Please wait

0001178670DEF 14AFALSEiso4217:USD00011786702024-01-012024-12-31000117867012024-01-012024-12-31000117867022024-01-012024-12-31000117867032024-01-012024-12-31000117867042024-01-012024-12-3100011786702023-01-012023-12-3100011786702022-01-012022-12-3100011786702021-01-012021-12-3100011786702020-01-012020-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001178670ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001178670ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001178670ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001178670ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Alnylam Pharmaceuticals, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

March 24, 2025

To our Stockholders:

We invite you to attend the 2025 Annual Meeting of Stockholders of Alnylam Pharmaceuticals, Inc., which will be held online on Thursday, May 8, 2025, beginning at 8:30 a.m., Eastern Time. You may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/ALNY2025, where you will be able to vote electronically and submit questions. You will need the 16-digit control number included with these proxy materials to attend the annual meeting.

The following notice of our annual meeting of stockholders contains details of the business to be conducted at the meeting. Only stockholders of record at the close of business on March 10, 2025 will be entitled to notice of, and to vote at, the annual meeting.

On behalf of our Board of Directors, thank you for your continued support of Alnylam.

Very truly yours,

YVONNE L. GREENSTREET, M.D.

Chief Executive Officer and Director

On behalf of the Board of Directors of Alnylam Pharmaceuticals, Inc.

| | | | | | | | |

| | Notice of 2025 Annual Meeting of Stockholders |

| |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Items of Business | | | Date and Time Thursday, May 8, 2025 | 8:30 a.m., Eastern Time Location Online at www.virtualshareholdermeeting.com/ALNY2025 To participate in the annual meeting virtually via the Internet, please visit www.virtualshareholdermeeting.com/ALNY2025. You will need the 16-digit control number included on your proxy card or the instructions that accompanied your proxy materials. Stockholders will be able to vote and submit questions during the annual meeting. Record Date March 10, 2025. Only Alnylam stockholders of record at the close of business on the record date for the annual meeting are entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement thereof. You will not be able to attend the annual meeting in person. |

| 1 | | To elect four (4) members to our board of directors, as nominated by our board of directors, each to serve as a Class III director for a term ending in 2028, or until a successor has been duly elected and qualified; | | |

| | | | | |

| | | | | |

| 2 | | To approve an amendment to our Restated Certificate of Incorporation allowing for officer exculpation; | | |

| | | | | |

| | | | | |

| 3 | | To approve our Second Amended and Restated 2018 Stock Incentive Plan, to, among other things, increase the number of shares authorized for issuance thereunder by 7,000,000 shares; | | |

| | | | | |

| | | | | |

| 4 | | To approve, on a non-binding advisory basis, the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in this proxy statement; | | |

| | | | | |

| | | | | |

| 5 | | To ratify the appointment of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2025; and | | |

| | | | | |

| | | | | |

| 6 | | To transact any other business that may properly come before the annual meeting or any adjournment or postponement thereof. | | |

| | | | | | |

Voting

Proposal 1 relates solely to the election of four (4) Class III directors nominated by our board of directors and does not include any other matters relating to the election of directors, including without limitation, the election of directors nominated by any stockholder of the company.

Your vote is important regardless of the number of shares you own. Whether or not you plan to participate in the annual meeting online, we hope you will take the time to vote your shares. To ensure your representation at the annual meeting, if you are a stockholder of record, please vote in one of these three ways:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Vote Over the Internet by going to www.proxyvote.com and entering the 16-digit control number provided on your proxy card or voting instruction form. | | | Vote by Telephone by calling 1-800-690-6903 or the number on your proxy card or voting instruction form. You will need the 16-digit control number provided on your proxy card or voting instruction form. | | | Vote by Mail if you received printed proxy materials, by completing, signing and dating the proxy card or voting instruction form and mailing it in the accompanying pre-addressed envelope. If you vote over the Internet or by telephone, please do not mail your proxy. |

If you choose to vote your shares by mail or by telephone or Internet in advance of the meeting, your vote must be received by 11:59 p.m., Eastern Time on May 7, 2025 to be counted.

If you vote via the Internet or by telephone in advance of the meeting or if you mail your proxy in, you will not limit your right to vote online at the annual meeting. If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

Notice of 2025 Annual Meeting of Stockholders

| | | | | | | | | | | | | | |

By Order of the Board of Directors, Robert W. Hesslein Executive Vice President, Chief Legal Officer and Secretary Cambridge, Massachusetts March 24, 2025 | | | | |

| | IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 8, 2025 This Notice of 2025 Annual Meeting, Proxy Statement, 2024 Annual Report on Form 10-K and Annual Report to Stockholders are available for viewing, printing and downloading at www.proxyvote.com. | |

| | | |

| |

Notice of 2025 Annual Meeting of Stockholders

Cautionary Note Regarding Forward-Looking Statements

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical statements of fact regarding Alnylam’s expectations, beliefs, goals, plans or prospects including, without limitation, statements regarding Alnylam’s expectations with respect to its “Alnylam P5x25” goals; the company’s projected commercial and financial performance; the anticipated timelines and progress with respect to the company’s environmental sustainability, corporate responsibility and environmental, social and governance initiatives; the company’s commitments and progress pursuant to its Patient Access Philosophy; and the company’s plans with respect to stockholder engagement, should be considered forward-looking statements. Actual results and future plans may differ materially from those indicated by these forward-looking statements as a result of various important risks, uncertainties and other factors, including, without limitation, risks and uncertainties relating to: Alnylam’s ability to successfully execute on its “Alnylam P5x25” strategy; Alnylam’s ability to discover and develop novel drug candidates and delivery approaches and successfully demonstrate the efficacy and safety of its product candidates; the pre-clinical and clinical results for Alnylam’s product candidates, including vutrisiran, zilebesiran, nucresiran and mivelsiran; actions or advice of regulatory agencies and Alnylam’s ability to obtain and maintain regulatory approval for its product candidates, as well as favorable pricing and reimbursement; successfully launching, marketing and selling Alnylam’s approved products globally; delays, interruptions or failures in the manufacture and supply of Alnylam’s product candidates or its marketed products; obtaining, maintaining and protecting intellectual property; Alnylam’s ability to successfully expand the approved indications for AMVUTTRA in the future; Alnylam’s ability to manage its growth and operating expenses through disciplined investment in operations and its ability to achieve a self-sustainable financial profile; Alnylam’s ability to maintain strategic business collaborations; Alnylam’s dependence on third parties for the development and commercialization of certain products; the outcome of litigation; the risk of government investigations; and unexpected expenditures; as well as those risks and uncertainties more fully discussed in the “Risk Factors” filed with Alnylam’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, or SEC, on February 13, 2025, as may be updated from time to time in other filings that Alnylam makes with the SEC. In addition, any forward-looking statements represent Alnylam’s views only as of the date of this proxy statement and should not be relied upon as representing its views as of any subsequent date. Alnylam explicitly disclaims any obligation, except to the extent required by law, to update any forward-looking statements.

