Please wait

Exhibit 10.1

NICOLET BANKSHARES, INC.

FORM OF RESTRICTED STOCK AND RESTRICTED STOCK UNIT AWARD AGREEMENT

This is a restricted stock and restricted stock unit award agreement (this “Agreement”) dated as of September 8, 2025 (the “Grant Date”), between Nicolet Bankshares, Inc., a Wisconsin corporation (the “Company”) and Michael Daniels (the “Grantee”). Capitalized terms used in this Agreement and not defined herein shall have the meanings given in the Nicolet Bankshares, Inc. 2011 Long-Term Incentive Plan, as amended and restated (the “Plan”).

RECITALS

WHEREAS, the Company adopted the Plan, which is administered by the Compensation Committee (the “Committee”) of the Company; and

WHEREAS, the Committee has designated the Grantee as a Participant in the Plan and wishes to set forth in this Agreement the Grantee’s right to receive: (i) restricted shares of Company Stock (“Restricted Stock”), and (ii) restricted stock units (“RSU”), as set forth in this Agreement and Exhibit A attached hereto and incorporated herein (the Restricted Stock and the RSUs are each referred to as an “Award” or, collectively, the “Awards”).

AGREEMENTS

The Grantee and the Company agree as follows:

1.Grant of Restricted Stock. The Company grants to the Grantee Thirty Thousand (30,000) shares of Restricted Stock, subject to the terms and conditions set forth in this Agreement and the Plan.

2.Grant of RSUs. The Company grants to the Grantee up to Sixty Thousand (60,000) RSUs, which shall vest on the satisfaction of various performance-based metrics and be subject to the terms and conditions set forth below and in the Plan, with each RSU representing the right to receive one share of Company Stock.

3.Transfer Restrictions on Awards. During the period of time that any shares of Restricted Stock are unvested, or until the delivery of shares of Stock with respect to RSUs that have become vested, the Awards (as applicable) may not be sold, transferred, pledged, exchanged, hypothecated or otherwise disposed of, other than by will or pursuant to the applicable laws of descent and distribution. Any attempted sale, transfer, pledge, exchange, hypothecation or other disposition of the Awards not specifically permitted by the Plan or this Agreement shall be null and void and without effect.

4.Vesting; Settlement.

4.1Restricted Stock. The Restricted Stock shall become fully vested and all restrictions thereon shall lapse on December 31, 2030, or if earlier, upon the Grantee’s involuntary Separation from Service by the Company without Cause or Separation from Service due to a resignation by the Grantee for Good Reason (each as defined in the Grantee’s employment agreement with the Company as in effect on the Grant Date, as amended from time to time (“Employment Agreement”)), including where such separation is due to his death or Disability.

4.2RSUs. The RSUs shall vest and become nonforfeitable if and to the extent that the Committee determines, in its sole discretion, that the performance criteria set forth on Exhibit A are met as of the end of the Performance Period on December 31, 2030; provided, however, that in the event of the Grantee’s earlier involuntary Separation from Service by the Company without Cause or Separation from Service due to resignation by the Grantee for Good Reason (each as defined in the Employment Agreement), including where such separation is due to his death or Disability, the RSUs shall immediately vest based on (a) if such separation occurs within twelve (12) months following a Change of Control (as defined in the Employment Agreement), deemed achievement of all performance criteria at maximum levels, or (b) for all other such separations, deemed achievement of all performance criteria at the greater of (i) target levels, or (ii) the levels achieved as of the date of such Separation from Service, as determined by the Committee in its sole and good faith discretion. A determination as to whether and at what level(s) the performance criteria have been met shall be made by the Committee as soon as practicable following, as applicable, the close of the Performance Period or the Grantee’s Separation from Service, which determination shall be final and binding on all parties. The Company shall issue to the Grantee the applicable number of shares of Stock owed pursuant to this Section 4.2 with respect to vested RSUs within 60 days following the date of such determination by the Committee; provided, however, that in no event shall the determination by the Committee be made after the end of the calendar year following the calendar year in which the applicable Performance Period ends or Separation from Service occurs.

