Q3 2025 RESULTS PRESENTATION

NYSE: PFS Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” "project," "intend," “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in Item 1A of the Company's Annual Report on Form 10-K, as supplemented by its Quarterly Reports on Form 10-Q, and those related to the economic environment, particularly in the market areas in which the Company operates, inflation and unemployment, competitive products and pricing, real estate values, fiscal and monetary policies of the U.S. Government, tariffs, changes in accounting policies and practices that may be adopted by the regulatory agencies and the accounting standards setters, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, potential goodwill impairment, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets, the availability of and costs associated with sources of liquidity, and the impact of a recent shutdown of the federal government. The Company cautions readers not to place undue reliance on any such forward-looking statements which speak only as of the date they are made. The Company advises readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not assume any duty, and does not undertake, to update any forward-looking statements to reflect events or circumstances after the date of this statement. 2

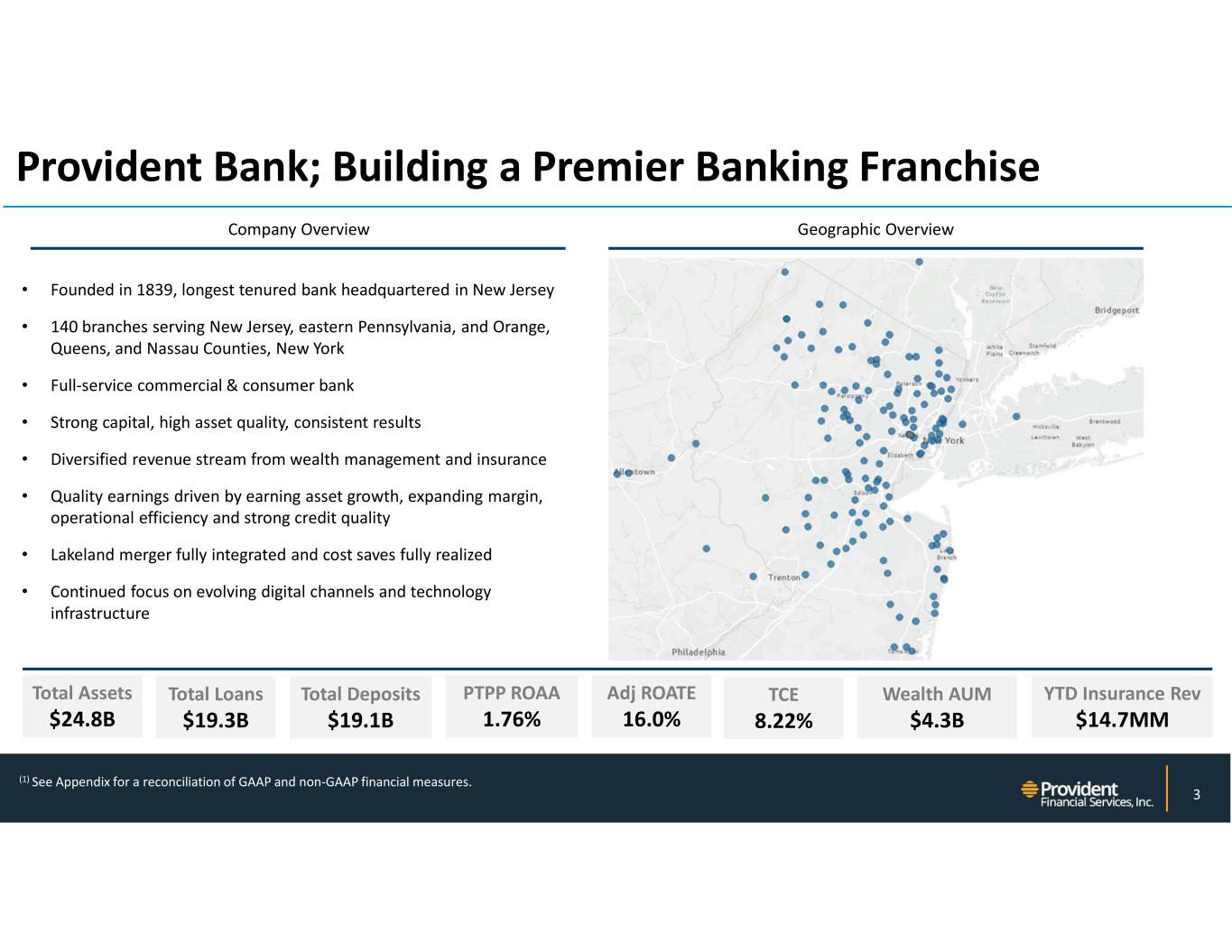

NYSE: PFS Provident Bank; Building a Premier Banking Franchise 3 (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. Total Assets $24.8B Total Loans $19.3B Total Deposits $19.1B PTPP ROAA 1.76% Adj ROATE 16.0% Wealth AUM $4.3B YTD Insurance Rev $14.7MM Company Overview Geographic Overview • Founded in 1839, longest tenured bank headquartered in New Jersey • 140 branches serving New Jersey, eastern Pennsylvania, and Orange, Queens, and Nassau Counties, New York • Full-service commercial & consumer bank • Strong capital, high asset quality, consistent results • Diversified revenue stream from wealth management and insurance • Quality earnings driven by earning asset growth, expanding margin, operational efficiency and strong credit quality • Lakeland merger fully integrated and cost saves fully realized • Continued focus on evolving digital channels and technology infrastructure TCE 8.22%

