Please wait

Exhibit T3 E-1

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

In re

|

|

|

) |

|

|

Chapter 11 |

|

|

|

) |

|

|

|

CHARTER COMMUNICATIONS, INC., et al.,1

|

|

|

) |

|

|

Case No. 09-11435 (JMP) |

|

|

|

) |

|

|

|

Debtors.

|

|

|

) |

|

|

Jointly Administered |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

DEBTORS’ DISCLOSURE STATEMENT PURSUANT

TO CHAPTER 11 OF THE BANKRUPTCY CODE

WITH RESPECT TO THE DEBTORS’ JOINT PLAN OF REORGANIZATION

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY

NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS

DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY

COURT. THE INFORMATION IN THIS DISCLOSURE STATEMENT IS SUBJECT TO CHANGE. THIS DISCLOSURE

STATEMENT IS NOT AN OFFER TO SELL ANY SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY ANY

SECURITIES.

| |

|

|

KIRKLAND & ELLIS LLP

|

|

KIRKLAND & ELLIS LLP |

Citigroup Center

|

|

200 East Randolph Drive |

153 East 53rd Street

|

|

Chicago, Illinois 60601-6636 |

New York, New York 10022-4611

|

|

Telephone: (312) 861-2000 |

Telephone: (212) 446-4800

|

|

Facsimile: (312) 851-2200 |

Facsimile: (212) 446-4900

|

|

Ray C. Schrock |

Richard M. Cieri |

|

|

Paul M. Basta |

|

|

Stephen E. Hessler |

|

|

|

|

|

|

|

Counsel to the Debtors and Debtors in Possession

(other than Charter Investment, Inc.) |

TOGUT, SEGAL & SEGAL LLP |

|

|

One Penn Plaza |

|

|

New York, New York 10119 |

|

|

Telephone: (212) 594-5000 |

|

|

Facsimile: (212) 967-4258 |

|

|

Albert Togut |

|

|

Frank A. Oswald |

|

|

|

|

Counsel to the Debtor and Debtor in Possession Charter

Investment, Inc. |

|

|

|

| 1 |

|

The Debtors in these cases include: Ausable Cable TV, Inc.; Hometown TV, Inc.;

Plattsburgh Cablevision, Inc.; Charter Communications Entertainment, LLC; Falcon First Cable

of New York, Inc.; Charter Communications, Inc.; Charter Communications Holding Company, LLC;

CCHC, LLC; Charter Communications Holdings, LLC; CCH I Holdings, LLC; CCH I, LLC; CCH II, LLC;

CCO Holdings, LLC; Charter Communications Operating, LLC; American Cable Entertainment

Company, LLC; Athens Cablevision, Inc.; Cable Equities Colorado, LLC; Cable Equities of

Colorado Management Corp.; CC 10, LLC; CC Fiberlink, LLC; CC Michigan, LLC; CC Systems, LLC;

CC V Holdings, LLC; CC VI Fiberlink, LLC; CC VI Operating, LLC; CC VII Fiberlink, LLC; CC VIII

Fiberlink, LLC; CC VIII Holdings, LLC; CC VIII Leasing of Wisconsin, LLC; CC VIII Operating,

LLC; CC VIII, LLC; CCH I Capital Corp.; CCH I Holdings Capital Corp.; CCH II Capital Corp.;

CCO Fiberlink, LLC; CCO Holdings Capital Corp.; CCO NR Holdings, LLC; CCO Purchasing, LLC;

Charter Advertising of Saint Louis, LLC; Charter Cable Leasing of Wisconsin, LLC; Charter

Cable Operating Company, L.L.C.; Charter Cable Partners, L.L.C.; Charter Communications

Entertainment I, DST; Charter Communications Entertainment I, LLC; Charter Communications

Entertainment II, LLC; Charter Communications Holdings Capital Corporation; Charter

Communications Operating Capital Corp.; Charter Communications Properties LLC; Charter

Communications V, LLC; Charter Communications Ventures, LLC; Charter Communications VI, LLC;

Charter Communications VII, LLC; Charter Communications, LLC; Charter Distribution, LLC;

Charter Fiberlink — Alabama, LLC; Charter Fiberlink AR-CCVII, LLC; Charter Fiberlink

AZ-CCVII, LLC; Charter Fiberlink CA-CCO, LLC; Charter Fiberlink CA-CCVII, LLC; Charter

Fiberlink CC VIII, LLC; Charter Fiberlink CCO, LLC; Charter Fiberlink CT-CCO, LLC; (continued

on next page) |

(continued)

|

|

|

| |

|

Charter Fiberlink — Georgia, LLC; Charter Fiberlink ID-CCVII, LLC; Charter Fiberlink — Illinois,

LLC; Charter Fiberlink IN-CCO, LLC; Charter Fiberlink KS-CCO, LLC; Charter Fiberlink LA-CCO, LLC;

Charter Fiberlink MA-CCO, LLC; Charter Fiberlink — Michigan, LLC; Charter Fiberlink — Missouri,

LLC; Charter Fiberlink MS-CCVI, LLC; Charter Fiberlink NC-CCO, LLC; Charter Fiberlink NC-CCVII,

LLC; Charter Fiberlink — Nebraska, LLC; Charter Fiberlink NH-CCO, LLC; Charter Fiberlink NM-CCO,

LLC; Charter Fiberlink NV-CCVII, LLC; Charter Fiberlink NY-CCO, LLC; Charter Fiberlink NY-CCVII,

LLC; Charter Fiberlink OH-CCO, LLC; Charter Fiberlink OK-CCVII, LLC; Charter Fiberlink OR-CCVII,

LLC; Charter Fiberlink SC-CCO, LLC; Charter Fiberlink SC-CCVII, LLC; Charter Fiberlink —

Tennessee, LLC; Charter Fiberlink TX-CCO, LLC; Charter Fiberlink UT-CCVII, LLC; Charter Fiberlink

VA-CCO, LLC; Charter Fiberlink VT-CCO, LLC; Charter Fiberlink WA-CCVII, LLC; Charter Fiberlink —

Wisconsin, LLC; Charter Fiberlink WV-CCO, LLC; Charter Fiberlink, LLC; Charter Gateway, LLC;

Charter Helicon, LLC; Charter Investment, Inc.; Charter RMG, LLC; Charter Stores FCN, LLC; Charter

Video Electronics, Inc.; Dalton Cablevision, Inc.; Enstar Communications Corporation; Falcon Cable

Communications, LLC; Falcon Cable Media, a California Limited Partnership; Falcon Cable Systems

Company II, L.P.; Falcon Cablevision, a California Limited Partnership; Falcon Community Cable,

L.P.; Falcon Community Ventures I, LP; Falcon First Cable of the Southeast, Inc.; Falcon First,

Inc.; Falcon Telecable, a California Limited Partnership; Falcon Video Communications, L.P.;

Helicon Partners I, L.P.; HPI Acquisition Co., L.L.C.; Interlink Communications Partners, LLC; Long

Beach, LLC; Marcus Cable Associates, L.L.C.; Marcus Cable of Alabama, L.L.C.; Marcus Cable, Inc.;

Midwest Cable Communications, Inc.; Pacific Microwave; Peachtree Cable TV, L.P.; Peachtree Cable

T.V., LLC; Renaissance Media LLC; Rifkin Acquisition Partners, LLC; Robin Media Group, Inc.;

