.2

Performance & Essential Materials Segment (PEM) Profitability Improvement Plan Update December 15, 2025

.2

Performance & Essential Materials Segment (PEM) Profitability Improvement Plan Update December 15, 2025

PEM Profitability Improvement Plan Update PEM profitability has been pressured by low market pricing as the result of global overcapacity in certain products, primarily the chlorovinyls chain and styrene, and an increase in low-priced Asian exports We are extending our footprint optimization to include the shutdown of three North American chlorovinyl plants that are higher cost and serve low-priced export markets We are also taking strategic action to exit the styrene business due to an unfavorable near- and long-term outlook for exports These actions are expected to improve annual EBITDA by ~$100MM with FCF savings of ~$175MM in 2026; and <1 year payback on ~$58MM of cash costs to execute the plan Following these optimization actions, we will be better positioned to serve our valued customers as a leading global chlorovinyls producer Our Profitability Improvement Plan Targets Returning PEM’s Return on Investment to an Appropriate Level 2

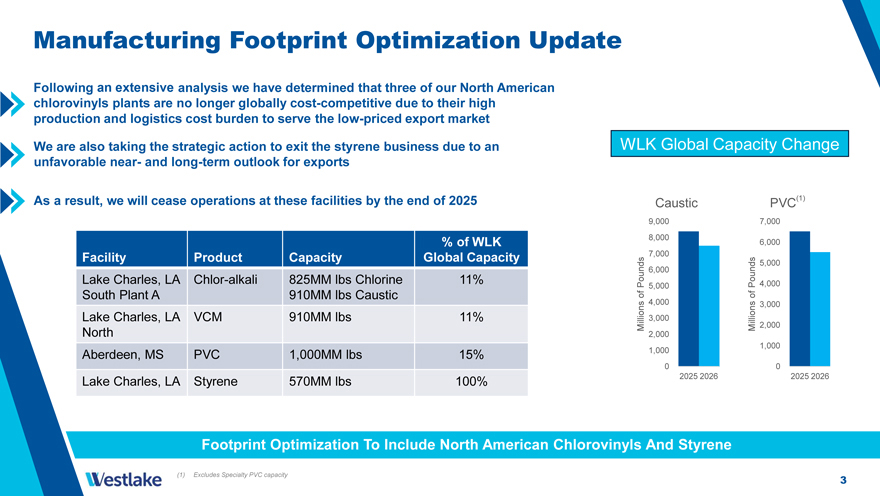

Manufacturing Footprint Optimization Update Following a thorough analysis we have determined that three of our North American chlorovinyls plants are no longer globally cost-competitive due to their high production and logistics cost burden to serve the low-priced export market We are also taking strategic action to exit the styrene business due to an WLK Global Capacity Change unfavorable near- and long-term outlook for exports As a result, we will cease operations at these facilities by the end of 2025 Caustic PVC(1) 9,000 7,000 8,000 % of WLK 6,000 Facility Product Capacity Global Capacity 7,000 5,000 Lake Charles, LA Chlor-alkali 825MM lbs Chlorine 11% 6,000 Pounds 5,000 Pounds 4,000 South Plant A 910MM lbs Causticofof 4, 000 3,000 Lake Charles, LA VCM 910MM lbs 11% Millions 3,000 Millions 2,000 North 2,000 1,000 Aberdeen, MS PVC 1,000MM lbs 15% 1,000 0 0 Lake Charles, LA Styrene 570MM lbs 100% 2025 2026 2025 2026 Footprint Optimization To Include North American Chlorovinyls And Styrene (1) Excludes Specialty PVC capacity 3

