LETTER FROM ROBERT OCTOBER 29, 2025 Dear Investor, Our first quarter marked a strong start to the fiscal year. Our revenue growth rate improved sequentially, exceeding our annual guidance range. Coupled with strong profitability this provides a very good foundation for achieving or exceeding our FY2026 financial objectives. Summary financial results for Q1 FY2026 compared to Q1 FY2025: • Revenue grew 7% on a reported basis and 4% on an organic constant-currency basisa. • Consolidated gross profit grew 5% and consolidated gross margin was 46.7%, 80 basis points lower, influenced by the continued mix shift to products that have higher order values and gross profits, but lower gross margins. The net tariff impact on gross profit during the quarter was minimal. • Consolidated advertising as a percent of revenue was 13.4%, a decrease of 80 basis points. • Operating income increased $9.6 million to $49.0 million, driven by gross profit growth. • Net income increased $18.9 million to $6.5 million. This was driven by the operating income growth described above and unrealized gains on currency hedges compared to unrealized losses in the year-ago period. This was partially offset by $8.8 million of higher income tax expense. • Adjusted EBITDAa increased $10.9 million to $98.7 million, our highest-ever Q1 adjusted EBITDA, 11% above our previous high in Q1 FY2024 and up 12% versus the prior year. This was driven by gross profit growth as well as $2.9 million in year-over-year currency benefits, net of realized losses on currency hedges. • Operating cash flow increased $20.7 million to $25.1 million, primarily driven by a $29.2 million reduction in net working capital outflows, partially offset by a $2.8 million increase in cash interest payments, net of interest income. • Adjusted free cash flowa improved by $7.9 million to an outflow of $17.8 million, driven by the operating cash flow increase described above. This improvement was partially offset by planned higher capital expenditures and capitalized software expense versus the prior year. • During Q1 FY2026, we repurchased 45,000 Cimpress shares for $2.7 million at an average price of $60.58 per share inclusive of transaction costs. • Net leveragea at September 30, 2025 was 3.1 times trailing-twelve month EBITDA as calculated under our credit agreement, flat from Q4 FY2025. • Our liquidity position remains strong with cash and cash equivalents of $200.5 million as of September 30, 2025. Our $250 million revolving credit facility remained undrawn at the end of the quarter. Segment Commentary Vista Q1 revenue grew 6% year over year and 5% on an organic constant-currency basisa. Product innovation within Vista and the Cimpress network of production facilities drove growth in elevated products. Promotional products, apparel and gifts, and packaging and labels each grew at double-digit year-over-year rates. The business card and stationery product category declined 1% year over year on a constant-currency basis in Q1 FY2026, versus a 4% decline in Q1 FY2025. Q1 results demonstrated that, as described in our most recent annual letter, as Vista improves its elevated product capabilities, product range and value proposition, it is earning substantially higher wallet share and per-customer lifetime value from many of its small business customers. VistaPrint's variable gross profit per customer at reported currency rates increased 7% versus last year, from $79.82 to $85.32; this metric has been added to the Vista section of this earnings document and our published financial and operating metrics spreadsheet for historical trends. Vista Q1 segment EBITDA grew 11% year over year to $90.0 million, an increase of $8.8 million from the prior-year period. Gross margin increased 30 basis points, and advertising as a percent of revenue decreased 60 basis points. Segment EBITDA also benefited from operating expense leverage, an example of which is the roll-out in our customer service operations of a generative AI-chatbot, agent assist, and improved customer self-service features a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 2 of 30

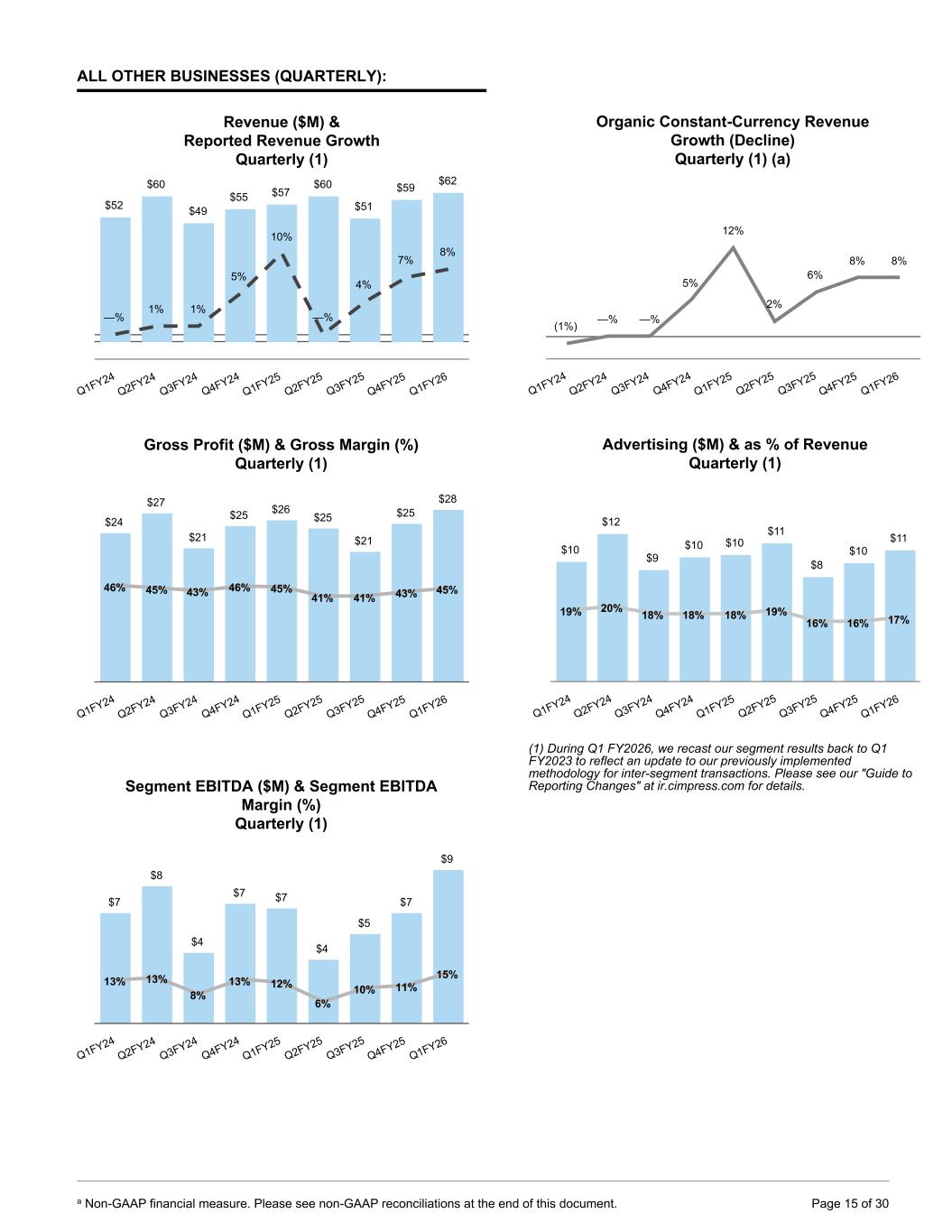

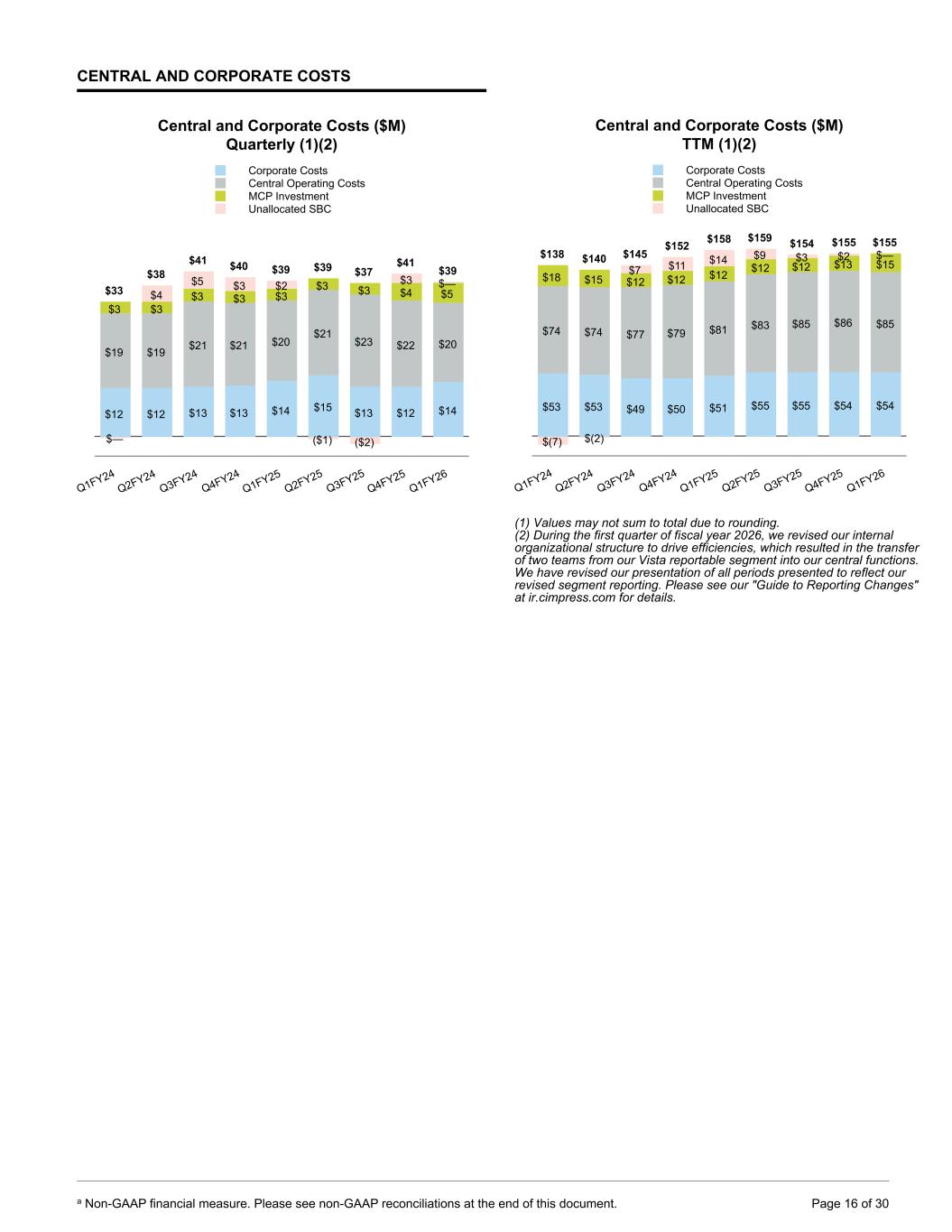

that collectively have improved customer care efficiency by 6% year over year. Profitability also benefited from the cost-reduction action taken during Q4 FY2025, as well as $0.9 million in year-over-year currency tailwinds during Q1. PrintBrothers and The Print Group (our combined Upload & Print businesses) each grew Q1 revenue year over year by 15% on a reported basis (15% combineda), and on an organic constant-currency basis each grew 8% (8% combined). Customer and order growth drove revenue growth in the PrintBrothers segment. Increased cross- Cimpress fulfillment drove revenue growth in The Print Group. Q1 segment EBITDA increased year over year by $5.5 million for PrintBrothers and by $0.6 million for The Print Group, driven by the revenue growth described above. Combineda Upload & Print EBITDA grew $6.1 million year over year, including a currency benefit of $2.7 million. National Pen Q1 revenue grew 10% year over year on a reported basis, and 8% on an organic constant-currency basis driven by increased cross-Cimpress fulfillment and tariff-related pricing increases. Segment EBITDA at National Pen grew $2.2 million driven by lower advertising spend and lower variable compensation expense. National Pen is also benefitting from cost reductions implemented during FY2025. All Other Businesses Q1 revenue grew 8% year over year on both a reported basis and an organic constant- currency basis. BuildASign, the largest business in this segment, drove growth through increased cross-Cimpress fulfillment and packaging product growth, partially offset by a decline in signage products. Our Printi business in Brazil delivered strong growth in the quarter. Segment EBITDA increased by $2.2 million. Central and Corporate Costs excluding unallocated share-based compensation increased $1.4 million year over year in Q1 from higher compensation costs and higher operating costs primarily driven by increased adoption of our mass customization platform (MCP). The increased adoption and operational maturity of MCP is driving improved profitability in our businesses through increased cross-Cimpress fulfillment and enabling further opportunity for us to reduce duplicative technology costs. Outlook We are reiterating our previously established FY2026 annual outlook as follows, and our Q1 results position us well to achieve or exceed these expectations: • Revenue growth of 5% - 6%, and organic constant-currency revenue growtha of 2% - 3%. This assumes full-year currency rates similar to recent average rates. • Net income of at least $72 million and adjusted EBITDAa of at least $450 million. • Operating cash flow of $310 million, and adjusted free cash flowa of approximately $140 million. As noted in July, we set our FY2026 guidance at a level that we believe incorporates continued risk from the trade and macroeconomic environment, and we remain in a financial position that allows us to manage through volatility, if any, posed by this environment. At our September investor day, we discussed our outlook through FY2028, as that will be the first full year that we expect to see approximately $70 million to $80 million of benefits from efficiency gains we plan to achieve from a combination of operating expense constraints, manufacturing investments, and other cost improvements. Successful execution of our plans would result in Cimpress delivering at least $200 million of net income and at least $600 million of adjusted EBITDA in FY2028, with approximately 45% conversion of adjusted EBITDA to adjusted free cash flow. As noted in our investor day, we have goals and aspirations to chart an even stronger financial course over this time period and we are actively working to do so. Achieving or exceeding our FY2028 outlook will generate strong growth in free cash flow per share and materially reduce our net leverage ratio while still allowing ample room for share repurchases or other capital allocation along the way. We expect net leverage to decrease slightly from current levels by the end of FY2026, and we expect that we will reduce net leverage to approximately 2.5x trailing-twelve- month EBITDA as calculated under our credit agreement exiting FY2027 on the way to meaningfully below 2.0x net leverage ending this three-year period, subject to capital allocation choices such as share repurchases. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 3 of 30

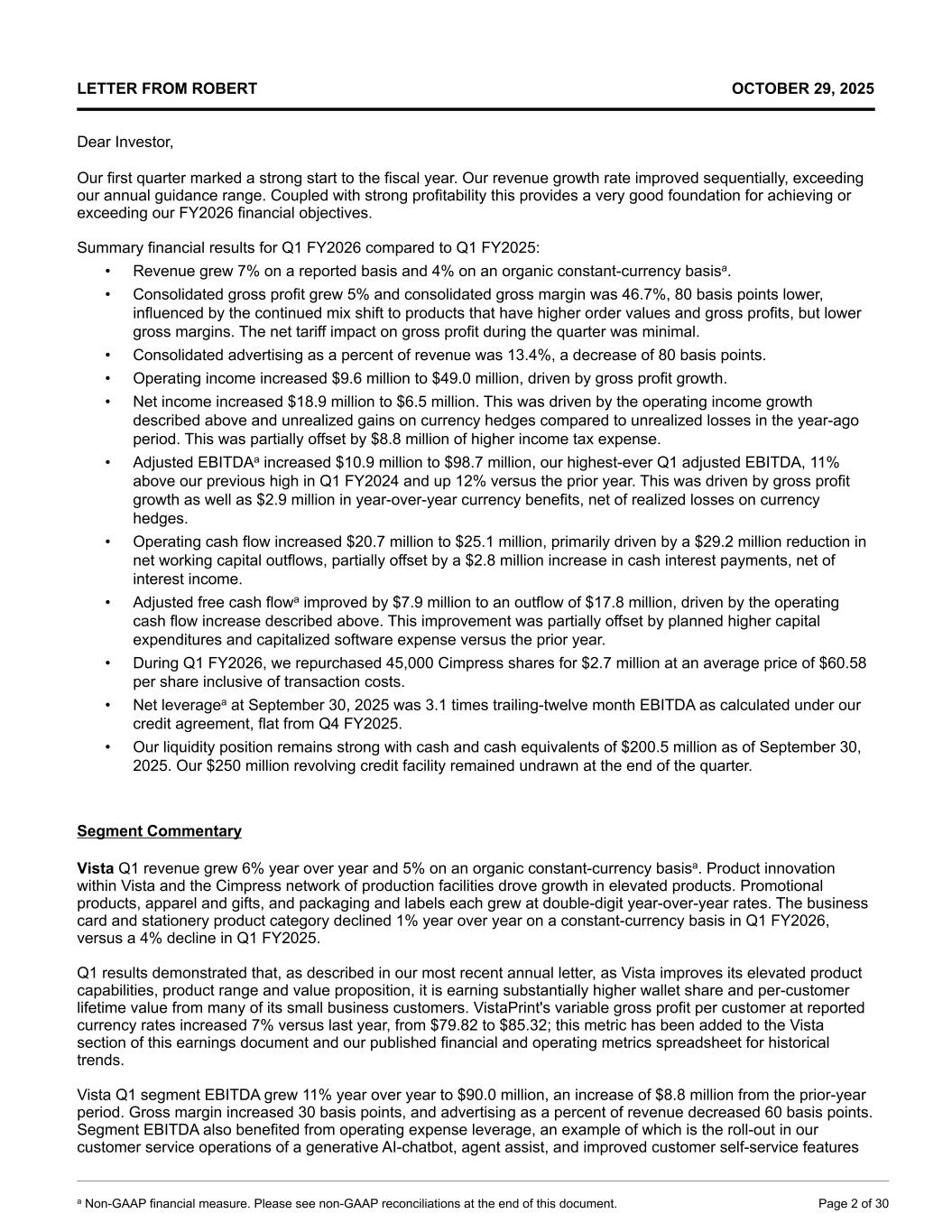

Conclusion We are off to a strong start in FY2026 and are well positioned to continue to progress against our strategic and financial goals as we continue to expand the value we deliver to customers and our competitive advantages for the years to come. As always, I thank our long-term investors for continuing to entrust your capital with Cimpress. Sincerely, Robert S. Keane Founder, Chairman & CEO Cimpress will host a public earnings call tomorrow, October 30, 2025 at 8:00 am ET, which you can join via the link on the events section of ir.cimpress.com. You may presubmit questions by emailing ir@cimpress.com, and you may also ask questions via chat during the live call. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 4 of 30

