.6 (9.7) Non-controlling interest effect of non-recurring items* 3.4 (0.1) (Gain)/loss on foreign exchange (6.6) 6.6 Tax effect on foreign exchange* (2.2) (0.3) NRV adjustment to stockpiles* — 3.0 Tax effect of NRV adjustments* — (0.8) South Deep deferred tax rate change* — (0.8) Normalised profit attributable to owners of the parent 2,684.4 1,226.7 Normalised profit is considered an important measure by Gold Fields of the profit realised by the Group in the ordinary course of operations. In addition, it forms the basis of the dividend payout policy. Normalised profit is defined as profit attributable to owners of the parent excluding gains and losses on foreign exchange, financial instruments, non-recurring NRV adjustments to stockpiles and non-recurring items after taxation and non-controlling interest. * Based on information underlying the reviewed condensed consolidated financial statement of Gold Fields for the year ended 31 December 2025 and 31 December 2024 Gold Fields Reviewed Results 2025 7

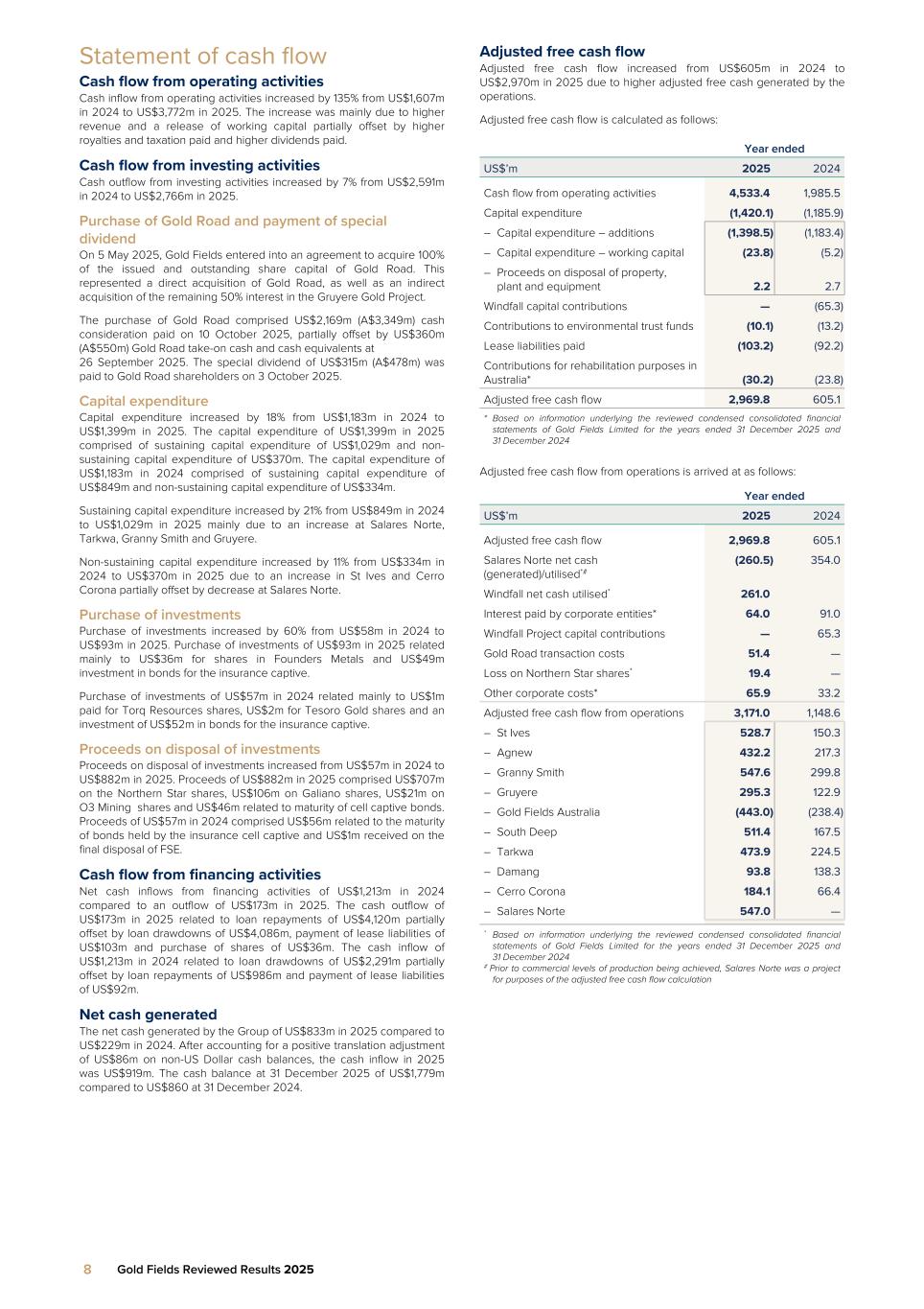

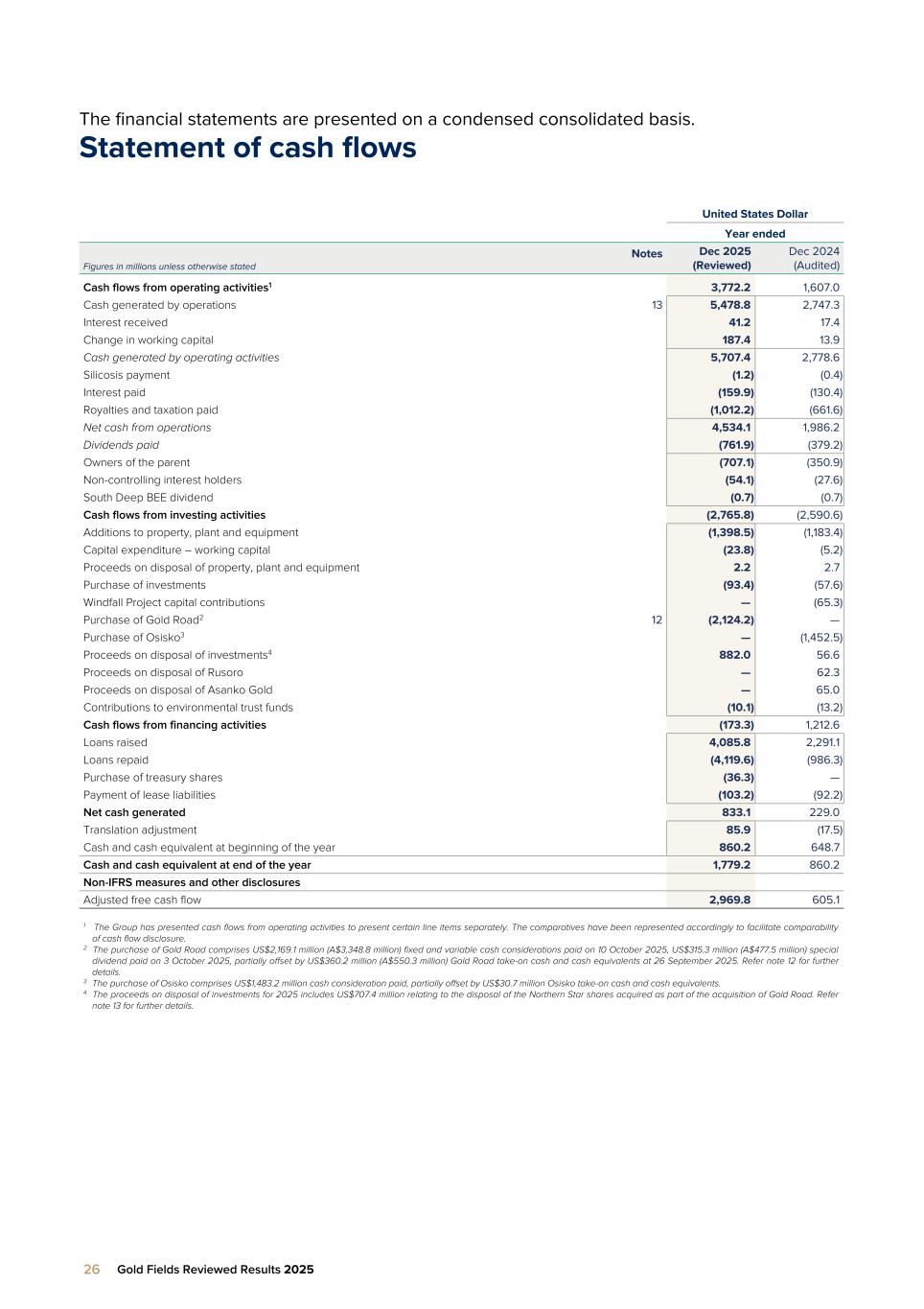

Statement of cash flow Cash flow from operating activities Cash inflow from operating activities increased by 135% from US$1,607m in 2024 to US$3,772m in 2025. The increase was mainly due to higher revenue and a release of working capital partially offset by higher royalties and taxation paid and higher dividends paid. Cash flow from investing activities Cash outflow from investing activities increased by 7% from US$2,591m in 2024 to US$2,766m in 2025. Purchase of Gold Road and payment of special dividend On 5 May 2025, Gold Fields entered into an agreement to acquire 100% of the issued and outstanding share capital of Gold Road. This represented a direct acquisition of Gold Road, as well as an indirect acquisition of the remaining 50% interest in the Gruyere Gold Project. The purchase of Gold Road comprised US$2,169m (A$3,349m) cash consideration paid on 10 October 2025, partially offset by US$360m (A$550m) Gold Road take-on cash and cash equivalents at 26 September 2025. The special dividend of US$315m (A$478m) was paid to Gold Road shareholders on 3 October 2025. Capital expenditure Capital expenditure increased by 18% from US$1,183m in 2024 to US$1,399m in 2025. The capital expenditure of US$1,399m in 2025 comprised of sustaining capital expenditure of US$1,029m and non- sustaining capital expenditure of US$370m. The capital expenditure of US$1,183m in 2024 comprised of sustaining capital expenditure of US$849m and non-sustaining capital expenditure of US$334m. Sustaining capital expenditure increased by 21% from US$849m in 2024 to US$1,029m in 2025 mainly due to an increase at Salares Norte, Tarkwa, Granny Smith and Gruyere. Non-sustaining capital expenditure increased by 11% from US$334m in 2024 to US$370m in 2025 due to an increase in St Ives and Cerro Corona partially offset by decrease at Salares Norte. Purchase of investments Purchase of investments increased by 60% from US$58m in 2024 to US$93m in 2025. Purchase of investments of US$93m in 2025 related mainly to US$36m for shares in Founders Metals and US$49m investment in bonds for the insurance captive. Purchase of investments of US$57m in 2024 related mainly to US$1m paid for Torq Resources shares, US$2m for Tesoro Gold shares and an investment of US$52m in bonds for the insurance captive. Proceeds on disposal of investments Proceeds on disposal of investments increased from US$57m in 2024 to US$882m in 2025. Proceeds of US$882m in 2025 comprised US$707m on the Northern Star shares, US$106m on Galiano shares, US$21m on O3 Mining shares and US$46m related to maturity of cell captive bonds. Proceeds of US$57m in 2024 comprised US$56m related to the maturity of bonds held by the insurance cell captive and US$1m received on the final disposal of FSE. Cash flow from financing activities Net cash inflows from financing activities of US$1,213m in 2024 compared to an outflow of US$173m in 2025. The cash outflow of US$173m in 2025 related to loan repayments of US$4,120m partially offset by loan drawdowns of US$4,086m, payment of lease liabilities of US$103m and purchase of shares of US$36m. The cash inflow of US$1,213m in 2024 related to loan drawdowns of US$2,291m partially offset by loan repayments of US$986m and payment of lease liabilities of US$92m. Net cash generated The net cash generated by the Group of US$833m in 2025 compared to US$229m in 2024. After accounting for a positive translation adjustment of US$86m on non-US Dollar cash balances, the cash inflow in 2025 was US$919m. The cash balance at 31 December 2025 of US$1,779m compared to US$860 at 31 December 2024. Adjusted free cash flow Adjusted free cash flow increased from US$605m in 2024 to US$2,970m in 2025 due to higher adjusted free cash generated by the operations. Adjusted free cash flow is calculated as follows: Year ended US$’m 2025 2024 Cash flow from operating activities 4,533.4 1,985.5 Capital expenditure (1,420.1) (1,185.9) – Capital expenditure – additions (1,398.5) (1,183.4) – Capital expenditure – working capital (23.8) (5.2) – Proceeds on disposal of property, plant and equipment 2.2 2.7 Windfall capital contributions — (65.3) Contributions to environmental trust funds (10.1) (13.2) Lease liabilities paid (103.2) (92.2) Contributions for rehabilitation purposes in Australia* (30.2) (23.8) Adjusted free cash flow 2,969.8 605.1 * Based on information underlying the reviewed condensed consolidated financial statements of Gold Fields Limited for the years ended 31 December 2025 and 31 December 2024 Adjusted free cash flow from operations is arrived at as follows: Year ended US$’m 2025 2024 Adjusted free cash flow 2,969.8 605.1 Salares Norte net cash (generated)/utilised*# (260.5) 354.0 Windfall net cash utilised* 261.0 Interest paid by corporate entities* 64.0 91.0 Windfall Project capital contributions — 65.3 Gold Road transaction costs 51.4 — Loss on Northern Star shares* 19.4 — Other corporate costs* 65.9 33.2 Adjusted free cash flow from operations 3,171.0 1,148.6 – St Ives 528.7 150.3 – Agnew 432.2 217.3 – Granny Smith 547.6 299.8 – Gruyere 295.3 122.9 – Gold Fields Australia (443.0) (238.4) – South Deep 511.4 167.5 – Tarkwa 473.9 224.5 – Damang 93.8 138.3 – Cerro Corona 184.1 66.4 – Salares Norte 547.0 — * Based on information underlying the reviewed condensed consolidated financial statements of Gold Fields Limited for the years ended 31 December 2025 and 31 December 2024 # Prior to commercial levels of production being achieved, Salares Norte was a project for purposes of the adjusted free cash flow calculation 8 Gold Fields Reviewed Results 2025