This summary highlights important information you will find in this proxy statement. As it is only a summary, please review the complete proxy statement before you vote.

Virtual Annual Meeting Information

| | | | | |

| |

Date: | Thursday, May 8, 2025 |

| |

| |

| Time: | 8:30 a.m., Eastern Time |

| |

| Online at www.virtualshareholdermeeting.com/ALNY2025

You will not be able to attend the annual meeting in person. |

| Location: |

|

| |

| Record Date: | March 10, 2025 |

| |

Voting Items and Board Recommendations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Election of Four (4) Class III Directors | | | | Approval of Charter Amendment Allowing for Officer Exculpation | | | | Approval of Second Amended and Restated 2018 Stock Incentive Plan | | | | Say-on-Pay—Advisory Vote on Approval of Executive Compensation | | | | Ratification of Independent Auditors | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | FOR ALL NOMINEES | | | | | FOR | | | | | FOR | | | | | FOR | | | | | FOR | |

| | | | | | | | | | | | | | | | | | | | | | | |

All proxies will be voted in accordance with the instructions contained in those proxies. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. On any other matters properly brought before the annual meeting, the named proxies may vote in accordance with their best judgment.

How to Vote

| | | | | | | | | | | |

| Vote Right Away Through Advance Voting Methods | Vote During Meeting |

| | | |

Vote by Internet Using Your Computer Go to www.proxyvote. com and enter the 16-digit control number provided on your proxy card or voting instruction form. | Vote by Telephone Call 1-800-690-6903 or the number on your proxy card or voting instruction form. You will need the 16-digit control number provided on your proxy card or voting instruction form. | Vote by Mail If you received printed proxy materials, complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope. | Vote During the Meeting See “Important Information About the Annual Meeting and Voting – Voting” for details on how to vote during the Annual Meeting. |

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 8, 2025

We are furnishing proxy materials to our stockholders primarily via the Internet. On or about March 26, 2025, we will mail to our stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including this proxy statement, our 2024 Annual Report on Form 10-K and our Annual Report to Stockholders. The Notice of Internet Availability also instructs you on how to submit your proxy or voting instructions through the Internet or to request a paper copy of our proxy materials, including a proxy card or voting instruction form that includes instructions on how to submit your proxy or voting instructions by mail or telephone. Other stockholders, in accordance with their prior requests, have received email access to our proxy materials and instructions to submit their vote via the Internet, or have been mailed paper copies of our proxy materials and a proxy card or voting instruction form.

This proxy statement, our 2024 Annual Report on Form 10-K and our Annual Report to Stockholders are available for viewing, printing and downloading at www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as filed with the SEC on February 13, 2025, will be furnished without charge to any stockholder upon written request to Alnylam Pharmaceuticals, Inc., 675 West Kendall Street, Henri A. Termeer Square, Cambridge, Massachusetts 02142, Attention: Investor Relations and Corporate Communications.

This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 are also available on the SEC’s website at www.sec.gov.

General

We believe that good corporate governance is important to ensure that Alnylam is managed for the long-term benefit of our stockholders. This section describes key corporate governance practices that we have adopted.

Corporate Governance Strengths

We are committed to exercising good corporate governance practices. We believe that good governance promotes the long-term interests of our stockholders and strengthens the accountability of our board of directors, or our board, and management. Our corporate governance practices are primarily designed to:

Corporate Governance Materials

Our board has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of Alnylam and our stockholders. These guidelines provide a framework for the conduct of business of our board.

The board has also adopted a code of business conduct and ethics, which applies to all of our officers, directors and employees, and has adopted charters for our audit committee, our people, culture and compensation committee (sometimes referred to in this proxy statement as our PC&C committee), our nominating and corporate governance committee, and our science and technology committee.

We have posted copies of these documents on the Corporate Governance page of the Investors section of our website, www.alnylam.com. We intend to disclose on our website any amendments to, or waivers from, our code of business conduct and ethics required to be disclosed by law or Nasdaq Global Select Market listing standards. Information appearing on our website is not a part of and is not incorporated into this proxy statement.

Policy Prohibiting Insider Trading and Related Procedures

We maintain an insider trading policy governing the purchase, sale and other dispositions of our securities that applies to all employees, directors, officers and other covered persons, as well as the company. We believe that our insider trading policy is reasonably designed to promote compliance with insider trading laws, rules and regulations, as well as applicable listing standards. A copy of our insider trading policy was filed as an exhibit to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Corporate Responsibility

Our culture is not one that accepts the status quo. Instead, we thrive on the potential of what can be. Alnylam employees seize the moment, cultivating opportunities to drive innovation forward in ways that shape the future. So too, our approach to Corporate Responsibility, or CR, is driven by our passion for taking courageous action to Improve the Health of Humanity.

This “Challenge Accepted” approach is rooted in our responsibility to be an ethical, values-based corporate citizen. It informs our business strategy and guides our ongoing work of tackling complex challenges and using our business as a force for good. Alnylam operates across six interrelated pillars that are key to our everyday operations and external impact: Patients, Science, Employees, Communities, Planet, and Governance.

| | | | | | | | | | | |

| | | |

| CORPORATE RESPONSIBILITY PILLARS |

Patients We strive to improve patients’ lives and enable access to potentially life-changing treatments. Science We advocate for science and innovation to address critical health and social issues. Employees We foster a culture in which employees feel included, supported, and heard. Communities We actively engage people in tackling the world’s most pressing community and health equity challenges. Planet We seek to improve the health and sustainability of our planet. Governance We set high standards for our employees and partners. | |

| | | |

|

Governance

Our board sets the tone for governance across our company. Our nominating and corporate governance committee provides direct oversight of, and engagement with, our CR and environmental, social and governance, or ESG, related matters. Our executive leadership team is also directly involved in CR through focus-area-specific teams that advance our work on a regular basis.

We have a CR Steering Committee structure that aligns key working groups for each of our CR pillars. Each pillar’s working group is led by a chair or chairs who are also members of the CR Steering Committee and key leaders from various company areas whose responsibilities align with each pillar. These individuals oversee, develop strategy for, and review reporting and key performance indicators surrounding, their individual pillars. By utilizing a cross-functional, team-based approach to CR, we continuously seek to integrate these strategies into our existing business initiatives.

