|

|

|

|

Penwest Pharmaceuticals Co. (NASDAQ: PPCO): The Case

for Change Tang Capital Partners, LP Perceptive Life Sciences Master Fund

Ltd. June 2010

|

|

|

|

|

Disclaimer In connection with Penwest Pharmaceutical

Co.’s upcoming 2010 annual meeting of shareholders (the “Annual Meeting”),

Tang Capital Partners, LP (“Tang Capital”) and Perceptive Life Sciences

Master Fund Ltd. (“Perceptive”) have filed with the Securities and

Exchange Commission (the “SEC”) a proxy statement (the “Tang Capital and

Perceptive Proxy Statement”) and related materials for the solicitation of

proxies from Penwest shareholders for use at the Annual Meeting. Tang

Capital and Perceptive, their director nominees and certain of their

affiliates are or may be deemed to be participants in the solicitation of

proxies with respect to the Annual Meeting. Information regarding Tang

Capital and Perceptive and their nominees and such participants is

contained in the Schedule 14A and related materials filed by Tang Capital

and Perceptive with the SEC. Penwest shareholders should read the Tang

Capital and Perceptive Proxy Statement and related materials filed with

the SEC with respect to the Annual Meeting because they contain important

information. These materials are available free of charge at the SEC’s

website at www.sec.gov. We have not sought or obtained consent from any

third party to use any statements or information included in this

presentation. Any such statements or information should not be viewed as

indicating the support of any third party. We are not recommending the

purchase or sale of any security. We reserve the right to change any of

our intentions or opinions expressed herein at any time and for any

reason. Certain matters addressed in this presentation are forward-looking

statements that involve certain risks and uncertainties. You should be

aware that actual results could differ materially from those contained in

the forward-looking statements. We assume no obligation to update any

information, including forward-looking information, contained herein.