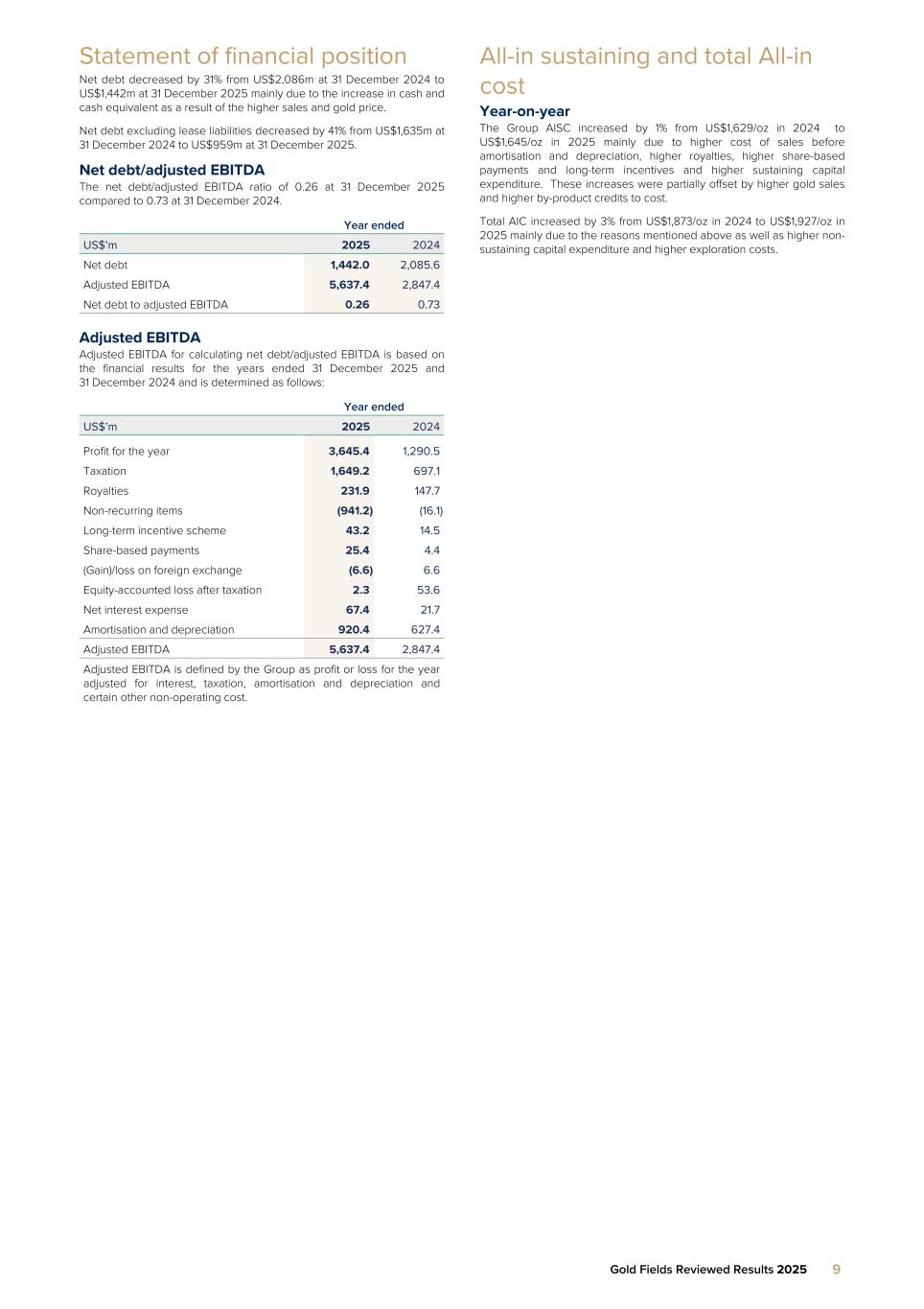

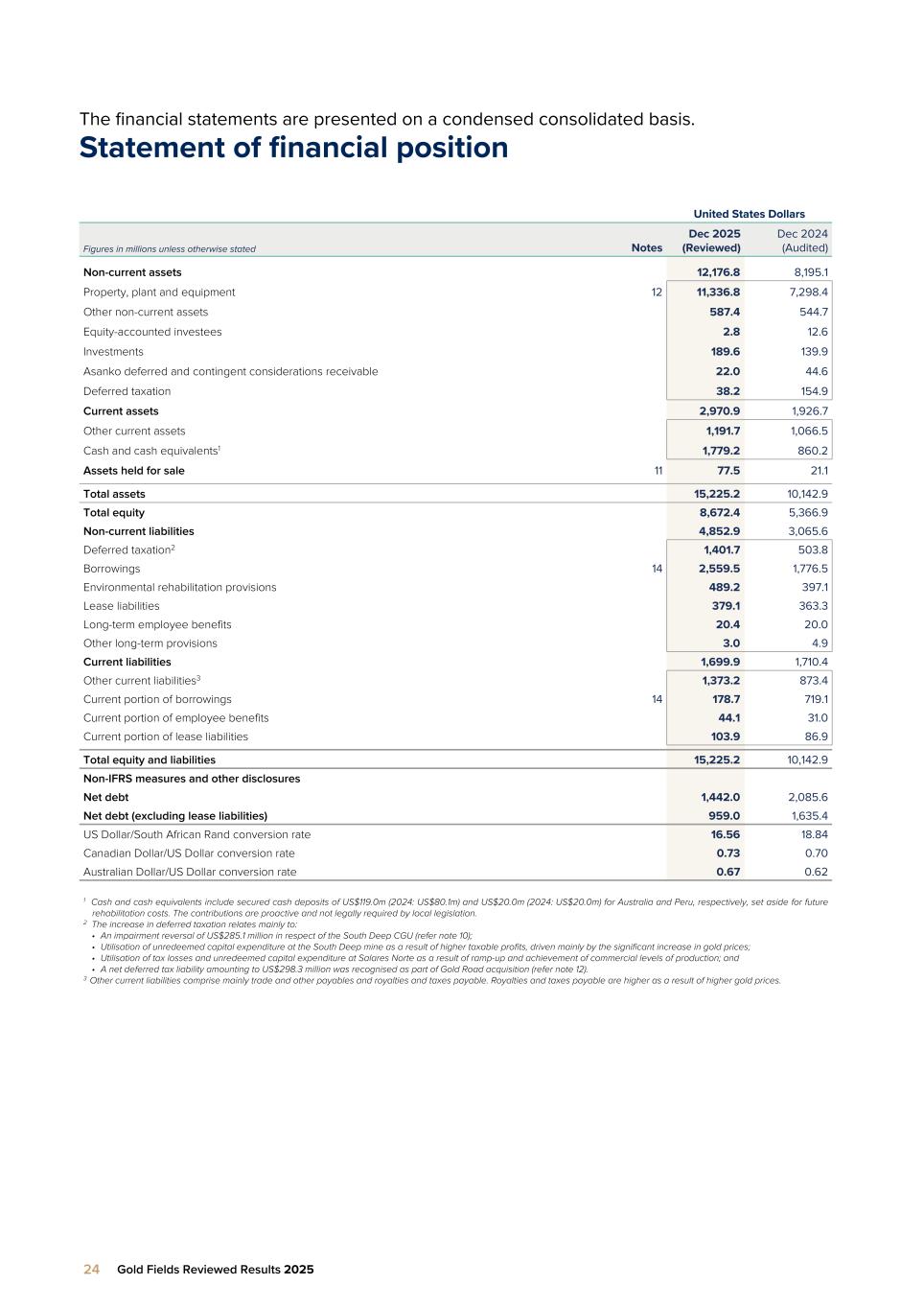

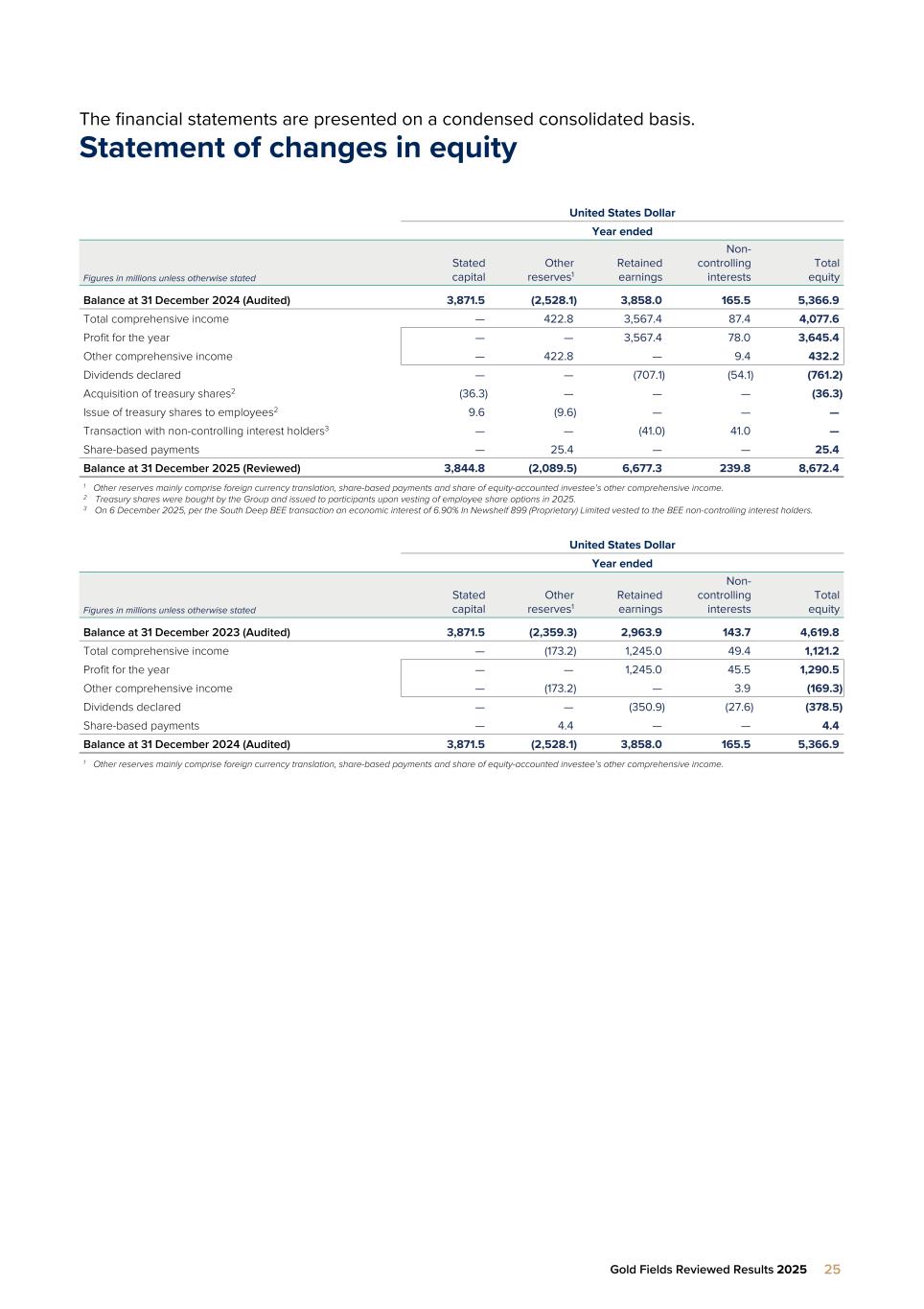

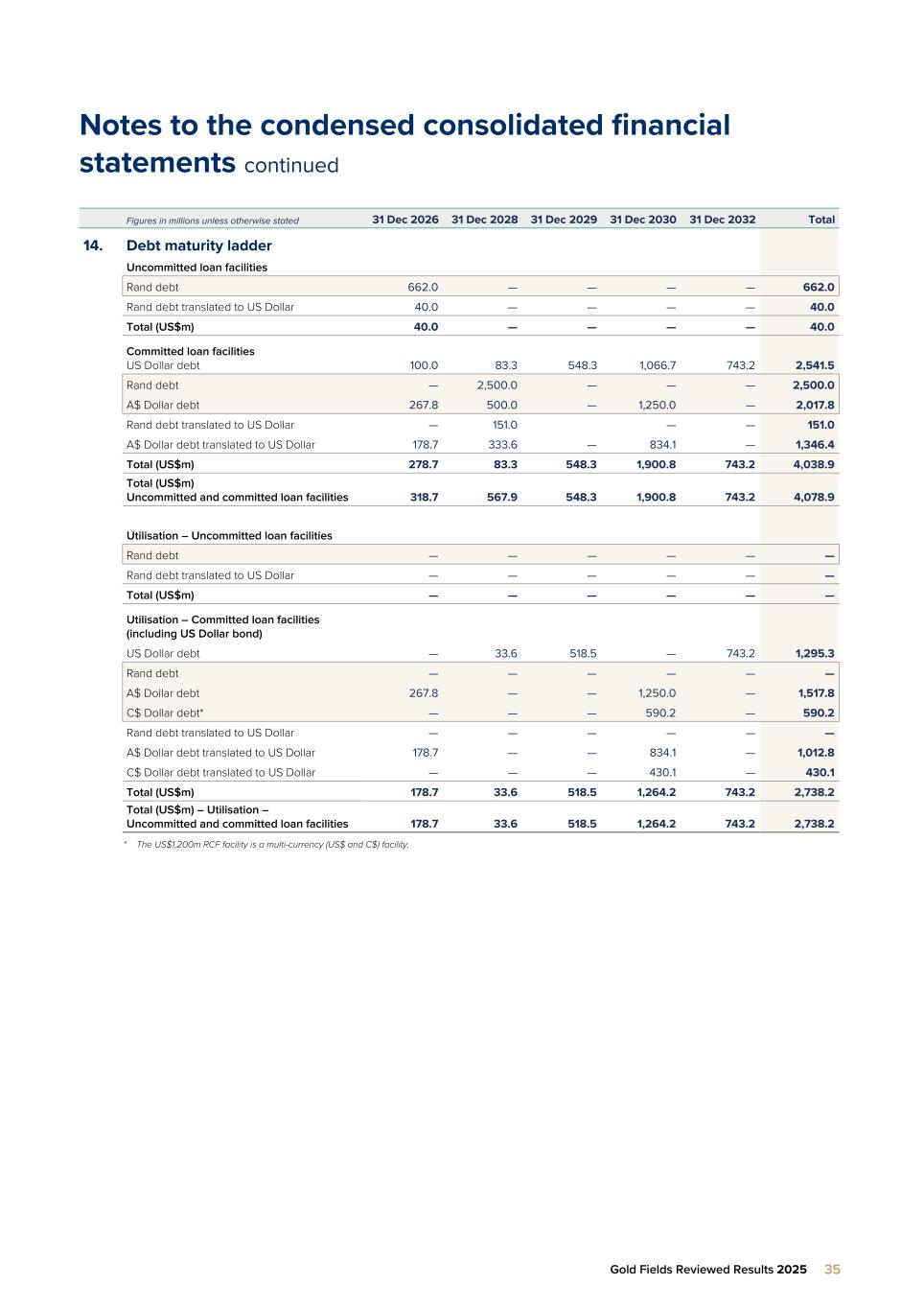

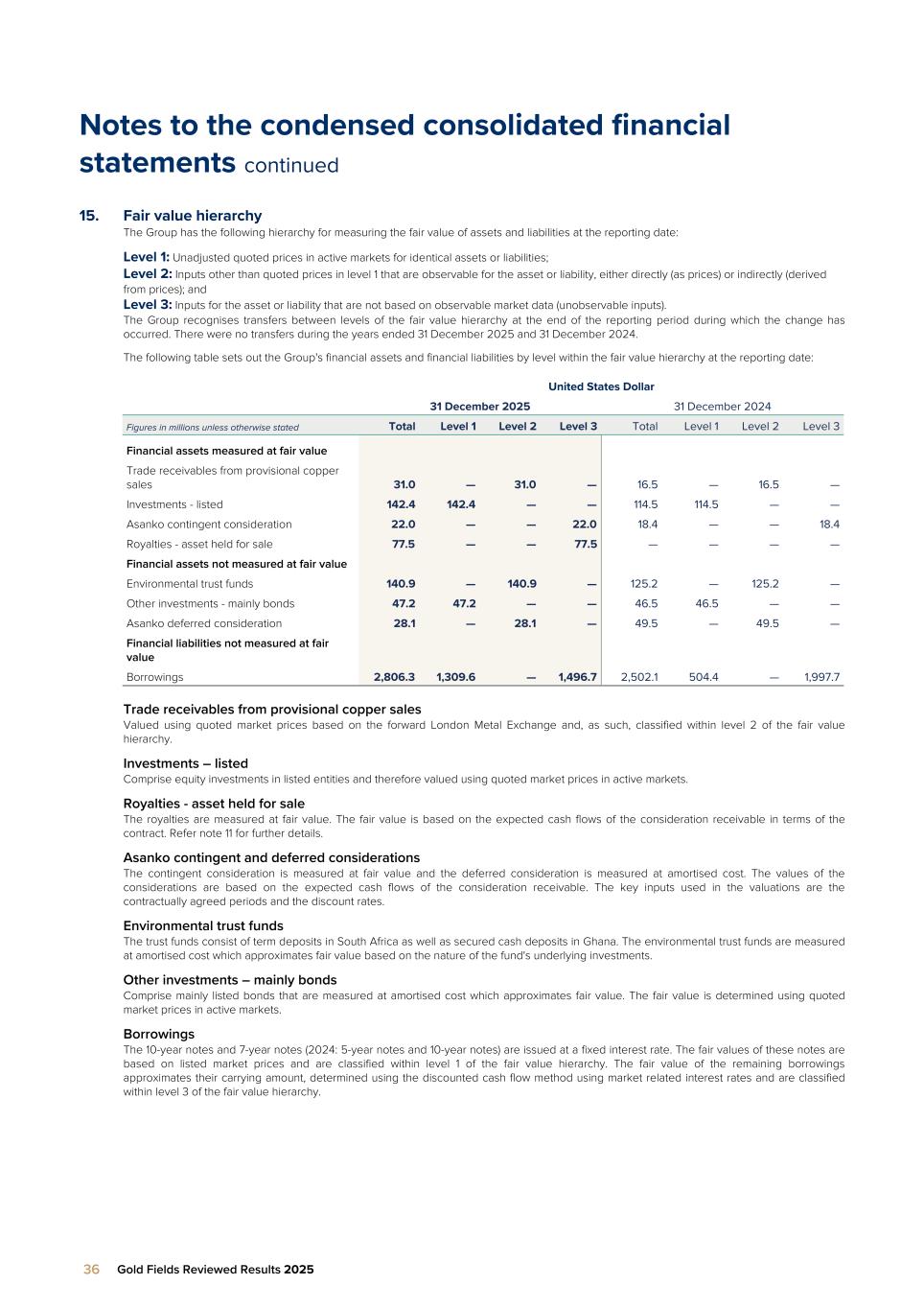

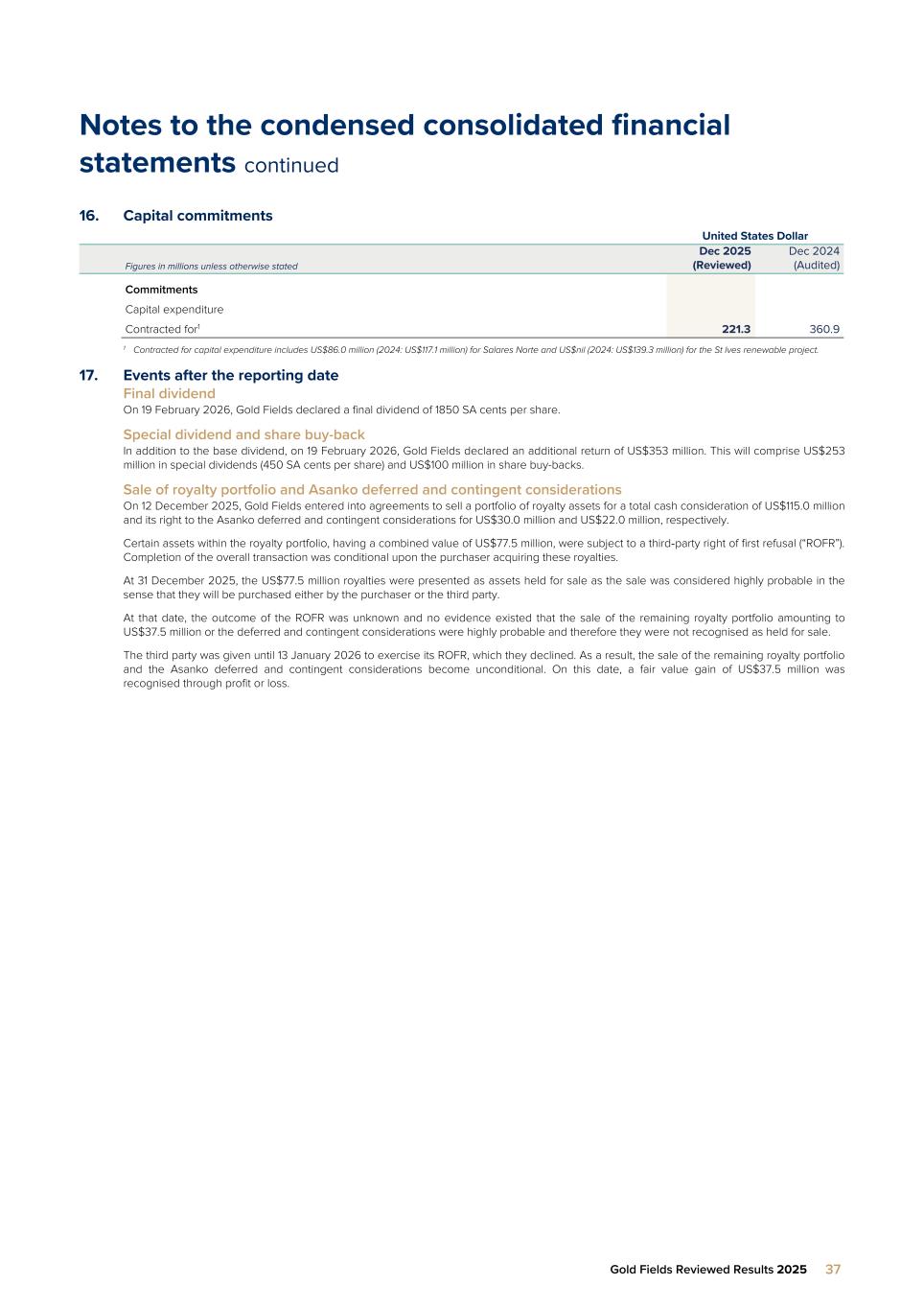

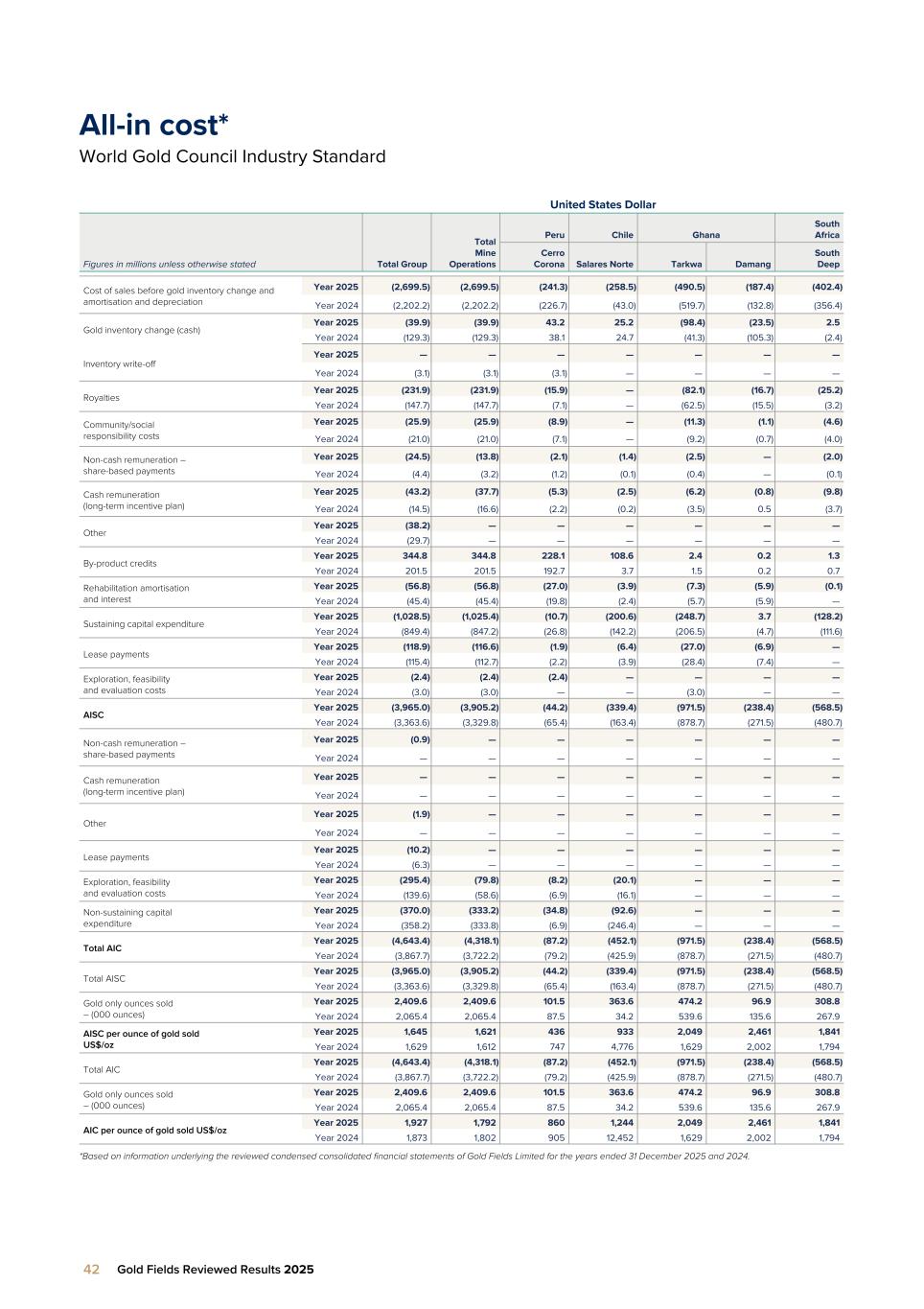

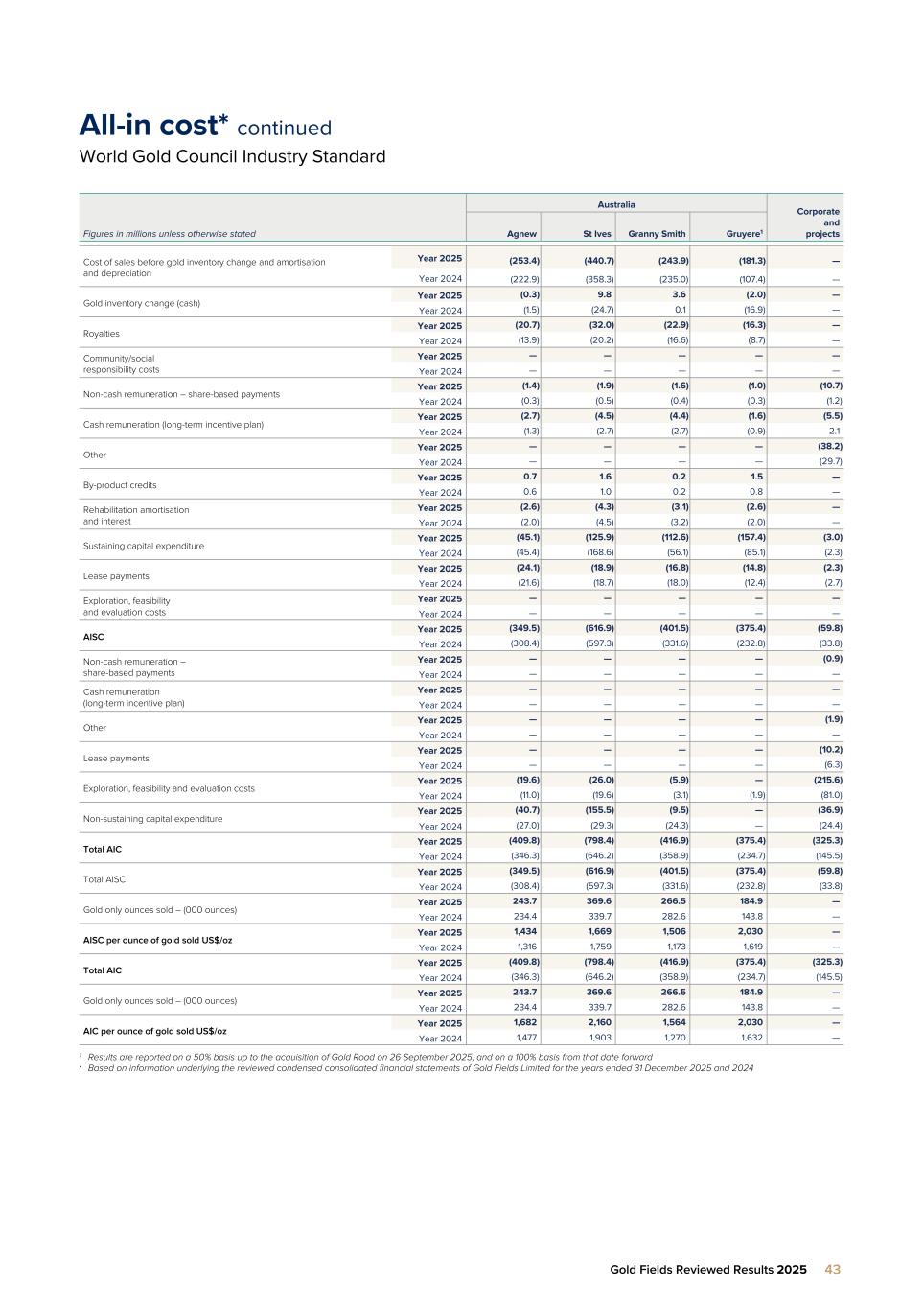

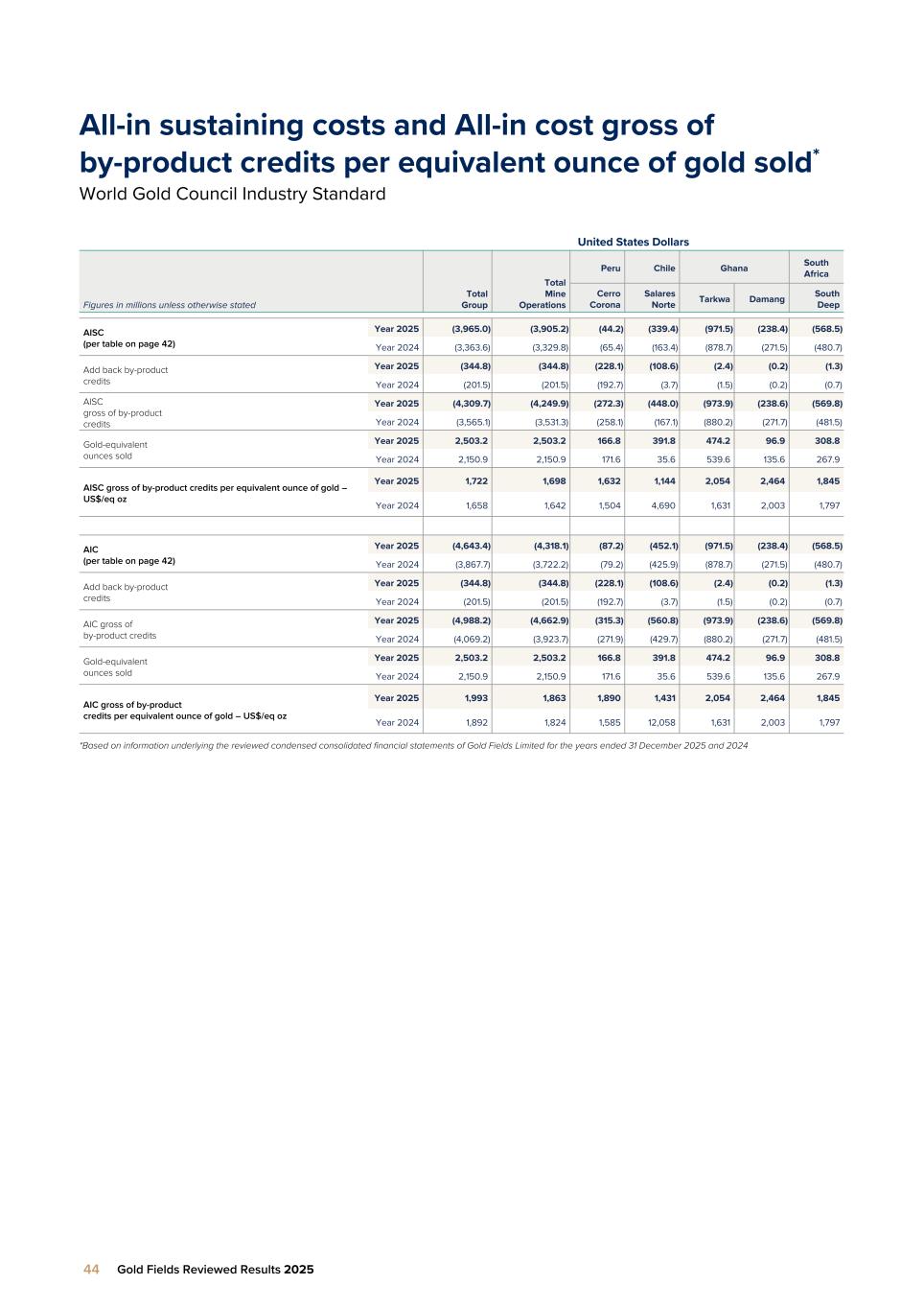

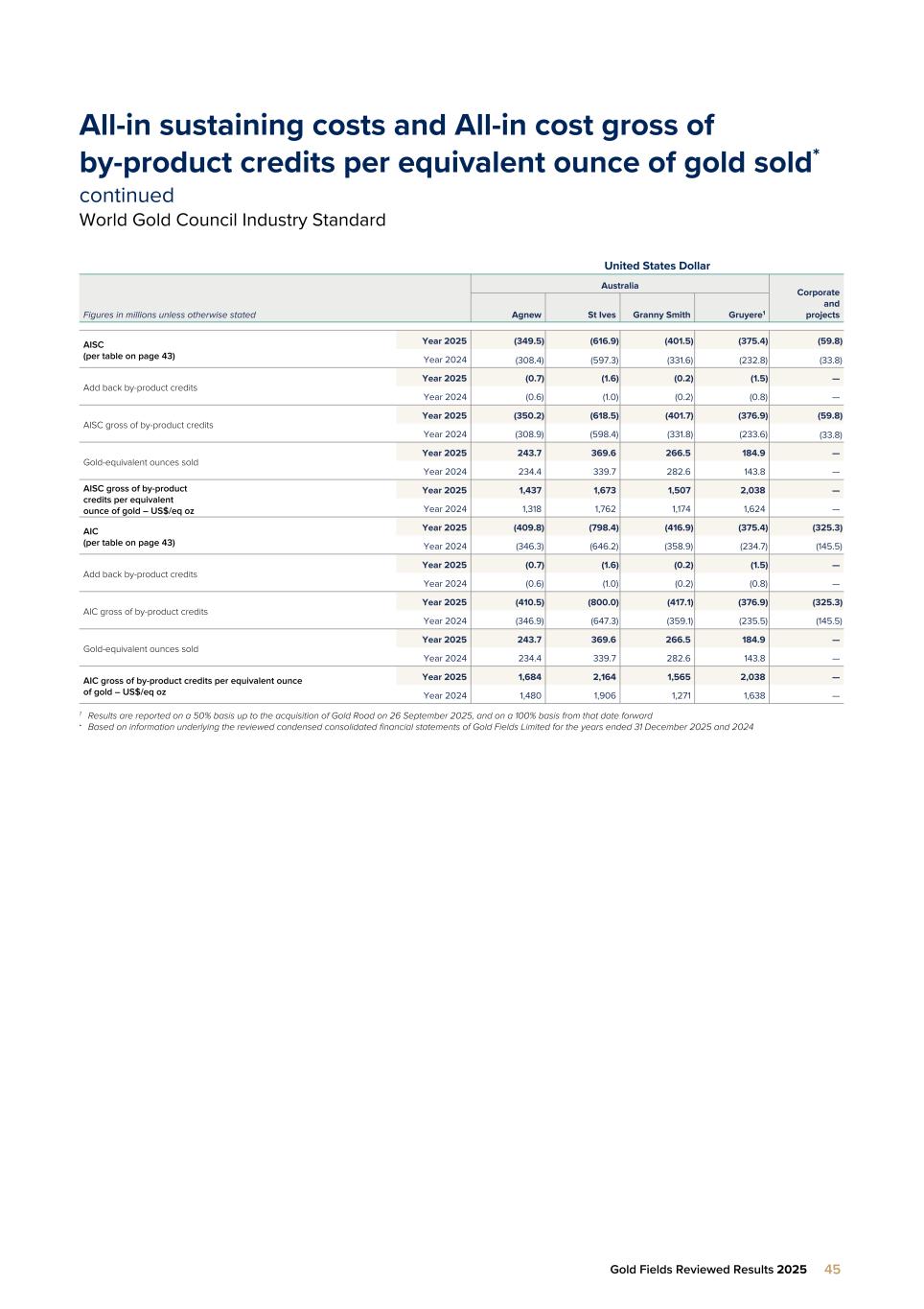

Statement of financial position Net debt decreased by 31% from US$2,086m at 31 December 2024 to US$1,442m at 31 December 2025 mainly due to the increase in cash and cash equivalent as a result of the higher sales and gold price. Net debt excluding lease liabilities decreased by 41% from US$1,635m at 31 December 2024 to US$959m at 31 December 2025. Net debt/adjusted EBITDA The net debt/adjusted EBITDA ratio of 0.26 at 31 December 2025 compared to 0.73 at 31 December 2024. Year ended US$’m 2025 2024 Net debt 1,442.0 2,085.6 Adjusted EBITDA 5,637.4 2,847.4 Net debt to adjusted EBITDA 0.26 0.73 Adjusted EBITDA Adjusted EBITDA for calculating net debt/adjusted EBITDA is based on the financial results for the years ended 31 December 2025 and 31 December 2024 and is determined as follows: Year