EARNINGS CALL 3rd Quarter 2025 October 22, 2025

2 This presentation contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding our expectations with regard to our business, financial and operating results, future economic performance and dividends, including our statements on the slide entitled "Management Outlook." The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and the Company's subsequent Quarterly Reports on Form 10-Q, each as filed with the Securities and Exchange Commission; adverse developments in the financial services industry generally and any related impact on depositor behavior; risks related to the sufficiency of liquidity; changes in international trade policies, tariffs and treaties affecting imports and exports, trade disputes, barriers to trade or the emergence of other trade restrictions, and their related impacts on macroeconomic conditions and customer behavior; the potential adverse effects of unusual and infrequently occurring events and any governmental or societal responses thereto; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; the impact on financial markets from geopolitical conflicts such as the wars in Ukraine and the Middle East; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; increased foreclosures and ownership of real property; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; any adverse determination by a court regarding the Cantor Group V loan and any adverse economic or other events impacting the collateral, borrower or guarantors with respect to such loan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this presentation to reflect new information, future events or otherwise, except to the extent required by federal securities laws. In light of these risks, uncertainties and assumptions, the forward-looking events in this presentation might not occur, and you should not put undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation contains both financial measures based on GAAP and non-GAAP based financial measures, which are used where management believes them to be helpful in understanding the Company’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the Company’s press release as of and for the quarter ended September 30, 2025. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Forward-Looking Statements

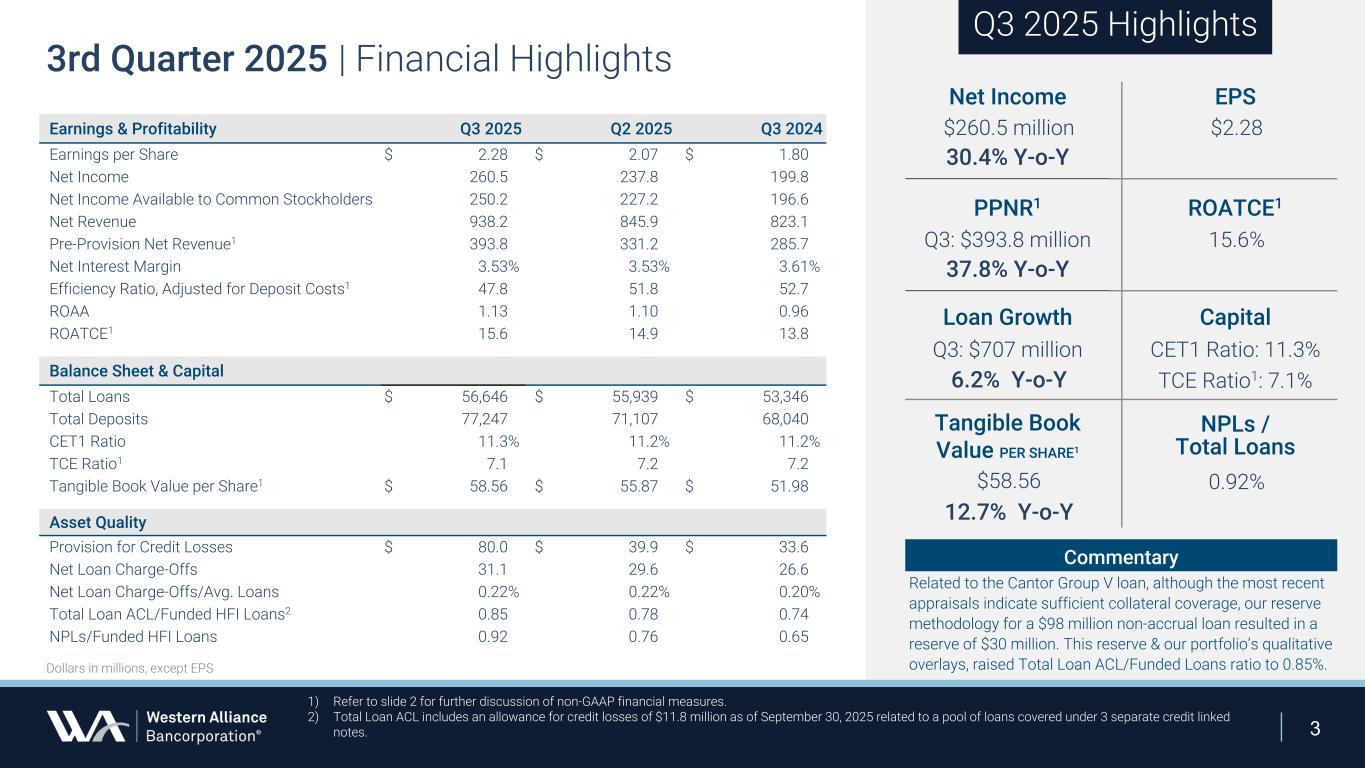

3 3rd Quarter 2025 | Financial Highlights Earnings & Profitability Q3 2025 Q2 2025 Q3 2024 Earnings per Share $ 2.28 $ 2.07 $ 1.80 Net Income 260.5 237.8 199.8 Net Income Available to Common Stockholders 250.2 227.2 196.6 Net Revenue 938.2 845.9 823.1 Pre-Provision Net Revenue1 393.8 331.2 285.7 Net Interest Margin 3.53% 3.53% 3.61% Efficiency Ratio, Adjusted for Deposit Costs1 47.8 51.8 52.7 ROAA 1.13 1.10 0.96 ROATCE1 15.6 14.9 13.8 Balance Sheet & Capital Total Loans $ 56,646 $ 55,939 $ 53,346 Total Deposits 77,247 71,107 68,040 CET1 Ratio 11.3% 11.2% 11.2% TCE Ratio1 7.1 7.2 7.2 Tangible Book Value per Share1 $ 58.56 $ 55.87 $ 51.98 Asset Quality Provision for Credit Losses $ 80.0 $ 39.9 $ 33.6 Net Loan Charge-Offs 31.1 29.6 26.6 Net Loan Charge-Offs/Avg. Loans 0.22% 0.22% 0.20% Total Loan ACL/Funded HFI Loans2 0.85 0.78 0.74 NPLs/Funded HFI Loans 0.92 0.76 0.65 Dollars in millions, except EPS 1) Refer to slide 2 for further discussion of non-GAAP financial measures. 2) Total Loan ACL includes an allowance for credit losses of $11.8 million as of September 30, 2025 related to a pool of loans covered under 3 separate credit linked notes. Q3 2025 Highlights Net Income EPS $260.5 million $2.28 30.4% Y-o-Y PPNR1 ROATCE1 Q3: $393.8 million 15.6% 37.8% Y-o-Y Loan Growth Capital Q3: $707 million CET1 Ratio: 11.3% 6.2% Y-o-Y TCE Ratio1: 7.1% Tangible Book Value PER SHARE1 NPLs / Total Loans $58.56 0.92% 12.7% Y-o-Y Commentary Related to the Cantor Group V loan, although the most recent appraisals indicate sufficient collateral coverage, our reserve methodology for a $98 million non-accrual loan resulted in a reserve of $30 million. This reserve & our portfolio’s qualitative overlays, raised Total Loan ACL/Funded Loans ratio to 0.85%.

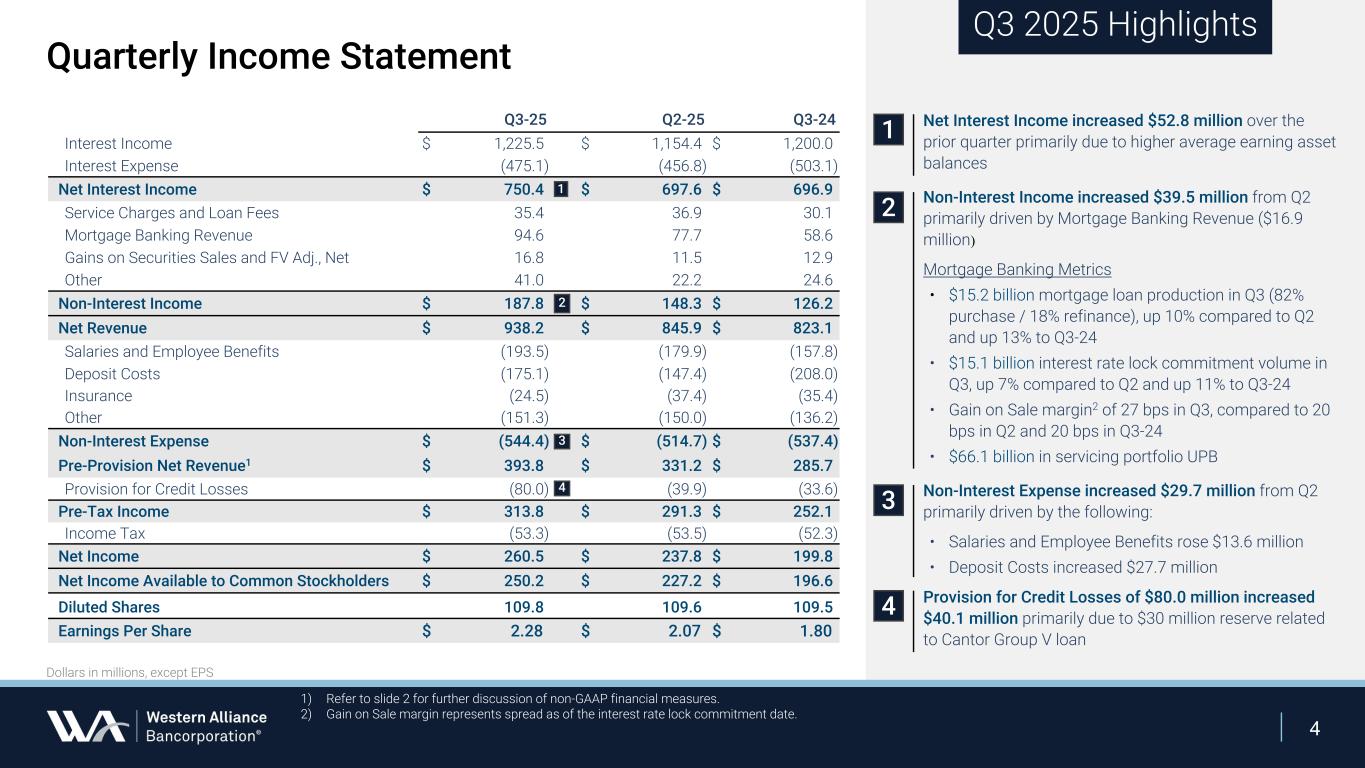

4 Q3-25 Q2-25 Q3-24 Interest Income $ 1,225.5 $ 1,154.4 $ 1,200.0 Interest Expense (475.1) (456.8) (503.1) Net Interest Income $ 750.4 $ 697.6 $ 696.9 Service Charges and Loan Fees 35.4 36.9 30.1 Mortgage Banking Revenue 94.6 77.7 58.6 Gains on Securities Sales and FV Adj., Net 16.8 11.5 12.9 Other 41.0 22.2 24.6 Non-Interest Income $ 187.8 $ 148.3 $ 126.2 Net Revenue $ 938.2 $ 845.9 $ 823.1 Salaries and Employee Benefits (193.5) (179.9) (157.8) Deposit Costs (175.1) (147.4) (208.0) Insurance (24.5) (37.4) (35.4) Other (151.3) (150.0) (136.2) Non-Interest Expense $ (544.4) $ (514.7) $ (537.4) Pre-Provision Net Revenue1 $ 393.8 $ 331.2 $ 285.7 Provision for Credit Losses (80.0) (39.9) (33.6) Pre-Tax Income $ 313.8 $ 291.3 $ 252.1 Income Tax (53.3) (53.5) (52.3) Net Income $ 260.5 $ 237.8 $ 199.8 Net Income Available to Common Stockholders $ 250.2 $ 227.2 $ 196.6 Diluted Shares 109.8 109.6 109.5 Earnings Per Share $ 2.28 $ 2.07 $ 1.80 Net Interest Income increased $52.8 million over the prior quarter primarily due to higher average earning asset balances Non-Interest Income increased $39.5 million from Q2 primarily driven by Mortgage Banking Revenue ($16.9 million) Mortgage Banking Metrics • $15.2 billion mortgage loan production in Q3 (82% purchase / 18% refinance), up 10% compared to Q2 and up 13% to Q3-24 • $15.1 billion interest rate lock commitment volume in Q3, up 7% compared to Q2 and up 11% to Q3-24 • Gain on Sale margin2 of 27 bps in Q3, compared to 20 bps in Q2 and 20 bps in Q3-24 • $66.1 billion in servicing portfolio UPB Non-Interest Expense increased $29.7 million from Q2 primarily driven by the following: • Salaries and Employee Benefits rose $13.6 million • Deposit Costs increased $27.7 million Provision for Credit Losses of $80.0 million increased $40.1 million primarily due to $30 million reserve related to Cantor Group V loan 1) Refer to slide 2 for further discussion of non-GAAP financial measures. 2) Gain on Sale margin represents spread as of the interest rate lock commitment date. Quarterly Income Statement Q3 2025 Highlights 1 2 3 1 2 4 Dollars in millions, except EPS 3 4

