Q1 2025 Investor Presentation This presentation includes forward-looking comments subject to important risks and uncertainties. It may also contain financial measures that are not in conformance with accounting principles generally accepted in the United States of America (GAAP). Refer to Hyster-Yale’s reports filed on Forms 8-K (current), 10-Q (quarterly), and 10-K (annual) for information on factors that could cause actual results to differ materially from information in this presentation and for information reconciling financial measures to GAAP. Past performance may not be representative of future results. Forward-looking information noted in the following slides is effective as May 6, 2025. Nothing in this presentation should be construed as reaffirming or disaffirming the outlook provided as of that date. This presentation is not an offer to sell or a solicitation of offers to buy any of Hyster-Yale’s securities. Safe Harbor Statement and Disclosure 2 Q1 2025 Quarterly Overview 4 One company with three businesses, each offering a full line of products and services Hyster-Yale (NYSE: HY) Enable lift truck versatility for handling unique and fragile loads. Provide essential transport solutions for warehouse and industrial applications. LIFT TRUCKS – Core Business1 BOLZONI – Attachment Business2 FOR EACH BUSINESS Board of Directors ● CEO ● P&L and balance sheet ● Tailored incentive plans 3 NUVERA – Fuel Cell Business

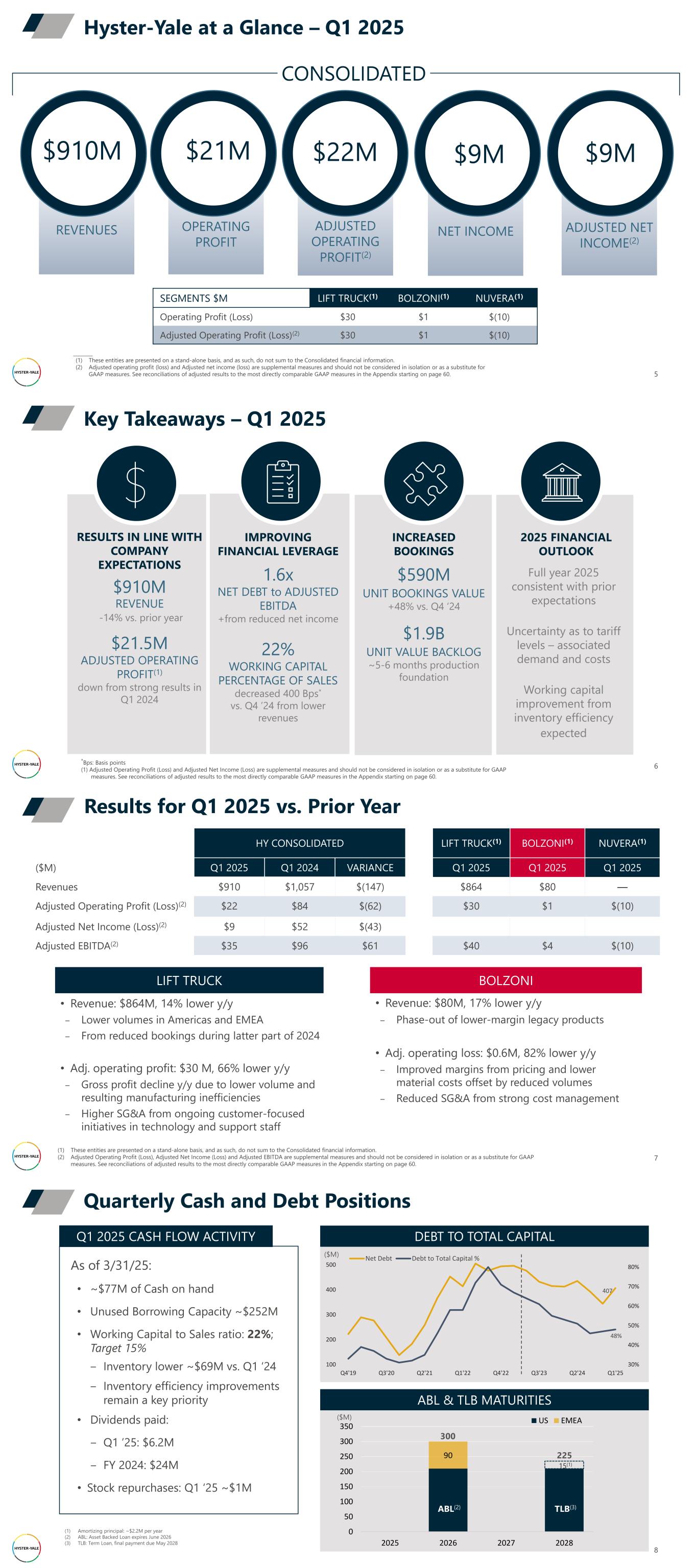

REVENUES OPERATING PROFIT ADJUSTED OPERATING PROFIT(2) NET INCOME ADJUSTED NET INCOME(2) 5 Hyster-Yale at a Glance – Q1 2025 $910M $21M $22M $9M $9M CONSOLIDATED SEGMENTS $M LIFT TRUCK(1) BOLZONI(1) NUVERA(1) Operating Profit (Loss) $30 $1 $(10) Adjusted Operating Profit (Loss)(2) $30 $1 $(10) ________ (1) These entities are presented on a stand-alone basis, and as such, do not sum to the Consolidated financial information. (2) Adjusted operating profit (loss) and Adjusted net income (loss) are supplemental measures and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations of adjusted results to the most directly comparable GAAP measures in the Appendix starting on page 60. Key Takeaways – Q1 2025 6 2025 FINANCIAL OUTLOOK IMPROVING FINANCIAL LEVERAGE 1.6x NET DEBT to ADJUSTED EBITDA +from reduced net income 22% WORKING CAPITAL PERCENTAGE OF SALES decreased 400 Bps* vs. Q4 ’24 from lower revenues INCREASED BOOKINGS $590M UNIT BOOKINGS VALUE +48% vs. Q4 ‘24 $1.9B UNIT VALUE BACKLOG ~5-6 months production foundation RESULTS IN LINE WITH COMPANY EXPECTATIONS $910M REVENUE -14% vs. prior year $21.5M ADJUSTED OPERATING PROFIT(1) down from strong results in Q1 2024 *Bps: Basis points (1) Adjusted Operating Profit (Loss) and Adjusted Net Income (Loss) are supplemental measures and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations of adjusted results to the most directly comparable GAAP measures in the Appendix starting on page 60. Full year 2025 consistent with prior expectations Uncertainty as to tariff levels – associated demand and costs Working capital improvement from inventory efficiency expected HY CONSOLIDATED LIFT TRUCK(1) BOLZONI(1) NUVERA(1) ($M) Q1 2025 Q1 2024 VARIANCE Q1 2025 Q1 2025 Q1 2025 Revenues $910 $1,057 $(147) $864 $80 — Adjusted Operating Profit (Loss)(2) $22 $84 $(62) $30 $1 $(10) Adjusted Net Income (Loss)(2) $9 $52 $(43) Adjusted EBITDA(2) $35 $96 $61 $40 $4 $(10) Results for Q1 2025 vs. Prior Year 7 (1) These entities are presented on a stand-alone basis, and as such, do not sum to the Consolidated financial information. (2) Adjusted Operating Profit (Loss), Adjusted Net Income (Loss) and Adjusted EBITDA are supplemental measures and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations of adjusted results to the most directly comparable GAAP measures in the Appendix starting on page 60. LIFT TRUCK • Revenue: $864M, 14% lower y/y ‒ Lower volumes in Americas and EMEA ‒ From reduced bookings during latter part of 2024 • Adj. operating profit: $30 M, 66% lower y/y ‒ Gross profit decline y/y due to lower volume and resulting manufacturing inefficiencies ‒ Higher SG&A from ongoing customer-focused initiatives in technology and support staff BOLZONI • Revenue: $80M, 17% lower y/y ‒ Phase-out of lower-margin legacy products • Adj. operating loss: $0.6M, 82% lower y/y ‒ Improved margins from pricing and lower material costs offset by reduced volumes ‒ Reduced SG&A from strong cost management Quarterly Cash and Debt Positions 8 As of 3/31/25: • ~$77M of Cash on hand • Unused Borrowing Capacity ~$252M • Working Capital to Sales ratio: 22%; Target 15% ‒ Inventory lower ~$69M vs. Q1 ‘24 ‒ Inventory efficiency improvements remain a key priority • Dividends paid: ‒ Q1 ’25: $6.2M ‒ FY 2024: $24M • Stock repurchases: Q1 ‘25 ~$1M Q1 2025 CASH FLOW ACTIVITY 407 48% 30% 40% 50% 60% 70% 80% 100 200 300 400 500 Q4'19 Q3'20 Q2'21 Q1'22 Q4'22 Q3'23 Q2'24 Q1'25 Net Debt Debt to Total Capital % DEBT TO TOTAL CAPITAL ($M) 90 0 50 100 150 200 250 300 350 2025 2026 2027 2028 US EMEA ABL & TLB MATURITIES 300 225 15(1) ABL(2) TLB(3) ($M) (1) Amortizing principal: ~$2.2M per year (2) ABL: Asset Backed Loan expires June 2026 (3) TLB: Term Loan, final payment due May 2028

9 Significant revenue and profit decline from robust prior year FY 2025 Outlook Q2 2025 • Operating profit moderately higher than Q1 2025 Full Year 2025 • Lower revenue compared to 2024 due to legacy product phase out • Operating profit slightly below 2024 ‒ Weaker demand partially offset by improved higher-margin product mix ‒ Reduced operating costs BOLZONI Q2 2025 • Operating profit decline vs. Q1 2025 ‒ Tariff impact and temporary pricing lag ‒ Increased quarterly production • Substantial operating profit decrease vs. 2024 ‒ Margins impacted by increased competitive dynamics ‒ Higher costs to propel strategic initiatives LIFT TRUCK HYSTER-YALE • Significant decreases in revenues, production levels and profits vs. exceptionally strong 2024 • Strong cash flow from operations moderately below 2024 level ‒ Working capital efficiencies, focused on inventory management • Rationalization and focus of energy management solutions activities Company Overview & Strategy Hyster-Yale (NYSE: HY) One company with three businesses, each offering a full line of products and services 11 *2025 LTM: Last Twelve Months as of 3/31/25 **JAPIC: Japan, Asia Pacific, India, China ($M) CONSOLIDATED FINANCIALS Revenues Adjusted Operating Profit(1) Adjusted Net Income(1) SALES BY SEGMENT EMEA 15.1% Americas 75.7% Bolzoni 4.6% JAPIC** 4.6% (1) Adjusted operating profit (loss) and Adjusted net income (loss) are supplemental measures and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations to the most directly comparable GAAP measures in the Appendix starting on page 60. Q1 2025 LTM* $4,162 $205 $116 BOLZONI – Attachment Business2 LIFT TRUCKS – Core Business1 NUVERA – Fuel Cell Business3 2025 0% Nuvera 12 Transforming the way the world moves materials from Port to Home Vision LIFT TRUCKS ATTACHMENTS Transformation focused on reducing the impact of material movement on people, the environment and the economy driven by the imagination and creativity of our team.

