| Investor Presentation JANUARY 2026 |

| A B O U T G L A U K O S 2 © 2026 Glaukos Corporation Disclaimer All statements other than statements of historical facts included in this presentation that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements are based on management’s current expectations, assumptions, estimates and beliefs. Although we believe that we have a reasonable basis for forward-looking statements contained herein, we caution you that they are based on current expectations about future events affecting us and are subject to risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that may cause our actual results to differ materially from those expressed or implied by forward-looking statements in this presentation. These potential risks and uncertainties that could cause actual results to differ materially from those described in forward-looking statements include, without limitation, our ability to successfully commercialize our iDose TR or Epioxa therapies; the impact of general macroeconomic conditions including foreign currency fluctuations and future health crises on our business; our ability to generate sales of our commercialized products and develop and commercialize additional products; our dependence on a limited number of third-party suppliers, some of which are single-source, for components of our products; the occurrence of a crippling accident, natural disaster, or other disruption at our primary facility, which may materially affect our manufacturing capacity and operations; securing or maintaining adequate coverage or reimbursement by government or third-party payors for our products or procedures using the iStent®, the iStent inject® W, iAccess, iPRIME, iStent infinite, iDose® TR, our corneal cross-linking products or other products in development, and our compliance with the requirements of participation in federal healthcare programs such as Medicare and Medicaid; our ability to properly train, and gain acceptance and trust from, ophthalmic surgeons in the use of our products; our compliance with federal, state and foreign laws and regulations for the approval and sale and marketing of our products and of our manufacturing processes; the lengthy and expensive clinical trial process and the uncertainty of timing and outcomes from any particular clinical trial or regulatory approval processes; the risk of recalls or serious safety issues with our products and the uncertainty of patient outcomes; healthcare legislative or regulatory reform measures and changes in U.S. and international trade policies, including budgetary cuts, government shutdowns, and the imposition of tariffs, which could have a material adverse effect on our results of operations and product commercial success; our ability to protect our information systems against cyber threats and cybersecurity incidents, and to comply with state, federal and foreign data privacy laws and regulations; and our ability to protect, and the expense and time-consuming nature of protecting, our intellectual property against third parties and competitors and the impact of any claims against us for infringement or misappropriation of third party intellectual property rights and any related litigation. These and other known risks, uncertainties and factors are described in detail under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission (SEC), including our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, which was filed with the SEC on October 31, 2025. Our filings with the SEC are available in the Investor Section of our website at www.glaukos.com or at www.sec.gov. In addition, information about the risks and benefits of our products is available on our website at www.glaukos.com. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on the forward-looking statements in this presentation, which speak only as of the date hereof. We do not undertake any obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except as may be required under applicable securities law. |

| A B O U T G L A U K O S 3 © 2026 Glaukos Corporation WE’LL Innovation is at the core of everything we do. We push the limits of science and technology to solve unmet needs in chronic eye diseases for the benefit of patients worldwide. Dropless Therapies Challenging conventional paradigms to advance the standards of care and improve outcomes Proven New Market Pioneer Building durable new markets to better serve physicians and patients Solutions Oriented; Creating & Exploiting Newest Technologies Unique hybrid pharmaceutical-device company transforming treatment options and GO quality of life for large and/or underserved patient populations FIRST |

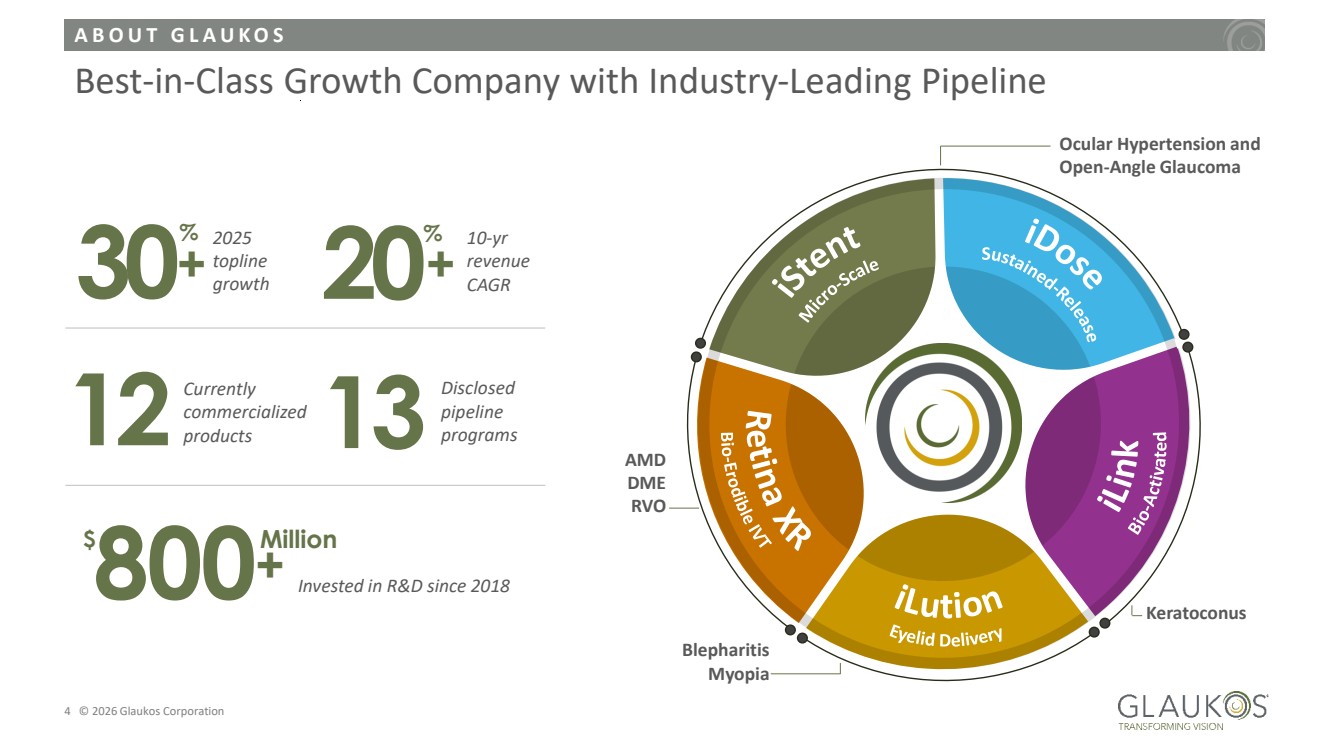

| A B O U T G L A U K O S 4 © 2026 Glaukos Corporation Best-in-Class Growth Company with Industry-Leading Pipeline 13 Disclosed pipeline 12 programs Currently commercialized products iStent Micro-Scale iDose Sustained-Release iLin k Bio-Activa t e d iLution Eyelid Delivery Retina XR Bio-Erodible IVT Ocular Hypertension and Open-Angle Glaucoma Keratoconus Blepharitis Myopia AMD DME RVO 30% 2025 topline growth 20% 10-yr revenue CAGR 800 $ Million Invested in R&D since 2018 + + + |

