Universal Technical Institute, Inc. Q4 2025 Financial Supplement

Financial Supplement Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). Forward-looking statements may contain words such as "goal," "target," "future," "estimate," "expect," "anticipate," "intend," "plan," "believe," "seek," "project," "may," "should," "will," the negative form of these expressions or similar expressions. These statements are based on our management’s current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements or events and circumstances reflected in the forward-looking statements will occur. Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual Report on Form 10-K, in our subsequent Quarterly Reports on Form 10-Q and certain of our Current Reports on Form 8-K, as well as any amendments thereto, filed with the Securities and Exchange Commission (the “SEC”). In addition, statements that refer to projections of earnings, revenue, costs or other financial items in future periods; anticipated growth and trends in our business or key markets; cost synergies, growth opportunities and other potential financial and operating benefits; future growth and revenues; future economic conditions and performance; anticipated performance of curriculum; plans, objectives and strategies for future operations; and other characterizations of future events or circumstances, and all other statements that are not statements of historical fact are forward-looking statements. Such statements are based on currently available operating, financial and competitive information and are subject to various risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in our forward-looking statements due to a number of factors, including, but not limited to, those set forth under the section entitled “Risk Factors” in our filings with the SEC. Important factors that could affect our actual results include, among other things, failure of our schools to comply with the extensive regulatory requirements for school operations; our failure to maintain eligibility for or our ability to process federal student financial assistance funds; the effect of current and future Title IV Program regulations arising out of negotiated rulemakings, including any potential reductions in funding or restrictions on the use of funds received through Title IV Programs; the effect of future legislative or regulatory initiatives related to veterans’ benefit programs; continued Congressional examination of the for-profit education sector; regulatory investigations of, or actions commenced against, us or other companies in our industry; changes in the state regulatory environment or budgetary constraints; failure to execute on our growth and diversification strategy, including effectively identifying, establishing and operating additional schools, programs or campuses; our failure to realize the expected benefits of our acquisitions, or our failure to successfully integrate our acquisitions; our failure to improve underutilized capacity at certain of our campuses; enrollment declines or challenges in our students’ ability to find employment as a result of macroeconomic conditions; our failure to maintain and expand existing industry relationships and develop new industry relationships; our ability to update and expand the content of existing programs and develop and integrate new programs in a timely and cost-effective manner while maintaining positive student outcomes; a loss of our senior management or other key employees; failure to comply with the restrictive covenants and our ability to pay the amounts when due under the Credit Agreement; and other risks that are described from time to time in our public filings. Given these risks, uncertainties and other factors, many of which are beyond our control, you should not place undue reliance on these forward-looking statements. Neither we nor any other person makes any representation as to the accuracy or completeness of these forward-looking statements and, except as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements, even if new information becomes available in the future. This presentation also contains estimates and other statistical data made by independent parties, and by us, relating to market size and growth and other data about our industry and our business. This data involves several assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. PAGE 2

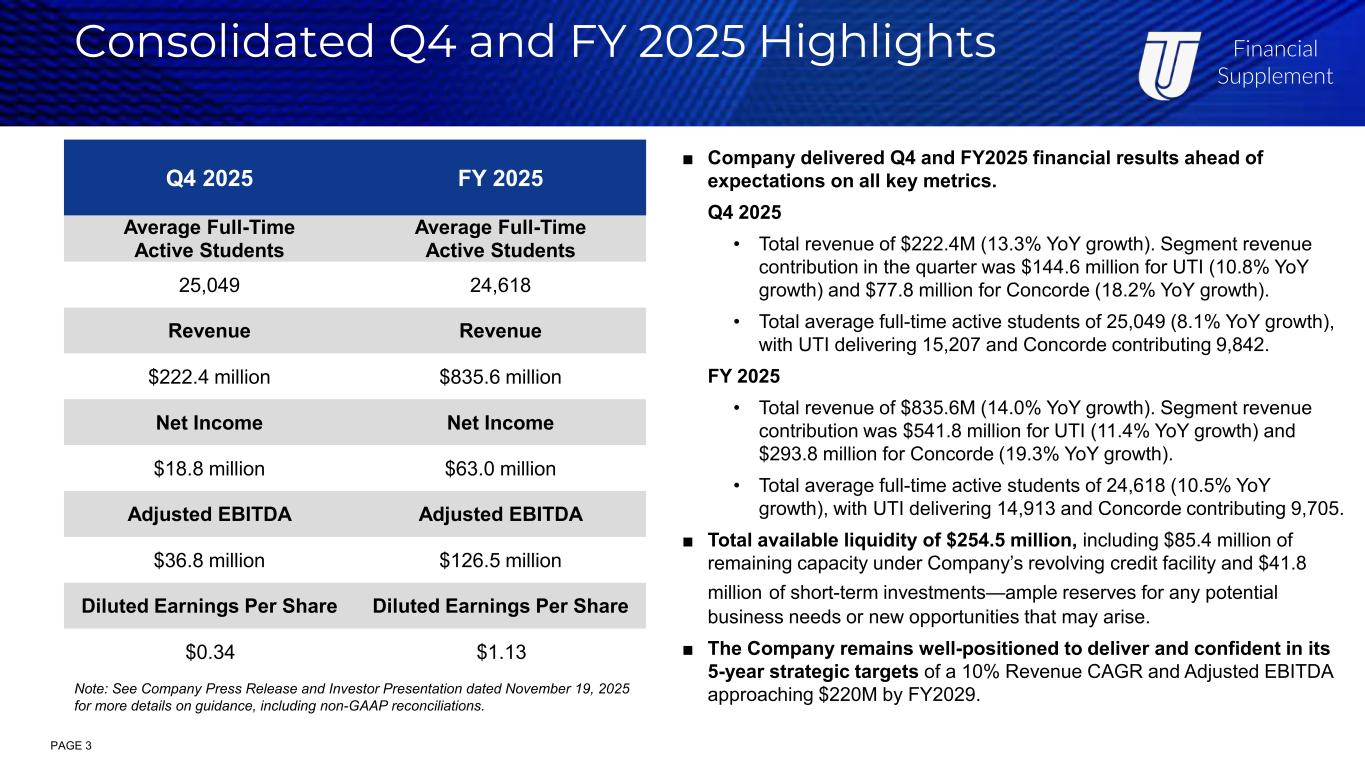

Financial Supplement Consolidated Q4 and FY 2025 Highlights Q4 2025 FY 2025 Average Full-Time Active Students Average Full-Time Active Students 25,049 24,618 Revenue Revenue $222.4 million $835.6 million Net Income Net Income $18.8 million $63.0 million Adjusted EBITDA Adjusted EBITDA $36.8 million $126.5 million Diluted Earnings Per Share Diluted Earnings Per Share $0.34 $1.13 PAGE 3 ■ Company delivered Q4 and FY2025 financial results ahead of expectations on all key metrics. Q4 2025 • Total revenue of $222.4M (13.3% YoY growth). Segment revenue contribution in the quarter was $144.6 million for UTI (10.8% YoY growth) and $77.8 million for Concorde (18.2% YoY growth). • Total average full-time active students of 25,049 (8.1% YoY growth), with UTI delivering 15,207 and Concorde contributing 9,842. FY 2025 • Total revenue of $835.6M (14.0% YoY growth). Segment revenue contribution was $541.8 million for UTI (11.4% YoY growth) and $293.8 million for Concorde (19.3% YoY growth). • Total average full-time active students of 24,618 (10.5% YoY growth), with UTI delivering 14,913 and Concorde contributing 9,705. ■ Total available liquidity of $254.5 million, including $85.4 million of remaining capacity under Company’s revolving credit facility and $41.8 million of short-term investments—ample reserves for any potential business needs or new opportunities that may arise. ■ The Company remains well-positioned to deliver and confident in its 5-year strategic targets of a 10% Revenue CAGR and Adjusted EBITDA approaching $220M by FY2029.Note: See Company Press Release and Investor Presentation dated November 19, 2025 for more details on guidance, including non-GAAP reconciliations.

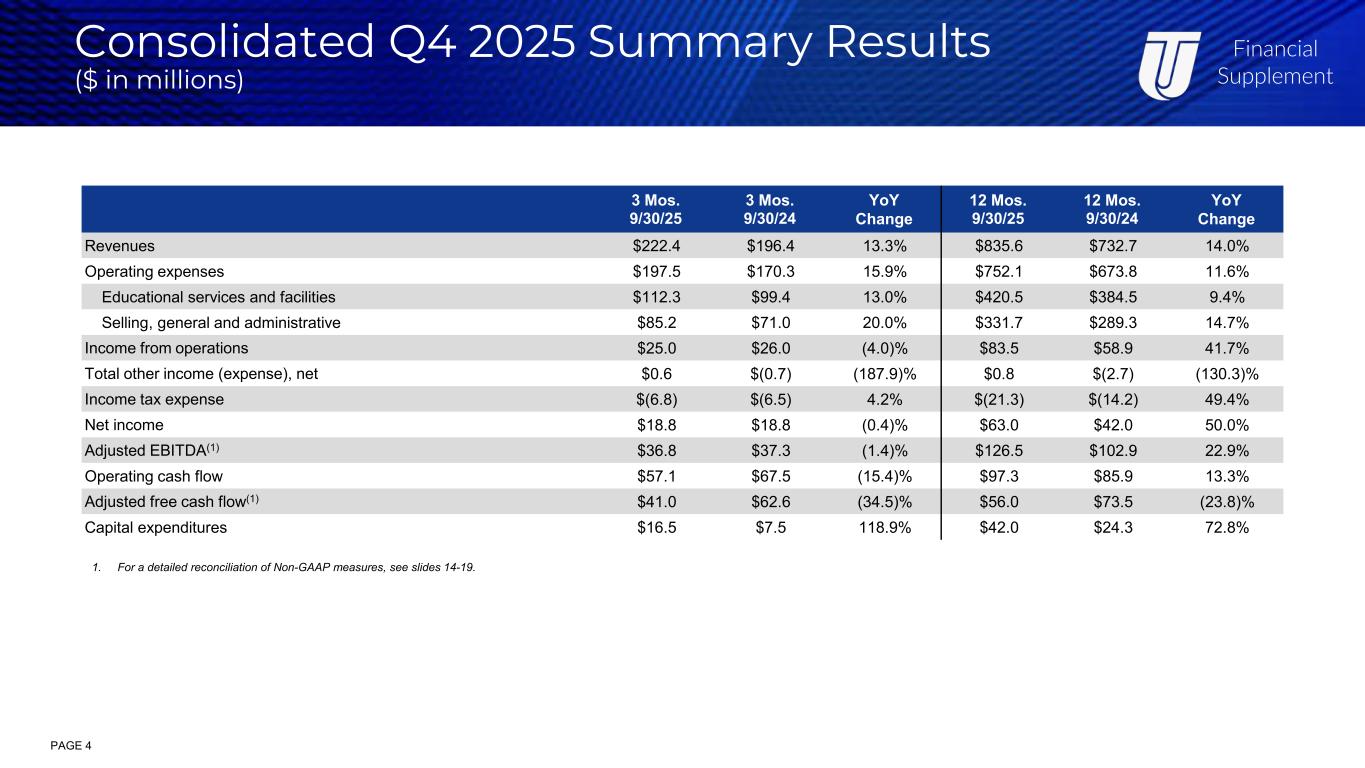

Financial Supplement Consolidated Q4 2025 Summary Results ($ in millions) ($ in millions, except for student data) 3 Mos. 9/30/25 3 Mos. 9/30/24 YoY Change 12 Mos. 9/30/25 12 Mos. 9/30/24 YoY Change Revenues $222.4 $196.4 13.3% $835.6 $732.7 14.0% Operating expenses $197.5 $170.3 15.9% $752.1 $673.8 11.6% Educational services and facilities $112.3 $99.4 13.0% $420.5 $384.5 9.4% Selling, general and administrative $85.2 $71.0 20.0% $331.7 $289.3 14.7% Income from operations $25.0 $26.0 (4.0)% $83.5 $58.9 41.7% Total other income (expense), net $0.6 $(0.7) (187.9)% $0.8 $(2.7) (130.3)% Income tax expense $(6.8) $(6.5) 4.2% $(21.3) $(14.2) 49.4% Net income $18.8 $18.8 (0.4)% $63.0 $42.0 50.0% Adjusted EBITDA(1) $36.8 $37.3 (1.4)% $126.5 $102.9 22.9% Operating cash flow $57.1 $67.5 (15.4)% $97.3 $85.9 13.3% Adjusted free cash flow(1) $41.0 $62.6 (34.5)% $56.0 $73.5 (23.8)% Capital expenditures $16.5 $7.5 118.9% $42.0 $24.3 72.8% PAGE 4 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-19.