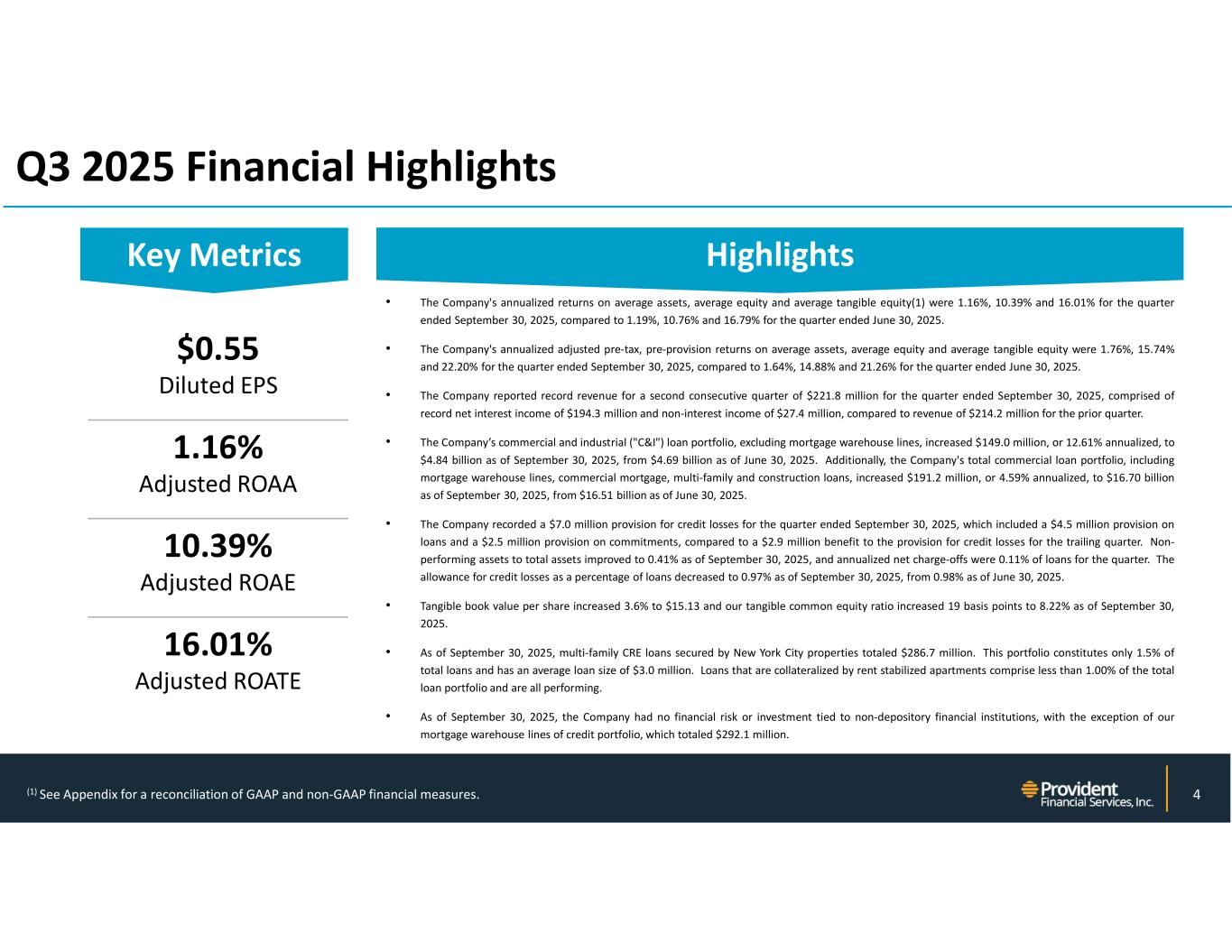

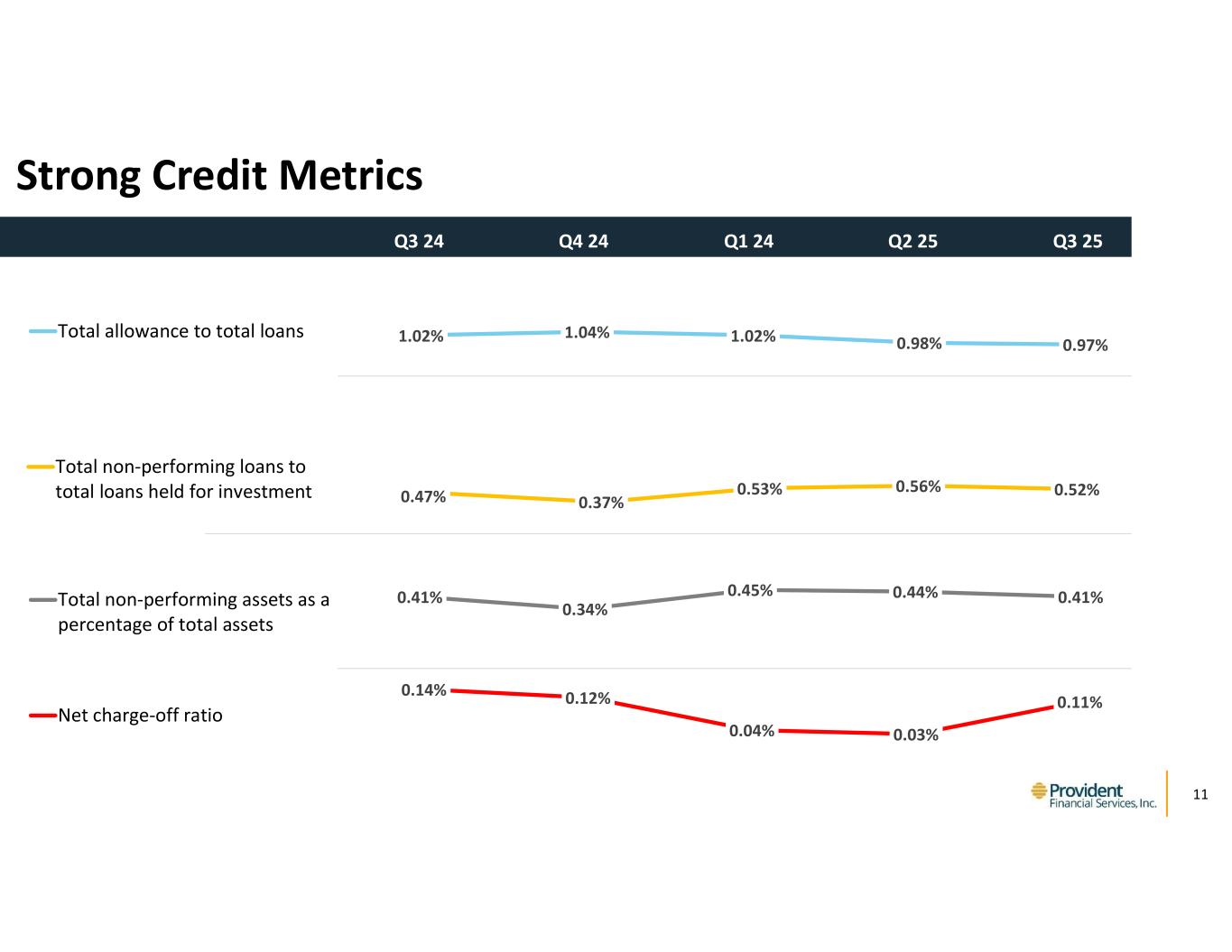

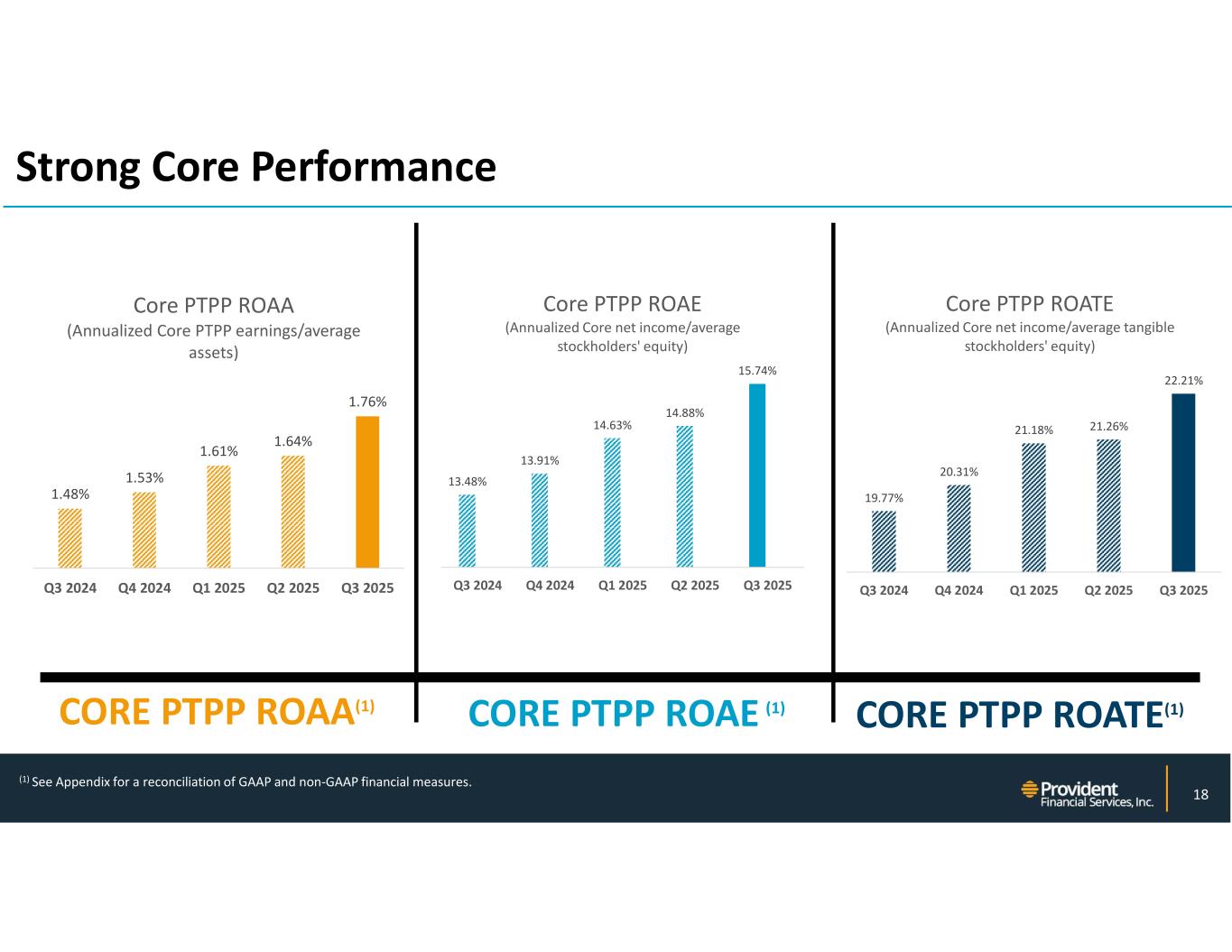

NYSE: PFS 4 Q3 2025 Financial Highlights $0.55 Diluted EPS 1.16% Adjusted ROAA 10.39% Adjusted ROAE 16.01% Adjusted ROATE Key Metrics Highlights • The Company's annualized returns on average assets, average equity and average tangible equity(1) were 1.16%, 10.39% and 16.01% for the quarter ended September 30, 2025, compared to 1.19%, 10.76% and 16.79% for the quarter ended June 30, 2025. • The Company's annualized adjusted pre-tax, pre-provision returns on average assets, average equity and average tangible equity were 1.76%, 15.74% and 22.20% for the quarter ended September 30, 2025, compared to 1.64%, 14.88% and 21.26% for the quarter ended June 30, 2025. • The Company reported record revenue for a second consecutive quarter of $221.8 million for the quarter ended September 30, 2025, comprised of record net interest income of $194.3 million and non-interest income of $27.4 million, compared to revenue of $214.2 million for the prior quarter. • The Company’s commercial and industrial ("C&I") loan portfolio, excluding mortgage warehouse lines, increased $149.0 million, or 12.61% annualized, to $4.84 billion as of September 30, 2025, from $4.69 billion as of June 30, 2025. Additionally, the Company's total commercial loan portfolio, including mortgage warehouse lines, commercial mortgage, multi-family and construction loans, increased $191.2 million, or 4.59% annualized, to $16.70 billion as of September 30, 2025, from $16.51 billion as of June 30, 2025. • The Company recorded a $7.0 million provision for credit losses for the quarter ended September 30, 2025, which included a $4.5 million provision on loans and a $2.5 million provision on commitments, compared to a $2.9 million benefit to the provision for credit losses for the trailing quarter. Non- performing assets to total assets improved to 0.41% as of September 30, 2025, and annualized net charge-offs were 0.11% of loans for the quarter. The allowance for credit losses as a percentage of loans decreased to 0.97% as of September 30, 2025, from 0.98% as of June 30, 2025. • Tangible book value per share increased 3.6% to $15.13 and our tangible common equity ratio increased 19 basis points to 8.22% as of September 30, 2025. • As of September 30, 2025, multi-family CRE loans secured by New York City properties totaled $286.7 million. This portfolio constitutes only 1.5% of total loans and has an average loan size of $3.0 million. Loans that are collateralized by rent stabilized apartments comprise less than 1.00% of the total loan portfolio and are all performing. • As of September 30, 2025, the Company had no financial risk or investment tied to non-depository financial institutions, with the exception of our mortgage warehouse lines of credit portfolio, which totaled $292.1 million. (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures.

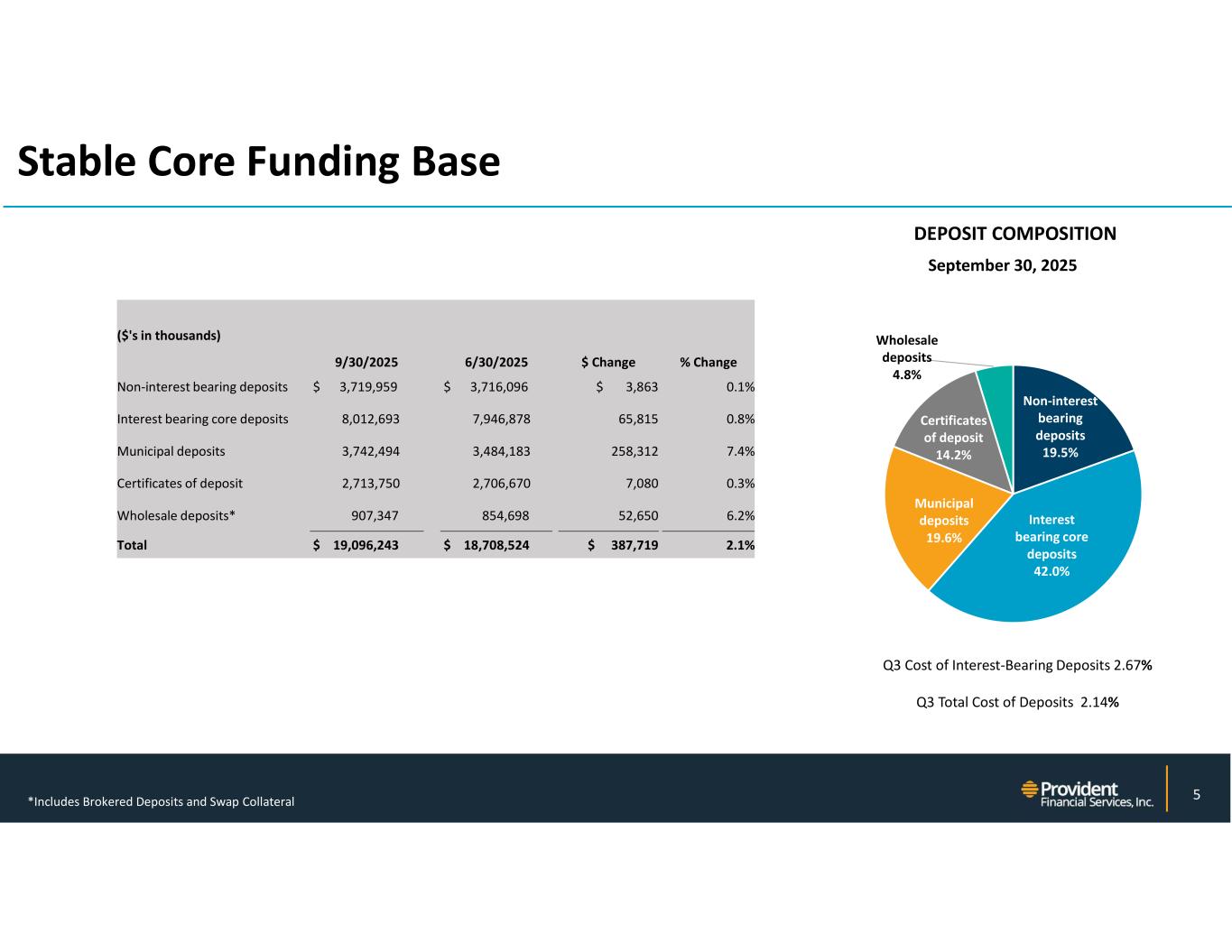

NYSE: PFS Stable Core Funding Base DEPOSIT COMPOSITION 5 Non-interest bearing deposits 19.5% Interest bearing core deposits 42.0% Municipal deposits 19.6% Certificates of deposit 14.2% Wholesale deposits 4.8% September 30, 2025 Q3 Cost of Interest-Bearing Deposits 2.67% Q3 Total Cost of Deposits 2.14% % Change$ Change 6/30/20259/30/2025 ($'s in thousands) 0.1%$ 3,863$ 3,716,096 $ 3,719,959 Non-interest bearing deposits 0.8%65,8157,946,878 8,012,693 Interest bearing core deposits 7.4%258,3123,484,183 3,742,494 Municipal deposits 0.3%7,0802,706,670 2,713,750 Certificates of deposit 6.2%52,650854,698 907,347 Wholesale deposits* 2.1%$ 387,719$ 18,708,524 $ 19,096,243 Total *Includes Brokered Deposits and Swap Collateral

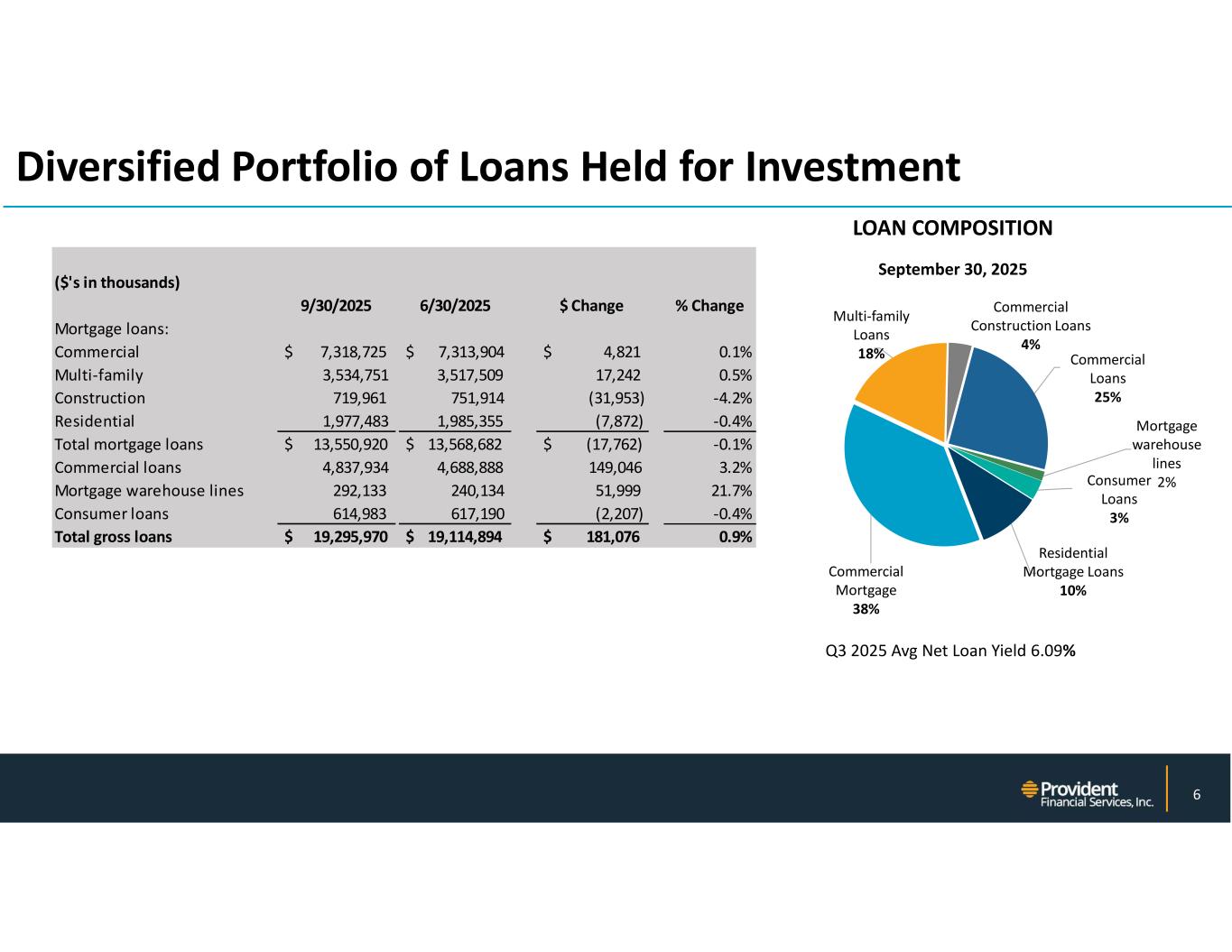

NYSE: PFS Diversified Portfolio of Loans Held for Investment September 30, 2025 6 Residential Mortgage Loans 10% Commercial Mortgage 38% Multi-family Loans 18% Commercial Construction Loans 4% Commercial Loans 25% Mortgage warehouse lines 2%Consumer Loans 3% LOAN COMPOSITION Q3 2025 Avg Net Loan Yield 6.09% ($'s in thousands) 9/30/2025 6/30/2025 $ Change % Change Mortgage loans: Commercial $ 7,318,725 $ 7,313,904 $ 4,821 0.1% Multi-family 3,534,751 3,517,509 17,242 0.5% Construction 719,961 751,914 (31,953) -4.2% Residential 1,977,483 1,985,355 (7,872) -0.4% Total mortgage loans $ 13,550,920 $ 13,568,682 $ (17,762) -0.1% Commercial loans 4,837,934 4,688,888 149,046 3.2% Mortgage warehouse lines 292,133 240,134 51,999 21.7% Consumer loans 614,983 617,190 (2,207) -0.4% Total gross loans $ 19,295,970 $ 19,114,894 $ 181,076 0.9%

