Please wait

0001223026falseN-CSRSThe Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8). 0001223026 2025-05-01 2025-10-31 0001223026 2025-10-31 0001223026 pmhifi:RiskMember 2025-05-01 2025-10-31 0001223026 pmhifi:CommonSharesMember 2025-05-01 2025-10-31 0001223026 pmhifi:CommonSharesMember 2024-05-01 2025-04-30 xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-21321

Pioneer Municipal High Income Fund, Inc.

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)

742-7825

Date of fiscal year end: April 30, 2026

Date of reporting period: May 1, 2024 through October 31, 2025

Form

N-CSR

is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule

30e-1

under the Investment Company Act of 1940 (17 CFR

270.30e-1). The

Commission may use the information provided on Form

N-CSR

in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form

N-CSR,

and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form

N-CSR

unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Pioneer Municipal High Income Fund, Inc.

Semi-Annual Report | October 31, 2025

Stockholders of Pioneer Municipal High Income Fund, Inc. (the “Fund”) approved the liquidation of the Fund pursuant to a Plan of Liquidation and Dissolution at a meeting of stockholders held on July 17, 2025. Since that date, the Fund has been operating under the Plan of Liquidation and Dissolution and is in the process of winding up its business and affairs, paying its liabilities and distributing its remaining assets to stockholders. Accordingly, the Fund no longer pursues its stated investment objective, complies with its investment limitations or engages in normal business activities. Prior to the opening of business on August 25, 2025, the Fund ceased trading on the New York Stock Exchange (NYSE) (see Notes to Financial Statements, Note 8). The Fund’s NYSE ticker symbol was MHI.

visit us:

www.pioneerinvestments.com

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

1

Portfolio Summary | 10/31/25*

Portfolio Diversification

(As a percentage of total investments)**

(As a percentage of total investments)**

(As a percentage of total investments)**

| (As a percentage of total investments)** |

| 1. |

Central Falls Detention Facility Corp., 7.25%, 7/15/35 |

39.64% |

| 2. |

Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.00%, 3/1/34 |

16.83 |

| 3. |

David Ellis Academy-West, 5.25%, 6/1/45 |

14.81 |

| 4. |

Philadelphia Authority for Industrial Development, Global Leadership Academy Charter School Project, Series A, 5.00%, 11/15/50 |

12.17 |

| 5. |

Philadelphia Authority for Industrial Development, 5.50%, 6/1/49 (144A) |

8.41 |

| 6. |

Arlington Higher Education Finance Corp., LTTS Charter School, Universal Academy, 5.45%, 3/1/49 (144A) |

8.14 |

* The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8). Information shown in the Portfolio Summary reflects remaining investments held by the Fund at October 31, 2025.

** Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

2

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

Schedule of Investments | 10/31/25*

|

|

|

|

|

|

Value |

| |

UNAFFILIATED ISSUERS — 69.1% |

|

| |

Municipal Bonds — 69.1% of Net Assets |

|

| |

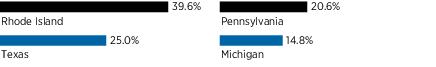

Michigan — 10.2% |

|

| 945,000 |

David Ellis Academy-West, 5.25%, 6/1/45 |

$ 881,458 |

| |

Total Michigan |

|

|

|

| |

Pennsylvania — 14.2% |

|

| 500,000 |

Philadelphia Authority for Industrial Development, 5.50%, 6/1/49 (144A) |

$ 500,580 |

| 1,000,000 |

Philadelphia Authority for Industrial Development, Global Leadership Academy Charter School Project, Series A, 5.00%, 11/15/50 |

724,670 |

| |

Total Pennsylvania |

$1,225,250 |

|

|

| |

Rhode Island — 27.4% |

|

| 5,900,000(a) |

Central Falls Detention Facility Corp., 7.25%, 7/15/35 |

$2,360,000 |

| |

Total Rhode Island |

|

|

|

| |

Texas — 17.3% |

|

| 490,000 |

Arlington Higher Education Finance Corp., LTTS Charter School, Universal Academy, 5.45%, 3/1/49 (144A) |

$ 484,277 |

| 1,000,000 |

Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.00%, 3/1/34 |

1,002,140 |

| |

Total Texas |

$1,486,417 |

|

|

| |

Total Municipal Bonds

(Cost $9,737,118) |

$5,953,125 |

|

|

| |

TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 69.1%

(Cost $9,737,118) |

$5,953,125 |

| |

OTHER ASSETS AND LIABILITIES — 30.9% |

$2,662,977 |

| |

net assets — 100.0% |

$8,616,102 |

| |

|

|

|

|

|

|

| (144A) |

The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At October 31, 2025, the value of these securities amounted to $984,857, or 11.4% of net assets applicable to common stockholders. |

| (a) |

Security is in default. |

| * |

The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8). Information shown in the Schedule of Investments reflects remaining investments held by the Fund at October 31, 2025. |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

3

Schedule of Investments | 10/31/25*

The concentration of investments as a percentage of total investments by type of obligation/market sector is as follows:

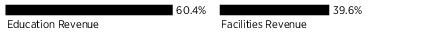

Revenue Bonds: |

|

| Education Revenue |

60.4% |

| Facilities Revenue |

39.6 |

| |

100.0% |

Purchases and sales of securities (excluding short-term investments and all derivative contracts except for options purchased) for the six months ended October 31, 2025, aggregated $44,303,962 and $287,712,453, respectively.

At October 31, 2025, the net unrealized depreciation on investments based on cost for federal tax purposes of $8,705,969 was as follows:

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost |

$18,706 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value |

(2,771,550) |

| Net unrealized depreciation |

$(2,752,844) |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

| Level 1 |

– |

unadjusted quoted prices in active markets for identical securities. |

| Level 2 |

– |

other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A. |

| Level 3 |

– |

significant unobservable inputs (including the Adviser’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A. |

The following is a summary of the inputs used as of October 31, 2025 in valuing the Fund’s investments:

| |

Level 1 |

Level 2 |

Level 3 |

Total |

| Municipal Bonds |

$— |

$5,953,125 |

$— |

$5,953,125 |

Total Investments in Securities |

|

|

|

|

During the period ended October 31, 2025, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

4

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

Statement of Assets and Liabilities | 10/31/25*

ASSETS: |

|

| Investments in unaffiliated issuers, at value (cost $9,737,118) |

$5,953,125 |

| Cash |

2,702,260 |

| Receivables — |

|

| Interest |

71,629 |

| Other assets |

104 |

Total assets |

|

LIABILITIES: |

|

| Payables — |

|

| Directors’ fees |

$797 |

| Professional fees |

54,002 |

| Transfer agent fees |

2,135 |

| Reimbursement of costs** |

4,361 |

| Administrative expenses |

22,906 |

| Accrued expenses |

26,815 |

Total liabilities |

|

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: |

|

| Paid-in capital |

$299,230,912 |

| Distributable earnings (loss) |

(290,614,810) |

Net assets |

|

NET ASSET VALUE PER COMMON SHARE: |

|

| Based on $8,616,102/22,771,349 common shares |

$0.38 |

* The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8).