Our work in CR aligns directly with our Alnylam P5x25 strategy. As we aim to become a top-tier biotech by the end of 2025, our expectations in CR and sustainability grow simultaneously. During 2024, we continued to invest in programs that meet the expectations of our stakeholders, the demands of the global regulatory environment, and the high threshold of integrity expected from our industry globally.

| | | | | | | | |

| | |

| CONTINUED INVESTMENT IN ESG AND CORPORATE RESPONSIBILITY ▪Annually, we publish a CR report that includes information regarding both ESG and CR at Alnylam. Our reporting is aligned with the most applicable global CR and ESG reporting frameworks, including the Sustainability Accounting Standards Board’s Biotechnology & Pharmaceuticals Standard and the Global Reporting Initiative Standard: Core Option Framework. ▪In 2025, we will share for the first time in our CR Report a complete greenhouse gas emissions footprint that includes Scope 1, 2, and 3 data, verified by an external third party. We continue to share data related to water and waste across our footprint. Transparency with this important environmental data drives our teams internally to pursue advancements in data management and appropriate target-setting measures globally, with a goal to align in 2026 with the requirements of compliance reporting under the Corporate Sustainability Reporting Directive, or CSRD, in the European Union. ▪In preparation for ongoing compliance and regulatory requirements in CR and ESG topics globally, in 2024 we launched an ESG Regulatory Working Group. Comprised of members of Alnylam’s legal, compliance, finance and ESG teams, the group will monitor global compliance-related requirements and ensure our reporting, materiality assessments and business initiatives align with global expectations from stakeholders. We anticipate the release of our first CSRD-compliant report in 2026. ▪We continue to evolve and expand our Alnylam Challengers Signature Social Impact Program and align community programming to our health equity principles globally. | |

| | |

|

Patient Access

Our Patient Access Philosophy was established in 2017 before we had launched our first commercial medicine. Our original philosophy was rooted in a belief that remains foundational to this day: for patients and society to benefit from our scientific breakthroughs, our therapeutics must reach the people who need them. The original philosophy had three sections: help patients, deliver value to payors and physicians, and be proactive and accountable. These tenets continue to underpin our drive to deliver sustainable value, significant impact, and better outcomes.

In 2024, we revisited the promises of our Patient Access Philosophy during a year in which we took significant steps toward transforming the lives of patients worldwide with the strong results of the HELIOS-B phase 3 clinical trial of vutrisiran for the treatment of ATTR amyloidosis with cardiomyopathy. Our goals in this process were to ensure an up-to-date perspective on our approach to patient access and to support affordability, expand the scope to serve our rapidly growing footprint, and reflect our proactive, collaborative approach to integrated access alongside all stakeholders in the patient journey. Alnylam Assist® provides personalized services to help patients understand insurance coverage, inform patients of options and eligibility for financial support, provide materials to start conversations with physicians and family members, and share information on patient advocacy organizations and other resources.

In 2024, we re-launched our Patient Access Philosophy to assert our belief in the value a global, independent biotechnology company can bring to the face of medicine and to model behavior for the good of science, patients, and society. Our Patient Access Philosophy includes the following commitments:

▪It is our responsibility to push the boundaries of discovery, development, and delivery to fuel significant, sustainable patient impact.

▪Together with partners in the healthcare ecosystem, we can reduce barriers to improve outcomes for all, and most importantly for the patient.

▪Our Patient Access Philosophy defines our role in a patient’s journey to innovative therapeutic options and holds us accountable to progress.

| | | | | | | | | | | | | | | | | |

| | | | | |

| 2024 PATIENT ACCESS HIGHLIGHTS | | | | |

| | | | | |

| 97% of U.S. residents with confirmed access to our therapies across commercial, Medicare, Medicaid, and other government payer categories | 860 patients worldwide receiving our therapies under Compassionate Use and early access | $0 Out-of-Pocket costs for a majority of patients | |

| | | | | |

| | | | | |

| 89% of countries in the European Union with access to our therapies | 2000+ U.S. patients enrolled in Alnylam Assist® | |

| | | | | |

|

Employee Talent

We are proud of our workforce and strive to create a culture in which everyone feels they belong and are empowered to achieve their full potential. As a leading biotechnology company, it is imperative that our R&D processes, clinical trials and patient advocacy efforts include representation from diverse populations who need access to our medicines. Our team members understand that the tenets of diversity and inclusion are a key part of our success as a company. It is essential that our team members feel a strong sense of community and belonging, and that they feel empowered by their work at Alnylam in meeting their personal and professional goals. We plan to continue to share highlights of employee accomplishments in our Annual Corporate Responsibility Report.

In 2024:

| | | | | | | | |

| | |

| ▪We continued positive results in our 2024 Culture Survey. Notably, 95% of employees are considered highly or moderately engaged, 93% of employees believe Alnylam is dedicated to the service of patients in need. ▪We joined the Veterans in Business Network to increase our spending with Veteran and Service-Disabled Veteran-Owned Enterprises. ▪We were named to Boston Globe’s “Top Places to Work” for the 10th year in a row. ▪We were named to Newsweek’s “Most Responsible Companies” for the 3rd year in a row. | |

| | |

|

Global Employee Snapshot as of December 31, 2024

ALNYLAM EMPLOYEES

1,758

Total U.S. employees

Environmental Sustainability

We recognize that the health of the global population is inextricably linked to the health of our planet. We believe it is essential to minimize our impact on the environment, and we work to address the growing threat of climate change globally, and our knowledge related to our environmental footprint continues to expand. We consistently work to enhance our data collection and monitoring processes, and seek out opportunities to reduce our environmental footprint, further integrating our commitment to environmental excellence into our global focus on transforming lives and improving the health of humanity.

In 2021, we began to monitor and report on Scopes 1 and 2 and select Scope 3 greenhouse gas emissions. In 2024, we added additional Scope 3 emissions categories to broaden the picture of our environmental footprint in preparation for developing pragmatic targets and meeting the requirements of CSRD and other regulatory requirements and reporting frameworks.

In 2024, we also continued to refine these processes and to decrease our environmental impact by:

| | | | | | | | |

| | |

| ▪Continuing to complete annual emissions and waste inventories and report on them in our annual CR Report, including third-party verification of emissions data. ▪Successful completion of a comprehensive water risk assessment for our global sites. ▪Investments in new green power purchase plans, with both our Norton and Alewife manufacturing facilities now powered by renewable energy. | |

| | |

|

Cybersecurity and Data Privacy

Our nominating and corporate governance committee assists our board in fulfilling its oversight responsibilities with respect to the management of risks associated with cybersecurity and data privacy. We have in place a cross-functional, enterprise-wide cybersecurity program that is integrated into our overall risk management process and strategy. As part of this program, we conduct continuous monitoring for anomalous behavior using a third-party security operations center. In addition, we engage a third party to conduct an annual independent cybersecurity program assessment to enhance our information security in alignment with leading practices, the constantly evolving cyber-risk landscape and applicable business considerations. By continuously assessing the cybersecurity landscape, we develop targeted strategies that identify and address the risks most likely to impact our company. We apply a global approach and seek to comply with the strictest data privacy standards in every country in which we operate to ensure we handle our patients’ personal data with integrity.

