UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

NEUPHORIA THERAPEUTICS INC.

(Name of Registrant as Specified in Its Charter)

LYNX1 MASTER FUND LP

LYNX1 CAPITAL MANAGEMENT LP

WESTON NICHOLS

NATHALI PARTYKA ZAMORA

STEPHEN DOBERSTEIN

KIMBERLY SMITH

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Lynx1 Master Fund LP, together with its affiliates (collectively, “Lynx1”), has filed a definitive proxy statement and accompanying BLUE universal proxy card with the U.S. Securities and Exchange Commission to solicit proxies for the election of Lynx1’s slate of highly qualified independent director candidates at the 2025 annual meeting of stockholders of Neuphoria Therapeutics Inc., a Delaware corporation.

On November 26, 2025, Lynx1 released the following investor presentation:

Lynx1 Master Fund RESTORING VALUE AT NEUPHORIA THERAPEUTICS November 2025 VOTE USING THE BLUE PROXY CARD This presentation is not in any way affiliated with, or approved, produced, endorsed or sponsored or licensed from, Neuphoria Therapeutics Inc. or any other companies referred to herein

Lynx1 Master Fund Disclaimers General Considerations The materials contained herein (the “Materials”) represent the opinions of Lynx1 Master Fund LP (“Lynx1”) and the other participants named in its proxy solicitation and are based on publicly available information with respect to Neuphoria Therapeutics Inc. (the “Company” or “Neuphoria”). Lynx1 recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with Lynx1’s conclusions. Lynx1 reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such changes, except as required by applicable law. Lynx1 disclaims any obligation to update the information or opinions contained herein, except as required by applicable law. Certain financial projections and statements made herein have been derived or obtained from filings made with the U.S. Securities and Exchange Commission (the “SEC”) or other regulatory authorities and from other third party reports. There is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein. The estimates, projections and potential impact of the opportunities identified by Lynx1 herein are based on assumptions that Lynx1 believes to be reasonable as of the date of the Materials, but there can be no assurance or guarantee that actual results or performance of the Company will not differ, and such differences may be material. The Materials are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security. Not an Offer to Sell or a Solicitation of an Offer to Sell Lynx1 and certain of the other participants currently beneficially own, and/or have an economic interest in, securities of the Company. It is possible that there will be developments in the future (including changes in price of the Company’s securities) that cause Lynx1 or one or more of the other participants from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities. To the extent that Lynx1 discloses information about its position or economic interest in the securities of the Company in the Materials, it is subject to change and Lynx1 expressly disclaims any obligation to update such information, except as required by applicable law. Forward-Looking Statements The Materials contain forward-looking statements. All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward-looking, and words such as “anticipate,” “believe,” “expect,” “potential,” “opportunity,” “estimate,” “plan,” “may,” “will,” “projects,” “targets,” “forecasts,” “seeks,” “could”, and the negatives thereof, and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of the Materials and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Lynx1 and the other participants. Although Lynx1 believes that the assumptions underlying the projected results or forward-looking statements are reasonable as of the date of the Materials, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected results or forward-looking statements included herein will prove to be accurate. In light of the significant uncertainties inherent in the projected results and forward-looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward-looking statements will be achieved. Lynx1 will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events, except as required by applicable law. Use of Third Party Statements Unless otherwise indicated herein, Lynx1 has not sought or obtained consent from any third party to use any statements, photos or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. No warranty is made as to the accuracy of data or information obtained or derived from filings made with the SEC by the Company or from any third-party source. All trade names, trademarks, service marks and logos herein are the property of their respective owners who retain all proprietary rights over their use.

Lynx1 Master Fund Lynx1 is an investment firm focused on U.S. public and About Lynx1: private biotech companies, pursuing a long-only equity strategy and partnering with its portfolio A Long-Term, companies over the long term to advance technological breakthroughs in human health Value-Driven Investor Lynx1 has a proven record of constructive board engagement across the biotech industry and backs its convictions with meaningful ownership that drives long-term value Annualized Lynx1 combines scientific rigor with industry insight to identify and advance breakthrough science Returns Since26.5% Lynx1 has been a shareholder of Neuphoria since Inception January 2023 and believes strongly in the Company’s science, as well as in the ability of a reconstituted Board to act in the best interests of all shareholders and deliver strong returns Lynx1 has a proven track record of creating meaningful value in the public markets Examples of Lynx1's Long-Term Investments 3

Lynx1 Master Fund Executive Summary Neuphoria is at a crossroads On October 20, 2025, Neuphoria announced the failure of its AFFIRM-1 Phase 3 clinical trial for the acute treatment of social anxiety disorder (“SAD”) to meet its primary endpoints and achieve statistical difference in its secondary endpoints (the “Announcement”) and, as a result, would discontinue its SAD program The design failures of the AFFIRM-1 trial are a result of poor leadership and Board oversight, resulting in a strategic review being the only logical path forward The Company appears to be contemplating advancing its drug for PTSD, which is highly concerning given the Board’s track record Since the Announcement, the Board has taken a series of miscalculated steps, evidencing its lack of competence to implement a new strategic direction for the Company The Board’s recent actions raise serious questions about entrenchment The Board’s actions are inconsistent with running a review of strategic alternatives Despite multiple good-faith outreach efforts, the Company consistently refused to engage with Lynx1—including misstating the Company’s ability to sell its royalty, repeatedly ignoring Lynx1's requests to meet with the Board and delayed delivery of an off- market NDA that would have required Lynx1 to withdraw its proxy contest and sit on the sidelines for two years The Company has built a war chest of cash with no clear, articulated purpose, causing dilution for existing shareholders, with the total share count increasing by 128% over a four-week period and at prices we believe were at a discount to the Company’s cash per share The Board has taken a series of incoherent, dilutive and destructive actions that call into question its ability to act as fiduciaries Our proposed nominees bring the skills and experience needed at this critical moment The Board urgently needs directors with deep clinical, operational and financial expertise to unlock value in existing assets and partnerships, and to support the Company’s go-forward strategy to evaluate potential opportunities We believe that, once elected, our fit-for-purpose candidates will end reckless dilution and will ensure that capital management is disciplined, strategic and aligned with the go-forward strategy Fresh, independent perspectives with deep biotech expertise are essential to challenge the status quo, evaluate all alternatives objectively and choose the path that delivers on the Company’s vision and maximizes shareholder value 4