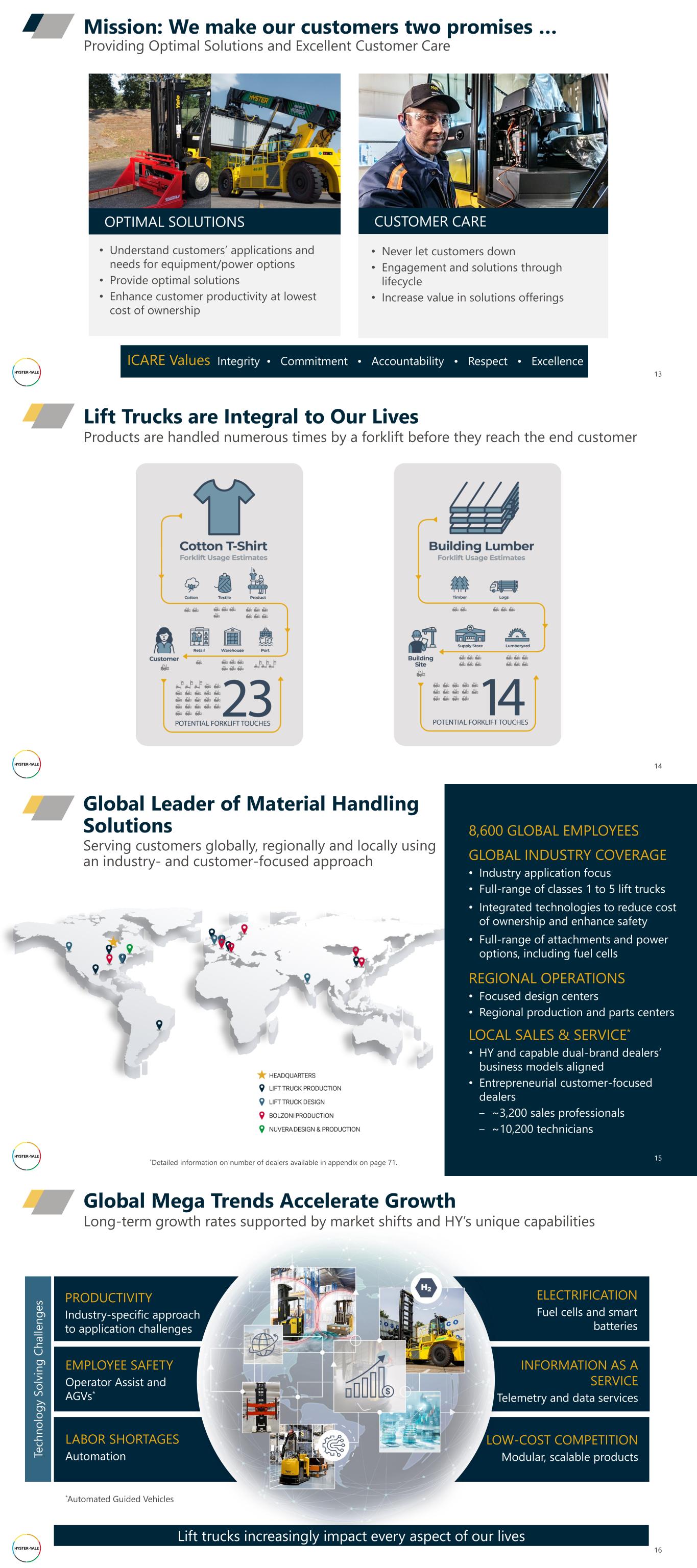

13 Mission: We make our customers two promises … Providing Optimal Solutions and Excellent Customer Care • Understand customers’ applications and needs for equipment/power options • Provide optimal solutions • Enhance customer productivity at lowest cost of ownership OPTIMAL SOLUTIONS • Never let customers down • Engagement and solutions through lifecycle • Increase value in solutions offerings CUSTOMER CARE Integrity • Commitment • Accountability • Respect • ExcellenceICARE Values 14 Products are handled numerous times by a forklift before they reach the end customer Lift Trucks are Integral to Our Lives 8,600 GLOBAL EMPLOYEES GLOBAL INDUSTRY COVERAGE • Industry application focus • Full-range of classes 1 to 5 lift trucks • Integrated technologies to reduce cost of ownership and enhance safety • Full-range of attachments and power options, including fuel cells REGIONAL OPERATIONS • Focused design centers • Regional production and parts centers LOCAL SALES & SERVICE* • HY and capable dual-brand dealers’ business models aligned • Entrepreneurial customer-focused dealers ‒ ~3,200 sales professionals ‒ ~10,200 technicians 15 Serving customers globally, regionally and locally using an industry- and customer-focused approach Global Leader of Material Handling Solutions *Detailed information on number of dealers available in appendix on page 71. Global Mega Trends Accelerate Growth Long-term growth rates supported by market shifts and HY’s unique capabilities ELECTRIFICATION Fuel cells and smart batteries INFORMATION AS A SERVICE Telemetry and data services LOW-COST COMPETITION Modular, scalable products 16 PRODUCTIVITY Industry-specific approach to application challenges EMPLOYEE SAFETY Operator Assist and AGVs* LABOR SHORTAGES AutomationTe ch n o lo g y S o lv in g C h a ll e n g e s *Automated Guided Vehicles Lift trucks increasingly impact every aspect of our lives

Electric ● Hydrogen ● ICE 17 100+ Years of Leading Innovations and Operational Excellence 17 *CB: Counterbalanced trucks CLASS 1 CLASS 2 CLASS 3 CB* WAREHOUSE ELECTRIC CLASS 4 CLASS 5 COUNTERBALANCED INTERNAL COMBUSTION (ICE) BIG TRUCKS: 8 to 52 TON BATTERY/FUEL CELL ICE CLASS 1 CLASS 5 Clamps ● Rotators ● Multipallets ● ForksAutomation ● Operator Assist ● Telematics TECHNOLOGY SOLUTIONS POWER OPTIONS ATTACHMENTS Full Range of products, power options and solutions CAPACITY RANGE: ~2,500 lbs to 100,000+ lbs Efficient capital deployment targeting high returns Unique Business Model 18 OPTIMIZE CAPITAL DEPLOYED • Independent dealer network • Independent suppliers • Financing arm (joint venture) CAPITAL EFFICIENT INVESTMENTS • Modular, scalable product platforms • Manufacturing footprint optimization • “Center of Gravity” suppliers INVESTMENT PRACTICES Focus on investments that enhance core lift truck business and drives strong ROTCE* *ROTCE: Return on Total Capital Employed 19 Operating Structure Optimized to Deliver Customer-Centric Solutions Through Our 2 Businesses CUSTOMERS • Global • Full product line • Solve biggest pain points • Optimal Solutions • Customer Care Disciplined people, thoughts and actions DISTRIBUTION • Exclusive, independent dealers • Direct sales to major accounts • Focus on: ‒ Share growth ‒ Capturing full customer potential INTERNAL CAPABILITIES • Modular, scalable platforms • “Center of gravity” suppliers • Optimized manufacturing footprint • Customer-focused aftermarket infrastructure 20 Service plus technology capabilities enhance the core and accelerate performance Well-Defined, Long-Term Strategies Across All Businesses ENABLE STAKEHOLDERS’ SUCCESS • Customers • Dealers • Suppliers • Employees • Shareholders Management incentives aligned with long-term value creation and shareholder success CORE GROWTH • Growth through our Economic engine - Consistent, pressure tested roadmap for GDP++ increases • Growth through industry expansion ENHANCE COMPETITIVE ADVANTAGE • Evolutionary service solutions enhance core growth • Revolutionary technology solutions accelerate growth • Accretive to core GDP++ growth POSITION FOR FUTURE GROWTH • Accretive capital allocation • Investing in strategic initiatives