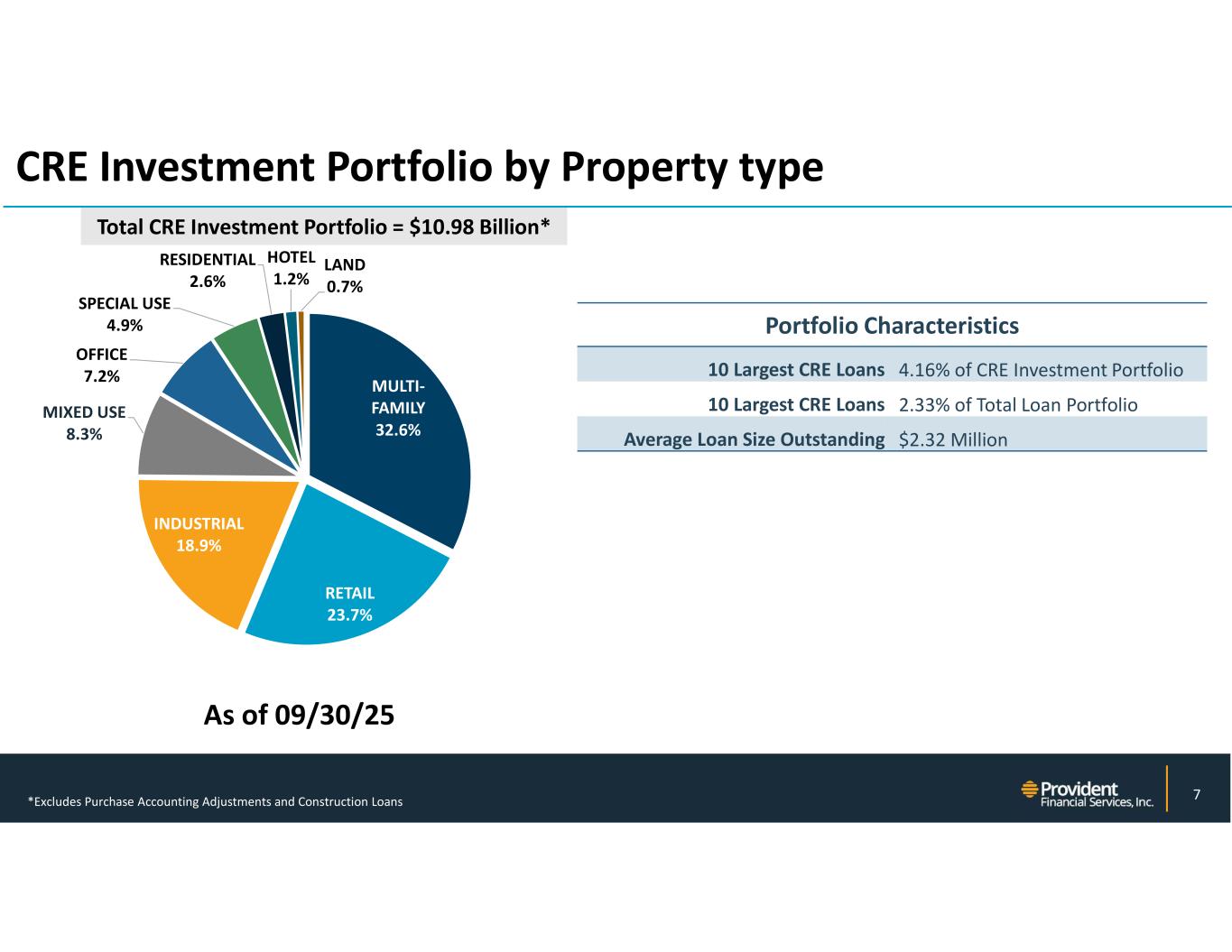

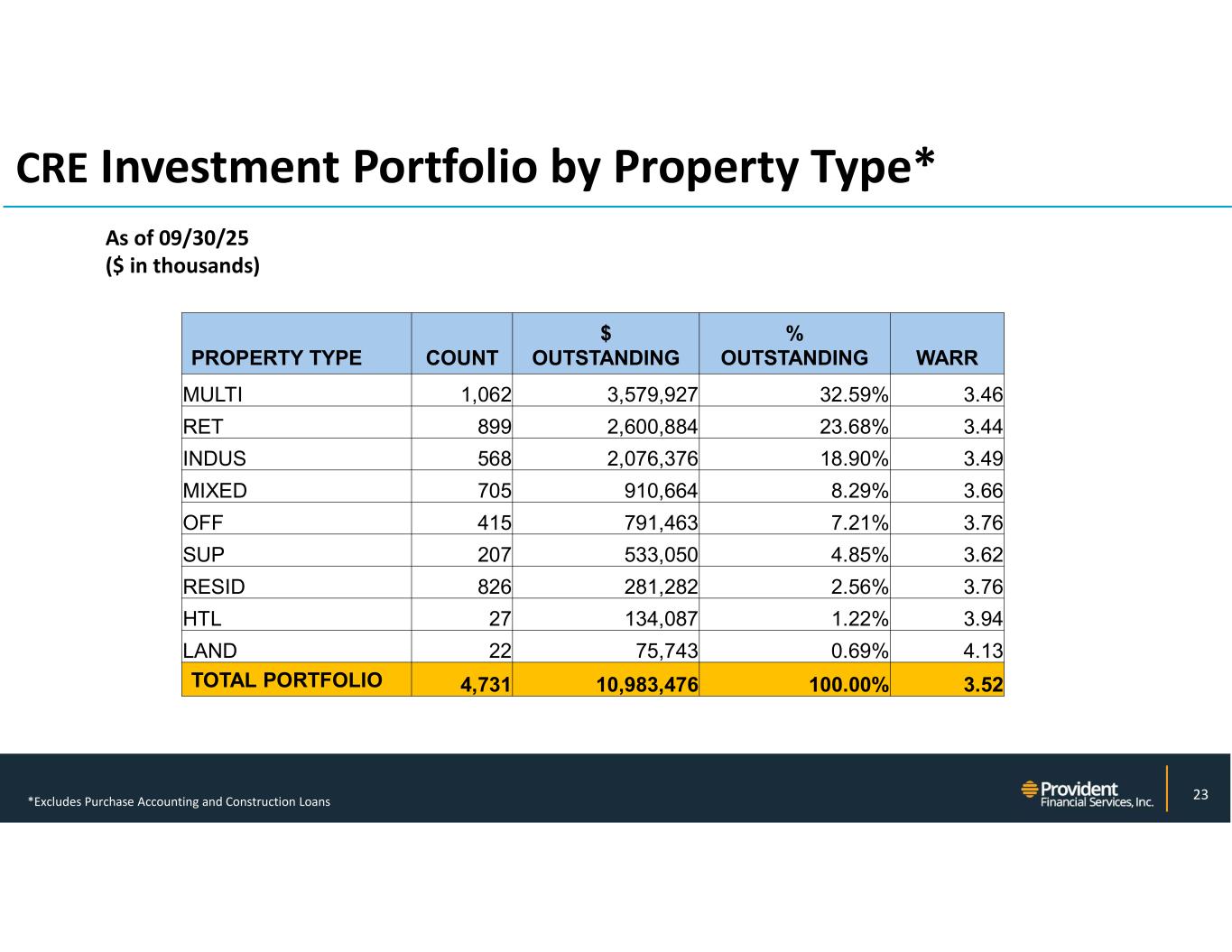

NYSE: PFS CRE Investment Portfolio by Property type 7 As of 09/30/25 MULTI- FAMILY 32.6% RETAIL 23.7% INDUSTRIAL 18.9% MIXED USE 8.3% OFFICE 7.2% SPECIAL USE 4.9% RESIDENTIAL 2.6% HOTEL 1.2% LAND 0.7% Portfolio Characteristics 4.16% of CRE Investment Portfolio10 Largest CRE Loans 2.33% of Total Loan Portfolio10 Largest CRE Loans $2.32 MillionAverage Loan Size Outstanding Total CRE Investment Portfolio = $10.98 Billion* *Excludes Purchase Accounting Adjustments and Construction Loans

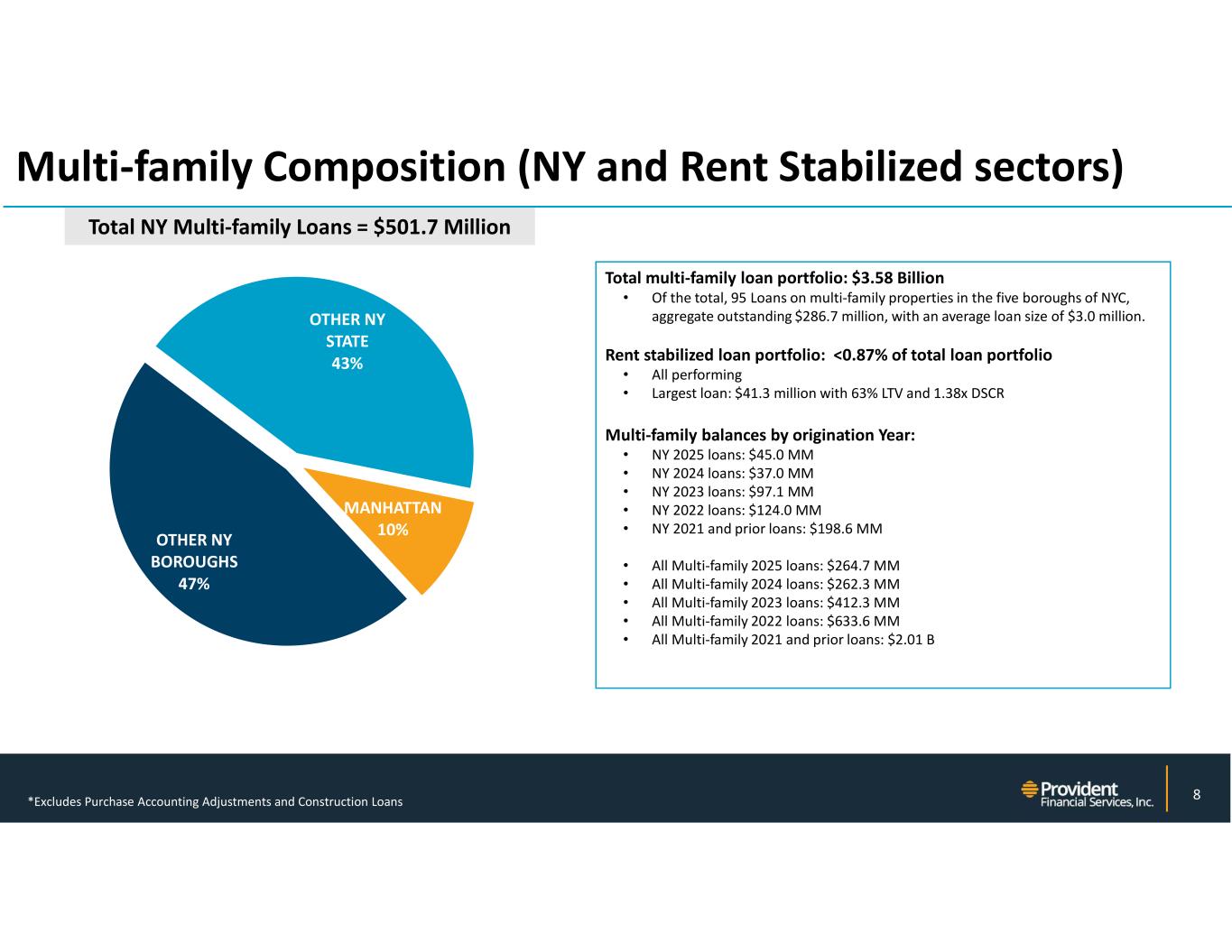

NYSE: PFS Multi-family Composition (NY and Rent Stabilized sectors) 8 OTHER NY BOROUGHS 47% OTHER NY STATE 43% MANHATTAN 10% Total NY Multi-family Loans = $501.7 Million Total multi-family loan portfolio: $3.58 Billion • Of the total, 95 Loans on multi-family properties in the five boroughs of NYC, aggregate outstanding $286.7 million, with an average loan size of $3.0 million. Rent stabilized loan portfolio: <0.87% of total loan portfolio • All performing • Largest loan: $41.3 million with 63% LTV and 1.38x DSCR Multi-family balances by origination Year: • NY 2025 loans: $45.0 MM • NY 2024 loans: $37.0 MM • NY 2023 loans: $97.1 MM • NY 2022 loans: $124.0 MM • NY 2021 and prior loans: $198.6 MM • All Multi-family 2025 loans: $264.7 MM • All Multi-family 2024 loans: $262.3 MM • All Multi-family 2023 loans: $412.3 MM • All Multi-family 2022 loans: $633.6 MM • All Multi-family 2021 and prior loans: $2.01 B *Excludes Purchase Accounting Adjustments and Construction Loans