ended US$’m 2025 2024 Profit for the year 3,645.4 1,290.5 Taxation 1,649.2 697.1 Royalties 231.9 147.7 Non-recurring items (941.2) (16.1) Long-term incentive scheme 43.2 14.5 Share-based payments 25.4 4.4 (Gain)/loss on foreign exchange (6.6) 6.6 Equity-accounted loss after taxation 2.3 53.6 Net interest expense 67.4 21.7 Amortisation and depreciation 920.4 627.4 Adjusted EBITDA 5,637.4 2,847.4 Adjusted EBITDA is defined by the Group as profit or loss for the year adjusted for interest, taxation, amortisation and depreciation and certain other non-operating cost. All-in sustaining and total All-in cost Year-on-year The Group AISC increased by 1% from US$1,629/oz in 2024 to US$1,645/oz in 2025 mainly due to higher cost of sales before amortisation and depreciation, higher royalties, higher share-based payments and long-term incentives and higher sustaining capital expenditure. These increases were partially offset by higher gold sales and higher by-product credits to cost. Total AIC increased by 3% from US$1,873/oz in 2024 to US$1,927/oz in 2025 mainly due to the reasons mentioned above as well as higher non- sustaining capital expenditure and higher exploration costs. Gold Fields Reviewed Results 2025 9

