Initial Public Offering – June 2014

Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333-194606 June 30, 2014

Forward Looking Statements

Some of the matters discussed in this presentation contain forward-looking statements that involve significant risks and uncertainties, including statements relating to the prospects for the Company’s Tarmogen technology, for the timing and outcome of the Company’s clinical trials, the potential approval to market any Tarmogens, and the Company’s capital needs. Actual events could differ materially from those projected and the Company cautions investors not to rely on the forward-looking statements contained in, or made in connection with, the presentation.

Among other things, the Company’s, or it’s collaborators’ clinical trials may be delayed or may eventually be unsuccessful. The Company may consume more cash than it currently anticipates and faster than projected or the Company’s collaborators may terminate or amend their agreements with the Company with terms which are adverse to the Company’s prospects. Competitive products may reduce or eliminate the commercial opportunities of the Company’s product candidates. If the FDA or foreign regulatory agencies determine that the Company’s product candidates do not meet safety or efficacy endpoints in clinical evaluations, they will not receive regulatory approval and the Company will not be able to market them. The Company may not enter into any additional strategic collaboration agreements. Operating expense and cash flow projections involve a high degree of uncertainty, including variances in future spending rates due to changes in corporate priorities, the timing and outcomes of clinical trials, regulatory and competitive developments and the impact on expenditures and available capital from licensing and strategic collaboration opportunities. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to significantly alter, delay, scale back or discontinue operations.

Additional risks and uncertainties relating to the Company and its business can be found in the “Risk Factors” section of the Company’s Registration Statement on Form S-1, as amended and the Company’s other Periodic and Current Reports filed with the SEC, if any. GlobeImmune undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in the Company’s expectations.

| 2 |

|

Free Writing Prospectus Statement

• This presentation highlights basic information about us and the offering.

Because it is a summary, it does not contain all of the information that you

should consider before investing in our common stock.

• We have filed a registration statement (including prospectus) with the United

States Securities and Exchange Commission (SEC) for the offering to which this

presentation relates. The registration statement has not yet become effective.

Before you invest, you should read the prospectus in the registration statement

(including the risk factors described therein) and other documents we have filed

with the SEC for more complete information about us and the offering. You

may get these documents, including the preliminary prospectus dated June 27,

2014 for free by visiting EDGAR on the SEC website at http://www.sec.gov.

| • |

|

Alternatively, we or any underwriter participating in the offering will arrange to |

send you the prospectus if you contact Aegis Capital Corp., Prospectus

Department, 810 Seventh Avenue, 18th Floor, New York, NY 10019, telephone

212-813-1010, email: prospectus@aegiscap.com

| 3 |

|

Initial Public Offering Summary

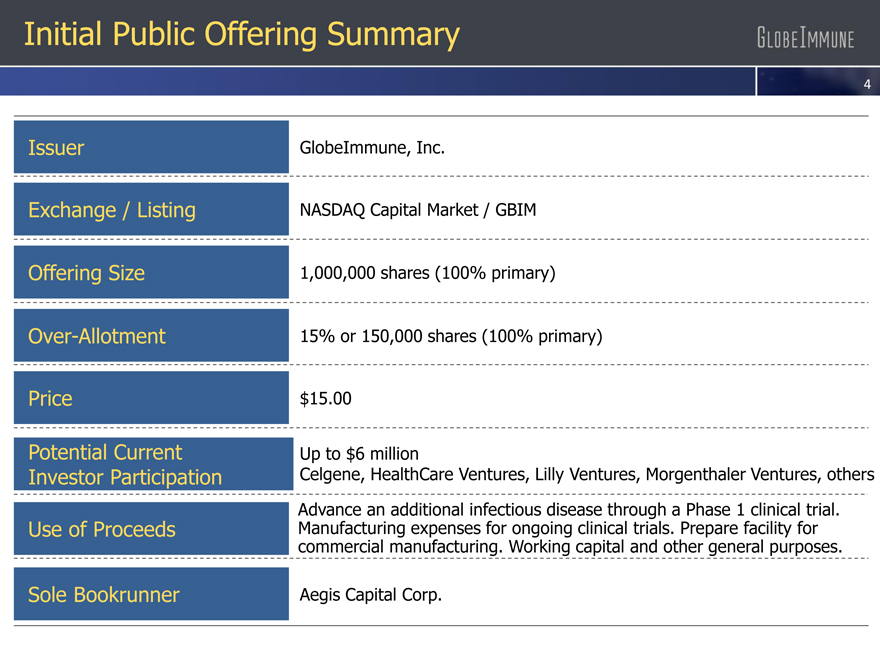

Issuer GlobeImmune, Inc.

Exchange / Listing NASDAQ Capital Market / GBIM

Offering Size 1,000,000 shares (100% primary)

Over-Allotment 15% or 150,000 shares (100% primary)

Price $15.00

Potential Current Up to $6 million

Investor Participation Celgene, HealthCare Ventures, Lilly Ventures, Morgenthaler Ventures, others

Advance an additional infectious disease through a Phase 1 clinical trial.

Use of Proceeds Manufacturing expenses for ongoing clinical trials. Prepare facility for

commercial manufacturing. Working capital and other general purposes.

Sole Bookrunner Aegis Capital Corp.

