Q4 2025 RESULTS PRESENTATION

Certain statements contained herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward- looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” "project," "intend," “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in Item 1A of the Company's Annual Report on Form 10-K, as supplemented by its Quarterly Reports on Form 10-Q, and those related to the economic environment, particularly in the market areas in which the Company operates, inflation and unemployment, competitive products and pricing, real estate values, fiscal and monetary policies of the U.S. Government, tariffs, changes in accounting policies and practices that may be adopted by the regulatory agencies and the accounting standards setters, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, potential goodwill impairment, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. The Company cautions readers not to place undue reliance on any such forward-looking statements which speak only as of the date they are made. The Company advises readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not assume any duty, and does not undertake, to update any forward-looking statements to reflect events or circumstances after the date of this statement. Forward Looking Statements 2

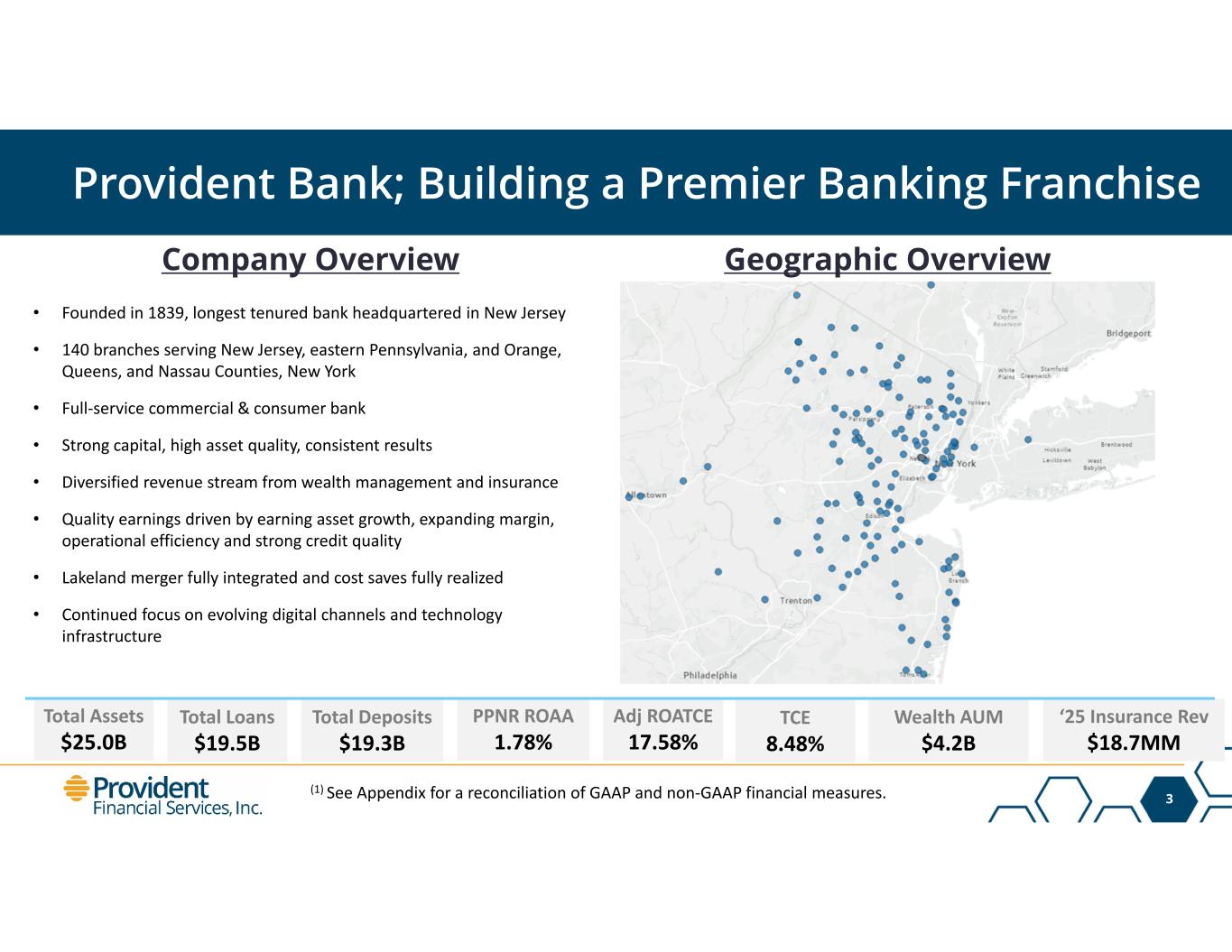

Provident Bank; Building a Premier Banking Franchise Total Assets $25.0B Total Loans $19.5B Total Deposits $19.3B PPNR ROAA 1.78% Adj ROATCE 17.58% Wealth AUM $4.2B ‘25 Insurance Rev $18.7MM Company Overview Geographic Overview • Founded in 1839, longest tenured bank headquartered in New Jersey • 140 branches serving New Jersey, eastern Pennsylvania, and Orange, Queens, and Nassau Counties, New York • Full-service commercial & consumer bank • Strong capital, high asset quality, consistent results • Diversified revenue stream from wealth management and insurance • Quality earnings driven by earning asset growth, expanding margin, operational efficiency and strong credit quality • Lakeland merger fully integrated and cost saves fully realized • Continued focus on evolving digital channels and technology infrastructure TCE 8.48% (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. 3

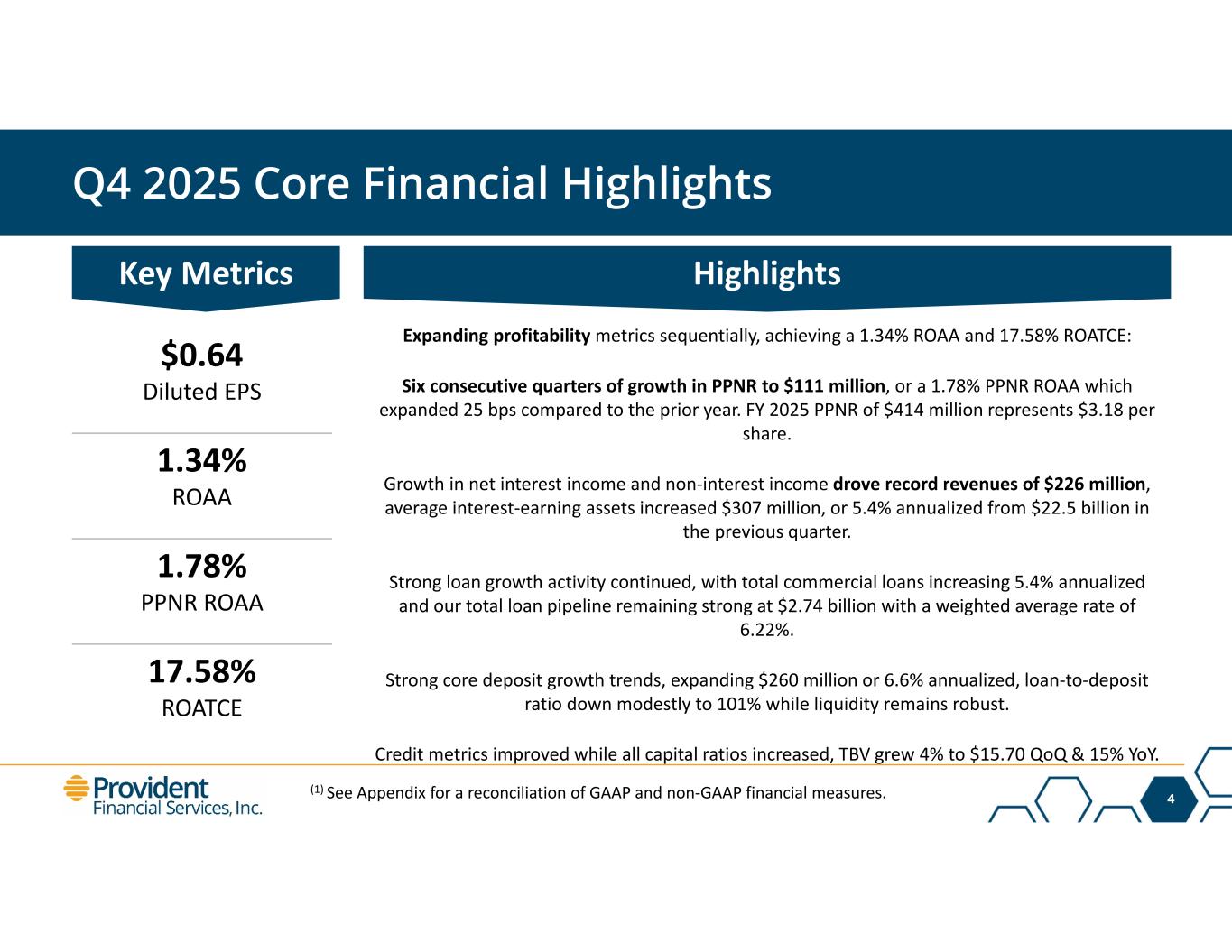

Q4 2025 Core Financial Highlights $0.64 Diluted EPS 1.34% ROAA 1.78% PPNR ROAA 17.58% ROATCE (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. 4 Key Metrics Highlights Expanding profitability metrics sequentially, achieving a 1.34% ROAA and 17.58% ROATCE: Six consecutive quarters of growth in PPNR to $111 million, or a 1.78% PPNR ROAA which expanded 25 bps compared to the prior year. FY 2025 PPNR of $414 million represents $3.18 per share. Growth in net interest income and non-interest income drove record revenues of $226 million, average interest-earning assets increased $307 million, or 5.4% annualized from $22.5 billion in the previous quarter. Strong loan growth activity continued, with total commercial loans increasing 5.4% annualized and our total loan pipeline remaining strong at $2.74 billion with a weighted average rate of 6.22%. Strong core deposit growth trends, expanding $260 million or 6.6% annualized, loan-to-deposit ratio down modestly to 101% while liquidity remains robust. Credit metrics improved while all capital ratios increased, TBV grew 4% to $15.70 QoQ & 15% YoY.