Lynx1 Master Fund About Neuphoria Therapeutics Company Overview Neuphoria is a clinical-stage biotech company developing impactful treatments for neuropsychiatric disorders. Its lead drug candidate, BNC210, is a first-of-its-kind drug designed to restore neurotransmitter balance in key brain areas. The Company has a strategic partnership with Merck for the treatment of cognitive deficits in Alzheimer’s disease and other central nervous system conditions, with the potential to generate up to hundreds of millions in milestones and royalties Value Creation Opportunity The Company is positioned at a pivotal moment in its evolution, with a robust strategic alternatives process offering the opportunity for value-maximizing transactional outcomes, delivering strong returns to all shareholders Unlocking the full value of the Company’s assets and potential strategic alternatives requires the right leadership and oversight Neuphoria’s problem is not its science, but its execution—we are calling for action now to implement the changes required to move the Company forward 5

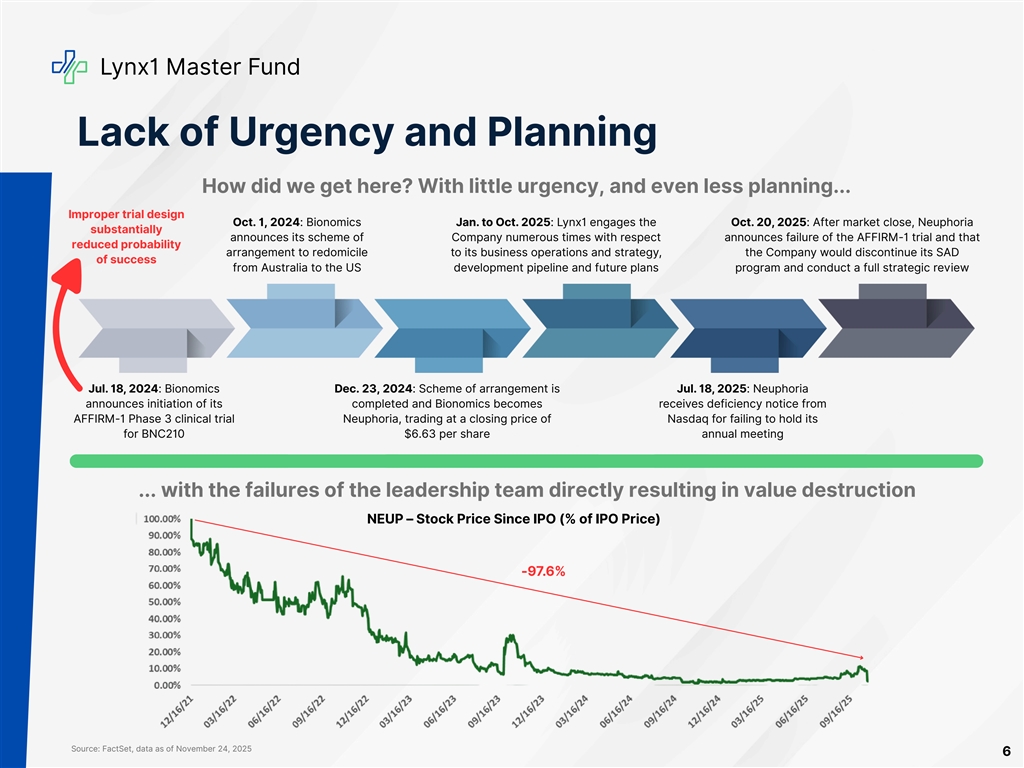

Lynx1 Master Fund Lack of Urgency and Planning How did we get here? With little urgency, and even less planning... Improper trial design Oct. 1, 2024: Bionomics Jan. to Oct. 2025: Lynx1 engages the Oct. 20, 2025: After market close, Neuphoria substantially announces its scheme of Company numerous times with respect announces failure of the AFFIRM-1 trial and that reduced probability arrangement to redomicile to its business operations and strategy, the Company would discontinue its SAD of success from Australia to the US development pipeline and future plans program and conduct a full strategic review Jul. 18, 2024: Bionomics Dec. 23, 2024: Scheme of arrangement is Jul. 18, 2025: Neuphoria announces initiation of its completed and Bionomics becomes receives deficiency notice from AFFIRM-1 Phase 3 clinical trial Neuphoria, trading at a closing price of Nasdaq for failing to hold its for BNC210 $6.63 per share annual meeting ... with the failures of the leadership team directly resulting in value destruction NEUP – Stock Price Since IPO (% of IPO Price) -97.6% Source: FactSet, data as of November 24, 2025 6