Scottsboro TV Cable, Inc.; Tennessee, LLC; The Helicon Group, L.P.; Tioga Cable Company, Inc.; and

Vista Broadband Communications, LLC. |

TABLE OF CONTENTS

| |

|

|

|

|

| |

|

Page |

|

Important Information About This Disclosure Statement |

|

|

1 |

|

| |

Questions and Answers Regarding this Disclosure Statement and the Plan |

|

|

4 |

|

| |

Our History and Our Chapter 11 Cases |

|

|

14 |

|

| |

Important Aspects of the Plan |

|

|

24 |

|

| |

Treatment of Claims Against and Interests in the Debtors |

|

|

32 |

|

| |

Management of the Company After the Effective Date |

|

|

56 |

|

| |

Composition of New Board of Directors After the Effective Date |

|

|

57 |

|

| |

The Reorganized Debtors Upon Emergence |

|

|

58 |

|

| |

The Reorganized Company’s Capitalization Upon Consummation of the Plan |

|

|

59 |

|

| |

Description of the New CCH II Notes |

|

|

62 |

|

| |

Description of Capital Stock |

|

|

64 |

|

| |

Reorganized Company’s Ownership Upon Emergence |

|

|

67 |

|

| |

Summary of Legal Proceedings |

|

|

68 |

|

| |

Projected Financial Information |

|

|

75 |

|

| |

Risk Factors |

|

|

76 |

|

| |

Confirmation Of The Plan |

|

|

90 |

|

| |

Effect Of Confirmation Of The Plan |

|

|

94 |

|

| |

Important Securities Law Disclosure |

|

|

98 |

|

| |

Voting Instructions |

|

|

99 |

|

| |

Certain U.S. Federal Income Tax Consequences Of The Plan |

|

|

102 |

|

| |

Recommendation |

|

|

110 |

|

i

EXHIBITS

| |

|

|

EXHIBIT A

|

|

Joint Plan of Reorganization |

|

|

|

EXHIBIT B

|

|

Disclosure Statement Order |

|

|

|

EXHIBIT C

|

|

Reorganized Debtors’ Financial Projections |

|

|

|

EXHIBIT D

|

|

Reorganized Debtors’ Valuation Analysis |

|

|

|

EXHIBIT E

|

|

Liquidation Analysis |

|

|

|

EXHIBIT F

|

|

Reconciliation of Non-GAAP Measures |

ii

Important Information About This Disclosure Statement

This Disclosure Statement provides information regarding the Plan of Reorganization that the

Debtors are seeking to have confirmed by the Bankruptcy Court. The Debtors believe that the Plan is

in the best interests of all creditors. The Debtors urge all holders of Claims and Interests

entitled to vote on the Plan to vote in favor of the Plan.

References to “New Class A Stock” in this Disclosure Statement are to the new Class A common

stock, par value $0.001 per share, references to “New Class B Stock” in this Disclosure Statement

are to the new Class B common stock, par value $0.001 per share, and references to “New Preferred

Stock” in this Disclosure Statement are to the Series A 15% Pay-In-Kind Preferred Stock, par value

$.001 per share, in each case that reorganized Charter Communications, Inc. (the “Reorganized

Company”) will issue upon emergence as described in this Disclosure Statement and in accordance

with the Plan. References to “New Common Stock” in this Disclosure Statement are to the New Class A

Stock and New Class B Stock, collectively.

References to the New CCH II Notes are to the 13.5% Senior Notes due 2016 that CCH II, LLC and

CCH II Capital Corp. will issue upon emergence as described in this Disclosure Statement and in

accordance with the Plan.

References to the “Plan” are to the Joint Plan of Reorganization attached as Exhibit A

hereto. All capitalized terms used but not otherwise defined herein will have the meaning ascribed

to them in the Plan.

References to the “Bankruptcy Court” are to the United States Bankruptcy Court for the

Southern District of New York, the court in which Charter Communications, Inc. (“CCI”) and its

direct and indirect subsidiaries and certain of its affiliates (collectively, the “Debtors”) filed

voluntary petitions seeking reorganization relief under the provisions of Chapter 11 of the

Bankruptcy Code. References to the “Petition Date” are to March 27, 2009.

Unless the context requires otherwise, reference to “we,” “our,” and “us” are to the

Debtors.

The confirmation of the Plan and effectiveness of the Plan are subject to certain material

conditions precedent described herein. There is no assurance that the Plan will be confirmed, or

if confirmed, that the conditions required to be satisfied will be satisfied or waived.

You are encouraged to read this Disclosure Statement in its entirety, including without

limitation, the Plan, which is annexed as Exhibit A hereto, and the section entitled “Risk

Factors,” prior to submitting your ballot to vote on the Plan.

The Bankruptcy Court’s approval of this Disclosure Statement does not constitute a guarantee

of the accuracy or completeness of the information contained herein or an endorsement of the merits

of the Plan by the Bankruptcy Court.

Summaries of the Plan and statements made in this Disclosure Statement are qualified in their

entirety by reference to the Plan, the exhibits and schedules attached to the Plan and this

Disclosure Statement and the Plan Supplement. The statements contained in this Disclosure Statement

are made only as of the date of this Disclosure Statement, and there is no assurance that the

statements contained herein will be correct at any time after such date. Except as otherwise

provided in the Plan or in accordance with applicable law, the Debtors are under no duty to update

or supplement this Disclosure Statement.

The information contained in this Disclosure Statement is included for purposes of soliciting

acceptances to, and confirmation of, the Plan and may not be relied on for any other purpose. The

Debtors believe that the summary of certain provisions of the Plan and certain other documents and

financial information contained or referenced in this Disclosure Statement is fair and accurate.

The summaries of the financial information and the documents annexed to this Disclosure Statement,

including, but not limited to, the Plan and the Plan Documents, or otherwise incorporated herein by

reference, are qualified in their entirety by reference to those documents. In the

1

event of any inconsistency between this Disclosure Statement and the Plan, the relevant provision

of the Plan, as it relates to such inconsistency, will govern.

No representations concerning the Debtors or the value of the Debtors’ property have been

authorized by the Debtors other than as set forth in this Disclosure Statement. Any information,

representations or inducements made to obtain acceptance of the Plan, which are other than or

inconsistent with the information contained in this Disclosure Statement and in the Plan, should

not be relied on by any claim holder entitled to vote on the Plan.

This Disclosure Statement has not been approved or disapproved by the United States Securities

and Exchange Commission (the “SEC”) or any similar federal, state, local or foreign regulatory

agency, nor has the SEC or any other such agency passed upon the accuracy or adequacy of the

statements contained in this Disclosure Statement.

The Debtors have sought to ensure the accuracy of the financial information provided in this

Disclosure Statement, but the financial information contained in, or incorporated by reference

into, this Disclosure Statement has not been and will not be audited or reviewed by the Debtors’

independent auditors unless explicitly provided otherwise.

Some of the securities described in this Disclosure Statement will be issued without

registration under the Securities Act of 1933, as amended (the “Securities Act”), or similar

federal, state, local or foreign laws, in reliance on the exemption set forth in section 1145 of

the Bankruptcy Code. Other securities may be issued pursuant to other applicable exemptions under

the federal securities laws. To the extent exemptions from registration, other than section 1145,

apply, such securities may not be offered or sold except pursuant to a valid exemption or upon

registration under the Securities Act.