| 4 |

|

GlobeImmune

| • |

|

Differentiated immunotherapeutic platform |

| • |

|

Proof of concept in infectious disease & oncology |

– 4 ongoing phase 2 studies with multiple upcoming readouts

| • |

|

Major alliances with Gilead and Celgene |

– Over $60 million in partnership revenue to date

– Upcoming data from randomized phase 2 HBV trial

– Upcoming complete data from chordoma phase 1 patients

| • |

|

Multiple additional proprietary programs |

| 5 |

|

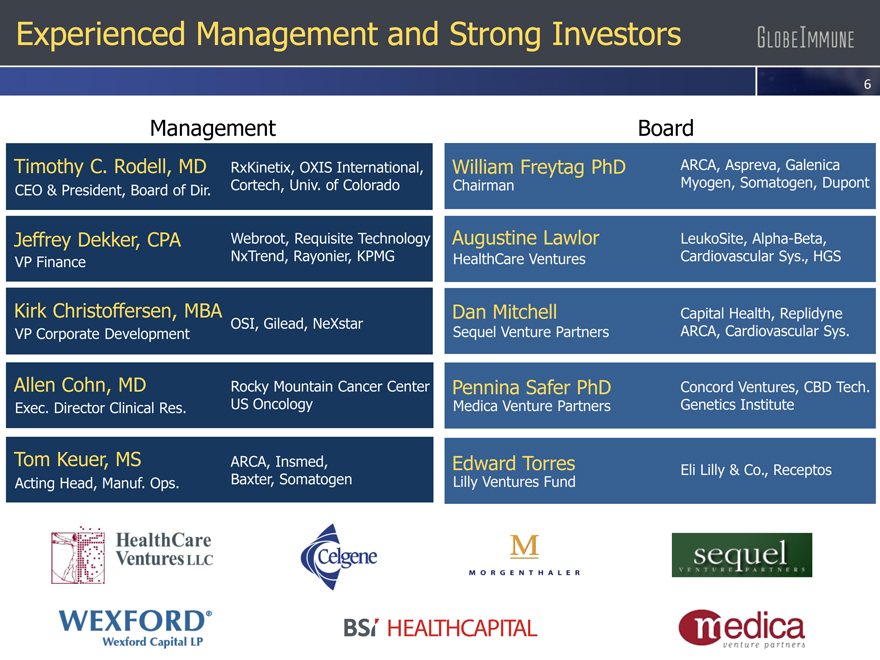

Experienced Management and Strong Investors

Management

Timothy C. Rodell, MD

RxKinetix, OXIS International,

CEO & President, Board of Dir.

Cortech, Univ. of Colorado

Jeffrey Dekker, CPA Webroot, Requisite Technology

VP Finance NxTrend, Rayonier, KPMG

Kirk Christoffersen, MBA

VP Corporate Development OSI, Gilead, NeXstar

Allen Cohn, MD Rocky Mountain Cancer Center

Exec. Director Clinical Res. US Oncology

Tom Keuer, MS ARCA, Insmed,

Acting Head, Manuf. Ops. Baxter, Somatogen

William Freytag PhD

Chairman

Augustine Lawlor

HealthCare Ventures

Dan Mitchell

Sequel Venture Partners

Pennina Safer PhD

Medica Venture Partners

Edward Torres

Lilly Ventures Fund

Board

ARCA, Aspreva, Galenica Myogen, Somatogen, Dupont

LeukoSite, Alpha-Beta, Cardiovascular Sys., HGS

Capital Health, Replidyne ARCA, Cardiovascular Sys.

Concord Ventures, CBD Tech. Genetics Institute

Eli Lilly & Co., Receptos

| 6 |

|

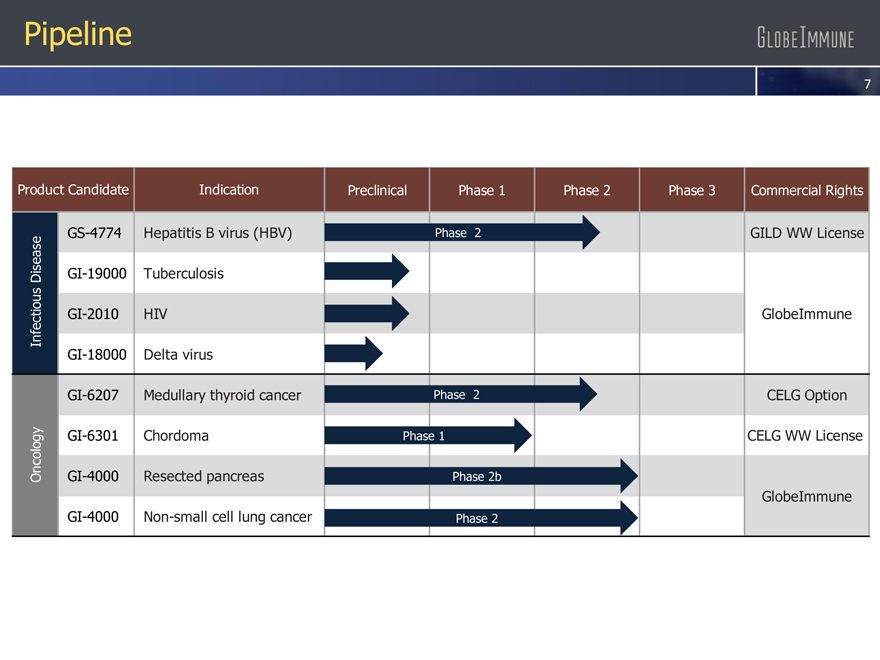

Pipeline

Product Candidate Indication Preclinical Phase 1 Phase 2 Phase 3 Commercial Rights

GS-4774 Hepatitis B virus (HBV) Phase 2 GILD WW License

ease

s

i GI-19000 Tuberculosis

D

s

iou

nfect GI-2010 HIV GlobeImmune

I

GI-18000 Delta virus

GI-6207 Medullary thyroid cancer Phase 2 CELG Option

y GI-6301 Chordoma Phase 1 CELG WW License

og

ol

c

On GI-4000 Resected pancreas Phase 2b

GlobeImmune

GI-4000 Non-small cell lung cancer Phase 2

| 7 |

|

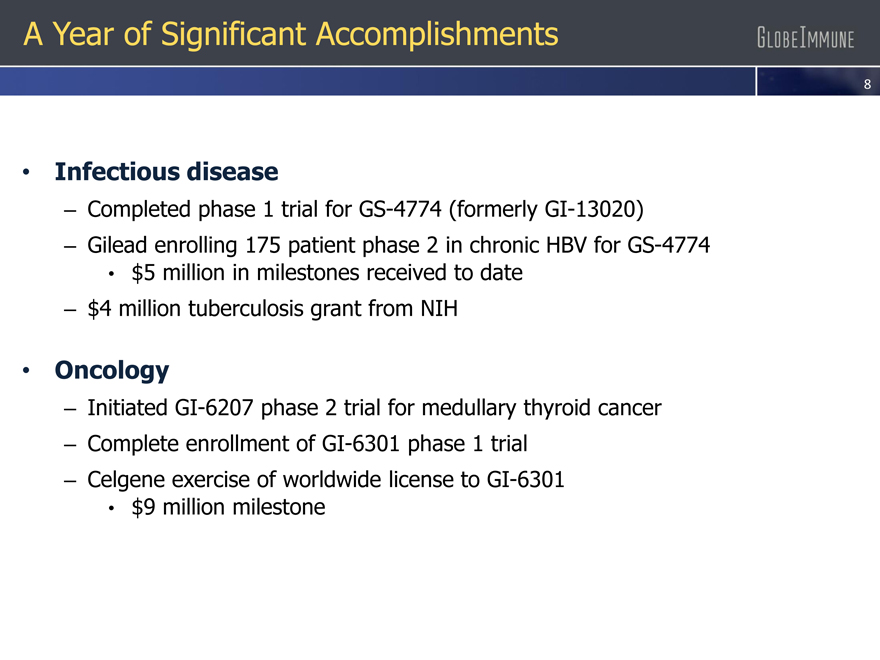

A Year of Significant Accomplishments

| • |

|

Infectious disease |

– Completed phase 1 trial for GS-4774 (formerly GI-13020)