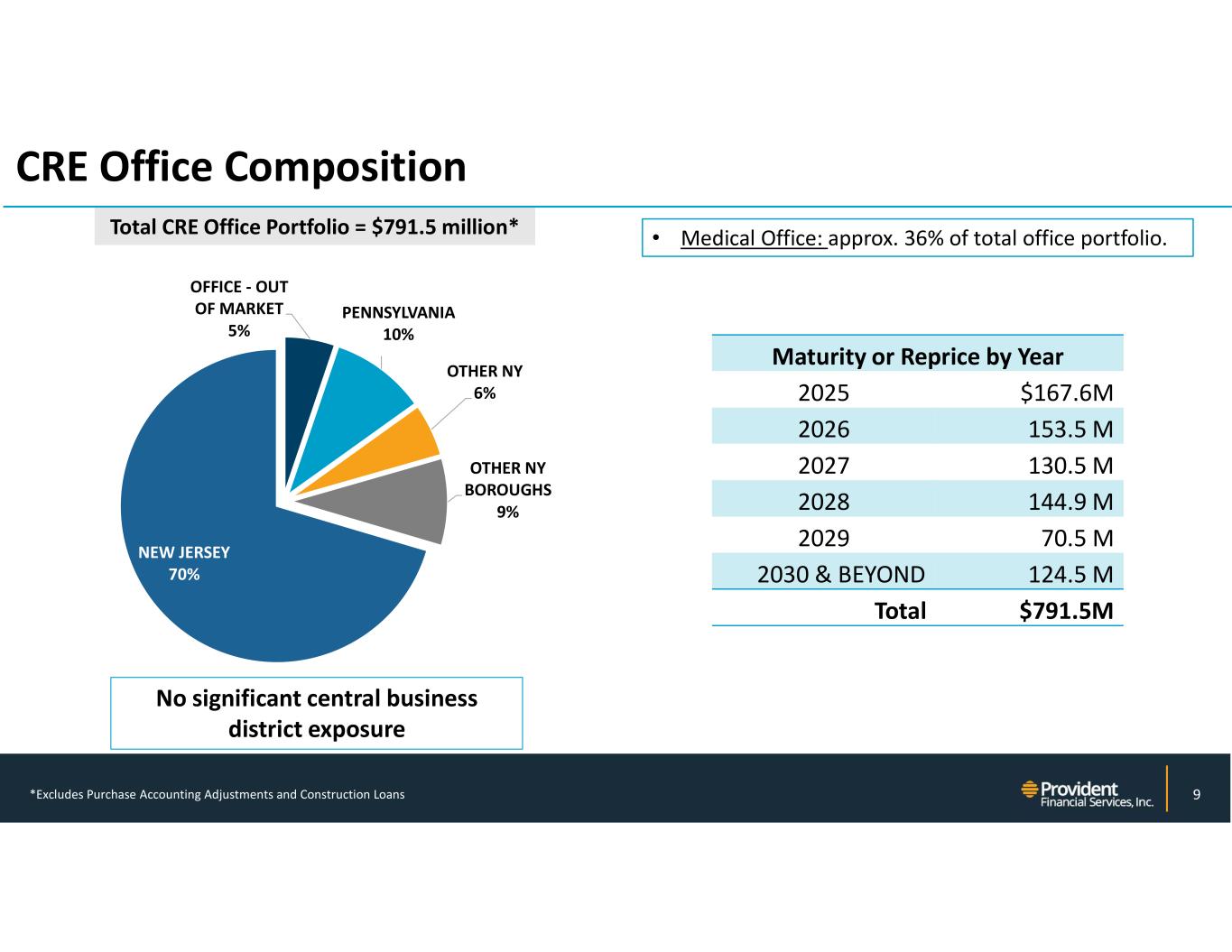

NYSE: PFS CRE Office Composition 9 • Medical Office: approx. 36% of total office portfolio. Maturity or Reprice by Year $167.6M2025 153.5 M2026 130.5 M2027 144.9 M2028 70.5 M2029 124.5 M2030 & BEYOND $791.5MTotal OFFICE - OUT OF MARKET 5% PENNSYLVANIA 10% OTHER NY 6% OTHER NY BOROUGHS 9% NEW JERSEY 70% No significant central business district exposure Total CRE Office Portfolio = $791.5 million* *Excludes Purchase Accounting Adjustments and Construction Loans

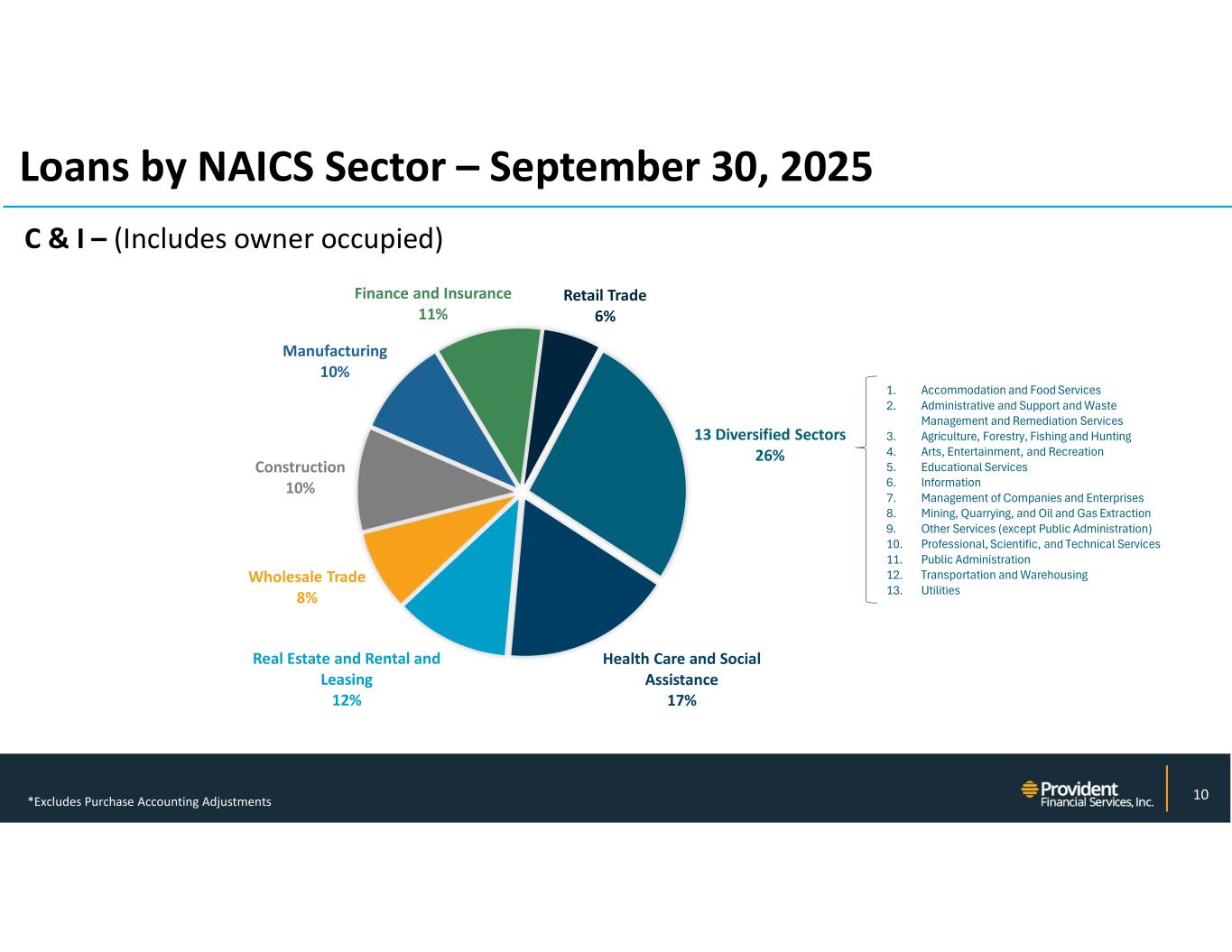

NYSE: PFS C & I – (Includes owner occupied) Loans by NAICS Sector – September 30, 2025 10 Health Care and Social Assistance 17% Real Estate and Rental and Leasing 12% Wholesale Trade 8% Construction 10% Manufacturing 10% Finance and Insurance 11% Retail Trade 6% 13 Diversified Sectors 26% 1. Accommodation and Food Services 2. Administrative and Support and Waste Management and Remediation Services 3. Agriculture, Forestry, Fishing and Hunting 4. Arts, Entertainment, and Recreation 5. Educational Services 6. Information 7. Management of Companies and Enterprises 8. Mining, Quarrying, and Oil and Gas Extraction 9. Other Services (except Public Administration) 10. Professional, Scientific, and Technical Services 11. Public Administration 12. Transportation and Warehousing 13. Utilities *Excludes Purchase Accounting Adjustments

Strong Credit Metrics 11 1.02% 1.04% 1.02% 0.98% 0.97% Total allowance to total loans 0.47% 0.37% 0.53% 0.56% 0.52% Total non-performing loans to total loans held for investment 0.41% 0.34% 0.45% 0.44% 0.41%Total non-performing assets as a percentage of total assets 0.14% 0.12% 0.04% 0.03% 0.11% Net charge-off ratio Q3 24 Q2 25 Q3 25Q4 24 Q1 24

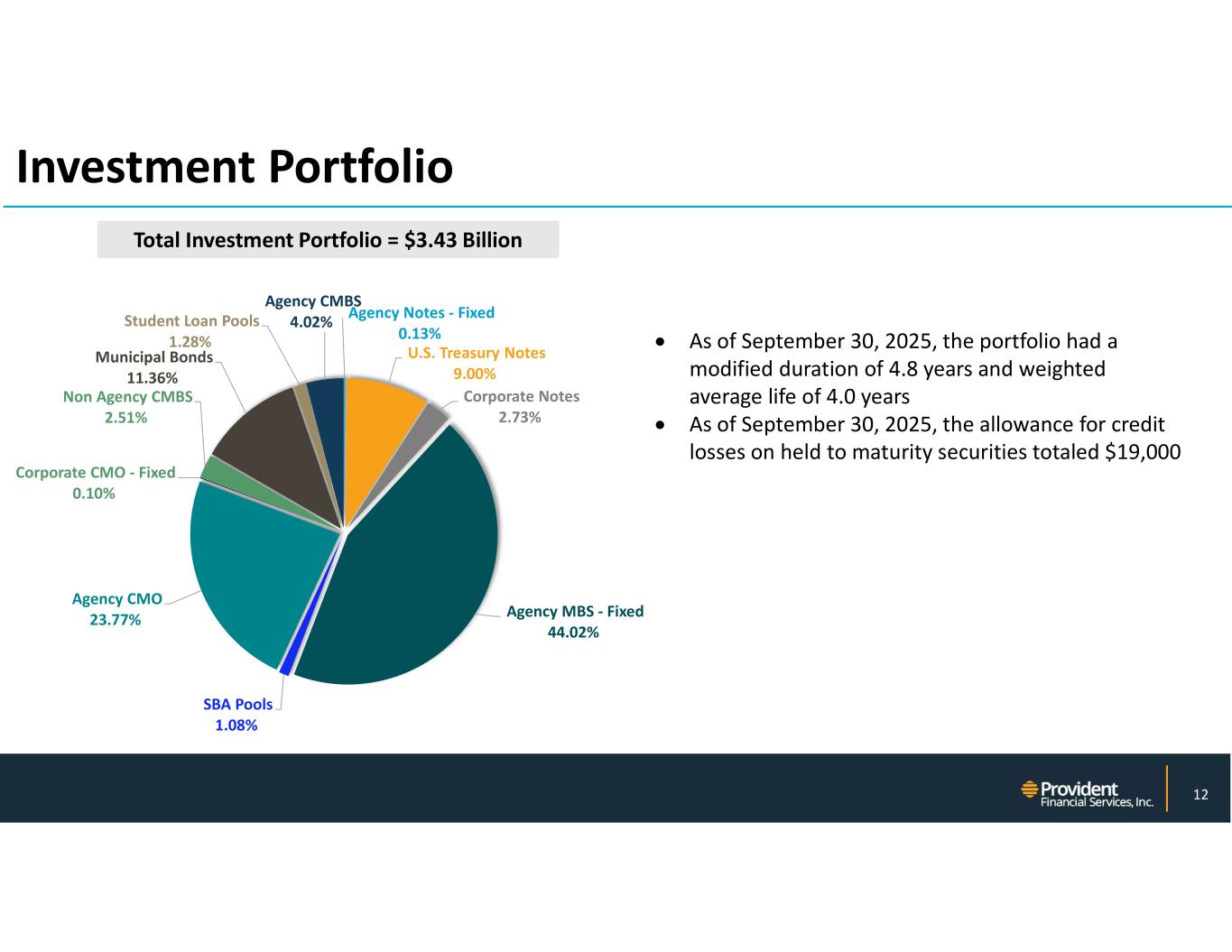

NYSE: PFS Agency Notes - Fixed 0.13% U.S. Treasury Notes 9.00% Corporate Notes 2.73% Agency MBS - Fixed 44.02% SBA Pools 1.08% Agency CMO 23.77% Corporate CMO - Fixed 0.10% Non Agency CMBS 2.51% Municipal Bonds 11.36% Student Loan Pools 1.28% Agency CMBS 4.02% Investment Portfolio 12 Total Investment Portfolio = $3.43 Billion As of September 30, 2025, the portfolio had a modified duration of 4.8 years and weighted average life of 4.0 years As of September 30, 2025, the allowance for credit losses on held to maturity securities totaled $19,000

