| Investor Presentation January 2026 | Nasdaq: COLL Healthier people. Stronger communities. |

| Forward-Looking Statements This presentation contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. We may, in some cases, use terms such as "predicts," "forecasts," "believes," "potential," "proposed," "continue," "estimates," "anticipates," "expects," "plans," "intends," "may," "could," "might," "should" or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Examples of forward-looking statements contained in this presentation include, among others, statements related to our full-year 2025 or 2026 financial guidance, including projected product revenue, adjusted operating expenses and adjusted EBITDA, current and future market opportunities for our products and our assumptions related thereto, expectations (financial or otherwise) and intentions, and other statements that are not historical facts. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results, performance, or achievements to differ materially from the company's current expectations, including risks relating to, among others: unknown liabilities; risks related to future opportunities and plans for our products, including uncertainty of the expected financial performance of such products; our ability to commercialize and grow sales of our products; our ability to manage our relationships with licensors; the success of competing products that are or become available; our ability to maintain regulatory approval of our products, and any related restrictions, limitations, and/or warnings in the label of our products; the size of the markets for our products, and our ability to service those markets; our ability to obtain reimbursement and third-party payor contracts for our products; the rate and degree of market acceptance of our products; the costs of commercialization activities, including marketing, sales and distribution; changing market conditions for our products; the outcome of any patent infringement or other litigation that may be brought by or against us; the outcome of any governmental investigation related to our business; our ability to secure adequate supplies of active pharmaceutical ingredient for each of our products and manufacture adequate supplies of commercially saleable inventory; our ability to obtain funding for our operations and business development; regulatory developments in the U.S.; our expectations regarding our ability to obtain and maintain sufficient intellectual property protection for our products; our ability to comply with stringent U.S. and foreign government regulation in the manufacture of pharmaceutical products, including U.S. Drug Enforcement Agency compliance; our customer concentration; and the accuracy of our estimates regarding expenses, revenue, capital requirements and need for additional financing. These and other risks are described under the heading "Risk Factors" in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q and other filings with the SEC. Any forward-looking statements that we make in this presentation speak only as of the date of this presentation. We assume no obligation to update our forward-looking statements whether as a result of new information, future events or otherwise, after the date of this presentation. Non-GAAP Financial Measures To supplement our financial results presented on a GAAP basis, we have included information about certain non-GAAP financial measures. We believe the presentation of these non-GAAP financial measures, when viewed with our results under GAAP and the accompanying reconciliations, provide analysts, investors, lenders, and other third parties with insights into how we evaluate normal operational activities, including our ability to generate cash from operations, on a comparable year-over-year basis and manage our budgeting and forecasting. In addition, certain non-GAAP financial measures, primarily Adjusted EBITDA, are used to measure performance when determining components of annual compensation for substantially all non-sales force employees, including senior management. In this presentation, we discuss the following financial measures that are not calculated in accordance with GAAP, to supplement our consolidated financial statements presented on a GAAP basis. Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that represents GAAP net income or loss adjusted to exclude interest expense, interest income, the benefit from or provision for income taxes, depreciation, amortization, stock-based compensation, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations. Adjusted EBITDA, as used by us, may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. There are several limitations related to the use of adjusted EBITDA rather than net income or loss, which is the nearest GAAP equivalent, such as: • adjusted EBITDA excludes depreciation and amortization, and, although these are non-cash expenses, the assets being depreciated or amortized may have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA; • adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs; • adjusted EBITDA does not reflect the benefit from or provision for income taxes or the cash requirements to pay taxes; • adjusted EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; • we exclude stock-based compensation expense from adjusted EBITDA although: (i) it has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy; and (ii) if we did not pay out a portion of our compensation in the form of stock-based compensation, the cash salary expense included in operating expenses would be higher, which would affect our cash position; • we exclude impairment expenses from adjusted EBITDA and, although these are non-cash expenses, the asset(s) being impaired may have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA; • we exclude restructuring expenses from adjusted EBITDA. Restructuring expenses primarily include employee severance and contract termination costs that are not related to acquisitions. The amount and/or frequency of these restructuring expenses are not part of our underlying business; • we exclude litigation settlements and contingencies that are subject to recovery from adjusted EBITDA, as well as any applicable income items, credit adjustments, or recoveries due to subsequent changes in estimates. This does not include our legal fees to defend claims, which are expensed as incurred; • we exclude acquisition related expenses as the amount and/or frequency of these expenses are not part of our underlying business. Acquisition related expenses include transaction costs, which primarily consisted of financial advisory, banking, legal, and regulatory fees, and other consulting fees, incurred to complete the acquisition, employee-related expenses (severance cost and benefits) for terminated employees after the acquisition, legal defense expenses for specific acquired claims that relate to acts that occurred prior to our acquisition, and miscellaneous other acquisition related expenses incurred; • we exclude recognition of the step-up basis in inventory from acquisitions (i.e., the adjustment to record inventory from historic cost to fair value at acquisition) as the adjustment does not reflect the ongoing expense associated with sale of our products as part of our underlying business; • we exclude losses on extinguishments of debt as these expenses are episodic in nature and do not directly correlate to the cost of operating our business on an ongoing basis; • we exclude executive transition expenses from adjusted EBITDA as the amount and/or frequency of these expenses are episodic in nature and do not directly correlate to the cost of operating our business on an ongoing basis; and • we exclude other expenses, from time to time, that are episodic in nature and do not directly correlate to the cost of operating our business on an ongoing basis. Adjusted Operating Expenses Adjusted operating expenses is a non-GAAP financial measure that represents GAAP operating expenses adjusted to exclude stock-based compensation expense, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations. Adjusted Net Income and Adjusted Earnings Per Share Adjusted net income is a non-GAAP financial measure that represents GAAP net income or loss adjusted to exclude significant income and expense items that are non-cash or not indicative of ongoing operations, including consideration of the tax effect of the adjustments. Adjusted earnings per share is a non-GAAP financial measure that represents adjusted net income per share. Adjusted weighted-average shares - diluted is calculated in accordance with the treasury stock, if-converted, or contingently issuable accounting methods, depending on the nature of the security. Reconciliations of adjusted EBITDA and adjusted operating expenses to the most directly comparable GAAP financial measures are included in this presentation. The Company has not provided a reconciliation of its full-year 2025 or 2026 guidance for adjusted EBITDA or adjusted operating expenses to the most directly comparable forward-looking GAAP measures, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K, because the Company is unable to predict, without unreasonable efforts, the timing and amount of items that would be included in such a reconciliation, including, but not limited to, stock-based compensation expense, acquisition related expense and litigation settlements. These items are uncertain and depend on various factors that are outside of the Company’s control or cannot be reasonably predicted. While the Company is unable to address the probable significance of these items, they could have a material impact on GAAP net income and operating expenses for the guidance period. A reconciliation of adjusted EBITDA or adjusted operating expenses would imply a degree of precision and certainty as to these future items that does not exist and could be confusing to investors. |

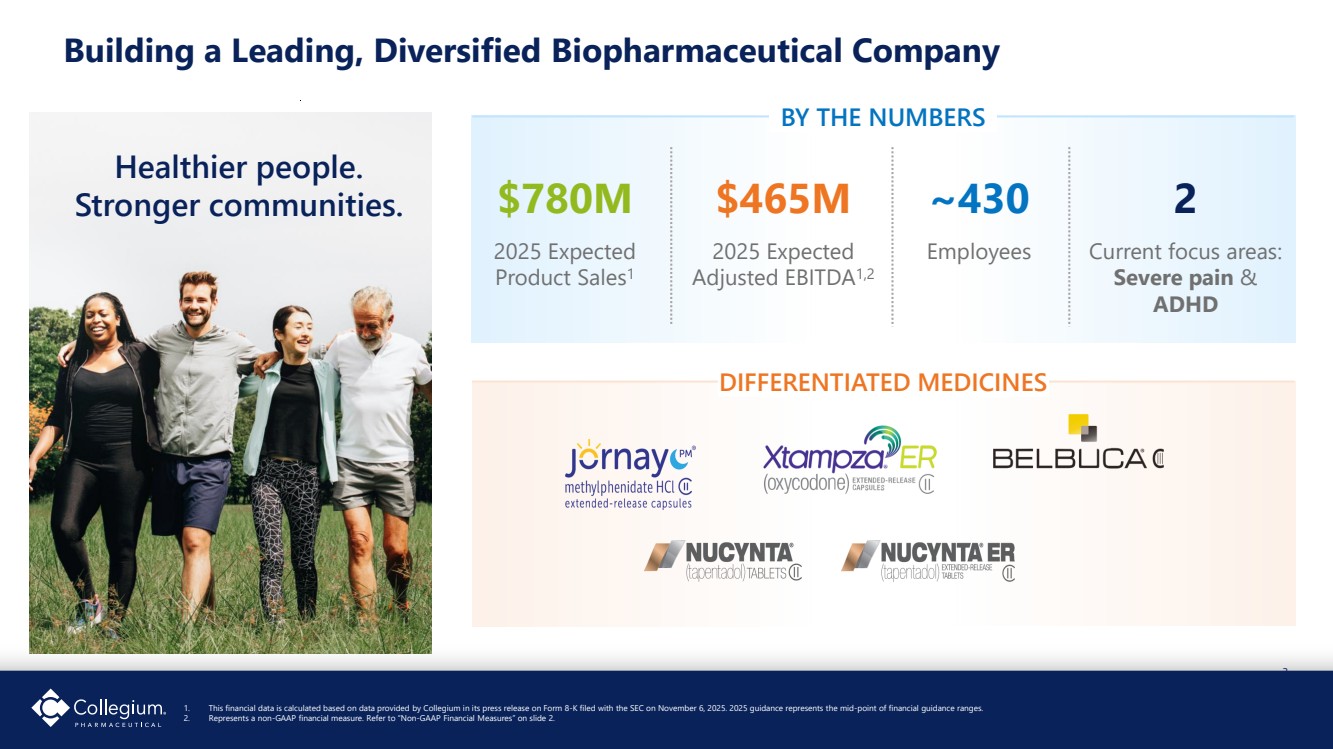

| 3 Building a Leading, Diversified Biopharmaceutical Company 1. This financial data is calculated based on data provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025. 2025 guidance represents the mid-point of financial guidance ranges. 2. Represents a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” on slide 2. Healthier people. Stronger communities. DIFFERENTIATED MEDICINES $465M 2025 Expected Adjusted EBITDA1,2 $780M 2025 Expected Product Sales1 ~430 Employees 2 Current focus areas: Severe pain & ADHD BY THE NUMBERS |

| Committed to Making a Positive Difference for Patients and the Communities We Serve 4 Delivering differentiated medicines that uniquely serve patient unmet need Keeping Patients at the Center of Everything We Do Leading with science Operating with integrity Investing in our people Investing in Our People and Communities Fostering an engaging, collaborative, and respectful corporate culture Doing Good as We Do Well 4 |

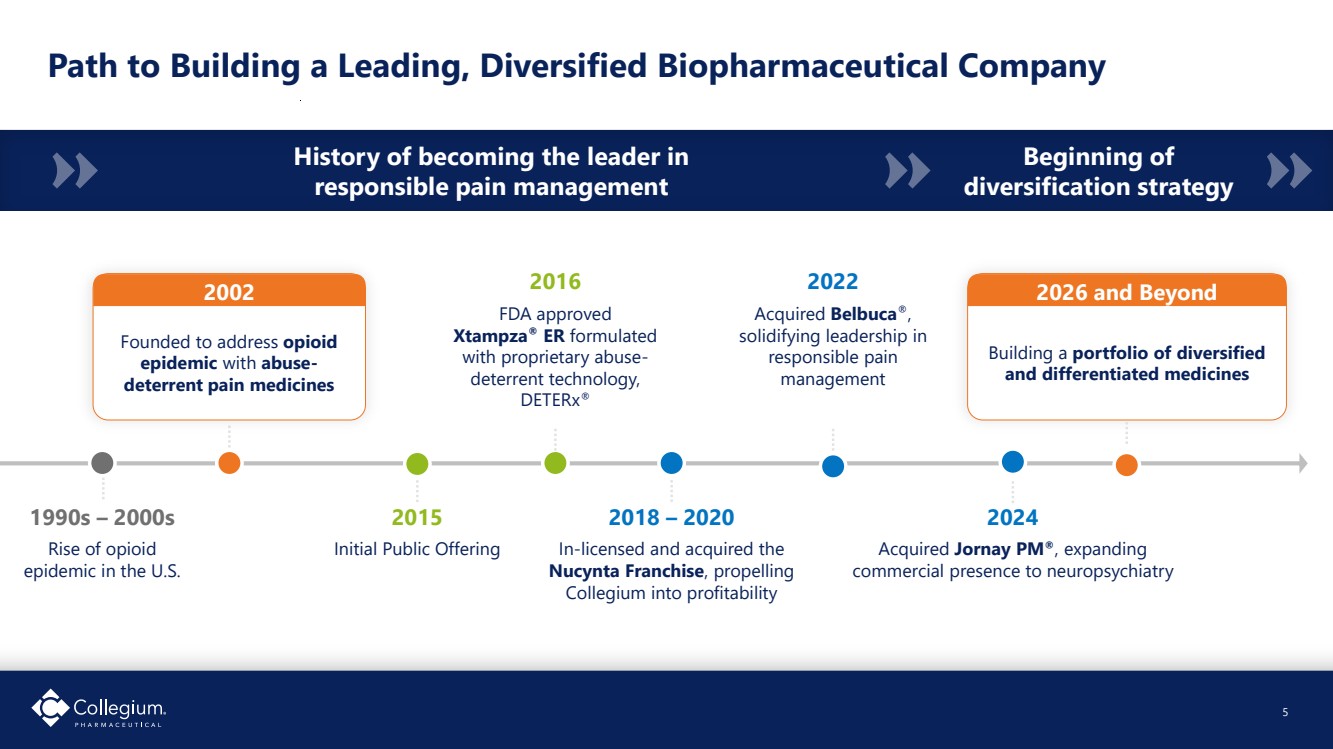

| Building a portfolio of diversified and differentiated medicines Path to Building a Leading, Diversified Biopharmaceutical Company 5 1990s – 2000s Rise of opioid epidemic in the U.S. 2016 FDA approved Xtampza® ER formulated with proprietary abuse-deterrent technology, DETERx® 2018 – 2020 In-licensed and acquired the Nucynta Franchise, propelling Collegium into profitability 2022 Acquired Belbuca®, solidifying leadership in responsible pain management 2024 Acquired Jornay PM®, expanding commercial presence to neuropsychiatry 2015 Initial Public Offering 2026 and Beyond Founded to address opioid epidemic with abuse-deterrent pain medicines 2002 History of becoming the leader in responsible pain management Beginning of diversification strategy |