– Gilead enrolling 175 patient phase 2 in chronic HBV for GS-4774

| • |

|

$5 million in milestones received to date |

– $4 million tuberculosis grant from NIH

| • |

|

Oncology |

– Initiated GI-6207 phase 2 trial for medullary thyroid cancer

– Complete enrollment of GI-6301 phase 1 trial

– Celgene exercise of worldwide license to GI-6301

| • |

|

$9 million milestone |

| 8 |

|

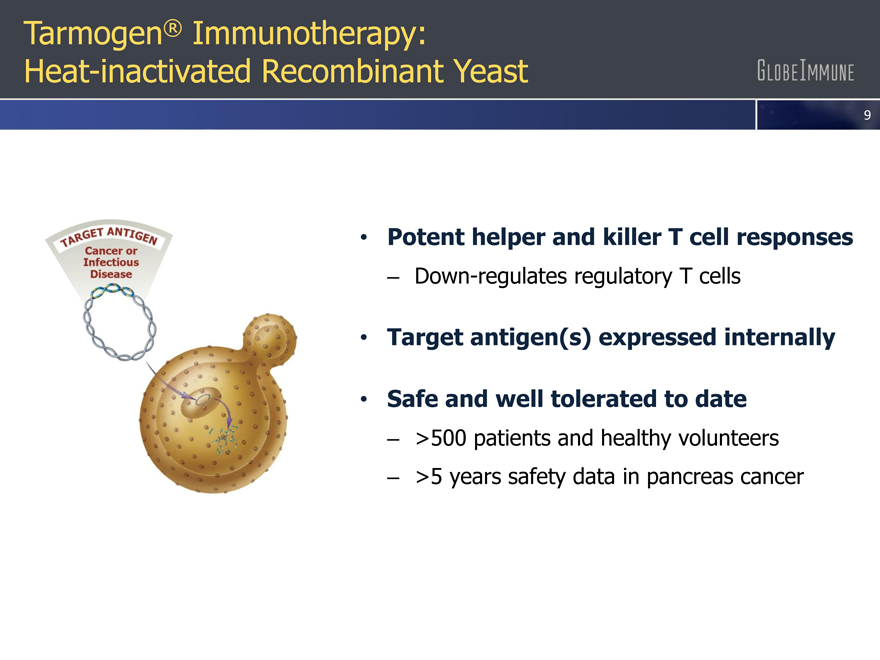

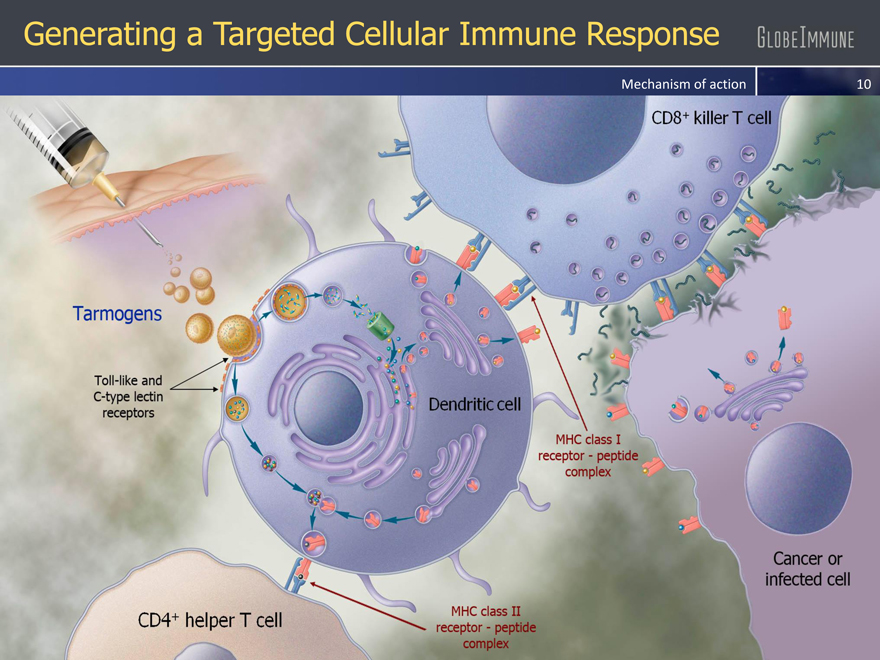

Tarmogen® Immunotherapy: Heat-inactivated Recombinant Yeast

| • |

|

Potent helper and killer T cell responses |

– Down-regulates regulatory T cells

| • |

|

Target antigen(s) expressed internally |

| • |

|

Safe and well tolerated to date |

– >500 patients and healthy volunteers

– >5 years safety data in pancreas cancer

9

Generating a Targeted Cellular Immune Response

Mechanism of action

10

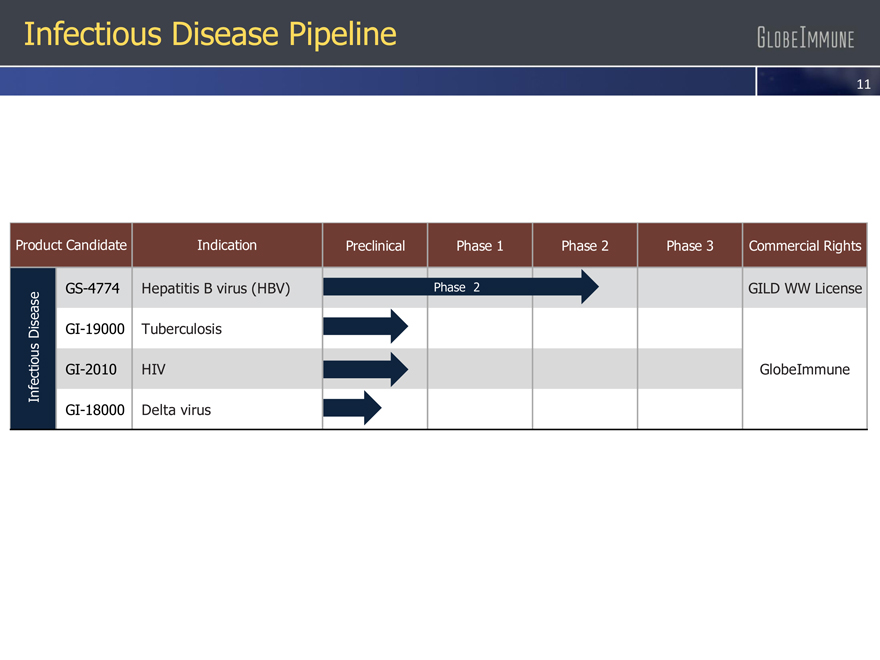

Infectious Disease Pipeline

Product Candidate Indication Preclinical Phase 1 Phase 2 Phase 3 Commercial Rights