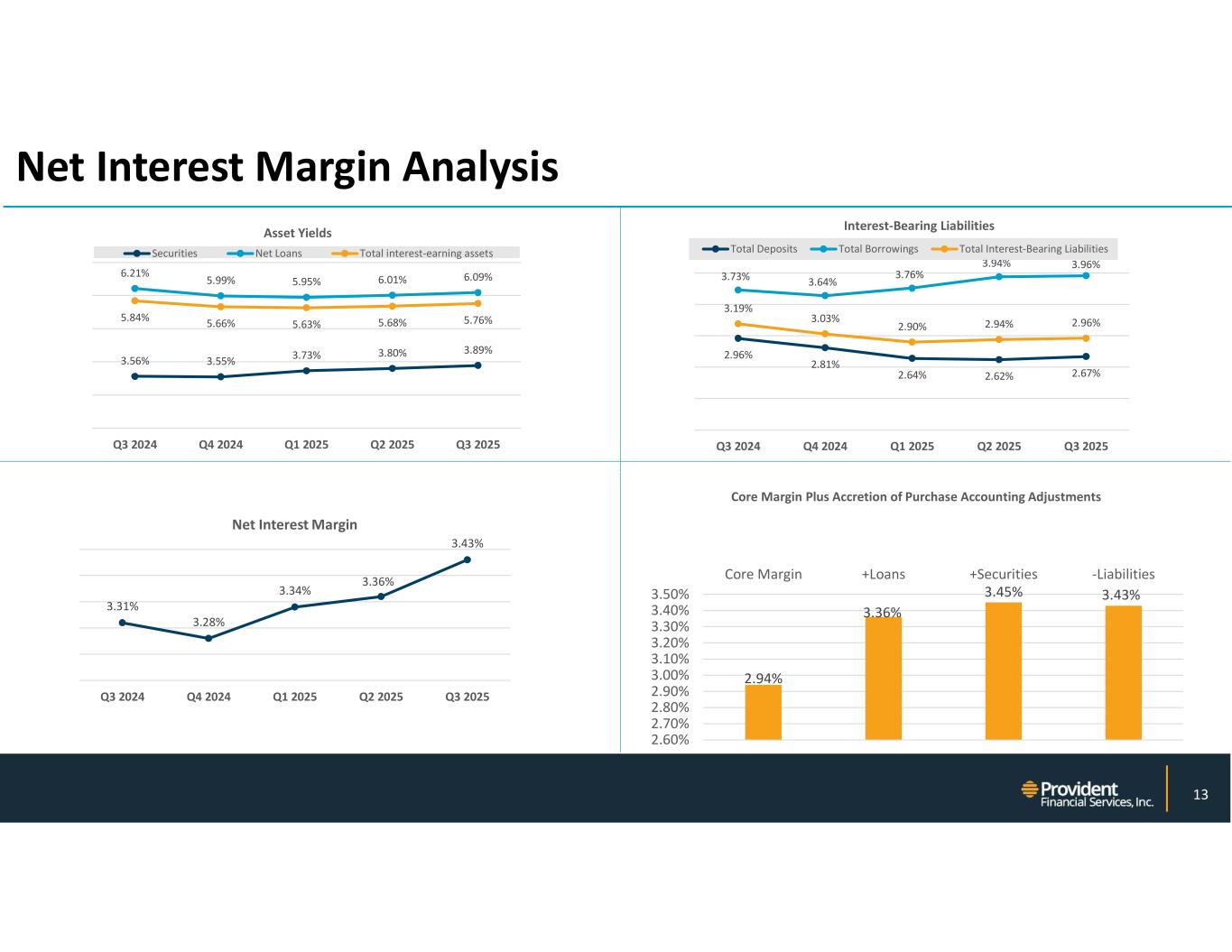

NYSE: PFS Net Interest Margin Analysis 13 3.56% 3.55% 3.73% 3.80% 3.89% 6.21% 5.99% 5.95% 6.01% 6.09% 5.84% 5.66% 5.63% 5.68% 5.76% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Asset Yields Securities Net Loans Total interest-earning assets 2.96% 2.81% 2.64% 2.62% 2.67% 3.73% 3.64% 3.76% 3.94% 3.96% 3.19% 3.03% 2.90% 2.94% 2.96% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Interest-Bearing Liabilities Total Deposits Total Borrowings Total Interest-Bearing Liabilities 3.31% 3.28% 3.34% 3.36% 3.43% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Net Interest Margin 2.94% 3.36% 3.45% 3.43% 2.60% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% Core Margin +Loans +Securities -Liabilities Core Margin Plus Accretion of Purchase Accounting Adjustments

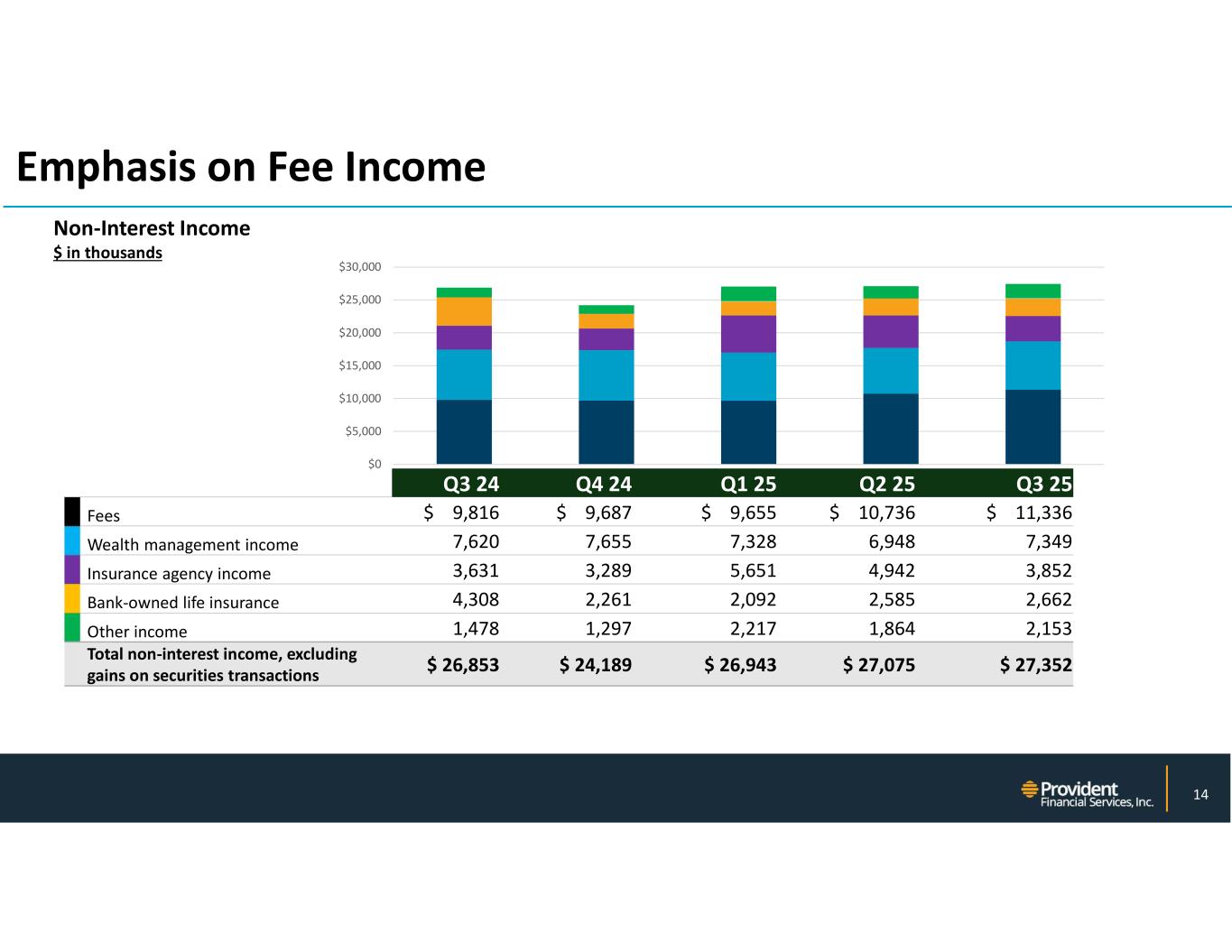

NYSE: PFS $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Emphasis on Fee Income Non-Interest Income $ in thousands 14 Q3 25Q2 25Q1 25Q4 24Q3 24 $ 11,336 $ 10,736 $ 9,655 $ 9,687 $ 9,816 Fees 7,349 6,948 7,328 7,655 7,620 Wealth management income 3,852 4,942 5,651 3,289 3,631 Insurance agency income 2,662 2,585 2,092 2,261 4,308 Bank-owned life insurance 2,153 1,864 2,217 1,297 1,478 Other income $ 27,352 $ 27,075 $ 26,943 $ 24,189 $ 26,853 Total non-interest income, excluding gains on securities transactions

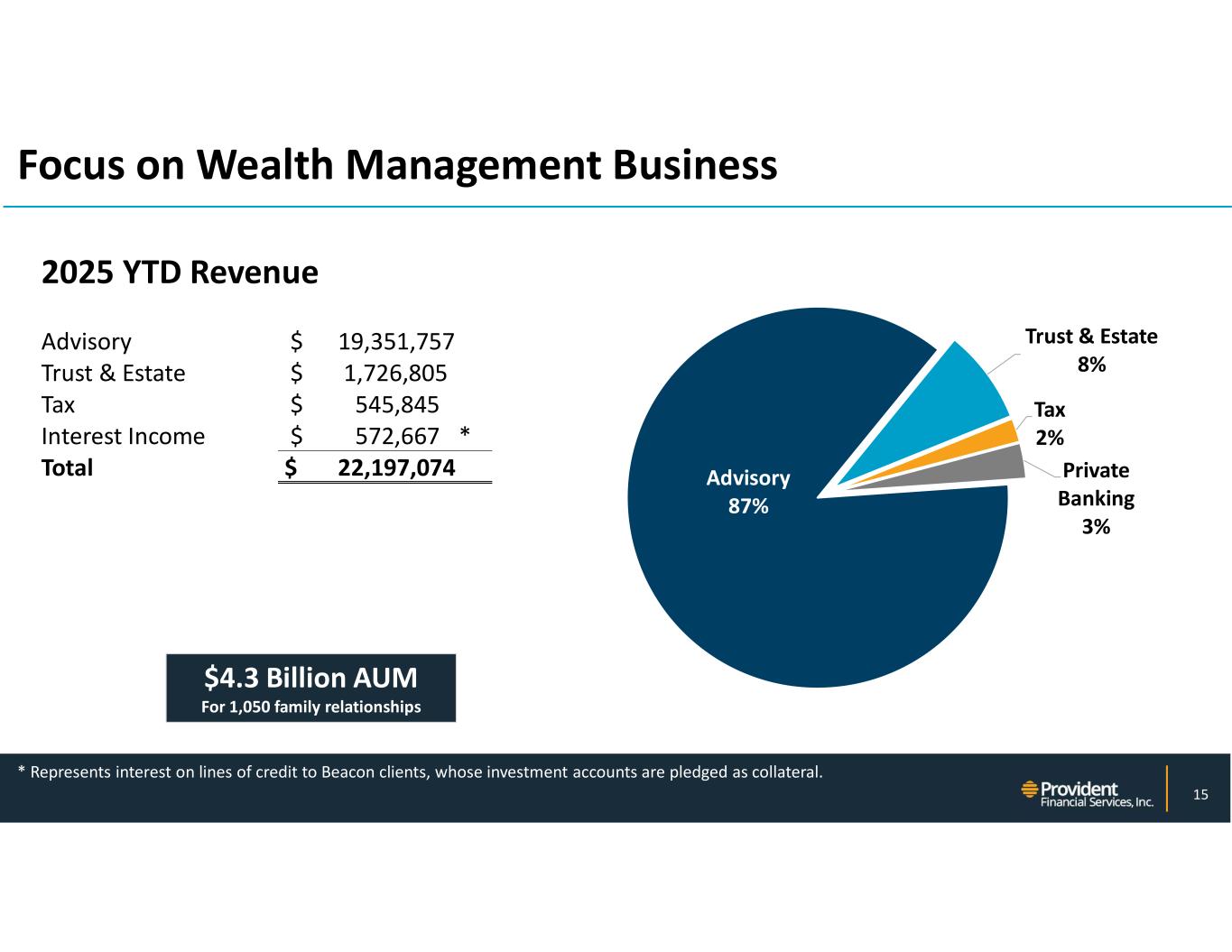

NYSE: PFS * Represents interest on lines of credit to Beacon clients, whose investment accounts are pledged as collateral. Advisory 87% Trust & Estate 8% Tax 2% Private Banking 3% Focus on Wealth Management Business 15 $4.3 Billion AUM For 1,050 family relationships 2025 YTD Revenue $ 19,351,757 Advisory $ 1,726,805 Trust & Estate $ 545,845 Tax *$ 572,667 Interest Income $ 22,197,074 Total