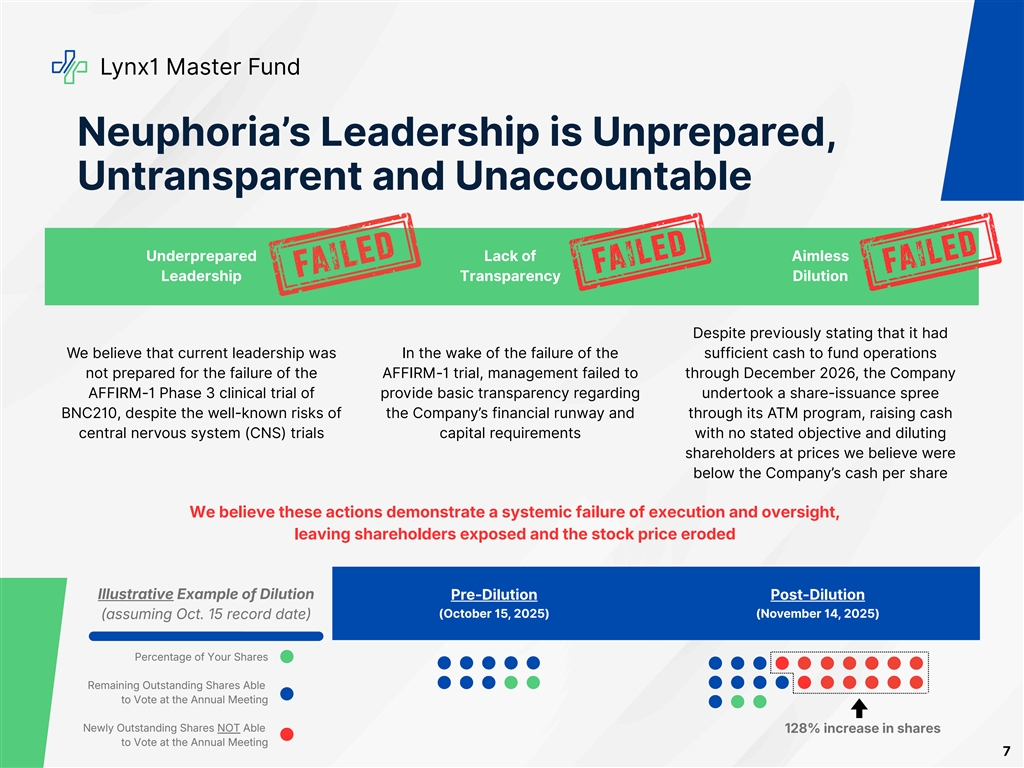

Lynx1 Master Fund Neuphoria’s Leadership is Unprepared, Untransparent and Unaccountable Underprepared Lack of Aimless Leadership Transparency Dilution Despite previously stating that it had We believe that current leadership was In the wake of the failure of the sufficient cash to fund operations not prepared for the failure of the AFFIRM-1 trial, management failed to through December 2026, the Company AFFIRM-1 Phase 3 clinical trial of provide basic transparency regarding undertook a share-issuance spree BNC210, despite the well-known risks of the Company’s financial runway and through its ATM program, raising cash central nervous system (CNS) trials capital requirements with no stated objective and diluting shareholders at prices we believe were below the Company’s cash per share We believe these actions demonstrate a systemic failure of execution and oversight, leaving shareholders exposed and the stock price eroded Illustrative Example of Dilution Pre-Dilution Post-Dilution (October 15, 2025) (November 14, 2025) (assuming Oct. 15 record date) Percentage of Your Shares Remaining Outstanding Shares Able to Vote at the Annual Meeting Newly Outstanding Shares NOT Able 128% increase in shares to Vote at the Annual Meeting 7

Lynx1 Master Fund Why Are We Seeking Board Representation? The failure of the AFFIRM-1 Phase 3 clinical trial to meet its primary endpoint exposed critical gaps in leadership’s ability to The Board is execute the Company’s clinical and strategic vision Not Well The Company is now exploring strategic alternatives, yet the current Board is comprised of individuals without the necessary Equipped for skillsets and who have already failed in executing their responsibilities Go-Forward The Board urgently needs directors with deep clinical, operational and financial expertise to unlock value in existing assets and Strategy partnerships and to support the Company’s go-forward strategy to evaluate potential opportunities The Company has built a war chest of cash, issuing shares that have diluted shareholders, with the total share count increasing by 128% over a four-week period and at prices we believe were at a discount to the Company’s cash per share The Board’s Raising substantial cash—despite the Company’s own disclosure that it had sufficient cash to fund operations through Actions Are December 2026—is both value-destructive and illogical, reducing the value that could be delivered to shareholders in any Not Aligned strategic transaction with Its We believe the real alternatives on the table are: (1) a reverse merger with another biotech company, (2) acquiring a biotech Articulated company or its assets or (3) advancing Neuphoria’s own pipeline Plan We believe that, once elected, our fit-for-purpose candidates would end reckless spending and would ensure that capital management is disciplined, strategic and aligned with the Board’s go-forward strategy Recent acts of entrenchment raise serious concerns about the Board’s intentions, including the use of a record date that The Board disenfranchises the current electorate, and setting a meeting date that gave shareholders only 10 days to nominate directors Has Taken Actions to The Board’s decision to hire an investment bank to run a strategic review that also earns 3% on proceeds generated under its ATM program exemplifies the Board’s lack of understanding of, or comfort with, incentives and conflicts of interest Entrench the Current Fresh, independent perspectives with deep biotech expertise are essential to challenge the status quo, evaluate all alternatives Directors objectively and choose the path that delivers on the Company’s vision and maximizes shareholder value Real change starts with real independence—our proposed nominees are both highly qualified and independent of the Company and Lynx1 8

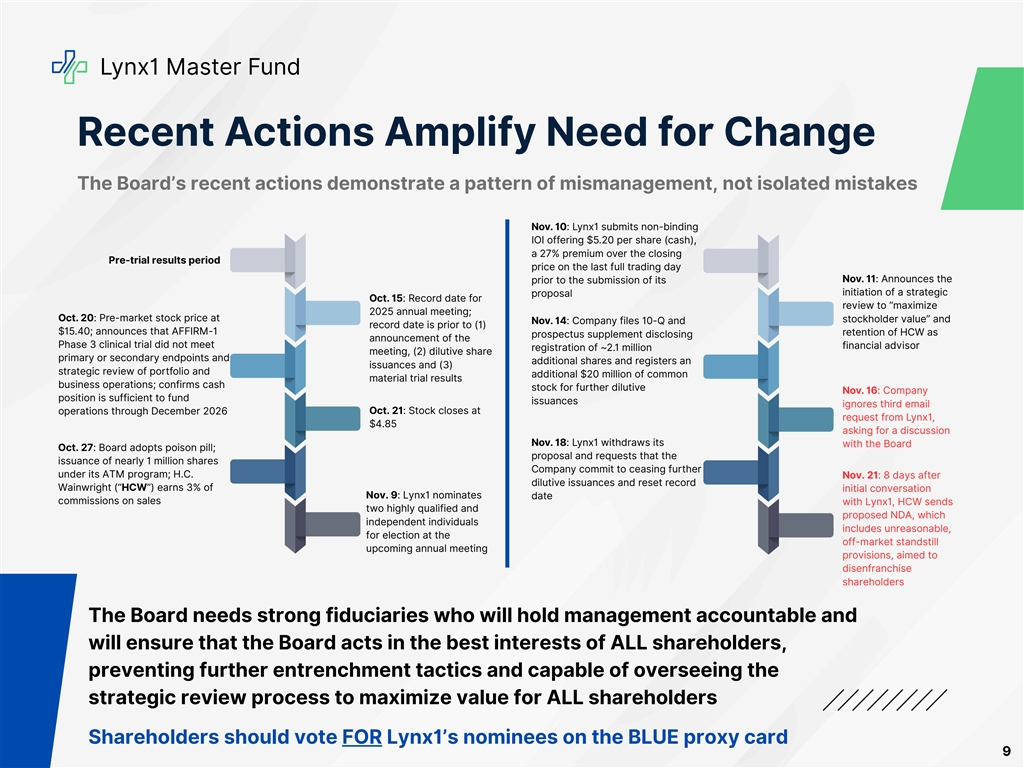

Lynx1 Master Fund Recent Actions Amplify Need for Change The Board’s recent actions demonstrate a pattern of mismanagement, not isolated mistakes Nov. 10: Lynx1 submits non-binding IOI offering $5.20 per share (cash), a 27% premium over the closing Pre-trial results period price on the last full trading day Nov. 11: Announces the prior to the submission of its initiation of a strategic proposal Oct. 15: Record date for review to “maximize 2025 annual meeting; Oct. 20: Pre-market stock price at stockholder value” and Nov. 14: Company files 10-Q and record date is prior to (1) $15.40; announces that AFFIRM-1 retention of HCW as prospectus supplement disclosing announcement of the Phase 3 clinical trial did not meet financial advisor registration of ~2.1 million meeting, (2) dilutive share primary or secondary endpoints and additional shares and registers an issuances and (3) strategic review of portfolio and additional $20 million of common material trial results business operations; confirms cash stock for further dilutive Nov. 16: Company position is sufficient to fund issuances ignores third email operations through December 2026 Oct. 21: Stock closes at request from Lynx1, $4.85 asking for a discussion Nov. 18: Lynx1 withdraws its with the Board Oct. 27: Board adopts poison pill; proposal and requests that the issuance of nearly 1 million shares Company commit to ceasing further under its ATM program; H.C. Nov. 21: 8 days after dilutive issuances and reset record Wainwright (“HCW”) earns 3% of initial conversation Nov. 9: Lynx1 nominates date commissions on sales with Lynx1, HCW sends two highly qualified and proposed NDA, which independent individuals includes unreasonable, for election at the off-market standstill upcoming annual meeting provisions, aimed to disenfranchise shareholders The Board needs strong fiduciaries who will hold management accountable and will ensure that the Board acts in the best interests of ALL shareholders, preventing further entrenchment tactics and capable of overseeing the strategic review process to maximize value for ALL shareholders Shareholders should vote FOR Lynx1’s nominees on the BLUE proxy card 9