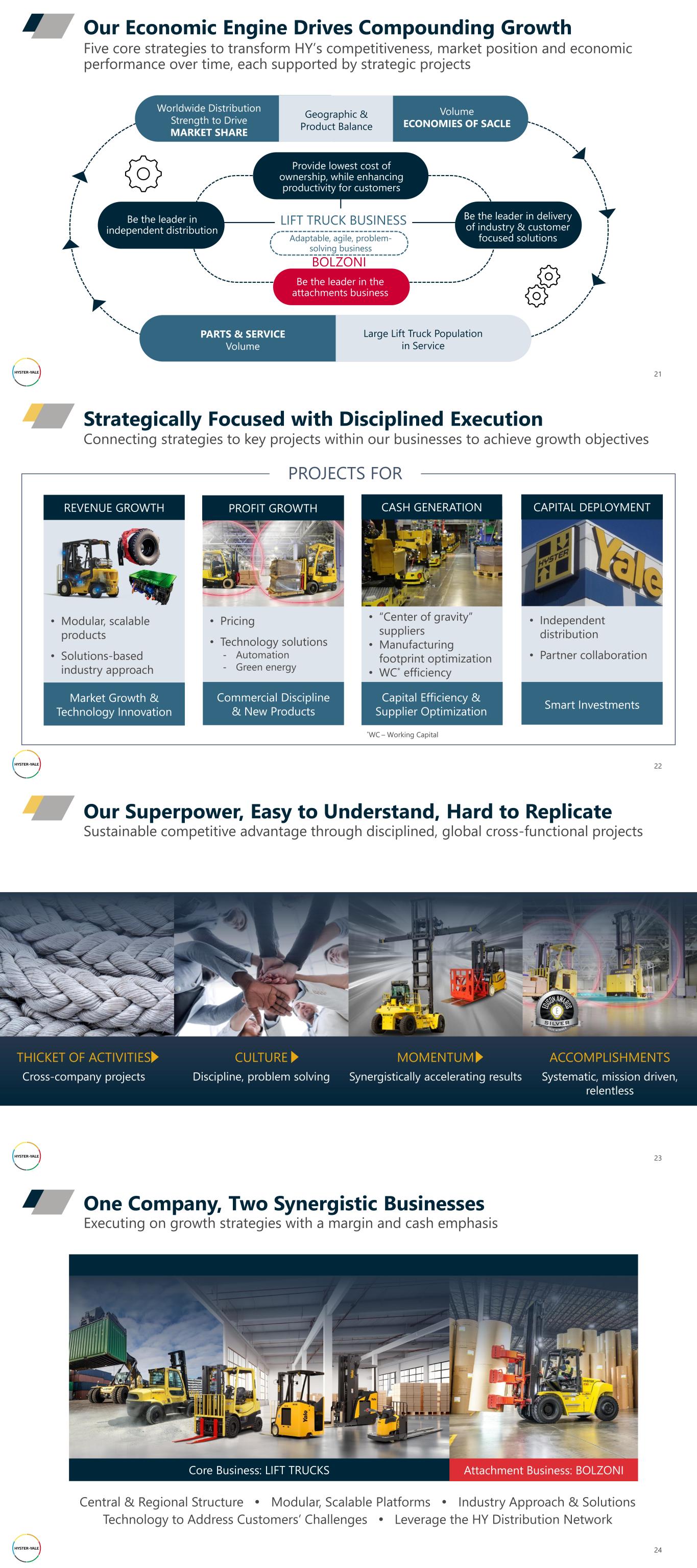

Be the leader in independent distribution LIFT TRUCK BUSINESS Five core strategies to transform HY’s competitiveness, market position and economic performance over time, each supported by strategic projects Our Economic Engine Drives Compounding Growth 21 Provide lowest cost of ownership, while enhancing productivity for customers Be the leader in the attachments business BOLZONI Worldwide Distribution Strength to Drive MARKET SHARE Volume ECONOMIES OF SACLE Geographic & Product Balance PARTS & SERVICE Volume Large Lift Truck Population in Service Be the leader in delivery of industry & customer focused solutionsAdaptable, agile, problem- solving business Commercial Discipline & New Products • Pricing • Technology solutions - Automation - Green energy REVENUE GROWTH Market Growth & Technology Innovation • Modular, scalable products • Solutions-based industry approach 22 Strategically Focused with Disciplined Execution Capital Efficiency & Supplier Optimization • “Center of gravity” suppliers • Manufacturing footprint optimization • WC* efficiency Smart Investments • Independent distribution • Partner collaboration PROFIT GROWTH CAPITAL DEPLOYMENTCASH GENERATION Connecting strategies to key projects within our businesses to achieve growth objectives PROJECTS FOR *WC – Working Capital 23 Sustainable competitive advantage through disciplined, global cross-functional projects Our Superpower, Easy to Understand, Hard to Replicate THICKET OF ACTIVITIES Cross-company projects CULTURE Discipline, problem solving MOMENTUM Synergistically accelerating results ACCOMPLISHMENTS Systematic, mission driven, relentless One Company, Two Synergistic Businesses 24 Executing on growth strategies with a margin and cash emphasis Core Business: LIFT TRUCKS Central & Regional Structure • Modular, Scalable Platforms • Industry Approach & Solutions Technology to Address Customers’ Challenges • Leverage the HY Distribution Network Attachment Business: BOLZONI

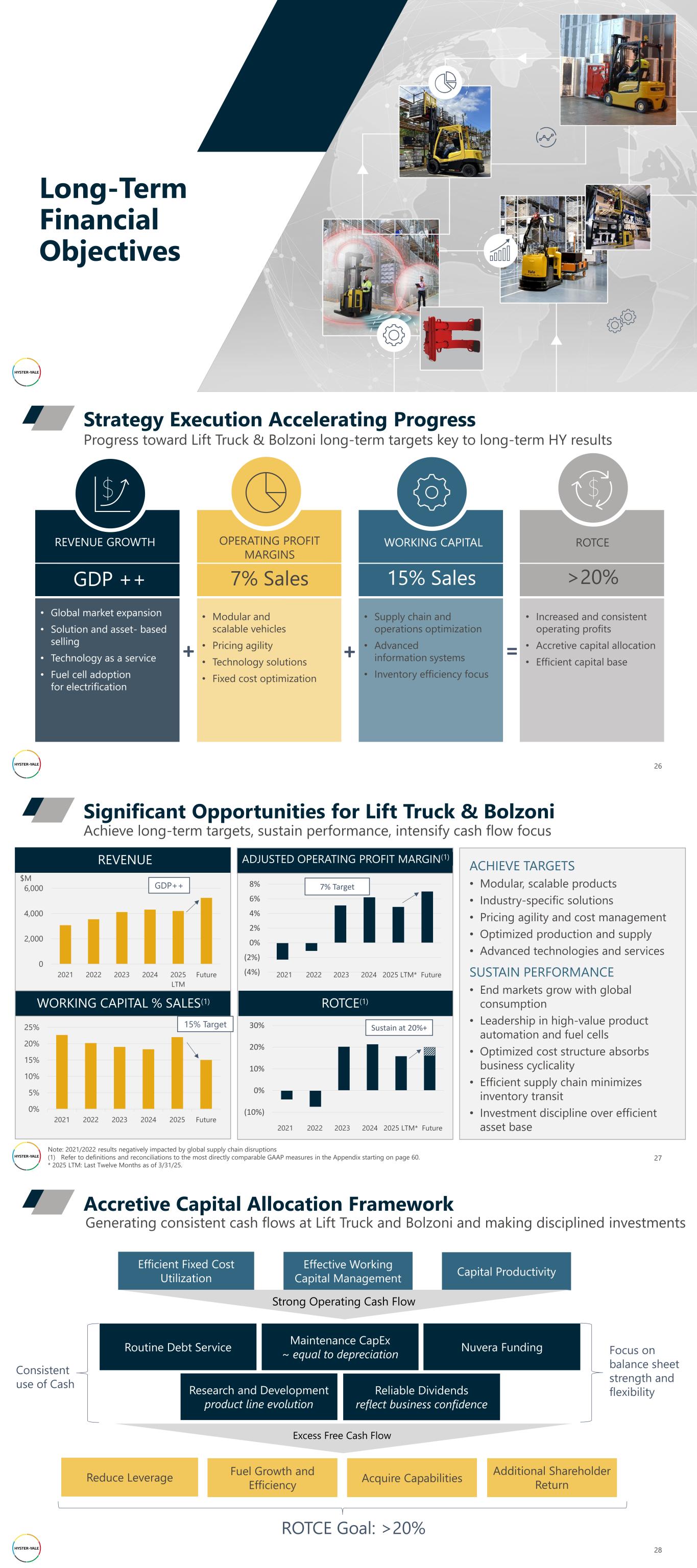

Long-Term Financial Objectives REVENUE GROWTH GDP ++ • Global market expansion • Solution and asset- based selling • Technology as a service • Fuel cell adoption for electrification OPERATING PROFIT MARGINS 7% Sales • Modular and scalable vehicles • Pricing agility • Technology solutions • Fixed cost optimization WORKING CAPITAL 15% Sales • Supply chain and operations optimization • Advanced information systems • Inventory efficiency focus ROTCE >20% • Increased and consistent operating profits • Accretive capital allocation • Efficient capital base 26 Progress toward Lift Truck & Bolzoni long-term targets key to long-term HY results Strategy Execution Accelerating Progress + + = 27 Achieve long-term targets, sustain performance, intensify cash flow focus Significant Opportunities for Lift Truck & Bolzoni REVENUE WORKING CAPITAL % SALES(1) ADJUSTED OPERATING PROFIT MARGIN(1) ROTCE(1) ACHIEVE TARGETS • Modular, scalable products • Industry-specific solutions • Pricing agility and cost management • Optimized production and supply • Advanced technologies and services SUSTAIN PERFORMANCE • End markets grow with global consumption • Leadership in high-value product automation and fuel cells • Optimized cost structure absorbs business cyclicality • Efficient supply chain minimizes inventory transit • Investment discipline over efficient asset base 0 2,000 4,000 6,000 2021 2022 2023 2024 2025 LTM Future GDP++ $M (4%) (2%) 0% 2% 4% 6% 8% 2021 2022 2023 2024 2025 LTM* Future 7% Target (10%) 0% 10% 20% 30% Sustain at 20%+ Note: 2021/2022 results negatively impacted by global supply chain disruptions (1) Refer to definitions and reconciliations to the most directly comparable GAAP measures in the Appendix starting on page 60. * 2025 LTM: Last Twelve Months as of 3/31/25. 0% 5% 10% 15% 20% 25% 2021 2022 2023 2024 2025 Future 15% Target 2021 2022 2023 2024 2025 LTM* Future 28 Generating consistent cash flows at Lift Truck and Bolzoni and making disciplined investments Accretive Capital Allocation Framework Efficient Fixed Cost Utilization Effective Working Capital Management Capital Productivity Reduce Leverage Fuel Growth and Efficiency Acquire Capabilities Routine Debt Service Maintenance CapEx ~ equal to depreciation Research and Development product line evolution Reliable Dividends reflect business confidence Strong Operating Cash Flow Excess Free Cash Flow Consistent use of Cash Focus on balance sheet strength and flexibility ROTCE Goal: >20% Additional Shareholder Return Nuvera Funding