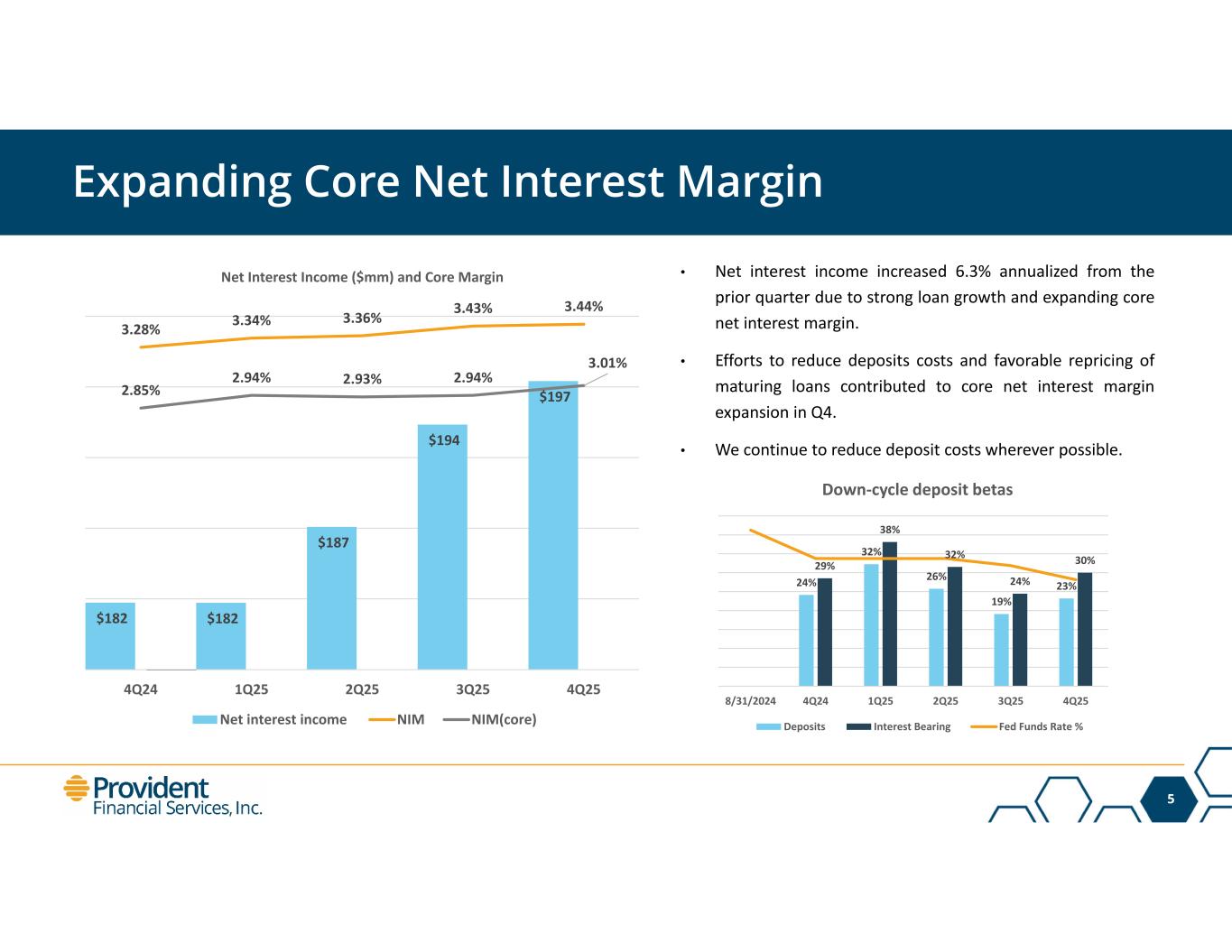

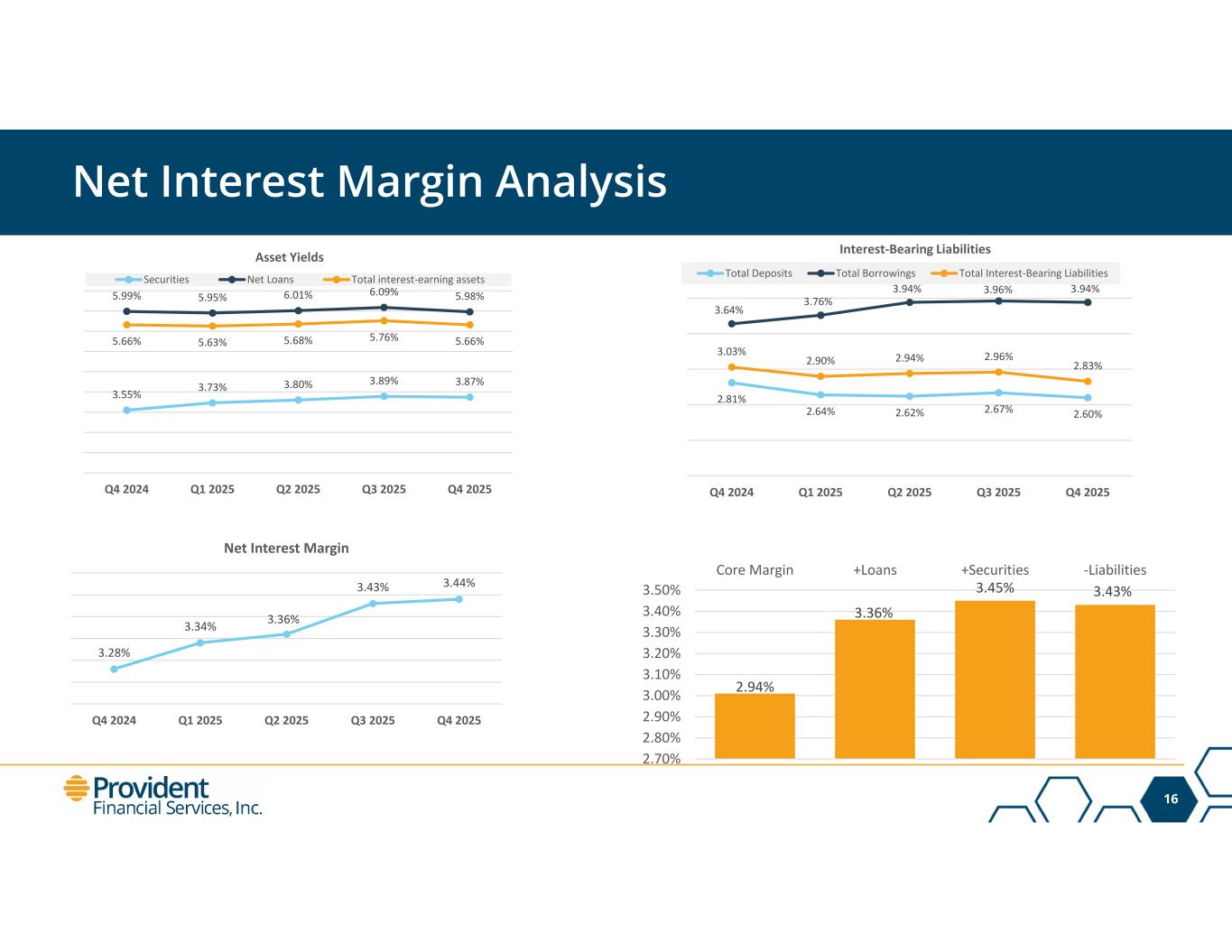

Expanding Core Net Interest Margin • Net interest income increased 6.3% annualized from the prior quarter due to strong loan growth and expanding core net interest margin. • Efforts to reduce deposits costs and favorable repricing of maturing loans contributed to core net interest margin expansion in Q4. • We continue to reduce deposit costs wherever possible. 5 $182 $182 $187 $194 $197 3.28% 3.34% 3.36% 3.43% 3.44% 2.85% 2.94% 2.93% 2.94% 3.01% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 3.20% 3.40% 3.60% $177 $182 $187 $192 $197 $202 4Q24 1Q25 2Q25 3Q25 4Q25 Net Interest Income ($mm) and Core Margin Net interest income NIM NIM(core) 24% 32% 26% 19% 23% 29% 38% 32% 24% 30% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 8/31/2024 4Q24 1Q25 2Q25 3Q25 4Q25 Down-cycle deposit betas Deposits Interest Bearing Fed Funds Rate %

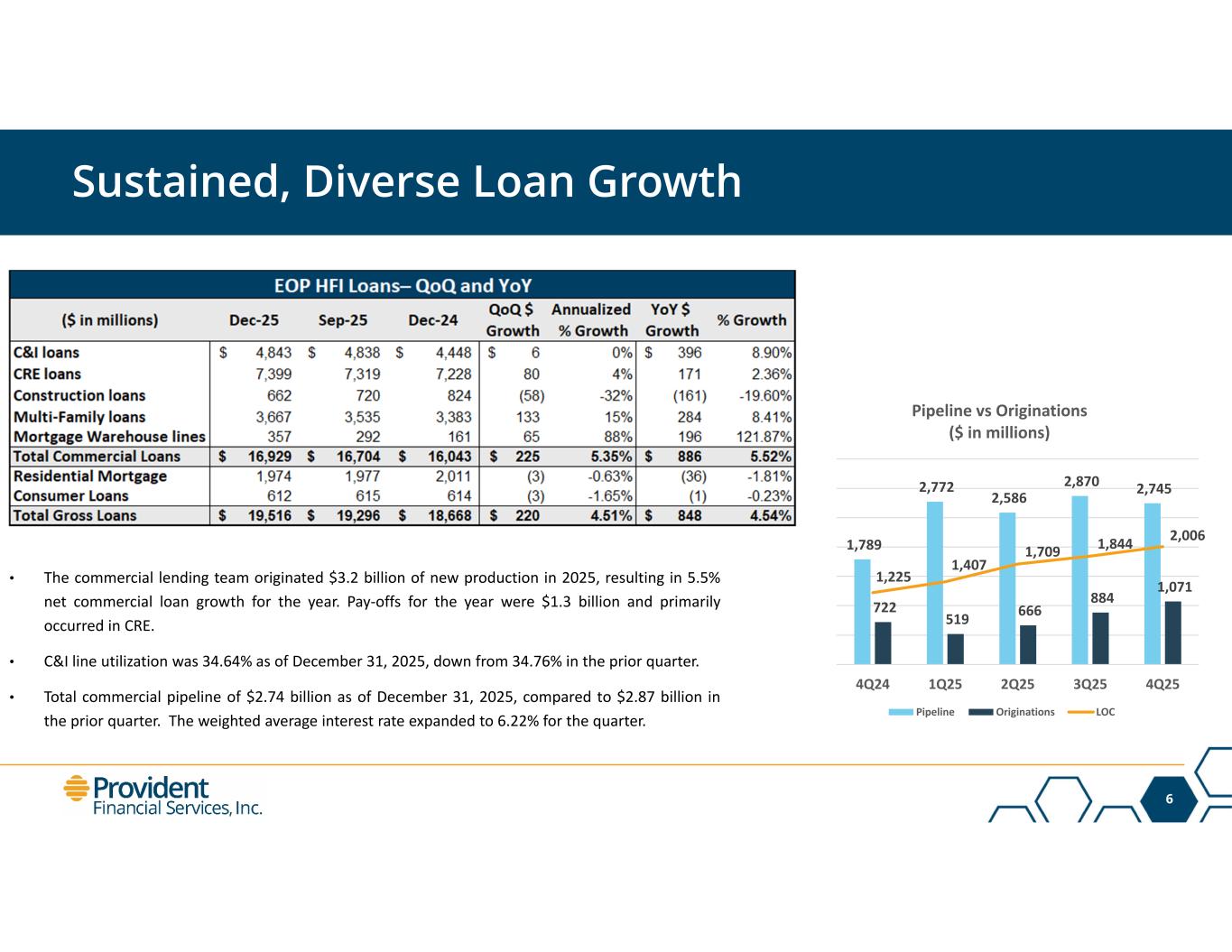

Sustained, Diverse Loan Growth 6 • The commercial lending team originated $3.2 billion of new production in 2025, resulting in 5.5% net commercial loan growth for the year. Pay-offs for the year were $1.3 billion and primarily occurred in CRE. • C&I line utilization was 34.64% as of December 31, 2025, down from 34.76% in the prior quarter. • Total commercial pipeline of $2.74 billion as of December 31, 2025, compared to $2.87 billion in the prior quarter. The weighted average interest rate expanded to 6.22% for the quarter. 1,789 2,772 2,586 2,870 2,745 722 519 666 884 1,071 1,225 1,407 1,709 1,844 2,006 - 500 1,000 1,500 2,000 2,500 3,000 3,500 4Q24 1Q25 2Q25 3Q25 4Q25 Pipeline vs Originations ($ in millions) Pipeline Originations LOC

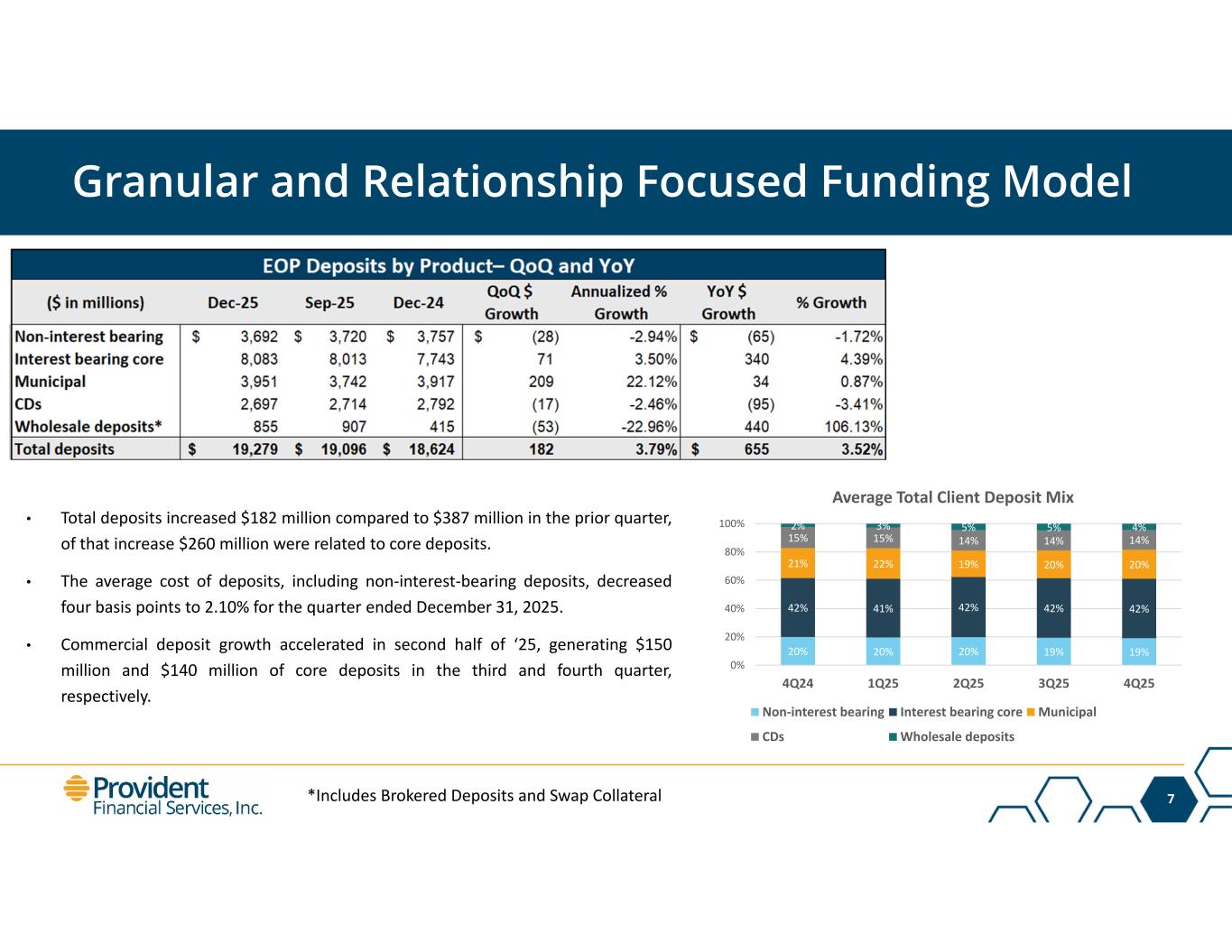

Granular and Relationship Focused Funding Model • Total deposits increased $182 million compared to $387 million in the prior quarter, of that increase $260 million were related to core deposits. • The average cost of deposits, including non-interest-bearing deposits, decreased four basis points to 2.10% for the quarter ended December 31, 2025. • Commercial deposit growth accelerated in second half of ‘25, generating $150 million and $140 million of core deposits in the third and fourth quarter, respectively. 7*Includes Brokered Deposits and Swap Collateral 20% 20% 20% 19% 19% 42% 41% 42% 42% 42% 21% 22% 19% 20% 20% 15% 15% 14% 14% 14% 2% 3% 5% 5% 4% 0% 20% 40% 60% 80% 100% 4Q24 1Q25 2Q25 3Q25 4Q25 Average Total Client Deposit Mix Non-interest bearing Interest bearing core Municipal CDs Wholesale deposits