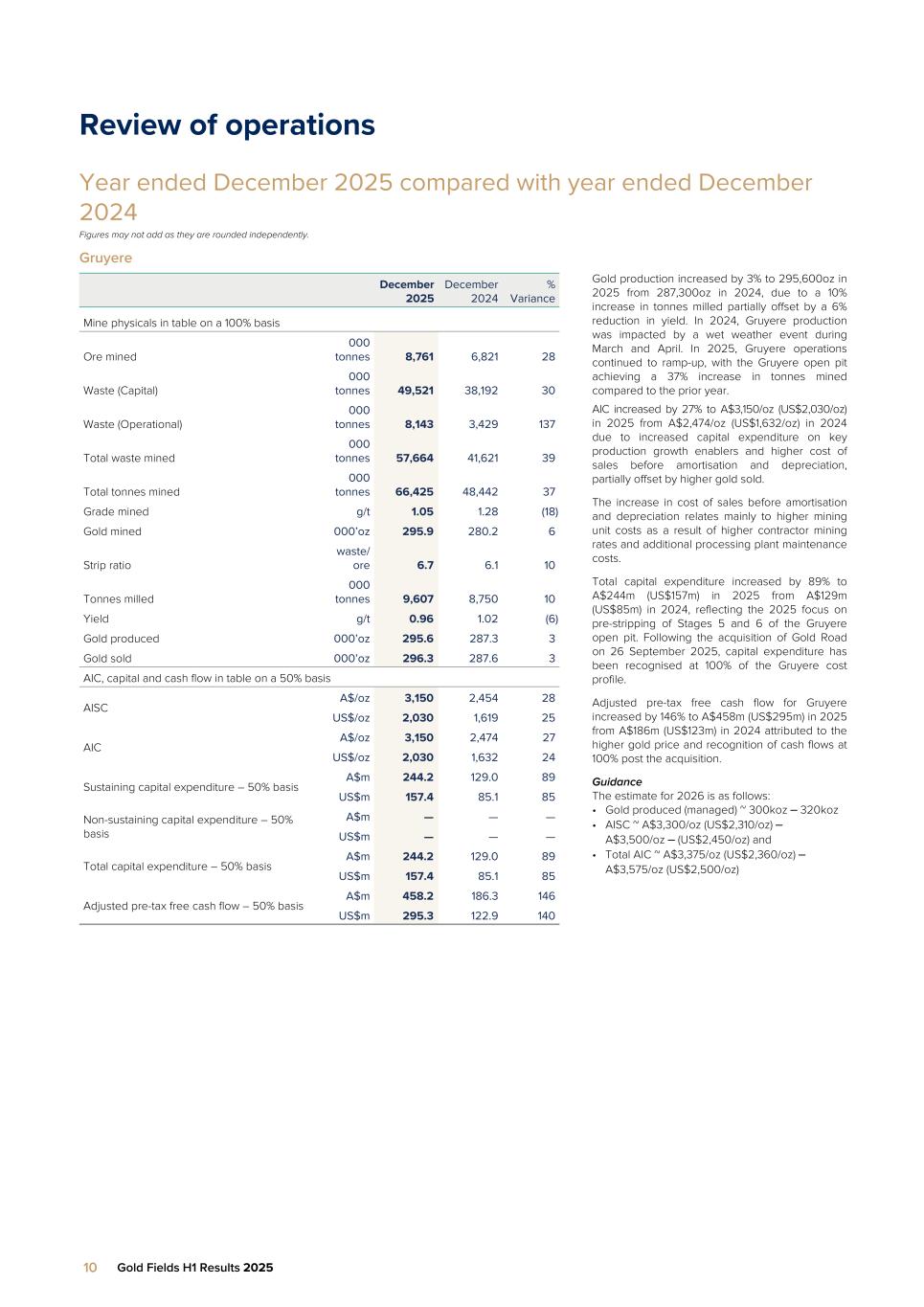

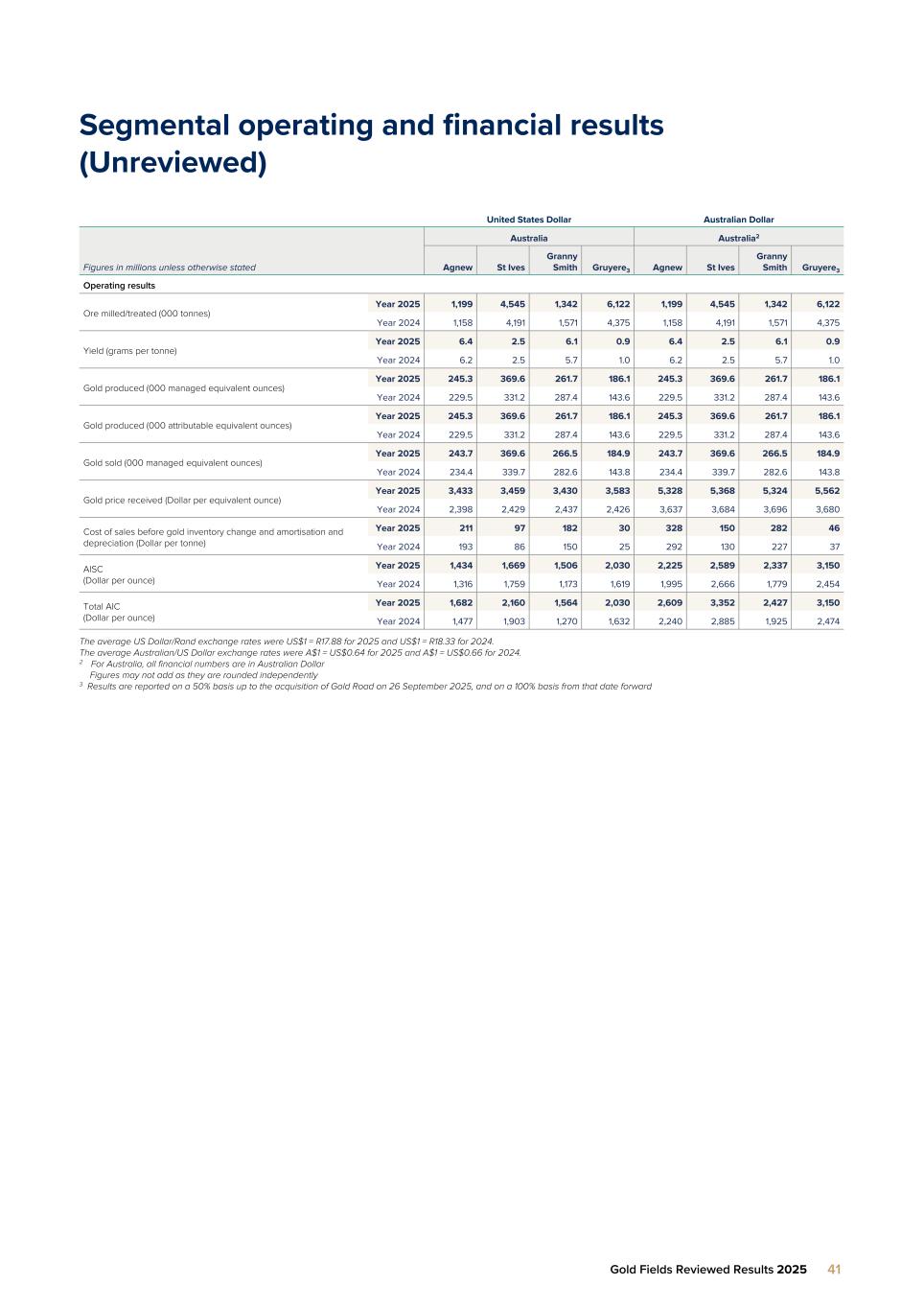

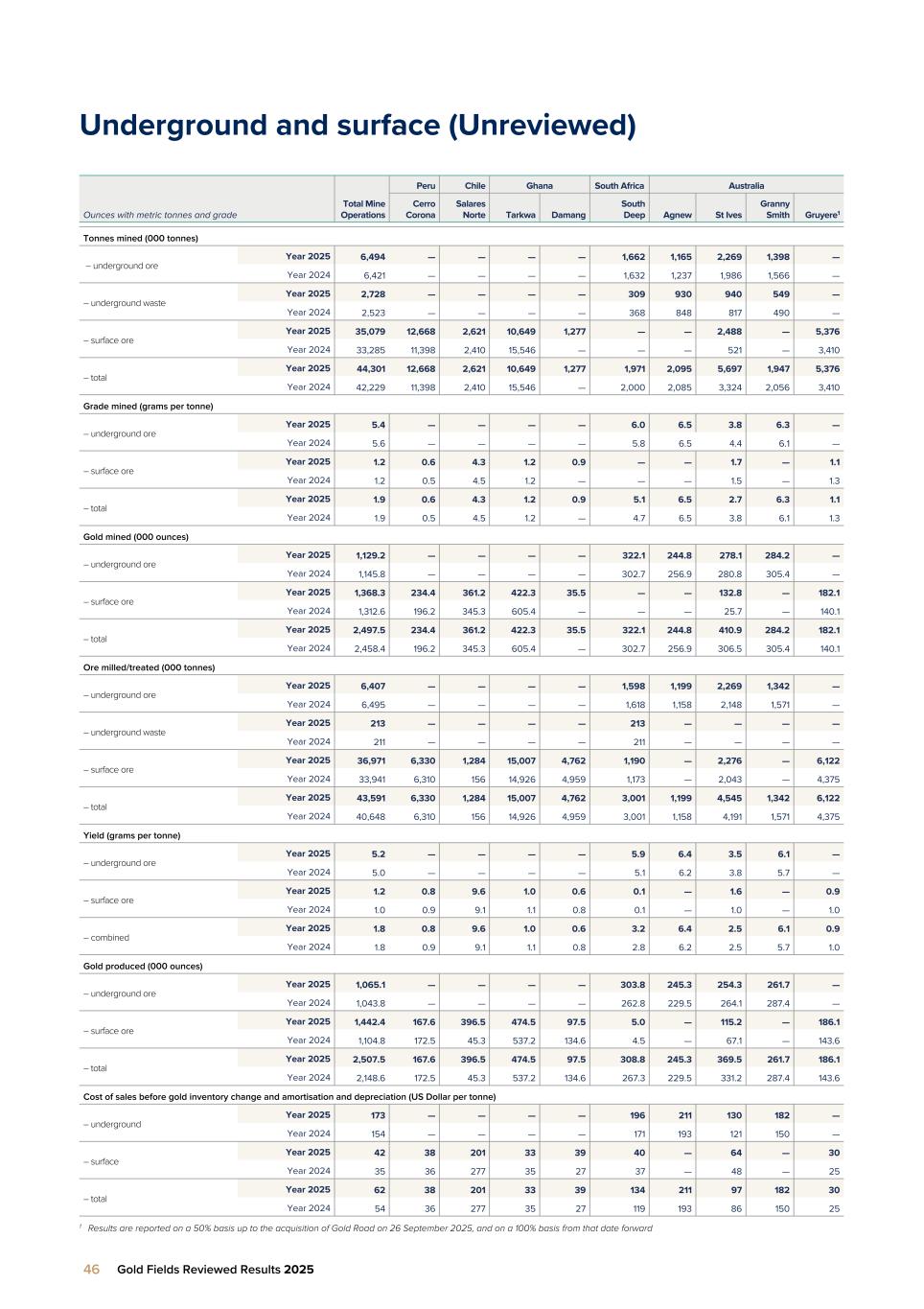

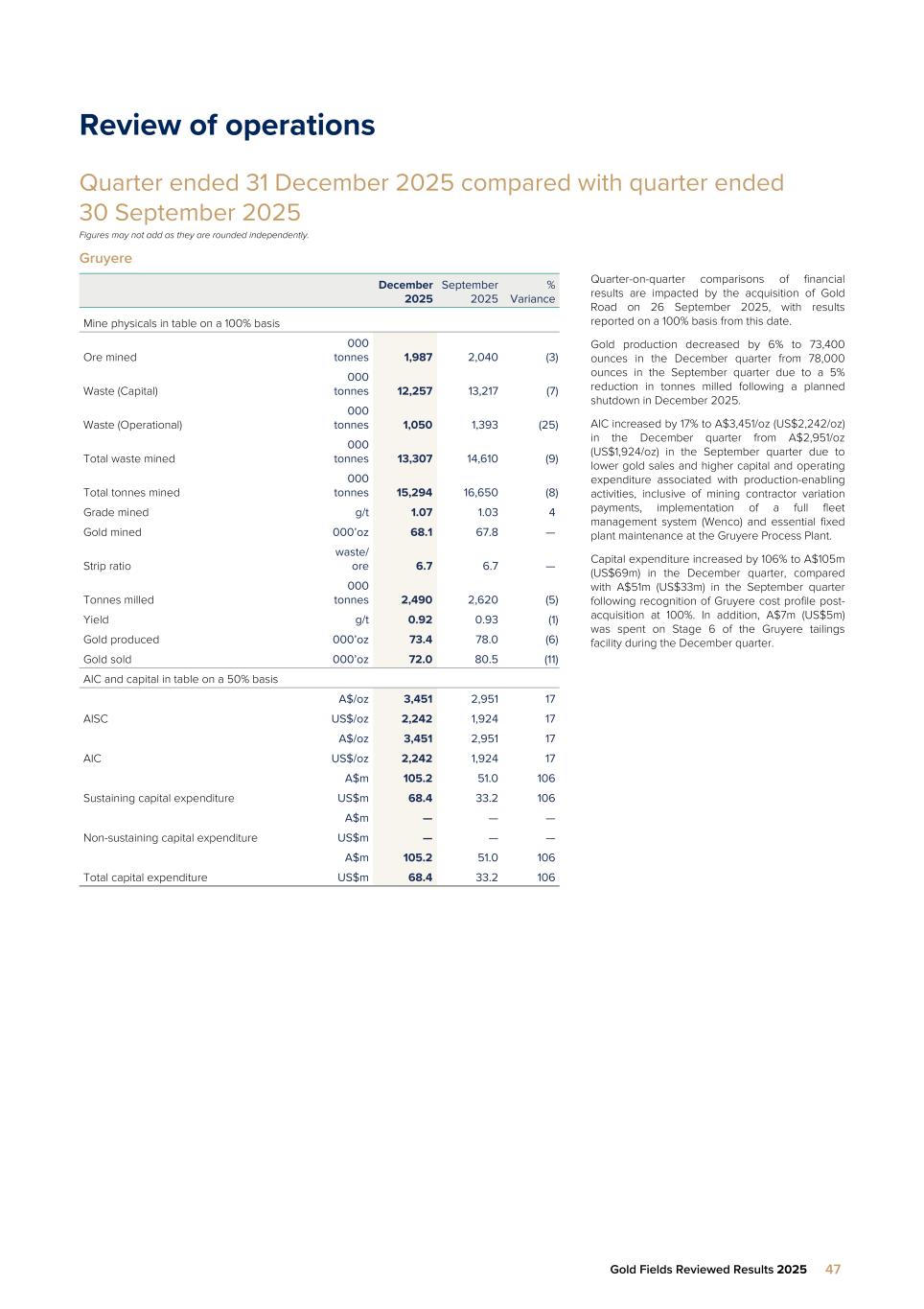

Review of operations Year ended December 2025 compared with year ended December 2024 Figures may not add as they are rounded independently. Gruyere December 2025 December 2024 % Variance Mine physicals in table on a 100% basis Ore mined 000 tonnes 8,761 6,821 28 Waste (Capital) 000 tonnes 49,521 38,192 30 Waste (Operational) 000 tonnes 8,143 3,429 137 Total waste mined 000 tonnes 57,664 41,621 39 Total tonnes mined 000 tonnes 66,425 48,442 37 Grade mined g/t 1.05 1.28 (18) Gold mined 000’oz 295.9 280.2 6 Strip ratio waste/ ore 6.7 6.1 10 Tonnes milled 000 tonnes 9,607 8,750 10 Yield g/t 0.96 1.02 (6) Gold produced 000’oz 295.6 287.3 3 Gold sold 000’oz 296.3 287.6 3 AIC, capital and cash flow in table on a 50% basis AISC A$/oz 3,150 2,454 28 US$/oz 2,030 1,619 25 AIC A$/oz 3,150 2,474 27 US$/oz 2,030 1,632 24 Sustaining capital expenditure – 50% basis A$m 244.2 129.0 89 US$m 157.4 85.1 85 Non-sustaining capital expenditure – 50% basis A$m — — — US$m — — — Total capital expenditure – 50% basis A$m 244.2 129.0 89 US$m 157.4 85.1 85 Adjusted pre-tax free cash flow – 50% basis A$m 458.2 186.3 146 US$m 295.3 122.9 140 Gold production increased by 3% to 295,600oz in 2025 from 287,300oz in 2024, due to a 10% increase in tonnes milled partially offset by a 6% reduction in yield. In 2024, Gruyere production was impacted by a wet weather event during March and April. In 2025, Gruyere operations continued to ramp-up, with the Gruyere open pit achieving a 37% increase in tonnes mined compared to the prior year. AIC increased by 27% to A$3,150/oz (US$2,030/oz) in 2025 from A$2,474/oz (US$1,632/oz) in 2024 due to increased capital expenditure on key production growth enablers and higher cost of sales before amortisation and depreciation, partially offset by higher gold sold. The increase in cost of sales before amortisation and depreciation relates mainly to higher mining unit costs as a result of higher contractor mining rates and additional processing plant maintenance costs. Total capital expenditure increased by 89% to A$244m (US$157m) in 2025 from A$129m (US$85m) in 2024, reflecting the 2025 focus on pre-stripping of Stages 5 and 6 of the Gruyere open pit. Following the acquisition of Gold Road on 26 September 2025, capital expenditure has been recognised at 100% of the Gruyere cost profile. Adjusted pre-tax free cash flow for Gruyere increased by 146% to A$458m (US$295m) in 2025 from A$186m (US$123m) in 2024 attributed to the higher gold price and recognition of cash flows at 100% post the acquisition. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 300koz – 320koz • AISC ~ A$3,300/oz (US$2,310/oz) – A$3,500/oz – (US$2,450/oz) and • Total AIC ~ A$3,375/oz (US$2,360/oz) – A$3,575/oz (US$2,500/oz) 10 Gold Fields H1 Results 2025

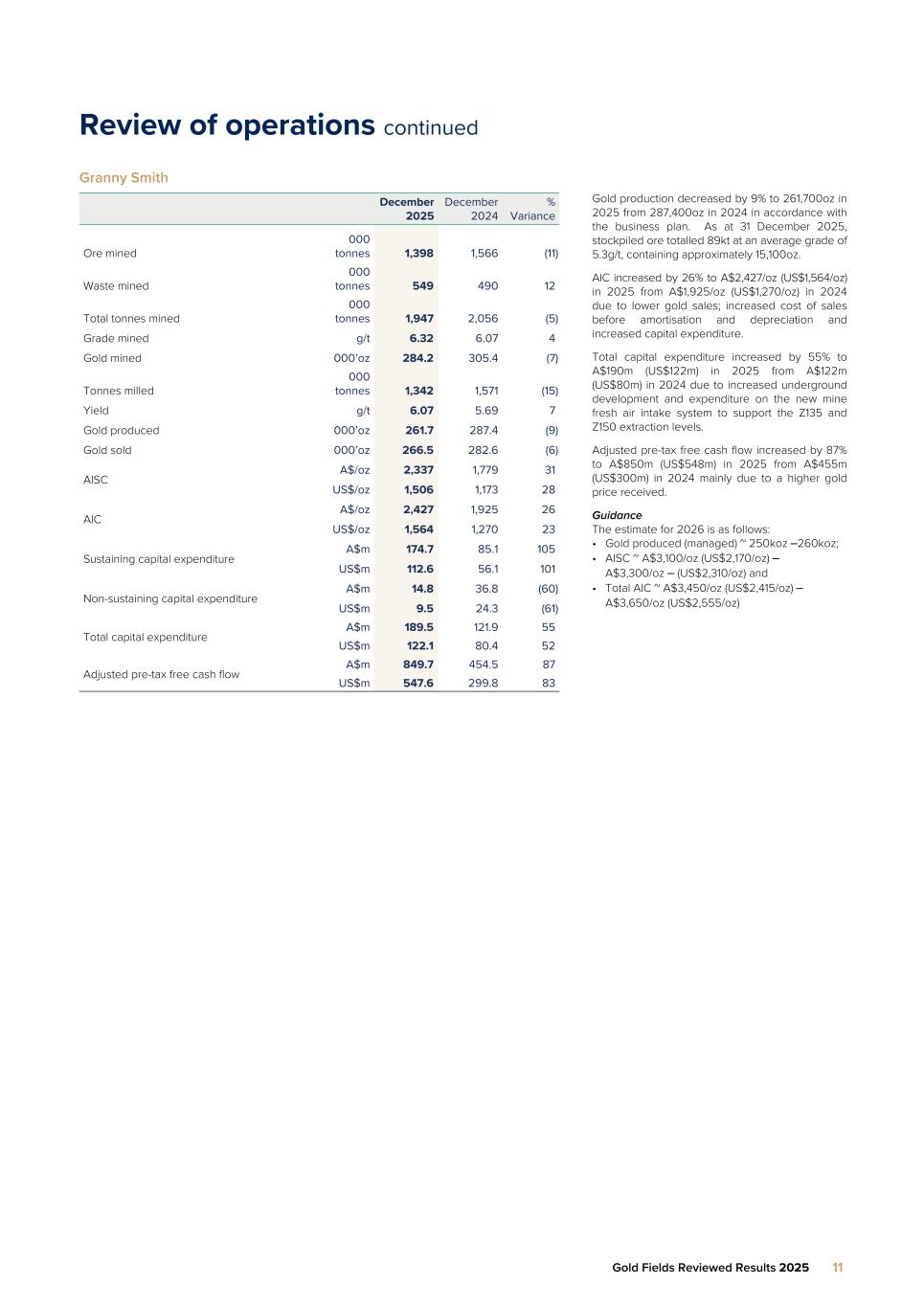

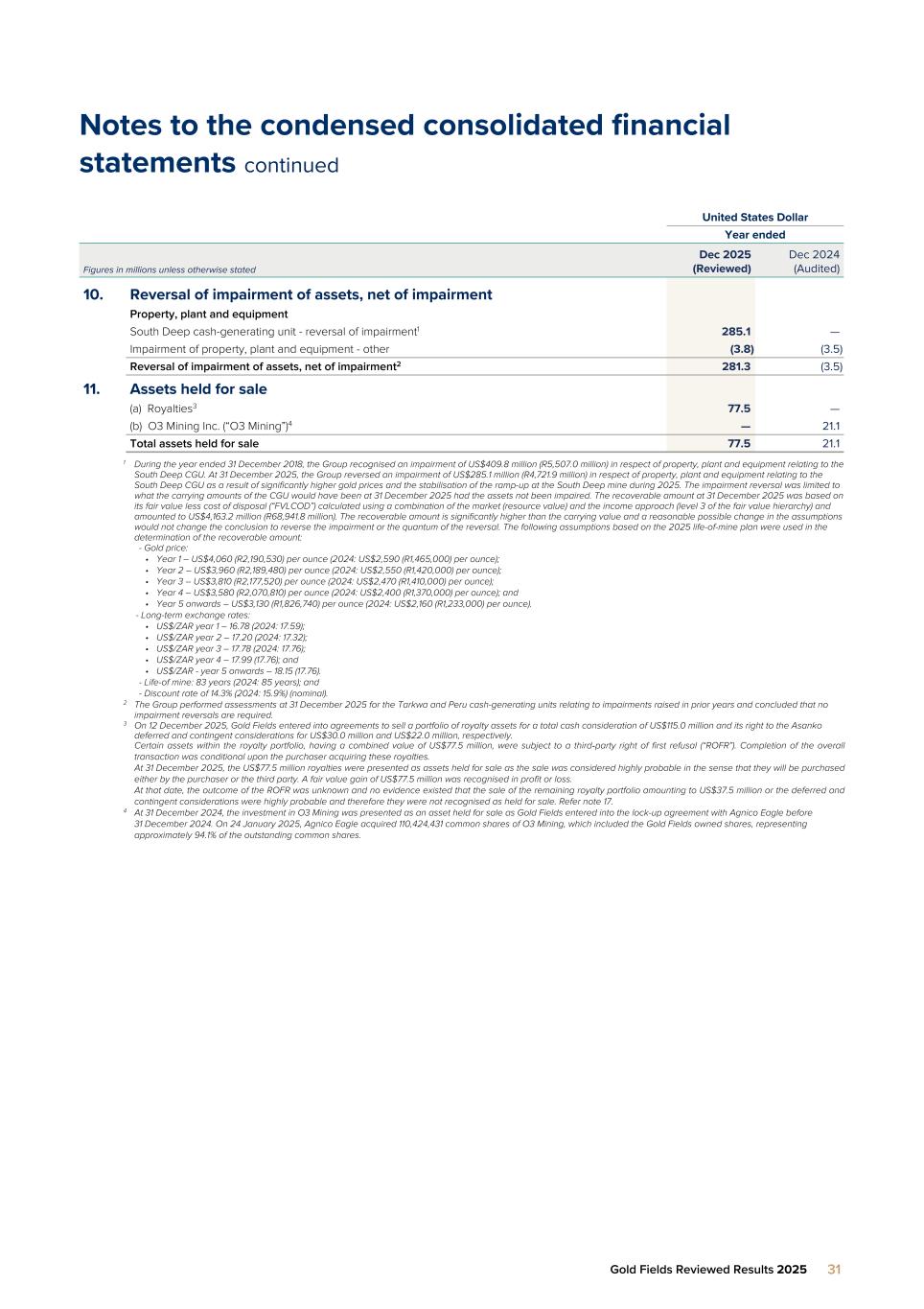

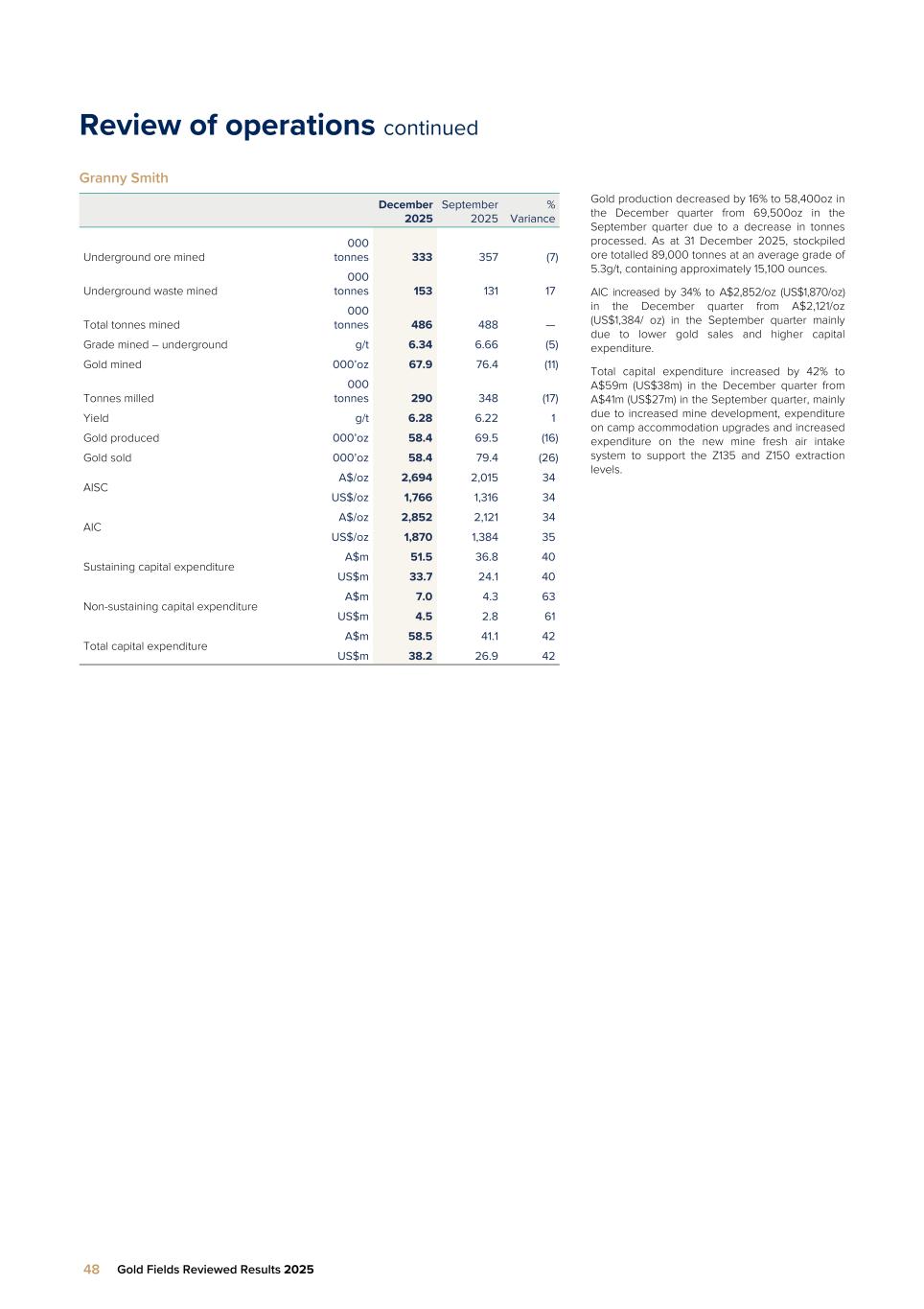

Review of operations continued Granny Smith December 2025 December 2024 % Variance Ore mined 000 tonnes 1,398 1,566 (11) Waste mined 000 tonnes 549 490 12 Total tonnes mined 000 tonnes 1,947 2,056 (5) Grade mined g/t 6.32 6.07 4 Gold mined 000’oz 284.2 305.4 (7) Tonnes milled 000 tonnes 1,342 1,571 (15) Yield g/t 6.07 5.69 7 Gold produced 000’oz 261.7 287.4 (9) Gold sold 000’oz 266.5 282.6 (6) AISC A$/oz 2,337 1,779 31 US$/oz 1,506 1,173 28 AIC A$/oz 2,427 1,925 26 US$/oz 1,564 1,270 23 Sustaining capital expenditure A$m 174.7 85.1 105 US$m 112.6 56.1 101 Non-sustaining capital expenditure A$m 14.8 36.8 (60) US$m 9.5 24.3 (61) Total capital expenditure A$m 189.5 121.9 55 US$m 122.1 80.4 52 Adjusted pre-tax free cash flow A$m 849.7 454.5 87 US$m 547.6 299.8 83 Gold production decreased by 9% to 261,700oz in 2025 from 287,400oz in 2024 in accordance with the business plan. As at 31 December 2025, stockpiled ore totalled 89kt at an average grade of 5.3g/t, containing approximately 15,100oz. AIC increased by 26% to A$2,427/oz (US$1,564/oz) in 2025 from A$1,925/oz (US$1,270/oz) in 2024 due to lower gold sales; increased cost of sales before amortisation and depreciation and increased capital expenditure. Total capital expenditure increased by 55% to A$190m (US$122m) in 2025 from A$122m (US$80m) in 2024 due to increased underground development and expenditure on the new mine fresh air intake system to support the Z135 and Z150 extraction levels. Adjusted pre-tax free cash flow increased by 87% to A$850m (US$548m) in 2025 from A$455m (US$300m) in 2024 mainly due to a higher gold price received. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 250koz –260koz; • AISC ~ A$3,100/oz (US$2,170/oz) – A$3,300/oz – (US$2,310/oz) and • Total AIC ~ A$3,450/oz (US$2,415/oz) – A$3,650/oz (US$2,555/oz) Gold Fields Reviewed Results 2025 11