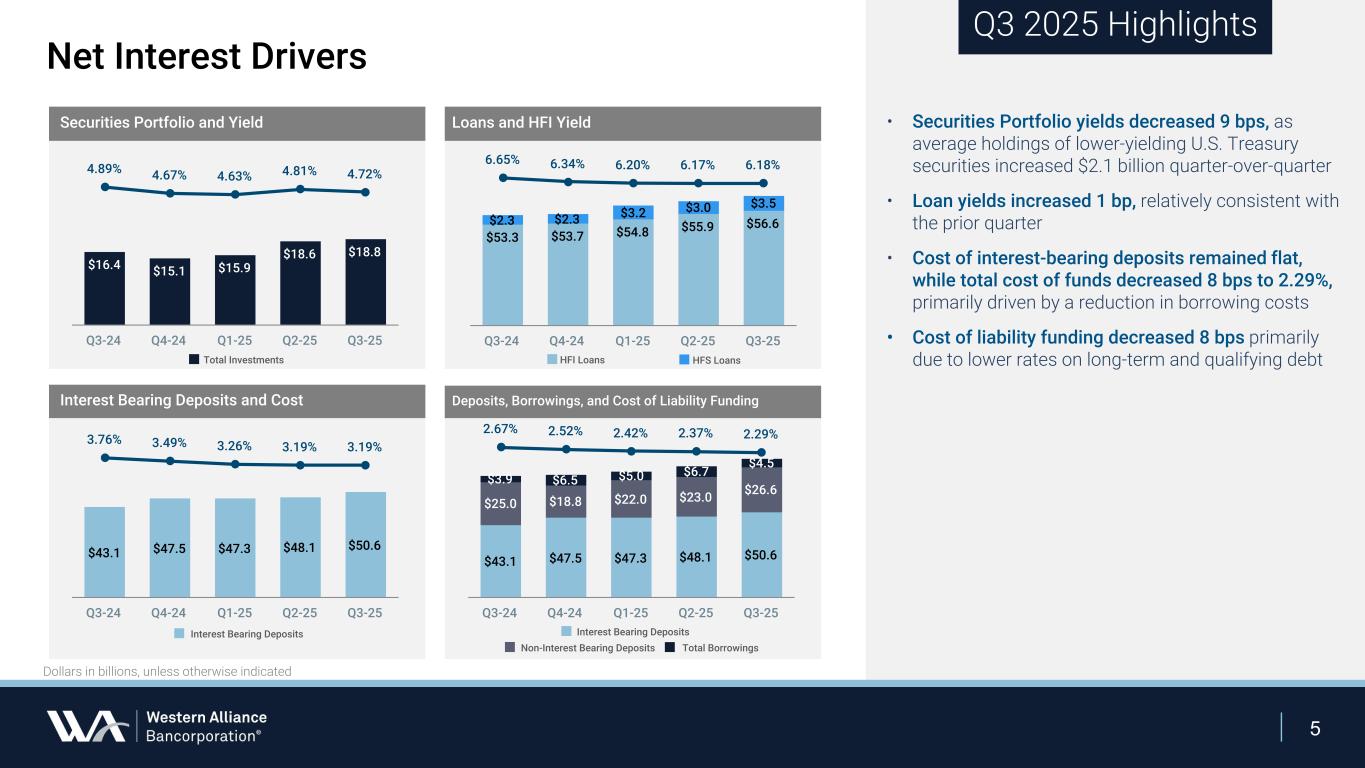

5 • Securities Portfolio yields decreased 9 bps, as average holdings of lower-yielding U.S. Treasury securities increased $2.1 billion quarter-over-quarter • Loan yields increased 1 bp, relatively consistent with the prior quarter • Cost of interest-bearing deposits remained flat, while total cost of funds decreased 8 bps to 2.29%, primarily driven by a reduction in borrowing costs • Cost of liability funding decreased 8 bps primarily due to lower rates on long-term and qualifying debt Interest Bearing Deposits and Cost Loans and HFI Yield Deposits, Borrowings, and Cost of Liability Funding Securities Portfolio and Yield $16.4 $15.1 $15.9 $18.6 $18.8 4.89% 4.67% 4.63% 4.81% 4.72% Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $53.3 $53.7 $54.8 $55.9 $56.6$2.3 $2.3 $3.2 $3.0 $3.5 6.65% 6.34% 6.20% 6.17% 6.18% Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $43.1 $47.5 $47.3 $48.1 $50.6 3.76% 3.49% 3.26% 3.19% 3.19% Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $43.1 $47.5 $47.3 $48.1 $50.6 $25.0 $18.8 $22.0 $23.0 $26.6 $3.9 $6.5 $5.0 $6.7 $4.5 2.67% 2.52% 2.42% 2.37% 2.29% Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Non-Interest Bearing Deposits Total Borrowings Q3 2025 Highlights Net Interest Drivers Dollars in billions, unless otherwise indicated Interest Bearing DepositsInterest Bearing Deposits Total Investments HFI Loans HFS Loans

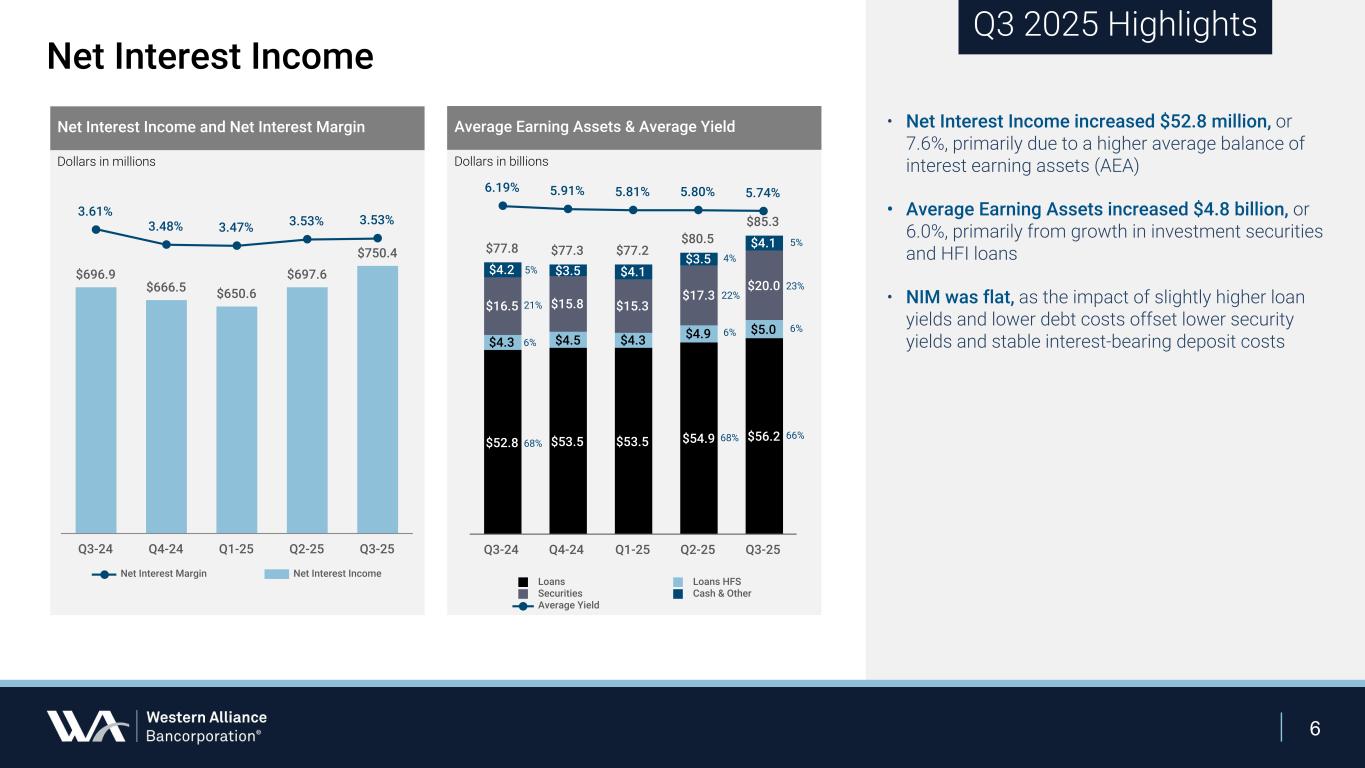

6 • Net Interest Income increased $52.8 million, or 7.6%, primarily due to a higher average balance of interest earning assets (AEA) • Average Earning Assets increased $4.8 billion, or 6.0%, primarily from growth in investment securities and HFI loans • NIM was flat, as the impact of slightly higher loan yields and lower debt costs offset lower security yields and stable interest-bearing deposit costs Net Interest Income and Net Interest Margin $696.9 $666.5 $650.6 $697.6 $750.4 3.61% 3.48% 3.47% 3.53% 3.53% Net Interest Margin Net Interest Income Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $77.8 $77.3 $77.2 $80.5 $85.3 $52.8 $53.5 $53.5 $54.9 $56.2 $4.3 $4.5 $4.3 $4.9 $5.0 $16.5 $15.8 $15.3 $17.3 $20.0 $4.2 $3.5 $4.1 $3.5 $4.1 6.19% 5.91% 5.81% 5.80% 5.74% Loans Loans HFS Securities Cash & Other Average Yield Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Average Earning Assets & Average Yield Dollars in millions Dollars in billions Net Interest Income Q3 2025 Highlights 5% 21% 6% 4% 22% 6% 5% 23% 6% 68% 68% 66%