The Debtors make statements in this Disclosure Statement that are considered forward-looking

statements under the federal securities laws. The Debtors consider all statements regarding

anticipated or future matters, including the following, to be forward-looking statements:

| • |

|

any future effects as a result of the pendency of the

Chapter 11 Cases; |

| • |

|

the Debtors’ expected future financial position,

liquidity, results of operations, profitability and cash

flows; |

| • |

|

projected cost reductions; |

| • |

|

projected and estimated liability costs, including

pension, retiree, tort and environmental costs and

costs of environmental remediation; |

| • |

|

disruption of operations; |

| • |

|

plans and objectives of management for future

operations; |

| • |

|

contractual obligations; |

| • |

|

off-balance sheet arrangements; |

| • |

|

growth opportunities for existing products and

services; |

| • |

|

projected price increases; |

| • |

|

projected general market conditions; |

| • |

|

benefits from new technology; and |

| • |

|

effect of changes in accounting due to recently

issued accounting standards. |

2

Statements concerning these and other matters are not guarantees of the Debtors’ future

performance. Such statements represent the Debtors’ estimates and assumptions only as of the date

such statements were made. There are risks, uncertainties and other important factors that could

cause the Debtors’ actual performance or achievements to be materially different from those they

may project and the Debtors undertake no obligation to update any such statement. These risks,

uncertainties and factors include:

| • |

|

the Debtors’ ability to confirm and consummate the

Plan; |

| • |

|

the Debtors’ ability to reduce their overall financial

leverage; |

| • |

|

the potential adverse impact of the Chapter 11 Cases

on the Debtors’ operations, management and

employees, and the risks associated with operating

businesses in the Chapter 11 Cases; |

| • |

|

customer response to the Chapter 11 Cases; |

| • |

|

inability to have Claims discharged/settled during

the Chapter 11 proceedings; |

| • |

|

the reinstatement and unimpairment of certain credit

facilities, indentures and notes may be challenged

by the banks and/or other interested parties; |

| • |

|

our ability to comply with all covenants in our

indentures and credit facilities, any violation of

which, if not cured in a timely manner, could trigger

defaults under and acceleration of our indebtedness

and our other obligations under cross-default

provisions; |

| • |

|

the availability and access, in general, of funds to

meet interest payment obligations under our debt

and to fund our operations and necessary capital

expenditures, either through cash on hand, cash

flows from operating activities, further borrowings

or other sources and, in particular, our ability to

fund debt obligations (by dividend, investment or

otherwise) to the applicable obligor of such debt; |

| • |

|

our ability to repay debt prior to or when it becomes

due and/or successfully access the capital or credit

markets to refinance that debt through new

issuances, exchange offers or otherwise, including

restructuring our balance sheet and leverage

position, especially given recent volatility and

disruption in the capital and credit markets; |

| • |

|

the impact of competition from other distributors,

including, but not limited to, incumbent telephone

companies, direct broadcast satellite operators,

wireless broadband providers, and digital subscriber

line (“DSL”) providers; |

| • |

|

difficulties in growing and operating our telephone

services, while adequately meeting customer

expectations for the reliability of voice services; |

| • |

|

our ability to adequately meet demand for

installations and customer service; |

| • |

|

our ability to sustain and grow revenues and cash

flows from operating activities by offering video,

high-speed Internet, telephone and other services,

and to maintain and grow our customer base,

particularly in the face of increasingly aggressive

competition; |

| • |

|

our ability to obtain programming at reasonable

prices or to adequately raise prices to offset the

effects of higher programming costs; |

| • |

|

general business conditions, economic uncertainty

or downturn, including the recent volatility and

disruption in the capital and credit markets and the

significant downturn in the housing sector and

overall economy; and |

| • |

|

the effects of governmental regulation on our

business. |

Additional factors that could cause actual results to differ materially from the

forward-looking statements we make in this Disclosure Statement are set forth in the reports or

documents that we file from time to time with the SEC, including our most recent Annual Report on

Form 10-K filed with the SEC on March 16, 2009 (File No. 001-33664), including any amendments

thereto, each of which is hereby incorporated by reference herein.

3

Questions and Answers Regarding this Disclosure Statement and the Plan

Why are the Debtors sending me this Disclosure Statement?

The Debtors are seeking to obtain Bankruptcy Court approval of the Plan. Prior to soliciting

acceptances of the Plan, section 1125 of the Bankruptcy Code requires the Debtors to prepare a

Disclosure Statement containing adequate information of a kind, and in sufficient detail, to enable

a hypothetical reasonable investor to make an informed judgment regarding acceptance of the Plan.

This Disclosure Statement is being submitted in accordance with such requirements.

Am I entitled to vote on the Plan? What will I receive from the Debtors if the Plan is consummated?

Your ability to vote and your distribution under the Plan, if any, depend on what kind of

Claim or Interest you hold. A summary of the classes of Claims and Interests and their respective

voting statuses and anticipated recoveries is set forth below.

The following chart is a summary of the classification and treatment of Claims and Interests

and the potential distributions under the Plan. Any estimates of Claims or Interests in this

Disclosure Statement may vary from the final amounts allowed by the Bankruptcy Court. As a result

of the foregoing and other uncertainties which are inherent in the estimates, the estimated

recoveries in this Disclosure Statement may vary from the actual recoveries received. In addition,

your ability to receive distributions under the Plan depends upon the ability of the Debtors to

obtain Confirmation of the Plan and meet the conditions to the Effective Date of the Plan. See

“Confirmation of the Plan,” which begins on page 90, for a discussion of the conditions to the

Effectiveness of the Plan. The recoveries set forth below are projected recoveries only and may

change based upon changes in the amount of Allowed Claims as well as other factors related to the

Debtors’ business operations and general economic conditions. Reference should be made to this

entire Disclosure Statement and the Plan for a complete description of the classification and

treatment of Allowed Claims against and Interests in each of the Debtors.

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Estimated |

| |

|

|

|

|

|

|

|

Recovery |

| |

|

|

|

|

|

|

|

Under the |

| Class |

|

Claims and Interests |

|

Status |

|

Voting Rights |

|

Plan |

| CCI |

| |

|

|

|

|

|

|

|

|

|

|

| A-1

|

|

Priority Non-Tax Claims

against CCI

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| A-2

|

|

Secured Claims against CCI

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| A-3

|

|

General Unsecured Claims

against CCI (other than all

General Unsecured Claims

against CCI held by any CII

Settlement Claim Party)

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| A-4

|

|

CCI Notes Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

19.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| A-5

|

|

Section 510(b) Claims

against CCI (other than all

Section 510(b) Claims

against CCI held by any CII

Settlement Claim Party)

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| A-6

|

|

Interests in CCI (other than

all Interests in CCI held by

any CII Settlement Claim

Party)