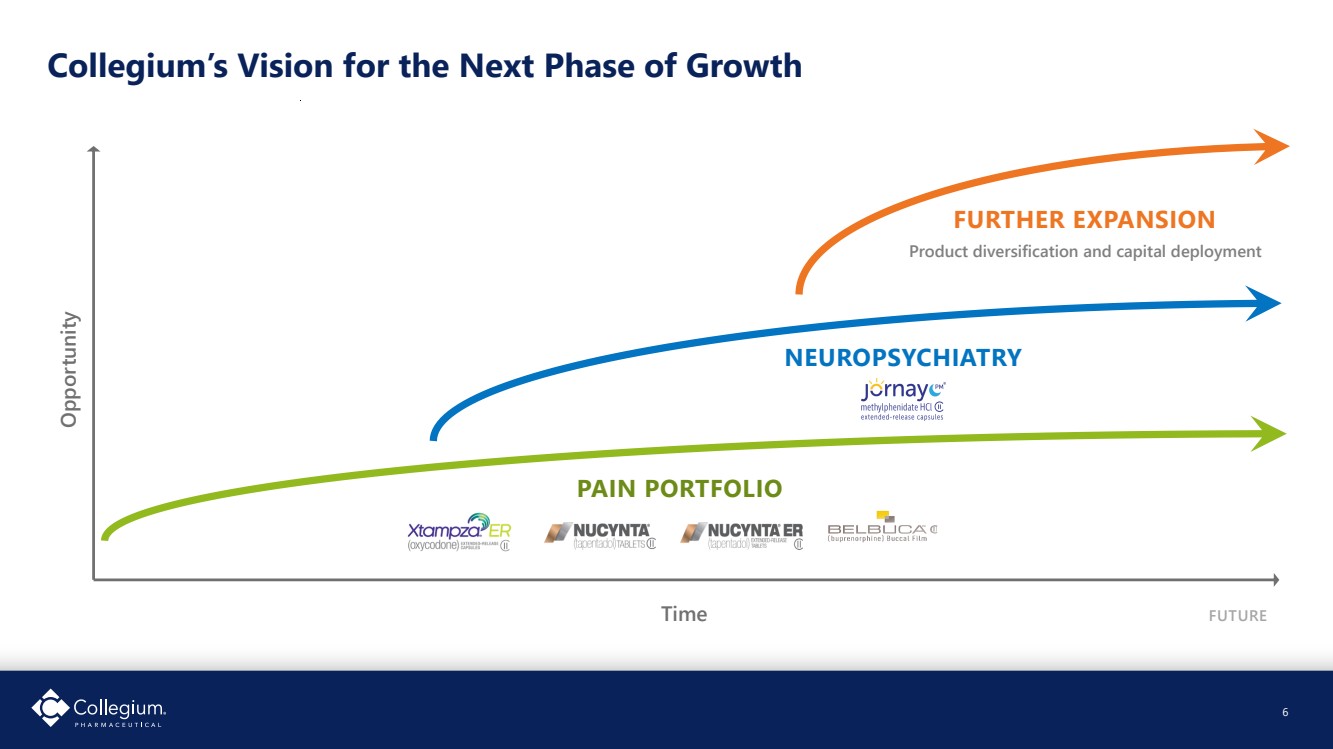

| Collegium’s Vision for the Next Phase of Growth 6 Time Opportunity FUTURE FURTHER EXPANSION Product diversification and capital deployment NEUROPSYCHIATRY PAIN PORTFOLIO FUTURE |

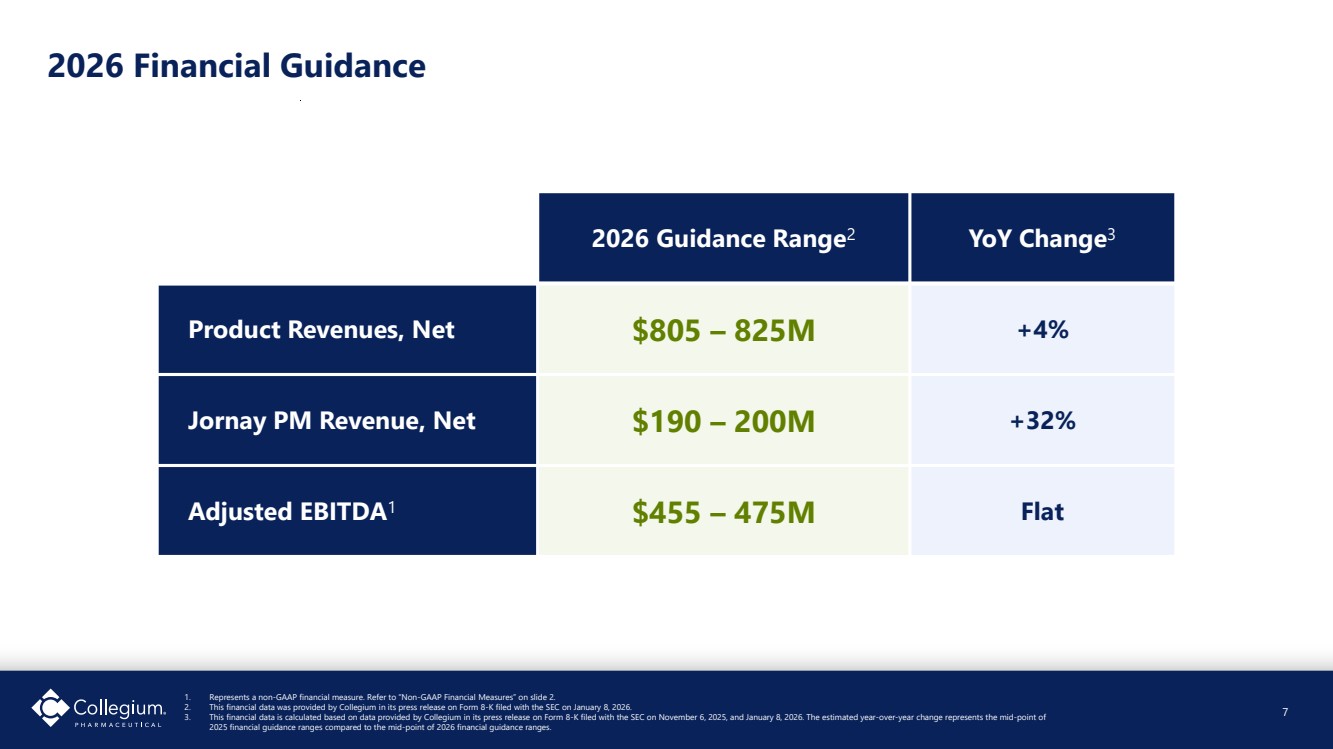

| 2026 Guidance Range2 YoY Change3 Product Revenues, Net $805 – 825M +4% Jornay PM Revenue, Net $190 – 200M +32% Adjusted EBITDA1 $455 – 475M Flat 2026 Financial Guidance 7 1. Represents a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” on slide 2. 2. This financial data was provided by Collegium in its press release on Form 8-K filed with the SEC on January 8, 2026. 3. This financial data is calculated based on data provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025, and January 8, 2026. The estimated year-over-year change represents the mid-point of 2025 financial guidance ranges compared to the mid-point of 2026 financial guidance ranges. |

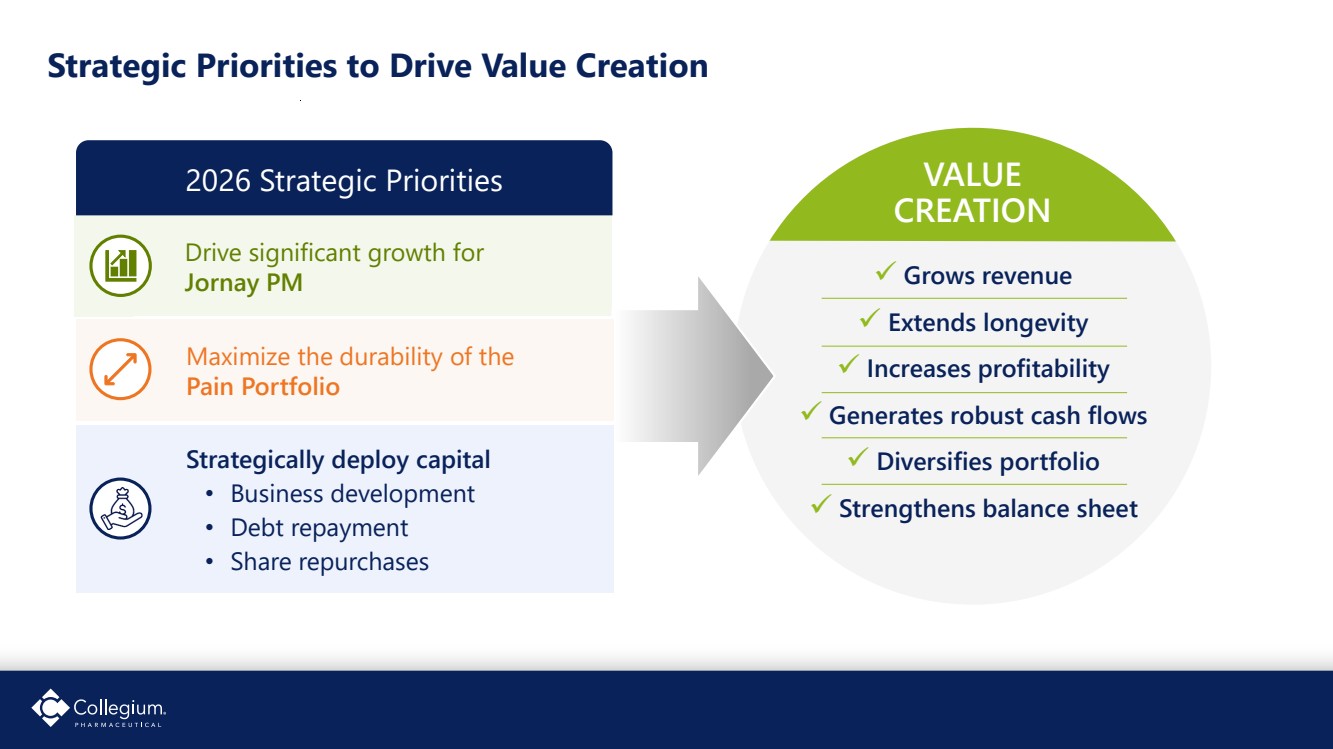

| Drive significant growth for Jornay PM 8 Strategic Priorities to Drive Value Creation ✓ Grows revenue ✓ Extends longevity ✓ Increases profitability ✓ Generates robust cash flows ✓ Diversifies portfolio ✓ Strengthens balance sheet VALUE CREATION 2026 Strategic Priorities Maximize the durability of the Pain Portfolio Strategically deploy capital • Business development • Debt repayment • Share repurchases |