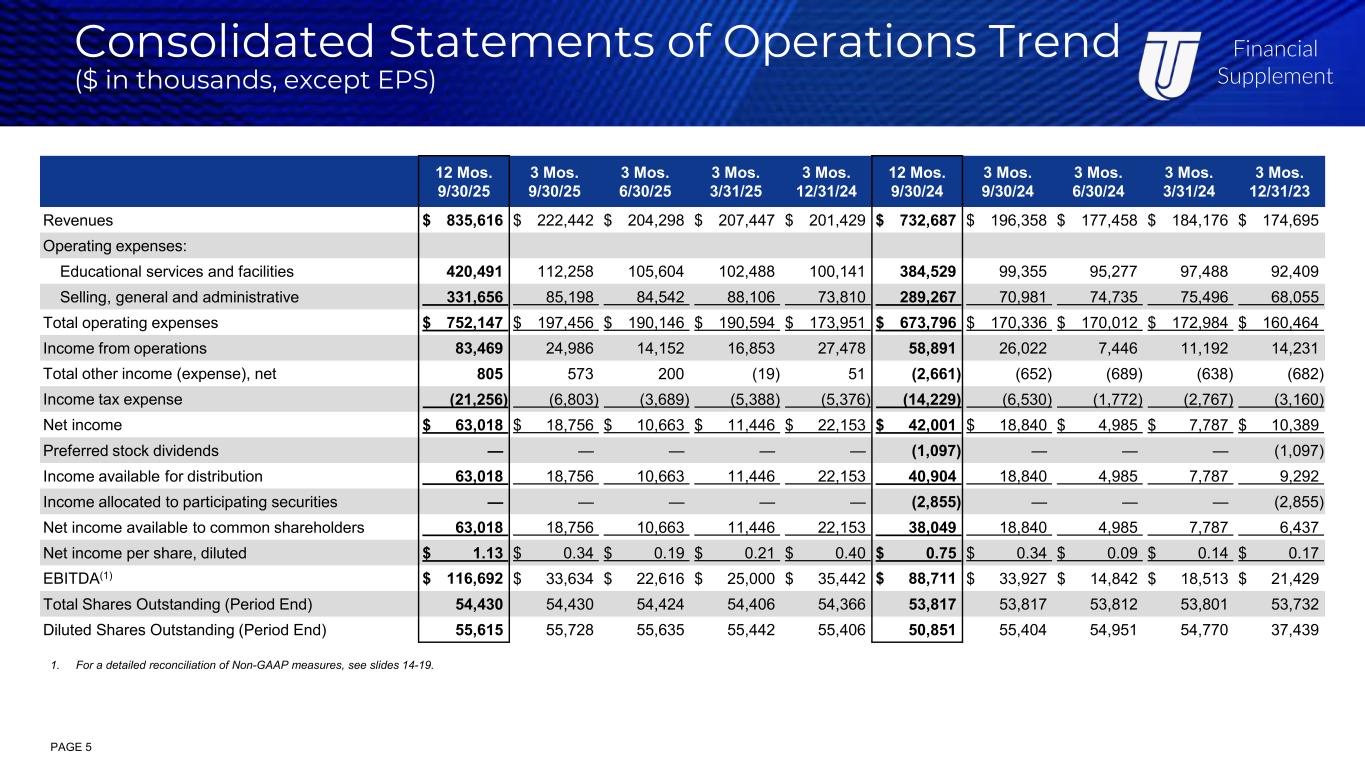

Financial Supplement Consolidated Statements of Operations Trend ($ in thousands, except EPS) 12 Mos. 9/30/25 3 Mos. 9/30/25 3 Mos. 6/30/25 3 Mos. 3/31/25 3 Mos. 12/31/24 12 Mos. 9/30/24 3 Mos. 9/30/24 3 Mos. 6/30/24 3 Mos. 3/31/24 3 Mos. 12/31/23 Revenues $ 835,616 $ 222,442 $ 204,298 $ 207,447 $ 201,429 $ 732,687 $ 196,358 $ 177,458 $ 184,176 $ 174,695 Operating expenses: Educational services and facilities 420,491 112,258 105,604 102,488 100,141 384,529 99,355 95,277 97,488 92,409 Selling, general and administrative 331,656 85,198 84,542 88,106 73,810 289,267 70,981 74,735 75,496 68,055 Total operating expenses $ 752,147 $ 197,456 $ 190,146 $ 190,594 $ 173,951 $ 673,796 $ 170,336 $ 170,012 $ 172,984 $ 160,464 Income from operations 83,469 24,986 14,152 16,853 27,478 58,891 26,022 7,446 11,192 14,231 Total other income (expense), net 805 573 200 (19) 51 (2,661) (652) (689) (638) (682) Income tax expense (21,256) (6,803) (3,689) (5,388) (5,376) (14,229) (6,530) (1,772) (2,767) (3,160) Net income $ 63,018 $ 18,756 $ 10,663 $ 11,446 $ 22,153 $ 42,001 $ 18,840 $ 4,985 $ 7,787 $ 10,389 Preferred stock dividends — — — — — (1,097) — — — (1,097) Income available for distribution 63,018 18,756 10,663 11,446 22,153 40,904 18,840 4,985 7,787 9,292 Income allocated to participating securities — — — — — (2,855) — — — (2,855) Net income available to common shareholders 63,018 18,756 10,663 11,446 22,153 38,049 18,840 4,985 7,787 6,437 Net income per share, diluted $ 1.13 $ 0.34 $ 0.19 $ 0.21 $ 0.40 $ 0.75 $ 0.34 $ 0.09 $ 0.14 $ 0.17 EBITDA(1) $ 116,692 $ 33,634 $ 22,616 $ 25,000 $ 35,442 $ 88,711 $ 33,927 $ 14,842 $ 18,513 $ 21,429 Total Shares Outstanding (Period End) 54,430 54,430 54,424 54,406 54,366 53,817 53,817 53,812 53,801 53,732 Diluted Shares Outstanding (Period End) 55,615 55,728 55,635 55,442 55,406 50,851 55,404 54,951 54,770 37,439 PAGE 5 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-19.

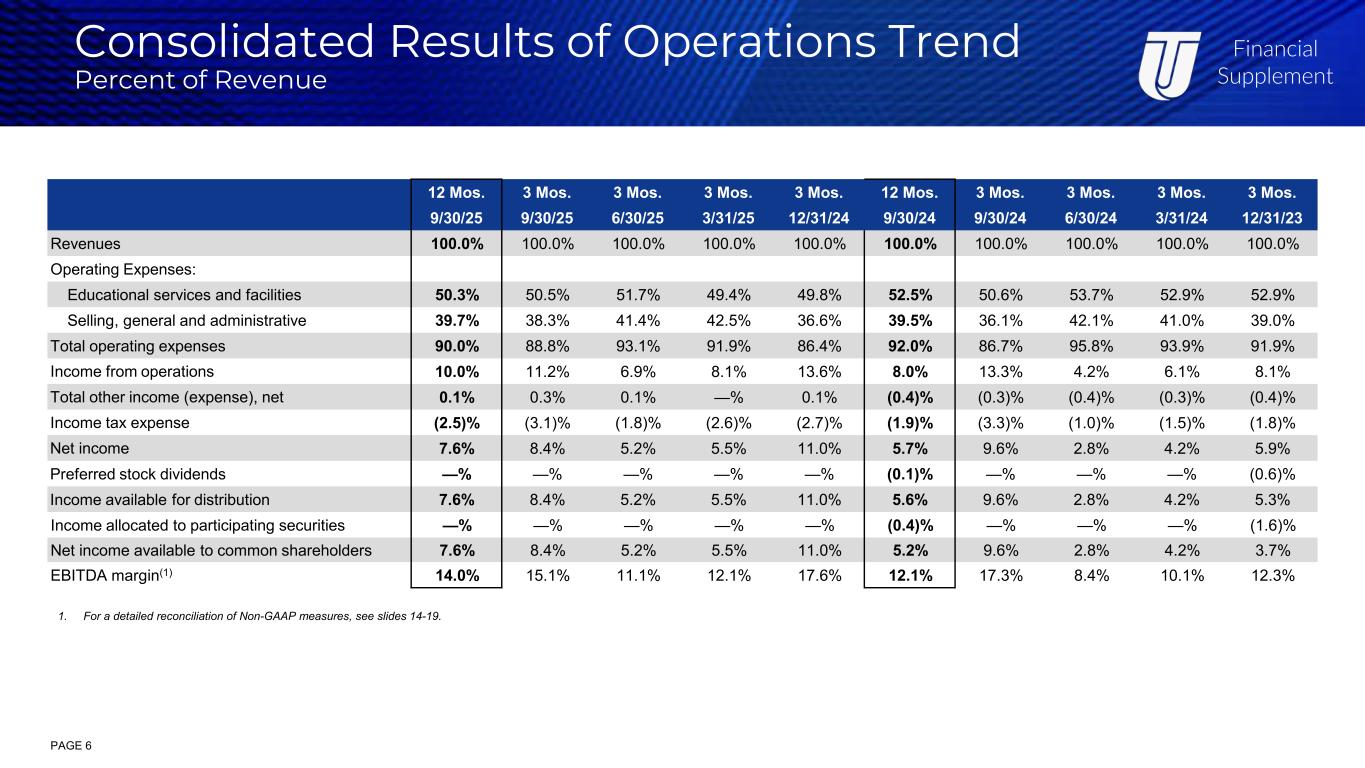

Financial Supplement Consolidated Results of Operations Trend Percent of Revenue 12 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 12 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 9/30/25 9/30/25 6/30/25 3/31/25 12/31/24 9/30/24 9/30/24 6/30/24 3/31/24 12/31/23 Revenues 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Operating Expenses: Educational services and facilities 50.3% 50.5% 51.7% 49.4% 49.8% 52.5% 50.6% 53.7% 52.9% 52.9% Selling, general and administrative 39.7% 38.3% 41.4% 42.5% 36.6% 39.5% 36.1% 42.1% 41.0% 39.0% Total operating expenses 90.0% 88.8% 93.1% 91.9% 86.4% 92.0% 86.7% 95.8% 93.9% 91.9% Income from operations 10.0% 11.2% 6.9% 8.1% 13.6% 8.0% 13.3% 4.2% 6.1% 8.1% Total other income (expense), net 0.1% 0.3% 0.1% —% 0.1% (0.4)% (0.3)% (0.4)% (0.3)% (0.4)% Income tax expense (2.5)% (3.1)% (1.8)% (2.6)% (2.7)% (1.9)% (3.3)% (1.0)% (1.5)% (1.8)% Net income 7.6% 8.4% 5.2% 5.5% 11.0% 5.7% 9.6% 2.8% 4.2% 5.9% Preferred stock dividends —% —% —% —% —% (0.1)% —% —% —% (0.6)% Income available for distribution 7.6% 8.4% 5.2% 5.5% 11.0% 5.6% 9.6% 2.8% 4.2% 5.3% Income allocated to participating securities —% —% —% —% —% (0.4)% —% —% —% (1.6)% Net income available to common shareholders 7.6% 8.4% 5.2% 5.5% 11.0% 5.2% 9.6% 2.8% 4.2% 3.7% EBITDA margin(1) 14.0% 15.1% 11.1% 12.1% 17.6% 12.1% 17.3% 8.4% 10.1% 12.3% PAGE 6 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-19.