5.Forfeiture of Awards. In the event of the Grantee’s Separation from Service for any reason other than an involuntary Separation from Service by the Company without Cause or Separation from Service due to resignation by the Grantee for Good Reason as described in Sections 4.1 and 4.2, any unvested Awards held by the Grantee shall be automatically forfeited by the Grantee as of the date of such Separation from Service and all unvested shares of Restricted Stock shall be reacquired by the Company at no cost to the Company, automatically and immediately. Neither the Grantee nor any of the Grantee’s successors, heirs, assigns or personal representatives shall have any rights or interests in any Awards that are so forfeited.

6.Tax Withholding.

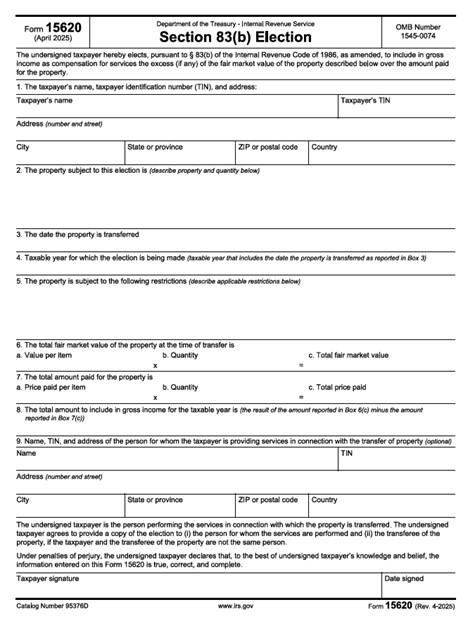

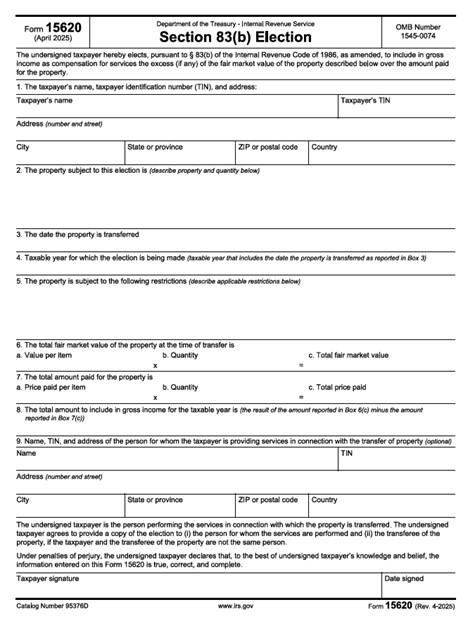

6.1At the time the Awards vest, in whole or in part, and at any time thereafter as requested by the Company, the Grantee hereby agrees to make adequate provision for (including by means of a “same day sale” pursuant to a program developed under Regulation T as promulgated by the Federal Reserve Board, to the extent permitted by the Company), any sums required to satisfy the federal, state, local and foreign tax withholding obligations of the Company or an Affiliate, if any, which arise in connection with the vesting and/or settlement of the Awards. For purposes of this Section 6, the shares of Restricted Stock shall be considered to be vested and settled in the tax year in which the Grantee makes a valid election with the Internal Revenue Service pursuant to Section 83(b) of the Code.

6.2In the event that the Grantee fails to make the adequate provisions contemplated by Section 6.1 above, then, subject to compliance with any applicable legal conditions or restrictions, the Company shall have the option in its sole discretion (but not the obligation) to withhold from fully vested Stock otherwise issuable to the Grantee upon the settlement of the Awards a number of whole shares of Stock having a Fair Market Value, determined by the Company as of the date of vesting or settlement (as applicable), not in excess of the amount of tax required to be withheld by law (or such lower amount as may be necessary to avoid classification of the Awards as a liability for financial accounting purposes).

6.3The Company assumes no responsibility for individual income taxes, penalties or interest related to grant, vesting or settlement of any Award. Neither the Company nor any Affiliate makes any representation or undertaking regarding the tax treatment in connection with the grant, vesting or settlement of the Awards. The Grantee acknowledges that the Company may be required to withhold federal, state and/or local taxes in connection with the grant, vesting, and/or settlement of the Awards. The Grantee further acknowledges that the Grantee has been informed that, with respect to the Restricted Stock, the Grantee may file an election with the Internal Revenue Service within 30 days following the Grant Date, electing pursuant to Section 83(b) of the Code to be taxed currently on any difference between the purchase price (if any) that the Grantee paid as consideration for the Restricted Stock and the fair market value of the shares of Restricted Stock. A form of election under Section 83(b) is attached hereto as Exhibit B for reference. The Grantee is strongly encouraged to seek the advice of the Grantee’s own tax consultants in connection with these Awards, including the advisability of filing the election under Section 83(b) of the Code.