GS-4774 Hepatitis B virus (HBV) Phase 2 GILD WW License

GI-19000 Tuberculosis

Infectious Disease GI-2010 HIV GlobeImmune

GI-18000 Delta virus

11

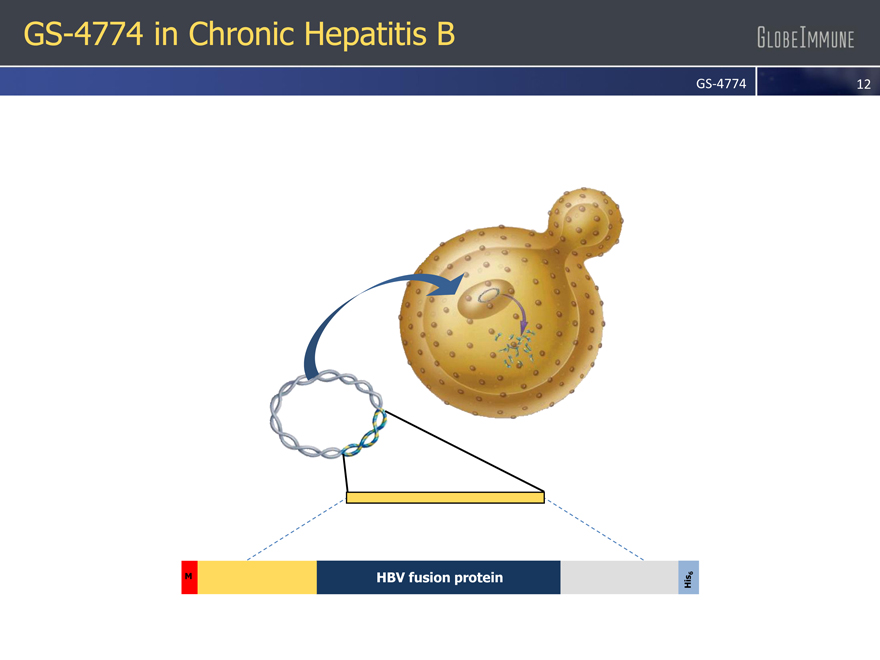

GS-4774 in Chronic Hepatitis B

GS-4774

HBV fusion protein

M

His 6

12

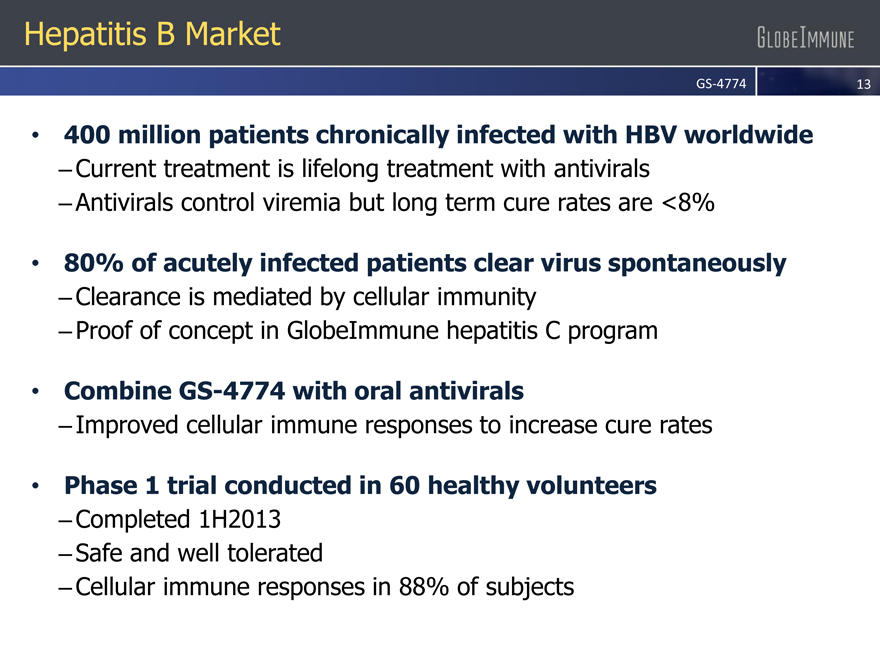

Hepatitis B Market

GS-4774

| • |

|

400 million patients chronically infected with HBV worldwide |

– Current treatment is lifelong treatment with antivirals

– Antivirals control viremia but long term cure rates are <8%

| • |

|

80% of acutely infected patients clear virus spontaneously |

– Clearance is mediated by cellular immunity

– Proof of concept in GlobeImmune hepatitis C program

| • |

|

Combine GS-4774 with oral antivirals |

– Improved cellular immune responses to increase cure rates

| • |

|

Phase 1 trial conducted in 60 healthy volunteers |

– Completed 1H2013

– Safe and well tolerated

– Cellular immune responses in 88% of subjects

13

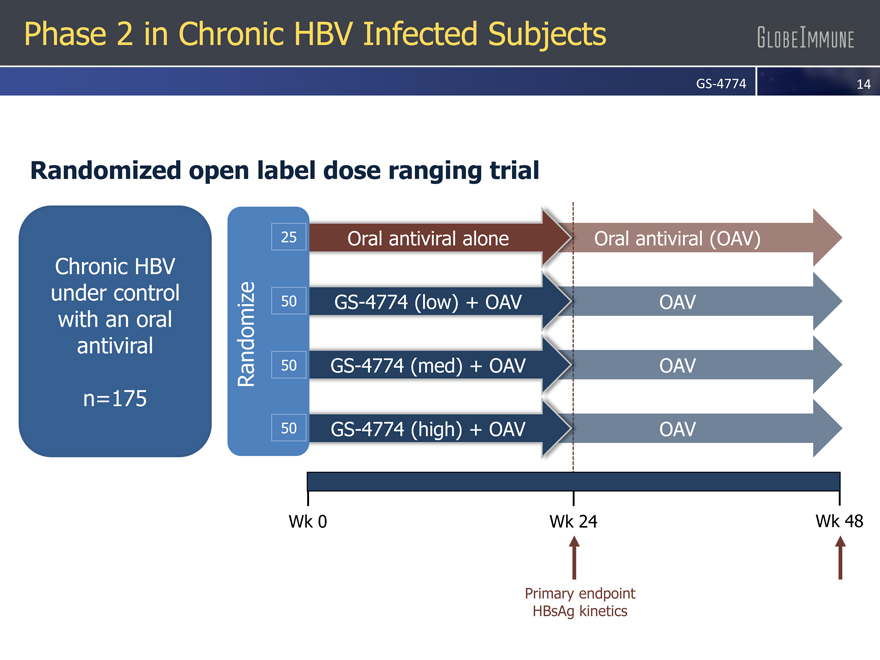

Phase 2 in Chronic HBV Infected Subjects

GS-4774

Randomized open label dose ranging trial

Chronic HBV under control with an oral antiviral

n=175

25 Oral antiviral alone Oral antiviral (OAV)

50 GS-4774 (low) + OAV OAV

50 GS-4774 (med) + OAV OAV

50 GS-4774 (high) + OAV OAV

Wk 0 Wk 24 Wk 48

Primary endpoint

HBsAg kinetics Randomize

14

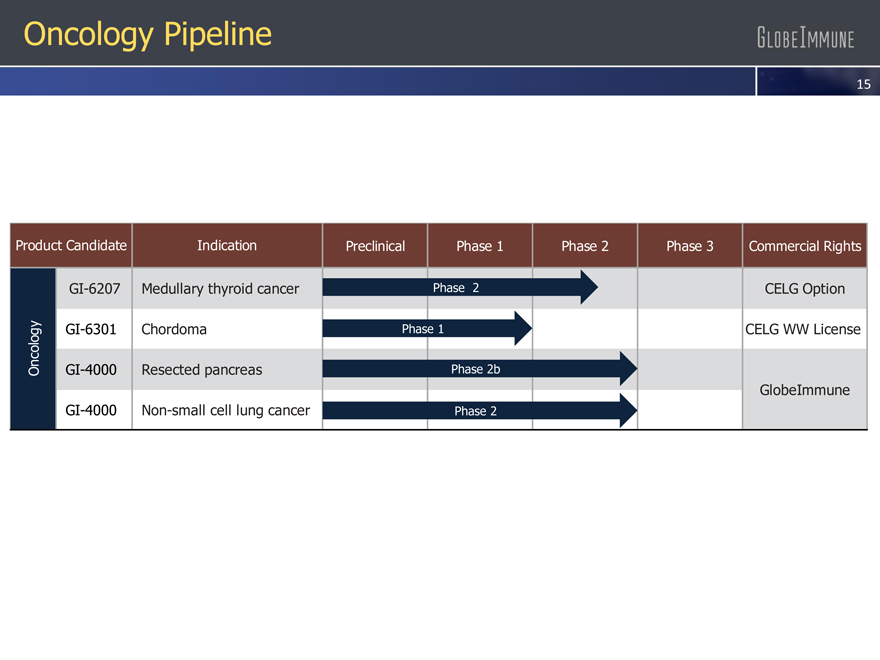