NYSE: PFS AVERAGE CLIENT SIZE $4,000,000 As of September 30, 2025, based on AUM of $4.3B for 1,050 family relationships AVERAGE FEE 72 bps EBITDA & NET INCOME EBITDA (YTD September 30, 2025) $ 9,438,000 Net Income (YTD September 30, 2025) $ 6,601,000 CROSSOVER PROVIDENT/BEACON (HOW MANY PROVIDENT CUSTOMERS ARE BEACON CLIENTS) 122 Provident Bank households are also Beacon clients Focus on Wealth Management Business 16

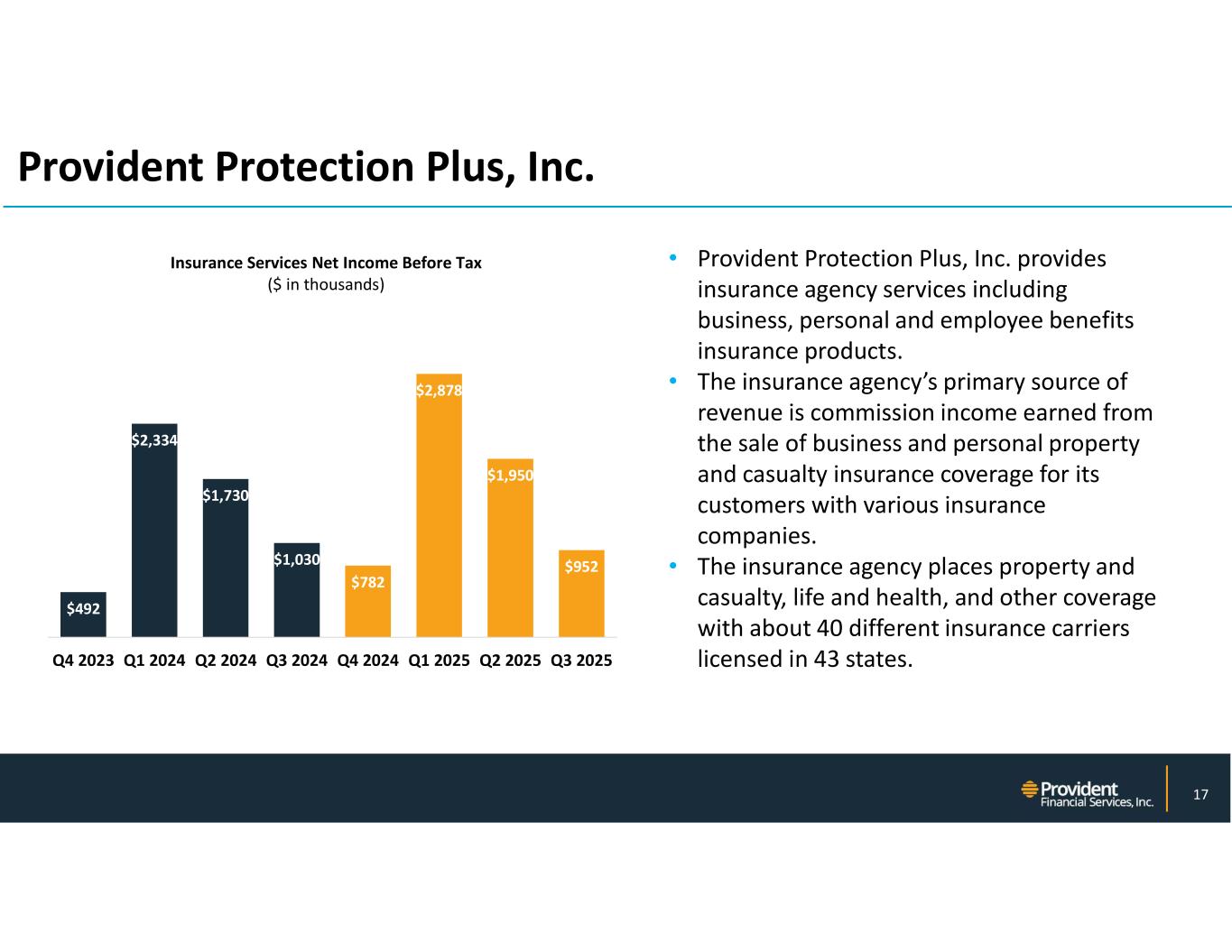

NYSE: PFS • Provident Protection Plus, Inc. provides insurance agency services including business, personal and employee benefits insurance products. • The insurance agency’s primary source of revenue is commission income earned from the sale of business and personal property and casualty insurance coverage for its customers with various insurance companies. • The insurance agency places property and casualty, life and health, and other coverage with about 40 different insurance carriers licensed in 43 states. Provident Protection Plus, Inc. 17 $492 $2,334 $1,730 $1,030 $782 $2,878 $1,950 $952 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Insurance Services Net Income Before Tax ($ in thousands)

NYSE: PFS 1.48% 1.53% 1.61% 1.64% 1.76% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Core PTPP ROAA (Annualized Core PTPP earnings/average assets) CORE PTPP ROAA(1) (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. Strong Core Performance 18 19.77% 20.31% 21.18% 21.26% 22.21% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Core PTPP ROATE (Annualized Core net income/average tangible stockholders' equity) CORE PTPP ROATE(1) 13.48% 13.91% 14.63% 14.88% 15.74% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Core PTPP ROAE (Annualized Core net income/average stockholders' equity) CORE PTPP ROAE (1)

NYSE: PFS Performance Ratios – Bank Capital 19 9. 70 9. 72 9. 98 10 .1 2 10 .2 711 .5 1 11 .4 2 11 .7 1 11 .7 3 11 .9 0 11 .5 1 11 .4 2 11 .7 1 11 .7 3 11 .9 0 12 .4 6 12 .4 0 12 .7 1 12 .6 9 12 .8 6 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Tier 1 leverage capital Common equity Tier 1 risk-based capital Tier 1 risk-based capital Total risk-based capital

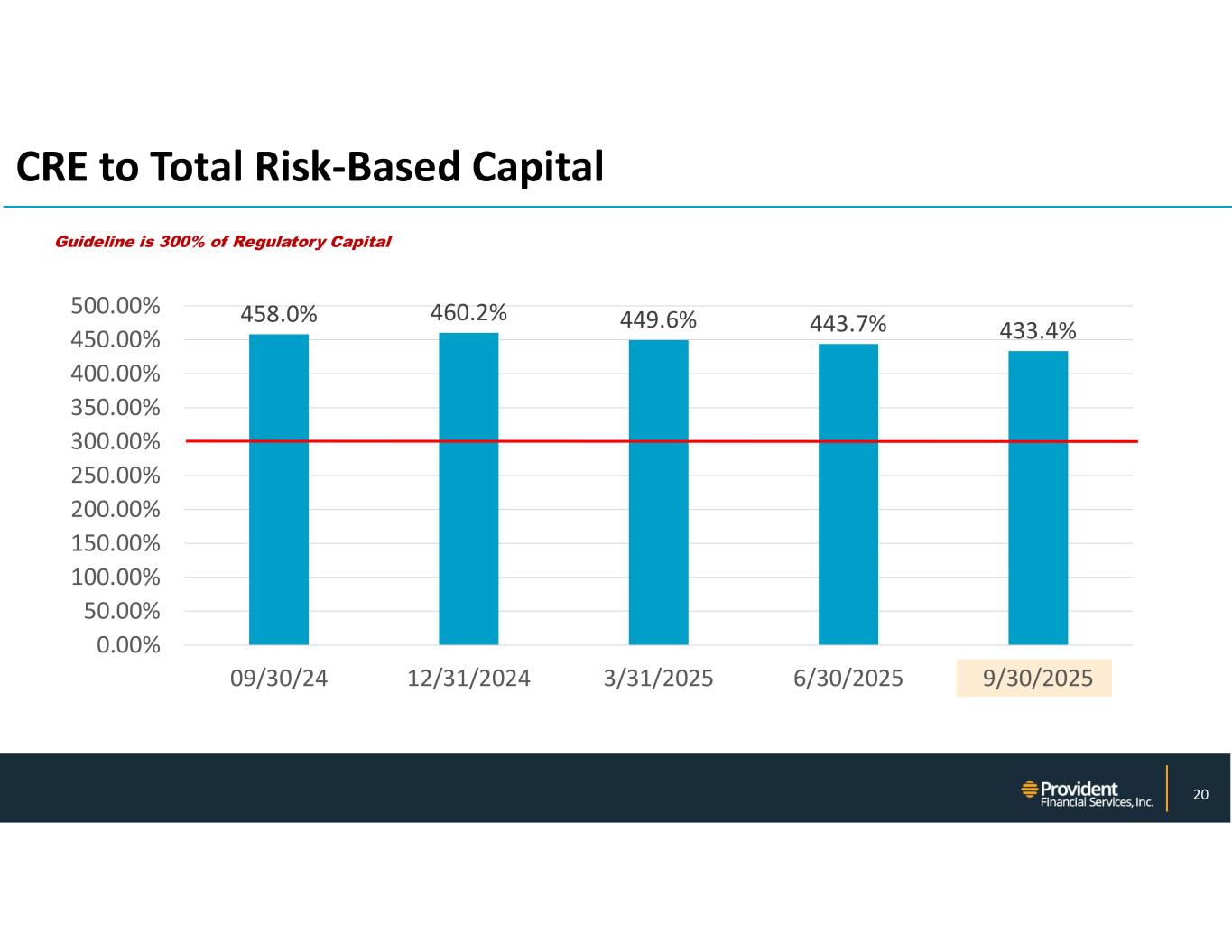

NYSE: PFS Guideline is 300% of Regulatory Capital CRE to Total Risk-Based Capital 20 458.0% 460.2% 449.6% 443.7% 433.4% 0.00% 50.00% 100.00% 150.00% 200.00% 250.00% 300.00% 350.00% 400.00% 450.00% 500.00% 09/30/24 12/31/2024 3/31/2025 6/30/2025 9/30/2025

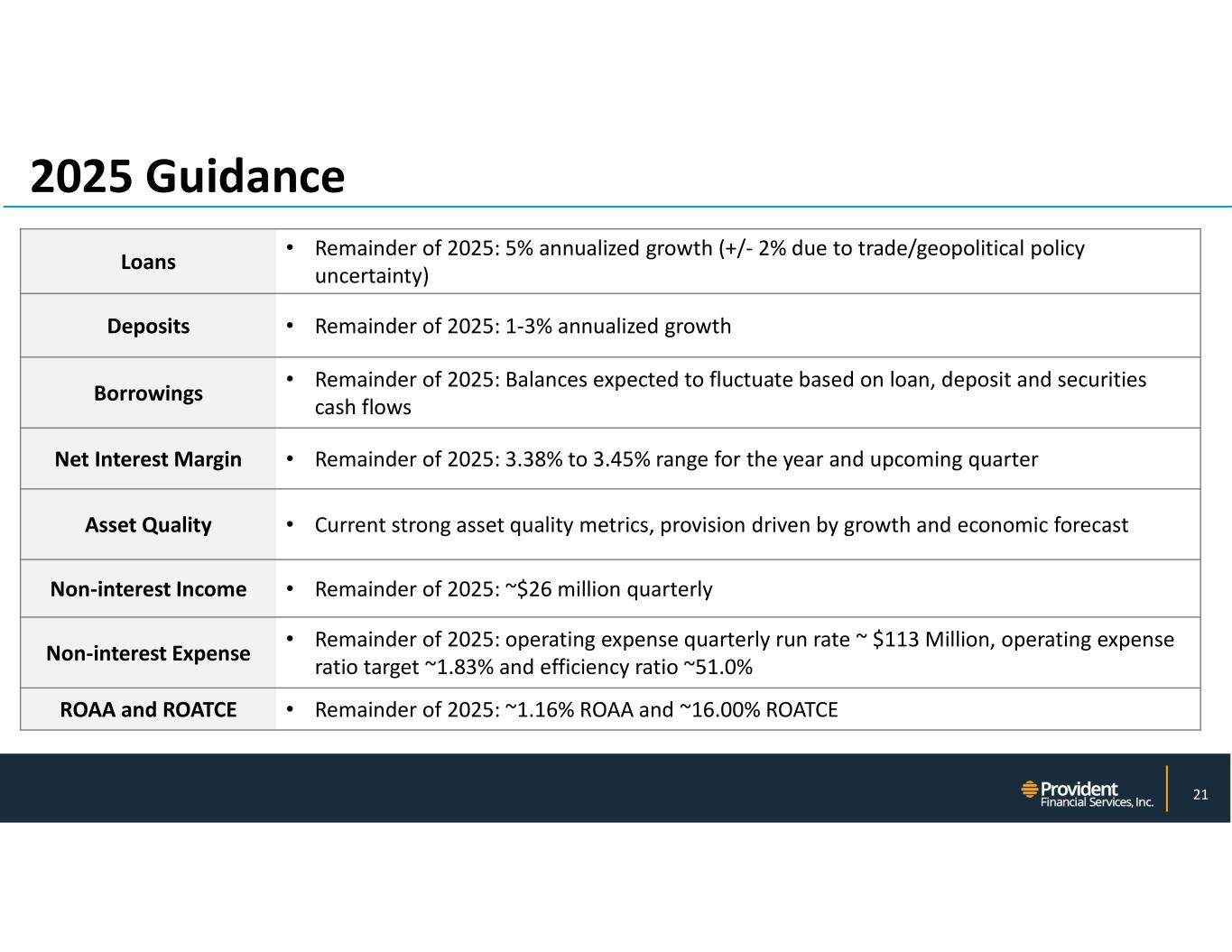

NYSE: PFS 2025 Guidance 21 • Remainder of 2025: 5% annualized growth (+/- 2% due to trade/geopolitical policy uncertainty) Loans • Remainder of 2025: 1-3% annualized growthDeposits • Remainder of 2025: Balances expected to fluctuate based on loan, deposit and securities cash flowsBorrowings • Remainder of 2025: 3.38% to 3.45% range for the year and upcoming quarterNet Interest Margin • Current strong asset quality metrics, provision driven by growth and economic forecastAsset Quality • Remainder of 2025: ~$26 million quarterlyNon-interest Income • Remainder of 2025: operating expense quarterly run rate ~ $113 Million, operating expense ratio target ~1.83% and efficiency ratio ~51.0%Non-interest Expense • Remainder of 2025: ~1.16% ROAA and ~16.00% ROATCEROAA and ROATCE