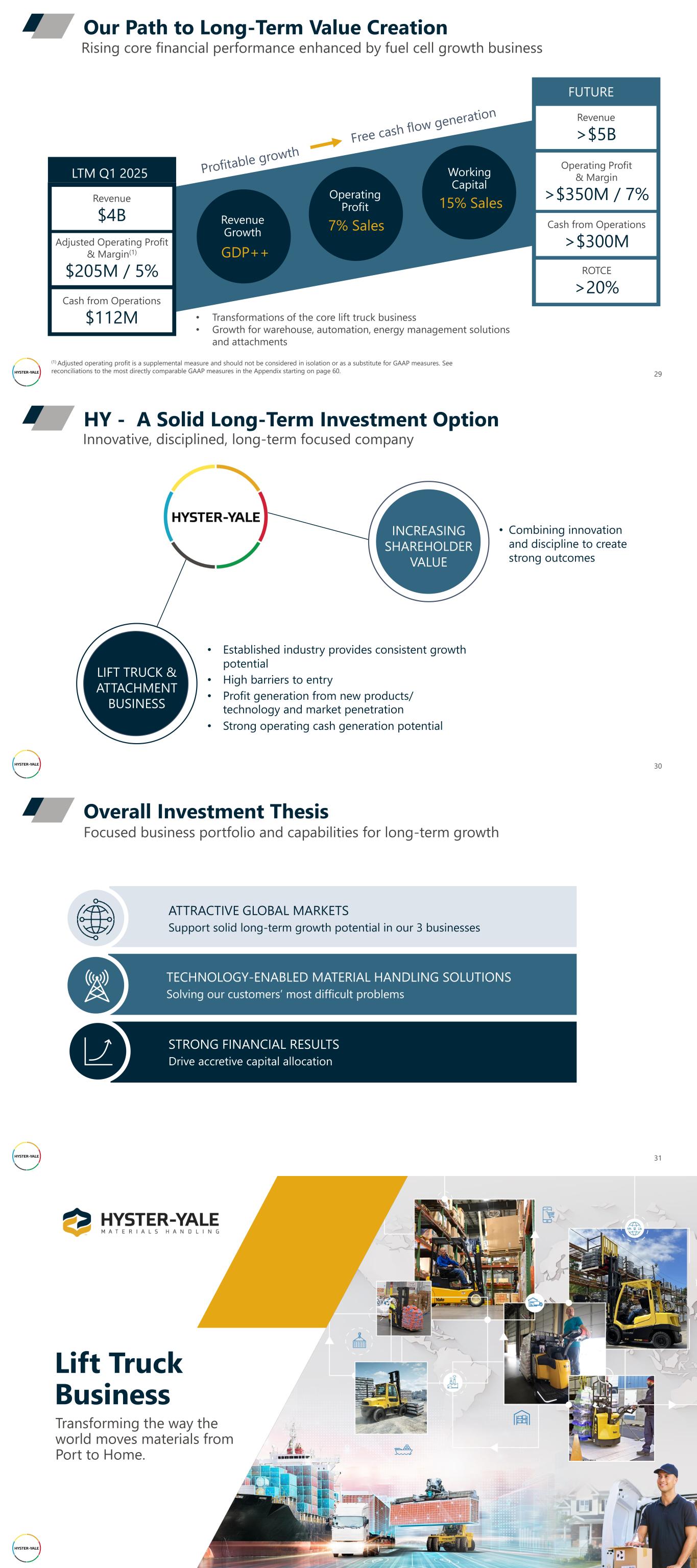

Rising core financial performance enhanced by fuel cell growth business Our Path to Long-Term Value Creation Adjusted Operating Profit & Margin(1) $205M / 5% Revenue $4B Cash from Operations $112M LTM Q1 2025 Operating Profit & Margin >$350M / 7% Revenue >$5B Cash from Operations >$300M FUTURE ROTCE >20% Revenue Growth GDP++ Operating Profit 7% Sales Working Capital 15% Sales 29 (1) Adjusted operating profit is a supplemental measure and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations to the most directly comparable GAAP measures in the Appendix starting on page 60. • Transformations of the core lift truck business • Growth for warehouse, automation, energy management solutions and attachments 30 Innovative, disciplined, long-term focused company HY - A Solid Long-Term Investment Option • Established industry provides consistent growth potential • High barriers to entry • Profit generation from new products/ technology and market penetration • Strong operating cash generation potential • Combining innovation and discipline to create strong outcomes INCREASING SHAREHOLDER VALUE LIFT TRUCK & ATTACHMENT BUSINESS TECHNOLOGY-ENABLED MATERIAL HANDLING SOLUTIONS Solving our customers’ most difficult problems 31 Focused business portfolio and capabilities for long-term growth Overall Investment Thesis ATTRACTIVE GLOBAL MARKETS Support solid long-term growth potential in our 3 businesses STRONG FINANCIAL RESULTS Drive accretive capital allocation Lift Truck Business Transforming the way the world moves materials from Port to Home.

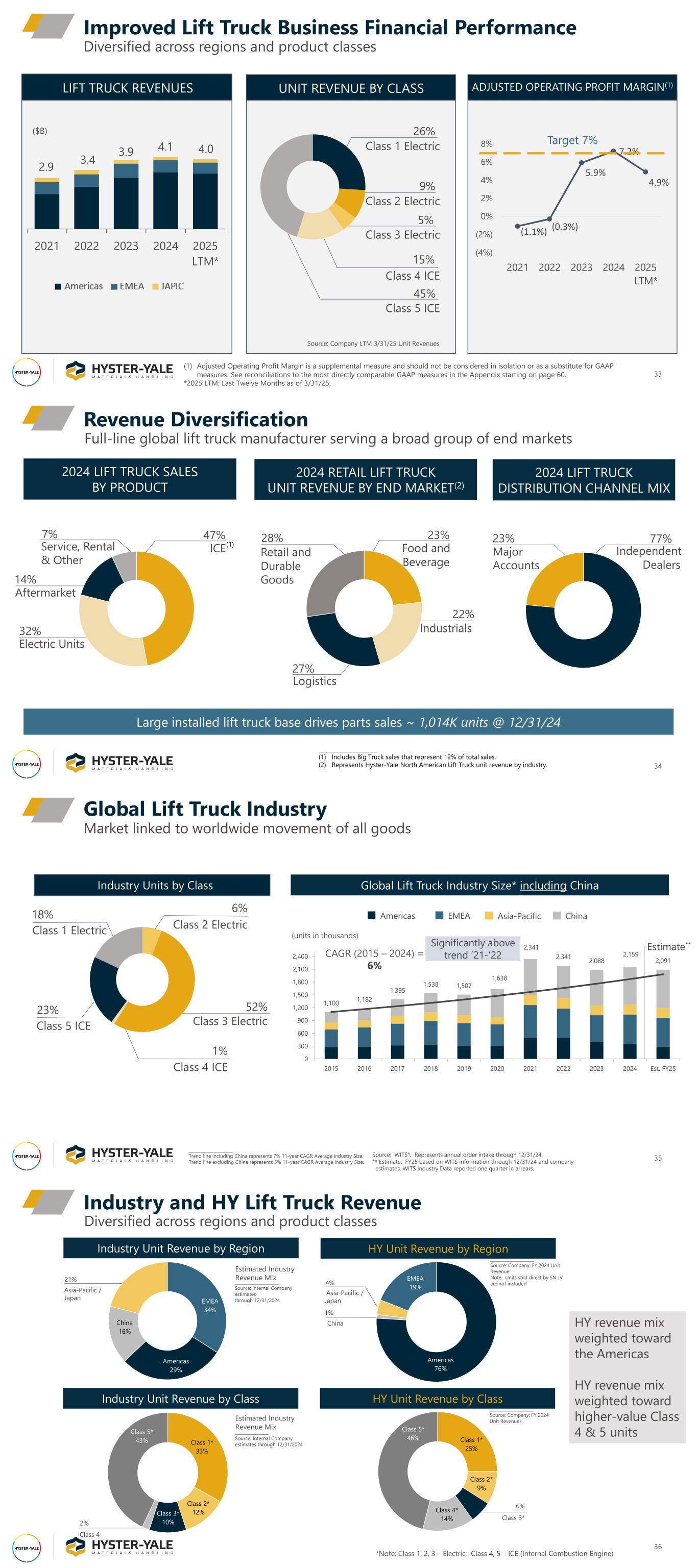

33 Diversified across regions and product classes Improved Lift Truck Business Financial Performance 2.9 3.4 3.9 4.1 4.0 2021 2022 2023 2024 2025 LTM* LIFT TRUCK REVENUES UNIT REVENUE BY CLASS 26% Class 1 Electric 9% Class 2 Electric 5% Class 3 Electric 15% Class 4 ICE Class 5 ICE 45% ADJUSTED OPERATING PROFIT MARGIN(1) (1.1%) (0.3%) 5.9% 7.2% 4.9% (4%) (2%) 0% 2% 4% 6% 8% 2021 2022 2023 2024 2025 LTM* Target 7% Source: Company LTM 3/31/25 Unit Revenues ($B) (1) Adjusted Operating Profit Margin is a supplemental measure and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations to the most directly comparable GAAP measures in the Appendix starting on page 60. *2025 LTM: Last Twelve Months as of 3/31/25. 22% Industrials Full-line global lift truck manufacturer serving a broad group of end markets 14% Service, Rental & Other Electric Units Aftermarket 7% Independent Dealers 34 Revenue Diversification 2024 LIFT TRUCK SALES BY PRODUCT _____________________ (1) Includes Big Truck sales that represent 12% of total sales. (2) Represents Hyster-Yale North American Lift Truck unit revenue by industry. 2024 RETAIL LIFT TRUCK UNIT REVENUE BY END MARKET(2) (1) 2024 LIFT TRUCK DISTRIBUTION CHANNEL MIX 77%23% Major Accounts Food and Beverage 23%28% Retail and Durable Goods Logistics 27% ICE 47% 32% Large installed lift truck base drives parts sales ~ 1,014K units @ 12/31/24 _____________________ Trend line including China represents 7% 11-year CAGR Average Industry Size. Trend line excluding China represents 5% 11-year CAGR Average Industry Size. Market linked to worldwide movement of all goods Global Lift Truck Industry 35 Source: WITS*. Represents annual order intake through 12/31/24. ** Estimate: FY25 based on WITS information through 12/31/24 and company estimates. WITS Industry Data reported one quarter in arrears. Industry Units by Class 18% Class 1 Electric 6% Class 2 Electric 52% Class 3 Electric 1% Class 4 ICE Class 5 ICE 23% 1,100 1,182 1,395 1,538 1,507 1,638 2,341 2,341 2,088 2,159 2,091 0 300 600 900 1,200 1,500 1,800 2,100 2,400 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Est. FY25 CAGR (2015 – 2024) = 6% Global Lift Truck Industry Size* including China Significantly above trend ’21-’22 (units in thousands) Americas EMEA Asia-Pacific China Estimate** Diversified across regions and product classes Industry and HY Lift Truck Revenue 36 *Note: Class 1, 2, 3 – Electric; Class 4, 5 – ICE (Internal Combustion Engine) Class 1* 33% Class 2* 12%Class 3* 10% Class 5* 43% ________________ Source: Internal Company estimates through 12/31/2024 Estimated Industry Revenue Mix Industry Unit Revenue by Class Class 4 2% Class 1* 25% Class 2* 9% Class 4* 14% Class 5* 46% HY Unit Revenue by Class _____________________ Source: Company: FY 2024 Unit Revenues 6% Class 3* HY Unit Revenue by Region Americas 76% EMEA 19% _____________________ Source: Company: FY 2024 Unit Revenue Note: Units sold direct by SN JV are not included China 1% 4% Asia-Pacific / JapanEMEA 34% Americas 29% China 16% _____________________ Source: Internal Company estimates through 12/31/2024 Estimated Industry Revenue Mix Industry Unit Revenue by Region 21% Asia-Pacific / Japan HY revenue mix weighted toward the Americas HY revenue mix weighted toward higher-value Class 4 & 5 units