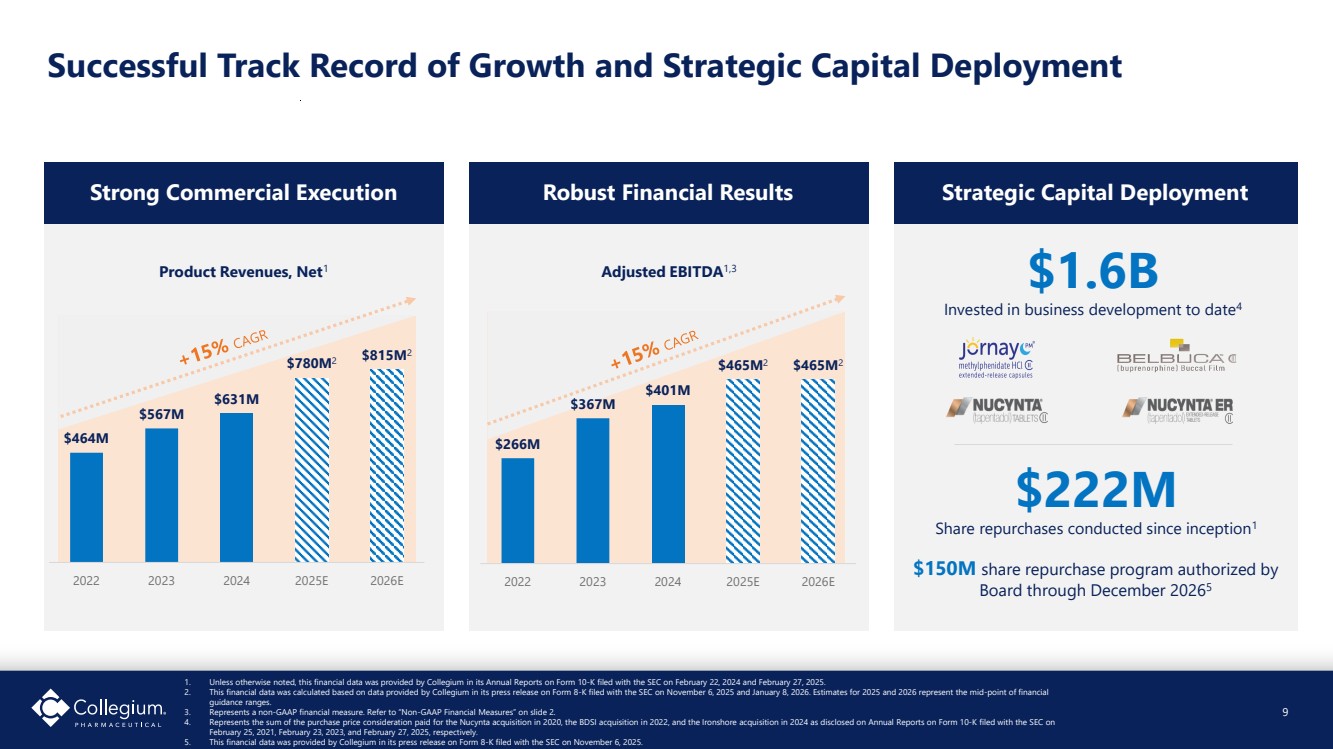

| Successful Track Record of Growth and Strategic Capital Deployment Strong Commercial Execution Robust Financial Results Strategic Capital Deployment $1.6B Invested in business development to date4 1. Unless otherwise noted, this financial data was provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. 2. This financial data was calculated based on data provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025 and January 8, 2026. Estimates for 2025 and 2026 represent the mid-point of financial guidance ranges. 3. Represents a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” on slide 2. 4. Represents the sum of the purchase price consideration paid for the Nucynta acquisition in 2020, the BDSI acquisition in 2022, and the Ironshore acquisition in 2024 as disclosed on Annual Reports on Form 10-K filed with the SEC on February 25, 2021, February 23, 2023, and February 27, 2025, respectively. 5. This financial data was provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025. $222M Share repurchases conducted since inception1 $150M share repurchase program authorized by Board through December 20265 9 Adjusted EBITDA1,3 $464M $567M $631M $780M2 $815M2 2022 2023 2024 2025E 2026E $266M $367M $401M $465M2 $465M2 2022 2023 2024 2025E 2026E Product Revenues, Net1 |

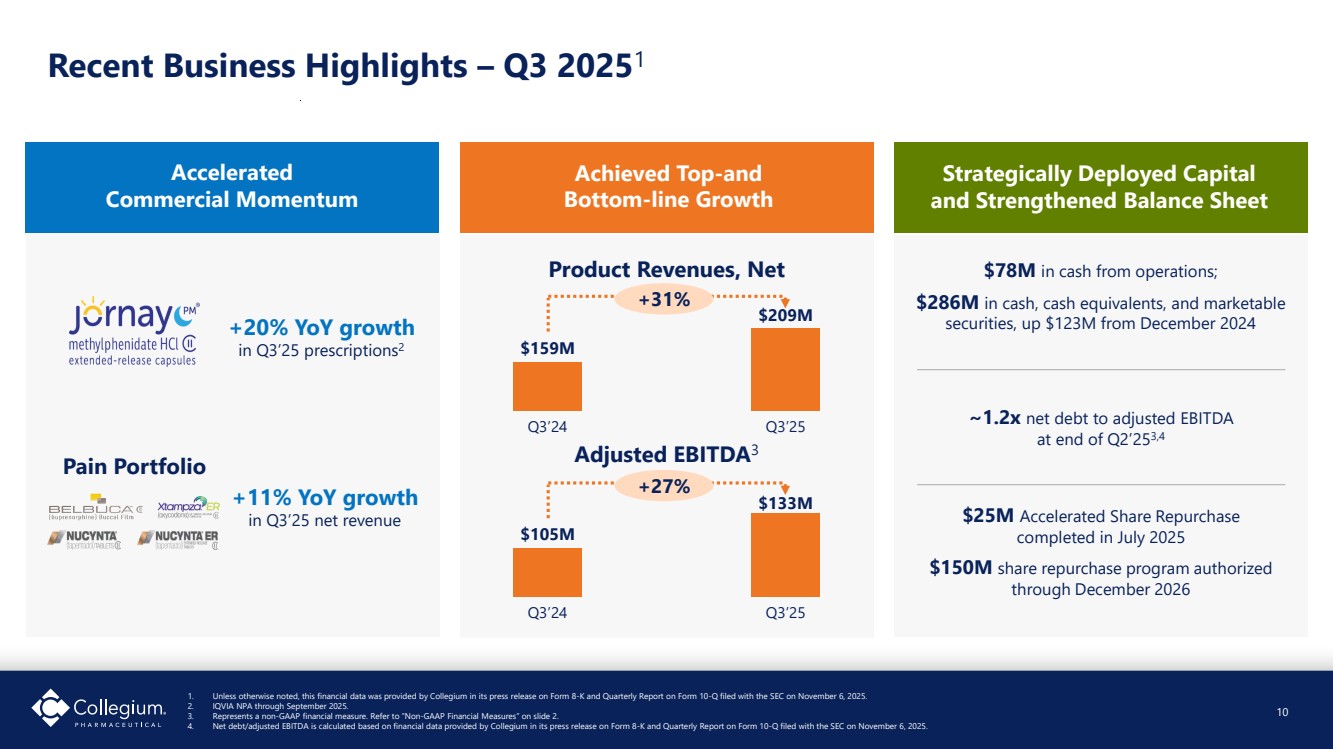

| Recent Business Highlights – Q3 20251 1. Unless otherwise noted, this financial data was provided by Collegium in its press release on Form 8-K and Quarterly Report on Form 10-Q filed with the SEC on November 6, 2025. 2. IQVIA NPA through September 2025. 3. Represents a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” on slide 2. 4. Net debt/adjusted EBITDA is calculated based on financial data provided by Collegium in its press release on Form 8-K and Quarterly Report on Form 10-Q filed with the SEC on November 6, 2025. Accelerated Commercial Momentum +20% YoY growth in Q3’25 prescriptions2 +11% YoY growth in Q3’25 net revenue Pain Portfolio Strategically Deployed Capital and Strengthened Balance Sheet $78M in cash from operations; $286M in cash, cash equivalents, and marketable securities, up $123M from December 2024 ~1.2x net debt to adjusted EBITDA at end of Q2’253,4 $25M Accelerated Share Repurchase completed in July 2025 $150M share repurchase program authorized through December 2026 10 Achieved Top-and Bottom-line Growth Product Revenues, Net $159M Q3’24 $209M Q3’25 $105M Q3’24 $133M Q3’25 +31% +27% Adjusted EBITDA3 |

| Driving Significant Growth in Jornay PM |

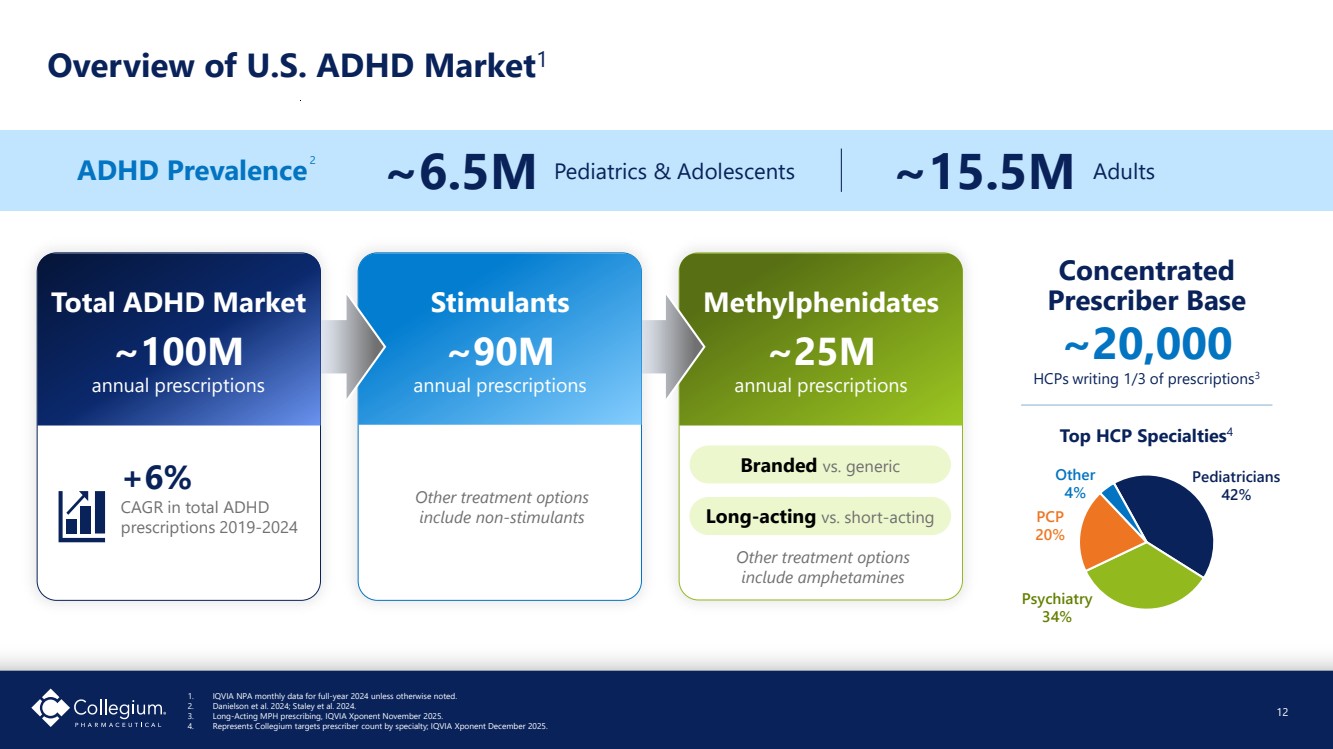

| Methylphenidates ~25M annual prescriptions Long-acting vs. short-acting Branded vs. generic Stimulants ~90M annual prescriptions Overview of U.S. ADHD Market1 12 Total ADHD Market ~100M annual prescriptions +6% CAGR in total ADHD prescriptions 2019-2024 Other treatment options include non-stimulants ~20,000 HCPs writing 1/3 of prescriptions3 Concentrated Prescriber Base 2 Pediatricians 42% Psychiatry 34% PCP 20% Other 4% Top HCP Specialties4 Other treatment options include amphetamines ADHD Prevalence ~6.5M Pediatrics & Adolescents ~15.5M Adults 1. IQVIA NPA monthly data for full-year 2024 unless otherwise noted. 2. Danielson et al. 2024; Staley et al. 2024. 3. Long-Acting MPH prescribing, IQVIA Xponent November 2025. 4. Represents Collegium targets prescriber count by specialty; IQVIA Xponent December 2025. |

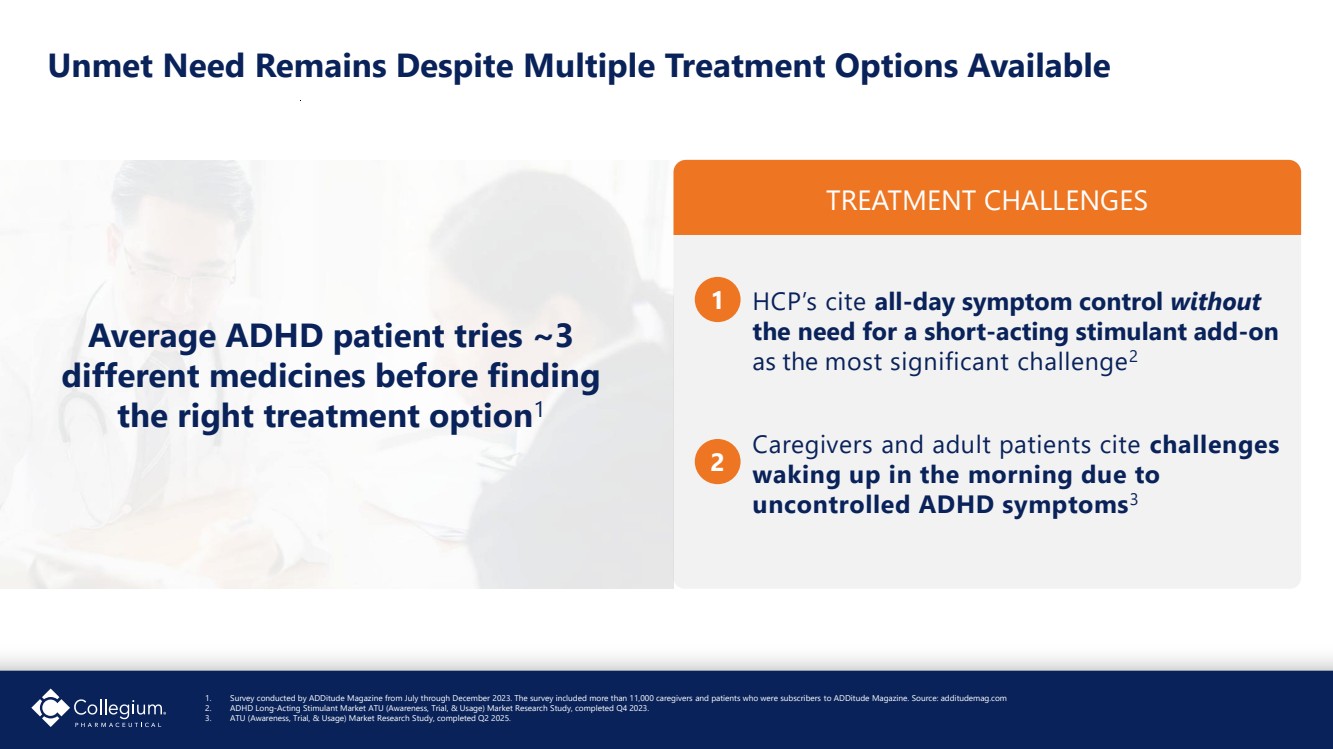

| Unmet Need Remains Despite Multiple Treatment Options Available HCP’s cite all-day symptom control without the need for a short-acting stimulant add-on as the most significant challenge2 Caregivers and adult patients cite challenges waking up in the morning due to uncontrolled ADHD symptoms3 TREATMENT CHALLENGES 1 2 1. Survey conducted by ADDitude Magazine from July through December 2023. The survey included more than 11,000 caregivers and patients who were subscribers to ADDitude Magazine. Source: additudemag.com 2. ADHD Long-Acting Stimulant Market ATU (Awareness, Trial, & Usage) Market Research Study, completed Q4 2023. 3. ATU (Awareness, Trial, & Usage) Market Research Study, completed Q2 2025. Average ADHD patient tries ~3 different medicines before finding the right treatment option1 |

| 14 Highly Differentiated Medicine in the ADHD Market • Highly differentiated central nervous system (CNS) stimulant prescription medicine for the treatment of ADHD in people six years of age and older in the U.S. • Only stimulant ADHD medication with once-daily evening dosing that provides symptom control upon awakening, eliminating need to dose in the morning and wait for onset of action • Smooth symptom control throughout the day, which may eliminate the need for short-acting stimulant add-ons • Slow absorption in colon, providing smooth onset and offset of effect |