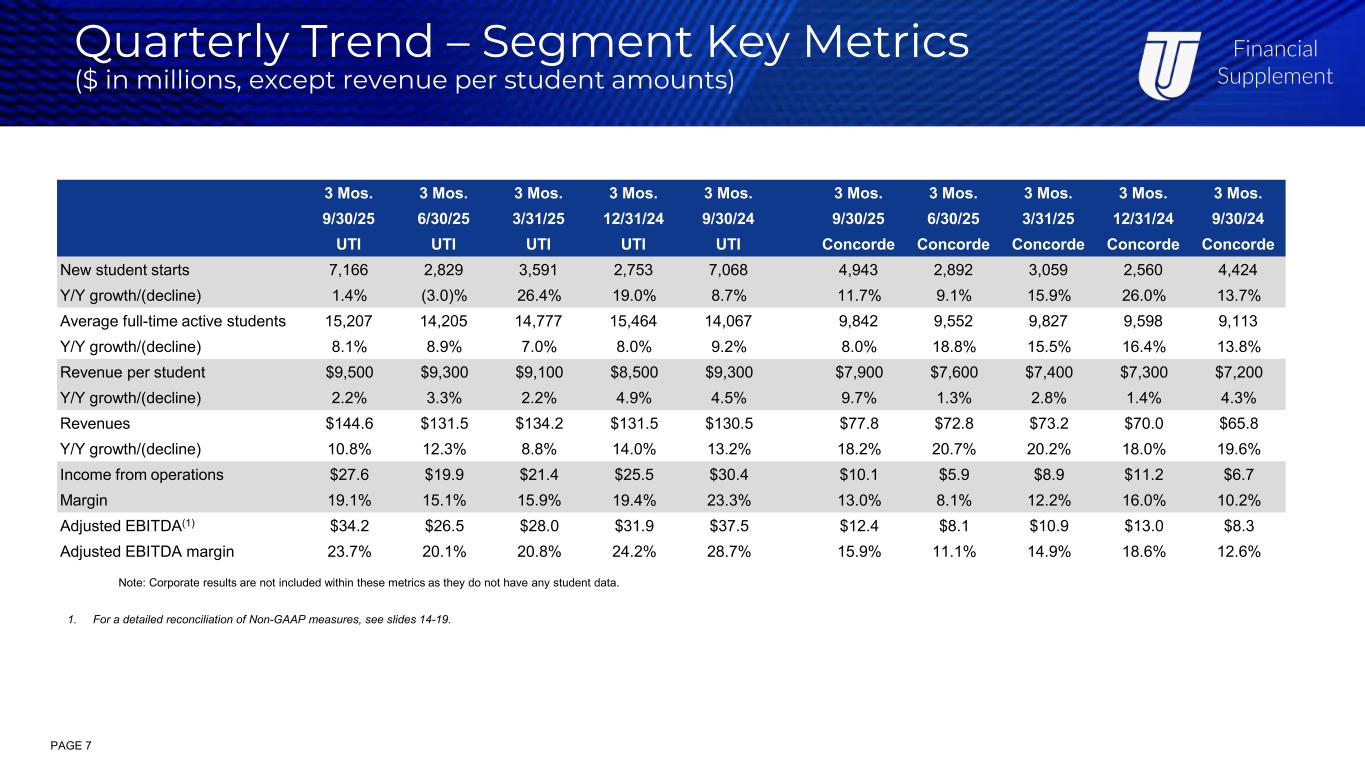

Financial Supplement Quarterly Trend – Segment Key Metrics ($ in millions, except revenue per student amounts) ($ in millions, except for student data) 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 9/30/25 6/30/25 3/31/25 12/31/24 9/30/24 9/30/25 6/30/25 3/31/25 12/31/24 9/30/24 UTI UTI UTI UTI UTI Concorde Concorde Concorde Concorde Concorde New student starts 7,166 2,829 3,591 2,753 7,068 4,943 2,892 3,059 2,560 4,424 Y/Y growth/(decline) 1.4% (3.0)% 26.4% 19.0% 8.7% 11.7% 9.1% 15.9% 26.0% 13.7% Average full-time active students 15,207 14,205 14,777 15,464 14,067 9,842 9,552 9,827 9,598 9,113 Y/Y growth/(decline) 8.1% 8.9% 7.0% 8.0% 9.2% 8.0% 18.8% 15.5% 16.4% 13.8% Revenue per student $9,500 $9,300 $9,100 $8,500 $9,300 $7,900 $7,600 $7,400 $7,300 $7,200 Y/Y growth/(decline) 2.2% 3.3% 2.2% 4.9% 4.5% 9.7% 1.3% 2.8% 1.4% 4.3% Revenues $144.6 $131.5 $134.2 $131.5 $130.5 $77.8 $72.8 $73.2 $70.0 $65.8 Y/Y growth/(decline) 10.8% 12.3% 8.8% 14.0% 13.2% 18.2% 20.7% 20.2% 18.0% 19.6% Income from operations $27.6 $19.9 $21.4 $25.5 $30.4 $10.1 $5.9 $8.9 $11.2 $6.7 Margin 19.1% 15.1% 15.9% 19.4% 23.3% 13.0% 8.1% 12.2% 16.0% 10.2% Adjusted EBITDA(1) $34.2 $26.5 $28.0 $31.9 $37.5 $12.4 $8.1 $10.9 $13.0 $8.3 Adjusted EBITDA margin 23.7% 20.1% 20.8% 24.2% 28.7% 15.9% 11.1% 14.9% 18.6% 12.6% PAGE 7 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-19. Note: Corporate results are not included within these metrics as they do not have any student data.

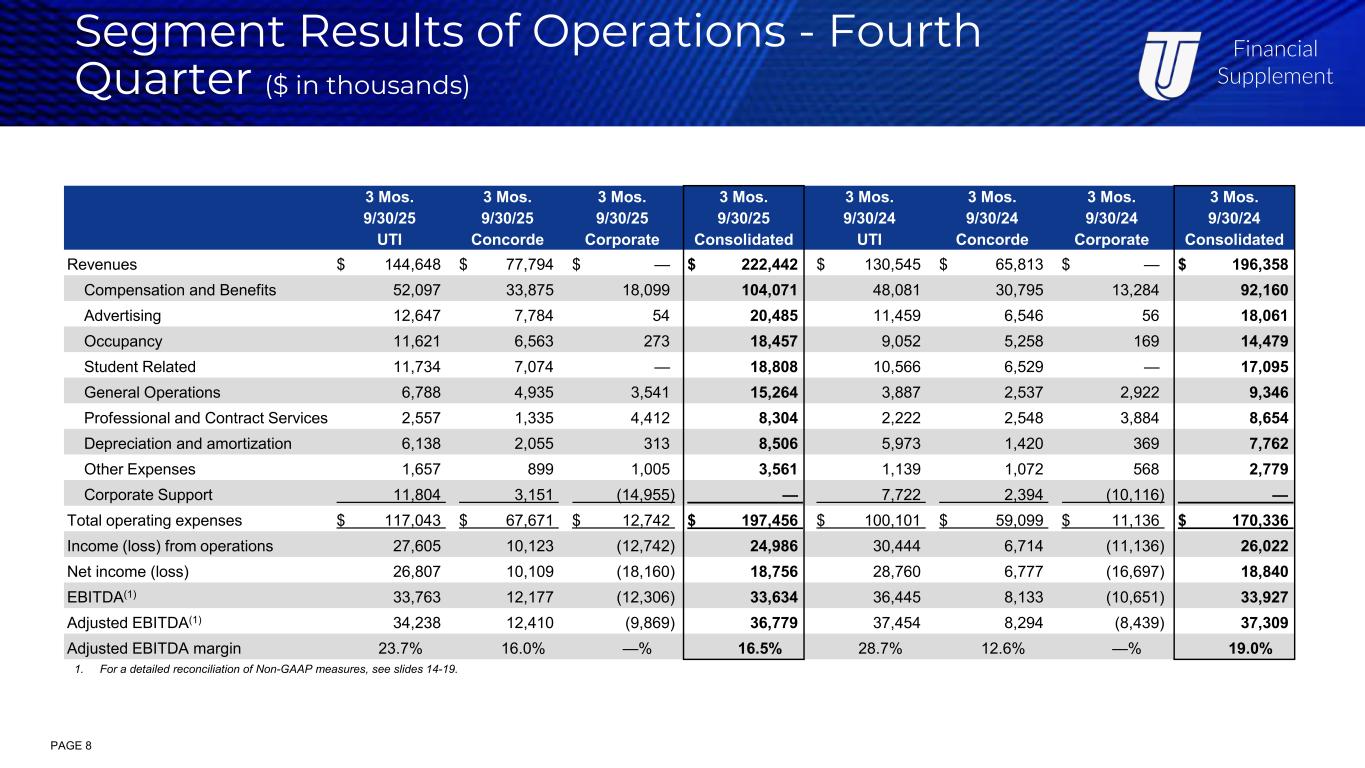

Financial Supplement Segment Results of Operations - Fourth Quarter ($ in thousands) PAGE 8 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 3 Mos. 9/30/25 9/30/25 9/30/25 9/30/25 9/30/24 9/30/24 9/30/24 9/30/24 UTI Concorde Corporate Consolidated UTI Concorde Corporate Consolidated Revenues $ 144,648 $ 77,794 $ — $ 222,442 $ 130,545 $ 65,813 $ — $ 196,358 Compensation and Benefits 52,097 33,875 18,099 104,071 48,081 30,795 13,284 92,160 Advertising 12,647 7,784 54 20,485 11,459 6,546 56 18,061 Occupancy 11,621 6,563 273 18,457 9,052 5,258 169 14,479 Student Related 11,734 7,074 — 18,808 10,566 6,529 — 17,095 General Operations 6,788 4,935 3,541 15,264 3,887 2,537 2,922 9,346 Professional and Contract Services 2,557 1,335 4,412 8,304 2,222 2,548 3,884 8,654 Depreciation and amortization 6,138 2,055 313 8,506 5,973 1,420 369 7,762 Other Expenses 1,657 899 1,005 3,561 1,139 1,072 568 2,779 Corporate Support 11,804 3,151 (14,955) — 7,722 2,394 (10,116) — Total operating expenses $ 117,043 $ 67,671 $ 12,742 $ 197,456 $ 100,101 $ 59,099 $ 11,136 $ 170,336 Income (loss) from operations 27,605 10,123 (12,742) 24,986 30,444 6,714 (11,136) 26,022 Net income (loss) 26,807 10,109 (18,160) 18,756 28,760 6,777 (16,697) 18,840 EBITDA(1) 33,763 12,177 (12,306) 33,634 36,445 8,133 (10,651) 33,927 Adjusted EBITDA(1) 34,238 12,410 (9,869) 36,779 37,454 8,294 (8,439) 37,309 Adjusted EBITDA margin 23.7% 16.0% —% 16.5% 28.7% 12.6% —% 19.0% 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-19.

