January 2026 44th Annual J.P. Morgan Healthcare Conference Redefining Possibilities in Rare Disease Renee Gala, President & CEO

January 2026 44th Annual J.P. Morgan Healthcare Conference Redefining Possibilities in Rare Disease Renee Gala, President & CEO

Transforming Lives. Redefining Possibilities. Caution Concerning Forward-Looking Statements This presentation contains forward-looking statements and financial targets, including, but not limited to, statements related to: the Company’s growth prospects and future financial and operating results, including the ability of the Company’s portfolio to drive long-term shareholder value; expectations with respect to indication expansion opportunities; 2025 total revenue guidance and 2025 revenue for each of Xywav, Epidiolex and Modeyso and the Company’s expectations related thereto; the Company’s ability to drive significant cash flow generation; the Company’s commercial expectations, including with respect to revenue diversification and its expectations for significant growth; the Company’s expectations with respect to the commercial potential of its products and product candidates, including the peak potential of zanidatamab and Modeyso, growth opportunities for Epidiolex/Epidyolex, Modeyso, Xywav, Zepzelca and Ziihera, and the potential regulatory paths related thereto; the value and growth potential of its products; the Company’s net product sales and goals for net product sales from new and acquired products; the Company’s views and expectations relating to its patent portfolio, including with respect to expected patent protection; planned or anticipated clinical trial events, including with respect to initiations, enrollment and data read-outs, and the anticipated timing thereof, and planned or anticipated regulatory submissions and filings and other regulatory matters, including potential approvals, including the timing thereof, such as the timing of the supplemental biologics license application for, and launch and approval of, zanidatamab in 1L GEA; and other statements that are not historical facts. These forward-looking statements are based on the Company’s current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: maintaining or increasing sales of and revenue from Xywav, Zepzelca, Epidiolex / Epidyolex, Modeyso, Ziihera and other key marketed products; effectively launching and commercializing the Company’s other products and product candidates; the successful completion of development and regulatory activities with respect to the Company’s product candidates; obtaining and maintaining adequate coverage and reimbursement for the Company’s products; the time-consuming and uncertain regulatory approval process, including the risk that the Company’s current and/or planned regulatory submissions may not be submitted, accepted or approved by applicable regulatory authorities in a timely manner or at all, including the risk that the Company’s supplemental biologics license application submission for zanidatamab in 1L GEA may not be approved in a timely manner or at all; the costly and time-consuming pharmaceutical product development and the uncertainty of clinical success, including risks related to failure or delays in successfully initiating or completing clinical trials and assessing patients; global economic, financial, and healthcare system disruptions and the current and potential future negative impacts to the Company’s business operations and financial results; protecting and enhancing the Company’s intellectual property rights and the Company’s commercial success being dependent upon its obtaining, maintaining and defending intellectual property protection for its products and product candidates; delays or problems in the supply or manufacture of the Company’s products and product candidates; complying with applicable U.S. and non-U.S. regulatory requirements, including those governing the research, development, manufacturing and distribution of controlled substances; government investigations, legal proceedings and other actions; identifying and consummating corporate development transactions, financing these transactions and successfully integrating acquired product candidates, products and businesses; the Company’s ability to realize the anticipated benefits of its collaborations and license agreements with third parties; the sufficiency of the Company’s cash flows and capital resources; the Company’s ability to achieve targeted or expected future financial performance and results and the uncertainty of future tax, accounting and other provisions and estimates; the Company’s ability to meet its projected long-term goals and objectives, in the time periods that the Company anticipates, or at all, and the inherent uncertainty and significant judgments and assumptions underlying the Company’s long-term goals and objectives; the completion of financial closing procedures, final audit adjustments and other developments that may arise that would cause the Company’s expectations with respect to the Company’s 2025 revenue guidance to differ, perhaps materially, from the financial results that will be reflected in the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2025; and other risks and uncertainties affecting the Company, including those described from time to time under the caption “Risk Factors” and elsewhere in the Company’s Securities and Exchange Commission filings and reports, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 as supplemented by the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, and its future filings and reports. Other risks and uncertainties of which the Company is not currently aware may also affect its forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this presentation are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by the Company on its website or otherwise. The Company undertakes no obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Strong Momentum from an Outstanding 2025 Research and Commercial Corporate Corporate Development Development Rapid approval1 / launch exceeding expectations Settled outstanding ANDA litigation = Acquisition durability into the very-late 2030’s Practice-changing 1L GEA data derisks $2B+ opportunity Added Modeyso and sleep neuro-oncology expertise Resolved litigation, removing uncertainty Received FDA approval and launched in 1LM ES-SCLC2 Successful CEO transition Licensing agreement builds on Reduced leverage with $750M Showcased strong combination Achieved $1B+ sales3 debt paydown data at ASCO in 1LM ES-SCLC epilepsy franchise Achieved 2025 Increased equity value 5 total revenue guidance3,4 by $2.8 billion 1Received accelerated approval by FDA on August 6, 2025; 2FDA approval of Zepzelca in combination with Tecentriq (atezolizumab) as first-line maintenance therapy for ES-SCLC; 3Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2025, and actual results may differ; 4The company expects that for the year ended December 31, 2025, reported total revenues will January 2026 l 3 meet the guidance range provided on November 5, 2025; 5Equity value increase YE2025 vs. YE2024.

