UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

ASA GOLD AND PRECIOUS METALS LIMITED

(Name of Registrant as Specified In Its Charter)

AXEL MERK

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

ASA Gold & Precious Metals Fund Established 1958 Stop the Power Grab & Restore Fair Process Vote AGAINST Saba’s proposals May 2025 This presentation is prepared by and paid for by Axel Merk, made solely in his individual capacity as a shareholder of ASA Gold & Precious Metals Ltd. (“ASA”). It has not been approved by ASA.

Why I’m Engaged Why I’m Speaking – As a Shareholder • I’m a significant shareholder, owning over $8.5 million in ASA stock together with my wife • I’m the founder of Merk Investments and serve as ASA’s COO — with no separate compensation for that role • I’m conducting this campaign in my personal capacity as a shareholder and paying for it personally • I’m motivated by one thing: ensuring shareholders have the facts and a fair process before control of ASA is handed to one side • While I’m associated with ASA’s adviser, that relationship is not at issue in this vote — ASA’s board and each of the individual directors is fully independent from me in accordance with the federal securities laws • I’ve received legal threats from Saba but cannot let Saba’s pressure tactics deter me from standing up for myself and for all shareholders This campaign is about governance 2

Summary: Vote AGAINST Vote AGAINST Saba’s proposals to add a fifth director to ASA’s board This vote preempts the AGM and strips shareholders of meaningful choice All shareholders — not Saba alone — should decide ASA’s future What It Means for Shareholders Saba has not disclosed a strategy or new ideas No plan Shareholders are forced to evaluate Saba’s nominee on a compressed schedule, before the AGM No competition None proposed No process Saba is pursuing control No engagement A fifth Saba director now would hand them effective board control No accountability 3

Narrative Designed to Mislead This presentation contains facts that challenge what Saba has portrayed. • We respectfully ask you to evaluate actions — not just narratives Look at Saba’s actions — including how they treat dissent — not just their promises Reality Saba Framing +1 director = control +1 director = balance No competing slate allowed “Open process” None proposed “Fresh ideas” Pre - emptive power grab “Shareholder democracy” 4

Shareholder Choice Threatened The Issue Is Shareholder Choice • Saba already holds 2 of 4 board seats • They are now calling a special meeting to add a fifth seat — creating a 3 – 2 voting bloc • This would give them board control while the AGM remains stalled — a meeting that, historically, was set in December and held in March or April . • Saba has blocked a company slate and refused to engage on alternatives that could unify the board Adding +1 now preempts the AGM and removes choice from shareholders 5

Saba Shuts Door on Proposals Saba Shut the Door on Credible Proposals to Resolve the Deadlock • Serious proposals — brought by outside parties and facilitated by the adviser — aimed to end the board deadlock and deliver value to shareholders • Two of the three proposals excluded the adviser entirely. One offered a capital infusion at NAV, a tender exit for Saba, and long - term fund stability • Saba was approached, and did not constructively engage: • One party was told they were too late (last October!) • Another was misrepresented in Saba’s own presentation • Saba chose to walk away — closing the door on a credible resolution path See Appendix for proposal highlights in “Fresh Ideas: Merk” 6

Saba: Boardroom Autocrat Board Control Dispute Following 2024 Annual Meeting – April 24, 2024 • Immediately following ASA’s 2024 annual meeting — but before the results had been certified — two of Saba’s two director nominees asserted control of the board and appointed two additional directors in violation of ASA’s bylaws, Bermuda law, and Section 16(a) of the Investment Company Act • Saba issued a press release and filed a Schedule 13D/A announcing their actions. The next day, Saba retracted its actions and amended its SEC filings. The incident caused shareholder confusion and disrupted governance at a critical time These actions reflected a serious breakdown in governance norms and an effort to assert control outside of proper shareholder processes 7

Saba’s Tactics to Seize Control A Pattern of Control - Seeking Behavior • The April 2024 incident was not isolated — it was the beginning of a sustained effort to bypass process and concentrate power • That incident was the first glimpse of Saba’s refusal to accept the authority of anyone but themselves • What followed was a series of tactics aimed at asserting control: • Legal tactics used to stall governance and gain procedural advantages • Blocking of alternative nominees and shareholder proposals • Attempts to bypass the AGM and preempt shareholder nominations • Public filings and letters that distort facts and intimidate dissent This behavior consistently sidelines shareholder choice in favor of Saba’s agenda Let’s not confuse aggressiveness with legitimacy. A pattern has emerged — and it threatens governance integrity and harms shareholders 8