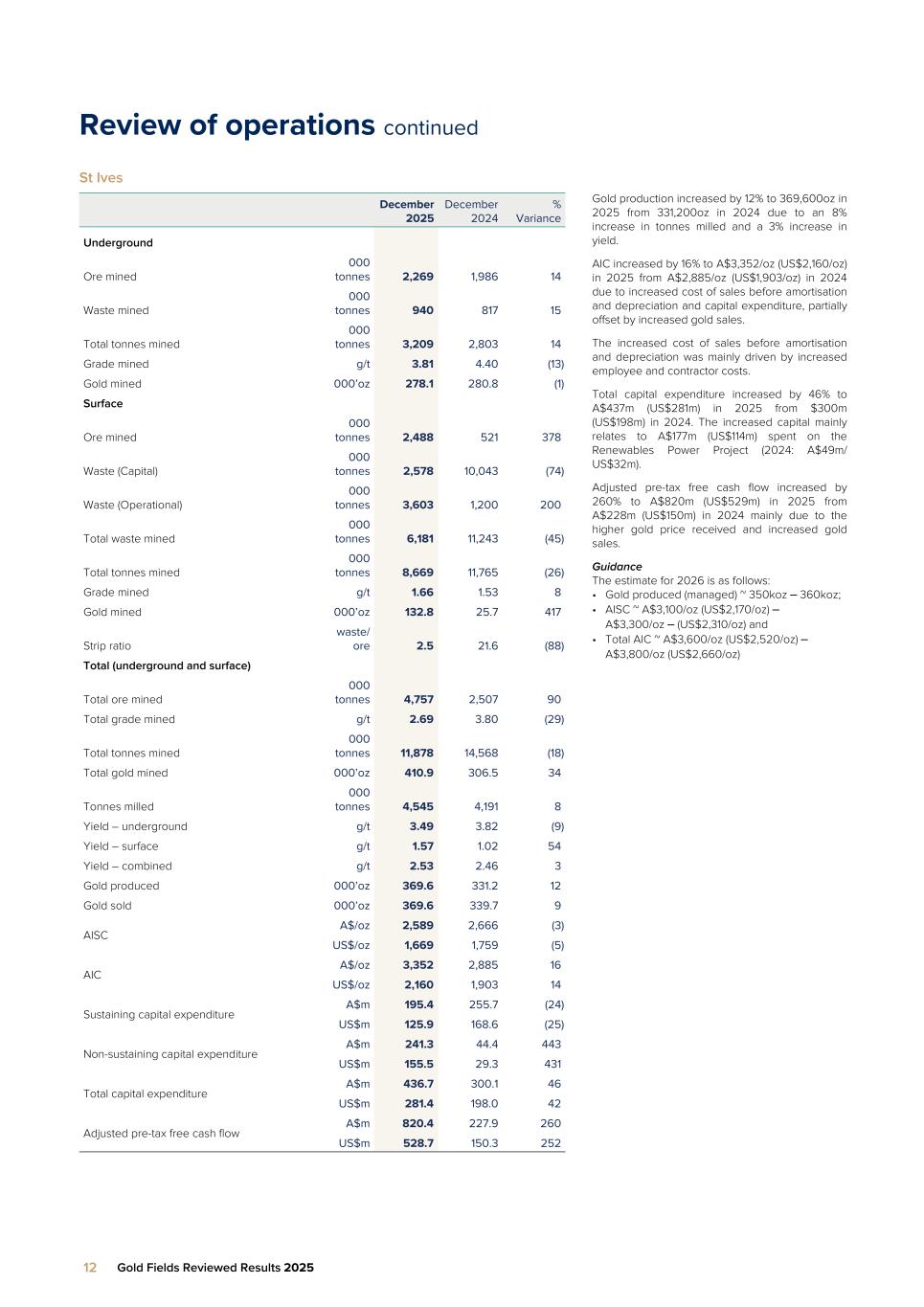

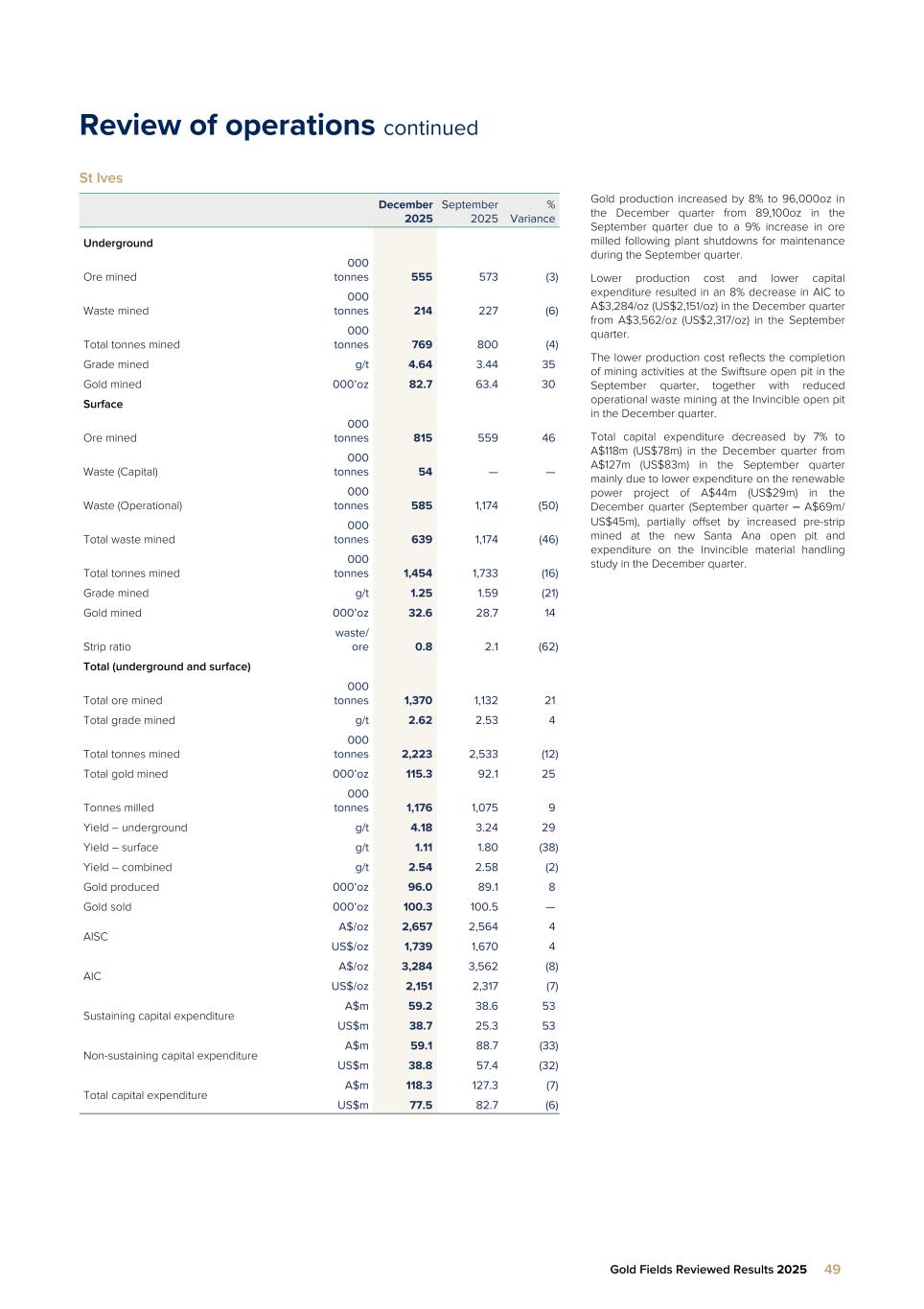

Review of operations continued St Ives December 2025 December 2024 % Variance Underground Ore mined 000 tonnes 2,269 1,986 14 Waste mined 000 tonnes 940 817 15 Total tonnes mined 000 tonnes 3,209 2,803 14 Grade mined g/t 3.81 4.40 (13) Gold mined 000’oz 278.1 280.8 (1) Surface Ore mined 000 tonnes 2,488 521 378 Waste (Capital) 000 tonnes 2,578 10,043 (74) Waste (Operational) 000 tonnes 3,603 1,200 200 Total waste mined 000 tonnes 6,181 11,243 (45) Total tonnes mined 000 tonnes 8,669 11,765 (26) Grade mined g/t 1.66 1.53 8 Gold mined 000’oz 132.8 25.7 417 Strip ratio waste/ ore 2.5 21.6 (88) Total (underground and surface) Total ore mined 000 tonnes 4,757 2,507 90 Total grade mined g/t 2.69 3.80 (29) Total tonnes mined 000 tonnes 11,878 14,568 (18) Total gold mined 000’oz 410.9 306.5 34 Tonnes milled 000 tonnes 4,545 4,191 8 Yield – underground g/t 3.49 3.82 (9) Yield – surface g/t 1.57 1.02 54 Yield – combined g/t 2.53 2.46 3 Gold produced 000’oz 369.6 331.2 12 Gold sold 000’oz 369.6 339.7 9 AISC A$/oz 2,589 2,666 (3) US$/oz 1,669 1,759 (5) AIC A$/oz 3,352 2,885 16 US$/oz 2,160 1,903 14 Sustaining capital expenditure A$m 195.4 255.7 (24) US$m 125.9 168.6 (25) Non-sustaining capital expenditure A$m 241.3 44.4 443 US$m 155.5 29.3 431 Total capital expenditure A$m 436.7 300.1 46 US$m 281.4 198.0 42 Adjusted pre-tax free cash flow A$m 820.4 227.9 260 US$m 528.7 150.3 252 Gold production increased by 12% to 369,600oz in 2025 from 331,200oz in 2024 due to an 8% increase in tonnes milled and a 3% increase in yield. AIC increased by 16% to A$3,352/oz (US$2,160/oz) in 2025 from A$2,885/oz (US$1,903/oz) in 2024 due to increased cost of sales before amortisation and depreciation and capital expenditure, partially offset by increased gold sales. The increased cost of sales before amortisation and depreciation was mainly driven by increased employee and contractor costs. Total capital expenditure increased by 46% to A$437m (US$281m) in 2025 from $300m (US$198m) in 2024. The increased capital mainly relates to A$177m (US$114m) spent on the Renewables Power Project (2024: A$49m/ US$32m). Adjusted pre-tax free cash flow increased by 260% to A$820m (US$529m) in 2025 from A$228m (US$150m) in 2024 mainly due to the higher gold price received and increased gold sales. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 350koz – 360koz; • AISC ~ A$3,100/oz (US$2,170/oz) – A$3,300/oz – (US$2,310/oz) and • Total AIC ~ A$3,600/oz (US$2,520/oz) – A$3,800/oz (US$2,660/oz) 12 Gold Fields Reviewed Results 2025

