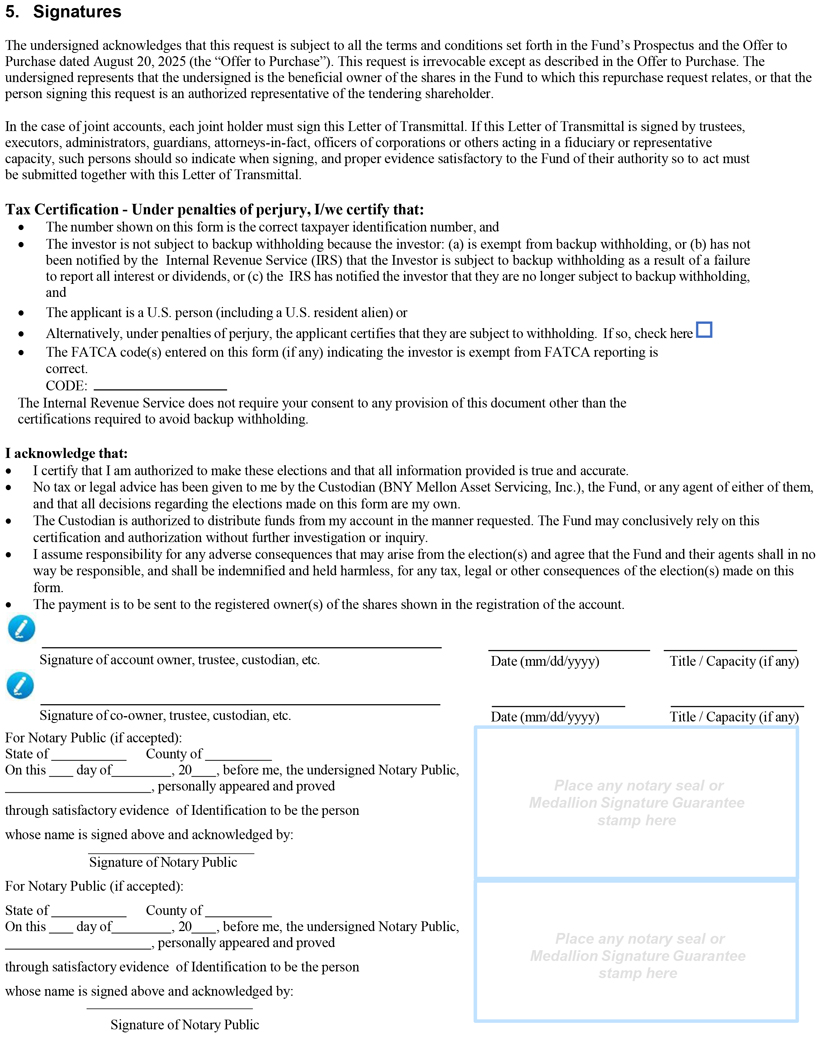

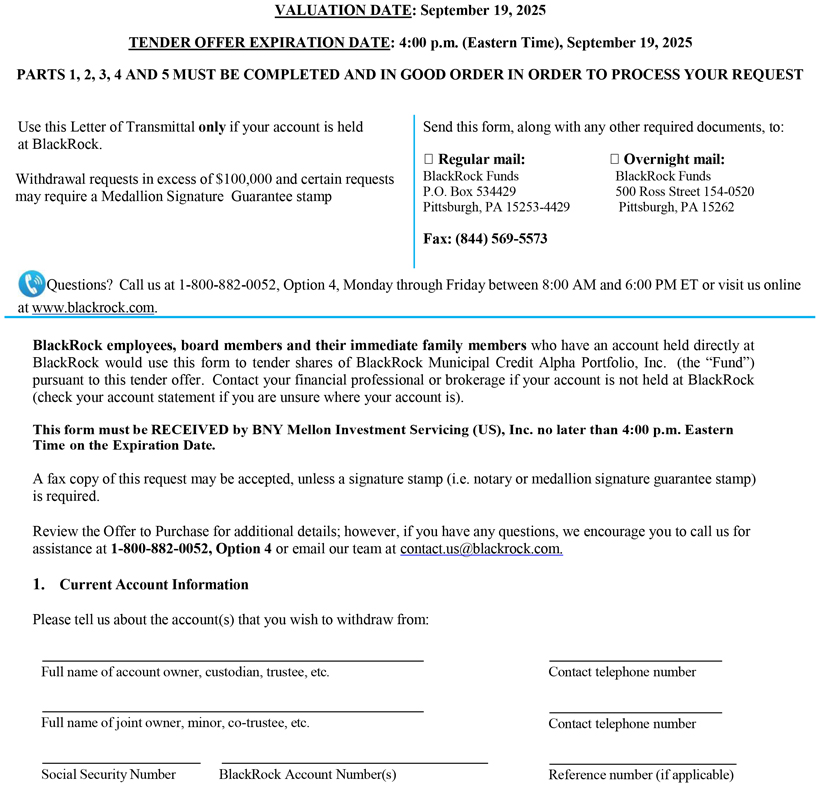

VALUATION DATE: September 19, 2025 TENDER OFFER EXPIRATION DATE: 4:00 p.m. (Eastern Time), September 19, 2025 PARTS 1, 2, 3, 4 AND 5 MUST BE COMPLETED AND IN GOOD ORDER IN ORDER TO PROCESS YOUR REQUEST BlackRock employees, board members and their immediate family members who have an account held directly at BlackRock would use this form to tender shares of BlackRock Municipal Credit Alpha Portfolio, Inc. (the “Fund”) pursuant to this tender offer. Contact your financial professional or brokerage if your account is not held at BlackRock (check your account statement if you are unsure where your account is). Use this Letter of Transmittal only if your account is held at BlackRock. Withdrawal requests in excess of $100,000 and certain requests may require a Medallion Signature Guarantee stamp Send this form, along with any other required documents, to: ☐ Regular mail: ☐ Overnight mail: BlackRock FundsBlackRock Funds P.O. Box 534429500 Ross Street 154-0520 Pittsburgh, PA 15253-4429Pittsburgh, PA 15262 Fax: (844) 569-5573 Questions? Call us at 1-800-882-0052, Option 4, Monday through Friday between 8:00 AM and 6:00 PM ET or visit us online at www.blackrock.com. This form must be RECEIVED by BNY Mellon Investment Servicing (US), Inc. no later than 4:00 p.m. Eastern Time on the Expiration Date. A fax copy of this request may be accepted, unless a signature stamp (i.e. notary or medallion signature guarantee stamp) is required. Review the Offer to Purchase for additional details; however, if you have any questions, we encourage you to call us for assistance at 1-800-882-0052, Option 4 or email our team at contact.us@blackrock.com. 1. Current Account Information Please tell us about the account(s) that you wish to withdraw from: Full name of account owner, custodian, trustee, etc. Full name of joint owner, minor, co-trustee, etc. Social Security NumberBlackRock Account Number(s) Contact telephone number Contact telephone number Reference number (if applicable)

| Letter of Transmittal – BlackRock Municipal Credit Alpha Portfolio, Inc. | Page 3 |