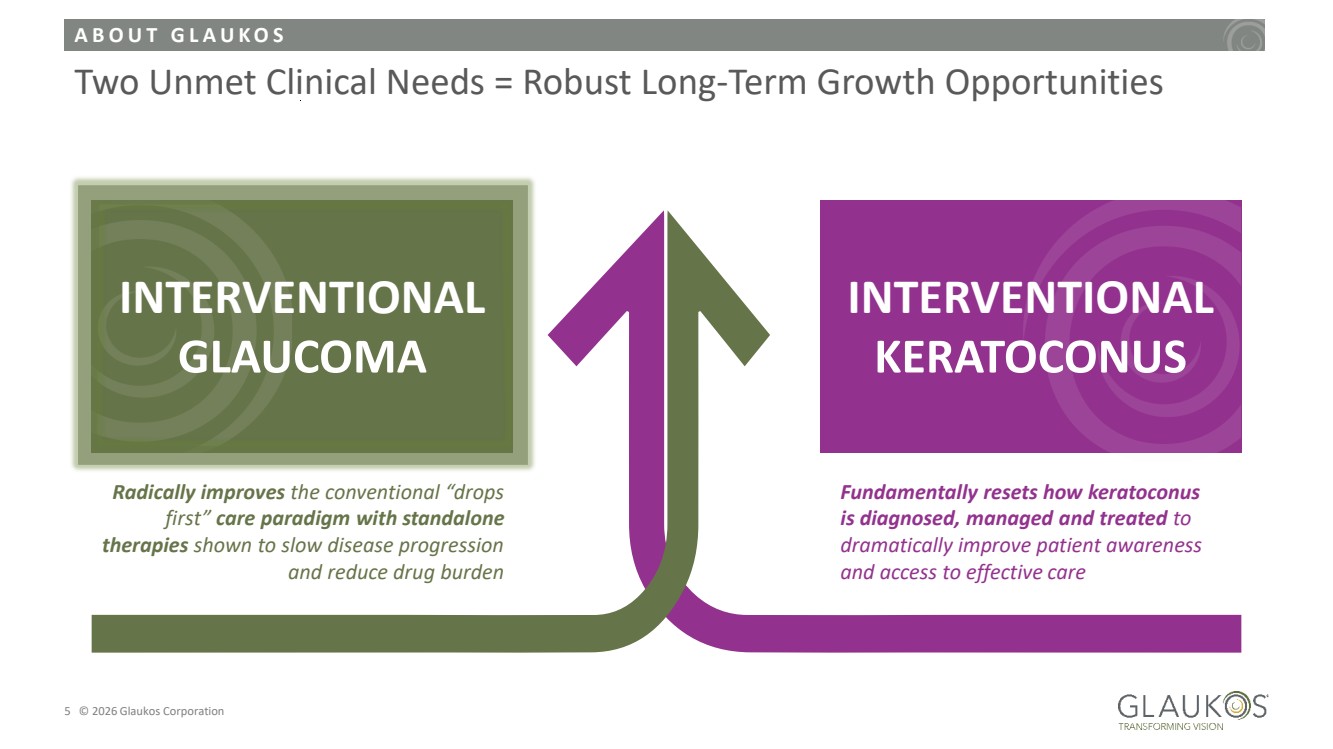

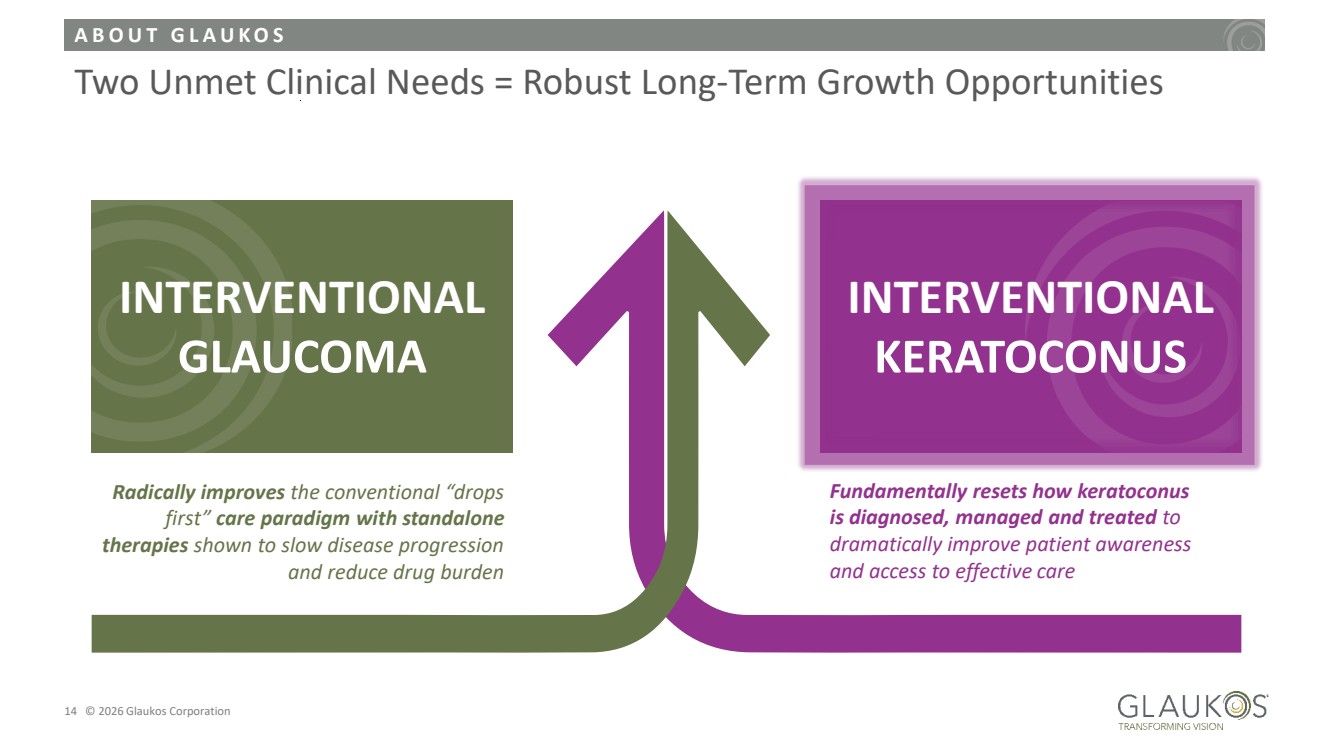

| A B O U T G L A U K O S 5 © 2026 Glaukos Corporation Two Unmet Clinical Needs = Robust Long-Term Growth Opportunities Fundamentally resets how keratoconus is diagnosed, managed and treated to dramatically improve patient awareness and access to effective care INTERVENTIONAL KERATOCONUS Radically improves the conventional “drops first” care paradigm with standalone therapies shown to slow disease progression and reduce drug burden INTERVENTIONAL GLAUCOMA |

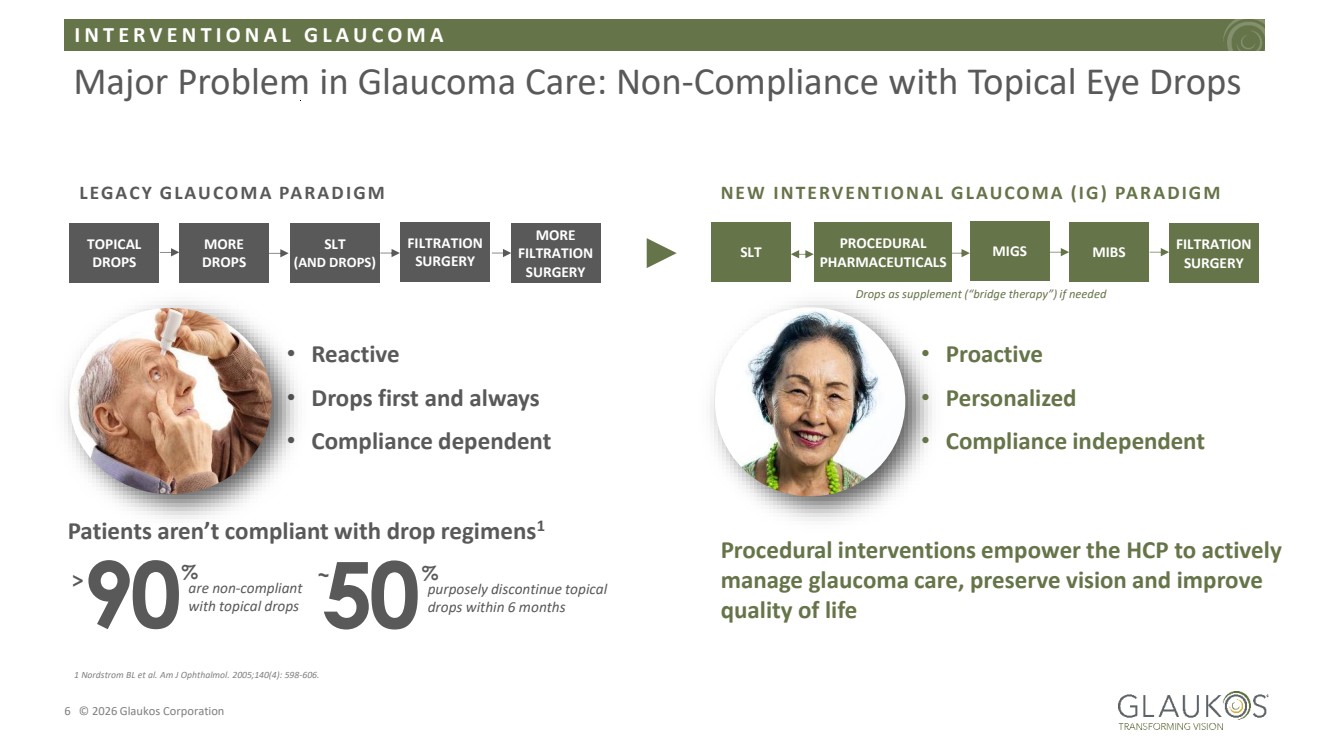

| I N T E R V E N T I O N A L G L A U C O M A 6 © 2026 Glaukos Corporation Major Problem in Glaucoma Care: Non-Compliance with Topical Eye Drops 1 Nordstrom BL et al. Am J Ophthalmol. 2005;140(4): 598-606. % 90are non-compliant with topical drops 50~ % purposely discontinue topical drops within 6 months Patients aren’t compliant with drop regimens1 > Topical medications used as a supplement (“bridge therapy”) as needed LEG ACY G LAUCOMA PARAD IGM • Reactive • Drops first and always • Compliance dependent TOPICAL DROPS MORE DROPS SLT (AND DROPS) FILTRATION SURGERY MORE FILTRATION SURGERY Drops as supplement (“bridge therapy”) if needed NEW INTERVENTIONAL G LAUCOMA (IG ) PARADIGM SLT PROCEDURAL PHARMACEUTICALS MIGS MIBS FILTRATION SURGERY Procedural interventions empower the HCP to actively manage glaucoma care, preserve vision and improve quality of life • Proactive • Personalized • Compliance independent |