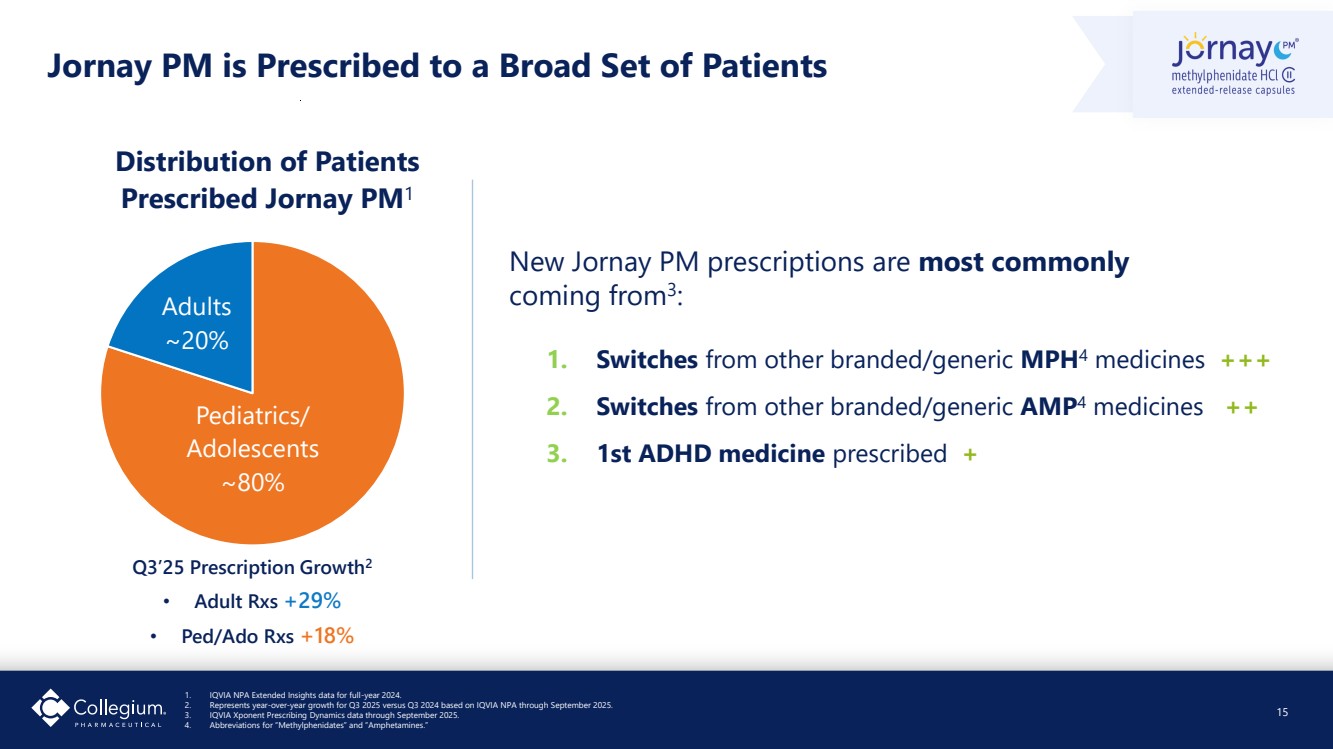

| Pediatrics/ Adolescents ~80% Adults ~20% Distribution of Patients Prescribed Jornay PM1 New Jornay PM prescriptions are most commonly coming from3 : 1. Switches from other branded/generic MPH4 medicines +++ 2. Switches from other branded/generic AMP4 medicines ++ 3. 1st ADHD medicine prescribed + Jornay PM is Prescribed to a Broad Set of Patients 15 1. IQVIA NPA Extended Insights data for full-year 2024. 2. Represents year-over-year growth for Q3 2025 versus Q3 2024 based on IQVIA NPA through September 2025. 3. IQVIA Xponent Prescribing Dynamics data through September 2025. 4. Abbreviations for “Methylphenidates” and “Amphetamines.” Q3’25 Prescription Growth2 • Adult Rxs +29% • Ped/Ado Rxs +18% |

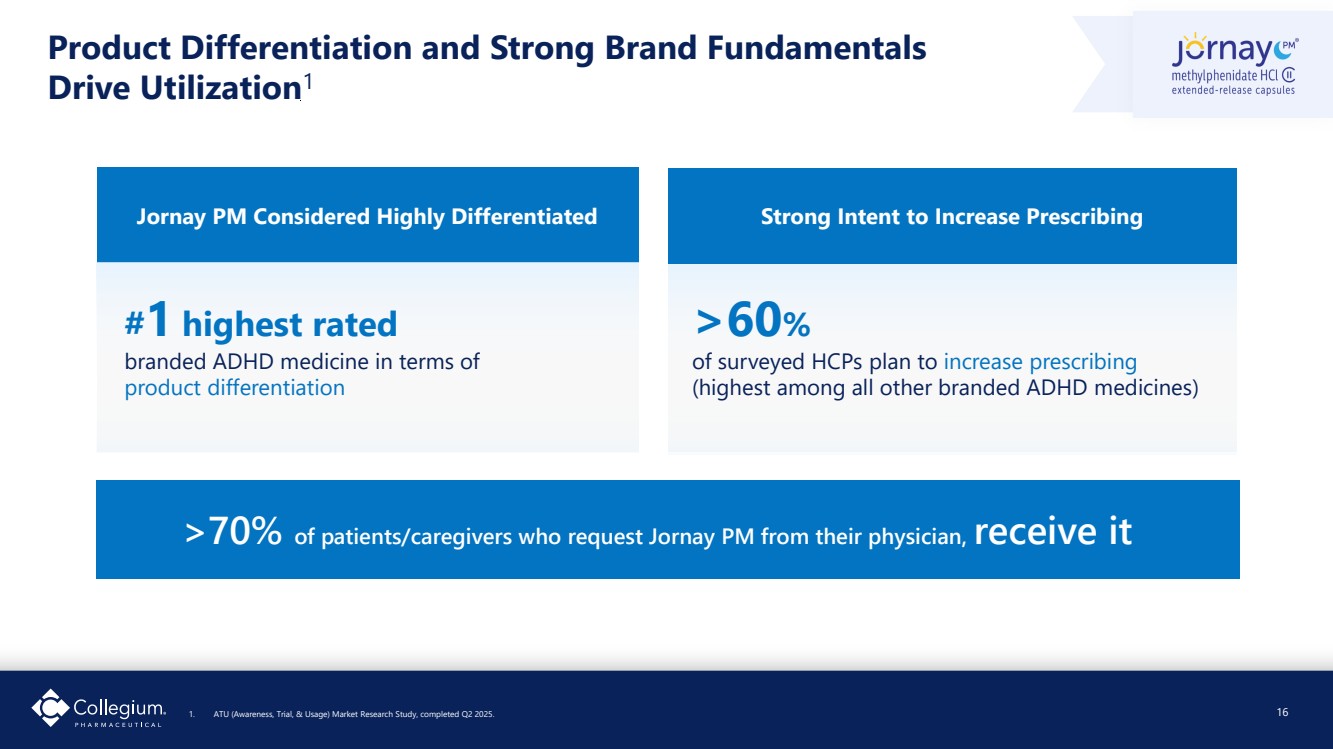

| Product Differentiation and Strong Brand Fundamentals Drive Utilization1 1. ATU (Awareness, Trial, & Usage) Market Research Study, completed Q2 2025. 16 Jornay PM Considered Highly Differentiated Strong Intent to Increase Prescribing #1 highest rated branded ADHD medicine in terms of product differentiation >60% of surveyed HCPs plan to increase prescribing (highest among all other branded ADHD medicines) >70% of patients/caregivers who request Jornay PM from their physician, receive it |

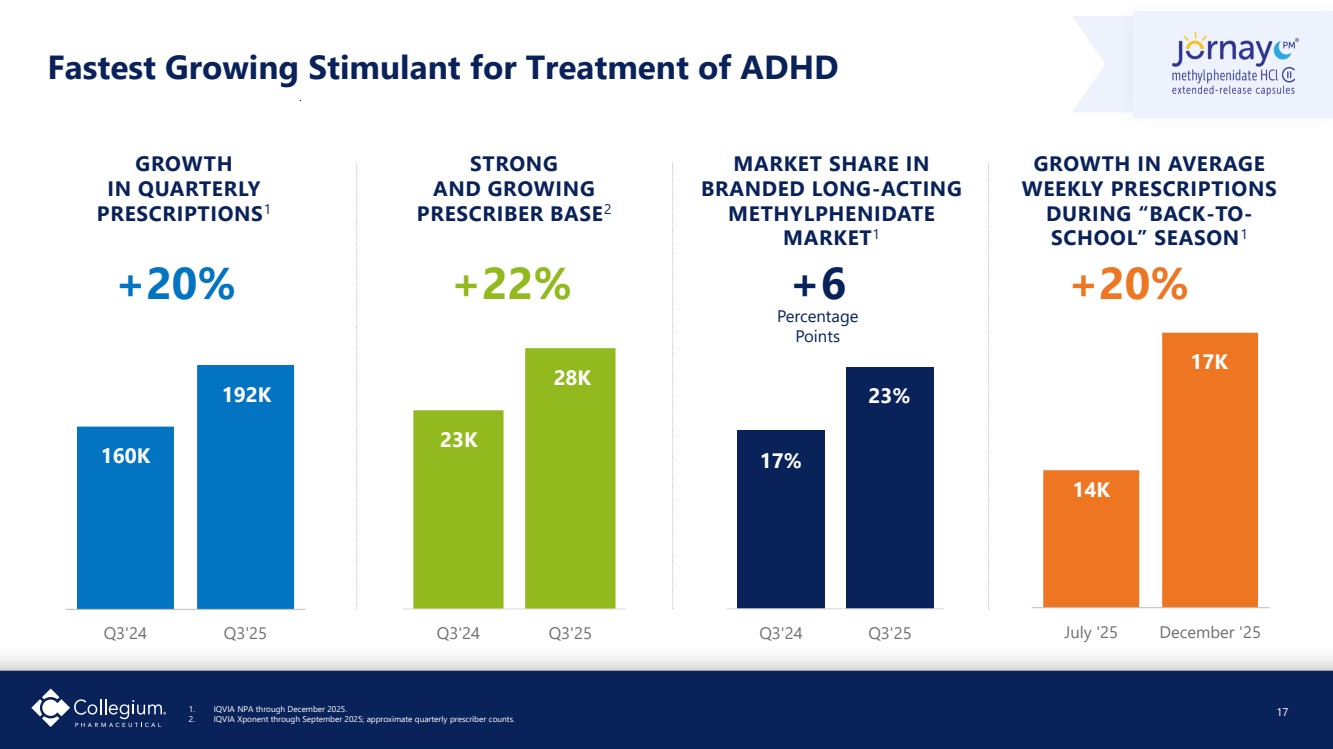

| Q3'24 Q3'25 Q3'24 Q3'25 Fastest Growing Stimulant for Treatment of ADHD 17 STRONG AND GROWING PRESCRIBER BASE2 GROWTH IN QUARTERLY PRESCRIPTIONS1 MARKET SHARE IN BRANDED LONG-ACTING METHYLPHENIDATE MARKET1 Q3'24 Q3'25 +20% +22% GROWTH IN AVERAGE WEEKLY PRESCRIPTIONS DURING “BACK-TO-SCHOOL” SEASON1 July '25 December '25 +20% 160K 192K 23K 28K 17% 23% 14K 17K +6 Percentage Points 1. IQVIA NPA through December 2025. 2. IQVIA Xponent through September 2025; approximate quarterly prescriber counts. |