2

|

|

|

|

|

Executive

Summary

Tang

Capital and Perceptive are the two largest shareholders of

Penwest

Legacy

leadership has failed to deliver value to shareholders

Despite

approval of shareholder resolution with a 64% vote, Penwest continues to

waste corpporate assets aggainst the will of shareholders

Penwest

is pursuing a high-risk gamble that is a complete departure from its core

competency

Stock

activity over past year confirms shareholders’ desire for

change

Penwest’s

corporate governance is structured to avoid shareholder

accountability

Our

directors and nominees have the determination, experience and expertise to

implement the operating plan that shareholders want and the one that will

maximize shareholder value

|

|

|

|

|

Background on the Parties 4

|

|

|

|

|

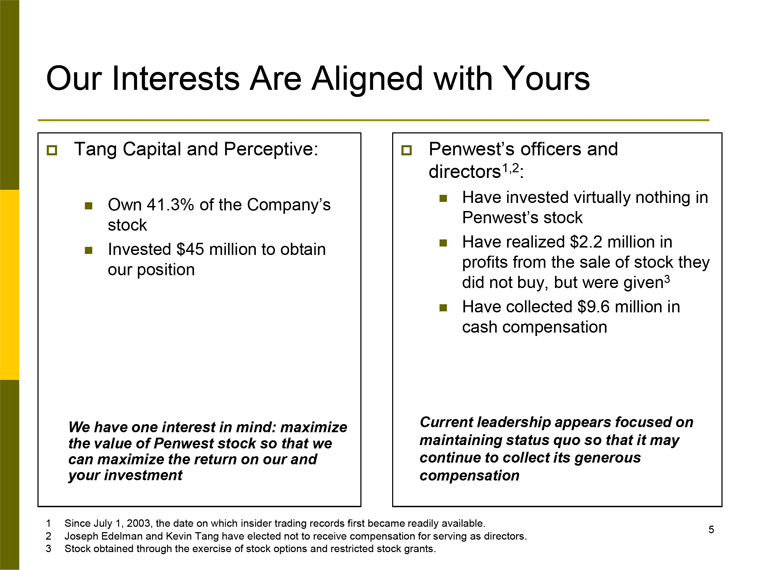

Our Interests Are Aligned with Yours o Tang Capital and

Perceptive: o Penwest’s officers and directors 1,2: o Own 41.3%

of the Company’s stock o Have invested virtually nothing in Penwest’s

stock o Invested $45 million to obtain o Have realized $2.2 million in

profits our position from the sale of stock they did not buy, but were

given 3 o

Have collected $9.6 million in cash compensation We have one interest in

mind: maximize Current leadership appears focused on the value of Penwest

stock so that we maintaining status quo so that it may can maximize the

return on our and continue to collect its generous your investment

compensation 1 Since July 1, 2003, the date on which insider trading

records first became readily available. 2 Joseph Edelman and Kevin Tang

have elected not to receive compensation for serving as directors. 3 Stock

obtained through the exercise of stock options and restricted stock

grants. 5

|

|

|

|

|

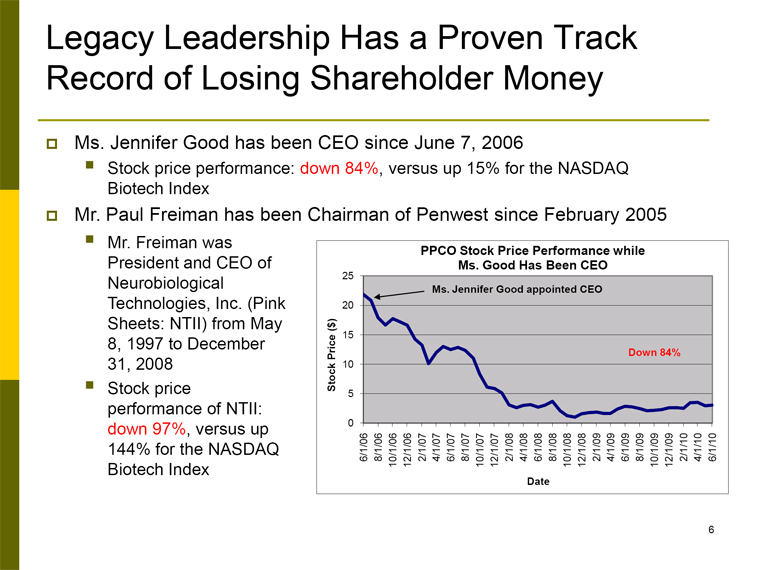

Legacy Leadership Has a Proven Track Record of Losing

Shareholder Money o Ms. Jennifer Good has been CEO since June 7, 2006 o

Stock price performance: down 84%, versus up 15% for the NASDAQ Biotech

Index o Mr. Paul Freiman has been Chairman of Penwest since February 2005

o Mr. Freiman was President and CEO of Neurobiological Technologies, Inc.

(Pink Sheets: NTII) from May 8, 1997 to December 31, 2008 o Stock price

performance of NTII: down 97%, versus up 144% for the NASDAQ Biotech Index

6

|

|

|

|

|

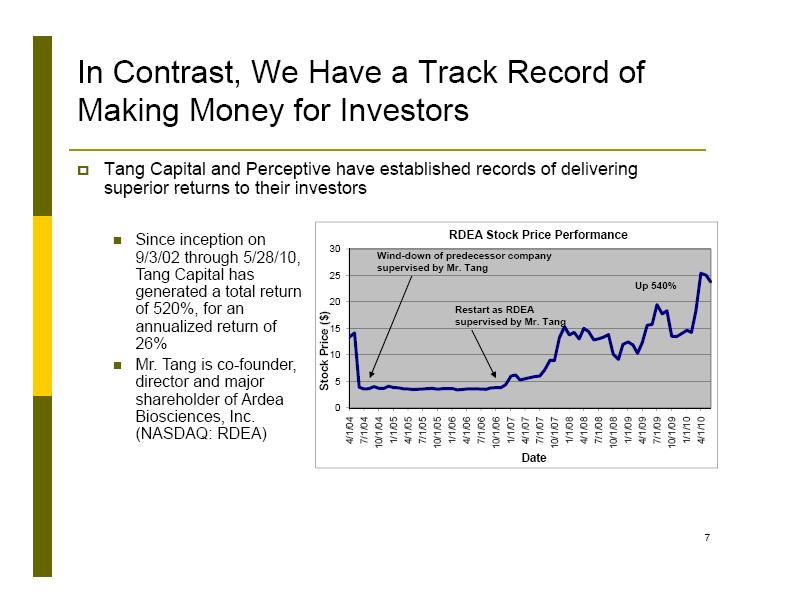

In

Contrast, We Have a Track Record of Making Money for

Investors

Tang

Capital and Perceptive have established records of delivering superior

returns to their investors superior returns to their

investors

Since

inception on 9/3/02 through 5/28/10, Tang Capital has generated a total

return of 520%, for an annualized return of 26%

Mr.