The Crisis Saba Created A power play that disrupted ASA’s ability to function • Saba’s directors have paralyzed board operations while blocking solutions — and now seek emergency powers to “fix” the crisis they created • ASA’s fund administrator gave notice of resignation following Saba’s threats — one of several service providers sidelined or undermined • Directors, officers, counsel, service providers and vendors have faced escalating legal pressure — most of it behind the scenes. This isn’t activism. It’s governance sabotage 9

Source of Escalating Costs: Saba 8 - K Disclosure Reveals Tactics Driving Legal Spend • On October 14, 2024, Saba Directors made unsubstantiated, untrue allegations and demanded indemnity — enabling them to retain separate legal counsel at shareholder expense. This, in turn, required the other directors to retain separate counsel. The result was a fractured board and escalating legal costs . • The maneuver was not publicly disclosed until November 8, 2024, when an 8 - K was issued with the relevant correspondence — weeks after the initial action. The delay underscores how difficult it was to bring this to light Saba’s directors are the cause of escalating costs. Proof is in the 8 - K 10

Saba’s Conduct Administrator Resignation Saba’s pattern has been one of disruption, followed by efforts to obscure it — including blocking or delaying public disclosure. On May 12, Saba filed a proxy presentation with the SEC, in which ASA Director Paul Kazarian appears to have disclosed confidential information: that ASA’s fund administrator gave notice to terminate services by July 31, 2025 , calling it an “extremely time - sensitive situation” What Saba did not disclose: • This resignation notice has not been made public through appropriate channels. Proxy materials are not the proper venue, and Mr. Kazarian has not worked with the Board to disclose the information appropriately • The resignation followed threats by Saba’s legal counsel against the ASA Secretary, an employee of the administrator. This served only to undermine ASA’s operations — and it has driven up fund costs, as the allegations were prepared at shareholder expense • In my capacity as COO, I have initiated outreach to solicit proposals to find a new fund administrator, given the urgency of the situation 11

Saba: Strategic Lawfare Part II Saba’s Paul Kazarian Suppresses Shareholder Choice • On April 30, 2025, Saba Director Paul Kazarian filed a petition in Bermuda that stopped two of ASA’s Directors from representing the rights of all shareholders • The injunction is preliminary – it does not reflect a ruling on the merits. Instead, it reflects that the Court found jurisdiction and granted temporary relief pending a full hearing • Saba’s filing provides incomplete information to shareholders — failing to explain, amongst other important facts, that Saba Director Kazarian’s petition is subject to a hearing on the merits on May 21 – 22 • I am not party to the injunction. However, Saba Director Paul Kazarian has alleged collusion, which has effectively limited what I can say both in my proxy solicitation and in this presentation — since there’s a real risk he’ll twist any comments to support his agenda Saba’s goal is disruption to allow their candidate to run unopposed Saba strategically suppresses shareholder choice 12

Saba Wants Fixed Income Fund Saba wants to repurpose ASA into a Saba managed fixed income fund • In a January 30, 2025, letter , Saba writes: “We have repeatedly raised … exploring a fixed income strategy on several occasions” • Saba frames their nominee as not pre - committed and that proper procedures would be followed if a change in mandate were to take place • Saba knows that implementing change at that point faces much lower hurdles, as evidenced by a record of repurposing funds in the past into multi - asset strategies, managed by Saba. The strategies include closed - end fund arbitrage to further their activism. See the Appendix for details • Saba is promoting a narrative inconsistent with their actions, preventing shareholders from gaining the full picture ASA’s future as a precious metals fund is at stake — and Saba is asking shareholders to vote without disclosing that intent 13

When Shareholder Choice Breaks Challenges to Genuine Shareholder Representation • Activist voices are often well - resourced and aggressive • Other shareholders — including RIAs and retail — typically lack the infrastructure and incentive to organize, respond, or even vote • Intimidation works. It silences dissent. Few are willing to endure the pressure campaign an activist can mount The issue isn’t activists having a voice — it’s that other shareholders often don’t 14

Unified Slate: A Fair Choice A Governance Fix Saba Won’t Mention • To address the deadlock, the Board could offer both a Saba slate and a competing slate developed through the company’s regular nomination process • The proxy statement can present both options clearly — giving shareholders a meaningful choice • Saba’s own materials complain that a company slate without Saba would disadvantage them — this proposal addresses that concern directly • Unified slates are widely used in public companies Saba spins narratives — but fails on governance 15

What Saba Has NOT Done What Saba Has NOT Done • No strategic plan has been presented • No new investment ideas have been proposed since gaining board seats • No disclosure of a long - term vision for the fund • No explanation of what they would do differently, or better • Saba’s ISS deck omits performance, the discount, and portfolio structure. Saba hasn’t just said little — they’ve proposed nothing. 16