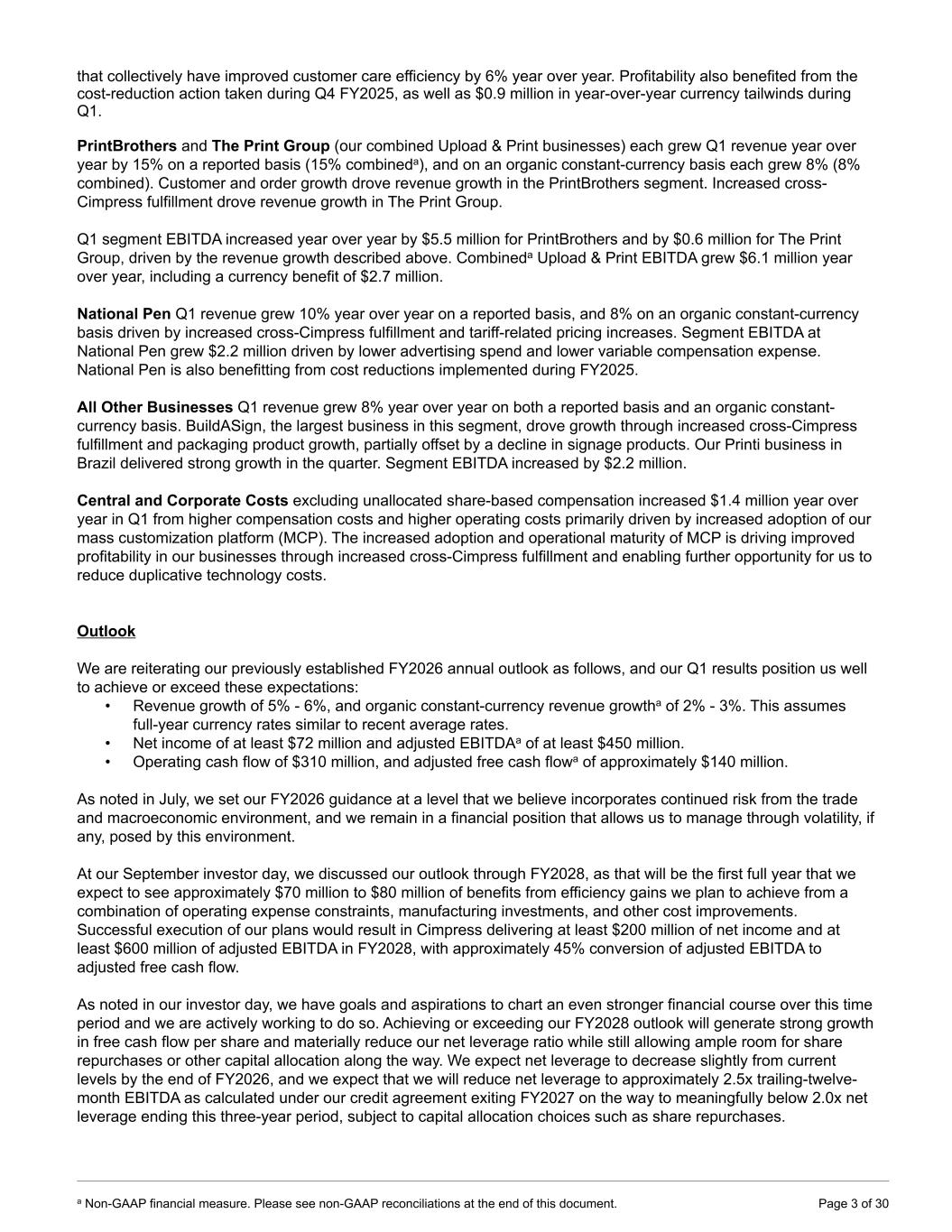

SUMMARY CONSOLIDATED RESULTS: THREE-YEAR TREND $ in thousands, except percentages REVENUE BY REPORTABLE SEGMENT, TOTAL REVENUE, INCOME FROM OPERATIONS, AND NET INCOME (LOSS): Q1 FY2024 Q1 FY2025 Q1 FY2026 Vista 1 $ 396,890 $ 429,576 $ 454,909 PrintBrothers 1 152,579 160,424 184,711 The Print Group 1 79,489 84,202 96,710 National Pen 1 86,909 93,590 103,209 All Other Businesses 1 51,929 57,240 61,742 Inter-segment eliminations 1 (10,502) (20,063) (38,004) Total revenue $ 757,294 $ 804,969 $ 863,277 Reported revenue growth 8 % 6 % 7 % Organic constant-currency revenue growtha 4 % 6 % 4 % Income from operations $ 34,100 $ 39,339 $ 48,971 Income from operations margin 5 % 5 % 6 % Net income (loss) $ 4,569 $ (12,384) $ 6,520 Net income (loss) margin 1 % (2) % 1 % Net income (loss) year-over-year growth (decline) 118 % (371) % 153 % EBITDA BY REPORTABLE SEGMENT ("SEGMENT EBITDA") AND ADJUSTED EBITDA3, a: Q1 FY2024 Q1 FY2025 Q1 FY2026 Vista 1,4 $ 81,161 $ 81,142 $ 89,986 PrintBrothers 1 20,227 20,194 25,739 The Print Group 1 12,569 18,062 18,671 National Pen 1 (8,649) (4,572) (2,392) All Other Businesses 1 6,544 6,862 9,080 Inter-segment elimination 1 (4,153) (8,459) (15,835) Total segment EBITDAa, 4 $ 107,699 $ 113,229 $ 125,249 Central & corporate costs ex unallocated SBC4 (33,814) (37,025) (38,424) Unallocated share-based compensation 348 (1,834) (211) Exclude: share-based compensation expense 2 12,453 15,633 14,793 Include: Realized gains (losses) on certain currency derivatives not included in segment EBITDA 2,050 (2,232) (2,692) Adjusted EBITDAa $ 88,736 $ 87,771 $ 98,715 Adjusted EBITDA margina 12 % 11 % 11 % Adjusted EBITDA year-over-year (decline) growtha 95 % (1) % 12 % 1 During the first quarter of fiscal year 2026, we made updates to our previously implemented methodology used for inter-segment transactions for purposes of measuring and reporting our segment financial performance. We have revised the prior periods starting in Q1 FY2023 to incorporate this change. Please refer to the Q1 FY2026 Guide to Reporting Changes at ir.cimpress.com for more information. 2 SBC expense listed above excludes the portion included in restructuring-related charges to avoid double counting. 3 Values may not sum due to rounding. 4During the first quarter of fiscal year 2026, we revised our internal organizational structure to drive efficiencies, which resulted in the transfer of two teams from our Vista reportable segment into our central functions. We have revised our presentation of all periods presented to ensure comparability and reflect our revised segment reporting. Please refer to the Q1 FY2026 Guide to Reporting Changes at ir.cimpress.com for more information. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 5 of 30

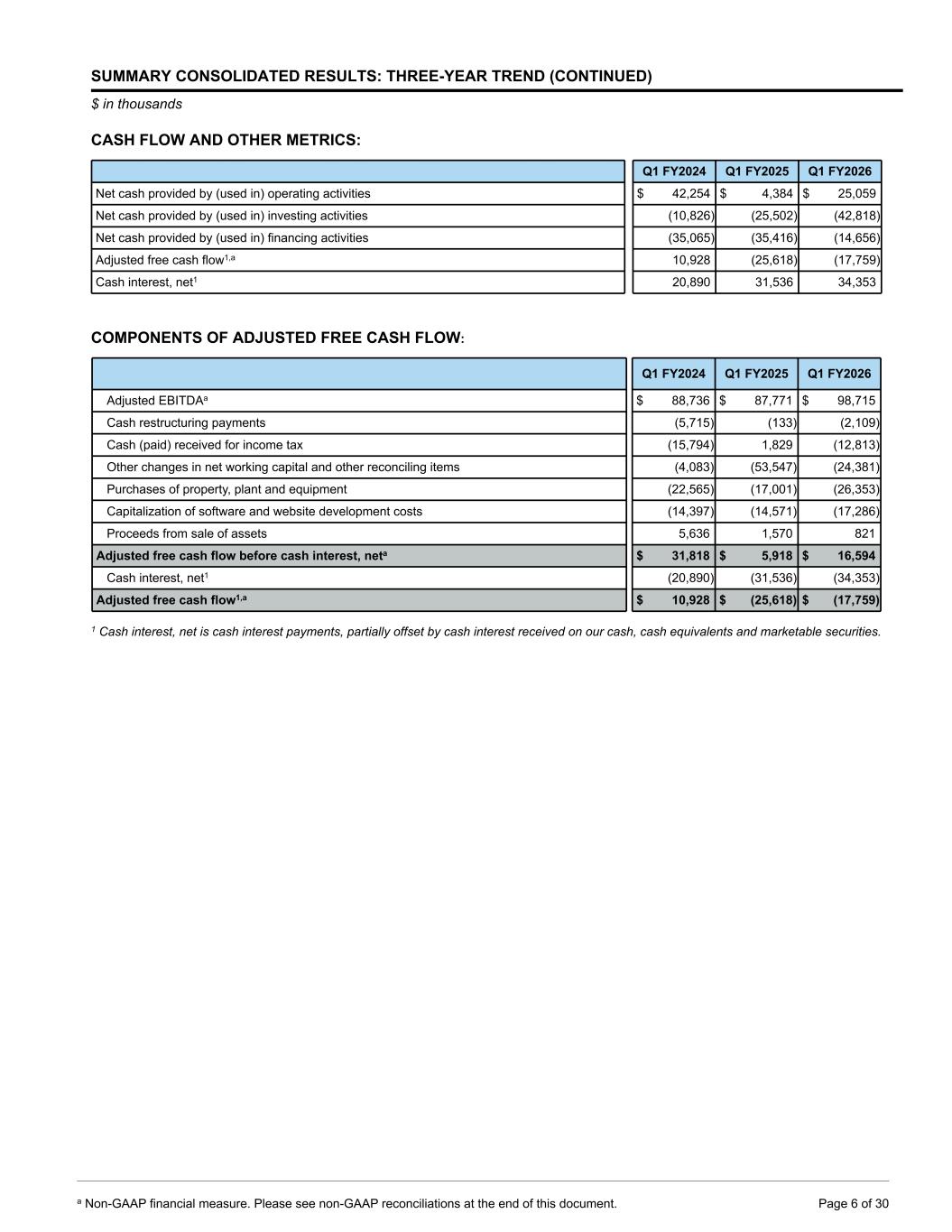

SUMMARY CONSOLIDATED RESULTS: THREE-YEAR TREND (CONTINUED) $ in thousands CASH FLOW AND OTHER METRICS: Q1 FY2024 Q1 FY2025 Q1 FY2026 Net cash provided by (used in) operating activities $ 42,254 $ 4,384 $ 25,059 Net cash provided by (used in) investing activities (10,826) (25,502) (42,818) Net cash provided by (used in) financing activities (35,065) (35,416) (14,656) Adjusted free cash flow1,a 10,928 (25,618) (17,759) Cash interest, net1 20,890 31,536 34,353 COMPONENTS OF ADJUSTED FREE CASH FLOW: Q1 FY2024 Q1 FY2025 Q1 FY2026 Adjusted EBITDAa $ 88,736 $ 87,771 $ 98,715 Cash restructuring payments (5,715) (133) (2,109) Cash (paid) received for income tax (15,794) 1,829 (12,813) Other changes in net working capital and other reconciling items (4,083) (53,547) (24,381) Purchases of property, plant and equipment (22,565) (17,001) (26,353) Capitalization of software and website development costs (14,397) (14,571) (17,286) Proceeds from sale of assets 5,636 1,570 821 Adjusted free cash flow before cash interest, neta $ 31,818 $ 5,918 $ 16,594 Cash interest, net1 (20,890) (31,536) (34,353) Adjusted free cash flow1,a $ 10,928 $ (25,618) $ (17,759) 1 Cash interest, net is cash interest payments, partially offset by cash interest received on our cash, cash equivalents and marketable securities. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 6 of 30

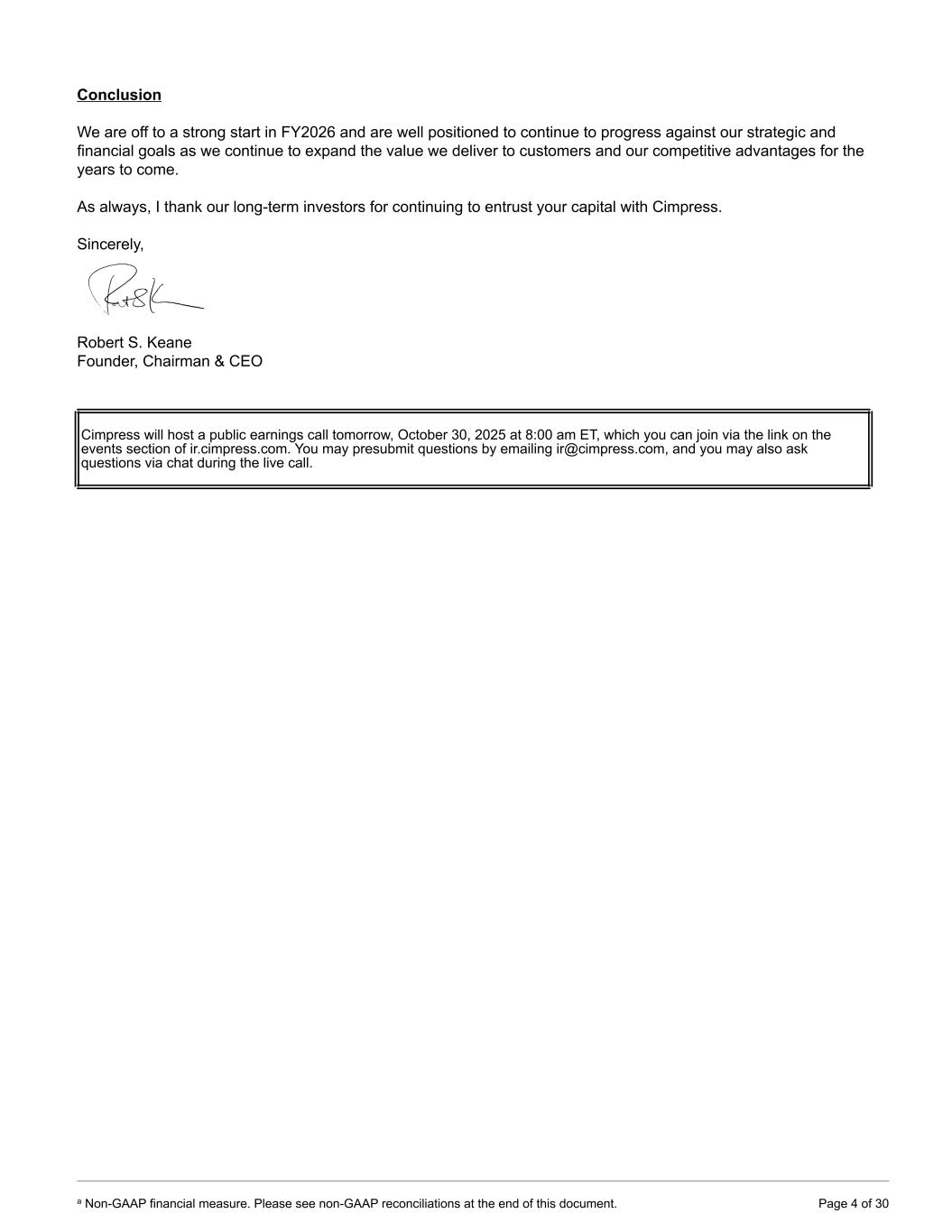

INCOME STATEMENT HIGHLIGHTS Revenue ($M) & Reported Revenue Growth $757 $921 $781 $833 $805 $939 $789 $869 $863 8% 9% 5% 6% 6% 2% 1% 4% 7% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) (Quarterly) $359 $458 $376 $404 $382 $450 $373 $413 $403 47% 50% 48% 49% 48% 48% 47% 47% 47% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Contribution Profit ($M) & Contribution Margin (%) (Quarterly) (a) $236 $319 $260 $286 $254 $303 $255 $300 $272 31% 35% 33% 34% 32% 32% 32% 34% 31% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Organic Constant-Currency Revenue Growth (a) 4% 6% 4% 6% 6% 2% 3% 2% 4% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) (TTM) $1,472 $1,540 $1,569 $1,597 $1,621 $1,612 $1,609 $1,617 $1,638 47% 48% 48% 49% 49% 48% 48% 48% 47% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Contribution Profit ($M) & Contribution Margin (%) (TTM) (a) $998 $1,058 $1,081 $1,101 $1,118 $1,102 $1,098 $1,111 $1,129 32% 33% 33% 33% 34% 33% 33% 33% 33% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 7 of 30