Oncology Pipeline

Medullary thyroid cancer Chordoma Resected pancreas Non-small cell lung cancer

Product Candidate

GI-6207

GI-6301

Indication

Oncology GI-4000

GI-4000

Preclinical Phase 1 Phase 2 Phase 3

Phase 2 Phase 1 Phase 2b Phase 2

Commercial Rights

CELG Option

CELG WW License

GlobeImmune

15

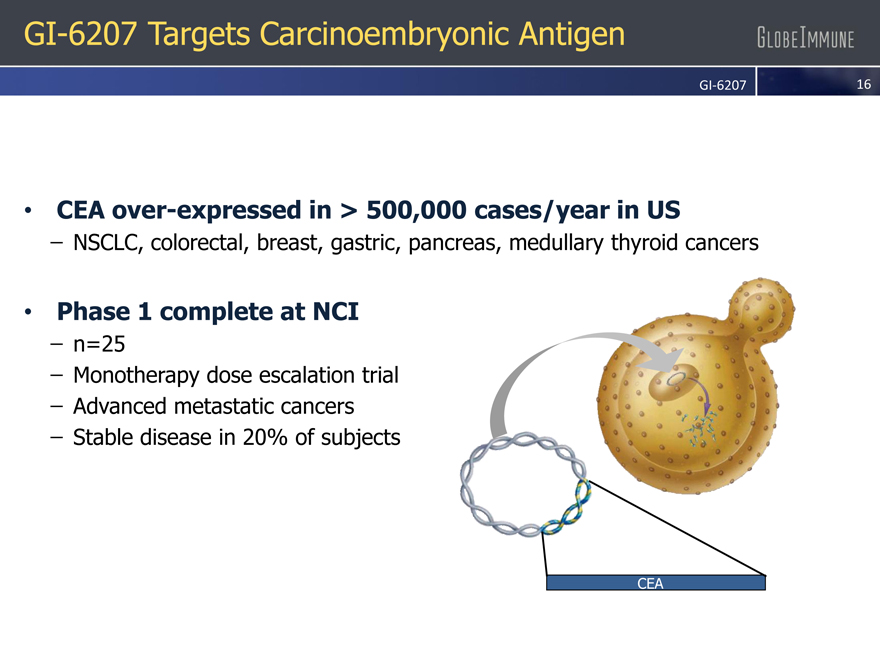

GI-6207 Targets Carcinoembryonic Antigen

GI-6207

| • |

|

CEA over-expressed in > 500,000 cases/year in US |

NSCLC, colorectal, breast, gastric, pancreas, medullary thyroid cancers

| • |

|

Phase 1 complete at NCI |

n=25

Monotherapy dose escalation trial

Advanced metastatic cancers

Stable disease in 20% of subjects

CEA

16

Medullary Thyroid Cancer

GI-6207

GI-6207

| • |

|

MTC represents 8% of all thyroid cancer cases annually in US |

| • |

|

Resection is the only opportunity for cure |

– In less symptomatic metastatic disease SoC is observation

| • |

|

25% and 10% survival at 5 and 10 years with metastases |

| • |

|

Vandetanib and cabozantinib approved for metastatic disease |

– Due to toxicity used only in very symptomatic patients

Vandetanib Cabozantinib

WARNING:

QT PROLONGATION, TORSADES DE POINTES, AND SUDDEN DEATH

See full prescribing information for full boxed warning.

WARNING:

PERFORATIONS AND FISTULAS, and HEMORRHAGE

See full prescribing information for full boxed warning.