Guided by our nominating and corporate governance committee, we continue to invest in cybersecurity and data privacy resources. In 2024, we:

| | | | | | | | |

| | |

| ▪Maintained a dedicated data governance committee, or DGC, comprised of leaders from our information security, technology and intellectual property groups. The DGC has established policies and procedures regarding data collection, retention, storage, and destruction that will be implemented across all of our business units in 2025; ▪The DGC recognized the growth of generative artificial intelligence, or AI, and large language models, or LLMs, as business tools, and created a set of global guidelines to understand and evaluate AI and LLM technologies and explore their use across our organization. These guidelines encourage employees to consider confidentiality, personal data, intellectual property, and other considerations in using these technologies; and ▪Continued to implement our “Privacy By Design” process globally, embedding our commitment to privacy into business processes and ensuring our technology enables privacy and data protection for employees, patients and partners. | |

| | |

|

For additional information please view our Corporate Responsibility website and our Annual Corporate Responsibility Report, published in May each year.

| | | | | | | | |

| | |

PROPOSAL 1 | |

| | |

| | |

Information Concerning Director Nominees – Election of Class III Directors |

Alnylam has led the translation of RNA interference, or RNAi, into a whole new class of innovative medicines for people afflicted with rare and prevalent diseases with unmet need. Based on Nobel Prize-winning science, RNAi therapeutics represent a powerful, clinically validated approach that has yielded transformative medicines. Since our founding in 2002, Alnylam has led the RNAi revolution and continues to deliver on a bold vision to turn scientific possibility into reality. Our commercial RNAi therapeutic products are ONPATTRO® (patisiran), AMVUTTRA® (vutrisiran), GIVLAARI® (givosiran), OXLUMO® (lumasiran), and Leqvio® (inclisiran), which is being developed and commercialized by our partner, Novartis. We also have a deep pipeline of investigational medicines, including multiple product candidates that are in late-stage development.

We have three classes of directors: Class I, Class II and Class III. At each annual meeting, directors are elected for a term of three years to succeed those whose terms are expiring. The directors are divided as equally as possible among the three classes, and the terms of the three classes are staggered so that only one class is elected by stockholders annually. There are currently four members in each of Class I, II and III.

In March 2025, Dr. Phillip A. Sharp announced his intention to retire from our board of directors, effective as of May 8, 2025. Dr. Sharp is a scientific founder of Alnylam and Nobel Prize recipient, and was most recently elected to our board of directors in June 2023 and serves as a Class I director.

At the annual meeting, we are proposing the election of four (4) Class III directors to hold office until the annual meeting of stockholders to be held in 2028, or until their respective successors have been duly elected and qualified. Upon the recommendation of our nominating and corporate governance committee, our board has nominated Carolyn R. Bertozzi, Ph.D., Margaret A. Hamburg, M.D., Colleen F. Reitan and Amy W. Schulman for election to the board of directors as Class III directors. Each of Drs. Bertozzi and Hamburg and Mses. Reitan and Schulman is currently serving as a Class III director. Dr. Bertozzi has served as a director since January 2023, Dr. Hamburg has served as a director since January 2019, Ms. Reitan has served as a director since June 2018 and Ms. Schulman has served as a director since July 2014. The persons named in the enclosed proxy will vote to elect each nominee as a Class III director unless the proxy is marked otherwise. Drs. Bertozzi and Hamburg and Mses. Reitan and Schulman have indicated their willingness to serve on our board, but if any nominee should be unwilling or unable to serve, the person acting under the proxy may vote the proxy for a substitute nominee designated by our board, unless the board reduces the number of directors accordingly.

Each nominee for Class III director will be elected to serve on our board if the number of shares voted “For” that nominee exceeds the number of shares voted “Against” that nominee. As described more fully below under the heading “Majority Voting Policy,” we have adopted a resignation policy in the event a director nominee does not receive a majority of such votes. Abstentions and broker non-votes, if any, are not counted for purposes of this proposal.

| | | | | | | | |

| | |

BOARD RECOMMENDATION Our board of directors unanimously recommends a vote FOR the election of each of Drs. Bertozzi and Hamburg and Mses. Reitan and Schulman as a Class III director. | |

| | |

Set forth below for each continuing director, including the Class III director nominees, is information as of March 1, 2025 with respect to his or her (a) name and age, (b) positions and offices at Alnylam, if any, (c) principal occupation and business experience during at least the past five years, (d) directorships, if any, of other publicly-held companies, held currently or during the past five years, and (e) the year such person became a member of our board of directors. We have also included information below regarding each continuing director’s specific experience, qualifications, attributes, and skills that led the nominating and corporate governance committee and our board of directors to the conclusion that he or she should serve as a director in light of our business and structure. Our board has determined that each director

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

serving on our board of directors, with the exception of our chief executive officer, or CEO, Dr. Greenstreet, and our former executive chair, Mr. Bonney, are independent within the meaning of the director independence standards of the Nasdaq Global Select Market and the Securities Exchange Act of 1934, as amended, or the Exchange Act. There are no family relationships among any of our directors or executive officers.

Class III—Directors/Nominees to be elected at the 2025 annual meeting (terms expiring in 2028)

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Dr. Bertozzi has served as the Anne T. and Robert M. Bass Professor of Chemistry at Stanford University since 2015 and as the Baker Family Director of Stanford’s Sarafan ChEM-H Institute since 2021. Since 2000, Dr. Bertozzi has also served as an Investigator at the Howard Hughes Medical Institute. From 1996 to 2015, she was a professor of Chemistry and Molecular and Cell Biology at the University of California, Berkeley. Dr. Bertozzi was jointly awarded the 2022 Nobel Prize in Chemistry and the 2022 Wolf Prize in Chemistry. She is a member of the National Academy of Sciences, the National Academy of Medicine and National Academy of Inventors, as well as the Royal Society (UK), Accademia Nazionale dei Lincei and the German Academy of Sciences Leopoldina. Dr. Bertozzi also serves as a director of OmniAb, Inc. and previously served as a director of Eli Lilly and Company. KEY CONTRIBUTIONS TO THE BOARD Dr. Bertozzi is a pioneer for emerging technology and has founded several biopharmaceutical companies and guided more than a dozen academic and professional organizations and life sciences companies in leadership and board positions. Her deep technical and leadership expertise, as well as her corporate governance experience in the biopharmaceutical industry, enables her to make significant contributions to our board, and nominating and corporate governance and science and technology committees, on which she serves, as we expand our early stage clinical pipeline, advance our late stage clinical programs towards commercialization, and further strengthen our global commercial operations. |