37 Growth Potential Beyond GDP+ Market Growth Rate Robotics Modular, Scalable Operator Assist Installation, Commissioning Telematics Electrification Warehouse Engineered Solutions Independent Dealers Fleet & Consulting Connected Lift Trucks Customer Care (HYCare) Subscription Support Breadth Exclusive Features Scalability Integrated Solutions Modular Design HY COMPETITIVE ADVANTAGES Evolutionary advantages enhance the core • Revolutionary shifts accelerate performance Evolving capabilities align with market growth elements Lift Trucks (Core Products) Economic Engine GDP+ Revolutionary GDP++ Core Lift Truck Products Technology to Enhance User Outcomes Services Provided to Customers Evolutionary LIFT TRUCK MARKET PENETRATION Americas EMEA JAPIC To ta l M ar ke t Si ze AMERICAS WAREHOUSE VS. INDUSTRIALS Key Opportunities for Market Share Growth 38 Growth Opportunity • Modular, scalable products fit for region • Globally enhanced sales process & capabilities • Strengthening AsOne distribution • Focused leadership, talent and organization REGIONAL GROWTH POTENTIAL • New warehouse-focused Yale® branding • Specialization + emerging technology solutions • Evolving electrification capabilities • Enhanced industry focused coverage INDUSTRY GROWTH POTENTIAL Warehouse Industrials To ta l M ar ke t Si ze Hyster-Yale Others Hyster-Yale Others Leverage global capabilities to achieve share potential across markets (1) Majority of China market dominated by Chinese OEMs – not readily accessible to non-Chinese OEMs China(1) Market Growth Opportunity Source: WITS shipments* data LTM 12/31/23 and Company shipments LTM 12/31/23 *WITS shipments* data available 6 mos. in arrears. 39 Expanding Solutions Address Global Industry Requirements Enhancing competitive capabilities through product breadth, scalability and technology MODULAR / SCALABLE PLATFORM BREADTH Simplifies operations; maximizes configurability; generates enhanced profits Complete product range to serve nearly every application EMERGING TECHNOLOGIES Practical innovations across platforms simplify adoption Image ELECTRIFICATION Rapidly adding electrification power options for all models to support zero emissions 2021 2022 2023 2024 2025 LTM* Americas EMEA JAPIC (1) 12% 0.3%(2) 2% 6% 11% Right Truck, Right Price, Right Application • 9 component modules; commonality enables design, assembly and parts synergies • Modules scale up/down with interchangeable function and value components Supply Chain and Manufacturing Optimization • Concentration/growth of global sourcing partners ‒ Goal: ~70% supplier reduction over next 4 years • Transition to localized supplier production and managed inventory ‒ JIT*** sequenced assemblies reduce working capital • Standardized global tools/processes drive manufacturing agility/configurability • Technology/automation optimize labor, safety and performance • Global core production capabilities/capacity optimize cost Core Product Strategy – Modular & Scalable Platforms 40 (1) Percentages represent modular, scalable shipments as % of total unit shipments. *2025 LTM: Last Twelve Months as of 3/31/25 **ICE: Internal Combustion Engine *** JIT: Just in Time Modular, Scalable, 2- to 3.5-ton ICE** Truck Shipments Accelerating Provides increased market share, profitability, cash efficiency & improved working capital levels

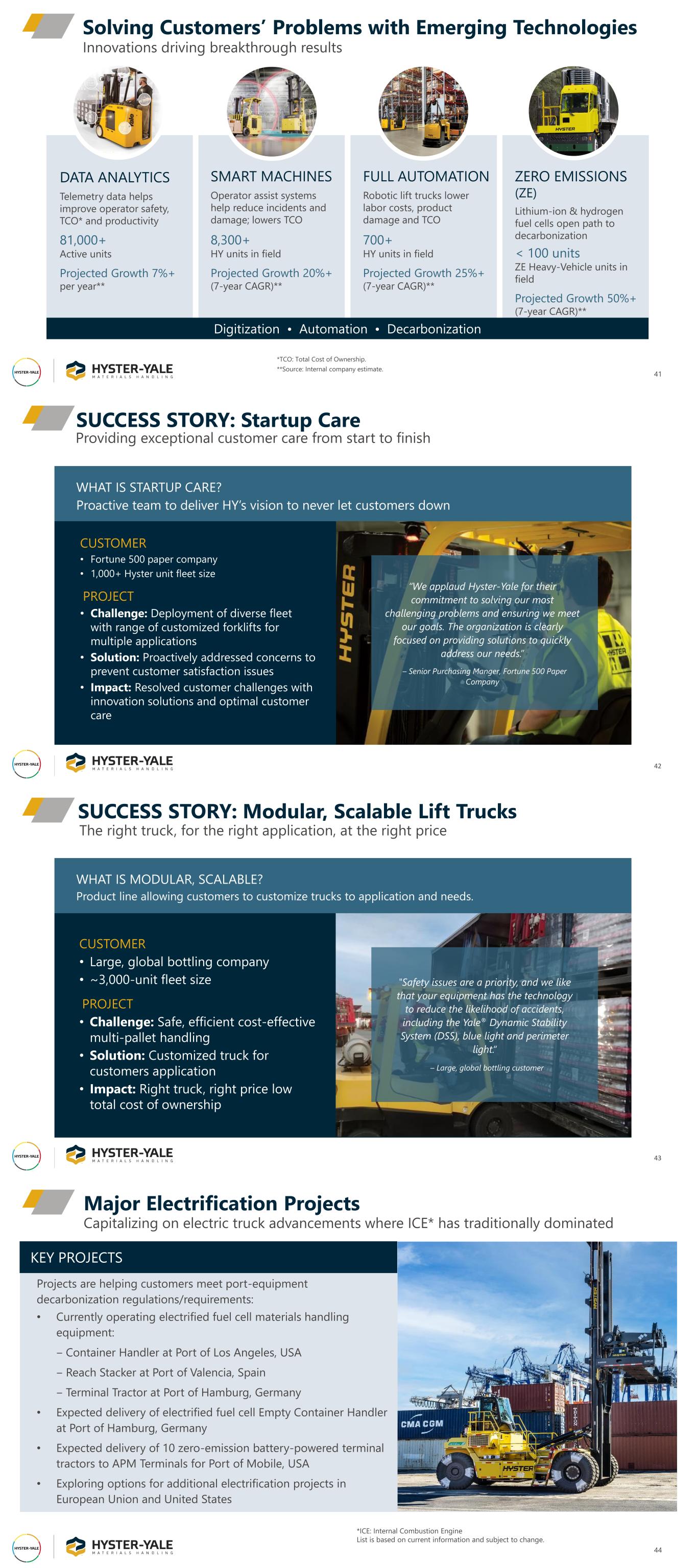

Solving Customers’ Problems with Emerging Technologies 41 Innovations driving breakthrough results DATA ANALYTICS Telemetry data helps improve operator safety, TCO* and productivity 81,000+ Active units Projected Growth 7%+ per year** SMART MACHINES Operator assist systems help reduce incidents and damage; lowers TCO 8,300+ HY units in field Projected Growth 20%+ (7-year CAGR)** FULL AUTOMATION Robotic lift trucks lower labor costs, product damage and TCO 700+ HY units in field Projected Growth 25%+ (7-year CAGR)** ZERO EMISSIONS (ZE) Lithium-ion & hydrogen fuel cells open path to decarbonization < 100 units ZE Heavy-Vehicle units in field Projected Growth 50%+ (7-year CAGR)** Digitization • Automation • Decarbonization *TCO: Total Cost of Ownership. **Source: Internal company estimate. SUCCESS STORY: Startup Care 42 Providing exceptional customer care from start to finish WHAT IS STARTUP CARE? Proactive team to deliver HY’s vision to never let customers down CUSTOMER • Fortune 500 paper company • 1,000+ Hyster unit fleet size PROJECT • Challenge: Deployment of diverse fleet with range of customized forklifts for multiple applications • Solution: Proactively addressed concerns to prevent customer satisfaction issues • Impact: Resolved customer challenges with innovation solutions and optimal customer care “We applaud Hyster-Yale for their commitment to solving our most challenging problems and ensuring we meet our goals. The organization is clearly focused on providing solutions to quickly address our needs.” – Senior Purchasing Manger, Fortune 500 Paper Company SUCCESS STORY: Modular, Scalable Lift Trucks 43 WHAT IS MODULAR, SCALABLE? Product line allowing customers to customize trucks to application and needs. CUSTOMER • Large, global bottling company • ~3,000-unit fleet size PROJECT • Challenge: Safe, efficient cost-effective multi-pallet handling • Solution: Customized truck for customers application • Impact: Right truck, right price low total cost of ownership "Safety issues are a priority, and we like that your equipment has the technology to reduce the likelihood of accidents, including the Yale® Dynamic Stability System (DSS), blue light and perimeter light.“ – Large, global bottling customer The right truck, for the right application, at the right price Capitalizing on electric truck advancements where ICE* has traditionally dominated Major Electrification Projects 44 *ICE: Internal Combustion Engine List is based on current information and subject to change. KEY PROJECTS Projects are helping customers meet port-equipment decarbonization regulations/requirements: • Currently operating electrified fuel cell materials handling equipment: ‒ Container Handler at Port of Los Angeles, USA ‒ Reach Stacker at Port of Valencia, Spain ‒ Terminal Tractor at Port of Hamburg, Germany • Expected delivery of electrified fuel cell Empty Container Handler at Port of Hamburg, Germany • Expected delivery of 10 zero-emission battery-powered terminal tractors to APM Terminals for Port of Mobile, USA • Exploring options for additional electrification projects in European Union and United States

EXPECTED LAUNCHES IN 2025 • New modular 2- to 3.5-ton Pneumatic ICE* Standard & Value Configurations for Americas & EMEA regions • New modular 1-2.0 ton pneumatic and 1-3.5-ton cushion products for Americas & EMEA regions • New modular 2- to 3.5-ton electric counterbalance product • Localization of 10-18 Ton CB** ICE truck for China and AP regions • New 2-ton Platform Pallet Truck Standard Configuration for AP region • New entry level stacker 1.2 ton for all regions • Targeted introductions of internally developed, modular automated trucks for Americas region • Expand options for Hyster® UT, Yale® UX, and Maximal-branded lift trucks for global regions 45 Upcoming Product Launches *ICE: Internal Combustion Engine; **CB: Counterbalanced List is based on current information and subject to change. HY’s Automation Journey 46 Flexible solution to reduce labor costs and total cost of ownership CUSTOMER SUCCESS ORIGINAL SOLUTIONS INTERNALLY DEVELOPED AUTOMATION Generation 2 automated lift trucks, Hyster Atlas and Yale Relay , testing at customer locations; co- developing automation software with 3rd party technology provider Generation 1 automated truck options launched in 2016 with 316 Class 3 trucks delivered to date 2 3 1 Generation 1 successful installation at large consumer goods customer site • 542 Class 2 trucks delivered • 67 units on current order • 8 locations fully installed • 2 international locations to be added in 2025 KEY BENEFITS • Technology fully supported by HY and its dealer network • HY automated lift truck portal is simple, adaptable and easy-to use • Lower total cost of ownership and clearer return on investment DETAILS Leveraging Independent Distribution to Win 47 Delivering exceptional customer experience while increasing capital efficiency Independent DISTRIBUTION Model • Exclusive, independent distributors worldwide ‒ Working to increase dual-branded dealerships as markets mature • Entrepreneurial customer focus • Investment in dealer/retail excellence • Coordination of dealer and major account coverage • Commercial leadership and enablement • Solution-focused capital investments • High return on total capital employed • Differentiated AsOne value to customer • OEM and dealer aligned business models • Optimizes long-term strategy and agility SYNERGY DEALER HYSTER-YALE Lift Truck Business is the Core Platform for Delivering Value 48 Vehicle for high-margin solutions and service growth KEY TAKEAWAYS • Experienced, global market leader • Mature lift truck industry provides core platform for growth • GDP+ market growth with HY share upside potential • Strategically positioned for profit expansion across business