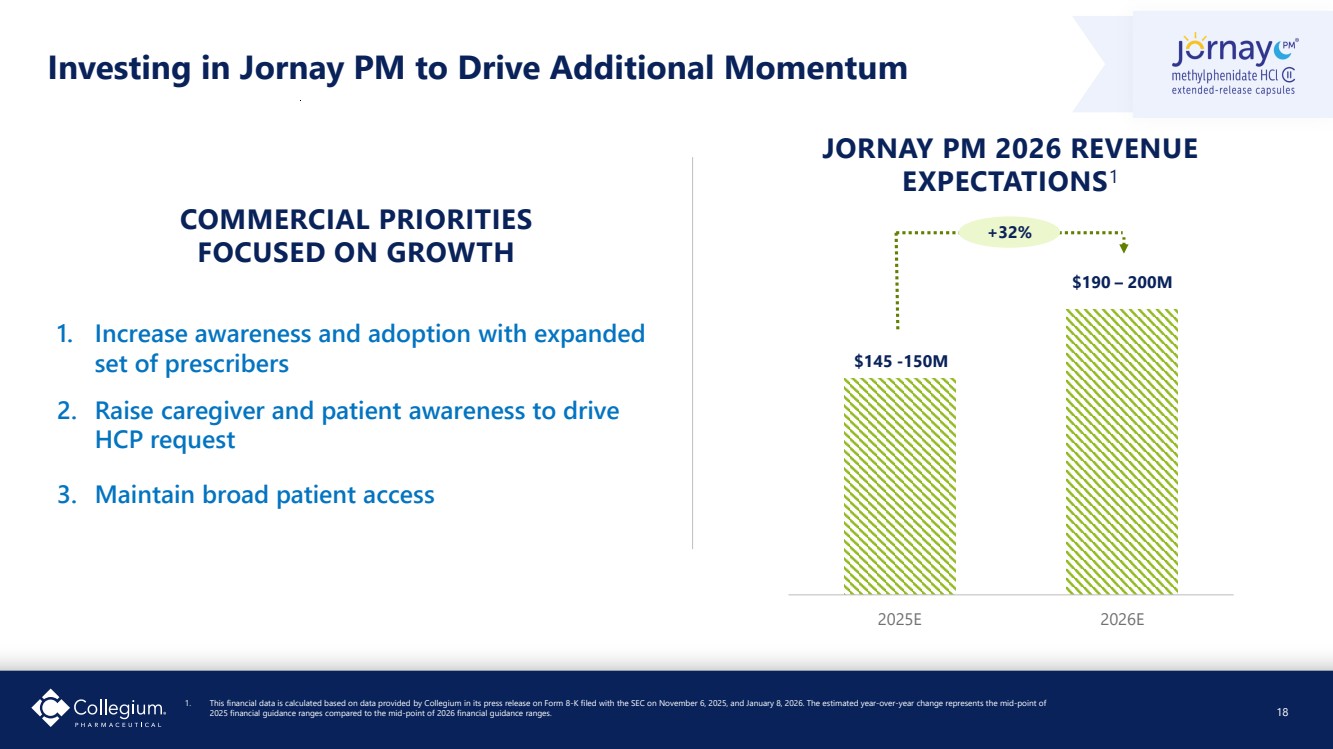

| Investing in Jornay PM to Drive Additional Momentum 18 1. Increase awareness and adoption with expanded set of prescribers 2. Raise caregiver and patient awareness to drive HCP request 3. Maintain broad patient access $145 -150M $190 – 200M 2025E 2026E JORNAY PM 2026 REVENUE EXPECTATIONS1 COMMERCIAL PRIORITIES FOCUSED ON GROWTH +32% 1. This financial data is calculated based on data provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025, and January 8, 2026. The estimated year-over-year change represents the mid-point of 2025 financial guidance ranges compared to the mid-point of 2026 financial guidance ranges. |

| Maximizing the Durability of the Pain Portfolio |

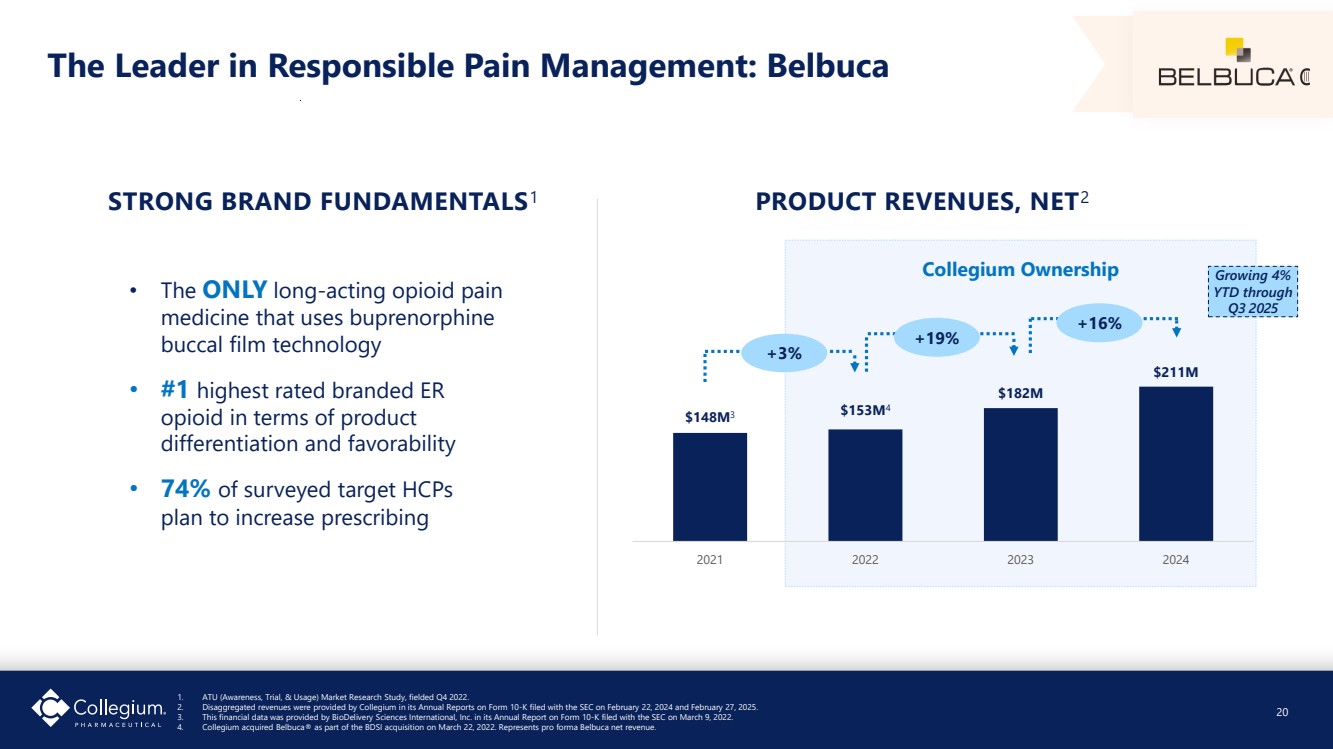

| The Leader in Responsible Pain Management: Belbuca • The ONLY long-acting opioid pain medicine that uses buprenorphine buccal film technology • #1 highest rated branded ER opioid in terms of product differentiation and favorability • 74% of surveyed target HCPs plan to increase prescribing STRONG BRAND FUNDAMENTALS1 $148M3 $153M4 $182M $211M 2021 2022 2023 2024 PRODUCT REVENUES, NET2 +16% +19% +3% Collegium Ownership 1. ATU (Awareness, Trial, & Usage) Market Research Study, fielded Q4 2022. 2. Disaggregated revenues were provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. 3. This financial data was provided by BioDelivery Sciences International, Inc. in its Annual Report on Form 10-K filed with the SEC on March 9, 2022. 4. Collegium acquired Belbuca® as part of the BDSI acquisition on March 22, 2022. Represents pro forma Belbuca net revenue. 20 Growing 4% YTD through Q3 2025 |

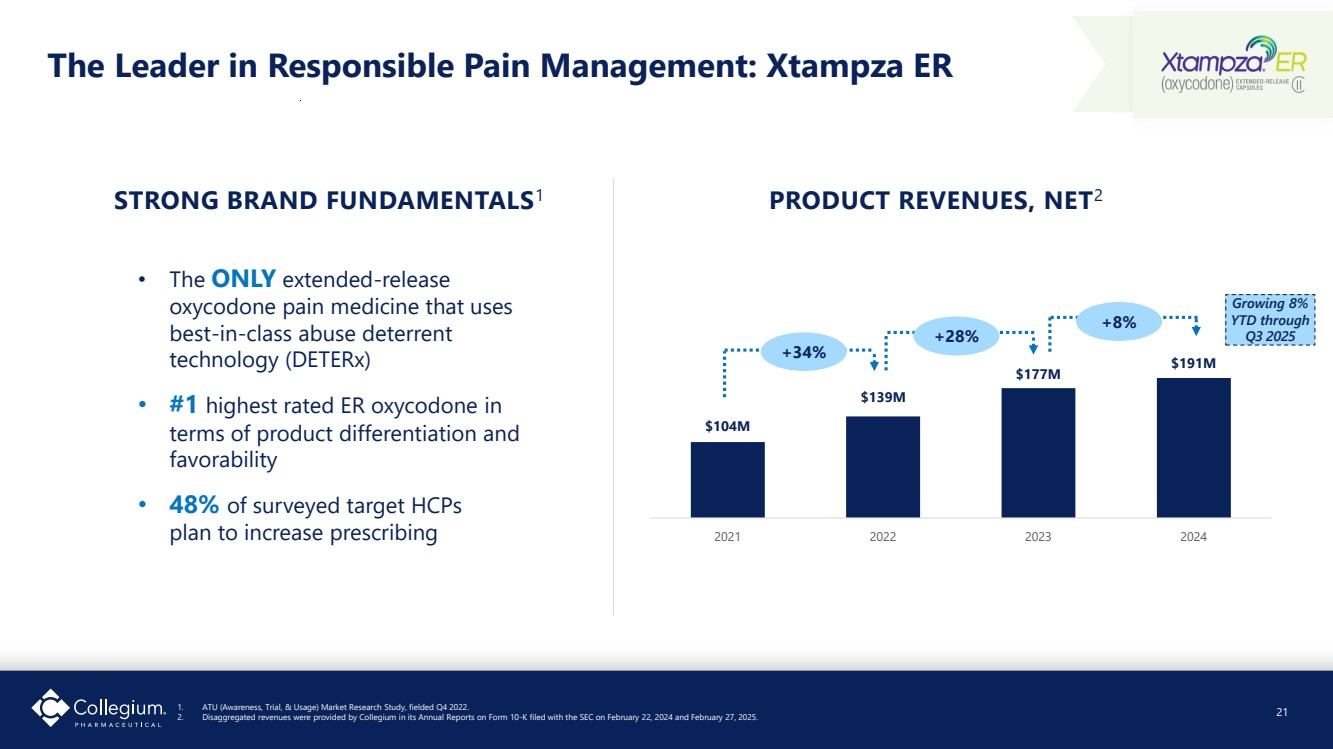

| The Leader in Responsible Pain Management: Xtampza ER • The ONLY extended-release oxycodone pain medicine that uses best-in-class abuse deterrent technology (DETERx) • #1 highest rated ER oxycodone in terms of product differentiation and favorability • 48% of surveyed target HCPs plan to increase prescribing STRONG BRAND FUNDAMENTALS1 $104M $139M $177M $191M 2021 2022 2023 2024 PRODUCT REVENUES, NET2 +8% +28% +34% 21 1. ATU (Awareness, Trial, & Usage) Market Research Study, fielded Q4 2022. 2. Disaggregated revenues were provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. Growing 8% YTD through Q3 2025 |

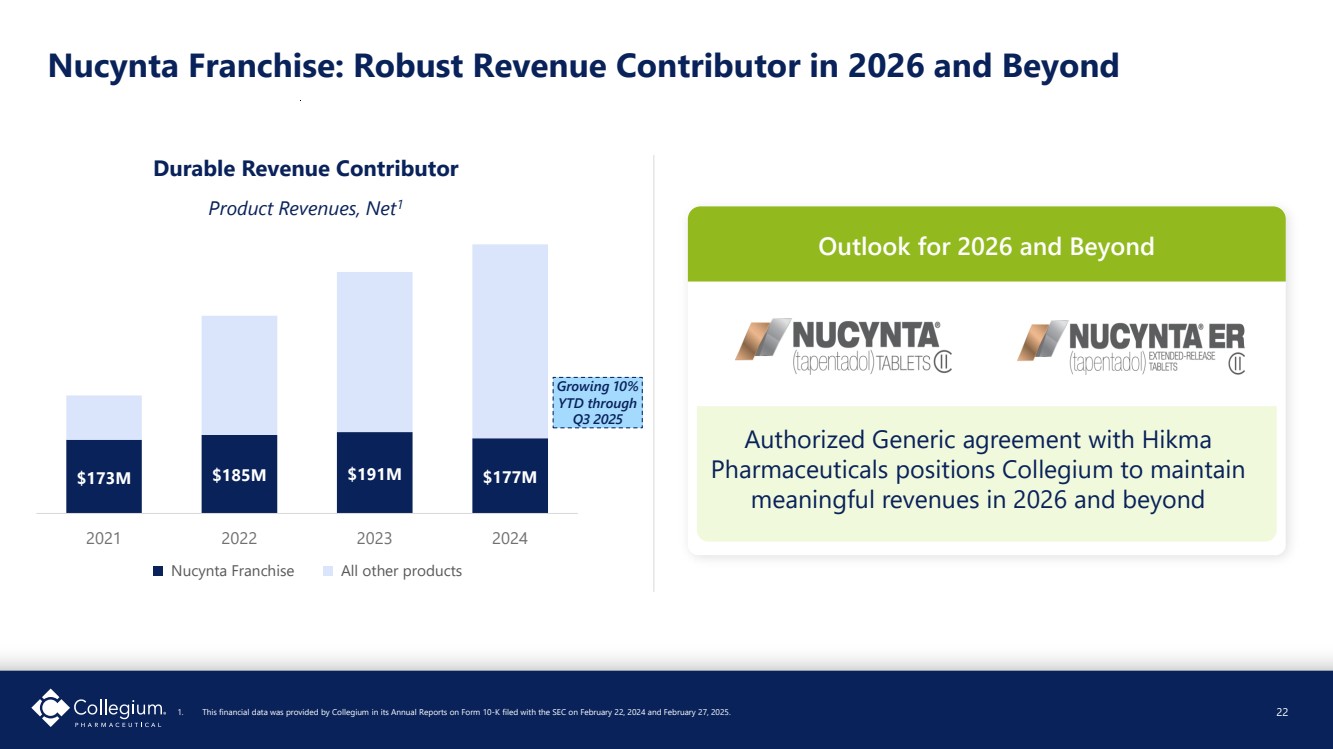

| $173M $185M $191M $177M 2021 2022 2023 2024 Product Revenues, Net1 Nucynta Franchise All other products Nucynta Franchise: Robust Revenue Contributor in 2026 and Beyond Durable Revenue Contributor 1. This financial data was provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. 22 Outlook for 2026 and Beyond Authorized Generic agreement with Hikma Pharmaceuticals positions Collegium to maintain meaningful revenues in 2026 and beyond Growing 10% YTD through Q3 2025 |