|

Carolyn R. Bertozzi, Ph.D. INDEPENDENT DIRECTOR Director since: 2023 Age: 58 Committees: ▪Nominating and Corporate Governance Committee ▪Science and Technology Committee |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Dr. Hamburg currently serves as Co-President (volunteer) of the InterAcademy Partnership. From May 2009 to April 2015, Dr. Hamburg served as the Commissioner of the U.S. Food and Drug Administration (FDA). Most recently, Dr. Hamburg was Interim Vice President, Global Biological Policy and Programs at the Nuclear Threat Initiative. Dr. Hamburg completed a five-year term as Foreign Secretary of the National Academy of Medicine, serving from April 2015 to July 2020, and completed her service as President/Chair of the Board of the American Association for the Advancement of Science (AAAS) in February 2020. From January 2001 to May 2009, Dr. Hamburg worked for the Nuclear Threat Initiative, first as Vice President for biological programs, then as Senior Scientist. From November 1997 to January 2001, Dr. Hamburg served as the Assistant Secretary for Planning and Evaluation in the Department of Health and Human Services. Prior to that, she was New York City’s health commissioner. Dr. Hamburg currently serves on a number of non-profit boards and advisory committees. She is also a Commissioner on the Bipartisan Commission on Biodefense and the Harvard Medical School Board of Fellows. She currently chairs the Boards of The Commonwealth Fund, Ending Pandemics and the Advisory Board for the Center on Regulatory Excellence, Duke-NUS School of Medicine in Singapore. Dr. Hamburg recently stepped down from positions as the Vice Chair of President Biden’s Intelligence Advisory Board and as a member of the Foreign Affairs Policy Board to the Secretary of State. KEY CONTRIBUTIONS TO THE BOARD Dr. Hamburg has an extensive background in matters of science, medicine, public health and regulatory issues, having held policy positions in the Biden, Obama, Clinton and Reagan administrations, including serving as the Commissioner of the FDA. She has performed basic and clinical research at the National Institutes of Health and Rockefeller University. Dr. Hamburg’s distinguished career and expertise in the field brings a unique regulatory and policy perspective, as well as valuable scientific and operational expertise, to our board and our nominating and corporate governance committee as we initiate additional clinical trials, expand our portfolio of marketed products, advance our robust clinical pipeline towards commercialization, and further strengthen our global commercial infrastructure. |

|

Margaret A. Hamburg, M.D. INDEPENDENT DIRECTOR Director since: 2019 Age: 69 Committees: ▪Nominating and Corporate Governance Committee |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Ms. Reitan served as President of Plan Operations of Health Care Service Corporation, or HCSC, the largest customer-owned health insurer in the United States and an independent licensee of Blue Cross and Blue Shield Association, from October 2015 to April 2018. She also served as the Chief Operating Officer of HCSC from January 2009 to January 2015. Previously, Ms. Reitan served as President and Chief Operating Officer of Blue Cross Blue Shield of Minnesota from 2006 to 2008. Ms. Reitan also serves as a director of Myriad Genetics, Inc. KEY CONTRIBUTIONS TO THE BOARD Ms. Reitan brings to our board over 30 years of experience in the healthcare payor and reimbursement market, including most recently as President of Plan Operations of HCSC. Ms. Reitan’s experience with provider network management, strategic planning and business development provide valuable insight to our board and management as we continue to navigate the increasingly complex healthcare payor and reimbursement market and to advance our ongoing commitment to provide innovative value-based agreements and deliver fair value to payors and providers. Ms. Reitan’s extensive background in business management also makes her an asset to our audit committee and our PC&C committee, which she chairs. |

|

Colleen F. Reitan INDEPENDENT DIRECTOR Director since: 2018 Age: 65 Committees: ▪Audit Committee ▪People, Culture and Compensation Committee (Chair) |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Ms. Schulman has served as a member of our board of directors since July 2014 and has served as chair of our board since January 2023. Prior to that, she served as our lead independent director from August 2021 to January 2023. Ms. Schulman joined Polaris Partners, a venture capital firm, in August 2014 where she is currently a managing partner. Ms. Schulman also serves as Executive Chair of Lyndra Therapeutics, Inc., a biotechnology company, where she was co-founder and served as the company’s initial Chief Executive Officer from 2015 to 2019. She also manages the LS Polaris Innovation Fund, which was formed in 2017. Ms. Schulman served as a senior lecturer at Harvard Business School from July 2014 to July 2021, and resumed this role in January 2025. Ms. Schulman was previously the Executive Vice President and General Counsel of Pfizer Inc., or Pfizer, a global pharmaceutical company, from May 2008 to July 2014, where she also served as the Business Unit Lead for Pfizer’s Consumer Healthcare business from 2012 to 2013. Before joining Pfizer, she was a partner at DLA Piper, a global law firm. Ms. Schulman also serves as a director of Fractyl Health, Inc. and previously served as a director of SQZ Biotech, Cyclerion Therapeutics, Inc., Hudson Executive Investment Corp. and Hudson Executive Investment Corp. II. KEY CONTRIBUTIONS TO THE BOARD Ms. Schulman’s extensive industry and leadership experience enable her to make significant contributions as chair of our board. Her unique qualifications in a number of critical areas, including commercial strategy and capability building, as well as legal, regulatory, and transactional considerations, bring to our board a diverse background. In addition, her experience at Pfizer as Executive Sponsor of Pfizer’s Global Women’s Council, where she helped shape efforts to increase diversity and expand opportunities for both women and men across the company, has been an important resource as we continue to grow our workforce to support the expansion of our portfolio of marketed products, advance our robust clinical pipeline towards commercialization, and further strengthen our global commercial infrastructure. This experience also provides a unique and critical perspective for Ms. Schulman in her role as a member of our nominating and corporate governance committee. |

|

Amy W. Schulman CHAIR OF THE BOARD Director since: 2014 Age: 64 Committees: ▪Nominating and Corporate Governance Committee |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

Class I—Directors Whose Terms Expire in 2026

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Mr. Bonney served as chair of our board from December 2015 to August 2021 and as executive chair of our board from August 2021 to January 2023. Mr. Bonney previously served as the chair of the board of directors of Kaleido Biosciences, Inc., a biotechnology company, from June 2017 until August 2021. Between August 2018 and October 2020, he served as Kaleido’s Executive Chair, and served as Kaleido’s Chief Executive Officer from June 2017 until August 2018. Mr. Bonney was a Partner at Third Rock Ventures, a healthcare venture firm, from January to July 2016. Mr. Bonney previously served as the Chief Executive Officer and a member of the board of directors of Cubist Pharmaceuticals, Inc., or Cubist, a biopharmaceutical company (now a wholly-owned subsidiary of Merck & Co., Inc.), from June 2003 until his retirement in December 2014. From January 2002 to June 2003, he served as Cubist’s President and Chief Operating Officer. Mr. Bonney currently serves as the chair of the board of directors of Autolus Therapeutics plc, a biopharmaceutical company, and previously served as the chair of the board of directors of Magenta Therapeutics, Inc. and as a director of Bristol-Myers Squibb Company, Syros Pharmaceuticals, Inc. and Sarepta Therapeutics, Inc. KEY CONTRIBUTIONS TO THE BOARD Mr. Bonney possesses over 30 years of operational, commercial and senior management experience in the biopharmaceutical industry, including his long tenure as the Chief Executive Officer and a director of Cubist. Mr. Bonney also has a keen understanding of the interplay between management and the board and is well-versed in the current best practices in corporate governance and ethics and compliance matters. His breadth of experience and deep commercial background enable him to make significant contributions to our board as we continue to enhance our ethics and compliance function, expand our portfolio of marketed products, advance our robust clinical pipeline towards commercialization, and further strengthen our global commercial infrastructure. |