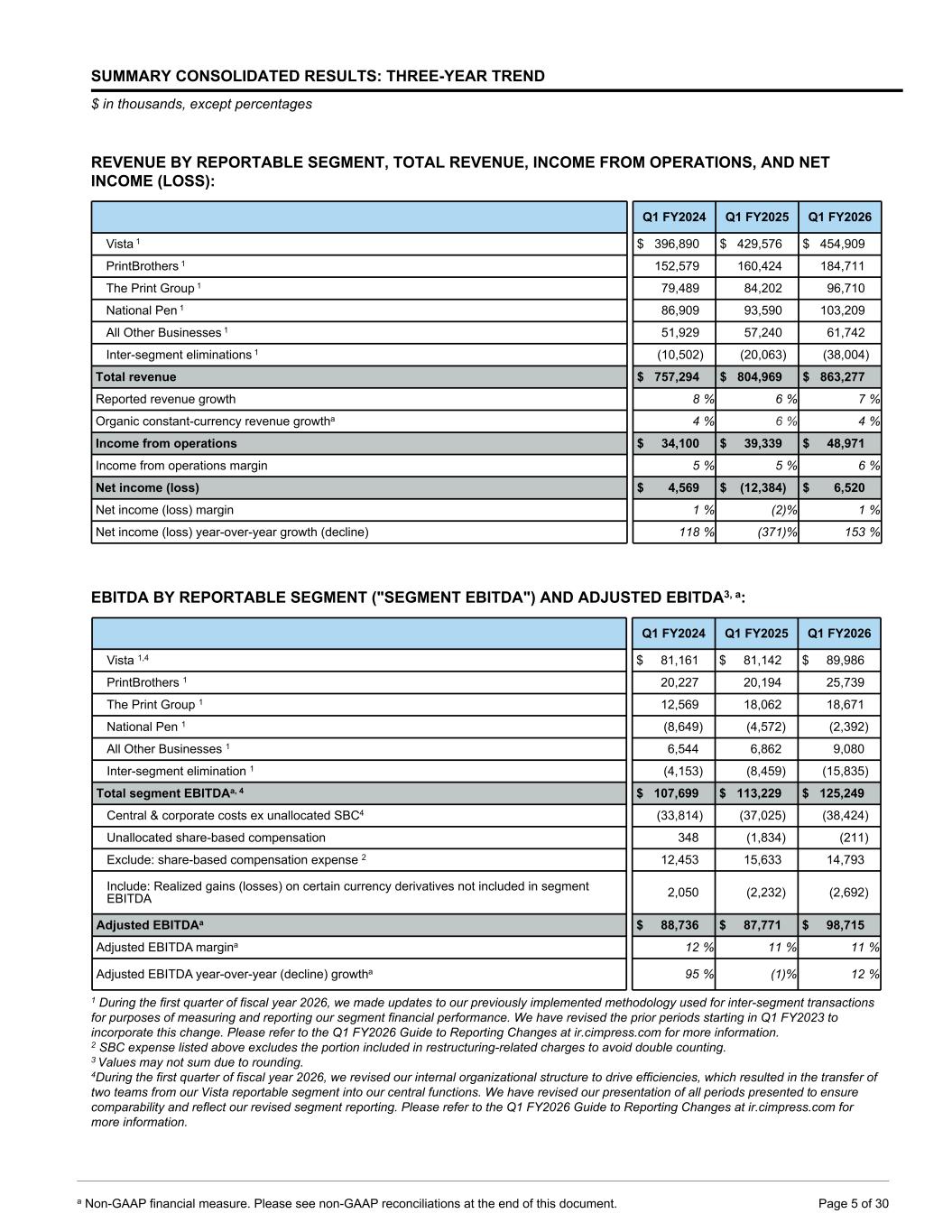

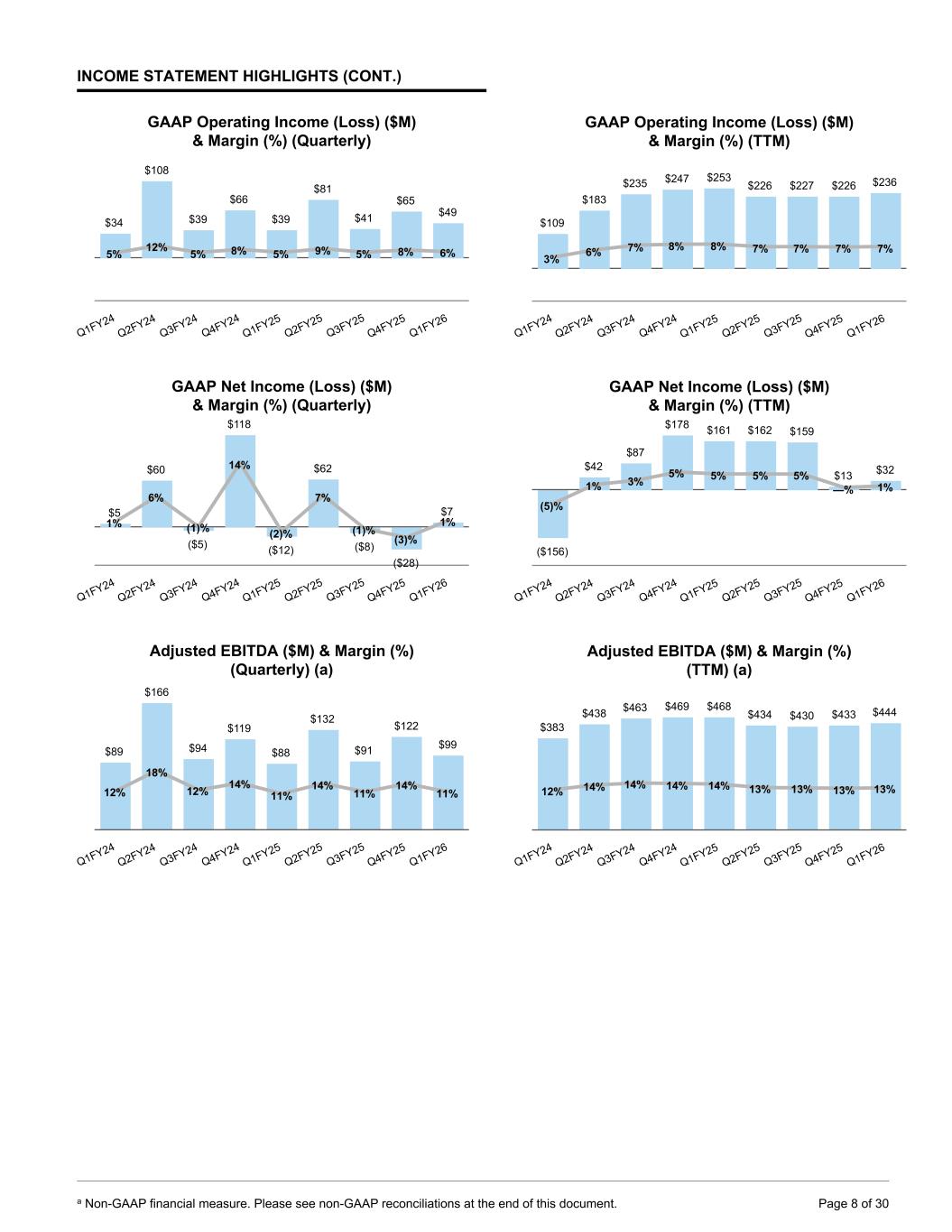

INCOME STATEMENT HIGHLIGHTS (CONT.) GAAP Operating Income (Loss) ($M) & Margin (%) (Quarterly) $34 $108 $39 $66 $39 $81 $41 $65 $49 5% 12% 5% 8% 5% 9% 5% 8% 6% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 GAAP Net Income (Loss) ($M) & Margin (%) (Quarterly) $5 $60 ($5) $118 ($12) $62 ($8) ($28) $7 1% 6% (1)% 14% (2)% 7% (1)% (3)% 1% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Adjusted EBITDA ($M) & Margin (%) (Quarterly) (a) $89 $166 $94 $119 $88 $132 $91 $122 $99 12% 18% 12% 14% 11% 14% 11% 14% 11% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 GAAP Operating Income (Loss) ($M) & Margin (%) (TTM) $109 $183 $235 $247 $253 $226 $227 $226 $236 3% 6% 7% 8% 8% 7% 7% 7% 7% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 GAAP Net Income (Loss) ($M) & Margin (%) (TTM) ($156) $42 $87 $178 $161 $162 $159 $13 $32 (5)% 1% 3% 5% 5% 5% 5% —% 1% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Adjusted EBITDA ($M) & Margin (%) (TTM) (a) $383 $438 $463 $469 $468 $434 $430 $433 $444 12% 14% 14% 14% 14% 13% 13% 13% 13% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 8 of 30

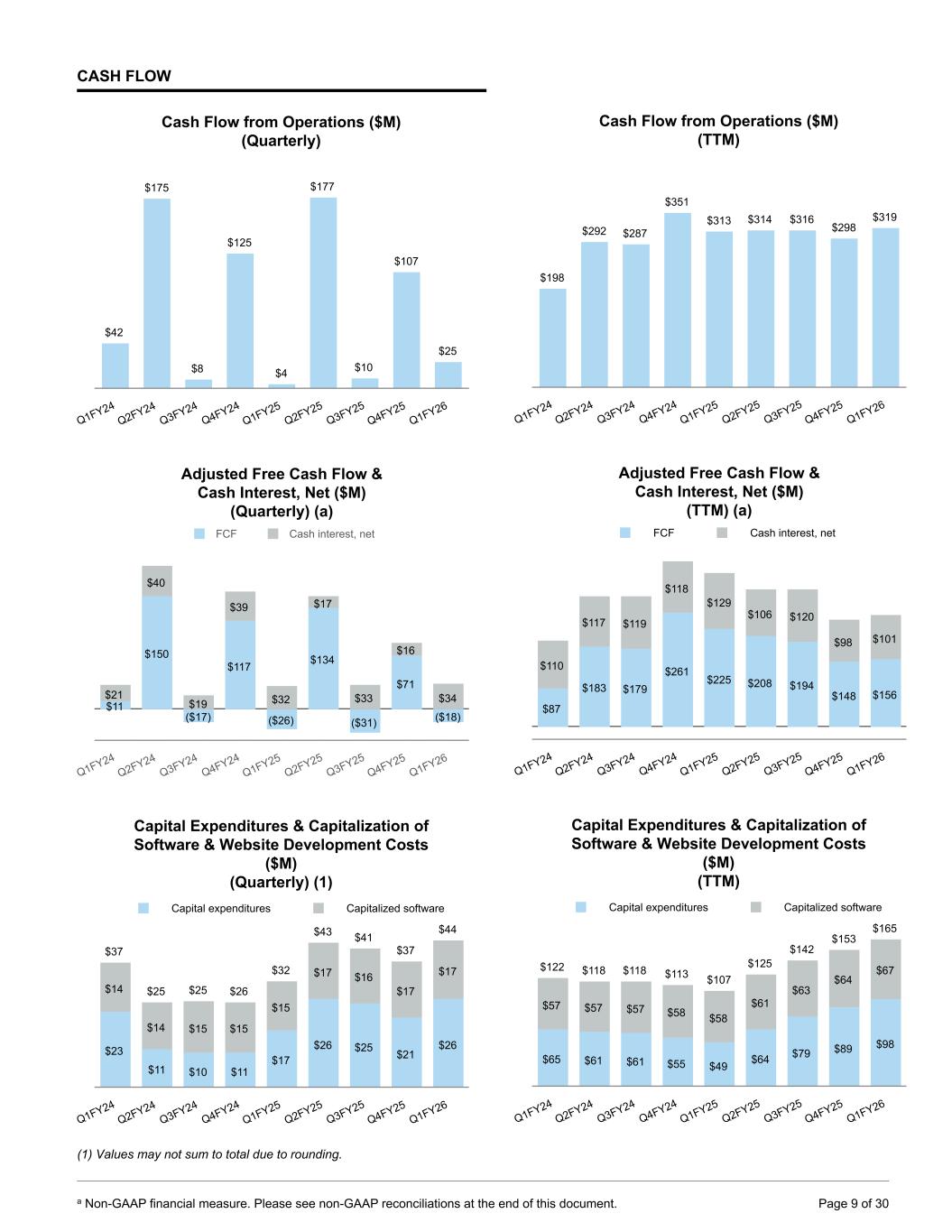

CASH FLOW Cash Flow from Operations ($M) (Quarterly) $42 $175 $8 $125 $4 $177 $10 $107 $25 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Adjusted Free Cash Flow & Cash Interest, Net ($M) (Quarterly) (a) $11 $150 ($17) $117 ($26) $134 ($31) $71 ($18) $21 $40 $19 $39 $32 $17 $33 $16 $34 FCF Cash interest, net Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Capital Expenditures & Capitalization of Software & Website Development Costs ($M) (Quarterly) (1) $23 $11 $10 $11 $17 $26 $25 $21 $26 $14 $14 $15 $15 $15 $17 $16 $17 $17 $37 $25 $25 $26 $32 $43 $41 $37 $44 Capital expenditures Capitalized software Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) Values may not sum to total due to rounding. Cash Flow from Operations ($M) (TTM) $198 $292 $287 $351 $313 $314 $316 $298 $319 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Adjusted Free Cash Flow & Cash Interest, Net ($M) (TTM) (a) $87 $183 $179 $261 $225 $208 $194 $148 $156 $110 $117 $119 $118 $129 $106 $120 $98 $101 FCF Cash interest, net Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Capital Expenditures & Capitalization of Software & Website Development Costs ($M) (TTM) $65 $61 $61 $55 $49 $64 $79 $89 $98 $57 $57 $57 $58 $58 $61 $63 $64 $67$122 $118 $118 $113 $107 $125 $142 $153 $165 Capital expenditures Capitalized software Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 9 of 30

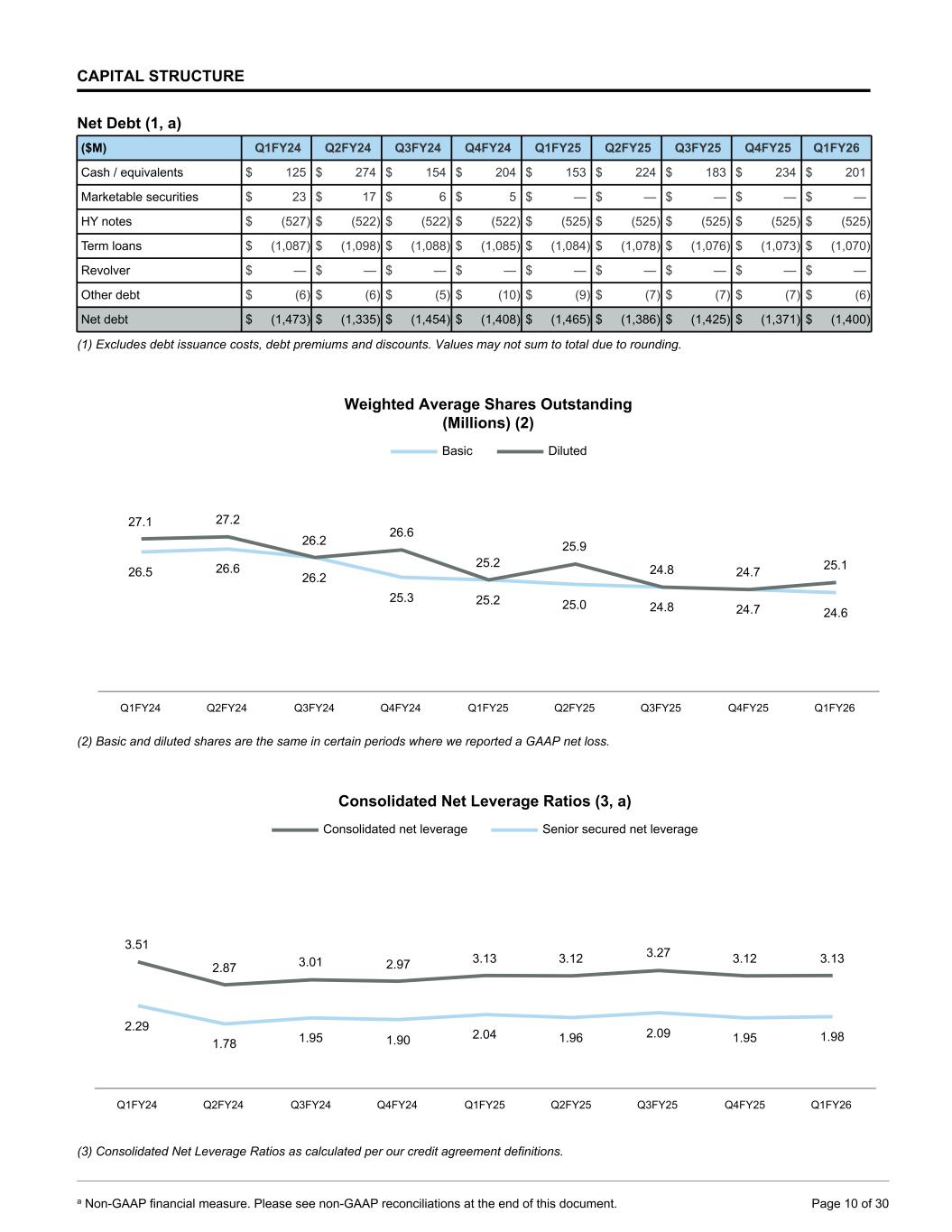

CAPITAL STRUCTURE Net Debt (1, a) ($M) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Cash / equivalents $ 125 $ 274 $ 154 $ 204 $ 153 $ 224 $ 183 $ 234 $ 201 Marketable securities $ 23 $ 17 $ 6 $ 5 $ — $ — $ — $ — $ — HY notes $ (527) $ (522) $ (522) $ (522) $ (525) $ (525) $ (525) $ (525) $ (525) Term loans $ (1,087) $ (1,098) $ (1,088) $ (1,085) $ (1,084) $ (1,078) $ (1,076) $ (1,073) $ (1,070) Revolver $ — $ — $ — $ — $ — $ — $ — $ — $ — Other debt $ (6) $ (6) $ (5) $ (10) $ (9) $ (7) $ (7) $ (7) $ (6) Net debt $ (1,473) $ (1,335) $ (1,454) $ (1,408) $ (1,465) $ (1,386) $ (1,425) $ (1,371) $ (1,400) (1) Excludes debt issuance costs, debt premiums and discounts. Values may not sum to total due to rounding. Weighted Average Shares Outstanding (Millions) (2) 26.5 26.6 26.2 25.3 25.2 25.0 24.8 24.7 24.6 27.1 27.2 26.2 26.6 25.2 25.9 24.8 24.7 25.1 Basic Diluted Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (2) Basic and diluted shares are the same in certain periods where we reported a GAAP net loss. Consolidated Net Leverage Ratios (3, a) 3.51 2.87 3.01 2.97 3.13 3.12 3.27 3.12 3.13 2.29 1.78 1.95 1.90 2.04 1.96 2.09 1.95 1.98 Consolidated net leverage Senior secured net leverage Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (3) Consolidated Net Leverage Ratios as calculated per our credit agreement definitions. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 10 of 30

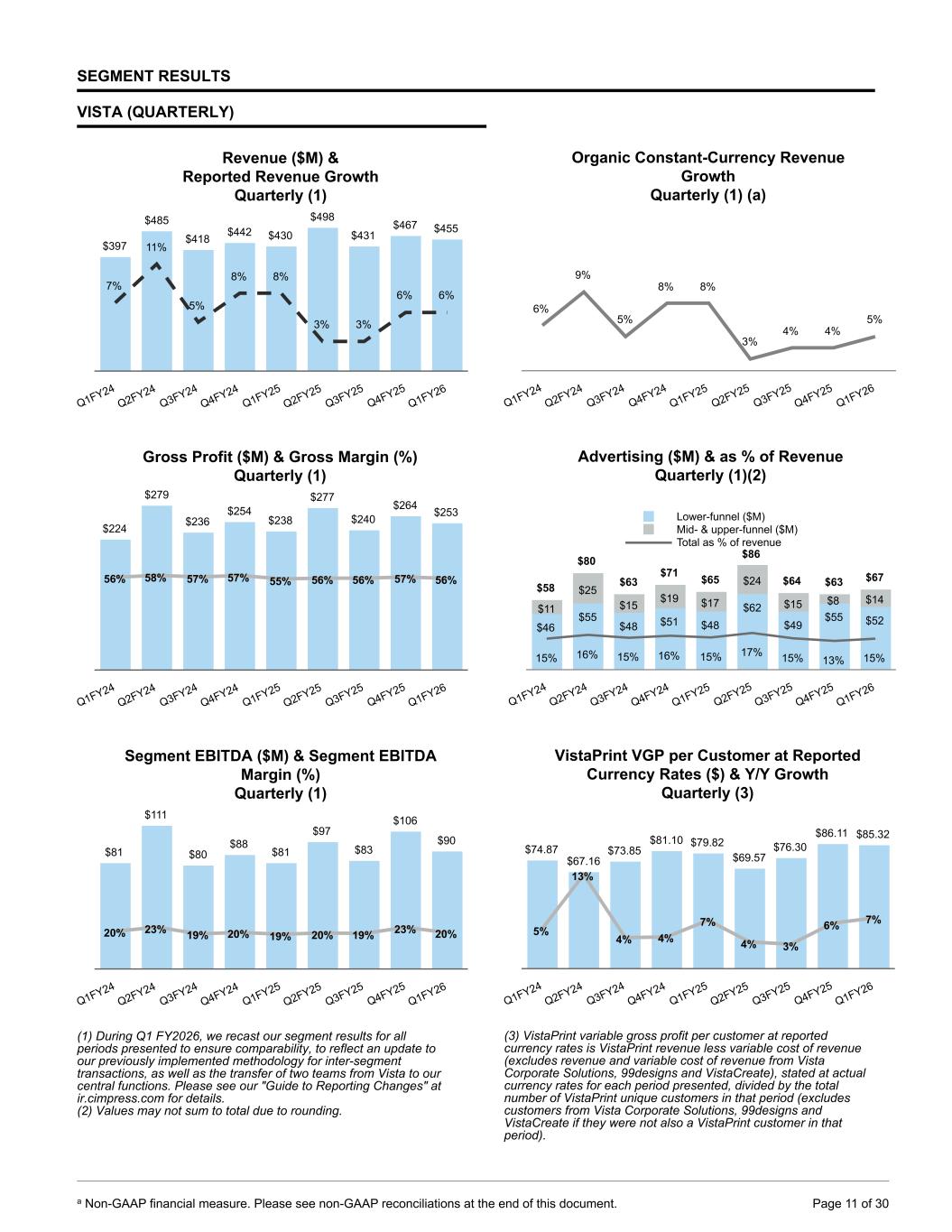

SEGMENT RESULTS VISTA (QUARTERLY) Revenue ($M) & Reported Revenue Growth Quarterly (1) $397 $485 $418 $442 $430 $498 $431 $467 $455 7% 11% 5% 8% 8% 3% 3% 6% 6% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $224 $279 $236 $254 $238 $277 $240 $264 $253 56% 58% 57% 57% 55% 56% 56% 57% 56% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $81 $111 $80 $88 $81 $97 $83 $106 $90 20% 23% 19% 20% 19% 20% 19% 23% 20% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) During Q1 FY2026, we recast our segment results for all periods presented to ensure comparability, to reflect an update to our previously implemented methodology for inter-segment transactions, as well as the transfer of two teams from Vista to our central functions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. (2) Values may not sum to total due to rounding. Organic Constant-Currency Revenue Growth Quarterly (1) (a) 6% 9% 5% 8% 8% 3% 4% 4% 5% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Advertising ($M) & as % of Revenue Quarterly (1)(2) $58 $80 $63 $71 $65 $86 $64 $63 $67 $46 $55 $48 $51 $48 $62 $49 $55 $52 $11 $25 $15 $19 $17 $24 $15 $8 $14 15% 16% 15% 16% 15% 17% 15% 13% 15% Lower-funnel ($M) Mid- & upper-funnel ($M) Total as % of revenue Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 VistaPrint VGP per Customer at Reported Currency Rates ($) & Y/Y Growth Quarterly (3) $74.87 $67.16 $73.85 $81.10 $79.82 $69.57 $76.30 $86.11 $85.32 5% 13% 4% 4% 7% 4% 3% 6% 7% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (3) VistaPrint variable gross profit per customer at reported currency rates is VistaPrint revenue less variable cost of revenue (excludes revenue and variable cost of revenue from Vista Corporate Solutions, 99designs and VistaCreate), stated at actual currency rates for each period presented, divided by the total number of VistaPrint unique customers in that period (excludes customers from Vista Corporate Solutions, 99designs and VistaCreate if they were not also a VistaPrint customer in that period). a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 11 of 30