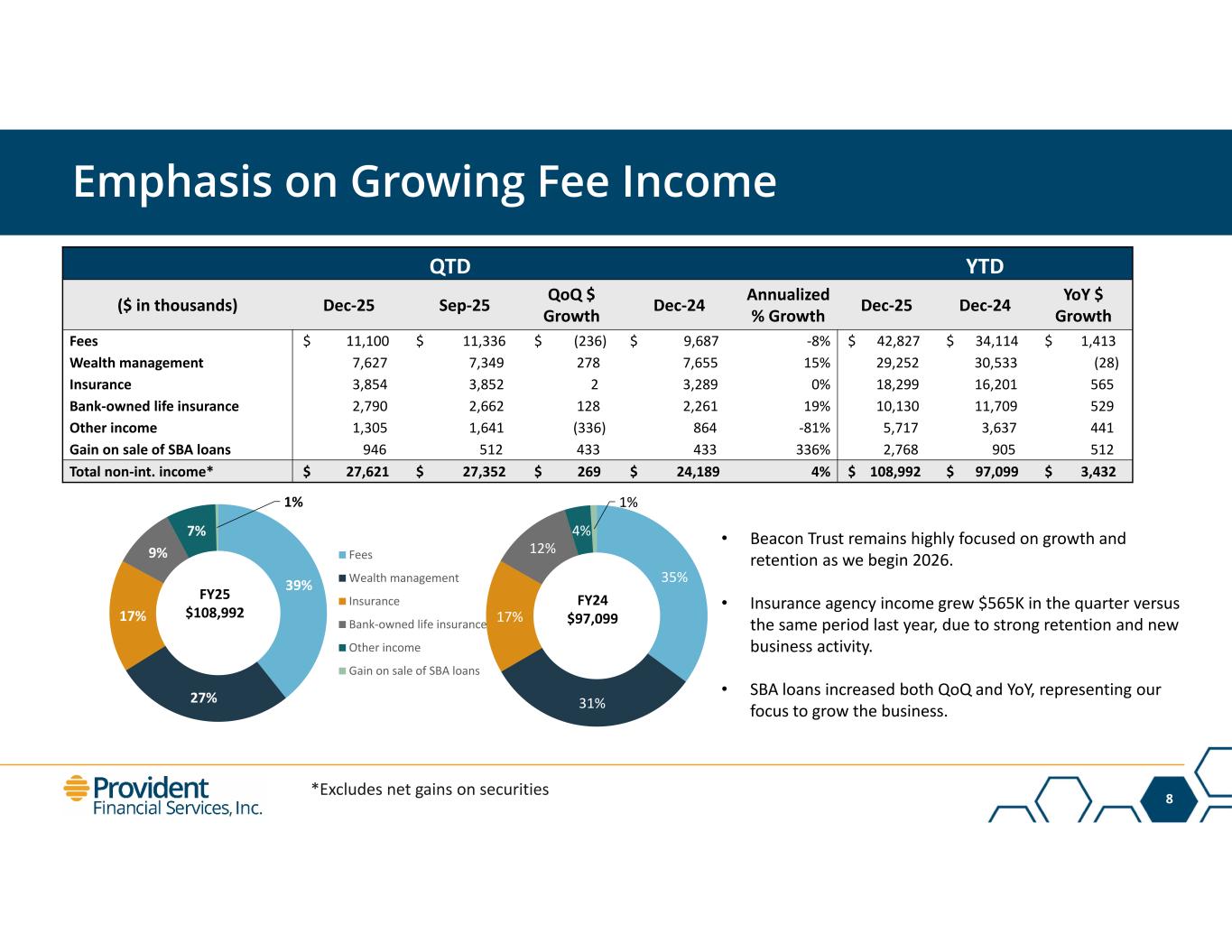

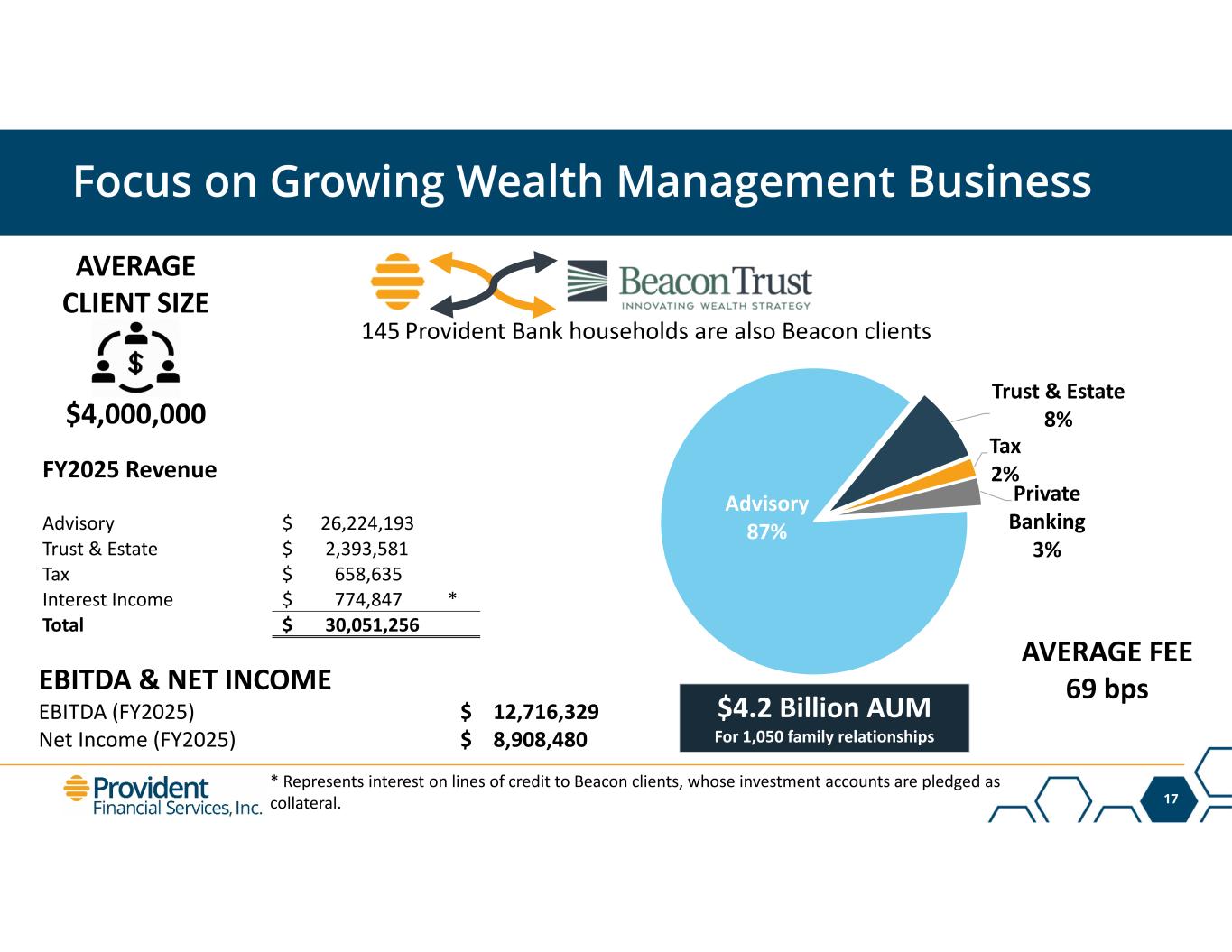

Emphasis on Growing Fee Income 8 • Beacon Trust remains highly focused on growth and retention as we begin 2026. • Insurance agency income grew $565K in the quarter versus the same period last year, due to strong retention and new business activity. • SBA loans increased both QoQ and YoY, representing our focus to grow the business. 39% 27% 17% 9% 7% 1% Fees Wealth management Insurance Bank-owned life insurance Other income Gain on sale of SBA loans FY25 $108,992 35% 31% 17% 12% 4% 1% FY24 $97,099 YTDQTD YoY $ GrowthDec-24Dec-25Annualized % GrowthDec-24QoQ $ GrowthSep-25Dec-25($ in thousands) $ 1,413 $ 34,114 $ 42,827 -8%$ 9,687 $ (236)$ 11,336 $ 11,100 Fees (28)30,533 29,252 15%7,655 278 7,349 7,627 Wealth management 565 16,201 18,299 0%3,289 2 3,852 3,854 Insurance 529 11,709 10,130 19%2,261 128 2,662 2,790 Bank-owned life insurance 441 3,637 5,717 -81%864 (336)1,641 1,305 Other income 512 905 2,768 336%433 433 512 946 Gain on sale of SBA loans $ 3,432 $ 97,099 $ 108,992 4%$ 24,189 $ 269 $ 27,352 $ 27,621 Total non-int. income* *Excludes net gains on securities

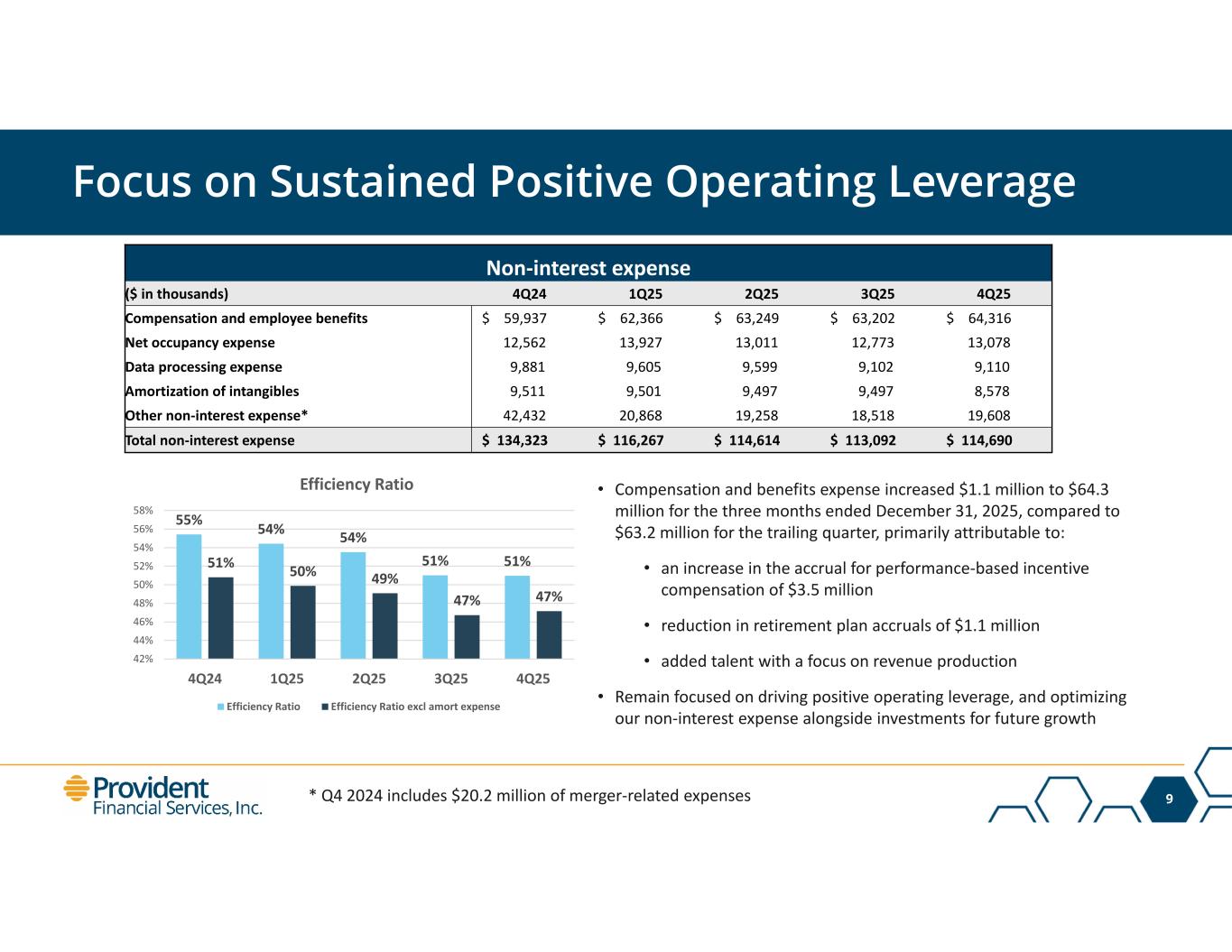

Focus on Sustained Positive Operating Leverage 9 • Compensation and benefits expense increased $1.1 million to $64.3 million for the three months ended December 31, 2025, compared to $63.2 million for the trailing quarter, primarily attributable to: • an increase in the accrual for performance-based incentive compensation of $3.5 million • reduction in retirement plan accruals of $1.1 million • added talent with a focus on revenue production • Remain focused on driving positive operating leverage, and optimizing our non-interest expense alongside investments for future growth * Q4 2024 includes $20.2 million of merger-related expenses Non-interest expense 4Q253Q252Q251Q254Q24($ in thousands) $ 64,316 $ 63,202 $ 63,249 $ 62,366 $ 59,937 Compensation and employee benefits 13,078 12,773 13,011 13,927 12,562 Net occupancy expense 9,110 9,102 9,599 9,605 9,881 Data processing expense 8,578 9,497 9,497 9,501 9,511 Amortization of intangibles 19,608 18,518 19,258 20,868 42,432 Other non-interest expense* $ 114,690 $ 113,092 $ 114,614 $ 116,267 $ 134,323 Total non-interest expense 55% 54% 54% 51% 51%51% 50% 49% 47% 47% 42% 44% 46% 48% 50% 52% 54% 56% 58% 4Q24 1Q25 2Q25 3Q25 4Q25 Efficiency Ratio Efficiency Ratio Efficiency Ratio excl amort expense