Energy Solutions Program 49 • Announced strategic business realignment of Nuvera Fuel Cell Business on April 30, 2025, to increase near term profits and create an integrated energy solutions program • Initiative furthers HY’s transformation of its core counterbalanced Lift Truck business through product innovation and optimized operations • Takes advantage of Nuvera's technical skills for: • more rapid maturity, growth and profitability of its battery and charger programs, • development, manufacturing and commercialization of its charging platforms for off grid power solutions, and • completion of its port equipment electric power solutions. KEY TAKEAWAYS Strategic realignment of Nuvera fuel cell business Electrical Energy Solutions for Lift Trucks 50 Single-source, integrated, value-delivered electric power options CURRENT: Multi-Source Solution • Lift truck supplied by HY • Battery supplied by 3rd party • Charger supplied by 3rd party • Solutions backed by multiple sources • Issue resolution involves multiple parties FUTURE: Single-Source Solution Truck Battery Charger Truck Battery Charger HY BENEFITS • Additional margin • Incremental growth • Aftersales component revenue • Dealer revenue growth *TCO: Total Cost of Ownership • Integrated lift truck, battery and charger supplied by HY • Customized power solution for lift truck usage • Right truck, battery and charger at the right price – lower TCO* • Total factory backed solution • Simple issue resolution Integrated Truck, Battery & Charger Bolzoni Attachments Need a good Bolzoni photo on a Hyster truck Transforming the way the world moves materials from Port to Home. Award-winning Attachment Business makes HY leading industry player Bolzoni Attachments are Critical to Productivity Solutions 52 Focused on serving lift truck OEMs* and other attachment customers using an industry approach and dealer collaboration *OEM: Original Equipment Manufacturer

ADJUSTED OPERATING PROFIT MARGIN(1) (0.5%) 1.7% 4.1% 3.5% 2.9% (2%) 0% 2% 4% 6% 8% 2021 2022 2023 2024 2025 LTM* NET SALES BY PRODUCT LINE Diversified across regions and product classes Accelerating Financial Performance 53 NET SALES • Slight decrease in revenue with planned phase-out of legacy products sold to Lift Truck business Target 7% 348 356 375 379 363 2021 2022 2023 2024 2025 LTM* 47% Attachments 2% Lift Tables 8% Forks 43% Legacy Components Source: Company LTM 3/31/25 Unit Revenues ($M) (1) Adjusted operating profit is a supplemental measure and should not be considered in isolation or as a substitute for GAAP measures. See reconciliations of adjusted results to the most directly comparable GAAP measures in the Appendix starting on page 60. *2025 LTM: Last Twelve Months as of 3/31/25. BOLZONI ATTACHMENT MARKET PENETRATION* Leveraging high-quality products and deep industry experience Significant Global Growth Opportunities 54 EMEA Americas JAPIC To ta l M ar ke t Si ze Bolzoni Others AREAS OF FOCUS EXPANDING MARKET SHARE • Americas and JAPIC markets • Products well aligned with market segment needs • Increased sales and marketing capabilities INDUSTRY FOCUS • One company, 3 brands serving multiple industries • Well-respected brands in many industries • Innovative, high-quality products sold across geographies, major OEMs and industries PRODUCT DEVELOPMENT, NEW TECHNOLOGIES • Economic trends, customer challenges and automation driving need for technology enhancements Growth Opportunity *Internal company estimates GROWTH AUTOMOTIVE & 3PL* Preferred supplier of high- performance rotating tire clamp in growth industries PULP & PAPER Auramo Paper roll clamps well-respected industry brand HOME APPLIANCES Bolzoni High-tech carton clamp helps reduce product damage BEVERAGE Meyer Innovative double-pallet handler; industry-standard; productivity multiplier Leveraging high-quality, respected brands and products in growth industries 55 Driving Growth, Industry by Industry *3PL: Third-Party Logistics • Easy-Connect Product range introduced with advanced technologies for smart logistics and Internet/Wi-Fi-enabled options • Home Appliance (HA) Telescopic clamp introduced in 2024. Designed to easily handle home appliances and less than one pallet loads in confined spaces. Solving customers’ challenges through product and technological development Product Development Focus Feeds Growth 56 Sales growth Research & Development solving challenges New products / technology developed Customer input: new handling- application needs • AGVs growing in specific industries • Collaborating with AGV manufacturers for integrated attachments FUTURE DEVELOPMENT RECENT PRODUCT LAUNCHES HA Telescopic Clamp

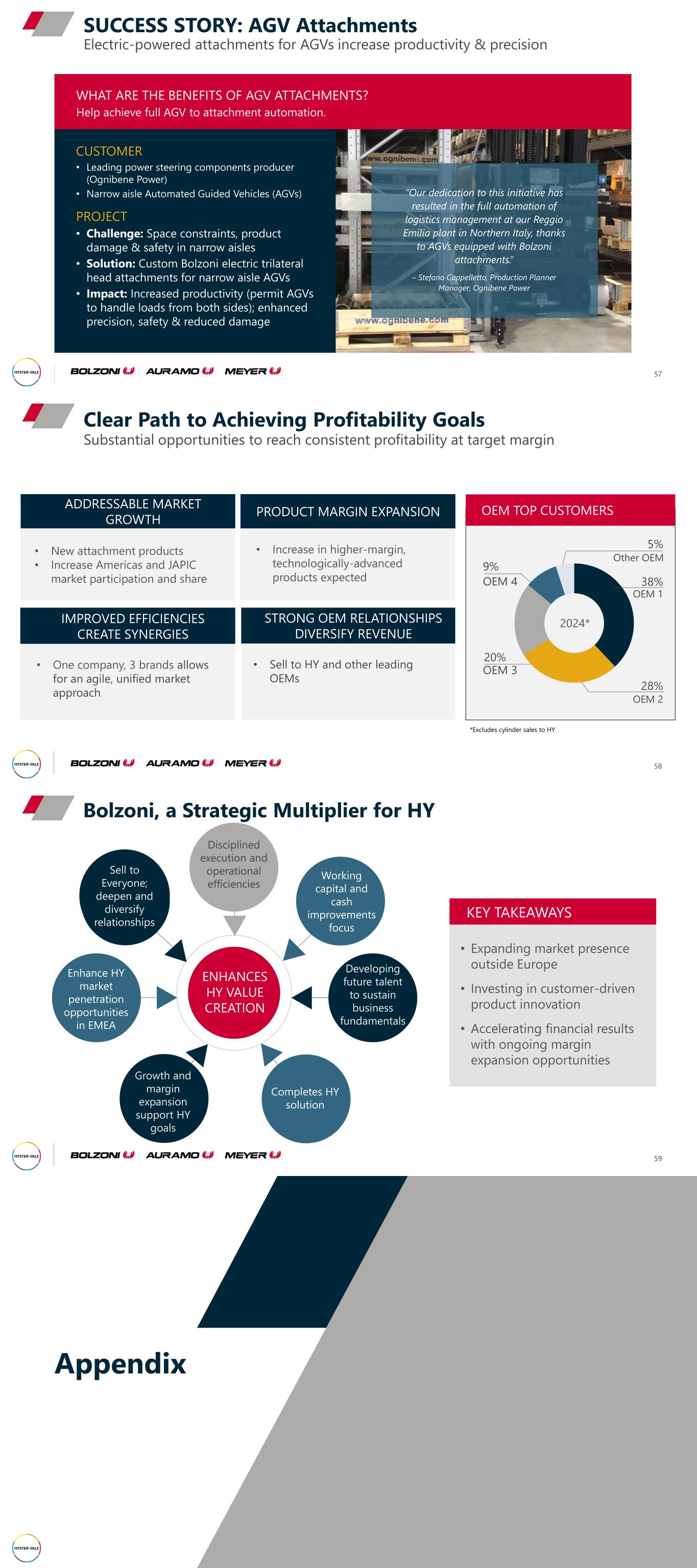

Electric-powered attachments for AGVs increase productivity & precision SUCCESS STORY: AGV Attachments 57 WHAT ARE THE BENEFITS OF AGV ATTACHMENTS? Help achieve full AGV to attachment automation. “Our dedication to this initiative has resulted in the full automation of logistics management at our Reggio Emilia plant in Northern Italy, thanks to AGVs equipped with Bolzoni attachments.” – Stefano Cappelletto, Production Planner Manager, Ognibene Power CUSTOMER • Leading power steering components producer (Ognibene Power) • Narrow aisle Automated Guided Vehicles (AGVs) PROJECT • Challenge: Space constraints, product damage & safety in narrow aisles • Solution: Custom Bolzoni electric trilateral head attachments for narrow aisle AGVs • Impact: Increased productivity (permit AGVs to handle loads from both sides); enhanced precision, safety & reduced damage 28% OEM 2 20% OEM 3 9% OEM 4 Substantial opportunities to reach consistent profitability at target margin Clear Path to Achieving Profitability Goals 58 *Excludes cylinder sales to HY PRODUCT MARGIN EXPANSION IMPROVED EFFICIENCIES CREATE SYNERGIES STRONG OEM RELATIONSHIPS DIVERSIFY REVENUE • New attachment products • Increase Americas and JAPIC market participation and share • One company, 3 brands allows for an agile, unified market approach • Sell to HY and other leading OEMs • Increase in higher-margin, technologically-advanced products expected 2024* 5% Other OEM 38% OEM 1 OEM TOP CUSTOMERS ADDRESSABLE MARKET GROWTH Bolzoni, a Strategic Multiplier for HY 59 KEY TAKEAWAYS • Expanding market presence outside Europe • Investing in customer-driven product innovation • Accelerating financial results with ongoing margin expansion opportunities ENHANCES HY VALUE CREATION Working capital and cash improvements focus Completes HY solution Enhance HY market penetration opportunities in EMEA Developing future talent to sustain business fundamentals Growth and margin expansion support HY goals Sell to Everyone; deepen and diversify relationships Disciplined execution and operational efficiencies Appendix