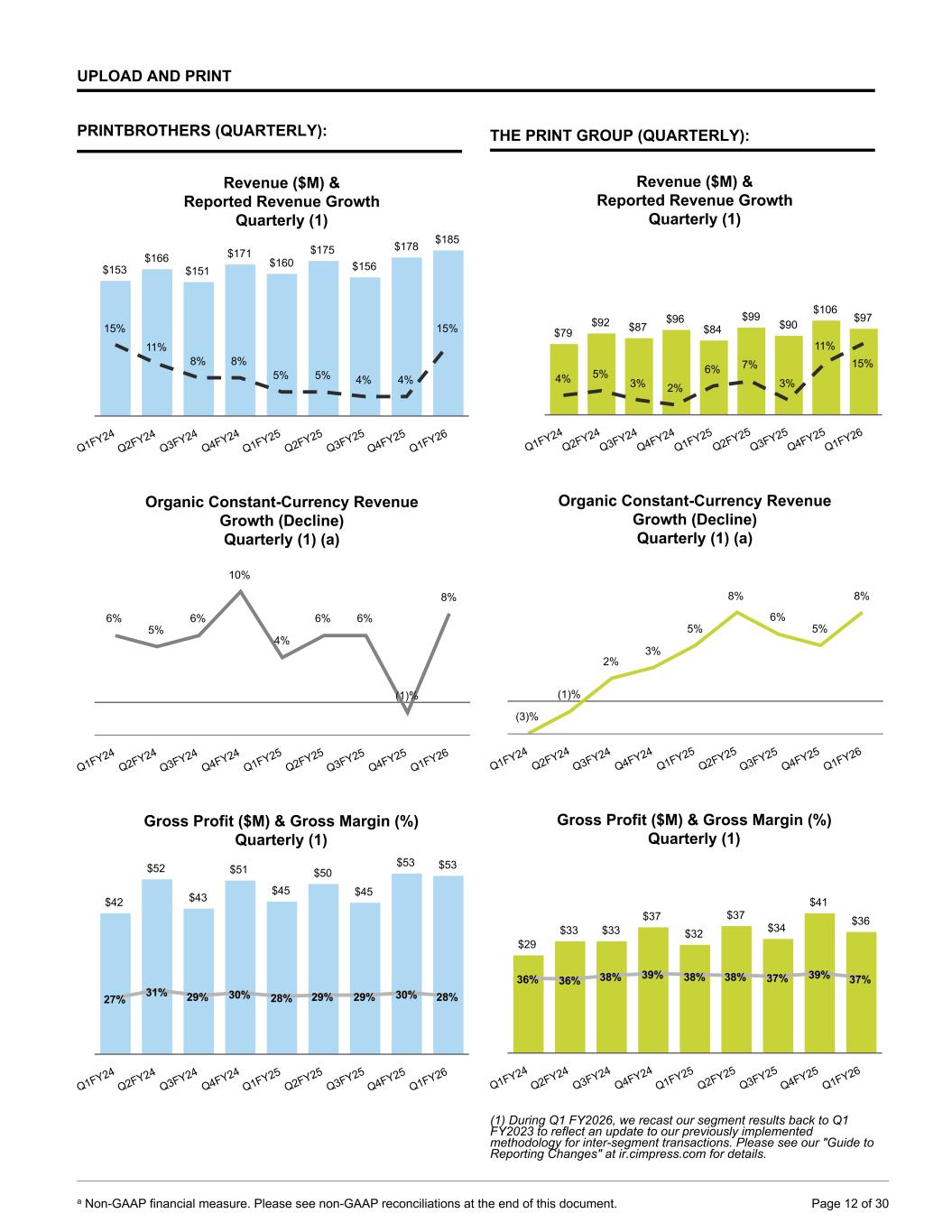

UPLOAD AND PRINT PRINTBROTHERS (QUARTERLY): Revenue ($M) & Reported Revenue Growth Quarterly (1) $153 $166 $151 $171 $160 $175 $156 $178 $185 15% 11% 8% 8% 5% 5% 4% 4% 15% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Organic Constant-Currency Revenue Growth (Decline) Quarterly (1) (a) 6% 5% 6% 10% 4% 6% 6% (1)% 8% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $42 $52 $43 $51 $45 $50 $45 $53 $53 27% 31% 29% 30% 28% 29% 29% 30% 28% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 THE PRINT GROUP (QUARTERLY): Revenue ($M) & Reported Revenue Growth Quarterly (1) $79 $92 $87 $96 $84 $99 $90 $106 $97 4% 5% 3% 2% 6% 7% 3% 11% 15% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 0 100 Organic Constant-Currency Revenue Growth (Decline) Quarterly (1) (a) (3)% (1)% 2% 3% 5% 8% 6% 5% 8% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $29 $33 $33 $37 $32 $37 $34 $41 $36 36% 36% 38% 39% 38% 38% 37% 39% 37% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter-segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 12 of 30

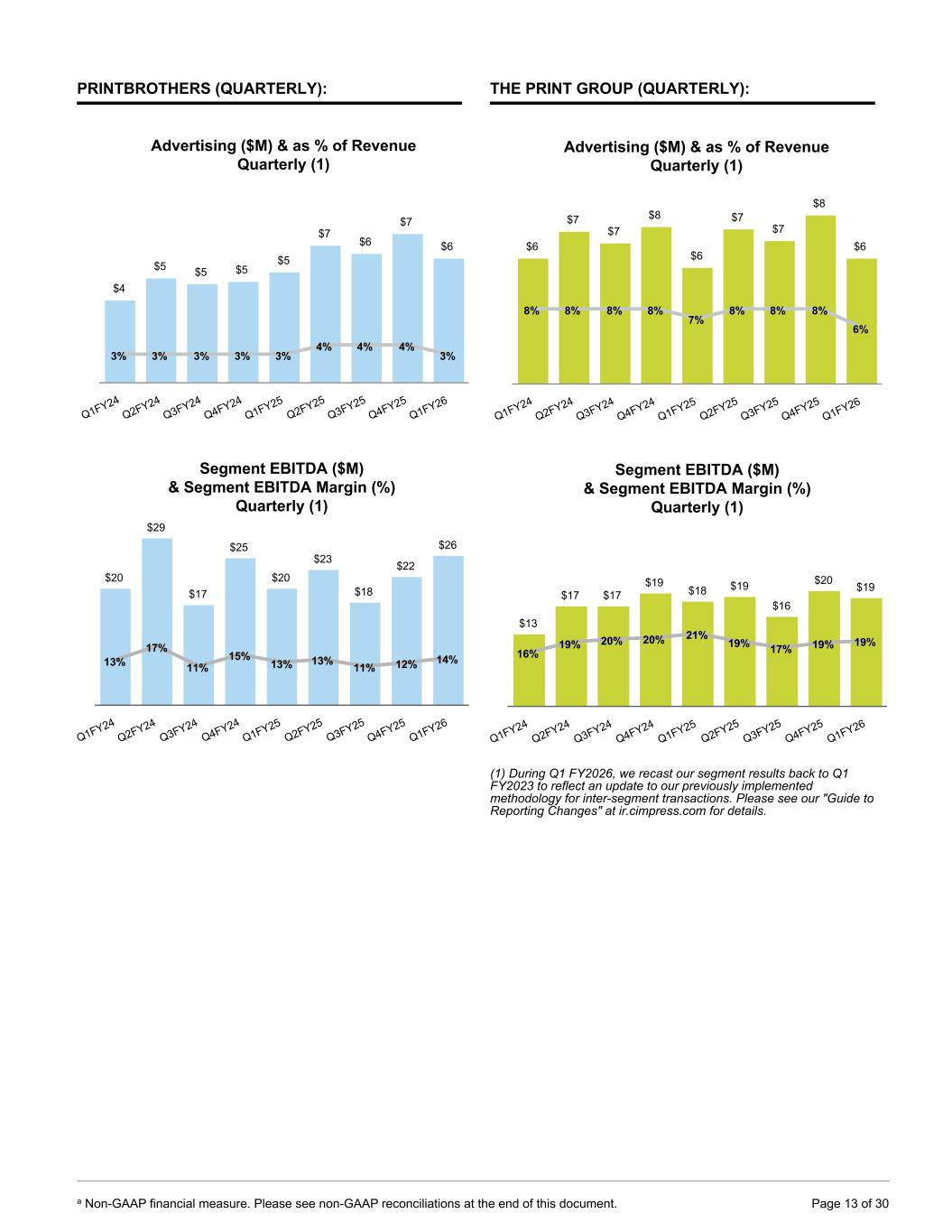

PRINTBROTHERS (QUARTERLY): Advertising ($M) & as % of Revenue Quarterly (1) $4 $5 $5 $5 $5 $7 $6 $7 $6 3% 3% 3% 3% 3% 4% 4% 4% 3% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $20 $29 $17 $25 $20 $23 $18 $22 $26 13% 17% 11% 15% 13% 13% 11% 12% 14% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 THE PRINT GROUP (QUARTERLY): Advertising ($M) & as % of Revenue Quarterly (1) $6 $7 $7 $8 $6 $7 $7 $8 $6 8% 8% 8% 8% 7% 8% 8% 8% 6% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $13 $17 $17 $19 $18 $19 $16 $20 $19 16% 19% 20% 20% 21% 19% 17% 19% 19% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter-segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 13 of 30

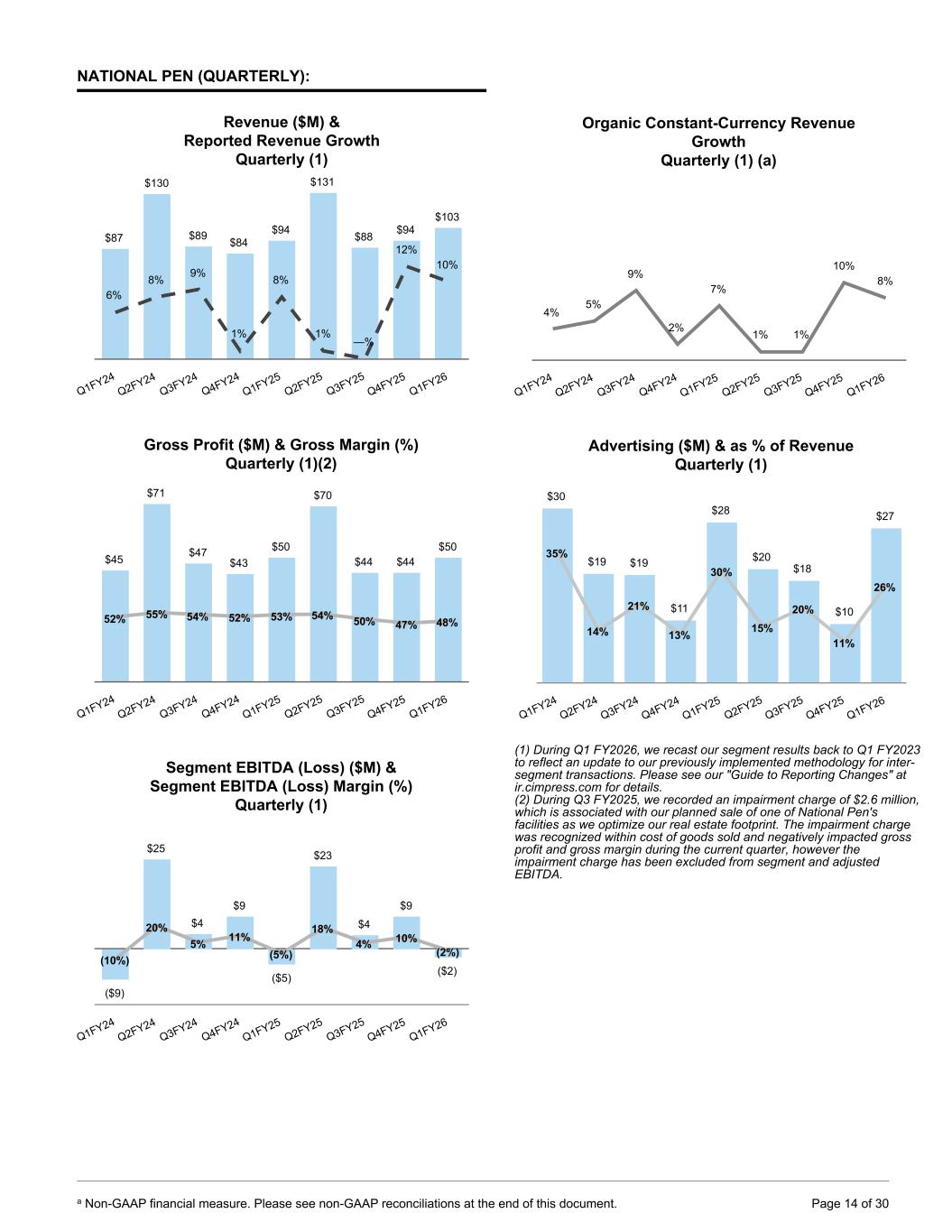

NATIONAL PEN (QUARTERLY): Revenue ($M) & Reported Revenue Growth Quarterly (1) $87 $130 $89 $84 $94 $131 $88 $94 $103 6% 8% 9% 1% 8% 1% —% 12% 10% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) Quarterly (1)(2) $45 $71 $47 $43 $50 $70 $44 $44 $50 52% 55% 54% 52% 53% 54% 50% 47% 48% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Segment EBITDA (Loss) ($M) & Segment EBITDA (Loss) Margin (%) Quarterly (1) ($9) $25 $4 $9 ($5) $23 $4 $9 ($2) (10%) 20% 5% 11% (5%) 18% 4% 10% (2%) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Organic Constant-Currency Revenue Growth Quarterly (1) (a) 4% 5% 9% 2% 7% 1% 1% 10% 8% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Advertising ($M) & as % of Revenue Quarterly (1) $30 $19 $19 $11 $28 $20 $18 $10 $27 35% 14% 21% 13% 30% 15% 20% 11% 26% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter- segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. (2) During Q3 FY2025, we recorded an impairment charge of $2.6 million, which is associated with our planned sale of one of National Pen's facilities as we optimize our real estate footprint. The impairment charge was recognized within cost of goods sold and negatively impacted gross profit and gross margin during the current quarter, however the impairment charge has been excluded from segment and adjusted EBITDA. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 14 of 30

ALL OTHER BUSINESSES (QUARTERLY): Revenue ($M) & Reported Revenue Growth Quarterly (1) $52 $60 $49 $55 $57 $60 $51 $59 $62 —% 1% 1% 5% 10% —% 4% 7% 8% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Gross Profit ($M) & Gross Margin (%) Quarterly (1) $24 $27 $21 $25 $26 $25 $21 $25 $28 46% 45% 43% 46% 45% 41% 41% 43% 45% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Segment EBITDA ($M) & Segment EBITDA Margin (%) Quarterly (1) $7 $8 $4 $7 $7 $4 $5 $7 $9 13% 13% 8% 13% 12% 6% 10% 11% 15% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Organic Constant-Currency Revenue Growth (Decline) Quarterly (1) (a) (1%) —% —% 5% 12% 2% 6% 8% 8% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Advertising ($M) & as % of Revenue Quarterly (1) $10 $12 $9 $10 $10 $11 $8 $10 $11 19% 20% 18% 18% 18% 19% 16% 16% 17% Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter-segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 15 of 30

CENTRAL AND CORPORATE COSTS Central and Corporate Costs ($M) Quarterly (1)(2) $12 $12 $13 $13 $14 $15 $13 $12 $14 $19 $19 $21 $21 $20 $21 $23 $22 $20 $3 $3 $3 $3 $3 $3 $3 $4 $5 $— $4 $5 $3 $2 ($1) ($2) $3 $—$33 $38 $41 $40 $39 $39 $37 $41 $39 Corporate Costs Central Operating Costs MCP Investment Unallocated SBC Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Central and Corporate Costs ($M) TTM (1)(2) $53 $53 $49 $50 $51 $55 $55 $54 $54 $74 $74 $77 $79 $81 $83 $85 $86 $85 $18 $15 $12 $12 $12 $12 $12 $13 $15 $(7) $(2) $7 $11 $14 $9 $3 $2 $—$138 $140 $145 $152 $158 $159 $154 $155 $155 Corporate Costs Central Operating Costs MCP Investment Unallocated SBC Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 (1) Values may not sum to total due to rounding. (2) During the first quarter of fiscal year 2026, we revised our internal organizational structure to drive efficiencies, which resulted in the transfer of two teams from our Vista reportable segment into our central functions. We have revised our presentation of all periods presented to reflect our revised segment reporting. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 16 of 30

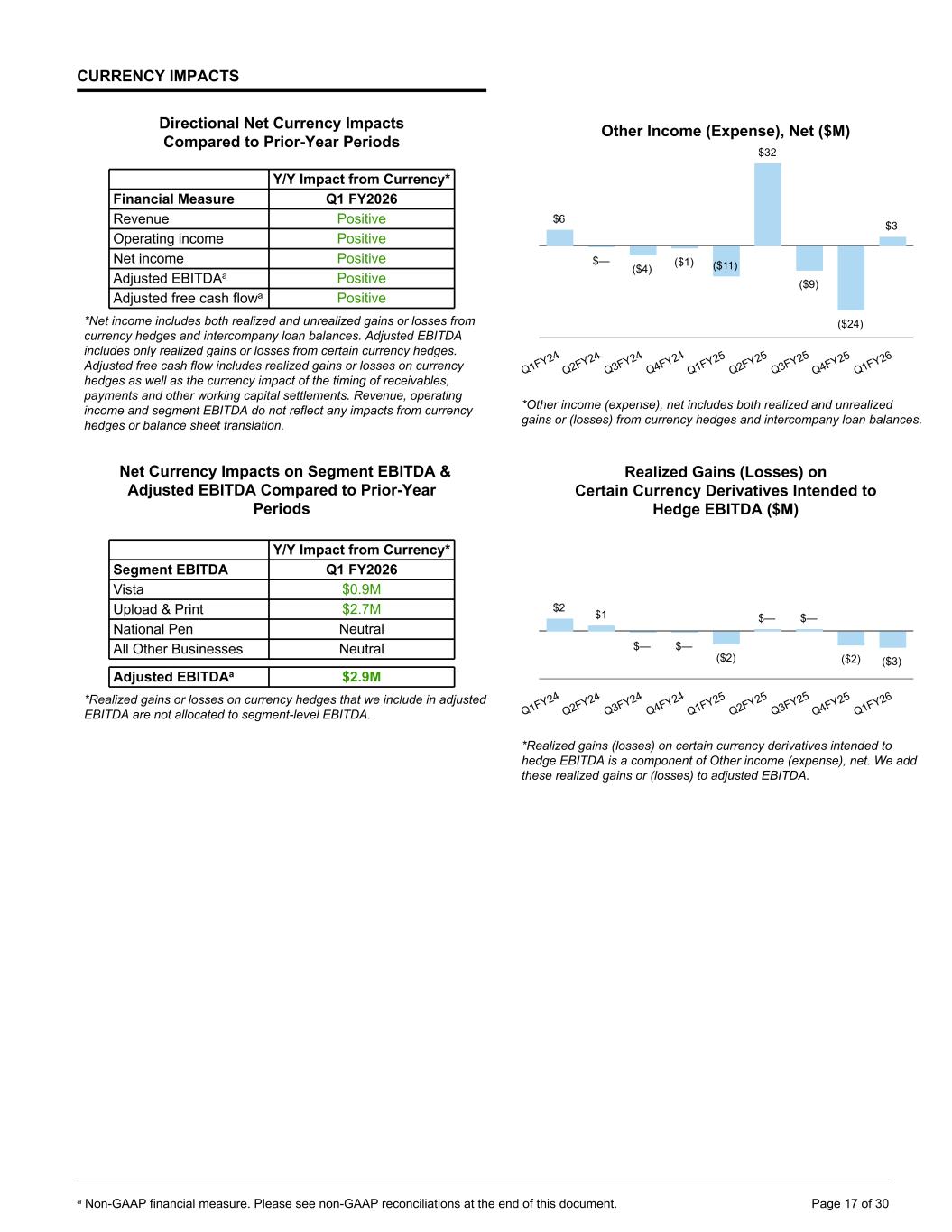

CURRENCY IMPACTS Directional Net Currency Impacts Compared to Prior-Year Periods Y/Y Impact from Currency* Financial Measure Q1 FY2026 Revenue Positive Operating income Positive Net income Positive Adjusted EBITDAa Positive Adjusted free cash flowa Positive *Net income includes both realized and unrealized gains or losses from currency hedges and intercompany loan balances. Adjusted EBITDA includes only realized gains or losses from certain currency hedges. Adjusted free cash flow includes realized gains or losses on currency hedges as well as the currency impact of the timing of receivables, payments and other working capital settlements. Revenue, operating income and segment EBITDA do not reflect any impacts from currency hedges or balance sheet translation. Net Currency Impacts on Segment EBITDA & Adjusted EBITDA Compared to Prior-Year Periods Y/Y Impact from Currency* Segment EBITDA Q1 FY2026 Vista $0.9M Upload & Print $2.7M National Pen Neutral All Other Businesses Neutral Adjusted EBITDAa $2.9M *Realized gains or losses on currency hedges that we include in adjusted EBITDA are not allocated to segment-level EBITDA. Other Income (Expense), Net ($M) $6 $— ($4) ($1) ($11) $32 ($9) ($24) $3 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 *Other income (expense), net includes both realized and unrealized gains or (losses) from currency hedges and intercompany loan balances. Realized Gains (Losses) on Certain Currency Derivatives Intended to Hedge EBITDA ($M) $2 $1 $— $— ($2) $— $— ($2) ($3) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 *Realized gains (losses) on certain currency derivatives intended to hedge EBITDA is a component of Other income (expense), net. We add these realized gains or (losses) to adjusted EBITDA. a Non-GAAP financial measure. Please see non-GAAP reconciliations at the end of this document. Page 17 of 30