** Reimbursement to Victory Capital for costs incurred under interim advisory agreement and liquidation agreement (see Notes to Financial Statements, Note 2).

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

5

Statement of Operations

(unaudited)

FOR THE SIX MONTHS ENDED 10/31/25

*

INVESTMENT INCOME: |

|

|

| Interest from unaffiliated issuers |

$3,702,636 |

|

| Total Investment Income |

|

|

EXPENSES: |

|

|

| Reimbursement of costs** |

$428,361 |

|

| Administrative expenses |

40,209 |

|

| Transfer agent fees |

6,852 |

|

| Stockholder communications expense |

13,825 |

|

| Custodian fees |

82 |

|

| Professional fees |

12,265 |

|

| Printing expense |

2,664 |

|

| Officers’ and Directors’ fees |

3,770 |

|

| Insurance expense |

3,003 |

|

| Interest expense |

759,454 |

|

| Miscellaneous |

33,925 |

|

| Total expenses |

|

$1,304,410 |

| Net investment income |

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: |

|

|

| Net realized gain (loss) on: |

|

|

| Investments in unaffiliated issuers |

$(15,504,055) |

|

| Futures contracts |

(274,153) |

$(15,778,208) |

| Change in net unrealized appreciation (depreciation) on: |

|

|

| Investments in unaffiliated issuers |

$2,486,353 |

|

| Futures contracts |

(51,427) |

$2,434,926 |

| Net realized and unrealized gain (loss) on investments |

|

$(13,343,282) |

| Net decrease in net assets resulting from operations |

|

|

* The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8).

** Reimbursement to Victory Capital for costs incurred under interim advisory agreement and liquidation agreement (see Notes to Financial Statements, Note 2).

The accompanying notes are an integral part of these financial statements.

6

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

Statements of Changes in Net Assets

*

| |

Six Months

Ended

10/31/25

(unaudited) |

Year

Ended

4/30/25 |

FROM OPERATIONS: |

|

|

| Net investment income (loss) |

$2,398,226 |

$10,231,623 |

| Net realized gain (loss) on investments |

(15,778,208) |

(8,379,611) |

| Change in net unrealized appreciation (depreciation) on investments |

2,434,926 |

3,444,904 |

| Net increase (decrease) in net assets resulting from operations |

|

|

DISTRIBUTIONS TO COMMON STOCKHOLDERS: |

|

|

| ($8.69 and $0.42 per share, respectively) |

$(197,927,769) |

$(9,563,967) |

| Total distributions to common stockholders |

$(197,927,769) |

$(9,563,967) |

Net decrease in net assets applicable to common stockholders |

$(208,872,825) |

|

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: |

|

|

| Beginning of period |

$217,488,927 |

$221,755,978 |

| End of period |

|

$217,488,927 |

* The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8).

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

7

Statement of Cash Flows (unaudited)

FOR THE SIX MONTHS ENDED 10/31/25*

Cash Flows From Operating Activities |

|

| Net decrease in net assets resulting from operations |

$(10,945,056) |

Adjustments to reconcile net increase in net assets resulting from operations to net cash and restricted cash from operating activities: |

|

| Purchases of investment securities |

$(52,444,561) |

| Proceeds from disposition and maturity of investment securities |

295,107,837 |

| Net sales of short term investments |

47,251 |

| Net accretion and amortization of discount/premium on investment securities |

(232,866) |

| Net realized loss on investments in unaffiliated issuers |

15,504,055 |

| Change in unrealized appreciation on investments in unaffiliated issuers |

(2,486,353) |

| Decrease in due from broker for futures |

38,063 |

| Decrease in interest receivable |

4,339,951 |

| Decrease in distributions paid in advance |

796,997 |

| Decrease in variation margin for futures contracts |

(38,063) |

| Decrease in management fees payable |

(127,572) |

| Increase in directors’ fees payable |

30 |

| Increase in professional fees payable |

54,002 |

| Increase in transfer agent fees payable |

2,135 |

| Decrease in administrative expenses payable |

(13,336) |

| Decrease in accrued expenses payable |

(107,377) |

| Net cash and restricted cash from operating activities |

$249,495,137 |

Cash Flows Used In Financing Activities: |

|

| VMTP Shares Redeemed |

(50,000,000) |

| Distributions to stockholders |

(198,724,766) |

| Net cash flows used in financing activities |

$(248,724,766) |

NET INCREASE (DECREASE) IN CASH AND RESTRICTED CASH |

$770,371 |

Cash and Restricted Cash: |

|

| Beginning of period** |

$1,931,889 |

| End of period** |

$2,702,260 |

Cash Flow Information: |

|

| Cash paid for interest |

$759,454 |

The accompanying notes are an integral part of these financial statements

8

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

| |

Six Months

Ended

10/31/25 |

Year Ended

4/30/25 |

| Cash |

$2,702,260 |

$1,043,151 |

| Restricted cash |

— |

888,738 |

Total cash and restricted cash shown in the Statement of Cash Flows |

$2,702,260 |

$1,931,889 |

* The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8).

** The table above provides a reconciliation of cash and restricted cash reported within the Statement of Assets and Liabilities that sum to the total of the same such amounts shown in the Statement of Cash Flows.