Tang is co-founder, director and major shareholder of Ardea Biosciences,

Inc. (NASDAQ: RDEA)

Wind-down

of predecessor company supervised by Mr. Tang

Restart

as RDEA supervised by Mr. Tang

Up

540%

|

|

|

|

|

Background on Penwest 8

|

|

|

|

|

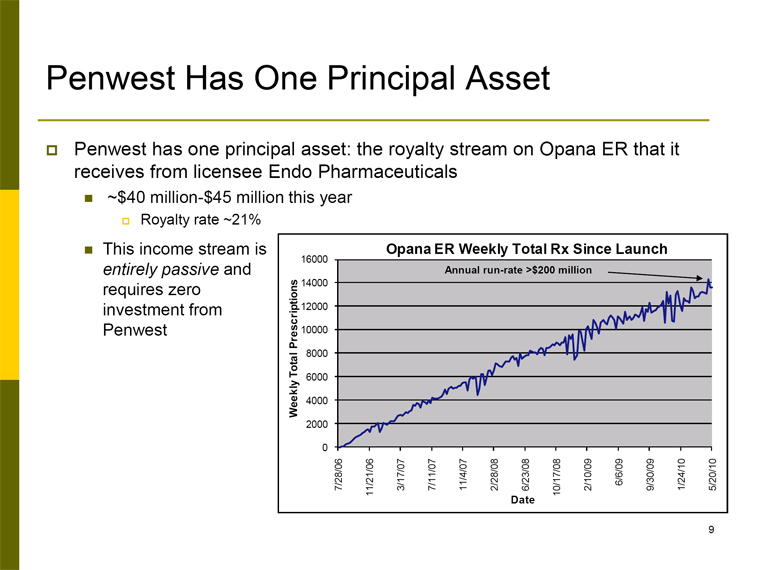

Penwest Has One Principal Asset o Penwest has one

principal asset: the royalty stream on Opana ER that it receives from

licensee Endo Pharmaceuticals o ~$40 million-$45 million this year o

Royalty rate ~21% o This income stream is entirely passive and requires

zero investment from Penwest 9

|

|

|

|

|

Penwest Continues to Squander Its Royalty Asset on

Wasteful Endeavors o While it has taken some half-measures in response to

shareholder pressure, Penwest continues to waste shareholder capital o

Over the past year, Penwest has spent approximately $15 million-$16

million on excess overhead and a high-risk development program that we

believe will not generate a positive return on investment o As a result,

an estimated $0.47-$0.50 per share of shareholder value has been lost in

the past year alone o As an example of its wasteful habits, Penwest is

paying $150,000 for its proxy solicitation firm versus our $12,500 for the

identical services 10

|

|

|

|

|

A0001 Is a High-Risk Gamble and Complete Departure from

Core Competency o A0001 is a high-risk gamble that is a complete departure

from Penwest’s core competency as a drug delivery company o Penwest is a

drug delivery company o Takes already proven drugs usually from partner

companies o Formulates them with its TIMERx drug delivery technology for

less-frequent dosing o A0001 is a molecule that has never been shown to be

effective in any disease o Penwest is targeting a group of diseases in

which no molecule ever has proven effective o Approximately 90% of drugs