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CII |

| |

|

|

|

|

|

|

|

|

|

|

| B-1

|

|

Priority Non-Tax Claims

against CII

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

4

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Estimated |

| |

|

|

|

|

|

|

|

Recovery |

| |

|

|

|

|

|

|

|

Under the |

| Class |

|

Claims and Interests |

|

Status |

|

Voting Rights |

|

Plan |

| B-2

|

|

Secured Claims against CII

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| B-3

|

|

General Unsecured Claims

against CII

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| B-4

|

|

CII Shareholder Claims

|

|

Impaired

|

|

Entitled to Vote |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Holdco, Enstar Communications Corporation, and Charter Gateway, LLC |

| |

|

|

|

|

|

|

|

|

|

|

| C-1

|

|

Priority Non-Tax Claims

against Holdco, Enstar

Communications

Corporation, and Charter

Gateway, LLC

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| C-2

|

|

Secured Claims against

Holdco, Enstar

Communications

Corporation, and Charter

Gateway, LLC

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| C-3

|

|

General Unsecured Claims

against Holdco, Enstar

Communications

Corporation, and Charter

Gateway, LLC

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| C-4

|

|

Holdco Notes Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

3.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| C-5

|

|

Section 510(b) Claims

against Holdco, Enstar

Communications

Corporation, and Charter

Gateway, LLC

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| C-6

|

|

Interests in Holdco, Enstar

Communications

Corporation, and Charter

Gateway, LLC (other than

all Interests in Holdco held

by any CII Settlement Claim

Party)

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CCHC |

| |

|

|

|

|

|

|

|

|

|

|

| D-1

|

|

Priority Non-Tax Claims

against CCHC

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| D-2

|

|

Secured Claims against

CCHC

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| D-3

|

|

General Unsecured Claims

against CCHC (other than all

General Unsecured Claims

against CCHC held by any

CII Settlement Claim Party)

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| D-4

|

|

Section 510(b) Claims

against CCHC

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| D-5

|

|

Interests in CCHC

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CCH and Charter Communications Holdings Capital Corp. |

5

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Estimated |

| |

|

|

|

|

|

|

|

Recovery |

| |

|

|

|

|

|

|

|

Under the |

| Class |

|

Claims and Interests |

|

Status |

|

Voting Rights |

|

Plan |

| E-1

|

|

Priority Non-Tax Claims

against CCH and Charter

Communications Holdings

Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| E-2

|

|

Secured Claims against CCH

and Charter

Communications Holdings

Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| E-3

|

|

General Unsecured Claims

against CCH and Charter

Communications Holdings

Capital Corp.

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| E-4

|

|

CCH Notes Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

0.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| E-5

|

|

Section 510(b) Claims

against CCH and Charter

Communications Holdings

Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| E-6

|

|

Interests in CCH and Charter

Communications Holdings

Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CIH and CCH I Holdings Capital Corp. |

| |

|

|

|

|

|

|

|

|

|

|

| F-1

|

|

Priority Non-Tax Claims

against CIH and CCH I

Holdings Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| F-2

|

|

Secured Claims against CIH

and CCH I Holdings Capital

Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| F-3

|

|

General Unsecured Claims

against CIH and CCH I

Holdings Capital Corp.

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| F-4

|

|

CIH Notes Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

0.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| F-5

|

|

Section 510(b) Claims

against CIH and CCH I

Holdings Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| F-6

|

|

Interests in CIH and CCH I

Holdings Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CCH I and CCH I Capital Corp. |

| |

|

|

|

|

|

|

|

|

|

|

| G-1

|

|

Priority Non-Tax Claims

against CCH I and CCH I

Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| G-2

|

|

Secured Claims against

CCH I and CCH I Capital

Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| G-3

|

|

General Unsecured Claims

against CCH I and CCH I

Capital Corp.

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| G-4

|

|

CCH I Notes Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

12.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| G-5

|

|

Section 510(b) Claims

against CCH I and CCH I

Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

6

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Estimated |

| |

|

|

|

|

|

|

|

Recovery |

| |

|

|

|

|

|

|

|

Under the |

| Class |

|

Claims and Interests |

|

Status |

|

Voting Rights |

|

Plan |

| G-6

|

|

Interests in CCH I and

CCH I Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CCH II and CCH II Capital Corp. |

| |

|

|

|

|

|

|

|

|

|

|

| H-1

|

|

Priority Non-Tax Claims

against CCH II and CCH II

Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| H-2

|

|

Secured Claims against

CCH II and CCH II Capital

Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| H-3

|

|

General Unsecured Claims

against CCH II and CCH II

Capital Corp.

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| H-4

|

|

CCH II Notes Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| H-5

|

|

Section 510(b) Claims

against CCH II and CCH II

Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| H-6

|

|

Interests in CCH II and

CCH II Capital Corp.

|

|

Impaired

|

|

Not Entitled to Vote (Deemed to

Reject)

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| CCOH and CCO Holdings Capital Corp. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| I-1

|

|

CCOH Credit Facility

Claims

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| I-2

|

|

CCOH Notes Claims

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| I-3

|

|

Priority Non-Tax Claims

against CCOH and CCO

Holdings Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| I-4

|

|

Secured Claims against

CCOH and CCO Holdings

Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| I-5

|

|

General Unsecured Claims

against CCOH and CCO

Holdings Capital Corp.

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| I-6

|

|

Interests in CCOH and CCO

Holdings Capital Corp.

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

N/A |

|

| |

|

|

|

|

|

|

|

|

|

|

| CCO and its direct and indirect subsidiaries (other than the CC VIII Preferred Units held by Holders of CII Settlement Claims) |

| |

|

|

|

|

|

|

|

|

|

|

| J-1

|

|

CCO Credit Facility Claims

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| J-2

|

|

CCO Swap Agreements

Claims

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| J-3

|

|

CCO Notes Claims

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| J-4

|

|

Priority Non-Tax Claims

against CCO and its direct

and indirect subsidiaries

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| J-5

|

|

Secured Claims against CCO

and its direct and indirect

subsidiaries

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| J-6

|

|

General Unsecured Claims

against CCO and its direct

and indirect subsidiaries

|

|

Impaired

|

|

Entitled to Vote

|

|

|

100 |

% |

7

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Estimated |

| |

|

|

|

|

|

|

|

Recovery |

| |

|

|

|

|

|

|

|

Under the |

| Class |

|

Claims and Interests |

|

Status |

|

Voting Rights |

|

Plan |

| J-7

|

|

Interests in CCO and its

direct and indirect

subsidiaries (other than CC

VIII Preferred Units held by

a CII Settlement Claim

Party)

|

|

Unimpaired

|

|

Not Entitled to Vote (Deemed to

Accept)

|

|

N/A |

In the ordinary course of the Debtors’ business, certain of the Debtors hold Claims or other

Interests in the form of intercompany Claims or Interests (the “Intercompany Claims or Interests”).

The summary above includes Intercompany Claims or Interests between certain Debtors, which may or

may not be impaired depending on which Debtors such Claims or Interests are against.

For more information about the treatment of Claims and Interests see “Treatment of Claims

Against and Interests in the Debtors,” which begins on page 32.

What happens to my recovery if the Plan is not confirmed, or does not go effective?

In the event that the Plan is not confirmed, there is no assurance that the Debtors will be

able to reorganize their business. If the Plan is not confirmed in a timely manner, it is unclear

whether the transactions contemplated thereby could be implemented and what Holders of Claims and

Interests would ultimately receive in respect of their Claims and Interests. It is possible that

any alternative may provide Holders of Claims or Interests with less than they would have received

pursuant to the Plan. Moreover, nonconfirmation of the Plan may result in an extended Chapter 11

proceeding. For a more detailed description of the consequences of this or of a liquidation

scenario, see “Confirmation of the Plan — Best Interests of Creditors/Liquidation Analysis,” which

begins on page 91, and the Liquidation Analysis attached as Exhibit E to this Disclosure

Statement.

If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes

effective, and what do you mean when you refer to “Confirmation,” “Effective Date” and

“consummation?”

“Confirmation” of the Plan refers to the approval of the Plan by the Bankruptcy Court.