17

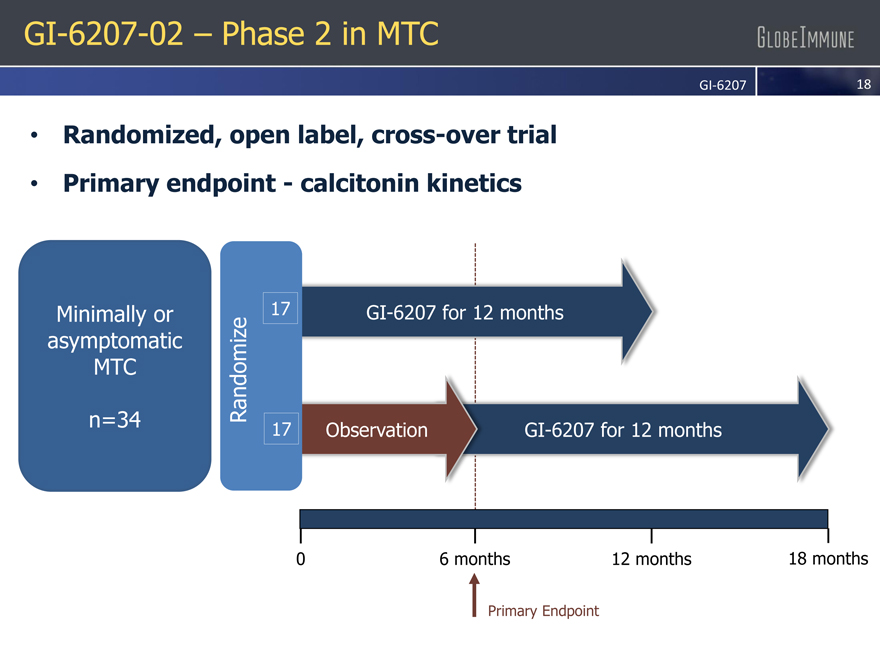

GI-6207-02 – Phase 2 in MTC

GI-6207

| • |

|

Randomized, open label, cross-over trial |

GI-6207 for 12 months

Observation GI-6207 for 12 months

| 6 |

|

months 12 months 18 months |

Primary Endpoint

| • |

|

Primary endpoint—calcitonin kinetics |

Minimally or 17 asymptomatic

MTC Randomize n=34 17

0

18

GI-6301 Targets Brachyury Expressing Cancers

GI-6301

Brachyury

Lung, breast, colon, bladder, kidney, ovary, pancreas, chordoma

Transcription factor involved in normal embryogenesis

Important driver of metastasis

Brachyury

19

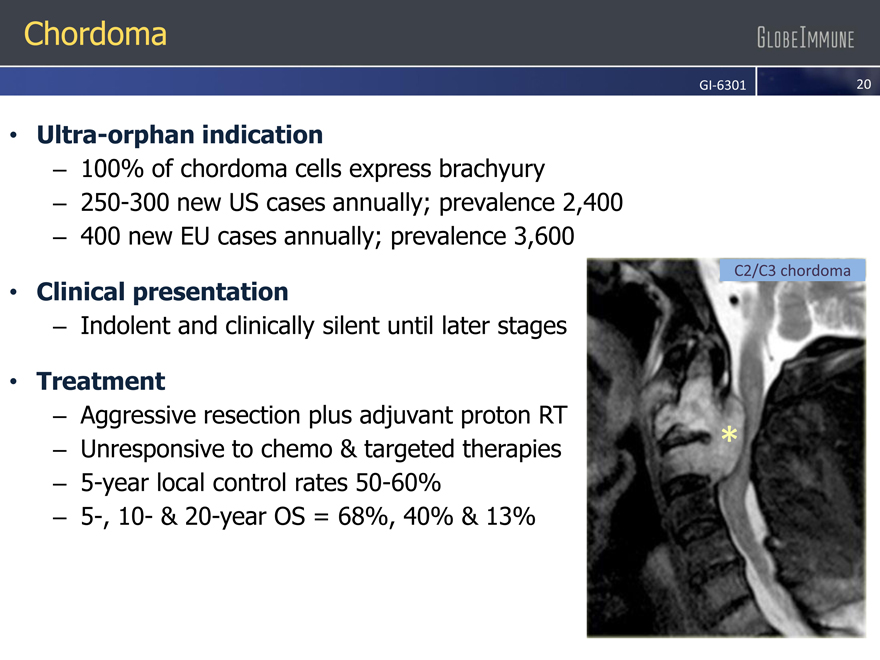

Chordoma

Ultra-orphan indication

– 100% of chordoma cells express brachyury

– 250-300 new US cases annually; prevalence 2,400

– 400 new EU cases annually; prevalence 3,600

Clinical presentation

– Indolent and clinically silent until later stages

Treatment

– Aggressive resection plus adjuvant proton RT

– Unresponsive to chemo & targeted therapies

– 5-year local control rates 50-60%

– 5-, 10- & 20-year OS = 68%, 40% & 13%

GI-6301 20

C2/C3 chordoma

20

GI-6301 Clinical Summary

GI-6301

NCI sponsored phase 1

34 subject, open label dose escalation trial

4 dose groups

Fully enrolled

Ten chordoma patients enrolled in Phase 1

Initial chordoma results presented at ASCO 2014

Phase 2 trial being designed

21

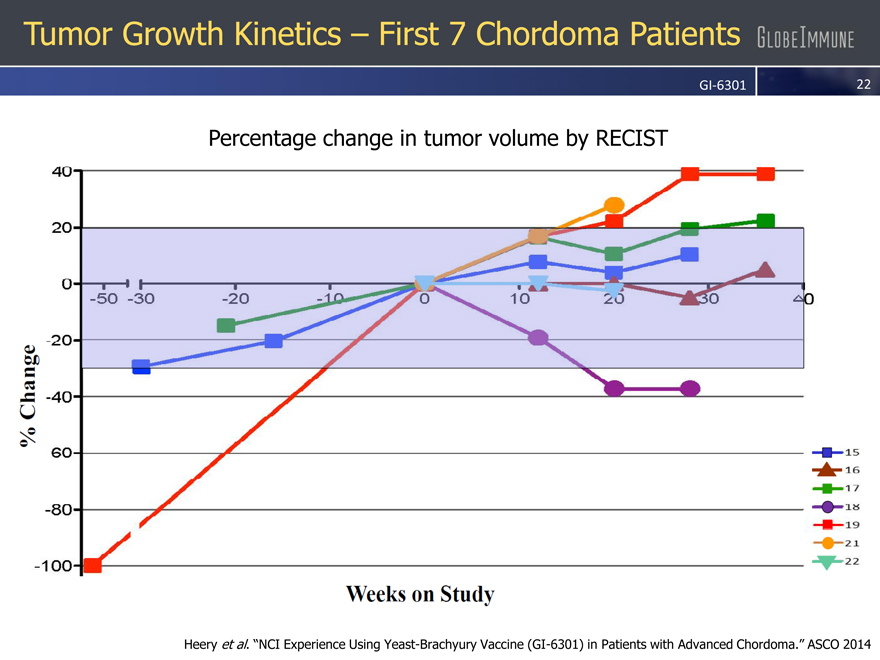

Tumor Growth Kinetics – First 7 Chordoma Patients

GI-6301

Percentage change in tumor volume by RECIST

Heery et al. “NCI Experience Using Yeast-Brachyury Vaccine (GI-6301) in Patients with Advanced Chordoma.” ASCO 2014

22

GI-4000 Targets Mutated Ras

GI-4000

Critical molecular target in multiple cancers

~200,000 Ras mutation+ cancer cases/year in U.S.