What Saba HAS Done What Saba HAS Done • Delayed disclosure of governance events (e.g. November deadlock) • Triggered costly litigation • Caused the resignation of ASA’s administrator by threatening them • Created public confusion through selective disclosure of board information • Inappropriately disclosed confidential Board information to the public This pattern undermines ASA’s governance — and shareholder trust. 17

A High - Performing Gold Fund ASA Is a Gold Fund — And a High - Performing One • ASA is a ~70 year - old closed - end fund focused on precious metals equity • The strategy is working despite the disruptions at the board : performance has been strong, with long - term orientation • ASA under Merk Investments’ management is focused on capturing company - specific catalysts in addition to benefiting from a rising price of gold. In practice, this means investing in comparatively illiquid companies — providing shareholders access to a strategy through a liquid closed - end fund wrapper, something not accessible through mutual funds or ETFs • Saba is on record stating they do not want this to be a mining fund This is not about change vs. status quo. It’s about control vs. choice. A high - performing fund like ASA does not warrant a covert activist takeover. 18

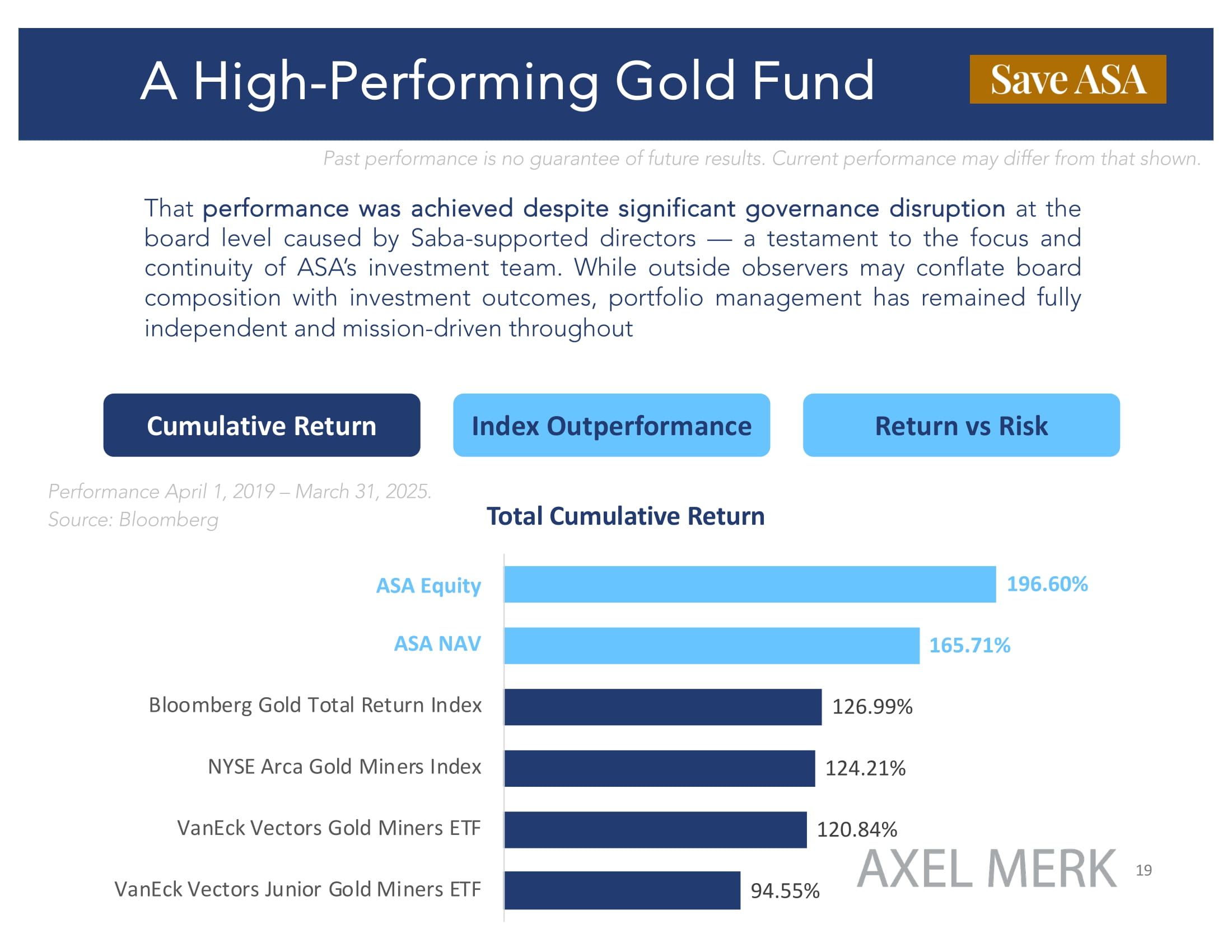

A High - Performing Gold Fund 19 Past performance is no guarantee of future results. Current performance may differ from that shown. That performance was achieved despite significant governance disruption at the board level caused by Saba - supported directors — a testament to the focus and continuity of ASA’s investment team . While outside observers may conflate board composition with investment outcomes, portfolio management has remained fully independent and mission - driven throughout Index Outperformance Cumulative Return Return vs Risk ASA Equity ASA NAV Total Cumulative Return Performance April 1, 2019 – March 31, 2025. Source: Bloomberg 196.60% ASA Equity 165.71% ASA NAV 126.99% Bloomberg Gold Total Return Index 124.21% NYSE Arca Gold Miners Index 120.84% VanEck Vectors Gold Miners ETF 94.55% VanEck Vectors Junior Gold Miners ETF

