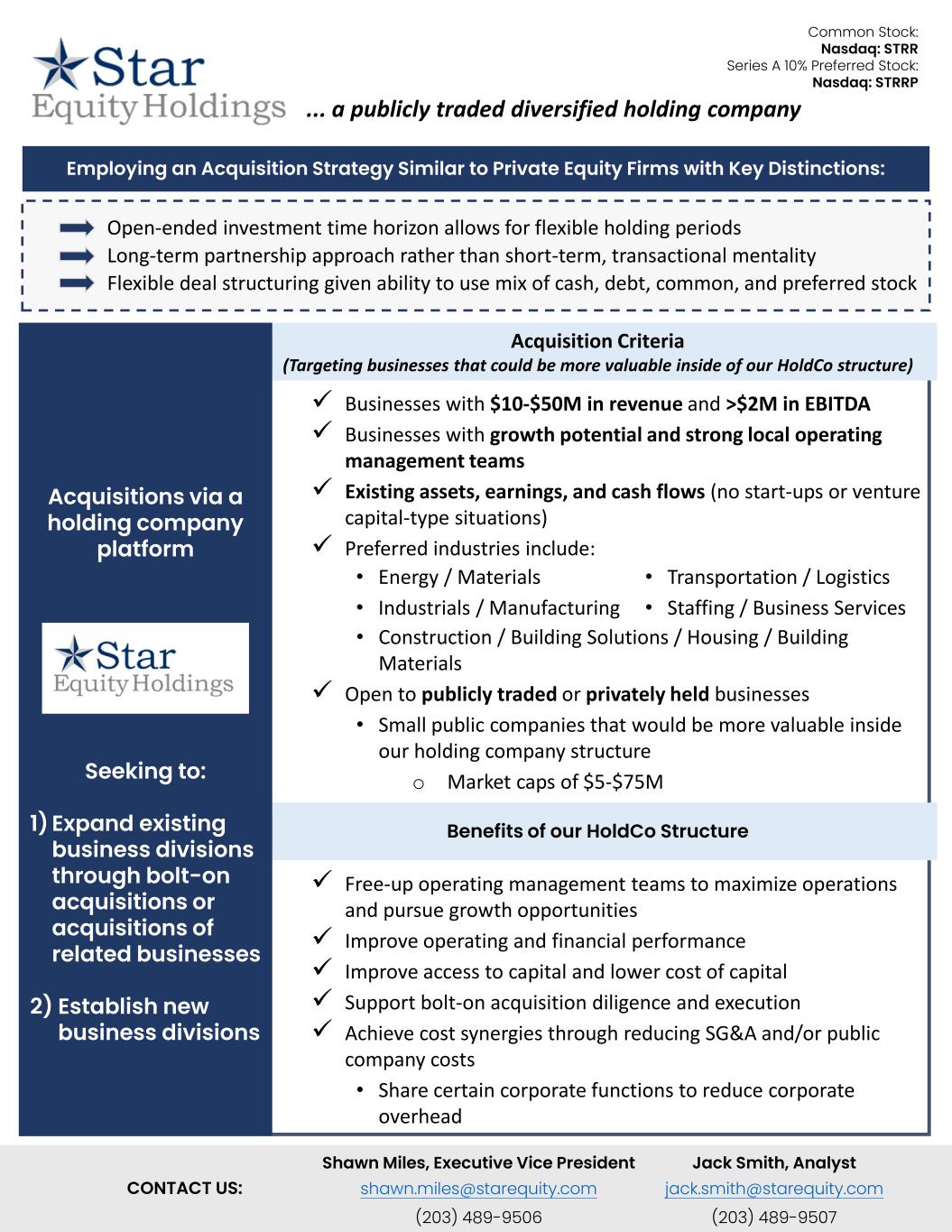

Common Stock: Nasdaq: STRR Series A 10% Preferred Stock: Nasdaq: STRRP Acquisition Criteria (Targeting businesses that could be more valuable inside of our HoldCo structure) ✓ Businesses with $10-$50M in revenue and >$2M in EBITDA ✓ Businesses with growth potential and strong local operating management teams ✓ Existing assets, earnings, and cash flows (no start-ups or venture capital-type situations) ✓ Preferred industries include: • Construction / Building Solutions / Housing / Building Materials ✓ Open to publicly traded or privately held businesses • Small public companies that would be more valuable inside our holding company structure o Market caps of $5-$75M ✓ Free-up operating management teams to maximize operations and pursue growth opportunities ✓ Improve operating and financial performance ✓ Improve access to capital and lower cost of capital ✓ Support bolt-on acquisition diligence and execution ✓ Achieve cost synergies through reducing SG&A and/or public company costs • Share certain corporate functions to reduce corporate overhead Benefits of our HoldCo Structure Shawn Miles, Executive Vice President shawn.miles@starequity.com (203) 489-9506 Jack Smith, Analyst jack.smith@starequity.com (203) 489-9507 CONTACT US: Employing an Acquisition Strategy Similar to Private Equity Firms with Key Distinctions: Acquisitions via a holding company platform Seeking to: 1) Expand existing business divisions through bolt-on acquisitions or acquisitions of related businesses 2) Establish new business divisions ... a publicly traded diversified holding company Open-ended investment time horizon allows for flexible holding periods Long-term partnership approach rather than short-term, transactional mentality Flexible deal structuring given ability to use mix of cash, debt, common, and preferred stock • Energy / Materials • Industrials / Manufacturing • Transportation / Logistics • Staffing / Business Services