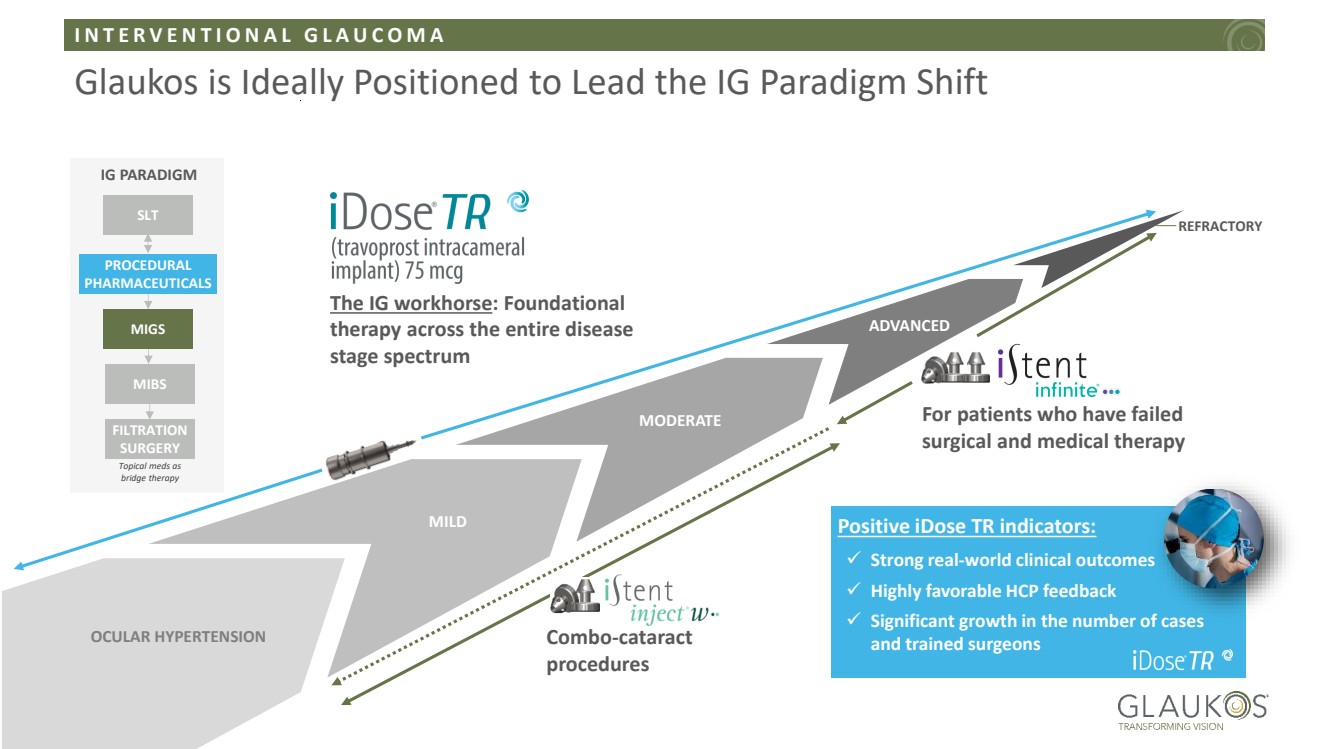

| I N T E R V E N T I O N A L G L A U C O M A 7 © 2026 Glaukos Corporation Glaukos is Ideally Positioned to Lead the IG Paradigm Shift OCULAR HYPERTENSION ADVANCED MODERATE MILD REFRACTORY The IG workhorse: Foundational therapy across the entire disease stage spectrum For patients who have failed surgical and medical therapy IG PARADIGM SLT PROCEDURAL PHARMACEUTICALS MIGS MIBS FILTRATION SURGERY Topical meds as bridge therapy Combo-cataract procedures ✓ Strong real-world clinical outcomes ✓ Highly favorable HCP feedback ✓ Significant growth in the number of cases and trained surgeons Positive iDose TR indicators: |

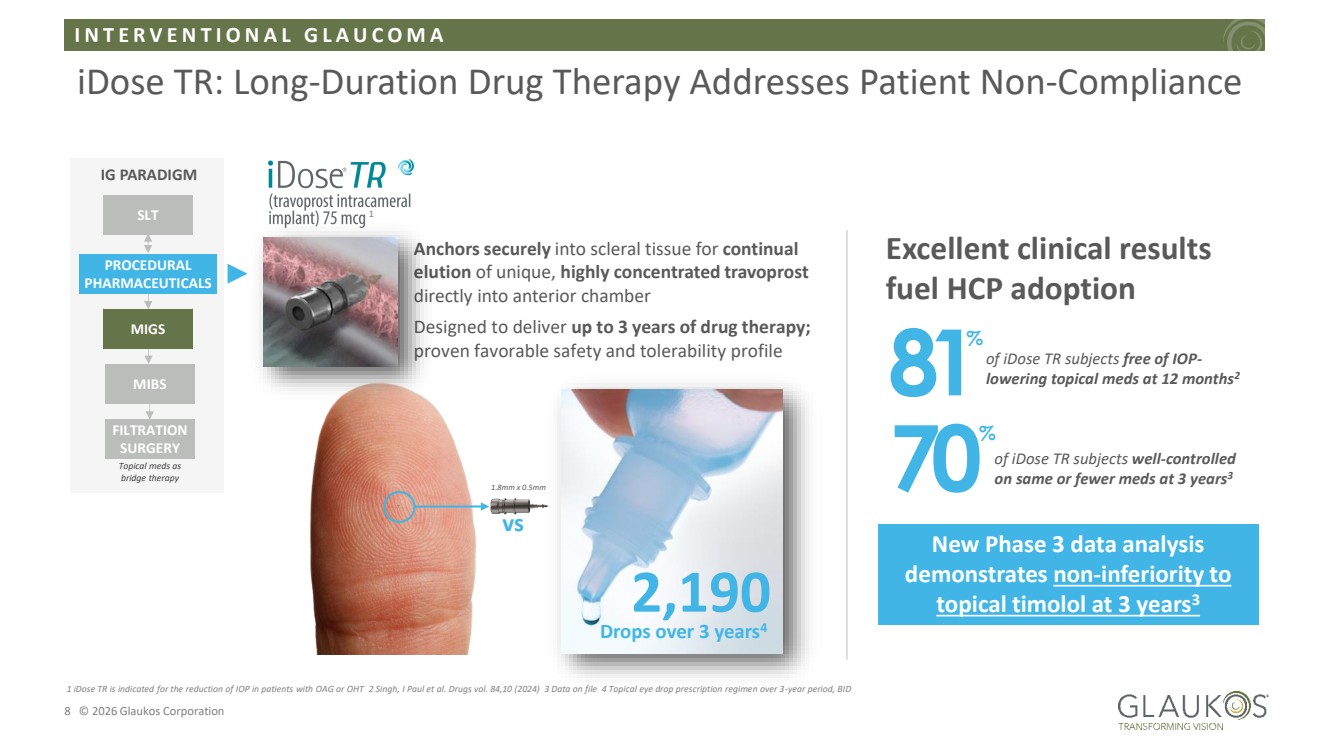

| I N T E R V E N T I O N A L G L A U C O M A 8 © 2026 Glaukos Corporation iDose TR: Long-Duration Drug Therapy Addresses Patient Non-Compliance Anchors securely into scleral tissue for continual elution of unique, highly concentrated travoprost directly into anterior chamber Designed to deliver up to 3 years of drug therapy; proven favorable safety and tolerability profile IG PARADIGM SLT PROCEDURAL PHARMACEUTICALS MIGS MIBS FILTRATION SURGERY Topical meds as bridge therapy Excellent clinical results fuel HCP adoption vs 2,190 Drops over 3 years4 81of iDose TR subjects free of IOP-lowering topical meds at 12 months2 % 70of iDose TR subjects well-controlled on same or fewer meds at 3 years3 % 1 iDose TR is indicated for the reduction of IOP in patients with OAG or OHT 2 Singh, I Paul et al. Drugs vol. 84,10 (2024) 3 Data on file 4 Topical eye drop prescription regimen over 3-year period, BID 1 1.8mm x 0.5mm New Phase 3 data analysis demonstrates non-inferiority to topical timolol at 3 years3 |

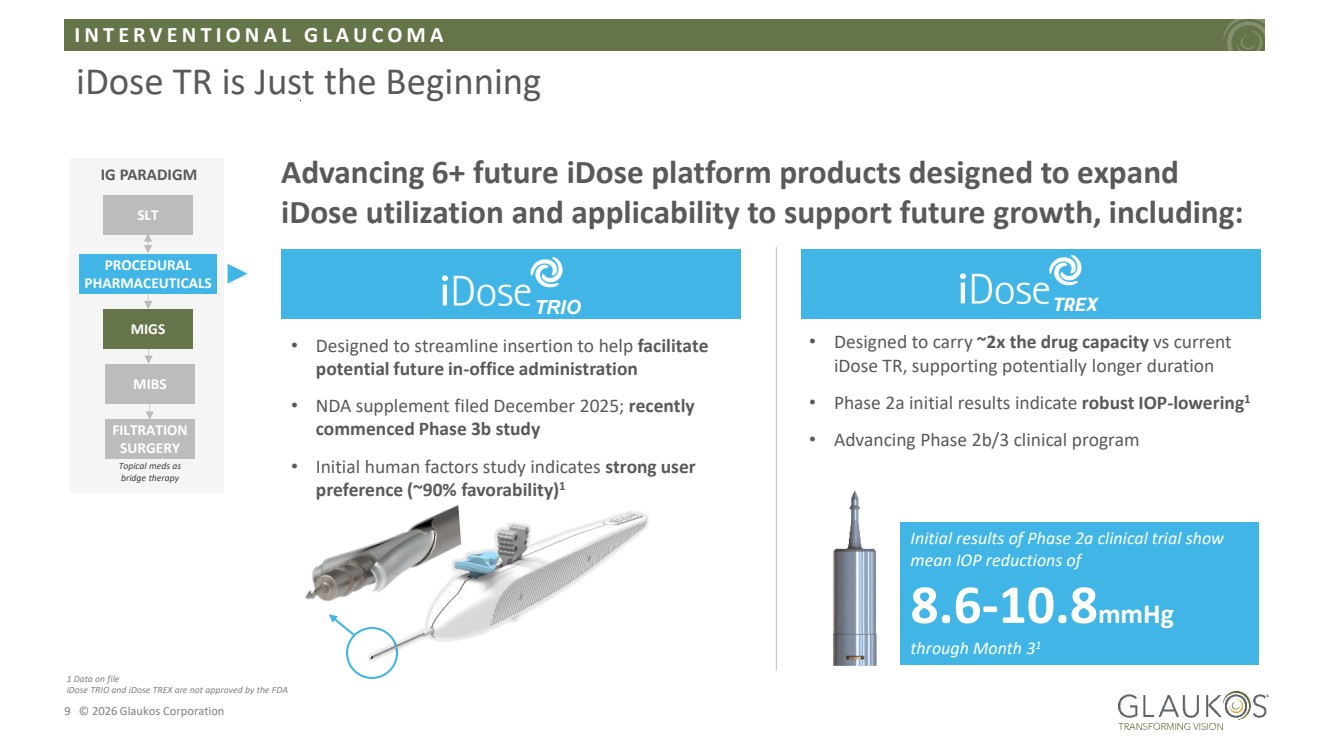

| I N T E R V E N T I O N A L G L A U C O M A 9 © 2026 Glaukos Corporation iDose TR is Just the Beginning IG PARADIGM SLT PROCEDURAL PHARMACEUTICALS MIGS MIBS FILTRATION SURGERY Topical meds as bridge therapy • Designed to streamline insertion to help facilitate potential future in-office administration • NDA supplement filed December 2025; recently commenced Phase 3b study • Initial human factors study indicates strong user preference (~90% favorability)1 • Designed to carry ~2x the drug capacity vs current iDose TR, supporting potentially longer duration • Phase 2a initial results indicate robust IOP-lowering1 • Advancing Phase 2b/3 clinical program Initial results of Phase 2a clinical trial show mean IOP reductions of 8.6-10.8mmHg through Month 31 Advancing 6+ future iDose platform products designed to expand iDose utilization and applicability to support future growth, including: TRIO 1 Data on file iDose TRIO and iDose TREX are not approved by the FDA |