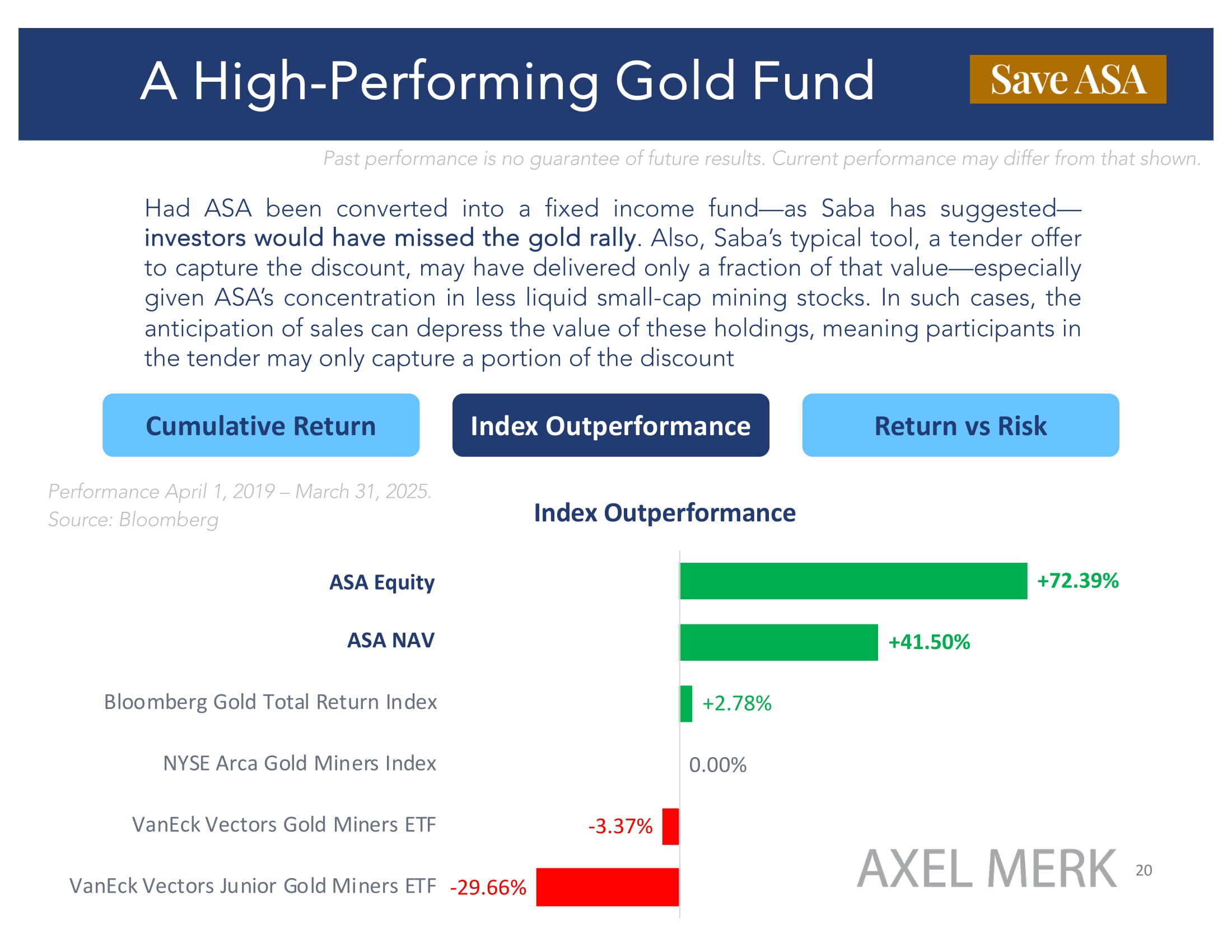

A High - Performing Gold Fund 20 Past performance is no guarantee of future results. Current performance may differ from that shown. Had ASA been converted into a fixed income fund — as Saba has suggested — investors would have missed the gold rally . Also, Saba’s typical tool, a tender offer to capture the discount, may have delivered only a fraction of that value — especially given ASA’s concentration in less liquid small - cap mining stocks . In such cases, the anticipation of sales can depress the value of these holdings, meaning participants in the tender may only capture a portion of the discount Cumulative Return Index Outperformance Return vs Risk ASA Equity ASA NAV Index Outperformance +72.39% ASA Equity +41.50% ASA NAV +2.78% Bloomberg Gold Total Return Index 0.00% NYSE Arca Gold Miners Index - 3.37% VanEck Vectors Gold Miners ETF - 29.66% VanEck Vectors Junior Gold Miners ETF Performance April 1, 2019 – March 31, 2025. Source: Bloomberg

A High - Performing Gold Fund 21 Past performance is no guarantee of future results. Current performance may differ from that shown. ASA’s performance also looks favorable on a risk - adjusted basis Index Outperformance Cumulative Return Return vs Risk 0.92 0.56 0.54 0.45 0.36 0.25 Bloomberg Gold Total Return Index ASA Equity ASA NAV NYSE Arca Gold Miners Index VanEck Vectors Gold Miners ETF VanEck Vectors Junior Gold Miners ETF Annualized Return / Risk ASA Equity ASA NAV Performance April 1, 2019 – March 31, 2025. Source: Bloomberg

Performance 22 ASA has delivered strong, risk - adjusted performance. ASA ranks at or near the top of publicly available gold and precious metals strategies over 1 - , 2 - , 5 - , & 6 - year periods (as of March 31, 2025) Data as of March 31 , 2025 . Source : Bloomberg The 10 - year return includes 4 3 ⁄ 4 years of the previous portfolio management team . Peter Maletis began managing ASA on April 1 , 2019 . On April 12 , 2019 , ASA shareholders approved Merk Investments as the Fund’s investment manager . Jamie Holman joined the