Confirmation of the Plan does not guarantee that you will receive the distribution indicated under

the Plan. After Confirmation of the Plan by the Bankruptcy Court, there are conditions that need to

be satisfied or waived so that the Plan can be consummated and go effective. References to the

“Effective Date” mean the date that all conditions to the Plan have been satisfied or waived and

the Plan has been fully consummated. Distributions will only be made on the Effective Date or as

soon as practicable thereafter. See “Confirmation of the Plan,” which begins on page 90, for a

discussion of the conditions to consummation.

Where is the cash required to fund the Plan coming from?

The cash required to fund the Plan will come from cash from operations, the sale and issuance

of up to $267 million aggregate principal amount of additional New CCH II Notes and the proceeds of

an offering of rights (the “Rights”) to holders, as of the close of business on April 17, 2009,

which is the date that is 12 days prior to the date for which the Disclosure Statement hearing was

originally scheduled (the “Rights Offering Record Date”), of senior notes of CCH I (“CCH I Notes”),

or transferees of such holders, that have completed and delivered an investor certification by May

11, 2009 and are accredited investors (as defined under Rule 501 of the Securities Act) or

qualified institutional buyers (as defined in Rule 144A under the Securities Act) (together, the

“Eligible CCH I Notes Claim Holders”), to purchase shares of New Class A Stock along with the

issuance of shares of New Class A Stock to existing holders of CCH I Notes as of such date and that

have timely and affirmatively demonstrated that they are not Eligible CCH I Notes Claim Holders

(such offering of Rights and issuance of shares, together, the “Rights Offering”). Specifically, up

to approximately $1.6 billion in cash proceeds will be raised through the Rights Offering and up to

an additional $400 million in cash proceeds may be raised through the Overallotment Option. Certain

holders of approximately $4.1 billion in aggregate principal amount of notes issued by CCH I and

CCH II (the “Committed Parties”) have agreed to fully backstop the Rights Offering and have

committed to purchase the

8

additional New CCH II Notes as described above (the “New CCH II Notes Commitment”). See “Important

Aspects of the Plan,” which begins on page 24.

Are there risks to owning an interest in the Debtors upon emergence from bankruptcy?

Yes, please see “Risk Factors,” which begins on page 76.

What are the terms of the New CCH II Notes?

The terms of the New CCH II Notes are described in “Description of the New CCH II Notes,”

which begins on page 62.

Is there potential litigation related to the Plan?

Yes, in the event it becomes necessary to confirm the Plan over the objection of certain

Classes, the Debtors may seek confirmation of the Plan notwithstanding the dissent of certain

Classes of Claims. The Bankruptcy Court may confirm the Plan pursuant to the “cramdown” provisions

of the Bankruptcy Code, which allow the Bankruptcy Court to confirm a plan that has been rejected

by an impaired Class of Claims if it determines that the Plan satisfies section 1129(b) of the

Bankruptcy Code.

In addition, certain creditors have challenged the reinstatement and unimpairment of certain

credit facilities, indentures and notes under, and other aspects of, the Plan. See “Summary of

Legal Proceedings — Legal Proceedings in Bankruptcy Court — Challenges to the Plan” which begins

on page 68 and “Risk Factors — Risks Relating to Bankruptcy — The Debtors May Not Be Able to

Obtain Confirmation of the Plan,” which begins on page 76.

Will CCI, during the Chapter 11 Cases, and the Reorganized Company thereafter, continue

filing reports with the SEC?

Yes, it is expected that CCI and the Reorganized Company will continue to file periodic and

other reports with the SEC.

Will the New Class A Stock be listed on any stock exchange?

The Reorganized Company will cause the New Class A Stock to be listed on the NASDAQ Global

Select Market as promptly as practicable but in no event prior to the later of (x) the 46th day

following the Effective Date and (y) October 15, 2009 (unless Paul G. Allen and the Reorganized

Company agree to an earlier date), and the Reorganized Company will maintain such listing

thereafter.

Who will receive the Reorganized Company’s capital stock and what rights will the

Reorganized Company’s new stockholders have?

New Class A Stock. Shares of New Class A Stock will be issued to (a) participants in

the Rights Offering (in the case of an Eligible CCH I Notes Claim Holder, upon the exercise of its

Rights), (b) Equity Backstop Parties upon the exercise of the Overallotment Option, (c) Holders of

Claims with respect to the CCH I Notes, (d) the Allen Entities upon exchange of their Reorganized

Holdco equity pursuant to the reorganized Holdco Exchange Agreement, to be entered into by the

Reorganized Company, reorganized Holdco, reorganized CII and Mr. Allen (the “Reorganized Holdco

Exchange Agreement”), (e) holders of Warrants upon any exercise of such Warrants, and

(f) holders of equity-based awards issued under the Management Incentive Plan, in each case in the

respective amounts

described in the Plan. Under the Plan, approximately 19.5% of the New Class A Stock will be

distributed to CCH I Notes Claim Holders and approximately 80.5% of the New Class A Stock will be

sold pursuant to the Rights Offering (which percentages do not give effect to any exercise of the

CCH Warrants, CIH Warrants, or CII Settlement Claim Warrants or the Overallotment Option). See

“The Reorganized Company’s Ownership Upon Emergence,” which begins on page 67. Except as otherwise

provided in the Reorganized Company’s amended and restated certificate of incorporation (the

“Amended and Restated Certificate of Incorporation”), each share of New Class A Stock will be

entitled to one vote.

9

New Class B Stock. The New Class B Stock will be identical to the New Class A Stock

except with respect to certain voting, transfer and conversion rights. Each share of New Class B

Stock will be entitled to a number of votes such that the aggregate number of votes attributable to

the shares of New Class B Stock will at all times equal 35% of the combined voting power of the

capital stock of the Reorganized Company. Subject to the Lock-Up Agreement, each share of New

Class B Stock will be convertible into one share of New Class A Stock at the option of the Holder.

In addition, each share of New Class B Stock will be convertible into one share of New Class A

Stock (i) at any time on or after January 1, 2011 and until September 15, 2014, at the election of

a majority of the disinterested members of the Board of Directors, and (ii) at any time on or after

September 15, 2014 at the election of a majority of the members of the Board of Directors (other

than members of the Board of Directors elected by the holders of New Class B Stock). New Class B

Stock will only be issued to and can only be held by the Authorized Class B Holders. New Class B

Stock will be subject to restrictions on conversion and transfer as set forth in the Lock-Up

Agreement to be entered into between the Reorganized Company and Mr. Allen (the “Lock-Up

Agreement”). See “Important Aspects of the Plan — Lock-Up Agreement” on page 28.

New Preferred Stock. Shares of New Preferred Stock will be issued to Holders of CCI

Notes in the respective amounts described in the Plan. The New Preferred Stock will not be

publicly listed or traded.

Warrants. Warrants to be issued pursuant to the Plan will consist solely of CIH

Warrants, CCH Warrants and CII Settlement Claim Warrants.

See “Description of Capital Stock,” which begins on page 64.

Will there be releases granted to parties in interest as part of the Plan?

Yes, see “Releases,” which begins on page 96.

What are the contents of the solicitation packages to be sent to creditors who are eligible to vote

on the Plan?