7.Code Section 409A. It is the Company’s intent that payments under this Agreement shall be exempt from Section 409A of the Internal Revenue Code (“Section 409A”) to the extent applicable, and that this Agreement be administered accordingly. Notwithstanding anything to the contrary contained in this Agreement or the Employment Agreement, to the extent that any payment or benefit under this Agreement is determined by the Company to constitute “non-qualified deferred compensation” subject to Section 409A and is payable to the Grantee by reason of termination of the Grantee’s employment, then (a) such payment or benefit shall be made or provided to the Grantee only upon a Separation from Service and (b) if the Grantee is a “specified employee” (within the meaning of Section 409A and as determined by the Company), such payment or benefit (including the delivery of Stock) shall not be made or provided before the date that is six months and one day after the date of the Grantee’s separation from service (or earlier death). The Grantee hereby agrees that the Company does not have a duty to design or administer the Plan or its other compensation programs in a manner that minimizes the Grantee’s tax

liabilities. The Grantee will not make any claim against the Company, or any of its officers, directors, employees or Affiliates related to tax liabilities arising from the Awards or the Grantee’s other compensation.

8.Restrictive Covenants. As a condition to the grant of this Award, the Grantee agrees to comply in full with, and be subject to, all non-competition and non-solicitation (of customers and employees) obligations and Employer Information protections set forth in his Employment Agreement, which provisions are incorporated herein by reference. The Grantee further agrees to comply with all of the Company’s policies and procedures, as well as all applicable laws, for the protection of Employer Information. Any violation of these covenants shall entitle the Company to all remedies set forth in the Employment Agreement.

9.Restrictions Imposed by Law. Notwithstanding any other provision of this Agreement, the Grantee agrees that the Company will not be obligated to deliver any shares of Stock with respect to any Award if counsel to the Company determines that such exercise, delivery or payment would violate any law or regulation of any governmental authority or any agreement between the Company and any national securities exchange upon which the Stock is listed.

10.No Shareholder Status; No Dividends.

10.1Restricted Stock. With respect to each share of Restricted Stock issued pursuant to this Agreement, the Grantee shall have all of the rights of a shareholder of the Company, including the right to vote the Restricted Stock and the right to receive dividends thereon; provided, however, that any such dividends shall be held by the Company and distributed to the Grantee only if and to the extent that the underlying Restricted Stock as to which such dividend applies vests. Any such dividend shall be paid to the Grantee promptly following such vesting date (in all events, within 30 days).

10.2RSUs. The Grantee shall have no rights as a shareholder with respect to any RSUs granted pursuant to this Agreement or shares of Stock that may become issuable upon vesting of RSUs until such shares have been duly issued and delivered to the Grantee. No adjustment shall be made for dividends of any kind or description whatsoever or for distributions of other rights of any kind or description whatsoever respecting the shares prior to such issuance. The Grantee shall have no Dividend Equivalent rights hereunder with respect to RSUs.

11.Modification, Amendment, and Cancellation. The Committee or Board of Directors of the Company shall have the right unilaterally to modify, amend or cancel these Awards and this Agreement in accordance with the terms of the Plan. These Awards shall be subject to adjustment for changes in the Company’s capitalization as provided in the Plan.

12.Provisions Consistent with Plan. This Agreement is intended to be construed to be consistent with, and is subject to, all applicable provisions of the Plan, and the Plan is incorporated herein by reference. In the event of a conflict between the provisions of this Agreement and the Plan, the provisions of the Plan shall prevail.