at a similar stage of development fail to make it to market This

proposition, which is much higher risk and more capital intensive than

Penwest’s original business plan, is not what shareholders signed up for

11

|

|

|

|

|

Last Year’s Vote 12

|

|

|

|

|

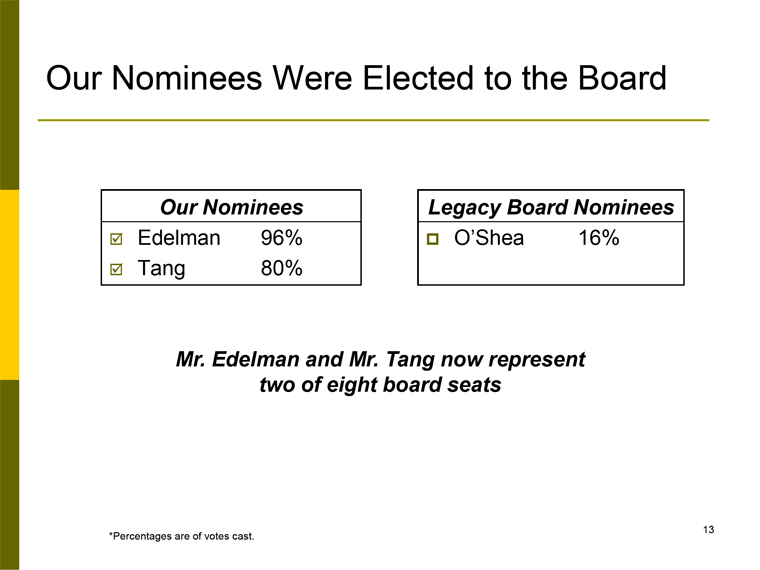

Our Nominees Were Elected to the Board Our Nominees

Legacy Board Nominees o Edelman 96% o O’Shea 16% o Tang 80% Mr. Edelman

and Mr. Tang now represent two of eight board seats * Percentages are of

votes cast. 13

|

|

|

|

|

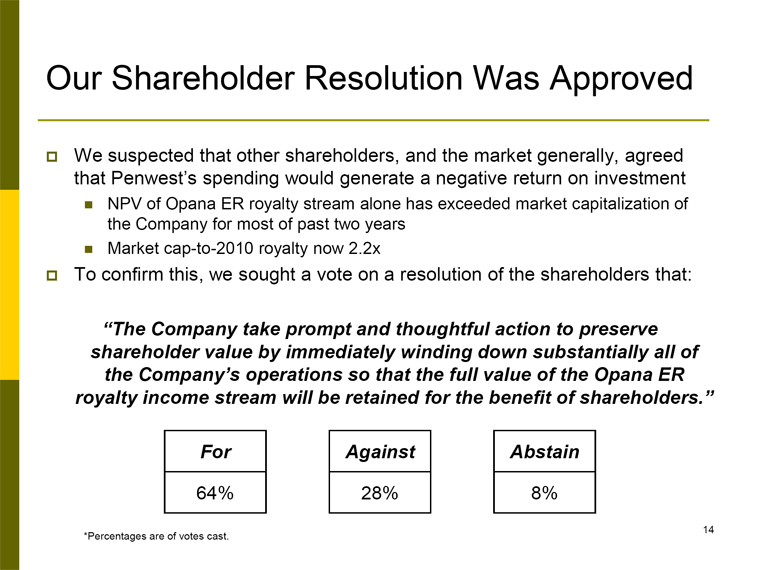

Our Shareholder Resolution Was Approved o We suspected

that other shareholders, and the market generally, agreed that Penwest’s

spending would generate a negative return on investment o NPV of Opana ER

royalty stream alone has exceeded market capitalization of the Company for

most of past two years o Market cap-to-2010 royalty now 2.2x o To confirm

this, we sought a vote on a resolution of the shareholders that: “The

Company take prompt and thoughtful action to preserve shareholder value by

immediately winding down substantially all of the Company’s operations so

that the full value of the Opana ER royalty income stream will be retained

for the benefit of shareholders.” For Against Abstain 64% 28% 8% *

Percentages are of votes cast. 14

|

|

|

|

|

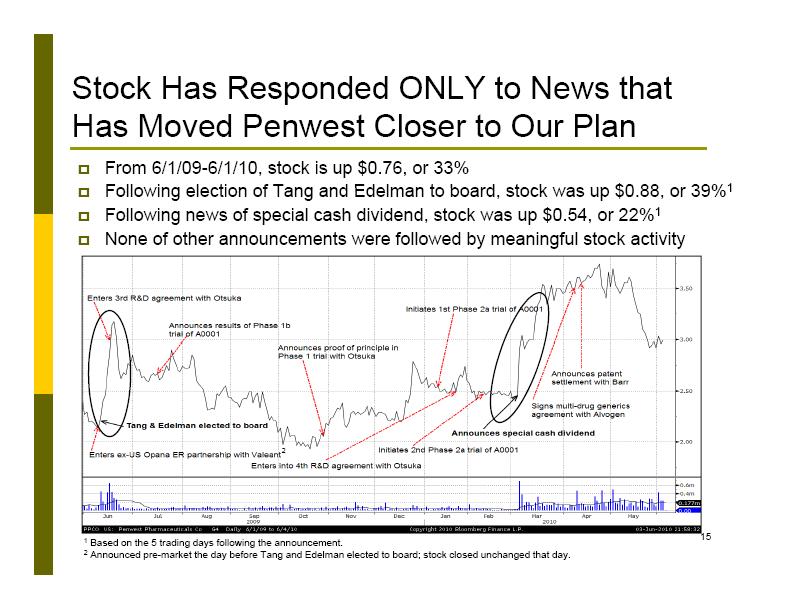

Stock

Has Responded ONLY to News that Has Moved Penwest Closer to Our

Plan

From

6/1/09-6/1/10, stock is up $0.76, or 33%

Following

election of Tang and Edelman to board stock was up $0 88 or

39%1

Following

election of Tang and Edelman to board, stock was up $0.88, or

39%1

Following

news of special cash dividend, stock was up $0.54, or 22%1

None

of other announcements were followed by meaningful stock

activity

1

Based on the 5 trading days following the announcement.