The accompanying notes are an integral part of these financial statements

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

9

| |

Six Months

Ended

10/31/25

(unaudited) |

Year

Ended

4/30/25 |

Year

Ended

4/30/24 |

Year

Ended

4/30/23 |

Year

Ended

4/30/22 |

Year

Ended

4/30/21 |

Per Share Operating Performance |

|

|

|

|

|

|

| Net asset value, beginning of period |

$9.55 |

$9.74 |

$10.17 |

$10.90 |

$13.14 |

$12.31 |

| Increase (decrease) from investment operations:(a) |

|

|

|

|

|

|

| Net investment income (loss)(b) |

$0.11 |

$0.45 |

$0.35 |

$0.40 |

$0.53 |

$0.55 |

| Net realized and unrealized gain (loss) on investments |

(0.59) |

(0.22) |

(0.42) |

(0.61) |

(2.29) |

0.87 |

Net increase (decrease) from investment operations |

|

|

|

|

|

|

| Distributions to stockholders: |

|

|

|

|

|

|

Net investment income and previously undistributed net

investment income |

$(8.69)** |

$(0.42) |

$(0.35) |

$(0.46)** |

$(0.48) |

$(0.59)** |

| Tax return of capital |

— |

— |

(0.01) |

(0.06) |

— |

— |

Total distributions |

|

|

|

|

|

|

Net increase (decrease) in net asset value |

|

|

|

|

|

|

| Net asset value, end of period |

$0.38 |

$9.55 |

$9.74 |

$10.17 |

$10.90 |

$13.14 |

| Market value, end of period |

$0.00 |

$9.12 |

$8.49 |

$8.78 |

$9.57 |

$12.61 |

Total return at net asset value(c) |

(2.56)%(d) |

2.53% |

(0.02)%(e) |

(1.17)% |

(13.64)% |

12.04% |

Total return at market value(c) |

0.00%(d) |

12.33% |

0.95% |

(2.82)% |

(20.99)% |

22.33% |

| Ratios to average net assets of common stockholders: |

|

|

|

|

|

|

| Total expenses plus interest expense(f)(g) |

1.88%(h) |

2.22% |

4.16% |

3.15% |

1.56% |

1.62% |

| Net investment income |

3.46%(h) |

4.49% |

3.61% |

3.95% |

4.15% |

4.22% |

| Portfolio turnover rate |

33% |

43% |

35% |

60% |

11% |

10% |

| Net assets of common stockholders, end of period (in thousands) |

$8,616 |

$217,489 |

$221,756 |

$231,560 |

$248,284 |

$299,280 |

| Preferred shares outstanding (in thousands)(i)(j)(k)(l)(m) |

$— |

$50,000 |

$50,000 |

$129,000 |

$145,000 |

$145,000 |

| Asset coverage per preferred share, end of period |

$— |

$534,978 |

$543,512 |

$279,504 |

$271,230 |

$306,399 |

| Average market value per preferred share(n) |

$— |

$100,000 |

$100,000 |

$100,000 |

$100,000 |

$100,000 |

The accompanying notes are an integral part of these financial statements.

10

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

| |

Six Months

Ended

10/31/25

(unaudited) |

Year

Ended

4/30/25 |

Year

Ended

4/30/24 |

Year

Ended

4/30/23 |

Year

Ended

4/30/22 |

Year

Ended

4/30/21 |

Liquidation value, including interest expense payable,

per preferred share |

$— |

$100,000 |

$100,000 |

$100,000 |

$100,000 |

$99,999 |

| * |

The Fund is in the process of liquidating its assets pursuant to the Plan of Liquidation and Dissolution approved by stockholders at a meeting held on July 17, 2025 (see Notes to Financial Statements, Note 8). |

| ** |

The amount of distributions made to stockholders during the year were in excess of the net investment income earned by the Fund during the period. The Fund has accumulated undistributed net investment income which is part of the Fund’s NAV. A portion of the accumulated net investment income was distributed to stockholders during the period. A decrease in distributions may have a negative effect on the market value of the Fund's shares. |

| (a) |

The per common share data presented above is based upon the average common shares outstanding for the periods presented. |

| (b) |

Beginning April 30, 2020, distribution payments to preferred stockholders are included as a component of net investment income. |

| (c) |

Total investment return is calculated assuming a purchase of common shares at the current net asset value or market value on the first day and a sale at the current net asset value or market value on the last day of the periods reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. Past performance is not a guarantee of future results. |

| (d) |

Not annualized. |

| (e) |

For the year ended April 30, 2024, the Fund’s total return includes a reimbursement by the Advisor (see Notes to the Financial Statements-Note 1B). If the Fund had not been reimbursed by the Advisor the total return would have been (0.12)%. |

| (f) |

Includes interest expense of 1.10%, 2.86%, 1.94%, 0.45%, 0.47% and 1.10%, respectively. |

| (g) |

Prior to April 30, 2020, the expense ratios do not reflect the effect of distribution payments to preferred stockholders. |

| (h) |

Annualized. |

| (i) |

The Fund issued 200 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on February 16, 2021. |

| (j) |

The Fund redeemed 160 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on November 14, 2022. |

| (k) |

The Fund redeemed 155 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on October 11, 2023. |

| (l) |

The Fund redeemed 635 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on February 29, 2024. |

| (m) |

The Fund redeemed 500 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on August 18, 2025. |

| (n) |

Market value is redemption value without an active market. |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

11

Notes to Financial Statements | 10/31/25

1. Organization and Significant Accounting Policies

Pioneer Municipal High Income Fund, Inc. (the “Fund”) is organized as a Maryland corporation. Prior to April 21, 2021, the Fund was organized as a Delaware statutory trust. On April 21, 2021, the Fund redomiciled to a Maryland corporation through a statutory merger of the predecessor Delaware statutory trust with and into a newly-established Maryland corporation formed for the purpose of effecting the redomiciling. The Fund was originally organized on March 13, 2003. Prior to commencing operations on July 21, 2003, the Fund had no operations other than matters relating to its organization and registration as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act"). Since July 17, 2025, the Fund has been operating under a Plan of Liquidation and Dissolution, and is in the process of winding up its business and affairs, paying its liabilities and distributing its remaining assets to stockholders (see Note 8). Accordingly, the Fund no longer pursues its stated investment objective, complies with its investment limitations or engages in normal business activities. Prior to the Fund's liquidation, the investment objective of the Fund was to seek a high level of current income exempt from regular federal income tax, and the Fund could, as a secondary objective, also seek capital appreciation to the extent that it was consistent with the Fund's primary investment objective.

Prior to April 1, 2025, Amundi Asset Management US, Inc., an indirect, wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., served as the Fund’s investment adviser ("Amundi US"). From April 1, 2025 through August 29, 2025, Victory Capital Management Inc. ("Victory Capital" or the "Adviser") served as the Fund's investment adviser. See Note 2.

During the periods covered by these financial statements, the Fund complied with Rule 18f-4 under the 1940 Act, which governs the use of derivatives by registered investment companies. Rule 18f-4 permits funds to enter into derivatives transactions (as defined in Rule 18f-4) and certain other transactions notwithstanding the restrictions on the issuance of “senior securities” under Section 18 of the 1940 Act. Rule 18f-4 requires a Fund to establish and maintain a comprehensive derivatives risk management program, appoint a derivatives risk manager and comply with a relative or absolute limit on fund leverage risk calculated based on value-at-risk (“VaR”), unless the fund uses derivatives in only a limited manner (a "limited derivatives user"). The Fund is currently a limited derivatives user for purposes of Rule 18f-4.