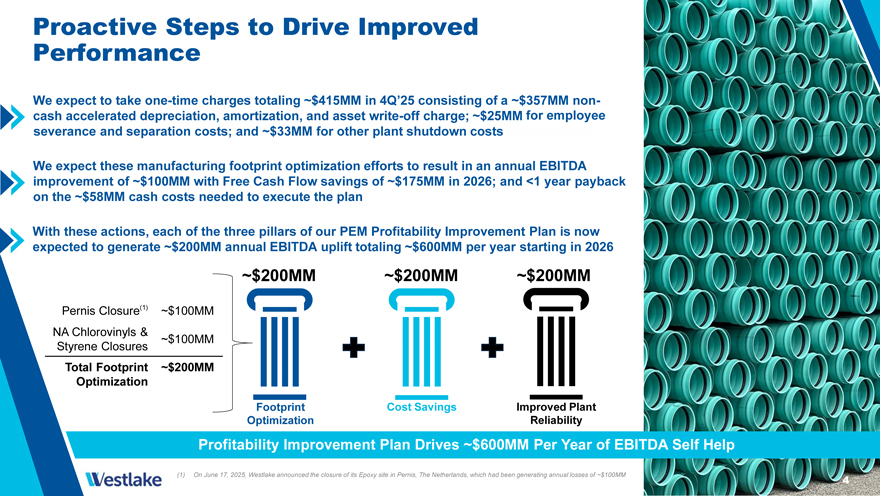

Proactive Performance Steps to Drive Improved We expect to take one-time charges totaling ~$415MM in 4Q’25 consisting of a ~$357MM non-cash accelerated depreciation, amortization, and asset write-off charge; the accrual of ~$25MM for employee severance and separation costs; and ~$33MM for other plant shutdown costs We expect these manufacturing footprint optimization efforts to result in an annual EBITDA improvement of ~$100MM with Free Cash Flow savings of ~$175MM in 2026; and <1 year payback on the ~$58MM cash costs needed to execute the plan With these actions, each of the three pillars of our PEM Profitability Improvement Plan is now expected to generate ~$200MM annual EBITDA uplift totaling ~$600MM per year starting in 2026 ~$200MM ~$200MM ~$200MM Pernis Closure(1) ~$100MM NA Chlorovinyls & ~$100MM Styrene Closures Total Footprint ~$200MM Optimization Footprint Cost Savings Improved Plant Optimization Reliability Profitability Improvement Plan Drives ~$600MM Per Year of EBITDA Self Help (1) On June 17, 2025, Westlake announced the closure of its Epoxy site in Pernis, The Netherlands, which had been generating annual losses of ~$100MM 44

Safe Harbor Language This presentation contains certain forward-looking statements including statements regarding our cost-saving objectives, the timing of the anticipated cessation of operations at certain of our production facilities, the anticipated effects of such closures on production capacity, the estimated pre-tax costs and expected cash outflows associated with a closure of such facilities, our cost control and efficiency efforts, and the anticipated savings and additional EBITDA and free cash flow resulting therefrom, our expected fourth quarter financial performance, including expectations regarding EBITDA, EBITDA margin and cash interest expense, outlook for the global market, including raw material costs, our competitive position, anticipated residential construction, repair and remodel activities and infrastructure growth, our energy and feedstock cost advantages in the North American chemicals market, trends in key product markets, our capital allocation strategy, our ability to cross-sell across our businesses, supply and demand dynamics as they relate to our products, and our ability to maintain a disciplined investment culture focused on efficient capital allocation. Actual results may differ materially depending on factors, including, but not limited to, the following: general economic and business conditions; the cyclical nature of the chemical and building products industries; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, European and worldwide economies, including those due to political tensions and conflict in the Middle East, Russia, Ukraine and elsewhere; uncertainties associated with pandemic infectious diseases; uncertainties associated with climate change; the potential impact on the demand for ethylene, polyethylene and polyvinyl chloride due to initiatives such as recycling and customers seeking alternatives to polymers; current and potential governmental regulatory actions in the United States and other countries; industry production capacity and operating rates; the supply/demand balance for our products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions; changes in laws or regulations, including trade policies and tariffs imposed on or by foreign jurisdictions; disruptions in global trade and the effect on trading relationships between the United States and other countries; technological developments; information systems failures and cyber attacks; foreign currency exchange risks; our ability to implement our business strategies; creditworthiness of our customers; and other factors described in our reports filed with the Securities and Exchange Commission. Many of these factors are beyond our ability to control or predict. Any of these factors, or a combination of these factors, could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. These forward-looking statements are not guarantees of our future performance, and our actual results and future developments may differ materially from those projected in the forward-looking statements. Management cautions against putting undue reliance on forward-looking statements. Every forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements. Investor Relations Contacts Steve Bender -Executive Vice President & Chief Financial Officer Jeff Holy -Vice President & Chief Accounting Officer Westlake Corporation 2801 Post Oak Boulevard, Suite 600 Houston, Texas 77056 713-960-9111 5