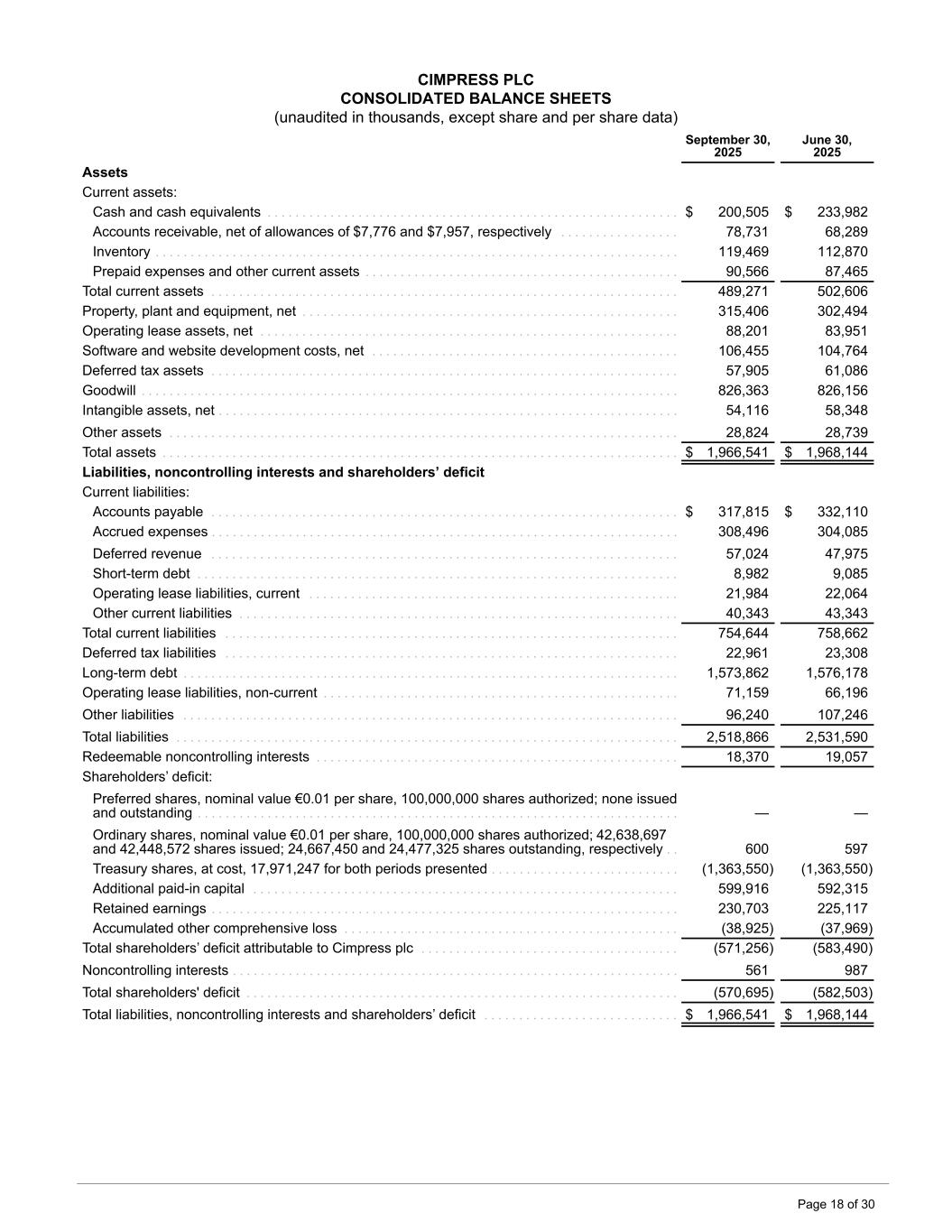

CIMPRESS PLC CONSOLIDATED BALANCE SHEETS (unaudited in thousands, except share and per share data) September 30, 2025 June 30, 2025 Assets Current assets: Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200,505 $ 233,982 Accounts receivable, net of allowances of $7,776 and $7,957, respectively . . . . . . . . . . . . . . . . . 78,731 68,289 Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119,469 112,870 Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90,566 87,465 Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 489,271 502,606 Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315,406 302,494 Operating lease assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88,201 83,951 Software and website development costs, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106,455 104,764 Deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57,905 61,086 Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 826,363 826,156 Intangible assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54,116 58,348 Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,824 28,739 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,966,541 $ 1,968,144 Liabilities, noncontrolling interests and shareholders’ deficit Current liabilities: Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 317,815 $ 332,110 Accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 308,496 304,085 Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57,024 47,975 Short-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,982 9,085 Operating lease liabilities, current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,984 22,064 Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,343 43,343 Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 754,644 758,662 Deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,961 23,308 Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,573,862 1,576,178 Operating lease liabilities, non-current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71,159 66,196 Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96,240 107,246 Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,518,866 2,531,590 Redeemable noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,370 19,057 Shareholders’ deficit: Preferred shares, nominal value €0.01 per share, 100,000,000 shares authorized; none issued and outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — Ordinary shares, nominal value €0.01 per share, 100,000,000 shares authorized; 42,638,697 and 42,448,572 shares issued; 24,667,450 and 24,477,325 shares outstanding, respectively . . 600 597 Treasury shares, at cost, 17,971,247 for both periods presented . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,363,550) (1,363,550) Additional paid-in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 599,916 592,315 Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230,703 225,117 Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (38,925) (37,969) Total shareholders’ deficit attributable to Cimpress plc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (571,256) (583,490) Noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 561 987 Total shareholders' deficit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (570,695) (582,503) Total liabilities, noncontrolling interests and shareholders’ deficit . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,966,541 $ 1,968,144 Page 18 of 30

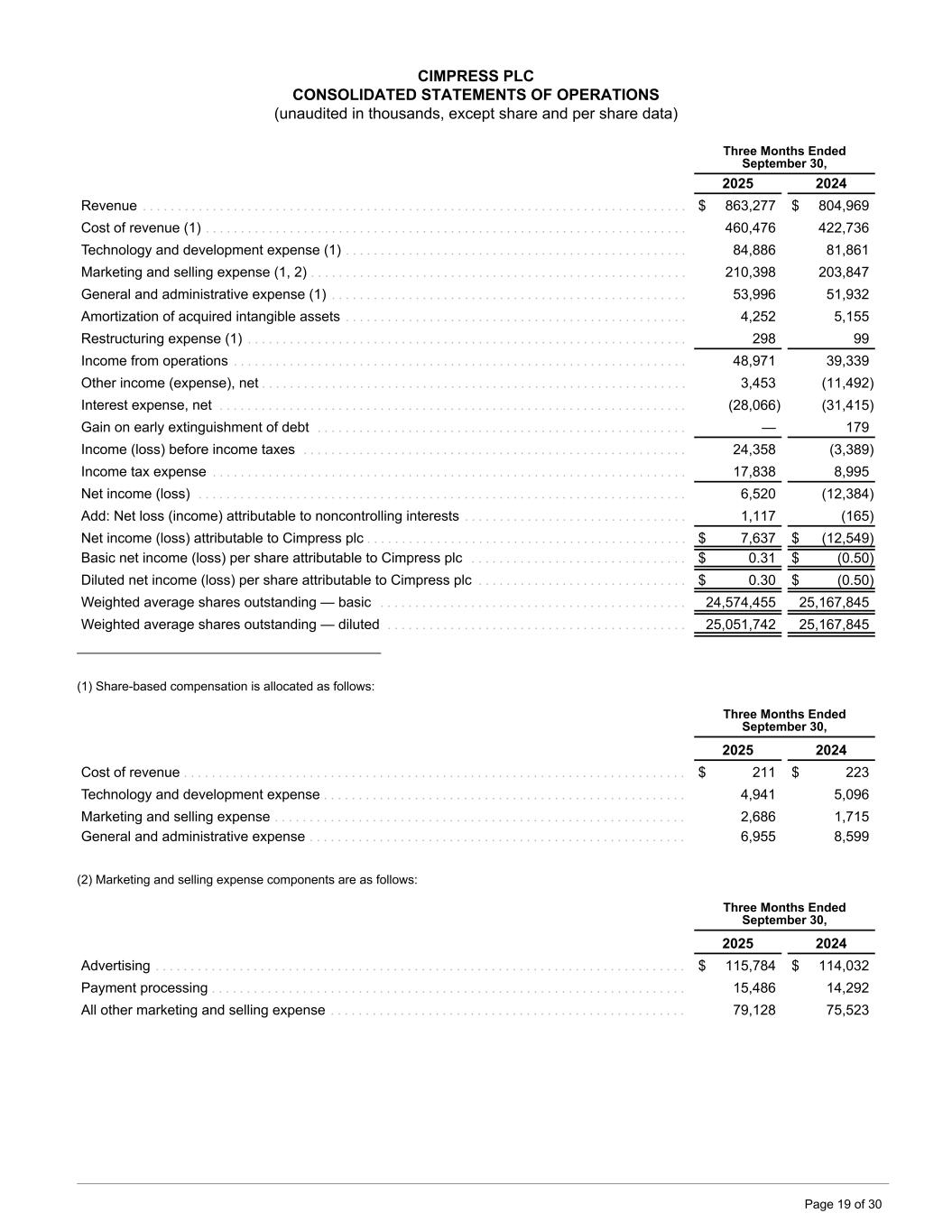

CIMPRESS PLC CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited in thousands, except share and per share data) Three Months Ended September 30, 2025 2024 Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 863,277 $ 804,969 Cost of revenue (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 460,476 422,736 Technology and development expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84,886 81,861 Marketing and selling expense (1, 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 210,398 203,847 General and administrative expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,996 51,932 Amortization of acquired intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,252 5,155 Restructuring expense (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 298 99 Income from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48,971 39,339 Other income (expense), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,453 (11,492) Interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (28,066) (31,415) Gain on early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 179 Income (loss) before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,358 (3,389) Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,838 8,995 Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,520 (12,384) Add: Net loss (income) attributable to noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,117 (165) Net income (loss) attributable to Cimpress plc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,637 $ (12,549) Basic net income (loss) per share attributable to Cimpress plc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.31 $ (0.50) Diluted net income (loss) per share attributable to Cimpress plc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.30 $ (0.50) Weighted average shares outstanding — basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,574,455 25,167,845 Weighted average shares outstanding — diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,051,742 25,167,845 ____________________________________________ (1) Share-based compensation is allocated as follows: Three Months Ended September 30, 2025 2024 Cost of revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 211 $ 223 Technology and development expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,941 5,096 Marketing and selling expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,686 1,715 General and administrative expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,955 8,599 (2) Marketing and selling expense components are as follows: Three Months Ended September 30, 2025 2024 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 115,784 $ 114,032 Payment processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,486 14,292 All other marketing and selling expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79,128 75,523 Page 19 of 30

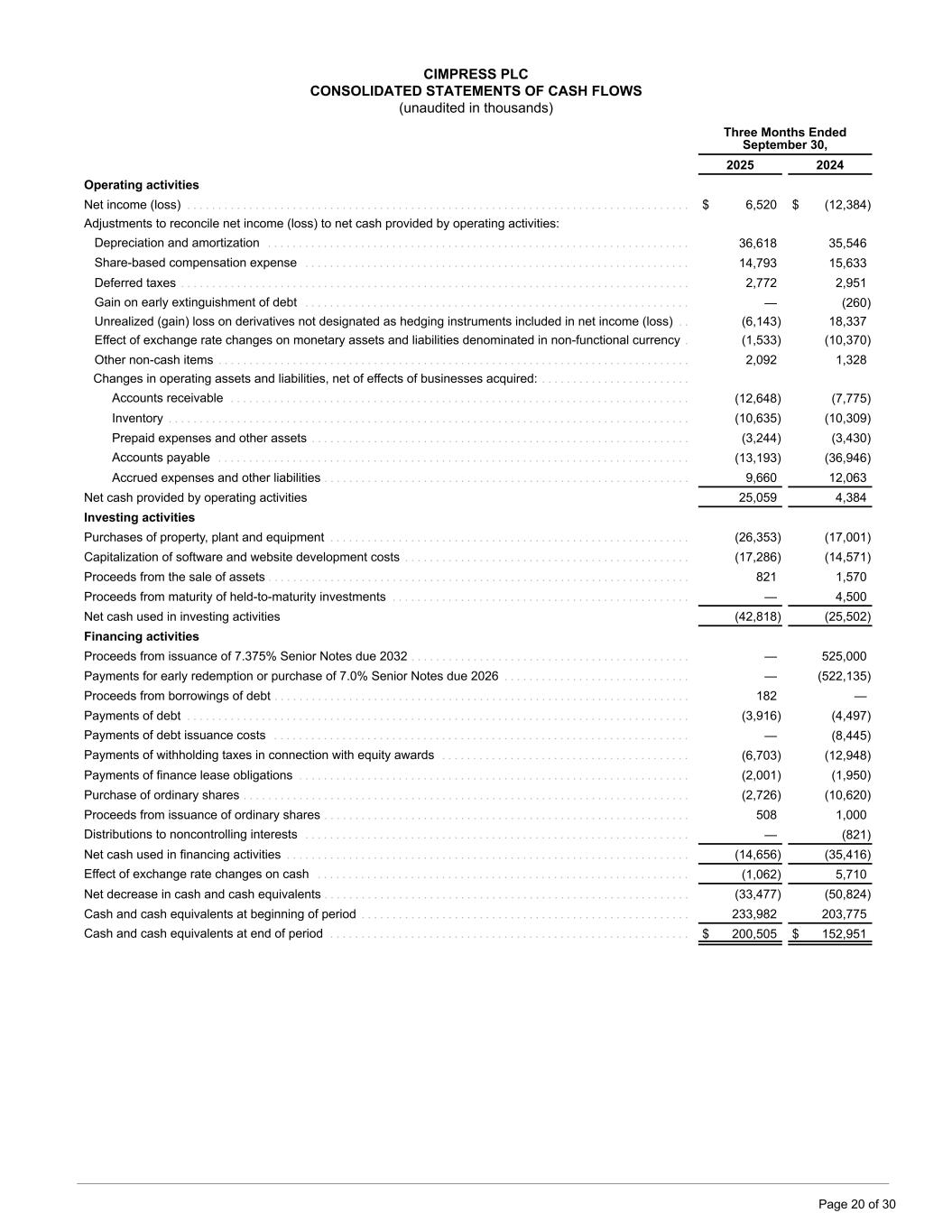

CIMPRESS PLC CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited in thousands) Three Months Ended September 30, 2025 2024 Operating activities Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,520 $ (12,384) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,618 35,546 Share-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,793 15,633 Deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,772 2,951 Gain on early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (260) Unrealized (gain) loss on derivatives not designated as hedging instruments included in net income (loss) . . (6,143) 18,337 Effect of exchange rate changes on monetary assets and liabilities denominated in non-functional currency . (1,533) (10,370) Other non-cash items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,092 1,328 Changes in operating assets and liabilities, net of effects of businesses acquired: . . . . . . . . . . . . . . . . . . . . . . . . Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12,648) (7,775) Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,635) (10,309) Prepaid expenses and other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,244) (3,430) Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,193) (36,946) Accrued expenses and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,660 12,063 Net cash provided by operating activities 25,059 4,384 Investing activities Purchases of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26,353) (17,001) Capitalization of software and website development costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,286) (14,571) Proceeds from the sale of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 821 1,570 Proceeds from maturity of held-to-maturity investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 4,500 Net cash used in investing activities (42,818) (25,502) Financing activities Proceeds from issuance of 7.375% Senior Notes due 2032 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 525,000 Payments for early redemption or purchase of 7.0% Senior Notes due 2026 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (522,135) Proceeds from borrowings of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 182 — Payments of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,916) (4,497) Payments of debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (8,445) Payments of withholding taxes in connection with equity awards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,703) (12,948) Payments of finance lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,001) (1,950) Purchase of ordinary shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,726) (10,620) Proceeds from issuance of ordinary shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 508 1,000 Distributions to noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (821) Net cash used in financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,656) (35,416) Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,062) 5,710 Net decrease in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (33,477) (50,824) Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 233,982 203,775 Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200,505 $ 152,951 Page 20 of 30

ABOUT NON-GAAP FINANCIAL MEASURES: To supplement Cimpress’ consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: Constant-currency revenue growth, organic constant-currency revenue growth, Upload & Print combined revenue and EBITDA, contribution profit, contribution margin, adjusted EBITDA, adjusted free cash flow, cash interest, net, consolidated net leverage ratio, and senior secured net leverage ratio: • Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior-year period’s average exchange rate for each currency to the U.S. dollar. • Organic constant-currency revenue growth excludes the impact of currency as defined above, as well as revenue from acquisitions and divestitures made during the past twelve months for each period presented, including Depositphotos/VistaCreate revenue from Q2 FY2022 through Q1 FY2023, and the revenue from several small acquired businesses for the first year after acquisition. • Upload & Print combined revenue is the combination of revenue for PrintBrothers and The Print Group in USD, adjusted to exclude inter-segment revenue when conducted between businesses in these segments. Upload & Print combined EBITDA is the combination of segment EBITDA for PrintBrothers and The Print Group, adjusted to exclude inter-segment EBITDA when conducted between businesses in these segments. • Contribution profit is revenue less cost of revenue and advertising and payment processing fees. Contribution margin is calculated as contribution profit divided by reported revenue. • Adjusted EBITDA is net income plus the following items; income tax expense (benefit); loss (gain) on early extinguishment of debt; interest expense, net; other income, net; depreciation and amortization; share-based compensation expense; restructuring-related charges and certain impairments and other adjustments. In addition, we adjust to include the effect of certain items that were previously added back as part of other income, net, which includes proceeds from insurance recoveries and realized gains or losses on currency derivatives that are intended to hedge our adjusted EBITDA exposure to foreign currencies for which we do not apply hedge accounting. • Adjusted free cash flow is defined as net cash provided by (used in) operating activities less purchases of property, plant and equipment, purchases of intangible assets not related to acquisitions, and capitalization of software and website development costs, plus payment of contingent consideration in excess of acquisition-date fair value, gains on proceeds from insurance, and proceeds from the sale of assets. • Cash interest, net is cash paid for interest, less cash received for interest. • Consolidated net leverage ratio is adjusted net debt as defined by our credit agreement divided by consolidated EBITDA as defined by our credit agreement. Adjusted net debt as defined by our credit agreement is calculated as our total debt outstanding, plus capital lease liabilities and minus cash and cash equivalents. Consolidated EBITDA as defined by our credit agreement is Adjusted EBITDA, as described above, plus additional adjustments primarily for non-cash/non-recurring items specified in our credit agreement, as well as the pro forma effect of certain cost- saving measures or material acquisitions for the trailing twelve month period. • Senior secured net leverage ratio is adjusted first lien debt as defined by our credit agreement divided by consolidated EBITDA as defined by our credit agreement. Adjusted first lien debt as defined by our credit agreement is total debt outstanding, plus capital lease liabilities, minus cash and cash equivalents, minus high yield notes. See "consolidated net leverage ratio" above for information regarding consolidated EBITDA as defined by our credit agreement. These non-GAAP financial measures are provided to enhance investors' understanding of our current operating results from the underlying and ongoing business, and of our credit risk and availability of capital, for the same reasons they are used by management. For example, for acquisitions we believe excluding the costs related to the purchase of a business (such as amortization of acquired intangible assets, contingent consideration, or impairment of goodwill) provides further insight into the performance of the underlying acquired business in addition to that provided by our GAAP net income. We do not, nor do we suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” included at the end of this document. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures. Page 21 of 30