| Strategically Deploying Capital and Creating Shareholder Value |

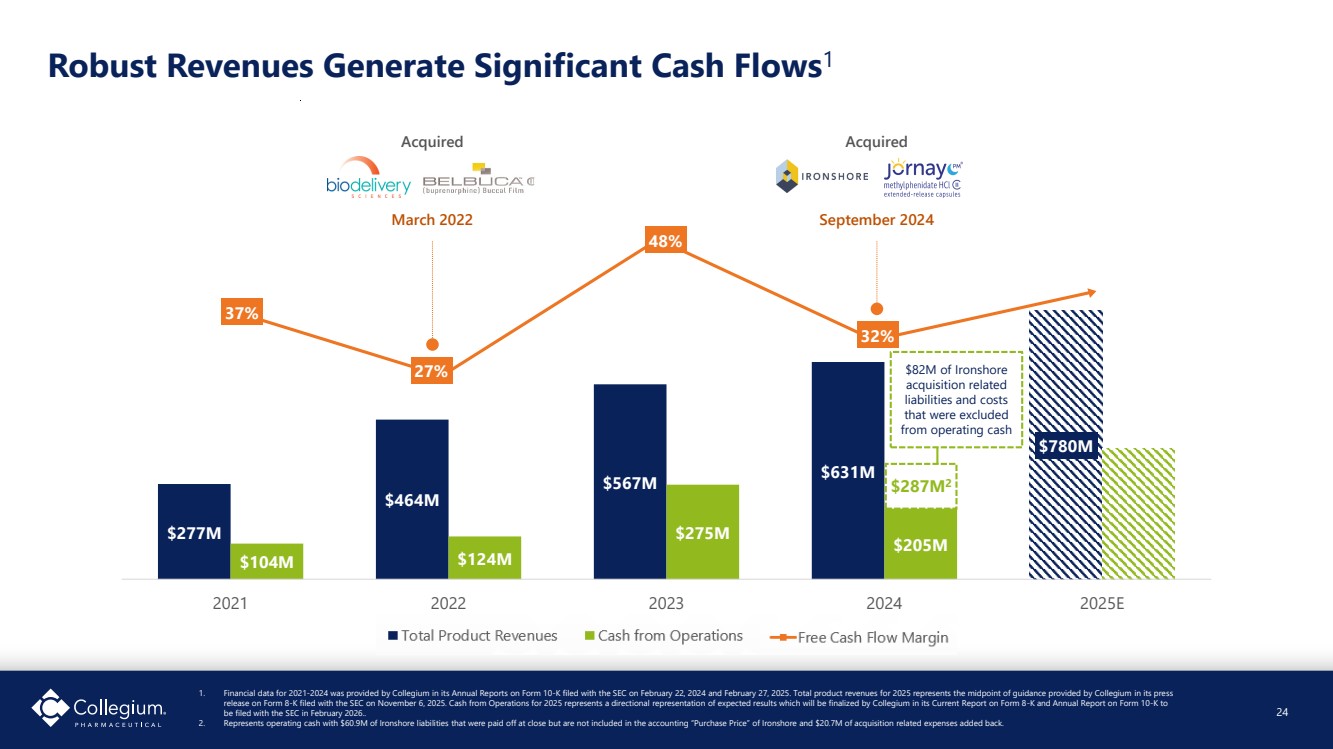

| $277M $464M $567M $631M $780M $104M $124M $275M $205M 2021 2022 2023 2024 2025E 37% 27% 48% 32% Robust Revenues Generate Significant Cash Flows1 $82M of Ironshore acquisition related liabilities and costs that were excluded from operating cash $287M2 Acquired March 2022 Acquired September 2024 24 1. Financial data for 2021-2024 was provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. Total product revenues for 2025 represents the midpoint of guidance provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025. Cash from Operations for 2025 represents a directional representation of expected results which will be finalized by Collegium in its Current Report on Form 8-K and Annual Report on Form 10-K to be filed with the SEC in February 2026.. 2. Represents operating cash with $60.9M of Ironshore liabilities that were paid off at close but are not included in the accounting “Purchase Price” of Ironshore and $20.7M of acquisition related expenses added back. |

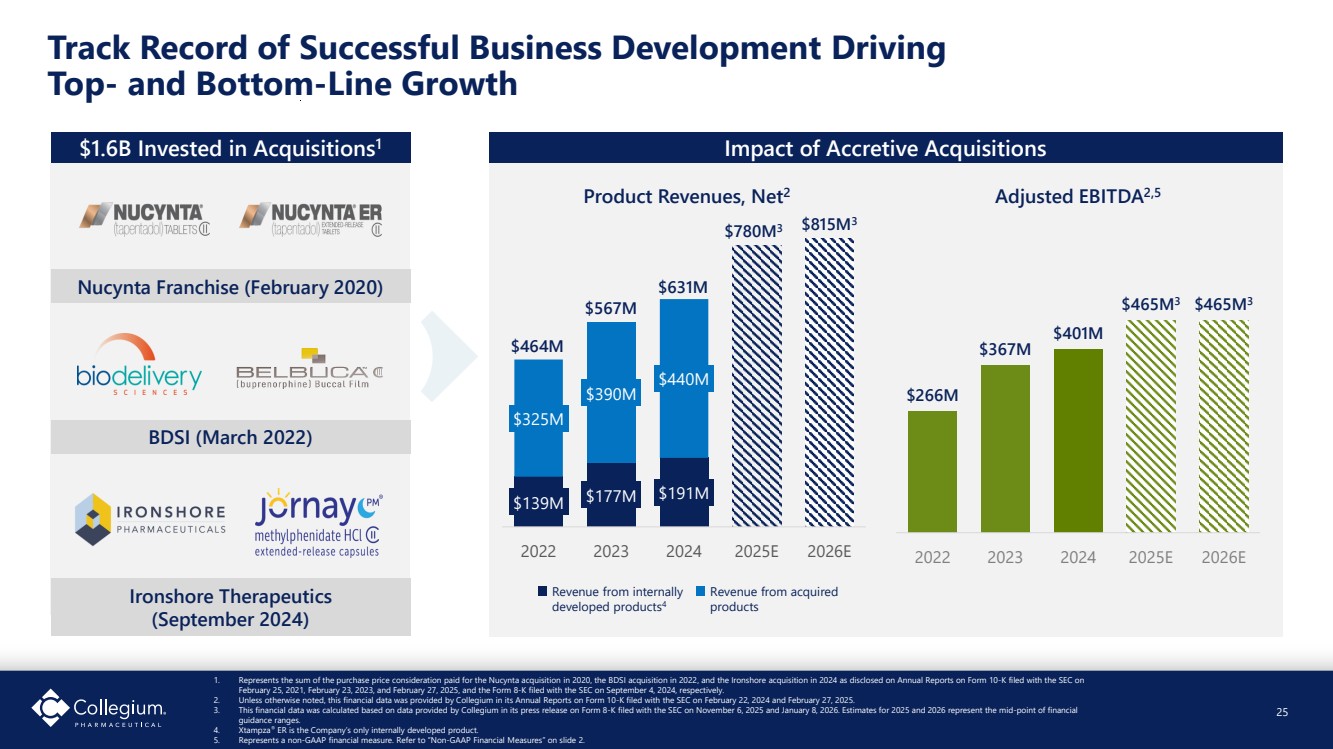

| $139M $177M $191M $325M $390M $440M 2022 2023 2024 2025E 2026E Track Record of Successful Business Development Driving Top- and Bottom-Line Growth 1. Represents the sum of the purchase price consideration paid for the Nucynta acquisition in 2020, the BDSI acquisition in 2022, and the Ironshore acquisition in 2024 as disclosed on Annual Reports on Form 10-K filed with the SEC on February 25, 2021, February 23, 2023, and February 27, 2025, and the Form 8-K filed with the SEC on September 4, 2024, respectively. 2. Unless otherwise noted, this financial data was provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. 3. This financial data was calculated based on data provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025 and January 8, 2026. Estimates for 2025 and 2026 represent the mid-point of financial guidance ranges. 4. Xtampza® ER is the Company’s only internally developed product. 5. Represents a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” on slide 2. 25 $1.6B Invested in Acquisitions1 Nucynta Franchise (February 2020) Impact of Accretive Acquisitions $266M $367M $401M $465M3 $465M3 2022 2023 2024 2025E 2026E Revenue from internally developed products4 Revenue from acquired products Product Revenues, Net2 Adjusted EBITDA2,5 BDSI (March 2022) Ironshore Therapeutics (September 2024) 25 $464M $567M $780M3 $631M $815M3 |

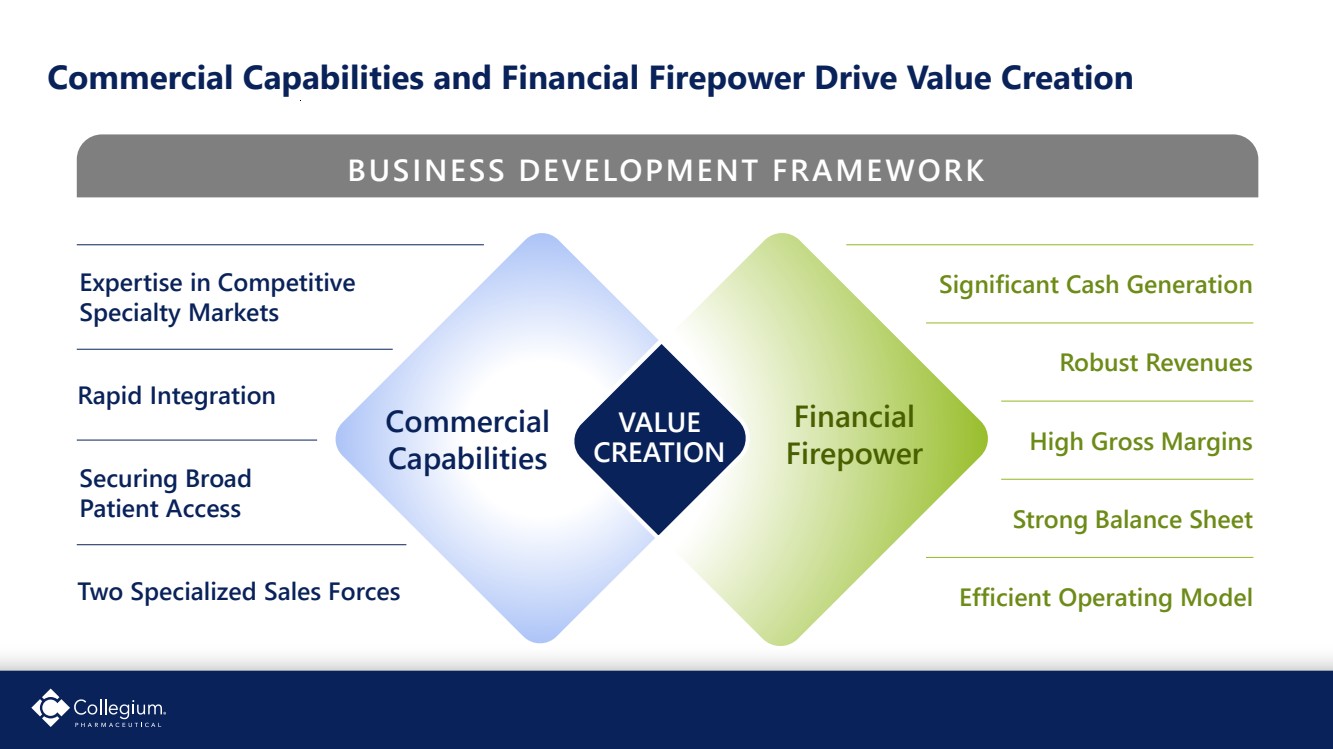

| Commercial Capabilities and Financial Firepower Drive Value Creation Efficient Operating Model Expertise in Competitive Specialty Markets Rapid Integration Securing Broad Patient Access Two Specialized Sales Forces Significant Cash Generation Robust Revenues Strong Balance Sheet High Gross Margins Commercial Capabilities Financial Firepower VALUE CREATION BUSINESS DEVELOPMENT FRAMEWORK |