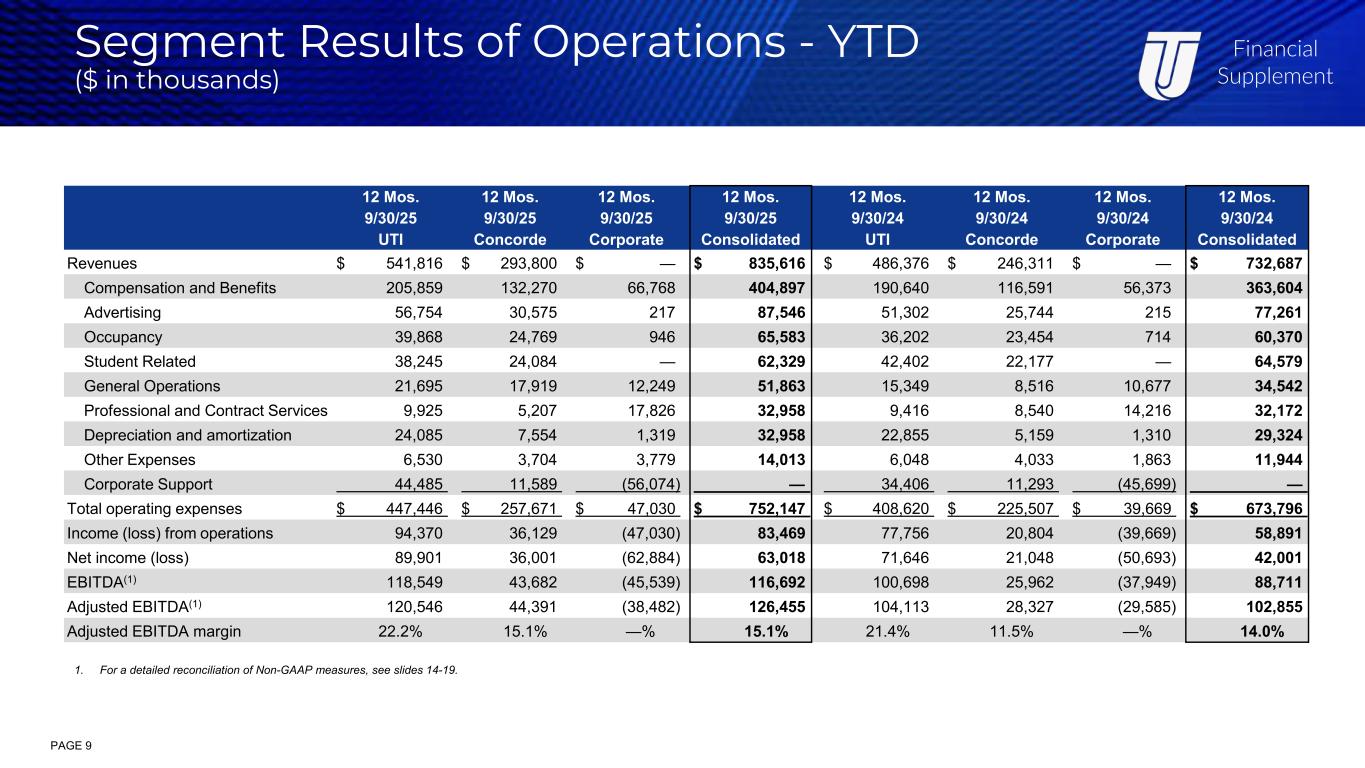

Financial Supplement Segment Results of Operations - YTD ($ in thousands) PAGE 9 12 Mos. 12 Mos. 12 Mos. 12 Mos. 12 Mos. 12 Mos. 12 Mos. 12 Mos. 9/30/25 9/30/25 9/30/25 9/30/25 9/30/24 9/30/24 9/30/24 9/30/24 UTI Concorde Corporate Consolidated UTI Concorde Corporate Consolidated Revenues $ 541,816 $ 293,800 $ — $ 835,616 $ 486,376 $ 246,311 $ — $ 732,687 Compensation and Benefits 205,859 132,270 66,768 404,897 190,640 116,591 56,373 363,604 Advertising 56,754 30,575 217 87,546 51,302 25,744 215 77,261 Occupancy 39,868 24,769 946 65,583 36,202 23,454 714 60,370 Student Related 38,245 24,084 — 62,329 42,402 22,177 — 64,579 General Operations 21,695 17,919 12,249 51,863 15,349 8,516 10,677 34,542 Professional and Contract Services 9,925 5,207 17,826 32,958 9,416 8,540 14,216 32,172 Depreciation and amortization 24,085 7,554 1,319 32,958 22,855 5,159 1,310 29,324 Other Expenses 6,530 3,704 3,779 14,013 6,048 4,033 1,863 11,944 Corporate Support 44,485 11,589 (56,074) — 34,406 11,293 (45,699) — Total operating expenses $ 447,446 $ 257,671 $ 47,030 $ 752,147 $ 408,620 $ 225,507 $ 39,669 $ 673,796 Income (loss) from operations 94,370 36,129 (47,030) 83,469 77,756 20,804 (39,669) 58,891 Net income (loss) 89,901 36,001 (62,884) 63,018 71,646 21,048 (50,693) 42,001 EBITDA(1) 118,549 43,682 (45,539) 116,692 100,698 25,962 (37,949) 88,711 Adjusted EBITDA(1) 120,546 44,391 (38,482) 126,455 104,113 28,327 (29,585) 102,855 Adjusted EBITDA margin 22.2% 15.1% —% 15.1% 21.4% 11.5% —% 14.0% 1. For a detailed reconciliation of Non-GAAP measures, see slides 14-19.

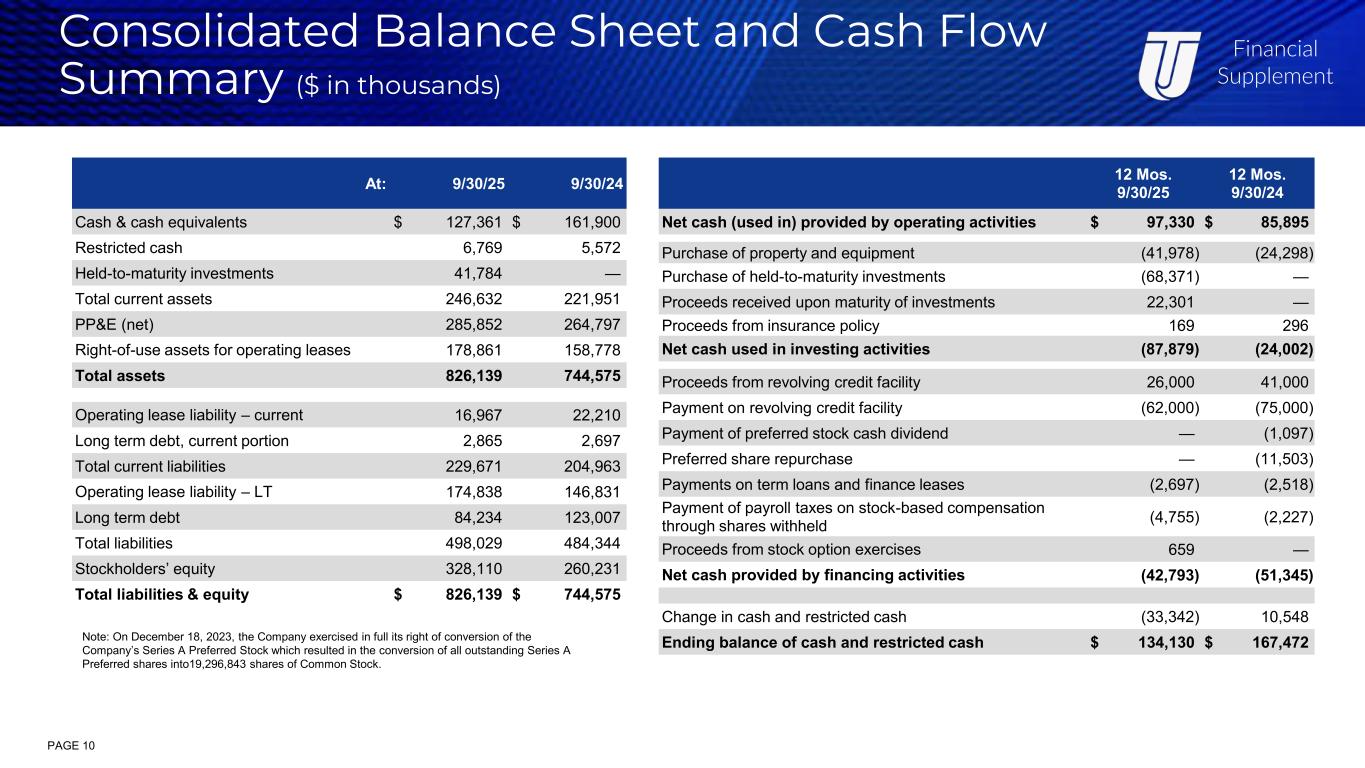

Financial Supplement Note: On December 18, 2023, the Company exercised in full its right of conversion of the Company’s Series A Preferred Stock which resulted in the conversion of all outstanding Series A Preferred shares into19,296,843 shares of Common Stock. Consolidated Balance Sheet and Cash Flow Summary ($ in thousands) At: 9/30/25 9/30/24 Cash & cash equivalents $ 127,361 $ 161,900 Restricted cash 6,769 5,572 Held-to-maturity investments 41,784 — Total current assets 246,632 221,951 PP&E (net) 285,852 264,797 Right-of-use assets for operating leases 178,861 158,778 Total assets 826,139 744,575 Operating lease liability – current 16,967 22,210 Long term debt, current portion 2,865 2,697 Total current liabilities 229,671 204,963 Operating lease liability – LT 174,838 146,831 Long term debt 84,234 123,007 Total liabilities 498,029 484,344 Stockholders’ equity 328,110 260,231 Total liabilities & equity $ 826,139 $ 744,575 12 Mos. 9/30/25 12 Mos. 9/30/24 Net cash (used in) provided by operating activities $ 97,330 $ 85,895 Purchase of property and equipment (41,978) (24,298) Purchase of held-to-maturity investments (68,371) — Proceeds received upon maturity of investments 22,301 — Proceeds from insurance policy 169 296 Net cash used in investing activities (87,879) (24,002) Proceeds from revolving credit facility 26,000 41,000 Payment on revolving credit facility (62,000) (75,000) Payment of preferred stock cash dividend — (1,097) Preferred share repurchase — (11,503) Payments on term loans and finance leases (2,697) (2,518) Payment of payroll taxes on stock-based compensation through shares withheld (4,755) (2,227) Proceeds from stock option exercises 659 — Net cash provided by financing activities (42,793) (51,345) Change in cash and restricted cash (33,342) 10,548 Ending balance of cash and restricted cash $ 134,130 $ 167,472 PAGE 10