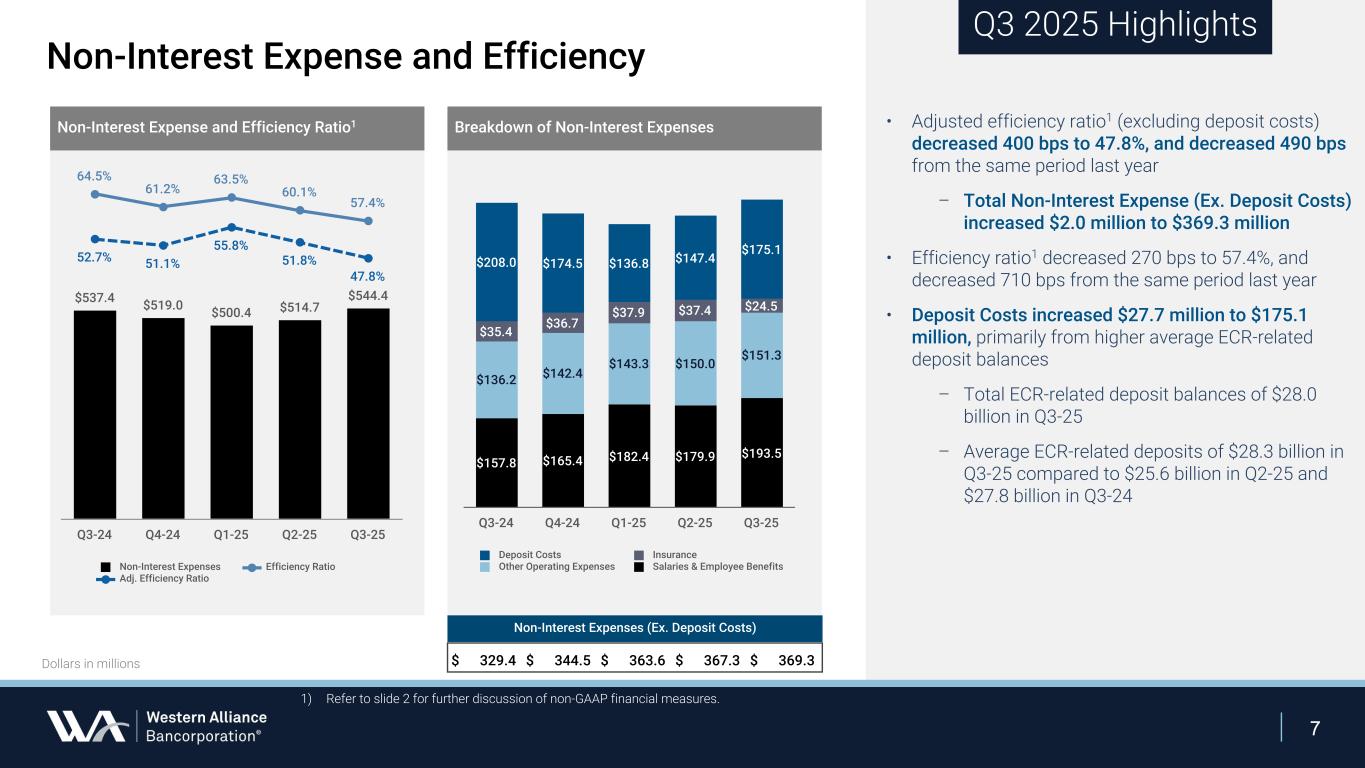

7 • Adjusted efficiency ratio1 (excluding deposit costs) decreased 400 bps to 47.8%, and decreased 490 bps from the same period last year – Total Non-Interest Expense (Ex. Deposit Costs) increased $2.0 million to $369.3 million • Efficiency ratio1 decreased 270 bps to 57.4%, and decreased 710 bps from the same period last year • Deposit Costs increased $27.7 million to $175.1 million, primarily from higher average ECR-related deposit balances – Total ECR-related deposit balances of $28.0 billion in Q3-25 – Average ECR-related deposits of $28.3 billion in Q3-25 compared to $25.6 billion in Q2-25 and $27.8 billion in Q3-24 $537.4 $519.0 $500.4 $514.7 $544.4 64.5% 61.2% 63.5% 60.1% 57.4% 52.7% 51.1% 55.8% 51.8% 47.8% Non-Interest Expenses Efficiency Ratio Adj. Efficiency Ratio Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Dollars in millions Non-Interest Expense and Efficiency $157.8 $165.4 $182.4 $179.9 $193.5 $136.2 $142.4 $143.3 $150.0 $151.3 $35.4 $36.7 $37.9 $37.4 $24.5 $208.0 $174.5 $136.8 $147.4 $175.1 Deposit Costs Insurance Other Operating Expenses Salaries & Employee Benefits Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q3 2025 Highlights Non-Interest Expense and Efficiency Ratio1 1) Refer to slide 2 for further discussion of non-GAAP financial measures. Breakdown of Non-Interest Expenses Non-Interest Expenses (Ex. Deposit Costs) $ 329.4 $ 344.5 $ 363.6 $ 367.3 $ 369.3

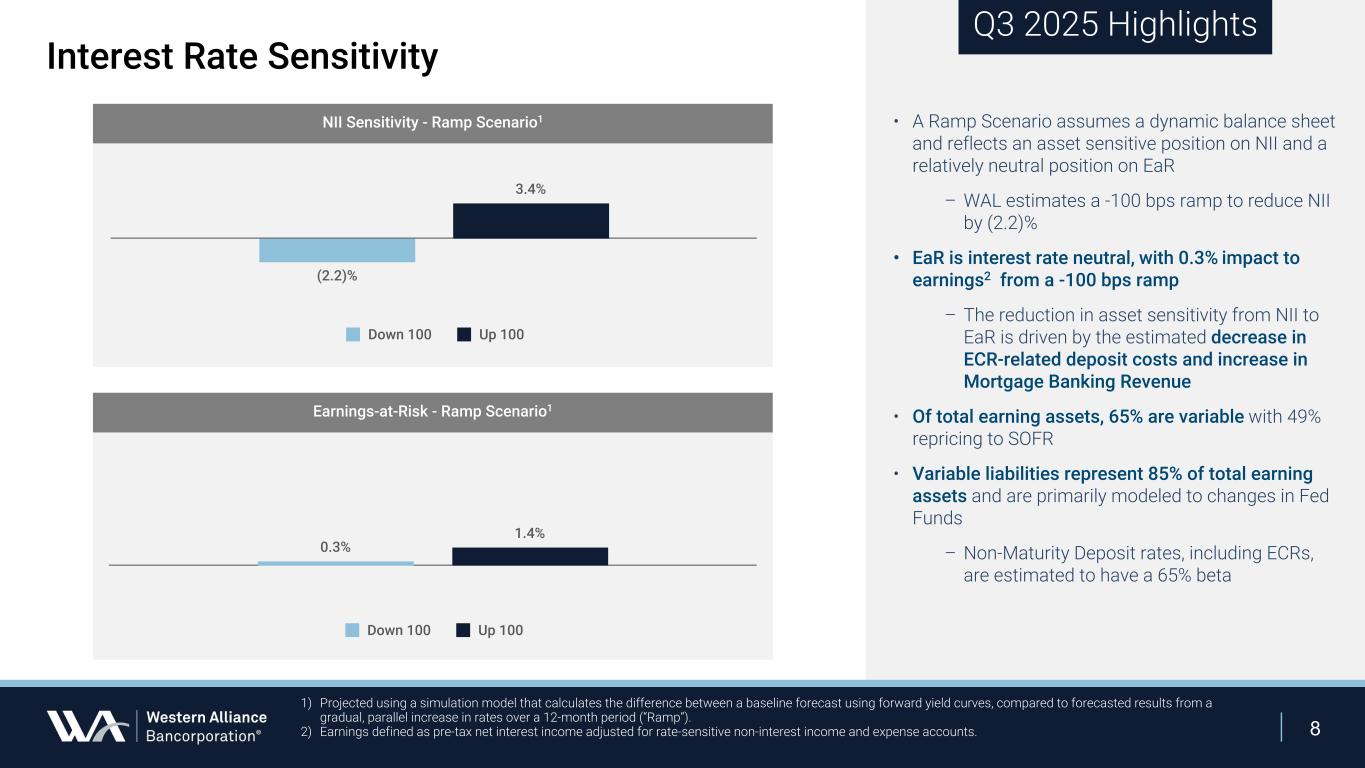

8 Interest Rate Sensitivity Q3 2025 Highlights • A Ramp Scenario assumes a dynamic balance sheet and reflects an asset sensitive position on NII and a relatively neutral position on EaR – WAL estimates a -100 bps ramp to reduce NII by (2.2)% • EaR is interest rate neutral, with 0.3% impact to earnings2 from a -100 bps ramp – The reduction in asset sensitivity from NII to EaR is driven by the estimated decrease in ECR-related deposit costs and increase in Mortgage Banking Revenue • Of total earning assets, 65% are variable with 49% repricing to SOFR • Variable liabilities represent 85% of total earning assets and are primarily modeled to changes in Fed Funds – Non-Maturity Deposit rates, including ECRs, are estimated to have a 65% beta (2.2)% 3.4% Down 100 Up 100 0.3% 1.4% Down 100 Up 100 1) Projected using a simulation model that calculates the difference between a baseline forecast using forward yield curves, compared to forecasted results from a gradual, parallel increase in rates over a 12-month period (“Ramp”). 2) Earnings defined as pre-tax net interest income adjusted for rate-sensitive non-interest income and expense accounts. NII Sensitivity - Ramp Scenario1 Earnings-at-Risk - Ramp Scenario1

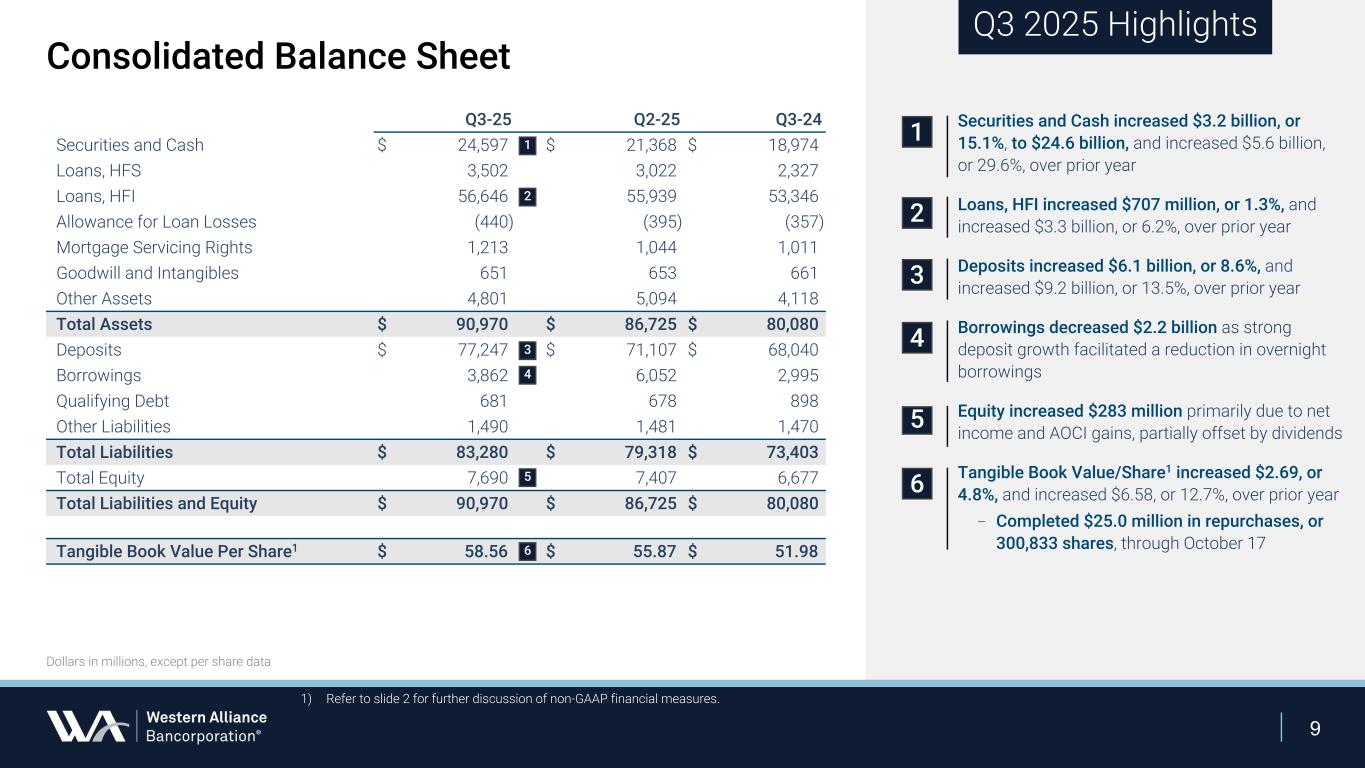

9 Q3-25 Q2-25 Q3-24 Securities and Cash $ 24,597 $ 21,368 $ 18,974 Loans, HFS 3,502 3,022 2,327 Loans, HFI 56,646 55,939 53,346 Allowance for Loan Losses (440) (395) (357) Mortgage Servicing Rights 1,213 1,044 1,011 Goodwill and Intangibles 651 653 661 Other Assets 4,801 5,094 4,118 Total Assets $ 90,970 $ 86,725 $ 80,080 Deposits $ 77,247 $ 71,107 $ 68,040 Borrowings 3,862 6,052 2,995 Qualifying Debt 681 678 898 Other Liabilities 1,490 1,481 1,470 Total Liabilities $ 83,280 $ 79,318 $ 73,403 Total Equity 7,690 7,407 6,677 Total Liabilities and Equity $ 90,970 $ 86,725 $ 80,080 Tangible Book Value Per Share1 $ 58.56 $ 55.87 $ 51.98 Dollars in millions, except per share data Consolidated Balance Sheet Q3 2025 Highlights 1 2 3 4 5 Securities and Cash increased $3.2 billion, or 15.1%, to $24.6 billion, and increased $5.6 billion, or 29.6%, over prior year Loans, HFI increased $707 million, or 1.3%, and increased $3.3 billion, or 6.2%, over prior year Deposits increased $6.1 billion, or 8.6%, and increased $9.2 billion, or 13.5%, over prior year Borrowings decreased $2.2 billion as strong deposit growth facilitated a reduction in overnight borrowings Equity increased $283 million primarily due to net income and AOCI gains, partially offset by dividends Tangible Book Value/Share1 increased $2.69, or 4.8%, and increased $6.58, or 12.7%, over prior year – Completed $25.0 million in repurchases, or 300,833 shares, through October 17 1) Refer to slide 2 for further discussion of non-GAAP financial measures. 6 1 2 3 4 5 6