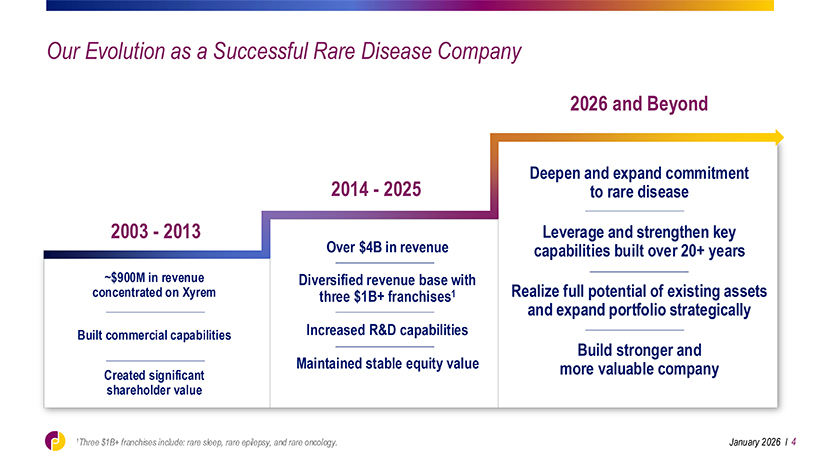

Our Evolution as a Successful Rare Disease Company 2026 and Beyond Deepen and expand commitment 2014—2025 to rare disease 2003—2013 Over $4B in revenue Leverage and strengthen key capabilities built over 20+ years ~$900M in revenue Diversified revenue base with concentrated on Xyrem three $1B+ franchises1 Realize full potential of existing assets and expand portfolio strategically Built commercial capabilities Increased R&D capabilities Build stronger and Maintained stable equity value more valuable company Created significant shareholder value 1Three $1B+ franchises include: rare sleep, rare epilepsy, and rare oncology. January 2026 l 4

Refined Strategic Focus on Rare Disease Playing to Jazz’s Strategic Advantages RARE RARE RARE NEW RARE ONCOLOGY EPILEPSY SLEEP THERAPEUTIC AREAS January 2026 l 5