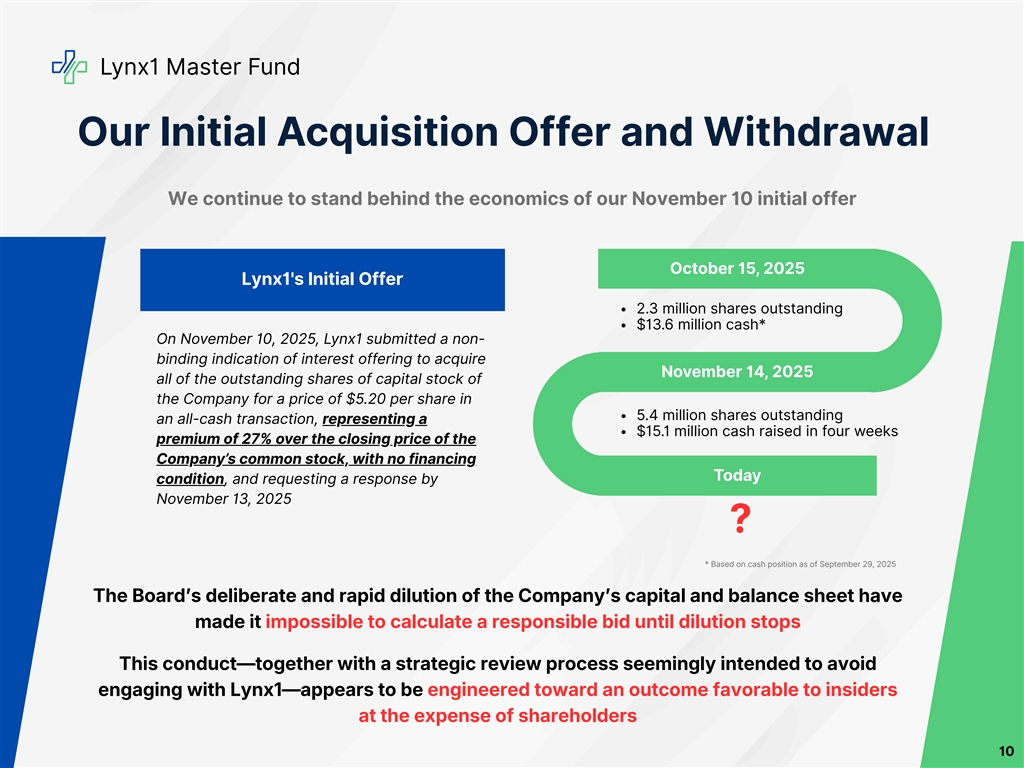

Lynx1 Master Fund Our Initial Acquisition Offer and Withdrawal We continue to stand behind the economics of our November 10 initial offer October 15, 2025 Lynx1's Initial Offer 2.3 million shares outstanding $13.6 million cash* On November 10, 2025, Lynx1 submitted a non- binding indication of interest offering to acquire November 14, 2025 all of the outstanding shares of capital stock of the Company for a price of $5.20 per share in 5.4 million shares outstanding an all-cash transaction, representing a $15.1 million cash raised in four weeks premium of 27% over the closing price of the Company’s common stock, with no financing Today condition, and requesting a response by November 13, 2025 ? * Based on cash position as of September 29, 2025 The Boardʼs deliberate and rapid dilution of the Companyʼs capital and balance sheet have made it impossible to calculate a responsible bid until dilution stops This conduct—together with a strategic review process seemingly intended to avoid engaging with Lynx1—appears to be engineered toward an outcome favorable to insiders at the expense of shareholders 10