In accordance with the terms of the Bankruptcy Court order approving this Disclosure

Statement, all parties in interest will receive a notice of the hearing on the Confirmation of the

Plan. Additionally, holders of Claims who are eligible to vote on the Plan will receive this

Disclosure Statement, including the exhibits attached hereto, and ballots to vote in respect of

their Claims. In addition, Eligible CCH I Notes Claim Holders will receive a separate solicitation

package, which will contain the Rights Offering Documents.

The notices sent to parties in interest will indicate that this Disclosure Statement, the Plan

(including the Plan Supplement) and all of the exhibits thereto are (and in the case of any other

supplement to the Plan will be) available for viewing by any party at: www.kccllc.net/charter.

How do I vote for or against the Plan?

This Disclosure Statement, accompanied by a ballot or ballots to be used for voting on the

Plan, is being distributed to the holders of Claims and Interests entitled to vote on the Plan. If

you are a holder of Claims or Interests in the following classes (collectively, the “Voting

Classes”), you may vote for or against the Plan by completing the ballot and returning it in the

envelope provided:

Class A-3 (General Unsecured Claims against CCI)

Class A-4 (CCI Notes Claims)

Class B-3 (General Unsecured Claims against CII)

Class B-4 (CII Shareholder Claims)

Class C-3 (General Unsecured Claims against Holdco, Enstar Communications Corporation, and

Charter Gateway LLC)

Class C-4 (Holdco Notes Claims)

Class D-3 (General Unsecured Claims against CCHC)

Class E-3 (General Unsecured Claims against CCH and Charter Communications Holdings Capital

Corp.)

Class E-4 (CCH Notes Claims)

Class F-3 (General Unsecured Claims against CIH and CCH I Holdings Capital Corp.)

10

Class F-4 (CIH Notes Claims)

Class G-3 (General Unsecured Claims against CCH I and

CCH I Capital Corp.)

Class G-4 (CCH I Notes Claims)

Class H-3 (General Unsecured

Claims against CCH II and CCH II Capital Corp.)

Class H-4 (CCH II Notes Claims)

Class I-5 (General Unsecured Claims against CCOH and CCO Holdings Capital Corp.)

Class J-2 (CCO Swap Agreements Claims)

Class J-6 (General Unsecured Claims against CCO and its

direct and indirect subsidiaries)

The Debtors, with the approval of the Bankruptcy Court, have engaged Financial Balloting

Group, LLC to serve as the voting agent for Claims in respect of debt securities and to assist CCI

with the subscription process in connection with the Rights Offering (the “Securities Voting Agent”

or “Subscription Agent,” as applicable), and Kurtzman Carson Consultants LLC to serve as the voting

agent with respect to any other Claims (the “Claims Voting Agent”) and to assist in the

solicitation process. The Claims Voting Agent and the Securities Voting Agent will, among other

things, answer questions, provide additional copies of all solicitation materials, and generally

oversee the solicitation process for their assigned Claims. The Claims Voting Agent and the

Securities Voting Agent will also process and tabulate ballots for each of their respective Classes

that are entitled to vote to accept or reject the Plan and will file a voting report as soon as

practicable before the Confirmation Hearing.

Detailed instructions regarding how to vote on the Plan are contained on the ballots and

related voting instructions distributed to Holders of Claims that are entitled to vote on the Plan.

In addition, see “Voting Instructions,” which begins on page 99.

What is the deadline to vote on the Plan?

All ballots or master ballots must be received on or before 5:00 p.m. (Eastern Time) on

June 15, 2009 (the “Voting Deadline”) by:

The Securities Voting Agent for Claims in respect of debt securities; and

The Claims Voting Agent for any other Claims.

Who can participate in the Rights Offering?

Pursuant to the rights offering procedures that are a part of the Rights Offering Documents

Eligible CCH I Notes Claim Holders will have the opportunity to purchase their pro rata share of

Rights to purchase New Class A Stock.

How do I elect to participate in the Rights Offering?

An investor certification is being distributed to the Holders of CCH I Notes Claims as of as

the Rights Offering Record Date. Only Holders of CCH I Notes Claims that timely complete the

certification and are otherwise Eligible CCH I Notes Claim Holders, which includes certain eligible

transferees, will be entitled to participate in the Rights Offering. If it is determined that you

are an Eligible CCH I Notes Claim Holder, you will receive additional materials instructing you how

to participate in the Rights Offering.

11

What is the deadline to submit an election to participate in the Rights Offering?

All rights exercise forms, which will be included in the packages of additional materials

to be sent to Eligible CCH I Notes Claim Holders must be received by the Securities Voting Agent on

or before 5:00 p.m. (Eastern Time) on June 11, 2009, which date is subject to an extension of up to

5 Business Days following the notification of the non exercise of the applicable right of first

refusal to allow the completion of necessary documentation, under certain circumstances (as

detailed in the Rights Offering Documents).

What will holders of CCH I Notes Claims that are not Eligible CCH I Notes Claim Holders receive in

respect of their CCH I Notes Claims?

Each Holder of CCH I Notes Claims that affirmatively represents it is not an Eligible CCH I

Notes Claim Holder on a timely submitted investor certification shall receive an amount of New

Class A Stock equal to the value of the Rights that such Holder would have been offered if it were

an accredited investor or qualified institutional buyer participating in the Rights Offering. The

value of a Right will be determined (based on the difference between the aggregate equity purchase

price of New Class A Stock embedded in a Right and the value of New Class A Stock at the

termination of the Rights Offering (assuming that the Overallotment Option is exercised in full and

subject to subsequent upward adjustment to the extent not exercised in full) that can be purchased

upon exercise of a Right) by CCI in good faith and in consultation with its financial advisor. The

value determination will be filed within 10 days of the termination of the Rights Offering with the

Bankruptcy Court (assuming that the Overallotment Option is exercised in full and subject to

subsequent upward adjustment to the extent not exercised in full), and notice thereof (which shall

include the value of each Right so determined) shall be delivered to each such Holder that timely

certified it is not an Eligible CCH I Notes Claim Holder within five days of CCI’s determination.

Holders receiving notice shall have 10 days following receipt of such notice to file a challenge to

such notice with the Bankruptcy Court, whose determination of such value shall be binding.

Why is the Bankruptcy Court holding a confirmation hearing?

Section 1128(a) of the Bankruptcy Code requires the Bankruptcy Court to hold a hearing on

confirmation of the Plan. Section 1128(b) of the Bankruptcy Code provides that any party in

interest may object to confirmation of the Plan.

When is the confirmation hearing set to occur?

The Bankruptcy Court has scheduled the confirmation hearing for July 20, 2009 to take place at

10:00 a.m. (Eastern Time) before the Honorable James M. Peck, United States Bankruptcy Judge, in

the United States Bankruptcy Court for the Southern District of New York, located at Alexander

Hamilton Custom House, One Bowling Green, New York, New York, 10004. The confirmation hearing may

be adjourned from time to time without further notice except for an announcement of the adjourned

date made at the confirmation hearing or any adjournment thereof.

Objections to Confirmation of the Plan must be filed and served on the Debtors, and certain

other parties, by no later than July 13, 2009 at 4:00 p.m. (Eastern Time) in accordance with the

notice of the confirmation hearing that accompanies this Disclosure Statement. Unless objections

to Confirmation of the Plan are timely served and filed in compliance with the disclosure statement

order, which is attached to this Disclosure Statement as Exhibit B, they might not be

considered by the Bankruptcy Court.