| I N T E R V E N T I O N A L G L A U C O M A 10 © 2026 Glaukos Corporation iStent infinite: Best-in-Class MIGS Therapy for Long-Term IOP Control IG PARADIGM SLT PROCEDURAL PHARMACEUTICALS MIGS MIBS FILTRATION SURGERY Topical meds as bridge therapy 2012 Pioneered MIGS with iStent approval iStent technologies supported by 300+ peer-reviewed publications 2018 Launched iStent inject 2022 2025 Launched iStent infinite for advanced glaucoma Completed enrollment in iStent infinite mild-to-moderate study iStent infinite backed by 14 YEARS of commercial MIGS leadership iStent infinite provides up to 240° of powerful outflow coverage Integrity Study Results Demonstrate Superior Safety & Efficacy Profile1 1 Ahmed, Iqbal Ike K et al. Ophthalmology and therapy vol. 14,5 (2025): 1005-1024 |

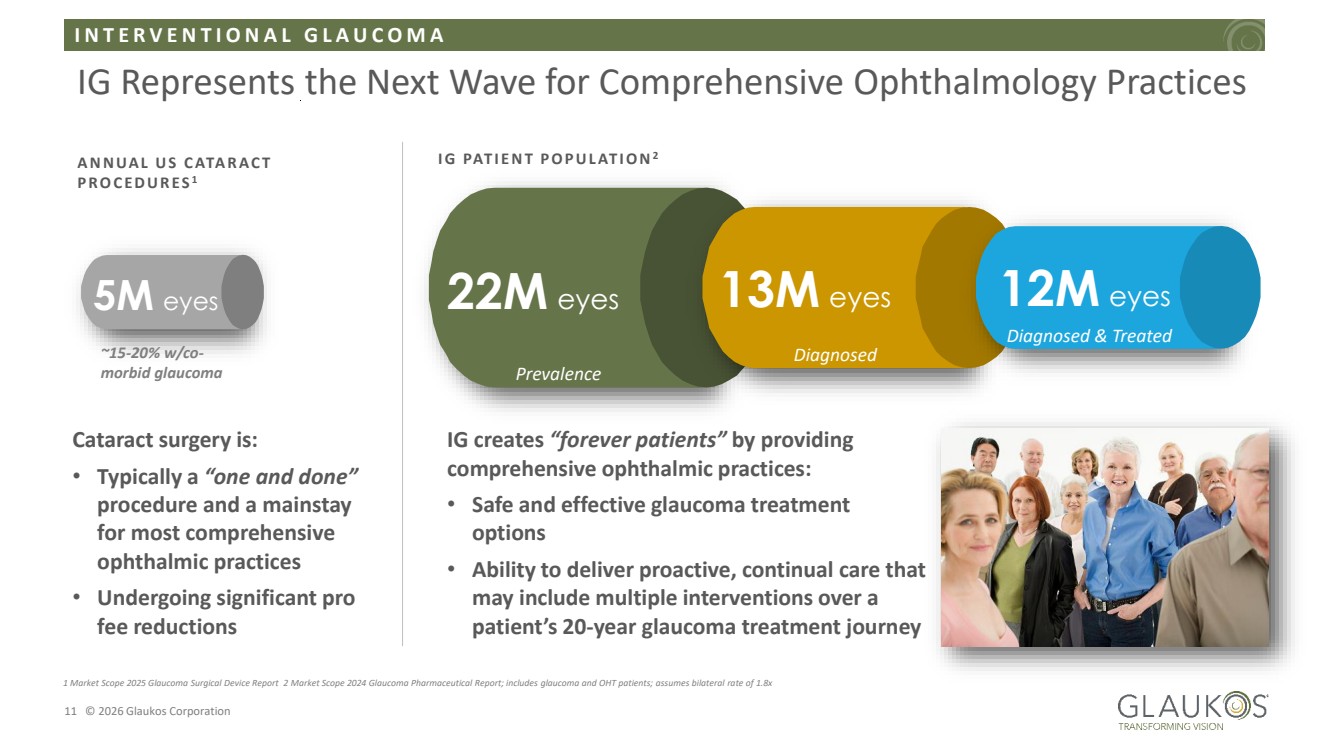

| I N T E R V E N T I O N A L G L A U C O M A 11 © 2026 Glaukos Corporation IG Represents the Next Wave for Comprehensive Ophthalmology Practices 1 Market Scope 2025 Glaucoma Surgical Device Report 2 Market Scope 2024 Glaucoma Pharmaceutical Report; includes glaucoma and OHT patients; assumes bilateral rate of 1.8x IG creates “forever patients” by providing comprehensive ophthalmic practices: • Safe and effective glaucoma treatment options • Ability to deliver proactive, continual care that may include multiple interventions over a patient’s 20-year glaucoma treatment journey I G PAT I E N T P O P U L AT I O N2 22M eyes 13M eyes 12M eyes Prevalence Diagnosed Diagnosed & Treated A N N UA L U S C ATA R A C T P R O C E D U R E S 1 5M eyes Cataract surgery is: • Typically a “one and done” procedure and a mainstay for most comprehensive ophthalmic practices • Undergoing significant pro fee reductions ~15-20% w/co-morbid glaucoma |

| I N T E R V E N T I O N A L G L A U C O M A 12 © 2026 Glaukos Corporation Ophthalmic surgeons seek to offset continued cataract surgery pro fee reductions, helping to drive adoption and utilization of IG therapy 1 3 In-office injectable delivery of iDose and repeat administration approval can drive 2 inflection in iDose role and IG therapy adoption Combination therapy has potential to become a preferred form of IG therapy 4 New sustained-release drug delivery products designed to offer longer duration have potential to fuel additional IG therapy adoption (iDose TREX) 5 PE groups are likely to gravitate to IG therapy due to the significant clinical benefits and practice efficiency it provides 6 A new breed of IG specialist could emerge, conducting primarily injection therapy while vertically integrated ODs and OD referral networks provide preparatory patient services IG: A Vision for the Next 10 Years By 2035, US ophthalmologists could be performing as many IG procedures as cataract procedures |