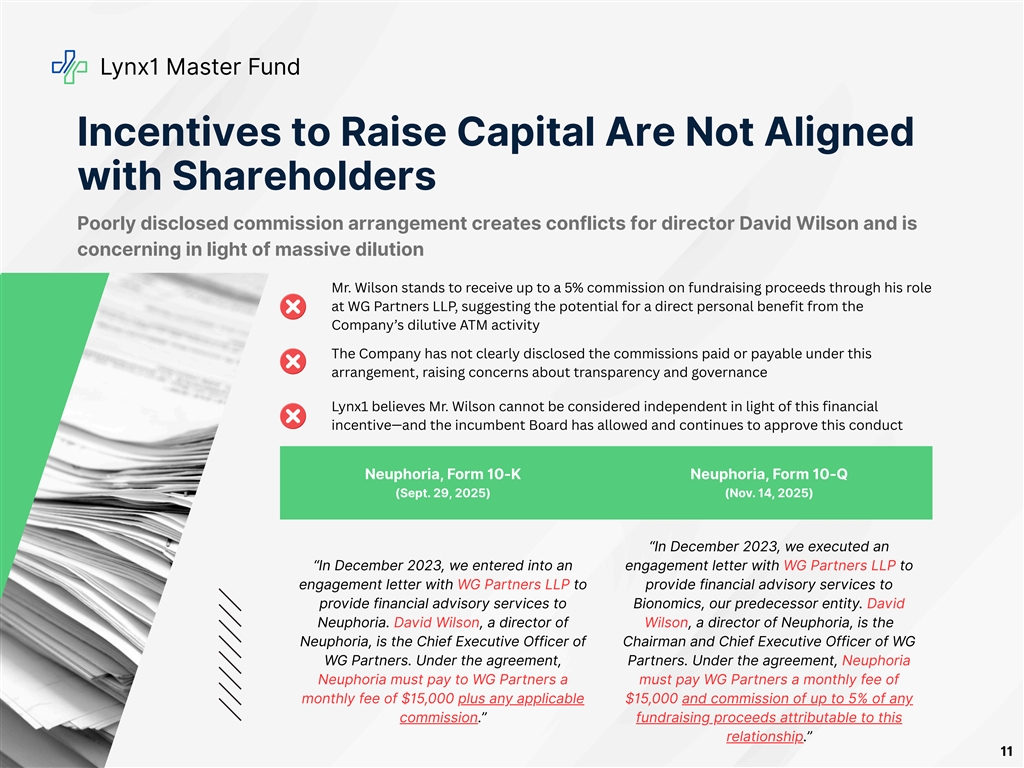

Lynx1 Master Fund Incentives to Raise Capital Are Not Aligned with Shareholders Poorly disclosed commission arrangement creates conflicts for director David Wilson and is concerning in light of massive dilution Mr. Wilson stands to receive up to a 5% commission on fundraising proceeds through his role at WG Partners LLP, suggesting the potential for a direct personal benefit from the Company’s dilutive ATM activity The Company has not clearly disclosed the commissions paid or payable under this arrangement, raising concerns about transparency and governance Lynx1 believes Mr. Wilson cannot be considered independent in light of this financial incentive—and the incumbent Board has allowed and continues to approve this conduct Neuphoria, Form 10-K Neuphoria, Form 10-Q (Sept. 29, 2025) (Nov. 14, 2025) “In December 2023, we executed an “In December 2023, we entered into an engagement letter with WG Partners LLP to engagement letter with WG Partners LLP to provide financial advisory services to provide financial advisory services to Bionomics, our predecessor entity. David Neuphoria. David Wilson, a director of Wilson, a director of Neuphoria, is the Neuphoria, is the Chief Executive Officer of Chairman and Chief Executive Officer of WG WG Partners. Under the agreement, Partners. Under the agreement, Neuphoria Neuphoria must pay to WG Partners a must pay WG Partners a monthly fee of monthly fee of $15,000 plus any applicable $15,000 and commission of up to 5% of any commission.” fundraising proceeds attributable to this relationship.” 11

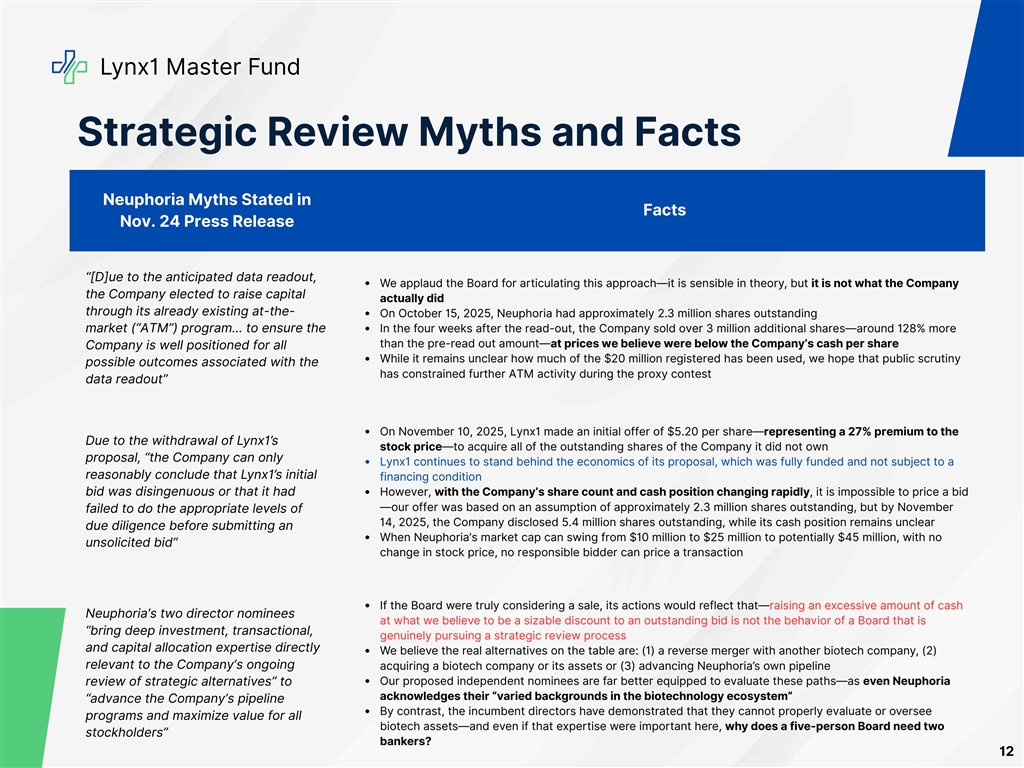

Lynx1 Master Fund Strategic Review Myths and Facts Neuphoria Myths Stated in Facts Nov. 24 Press Release “[D]ue to the anticipated data readout, We applaud the Board for articulating this approach—it is sensible in theory, but it is not what the Company the Company elected to raise capital actually did through its already existing at-the- On October 15, 2025, Neuphoria had approximately 2.3 million shares outstanding market (“ATM”) program… to ensure the In the four weeks after the read-out, the Company sold over 3 million additional shares—around 128% more than the pre-read out amount—at prices we believe were below the Company’s cash per share Company is well positioned for all While it remains unclear how much of the $20 million registered has been used, we hope that public scrutiny possible outcomes associated with the has constrained further ATM activity during the proxy contest data readout” On November 10, 2025, Lynx1 made an initial offer of $5.20 per share—representing a 27% premium to the Due to the withdrawal of Lynx1’s stock price—to acquire all of the outstanding shares of the Company it did not own proposal, “the Company can only Lynx1 continues to stand behind the economics of its proposal, which was fully funded and not subject to a reasonably conclude that Lynx1’s initial financing condition bid was disingenuous or that it had However, with the Company’s share count and cash position changing rapidly, it is impossible to price a bid —our offer was based on an assumption of approximately 2.3 million shares outstanding, but by November failed to do the appropriate levels of 14, 2025, the Company disclosed 5.4 million shares outstanding, while its cash position remains unclear due diligence before submitting an When Neuphoria’s market cap can swing from $10 million to $25 million to potentially $45 million, with no unsolicited bid” change in stock price, no responsible bidder can price a transaction If the Board were truly considering a sale, its actions would reflect that—raising an excessive amount of cash Neuphoria’s two director nominees at what we believe to be a sizable discount to an outstanding bid is not the behavior of a Board that is “bring deep investment, transactional, genuinely pursuing a strategic review process and capital allocation expertise directly We believe the real alternatives on the table are: (1) a reverse merger with another biotech company, (2) relevant to the Company’s ongoing acquiring a biotech company or its assets or (3) advancing Neuphoria’s own pipeline Our proposed independent nominees are far better equipped to evaluate these paths—as even Neuphoria review of strategic alternatives” to acknowledges their “varied backgrounds in the biotechnology ecosystem” “advance the Company’s pipeline By contrast, the incumbent directors have demonstrated that they cannot properly evaluate or oversee programs and maximize value for all biotech assets—and even if that expertise were important here, why does a five-person Board need two stockholders” bankers? 12