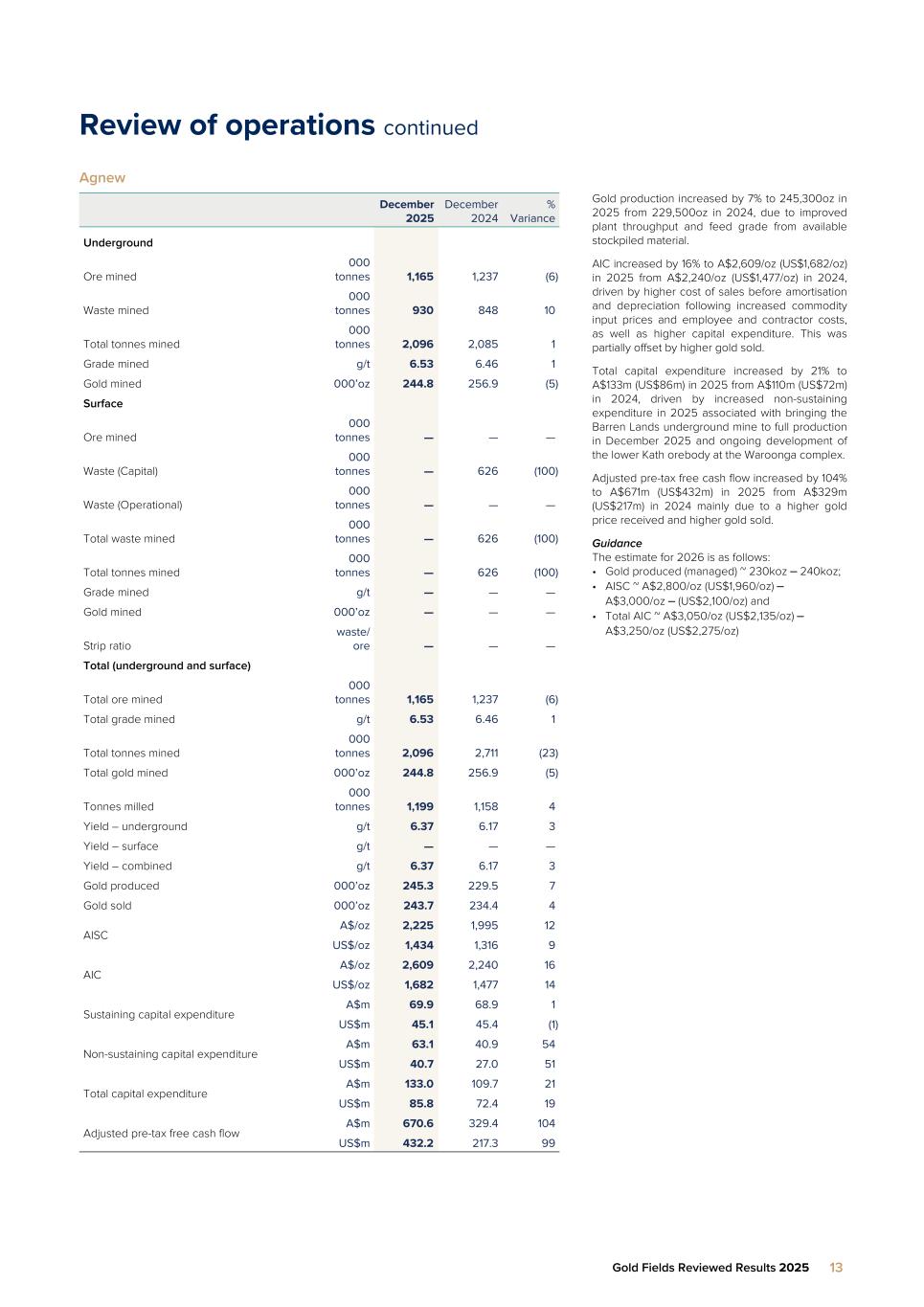

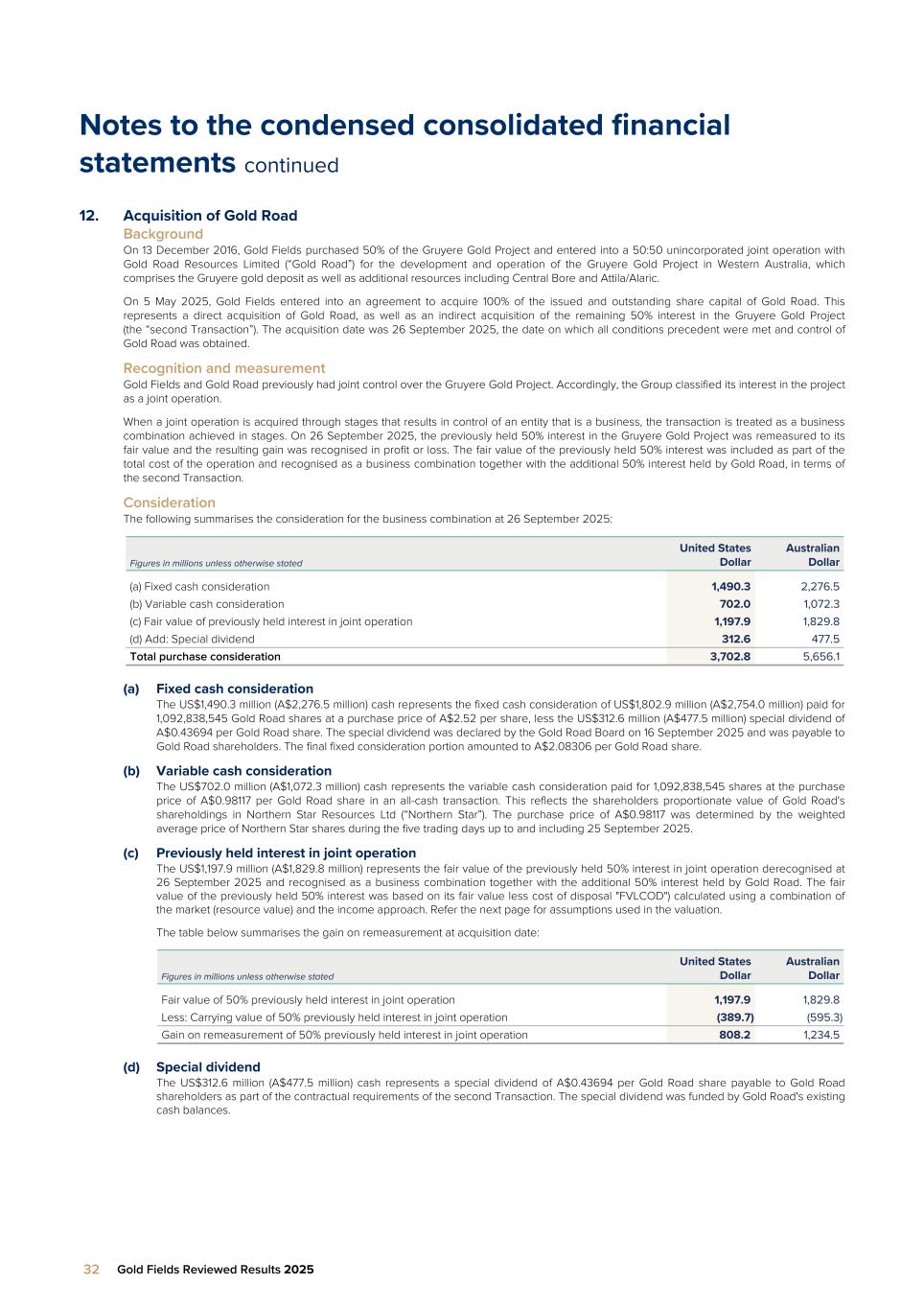

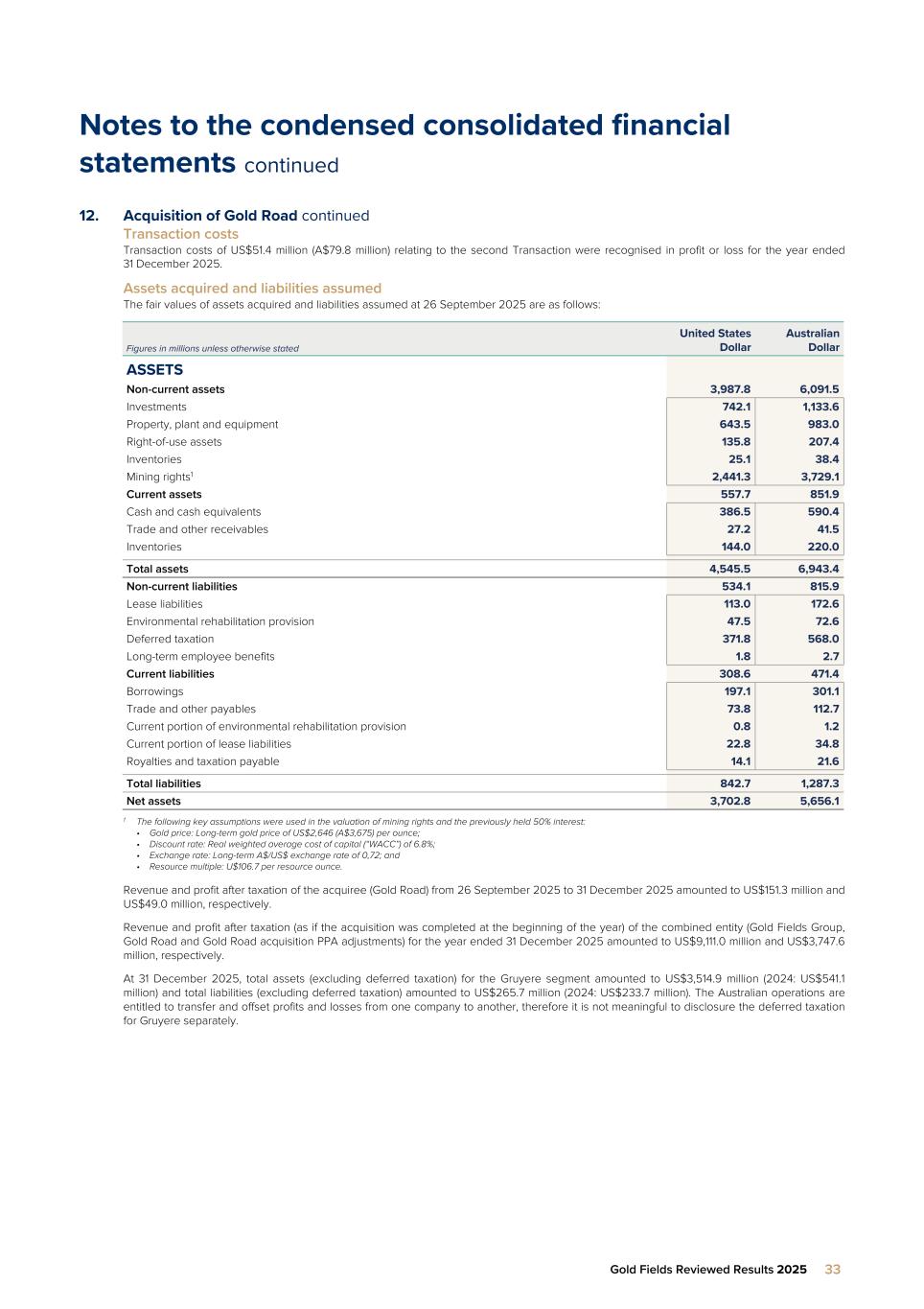

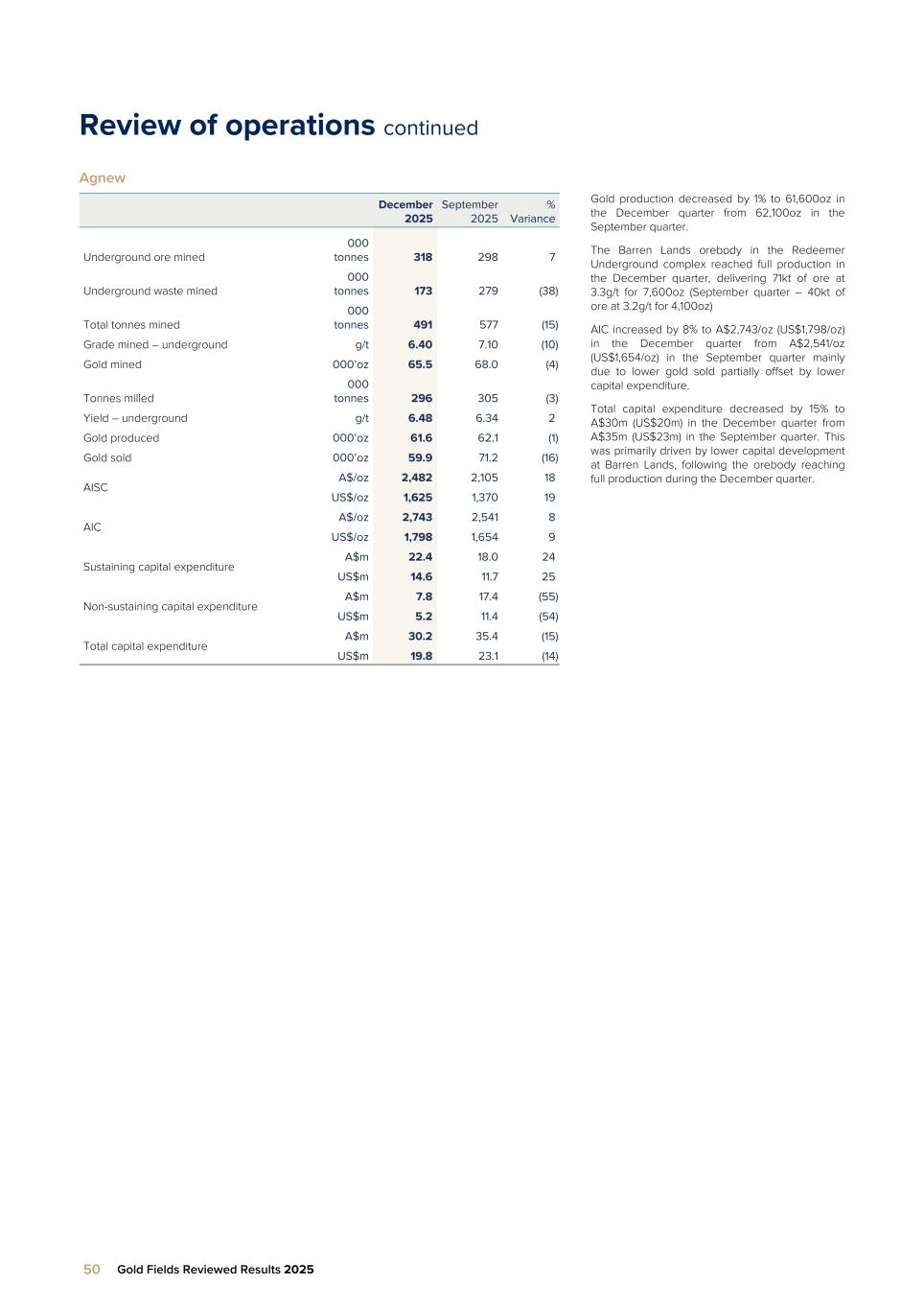

Review of operations continued Agnew December 2025 December 2024 % Variance Underground Ore mined 000 tonnes 1,165 1,237 (6) Waste mined 000 tonnes 930 848 10 Total tonnes mined 000 tonnes 2,096 2,085 1 Grade mined g/t 6.53 6.46 1 Gold mined 000’oz 244.8 256.9 (5) Surface Ore mined 000 tonnes — — — Waste (Capital) 000 tonnes — 626 (100) Waste (Operational) 000 tonnes — — — Total waste mined 000 tonnes — 626 (100) Total tonnes mined 000 tonnes — 626 (100) Grade mined g/t — — — Gold mined 000’oz — — — Strip ratio waste/ ore — — — Total (underground and surface) Total ore mined 000 tonnes 1,165 1,237 (6) Total grade mined g/t 6.53 6.46 1 Total tonnes mined 000 tonnes 2,096 2,711 (23) Total gold mined 000’oz 244.8 256.9 (5) Tonnes milled 000 tonnes 1,199 1,158 4 Yield – underground g/t 6.37 6.17 3 Yield – surface g/t — — — Yield – combined g/t 6.37 6.17 3 Gold produced 000’oz 245.3 229.5 7 Gold sold 000’oz 243.7 234.4 4 AISC A$/oz 2,225 1,995 12 US$/oz 1,434 1,316 9 AIC A$/oz 2,609 2,240 16 US$/oz 1,682 1,477 14 Sustaining capital expenditure A$m 69.9 68.9 1 US$m 45.1 45.4 (1) Non-sustaining capital expenditure A$m 63.1 40.9 54 US$m 40.7 27.0 51 Total capital expenditure A$m 133.0 109.7 21 US$m 85.8 72.4 19 Adjusted pre-tax free cash flow A$m 670.6 329.4 104 US$m 432.2 217.3 99 Gold production increased by 7% to 245,300oz in 2025 from 229,500oz in 2024, due to improved plant throughput and feed grade from available stockpiled material. AIC increased by 16% to A$2,609/oz (US$1,682/oz) in 2025 from A$2,240/oz (US$1,477/oz) in 2024, driven by higher cost of sales before amortisation and depreciation following increased commodity input prices and employee and contractor costs, as well as higher capital expenditure. This was partially offset by higher gold sold. Total capital expenditure increased by 21% to A$133m (US$86m) in 2025 from A$110m (US$72m) in 2024, driven by increased non-sustaining expenditure in 2025 associated with bringing the Barren Lands underground mine to full production in December 2025 and ongoing development of the lower Kath orebody at the Waroonga complex. Adjusted pre-tax free cash flow increased by 104% to A$671m (US$432m) in 2025 from A$329m (US$217m) in 2024 mainly due to a higher gold price received and higher gold sold. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 230koz – 240koz; • AISC ~ A$2,800/oz (US$1,960/oz) – A$3,000/oz – (US$2,100/oz) and • Total AIC ~ A$3,050/oz (US$2,135/oz) – A$3,250/oz (US$2,275/oz) Gold Fields Reviewed Results 2025 13

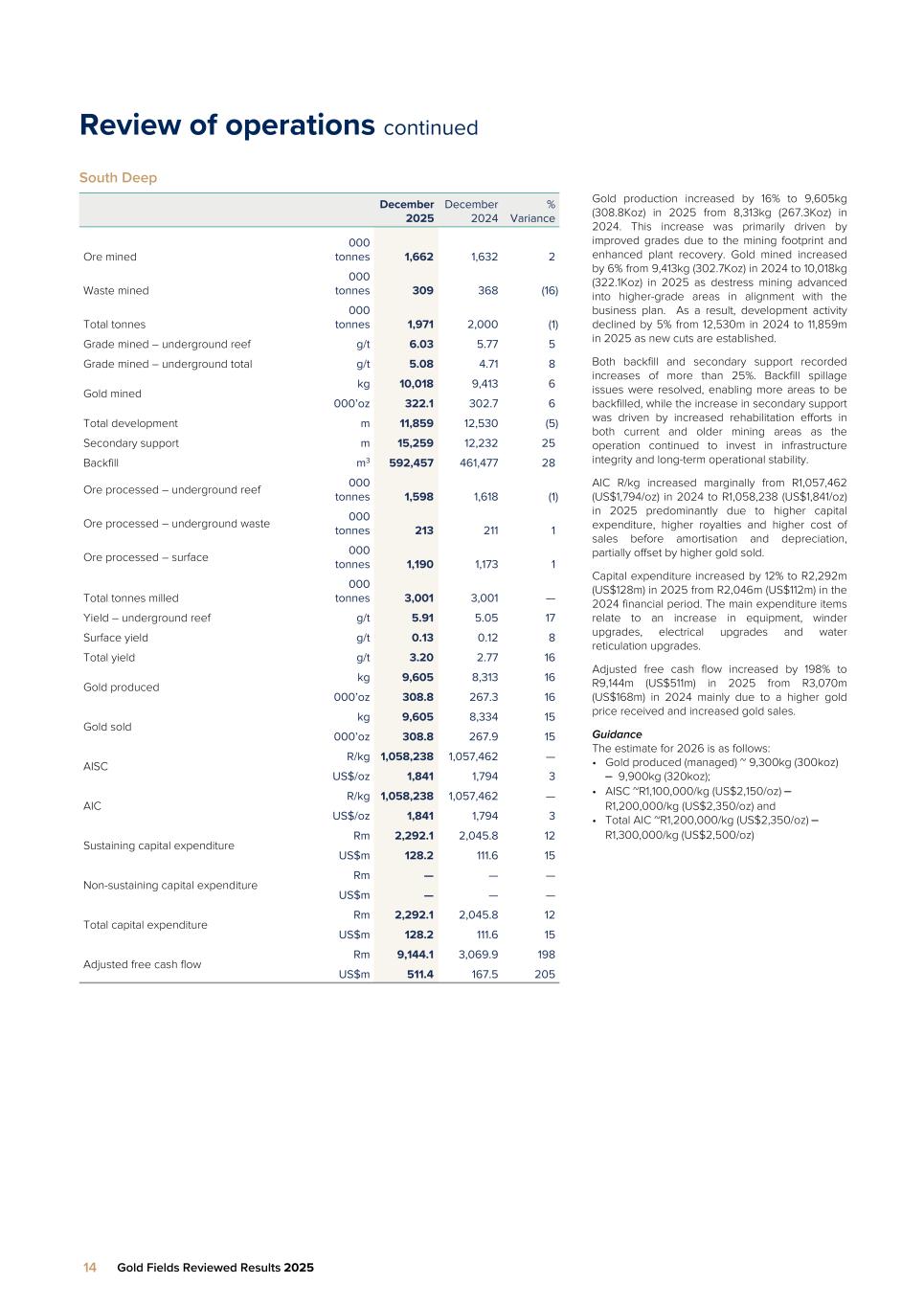

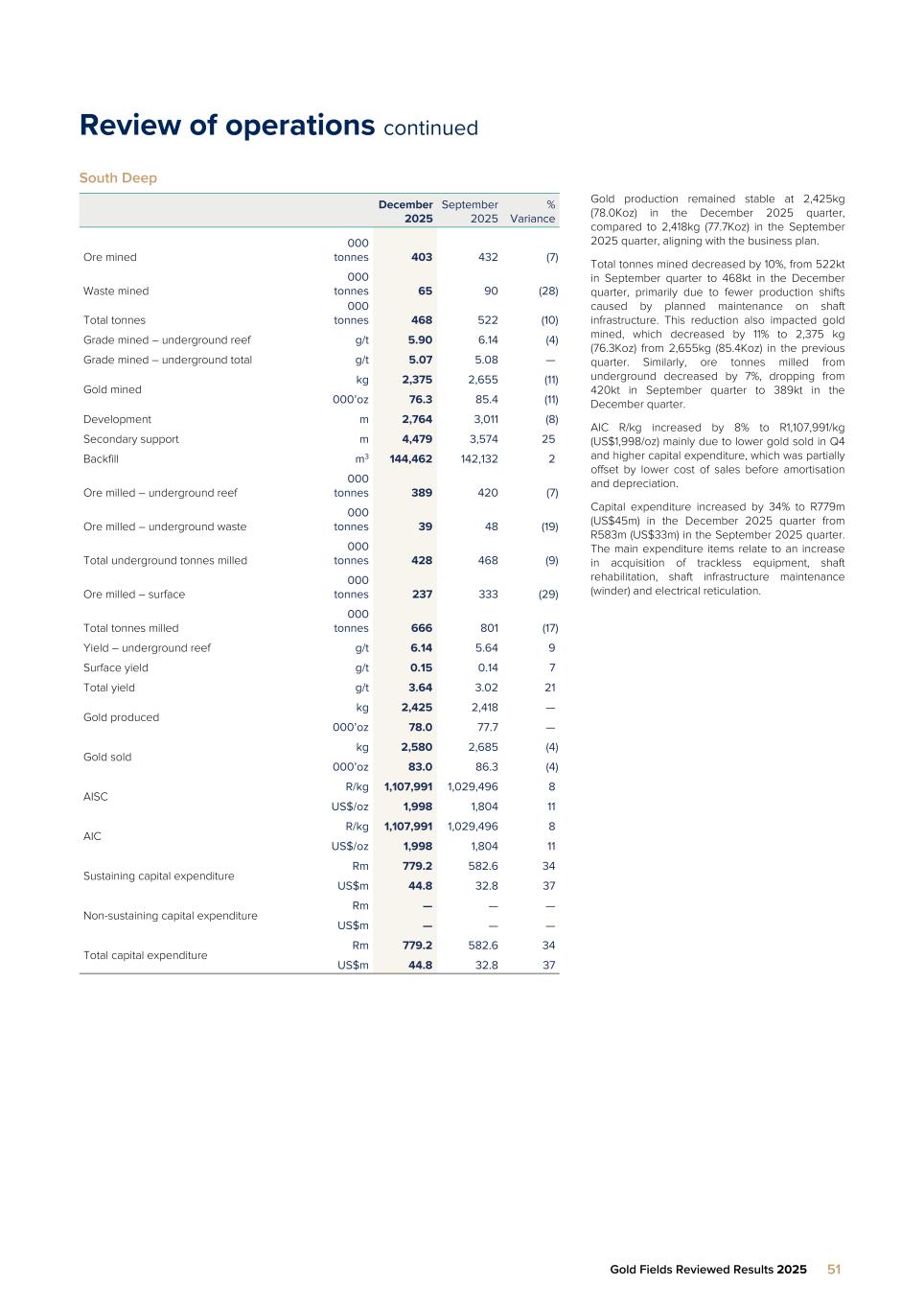

Review of operations continued South Deep December 2025 December 2024 % Variance Ore mined 000 tonnes 1,662 1,632 2 Waste mined 000 tonnes 309 368 (16) Total tonnes 000 tonnes 1,971 2,000 (1) Grade mined – underground reef g/t 6.03 5.77 5 Grade mined – underground total g/t 5.08 4.71 8 Gold mined kg 10,018 9,413 6 000’oz 322.1 302.7 6 Total development m 11,859 12,530 (5) Secondary support m 15,259 12,232 25 Backfill m3 592,457 461,477 28 Ore processed – underground reef 000 tonnes 1,598 1,618 (1) Ore processed – underground waste 000 tonnes 213 211 1 Ore processed – surface 000 tonnes 1,190 1,173 1 Total tonnes milled 000 tonnes 3,001 3,001 — Yield – underground reef g/t 5.91 5.05 17 Surface yield g/t 0.13 0.12 8 Total yield g/t 3.20 2.77 16 Gold produced kg 9,605 8,313 16 000’oz 308.8 267.3 16 Gold sold kg 9,605 8,334 15 000’oz 308.8 267.9 15 AISC R/kg 1,058,238 1,057,462 — US$/oz 1,841 1,794 3 AIC R/kg 1,058,238 1,057,462 — US$/oz 1,841 1,794 3 Sustaining capital expenditure Rm 2,292.1 2,045.8 12 US$m 128.2 111.6 15 Non-sustaining capital expenditure Rm — — — US$m — — — Total capital expenditure Rm 2,292.1 2,045.8 12 US$m 128.2 111.6 15 Adjusted free cash flow Rm 9,144.1 3,069.9 198 US$m 511.4 167.5 205 Gold production increased by 16% to 9,605kg (308.8Koz) in 2025 from 8,313kg (267.3Koz) in 2024. This increase was primarily driven by improved grades due to the mining footprint and enhanced plant recovery. Gold mined increased by 6% from 9,413kg (302.7Koz) in 2024 to 10,018kg (322.1Koz) in 2025 as destress mining advanced into higher-grade areas in alignment with the business plan. As a result, development activity declined by 5% from 12,530m in 2024 to 11,859m in 2025 as new cuts are established. Both backfill and secondary support recorded increases of more than 25%. Backfill spillage issues were resolved, enabling more areas to be backfilled, while the increase in secondary support was driven by increased rehabilitation efforts in both current and older mining areas as the operation continued to invest in infrastructure integrity and long-term operational stability. AIC R/kg increased marginally from R1,057,462 (US$1,794/oz) in 2024 to R1,058,238 (US$1,841/oz) in 2025 predominantly due to higher capital expenditure, higher royalties and higher cost of sales before amortisation and depreciation, partially offset by higher gold sold. Capital expenditure increased by 12% to R2,292m (US$128m) in 2025 from R2,046m (US$112m) in the 2024 financial period. The main expenditure items relate to an increase in equipment, winder upgrades, electrical upgrades and water reticulation upgrades. Adjusted free cash flow increased by 198% to R9,144m (US$511m) in 2025 from R3,070m (US$168m) in 2024 mainly due to a higher gold price received and increased gold sales. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 9,300kg (300koz) – 9,900kg (320koz); • AISC ~R1,100,000/kg (US$2,150/oz) – R1,200,000/kg (US$2,350/oz) and • Total AIC ~R1,200,000/kg (US$2,350/oz) – R1,300,000/kg (US$2,500/oz) 14 Gold Fields Reviewed Results 2025