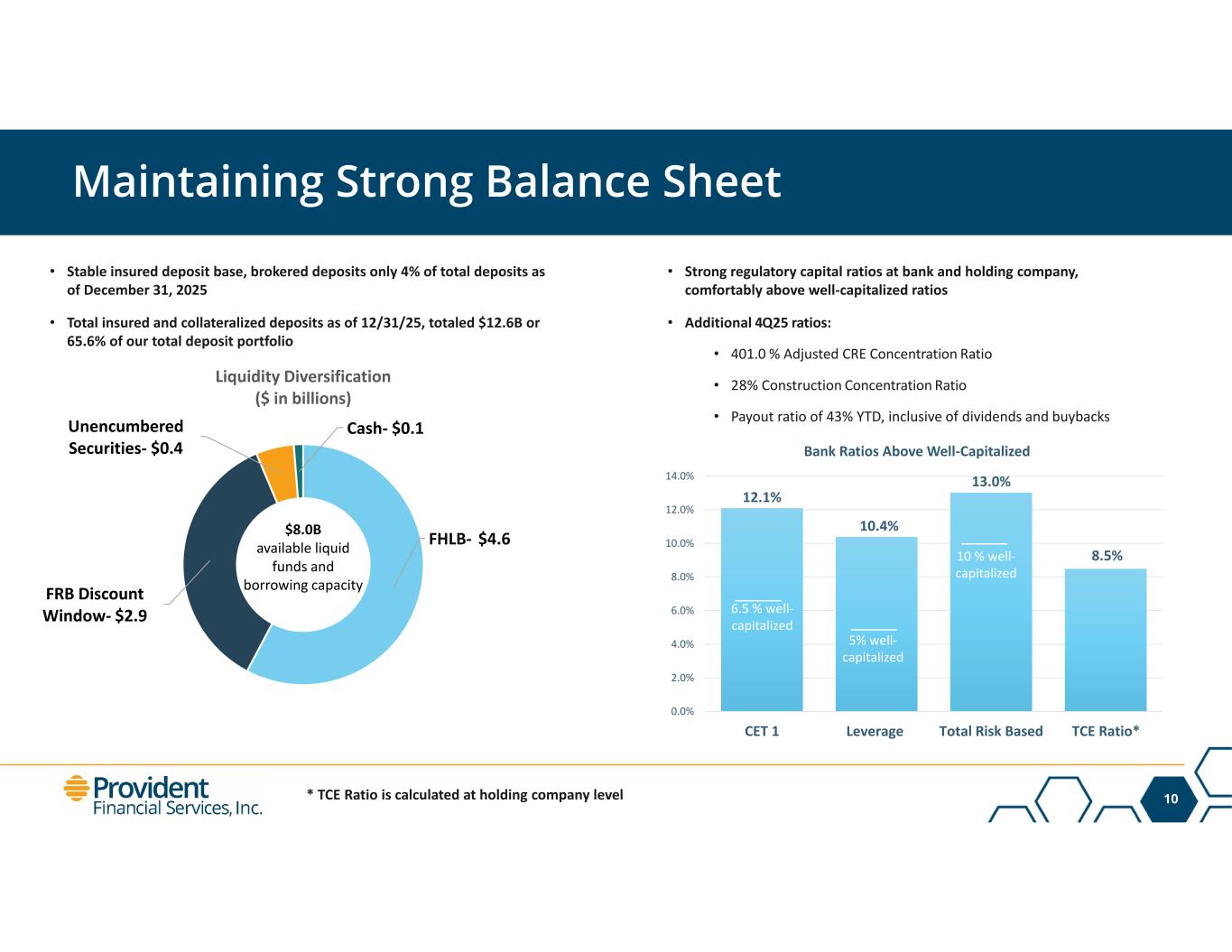

Maintaining Strong Balance Sheet • Stable insured deposit base, brokered deposits only 4% of total deposits as of December 31, 2025 • Total insured and collateralized deposits as of 12/31/25, totaled $12.6B or 65.6% of our total deposit portfolio • Strong regulatory capital ratios at bank and holding company, comfortably above well-capitalized ratios • Additional 4Q25 ratios: • 401.0 % Adjusted CRE Concentration Ratio • 28% Construction Concentration Ratio • Payout ratio of 43% YTD, inclusive of dividends and buybacks 10 FHLB- $4.6 FRB Discount Window- $2.9 Unencumbered Securities- $0.4 Cash- $0.1 Liquidity Diversification ($ in billions) $8.0B available liquid funds and borrowing capacity 12.1% 10.4% 13.0% 8.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% CET 1 Leverage Total Risk Based TCE Ratio* Bank Ratios Above Well-Capitalized 5% well- capitalized 6.5 % well- capitalized 10 % well- capitalized * TCE Ratio is calculated at holding company level

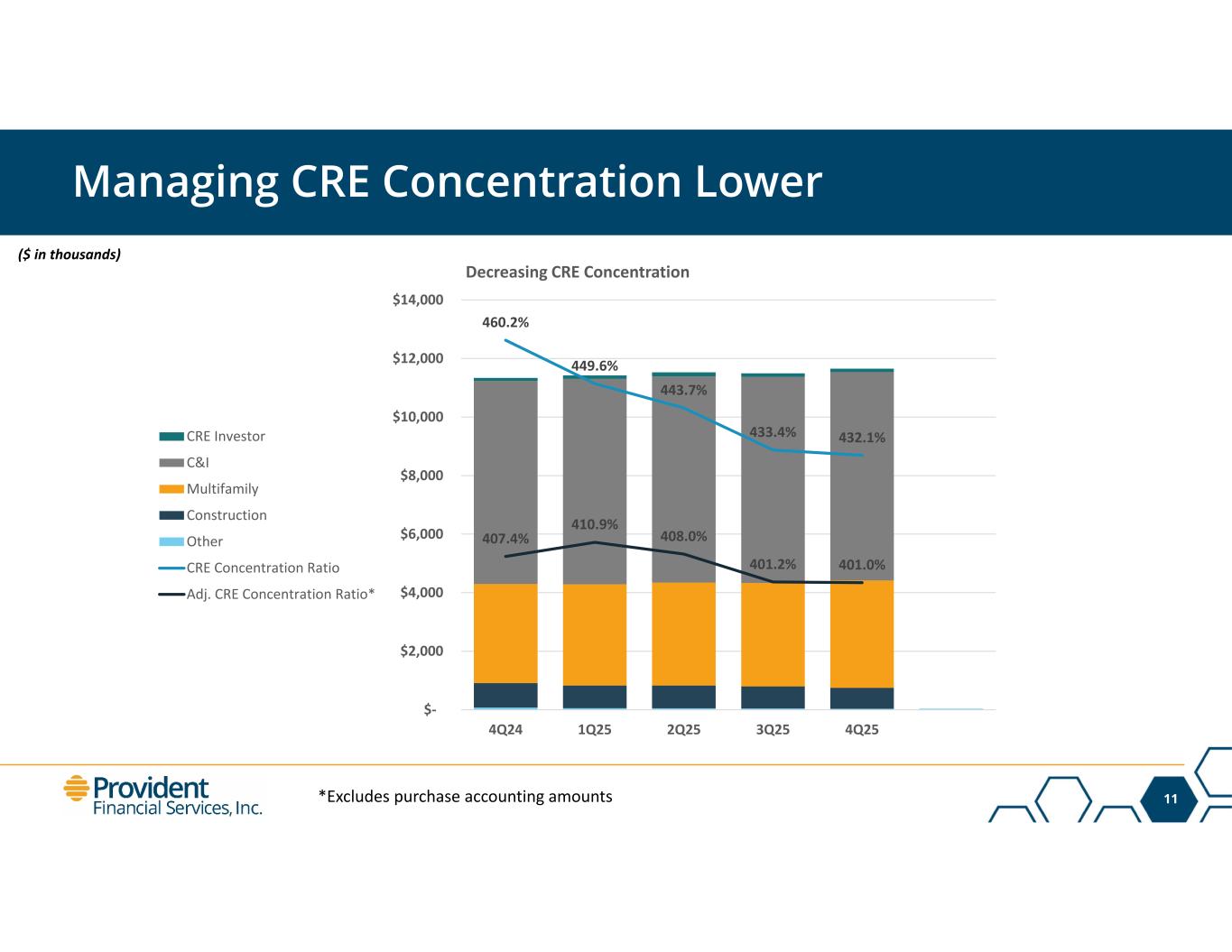

Managing CRE Concentration Lower 11 ($ in thousands) *Excludes purchase accounting amounts 460.2% 449.6% 443.7% 433.4% 432.1% 407.4% 410.9% 408.0% 401.2% 401.0% $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 4Q24 1Q25 2Q25 3Q25 4Q25 Decreasing CRE Concentration CRE Investor C&I Multifamily Construction Other CRE Concentration Ratio Adj. CRE Concentration Ratio*

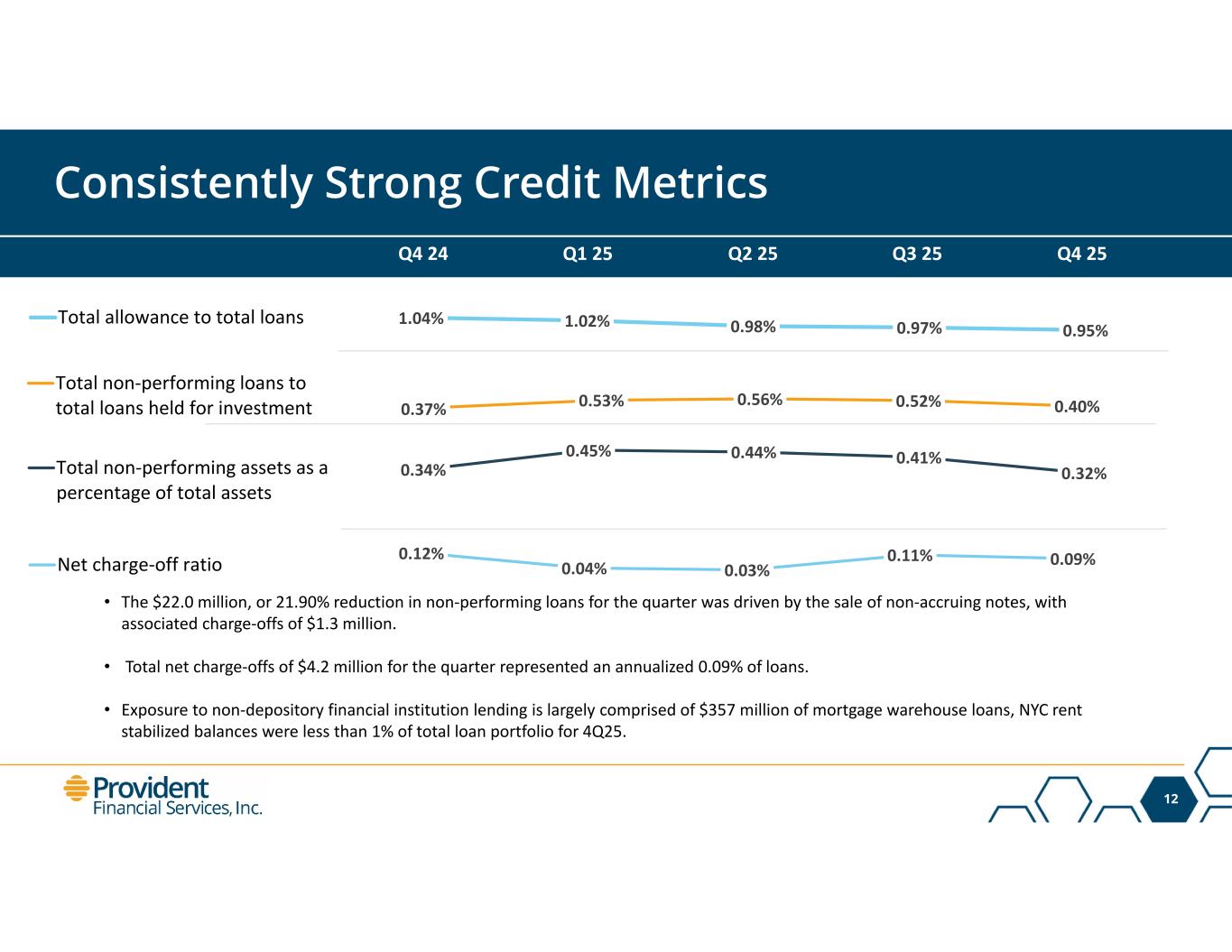

Consistently Strong Credit Metrics 1.04% 1.02% 0.98% 0.97% 0.95% Total allowance to total loans 0.37% 0.53% 0.56% 0.52% 0.40% Total non-performing loans to total loans held for investment 0.34% 0.45% 0.44% 0.41% 0.32%Total non-performing assets as a percentage of total assets Q4 24 Q3 25 Q4 25Q1 25 Q2 25 0.12% 0.04% 0.03% 0.11% 0.09%Net charge-off ratio • The $22.0 million, or 21.90% reduction in non-performing loans for the quarter was driven by the sale of non-accruing notes, with associated charge-offs of $1.3 million. • Total net charge-offs of $4.2 million for the quarter represented an annualized 0.09% of loans. • Exposure to non-depository financial institution lending is largely comprised of $357 million of mortgage warehouse loans, NYC rent stabilized balances were less than 1% of total loan portfolio for 4Q25. 12