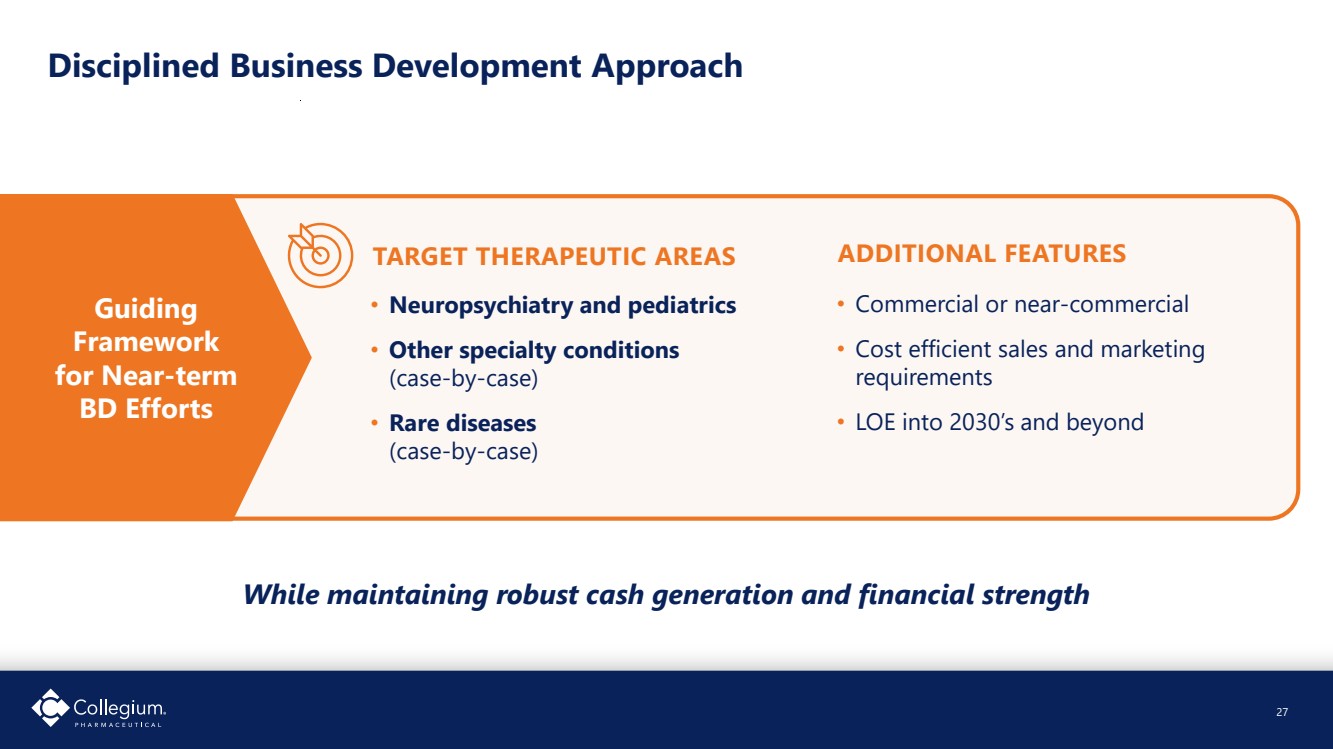

| Disciplined Business Development Approach TARGET THERAPEUTIC AREAS • Neuropsychiatry and pediatrics • Other specialty conditions (case-by-case) • Rare diseases (case-by-case) Guiding Framework for Near-term BD Efforts ADDITIONAL FEATURES While maintaining robust cash generation and financial strength 27 • Commercial or near-commercial • Cost efficient sales and marketing requirements • LOE into 2030’s and beyond |

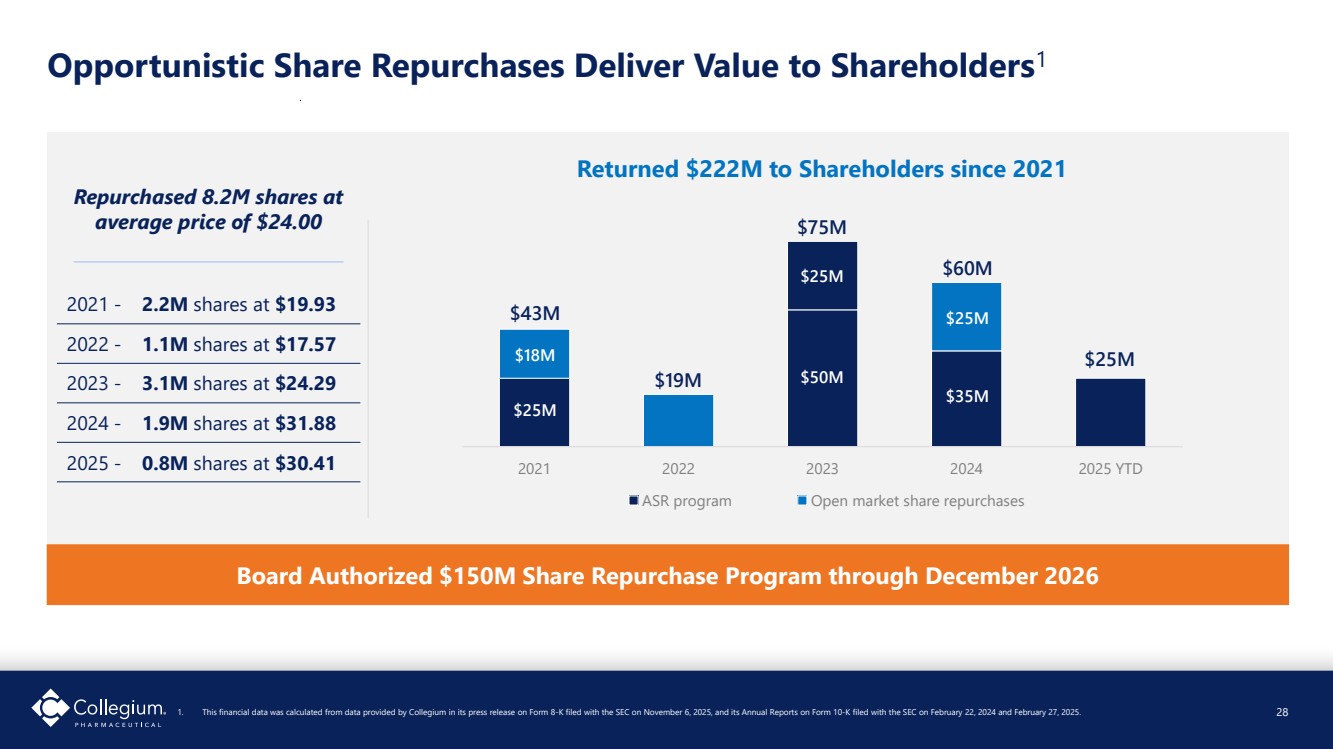

| 2021 2022 2023 2024 2025 YTD ASR program Open market share repurchases Opportunistic Share Repurchases Deliver Value to Shareholders1 28 $43M $19M $75M $25M $50M $25M Repurchased 8.2M shares at average price of $24.00 Board Authorized $150M Share Repurchase Program through December 2026 Returned $222M to Shareholders since 2021 2021 - 2.2M shares at $19.93 2022 - 1.1M shares at $17.57 2023 - 3.1M shares at $24.29 2024 - 1.9M shares at $31.88 2025 - 0.8M shares at $30.41 $35M $60M $18M $25M $25M 1. This financial data was calculated from data provided by Collegium in its press release on Form 8-K filed with the SEC on November 6, 2025, and its Annual Reports on Form 10-K filed with the SEC on February 22, 2024 and February 27, 2025. 28 |

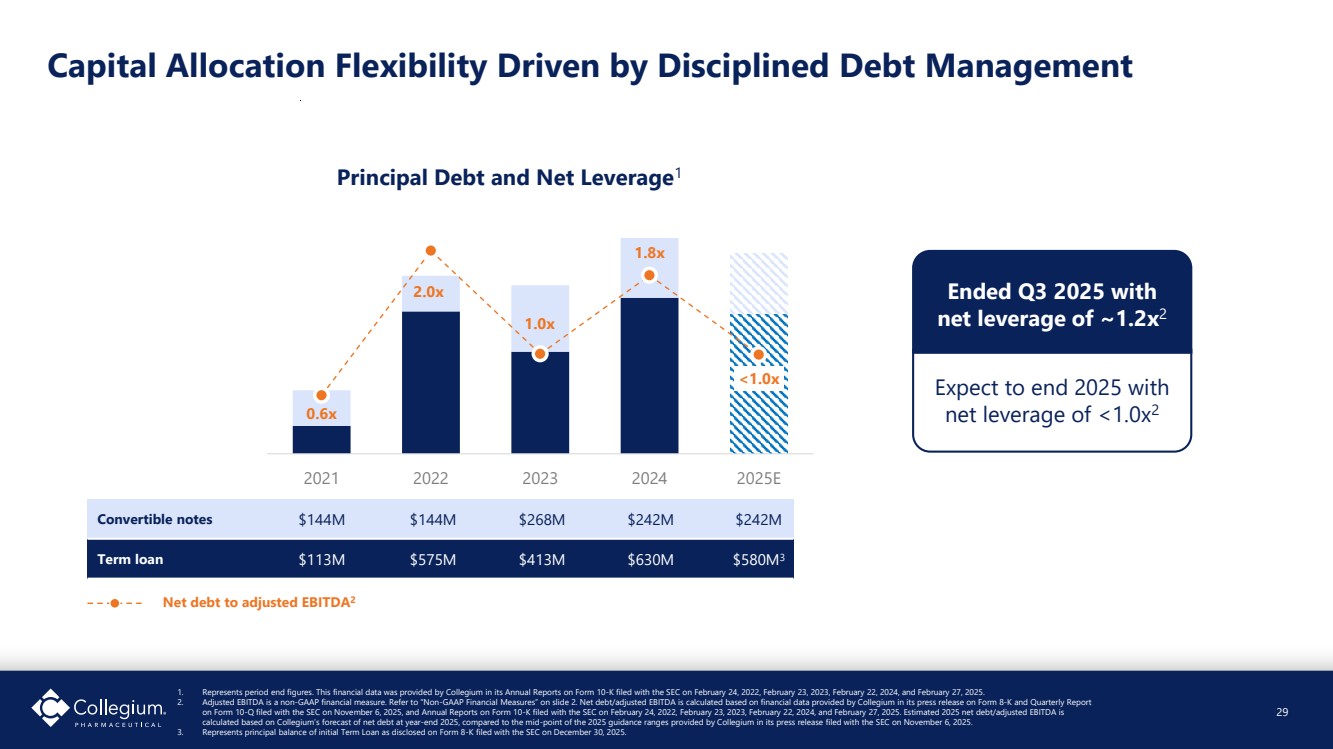

| Capital Allocation Flexibility Driven by Disciplined Debt Management 0.6x 2.0x 1.0x 1.8x <1.0x - 0.5 1.0 1.5 2.0 2.5 - 100 200 300 400 500 600 700 800 900 1,000 2021 2022 2023 2024 2025E Principal Debt and Net Leverage1 Convertible notes $144M $144M $268M $242M $242M Term loan $113M $575M $413M $630M $580M3 Ended Q3 2025 with net leverage of ~1.2x2 Expect to end 2025 with net leverage of <1.0x2 Net debt to adjusted EBITDA2 29 1. Represents period end figures. This financial data was provided by Collegium in its Annual Reports on Form 10-K filed with the SEC on February 24, 2022, February 23, 2023, February 22, 2024, and February 27, 2025. 2. Adjusted EBITDA is a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” on slide 2. Net debt/adjusted EBITDA is calculated based on financial data provided by Collegium in its press release on Form 8-K and Quarterly Report on Form 10-Q filed with the SEC on November 6, 2025, and Annual Reports on Form 10-K filed with the SEC on February 24, 2022, February 23, 2023, February 22, 2024, and February 27, 2025. Estimated 2025 net debt/adjusted EBITDA is calculated based on Collegium’s forecast of net debt at year-end 2025, compared to the mid-point of the 2025 guidance ranges provided by Collegium in its press release filed with the SEC on November 6, 2025. 3. Represents principal balance of initial Term Loan as disclosed on Form 8-K filed with the SEC on December 30, 2025. |