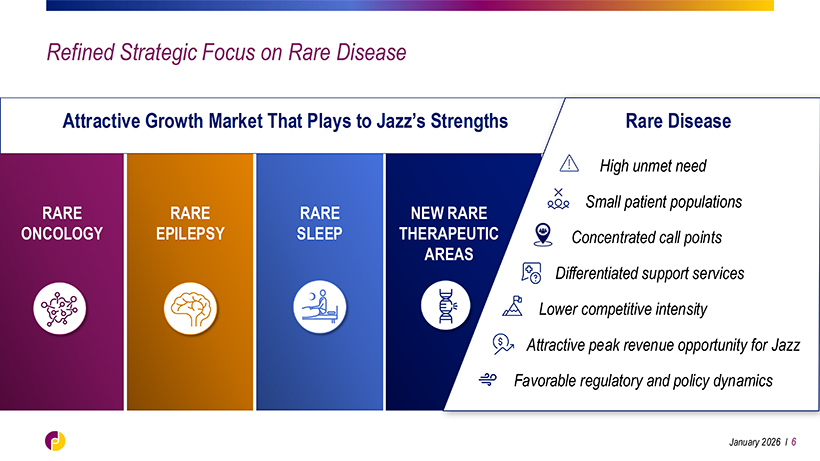

Refined Strategic Focus on Rare Disease Attractive Growth Market That Plays to Jazz’s Strengths Rare Disease High unmet need Small patient populations RARE RARE RARE NEW RARE ONCOLOGY EPILEPSY SLEEP THERAPEUTIC Concentrated call points AREAS Differentiated support services Lower competitive intensity Attractive peak revenue opportunity for Jazz Favorable regulatory and policy dynamics January 2026 l 6

How Jazz Will Compete in Rare Disease Leveraging Expertise to Optimize Future Investments and Growth • Focus on areas of significant unmet need • Pursue innovative products with potential to be standards of care • Prepared to assume greater clinical risk within areas of existing expertise • Build $1B+ franchises with multiple assets to enhance profitability • Source products from internal research and corporate development • Augment our customer centricity and digital / AI capabilities • Leverage strong track record of acquiring or launching assets in rare disease with three $1B+ rare disease franchises (sleep, epilepsy, oncology) January 2026 l 7

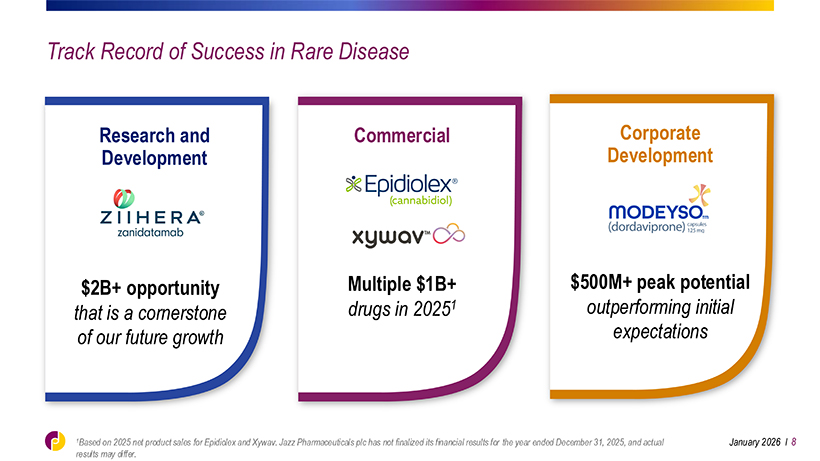

Track Record of Success in Rare Disease Research and Commercial Corporate Development Development $2B+ opportunity Multiple $1B+ $500M+ peak potential that is a cornerstone drugs in 20251 outperforming initial of our future growth expectations 1Based on 2025 net product sales for Epidiolex and Xywav. Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2025, and actual January 2026 l 8 results may differ.

RESEARCH AND DEVELOPMENT Zanidatamab: High Value, De-Risked Asset with Broad Potential Across Indications Zanidatamab is a highly active, differentiated HER2-targeted bispecific mAb with compelling survival data Novel and Best-in-Class Compelling $2B+ Differentiated Profile Phase 3 Data Commercial MOA Addresses in 1L GEA Opportunity Unmet Need January 2026 l 9