2

Announced pre-market the day before Tang and Edelman elected to board;

stock closed unchanged that

day.

|

|

|

|

|

Why Has Nothing Happened? 16

|

|

|

|

|

All Year Long, We Have Been Out-Voted o Because Penwest

has a staggered board, we only were able to elect two of eight directors o

We have been out-voted by the legacy leadership on all proposals we have

made o Implementation of shareholder resolution - rejected o

Discontinuation of A0001 - rejected o Deeper spending cuts - rejected o

Tang as CEO for zero compensation - rejected 17

|

|

|

|

|

If you vote for our nominees, you not only will be

voting for three highly qualified individuals, but you also will be giving

us the ability to deliver on an operating plan that the majority of

shareholders voted for 18

|

|

|

|

|

Our Proposed Operating Plan o Curtail substantially all

spending on A0001 as quickly as current commitments and scientific

prudence allow o Immediately explore ways to monetize this early-stage,

high-risk development candidate o corporate partnership o asset sale o

Significantly reduce headcount and other overhead expenses o Conduct

rapid, detailed review of current employee base with the view towards

eliminating all positions that are: o not funded by ongoing drug delivery

collaborations o not necessary for the new operating plan o Most positions

not funded by ongoing collaborations can be eliminated 19

|

|

|

|

|

Our Proposed Operating Plan (cont.) o Explore ways to

monetize TIMERx drug delivery technology o collaborations that make

economic sense o sale of the asset o Explore ways to return capital to

shareholders o beyond stated plan to pay special cash dividend in 4Q 2010

o in the most tax-efficient manner available o Evaluate executive

management team to ensure that its key members are: o aligned with the

interests of shareholders o capable of executing the new operating plan

20

|

|

|

|

|

Our Nominees o Roderick Wong, M.D. is a seasoned

investment professional with particular expertise in evaluating and

investing in biopharmaceutical companies o Has invested in more than 100

health care companies representing more than $1 billion in invested

capital o Managing Member of RTW Investments o Managing Director/Portfolio

Manager of Davidson Kempner Healthcare Funds o Healthcare Analyst at Sigma

Capital Management o Adjunct Assistant Professor at NYU Stern Business

School, where he teaches MBA course entitled Financial Analysis in

Healthcare o Member of biotechnology equity research team at Cowen &

Company o M.D. from University of Pennsylvania Medical School o MBA from

Harvard Business School o Phi Beta Kappa with a BS in Economics from Duke

University 21

|

|

|

|

|

Our Nominees (cont.) o Saiid Zarrabian is a seasoned

executive with extensive operating experience in the life sciences

industry o He has been an effective manager of both growing and maturing

companies o President and Chief Executive Officer of Cyntellect, Inc. o

President and Chief Operating Officer of Senomyx, Inc. (NASDAQ: SNMX) o

Chief Operating Officer of Pharmacopeia, Inc., now Ligand Pharmaceuticals

Incorporated (NASDAQ: LGND) o President and Chief Operating Officer of

Molecular Simulations, Inc. o He also has experience governing life

sciences companies as a board member o Ambit Biosciences Corporation o

eMolecules, Inc. o Cyntellect, Inc. 22

|

|

|

|

|

Our Nominees (cont.) o John Lemkey has extensive

knowledge of financial and tax-related matters o Chief Financial Officer

of Tang Capital o Manages accounting, finance and administrative staff,

performs financial and valuation analyses, reviews business plans,

designs, negotiates and manages complex financial transactions and

interacts with management and boards of directors of portfolio companies o

Auditor for Ernst and Young LLP o Certified Public Accountant in the state

of California (inactive) o BS in Accounting from the University of

Southern California 23

|

|

|

|

|

Our Pledge to Make the Board Accountable to

Shareholders o Penwest’s corporate governance is a disgrace o Policies and

tactics borne out of explicit desire to suppress shareholder input and

avoid accountability o staggered board o establishment of a poison pill If

our nominees are elected, we pledge to recommend that the board eliminates

staggered board and poison pill and takes other actions necessary to make

the board wholly accountable to shareholders 24

|

|

|

|

|

Contact Information Kevin Tang, Tang Capital Partners,

LP 4401 Eastgate Mall San Diego, CA 92121 (858) 200-3830 Joseph Edelman,

Perceptive Life Sciences Master Fund Ltd. 499 Park Avenue, 25th Floor New

York, NY 10022 (646) 205-5320 Peter Casey, The Altman Group 1200 Wall

Street West, 3rd Floor Lyndhurst, NJ 07071 Shareholders call toll free:

(866) 620-7619 Banks and brokers call collect: (201) 806-2214 Fax: (201)

460-0050 25

|