12

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

The Fund adopted Financial Accounting Standards Board Update 2023-07, Segment Reporting (Topic 280) - Improvements to Reportable Segment Disclosures (ASU 2023-07) during the period. The Fund’s adoption of the new standard impacted financial statement disclosures only and did not affect the Fund’s financial position or results of operations. The management committee of the Fund’s investment adviser acts as the Fund’s Chief Operations Decision Maker (CODM), which assesses performance and allocates resources with respect to the Fund. The Fund’s operations constitute a single operating segment and therefore, a single reportable segment, because the Fund has a single investment strategy as disclosed in its prospectus, against which the CODM manages the business activities using information of the Fund as a whole, and assesses performance of the Fund. The financial information provided to and reviewed by the CODM is the same as that presented within the Fund’s financial statements.

On December 14, 2023, the Financial Accounting Standards Board (FASB) issued ASU 2023-09, which establishes new income tax disclosure requirements and modifies or eliminates certain existing disclosure provisions. The amendments in this ASU are intended to address investor requests for more transparency about income tax information and to improve the effectiveness of income tax disclosures. ASU 2023-09 applies to all entities that are subject to ASC 740, Income Taxes. The ASU is effective for annual periods beginning after December 15, 2024. Management is currently evaluating the impact of ASU 2023-09 and does not believe it will have a material impact on the Fund’s financial statements.

The Fund is a series portfolio of a registered investment company and follows investment company accounting and reporting guidance under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

A. |

Security Valuation |

| |

The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE. |

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

13

| |

Fixed income securities are valued by using prices supplied by independent pricing services, which consider such factors as market prices, market events, quotations from one or more brokers, Treasury spreads, yields, maturities and ratings, or may use a pricing matrix or other fair value methods or techniques to provide an estimated value of the security or instrument. A pricing matrix is a means of valuing a debt security on the basis of current market prices for other debt securities, historical trading patterns in the market for fixed income securities and/or other factors. Non-U.S. debt securities that are listed on an exchange will be valued at the bid price obtained from an independent third party pricing service. When independent third party pricing services are unable to supply prices, or when prices or market quotations are considered to be unreliable, the value of that security may be determined using quotations from one or more broker-dealers. |

| |

Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser. The Adviser is designated as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Adviser's fair valuation team is responsible for monitoring developments that may impact fair valued securities. |

| |

Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Adviser may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund’s net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity, tariffs, or trading halts. Thus, the valuation of the Fund’s securities may differ significantly from exchange prices, and such differences could be material. |

B. |

Investment Income and Transactions |

| |

Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities. |

| |

Discounts and premiums on purchase prices of debt securities are accreted or amortized, respectively, daily, into interest income on an effective yield to maturity basis with a corresponding increase or |

14

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

| |

decrease in the cost basis of the security. Premiums and discounts related to certain mortgage-backed securities are amortized or accreted in proportion to the monthly paydowns. |

| |

Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively. |

| |

Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes. |

C. |

Federal Income Taxes |

| |

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its stockholders. Therefore, no provision for federal income taxes is required. As of October 31, 2025, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities. |

| |

The amount and character of income and capital gain distributions to stockholders are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences. |

| |

At April 30, 2025, the Fund was permitted to carry forward indefinitely $5,789,143 of short-term losses and $70,410,041 of long-term losses. |

| |

The tax character of current year distributions payable will be determined at the end of the current taxable year. The tax character of distributions paid during the year ended April 30, 2025 was as follows: |

| |

2025 |

Distributions paid from: |

|

| Tax-exempt income |

$12,198,899 |

| Ordinary income |

202,441 |

Total |

$12,401,340 |

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

15

The following shows the components of distributable earnings (losses) on a federal income tax basis at April 30, 2025:

| |

2025 |

Distributable earnings/(losses): |

|

| Undistributed tax-exempt income |

$493,393 |

| Capital loss carryforward |

(76,199,184) |

| Other book/tax temporary differences |

(796,997) |

| Net unrealized depreciation |

(5,239,197) |

Total |

$(81,741,985) |

The difference between book-basis and tax-basis unrealized depreciation is primarily attributable to the tax adjustments relating to wash sales, the book/tax differences in the accrual of income on securities in default, and discounts on fixed income securities.

D. |

Automatic Dividend Reinvestment Plan |

| |

Prior to the Fund's liquidation (See Note 8), all stockholders whose shares are registered in their own names automatically participated in the Automatic Dividend Reinvestment Plan (the “Plan”), under which participants received all dividends and capital gain distributions (collectively, dividends) in full and fractional shares of the Fund in lieu of cash. |

| |

Whenever the Fund declared a dividend on shares payable in cash, participants in the Plan received the equivalent in shares acquired by Equiniti Trust Company, the agent for stockholders in administering the Plan (the “Plan Agent”) either (i) through receipt of additional unissued but authorized shares from the Fund or (ii) by purchase of outstanding shares on the New York Stock Exchange or elsewhere. If, on the payment date for any dividend, the net asset value per share was equal to or less than the market price per share plus estimated brokerage trading fees (market premium), the Plan Agent invested the dividend amount in newly issued shares. The number of newly issued shares credited to each account was determined by dividing the dollar amount of the dividend by the net asset value per share on the date the shares were issued, provided that the maximum discount from the then current market price per share on the date of issuance did not exceed 5%. If, on the payment date for any dividend, the net asset value per share was greater than the market value (market discount), the Plan Agent invested the dividend amount in shares acquired in open-market purchases. Each participant paid a pro rata share of brokerage trading fees incurred with respect to the Plan Agent’s open-market purchases. Participating in the Plan did not relieve stockholders from any federal, state or local taxes which may be due on dividends paid in any taxable year. |