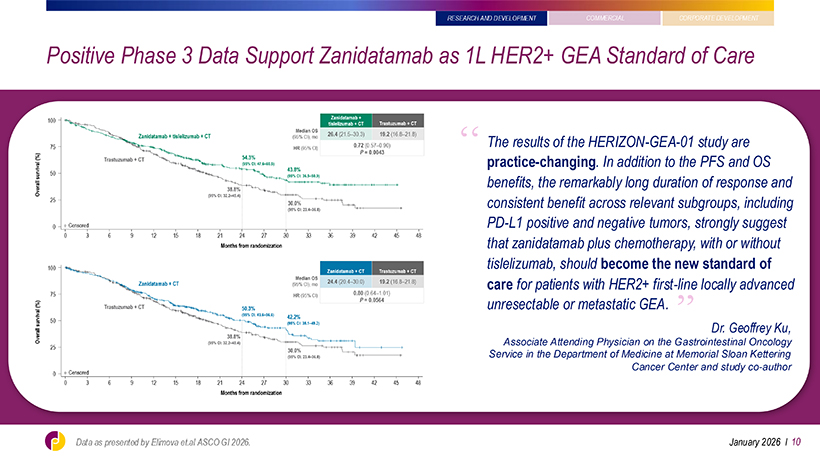

RESEARCH AND DEVELOPMENT Positive Phase 3 Data Support Zanidatamab as 1L HER2+ GEA Standard of Care ‘‘ The results of the HERIZON-GEA-01 study are practice-changing. In addition to the PFS and OS benefits, the remarkably long duration of response and consistent benefit across relevant subgroups, including PD-L1 positive and negative tumors, strongly suggest that zanidatamab plus chemotherapy, with or without tislelizumab, should become the new standard of care for patients with HER2+ first-line locally advanced unresectable or metastatic GEA. ‘‘ Dr. Geoffrey Ku, Associate Attending Physician on the Gastrointestinal Oncology Service in the Department of Medicine at Memorial Sloan Kettering Cancer Center and study co-author January 2026 l 10

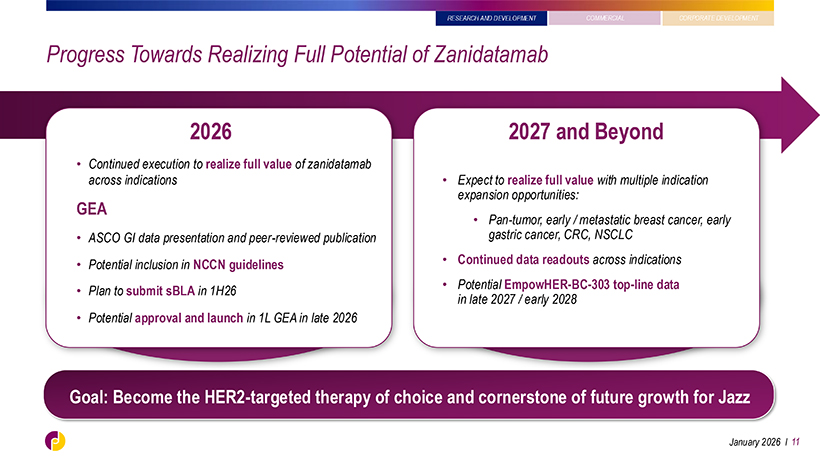

RESEARCH AND DEVELOPMENT Progress Towards Realizing Full Potential of Zanidatamab 2026 2027 and Beyond • Continued execution to realize full value of zanidatamab across indications • Expect to realize full value with multiple indication expansion opportunities: GEA • Pan-tumor, early / metastatic breast cancer, early • ASCO GI data presentation and peer-reviewed publication gastric cancer, CRC, NSCLC • Potential inclusion in NCCN guidelines • Continued data readouts across indications • Potential EmpowHER-BC-303 top-line data • Plan to submit sBLA in 1H26 in late 2027 / early 2028 • Potential approval and launch in 1L GEA in late 2026 Goal: Become the HER2-targeted therapy of choice and cornerstone of future growth for Jazz January 2026 l 11

COMMERCIAL Driving Durable Growth Through Strong Commercial Execution Epidiolex Xywav Standard of care in LGS, DS, and TSC Differentiated low-sodium oxybate ✓ Strong commercial execution achieving ✓ Focused on continued commercial execution $1B+ in sales1 in 2025 achieving $1B+ in sales in 2025 ✓ Durable asset with robust IP protection ✓ Only approved drug to treat IH ✓ Further development opportunities, including ✓ Orphan drug exclusivity into 2028 with multiple additional formulation work orange-book listed patents through 2041 1Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2025, and actual results may differ. January 2026 l 12