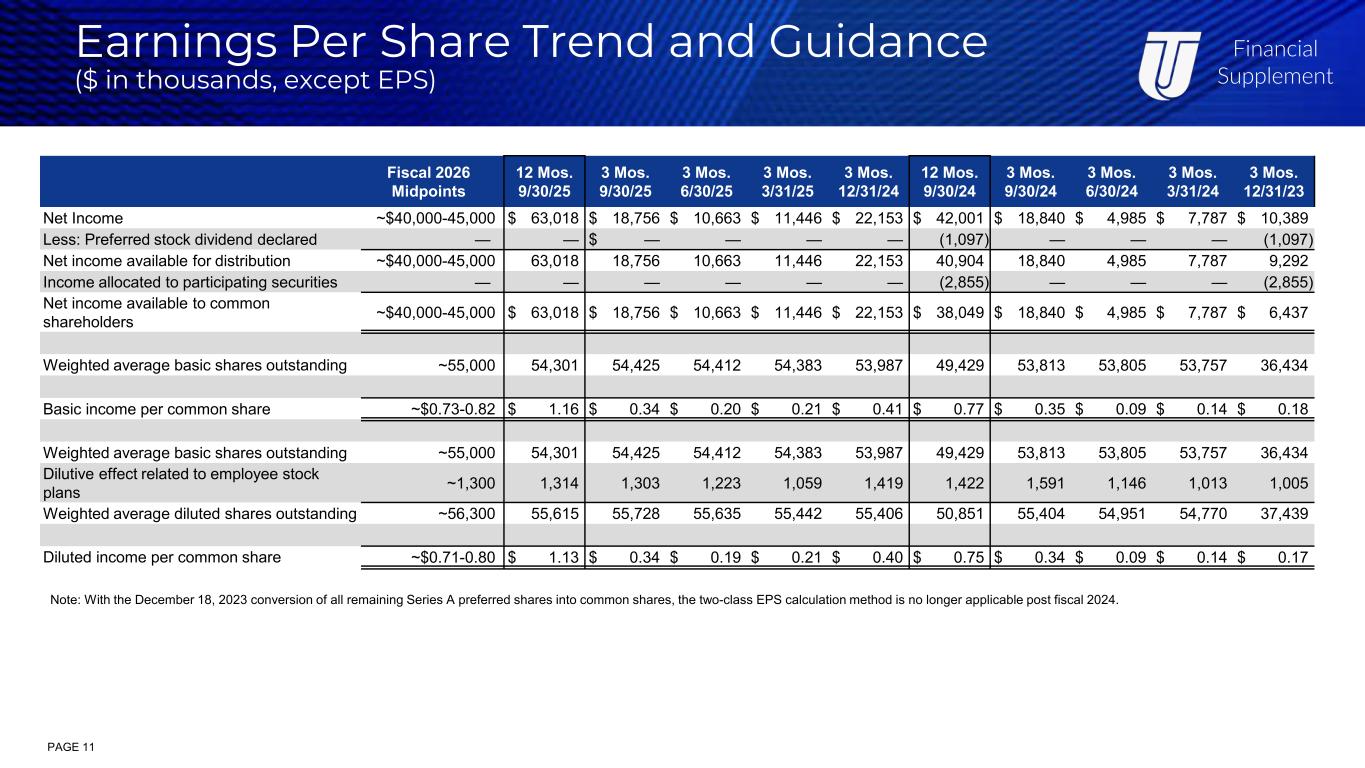

Financial Supplement Earnings Per Share Trend and Guidance ($ in thousands, except EPS) Fiscal 2026 Midpoints 12 Mos. 9/30/25 3 Mos. 9/30/25 3 Mos. 6/30/25 3 Mos. 3/31/25 3 Mos. 12/31/24 12 Mos. 9/30/24 3 Mos. 9/30/24 3 Mos. 6/30/24 3 Mos. 3/31/24 3 Mos. 12/31/23 Net Income ~$40,000-45,000 $ 63,018 $ 18,756 $ 10,663 $ 11,446 $ 22,153 $ 42,001 $ 18,840 $ 4,985 $ 7,787 $ 10,389 Less: Preferred stock dividend declared — — $ — — — — (1,097) — — — (1,097) Net income available for distribution ~$40,000-45,000 63,018 18,756 10,663 11,446 22,153 40,904 18,840 4,985 7,787 9,292 Income allocated to participating securities — — — — — — (2,855) — — — (2,855) Net income available to common shareholders ~$40,000-45,000 $ 63,018 $ 18,756 $ 10,663 $ 11,446 $ 22,153 $ 38,049 $ 18,840 $ 4,985 $ 7,787 $ 6,437 Weighted average basic shares outstanding ~55,000 54,301 54,425 54,412 54,383 53,987 49,429 53,813 53,805 53,757 36,434 Basic income per common share ~$0.73-0.82 $ 1.16 $ 0.34 $ 0.20 $ 0.21 $ 0.41 $ 0.77 $ 0.35 $ 0.09 $ 0.14 $ 0.18 Weighted average basic shares outstanding ~55,000 54,301 54,425 54,412 54,383 53,987 49,429 53,813 53,805 53,757 36,434 Dilutive effect related to employee stock plans ~1,300 1,314 1,303 1,223 1,059 1,419 1,422 1,591 1,146 1,013 1,005 Weighted average diluted shares outstanding ~56,300 55,615 55,728 55,635 55,442 55,406 50,851 55,404 54,951 54,770 37,439 Diluted income per common share ~$0.71-0.80 $ 1.13 $ 0.34 $ 0.19 $ 0.21 $ 0.40 $ 0.75 $ 0.34 $ 0.09 $ 0.14 $ 0.17 PAGE 11 Note: With the December 18, 2023 conversion of all remaining Series A preferred shares into common shares, the two-class EPS calculation method is no longer applicable post fiscal 2024.

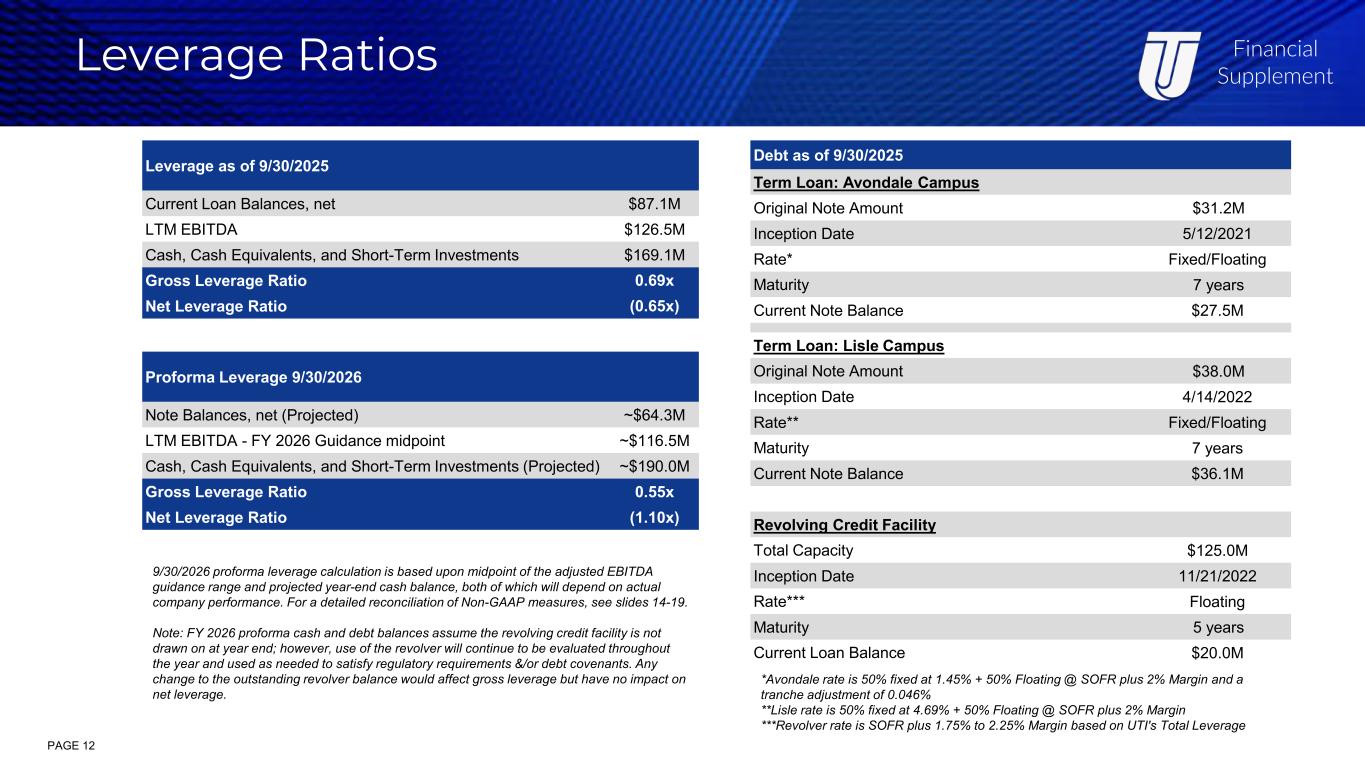

Financial Supplement Leverage as of 9/30/2025 Current Loan Balances, net $87.1M LTM EBITDA $126.5M Cash, Cash Equivalents, and Short-Term Investments $169.1M Gross Leverage Ratio 0.69x Net Leverage Ratio (0.65x) Debt as of 9/30/2025 Term Loan: Avondale Campus Original Note Amount $31.2M Inception Date 5/12/2021 Rate* Fixed/Floating Maturity 7 years Current Note Balance $27.5M Term Loan: Lisle Campus Original Note Amount $38.0M Inception Date 4/14/2022 Rate** Fixed/Floating Maturity 7 years Current Note Balance $36.1M Revolving Credit Facility Total Capacity $125.0M Inception Date 11/21/2022 Rate*** Floating Maturity 5 years Current Loan Balance $20.0M 9/30/2026 proforma leverage calculation is based upon midpoint of the adjusted EBITDA guidance range and projected year-end cash balance, both of which will depend on actual company performance. For a detailed reconciliation of Non-GAAP measures, see slides 14-19. Note: FY 2026 proforma cash and debt balances assume the revolving credit facility is not drawn on at year end; however, use of the revolver will continue to be evaluated throughout the year and used as needed to satisfy regulatory requirements &/or debt covenants. Any change to the outstanding revolver balance would affect gross leverage but have no impact on net leverage. Leverage Ratios PAGE 12 *Avondale rate is 50% fixed at 1.45% + 50% Floating @ SOFR plus 2% Margin and a tranche adjustment of 0.046% **Lisle rate is 50% fixed at 4.69% + 50% Floating @ SOFR plus 2% Margin ***Revolver rate is SOFR plus 1.75% to 2.25% Margin based on UTI's Total Leverage Proforma Leverage 9/30/2026 Note Balances, net (Projected) ~$64.3M LTM EBITDA - FY 2026 Guidance midpoint ~$116.5M Cash, Cash Equivalents, and Short-Term Investments (Projected) ~$190.0M Gross Leverage Ratio 0.55x Net Leverage Ratio (1.10x)

