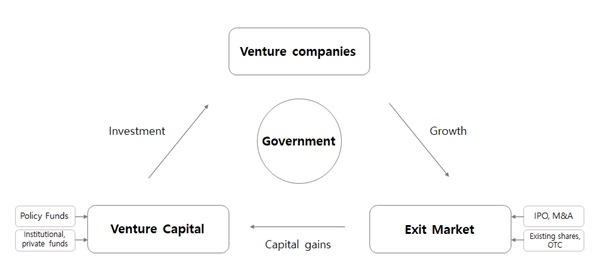

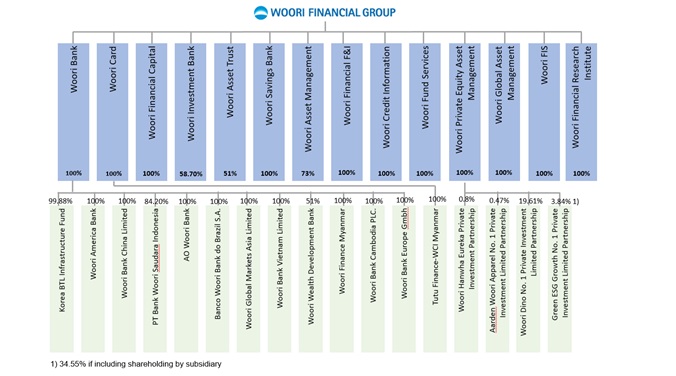

| The Company will continue to diversify its business structure by acquiring small-sized businesses including VC in the short-term and securities companies and insurance companies in the medium-and long-term. Accordingly, Woori Financial Group executed an SPA with DAOL Investment & Securities Co., Ltd. in order to take over 52% of the controlling shares of DAOL Investment Co., Ltd. last February, completed the transaction on March 23, and it became the 15th subsidiary. Upon the inclusion as a subsidiary, the name of the company was changed to Woori Venture Partners, and Woori Venture Partners is a No. 5 venture capital company operating a fund with a scale of approximately KRW 1.4 trillion as of the end of last year. As such, investors should note that the difference in such fields as management, business areas and business cultures arising from the Company’s pursuit of new businesses and the strategy of strengthening non-banking sector may affect the Company’s business.

L. Reputation risks due to fund sales by the bank subsidiary

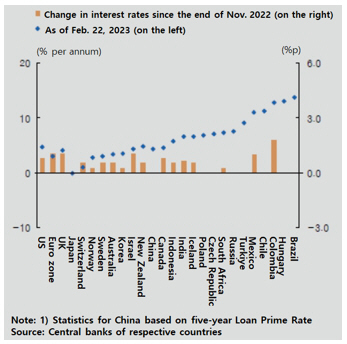

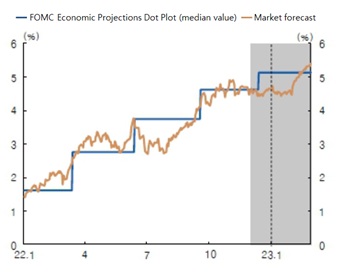

Financial markets both at home and abroad are faced with increasing volatility caused by the possibility of global economic downturn, U.S.-China trade dispute, COVID-19 and so on. For these reasons, interest rates have increasingly been volatile and increasing interest rate volatility has posed the possibility of losses on the part of investors as the derivative products linked to overseas interest rates have fallen below the barrier price. As such, the FSS conducted a joint inspection on financial institutions including Woori Bank Co., Ltd. on August 23, 2019, followed by another inspection later.

In that regard, the FSC convened the fourth regular meeting on March 4, 2020 and passed a resolution to enforce the measures the FSS had suggested after conducting an inspection on KEB Hana Bank Co., Ltd. and Woori Bank Co., Ltd. in connection with the derivative-linked financial products (DLF). Woori Bank Co., Ltd. was ordered (i) partial suspension on its business (i.e., no new sales of PEFs) for six months along with administrative fines and sanctions for violating the obligation of delivering investment prospectus and the regulations on advertisement of PEFs.

Meanwhile, the Lime Asset Management announced on October 8, 2019 that it would

suspend redemption for ‘Pluto FI D-1’ and ‘Tethys 2’ due to difficulties in securing liquidity. ø Please refer to the regular briefing of

the FSS (July 1, 2020)

As for the estimates for the down-payment to be returned and indemnification for loss that Woori Bank Co., Ltd. may have to pay as a result of dispute settlement by FSS regarding the losses on the part of the customers due to delayed fund redemption by Lime Asset Management, Woori Bank Co., Ltd. determined to deem the best estimates for the disbursement as provisions required to perform its obligation. As of the first quarter of 2023, Woori Bank recognized KRW 121.6 billion as estimated liabilities for the Lime Asset Management case.

At the 20th FSC regular meeting in November 2022, the FSC passed a resolution to enforce the measures to suspend business of selling PEFs for three months related to Woori Bank’s mis-selling of Lime Fund (administrative fines imposed in advance).

Investors should note that it is currently difficult to determine the scale of losses from the fund as the redemption of the fund was delayed, which may adversely affect the Company’s reputation in relation to its retail finance services provided to individual customers. |

11

Results of the Financial Dispute Settlement Committee related to the Lime Trade Finance Fund

Results of the Financial Dispute Settlement Committee related to the Lime Trade Finance Fund

.

. Share Exchange Agreement

Share Exchange Agreement