The Debtors will publish the notice of the confirmation hearing, which will contain the

deadline for objections to the Plan and the date and time of the confirmation hearing, in the

national edition of The Wall Street Journal, USA Today and the St. Louis Post-Dispatch to provide

notification to those persons who may not receive notice by mail.

What is the purpose of the confirmation hearing?

The consummation of a plan of reorganization is the principal objective of a Chapter 11 case.

The confirmation of a plan of reorganization by the Bankruptcy Court binds the debtor, any issuer

of securities under the plan of reorganization, any person acquiring property under the plan of

reorganization, any creditor or equity interest

12

holder of a debtor and any other person or entity

as may be ordered by the Bankruptcy Court in accordance with the applicable provisions of the

Bankruptcy Code. Subject to certain limited exceptions, the order issued by the Bankruptcy Court

confirming a plan of reorganization discharges a debtor from any debt that arose prior to the

confirmation of the plan of reorganization and provides for the treatment of such debt in

accordance with the terms of the confirmed plan of reorganization.

What role does the Bankruptcy Court play after the confirmation hearing?

After the Plan is confirmed, the Bankruptcy Court will still have exclusive jurisdiction over

all matters arising out of, or related to, the Chapter 11 Cases and the Plan, including disputes

over any Claims or Interests arising under the Chapter 11 Cases. In addition, the Bankruptcy Court

will have exclusive jurisdiction to ensure that distributions to holders of Claims are accomplished

pursuant to the Plan. See “Effects of Confirmation of the Plan

— Retention of Jurisdiction by the Bankruptcy Court,” which begins on page 94 for a further

description of the matters over which the Bankruptcy Court will retain jurisdiction following the

confirmation of the Plan.

What is the effect of the Plan on the Debtors’ ongoing business?

The Debtors are reorganizing pursuant to Chapter 11 of the Bankruptcy Code. As a result, the

confirmation of the Plan means that the Debtors will not be liquidated or forced to go out of

business. As more fully described in “The Reorganized Debtors Upon Emergence,” beginning on page

58, the Debtors will continue to operate their businesses going forward utilizing cash from

operations and cash received from the restructuring transactions described in this Disclosure

Statement and the Plan.

Will Any Party Have Significant Influence Over the Corporate Governance and Operations of the

Reorganized Company?

Yes. After the Effective Date, Mr. Allen and entities affiliated with Mr. Allen, will hold 35%

of the combined voting power of the capital stock of the Reorganized Company and will have the

right to elect four of 11 members of the Board of Directors. There may be additional holders of

significant voting power in the Reorganized Company, though pursuant to the Amended and Restated

Certificate of Incorporation, prior to September 15, 2014, the votes attributable to each share of

New Class A Stock held by any holder (other than Mr. Allen and certain of his affiliates) will be

automatically reduced pro rata among all shares of New Class A Stock held by such holder and (if

applicable) shares of New Class A Stock held by any other holder (other than Mr. Allen and certain

of his affiliates) included in any “person” or “group” with such holder so that no “person” or

“group” (other than Mr. Allen and certain of his affiliates) is or becomes the holder or beneficial

owner (as such term is used in Rule 13d-3 and Rule 13d-5 under the Exchange Act, except that in

calculating the beneficial ownership of any particular “person” (as such term is used in Section

13(d) of the Exchange Act) such “person”

shall be deemed to have beneficial ownership of all securities that such “person” has the

right to acquire, whether such right is currently exercisable or is exercisable only upon the

occurrence of a subsequent condition), directly or indirectly, of more than 34.9% of the combined

voting power of the capital stock of the Reorganized Company, subject to waiver by the

disinterested members of the Board of Directors as provided in the Amended and Restated Certificate

of Incorporation. We refer to this voting power limitation as the “Voting Threshold.”

Does the Company recommend voting in favor of the Plan?

Yes. In the opinion of the Debtors, the Plan is preferable to liquidation under Chapter 7 of

the Bankruptcy Code, as described in this Disclosure Statement, and any other reasonably available

alternative because the Debtors believe the Plan provides for a larger distribution to the Debtors’

creditors than would otherwise result from a liquidation or any other reasonably available

alternative. In the event of a liquidation, recoveries for Holders of Allowed Claims would be

significantly reduced, if not eliminated, and no recovery would be expected for Holders of General

Unsecured Claims. Accordingly, the Debtors recommend that holders of Claims and Interests who are

entitled to vote on the Plan support Confirmation of the Plan and vote to accept the Plan.

13

Our History and Our Chapter 11 Cases

The Debtors’ Business

The Debtors operate broadband communications businesses in the United States with

approximately 5.5 million customers at December 31, 2008. The Debtors offer to residential and

commercial customers traditional cable video programming (basic and digital video), high-speed

Internet services, and telephone services, as well as advanced broadband services such as high

definition television, Charter OnDemand™, and digital video recorder (“DVR”) service. The Debtors

sell their cable video programming, high-speed Internet, telephone, and advanced broadband services

primarily on a subscription basis. They also sell advertising to national and local clients on

advertising supported cable networks.

As of December 31, 2008, the Debtors served approximately 5.0 million video customers, of

which approximately 3.1 million were also digital video customers. The Debtors also served

approximately 2.9 million high-speed Internet customers and provided telephone service to

approximately 1.3 million customers.

The Debtors’ customers are served through a hybrid fiber and coaxial cable network with 95% of

homes passed at 550 MHZ or greater and 95% of plant miles two-way active. The Debtors provide

scalable, tailored broadband communications solutions to business organizations, such as

business-to-business Internet access, data networking, video and music entertainment services, and

business telephone. The Debtors also provide advertising solutions to local, national, and

regional businesses that target video customers.

The Debtors’ corporate office, which includes employees of CCI, is responsible for

coordinating and overseeing overall operations, including establishing company-wide policies and

procedures. The corporate office performs certain financial and administrative functions on a

centralized basis and performs these services on a cost reimbursement basis pursuant to a

management services agreement between CCO and CCI, which entitles CCI to payment for its

performance of various personnel, operational and financial functions. The Debtors’ field

operations are managed within two operating

groups.

The Debtors have a history of net losses. The Debtors’ net losses are principally

attributable to insufficient revenue to cover the combination of operating expenses and interest

expenses they incur because of their high amounts of debt, and depreciation expenses resulting from

the capital investments they have made and continue to make in their cable properties.

As of the Petition Date, the Debtors had approximately 16,500 employees, of which

approximately 100 employees were represented by collective bargaining agreements. For the year

ended December 31, 2008, the Debtors’ total revenues were approximately $6.5 billion. The Debtors

derive revenues largely from the monthly fees customers pay for the Debtors’ services. The prices

the Debtors charge for their products and services vary based on the level of service the customer

chooses and the geographic market. The Debtors’ corporate headquarters are located at 12405

Powerscourt Drive, St. Louis, Missouri 63131. For more information regarding the Debtors’

business, see CCI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008, filed

with the SEC on March 16, 2009.