ASA portfolio management team on April 1 , 2022 . Past performance is no guarantee of future results . Current performance may differ from that shown . ASA concentrates in the gold and precious minerals sector . This sector may be more volatile than other industries and may be affected by movements in commodity prices triggered by international monetary and political developments . The Company is a non - diversified fund and, as such, may invest in fewer investments . ASA Gold and Precious Metals Limited may invest in smaller - sized companies that may be more volatile and less liquid than larger, more - established companies . Investments in foreign securities, especially those in the emerging markets, may involve increased risk as well as exposure to currency fluctuations . Shares of closed - end funds frequently trade at a discount to their net asset value .

Performance 23 Data as of March 31 , 2025 . Source : Bloomberg The 10 - year return includes 4 3 ⁄ 4 years of the previous portfolio management team . Peter Maletis began managing ASA on April 1 , 2019 . On April 12 , 2019 , ASA shareholders approved Merk Investments as the Fund’s investment manager . Jamie Holman joined the ASA portfolio management team on April 1 , 2022 . Past performance is no guarantee of future results . Current performance may differ from that shown . ASA concentrates in the gold and precious minerals sector . This sector may be more volatile than other industries and may be affected by movements in commodity prices triggered by international monetary and political developments . The Company is a non - diversified fund and, as such, may invest in fewer investments . ASA Gold and Precious Metals Limited may invest in smaller - sized companies that may be more volatile and less liquid than larger, more - established companies . Investments in foreign securities, especially those in the emerging markets, may involve increased risk as well as exposure to currency fluctuations . Shares of closed - end funds frequently trade at a discount to their net asset value.