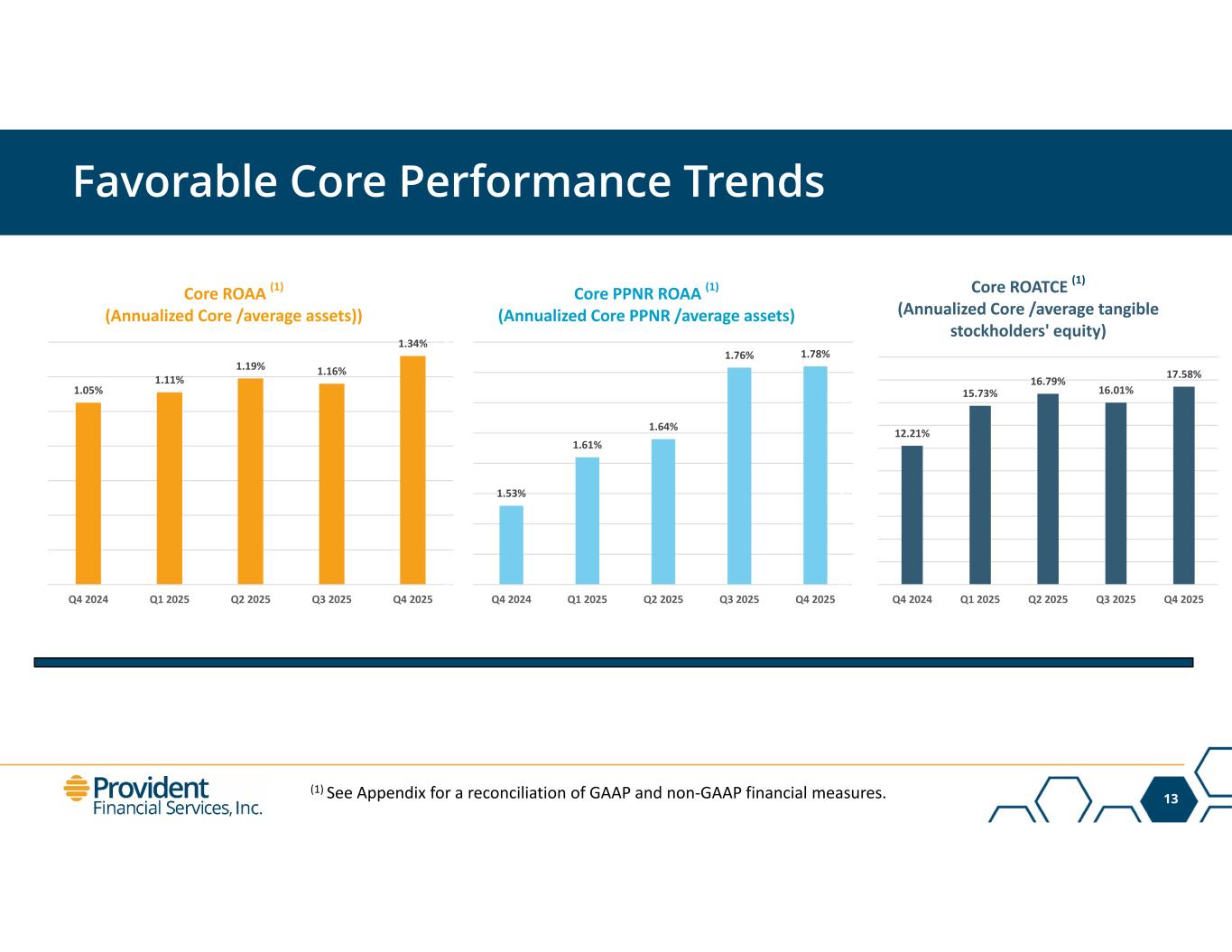

Favorable Core Performance Trends (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. 13 1.05% 1.11% 1.19% 1.16% 1.34% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Core ROAA (1) (Annualized Core /average assets)) 1.53% 1.61% 1.64% 1.76% 1.78% 1.40% 1.45% 1.50% 1.55% 1.60% 1.65% 1.70% 1.75% 1.80% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Core PPNR ROAA (1) (Annualized Core PPNR /average assets) 12.21% 15.73% 16.79% 16.01% 17.58% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Core ROATCE (1) (Annualized Core /average tangible stockholders' equity)

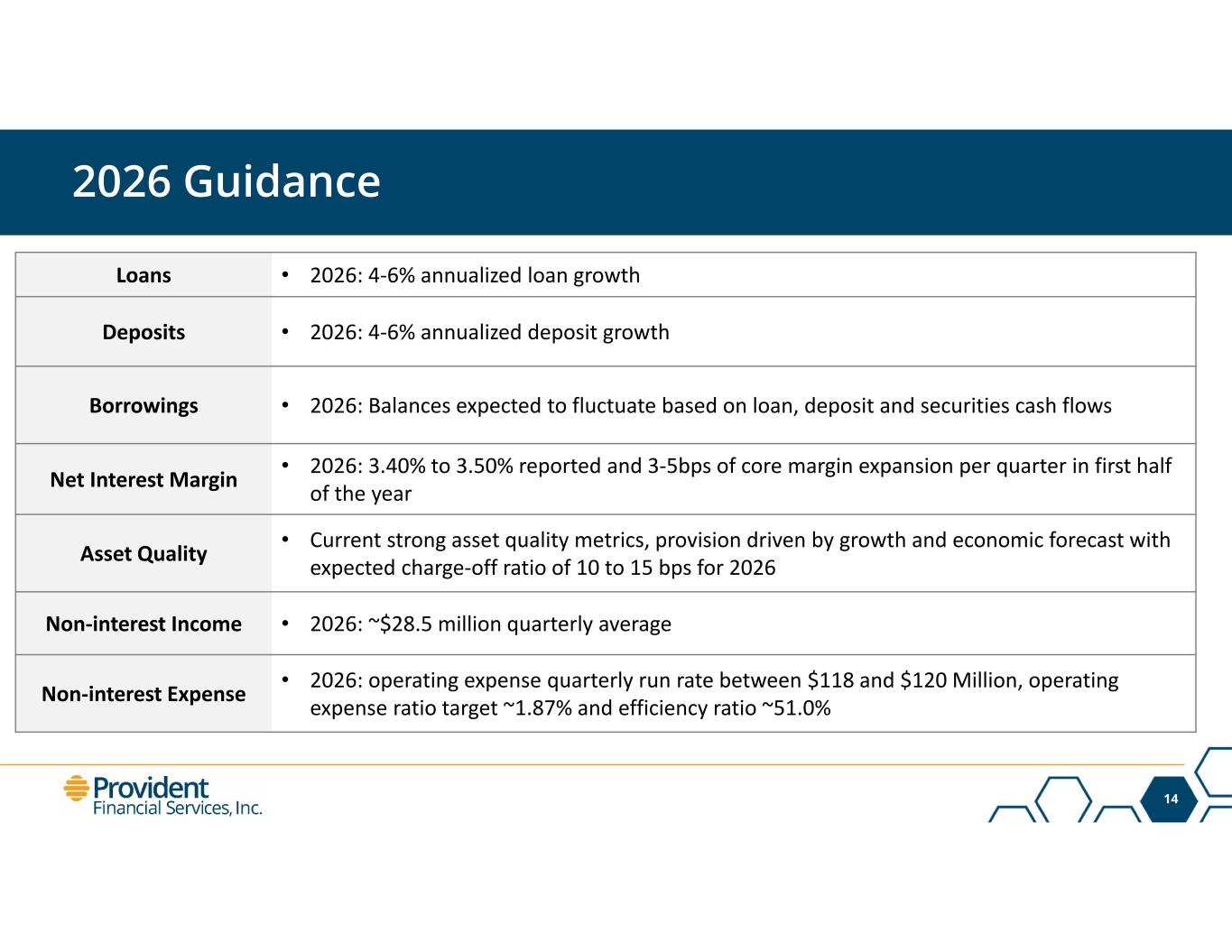

2026 Guidance • 2026: 4-6% annualized loan growth Loans • 2026: 4-6% annualized deposit growthDeposits • 2026: Balances expected to fluctuate based on loan, deposit and securities cash flowsBorrowings • 2026: 3.40% to 3.50% reported and 3-5bps of core margin expansion per quarter in first half of the yearNet Interest Margin • Current strong asset quality metrics, provision driven by growth and economic forecast with expected charge-off ratio of 10 to 15 bps for 2026Asset Quality • 2026: ~$28.5 million quarterly averageNon-interest Income • 2026: operating expense quarterly run rate between $118 and $120 Million, operating expense ratio target ~1.87% and efficiency ratio ~51.0%Non-interest Expense 14

APPENDIX 15

Net Interest Margin Analysis 3.55% 3.73% 3.80% 3.89% 3.87% 5.99% 5.95% 6.01% 6.09% 5.98% 5.66% 5.63% 5.68% 5.76% 5.66% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Asset Yields Securities Net Loans Total interest-earning assets 2.81% 2.64% 2.62% 2.67% 2.60% 3.64% 3.76% 3.94% 3.96% 3.94% 3.03% 2.90% 2.94% 2.96% 2.83% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Interest-Bearing Liabilities Total Deposits Total Borrowings Total Interest-Bearing Liabilities 3.28% 3.34% 3.36% 3.43% 3.44% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Net Interest Margin 2.94% 3.36% 3.45% 3.43% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% Core Margin +Loans +Securities -Liabilities 16

Focus on Growing Wealth Management Business Advisory 87% Trust & Estate 8% Tax 2% Private Banking 3% $4.2 Billion AUM For 1,050 family relationships FY2025 Revenue $ 26,224,193 Advisory $ 2,393,581 Trust & Estate $ 658,635 Tax *$ 774,847 Interest Income $ 30,051,256 Total * Represents interest on lines of credit to Beacon clients, whose investment accounts are pledged as collateral. 17 145 Provident Bank households are also Beacon clients AVERAGE CLIENT SIZE $4,000,000 AVERAGE FEE 69 bpsEBITDA & NET INCOME EBITDA (FY2025) $ 12,716,329 Net Income (FY2025) $ 8,908,480

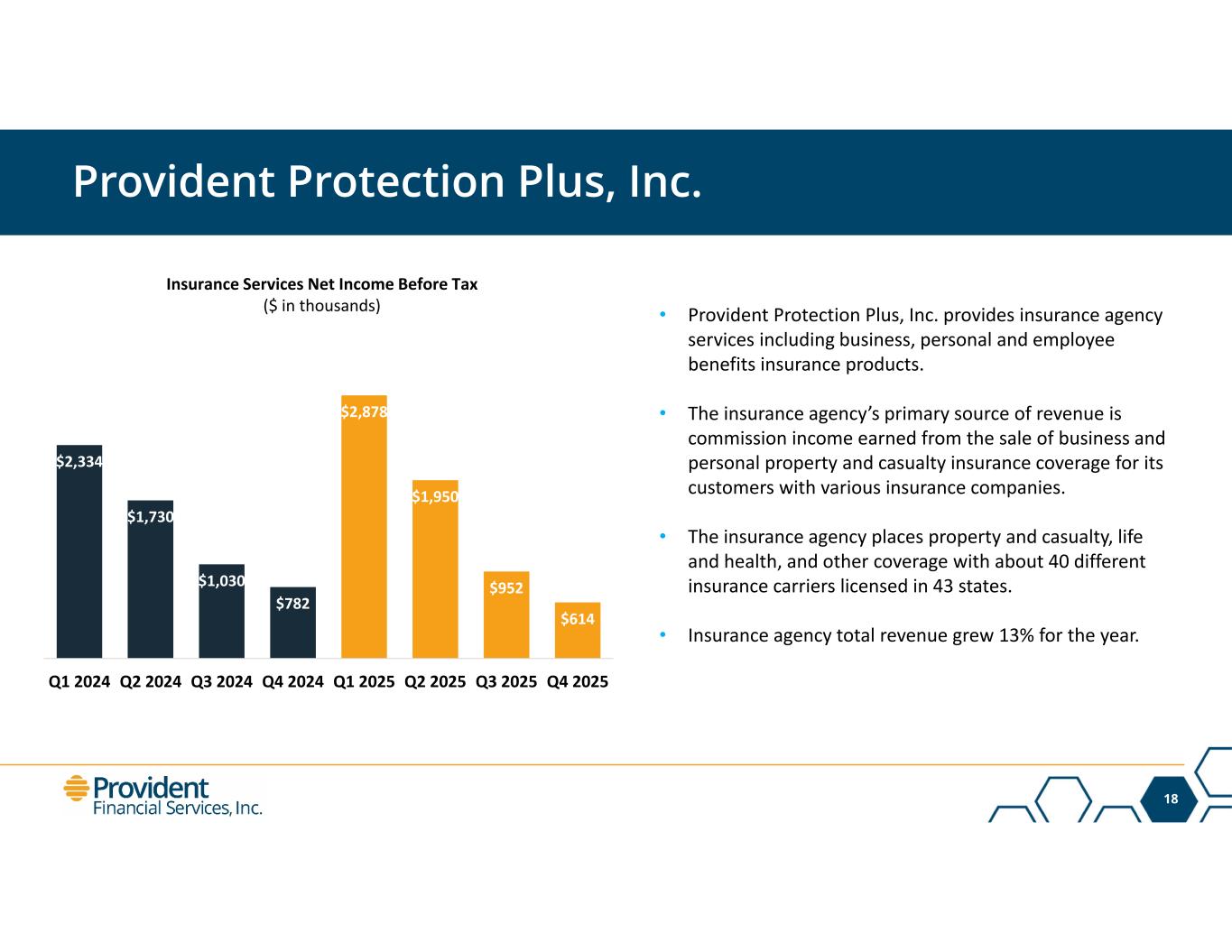

Provident Protection Plus, Inc. • Provident Protection Plus, Inc. provides insurance agency services including business, personal and employee benefits insurance products. • The insurance agency’s primary source of revenue is commission income earned from the sale of business and personal property and casualty insurance coverage for its customers with various insurance companies. • The insurance agency places property and casualty, life and health, and other coverage with about 40 different insurance carriers licensed in 43 states. • Insurance agency total revenue grew 13% for the year. $2,334 $1,730 $1,030 $782 $2,878 $1,950 $952 $614 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Insurance Services Net Income Before Tax ($ in thousands) 18