16

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

E. |

Risks |

| |

Prior to the Fund's liquidation (See Note 8), the Fund invested substantially all of its assets in municipal securities. The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated securities. Liquidity can be reduced unpredictably in response to overall economic conditions or credit tightening. Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities, potentially resulting in defaults. Issuers often depend on revenues from these projects to make principal and interest payments. The value of municipal securities can also be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory and political developments, tax law changes or other legislative actions, and by uncertainties and public perceptions concerning these and other factors. Municipal securities may be more susceptible to down-grades or defaults during recessions or similar periods of economic stress. Financial difficulties of municipal issuers may continue or get worse, particularly in the event of economic or market turmoil or a recession. To the extent the Fund invests significantly in a single state (including California and Massachusetts), city, territory (including Puerto Rico), or region, or in securities the payments on which are dependent upon a single project or source of revenues, or that relate to a sector or industry, including health care facilities, education, transportation, special revenues and pollution control, the Fund will be more susceptible to associated risks and developments. |

| |

The Fund invested in below investment grade (high yield) municipal securities. Debt securities rated below investment grade are commonly referred to as “junk bonds” and are considered speculative with respect to the issuer’s capacity to pay interest and repay principal. These securities involve greater risk of loss, are subject to greater price volatility, and may be less liquid and more difficult to value, especially during periods of economic uncertainty or change, than higher rated debt securities. |

| |

The market prices of the Fund’s fixed income securities may fluctuate significantly when interest rates change. The value of your investment will generally go down when interest rates rise. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. For example, if interest rates increase by 1%, the value of a Fund’s |

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

17

| |

portfolio with a portfolio duration of ten years would be expected to decrease by 10%, all other things being equal. A general rise in interest rates could adversely affect the price and liquidity of fixed income securities. The maturity of a security may be significantly longer than its effective duration. A security’s maturity and other features may be more relevant than its effective duration in determining the security’s sensitivity to other factors affecting the issuer or markets generally, such as changes in credit quality or in the yield premium that the market may establish for certain types of securities (sometimes called “credit spread”). In general, the longer its maturity the more a security may be susceptible to these factors. When the credit spread for a fixed income security goes up, or “widens”, the value of the security will generally go down. |

| |

If an issuer or guarantor of a security held by the Fund or a counterparty to a financial contract with the Fund defaults on its obligation to pay principal and/or interest, has its credit rating downgraded or is perceived to be less creditworthy, or the credit quality or value of any underlying assets declines, the value of your investment will typically decline. Changes in actual or perceived creditworthiness may occur quickly. The Fund could be delayed or hindered in its enforcement of rights against an issuer, guarantor or counterparty. |

F. |

Statement of Cash Flows |

| |

Information on financial transactions which have been settled through the receipt or disbursement of cash or restricted cash is presented in the Statement of Cash Flows. Cash as presented in the Fund’s Statement of Assets and Liabilities includes cash on hand at the Fund’s custodian bank and does not include any short-term investments. As of and for the six months ended October 31, 2025, the Fund had no restricted cash presented on the Statement of Assets and Liabilities. |

G. |

Futures Contracts |

| |

Prior to the Fund's liquidation (See Note 8), the Fund entered into futures transactions in order to attempt to hedge against changes in interest rates, securities prices and currency exchange rates or to seek to increase total return. Futures contracts are types of derivatives. Investments in futures contracts to increase total returns may be considered speculative. |

| |

All futures contracts entered into by the Fund are traded on a futures exchange. Upon entering into a futures contract, the Fund is required to deposit with a broker an amount of cash or securities equal to the minimum “initial margin” requirements of the associated futures |

18

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

| |

exchange. The amount of cash deposited with the broker as collateral at October 31, 2025 is recorded as “Futures collateral” on the Statement of Assets and Liabilities. |

| |

Subsequent payments for futures contracts (“variation margin”) are paid or received by the Fund, depending on the daily fluctuation in the value of the contracts, and are recorded by the Fund as unrealized appreciation or depreciation. Cash received from or paid to the broker related to previous margin movement is held in a segregated account at the broker and is recorded as either “Due from broker for futures” or “Due to broker for futures” on the Statement of Assets and Liabilities. When the contract is closed, the Fund realizes a gain or loss equal to the difference between the opening and closing value of the contract as well as any fluctuation in foreign currency exchange rates where applicable. Futures contracts are subject to market risk, interest rate risk and currency exchange rate risk. Changes in value of the contracts may not directly correlate to the changes in value of the underlying securities. With futures, there is reduced counterparty credit risk to the Fund since futures are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees the futures against default. |

| |

The average notional values of long position and short position futures contracts during the six months ended October 31, 2025 were $3,364,983 and $0, respectively. There were no open futures contracts outstanding at October 31, 2025. |

2. Investment Advisory Agreement

The Fund's investment adviser manages the Fund’s portfolio. Prior to April 1, 2025, Amundi US served as the Fund's investment adviser. Management fees payable under the Fund’s Investment Management Agreement with the Adviser were calculated daily and paid monthly at the annual rate of 0.60% of the Fund’s average daily managed assets. “Managed assets” means (a) the total assets of the Fund, including any form of investment leverage, minus (b) all accrued liabilities incurred in the normal course of operations, which shall not include any liabilities or obligations attributable to investment leverage obtained through (i) indebtedness of any type (including, without limitation, borrowing through a credit facility or the issuance of debt securities), (ii) the issuance of preferred stock or other similar preference securities, and/or (iii) any other means.

From April 1, 2025 until August 29, 2025, Victory Capital served as the Fund's investment adviser under an interim investment advisory agreement

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

19

(the “Interim Advisory Agreement"). Victory Capital was paid its costs incurred in performing its services under the Interim Advisory Agreement.

Stockholders of the Fund approved the liquidation of the Fund pursuant to a Plan of Liquidation and Dissolution at a meeting of stockholders held on July 17, 2025. Since that date, the Fund has been operating under the Plan of Liquidation and Dissolution, and is in the process of winding up its business and affairs, paying its liabilities and distributing its remaining assets to stockholders. The Fund entered into a Liquidation Agreement with Victory Capital as of August 29, 2025 in connection with the liquidation of the Fund. Pursuant to the Liquidation Agreement, the Fund shall reimburse Victory Capital for any costs incurred by Victory Capital in connection with the liquidation of the Fund.

Reflected on the Statement of Assets and Liabilities is $4,361 payable to Victory Capital at October 31, 2025 as reimbursement of costs incurred under the Interim Advisory Agreement and the Liquidation Agreement.

Effective April 1, 2025, Victory Capital also serves as the Fund’s administrator and fund accountant. Under the Administration and Fund Accounting Agreement, Victory Capital is paid an administration and servicing fee based on a percentage of the average daily net assets of the Fund. The tiered rates at which Victory Capital is paid by the Fund are shown in the table below:

Net Assets |

|

Up to $15

billion |

$15 billion to $30

billion |

$30 billion to $85

billion |

In excess of $85

billion |

|

| 0.08% |

0.05% |

0.04% |

0.03% |

|

Amounts incurred for the six months ended October 31, 2025, are reflected on the Statement of Operations in Administration expenses.