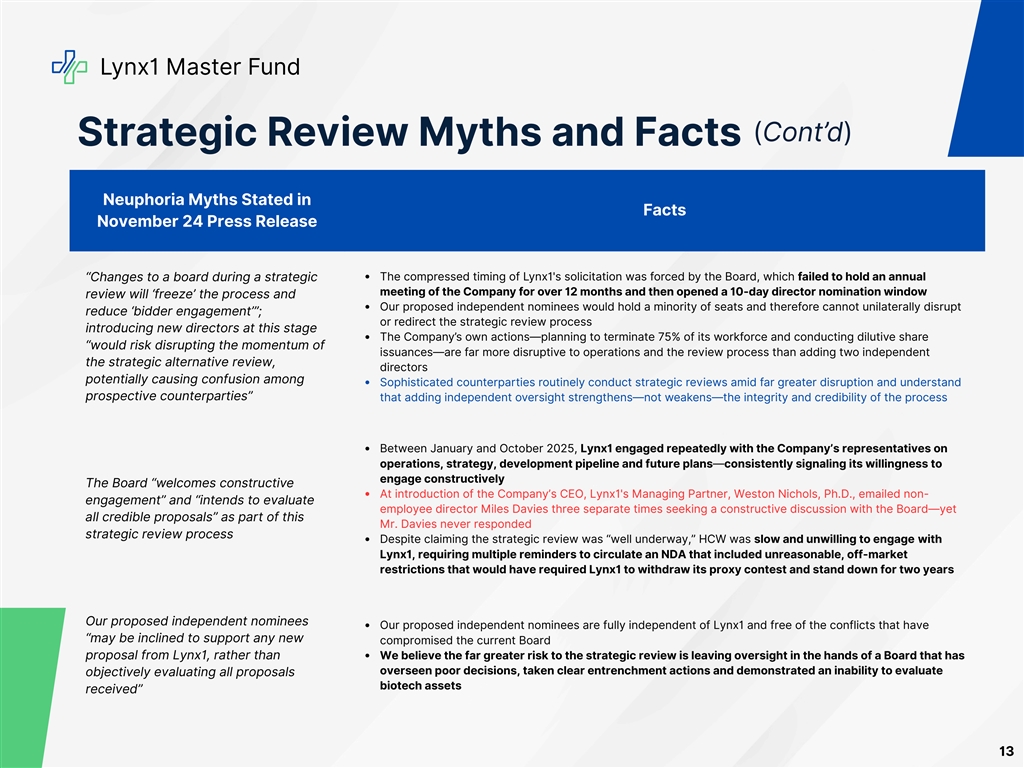

Lynx1 Master Fund (Cont’d) Strategic Review Myths and Facts Neuphoria Myths Stated in Facts November 24 Press Release “Changes to a board during a strategic The compressed timing of Lynx1's solicitation was forced by the Board, which failed to hold an annual meeting of the Company for over 12 months and then opened a 10-day director nomination window review will ‘freeze’ the process and Our proposed independent nominees would hold a minority of seats and therefore cannot unilaterally disrupt reduce ‘bidder engagement’”; or redirect the strategic review process introducing new directors at this stage The Company’s own actions—planning to terminate 75% of its workforce and conducting dilutive share “would risk disrupting the momentum of issuances—are far more disruptive to operations and the review process than adding two independent the strategic alternative review, directors potentially causing confusion among Sophisticated counterparties routinely conduct strategic reviews amid far greater disruption and understand prospective counterparties” that adding independent oversight strengthens—not weakens—the integrity and credibility of the process Between January and October 2025, Lynx1 engaged repeatedly with the Company’s representatives on operations, strategy, development pipeline and future plans—consistently signaling its willingness to engage constructively The Board “welcomes constructive At introduction of the Company’s CEO, Lynx1's Managing Partner, Weston Nichols, Ph.D., emailed non- engagement” and “intends to evaluate employee director Miles Davies three separate times seeking a constructive discussion with the Board—yet all credible proposals” as part of this Mr. Davies never responded strategic review process Despite claiming the strategic review was “well underway,” HCW was slow and unwilling to engage with Lynx1, requiring multiple reminders to circulate an NDA that included unreasonable, off-market restrictions that would have required Lynx1 to withdraw its proxy contest and stand down for two years Our proposed independent nominees Our proposed independent nominees are fully independent of Lynx1 and free of the conflicts that have “may be inclined to support any new compromised the current Board proposal from Lynx1, rather than We believe the far greater risk to the strategic review is leaving oversight in the hands of a Board that has overseen poor decisions, taken clear entrenchment actions and demonstrated an inability to evaluate objectively evaluating all proposals biotech assets received” 13