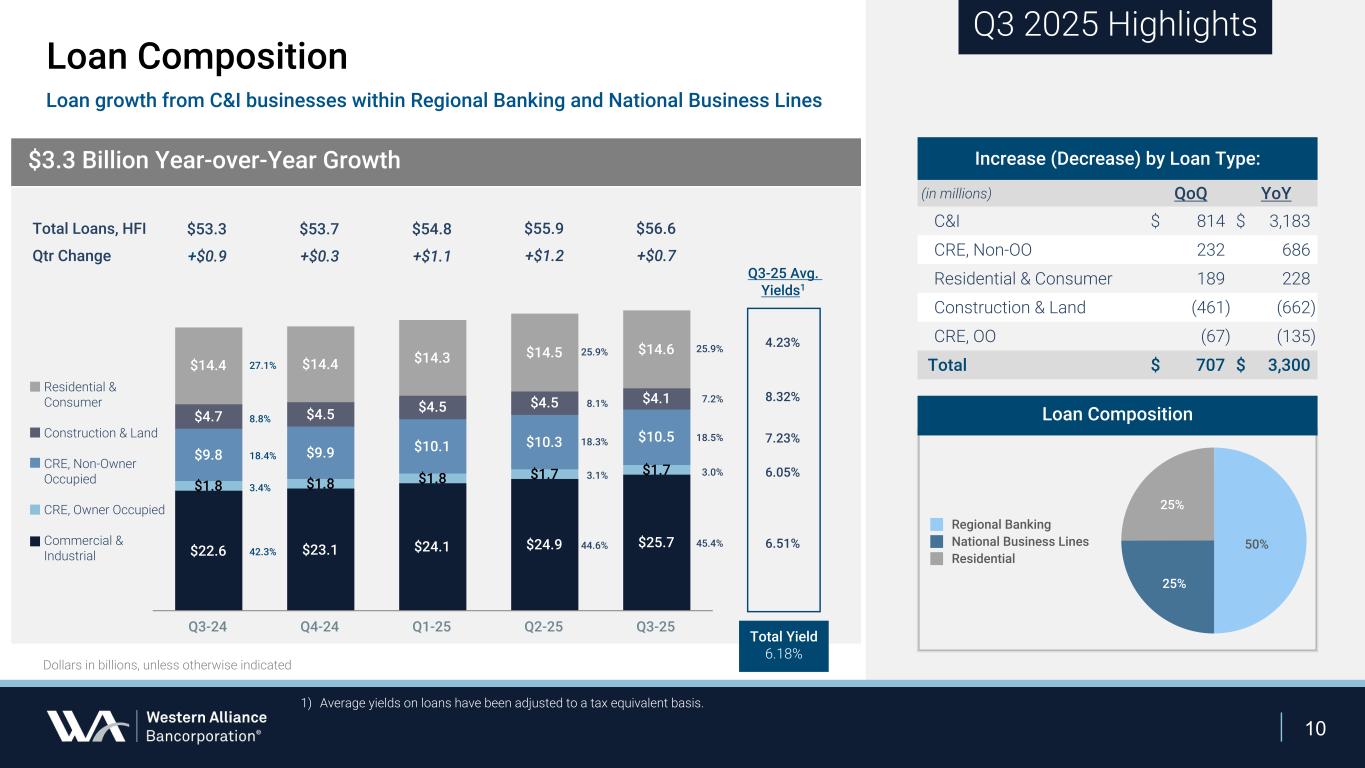

10 $3.3 Billion Year-over-Year Growth $22.6 $23.1 $24.1 $24.9 $25.7 $1.8 $1.8 $1.8 $1.7 $1.7 $9.8 $9.9 $10.1 $10.3 $10.5 $4.7 $4.5 $4.5 $4.5 $4.1 $14.4 $14.4 $14.3 $14.5 $14.6 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 27.1% 3.4% 18.4% 42.3% 8.8% 25.9% 3.0% 18.5% 45.4% 7.2% Residential & Consumer Construction & Land CRE, Non-Owner Occupied CRE, Owner Occupied Commercial & Industrial $53.3 +$0.9 $53.7 +$0.3 $54.8 +$1.1 $55.9 +$1.2 $56.6 +$0.7 Dollars in billions, unless otherwise indicated Total Loans, HFI Qtr Change Loan Composition Q3 2025 Highlights Increase (Decrease) by Loan Type: (in millions) QoQ YoY C&I $ 814 $ 3,183 CRE, Non-OO 232 686 Residential & Consumer 189 228 Construction & Land (461) (662) CRE, OO (67) (135) Total $ 707 $ 3,300 25.9% 3.1% 18.3% 44.6% 8.1% 4.23% 6.05% 7.23% 6.51% 8.32% Q3-25 Avg. Yields1 Total Yield 6.18% 1) Average yields on loans have been adjusted to a tax equivalent basis. Loan growth from C&I businesses within Regional Banking and National Business Lines 50% 25% 25% Regional Banking National Business Lines Residential Loan Composition

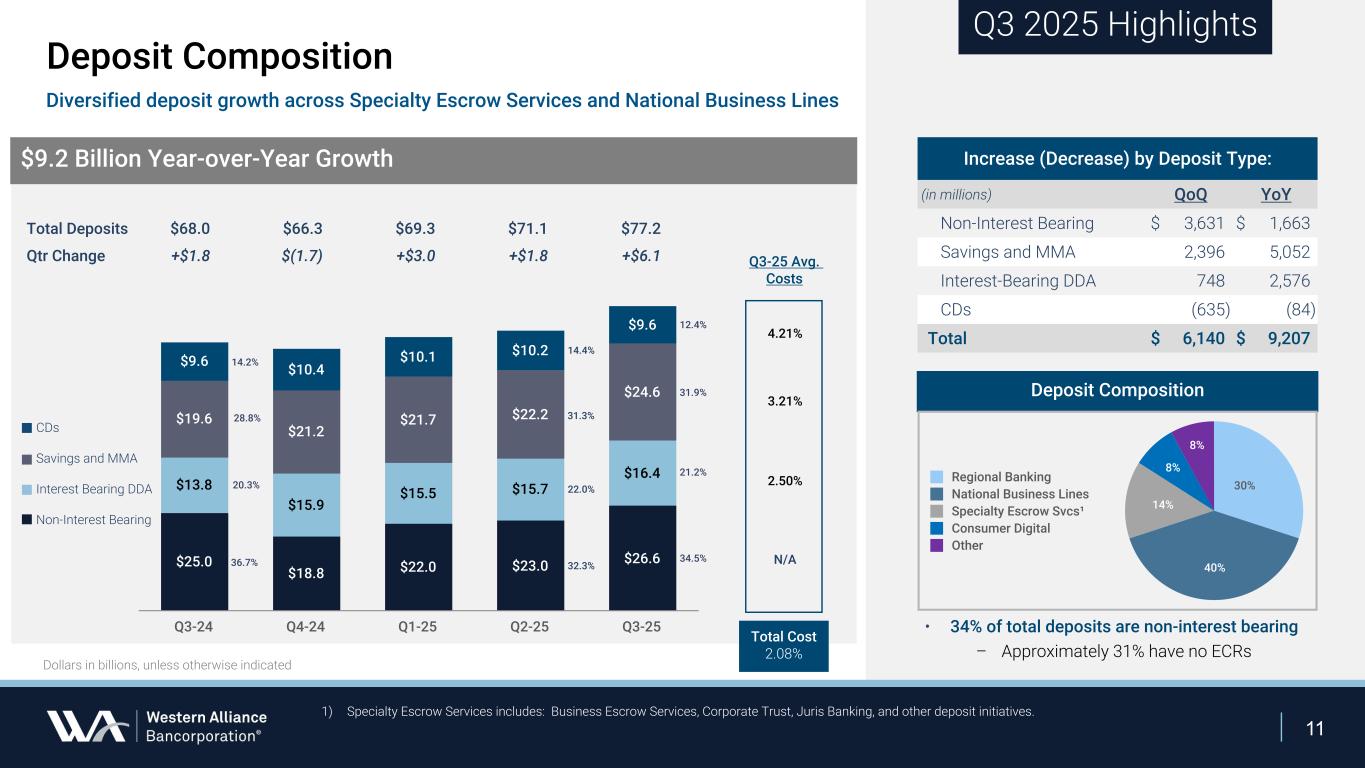

11 Diversified deposit growth across Specialty Escrow Services and National Business Lines Q3 2025 Highlights $25.0 $18.8 $22.0 $23.0 $26.6 $13.8 $15.9 $15.5 $15.7 $16.4 $19.6 $21.2 $21.7 $22.2 $24.6 $9.6 $10.4 $10.1 $10.2 $9.6 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 20.3% 14.2% 36.7% 28.8% 21.2% 12.4% 34.5% 31.9% $9.2 Billion Year-over-Year Growth CDs Savings and MMA Interest Bearing DDA Non-Interest Bearing $66.3 $(1.7) $68.0 +$1.8 $71.1 +$1.8 $77.2 +$6.1 Increase (Decrease) by Deposit Type: (in millions) QoQ YoY Non-Interest Bearing $ 3,631 $ 1,663 Savings and MMA 2,396 5,052 Interest-Bearing DDA 748 2,576 CDs (635) (84) Total $ 6,140 $ 9,207 $69.3 +$3.0 Total Deposits Qtr Change Deposit Composition Q3-25 Avg. Costs Total Cost 2.08% Dollars in billions, unless otherwise indicated 4.21% 2.50% N/A 3.21% 22.0% 14.4% 32.3% 31.3% Deposit Composition • 34% of total deposits are non-interest bearing – Approximately 31% have no ECRs 30% 40% 14% 8% 8% Regional Banking National Business Lines Specialty Escrow Svcs¹ Consumer Digital Other 1) Specialty Escrow Services includes: Business Escrow Services, Corporate Trust, Juris Banking, and other deposit initiatives.