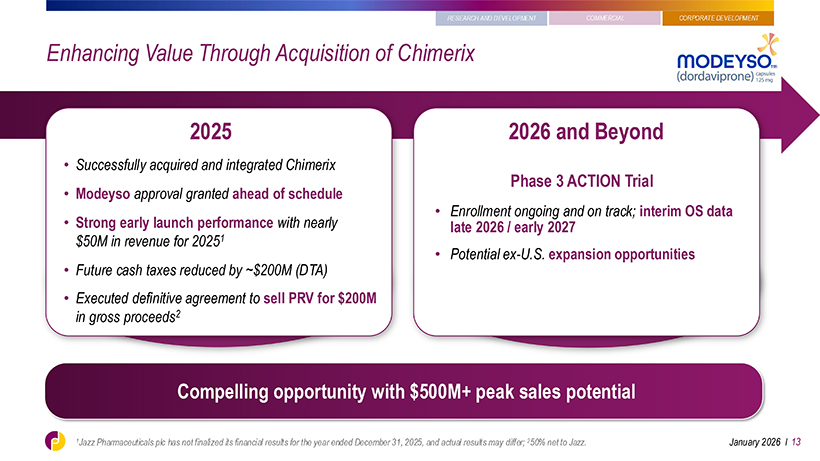

CORPORATE DEVELOPMENT Enhancing Value Through Acquisition of Chimerix 2025 2026 and Beyond • Successfully acquired and integrated Chimerix Phase 3 ACTION Trial • Modeyso approval granted ahead of schedule • Enrollment ongoing and on track; interim OS data • Strong early launch performance with nearly late 2026 / early 2027 $50M in revenue for 20251 • Potential ex-U.S. expansion opportunities • Future cash taxes reduced by ~$200M (DTA) • Executed definitive agreement to sell PRV for $200M in gross proceeds2 Compelling opportunity with $500M+ peak sales potential 1Confidential Jazz Pharmaceuticals —For Internal plc has Use not Only finalized its financial results for the year ended December 31, 2025, and actual results may differ; 250% net to Jazz. January 2026 l 13

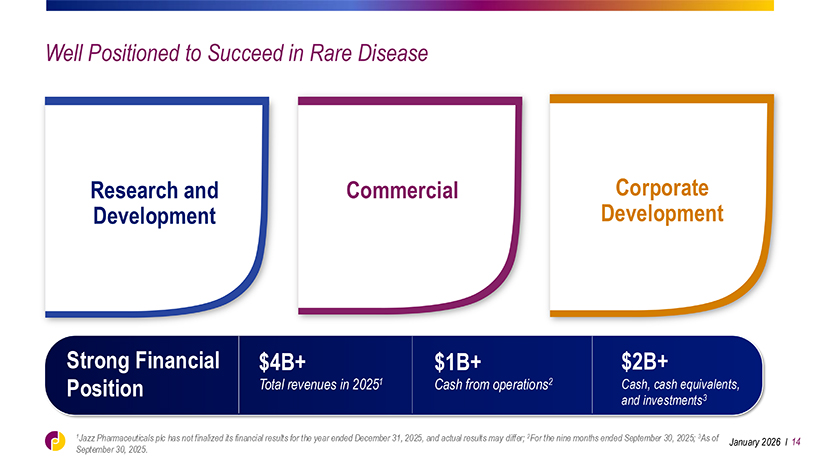

Well Positioned to Succeed in Rare Disease Research and Commercial Corporate Development Development Strong Financial $4B+ $1B+ $2B+ Position Total revenues in 20251 Cash from operations2 Cash, cash equivalents, and investments3 1Jazz Pharmaceuticals plc has not finalized its financial results for the year ended December 31, 2025, and actual results may differ; 2For the nine months ended September 30, 2025; 3As of January 2026 l 14 September 30, 2025.