Financial SupplementUse of Non-GAAP Financial Information PAGE 13 In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company also discloses certain non-GAAP financial information. These financial measures are not recognized measures under GAAP and are not intended to be and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company discloses these non-GAAP financial measures because it believes that they provide investors an additional analytical tool to clarify its results of operations and identify underlying trends. Additionally, the Company believes that these measures may also help investors compare its performance on a consistent basis across time periods. The Company defines adjusted EBITDA as net income (loss) before interest expense, interest income, income taxes, depreciation and amortization, adjusted for stock-based compensation expense and items not considered normal recurring operations. The Company defines adjusted free cash flow as net cash provided by (used in) operating activities less capital expenditures, adjusted for items not considered normal recurring operations. Management utilizes adjusted figures as performance measures internally for operating decisions, strategic planning, annual budgeting and forecasting. For the periods presented, our adjustments for items that management does not consider to be normal recurring operations include: • Acquisition-related costs: We have excluded costs associated with both potential and announced acquisitions to allow for comparable financial results to historical operations and forward-looking guidance. • Integration-related costs for completed acquisitions: We have excluded integration costs related to business structure realignment and new programs for recent acquisitions to allow for comparable financial results to historical operations and forward-looking guidance. In addition, the nature and amount of such charges vary significantly based on the size and timing of the programs. By excluding the referenced expenses from our non-GAAP financial measures, our management is able to further evaluate our ability to utilize existing assets and estimate their long-term value. Furthermore, our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance. • Restructuring charges: In December 2023, we announced plans to consolidate the two Houston, Texas campus locations to align the curriculum, student facing systems, and support services to better serve students seeking careers in in-demand fields. As part of the transition, the MIAT Houston campus, acquired in November 2021, began a phased teach-out in May 2024, and such campus began operating under the UTI brand. MIAT-Houston students who have not completed their programs before their program’s teach-out date may enroll at UTI-Houston to complete their program. Both facilities will remain in use post-consolidation. • Facility lease accounting adjustments: During 2024, we recorded a lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. This adjustment is not considered part of normal recurring operations. To obtain a complete understanding of our performance, these measures should be examined in connection with net income (loss) and net cash provided by (used in) operating activities, determined in accordance with GAAP, as presented in the financial statements and notes thereto included in the annual and quarterly filings with the SEC. Because the items excluded from these non-GAAP measures are significant components in understanding and assessing our financial performance under GAAP, these measures should not be considered to be an alternative to net income (loss) or net cash provided by (used in) operating activities as a measure of our operating performance or liquidity. Exclusion of items in the non-GAAP presentation should not be construed as an inference that these items are unusual, infrequent or non-recurring. Other companies, including other companies in the education industry, may define and calculate non-GAAP financial measures differently than we do, limiting their usefulness as a comparative measure across similarly titled performance measures presented by other companies. A reconciliation of the historical non-GAAP financial measures to the most directly comparable GAAP measures is included in the following slides and investors are encouraged to review the reconciliations. Information reconciling forward-looking adjusted EBITDA and adjusted free cash flow to the most directly comparable GAAP financial measure is unavailable to the company without unreasonable effort. The company is not able to provide a quantitative reconciliation of forward-looking adjusted EBITDA or adjusted free cash flow to the most directly comparable GAAP financial measure because certain items required for such reconciliation are uncertain, outside of the company’s control and/or cannot be reasonably predicted, including but not limited to the provision for (benefit from) income taxes. Preparation of such reconciliation would require a forward-looking statement of income and statement of cash flows prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to the company without unreasonable effort.

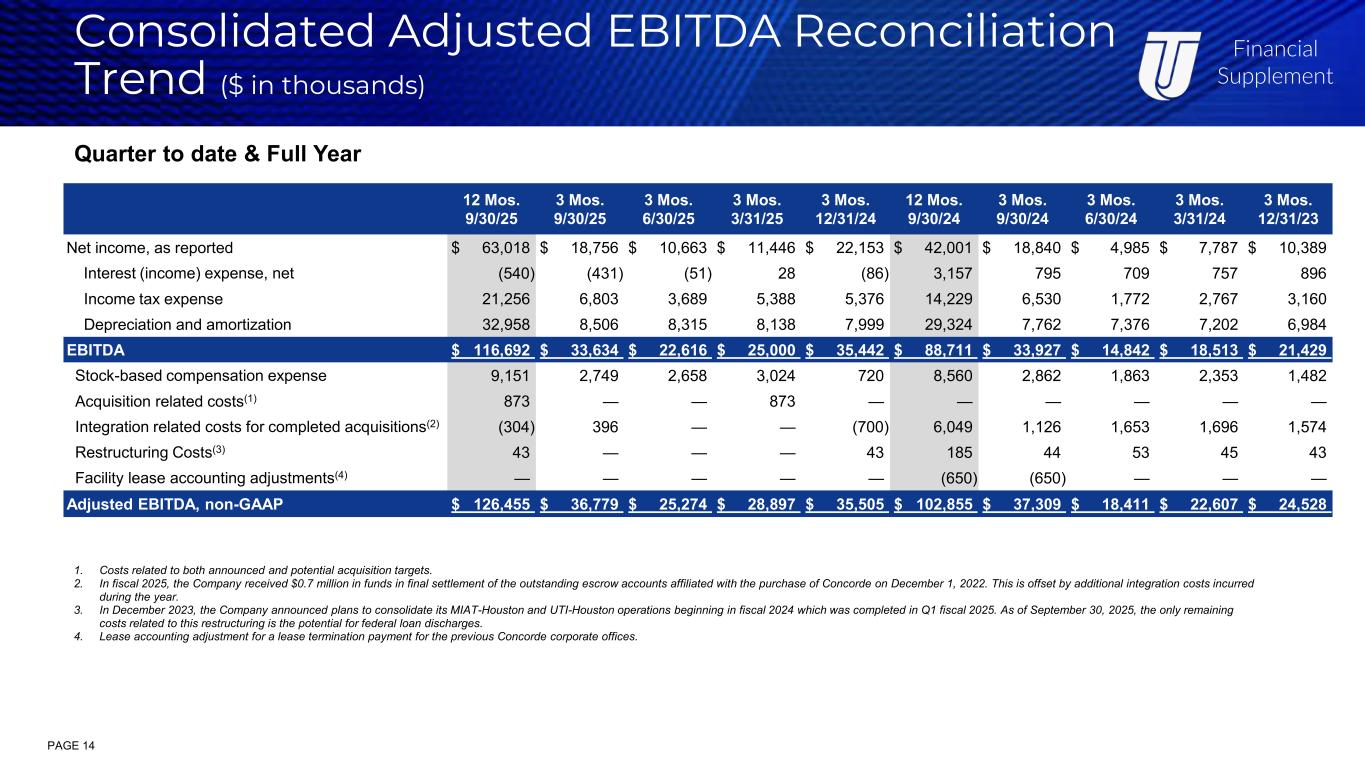

Financial Supplement Consolidated Adjusted EBITDA Reconciliation Trend ($ in thousands) 1. Costs related to both announced and potential acquisition targets. 2. In fiscal 2025, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. This is offset by additional integration costs incurred during the year. 3. In December 2023, the Company announced plans to consolidate its MIAT-Houston and UTI-Houston operations beginning in fiscal 2024 which was completed in Q1 fiscal 2025. As of September 30, 2025, the only remaining costs related to this restructuring is the potential for federal loan discharges. 4. Lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. 12 Mos. 9/30/25 3 Mos. 9/30/25 3 Mos. 6/30/25 3 Mos. 3/31/25 3 Mos. 12/31/24 12 Mos. 9/30/24 3 Mos. 9/30/24 3 Mos. 6/30/24 3 Mos. 3/31/24 3 Mos. 12/31/23 Net income, as reported $ 63,018 $ 18,756 $ 10,663 $ 11,446 $ 22,153 $ 42,001 $ 18,840 $ 4,985 $ 7,787 $ 10,389 Interest (income) expense, net (540) (431) (51) 28 (86) 3,157 795 709 757 896 Income tax expense 21,256 6,803 3,689 5,388 5,376 14,229 6,530 1,772 2,767 3,160 Depreciation and amortization 32,958 8,506 8,315 8,138 7,999 29,324 7,762 7,376 7,202 6,984 EBITDA $ 116,692 $ 33,634 $ 22,616 $ 25,000 $ 35,442 $ 88,711 $ 33,927 $ 14,842 $ 18,513 $ 21,429 Stock-based compensation expense 9,151 2,749 2,658 3,024 720 8,560 2,862 1,863 2,353 1,482 Acquisition related costs(1) 873 — — 873 — — — — — — Integration related costs for completed acquisitions(2) (304) 396 — — (700) 6,049 1,126 1,653 1,696 1,574 Restructuring Costs(3) 43 — — — 43 185 44 53 45 43 Facility lease accounting adjustments(4) — — — — — (650) (650) — — — Adjusted EBITDA, non-GAAP $ 126,455 $ 36,779 $ 25,274 $ 28,897 $ 35,505 $ 102,855 $ 37,309 $ 18,411 $ 22,607 $ 24,528 PAGE 14 Quarter to date & Full Year