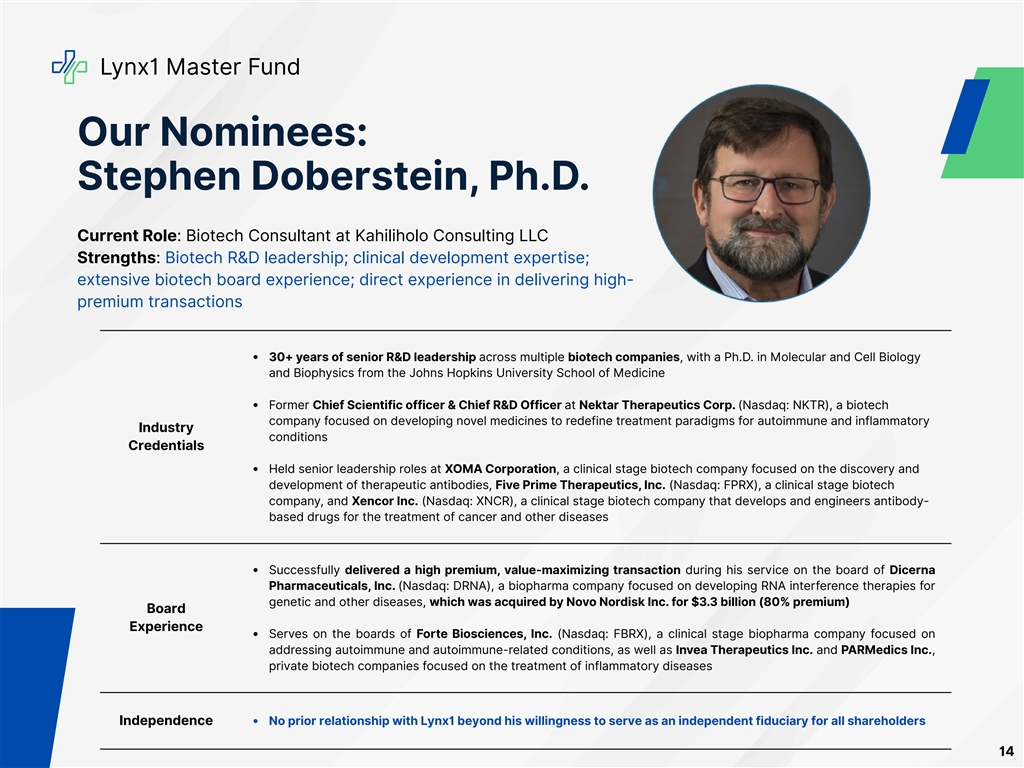

Lynx1 Master Fund Our Nominees: Stephen Doberstein, Ph.D. Current Role: Biotech Consultant at Kahiliholo Consulting LLC Strengths: Biotech R&D leadership; clinical development expertise; extensive biotech board experience; direct experience in delivering high- premium transactions 30+ years of senior R&D leadership across multiple biotech companies, with a Ph.D. in Molecular and Cell Biology and Biophysics from the Johns Hopkins University School of Medicine Former Chief Scientific officer & Chief R&D Officer at Nektar Therapeutics Corp. (Nasdaq: NKTR), a biotech company focused on developing novel medicines to redefine treatment paradigms for autoimmune and inflammatory Industry conditions Credentials Held senior leadership roles at XOMA Corporation, a clinical stage biotech company focused on the discovery and development of therapeutic antibodies, Five Prime Therapeutics, Inc. (Nasdaq: FPRX), a clinical stage biotech company, and Xencor Inc. (Nasdaq: XNCR), a clinical stage biotech company that develops and engineers antibody- based drugs for the treatment of cancer and other diseases Successfully delivered a high premium, value-maximizing transaction during his service on the board of Dicerna Pharmaceuticals, Inc. (Nasdaq: DRNA), a biopharma company focused on developing RNA interference therapies for genetic and other diseases, which was acquired by Novo Nordisk Inc. for $3.3 billion (80% premium) Board Experience Serves on the boards of Forte Biosciences, Inc. (Nasdaq: FBRX), a clinical stage biopharma company focused on addressing autoimmune and autoimmune-related conditions, as well as Invea Therapeutics Inc. and PARMedics Inc., private biotech companies focused on the treatment of inflammatory diseases Independence No prior relationship with Lynx1 beyond his willingness to serve as an independent fiduciary for all shareholders 14

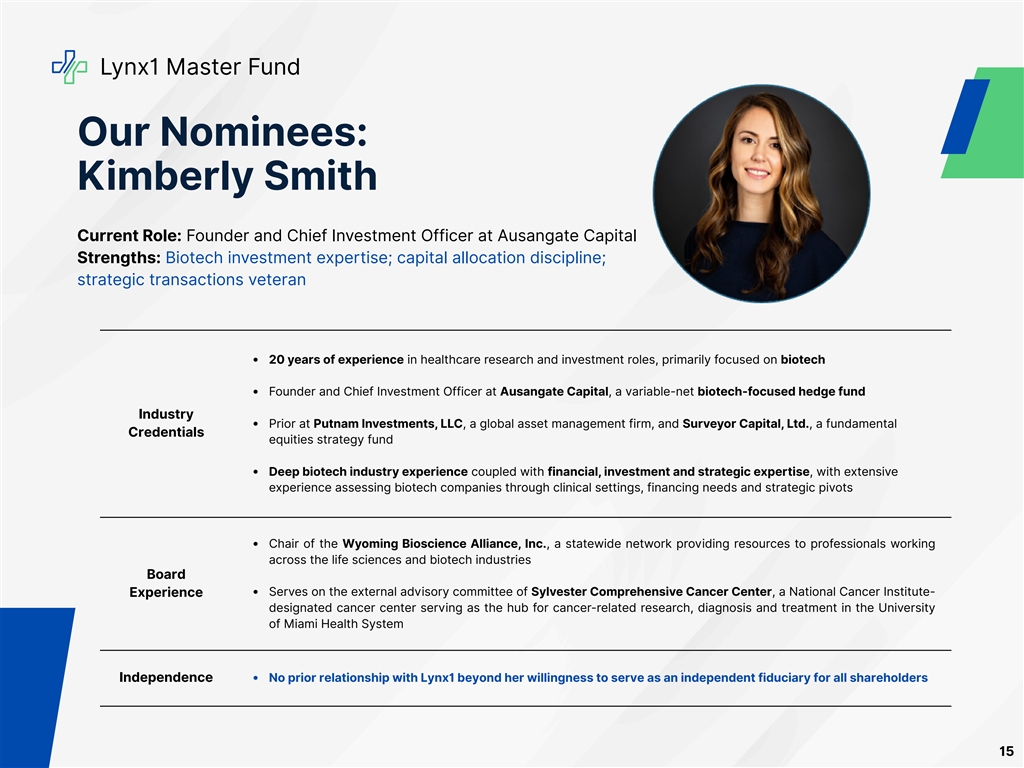

Lynx1 Master Fund Our Nominees: Kimberly Smith Current Role: Founder and Chief Investment Officer at Ausangate Capital Strengths: Biotech investment expertise; capital allocation discipline; strategic transactions veteran 20 years of experience in healthcare research and investment roles, primarily focused on biotech Founder and Chief Investment Officer at Ausangate Capital, a variable-net biotech-focused hedge fund Industry Prior at Putnam Investments, LLC, a global asset management firm, and Surveyor Capital, Ltd., a fundamental Credentials equities strategy fund Deep biotech industry experience coupled with financial, investment and strategic expertise, with extensive experience assessing biotech companies through clinical settings, financing needs and strategic pivots Chair of the Wyoming Bioscience Alliance, Inc., a statewide network providing resources to professionals working across the life sciences and biotech industries Board Serves on the external advisory committee of Sylvester Comprehensive Cancer Center, a National Cancer Institute- Experience designated cancer center serving as the hub for cancer-related research, diagnosis and treatment in the University of Miami Health System Independence No prior relationship with Lynx1 beyond her willingness to serve as an independent fiduciary for all shareholders 15