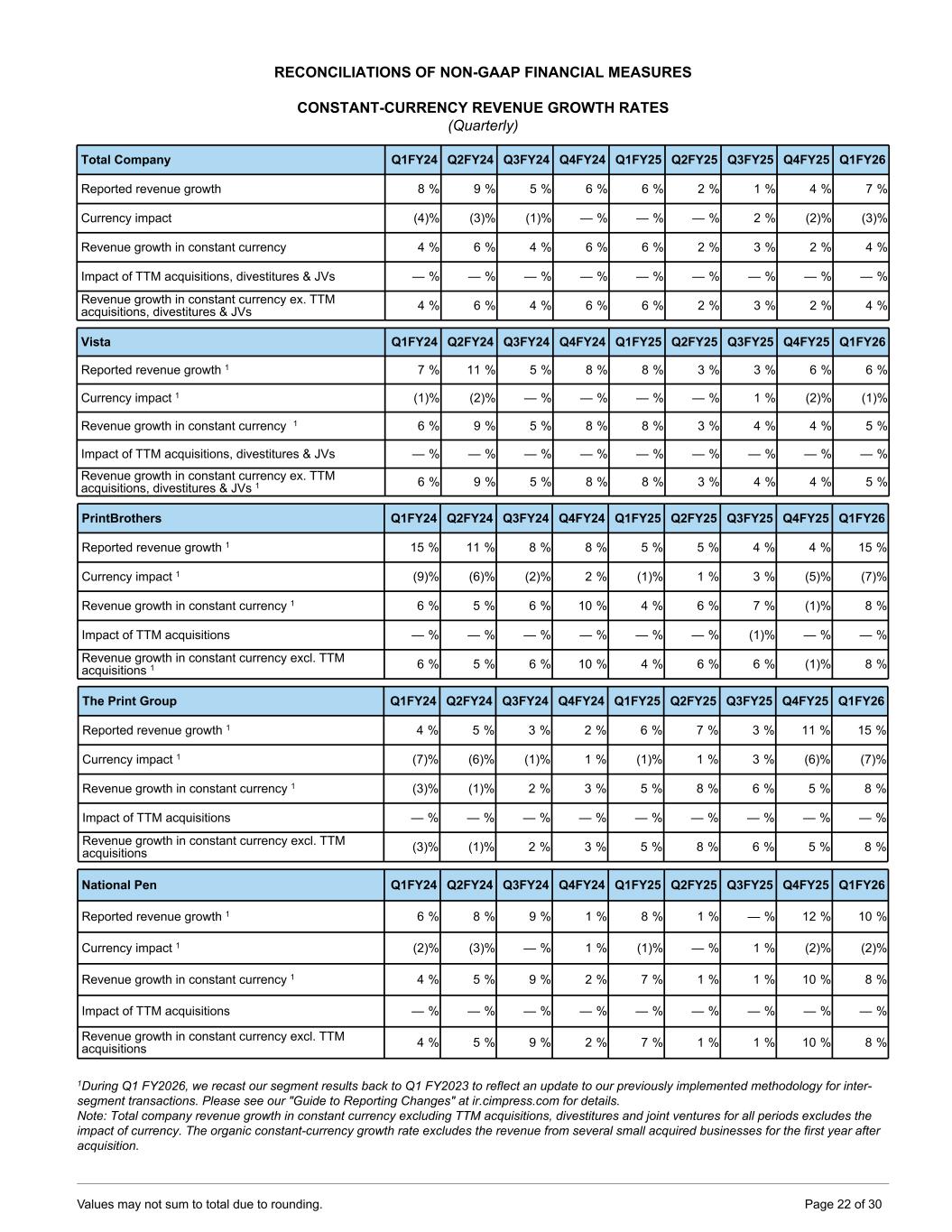

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES CONSTANT-CURRENCY REVENUE GROWTH RATES (Quarterly) Total Company Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 8 % 9 % 5 % 6 % 6 % 2 % 1 % 4 % 7 % Currency impact (4) % (3) % (1) % — % — % — % 2 % (2) % (3) % Revenue growth in constant currency 4 % 6 % 4 % 6 % 6 % 2 % 3 % 2 % 4 % Impact of TTM acquisitions, divestitures & JVs — % — % — % — % — % — % — % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 4 % 6 % 4 % 6 % 6 % 2 % 3 % 2 % 4 % Vista Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 1 7 % 11 % 5 % 8 % 8 % 3 % 3 % 6 % 6 % Currency impact 1 (1) % (2) % — % — % — % — % 1 % (2) % (1) % Revenue growth in constant currency 1 6 % 9 % 5 % 8 % 8 % 3 % 4 % 4 % 5 % Impact of TTM acquisitions, divestitures & JVs — % — % — % — % — % — % — % — % — % Revenue growth in constant currency ex. TTM acquisitions, divestitures & JVs 1 6 % 9 % 5 % 8 % 8 % 3 % 4 % 4 % 5 % PrintBrothers Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 1 15 % 11 % 8 % 8 % 5 % 5 % 4 % 4 % 15 % Currency impact 1 (9) % (6) % (2) % 2 % (1) % 1 % 3 % (5) % (7) % Revenue growth in constant currency 1 6 % 5 % 6 % 10 % 4 % 6 % 7 % (1) % 8 % Impact of TTM acquisitions — % — % — % — % — % — % (1) % — % — % Revenue growth in constant currency excl. TTM acquisitions 1 6 % 5 % 6 % 10 % 4 % 6 % 6 % (1) % 8 % The Print Group Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 1 4 % 5 % 3 % 2 % 6 % 7 % 3 % 11 % 15 % Currency impact 1 (7) % (6) % (1) % 1 % (1) % 1 % 3 % (6) % (7) % Revenue growth in constant currency 1 (3) % (1) % 2 % 3 % 5 % 8 % 6 % 5 % 8 % Impact of TTM acquisitions — % — % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions (3) % (1) % 2 % 3 % 5 % 8 % 6 % 5 % 8 % National Pen Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 1 6 % 8 % 9 % 1 % 8 % 1 % — % 12 % 10 % Currency impact 1 (2) % (3) % — % 1 % (1) % — % 1 % (2) % (2) % Revenue growth in constant currency 1 4 % 5 % 9 % 2 % 7 % 1 % 1 % 10 % 8 % Impact of TTM acquisitions — % — % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions 4 % 5 % 9 % 2 % 7 % 1 % 1 % 10 % 8 % 1During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter- segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Note: Total company revenue growth in constant currency excluding TTM acquisitions, divestitures and joint ventures for all periods excludes the impact of currency. The organic constant-currency growth rate excludes the revenue from several small acquired businesses for the first year after acquisition. Values may not sum to total due to rounding. Page 22 of 30

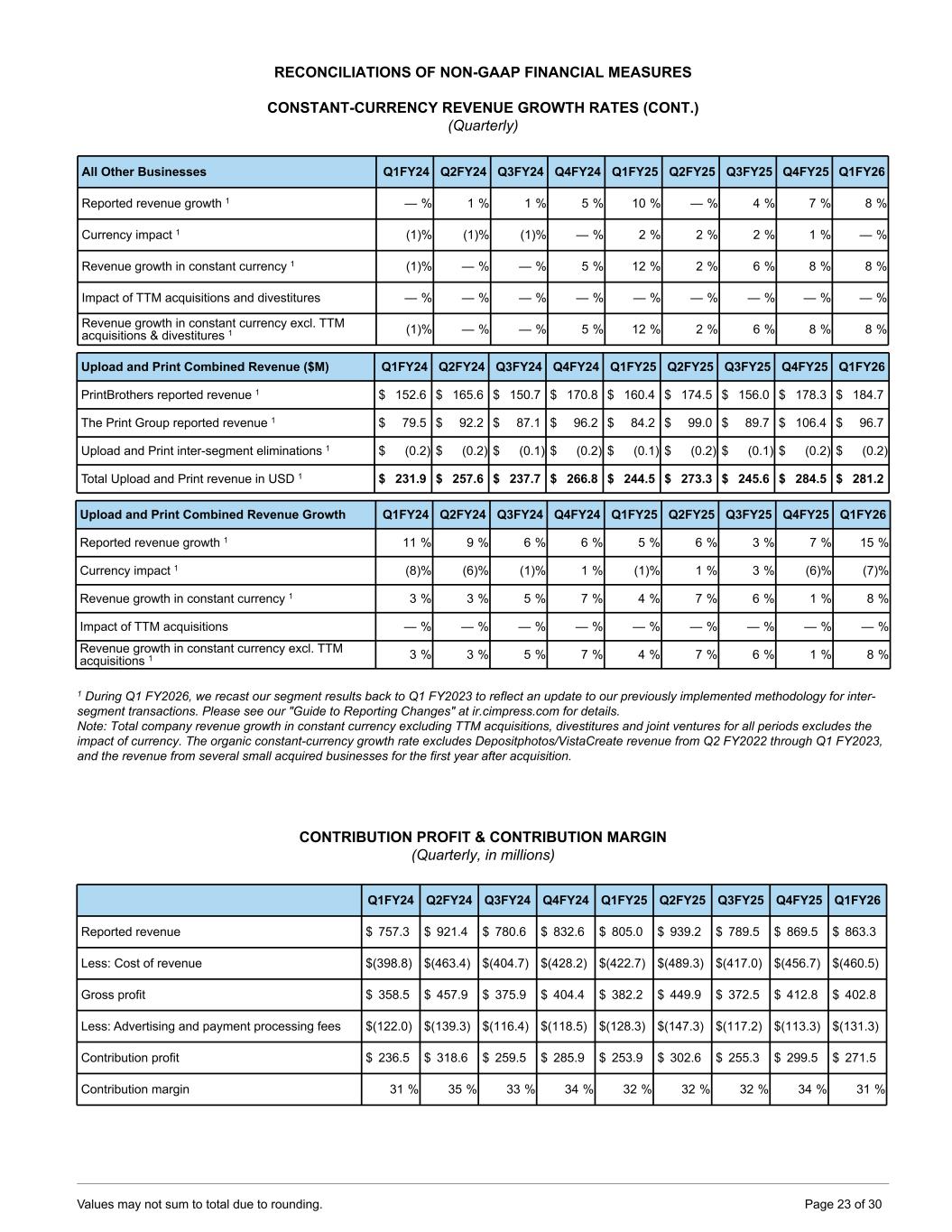

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES CONSTANT-CURRENCY REVENUE GROWTH RATES (CONT.) (Quarterly) All Other Businesses Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 1 — % 1 % 1 % 5 % 10 % — % 4 % 7 % 8 % Currency impact 1 (1) % (1) % (1) % — % 2 % 2 % 2 % 1 % — % Revenue growth in constant currency 1 (1) % — % — % 5 % 12 % 2 % 6 % 8 % 8 % Impact of TTM acquisitions and divestitures — % — % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions & divestitures 1 (1) % — % — % 5 % 12 % 2 % 6 % 8 % 8 % Upload and Print Combined Revenue ($M) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 PrintBrothers reported revenue 1 $ 152.6 $ 165.6 $ 150.7 $ 170.8 $ 160.4 $ 174.5 $ 156.0 $ 178.3 $ 184.7 The Print Group reported revenue 1 $ 79.5 $ 92.2 $ 87.1 $ 96.2 $ 84.2 $ 99.0 $ 89.7 $ 106.4 $ 96.7 Upload and Print inter-segment eliminations 1 $ (0.2) $ (0.2) $ (0.1) $ (0.2) $ (0.1) $ (0.2) $ (0.1) $ (0.2) $ (0.2) Total Upload and Print revenue in USD 1 $ 231.9 $ 257.6 $ 237.7 $ 266.8 $ 244.5 $ 273.3 $ 245.6 $ 284.5 $ 281.2 Upload and Print Combined Revenue Growth Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue growth 1 11 % 9 % 6 % 6 % 5 % 6 % 3 % 7 % 15 % Currency impact 1 (8) % (6) % (1) % 1 % (1) % 1 % 3 % (6) % (7) % Revenue growth in constant currency 1 3 % 3 % 5 % 7 % 4 % 7 % 6 % 1 % 8 % Impact of TTM acquisitions — % — % — % — % — % — % — % — % — % Revenue growth in constant currency excl. TTM acquisitions 1 3 % 3 % 5 % 7 % 4 % 7 % 6 % 1 % 8 % 1 During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter- segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Note: Total company revenue growth in constant currency excluding TTM acquisitions, divestitures and joint ventures for all periods excludes the impact of currency. The organic constant-currency growth rate excludes Depositphotos/VistaCreate revenue from Q2 FY2022 through Q1 FY2023, and the revenue from several small acquired businesses for the first year after acquisition. CONTRIBUTION PROFIT & CONTRIBUTION MARGIN (Quarterly, in millions) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Reported revenue $ 757.3 $ 921.4 $ 780.6 $ 832.6 $ 805.0 $ 939.2 $ 789.5 $ 869.5 $ 863.3 Less: Cost of revenue $ (398.8) $ (463.4) $ (404.7) $ (428.2) $ (422.7) $ (489.3) $ (417.0) $ (456.7) $ (460.5) Gross profit $ 358.5 $ 457.9 $ 375.9 $ 404.4 $ 382.2 $ 449.9 $ 372.5 $ 412.8 $ 402.8 Less: Advertising and payment processing fees $ (122.0) $ (139.3) $ (116.4) $ (118.5) $ (128.3) $ (147.3) $ (117.2) $ (113.3) $ (131.3) Contribution profit $ 236.5 $ 318.6 $ 259.5 $ 285.9 $ 253.9 $ 302.6 $ 255.3 $ 299.5 $ 271.5 Contribution margin 31 % 35 % 33 % 34 % 32 % 32 % 32 % 34 % 31 % Values may not sum to total due to rounding. Page 23 of 30

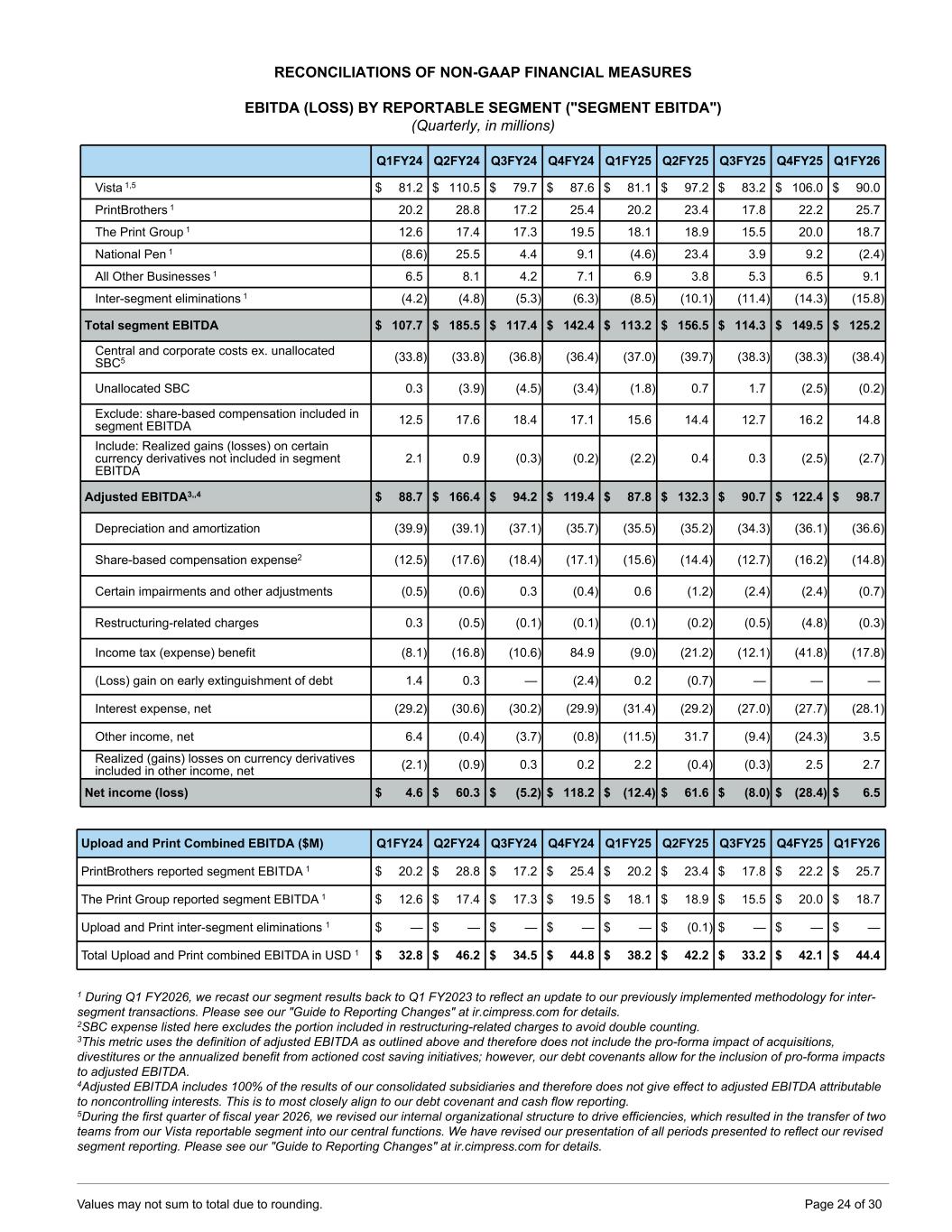

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES EBITDA (LOSS) BY REPORTABLE SEGMENT ("SEGMENT EBITDA") (Quarterly, in millions) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Vista 1,5 $ 81.2 $ 110.5 $ 79.7 $ 87.6 $ 81.1 $ 97.2 $ 83.2 $ 106.0 $ 90.0 PrintBrothers 1 20.2 28.8 17.2 25.4 20.2 23.4 17.8 22.2 25.7 The Print Group 1 12.6 17.4 17.3 19.5 18.1 18.9 15.5 20.0 18.7 National Pen 1 (8.6) 25.5 4.4 9.1 (4.6) 23.4 3.9 9.2 (2.4) All Other Businesses 1 6.5 8.1 4.2 7.1 6.9 3.8 5.3 6.5 9.1 Inter-segment eliminations 1 (4.2) (4.8) (5.3) (6.3) (8.5) (10.1) (11.4) (14.3) (15.8) Total segment EBITDA $ 107.7 $ 185.5 $ 117.4 $ 142.4 $ 113.2 $ 156.5 $ 114.3 $ 149.5 $ 125.2 Central and corporate costs ex. unallocated SBC5 (33.8) (33.8) (36.8) (36.4) (37.0) (39.7) (38.3) (38.3) (38.4) Unallocated SBC 0.3 (3.9) (4.5) (3.4) (1.8) 0.7 1.7 (2.5) (0.2) Exclude: share-based compensation included in segment EBITDA 12.5 17.6 18.4 17.1 15.6 14.4 12.7 16.2 14.8 Include: Realized gains (losses) on certain currency derivatives not included in segment EBITDA 2.1 0.9 (0.3) (0.2) (2.2) 0.4 0.3 (2.5) (2.7) Adjusted EBITDA3,,4 $ 88.7 $ 166.4 $ 94.2 $ 119.4 $ 87.8 $ 132.3 $ 90.7 $ 122.4 $ 98.7 Depreciation and amortization (39.9) (39.1) (37.1) (35.7) (35.5) (35.2) (34.3) (36.1) (36.6) Share-based compensation expense2 (12.5) (17.6) (18.4) (17.1) (15.6) (14.4) (12.7) (16.2) (14.8) Certain impairments and other adjustments (0.5) (0.6) 0.3 (0.4) 0.6 (1.2) (2.4) (2.4) (0.7) Restructuring-related charges 0.3 (0.5) (0.1) (0.1) (0.1) (0.2) (0.5) (4.8) (0.3) Income tax (expense) benefit (8.1) (16.8) (10.6) 84.9 (9.0) (21.2) (12.1) (41.8) (17.8) (Loss) gain on early extinguishment of debt 1.4 0.3 — (2.4) 0.2 (0.7) — — — Interest expense, net (29.2) (30.6) (30.2) (29.9) (31.4) (29.2) (27.0) (27.7) (28.1) Other income, net 6.4 (0.4) (3.7) (0.8) (11.5) 31.7 (9.4) (24.3) 3.5 Realized (gains) losses on currency derivatives included in other income, net (2.1) (0.9) 0.3 0.2 2.2 (0.4) (0.3) 2.5 2.7 Net income (loss) $ 4.6 $ 60.3 $ (5.2) $ 118.2 $ (12.4) $ 61.6 $ (8.0) $ (28.4) $ 6.5 Upload and Print Combined EBITDA ($M) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 PrintBrothers reported segment EBITDA 1 $ 20.2 $ 28.8 $ 17.2 $ 25.4 $ 20.2 $ 23.4 $ 17.8 $ 22.2 $ 25.7 The Print Group reported segment EBITDA 1 $ 12.6 $ 17.4 $ 17.3 $ 19.5 $ 18.1 $ 18.9 $ 15.5 $ 20.0 $ 18.7 Upload and Print inter-segment eliminations 1 $ — $ — $ — $ — $ — $ (0.1) $ — $ — $ — Total Upload and Print combined EBITDA in USD 1 $ 32.8 $ 46.2 $ 34.5 $ 44.8 $ 38.2 $ 42.2 $ 33.2 $ 42.1 $ 44.4 1 During Q1 FY2026, we recast our segment results back to Q1 FY2023 to reflect an update to our previously implemented methodology for inter- segment transactions. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. 2SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 3This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 4Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. 5During the first quarter of fiscal year 2026, we revised our internal organizational structure to drive efficiencies, which resulted in the transfer of two teams from our Vista reportable segment into our central functions. We have revised our presentation of all periods presented to reflect our revised segment reporting. Please see our "Guide to Reporting Changes" at ir.cimpress.com for details. Values may not sum to total due to rounding. Page 24 of 30