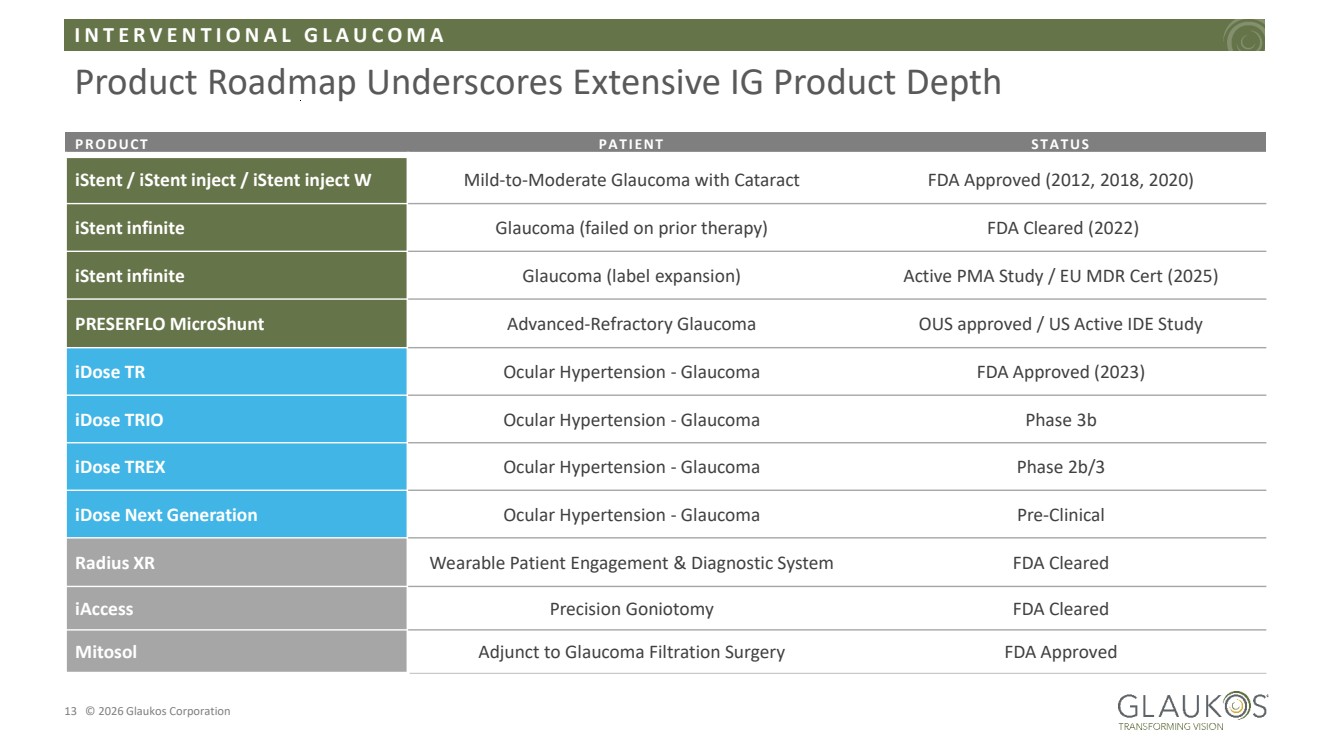

| I N T E R V E N T I O N A L G L A U C O M A 13 © 2026 Glaukos Corporation Product Roadmap Underscores Extensive IG Product Depth PRODUCT PAT IENT ST A T US iStent / iStent inject / iStent inject W Mild-to-Moderate Glaucoma with Cataract FDA Approved (2012, 2018, 2020) iStent infinite Glaucoma (failed on prior therapy) FDA Cleared (2022) iStent infinite Glaucoma (label expansion) Active PMA Study / EU MDR Cert (2025) PRESERFLO MicroShunt Advanced-Refractory Glaucoma OUS approved / US Active IDE Study iDose TR Ocular Hypertension - Glaucoma FDA Approved (2023) iDose TRIO Ocular Hypertension - Glaucoma Phase 3b iDose TREX Ocular Hypertension - Glaucoma Phase 2b/3 iDose Next Generation Ocular Hypertension - Glaucoma Pre-Clinical Radius XR Wearable Patient Engagement & Diagnostic System FDA Cleared iAccess Precision Goniotomy FDA Cleared Mitosol Adjunct to Glaucoma Filtration Surgery FDA Approved |

| A B O U T G L A U K O S 14 © 2026 Glaukos Corporation Two Unmet Clinical Needs = Robust Long-Term Growth Opportunities Fundamentally resets how keratoconus is diagnosed, managed and treated to dramatically improve patient awareness and access to effective care INTERVENTIONAL KERATOCONUS INTERVENTIONAL GLAUCOMA Radically improves the conventional “drops first” care paradigm with standalone therapies shown to slow disease progression and reduce drug burden |

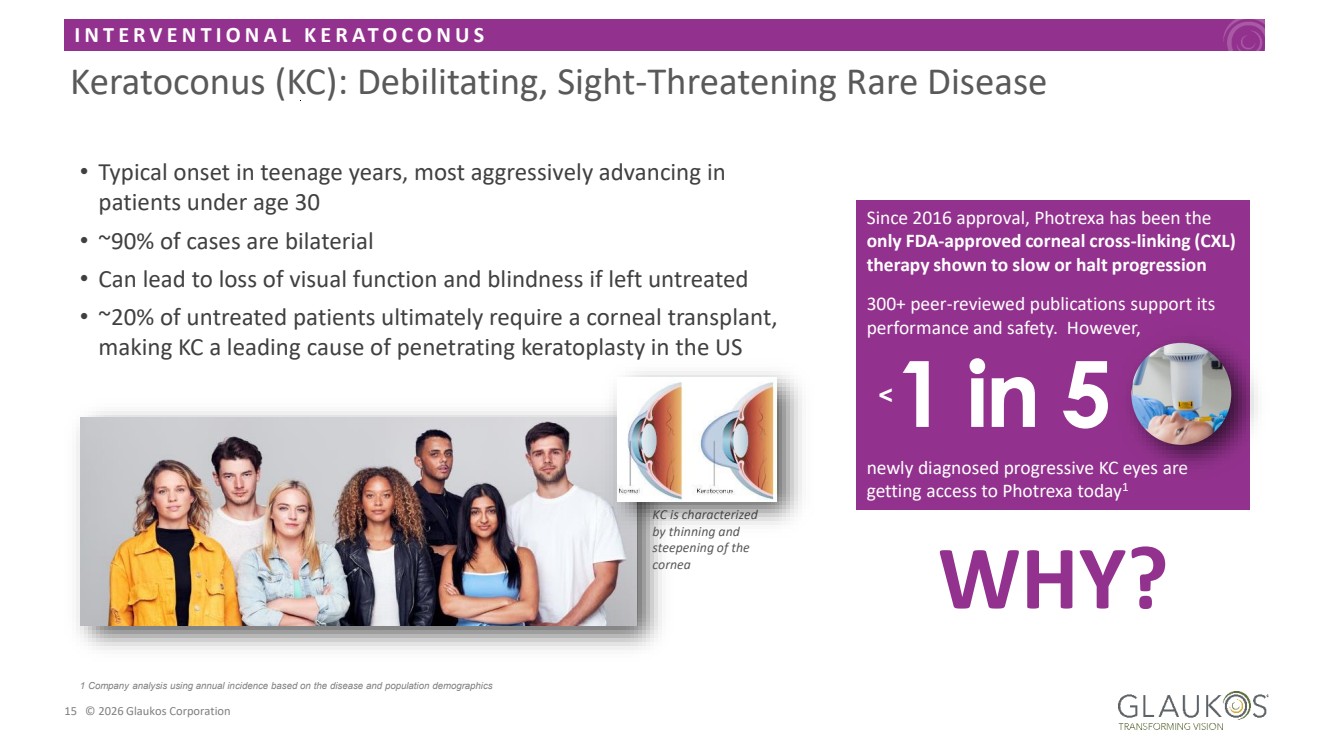

| I N T E R V E N T I O N A L K E R A T O C O N U S 15 © 2026 Glaukos Corporation Keratoconus (KC): Debilitating, Sight-Threatening Rare Disease Topical medications used as a supplement (“bridge therapy”) as needed OR KC is characterized by thinning and steepening of the cornea • Typical onset in teenage years, most aggressively advancing in patients under age 30 • ~90% of cases are bilaterial • Can lead to loss of visual function and blindness if left untreated • ~20% of untreated patients ultimately require a corneal transplant, making KC a leading cause of penetrating keratoplasty in the US Since 2016 approval, Photrexa has been the only FDA-approved corneal cross-linking (CXL) therapy shown to slow or halt progression 300+ peer-reviewed publications support its performance and safety. However, newly diagnosed progressive KC eyes are getting access to Photrexa today1 1 in 5 WHY? < 1 Company analysis using annual incidence based on the disease and population demographics |

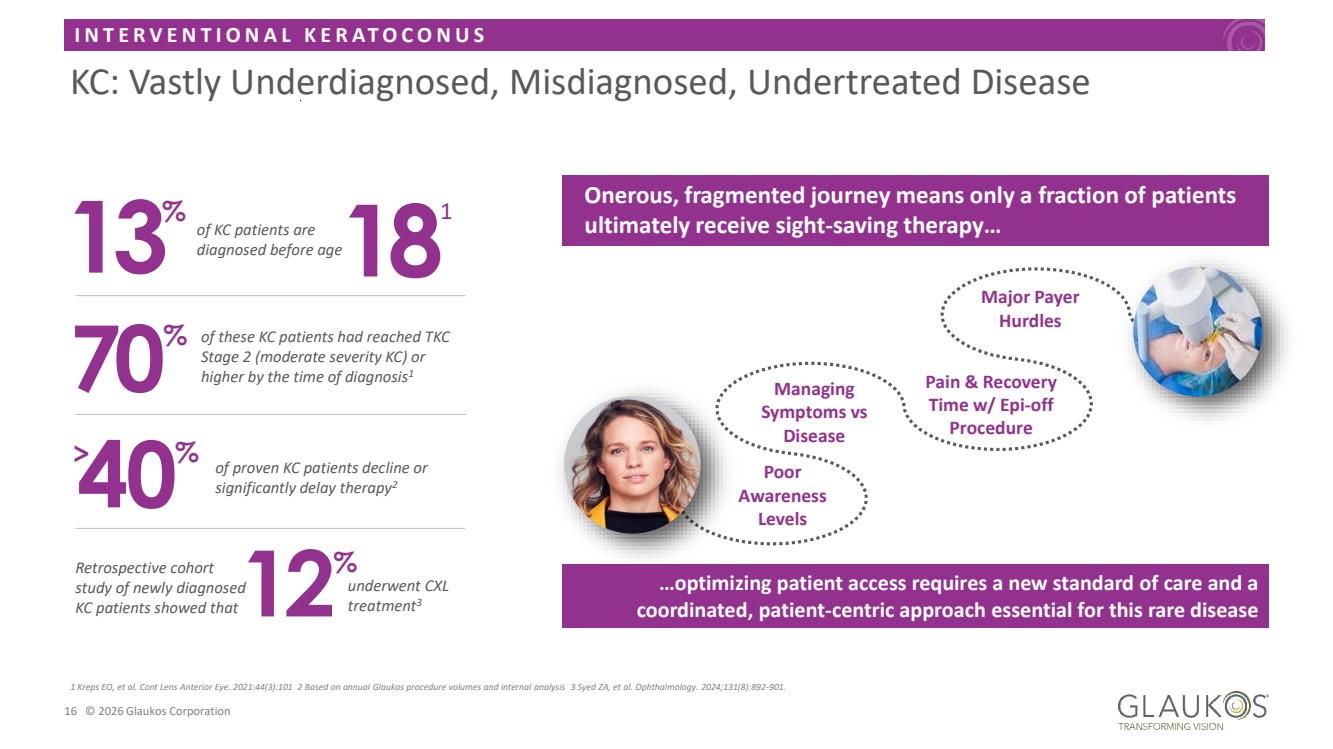

| I N T E R V E N T I O N A L K E R A T O C O N U S 16 © 2026 Glaukos Corporation KC: Vastly Underdiagnosed, Misdiagnosed, Undertreated Disease Topical medications used as a supplement (“bridge therapy”) as needed 1 Kreps EO, et al. Cont Lens Anterior Eye. 2021:44(3):101 2 Based on annual Glaukos procedure volumes and internal analysis 3 Syed ZA, et al. Ophthalmology. 2024;131(8):892-901. …optimizing patient access requires a new standard of care and a coordinated, patient-centric approach essential for this rare disease Onerous, fragmented journey means only a fraction of patients ultimately receive sight-saving therapy… Poor Awareness Levels Managing Symptoms vs Disease Pain & Recovery Time w/ Epi-off Procedure Major Payer Hurdles 40 of proven KC patients decline or significantly delay therapy2 > % 70% of these KC patients had reached TKC Stage 2 (moderate severity KC) or higher by the time of diagnosis1 Retrospective cohort study of newly diagnosed KC patients showed that12% underwent CXL treatment3 13 18 of KC patients are diagnosed before age % 1 |