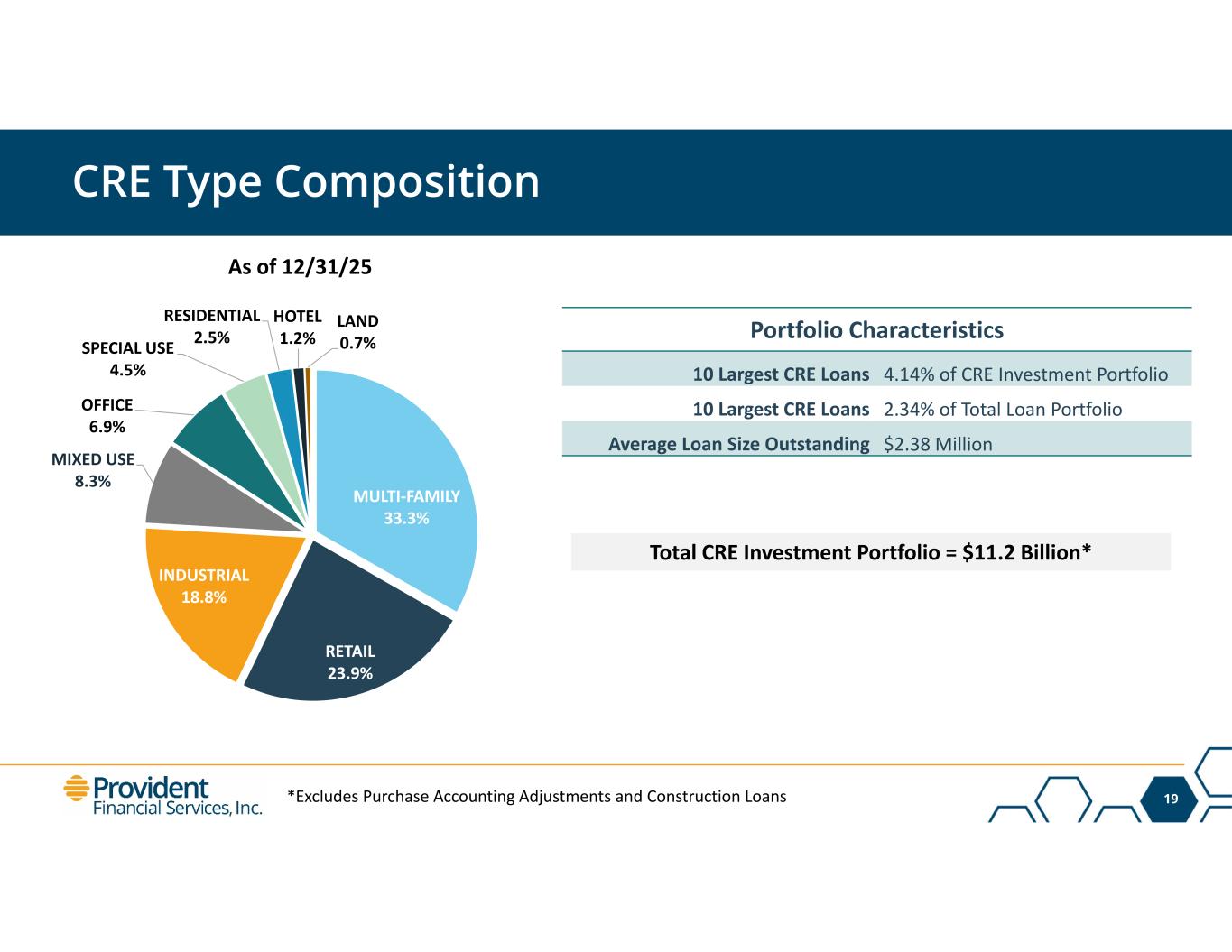

CRE Type Composition 19 MULTI-FAMILY 33.3% RETAIL 23.9% INDUSTRIAL 18.8% MIXED USE 8.3% OFFICE 6.9% SPECIAL USE 4.5% RESIDENTIAL 2.5% HOTEL 1.2% LAND 0.7% Portfolio Characteristics 4.14% of CRE Investment Portfolio10 Largest CRE Loans 2.34% of Total Loan Portfolio10 Largest CRE Loans $2.38 MillionAverage Loan Size Outstanding Total CRE Investment Portfolio = $11.2 Billion* *Excludes Purchase Accounting Adjustments and Construction Loans As of 12/31/25

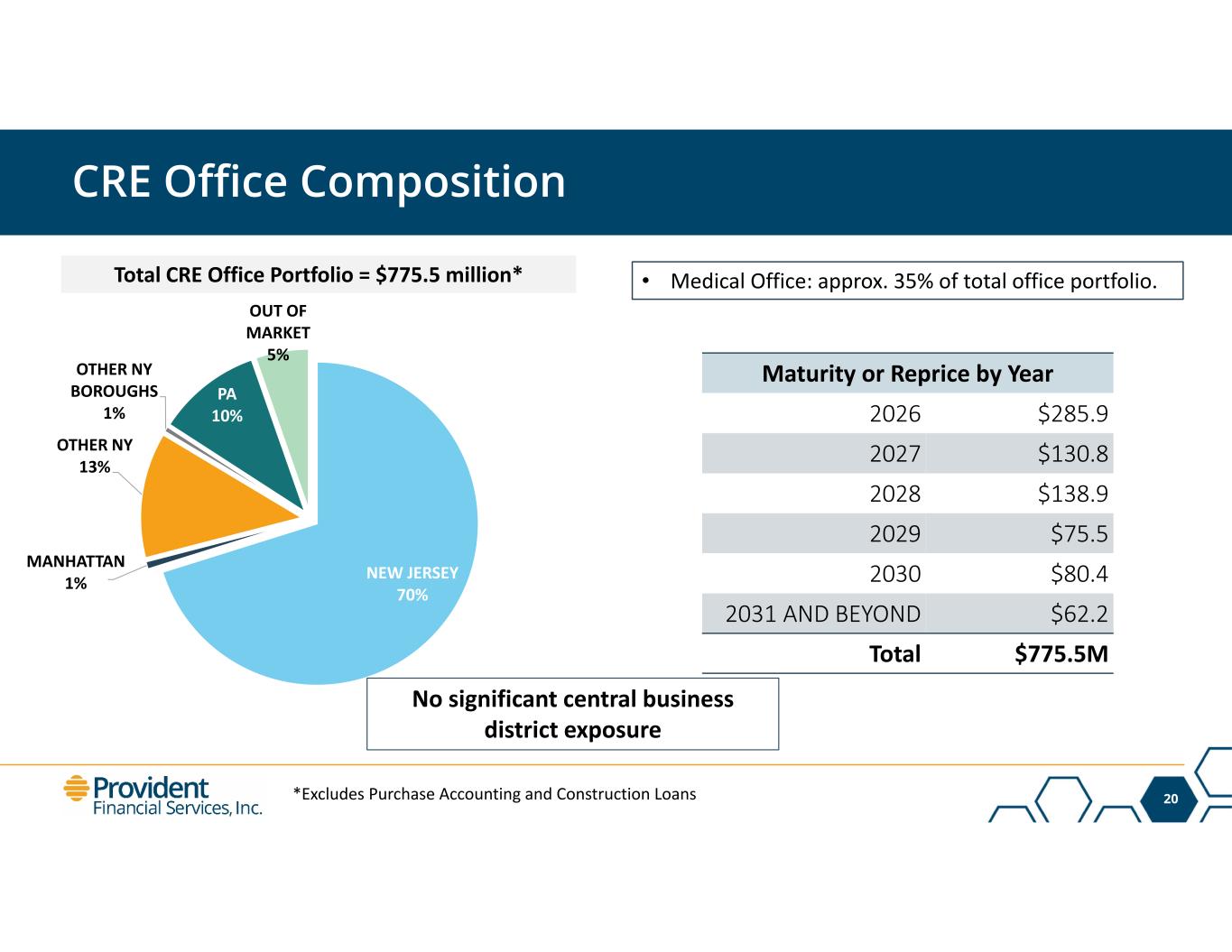

CRE Office Composition • Medical Office: approx. 35% of total office portfolio. Maturity or Reprice by Year $285.92026 $130.82027 $138.92028 $75.52029 $80.42030 $62.22031 AND BEYOND $775.5MTotal NEW JERSEY 70% MANHATTAN 1% OTHER NY 13% OTHER NY BOROUGHS 1% PA 10% OUT OF MARKET 5% No significant central business district exposure Total CRE Office Portfolio = $775.5 million* *Excludes Purchase Accounting and Construction Loans 20

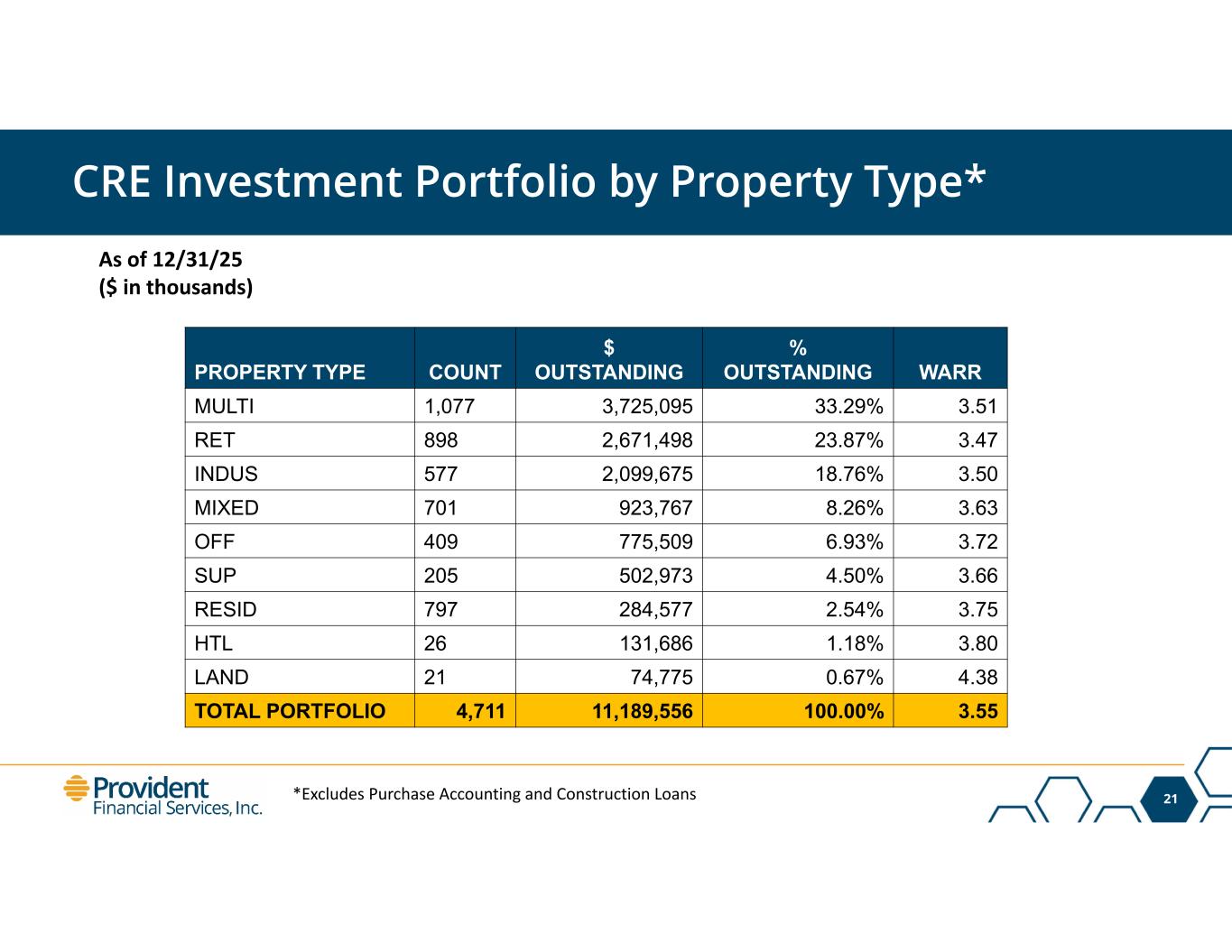

CRE Investment Portfolio by Property Type* As of 12/31/25 ($ in thousands) WARR % OUTSTANDING $ OUTSTANDINGCOUNT PROPERTY TYPE 3.5133.29%3,725,095 1,077MULTI 3.4723.87%2,671,498 898 RET 3.5018.76%2,099,675 577 INDUS 3.638.26%923,767 701 MIXED 3.726.93%775,509 409 OFF 3.664.50%502,973 205 SUP 3.752.54%284,577 797 RESID 3.801.18%131,686 26 HTL 4.380.67%74,775 21 LAND 3.55100.00%11,189,556 4,711TOTAL PORTFOLIO *Excludes Purchase Accounting and Construction Loans 21

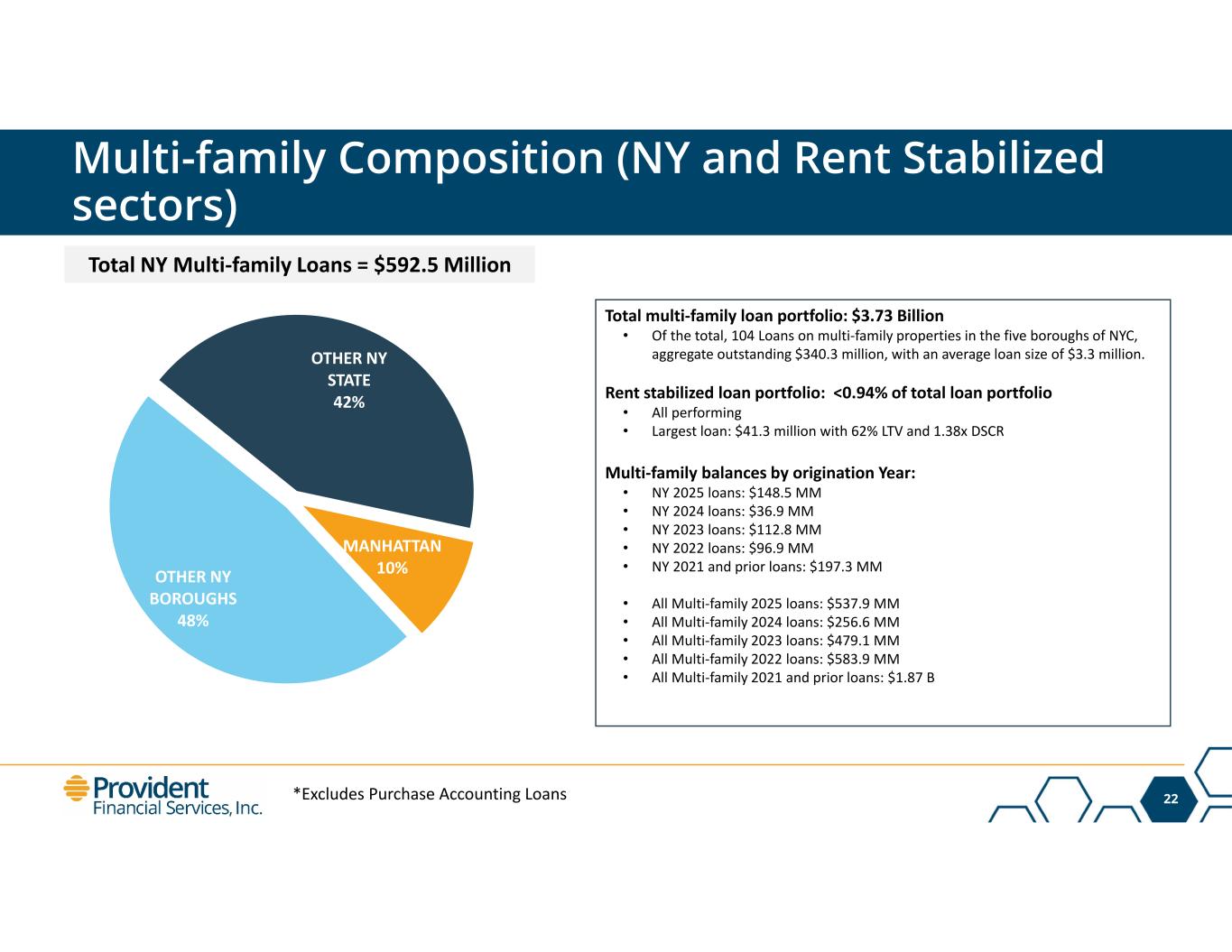

Multi-family Composition (NY and Rent Stabilized sectors) OTHER NY BOROUGHS 48% OTHER NY STATE 42% MANHATTAN 10% Total NY Multi-family Loans = $592.5 Million Total multi-family loan portfolio: $3.73 Billion • Of the total, 104 Loans on multi-family properties in the five boroughs of NYC, aggregate outstanding $340.3 million, with an average loan size of $3.3 million. Rent stabilized loan portfolio: <0.94% of total loan portfolio • All performing • Largest loan: $41.3 million with 62% LTV and 1.38x DSCR Multi-family balances by origination Year: • NY 2025 loans: $148.5 MM • NY 2024 loans: $36.9 MM • NY 2023 loans: $112.8 MM • NY 2022 loans: $96.9 MM • NY 2021 and prior loans: $197.3 MM • All Multi-family 2025 loans: $537.9 MM • All Multi-family 2024 loans: $256.6 MM • All Multi-family 2023 loans: $479.1 MM • All Multi-family 2022 loans: $583.9 MM • All Multi-family 2021 and prior loans: $1.87 B *Excludes Purchase Accounting Loans 22