– Poor prognosis

– Less responsive to chemotherapy and targeted agents

176 patient Phase 2 in resected pancreas cancer

– 2.6 month improvement in OS in subjects with residual disease

– Companion diagnostic BDX-001 appears to predict response to GI-4000

BDX-001 signature seen in ~50% of tested samples

Predicts 16.6 month improvement in overall survival with GI-4000

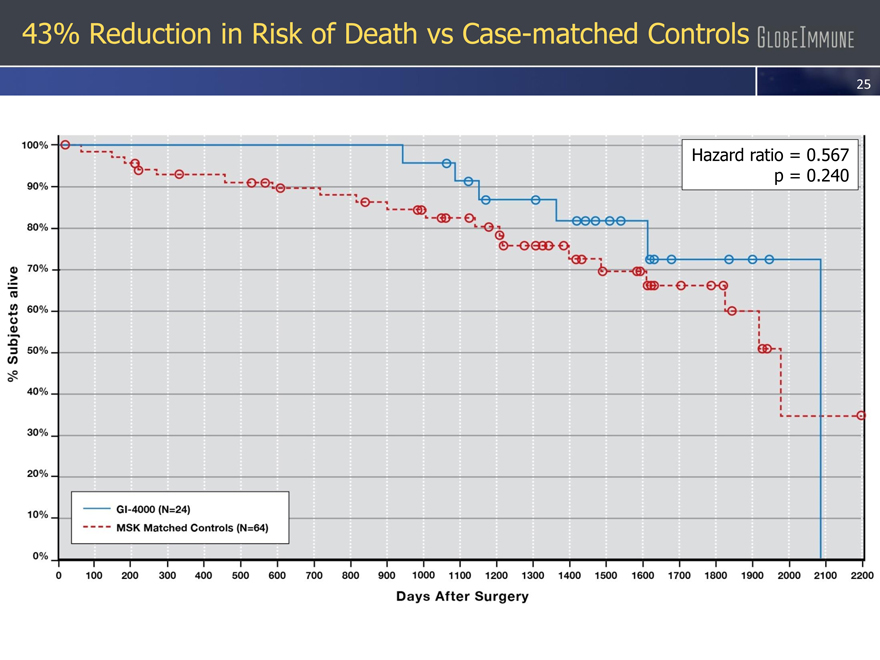

Phase 2 in non-small cell lung cancer

– 24 patient case-controlled study at Memorial Sloan Kettering

– 43% reduction in the risk of mortality compared with case-matched controls

23

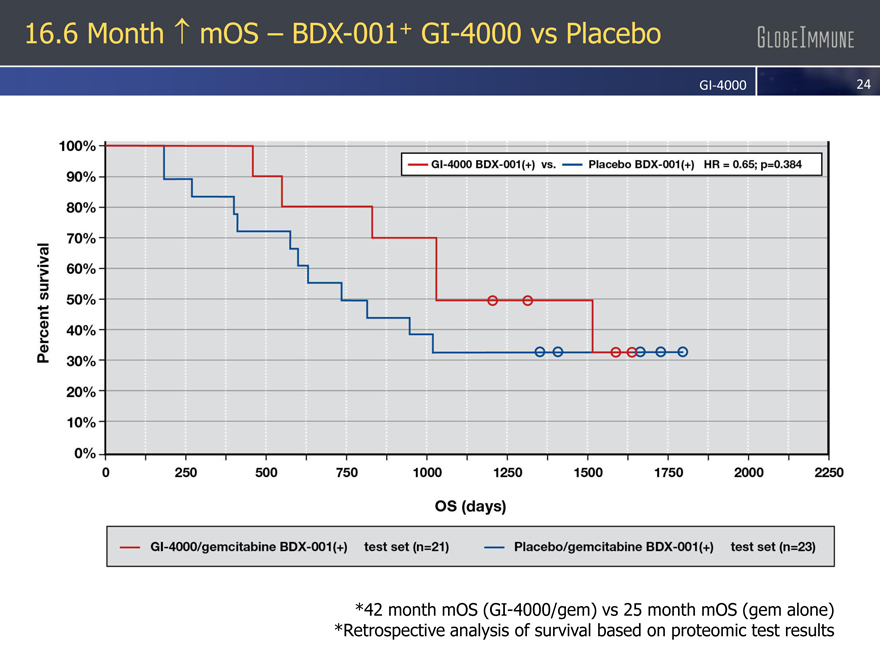

16.6 Month mOS – BDX-001+ GI-4000 vs Placebo

GI-4000

*42 month mOS (GI-4000/gem) vs 25 month mOS (gem alone)

*Retrospective analysis of survival based on proteomic test results

24

43% Reduction in Risk of Death vs Case-matched Controls

25

Key strategic collaborations

GlobeImmune

Gilead Alliance

GlobeImmune

GI-13020

27

Exclusive license to all HBV Tarmogens

– Signed in October 2011

GILEAD

Economics

– $10 million upfront

– Up to $135 million in potential clinical and regulatory milestones

– Up to $40 million in potential sales milestones

– Tiered royalties from high single digits to mid teens

Gilead funds clinical development and manufacturing

– Randomized phase 2 ongoing

Celgene Collaboration & Option Agreement

GlobeImmune

28

Exclusive option to oncology products

– Program-by-program basis

– GI-6301 licensed by Celgene in 2013

Celgene

Option agreement economics

– $40 million upfront

– Clinical, regulatory and commercial milestones for each product

– Celgene pays all future expenses for licensed products

– Royalties in the teens for products subject to option

Option structure

– GlobeImmune conducts early development through predefined endpoints

– Celgene has option to obtain an exclusive WW license

GI-6301 license

– $9M upfront; $145M in future milestones

– Tiered royalties high single to low double digits

Operations and financial

GlobeImmune

Financial Highlights

GlobeImmune

30

>$60 million partnership revenue to date from Gilead & Celgene

$119 million in 5

private rounds from premier VCs

$7.5 million convertible note, January 2014

– Converts to common stock at IPO

~$10 million in grants

$9.2 million in cash (3/31/14)

