UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

NEUPHORIA THERAPEUTICS INC.

(Name of Registrant as Specified in Its Charter)

LYNX1 MASTER FUND LP

LYNX1 CAPITAL MANAGEMENT LP

WESTON NICHOLS

NATHALI PARTYKA ZAMORA

STEPHEN DOBERSTEIN

KIMBERLY SMITH

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

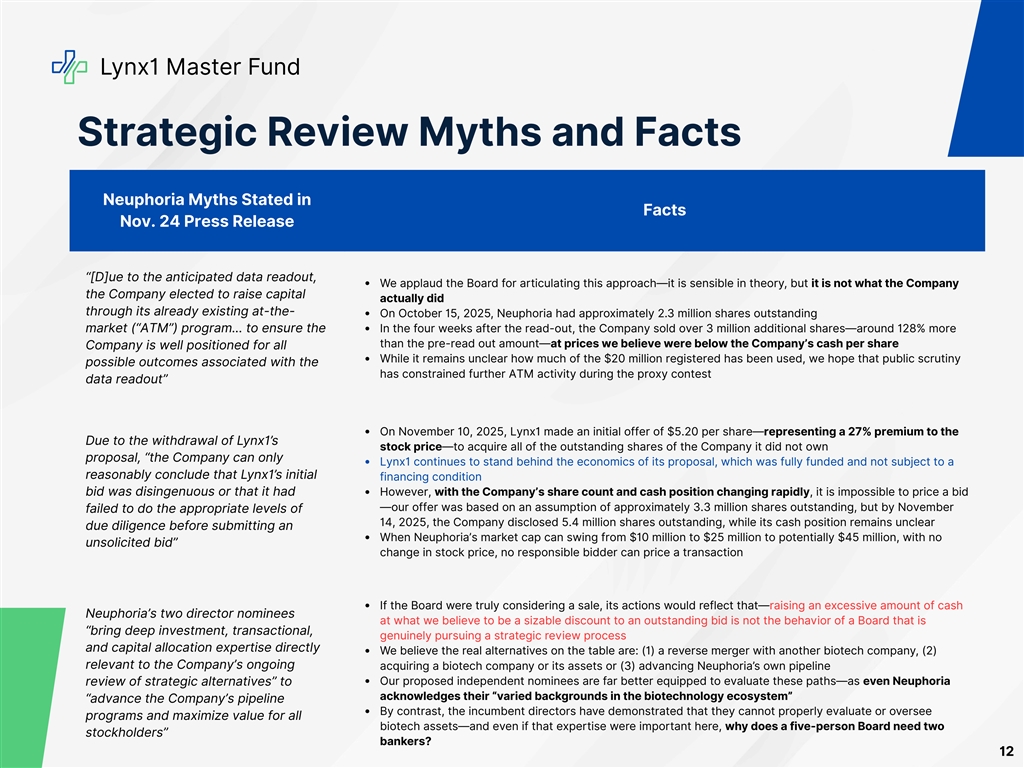

Lynx1 Master Fund Strategic Review Myths and Facts Neuphoria Myths Stated in Facts Nov. 24 Press Release “[D]ue to the anticipated data readout, We applaud the Board for articulating this approach—it is sensible in theory, but it is not what the Company the Company elected to raise capital actually did through its already existing at-the- On October 15, 2025, Neuphoria had approximately 2.3 million shares outstanding market (“ATM”) program… to ensure the In the four weeks after the read-out, the Company sold over 3 million additional shares—around 128% more than the pre-read out amount—at prices we believe were below the Company’s cash per share Company is well positioned for all While it remains unclear how much of the $20 million registered has been used, we hope that public scrutiny possible outcomes associated with the has constrained further ATM activity during the proxy contest data readout” On November 10, 2025, Lynx1 made an initial offer of $5.20 per share—representing a 27% premium to the Due to the withdrawal of Lynx1’s stock price—to acquire all of the outstanding shares of the Company it did not own proposal, “the Company can only Lynx1 continues to stand behind the economics of its proposal, which was fully funded and not subject to a reasonably conclude that Lynx1’s initial financing condition bid was disingenuous or that it had However, with the Company’s share count and cash position changing rapidly, it is impossible to price a bid —our offer was based on an assumption of approximately 3.3 million shares outstanding, but by November failed to do the appropriate levels of 14, 2025, the Company disclosed 5.4 million shares outstanding, while its cash position remains unclear due diligence before submitting an When Neuphoria’s market cap can swing from $10 million to $25 million to potentially $45 million, with no unsolicited bid” change in stock price, no responsible bidder can price a transaction If the Board were truly considering a sale, its actions would reflect that—raising an excessive amount of cash Neuphoria’s two director nominees at what we believe to be a sizable discount to an outstanding bid is not the behavior of a Board that is “bring deep investment, transactional, genuinely pursuing a strategic review process and capital allocation expertise directly We believe the real alternatives on the table are: (1) a reverse merger with another biotech company, (2) relevant to the Company’s ongoing acquiring a biotech company or its assets or (3) advancing Neuphoria’s own pipeline Our proposed independent nominees are far better equipped to evaluate these paths—as even Neuphoria review of strategic alternatives” to acknowledges their “varied backgrounds in the biotechnology ecosystem” “advance the Company’s pipeline By contrast, the incumbent directors have demonstrated that they cannot properly evaluate or oversee programs and maximize value for all biotech assets—and even if that expertise were important here, why does a five-person Board need two stockholders” bankers? 12