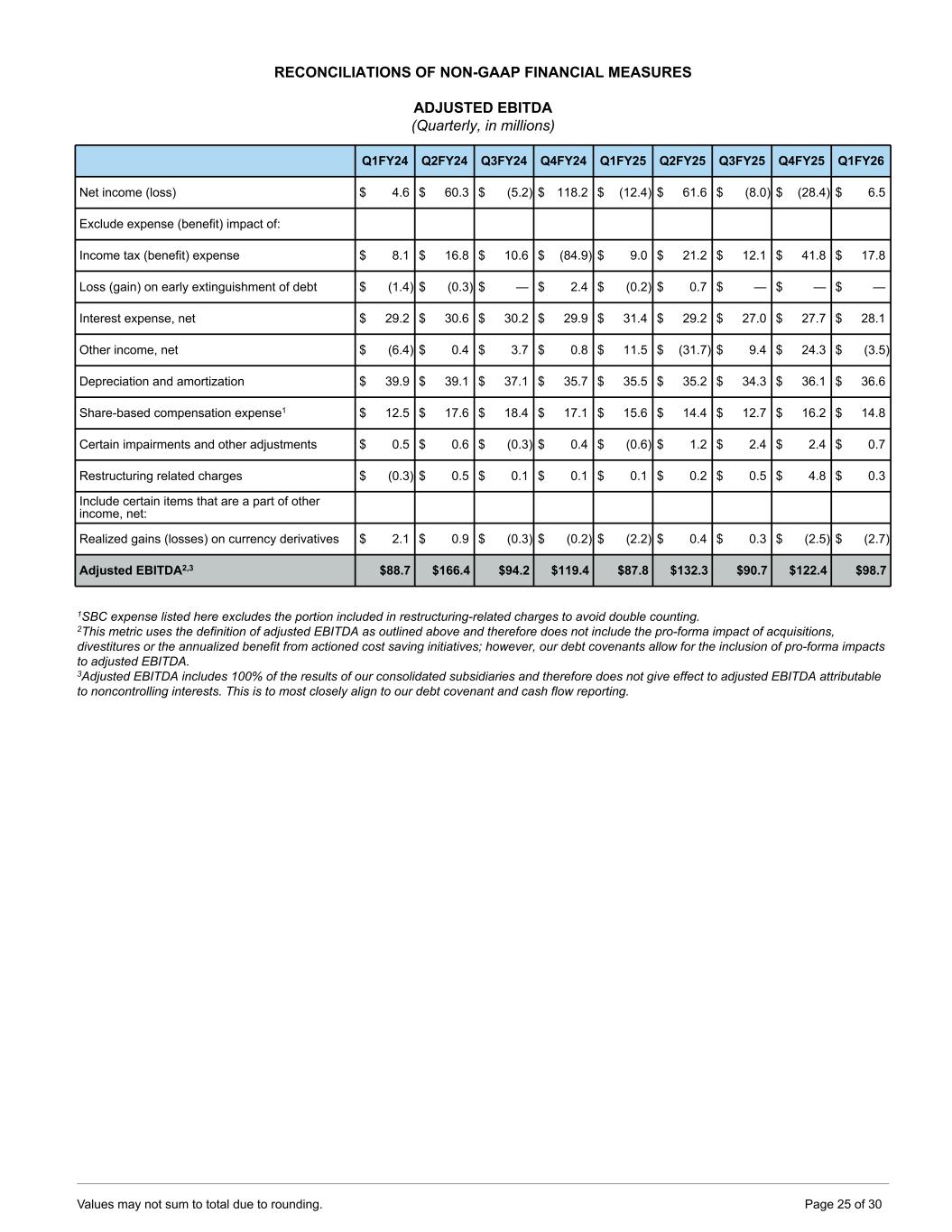

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES ADJUSTED EBITDA (Quarterly, in millions) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Net income (loss) $ 4.6 $ 60.3 $ (5.2) $ 118.2 $ (12.4) $ 61.6 $ (8.0) $ (28.4) $ 6.5 Exclude expense (benefit) impact of: Income tax (benefit) expense $ 8.1 $ 16.8 $ 10.6 $ (84.9) $ 9.0 $ 21.2 $ 12.1 $ 41.8 $ 17.8 Loss (gain) on early extinguishment of debt $ (1.4) $ (0.3) $ — $ 2.4 $ (0.2) $ 0.7 $ — $ — $ — Interest expense, net $ 29.2 $ 30.6 $ 30.2 $ 29.9 $ 31.4 $ 29.2 $ 27.0 $ 27.7 $ 28.1 Other income, net $ (6.4) $ 0.4 $ 3.7 $ 0.8 $ 11.5 $ (31.7) $ 9.4 $ 24.3 $ (3.5) Depreciation and amortization $ 39.9 $ 39.1 $ 37.1 $ 35.7 $ 35.5 $ 35.2 $ 34.3 $ 36.1 $ 36.6 Share-based compensation expense1 $ 12.5 $ 17.6 $ 18.4 $ 17.1 $ 15.6 $ 14.4 $ 12.7 $ 16.2 $ 14.8 Certain impairments and other adjustments $ 0.5 $ 0.6 $ (0.3) $ 0.4 $ (0.6) $ 1.2 $ 2.4 $ 2.4 $ 0.7 Restructuring related charges $ (0.3) $ 0.5 $ 0.1 $ 0.1 $ 0.1 $ 0.2 $ 0.5 $ 4.8 $ 0.3 Include certain items that are a part of other income, net: Realized gains (losses) on currency derivatives $ 2.1 $ 0.9 $ (0.3) $ (0.2) $ (2.2) $ 0.4 $ 0.3 $ (2.5) $ (2.7) Adjusted EBITDA2,3 $88.7 $166.4 $94.2 $119.4 $87.8 $132.3 $90.7 $122.4 $98.7 1SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 2This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 3Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. Values may not sum to total due to rounding. Page 25 of 30

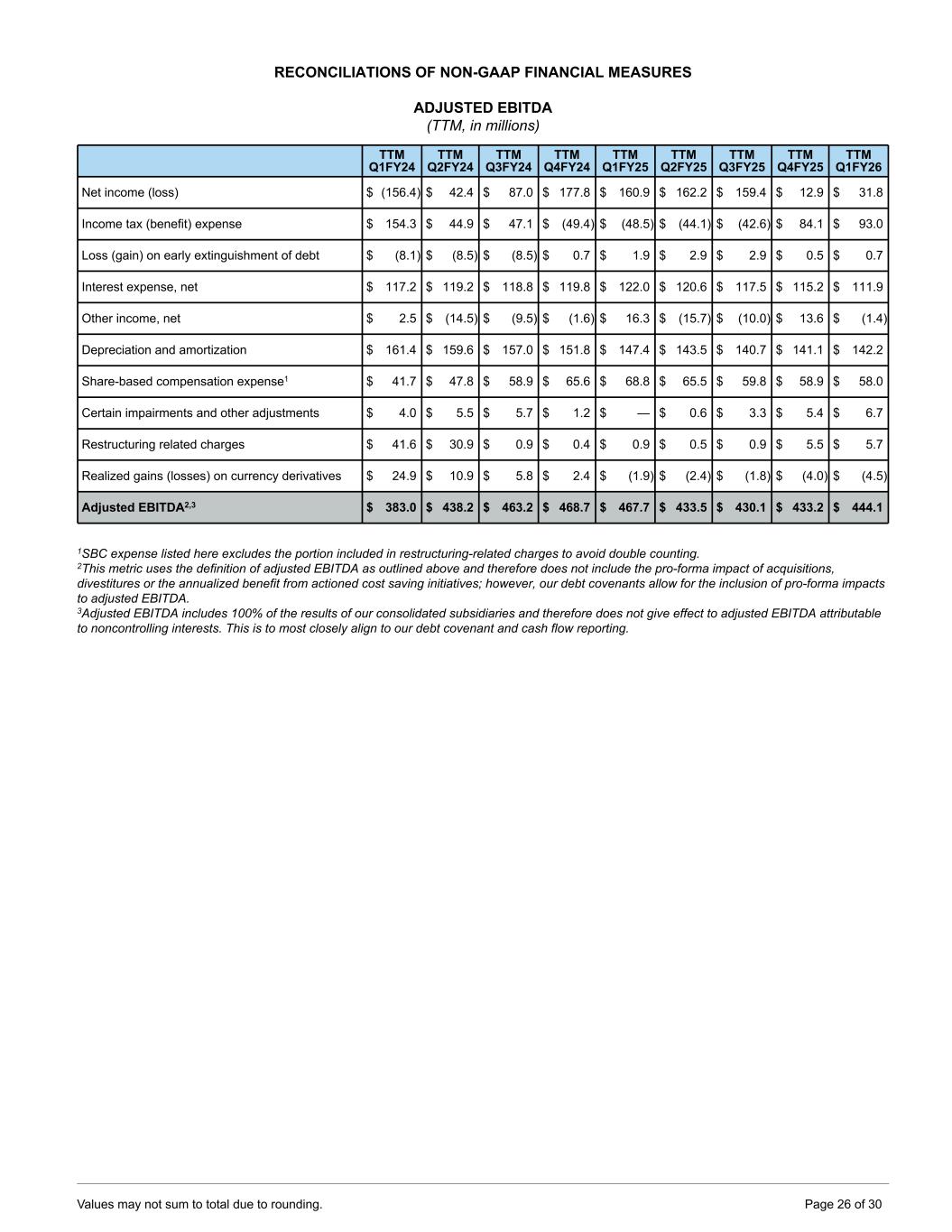

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES ADJUSTED EBITDA (TTM, in millions) TTM Q1FY24 TTM Q2FY24 TTM Q3FY24 TTM Q4FY24 TTM Q1FY25 TTM Q2FY25 TTM Q3FY25 TTM Q4FY25 TTM Q1FY26 Net income (loss) $ (156.4) $ 42.4 $ 87.0 $ 177.8 $ 160.9 $ 162.2 $ 159.4 $ 12.9 $ 31.8 Income tax (benefit) expense $ 154.3 $ 44.9 $ 47.1 $ (49.4) $ (48.5) $ (44.1) $ (42.6) $ 84.1 $ 93.0 Loss (gain) on early extinguishment of debt $ (8.1) $ (8.5) $ (8.5) $ 0.7 $ 1.9 $ 2.9 $ 2.9 $ 0.5 $ 0.7 Interest expense, net $ 117.2 $ 119.2 $ 118.8 $ 119.8 $ 122.0 $ 120.6 $ 117.5 $ 115.2 $ 111.9 Other income, net $ 2.5 $ (14.5) $ (9.5) $ (1.6) $ 16.3 $ (15.7) $ (10.0) $ 13.6 $ (1.4) Depreciation and amortization $ 161.4 $ 159.6 $ 157.0 $ 151.8 $ 147.4 $ 143.5 $ 140.7 $ 141.1 $ 142.2 Share-based compensation expense1 $ 41.7 $ 47.8 $ 58.9 $ 65.6 $ 68.8 $ 65.5 $ 59.8 $ 58.9 $ 58.0 Certain impairments and other adjustments $ 4.0 $ 5.5 $ 5.7 $ 1.2 $ — $ 0.6 $ 3.3 $ 5.4 $ 6.7 Restructuring related charges $ 41.6 $ 30.9 $ 0.9 $ 0.4 $ 0.9 $ 0.5 $ 0.9 $ 5.5 $ 5.7 Realized gains (losses) on currency derivatives $ 24.9 $ 10.9 $ 5.8 $ 2.4 $ (1.9) $ (2.4) $ (1.8) $ (4.0) $ (4.5) Adjusted EBITDA2,3 $ 383.0 $ 438.2 $ 463.2 $ 468.7 $ 467.7 $ 433.5 $ 430.1 $ 433.2 $ 444.1 1SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 2This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 3Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. Values may not sum to total due to rounding. Page 26 of 30

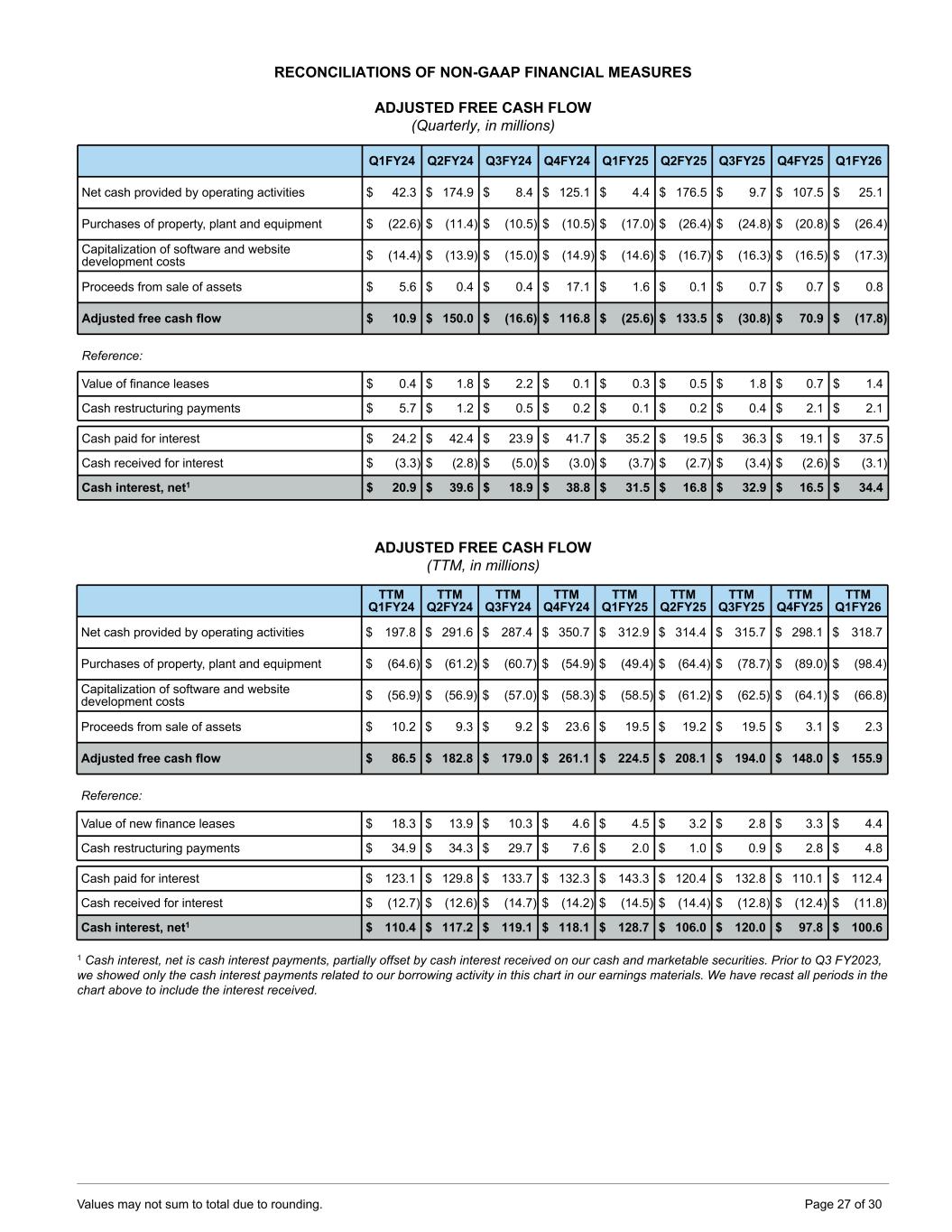

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES ADJUSTED FREE CASH FLOW (Quarterly, in millions) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Net cash provided by operating activities $ 42.3 $ 174.9 $ 8.4 $ 125.1 $ 4.4 $ 176.5 $ 9.7 $ 107.5 $ 25.1 Purchases of property, plant and equipment $ (22.6) $ (11.4) $ (10.5) $ (10.5) $ (17.0) $ (26.4) $ (24.8) $ (20.8) $ (26.4) Capitalization of software and website development costs $ (14.4) $ (13.9) $ (15.0) $ (14.9) $ (14.6) $ (16.7) $ (16.3) $ (16.5) $ (17.3) Proceeds from sale of assets $ 5.6 $ 0.4 $ 0.4 $ 17.1 $ 1.6 $ 0.1 $ 0.7 $ 0.7 $ 0.8 Adjusted free cash flow $ 10.9 $ 150.0 $ (16.6) $ 116.8 $ (25.6) $ 133.5 $ (30.8) $ 70.9 $ (17.8) Reference: Value of finance leases $ 0.4 $ 1.8 $ 2.2 $ 0.1 $ 0.3 $ 0.5 $ 1.8 $ 0.7 $ 1.4 Cash restructuring payments $ 5.7 $ 1.2 $ 0.5 $ 0.2 $ 0.1 $ 0.2 $ 0.4 $ 2.1 $ 2.1 Cash paid for interest $ 24.2 $ 42.4 $ 23.9 $ 41.7 $ 35.2 $ 19.5 $ 36.3 $ 19.1 $ 37.5 Cash received for interest $ (3.3) $ (2.8) $ (5.0) $ (3.0) $ (3.7) $ (2.7) $ (3.4) $ (2.6) $ (3.1) Cash interest, net1 $ 20.9 $ 39.6 $ 18.9 $ 38.8 $ 31.5 $ 16.8 $ 32.9 $ 16.5 $ 34.4 ADJUSTED FREE CASH FLOW (TTM, in millions) TTM Q1FY24 TTM Q2FY24 TTM Q3FY24 TTM Q4FY24 TTM Q1FY25 TTM Q2FY25 TTM Q3FY25 TTM Q4FY25 TTM Q1FY26 Net cash provided by operating activities $ 197.8 $ 291.6 $ 287.4 $ 350.7 $ 312.9 $ 314.4 $ 315.7 $ 298.1 $ 318.7 Purchases of property, plant and equipment $ (64.6) $ (61.2) $ (60.7) $ (54.9) $ (49.4) $ (64.4) $ (78.7) $ (89.0) $ (98.4) Capitalization of software and website development costs $ (56.9) $ (56.9) $ (57.0) $ (58.3) $ (58.5) $ (61.2) $ (62.5) $ (64.1) $ (66.8) Proceeds from sale of assets $ 10.2 $ 9.3 $ 9.2 $ 23.6 $ 19.5 $ 19.2 $ 19.5 $ 3.1 $ 2.3 Adjusted free cash flow $ 86.5 $ 182.8 $ 179.0 $ 261.1 $ 224.5 $ 208.1 $ 194.0 $ 148.0 $ 155.9 Reference: Value of new finance leases $ 18.3 $ 13.9 $ 10.3 $ 4.6 $ 4.5 $ 3.2 $ 2.8 $ 3.3 $ 4.4 Cash restructuring payments $ 34.9 $ 34.3 $ 29.7 $ 7.6 $ 2.0 $ 1.0 $ 0.9 $ 2.8 $ 4.8 Cash paid for interest $ 123.1 $ 129.8 $ 133.7 $ 132.3 $ 143.3 $ 120.4 $ 132.8 $ 110.1 $ 112.4 Cash received for interest $ (12.7) $ (12.6) $ (14.7) $ (14.2) $ (14.5) $ (14.4) $ (12.8) $ (12.4) $ (11.8) Cash interest, net1 $ 110.4 $ 117.2 $ 119.1 $ 118.1 $ 128.7 $ 106.0 $ 120.0 $ 97.8 $ 100.6 1 Cash interest, net is cash interest payments, partially offset by cash interest received on our cash and marketable securities. Prior to Q3 FY2023, we showed only the cash interest payments related to our borrowing activity in this chart in our earnings materials. We have recast all periods in the chart above to include the interest received. Values may not sum to total due to rounding. Page 27 of 30