13.Clawback. By accepting the Awards made under this Agreement, the Grantee agrees that the Company may recover some or all of the Stock transferred to the Grantee under this Agreement, or recoup some or all of the value thereof via offset from other amounts owed to the Grantee by the Company or its Affiliate(s), at any time prior to December 31, 2033, if and to the extent that the Committee concludes that (a) federal or state law or the listing requirements of the exchange on which the Company’s Stock is listed for trading so require, (b) the performance criteria required herein were not met, or not met to the extent necessary to support delivery of the same number of shares, (c) as required by Section 304 of the Sarbanes-Oxley Act of 2002, after a restatement of the Company’s financial results as reported to the United States Securities and Exchange Commission, or (d) to the extent provided by the clawback or recoupment provisions set forth in his Employment Agreement. The Grantee agrees to promptly comply with any Company demand for recovery or recoupment.

14.Employment Rights. Nothing in this Agreement will confer upon the Grantee any right to continued employment with the Company or its Affiliates or affect the right of the Company to terminate the employment of the Grantee at any time for any reason.

15.Governing Law. This Agreements and the Awards issued hereunder shall be construed, administered, and enforced according to the laws of the State of Wisconsin, without giving effect to principals of conflicts of laws, and applicable provisions of federal law.

NICOLET BANKSHARES, INC.

By: ________________________________

Its: ________________________________

Date: ________________________________

GRANTEE

__________________________________________

Signature

Date: _____________________________________

EXHIBIT A

RSU VESTING AND PERFORMANCE CONDITIONS

Fifty percent (50%) of the RSUs granted pursuant to this Agreement are subject to ROAA-based vesting, and fifty percent (50%) are subject to cumulative EPS-based vesting, both measured as of December 31, 2030:

Return on Average Assets (ROAA) Based Vesting: | | | | | | | | | | | | | | |

| Below Minimum | Minimum | Target | Maximum |

| Peer Bank Average ROAA Percentile | Less than 60th | 60th | 70th | 80th or greater |

| RSUs Vested | 0 | 7,500 | 15,000 | 30,000 |

When such determination is at a level between Minimum and Target or between Target and Maximum, the Committee shall interpolate to determine the applicable vesting percentage.

Cumulative Earnings Per Share (EPS) Based Vesting: | | | | | | | | | | | | | | |

| Below Minimum | Minimum | Target | Maximum |

| Cumulative 5-Year EPS | Less than $45 | $45 | $50 | $60 or greater |

| RSUs Vested | 0 | 7,500 | 15,000 | 30,000 |

When such determination is at a level between Minimum and Target or between Target and Maximum, the Committee shall interpolate to determine the applicable vesting percentage. If the number of shares of the Company’s outstanding Stock changes during the Performance Period as a result of a Stock dividend or split, the cumulative EPS targets will be adjusted to the same extent and in the same fashion as GAAP requires EPS measures to be adjusted.

Definitions: For the purposes of this Award:

“Cumulative Five-Year EPS” means the cumulative total of the Company’s EPS for each of the years in the Performance Period.

“Earnings Per Share” or “EPS” means the diluted earnings per share of the Company as determined for financial reporting purposes consistent with ASC 260, excluding any acquisition costs and restructuring adjustments based on EPS as a result of a business combination that occurs during the Performance Period in accordance with ASC 805.

“Peer Bank” means the group of exchange-traded depository institutions and their holding companies headquartered in the United States with greater than $1 billion in assets.

“Peer Bank Average ROAA Percentile” means the percentile ranking of the Company’s ROAA for the years in the Performance Period compared to the simple average ROAAs of the Peer Banks for the years in the Performance Period, as measured and published by S&P Global Market Intelligence or its successor. If there is a change or extraordinary event that materially affects a Peer Bank during the Performance Period (e.g., a sale, liquidation, or acquisition), the Committee shall make such equitable adjustments to the Peer Bank group and Peer Bank Average ROAA Percentile as it determines, in its sole and good faith discretion, is necessary or advisable to carry out the original intent of the performance criteria.

“Performance Period” means the period commencing January 1, 2026 and ending December 31, 2030.

“ROAA” or “Return on Assets” means the Company’s (or Peer Bank’s) net income (in the case of the Company, determined in a manner consistent with the definition of EPS above) divided by average assets for a year, with average assets determined based on assets as of the same reporting periods for the Company as is used in determining average assets in S&P Global Market Intelligence’s rankings each year.

EXHIBIT B