Share Buyback 24 Saba Misrepresents Share Buyback — and Crosses a Line • Saba’s presentation misrepresents ASA’s buyback program and includes specific trading dates that were not publicly disclosed • This suggests access to non - public information, likely shared improperly by a Saba Director. If so, it raises serious legal and governance concerns • Separately, Saba falsely accused the adviser of sharing inside information with an outside investor — an allegation both unfounded and inappropriate • Such a claim, if believed, would imply a violation of securities law Repurchase Program Facts: • Implemented at the Board’s direction, recently renewed for another year • Managed by senior adviser staff not involved in ASA portfolio management • Governed by disclosure, trading protocols, and blackout periods Saba’s claims aren’t just misleading — they expose legal and ethical red flags

Trading Discount Tight 25 ASA’s Discount Has Narrowed — Shareholders Are Seeing Value • ASA currently ranks in the top 6% of all closed - end funds based on discount to NAV (ranked 373 of 397 as of May 13, 2025; Source: Sodali) • The discount has narrowed materially — reflecting investor confidence in the fund’s direction. • ASA’s narrowing discount reflects concrete fundamentals — including a disciplined repurchase program and strong investment performance. These have drawn investor interest. They are not outcomes of Saba’s tactics, but results of sound management ASA’s discount has narrowed — not because of noise, but because of substance Data as of May 16, 2025. Source: Bloomberg

Axel Merk 26 Shareholder , Founder of Merk Investments, COO of ASA Shareholder • Together with my wife, I am a significant shareholder, owning 317,660 shares (approximately 1.68% of shares outstanding) • Acting in my individual capacity • I’m in the unique position of having both a substantial stake in ASA and experience with Saba’s playbook to take advantage of closed - end fund structural vulnerabilities. One reason Saba often prevails is that other stakeholders aren’t equipped to stand up to a bully • Given my insight and experience I feel a responsibility to ensure shareholders have access to clear, accurate information as they assess what is at stake • ASA’s Board is fully independent from Merk Investments and must annually review and approve the advisory agreement. My campaign reflects my role as a shareholder • My multi - million - dollar investment in ASA speaks for itself. I am not “desperate,” as Saba has claimed in the past

Axel Merk 27 Shareholder, Founder of Merk Investments , COO of ASA Founder of Merk Investments • Merk has helped revitalize ASA. Since April 12, 2019 — when shareholders approved Merk as adviser — ASA’s net assets have grown from $195 million to approximately $600 million , net of expenses, dividends, and share repurchases • A strong commitment to retail investors, to transparency, leading the industry in publishing monthly holdings, holding webinars, explaining the investment process, making portfolio management available • A strong commitment to the products managed — ASA has 2 portfolio managers, whereas several larger products only have 1 . Focus is on the results for investors, accepting lower margins • A strong commitment to executing a mandate even when faced with substantial disruption at ASA’s board, as evidenced in ASA’s performance and executing the share repurchase program • As a registered investment adviser, Merk has a fiduciary duty to ASA and its shareholders — and I have acted accordingly. I’ve even facilitated proposals that would remove Merk entirely from ASA’s future. That should put to rest any concern that I place Merk’s interests ahead of ASA’s

Axel Merk Shareholder, Founder of Merk Investments, COO of ASA COO of ASA • I do not receive separate compensation for my role of COO of ASA • I step in when the Board is dysfunctional. Amongst others, I have initiated a search for a new administrator after the Saba Directors threatened the current administrator leading to them giving notice to terminate their services. As part of that search, I’ve also engaged with administrators of some Saba funds to reduce the risk of constructive solutions being undermined 28

Competing Visions Saba’s Vision — Based on Their Actions and Statements: • Repurpose ASA into a Saba - managed fixed income fund — presumably to align with their broader activist strategy and capabilities • Reject proposals related to gold investing, seemingly based on suspicion of association with Merk — regardless of merit A Better Governance Model: • A board committed to serving all shareholders — not narrow interests. • A board giving thoughtful consideration to proposals — evaluated on substance, not origin: • Preserves institutional knowledge by carrying forward a board member respected by institutions • Brings highest - caliber 40 Act expertise • Includes meaningful experience in the gold sector • In response to Saba’s suggestion of inappropriate ties: I have no prior relationships with individuals considered in the Board’s succession planning, apart from requesting to connect via LinkedIn ASA needs a qualified, deliberative board — not suspicion - driven obstruction 29

No Vetting, No Independence Saba’s proposed nominee could determine control of ASA • Shareholders have had no opportunity to independently assess the nominee’s qualifications or alignment • Any inquiries must be submitted in writing to the nominee’s counsel — who is also acting for Saba — raising serious questions about independence • This is not a transparent nomination process • Shareholders are being asked to rely solely on Saba’s assertions of independence — yet the nominee would hand Saba effective control. That is a significant risk absent independent vetting ISS policy emphasizes director independence, transparency, and process — those standards have not been met here. 30