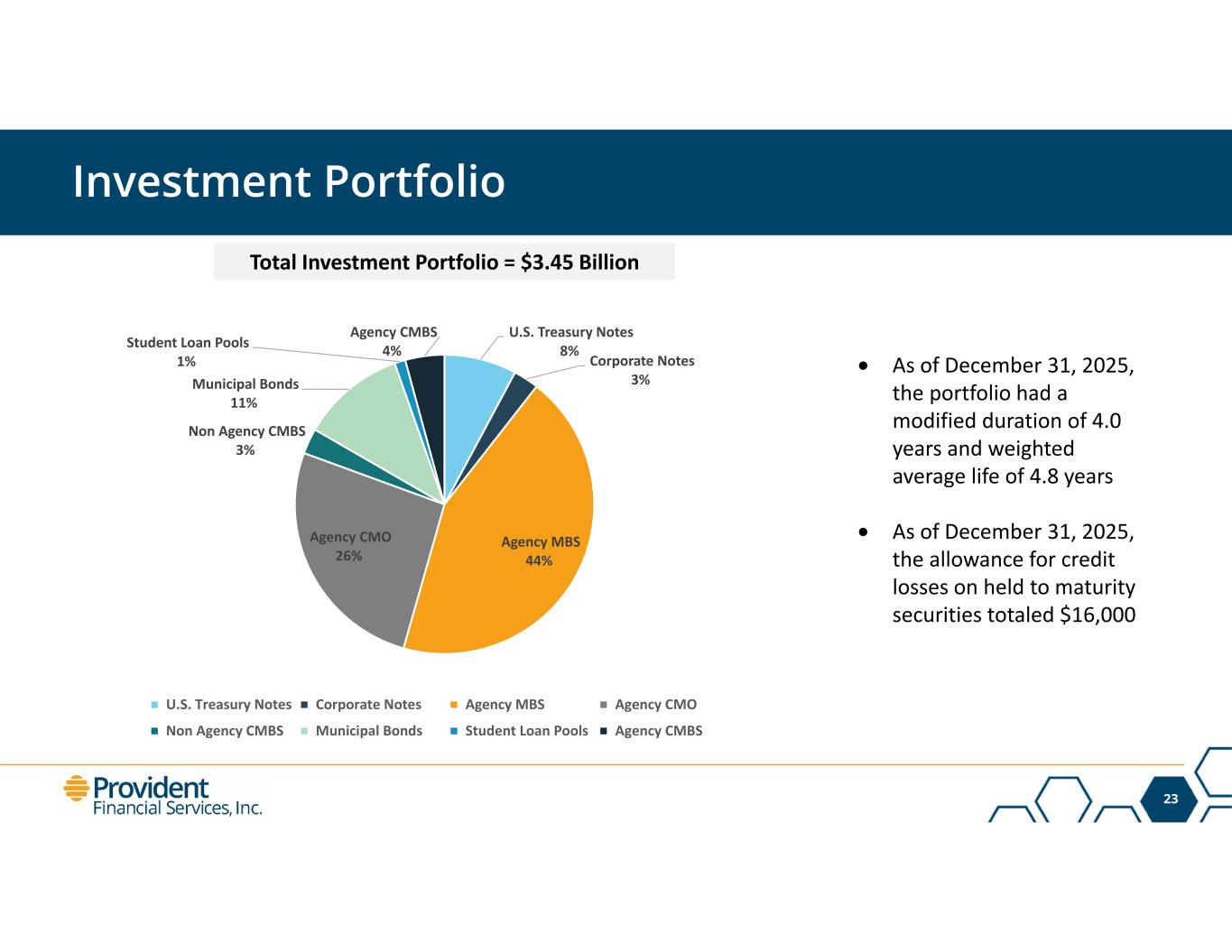

Investment Portfolio 23 Total Investment Portfolio = $3.45 Billion • As of December 31, 2025, the portfolio had a modified duration of 4.0 years and weighted average life of 4.8 years • As of December 31, 2025, the allowance for credit losses on held to maturity securities totaled $16,000 U.S. Treasury Notes 8% Corporate Notes 3% Agency MBS 44% Agency CMO 26% Non Agency CMBS 3% Municipal Bonds 11% Student Loan Pools 1% Agency CMBS 4% U.S. Treasury Notes Corporate Notes Agency MBS Agency CMO Non Agency CMBS Municipal Bonds Student Loan Pools Agency CMBS

Commitment You Can Count On. Guiding Principles Act with Integrity Be Accountable Promote Teamwork Pursue Excellence Build for the Future Our Pillars. Employee Experience Customer Experience Guiding Principles Our Mission. Commit ever day to deepen our emotional connections with our employees, customers, and the communities we serve by placing them at the center of all we do. Our Vision. A consistently high performing bank, committed to creating advocates for life. 24

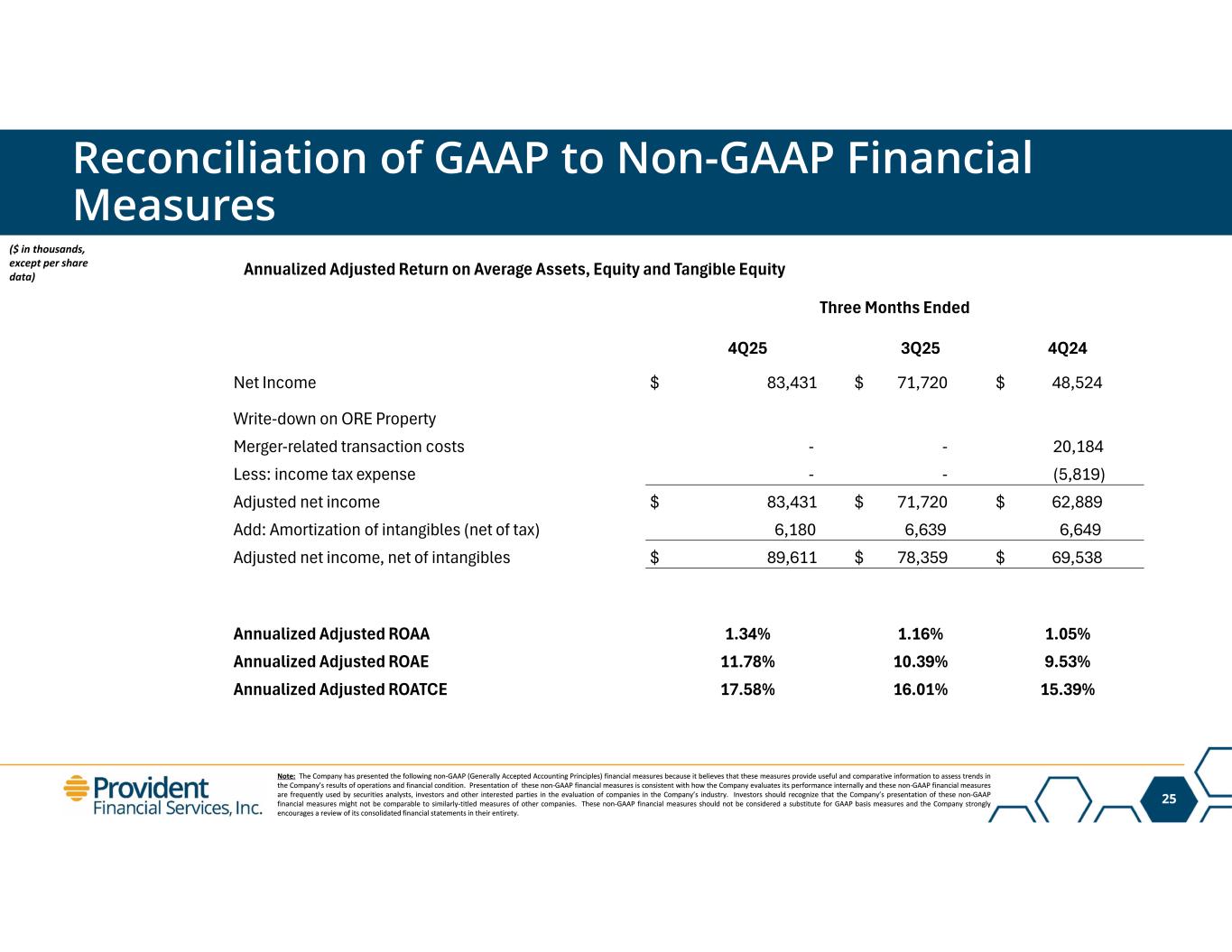

Reconciliation of GAAP to Non-GAAP Financial Measures 25 Annualized Adjusted Return on Average Assets, Equity and Tangible Equity Three Months Ended 4Q243Q254Q25 $ 48,524 $ 71,720 $ 83,431 Net Income Write-down on ORE Property 20,184 --Merger-related transaction costs (5,819)--Less: income tax expense $ 62,889 $ 71,720 $ 83,431 Adjusted net income 6,649 6,639 6,180 Add: Amortization of intangibles (net of tax) $ 69,538 $ 78,359 $ 89,611 Adjusted net income, net of intangibles 1.05%1.16%1.34%Annualized Adjusted ROAA 9.53%10.39%11.78%Annualized Adjusted ROAE 15.39%16.01%17.58%Annualized Adjusted ROATCE ($ in thousands, except per share data) Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety.

