|

TANG CAPITAL PARTNERS, LP

4401 EASTGATE MALL

SAN DIEGO, CA 92121

|

PERCEPTIVE LIFE SCIENCES MASTER FUND LTD.

499 PARK AVENUE, 25TH FLOOR

NEW YORK, NY 10022

|

June 4, 2010

Dear Fellow Penwest Shareholder:

It has been a year since we last addressed you, and, with this year’s annual shareholder meeting on June 22, 2010 rapidly approaching, we are writing you now to again seek your support in effecting much-needed change at your company. As a reminder, we are the two largest shareholders of Penwest Pharmaceuticals Co. and, like you, have much to gain or lose based on the future share price performance of Penwest’s stock. Tang Capital Partners, LP and Perceptive Life Sciences Master Fund Ltd., together with our affiliates, own 41.3% of the Company’s outstanding common stock.

Let us start by thanking you for your strong support at last year’s annual meeting. At that meeting, you elected Kevin Tang, manager of Tang Capital, and Joseph Edelman, manager of Perceptive, to your Board. Furthermore, you approved our shareholder resolution requesting that the Board take prompt and thoughtful action to wind down substantially all of the Company’s operations in order to preserve the full value of the Opana ER royalty stream for the benefit of shareholders. The voting results were not ambiguous: of the shares voted, more than 80% were voted for Kevin Tang and Joseph Edelman as director nominees, and 64% were voted for our shareholder resolution.

We are sad to report that, despite your clear vote for change at last year’s meeting, little in fact has changed at Penwest. Because Penwest has a “staggered” board, we only were able to nominate two directors last year. And, because Mr. Tang and Mr. Edelman have held only two of eight board seats since they were elected, they simply have been out-voted by the Company’s legacy leadership, which still represents the Board majority, on all proposals they have made. This includes implementation of measures in furtherance of the shareholder resolution for which you specifically voted and approved. Instead, over the objections of Mr. Tang and Mr. Edelman, the Company has continued to spend wastefully on overhead and programs that you voted against. This wasteful and

unnecessary spending has resulted in some $15 million-$16 million, or $0.47-$0.50 per share, in lost shareholder value in just the past year.

We do have some good news, however. On June 22, 2010, the shareholders of Penwest will vote to elect three directors to the Board. If our three nominees are chosen, then the Company’s legacy leadership finally will be reduced to a minority, and we at long last will be able to influence change at your company.

If, like us, you are a concerned shareholder who desires a board that is responsive to shareholders, will stop the wasteful spending and focus on maximizing shareholder value, then VOTE FOR CHANGE: VOTE FOR OUR NOMINEES on the GOLD proxy card today!

Our Plan to Maximize Value for Shareholders

Our view of Penwest only has been reinforced by the perspective we have gained by virtue of having Mr. Tang and Mr. Edelman serve as Board members over the past year. Specifically, we believe that Penwest’s most valuable asset is the royalty stream on Opana ER that it receives from licensee Endo Pharmaceuticals. Instead of harvesting the cash flow from this royalty stream for the benefit of shareholders, the Company continues to spend it on high-risk, non-core-competence activities that we believe will not generate a positive return on investment. Clearly, our view is shared by other shareholders and the market generally, as evidenced not only by last year’s vote on the shareholder resolution, but also the fact that the net present value of this income stream alone has exceeded the market capit

alization of the Company for most of the past year. It is time to stop the wasting of corporate assets. In order to maximize value for all shareholders, we believe that the Company should take the following actions:

|

●

|

Curtail substantially all spending on A0001 and immediately explore ways to monetize this early-stage, high-risk development candidate through a corporate partnership or asset sale. It is important to note that the development of A0001 is a complete departure from the core competency of Penwest, which is a drug delivery company that heretofore has taken already proven pharmaceuticals, usually from partner companies, and formulated them using its TIMERx drug delivery technology to allow for less-frequent dosing. A0001, by contrast, is a molecule that never has been shown to be effective at treating any human disease and, in fact, is being developed for a group of diseases where no molecule ever has been shown to be e

ffective. This proposition, which involves much greater risk and capital intensity than Penwest’s original business plan, is not the one that Penwest’s shareholders signed up for. Therefore, we believe that all research and development spending on A0001 should be eliminated as quickly as current commitments and scientific prudence allow;

|

| ● |

Significantly reduce headcount and other overhead expenses, which we believe continue to be maintained at levels that are in excess of what is required. Following the annual meeting, if our nominees are elected, we intend to conduct a rapid, detailed review of the Company’s current employee base with the view towards eliminating all positions that are not funded by ongoing drug delivery collaborations or not necessary for the Company’s new operating plan. We anticipate that most of the Company’s current positions that are not funded by ongoing collaborations can be eliminated;

|

|

●

|

Explore ways to monetize the Company’s proprietary TIMERx drug delivery technology through either collaborations that make economic sense or the sale of this asset;

|

|

●

|

Explore ways to return capital to shareholders, beyond the stated plan to pay a special cash dividend in the fourth quarter of 2010, in the most tax-efficient manner available; and

|

2

|

●

|

Evaluate the Company’s executive management team to ensure that its key members are aligned with the interests of shareholders and capable of executing the Company’s new operating plan.