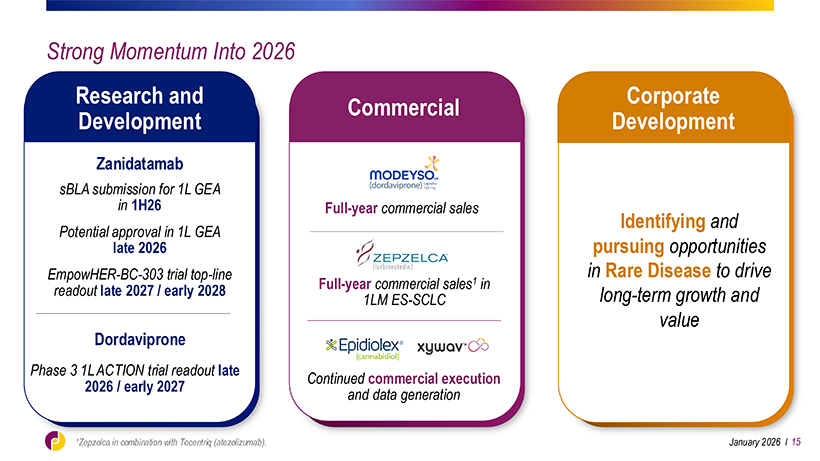

Strong Momentum Into 2026 Research and Corporate Commercial Development Development Zanidatamab sBLA submission for 1L GEA in 1H26 Full-year commercial sales Identifying and Potential approval in 1L GEA late 2026 pursuing opportunities EmpowHER-BC-303 trial top-line in Rare Disease to drive Full-year commercial sales1 in readout late 2027 / early 2028 long-term growth and 1LM ES-SCLC value Dordaviprone Phase 3NDA 1L ACTION filing for trial capsule readout late Continued commercial execution formulation 2026 / early mid 2027 2027 and data generation January 2026 l 15

THANK YOU

Q&A

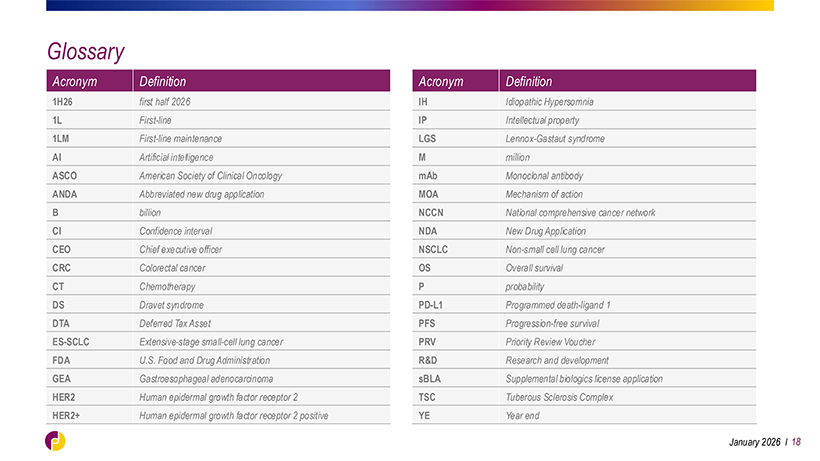

Glossary Acronym Definition Acronym Definition 1H26 first half 2026 IH Idiopathic Hypersomnia 1L First-line IP Intellectual property 1LM First-line maintenance LGS Lennox-Gastaut syndrome AI Artificial intelligence M million ASCO American Society of Clinical Oncology mAb Monoclonal antibody ANDA Abbreviated new drug application MOA Mechanism of action B billion NCCN National comprehensive cancer network CI Confidence interval NDA New Drug Application CEO Chief executive officer NSCLC Non-small cell lung cancer CRC Colorectal cancer OS Overall survival CT Chemotherapy P probability DS Dravet syndrome PD-L1 Programmed death-ligand 1 DTA Deferred Tax Asset PFS Progression-free survival ES-SCLC Extensive-stage small-cell lung cancer PRV Priority Review Voucher FDA U.S. Food and Drug Administration R&D Research and development GEA Gastroesophageal adenocarcinoma sBLA Supplemental biologics license application HER2 Human epidermal growth factor receptor 2 TSC Tuberous Sclerosis Complex HER2+ Human epidermal growth factor receptor 2 positive YE Year end January 2026 l 18