|

Michael W. Bonney NON-INDEPENDENT DIRECTOR Director since: 2014 Age: 66 |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Dr. Greenstreet has served as our Chief Executive Officer since January 2022 and as a member of our board of directors since October 2021. Dr. Greenstreet previously served as our President and Chief Operating Officer since October 2020 and was our Chief Operating Officer from September 2016 to October 2020. Prior to joining Alnylam, Dr. Greenstreet served as the founder and Managing Director of Highgate LLC, from January 2014 to August 2016. Prior to that time, Dr. Greenstreet served as the Senior Vice President and Head of Medicines Development at Pfizer from December 2010 to November 2013. Prior to joining Pfizer, Dr. Greenstreet worked for 18 years at GlaxoSmithKline plc, a multinational pharmaceutical, biologics, vaccines and consumer healthcare company, where she served in various positions, most recently as Senior Vice President and Chief of Strategy for Research and Development and as a member of the Product Management Board. Dr. Greenstreet currently serves as a director of The American Funds and as a member of the Biotechnology Industry Organization Health Section Governing Board. Dr. Greenstreet previously served on the board of directors of argenx SE and Pacira BioSciences, Inc. KEY CONTRIBUTIONS TO THE BOARD Dr. Greenstreet has over 25 years of experience in the biopharmaceutical industry, driving strategy and innovation, bringing transformative medicines to patients, and building successful businesses in the U.S., Europe and globally. Dr. Greenstreet’s significant experience in senior management roles at large pharmaceutical companies and her extensive expertise in drug development and commercialization bring a valuable perspective to our board. In addition, Dr. Greenstreet’s in-depth knowledge of our company, gained during her various senior management roles within the company, uniquely enable her to lead our Alnylam P5x25 strategy, which focuses on our planned transition to a top-tier biotech company by the end of 2025. |

|

Yvonne L. Greenstreet M.D. CHIEF EXECUTIVE OFFICER AND NON-INDEPENDENT DIRECTOR Director since: 2021 Age: 62 |

| |

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Dr. Sigal served as Chief Scientific Officer of Bristol-Myers Squibb, or BMS, a global biopharmaceutical company, from October 2004 to June 2013 and as a member of the BMS board of directors from March 2011 to June 2013. Dr. Sigal joined BMS in 1997 and held positions of increasing responsibility in drug discovery and development and was a member of the executive committee from September 2001 through June 2013. Prior to BMS, Dr. Sigal was Vice President of R&D and Chief Executive Officer for the genomics firm Mercator Genetics Inc. He served as a senior advisor to the healthcare team of New Enterprise Associates, a venture capital firm, from 2014 to 2023. Dr. Sigal currently serves as co-chair of the Scientific Advisory Board for Amgen, Inc. Dr. Sigal also serves as director of Vir Biotechnology, Inc. and formerly served as a director of Adaptimmune Therapeutics plc and Surface Oncology Inc. KEY CONTRIBUTIONS TO THE BOARD Dr. Sigal possesses extensive experience in the biopharmaceutical industry, including decades of senior leadership and board experience at biopharmaceutical companies. Dr. Sigal’s experience bringing numerous medicines to market in multiple therapeutic areas, including cardiometabolic disease, infectious disease, inflammatory disease, neuroscience and oncology, brings valuable experience to our board and our science and technology and PC&C committees, on which he serves, as we accelerate growth in our early stage pipeline, advance our late stage clinical development pipeline towards commercialization, and further strengthen our global commercial infrastructure. |

|

Elliott Sigal, M.D., Ph.D. INDEPENDENT DIRECTOR Director since: 2022 Age: 73 Committees: ▪People, Culture and Compensation Committee ▪Science and Technology Committee |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

Class II—Directors Whose Terms Expire in 2027

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Dr. Ausiello serves as the Director of the Center for Assessment Technology and Continuous Health (CATCH), Jackson Distinguished Professor of Clinical Medicine at Harvard Medical School and Physician-in-Chief Emeritus at Massachusetts General Hospital, and served as the Chief of Medicine at Massachusetts General Hospital from 1996 to April 2013. Dr. Ausiello was the President of the Association of American Physicians in 2006. He is a member of the National Academy of Medicine and the American Academy of Arts and Sciences. He also serves as a director of Seres Therapeutics, Inc., Rani Therapeutics Holdings, Inc. and Spexis AG. KEY CONTRIBUTIONS TO THE BOARD Dr. Ausiello’s experience as a practicing physician, a scientist and a nationally recognized leader in academic medicine enables him to bring valuable insights to our board, particularly as we initiate additional clinical trials, accelerate growth in our early stage pipeline, advance our late stage clinical development pipeline towards commercialization, and further strengthen our global commercial infrastructure. In addition, Dr. Ausiello oversaw a large research portfolio and an extensive research and education budget at Massachusetts General Hospital for nearly 20 years, providing him with a valuable perspective on drug discovery and development. Through his previous work as the Chief of Medicine at Massachusetts General Hospital, Dr. Ausiello also brings significant leadership, oversight and finance experience to our board. |

|

Dennis A. Ausiello, M.D. INDEPENDENT DIRECTOR Director since: 2012 Age: 79 Committees: ▪Nominating and Corporate Governance Committee ▪Science and Technology Committee |

| |

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Dr. Brandicourt has served as a Senior Advisor at Blackstone, a leading global investment firm, since December 2019. From April 2015 to August 2019, Dr. Brandicourt served as Chief Executive Officer and a member of the board of directors of Sanofi, a global biopharmaceutical company. Prior to Sanofi, he was Chief Executive Officer and Chair of Bayer HealthCare AG, a global life sciences company, from November 2013 to March 2015. Between 2000 and 2013, Dr. Brandicourt served in various operational and managerial positions at Pfizer, including as a member of the Executive Leadership Team and President and General Manager of the Emerging Markets and Established Products business units, among other roles. Dr. Brandicourt also serves as a director of BeiGene, Ltd. and previously served as a director of BenevolentAI. KEY CONTRIBUTIONS TO THE BOARD Dr. Brandicourt has over 30 years of global commercial experience in the biopharmaceutical industry, including as a senior leader of three large pharmaceutical companies. Dr. Brandicourt’s operational, global commercial and senior management experience provides a valuable perspective to our board as we expand our portfolio of marketed products, advance our robust clinical pipeline towards commercialization, and further strengthen our global commercial infrastructure. Dr. Brandicourt’s extensive background in business management and global commercial operations also makes him an asset to our audit and PC&C committees, on which he serves. |

|

Olivier Brandicourt, M.D. INDEPENDENT DIRECTOR Director since: 2020 Age: 69 Committees: ▪People, Culture and Compensation Committee ▪Audit Committee |

| |

Proposal 1: Information Concerning Director Nominees – Election of Class III Directors