|

With your support of our three nominees, we will work hard to ensure the implementation of these actions, each of which is aimed at eliminating corporate waste and maximizing the value ultimately available to be returned to shareholders from the Opana ER royalty stream and the Company’s other assets.

Our Directors and Nominees

We believe that our three nominees for election this year, together with Mr. Tang and Mr. Edelman, who you elected last year, possess the determination, experience and expertise to make the changes necessary to maximize value at Penwest.

|

●

|

Kevin Tang. Kevin Tang, who you elected last year, is the founder and manager of Tang Capital, an investment company focused on the biopharmaceutical industry with an established record of delivering superior returns to its investors. Since its inception on September 3, 2002 through May 28, 2010, Tang Capital has generated a total return, net of all fees and expenses, of 520%, for an annualized rate of return of 26%. Mr. Tang has nineteen years of experience evaluating biopharmaceutical companies in his current capacity as a portfolio manager and his prior capacity as a biotechnology analyst. He has considerable experience governing biopharmaceutical companies as a board member and currently is a director of A.P. Pharma, Inc. (NASDAQ: APPA) and Ardea

Biosciences, Inc. (NASDAQ: RDEA), which he co-founded in 2006.

|

|

●

|

Joseph Edelman. Joseph Edelman, who you elected last year, is the founder and manager of Perceptive, an investment company focused on the biopharmaceutical industry with an established record of delivering superior returns to its investors. Mr. Edelman has twenty years of experience evaluating biopharmaceutical companies in his current capacity as a portfolio manager and his prior capacity as a biotechnology analyst.

|

|

●

|

Roderick Wong, M.D. Roderick Wong, one of our nominees for election this year, is a seasoned investment professional with particular expertise in evaluating and investing in biopharmaceutical companies. In his capacity as Managing Member of RTW Investments, Managing Director and Portfolio Manager of the Davidson Kempner Healthcare Funds, and Healthcare Analyst at Sigma Capital Management, Dr. Wong has invested in more than 100 health care companies representing more than $1 billion in invested capital. Dr. Wong also serves as an Adjunct Assistant Professor at NYU Stern Business School, where he teaches an MBA course entitled Financial Analysis in Healthcare, and previously was a member of th

e biotechnology equity research team at Cowen & Company. Dr. Wong graduated from the University of Pennsylvania Medical School, received an MBA from Harvard Business School, and graduated Phi Beta Kappa with a BS in Economics from Duke University.

|

3

|

●

|

Saiid Zarrabian. Saiid Zarrabian, one of our nominees for election this year, is a seasoned executive with extensive operating experience in the life sciences industry. Importantly, he has been an effective manager of both growing and maturing companies. He has served as President and Chief Executive Officer of Cyntellect, Inc., President and Chief Operating Officer of Senomyx, Inc. (NASDAQ: SNMX), Chief Operating Officer of Pharmacopeia, Inc., now Ligand Pharmaceuticals Incorporated (NASDAQ: LGND), and President and Chief Operating Officer of Molecular Simulations, Inc. He also has experience governing life sciences companies as a board member and currently is a director of Ambit Biosciences Corporation, eMolecules, Inc., and Cyntellect, Inc.<

/div>

|

|

●

|

John Lemkey. John Lemkey, one of our nominees for election this year, has extensive knowledge of financial and tax-related matters. As the Chief Financial Officer of Tang Capital, Mr. Lemkey manages an accounting, finance and administrative staff, performs financial and valuation analyses, reviews business plans, designs, negotiates and manages complex financial transactions and interacts with management and boards of directors of portfolio companies. Previously, he was an auditor for Ernst and Young LLP. Mr. Lemkey is a Certified Public Accountant in the state of California (inactive) and received his B.S. degree in Accounting from the University of Southern California.

|

Our Pledge to Make the Board Accountable to the Shareholders

A final word on corporate governance. It is our belief that it is a board’s duty to govern a company for the benefit of the company’s shareholders, not itself or the management team. The shareholders are, after all, the owners of a company, and the salaries and fees paid to board members and managers are paid by them. As we have discussed in the past, we believe that Penwest’s corporate governance is a disgrace, and that the Company’s policies and tactics – ranging from its staggered board to its establishment of a “poison pill” – have been borne out of an explicit desire by the Company’s legacy leadership to suppress shareholder input and avoid accountability. This has to change. If our nominees are elected, we pledge to recommend

that the board eliminates the staggered board, eliminates the poison pill, and takes other actions necessary to make the board wholly accountable to the shareholders.