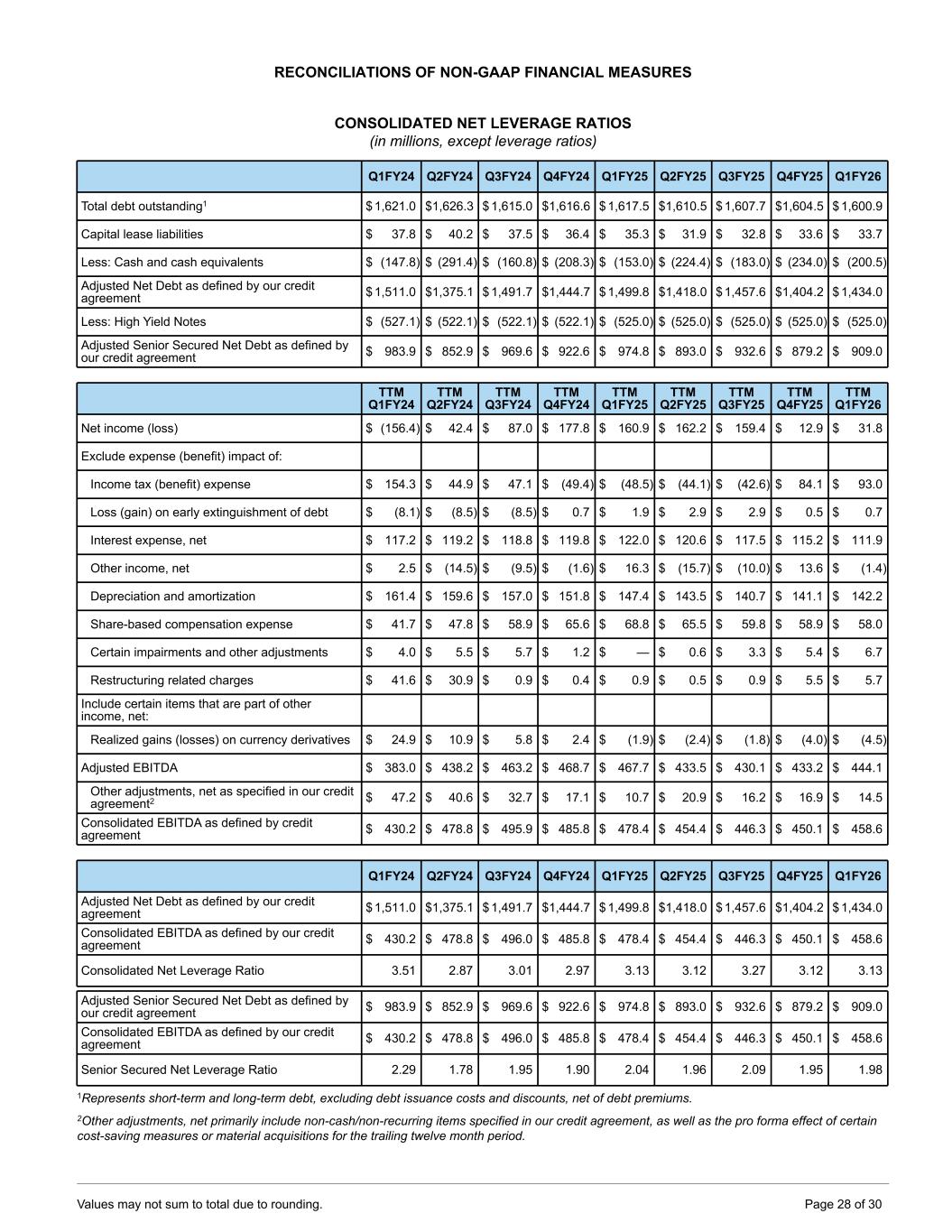

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES CONSOLIDATED NET LEVERAGE RATIOS (in millions, except leverage ratios) Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Total debt outstanding1 $ 1,621.0 $ 1,626.3 $ 1,615.0 $ 1,616.6 $ 1,617.5 $ 1,610.5 $ 1,607.7 $ 1,604.5 $ 1,600.9 Capital lease liabilities $ 37.8 $ 40.2 $ 37.5 $ 36.4 $ 35.3 $ 31.9 $ 32.8 $ 33.6 $ 33.7 Less: Cash and cash equivalents $ (147.8) $ (291.4) $ (160.8) $ (208.3) $ (153.0) $ (224.4) $ (183.0) $ (234.0) $ (200.5) Adjusted Net Debt as defined by our credit agreement $ 1,511.0 $ 1,375.1 $ 1,491.7 $ 1,444.7 $ 1,499.8 $ 1,418.0 $ 1,457.6 $ 1,404.2 $ 1,434.0 Less: High Yield Notes $ (527.1) $ (522.1) $ (522.1) $ (522.1) $ (525.0) $ (525.0) $ (525.0) $ (525.0) $ (525.0) Adjusted Senior Secured Net Debt as defined by our credit agreement $ 983.9 $ 852.9 $ 969.6 $ 922.6 $ 974.8 $ 893.0 $ 932.6 $ 879.2 $ 909.0 TTM Q1FY24 TTM Q2FY24 TTM Q3FY24 TTM Q4FY24 TTM Q1FY25 TTM Q2FY25 TTM Q3FY25 TTM Q4FY25 TTM Q1FY26 Net income (loss) $ (156.4) $ 42.4 $ 87.0 $ 177.8 $ 160.9 $ 162.2 $ 159.4 $ 12.9 $ 31.8 Exclude expense (benefit) impact of: Income tax (benefit) expense $ 154.3 $ 44.9 $ 47.1 $ (49.4) $ (48.5) $ (44.1) $ (42.6) $ 84.1 $ 93.0 Loss (gain) on early extinguishment of debt $ (8.1) $ (8.5) $ (8.5) $ 0.7 $ 1.9 $ 2.9 $ 2.9 $ 0.5 $ 0.7 Interest expense, net $ 117.2 $ 119.2 $ 118.8 $ 119.8 $ 122.0 $ 120.6 $ 117.5 $ 115.2 $ 111.9 Other income, net $ 2.5 $ (14.5) $ (9.5) $ (1.6) $ 16.3 $ (15.7) $ (10.0) $ 13.6 $ (1.4) Depreciation and amortization $ 161.4 $ 159.6 $ 157.0 $ 151.8 $ 147.4 $ 143.5 $ 140.7 $ 141.1 $ 142.2 Share-based compensation expense $ 41.7 $ 47.8 $ 58.9 $ 65.6 $ 68.8 $ 65.5 $ 59.8 $ 58.9 $ 58.0 Certain impairments and other adjustments $ 4.0 $ 5.5 $ 5.7 $ 1.2 $ — $ 0.6 $ 3.3 $ 5.4 $ 6.7 Restructuring related charges $ 41.6 $ 30.9 $ 0.9 $ 0.4 $ 0.9 $ 0.5 $ 0.9 $ 5.5 $ 5.7 Include certain items that are part of other income, net: Realized gains (losses) on currency derivatives $ 24.9 $ 10.9 $ 5.8 $ 2.4 $ (1.9) $ (2.4) $ (1.8) $ (4.0) $ (4.5) Adjusted EBITDA $ 383.0 $ 438.2 $ 463.2 $ 468.7 $ 467.7 $ 433.5 $ 430.1 $ 433.2 $ 444.1 Other adjustments, net as specified in our credit agreement2 $ 47.2 $ 40.6 $ 32.7 $ 17.1 $ 10.7 $ 20.9 $ 16.2 $ 16.9 $ 14.5 Consolidated EBITDA as defined by credit agreement $ 430.2 $ 478.8 $ 495.9 $ 485.8 $ 478.4 $ 454.4 $ 446.3 $ 450.1 $ 458.6 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Q3FY25 Q4FY25 Q1FY26 Adjusted Net Debt as defined by our credit agreement $ 1,511.0 $ 1,375.1 $ 1,491.7 $ 1,444.7 $ 1,499.8 $ 1,418.0 $ 1,457.6 $ 1,404.2 $ 1,434.0 Consolidated EBITDA as defined by our credit agreement $ 430.2 $ 478.8 $ 496.0 $ 485.8 $ 478.4 $ 454.4 $ 446.3 $ 450.1 $ 458.6 Consolidated Net Leverage Ratio 3.51 2.87 3.01 2.97 3.13 3.12 3.27 3.12 3.13 Adjusted Senior Secured Net Debt as defined by our credit agreement $ 983.9 $ 852.9 $ 969.6 $ 922.6 $ 974.8 $ 893.0 $ 932.6 $ 879.2 $ 909.0 Consolidated EBITDA as defined by our credit agreement $ 430.2 $ 478.8 $ 496.0 $ 485.8 $ 478.4 $ 454.4 $ 446.3 $ 450.1 $ 458.6 Senior Secured Net Leverage Ratio 2.29 1.78 1.95 1.90 2.04 1.96 2.09 1.95 1.98 1Represents short-term and long-term debt, excluding debt issuance costs and discounts, net of debt premiums. 2Other adjustments, net primarily include non-cash/non-recurring items specified in our credit agreement, as well as the pro forma effect of certain cost-saving measures or material acquisitions for the trailing twelve month period. Values may not sum to total due to rounding. Page 28 of 30

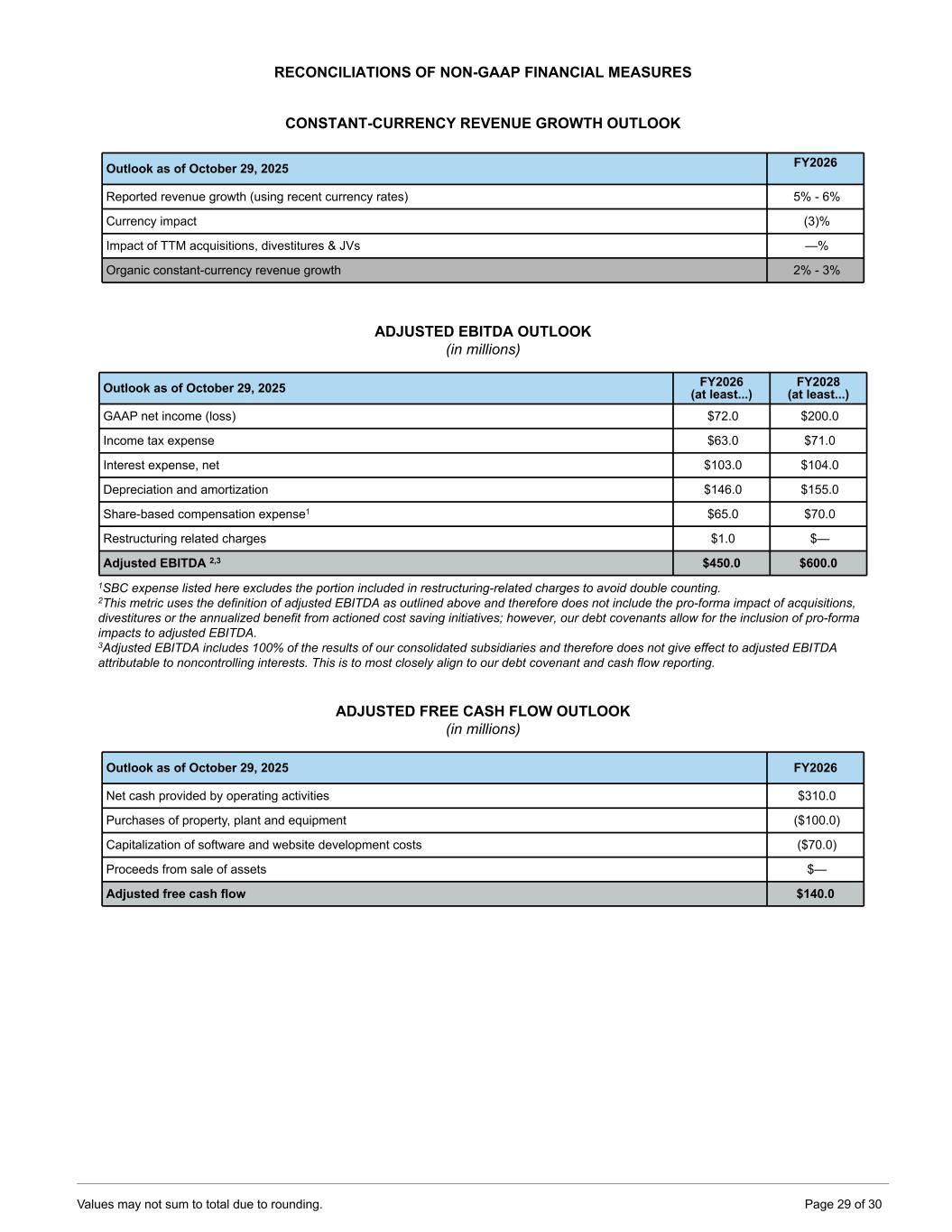

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES CONSTANT-CURRENCY REVENUE GROWTH OUTLOOK Outlook as of October 29, 2025 FY2026 Reported revenue growth (using recent currency rates) 5% - 6% Currency impact (3)% Impact of TTM acquisitions, divestitures & JVs —% Organic constant-currency revenue growth 2% - 3% ADJUSTED EBITDA OUTLOOK (in millions) Outlook as of October 29, 2025 FY2026 (at least...) FY2028 (at least...) GAAP net income (loss) $72.0 $200.0 Income tax expense $63.0 $71.0 Interest expense, net $103.0 $104.0 Depreciation and amortization $146.0 $155.0 Share-based compensation expense1 $65.0 $70.0 Restructuring related charges $1.0 $— Adjusted EBITDA 2,3 $450.0 $600.0 1SBC expense listed here excludes the portion included in restructuring-related charges to avoid double counting. 2This metric uses the definition of adjusted EBITDA as outlined above and therefore does not include the pro-forma impact of acquisitions, divestitures or the annualized benefit from actioned cost saving initiatives; however, our debt covenants allow for the inclusion of pro-forma impacts to adjusted EBITDA. 3Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to noncontrolling interests. This is to most closely align to our debt covenant and cash flow reporting. ADJUSTED FREE CASH FLOW OUTLOOK (in millions) Outlook as of October 29, 2025 FY2026 Net cash provided by operating activities $310.0 Purchases of property, plant and equipment ($100.0) Capitalization of software and website development costs ($70.0) Proceeds from sale of assets $— Adjusted free cash flow $140.0 Values may not sum to total due to rounding. Page 29 of 30

ABOUT CIMPRESS: Cimpress plc (Nasdaq: CMPR) helps millions of businesses build brands, stand out, and grow via custom print and promotional products. Founded in 1995, Cimpress is the global leader in web-to-print mass customization, delivering high-quality, affordable custom products quickly and conveniently—even in low quantities. Cimpress brands include VistaPrint, WIRmachenDRUCK, Pixartprinting, Pens.com, BuildASign, druck.at, Drukwerkdeal, easyflyer, Exaprint, Packstyle, Printi, Tradeprint and BoxUp. To learn more, visit https://www.cimpress.com. Cimpress and the Cimpress logo are trademarks of Cimpress plc or its subsidiaries. All other brand and product names appearing on this announcement may be trademarks or registered trademarks of their respective holders. CONTACT INFORMATION: Investor Relations: Media Relations: Meredith Burns Sara Litwiller ir@cimpress.com mediarelations@cimpress.com SAFE HARBOR STATEMENT: This earnings commentary contains statements about our future expectations, plans, and prospects of our business that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995, including but not limited to FY2026 guidance for revenue growth, organic constant- currency revenue growth, net income, adjusted EBITDA, operating cash flow, and adjusted free cash flow; statements regarding being positioned well to achieve or exceed guidance expectations and being in a financial position to manage through volatility posed by the trade and macroeconomic environment; expectations for benefits from efficiency gains from operating expense constraints, manufacturing investments, and other cost improvements; FY2028 outlook for net income, adjusted EBITDA, and conversion of adjusted EBITDA to adjusted free cash flow; statements regarding an even stronger financial course and achieving or exceeding the FY2028 outlook, driving strong growth in free cash flow per share, and materially reducing net leverage while still allowing ample room for share repurchases or other capital allocation; expectations regarding net leverage reductions for FY2026-FY2028; and other statements under the Outlook section, regarding achieving or exceeding FY2026 financial objectives, regarding further opportunity to reduce duplicative technology costs, and regarding being well positioned to continue to progress against strategic and financial goals and to expand the value delivered to customers and the company’s competitive advantages for the years to come. Forward-looking projections and expectations are inherently uncertain, are based on assumptions and judgments by management, and may turn out to be wrong. Our actual results may differ materially from those indicated by the forward-looking statements in this document as a result of various important factors, including but not limited to flaws in the assumptions and judgments upon which our forecasts and estimates are based; the development, duration, and severity of supply chain constraints and fluctuating inflation; our inability to make investments in our businesses and allocate our capital as planned or the failure of those investments and allocations to achieve the results we expect; costs and disruptions caused by acquisitions and minority investments; the failure of businesses we acquire or invest in to perform as expected; loss of key personnel or our inability to recruit talented personnel; our failure to develop and deploy our mass customization platform or the failure of the mass customization platform to drive the performance, efficiencies, and competitive advantage we expect; unanticipated changes in our markets, customers, or businesses; disruptions caused by geopolitical events or political instability and war in Ukraine, Israel, the Middle East, or elsewhere; changes in governmental policies, laws and regulations that affect our businesses, or in their enforcement or interpretation, including related to import tariffs; our failure to manage the growth and complexity of our business; our failure to maintain compliance with the covenants in our debt documents or to pay our debts when due; competitive pressures; general economic conditions; and other factors described in our Form 10-K for the fiscal year ended June 30, 2025 and subsequent documents we periodically file with the U.S. SEC. In addition, the statements and projections in this quarterly earnings document represent our expectations and beliefs as of the date of this document, and subsequent events and developments may cause these expectations, beliefs, and projections to change. We specifically disclaim any obligation to update any forward-looking statements. These forward-looking statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to the date of this document. Page 30 of 30