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Mr. Pyott served as the Chief Executive Officer of Allergan, Inc., or Allergan, a global specialty pharmaceutical and medical device company, from January 1998 to March 2015 and as the Chair of Allergan’s board of directors from March 2001 until March 2015. Prior to Allergan, Mr. Pyott served as the Head of the Nutrition Division at Novartis AG, a global healthcare company, and as a member of the Executive Committee of Switzerland-based Novartis AG. Mr. Pyott also serves as a director of BioMarin Pharmaceutical Inc. and Pliant Therapeutics, Inc. and as a member of the Supervisory Board of Royal Philips in the Netherlands. KEY CONTRIBUTIONS TO THE BOARD Mr. Pyott possesses over 30 years of operational, commercial and senior management experience, including his successful tenure as the Chief Executive Officer and Chair of the board of directors at Allergan, where he transformed the company from a small eye care business to a global specialty pharmaceutical and medical device company. His in-depth knowledge of pharmaceutical growth and commercial expansion, combined with his entrepreneurial leadership experience in the healthcare industry, position him well to serve as a member of our board and to make significant contributions as we expand our portfolio of marketed products, advance our robust clinical pipeline towards commercialization, and further strengthen our global commercial infrastructure. Mr. Pyott’s substantial public company governance experience from serving on the boards of several large public companies also makes him an asset to our board and to our nominating and corporate governance committee, which he chairs. |

|

David E.I. Pyott INDEPENDENT DIRECTOR Director since: 2015 Age: 71 Committees: ▪Nominating and Corporate Governance Committee (Chair) |

| |

| | | | | |

|

| |

| EXPERIENCE, EXPERTISE AND QUALIFICATIONS Mr. Kellogg served as Executive Vice President and Chief Corporate Strategy Officer of Celgene Corporation, or Celgene, a global biopharmaceutical company, from 2018 to 2019, and previously served as Executive Vice President and Chief Financial Officer of Celgene from 2014 to 2018. Prior to that, Mr. Kellogg was Chief Financial Officer and Executive Vice President of Merck & Co. Inc., a global biopharmaceutical company, from 2007 to 2014. From 2000 to 2007, Mr. Kellogg served as Executive Vice President, Finance and Chief Financial Officer at Biogen, Inc., a biotechnology company. Before that, he served as Senior Vice President, PepsiCo E-Commerce at PepsiCo Inc., a global food and beverage company, from March to July 2000 and as Senior Vice President and Chief Financial Officer, Frito-Lay International, a snack food manufacturer, from 1998 to 2000. Mr. Kellogg previously served as a director of Idorsia Ltd. KEY CONTRIBUTIONS TO THE BOARD Mr. Kellogg is a proven business, strategic and financial leader who brings to our board over 20 years of experience leading and scaling biotechnology companies and driving strategic transactions. Mr. Kellogg’s background includes executive management roles with responsibility for core financial functions, including investor relations, corporate strategy, business development and alliance management. Mr. Kellogg oversaw Biogen’s mergers with IDEC (Rituxan share) and Fumapharm (Tecfidera), Merck’s acquisition of Schering-Plough (Keytruda), and Celgene’s sale to Bristol-Myers Squibb. Mr. Kellogg’s financial expertise and experience in strategic transactions and organizational scaling will help advance our leading scientific capabilities and commercial performance as we advance our late stage clinical development pipeline and further strengthen our global commercial infrastructure, and position him well to serve as a member of our board and our audit committee, which he chairs. |

|

Peter N. Kellogg INDEPENDENT DIRECTOR Director since: 2023 Age: 68 Committees: ▪Audit Committee (Chair) |

| |

| | | | | | | | |

| | The Board of Directors and Its Committees |

| |

Board of Directors Meetings and Attendance

Our board met six times during 2024 either in person or by teleconference. During 2024, each of our directors attended at least 75% of the aggregate number of board meetings and meetings of the committees on which he or she then served.

Our directors are expected to participate in the virtual annual meeting of stockholders, unless they have a conflict that cannot be resolved. All of our then-current directors attended the 2024 annual meeting of stockholders.

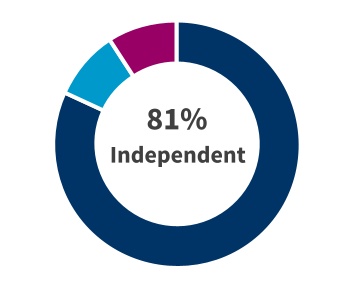

Board Determination of Independence

Under the Nasdaq listing standards, a director will qualify as an “independent director” if, in the opinion of our board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our board has determined that none of Mses. Reitan and Schulman, Drs. Ausiello, Bertozzi, Brandicourt, Hamburg, Sharp and Sigal, and Messrs. Pyott and Kellogg have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Nasdaq Rule 5605(a)(2). Mr. Bonney, who served as executive chair of our board from August 2021 to January 2023, and Dr. Greenstreet, our chief executive officer, are not considered “independent” directors. Our board of directors has determined that each member of our audit committee, PC&C committee and nominating and corporate governance committee is independent within the meaning of the applicable Nasdaq and SEC rules and regulations regarding “independence”. In making such determination, our board considered relationships, if any, that each non-employee director or family member of such director has with Alnylam, and other facts and circumstances our board deemed relevant in determining their independence.

Role of the Board

Our business is managed under the direction of the board of directors. Management has primary responsibility for the day-to-day operations and affairs of our company, and the role of our board is to provide independent oversight of management. In its oversight role, our board, as a whole and through its committees, is responsible for establishing broad corporate policies and reviewing our overall performance. Our board selects and provides for the succession of executive officers and, subject to stockholder election, directors. Our board also evaluates the performance of our chief executive officer, and, approves the compensation of our chief executive officer after considering the recommendations of our PC&C committee. Our board reviews and approves corporate objectives, strategies and annual investment plans, and evaluates significant policies and proposed major commitments of corporate resources. Our board also participates in decisions that have a potential major economic impact on our company. Management keeps our directors informed of company activity through regular communication, including written reports and presentations at board and committee meetings, as well as through regular informal updates between meetings with all or a subset of board members.

Board Leadership Structure

Our board has determined that the roles of chief executive officer and chair of our board of directors should be separated at the current time. Ms. Schulman, an independent director, has served as our chair since January 2023. Dr. Greenstreet has served as our chief executive officer and as a director since January 2022 and October 2021, respectively. Separating these positions allows our chief executive officer to focus on our day-to-day business operations, while allowing the chair to lead the board in its fundamental roles of providing both advice to and independent oversight of management. The board recognizes the time, effort and energy that is required of the chief executive officer to operate and manage the company, as well as the commitment required to serve as our chair, particularly as the board’s oversight responsibilities continue to grow. While our bylaws and corporate governance guidelines do not require that our chair and chief executive officer positions be separate, our board believes that our current leadership structure is appropriate because it provides an effective balance between strategy development and independent leadership and management oversight.