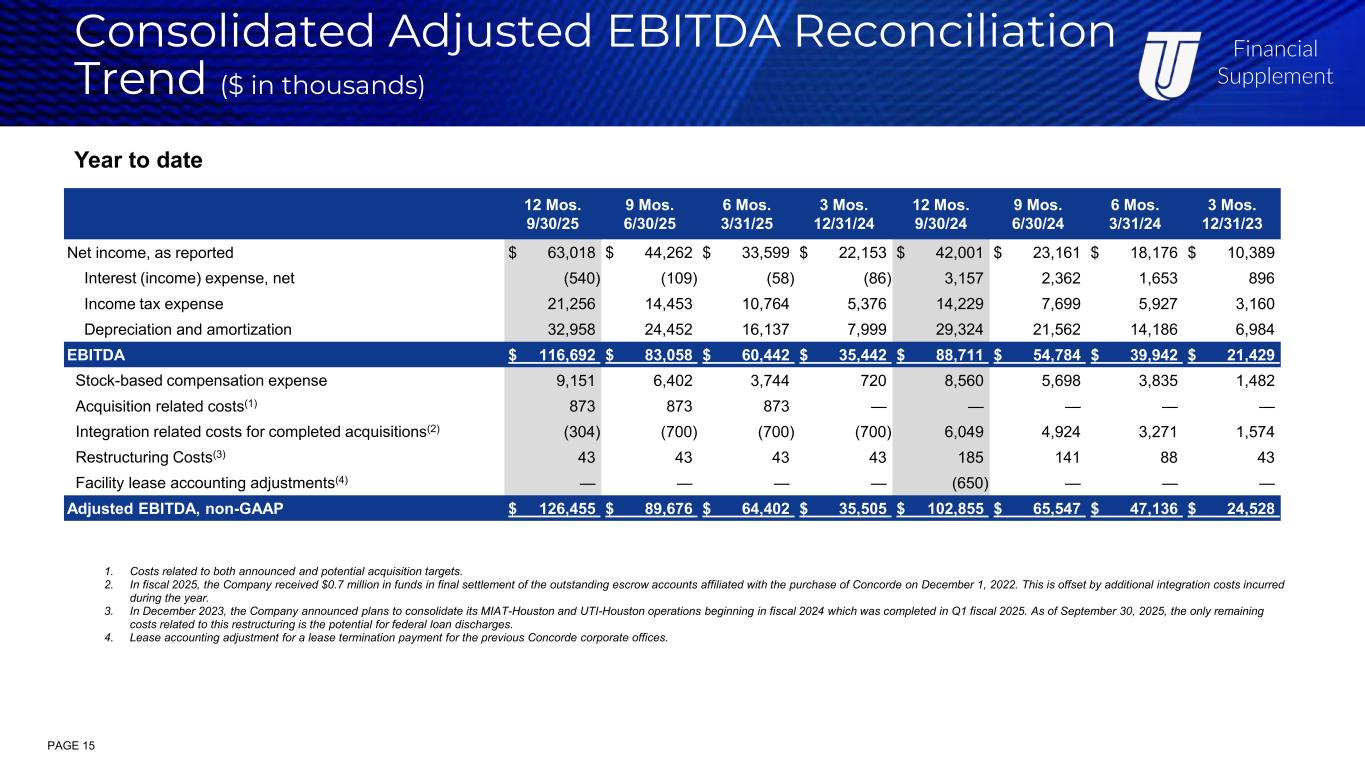

Financial Supplement Consolidated Adjusted EBITDA Reconciliation Trend ($ in thousands) 12 Mos. 9/30/25 9 Mos. 6/30/25 6 Mos. 3/31/25 3 Mos. 12/31/24 12 Mos. 9/30/24 9 Mos. 6/30/24 6 Mos. 3/31/24 3 Mos. 12/31/23 Net income, as reported $ 63,018 $ 44,262 $ 33,599 $ 22,153 $ 42,001 $ 23,161 $ 18,176 $ 10,389 Interest (income) expense, net (540) (109) (58) (86) 3,157 2,362 1,653 896 Income tax expense 21,256 14,453 10,764 5,376 14,229 7,699 5,927 3,160 Depreciation and amortization 32,958 24,452 16,137 7,999 29,324 21,562 14,186 6,984 EBITDA $ 116,692 $ 83,058 $ 60,442 $ 35,442 $ 88,711 $ 54,784 $ 39,942 $ 21,429 Stock-based compensation expense 9,151 6,402 3,744 720 8,560 5,698 3,835 1,482 Acquisition related costs(1) 873 873 873 — — — — — Integration related costs for completed acquisitions(2) (304) (700) (700) (700) 6,049 4,924 3,271 1,574 Restructuring Costs(3) 43 43 43 43 185 141 88 43 Facility lease accounting adjustments(4) — — — — (650) — — — Adjusted EBITDA, non-GAAP $ 126,455 $ 89,676 $ 64,402 $ 35,505 $ 102,855 $ 65,547 $ 47,136 $ 24,528 PAGE 15 1. Costs related to both announced and potential acquisition targets. 2. In fiscal 2025, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. This is offset by additional integration costs incurred during the year. 3. In December 2023, the Company announced plans to consolidate its MIAT-Houston and UTI-Houston operations beginning in fiscal 2024 which was completed in Q1 fiscal 2025. As of September 30, 2025, the only remaining costs related to this restructuring is the potential for federal loan discharges. 4. Lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. Year to date

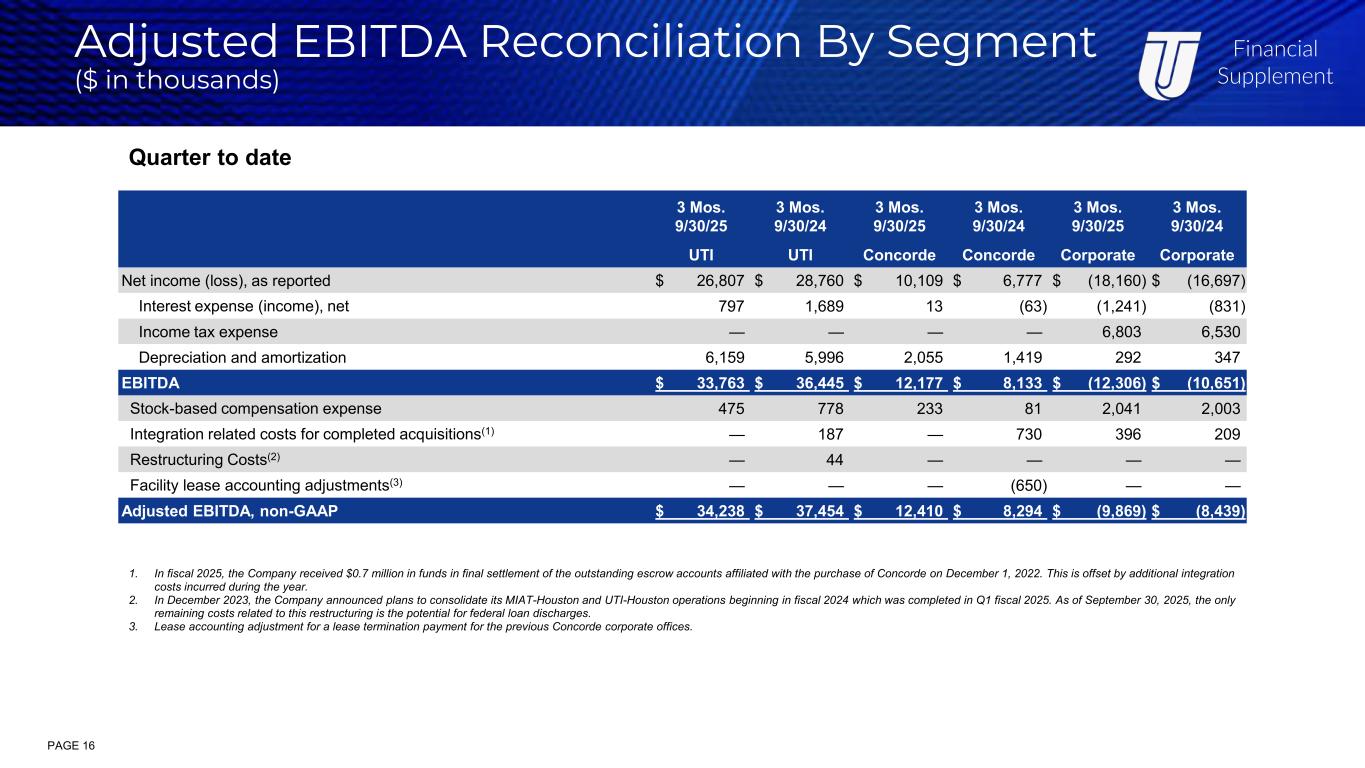

Financial Supplement Adjusted EBITDA Reconciliation By Segment ($ in thousands) 3 Mos. 9/30/25 3 Mos. 9/30/24 3 Mos. 9/30/25 3 Mos. 9/30/24 3 Mos. 9/30/25 3 Mos. 9/30/24 UTI UTI Concorde Concorde Corporate Corporate Net income (loss), as reported $ 26,807 $ 28,760 $ 10,109 $ 6,777 $ (18,160) $ (16,697) Interest expense (income), net 797 1,689 13 (63) (1,241) (831) Income tax expense — — — — 6,803 6,530 Depreciation and amortization 6,159 5,996 2,055 1,419 292 347 EBITDA $ 33,763 $ 36,445 $ 12,177 $ 8,133 $ (12,306) $ (10,651) Stock-based compensation expense 475 778 233 81 2,041 2,003 Integration related costs for completed acquisitions(1) — 187 — 730 396 209 Restructuring Costs(2) — 44 — — — — Facility lease accounting adjustments(3) — — — (650) — — Adjusted EBITDA, non-GAAP $ 34,238 $ 37,454 $ 12,410 $ 8,294 $ (9,869) $ (8,439) PAGE 16 1. In fiscal 2025, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. This is offset by additional integration costs incurred during the year. 2. In December 2023, the Company announced plans to consolidate its MIAT-Houston and UTI-Houston operations beginning in fiscal 2024 which was completed in Q1 fiscal 2025. As of September 30, 2025, the only remaining costs related to this restructuring is the potential for federal loan discharges. 3. Lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. Quarter to date

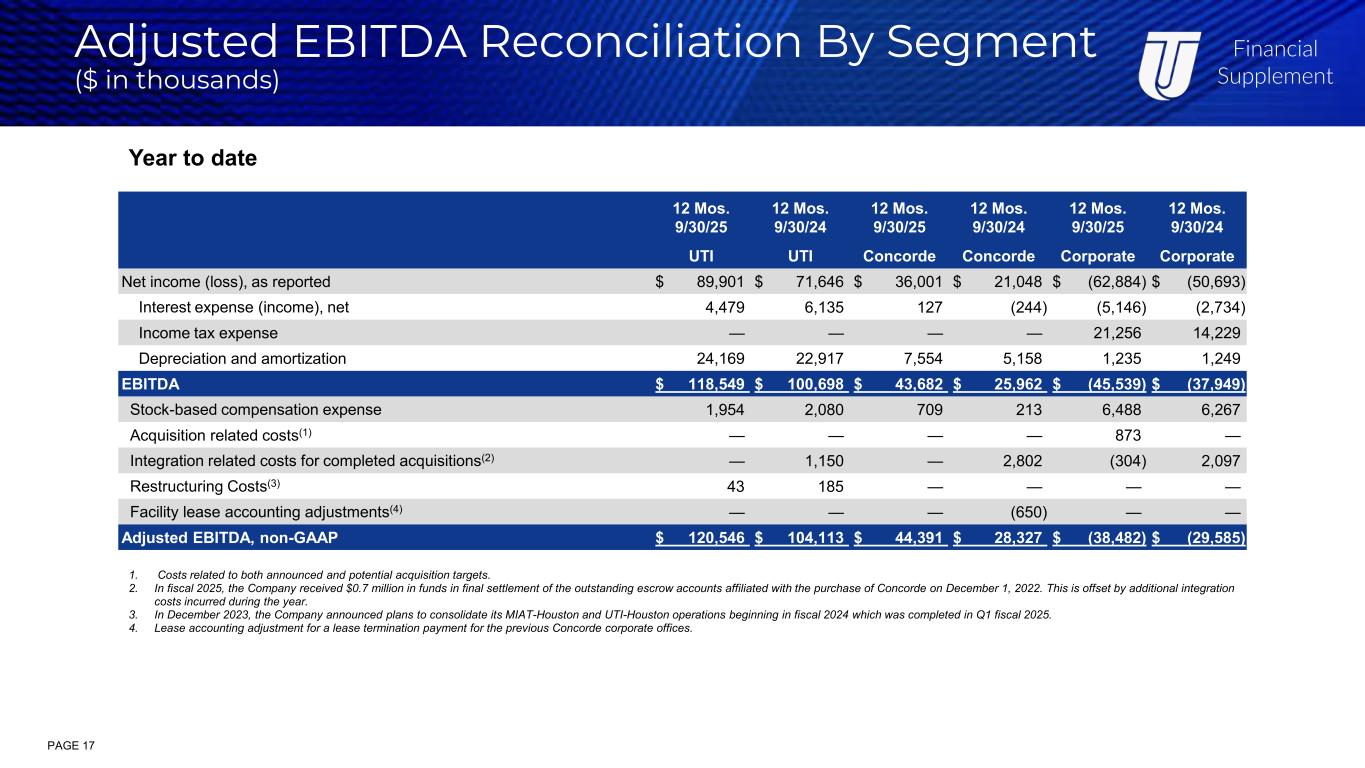

Financial Supplement Adjusted EBITDA Reconciliation By Segment ($ in thousands) 12 Mos. 9/30/25 12 Mos. 9/30/24 12 Mos. 9/30/25 12 Mos. 9/30/24 12 Mos. 9/30/25 12 Mos. 9/30/24 UTI UTI Concorde Concorde Corporate Corporate Net income (loss), as reported $ 89,901 $ 71,646 $ 36,001 $ 21,048 $ (62,884) $ (50,693) Interest expense (income), net 4,479 6,135 127 (244) (5,146) (2,734) Income tax expense — — — — 21,256 14,229 Depreciation and amortization 24,169 22,917 7,554 5,158 1,235 1,249 EBITDA $ 118,549 $ 100,698 $ 43,682 $ 25,962 $ (45,539) $ (37,949) Stock-based compensation expense 1,954 2,080 709 213 6,488 6,267 Acquisition related costs(1) — — — — 873 — Integration related costs for completed acquisitions(2) — 1,150 — 2,802 (304) 2,097 Restructuring Costs(3) 43 185 — — — — Facility lease accounting adjustments(4) — — — (650) — — Adjusted EBITDA, non-GAAP $ 120,546 $ 104,113 $ 44,391 $ 28,327 $ (38,482) $ (29,585) PAGE 17 Year to date 1. Costs related to both announced and potential acquisition targets. 2. In fiscal 2025, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. This is offset by additional integration costs incurred during the year. 3. In December 2023, the Company announced plans to consolidate its MIAT-Houston and UTI-Houston operations beginning in fiscal 2024 which was completed in Q1 fiscal 2025. 4. Lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices.