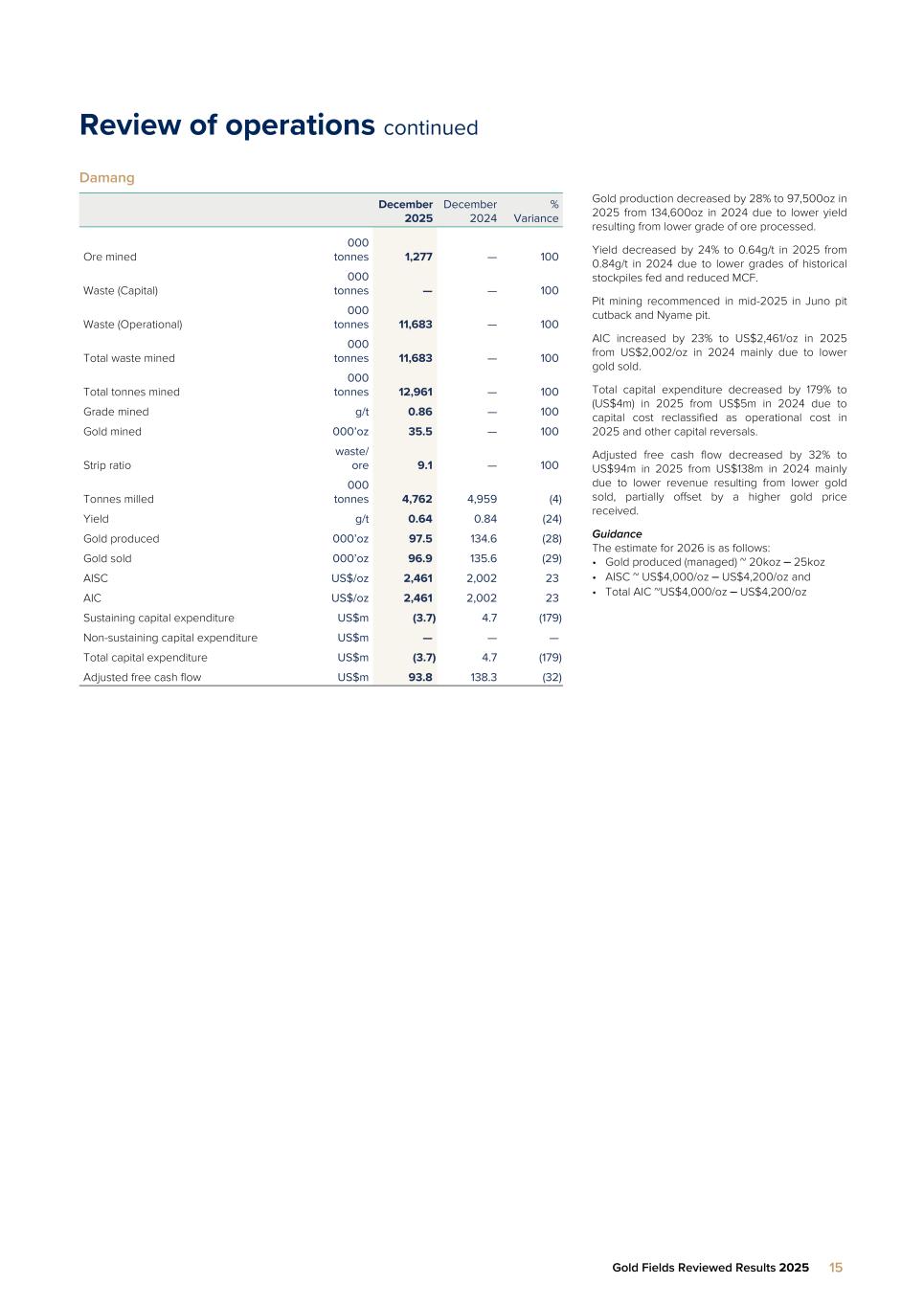

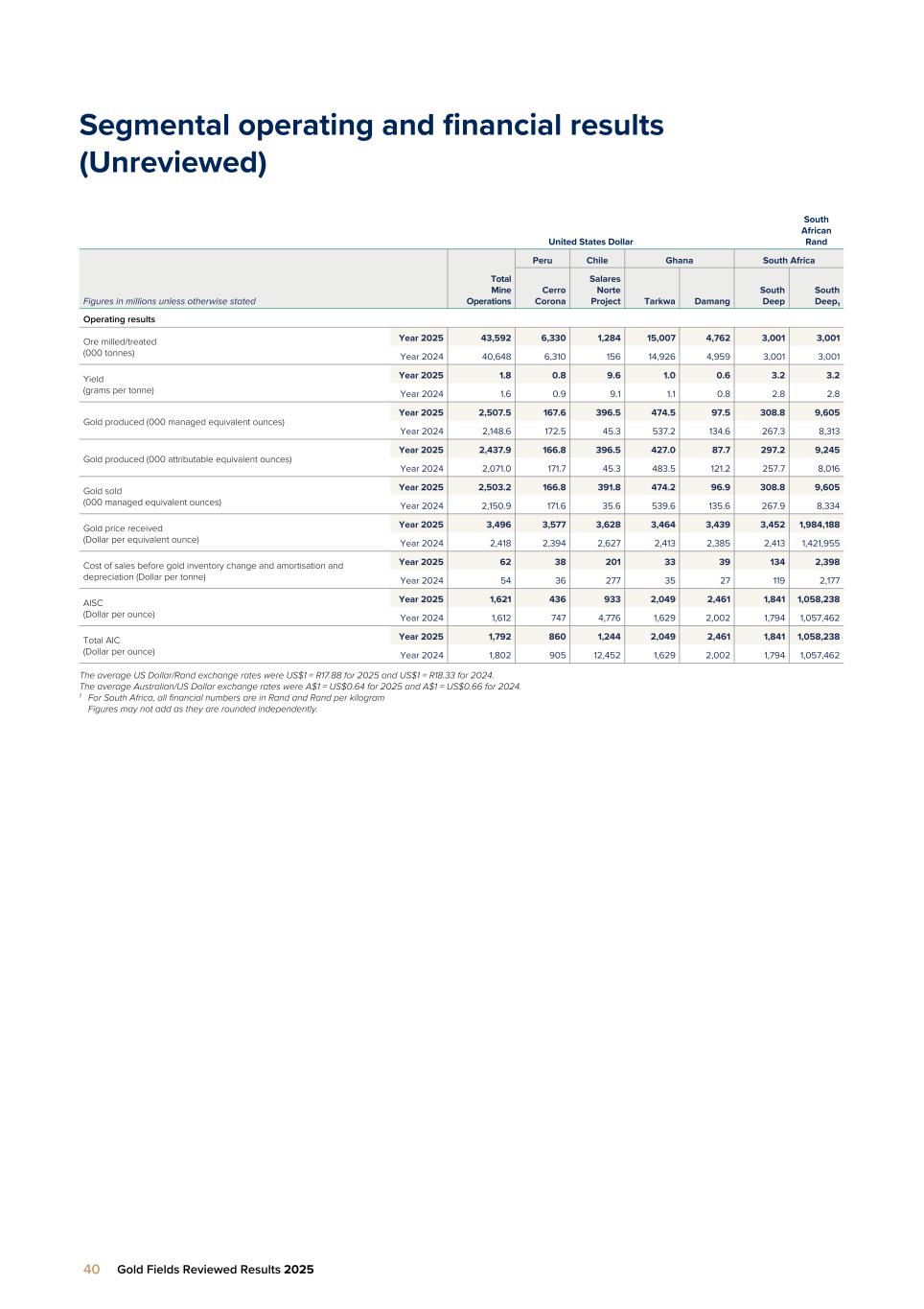

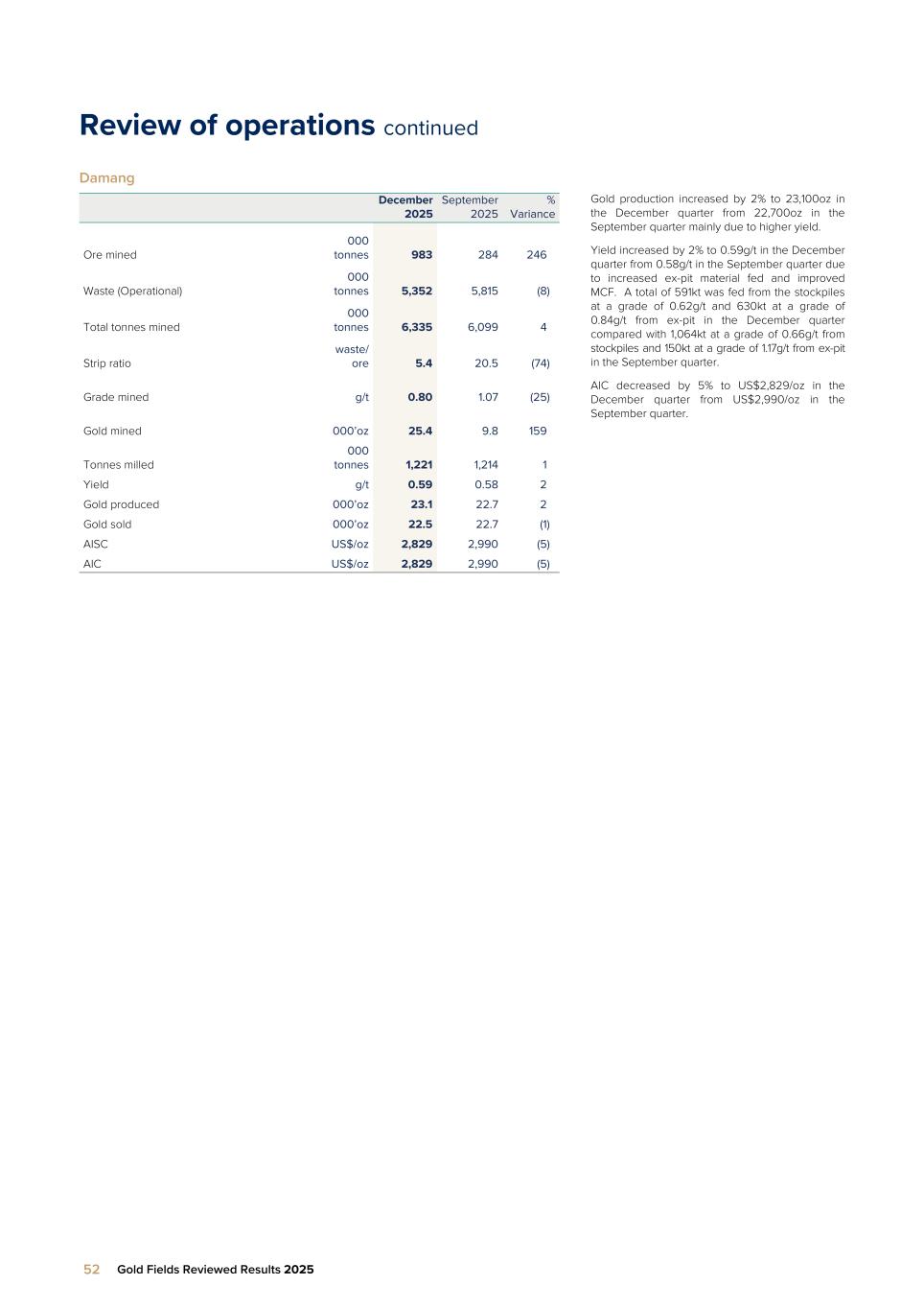

Review of operations continued Damang December 2025 December 2024 % Variance Ore mined 000 tonnes 1,277 — 100 Waste (Capital) 000 tonnes — — 100 Waste (Operational) 000 tonnes 11,683 — 100 Total waste mined 000 tonnes 11,683 — 100 Total tonnes mined 000 tonnes 12,961 — 100 Grade mined g/t 0.86 — 100 Gold mined 000’oz 35.5 — 100 Strip ratio waste/ ore 9.1 — 100 Tonnes milled 000 tonnes 4,762 4,959 (4) Yield g/t 0.64 0.84 (24) Gold produced 000’oz 97.5 134.6 (28) Gold sold 000’oz 96.9 135.6 (29) AISC US$/oz 2,461 2,002 23 AIC US$/oz 2,461 2,002 23 Sustaining capital expenditure US$m (3.7) 4.7 (179) Non-sustaining capital expenditure US$m — — — Total capital expenditure US$m (3.7) 4.7 (179) Adjusted free cash flow US$m 93.8 138.3 (32) Gold production decreased by 28% to 97,500oz in 2025 from 134,600oz in 2024 due to lower yield resulting from lower grade of ore processed. Yield decreased by 24% to 0.64g/t in 2025 from 0.84g/t in 2024 due to lower grades of historical stockpiles fed and reduced MCF. Pit mining recommenced in mid-2025 in Juno pit cutback and Nyame pit. AIC increased by 23% to US$2,461/oz in 2025 from US$2,002/oz in 2024 mainly due to lower gold sold. Total capital expenditure decreased by 179% to (US$4m) in 2025 from US$5m in 2024 due to capital cost reclassified as operational cost in 2025 and other capital reversals. Adjusted free cash flow decreased by 32% to US$94m in 2025 from US$138m in 2024 mainly due to lower revenue resulting from lower gold sold, partially offset by a higher gold price received. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 20koz – 25koz • AISC ~ US$4,000/oz – US$4,200/oz and • Total AIC ~US$4,000/oz – US$4,200/oz Gold Fields Reviewed Results 2025 15

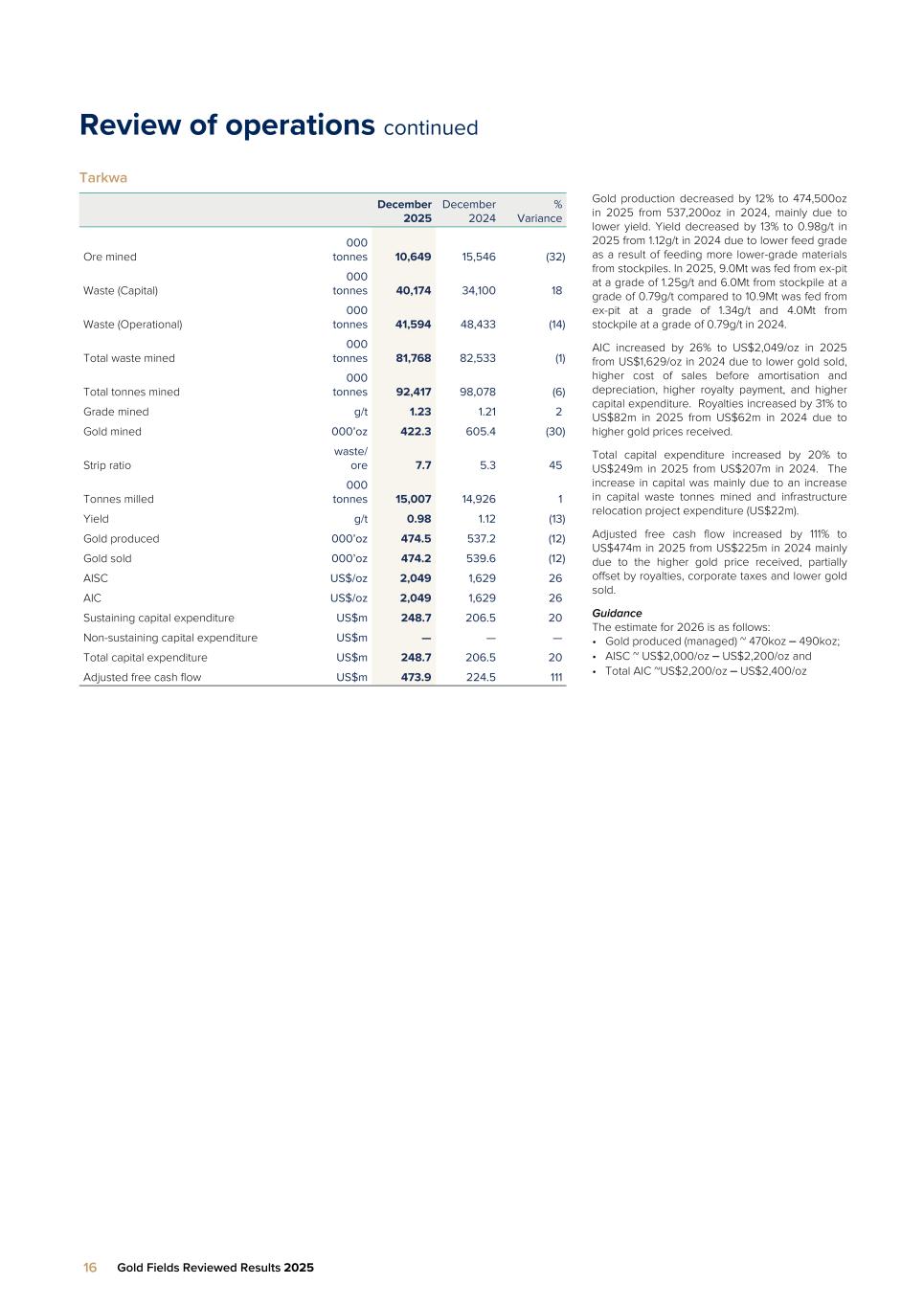

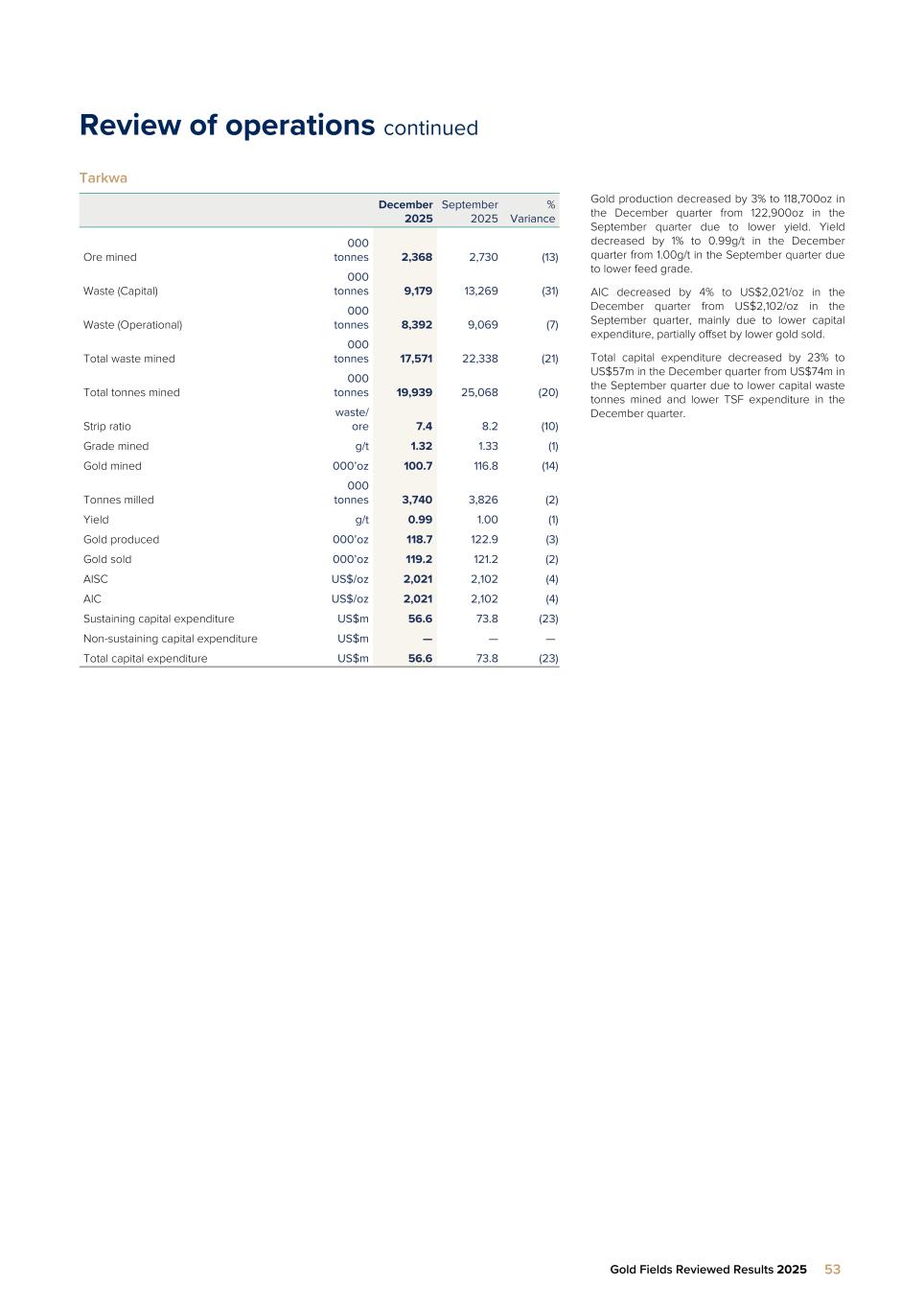

Review of operations continued Tarkwa December 2025 December 2024 % Variance Ore mined 000 tonnes 10,649 15,546 (32) Waste (Capital) 000 tonnes 40,174 34,100 18 Waste (Operational) 000 tonnes 41,594 48,433 (14) Total waste mined 000 tonnes 81,768 82,533 (1) Total tonnes mined 000 tonnes 92,417 98,078 (6) Grade mined g/t 1.23 1.21 2 Gold mined 000’oz 422.3 605.4 (30) Strip ratio waste/ ore 7.7 5.3 45 Tonnes milled 000 tonnes 15,007 14,926 1 Yield g/t 0.98 1.12 (13) Gold produced 000’oz 474.5 537.2 (12) Gold sold 000’oz 474.2 539.6 (12) AISC US$/oz 2,049 1,629 26 AIC US$/oz 2,049 1,629 26 Sustaining capital expenditure US$m 248.7 206.5 20 Non-sustaining capital expenditure US$m — — — Total capital expenditure US$m 248.7 206.5 20 Adjusted free cash flow US$m 473.9 224.5 111 Gold production decreased by 12% to 474,500oz in 2025 from 537,200oz in 2024, mainly due to lower yield. Yield decreased by 13% to 0.98g/t in 2025 from 1.12g/t in 2024 due to lower feed grade as a result of feeding more lower-grade materials from stockpiles. In 2025, 9.0Mt was fed from ex-pit at a grade of 1.25g/t and 6.0Mt from stockpile at a grade of 0.79g/t compared to 10.9Mt was fed from ex-pit at a grade of 1.34g/t and 4.0Mt from stockpile at a grade of 0.79g/t in 2024. AIC increased by 26% to US$2,049/oz in 2025 from US$1,629/oz in 2024 due to lower gold sold, higher cost of sales before amortisation and depreciation, higher royalty payment, and higher capital expenditure. Royalties increased by 31% to US$82m in 2025 from US$62m in 2024 due to higher gold prices received. Total capital expenditure increased by 20% to US$249m in 2025 from US$207m in 2024. The increase in capital was mainly due to an increase in capital waste tonnes mined and infrastructure relocation project expenditure (US$22m). Adjusted free cash flow increased by 111% to US$474m in 2025 from US$225m in 2024 mainly due to the higher gold price received, partially offset by royalties, corporate taxes and lower gold sold. Guidance The estimate for 2026 is as follows: • Gold produced (managed) ~ 470koz – 490koz; • AISC ~ US$2,000/oz – US$2,200/oz and • Total AIC ~US$2,200/oz – US$2,400/oz 16 Gold Fields Reviewed Results 2025