APPENDIX

NYSE: PFS As of 09/30/25 ($ in thousands) CRE Investment Portfolio by Property Type* 23*Excludes Purchase Accounting and Construction Loans WARR % OUTSTANDING $ OUTSTANDINGCOUNT PROPERTY TYPE 3.4632.59%3,579,927 1,062MULTI 3.4423.68%2,600,884 899RET 3.4918.90%2,076,376 568INDUS 3.668.29%910,664 705MIXED 3.767.21%791,463 415OFF 3.624.85%533,050 207SUP 3.762.56%281,282 826RESID 3.941.22%134,087 27HTL 4.130.69%75,743 22LAND 3.52100.00%10,983,476 4,731TOTAL PORTFOLIO

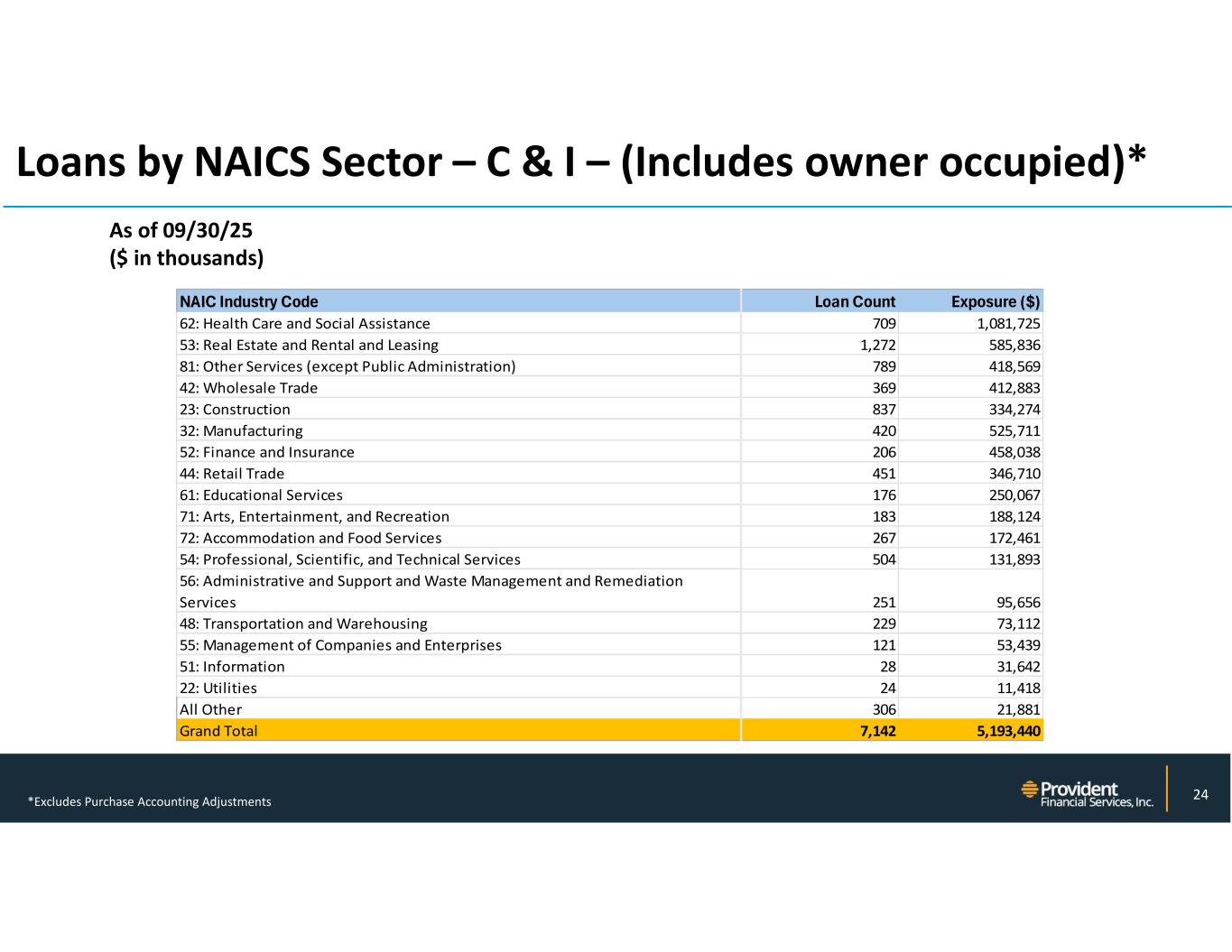

NYSE: PFS Loans by NAICS Sector – C & I – (Includes owner occupied)* 24*Excludes Purchase Accounting Adjustments NAIC Industry Code Loan Count Exposure ($) 62: Health Care and Social Assistance 709 1,081,725 53: Real Estate and Rental and Leasing 1,272 585,836 81: Other Services (except Public Administration) 789 418,569 42: Wholesale Trade 369 412,883 23: Construction 837 334,274 32: Manufacturing 420 525,711 52: Finance and Insurance 206 458,038 44: Retail Trade 451 346,710 61: Educational Services 176 250,067 71: Arts, Entertainment, and Recreation 183 188,124 72: Accommodation and Food Services 267 172,461 54: Professional, Scientific, and Technical Services 504 131,893 56: Administrative and Support and Waste Management and Remediation Services 251 95,656 48: Transportation and Warehousing 229 73,112 55: Management of Companies and Enterprises 121 53,439 51: Information 28 31,642 22: Utilities 24 11,418 All Other 306 21,881 Grand Total 7,142 5,193,440 As of 09/30/25 ($ in thousands)

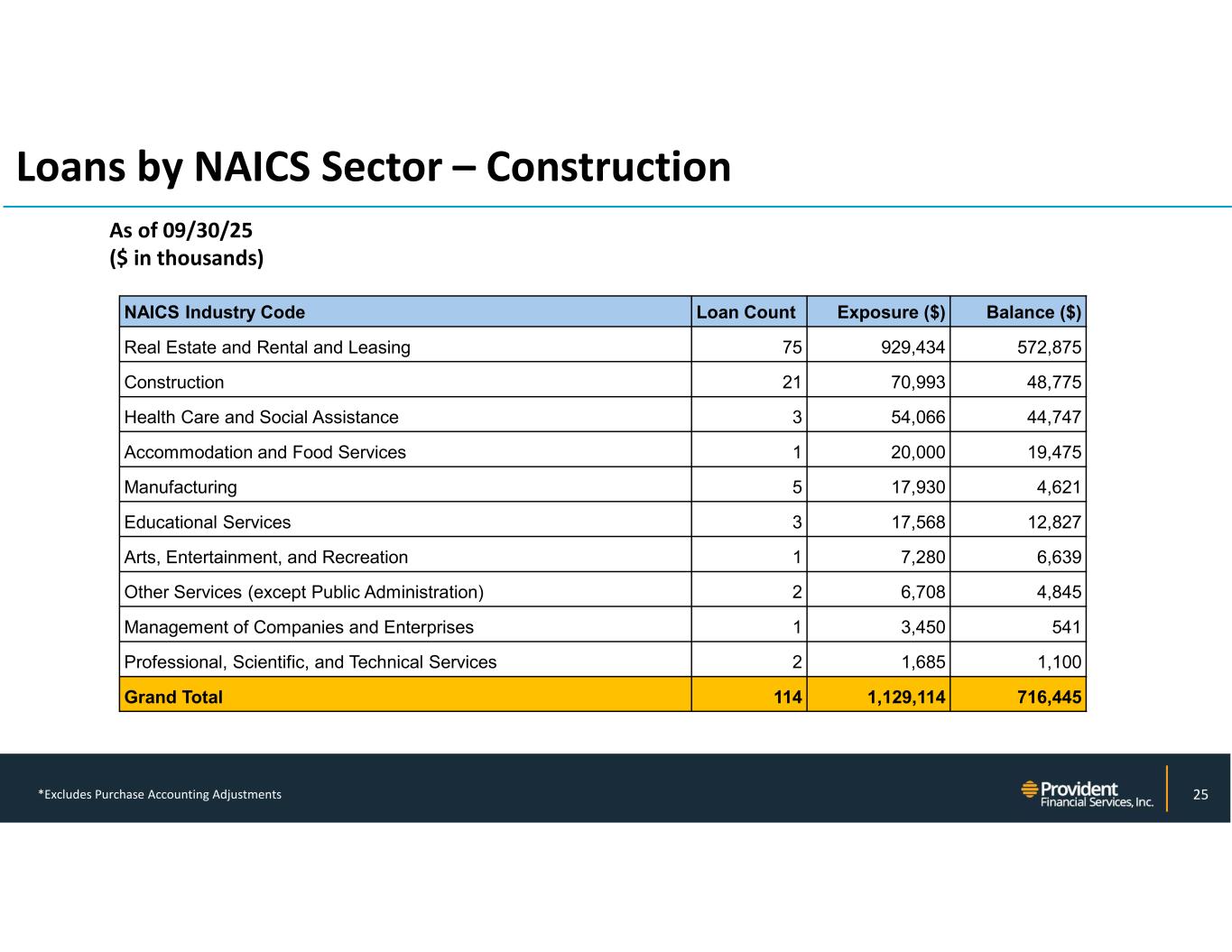

NYSE: PFS Loans by NAICS Sector – Construction 25*Excludes Purchase Accounting Adjustments Balance ($)Exposure ($)Loan CountNAICS Industry Code 572,875929,43475Real Estate and Rental and Leasing 48,77570,99321Construction 44,74754,0663Health Care and Social Assistance 19,47520,0001Accommodation and Food Services 4,62117,9305Manufacturing 12,82717,5683Educational Services 6,6397,2801Arts, Entertainment, and Recreation 4,8456,7082Other Services (except Public Administration) 5413,4501Management of Companies and Enterprises 1,1001,6852Professional, Scientific, and Technical Services 716,4451,129,114114Grand Total As of 09/30/25 ($ in thousands)