| I N T E R V E N T I O N A L K E R A T O C O N U S 17 © 2026 Glaukos Corporation Transformative Epioxa Therapy Ushers in New Standard of KC Care First and only FDA-approved epithelium-on treatment Incision-free, topical drug therapy catalyzed by oxygen and light Designed to slow or halt KC progression with a single administration Streamlined Procedure and Faster Recovery Time More Desirable Patient Experience Commercially available in 1Q 2026 Supplemental oxygen essential for efficiency |

| I N T E R V E N T I O N A L K E R A T O C O N U S 18 © 2026 Glaukos Corporation Rare Disease: Significant Investment to Dramatically Improve KC Patient Access Patient Education Advocacy Engagement Provider Awareness, Detection Centers & Tools Patient Service & Market Access Support Integrated IT Deployment Epioxa Sites of Care Specialty Pharma Support Engaged OD-MD Networks OTHER OPHTHALMIC RARE DISEASE PHARMACEUTICALS |

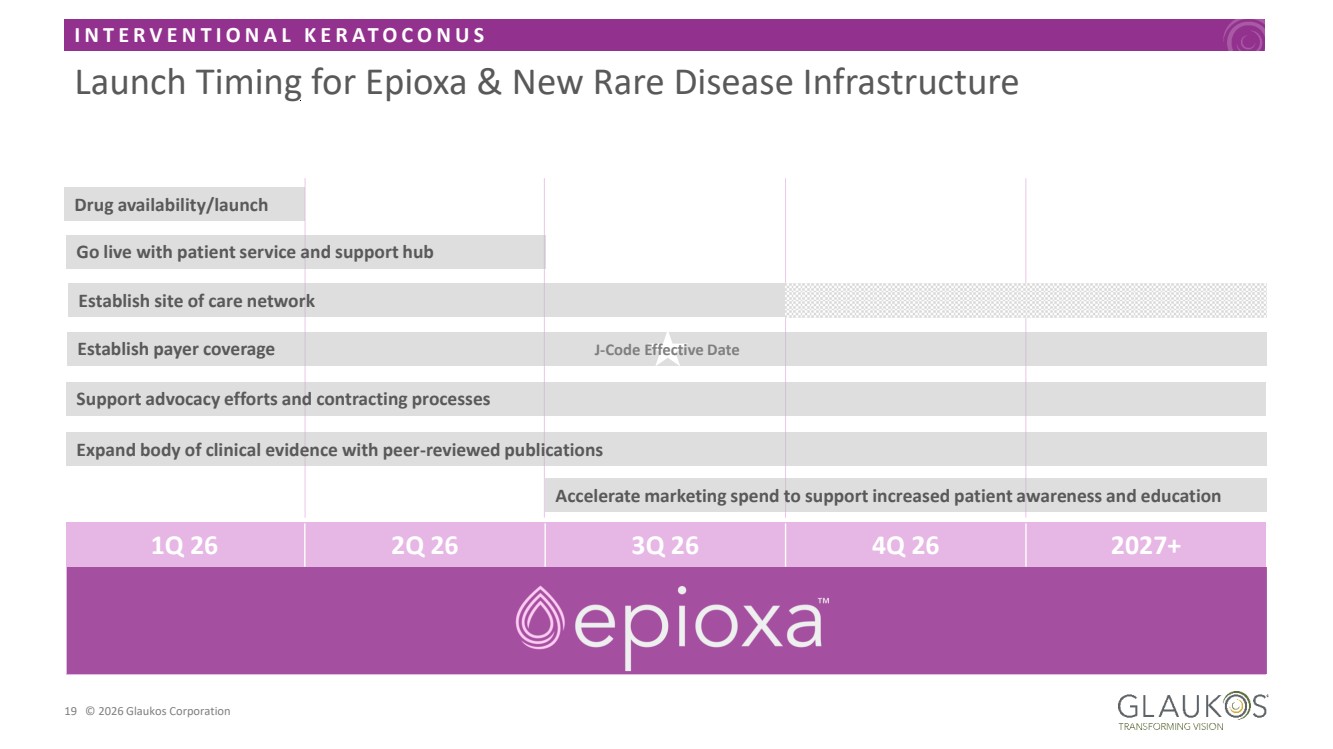

| I N T E R V E N T I O N A L K E R A T O C O N U S 19 © 2026 Glaukos Corporation Launch Timing for Epioxa & New Rare Disease Infrastructure 1Q 26 2Q 26 3Q 26 4Q 26 2027+ Go live with patient service and support hub Drug availability/launch Establish site of care network Establish payer coverage Support advocacy efforts and contracting processes J-Code Effective Date Accelerate marketing spend to support increased patient awareness and education Expand body of clinical evidence with peer-reviewed publications |

| I N T E R V E N T I O N A L K E R A T O C O N U S 20 © 2026 Glaukos Corporation WHAT IF? CUSTOMIZED, SPHERICAL THERAPY Use biomechanical modeling to deliver customized, patterned treatment that matches each patient’s unique corneal topography Use proprietary algorithm to precisely target UV energy for maximum CXL efficacy 3 rd Gen iLink is not approved by the FDA Next Game-Changing Program: Customized, Spherical Therapy for KC Currently in Phase 2 clinical trials Built on Epioxa advantages while further streamlining and enhancing patient experience Potential to be another game-changing advancement in KC care DESIGNED TO: |

| I N T E R V E N T I O N A L K E R A T O C O N U S 21 © 2026 Glaukos Corporation Product Roadmap for Sustained Leadership in Effective KC Care PRODUCT PAT IENT ST AT US Photrexa (Epi-off) Keratoconus FDA Approved (2016) Epioxa (Epi-on) Keratoconus FDA Approved (2025) iLink 3rd Generation Keratoconus Phase 2 iVeena (IVMED-80) Keratoconus Phase 2 iLinko2n Diagnostic Screening Tool Keratoconus Pre-Submission |

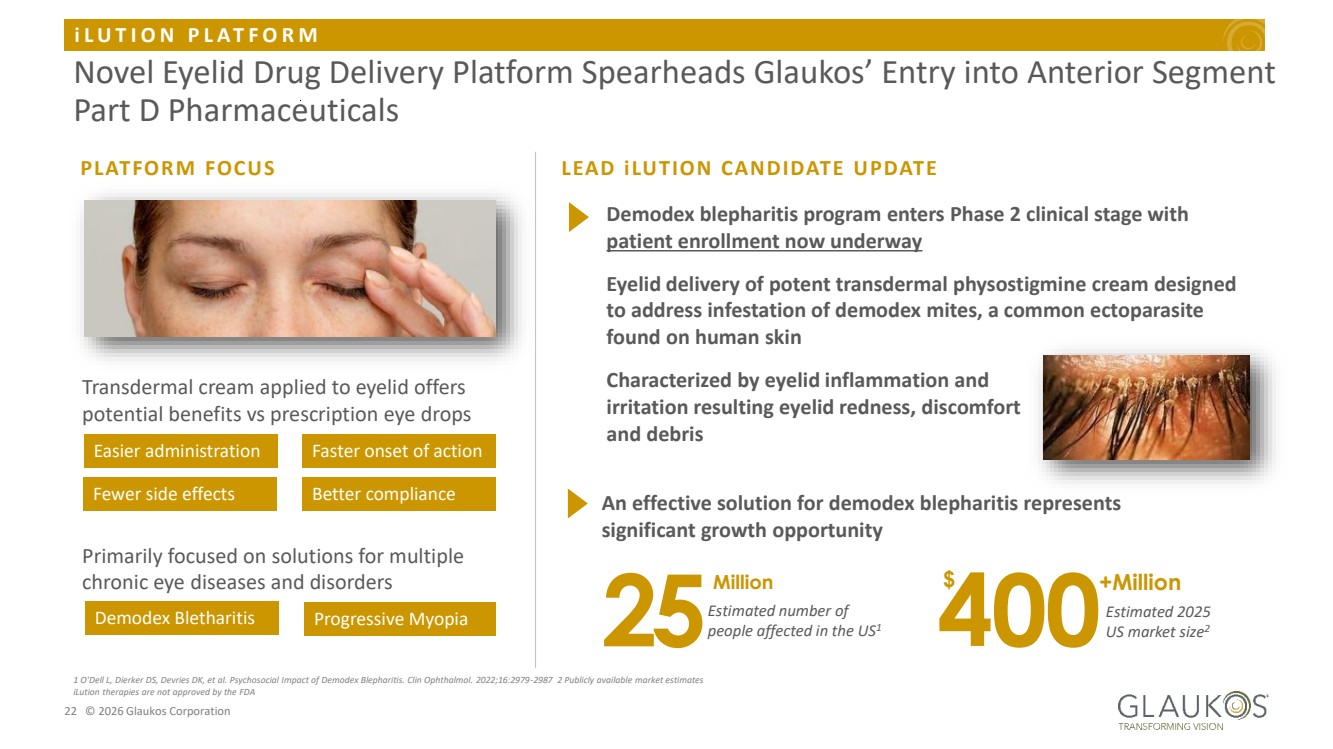

| i L U T I O N P L A T F O R M 22 © 2026 Glaukos Corporation Novel Eyelid Drug Delivery Platform Spearheads Glaukos’ Entry into Anterior Segment Part D Pharmaceuticals 1 O'Dell L, Dierker DS, Devries DK, et al. Psychosocial Impact of Demodex Blepharitis. Clin Ophthalmol. 2022;16:2979-2987 2 Publicly available market estimates iLution therapies are not approved by the FDA Transdermal cream applied to eyelid offers potential benefits vs prescription eye drops Primarily focused on solutions for multiple chronic eye diseases and disorders Easier administration Faster onset of action Fewer side effects Better compliance PLATFORM FOCUS Demodex Bletharitis Progressive Myopia Demodex blepharitis program enters Phase 2 clinical stage with patient enrollment now underway Eyelid delivery of potent transdermal physostigmine cream designed to address infestation of demodex mites, a common ectoparasite found on human skin Characterized by eyelid inflammation and irritation resulting eyelid redness, discomfort and debris Million 25Estimated number of people affected in the US1 400+Million Estimated 2025 US market size2 $ LEAD iLUTION CANDIDATE UPDATE An effective solution for demodex blepharitis represents significant growth opportunity |