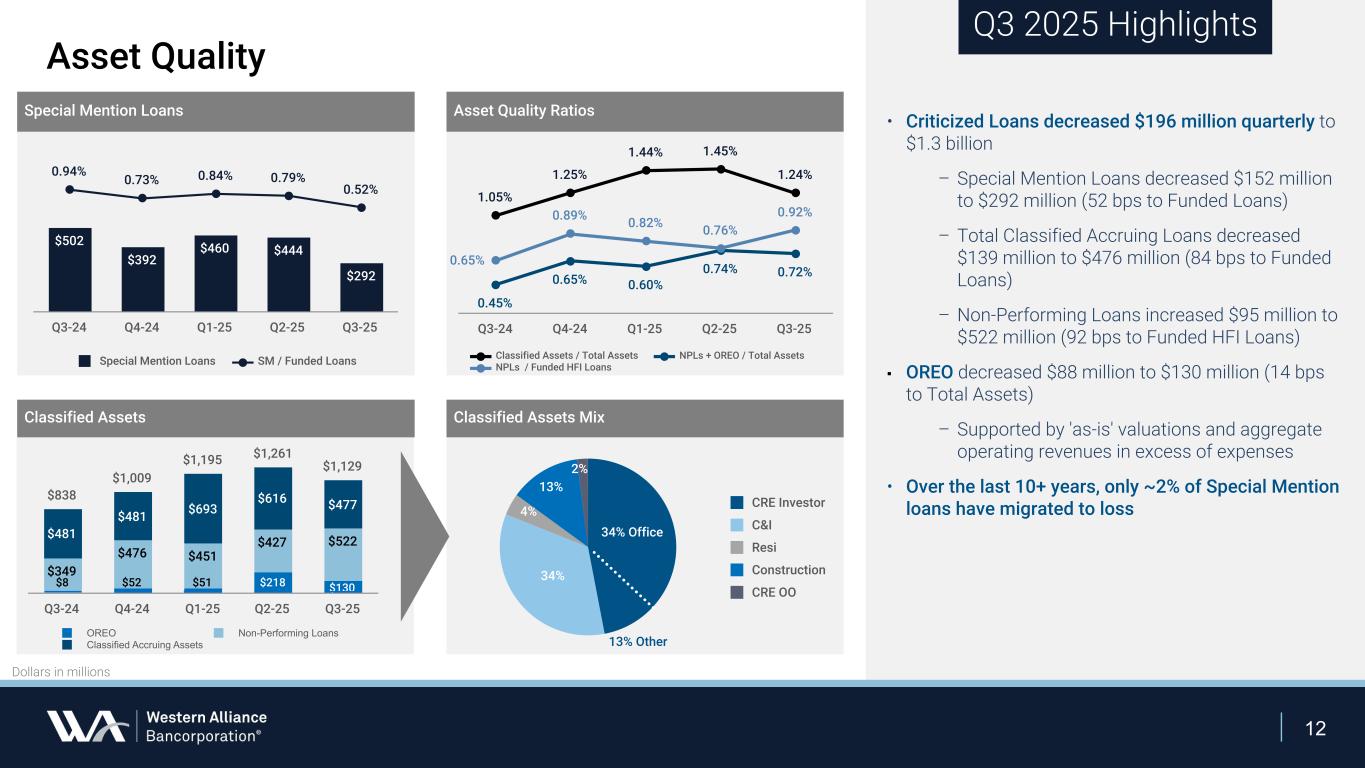

12 1.05% 1.25% 1.44% 1.45% 1.24% 0.45% 0.65% 0.60% 0.74% 0.72% 0.65% 0.89% 0.82% 0.76% 0.92% Classified Assets / Total Assets NPLs + OREO / Total Assets NPLs / Funded HFI Loans Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $838 $1,009 $1,195 $1,261 $1,129 $8 $52 $51 $218 $130 $349 $476 $451 $427 $522$481 $481 $693 $616 $477 OREO Non-Performing Loans Classified Accruing Assets Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Dollars in millions Asset Quality RatiosSpecial Mention Loans • Criticized Loans decreased $196 million quarterly to $1.3 billion – Special Mention Loans decreased $152 million to $292 million (52 bps to Funded Loans) – Total Classified Accruing Loans decreased $139 million to $476 million (84 bps to Funded Loans) – Non-Performing Loans increased $95 million to $522 million (92 bps to Funded HFI Loans) ▪ OREO decreased $88 million to $130 million (14 bps to Total Assets) – Supported by 'as-is' valuations and aggregate operating revenues in excess of expenses • Over the last 10+ years, only ~2% of Special Mention loans have migrated to loss Classified Assets $502 $392 $460 $444 $292 0.94% 0.73% 0.84% 0.79% 0.52% Special Mention Loans SM / Funded Loans Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q3 2025 Highlights Classified Assets Mix 34% 4% 13% 2% CRE Investor C&I Resi Construction CRE OO 13% Other 34% Office Asset Quality

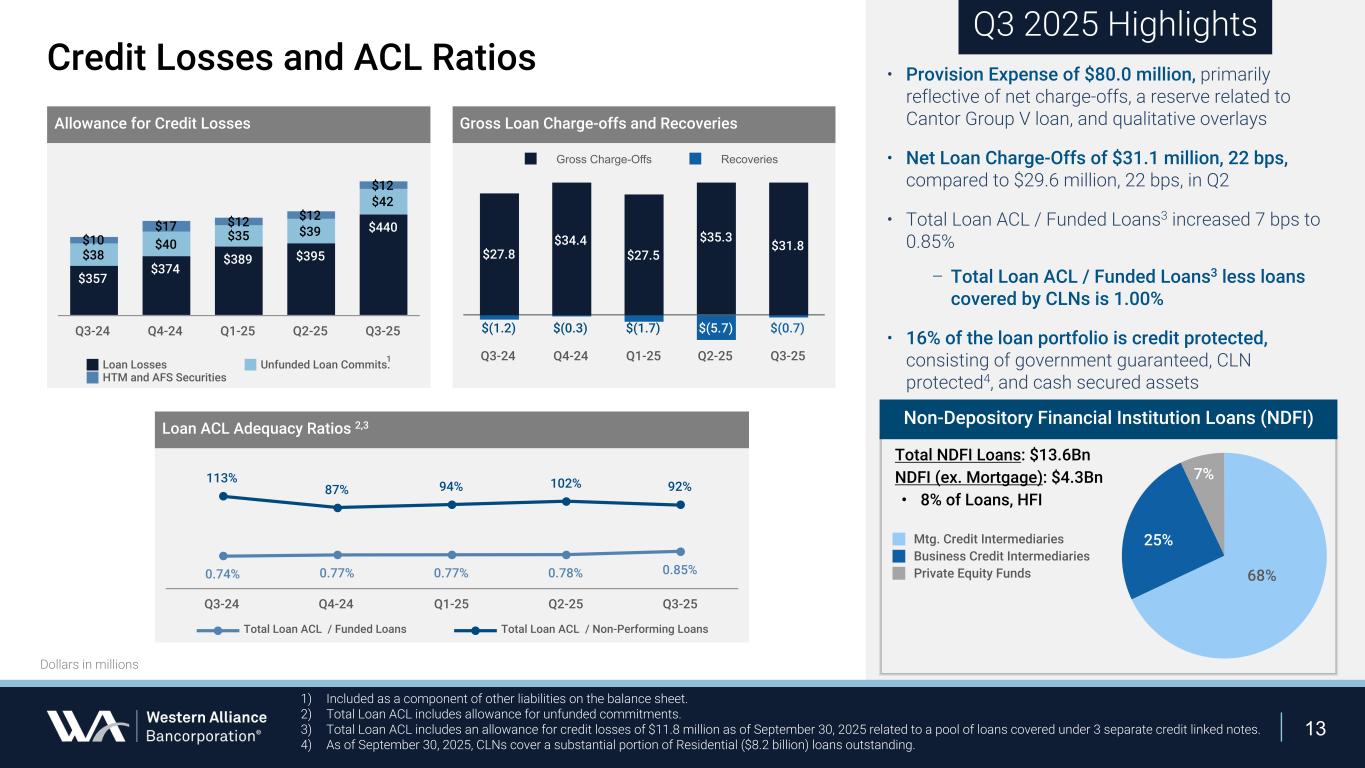

13 $27.8 $34.4 $27.5 $35.3 $31.8 $(1.2) $(0.3) $(1.7) $(5.7) $(0.7) Gross Charge-Offs Recoveries Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 $357 $374 $389 $395 $440 $38 $40 $35 $39 $42 $10 $17 $12 $12 $12 Loan Losses Unfunded Loan Commits. HTM and AFS Securities Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 0.74% 0.77% 0.77% 0.78% 0.85% 113% 87% 94% 102% 92% Total Loan ACL / Funded Loans Total Loan ACL / Non-Performing Loans Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Dollars in millions • Provision Expense of $80.0 million, primarily reflective of net charge-offs, a reserve related to Cantor Group V loan, and qualitative overlays • Net Loan Charge-Offs of $31.1 million, 22 bps, compared to $29.6 million, 22 bps, in Q2 • Total Loan ACL / Funded Loans3 increased 7 bps to 0.85% – Total Loan ACL / Funded Loans3 less loans covered by CLNs is 1.00% • 16% of the loan portfolio is credit protected, consisting of government guaranteed, CLN protected4, and cash secured assets Credit Losses and ACL Ratios Q3 2025 Highlights Gross Loan Charge-offs and RecoveriesAllowance for Credit Losses Loan ACL Adequacy Ratios 2,3 1) Included as a component of other liabilities on the balance sheet. 2) Total Loan ACL includes allowance for unfunded commitments. 3) Total Loan ACL includes an allowance for credit losses of $11.8 million as of September 30, 2025 related to a pool of loans covered under 3 separate credit linked notes. 4) As of September 30, 2025, CLNs cover a substantial portion of Residential ($8.2 billion) loans outstanding. 1 68% 25% 7% Mtg. Credit Intermediaries Business Credit Intermediaries Private Equity Funds Non-Depository Financial Institution Loans (NDFI) Total NDFI Loans: $13.6Bn NDFI (ex. Mortgage): $4.3Bn • 8% of Loans, HFI

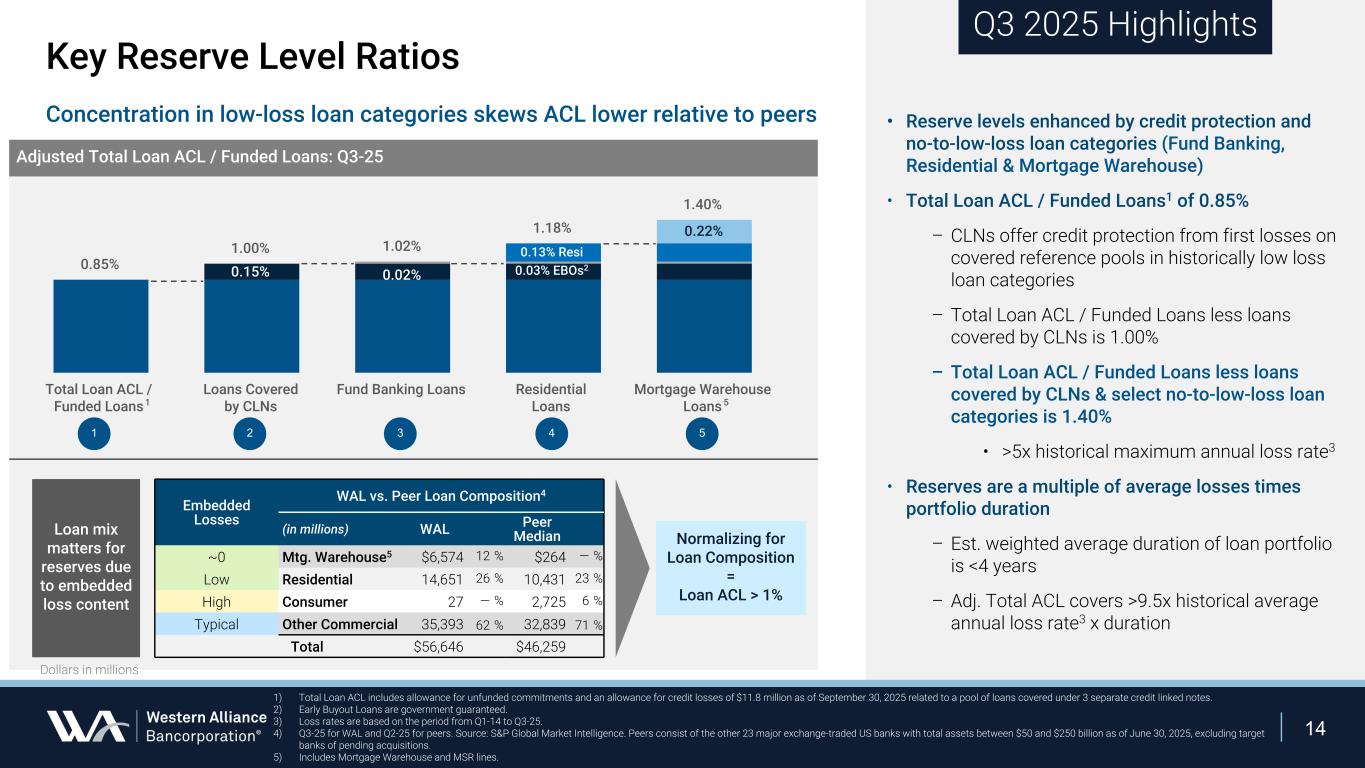

14 • Reserve levels enhanced by credit protection and no-to-low-loss loan categories (Fund Banking, Residential & Mortgage Warehouse) • Total Loan ACL / Funded Loans1 of 0.85% – CLNs offer credit protection from first losses on covered reference pools in historically low loss loan categories – Total Loan ACL / Funded Loans less loans covered by CLNs is 1.00% – Total Loan ACL / Funded Loans less loans covered by CLNs & select no-to-low-loss loan categories is 1.40% • >5x historical maximum annual loss rate3 • Reserves are a multiple of average losses times portfolio duration – Est. weighted average duration of loan portfolio is <4 years – Adj. Total ACL covers >9.5x historical average annual loss rate3 x duration Q3 2025 Highlights Adjusted Total Loan ACL / Funded Loans: Q3-25 1) Total Loan ACL includes allowance for unfunded commitments and an allowance for credit losses of $11.8 million as of September 30, 2025 related to a pool of loans covered under 3 separate credit linked notes. 2) Early Buyout Loans are government guaranteed. 3) Loss rates are based on the period from Q1-14 to Q3-25. 4) Q3-25 for WAL and Q2-25 for peers. Source: S&P Global Market Intelligence. Peers consist of the other 23 major exchange-traded US banks with total assets between $50 and $250 billion as of June 30, 2025, excluding target banks of pending acquisitions. 5) Includes Mortgage Warehouse and MSR lines. Key Reserve Level Ratios Concentration in low-loss loan categories skews ACL lower relative to peers 0.85% 1.00% 1.02% 1.18% 1.40% 0.15% 0.02% 0.22% Total Loan ACL / Funded Loans Loans Covered by CLNs Fund Banking Loans Residential Loans Mortgage Warehouse Loans 1 2 3 4 5 0.13% Resi 1 Embedded Losses WAL vs. Peer Loan Composition4 (in millions) WAL Peer Median ~0 Mtg. Warehouse5 $6,574 12 % $264 — % Low Residential 14,651 26 % 10,431 23 % High Consumer 27 — % 2,725 6 % Typical Other Commercial 35,393 62 % 32,839 71 % Total $56,646 $46,259 Loan mix matters for reserves due to embedded loss content Normalizing for Loan Composition = Loan ACL > 1% 0.03% EBOs2 Dollars in millions 5