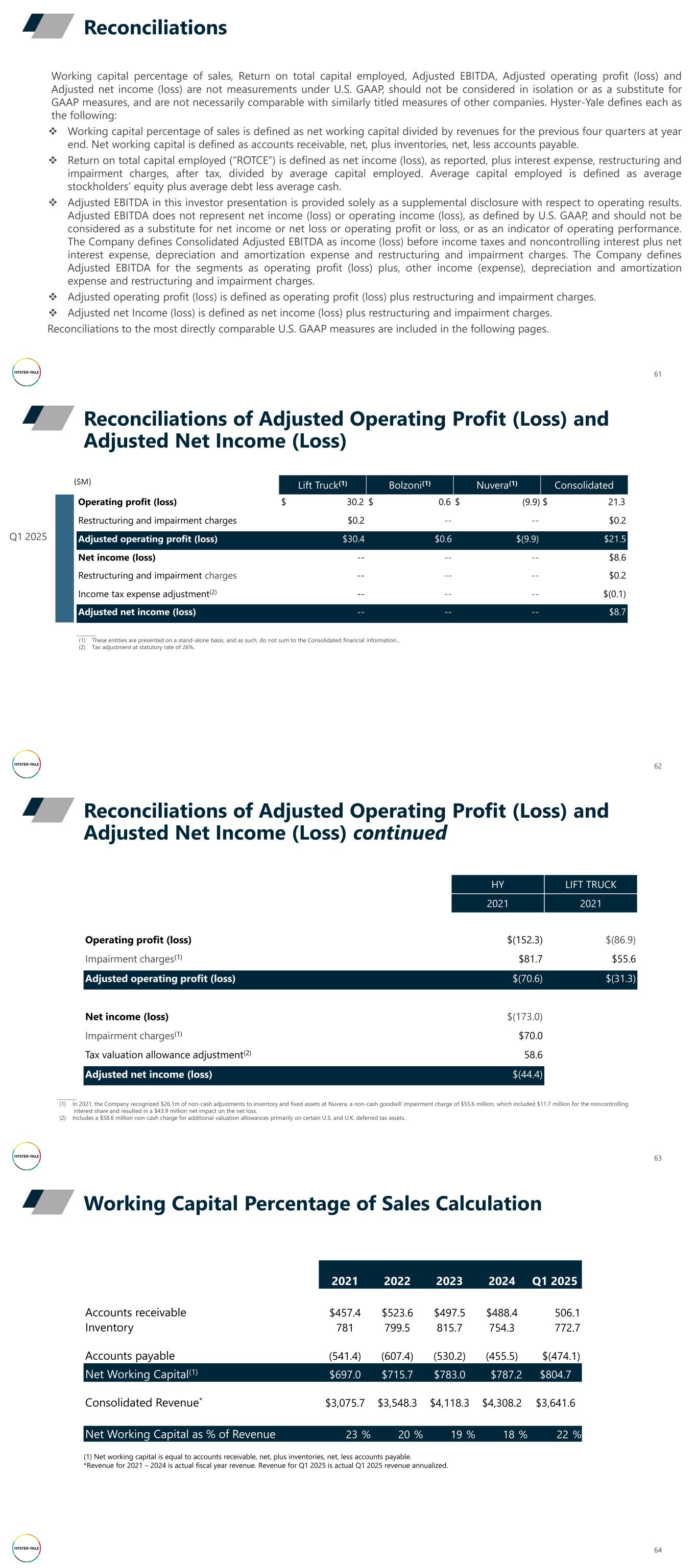

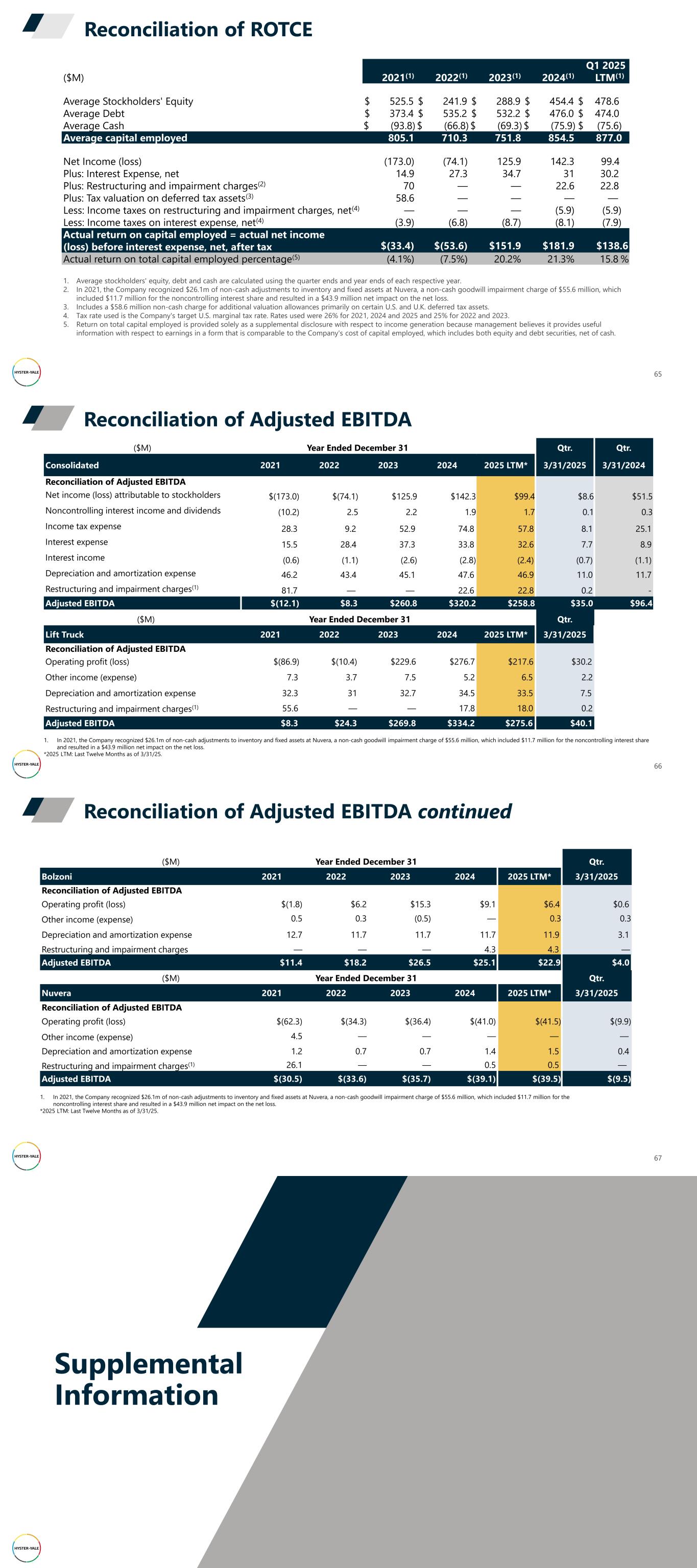

Reconciliations 61 Working capital percentage of sales, Return on total capital employed, Adjusted EBITDA, Adjusted operating profit (loss) and Adjusted net income (loss) are not measurements under U.S. GAAP, should not be considered in isolation or as a substitute for GAAP measures, and are not necessarily comparable with similarly titled measures of other companies. Hyster-Yale defines each as the following: ❖ Working capital percentage of sales is defined as net working capital divided by revenues for the previous four quarters at year end. Net working capital is defined as accounts receivable, net, plus inventories, net, less accounts payable. ❖ Return on total capital employed (“ROTCE”) is defined as net income (loss), as reported, plus interest expense, restructuring and impairment charges, after tax, divided by average capital employed. Average capital employed is defined as average stockholders’ equity plus average debt less average cash. ❖ Adjusted EBITDA in this investor presentation is provided solely as a supplemental disclosure with respect to operating results. Adjusted EBITDA does not represent net income (loss) or operating income (loss), as defined by U.S. GAAP, and should not be considered as a substitute for net income or net loss or operating profit or loss, or as an indicator of operating performance. The Company defines Consolidated Adjusted EBITDA as income (loss) before income taxes and noncontrolling interest plus net interest expense, depreciation and amortization expense and restructuring and impairment charges. The Company defines Adjusted EBITDA for the segments as operating profit (loss) plus, other income (expense), depreciation and amortization expense and restructuring and impairment charges. ❖ Adjusted operating profit (loss) is defined as operating profit (loss) plus restructuring and impairment charges. ❖ Adjusted net Income (loss) is defined as net income (loss) plus restructuring and impairment charges. Reconciliations to the most directly comparable U.S. GAAP measures are included in the following pages. Reconciliations of Adjusted Operating Profit (Loss) and Adjusted Net Income (Loss) 62 Lift Truck(1) Bolzoni(1) Nuvera(1) Consolidated Operating profit (loss) $ 30.2 $ 0.6 $ (9.9) $ 21.3 Restructuring and impairment charges $0.2 -- -- $0.2 Adjusted operating profit (loss) $30.4 $0.6 $(9.9) $21.5 Net income (loss) -- -- -- $8.6 Restructuring and impairment charges -- -- -- $0.2 Income tax expense adjustment(2) -- -- -- $(0.1) Adjusted net income (loss) -- -- -- $8.7 ________ (1) These entities are presented on a stand-alone basis, and as such, do not sum to the Consolidated financial information.. (2) Tax adjustment at statutory rate of 26%. Q1 2025 ($M) Reconciliations of Adjusted Operating Profit (Loss) and Adjusted Net Income (Loss) continued 63 HY LIFT TRUCK 2021 2021 Operating profit (loss) $(152.3) $(86.9) Impairment charges(1) $81.7 $55.6 Adjusted operating profit (loss) $(70.6) $(31.3) Net income (loss) $(173.0) Impairment charges(1) $70.0 Tax valuation allowance adjustment(2) 58.6 Adjusted net income (loss) $(44.4) ________ (1) In 2021, the Company recognized $26.1m of non-cash adjustments to inventory and fixed assets at Nuvera, a non-cash goodwill impairment charge of $55.6 million, which included $11.7 million for the noncontrolling interest share and resulted in a $43.9 million net impact on the net loss. (2) Includes a $58.6 million non-cash charge for additional valuation allowances primarily on certain U.S. and U.K. deferred tax assets. Working Capital Percentage of Sales Calculation 64 2021 2022 2023 2024 Q1 2025 Accounts receivable $457.4 $523.6 $497.5 $488.4 506.1 Inventory 781 799.5 815.7 754.3 772.7 Accounts payable (541.4) (607.4) (530.2) (455.5) $(474.1) Net Working Capital(1) $697.0 $715.7 $783.0 $787.2 $804.7 Consolidated Revenue* $3,075.7 $3,548.3 $4,118.3 $4,308.2 $3,641.6 Net Working Capital as % of Revenue 23 % 20 % 19 % 18 % 22 % (1) Net working capital is equal to accounts receivable, net, plus inventories, net, less accounts payable. *Revenue for 2021 – 2024 is actual fiscal year revenue. Revenue for Q1 2025 is actual Q1 2025 revenue annualized.