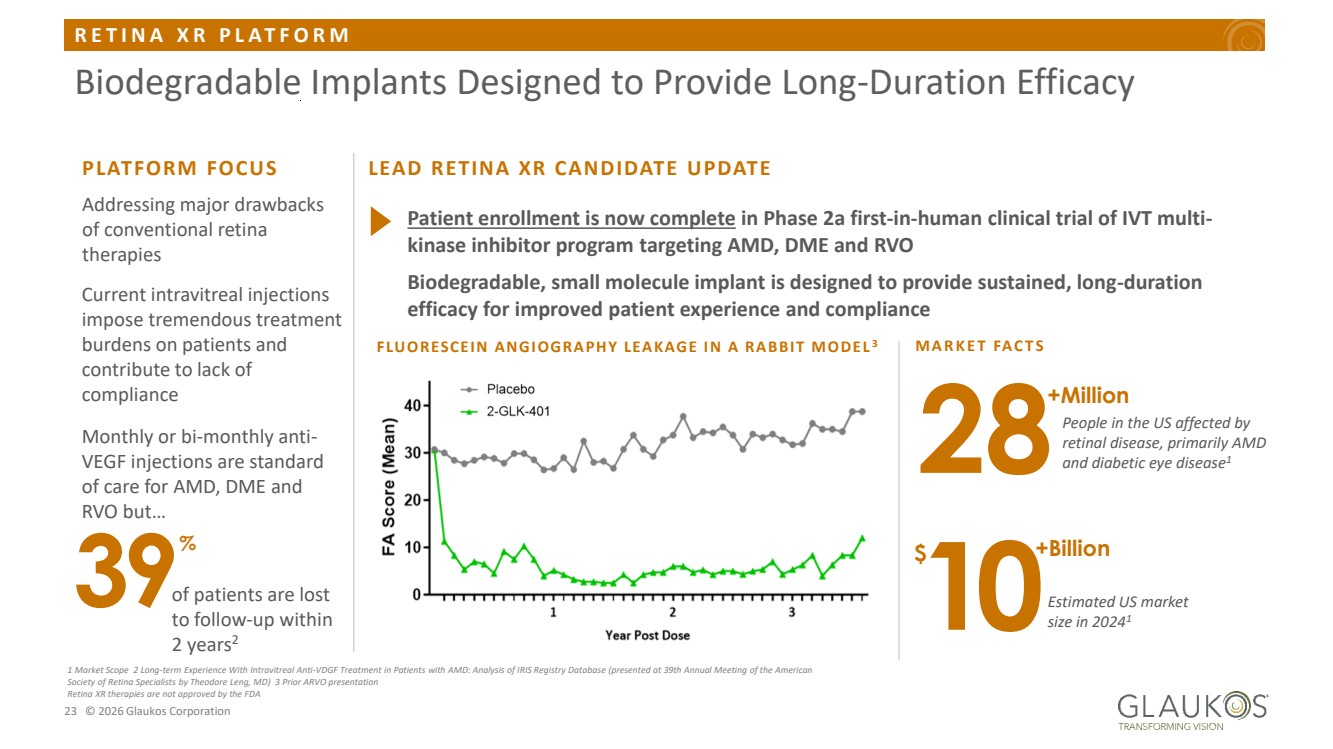

| R E T I N A X R P L A T F O R M 23 © 2026 Glaukos Corporation Biodegradable Implants Designed to Provide Long-Duration Efficacy 1 Market Scope 2 Long-term Experience With Intravitreal Anti-VDGF Treatment in Patients with AMD: Analysis of IRIS Registry Database (presented at 39th Annual Meeting of the American Society of Retina Specialists by Theodore Leng, MD) 3 Prior ARVO presentation Retina XR therapies are not approved by the FDA Current intravitreal injections impose tremendous treatment burdens on patients and contribute to lack of compliance Monthly or bi-monthly anti-VEGF injections are standard of care for AMD, DME and RVO but… 39% of patients are lost to follow-up within 2 years2 PLATFORM FOCUS Addressing major drawbacks of conventional retina therapies M A R K E T FA C T S $ Patient enrollment is now complete in Phase 2a first-in-human clinical trial of IVT multi-kinase inhibitor program targeting AMD, DME and RVO Biodegradable, small molecule implant is designed to provide sustained, long-duration efficacy for improved patient experience and compliance 28+Million People in the US affected by retinal disease, primarily AMD and diabetic eye disease1 10+Billion Estimated US market size in 20241 LEAD RETINA XR CANDIDATE UPDATE FLUORESCEIN ANGIOGRAPHY LEAKAGE IN A RABBIT MODEL 3 |

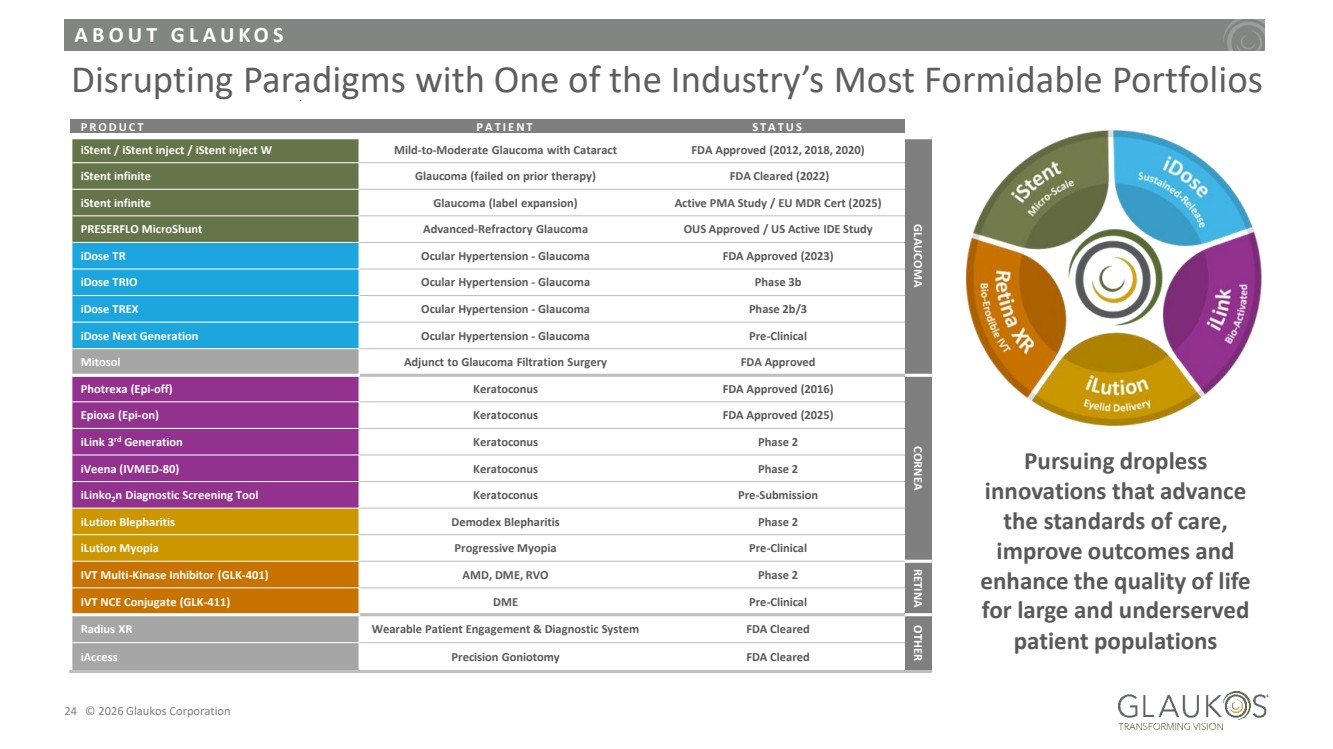

| A B O U T G L A U K O S 24 © 2026 Glaukos Corporation Disrupting Paradigms with One of the Industry’s Most Formidable Portfolios P R O D U C T P A T I E N T S T A T U S iStent / iStent inject / iStent inject W Mild-to-Moderate Glaucoma with Cataract FDA Approved (2012, 2018, 2020) GLAUCOMA iStent infinite Glaucoma (failed on prior therapy) FDA Cleared (2022) iStent infinite Glaucoma (label expansion) Active PMA Study / EU MDR Cert (2025) PRESERFLO MicroShunt Advanced-Refractory Glaucoma OUS Approved / US Active IDE Study iDose TR Ocular Hypertension - Glaucoma FDA Approved (2023) iDose TRIO Ocular Hypertension - Glaucoma Phase 3b iDose TREX Ocular Hypertension - Glaucoma Phase 2b/3 iDose Next Generation Ocular Hypertension - Glaucoma Pre-Clinical Mitosol Adjunct to Glaucoma Filtration Surgery FDA Approved Photrexa (Epi-off) Keratoconus FDA Approved (2016) CORNEA Epioxa (Epi-on) Keratoconus FDA Approved (2025) iLink 3rd Generation Keratoconus Phase 2 iVeena (IVMED-80) Keratoconus Phase 2 iLinko2n Diagnostic Screening Tool Keratoconus Pre-Submission iLution Blepharitis Demodex Blepharitis Phase 2 iLution Myopia Progressive Myopia Pre-Clinical IVT Multi-Kinase Inhibitor (GLK-401) AMD, DME, RVO Phase 2 RETINA IVT NCE Conjugate (GLK-411) DME Pre-Clinical Radius XR Wearable Patient Engagement & Diagnostic System FDA Cleared OTHER iAccess Precision Goniotomy FDA Cleared Pursuing dropless innovations that advance the standards of care, improve outcomes and enhance the quality of life for large and underserved patient populations |