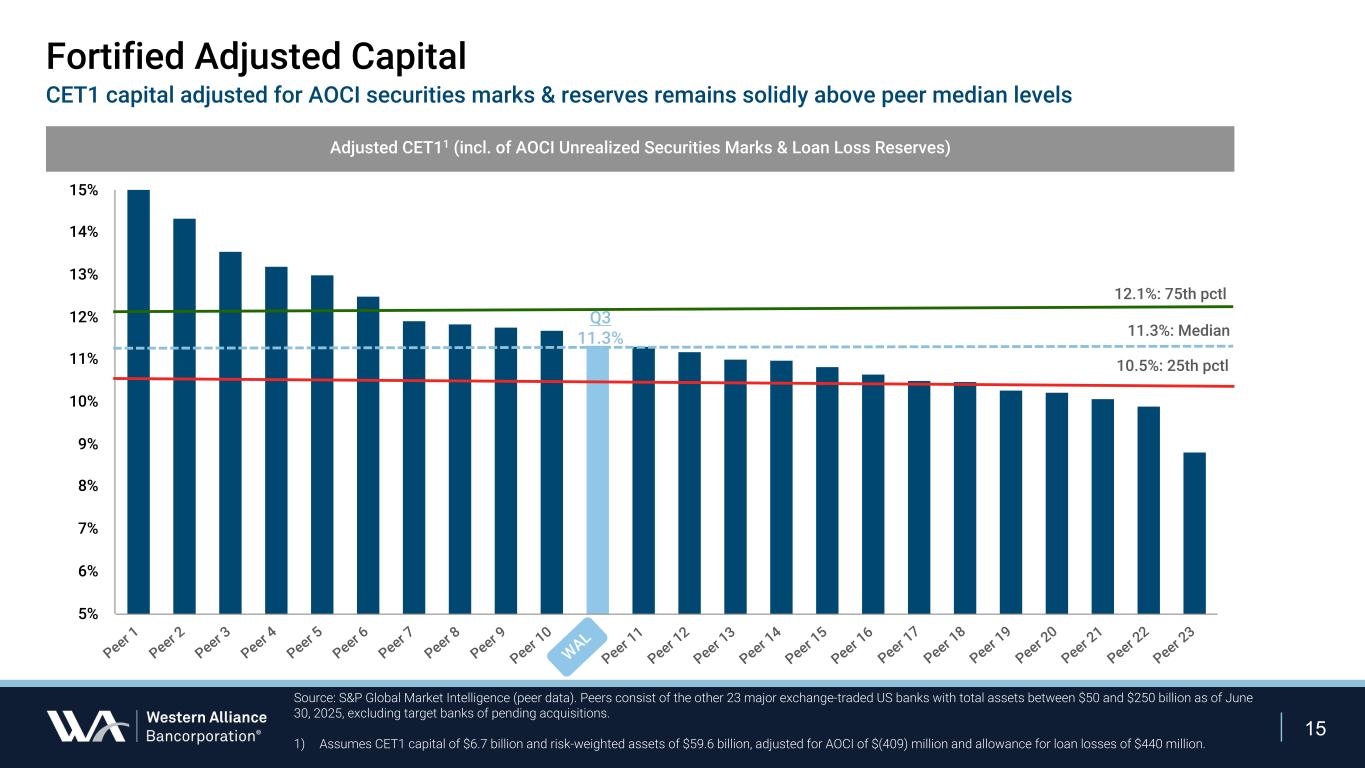

15 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 1 0 WAL Peer 1 1 Peer 1 2 Peer 1 3 Peer 1 4 Peer 1 5 Peer 1 6 Peer 1 7 Peer 1 8 Peer 1 9 Peer 2 0 Peer 2 1 Peer 2 2 Peer 2 3 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% Source: S&P Global Market Intelligence (peer data). Peers consist of the other 23 major exchange-traded US banks with total assets between $50 and $250 billion as of June 30, 2025, excluding target banks of pending acquisitions. 1) Assumes CET1 capital of $6.7 billion and risk-weighted assets of $59.6 billion, adjusted for AOCI of $(409) million and allowance for loan losses of $440 million. 11.3%: Median 12.1%: 75th pctl 10.5%: 25th pctl Adjusted CET11 (incl. of AOCI Unrealized Securities Marks & Loan Loss Reserves) Fortified Adjusted Capital CET1 capital adjusted for AOCI securities marks & reserves remains solidly above peer median levels Q3 11.3% WAL

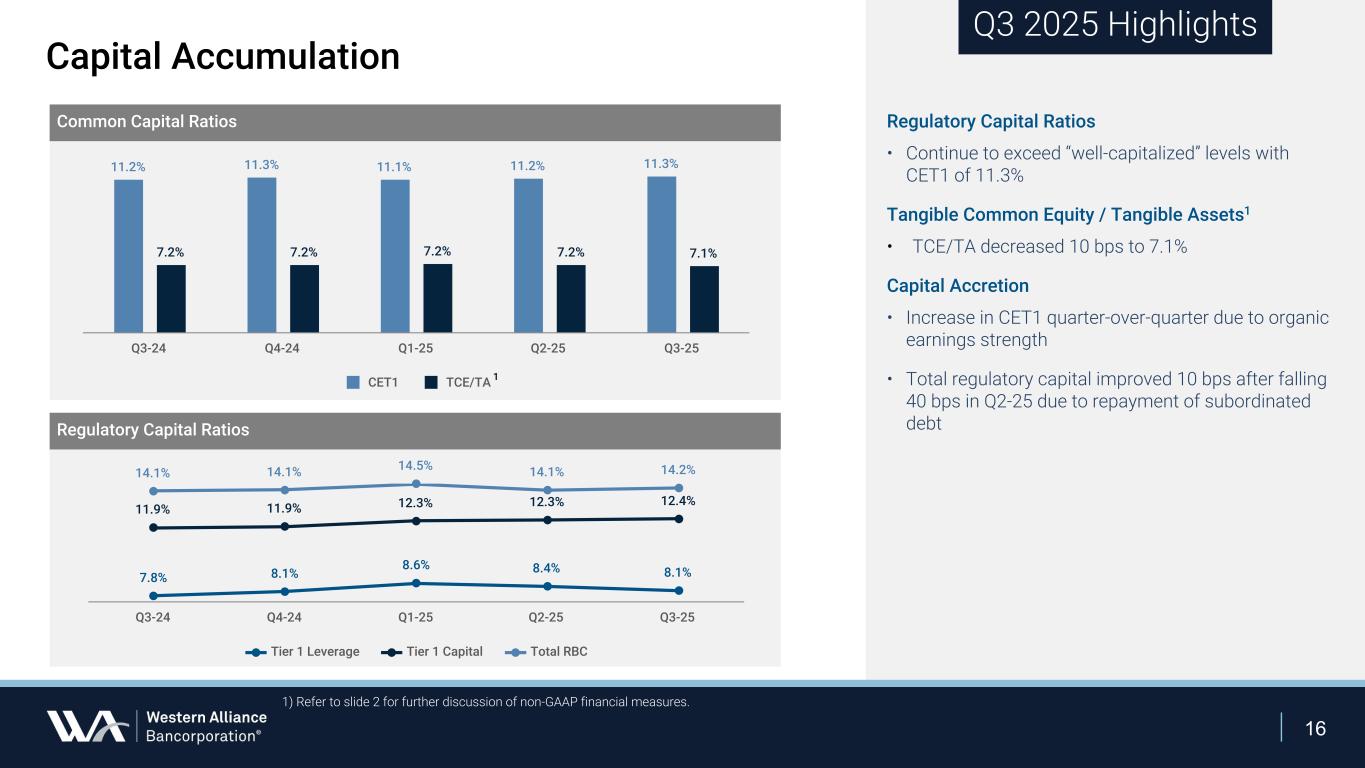

16 Regulatory Capital Ratios • Continue to exceed “well-capitalized” levels with CET1 of 11.3% Tangible Common Equity / Tangible Assets1 • TCE/TA decreased 10 bps to 7.1% Capital Accretion • Increase in CET1 quarter-over-quarter due to organic earnings strength • Total regulatory capital improved 10 bps after falling 40 bps in Q2-25 due to repayment of subordinated debt 11.2% 11.3% 11.1% 11.2% 11.3% 7.2% 7.2% 7.2% 7.2% 7.1% CET1 TCE/TA Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 1) Refer to slide 2 for further discussion of non-GAAP financial measures. 14.1% 14.1% 14.5% 14.1% 14.2% 11.9% 11.9% 12.3% 12.3% 12.4% 7.8% 8.1% 8.6% 8.4% 8.1% Tier 1 Leverage Tier 1 Capital Total RBC Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q3 2025 Highlights Common Capital Ratios Capital Accumulation Regulatory Capital Ratios 1