Bank of New York Mellon (“BNY”) acts as sub-administrator and sub-fund accountant to the Fund pursuant to a Sub-Administration and Sub-Fund Accounting Services Agreement between Victory Capital and BNY. Victory Capital pays BNY a fee for providing these services.

The Fund reimburses Victory Capital and BNY for out-of-pocket expenses incurred in providing these services and certain other expenses specifically allocated to the Fund. Amounts incurred for the six months ended October 31, 2025, are reflected on the Statement of Operations as Administration expenses.

3. Compensation of Officers and Directors

The Fund pays an annual fee to its Directors. The Adviser reimburses the Fund for fees paid to the Interested Directors. Except for the chief

20

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

compliance officer, the Fund does not pay any salary or other compensation to its officers. The Fund pays a portion of the chief compliance officer’s compensation for his services as the Fund’s chief compliance officer. Amundi US pays the remaining portion of the chief compliance officer’s compensation. For the six months ended October 31, 2025, the Fund paid $3,770 in Officers’ and Directors’ compensation, which is reflected on the Statement of Operations as Officers’ and Directors’ fees. At October 31, 2025, on its Statement of Assets and Liabilities, the Fund had a payable for Directors’ fees of $797 and a payable for administrative expenses of $22,906, which includes the payable for Officers’ compensation.

During the periods covered by these financial statements, Equiniti Trust Company, LLC ("EQ"), formerly known as American Stock Transfer & Trust Company, served as the transfer agent with respect to the Fund’s common shares. The Fund pays EQ an annual fee as is agreed to from time to time by the Fund and EQ for providing such services.

In addition, during the periods covered by the financial statements, the Fund reimbursed the transfer agent for out-of-pocket expenses incurred by the transfer agent related to stockholder communications activities such as proxy and statement mailings and outgoing phone calls.

5. Additional Disclosures about Derivative Instruments and Hedging Activities

Prior to the Fund's liquidation (See Note 8), the Fund entered into certain derivative contracts. The Fund’s use of derivatives may enhance or mitigate the Fund’s exposure to the following risks:

Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates.

Credit risk relates to the ability of the issuer of a financial instrument to make further principal or interest payments on an obligation or commitment that it has to the Fund.

Foreign exchange rate risk relates to fluctuations in the value of an asset or liability due to changes in currency exchange rates.

Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange rate risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

21

Commodity risk relates to the risk that the value of a commodity or commodity index will fluctuate based on increases or decreases in the commodities market and factors specific to a particular industry or commodity.

The effect of derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) on the Statement of Operations and Statement of Cash Flows by risk exposure at October 31, 2025, was as follows:

Statement of Operations |

Interest

Rate Risk |

Credit

Risk |

Foreign

Exchange

Rate Risk |

Equity

Risk |

Commodity

Risk |

Net Realized Gain (Loss) on |

|

|

|

|

|

| Futures contracts |

$(274,153) |

$— |

$— |

$— |

$— |

Total Value |

$(274,153) |

$— |

$— |

$— |

$— |

Change in Net Unrealized Appreciation (Depreciation) on |

|

|

|

|

|

| Futures contracts |

$(51,427) |

$— |

$— |

$— |

$— |

| Total Value |

$(51,427) |

$— |

$— |

$— |

$— |

There are 1,000,000,000 shares of common stock of the Fund (“common shares”), $0.001 par value per share authorized.

Transactions in common shares for the six months ended October 31, 2025 and year ended April 30, 2025 were as follows:

| |

10/31/25 |

4/30/25 |

| Shares outstanding at beginning of period |

22,771,349 |

22,771,349 |

Shares outstanding at end of period |

22,771,349 |

22,771,349 |

The Fund may classify or reclassify any unissued shares into one or more series of preferred shares.

As of October 31, 2025, the Fund had no outstanding Variable Rate MuniFund Term Preferred Shares Series 2021 (“Series 2021 VMTP Shares or “VMTP Shares”). The Fund issued 1,250 VMTP Shares on February 9, 2018 and 200 VMTP Shares on February 16, 2021. The Fund redeemed 160 VMTP Shares on November 14, 2022, 155 VMTP Shares on October 11, 2023, 635 VMTP Shares on February 29, 2024 and 500 VMTP Shares on August 18, 2025.

7. Variable Rate MuniFund Term Preferred Shares

Prior to the Fund's liquidation (see Note 8), the Fund had issued and outstanding 500 Series 2021 VMTP Shares, with a liquidation preference of $100,000 per share. VMTP Shares were issued via private placement and

22

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

were not publicly available. The Fund redeemed all of its outstanding VMTP shares on August 18, 2025 in connection with the liquidation of the Fund.

Dividends on the VMTP Shares (which were treated as interest payments for financial reporting purposes and were recorded as interest expense on the Statement of Operations) were declared daily, paid monthly and recorded as incurred. For the six months ended October 31, 2025, interest expense on VMTP Shares amounted to $759,454. The dividend rate for the VMTP Shares was determined weekly. Unpaid dividends on VMTP Shares were recognized as “Interest Expense Payable” on the Statement of Assets and Liabilities. For the six months ended October 31, 2025, there was no interest expense payable on VMTP Shares. From May 1, 2024 through April 30, 2025, the Series 2021 VMTP Shares paid an average dividend rate of 5.00%. The average liquidation value outstanding of VMTP Shares for the Fund during the six months ended October 31, 2025, was $50,000,000.

The Fund did not incur any offering costs as a result of the offering on February 16, 2021.

Transactions in the Series 2021 VMTP Shares during the Fund’s current and

prior reporting periods were as follows:

| |

Period Ended 10/31/25 |

Year Ended 4/30/25 |

| |

Shares |

Amount |

Shares |

Amount |

| VMTP Shares issued |

— |

$— |

— |

$— |

| VMTP Shares redeemed |

(500) |

(50,000,000) |

— |

— |

| Net decrease |

(500) |

$(50,000,000) |

— |

$— |

8. Plan of Liquidation and Dissolution

Stockholders of the Fund approved the liquidation of the Fund pursuant to a Plan of Liquidation and Dissolution at a meeting of stockholders held on July 17, 2025. Since that date, the Fund has been operating under the Plan of Liquidation and Dissolution, and is in the process of winding up its business and affairs, paying its liabilities and distributing its remaining assets to stockholders. Accordingly, the Fund no longer pursues its stated investment objective, complies with its investment limitations or engages in normal business activities. Prior to the opening of business on August 25, 2025, the Fund ceased trading on the New York Stock Exchange (NYSE). The Fund's NYSE ticker symbol was MHI.