There Is a Better Path There Is a Better Path — The AGM • Only an AGM offers shareholders a path to true resolution • Shareholders deserve the opportunity to evaluate: • Competing strategies • Candidate qualifications • Direction of the fund • This requires the opportunity for parallel slates , not unilateral appointments • Saba has declined to pursue this route • The special meeting circumvents that process, entrenching control and eliminating real choice A full and fair shareholder vote with parallel slates is the foundation of sound governance Vote NO to support shareholder rights, not factional power 31

What This Vote Is — and Isn’t What This Vote Is — and Isn’t This vote is about: • Preserving shareholder choice through an open and fair AGM process • Ensuring any shift in ASA’s strategy is subject to real investor scrutiny • Preventing unilateral control without transparency or accountability This vote is not about: • Blocking Saba from participating in a fair process • Entrenching Merk or anyone else — ASA’s Board is already independent from Merk Investments, and some proposals for ASA’s future have excluded Merk as investment adviser entirely • Determining ASA’s ultimate direction — that decision should come from all shareholders, not a procedural loophole At the AGM, shareholders will need to decide which path ASA should take. That choice must not be preempted through a procedural power grab 32

A Better Future Saba says it wants a better future for ASA. Here’s important context: • ASA may already be one of Saba’s most profitable closed - end fund investments. ASA’s strong positioning in a volatile sector, combined with its long - term gold exposure, likely outpaces Saba’s typical fixed income or hedged products — especially in a precious metals bull market • Precious metals equities exhibit the widest return dispersion in the S&P 500. That means: a) Skilled active management matters, and b) The space is notoriously difficult to hedge — making ASA ill - suited for “discount capture” activist strategies • ASA’s Bermuda - based structure operates under a unique SEC 7(d) exemptive order. Repositioning the fund (e.g., to fixed income) could incur significant costs, complexity, or regulatory barriers — if feasible at all I’ve spoken with many shareholders, retail and institutional, who value ASA’s distinct role in gold - focused equities. I’ve not heard investor demand to change that mandate — but I encourage open discussion and welcome all ideas brought in good faith The board needs clarity, not conflict . Once trust and structure are restored, there are paths to strengthen ASA for all investors — rooted in its purpose, not in tactical disruption 33

VOTE AGAINST I respectfully ask you to: • Vote AGAINST Saba’s +1 director proposal • Affirm the principle that shareholder choice comes before board control • See Saba’s proposal for what it is: a move to entrench itself under the guise of breaking a deadlock • Note that the Annual Meeting has yet to be scheduled — shareholders are still waiting for their proper vote Vote NO to reject a power grab that sidelines over 80% of shareholders — and challenges the duties directors owe to all investors Under Bermuda law, directors owe duties to all shareholders — not just those who nominate them. That principle is at stake in this vote 34

Setting the Record Straight Appendix • Fresh Ideas: Merk • Setting the Record Straight: Saba’s “Better Future” • Setting the Record Straight: Share Buyback • Setting the Record Straight: Alleged Erroneous Filings • Setting the Record Straight: Alleged Board Conspiracy • Setting the Record Straight: Trading Volume Spike • Setting the Record Straight: Saba’s Fixed Income Track Record 35

Fresh Ideas: Merk Merk Facilitated Serious Proposals to Resolve ASA’s Board Impasse • Merk Investments has consistently supported initiatives that advance ASA’s long - term value — even where such proposals might not benefit Merk directly • Merk has facilitated outreach from three independent parties with credible proposals. These have varied widely in vision and structure — including some that excluded Merk from any future role • One proposal includes: • A strategic investor bringing new assets to ASA at NAV • A tender offer giving Saba and others an exit opportunity • An active discount management framework • Long - term stabilization of governance This idea could deliver a win - win - win : peace at the board, real liquidity for activists, and long - term protection for shareholders This is a credible, shareholder - oriented solution — requiring only that board disputes be resolved 36

Fresh Ideas: Merk Excerpts of the win - win - win proposal Saba snubbed includes a capital infusion, a tender offer and an active discount management program Far from entrenchment for Merk, the proposal entails eliminating Merk 37

Fresh Ideas: Saba’s Reaction Saba’s Dismissal of Shareholder - Centered Proposals • Saba’s presentation misrepresents the proposals submitted to the Board • Since Saba publicly discloses these discussions, some clarification based on direct feedback from the proposing parties: • No proposal included formal or agreed compensation for Merk • Some affirmed ASA’s current investment strategy • One party approached Saba directly, in good faith — and had their outreach distorted • Another was told by Saba they were “too late” — in October 2024 Saba dismisses constructive dialogue and ignores real opportunities for consensus. 38