Your Vote is Very Important, and We Need Your Support, Regardless of the Number of Shares You Own.

|

●

|

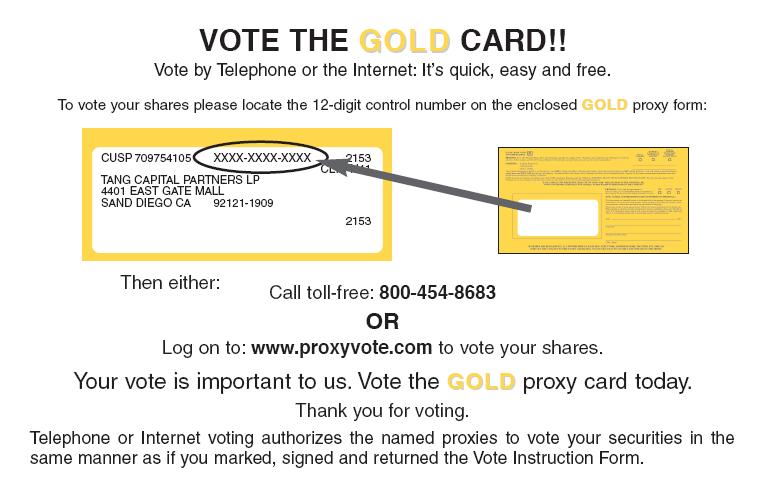

Please sign, date and return the enclosed GOLD proxy card in the provided postage-paid envelope TODAY.

|

|

●

|

If your Penwest shares are held in the name of a brokerage firm, bank, nominee or other institution, only it can sign a GOLD proxy card with respect to your shares and only after receiving your specific instructions. Accordingly, please contact the person responsible for your account and give instructions that a GOLD proxy card be signed representing your Penwest shares. We urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of your instructions to us in care of The Altman Group to the address below, so that we will be aware of all instructions given and can attempt to ensure that your instructions are followed.

|

4

|

●

|

Please DO NOT send back any white proxy card you receive from the Company, even to vote against its nominees. Doing so will cancel any prior vote you cast on the GOLD proxy card. Please return only the GOLD proxy card.

|

Again, every vote is important. Regardless of the number of shares you own, we urge you to VOTE FOR OUR NOMINEES ON THE GOLD PROXY CARD TODAY! If you have any questions or require assistance voting your proxy, please call The Altman Group at (866) 620-7619.

We thank you for your consideration.

Sincerely,

TANG CAPITAL PARTNERS, LP

Kevin Tang

PERCEPTIVE LIFE SCIENCES MASTER FUND LTD.

Joseph Edelman

5

In connection with Penwest Pharmaceutical Co’s upcoming 2010 annual meeting of shareholders (the “Annual Meeting”), Tang Capital Partners, LP (“Tang Capital”) and Perceptive Life Sciences Master Fund Ltd. (“Perceptive”) have filed with the Securities and Exchange Commission (the “SEC”) a proxy statement (the “Tang Capital and Perceptive Proxy Statement”) and related materials for the solicitation of proxies from Penwest shareholders for use at the Annual Meeting. Tang Capital and Perceptive, their director nominees and certain of their affiliates are or may be deemed to be participants in the solicitation of proxies with respect to the Annual Meeting. Information regarding Tang Capital and Perceptive and their nominees and such participants is contained in the Schedule 14A and related materials filed by Tang

Capital and Perceptive with the SEC. Penwest shareholders should read the Tang Capital and Perceptive Proxy Statement and related materials filed with the SEC with respect to the Annual Meeting because they contain important information. These materials are available without charge at the SEC’s website at www.sec.gov.

* * * * *

IMPORTANT

Your vote is important, no matter how many or how few shares you own. To vote your shares, please sign, date and return the enclosed GOLD proxy card. Do not return any white proxy card that you receive from management. If you have any questions or need assistance voting your shares, please contact The Altman Group, which is assisting us in this matter, at the following numbers:

The Altman Group

1200 Wall Street West, 3rd Floor

Lyndhurst, NJ 07071

Shareholders call toll free: (866) 620-7619

Banks and Brokers call collect: (201) 806-2214

Fax: (201) 460-0050

6