Reconciliation of ROTCE 65 Q1 2025 ($M) 2021(1) 2022(1) 2023(1) 2024(1) LTM(1) Average Stockholders' Equity $ 525.5 $ 241.9 $ 288.9 $ 454.4 $ 478.6 Average Debt $ 373.4 $ 535.2 $ 532.2 $ 476.0 $ 474.0 Average Cash $ (93.8) $ (66.8) $ (69.3) $ (75.9) $ (75.6) Average capital employed 805.1 710.3 751.8 854.5 877.0 Net Income (loss) (173.0) (74.1) 125.9 142.3 99.4 Plus: Interest Expense, net 14.9 27.3 34.7 31 30.2 Plus: Restructuring and impairment charges(2) 70 — — 22.6 22.8 Plus: Tax valuation on deferred tax assets(3) 58.6 — — — — Less: Income taxes on restructuring and impairment charges, net(4) — — — (5.9) (5.9) Less: Income taxes on interest expense, net(4) (3.9) (6.8) (8.7) (8.1) (7.9) Actual return on capital employed = actual net income (loss) before interest expense, net, after tax $(33.4) $(53.6) $151.9 $181.9 $138.6 Actual return on total capital employed percentage(5) (4.1%) (7.5%) 20.2% 21.3% 15.8 % 1. Average stockholders' equity, debt and cash are calculated using the quarter ends and year ends of each respective year. 2. In 2021, the Company recognized $26.1m of non-cash adjustments to inventory and fixed assets at Nuvera, a non-cash goodwill impairment charge of $55.6 million, which included $11.7 million for the noncontrolling interest share and resulted in a $43.9 million net impact on the net loss. 3. Includes a $58.6 million non-cash charge for additional valuation allowances primarily on certain U.S. and U.K. deferred tax assets. 4. Tax rate used is the Company's target U.S. marginal tax rate. Rates used were 26% for 2021, 2024 and 2025 and 25% for 2022 and 2023. 5. Return on total capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company's cost of capital employed, which includes both equity and debt securities, net of cash. Reconciliation of Adjusted EBITDA 66 ($M) Year Ended December 31 Qtr. Qtr. Consolidated 2021 2022 2023 2024 2025 LTM* 3/31/2025 3/31/2024 Reconciliation of Adjusted EBITDA Net income (loss) attributable to stockholders $(173.0) $(74.1) $125.9 $142.3 $99.4 $8.6 $51.5 Noncontrolling interest income and dividends (10.2) 2.5 2.2 1.9 1.7 0.1 0.3 Income tax expense 28.3 9.2 52.9 74.8 57.8 8.1 25.1 Interest expense 15.5 28.4 37.3 33.8 32.6 7.7 8.9 Interest income (0.6) (1.1) (2.6) (2.8) (2.4) (0.7) (1.1) Depreciation and amortization expense 46.2 43.4 45.1 47.6 46.9 11.0 11.7 Restructuring and impairment charges(1) 81.7 — — 22.6 22.8 0.2 - Adjusted EBITDA $(12.1) $8.3 $260.8 $320.2 $258.8 $35.0 $96.4 ($M) Year Ended December 31 Qtr. Lift Truck 2021 2022 2023 2024 2025 LTM* 3/31/2025 Reconciliation of Adjusted EBITDA Operating profit (loss) $(86.9) $(10.4) $229.6 $276.7 $217.6 $30.2 Other income (expense) 7.3 3.7 7.5 5.2 6.5 2.2 Depreciation and amortization expense 32.3 31 32.7 34.5 33.5 7.5 Restructuring and impairment charges(1) 55.6 — — 17.8 18.0 0.2 Adjusted EBITDA $8.3 $24.3 $269.8 $334.2 $275.6 $40.1 1. In 2021, the Company recognized $26.1m of non-cash adjustments to inventory and fixed assets at Nuvera, a non-cash goodwill impairment charge of $55.6 million, which included $11.7 million for the noncontrolling interest share and resulted in a $43.9 million net impact on the net loss. *2025 LTM: Last Twelve Months as of 3/31/25. Reconciliation of Adjusted EBITDA continued 67 ($M) Year Ended December 31 Qtr. Bolzoni 2021 2022 2023 2024 2025 LTM* 3/31/2025 Reconciliation of Adjusted EBITDA Operating profit (loss) $(1.8) $6.2 $15.3 $9.1 $6.4 $0.6 Other income (expense) 0.5 0.3 (0.5) — 0.3 0.3 Depreciation and amortization expense 12.7 11.7 11.7 11.7 11.9 3.1 Restructuring and impairment charges — — — 4.3 4.3 — Adjusted EBITDA $11.4 $18.2 $26.5 $25.1 $22.9 $4.0 ($M) Year Ended December 31 Qtr. Nuvera 2021 2022 2023 2024 2025 LTM* 3/31/2025 Reconciliation of Adjusted EBITDA Operating profit (loss) $(62.3) $(34.3) $(36.4) $(41.0) $(41.5) $(9.9) Other income (expense) 4.5 — — — — — Depreciation and amortization expense 1.2 0.7 0.7 1.4 1.5 0.4 Restructuring and impairment charges(1) 26.1 — — 0.5 0.5 — Adjusted EBITDA $(30.5) $(33.6) $(35.7) $(39.1) $(39.5) $(9.5) 1. In 2021, the Company recognized $26.1m of non-cash adjustments to inventory and fixed assets at Nuvera, a non-cash goodwill impairment charge of $55.6 million, which included $11.7 million for the noncontrolling interest share and resulted in a $43.9 million net impact on the net loss. *2025 LTM: Last Twelve Months as of 3/31/25. Supplemental Information

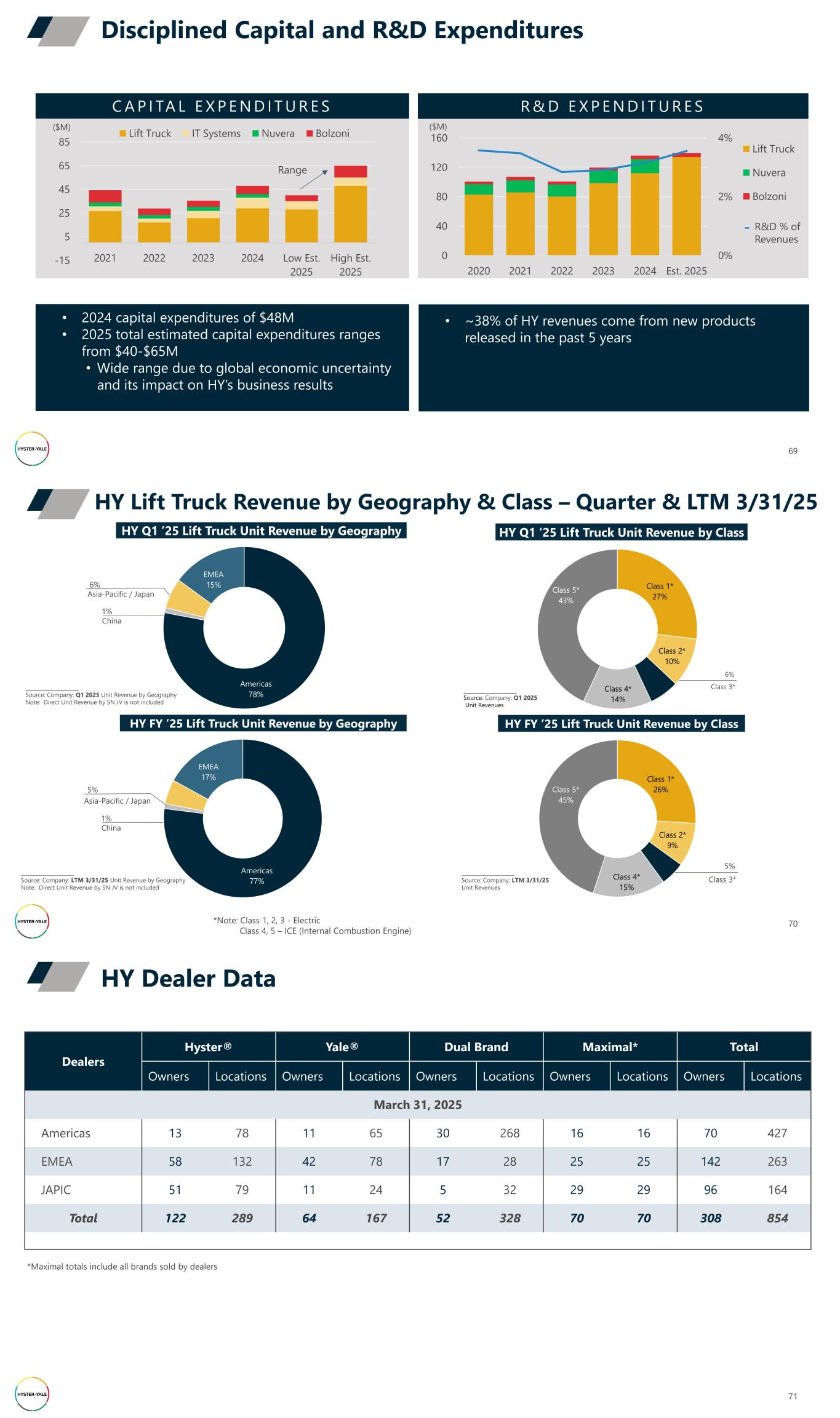

Disciplined Capital and R&D Expenditures 69 -15 5 25 45 65 85 2021 2022 2023 2024 Low Est. 2025 High Est. 2025 Lift Truck IT Systems Nuvera Bolzoni C A P I TA L E X P E N D I T U R E S R & D E X P E N D I T U R E S 0% 2% 4% 0 40 80 120 160 2020 2021 2022 2023 2024 Est. 2025 Lift Truck Nuvera Bolzoni ($M) ($M) • ~38% of HY revenues come from new products released in the past 5 years R&D % of Revenues • 2024 capital expenditures of $48M • 2025 total estimated capital expenditures ranges from $40-$65M • Wide range due to global economic uncertainty and its impact on HY’s business results Range Americas 78% EMEA 15% Class 1* 27% Class 2* 10% Class 4* 14% Class 5* 43% _____________________ Source: Company: Q1 2025 Unit Revenues Americas 77% EMEA 17% HY Lift Truck Revenue by Geography & Class – Quarter & LTM 3/31/25 70 Class 1* 26% Class 2* 9% Class 4* 15% Class 5* 45% 5% Class 3* _____________________ Source: Company: LTM 3/31/25 Unit Revenues _____________________ Source: Company: LTM 3/31/25 Unit Revenue by Geography Note: Direct Unit Revenue by SN JV is not included HY Q1 ‘25 Lift Truck Unit Revenue by ClassHY Q1 ’25 Lift Truck Unit Revenue by Geography HY FY ’25 Lift Truck Unit Revenue by Geography HY FY ’25 Lift Truck Unit Revenue by Class 5% Asia-Pacific / Japan 6% Asia-Pacific / Japan *Note: Class 1, 2, 3 - Electric Class 4, 5 – ICE (Internal Combustion Engine) 6% Class 3* _____________________ Source: Company: Q1 2025 Unit Revenue by Geography Note: Direct Unit Revenue by SN JV is not included China 1% China 1% HY Dealer Data 71 Dealers Hyster® Yale® Dual Brand Maximal* Total Owners Locations Owners Locations Owners Locations Owners Locations Owners Locations March 31, 2025 Americas 13 78 11 65 30 268 16 16 70 427 EMEA 58 132 42 78 17 28 25 25 142 263 JAPIC 51 79 11 24 5 32 29 29 96 164 Total 122 289 64 167 52 328 70 70 308 854 *Maximal totals include all brands sold by dealers