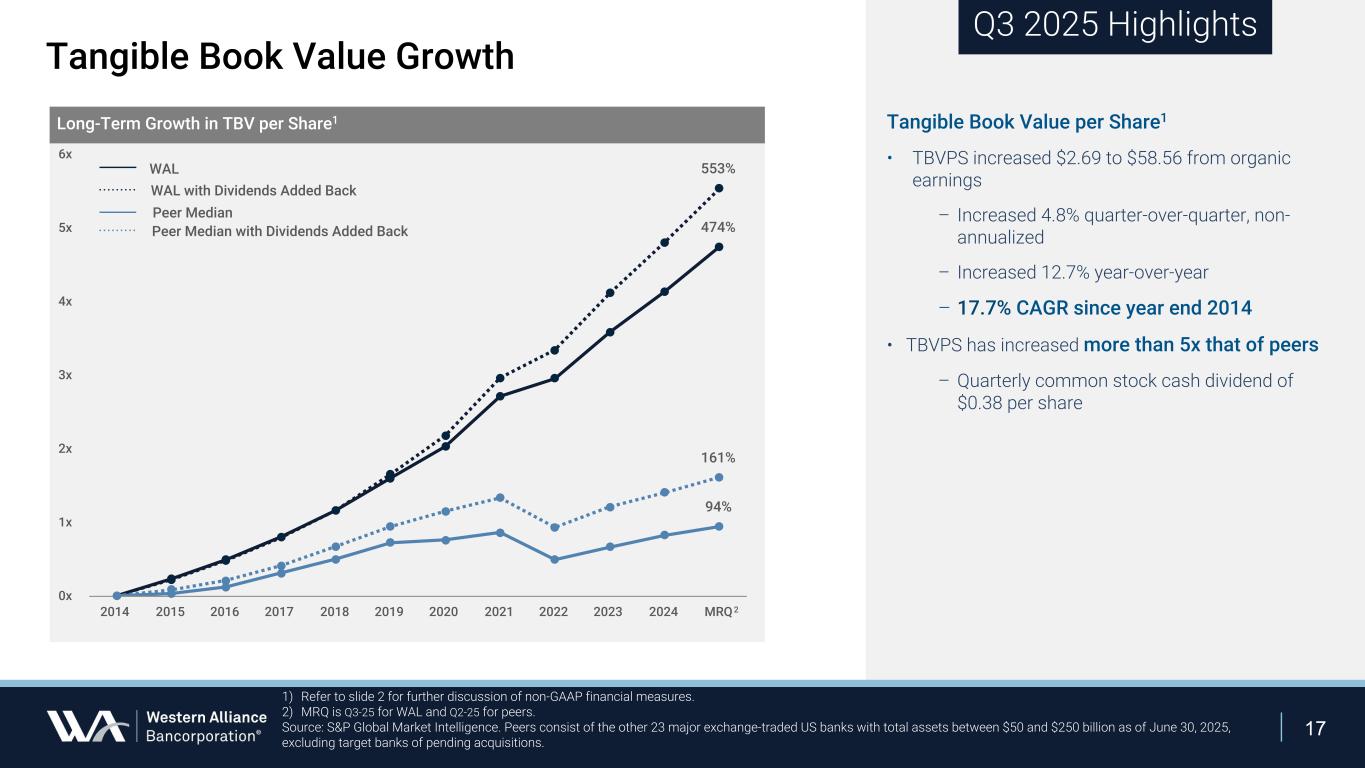

17 474% 553% 94% 161% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 MRQ 0x 1x 2x 3x 4x 5x 6x Tangible Book Value per Share1 • TBVPS increased $2.69 to $58.56 from organic earnings – Increased 4.8% quarter-over-quarter, non- annualized – Increased 12.7% year-over-year – 17.7% CAGR since year end 2014 • TBVPS has increased more than 5x that of peers – Quarterly common stock cash dividend of $0.38 per share 1) Refer to slide 2 for further discussion of non-GAAP financial measures. 2) MRQ is Q3-25 for WAL and Q2-25 for peers. Source: S&P Global Market Intelligence. Peers consist of the other 23 major exchange-traded US banks with total assets between $50 and $250 billion as of June 30, 2025, excluding target banks of pending acquisitions. Q3 2025 Highlights Tangible Book Value Growth Long-Term Growth in TBV per Share1 WAL Peer Median with Dividends Added Back Peer Median WAL with Dividends Added Back 2

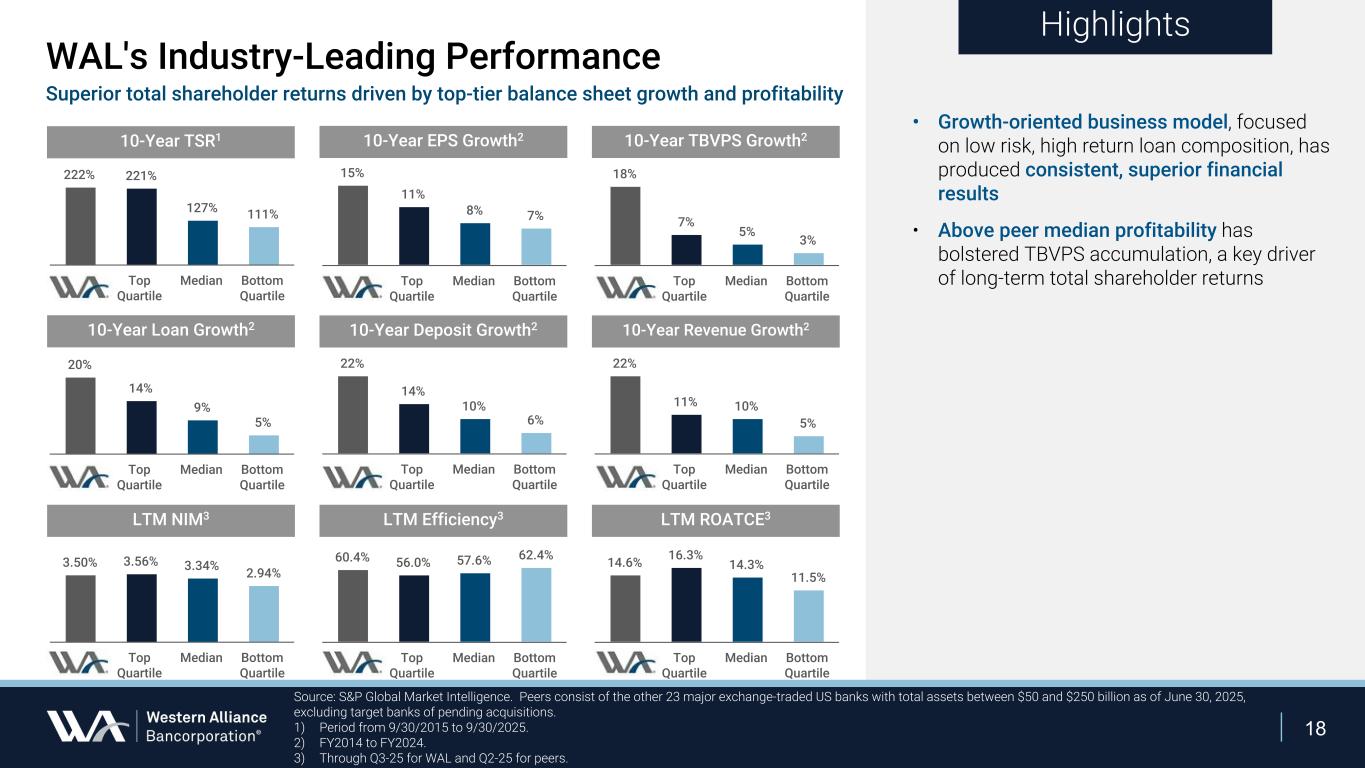

18 • Growth-oriented business model, focused on low risk, high return loan composition, has produced consistent, superior financial results • Above peer median profitability has bolstered TBVPS accumulation, a key driver of long-term total shareholder returns Highlights Source: S&P Global Market Intelligence. Peers consist of the other 23 major exchange-traded US banks with total assets between $50 and $250 billion as of June 30, 2025, excluding target banks of pending acquisitions. 1) Period from 9/30/2015 to 9/30/2025. 2) FY2014 to FY2024. 3) Through Q3-25 for WAL and Q2-25 for peers. WAL's Industry-Leading Performance Superior total shareholder returns driven by top-tier balance sheet growth and profitability 10-Year TSR1 10-Year EPS Growth2 10-Year TBVPS Growth2 222% 221% 127% 111% WAL Top Quartile Median Bottom Quartile 15% 11% 8% 7% WAL Top Quartile Median Bottom Quartile 18% 7% 5% 3% WAL Top Quartile Median Bottom Quartile 20% 14% 9% 5% WAL Top Quartile Median Bottom Quartile 22% 14% 10% 6% WAL Top Quartile Median Bottom Quartile 22% 11% 10% 5% WAL Top Quartile Median Bottom Quartile 14.6% 16.3% 14.3% 11.5% WAL Top Quartile Median Bottom Quartile 60.4% 56.0% 57.6% 62.4% WAL Top Quartile Median Bottom Quartile 3.50% 3.56% 3.34% 2.94% WAL Top Quartile Median Bottom Quartile 10-Year Loan Growth2 10-Year Deposit Growth2 10-Year Revenue Growth2 LTM NIM3 LTM Efficiency3 LTM ROATCE3

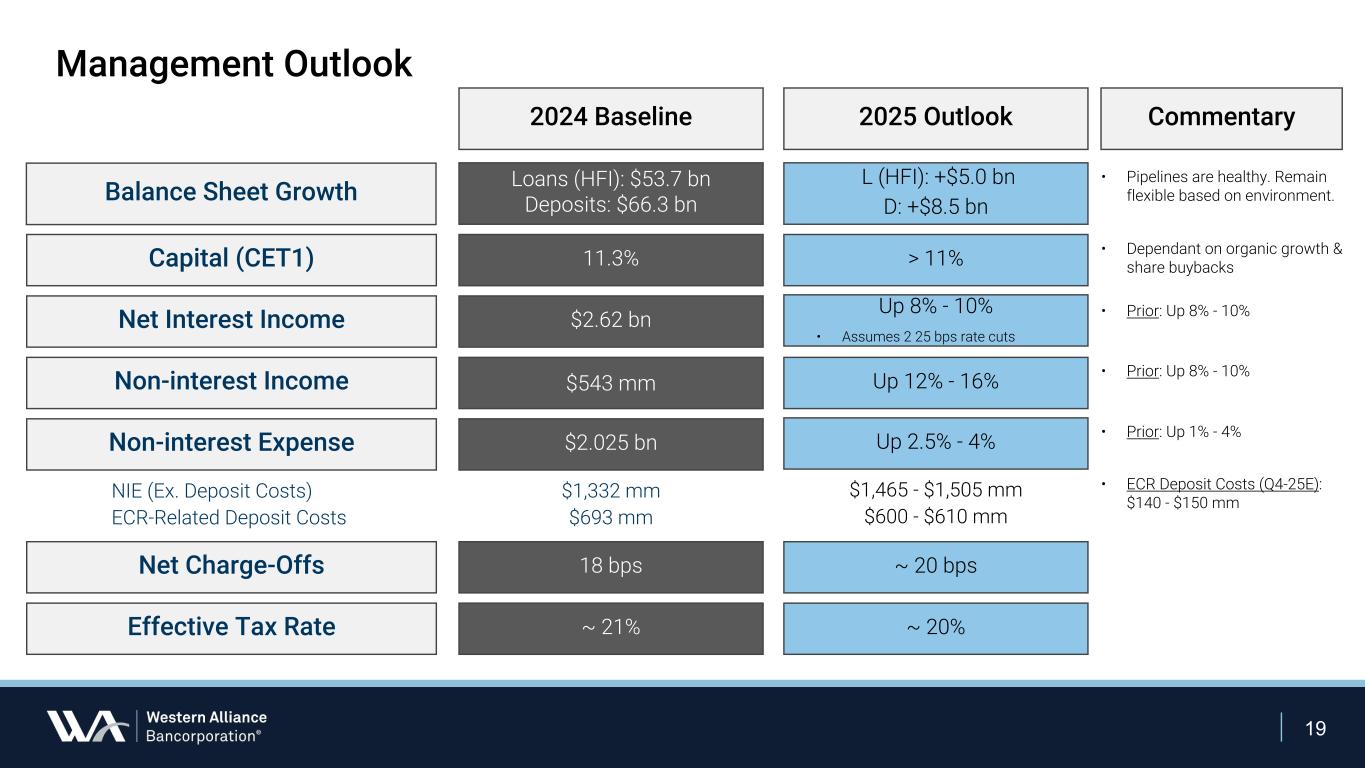

19 • Pipelines are healthy. Remain flexible based on environment.Balance Sheet Growth Capital (CET1) Net Interest Income Non-interest Income Non-interest Expense Net Charge-Offs Effective Tax Rate 2024 Baseline 2025 Outlook Loans (HFI): $53.7 bn Deposits: $66.3 bn L (HFI): +$5.0 bn D: +$8.5 bn 11.3% > 11% $2.62 bn Up 8% - 10% $543 mm Up 12% - 16% $2.025 bn 18 bps Up 2.5% - 4% ~ 20 bps ~ 21% ~ 20% NIE (Ex. Deposit Costs) ECR-Related Deposit Costs $1,465 - $1,505 mm $600 - $610 mm $1,332 mm $693 mm Management Outlook Commentary • ECR Deposit Costs (Q4-25E): $140 - $150 mm • Dependant on organic growth & share buybacks • Assumes 2 25 bps rate cuts • Prior: Up 8% - 10% • Prior: Up 1% - 4% • Prior: Up 8% - 10%