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

23

A primary liquidating distribution was paid in cash on August 27, 2025. to common stockholders of record on August 22, 2025:

Liquidating

Distribution* |

Tax-Exempt Income Distribution * |

Taxable Ordinary Income Distribution * |

|

| $8.5497 |

$0.0000 |

$0.0372 |

$8.5870 |

(*All amounts are expressed per common share.)

The Fund expects to make one or more additional liquidating distributions in connection with the liquidation of the remaining assets of the Fund. The liquidation is generally a taxable event for stockholders that are subject to U.S. federal income tax. Any stockholder that receives a distribution in a liquidation will generally realize capital gain or loss in an amount equal to the difference between the total amount of the liquidation distribution(s) received and the stockholder's adjusted basis in the Fund shares. Please consult your personal tax advisor with regard to the specific tax consequences of the liquidation.

24

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

Results of Special Stockholder Meeting

A Special Meeting of Stockholders of Pioneer Municipal High Income Fund, Inc. was held on July 17, 2025 to approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation and Dissolution as described in the Joint Proxy Statement.

The voting results were as follows:

Fund |

Total Votes |

Votes For |

Votes

Against |

Votes

Abstained |

| Pioneer Municipal High Income Fund, Inc. |

14,694,511 |

13,960,429 |

574,029 |

160,053 |

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

25

Investment Adviser and Administrator

Victory Capital Management Inc.

Custodian and Sub-Administrator

The Bank of New York Mellon Corporation

Independent Registered Public Accounting Firm

Deloitte & Touche LLP

Legal Counsel

Morgan, Lewis & Bockius LLP

Transfer Agent

Equiniti Trust Company, LLC

Proxy Voting Policies and Procedures of the Fund

are available without charge, upon request, by calling our toll free number (1-800-225-6292). Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is publicly available to stockholders at www.pioneerinvestments.com. This information is also available on the Securities and Exchange Commission’s web site at www.sec.gov.

26

Pioneer Municipal High Income Fund, Inc. |

Semi-Annual

|

10/31/25

How to Contact Victory Capital

We are pleased to offer a variety of convenient ways for you to contact us for assistance or information.

You can call Equiniti Trust Company, LLC (EQ) for:

Account Information

1-800-710-0935

Equiniti Trust

Company, LLC

Operations Center

6201 15th Ave.

Brooklyn, NY 11219

Website

https://equiniti.com/us

For additional information, please contact your investment adviser or visit our web site www.pioneerinvestments.com.

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Stockholders may view the filed Form N-PORT by visiting the Commission’s web site at https://www.sec.gov.

Victory Capital Management Inc.

60 State Street

Boston, MA 02109

© 2025 Victory Capital Management Inc. 19442-SFR-1225

ITEM 2. CODE OF ETHICS.

(a) Disclose whether, as of the end of the period covered by the report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. If the registrant has not adopted such a code of ethics, explain why it has not done so.

The registrant has adopted, as of the end of the period covered by this report, a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer and controller.

(b) For purposes of this Item, the term “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;

(3) Compliance with applicable governmental laws, rules, and regulations;

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.

(c) The registrant must briefly describe the nature of any amendment, during the period covered by the report, to a provision of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item. The registrant must file a copy of any such amendment as an exhibit pursuant to Item 19(a), unless the registrant has elected to satisfy paragraph (f) of this Item by posting its code of ethics on its website pursuant to paragraph (f)(2) of this Item, or by undertaking to provide its code of ethics to any person without charge, upon request, pursuant to paragraph (f)(3) of this Item.

The registrant has made no amendments to the code of ethics during the period covered by this report.

(d) If the registrant has, during the period covered by the report, granted a waiver, including an implicit waiver, from a provision of the code of ethics to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this Item, the registrant must briefly describe the nature of the waiver, the name of the person to whom the waiver was granted, and the date of the waiver.

Not applicable.

(e) If the registrant intends to satisfy the disclosure requirement under paragraph (c) or (d) of this Item regarding an amendment to, or a waiver from, a provision of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item by posting such information on its Internet website, disclose the registrant’s Internet address and such intention.

Not applicable.

(f) The registrant must:

(1) File with the Commission, pursuant to Item 19(a)(1), a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, as an exhibit to its annual report on this Form N-CSR (see attachment);

(2) Post the text of such code of ethics on its Internet website and disclose, in its most recent report on this Form N-CSR, its Internet address and the fact that it has posted such code of ethics on its Internet website; or

(3) Undertake in its most recent report on this Form N-CSR to provide to any person without charge, upon request, a copy of such code of ethics and explain the manner in which such request may be made. See Item 19(2)

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

(a) (1) Disclose that the registrant’s Board of Directors has determined that the registrant either:

(i) Has at least one audit committee financial expert serving on its audit committee; or

(ii) Does not have an audit committee financial expert serving on its audit committee.

The registrant’s Board of Directors has determined that the registrant has at least one audit committee financial expert.

(2) If the registrant provides the disclosure required by paragraph (a)(1)(i) of this Item, it must disclose the name of the audit committee financial expert and whether that person is “independent.” In order to be considered “independent” for purposes of this Item, a member of an audit committee may not, other than in his or her capacity as a member of the audit committee, the Board of Directors, or any other board committee:

(i) Accept directly or indirectly any consulting, advisory, or other compensatory fee from the issuer; or

(ii) Be an “interested person” of the investment company as defined in Section 2(a)(19) of the Act (15 U.S.C. 80a-2(a)(19)).

Mr. Fred J. Ricciardi, an independent Director, is such an audit committee financial expert.

(3) If the registrant provides the disclosure required by paragraph (a)(1) (ii) of this Item, it must explain why it does not have an audit committee financial expert.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Disclose, under the caption AUDIT FEES, the aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

N/A

(b) Disclose, under the caption AUDIT-RELATED FEES, the aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

N/A

(c) Disclose, under the caption TAX FEES, the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

N/A

(d) Disclose, under the caption ALL OTHER FEES, the aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

N/A

(e) (1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

PIONEER FUNDS

APPROVAL OF AUDIT, AUDIT-RELATED, TAX AND OTHER SERVICES

PROVIDED BY THE INDEPENDENT AUDITOR

SECTION I - POLICY PURPOSE AND APPLICABILITY

The Pioneer Funds recognize the importance of maintaining the independence of their outside auditors. Maintaining independence is a shared responsibility involving Amundi Asset Management US, Inc., the audit committee and the independent auditors.