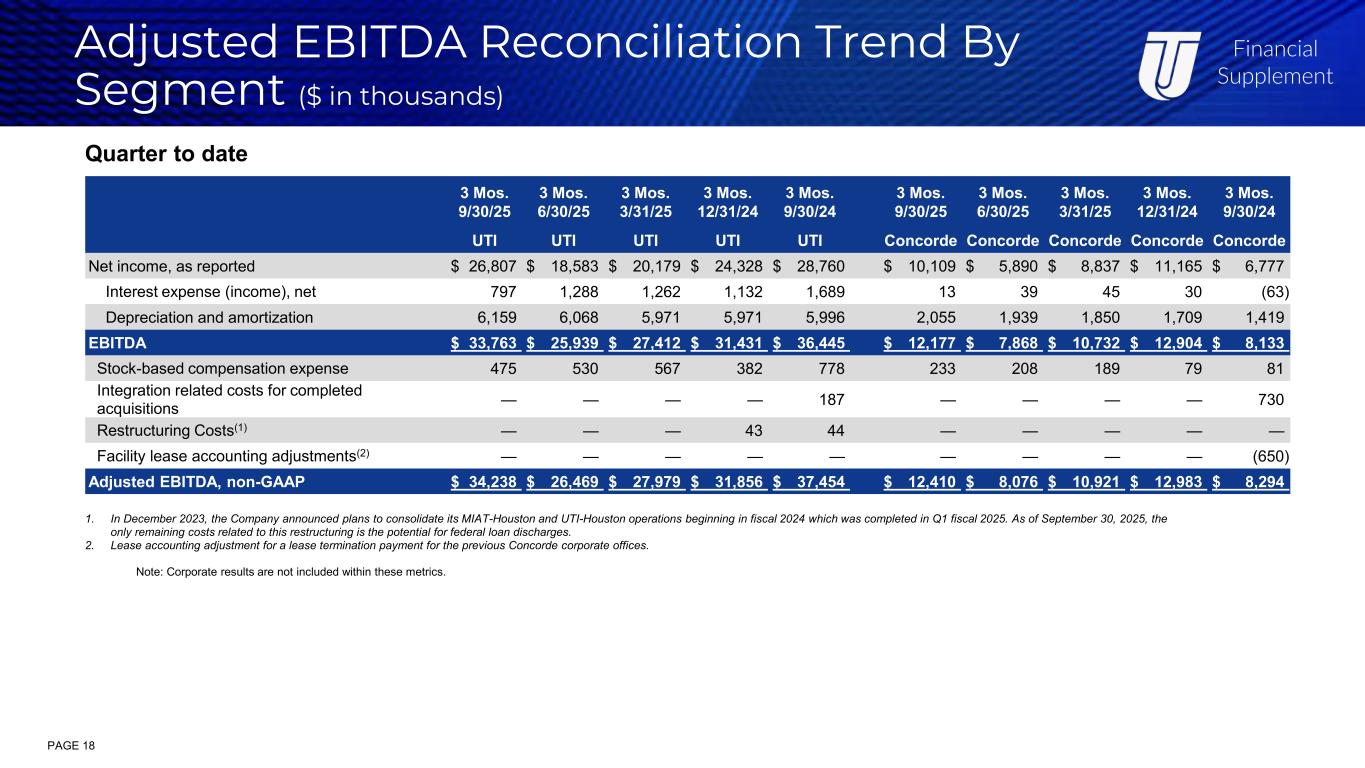

Financial Supplement Adjusted EBITDA Reconciliation Trend By Segment ($ in thousands) 3 Mos. 9/30/25 3 Mos. 6/30/25 3 Mos. 3/31/25 3 Mos. 12/31/24 3 Mos. 9/30/24 3 Mos. 9/30/25 3 Mos. 6/30/25 3 Mos. 3/31/25 3 Mos. 12/31/24 3 Mos. 9/30/24 UTI UTI UTI UTI UTI Concorde Concorde Concorde Concorde Concorde Net income, as reported $ 26,807 $ 18,583 $ 20,179 $ 24,328 $ 28,760 $ 10,109 $ 5,890 $ 8,837 $ 11,165 $ 6,777 Interest expense (income), net 797 1,288 1,262 1,132 1,689 13 39 45 30 (63) Depreciation and amortization 6,159 6,068 5,971 5,971 5,996 2,055 1,939 1,850 1,709 1,419 EBITDA $ 33,763 $ 25,939 $ 27,412 $ 31,431 $ 36,445 $ 12,177 $ 7,868 $ 10,732 $ 12,904 $ 8,133 Stock-based compensation expense 475 530 567 382 778 233 208 189 79 81 Integration related costs for completed acquisitions — — — — 187 — — — — 730 Restructuring Costs(1) — — — 43 44 — — — — — Facility lease accounting adjustments(2) — — — — — — — — — (650) Adjusted EBITDA, non-GAAP $ 34,238 $ 26,469 $ 27,979 $ 31,856 $ 37,454 $ 12,410 $ 8,076 $ 10,921 $ 12,983 $ 8,294 PAGE 18 Quarter to date 1. In December 2023, the Company announced plans to consolidate its MIAT-Houston and UTI-Houston operations beginning in fiscal 2024 which was completed in Q1 fiscal 2025. As of September 30, 2025, the only remaining costs related to this restructuring is the potential for federal loan discharges. 2. Lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. Note: Corporate results are not included within these metrics.

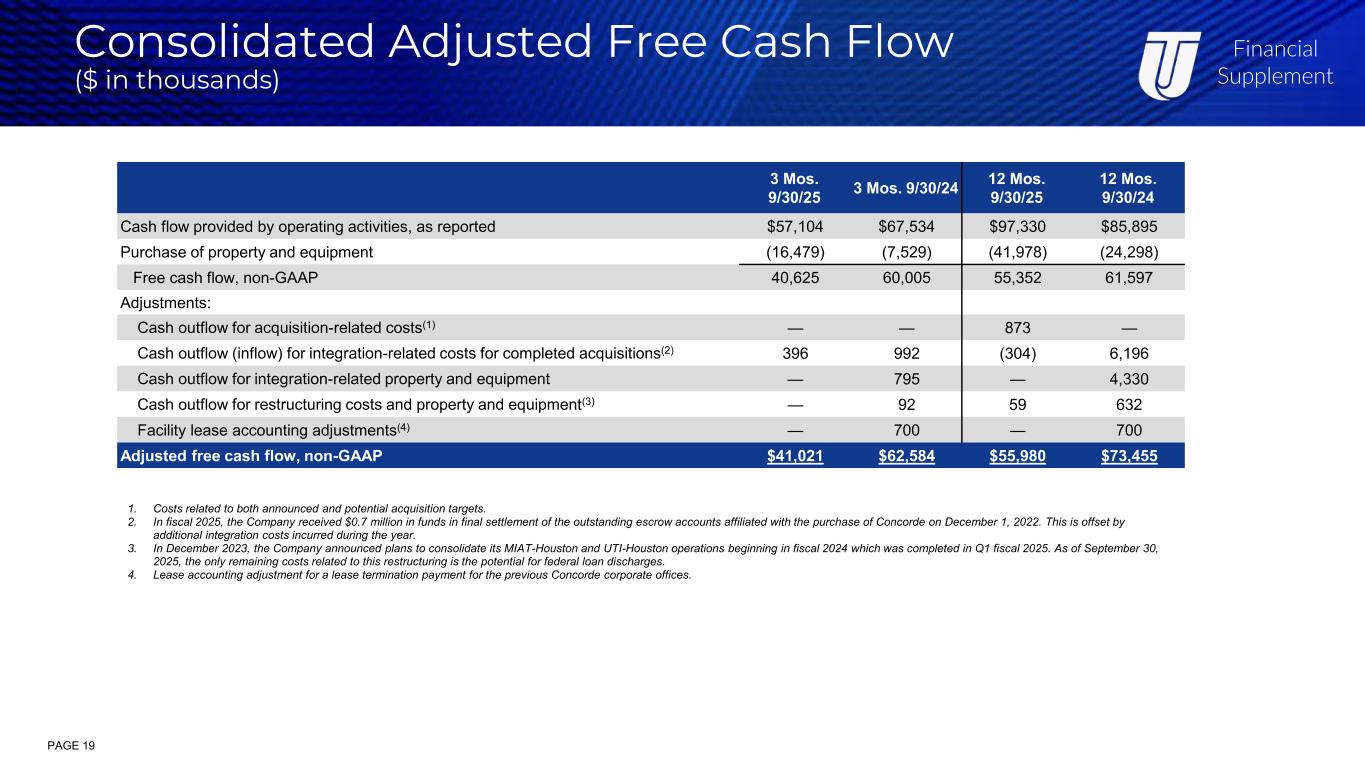

Financial Supplement Consolidated Adjusted Free Cash Flow ($ in thousands) 3 Mos. 9/30/25 3 Mos. 9/30/24 12 Mos. 9/30/25 12 Mos. 9/30/24 Cash flow provided by operating activities, as reported $57,104 $67,534 $97,330 $85,895 Purchase of property and equipment (16,479) (7,529) (41,978) (24,298) Free cash flow, non-GAAP 40,625 60,005 55,352 61,597 Adjustments: Cash outflow for acquisition-related costs(1) — — 873 — Cash outflow (inflow) for integration-related costs for completed acquisitions(2) 396 992 (304) 6,196 Cash outflow for integration-related property and equipment — 795 — 4,330 Cash outflow for restructuring costs and property and equipment(3) — 92 59 632 Facility lease accounting adjustments(4) — 700 — 700 Adjusted free cash flow, non-GAAP $41,021 $62,584 $55,980 $73,455 1. Costs related to both announced and potential acquisition targets. 2. In fiscal 2025, the Company received $0.7 million in funds in final settlement of the outstanding escrow accounts affiliated with the purchase of Concorde on December 1, 2022. This is offset by additional integration costs incurred during the year. 3. In December 2023, the Company announced plans to consolidate its MIAT-Houston and UTI-Houston operations beginning in fiscal 2024 which was completed in Q1 fiscal 2025. As of September 30, 2025, the only remaining costs related to this restructuring is the potential for federal loan discharges. 4. Lease accounting adjustment for a lease termination payment for the previous Concorde corporate offices. PAGE 19