Questions & Answers

Appendix

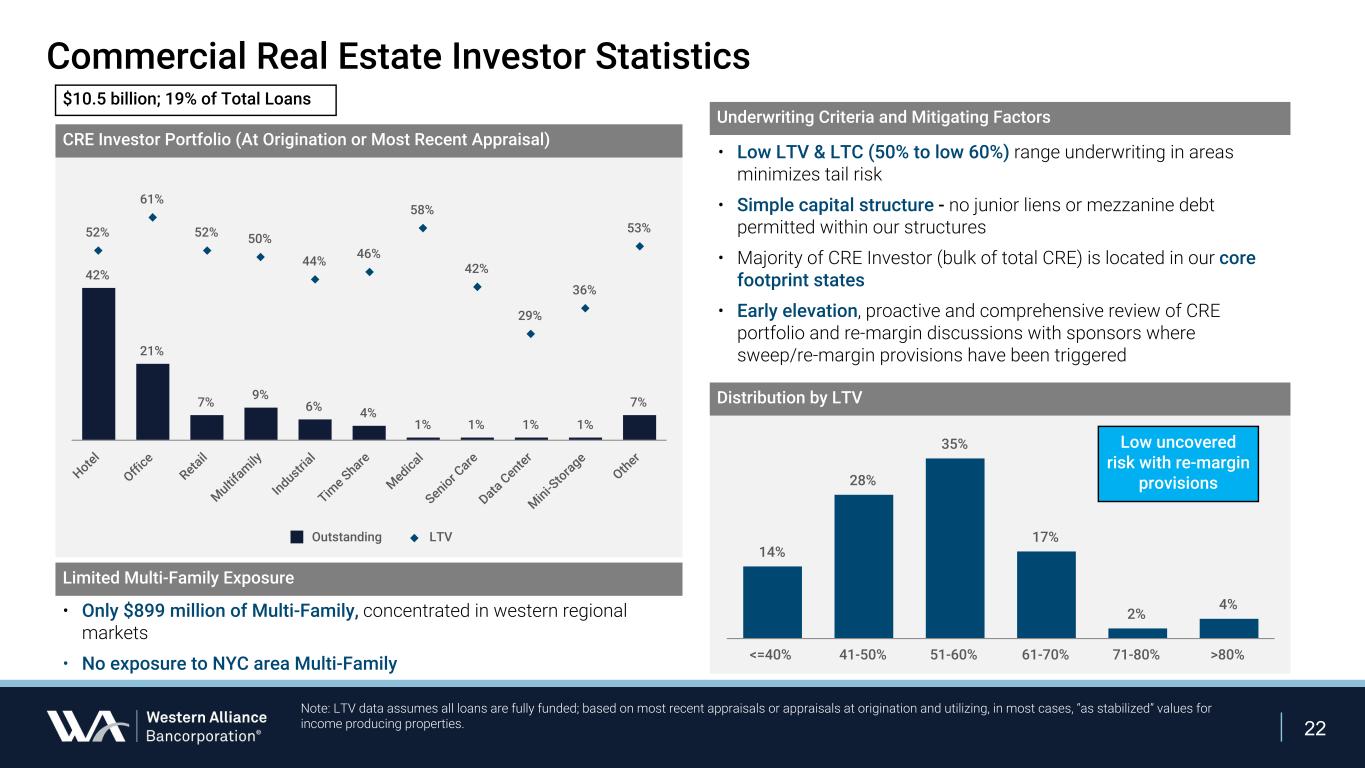

22 Commercial Real Estate Investor Statistics CRE Investor Portfolio (At Origination or Most Recent Appraisal) Note: LTV data assumes all loans are fully funded; based on most recent appraisals or appraisals at origination and utilizing, in most cases, “as stabilized” values for income producing properties. Underwriting Criteria and Mitigating Factors Distribution by LTV • Low LTV & LTC (50% to low 60%) range underwriting in areas minimizes tail risk • Simple capital structure - no junior liens or mezzanine debt permitted within our structures • Majority of CRE Investor (bulk of total CRE) is located in our core footprint states • Early elevation, proactive and comprehensive review of CRE portfolio and re-margin discussions with sponsors where sweep/re-margin provisions have been triggered 14% 28% 35% 17% 2% 4% <=40% 41-50% 51-60% 61-70% 71-80% >80% 42% 21% 7% 9% 6% 4% 1% 1% 1% 1% 7% 52% 61% 52% 50% 44% 46% 58% 42% 29% 36% 53% Outstanding LTV Hotel Offi ce Retail Multif amily Industr ial Tim e Share Medical Senior C are Data Center Mini-S torage Other Low uncovered risk with re-margin provisions • Only $899 million of Multi-Family, concentrated in western regional markets • No exposure to NYC area Multi-Family Limited Multi-Family Exposure $10.5 billion; 19% of Total Loans

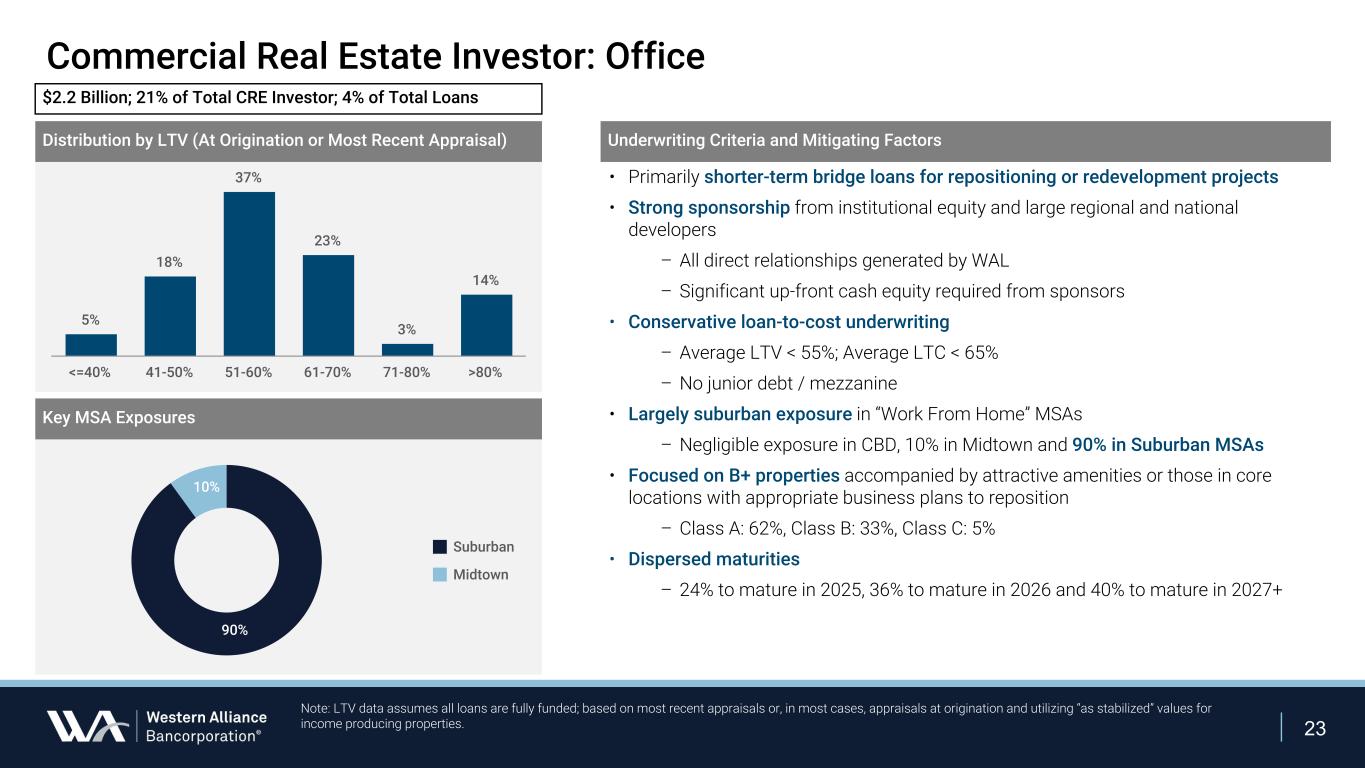

23 Commercial Real Estate Investor: Office Distribution by LTV (At Origination or Most Recent Appraisal) 5% 18% 37% 23% 3% 14% <=40% 41-50% 51-60% 61-70% 71-80% >80% Key MSA Exposures $2.2 Billion; 21% of Total CRE Investor; 4% of Total Loans Underwriting Criteria and Mitigating Factors • Primarily shorter-term bridge loans for repositioning or redevelopment projects • Strong sponsorship from institutional equity and large regional and national developers – All direct relationships generated by WAL – Significant up-front cash equity required from sponsors • Conservative loan-to-cost underwriting – Average LTV < 55%; Average LTC < 65% – No junior debt / mezzanine • Largely suburban exposure in “Work From Home” MSAs – Negligible exposure in CBD, 10% in Midtown and 90% in Suburban MSAs • Focused on B+ properties accompanied by attractive amenities or those in core locations with appropriate business plans to reposition – Class A: 62%, Class B: 33%, Class C: 5% • Dispersed maturities – 24% to mature in 2025, 36% to mature in 2026 and 40% to mature in 2027+ 90% 10% Suburban Midtown Note: LTV data assumes all loans are fully funded; based on most recent appraisals or, in most cases, appraisals at origination and utilizing “as stabilized” values for income producing properties.

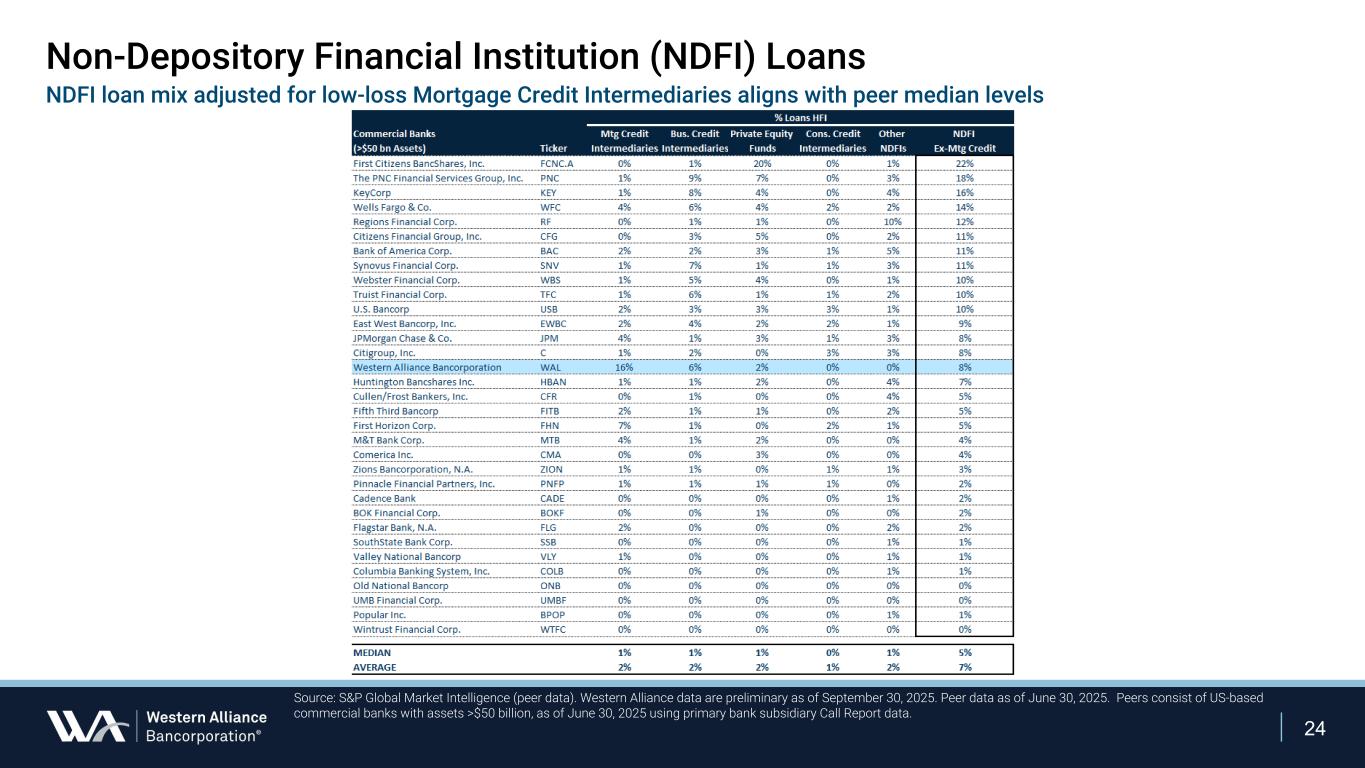

24 Source: S&P Global Market Intelligence (peer data). Western Alliance data are preliminary as of September 30, 2025. Peer data as of June 30, 2025. Peers consist of US-based commercial banks with assets >$50 billion, as of June 30, 2025 using primary bank subsidiary Call Report data. Non-Depository Financial Institution (NDFI) Loans NDFI loan mix adjusted for low-loss Mortgage Credit Intermediaries aligns with peer median levels