The Board of Directors and Its Committees

Rationale for Classified Board Structure

The time horizon required for successful development of therapeutics makes it vital that we have a board that understands the implications of this process and has the ability to develop and implement long-term strategies while benefiting from an in-depth knowledge of our business and operations. We believe that our classified board structure aligns with this long-term orientation and has enabled our board, which includes Nobel prize winners and members of the National Academy of Sciences, to provide educated and sophisticated oversight of management, which has enabled a track record of setting and exceeding five-year goals, and driven the creation of long-term stockholder value. In 2024, our nominating and corporate governance committee discussed the feedback received from stockholders on this topic and reviewed and discussed a detailed analysis of the costs and benefits of our classified board structure to facilitate the committee’s continued consideration of this feature of our governance. Following this review, at present, our board and nominating and corporate governance committee continue to believe that the classified board structure aligns with the company’s long-term orientation and enables the board to provide appropriate and expert oversight of management over the course of the multi-year life cycles of our clinical development programs, which our board believes ultimately drives the creation of sustainable stockholder value. In addition, the board believes three-year terms enhance the independence of our non-employee directors by providing continuity of service and protecting them against potential pressures from special interest groups or others who might have agendas contrary to the long-term interests of our stockholders. Our board and/or the nominating and corporate governance committee will periodically review and continue to consider whether our classified board structure aligns with the company’s long-term strategic objectives.

The Board’s Role in Risk Oversight

We face a number of risks in our business, including risks related to: launching, marketing and selling our approved products globally; preclinical and clinical research and development; manufacturing and clinical and commercial drug supply; regulatory reviews; our ability to obtain approval for new commercial products or additional indications for our existing products; policies and oversight; global growth and capability expansion; preparations for and execution of commercial operations; our ability to obtain reimbursement for approved products and the product candidates we are developing if, and when, they gain regulatory approval; intellectual property filings, prosecution, maintenance and challenges; the establishment and maintenance of strategic alliances; competition; cybersecurity; litigation and government investigations; and the ability to manage our expenses, access additional funding for our business and advance towards financial self-sustainability; as well as other risks. Our management is responsible for the day-to-day management of the risks we face, while our board of directors, as a whole and through its committees, has responsibility for the oversight of risk management.

Our board administers its risk oversight function directly and through its four committees.

Our chair meets regularly with our chief executive officer and other executive officers and members of senior management to discuss strategy and risks facing the company. Our chair and the chair of our nominating and corporate governance committee also meet with our global head of ethics and compliance individually and with our chief legal officer, to discuss the risks facing our business and our global compliance initiatives. Members of senior management attend the quarterly board meetings and are available to address any questions or concerns raised by our board on risk management-related and any other matters. Each quarter, our board of directors receives presentations from members of senior management, and may also receive reports from the committee chairs and outside consultants, among others. These presentations often include identification and assessment of risks our company currently faces or may face in the future. Annually, our board reviews and discusses with management an enterprise risk assessment focused on the key risks facing our business.

In addition, as part of its charter, the audit committee regularly discusses with management our risk exposures in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements with potential impact on our financial statements, and the steps we take to manage them. Our audit committee also oversees our internal audit function. The primary purpose of the internal audit function is to provide independent, objective assurance to senior management and the audit committee regarding the adequacy, efficiency and effectiveness of internal controls, which are designed to add value and strengthen our business operations.

The PC&C committee assists our board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs and succession planning for our executive officers, and evaluates potential risks associated with director compensation for consideration by the full board.

The nominating and corporate governance committee assists our board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors, corporate governance, cybersecurity, technical operations and non-financial compliance programs, including with respect to commercial activities and quality assurance.

Our chair, individually and with our chief legal officer, our global head of ethics and compliance, our head of internal audit, our chief information officer, and our chief technical operations and quality officer each provide the committee with regular updates.

The science and technology committee reviews and advises our board regarding risks arising from our discovery and development strategy and programs.

The Board of Directors and Its Committees

Board Committees

Our board of directors has established four standing committees — audit, PC&C, nominating and corporate governance, and science and technology — each of which operates under a written charter that has been approved by our board. We have posted copies of each committee’s charter on the Corporate Governance page of the Investors section of our website, www.alnylam.com. The members of each committee are appointed by our board, upon the recommendation of our nominating and corporate governance committee.

Our board has determined that all of the members of each of the audit, PC&C, and nominating and corporate governance committees are independent as defined under the Nasdaq Marketplace Rules, and, in the case of all members of our audit committee, the independence requirements of Rule 10A-3(b)(1) under the Exchange Act. Committee memberships as of March 1, 2025 are shown below:

| | | | | |

| |

Audit Committee | |

▪Peter N. Kellogg (Chair) ▪Olivier Brandicourt, M.D. ▪Colleen F. Reitan | Our audit committee met five times during 2024, either in person or by video teleconference. |

| |

| |

As described more fully in its charter, the audit committee oversees our accounting and financial reporting processes, internal controls and audit functions. In fulfilling its role, our audit committee is responsible for, among other things: ▪appointing, evaluating, retaining, approving the compensation of and, when necessary, terminating the engagement of our independent auditors; ▪taking appropriate action, or recommending that our board of directors take appropriate action, to oversee the independence of our independent auditors; ▪preapproving all audit services provided to the company and approving any compensation paid to the independent auditors; ▪reviewing and discussing with management and the independent auditors our annual and quarterly financial statements and related disclosures, including earnings releases, financial guidance and disclosure of non-GAAP financial measures; ▪monitoring our internal control over financial reporting, disclosure controls and procedures, and compliance with financial corporate securities, tax and similar regulatory or legal requirements relating to financial matters; ▪overseeing the work of the independent auditor, including resolving any disagreements between management and the independent auditor regarding financial reporting; ▪overseeing the performance of internal audit activities carried out by our internal audit function; ▪reviewing and discussing our financial risk management policies, including but not limited to our investment policy; ▪reviewing and approving matters related to tax planning; ▪establishing policies regarding hiring employees from our independent auditors and procedures for the receipt and retention of accounting-related complaints and concerns; ▪meeting independently with our independent auditors and management; and ▪preparing the annual audit committee report required by SEC rules, which is included below under the heading “Report of the Audit Committee.” In addition, our audit committee must approve or ratify any related person transaction as defined in our related person transaction policy. Our policies and procedures for the review and approval of related person transactions are summarized under the heading “Policies and Procedures for Related Person Transactions,” which appears below. The current members of our audit committee are Mr. Kellogg (Chair), Ms. Reitan and Dr. Brandicourt. We believe that each member of our audit committee satisfies the requirements for membership, including independence, under the Nasdaq Marketplace Rules and Rule 10A-3(b)(1) under the Exchange Act. Our board has determined that each of Mr. Kellogg and Ms. Reitan is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. No member of our audit committee is the beneficial owner of more than 10% of our common stock. |

|

The Board of Directors and Its Committees

| | | | | |

| |

People, Culture and Compensation Committee |

▪Colleen F. Reitan (Chair) ▪Olivier Brandicourt, M.D. ▪Elliott Sigal, M.D., Ph.D. | Our PC&C committee met four times during 2024, either in person or by video teleconference. |

| |

| |