Share Buyback Allegations Wrong 39 Saba’s presentation falsely alleges misconduct in ASA’s share repurchase activity — a serious claim that misrepresents how the process works • Merk follows a disciplined, compliance - driven process for ASA’s share repurchases. Day - to - day management is handled by a senior team member not involved in ASA’s portfolio • Each trading day, the team decides whether to enter the market, based on quantitative and qualitative criteria • Merk provides regular reports to ASA’s Board and a quarterly summary of activity • I recuse myself from participation when circumstances warrant — such as when I consider buying ASA shares. When recused, decisions are made independently under the program’s oversight • ASA’s Chief Compliance Officer may pause trading if material non - public information has not yet been disclosed • Controls are in place to protect shareholders and follow best practices • Any suggestion that inside information was shared externally is false, inappropriate, and — if true — would constitute a serious breach of securities law Saba’s own presentation publishes share repurchase dates that have not been publicly disclosed — raising serious concerns if that information came from a sitting Director. Careless dissemination of such trading data could give certain investors an unfair advantage and undermine the effectiveness of the repurchase program .

Alleged Erroneous Filings Alleged Erroneous Filings Saba alleges I falsely claimed an exemption in regulatory filings • My filings were appropriate. I had no intention of filing a proxy statement to fight Saba’s requisition to add a director to ASA’s board, but expressed my views as a shareholder • I changed my assessment when the opposition to Saba’s efforts was withdrawn • At that stage, I briefly paused the saveasa.com website to update the disclosure for the new role I was stepping into. • Out of respect for the process, I also removed information from the website that I learned about through filings that had been withdrawn. A reasonable argument could have been made that such information was fair game as it had been out in the public. Saba’s improper disclosure of confidential board information stands in contrast to that. On that note, the excerpt of the “win - win - win” proposal included in this presentation was provided directly to Merk by the proposing party and was not obtained from the Board 40

Alleged Board Conspiracy Alleged Board Conspiracy Conspiracy to only have 4 board members • In December 2024, a board member resigned for personal reasons. Saba alleges a conspiracy to cripple board function. ISS in 2024 recommended two board seats for Saba to give them a voice, but did not recommend control in significant part because they did not offer a detailed plan. Given ISS’s policies and arguments, it would have been doubtful that ISS would have favored for Saba to have three out of five board seats a year ago. 41

Trading Volume Spike Trading Volume Spike • On March 28, 2025 , ASA shares experienced an unusually large spike in trading volume, sharply narrowing the discount — an event later cited by Saba as evidence of market support for the Southern District of New York court ruling • However, subsequent information has indicated that this activity was the result of routine trading by an investor unaware of the court’s decision at the time Saba’s claim of investor endorsement was based on a misinterpretation of the facts 42

Saba’s Fixed Income Track Record Saba has a clear playbook: gain board control, change mandates, and repurpose funds to serve its broader strategy • • Saba has converted multiple funds (including SABA II and BRW closed - end funds) into fixed income or multi - asset vehicles after gaining board influence — often with limited shareholder transparency • These mandate changes generate a recurring revenue stream for Saba as the new manager, giving it a financial interest in shifting ASA’s strategy. Repurposed funds have supported Saba’s broader activist efforts, including closed - end fund arbitrage across its portfolio • These “solutions” rarely eliminate discounts — instead, they shrink fund size and raise expense ratios, harming long - term holders • ASA is subject to an SEC 7(d) order due to its Bermuda structure. A change in investment focus could raise regulatory concerns and complicate the fund’s continued operation Once Saba has control, a fundamental change in ASA’s strategy becomes the default scenario 43

Proxy Disclosure 44 This is a proxy solicitation by shareholder Axel Merk, made solely in his individual capacity. It is not part of a solicitation by ASA Gold and Precious Metals Limited (the “Company”), or any other shareholder, or group. Mr. Merk will be filing a final proxy statement with the United States Securities and Exchange Commission (the "SEC"). SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain the documents free of charge at the SEC's website, http://www.sec.gov. PLEASE READ THE PROXY STATEMENT CAREFULLY BEFORE MAKING A DECISION CONCERNING THE PROPOSALS. This presentation does not constitute a solicitation by Axel Merk of any approval or action of its shareholders. Mr. Merk will be soliciting proxies from shareholders against the Proposals. Mr. Merk also serves as President of Merk Investments LLC, the Company’s investment adviser, and as the Company’s Chief Operating Officer. You can obtain more information about Axel Merk and his positions and ownership in the Company’s common stock, by accessing his Proxy Statement on the SEC's website at http://www.sec.gov. Updated information with respect to Mr. Merk’s security holdings and the Proposals will be included in the final proxy statement to be filed with the SEC.