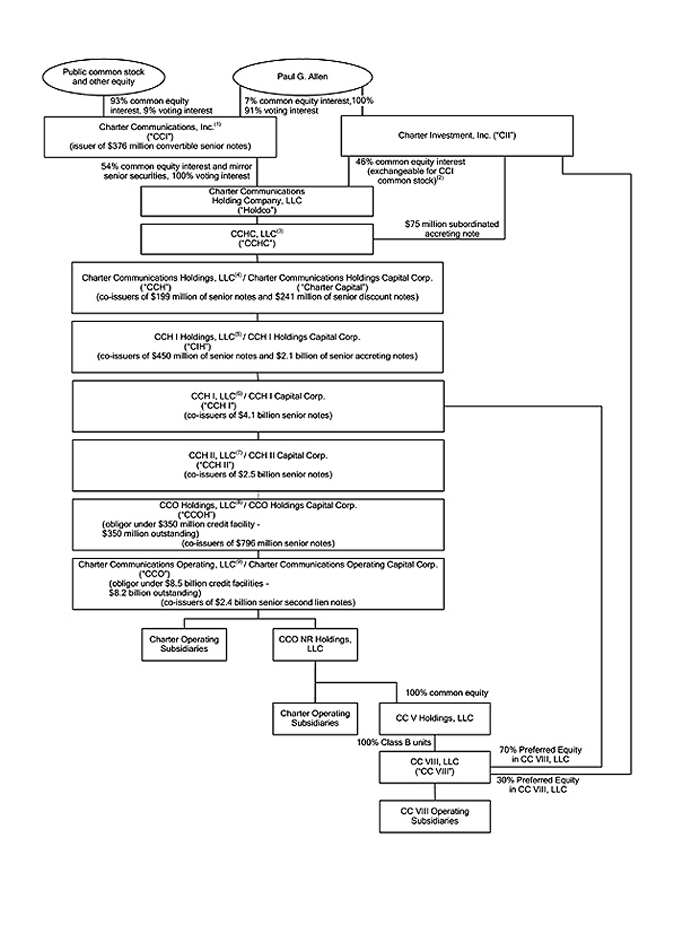

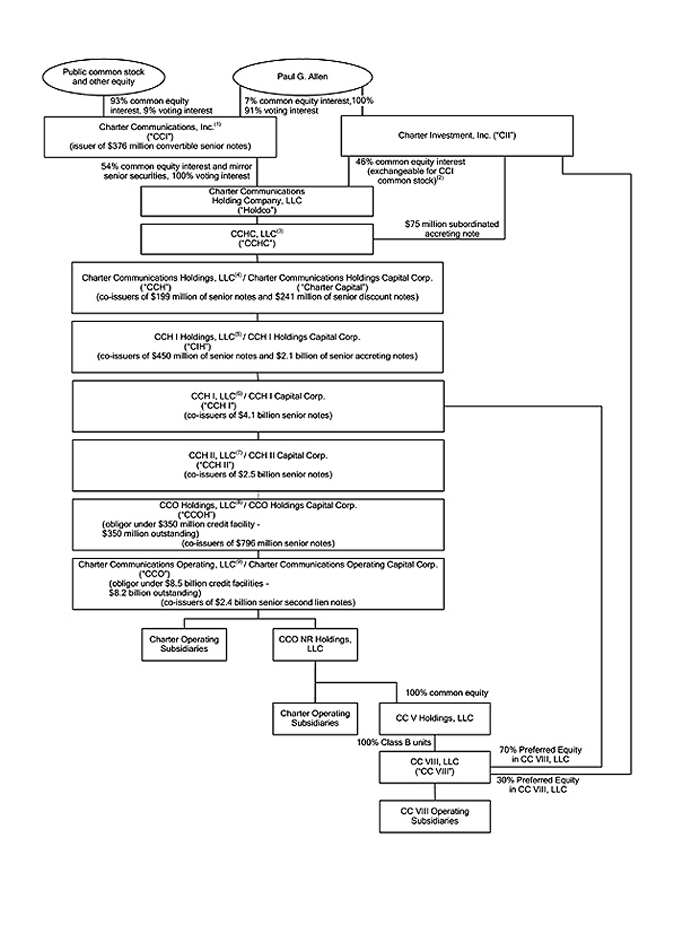

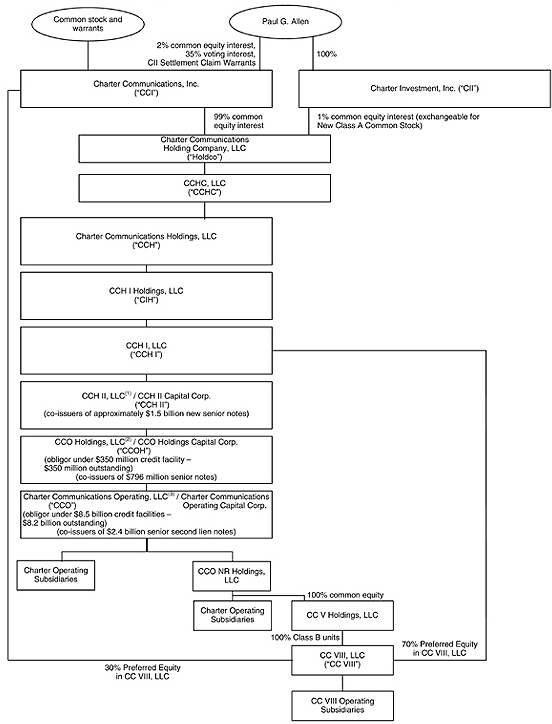

Corporate Organizational Structure

CCI is a holding company whose principal asset at February 28, 2009 is its 54% equity interest

(53% for accounting purposes) in Charter Communications Holdings Company, LLC (“Holdco”), the

direct parent of CCHC, LLC (“CCHC”). CCI is the managing member of Holdco. CCI also holds certain

indebtedness of Holdco that mirrors the terms of securities issued by CCI. CCI’s only business is

to act as the managing member of Holdco and its subsidiaries. As the managing member of Holdco,

CCI controls the affairs of Holdco and its limited liability company subsidiaries, including

Charter Communications Holdings, LLC (“CCH”).

CCH, including its direct and indirect subsidiaries CIH, CCH I, LLC (“CCH I”), CCH II, LLC

(“CCH II”), CCO Holdings, LLC (“CCOH”), and CCO, through the operating subsidiaries of CCO, operate

the Debtors’ broadband business. Charter Communications Holdings Capital Corp. (“Charter

Capital”), CCH I Holdings Capital Corp., CCH I Capital Corp., CCH II Capital Corp, CCO Holdings

Capital Corp., and Charter Communications Operating Capital Corp. are wholly-owned subsidiaries of

CCH, CIH, CCH I, CCH II, CCOH, and CCO,

14

respectively, and were formed and exist solely as

co-issuers of the debt issued with their parent companies, CCH, CIH, CCH I, CCH II, CCOH, and

CCO, respectively.

Mr. Allen owns 100% of Charter Investment, Inc. (“CII”) and controls CCI through a voting

control interest of approximately 91.1% as of February 28, 2009. In addition to directly owning

shares of CCI’s Class A common stock and Class B common stock, Mr. Allen indirectly owns, through

CII, approximately 46% of Holdco’s common equity interests and a note issued by CCHC exchangeable

into Holdco membership units. CII’s membership units in Holdco are exchangeable at any time for

shares of CCI’s Class B common stock on a one-for-one basis, which shares are in turn convertible

into CCI’s Class A common stock on a one-for-one basis. Mr. Allen would hold, directly and

indirectly, a common equity interest in CCI of approximately 52.2% on an as-exchanged basis as of

February 28, 2009. Each share of CCI Class A common stock is entitled to one vote. Through his

ownership of CCI’s Class B common stock, Mr. Allen is entitled to ten votes for each share of CCI’s