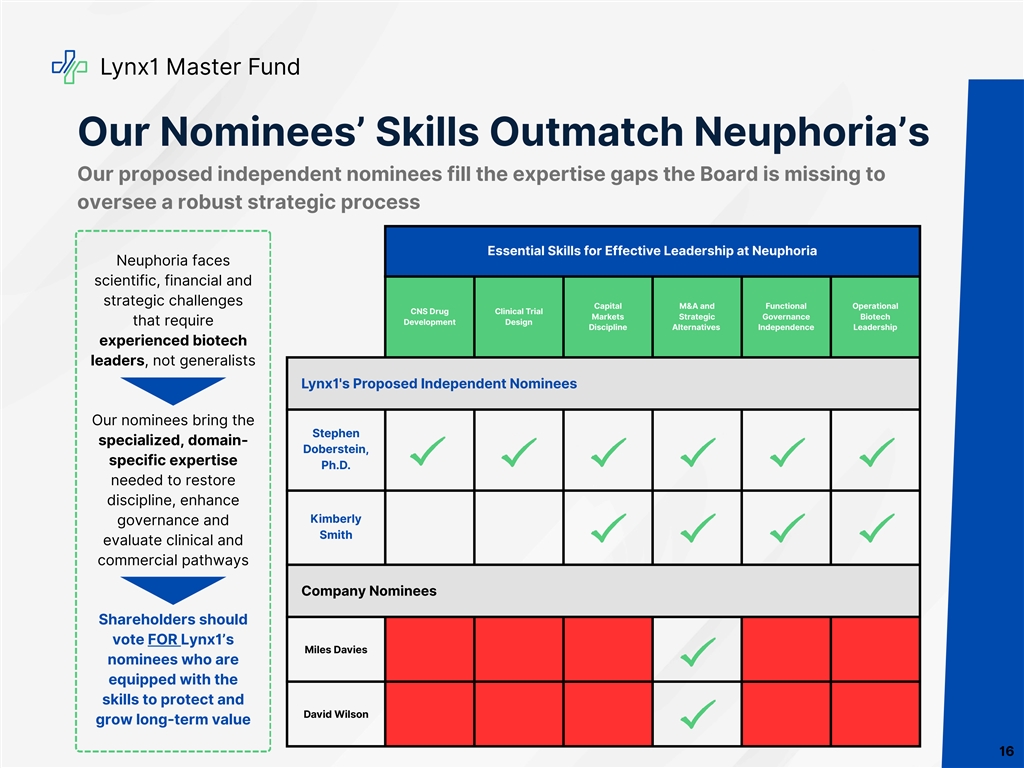

Lynx1 Master Fund Our Nominees’ Skills Outmatch Neuphoria’s Our proposed independent nominees fill the expertise gaps the Board is missing to oversee a robust strategic process Essential Skills for Effective Leadership at Neuphoria Neuphoria faces scientific, financial and strategic challenges Capital M&A and Functional Operational CNS Drug Clinical Trial Markets Strategic Governance Biotech that require Development Design Discipline Alternatives Independence Leadership experienced biotech leaders, not generalists Lynx1's Proposed Independent Nominees Our nominees bring the Stephen specialized, domain- Doberstein, specific expertise Ph.D. needed to restore discipline, enhance Kimberly governance and Smith evaluate clinical and commercial pathways Company Nominees Shareholders should vote FOR Lynx1’s Miles Davies nominees who are equipped with the skills to protect and David Wilson grow long-term value 16

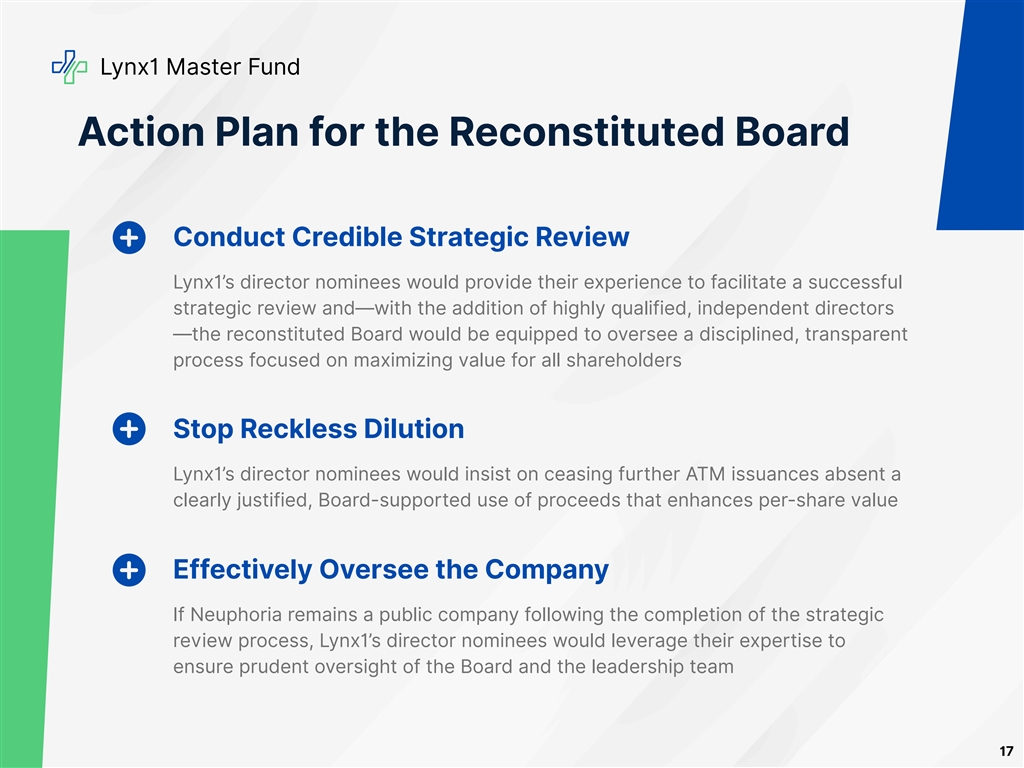

Lynx1 Master Fund Action Plan for the Reconstituted Board Conduct Credible Strategic Review Lynx1’s director nominees would provide their experience to facilitate a successful strategic review and—with the addition of highly qualified, independent directors —the reconstituted Board would be equipped to oversee a disciplined, transparent process focused on maximizing value for all shareholders Stop Reckless Dilution Lynx1’s director nominees would insist on ceasing further ATM issuances absent a clearly justified, Board-supported use of proceeds that enhances per-share value Effectively Oversee the Company If Neuphoria remains a public company following the completion of the strategic review process, Lynx1’s director nominees would leverage their expertise to ensure prudent oversight of the Board and the leadership team 17

Lynx1 Master Fund Vote the BLUE Card FOR Lynx1's Proposed Independent Nominees SUBMIT YOUR BLUE UNIVERSAL PROXY CARD TODAY ▶ Vote FOR Stephen Doberstein, Ph.D. and Kimberly Smith ▶ Vote WITHHOLD on the Company’s nominees ONLY THE LATEST-DATED CARD COUNTS There is NO need to use the Company’s white proxy card Neuphoria’s future depends on strong, independent oversight that puts shareholders’ interests first—protect your investment in Neuphoria by voting on the BLUE proxy card