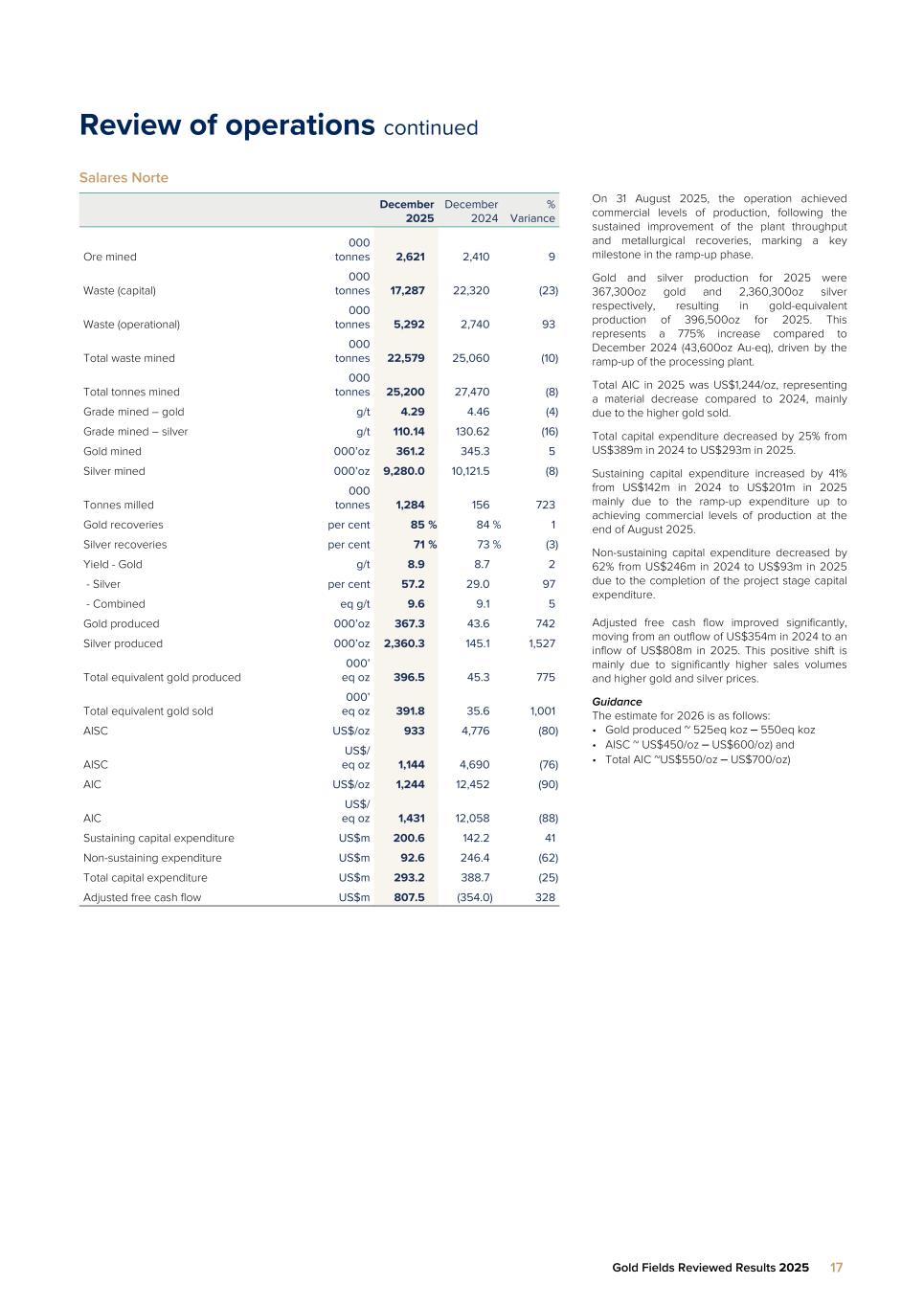

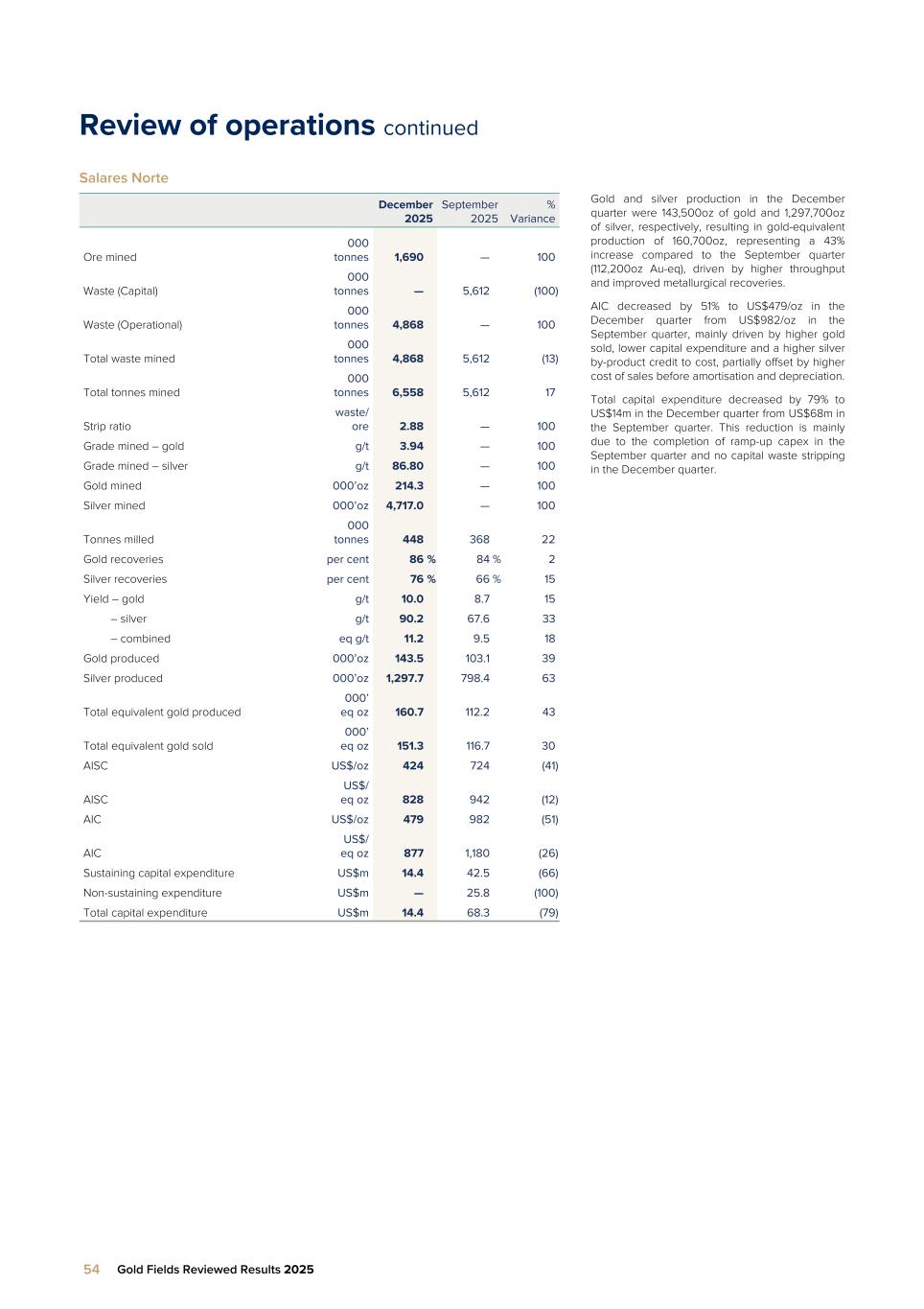

Review of operations continued Salares Norte December 2025 December 2024 % Variance Ore mined 000 tonnes 2,621 2,410 9 Waste (capital) 000 tonnes 17,287 22,320 (23) Waste (operational) 000 tonnes 5,292 2,740 93 Total waste mined 000 tonnes 22,579 25,060 (10) Total tonnes mined 000 tonnes 25,200 27,470 (8) Grade mined – gold g/t 4.29 4.46 (4) Grade mined – silver g/t 110.14 130.62 (16) Gold mined 000’oz 361.2 345.3 5 Silver mined 000’oz 9,280.0 10,121.5 (8) Tonnes milled 000 tonnes 1,284 156 723 Gold recoveries per cent 85 % 84 % 1 Silver recoveries per cent 71 % 73 % (3) Yield - Gold g/t 8.9 8.7 2 - Silver per cent 57.2 29.0 97 - Combined eq g/t 9.6 9.1 5 Gold produced 000’oz 367.3 43.6 742 Silver produced 000’oz 2,360.3 145.1 1,527 Total equivalent gold produced 000’ eq oz 396.5 45.3 775 Total equivalent gold sold 000’ eq oz 391.8 35.6 1,001 AISC US$/oz 933 4,776 (80) AISC US$/ eq oz 1,144 4,690 (76) AIC US$/oz 1,244 12,452 (90) AIC US$/ eq oz 1,431 12,058 (88) Sustaining capital expenditure US$m 200.6 142.2 41 Non-sustaining expenditure US$m 92.6 246.4 (62) Total capital expenditure US$m 293.2 388.7 (25) Adjusted free cash flow US$m 807.5 (354.0) 328 On 31 August 2025, the operation achieved commercial levels of production, following the sustained improvement of the plant throughput and metallurgical recoveries, marking a key milestone in the ramp-up phase. Gold and silver production for 2025 were 367,300oz gold and 2,360,300oz silver respectively, resulting in gold-equivalent production of 396,500oz for 2025. This represents a 775% increase compared to December 2024 (43,600oz Au-eq), driven by the ramp-up of the processing plant. Total AIC in 2025 was US$1,244/oz, representing a material decrease compared to 2024, mainly due to the higher gold sold. Total capital expenditure decreased by 25% from US$389m in 2024 to US$293m in 2025. Sustaining capital expenditure increased by 41% from US$142m in 2024 to US$201m in 2025 mainly due to the ramp-up expenditure up to achieving commercial levels of production at the end of August 2025. Non-sustaining capital expenditure decreased by 62% from US$246m in 2024 to US$93m in 2025 due to the completion of the project stage capital expenditure. Adjusted free cash flow improved significantly, moving from an outflow of US$354m in 2024 to an inflow of US$808m in 2025. This positive shift is mainly due to significantly higher sales volumes and higher gold and silver prices. Guidance The estimate for 2026 is as follows: • Gold produced ~ 525eq koz – 550eq koz • AISC ~ US$450/oz – US$600/oz) and • Total AIC ~US$550/oz – US$700/oz) Gold Fields Reviewed Results 2025 17

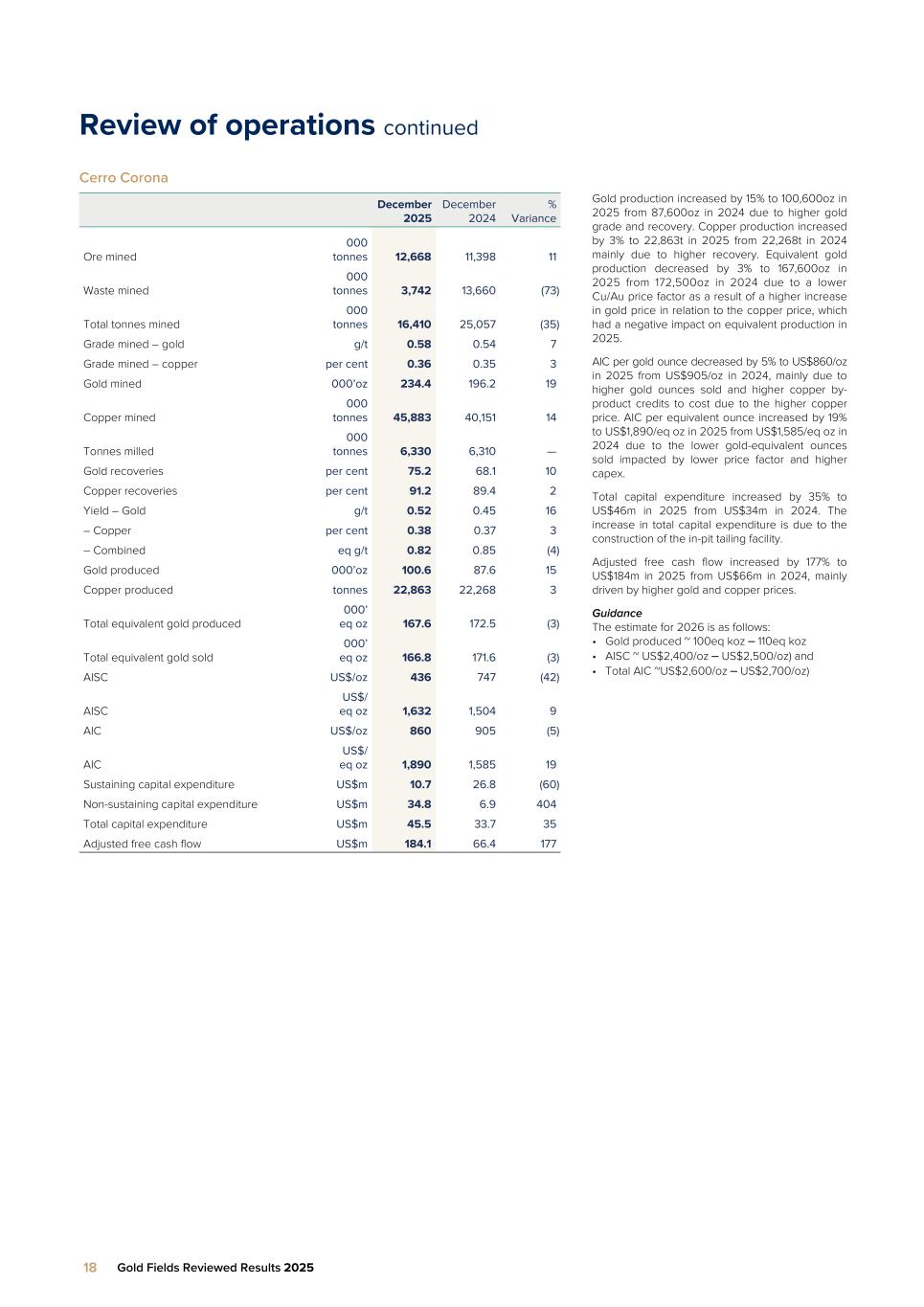

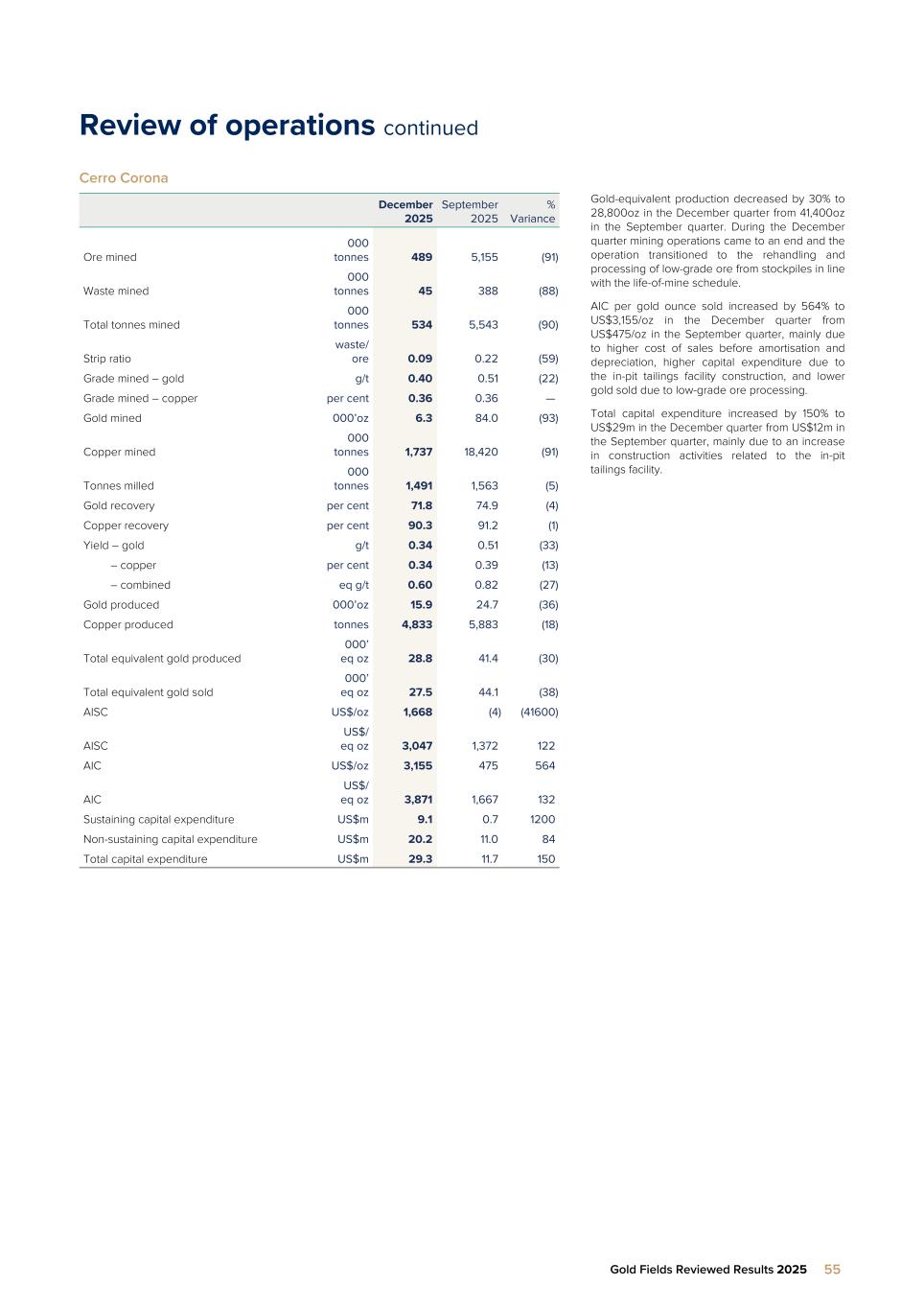

Review of operations continued Cerro Corona December 2025 December 2024 % Variance Ore mined 000 tonnes 12,668 11,398 11 Waste mined 000 tonnes 3,742 13,660 (73) Total tonnes mined 000 tonnes 16,410 25,057 (35) Grade mined – gold g/t 0.58 0.54 7 Grade mined – copper per cent 0.36 0.35 3 Gold mined 000’oz 234.4 196.2 19 Copper mined 000 tonnes 45,883 40,151 14 Tonnes milled 000 tonnes 6,330 6,310 — Gold recoveries per cent 75.2 68.1 10 Copper recoveries per cent 91.2 89.4 2 Yield – Gold g/t 0.52 0.45 16 – Copper per cent 0.38 0.37 3 – Combined eq g/t 0.82 0.85 (4) Gold produced 000’oz 100.6 87.6 15 Copper produced tonnes 22,863 22,268 3 Total equivalent gold produced 000’ eq oz 167.6 172.5 (3) Total equivalent gold sold 000’ eq oz 166.8 171.6 (3) AISC US$/oz 436 747 (42) AISC US$/ eq oz 1,632 1,504 9 AIC US$/oz 860 905 (5) AIC US$/ eq oz 1,890 1,585 19 Sustaining capital expenditure US$m 10.7 26.8 (60) Non-sustaining capital expenditure US$m 34.8 6.9 404 Total capital expenditure US$m 45.5 33.7 35 Adjusted free cash flow US$m 184.1 66.4 177 Gold production increased by 15% to 100,600oz in 2025 from 87,600oz in 2024 due to higher gold grade and recovery. Copper production increased by 3% to 22,863t in 2025 from 22,268t in 2024 mainly due to higher recovery. Equivalent gold production decreased by 3% to 167,600oz in 2025 from 172,500oz in 2024 due to a lower Cu/Au price factor as a result of a higher increase in gold price in relation to the copper price, which had a negative impact on equivalent production in 2025. AIC per gold ounce decreased by 5% to US$860/oz in 2025 from US$905/oz in 2024, mainly due to higher gold ounces sold and higher copper by- product credits to cost due to the higher copper price. AIC per equivalent ounce increased by 19% to US$1,890/eq oz in 2025 from US$1,585/eq oz in 2024 due to the lower gold-equivalent ounces sold impacted by lower price factor and higher capex. Total capital expenditure increased by 35% to US$46m in 2025 from US$34m in 2024. The increase in total capital expenditure is due to the construction of the in-pit tailing facility. Adjusted free cash flow increased by 177% to US$184m in 2025 from US$66m in 2024, mainly driven by higher gold and copper prices. Guidance The estimate for 2026 is as follows: • Gold produced ~ 100eq koz – 110eq koz • AISC ~ US$2,400/oz – US$2,500/oz) and • Total AIC ~US$2,600/oz – US$2,700/oz) 18 Gold Fields Reviewed Results 2025

Final and special dividend declaration Final dividend In line with the Company’s dividend policy, the Board has approved and declared a final dividend number 103 of 1850 SA cents per ordinary share (gross) in respect of the year ended 31 December 2025. Special dividend In addition the company declared a special dividend of 450 cents per share for the year ended 31 December 2025. The payment of the special dividend has been approved by the South African Reserve Bank. In accordance with paragraph 7.23 of the JSE Listings Requirements, the following additional information is disclosed: • The special and final dividend have been declared out of income reserves; • The local dividend withholding tax of 20% (twenty per cent) will be applicable to both special and final dividend • Gold Fields currently has 895,024,247 ordinary shares in issue • Gold Fields’ income tax number is 9160035607 • The gross final dividend amount is 1850 SA cents per ordinary shareholders exempt from dividends tax • The net final dividend amount is 1480 SA cents per ordinary share for shareholders liable to pay the dividends tax • The gross special dividend amount is 450 SA cents per ordinary shareholders exempt from dividends tax • The net special dividend amount is 360 SA cents per ordinary share for shareholders liable to pay the dividends tax Shareholders are advised of the following dates in respect of the special and final dividend: • Declaration date: Thursday, 19 February 2026 • Last date to trade cum-dividend: Tuesday, 10 March 2026 • Sterling and US Dollar conversion date: Wednesday, 11 March 2026 • Shares commence trading ex-dividend: Wednesday, 11 March 2026 • Record date: Friday, 13 March 2026 • Payment of dividend: Monday, 16 March 2026 Share certificates may not be dematerialised or rematerialised between Wednesday 11 March 2026 and Friday 13 March 2026, both dates inclusive. 19 Gold Fields H1 Results 2025