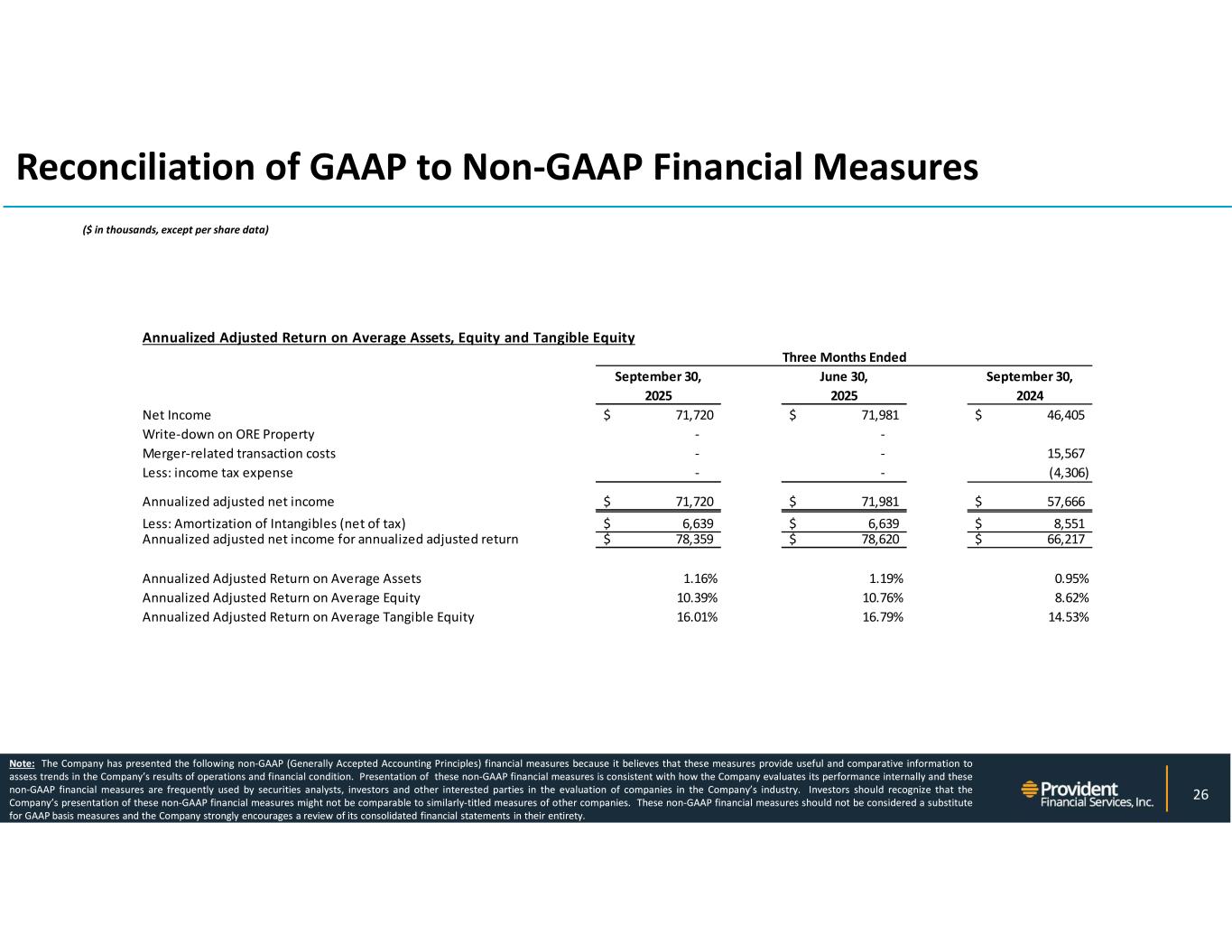

NYSE: PFS Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. ($ in thousands, except per share data) Reconciliation of GAAP to Non-GAAP Financial Measures 26 Annualized Adjusted Return on Average Assets, Equity and Tangible Equity September 30, June 30, September 30, 2025 2025 2024 Net Income 71,720$ 71,981$ 46,405$ Write-down on ORE Property - - Merger-related transaction costs - - 15,567 Less: income tax expense - - (4,306) Annualized adjusted net income 71,720$ 71,981$ 57,666$ Less: Amortization of Intangibles (net of tax) 6,639$ 6,639$ 8,551$ Annualized adjusted net income for annualized adjusted return 78,359$ 78,620$ 66,217$ Annualized Adjusted Return on Average Assets 1.16% 1.19% 0.95% Annualized Adjusted Return on Average Equity 10.39% 10.76% 8.62% Annualized Adjusted Return on Average Tangible Equity 16.01% 16.79% 14.53% Three Months Ended

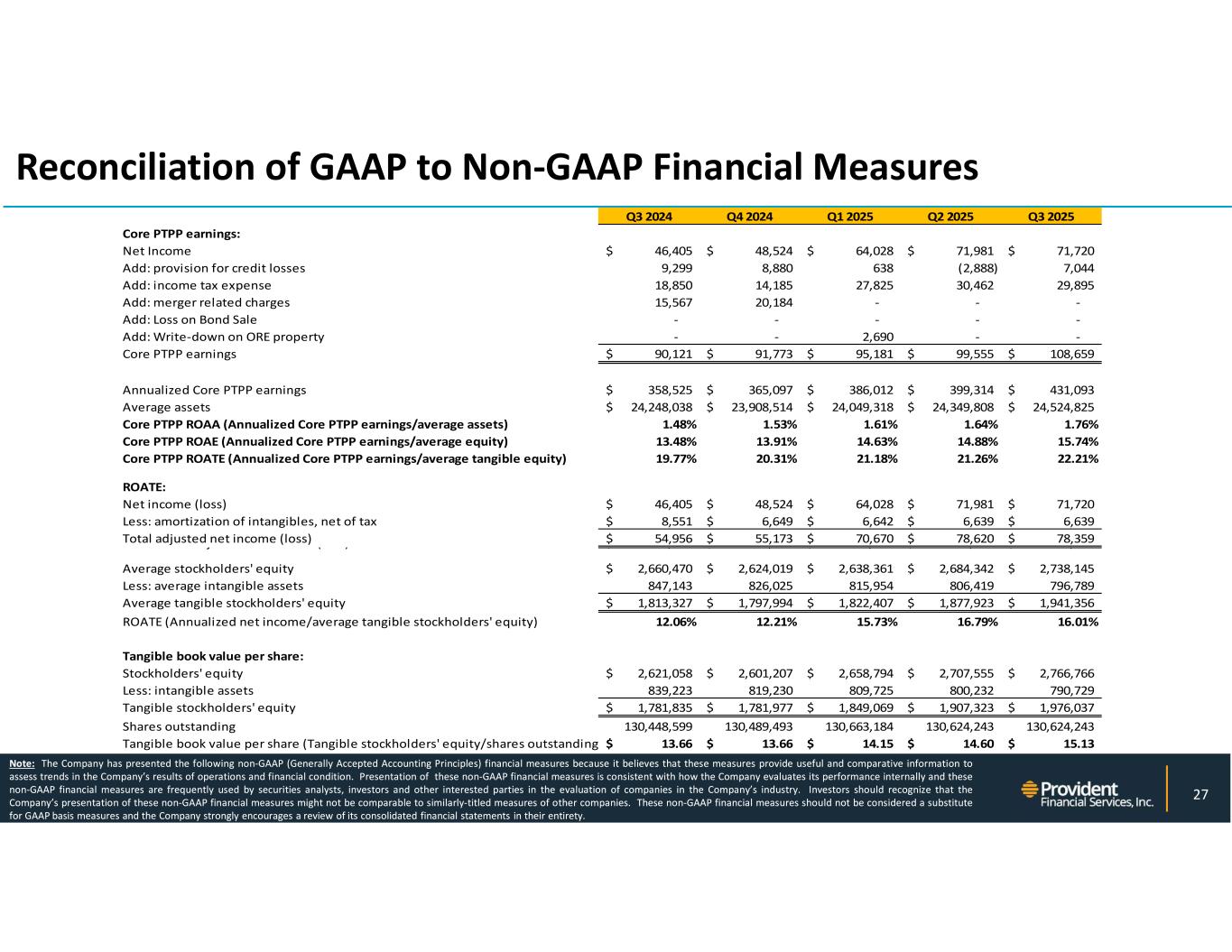

NYSE: PFS Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. Reconciliation of GAAP to Non-GAAP Financial Measures 27 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Core PTPP earnings: Net Income 46,405$ 48,524$ 64,028$ 71,981$ 71,720$ Add: provision for credit losses 9,299 8,880 638 (2,888) 7,044 Add: income tax expense 18,850 14,185 27,825 30,462 29,895 Add: merger related charges 15,567 20,184 - - - Add: Loss on Bond Sale - - - - - Add: Write-down on ORE property - - 2,690 - - Core PTPP earnings 90,121$ 91,773$ 95,181$ 99,555$ 108,659$ Annualized Core PTPP earnings 358,525$ 365,097$ 386,012$ 399,314$ 431,093$ Average assets 24,248,038$ 23,908,514$ 24,049,318$ 24,349,808$ 24,524,825$ Core PTPP ROAA (Annualized Core PTPP earnings/average assets) 1.48% 1.53% 1.61% 1.64% 1.76% Core PTPP ROAE (Annualized Core PTPP earnings/average equity) 13.48% 13.91% 14.63% 14.88% 15.74% Core PTPP ROATE (Annualized Core PTPP earnings/average tangible equity) 19.77% 20.31% 21.18% 21.26% 22.21% ROATE: Net income (loss) 46,405$ 48,524$ 64,028$ 71,981$ 71,720$ Less: amortization of intangibles, net of tax 8,551$ 6,649$ 6,642$ 6,639$ 6,639$ Total adjusted net income (loss) 54,956$ 55,173$ 70,670$ 78,620$ 78,359$ Annualized adjusted net income (loss) 218,629$ 219,493$ 286,606$ 318,848$ 317,789$ Average stockholders' equity 2,660,470$ 2,624,019$ 2,638,361$ 2,684,342$ 2,738,145$ Less: average intangible assets 847,143 826,025 815,954 806,419 796,789 Average tangible stockholders' equity 1,813,327$ 1,797,994$ 1,822,407$ 1,877,923$ 1,941,356$ ROATE (Annualized net income/average tangible stockholders' equity) 12.06% 12.21% 15.73% 16.79% 16.01% Tangible book value per share: Stockholders' equity 2,621,058$ 2,601,207$ 2,658,794$ 2,707,555$ 2,766,766$ Less: intangible assets 839,223 819,230 809,725 800,232 790,729 Tangible stockholders' equity 1,781,835$ 1,781,977$ 1,849,069$ 1,907,323$ 1,976,037$ Shares outstanding 130,448,599 130,489,493 130,663,184 130,624,243 130,624,243 Tangible book value per share (Tangible stockholders' equity/shares outstanding) 13.66$ 13.66$ 14.15$ 14.60$ 15.13$

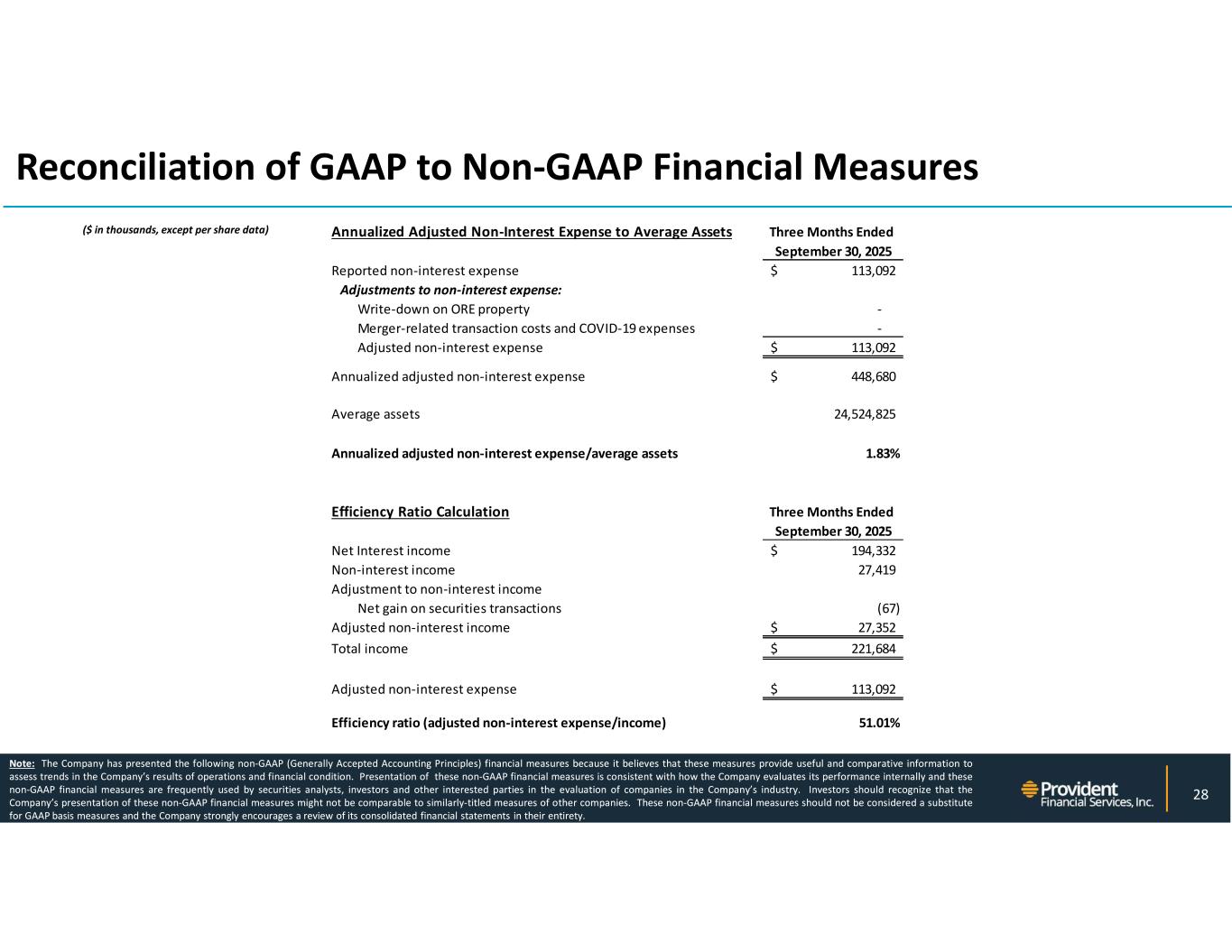

NYSE: PFS Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. ($ in thousands, except per share data) Reconciliation of GAAP to Non-GAAP Financial Measures 28 Annualized Adjusted Non-Interest Expense to Average Assets Three Months Ended September 30, 2025 Reported non-interest expense 113,092$ Adjustments to non-interest expense: Write-down on ORE property - Merger-related transaction costs and COVID-19 expenses - Adjusted non-interest expense 113,092$ Annualized adjusted non-interest expense 448,680$ Average assets 24,524,825 Annualized adjusted non-interest expense/average assets 1.83% Efficiency Ratio Calculation Three Months Ended September 30, 2025 Net Interest income 194,332$ Non-interest income 27,419 Adjustment to non-interest income Net gain on securities transactions (67) Adjusted non-interest income 27,352$ Total income 221,684$ Adjusted non-interest expense 113,092$ Efficiency ratio (adjusted non-interest expense/income) 51.01%

Q3 2025 RESULTS PRESENTATION