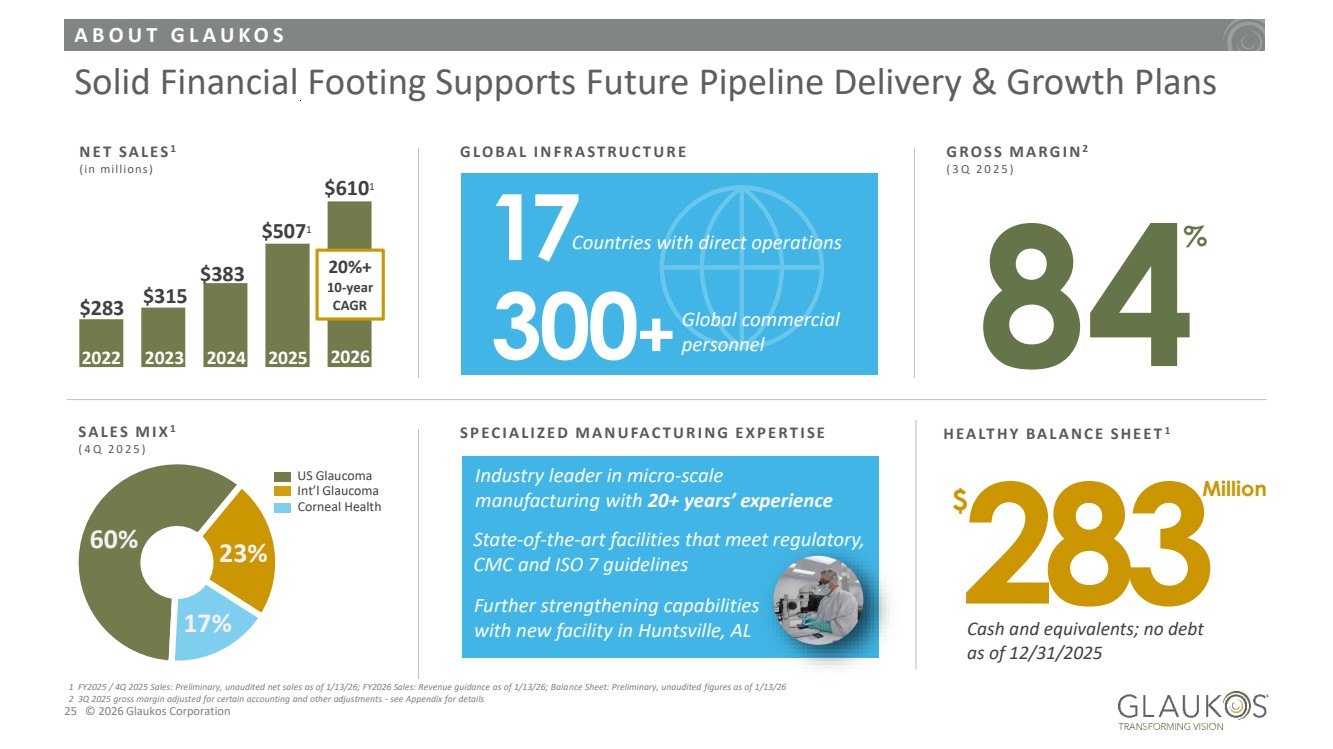

| A B O U T G L A U K O S 25 © 2026 Glaukos Corporation Solid Financial Footing Supports Future Pipeline Delivery & Growth Plans N E T S A L E S 1 (in millions) 2022 2023 $315 $283 20%+ 10-year CAGR $383 2024 $5071 2025 G LO B A L I N F R A ST R U C T U R E 17Countries with direct operations 300+ Global commercial personnel G R O S S M A R G I N2 ( 3 Q 2 0 2 5 ) 84% 60% 23% 17% S A L E S M I X1 ( 4 Q 2 0 2 5 ) US Glaucoma Corneal Health Int’l Glaucoma H E A LT H Y B A L A N C E S H E E T 1 283 Cash and equivalents; no debt as of 12/31/2025 $ Million S P E C I A L I Z E D M A N U FA C T U R I N G E X P E R T I S E Industry leader in micro-scale manufacturing with 20+ years’ experience State-of-the-art facilities that meet regulatory, CMC and ISO 7 guidelines Further strengthening capabilities with new facility in Huntsville, AL 1 FY2025 / 4Q 2025 Sales: Preliminary, unaudited net sales as of 1/13/26; FY2026 Sales: Revenue guidance as of 1/13/26; Balance Sheet: Preliminary, unaudited figures as of 1/13/26 2 3Q 2025 gross margin adjusted for certain accounting and other adjustments - see Appendix for details 2026 $6101 |

| WE’LL GO FIRST Innovation is at the core of everything we do. At Glaukos, we push the limits of science and technology to solve unmet needs in chronic eye diseases. |

|

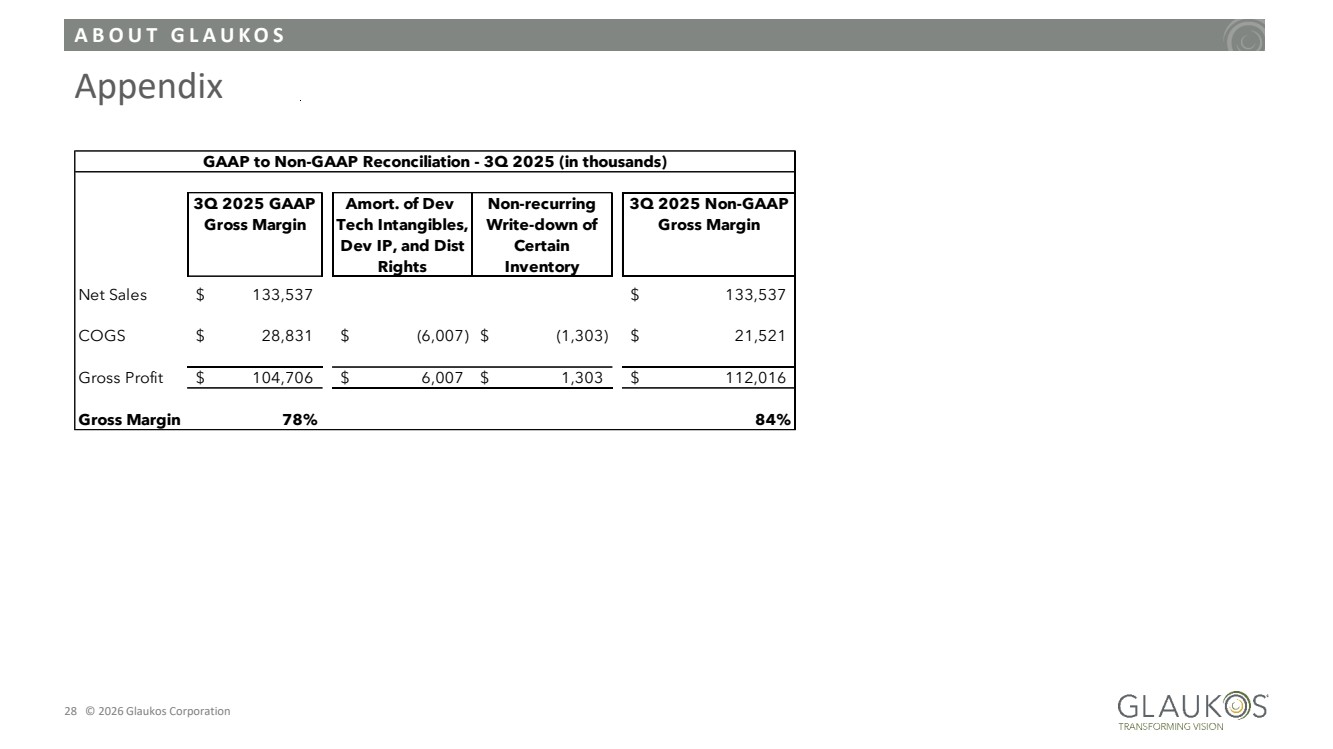

| A B O U T G L A U K O S 28 © 2026 Glaukos Corporation Appendix 3Q 2025 GAAP Amort. of Dev Non-recurring 3Q 2025 Non-GAAP Gross Margin Tech Intangibles, Dev IP, and Dist Rights Write-down of Certain Inventory Gross Margin Net Sales $ 133,537 $ 133,537 COGS $ 28,831 $ (6,007) $ (1,303) $ 21,521 Gross Profit $ 104,706 $ 6,007 $ 1,303 $ 112,016 Gross Margin 78% 84% GAAP to Non-GAAP Reconciliation - 3Q 2025 (in thousands) |