$15 million IPO provides funding through 2015

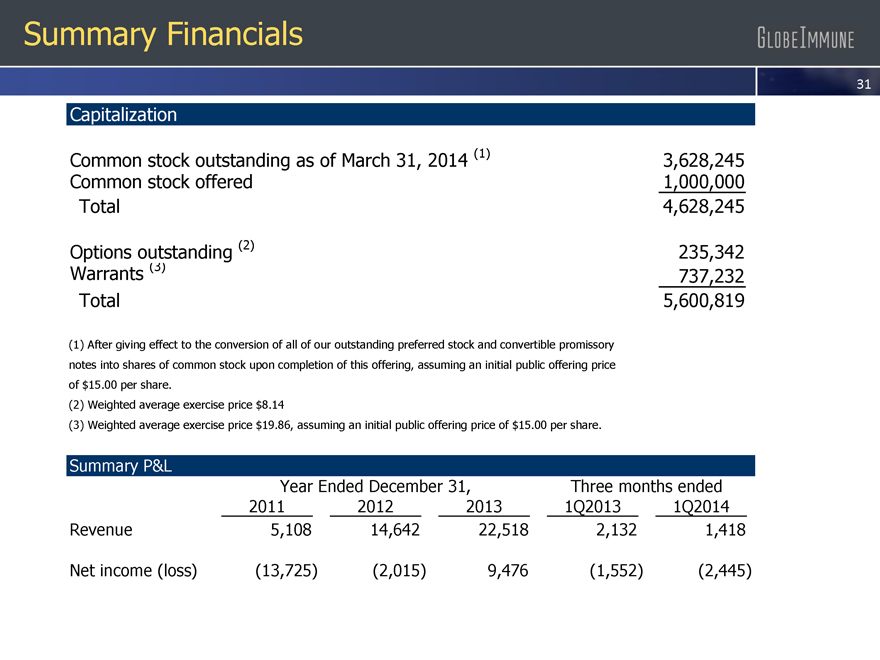

Summary Financials

GlobeImmune

31

Capitalization

Common stock outstanding as of March 31,

2014 (1)

3,628,245

Common stock offered

1,000,000

Total

4,628,245

Options outstanding (2)

235,342

Warrants (3)

737,232

Total

5,600,819

(1) After giving effect to the conversion of all of our outstanding preferred stock and convertible promissory notes into shares of common stock upon completion of this offering,

assuming an initial public offering price of $15.00 per share.

(2) Weighted average exercise price $8.14

(3) Weighted average exercise price $19.86, assuming an initial public offering price of $15.00 per share.

Summary P&L

Year Ended December 31,

Three months ended

2011

2012

2013

1Q2013

1Q2014

Revenue

5,108

14,642

22,518

2,132

1,418

Net income (loss)

(13,725)

(2,015)

9,476(1,552)

(2,445)

Efficient and Scalable Manufacturing

GlobeImmune

32

Established manufacturing

– Scaleable efficient process

250L commercial scale projected

Low capital cost

Portable equipment

– Facilitates technology transfer

Intellectual Property

GlobeImmune

33

302 patents and applications owned or licensed

108 allowed or issued

Cover platform, oncology, HCV, HBV, HDV, HIV, Ad-36,

influenza, fungal disease, tuberculosis,

other infectious

diseases, and methods of manufacture

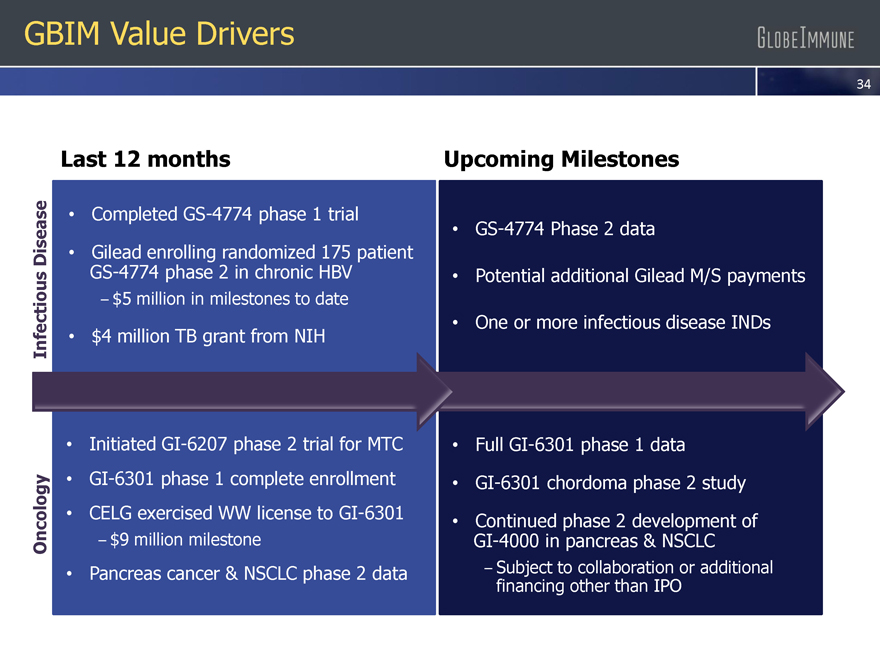

GBIM Value Drivers

GlobeImmune

34

Last 12 months Upcoming Milestones

Infectious Disease

Completed GS-4774 phase 1 trial

Gilead enrolling randomized 175 patient GS-4774 phase 2 in chronic HBV

– $5 million in milestones to date

$4 million TB grant from NIH

GS-4774 Phase 2 data

Potential additional Gilead M/S payments

One or more infectious disease INDs

Oncology

Initiated GI-6207 phase 2 trial for MTC

GI-6301 phase 1 complete enrollment

CELG exercised WW license to GI-6301

– $9 million milestone

Pancreas cancer & NSCLC phase 2 data

Full GI-6301 phase 1 data

GI-6301 chordoma phase 2 study

Continued phase 2 development of

GI-4000 in pancreas & NSCLC

– Subject to collaboration or additional financing other than IPO

Investment Overview

GlobeImmune

35

Targeting major diseases including HBV and multiple cancers

Alliances with Gilead and Celgene

– >$60 million in partnership revenue to date

Proof of concept in multiple diseases

Experienced management team

Multiple potential near term value drivers