The Funds recognize that a Fund’s independent auditors: 1) possess knowledge of the Funds, 2) are able to incorporate certain services into the scope of the audit, thereby avoiding redundant work, cost and disruption of Fund personnel and processes, and 3) have expertise that has value to the Funds. As a result, there are situations where it is desirable to use the Fund’s independent auditors for services in addition to the annual audit and where the potential for conflicts of interests are minimal. Consequently, this policy, which is intended to comply with Rule 210.2-01(C)(7), sets forth guidelines and procedures to be followed by the Funds when retaining the independent audit firm to perform audit, audit-related tax and other services under those circumstances, while also maintaining independence.

Approval of a service in accordance with this policy for a Fund shall also constitute approval for any other Fund whose pre-approval is required pursuant to Rule 210.2-01(c)(7)(ii).

In addition to the procedures set forth in this policy, any non-audit services that may be provided consistently with Rule 210.2-01 may be approved by the Audit Committee itself and any pre-approval that may be waived in accordance with Rule 210.2-01(c)(7)(i)(C) is hereby waived.

Selection of a Fund’s independent auditors and their compensation shall be determined by the Audit Committee and shall not be subject to this policy.

|

|

|

|

| |

|

| SECTION II - POLICY |

| SERVICE CATEGORY |

|

SERVICE CATEGORY DESCRIPTION |

|

SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES |

|

|

| |

| I. AUDIT SERVICES |

|

Services that are directly related to performing the independent audit of the Funds |

|

Accounting research assistance SEC consultation, registration statements, and reporting Tax accrual related matters Implementation of new accounting standards Compliance letters (e.g. rating agency letters) Regulatory reviews and assistance regarding financial matters Semi-annual reviews (if requested) Comfort letters for closed end offerings |

|

|

| |

| II. AUDIT-RELATED SERVICES |

|

Services which are not prohibited under Rule 210.2-01(C)(4) (the “Rule”) and are related extensions of the audit services support the audit, or use the knowledge/expertise gained from the audit procedures as a foundation to complete the project. In most cases, if the Audit-Related Services are not performed by the Audit firm, the scope of the Audit Services would likely increase. The Services are typically well-defined and governed by accounting professional standards (AICPA, SEC, etc.) |

|

AICPA attest and agreed-upon procedures Technology control assessments Financial reporting control assessments Enterprise security architecture assessment |

|

|

| |

| AUDIT COMMITTEE APPROVAL POLICY |

|

AUDIT COMMITTEE REPORTING POLICY |

|

| |

“One-time” pre-approval for the audit period for all pre-approved specific service subcategories. Approval of the independent auditors as auditors for a Fund shall constitute pre approval for these services. |

|

A summary of all such services and related fees reported at each regularly scheduled Audit Committee meeting. |

|

| |

“One-time” pre-approval for the fund fiscal year within a specified dollar limit for all pre-approved specific service subcategories |

|

A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. |

|

|

| |

Specific approval is needed to exceed the pre-approved dollar limit for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) Specific approval is needed to use the Fund’s auditors for Audit-Related Services not denoted as “pre-approved”, or to add a specific service subcategory as “pre-approved” |

|

|

SECTION III - POLICY DETAIL, CONTINUED

|

|

|

|

| |

| SERVICE CATEGORY |

|

SERVICE CATEGORY DESCRIPTION |

|

SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES |

|

|

| |

| III. TAX SERVICES |

|

Services which are not prohibited by the Rule, if an officer of the Fund determines that using the Fund’s auditor to provide these services creates significant synergy in the form of efficiency, minimized disruption, or the ability to maintain a desired level of confidentiality. |

|

Tax controversy assistance Tax compliance, tax returns, excise tax returns and support |

|

|

| |

| AUDIT COMMITTEE APPROVAL POLICY |

|

AUDIT COMMITTEE REPORTING POLICY |

|

| |

“One-time” pre-approval for the fund fiscal year within a specified dollar limit |

|

A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. |

|

| |

Specific approval is needed to exceed the pre-approved dollar limits for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) |

|

|

|

| |

Specific approval is needed to use the Fund’s auditors for tax services not denoted as pre-approved, or to add a specific service subcategory as “pre-approved” |

|

|

SECTION III - POLICY DETAIL, CONTINUED

|

|

|

|

| |

| SERVICE CATEGORY |

|

SERVICE CATEGORY DESCRIPTION |

|

SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES |

|

|

| |

| IV. OTHER SERVICES A. SYNERGISTIC, UNIQUE QUALIFICATIONS |

|

Services which are not prohibited by the Rule, if an officer of the Fund determines that using the Fund’s auditor to provide these services creates significant synergy in the form of efficiency, minimized disruption, the ability to maintain a desired level of confidentiality, or where the Fund’s auditors posses unique or superior qualifications to provide these services, resulting in superior value and results for the Fund. |

|

Business Risk Management support Other control and regulatory compliance projects |

|

|

| |

| AUDIT COMMITTEE APPROVAL POLICY |

|

AUDIT COMMITTEE REPORTING POLICY |

|

| |

“One-time” pre-approval for the fund fiscal year within a specified dollar limit |

|

A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. |

|

| |

Specific approval is needed to exceed the pre-approved dollar limits for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) |

|

|

|

| |

Specific approval is needed to use the Fund’s auditors for “Synergistic” or “Unique Qualifications” Other Services not denoted as pre-approved to the left, or to add a specific service subcategory as “pre-approved” |

|

|

SECTION III - POLICY DETAIL, CONTINUED

|

|

|

|

| |

| SERVICE CATEGORY |

|

SERVICE CATEGORY DESCRIPTION |

|

SPECIFIC PROHIBITED SERVICE SUBCATEGORIES |

|

|

| |

| PROHIBITED SERVICES |

|

Services which result in the auditors losing independence status under the Rule. |

|

1. Bookkeeping or other services related to the accounting records or financial statements of the audit client* |

|

|

| |

|

| |

| |

2. Financial information systems design and implementation* |

|

|

| |

|

| |

| |

3. Appraisal or valuation services, fairness* opinions, or contribution-in-kind reports |

|

|

| |

|

| |

| |

4. Actuarial services (i.e., setting actuarial reserves versus actuarial audit work)* |

|

|

| |

|

| |

| |

5. Internal audit outsourcing services* |

|

|

| |

|

| |

| |

6. Management functions or human resources |

|

|

| |

|

| |

| |

7. Broker or dealer, investment advisor, or investment banking services |

|

|

| |

|

| |

| |

8. Legal services and expert services unrelated to the audit |

|

|

| |

|

| |

| |

9. Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible |

|

|

| |

| AUDIT COMMITTEE APPROVAL POLICY |

|

AUDIT COMMITTEE REPORTING POLICY |

|

| |