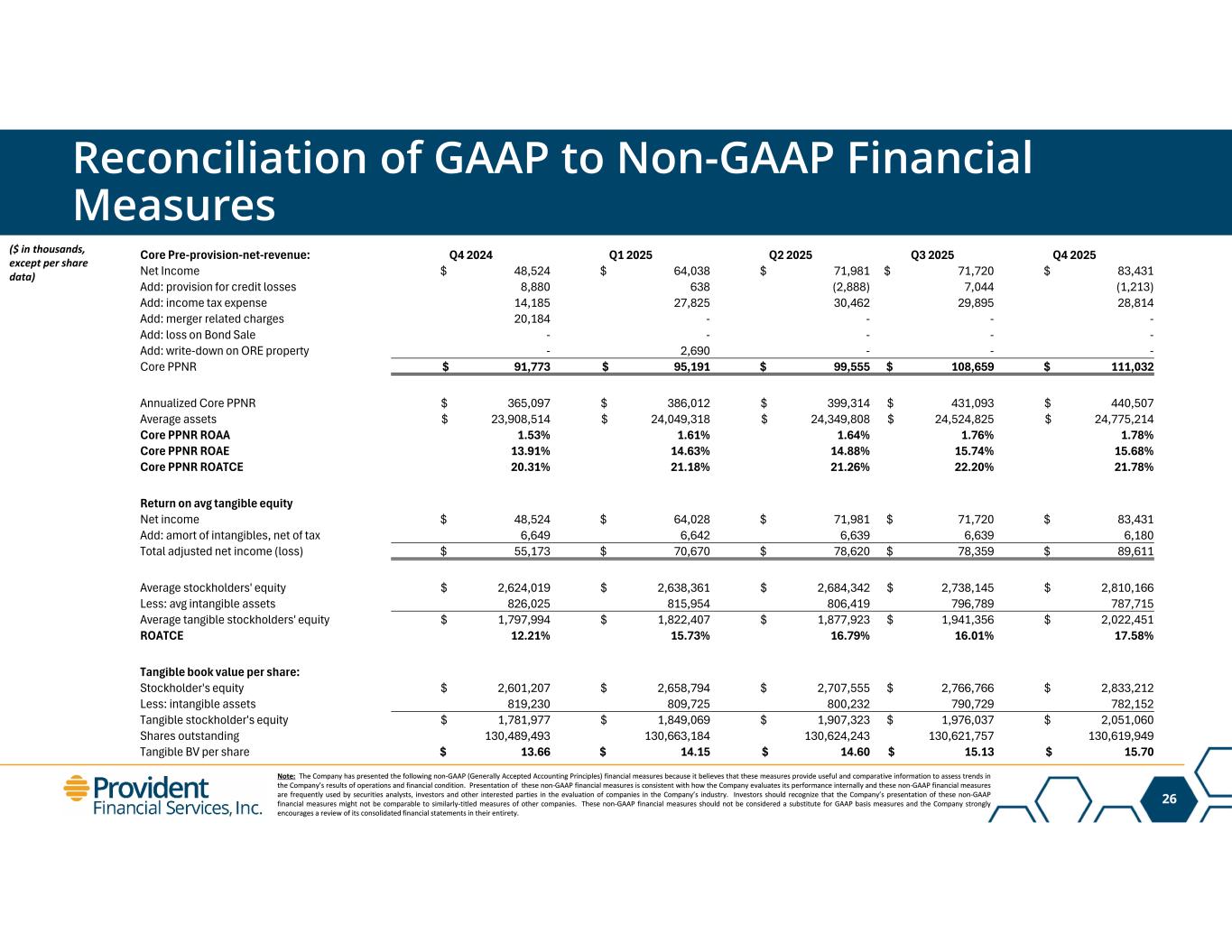

Reconciliation of GAAP to Non-GAAP Financial Measures 26 Q4 2025Q3 2025Q2 2025Q1 2025Q4 2024Core Pre-provision-net-revenue: $ 83,431 $ 71,720 $ 71,981 $ 64,038 $ 48,524 Net Income (1,213)7,044 (2,888)638 8,880 Add: provision for credit losses 28,814 29,895 30,462 27,825 14,185 Add: income tax expense ----20,184 Add: merger related charges -----Add: loss on Bond Sale ---2,690 -Add: write-down on ORE property $ 111,032 $ 108,659 $ 99,555 $ 95,191 $ 91,773 Core PPNR $ 440,507 $ 431,093 $ 399,314 $ 386,012 $ 365,097 Annualized Core PPNR $ 24,775,214 $ 24,524,825 $ 24,349,808 $ 24,049,318 $ 23,908,514 Average assets 1.78%1.76%1.64%1.61%1.53%Core PPNR ROAA 15.68%15.74%14.88%14.63%13.91%Core PPNR ROAE 21.78%22.20%21.26%21.18%20.31%Core PPNR ROATCE Return on avg tangible equity $ 83,431 $ 71,720 $ 71,981 $ 64,028 $ 48,524 Net income 6,180 6,639 6,639 6,642 6,649 Add: amort of intangibles, net of tax $ 89,611 $ 78,359 $ 78,620 $ 70,670 $ 55,173 Total adjusted net income (loss) $ 2,810,166 $ 2,738,145 $ 2,684,342 $ 2,638,361 $ 2,624,019 Average stockholders' equity 787,715 796,789 806,419 815,954 826,025 Less: avg intangible assets $ 2,022,451 $ 1,941,356 $ 1,877,923 $ 1,822,407 $ 1,797,994 Average tangible stockholders' equity 17.58%16.01%16.79%15.73%12.21%ROATCE Tangible book value per share: $ 2,833,212 $ 2,766,766 $ 2,707,555 $ 2,658,794 $ 2,601,207 Stockholder's equity 782,152 790,729 800,232 809,725 819,230 Less: intangible assets $ 2,051,060 $ 1,976,037 $ 1,907,323 $ 1,849,069 $ 1,781,977 Tangible stockholder's equity 130,619,949 130,621,757 130,624,243 130,663,184 130,489,493 Shares outstanding $ 15.70 $ 15.13 $ 14.60 $ 14.15 $ 13.66 Tangible BV per share ($ in thousands, except per share data) Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety.

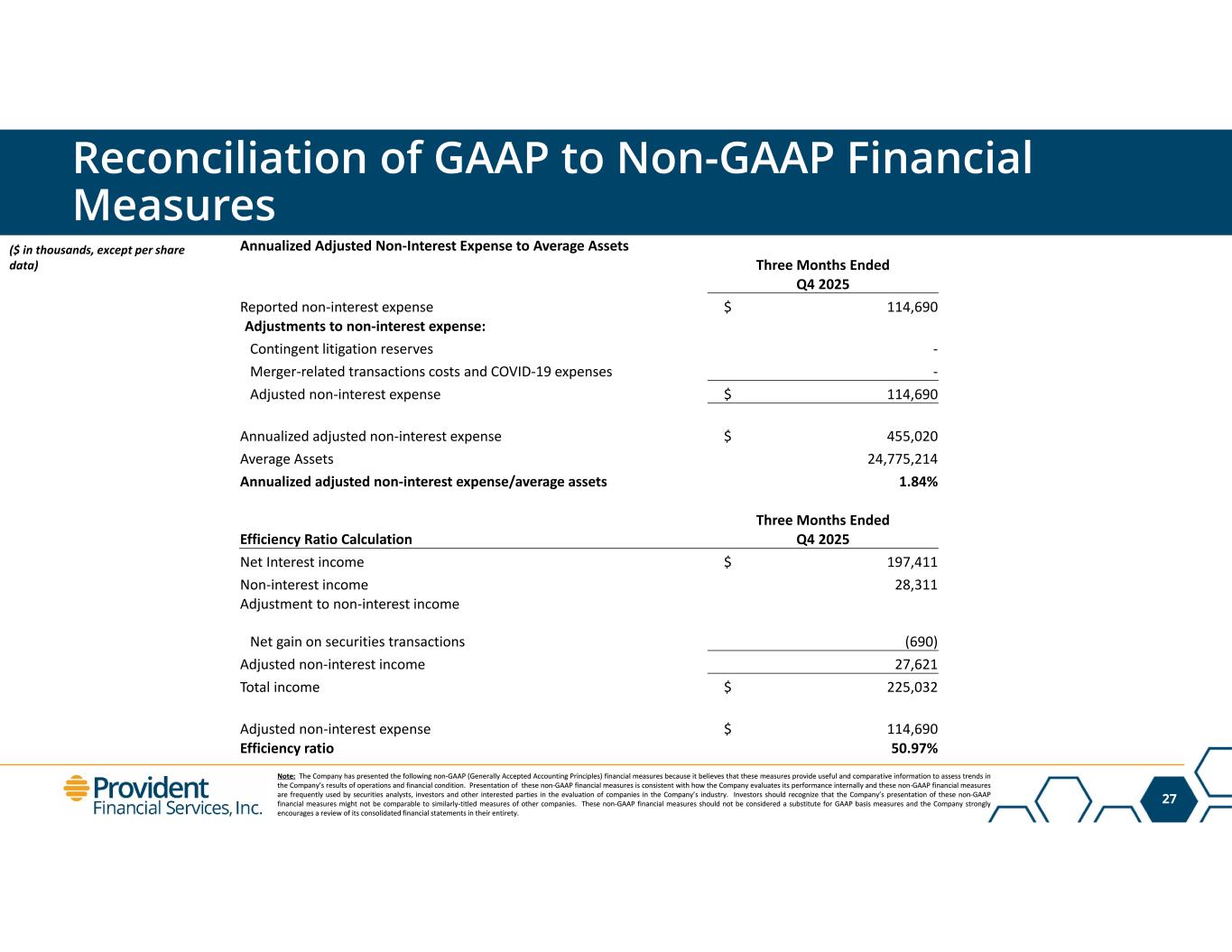

Reconciliation of GAAP to Non-GAAP Financial Measures 27 Annualized Adjusted Non-Interest Expense to Average Assets Three Months Ended Q4 2025 $ 114,690 Reported non-interest expense Adjustments to non-interest expense: -Contingent litigation reserves -Merger-related transactions costs and COVID-19 expenses $ 114,690 Adjusted non-interest expense $ 455,020 Annualized adjusted non-interest expense 24,775,214 Average Assets 1.84%Annualized adjusted non-interest expense/average assets Three Months Ended Q4 2025Efficiency Ratio Calculation $ 197,411 Net Interest income 28,311 Non-interest income Adjustment to non-interest income (690)Net gain on securities transactions 27,621 Adjusted non-interest income $ 225,032 Total income $ 114,690 Adjusted non-interest expense 50.97%Efficiency ratio Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. ($ in thousands, except per share data)

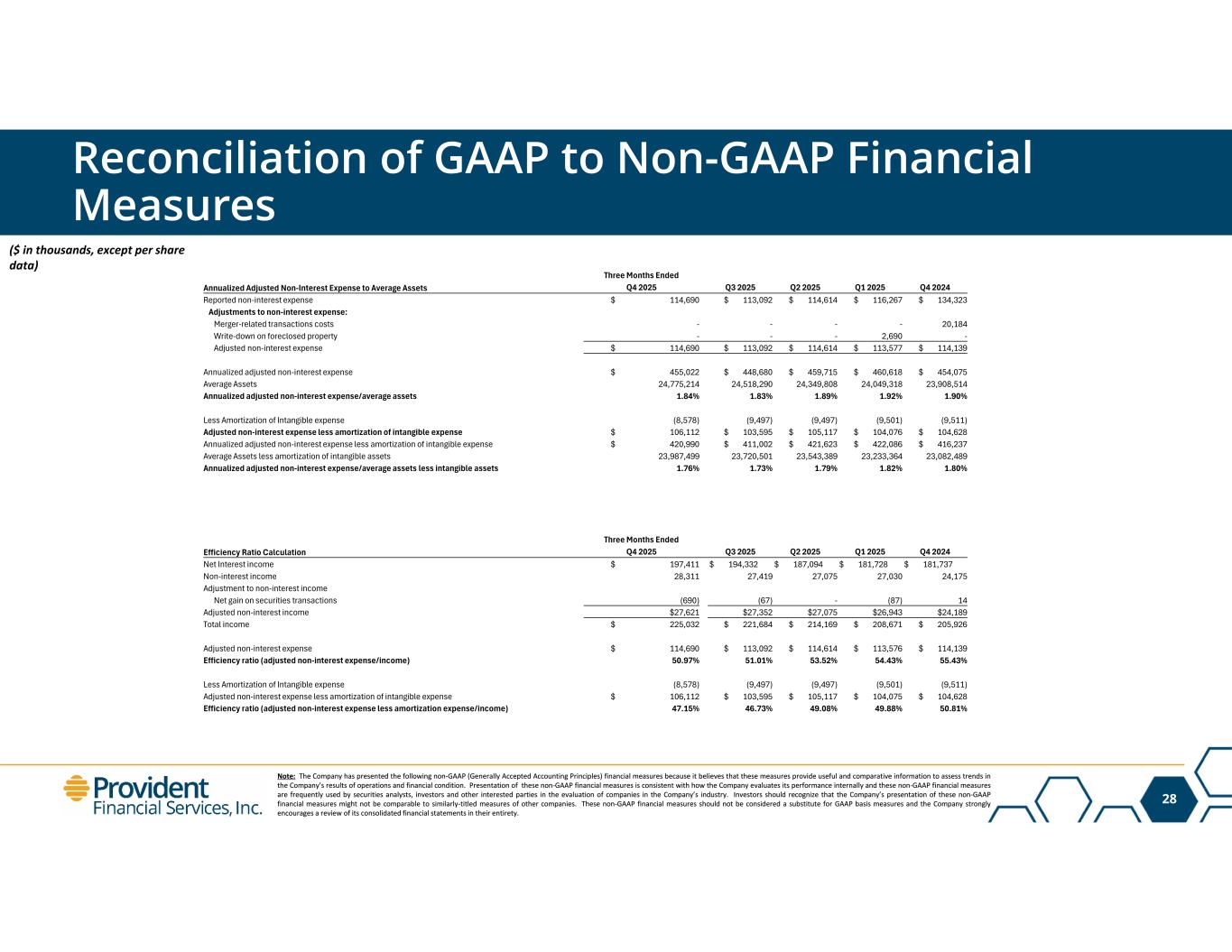

Reconciliation of GAAP to Non-GAAP Financial Measures 28 Note: The Company has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its consolidated financial statements in their entirety. ($ in thousands, except per share data) Three Months Ended Q4 2024Q1 2025Q2 2025Q3 2025Q4 2025Annualized Adjusted Non-Interest Expense to Average Assets $ 134,323 $ 116,267 $ 114,614 $ 113,092 $ 114,690 Reported non-interest expense Adjustments to non-interest expense: 20,184 ----Merger-related transactions costs -2,690 ---Write-down on foreclosed property $ 114,139 $ 113,577 $ 114,614 $ 113,092 $ 114,690 Adjusted non-interest expense $ 454,075 $ 460,618 $ 459,715 $ 448,680 $ 455,022 Annualized adjusted non-interest expense 23,908,514 24,049,318 24,349,808 24,518,290 24,775,214 Average Assets 1.90%1.92%1.89%1.83%1.84%Annualized adjusted non-interest expense/average assets (9,511)(9,501)(9,497)(9,497)(8,578)Less Amortization of Intangible expense $ 104,628 $ 104,076 $ 105,117 $ 103,595 $ 106,112 Adjusted non-interest expense less amortization of intangible expense $ 416,237 $ 422,086 $ 421,623 $ 411,002 $ 420,990 Annualized adjusted non-interest expense less amortization of intangible expense 23,082,489 23,233,364 23,543,389 23,720,501 23,987,499 Average Assets less amortization of intangible assets 1.80%1.82%1.79%1.73%1.76%Annualized adjusted non-interest expense/average assets less intangible assets Three Months Ended Q4 2024Q1 2025Q2 2025Q3 2025Q4 2025Efficiency Ratio Calculation $ 181,737 $ 181,728 $ 187,094 $ 194,332 $ 197,411 Net Interest income 24,175 27,030 27,075 27,419 28,311 Non-interest income Adjustment to non-interest income 14 (87)-(67)(690)Net gain on securities transactions $24,189$26,943$27,075$27,352$27,621Adjusted non-interest income $ 205,926 $ 208,671 $ 214,169 $ 221,684 $ 225,032 Total income $ 114,139 $ 113,576 $ 114,614 $ 113,092 $ 114,690 Adjusted non-interest expense 55.43%54.43%53.52%51.01%50.97%Efficiency ratio (adjusted non-interest expense/income) (9,511)(9,501)(9,497)(9,497)(8,578)Less Amortization of Intangible expense $ 104,628 $ 104,075 $ 105,117 $ 103,595 $ 106,112 Adjusted non-interest expense less amortization of intangible expense 50.81%49.88%49.08%46.73%47.15%Efficiency ratio (adjusted non-interest expense less amortization expense/income)

Q4 2025 RESULTS PRESENTATION