| Strong IP Management |

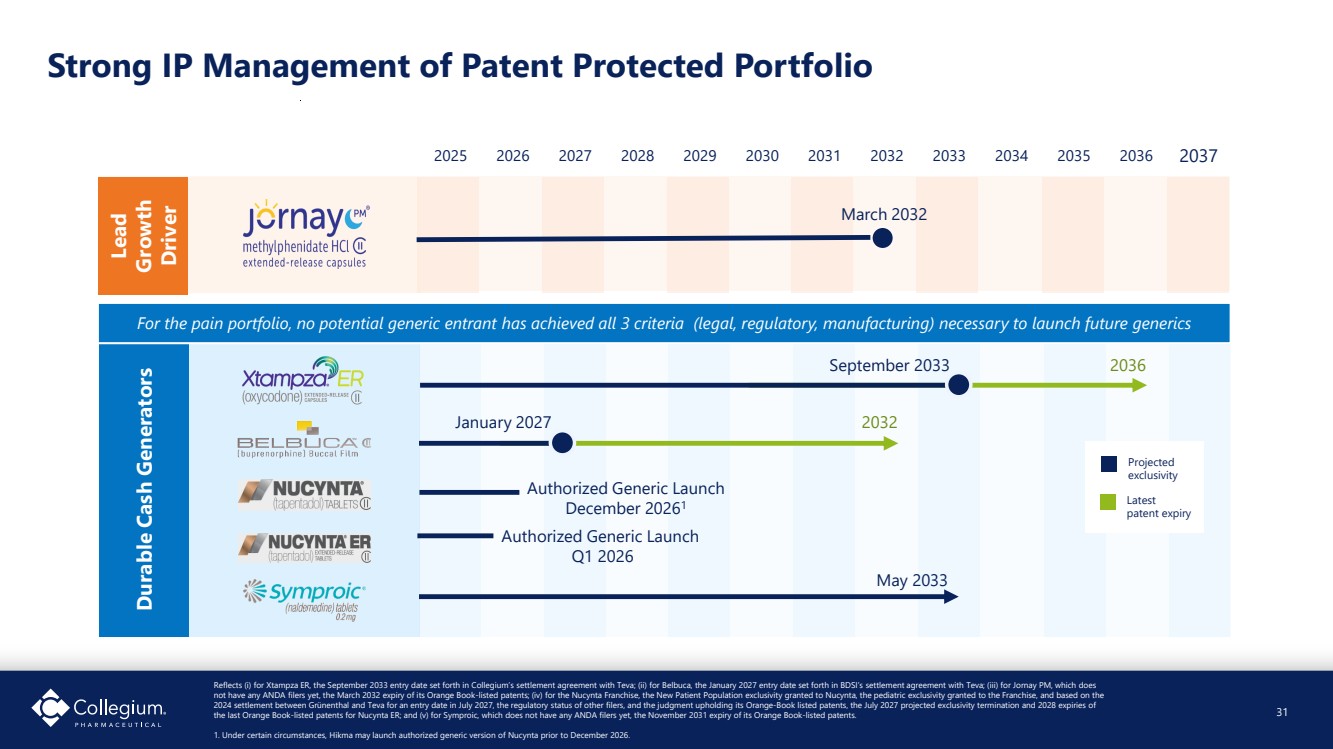

| Strong IP Management of Patent Protected Portfolio Reflects (i) for Xtampza ER, the September 2033 entry date set forth in Collegium’s settlement agreement with Teva; (ii) for Belbuca, the January 2027 entry date set forth in BDSI’s settlement agreement with Teva; (iii) for Jornay PM, which does not have any ANDA filers yet, the March 2032 expiry of its Orange Book-listed patents; (iv) for the Nucynta Franchise, the New Patient Population exclusivity granted to Nucynta, the pediatric exclusivity granted to the Franchise, and based on the 2024 settlement between Grünenthal and Teva for an entry date in July 2027, the regulatory status of other filers, and the judgment upholding its Orange-Book listed patents, the July 2027 projected exclusivity termination and 2028 expiries of the last Orange Book-listed patents for Nucynta ER; and (v) for Symproic, which does not have any ANDA filers yet, the November 2031 expiry of its Orange Book-listed patents. 1. Under certain circumstances, Hikma may launch authorized generic version of Nucynta prior to December 2026. September 2033 Durable Cash Generators 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 January 2027 May 2033 2036 2032 Projected exclusivity Latest patent expiry For the pain portfolio, no potential generic entrant has achieved all 3 criteria (legal, regulatory, manufacturing) necessary to launch future generics Lead Growth Driver 31 March 2032 Authorized Generic Launch December 20261 Authorized Generic Launch Q1 2026 |

| Summary |

| Creating Value for Shareholders 33 33 2026 STRATEGIC PRIORITIES VALUE CREATION 1. Drive significant growth for Jornay PM 2. Maximize the durability of the Pain Portfolio 3. Strategically deploy capital • Business Development • Debt repayment • Share repurchases Grow Revenue Extend longevity Increase profitability Generate robust cash flow Diversify portfolio Strengthen balance sheet |

| Important Safety Information |

| Important Safety Information about Jornay PM (methylphenidate HCI extended-release capsules) WARNING: ABUSE, MISUSE, AND ADDICTION JORNAY PM has a high potential for abuse and misuse, which can lead to the development of a substance use disorder, including addiction. Misuse and abuse of CNS stimulants, including JORNAY PM, can result in overdose and death, and this risk is increased with higher doses or unapproved methods of administration, such as snorting or injection. Before prescribing JORNAY PM, assess each patient’s risk for abuse, misuse, and addiction. Educate patients and their families about these risks, proper storage of the drug, and proper disposal of any unused drug. Throughout JORNAY PM treatment, reassess each patient’s risk of abuse, misuse, and addiction and frequently monitor for signs and symptoms of abuse, misuse and addiction. CONTRAINDICATIONS • Known hypersensitivity to methylphenidate or other components of JORNAY PM. Hypersensitivity reactions such as angioedema and anaphylactic reactions have been reported in patients treated with methylphenidate products. • Concurrent treatment with a monoamine oxidase inhibitor (MAOI), or use of an MAOI within the preceding 14 days because of the risk of hypertensive crisis. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at https://ironshorepharma.com/jornay-pm-label. 35 JORNAY PM (methylphenidate HCI extended-release capsules) |

| Important Safety Information about Jornay PM (methylphenidate HCI extended-release capsules) WARNINGS AND PRECAUTIONS JORNAY PM can cause serious adverse reactions and patients should be monitored for the following: • Risks to Patients with Serious Cardiac Disease: Sudden death has been reported in patients with structural cardiac abnormalities or other serious cardiac disease who were treated with CNS stimulants at the recommended ADHD dosage. Avoid use in patients with known structural cardiac abnormalities, cardiomyopathy, serious cardiac arrhythmia, coronary artery disease, or other serious cardiac disease. • Increased Blood Pressure and Heart Rate. • Psychiatric Adverse Reactions: Including exacerbation of behavior disturbance and thought disorder in patients with a pre-existing psychotic disorder, induction of a manic episode in patients with bipolar disorder, and new psychotic or manic symptoms. Prior to initiating treatment, screen patients for risk factors for psychiatric adverse reactions. If such symptoms occur, consider discontinuing JORNAY PM. • Priapism: Patients should seek immediate medical attention. • Peripheral Vasculopathy, including Raynaud’s Phenomenon: Observe patients for digital changes during treatment. • Weight Loss and Long-Term Suppression of Growth in Pediatric Patients: Monitor height and weight. • Increased Intraocular Pressure (IOP) and Glaucoma: Patients at risk for acute angle closure glaucoma should be evaluated by an ophthalmologist. Closely monitor patients with a history of abnormally increased IOP or open angle glaucoma. • Onset or Exacerbation of Motor and Verbal Tics, and Worsening of Tourette’s Syndrome. ADVERSE REACTIONS • The most common (≥5% and twice the rate of placebo) adverse reactions with methylphenidate are decreased appetite, insomnia, nausea, vomiting, dyspepsia, abdominal pain, decreased weight, anxiety, dizziness, irritability, affect lability, tachycardia, and increased blood pressure. • Additional adverse reactions (≥5% and twice the rate of placebo) in JORNAY PM-treated pediatric patients 6 to 12 years are headache, psychomotor hyperactivity, and mood swings. DRUG INTERACTIONS • Antihypertensive drugs: Monitor blood pressure data. Adjust dosage of antihypertensive drug as needed. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at https://ironshorepharma.com/jornay-pm-label. 36 JORNAY PM (methylphenidate HCI extended-release capsules) |

| Important Safety Information about XTAMPZA ER (oxycodone) extended-release capsules WARNING: SERIOUS AND LIFE-THREATENING RISKS FROM USE OF XTAMPZA ER Addiction, Abuse, and Misuse Because the use of XTAMPZA ER exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can lead to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and conditions. Life-Threatening Respiratory Depression Serious, life-threatening, or fatal respiratory depression may occur with use of XTAMPZA ER, especially during initiation or following a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of XTAMPZA ER are essential. Accidental Ingestion Accidental ingestion of even one dose of XTAMPZA ER, especially by children, can result in a fatal overdose of oxycodone. Risks From Concomitant Use With Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may result in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of XTAMPZA ER and benzodiazepines or other CNS depressants for use in patients for whom alternative treatment options are inadequate. Neonatal Opioid Withdrawal Syndrome (NOWS) If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which may be life-threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at XtampzaER.com/PI. 37 XTAMPZA ER (Oxycodone) extended-release capsules |

| Important Safety Information about XTAMPZA ER (oxycodone) extended-release capsules Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS-compliant education program and to counsel patients and caregivers on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. Cytochrome P450 3A4 Interaction The concomitant use of XTAMPZA ER with all cytochrome P450 3A4 inhibitors may result in an increase in oxycodone plasma concentrations, which could increase or prolong adverse drug effects and may cause potentially fatal respiratory depression. In addition, discontinuation of a concomitantly used cytochrome P450 3A4 inducer may result in an increase in oxycodone plasma concentration. Regularly evaluate patients receiving XTAMPZA ER and any CYP3A4 inhibitor or inducer. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at XtampzaER.com/PI. 38 XTAMPZA ER (Oxycodone) extended-release capsules |

| Important Safety Information about BELBUCA (buprenorphine buccal film) WARNING: SERIOUS AND LIFE-THREATENING RISKS FROM USE OF BELBUCA Addiction, Abuse, and Misuse BELBUCA exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can lead to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and conditions. Life-Threatening Respiratory Depression Serious, life-threatening, or fatal respiratory depression may occur with use of BELBUCA, especially during initiation or following a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of BELBUCA are essential. Misuse or abuse of BELBUCA by chewing, swallowing, snorting, or injecting buprenorphine extracted from the buccal film will result in the uncontrolled delivery of buprenorphine and poses a significant risk of overdose and death. Accidental Exposure Accidental exposure of even one dose of BELBUCA, especially in children, can result in a fatal overdose of buprenorphine. Risks from Concomitant Use with Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may result in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of BELBUCA and benzodiazepines or other CNS depressants for use in patients for whom alternative treatment options are inadequate. Neonatal Opioid Withdrawal Syndrome (NOWS) If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which may be life-threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS-compliant education program and to counsel patients and caregivers on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and Other Serious Risks at Belbuca.com/#isi-block. 39 BELBUCA (buprenorphine buccal film) |

| Important Safety Information about NUCYNTA ER (tapentadol) extended-release tablets WARNING: SERIOUS AND LIFE-THREATENING RISKS FROM USE OF NUCYNTA ER Addiction, Abuse, and Misuse Because the use of NUCYNTA ER exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can lead to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and conditions. Life-Threatening Respiratory Depression Serious, life-threatening, or fatal respiratory depression may occur with use of NUCYNTA ER, especially during initiation or following a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of NUCYNTA ER are essential. Instruct patients to swallow NUCYNTA ER tablets whole; crushing, chewing, or dissolving NUCYNTA ER tablets can cause rapid release and absorption of a potentially fatal dose of tapentadol. Accidental Ingestion Accidental ingestion of even one dose of NUCYNTA ER, especially by children, can result in a fatal overdose of tapentadol. Interaction with Alcohol Instruct patients not to consume alcoholic beverages or use prescription or nonprescription products that contain alcohol while taking NUCYNTA ER. The co-ingestion of alcohol with NUCYNTA ER may result in increased plasma tapentadol levels and a potentially fatal overdose of tapentadol. Risks From Concomitant Use With Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may result in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of NUCYNTA ER and benzodiazepines or other CNS depressants for use in patients for whom alternative treatment options are inadequate. 40 NUCYNTA ER (tapentadol) extended-release tablets See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at Nucynta.com/erPI. |

| Important Safety Information about NUCYNTA ER (tapentadol) extended-release tablets Neonatal Opioid Withdrawal Syndrome If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which may be life-threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS-compliant education program and to counsel patients and caregivers on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at Nucynta.com/erPI. 41 NUCYNTA ER (tapentadol) extended-release tablets |

| Important Safety Information about NUCYNTA (Tapentadol) tablets WARNING: SERIOUS AND LIFE-THREATENING RISKS FROM USE OF NUCYNTA TABLETS Addiction, Abuse, and Misuse Because the use of NUCYNTA tablets exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can lead to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and conditions. Life-Threatening Respiratory Depression Serious, life-threatening, or fatal respiratory depression may occur with use of NUCYNTA tablets, especially during initiation or following a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of NUCYNTA tablets are essential. Accidental Ingestion Accidental ingestion of even one dose of NUCYNTA tablets, especially by children, can result in a fatal overdose of tapentadol. Risks From Concomitant Use With Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may result in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of NUCYNTA tablets and benzodiazepines or other CNS depressants for use in patients for whom alternative treatment options are inadequate. Neonatal Opioid Withdrawal Syndrome (NOWS) If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which may be life-threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS-compliant education program and to counsel patients and caregivers on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse and other serious risks at Nucynta.com/irPI. 42 NUCYNTA (tapentadol) tablets |

| Important Safety Information about SYMPROIC (naldemedine) tablets SYMPROIC may cause serious side effects, including: – Tear in your stomach or intestinal wall (perforation). Stomach pain that is severe can be a sign of a serious medical condition. If you get stomach pain that does not go away, stop taking SYMPROIC and get emergency medical help right away – Opioid withdrawal. You may have symptoms of opioid withdrawal during treatment with SYMPROIC including sweating, chills, tearing, warm or hot feeling to your face (flush), sneezing, fever, feeling cold, abdominal pain, diarrhea, nausea, and vomiting. Tell your healthcare provider if you have any of these symptoms Do not take SYMPROIC if you: – Have a bowel blockage (intestinal obstruction) or have a history of bowel blockage – Are allergic to SYMPROIC or any of the ingredients in SYMPROIC. See the Medication Guide for a complete list of ingredients in SYMPROIC. Tell your healthcare provider or pharmacist before you start or stop any medicines during treatment with SYMPROIC Before you take SYMPROIC, tell your healthcare provider about all of your medical conditions, including if you: – Have any stomach or bowel (intestines) problems, including stomach ulcer, Crohn’s disease, diverticulitis, cancer of the stomach or bowel, or Ogilvie’s syndrome – Have liver problems – Are pregnant or plan to become pregnant. Taking SYMPROIC during pregnancy may cause opioid withdrawal symptoms in your unborn baby. Tell your healthcare provider right away if you become pregnant during treatment with SYMPROIC – Are breastfeeding or plan to breastfeed. It is not known if SYMPROIC passes into your breast milk. You should not breastfeed during treatment with SYMPROIC and for 3 days after your last dose. Taking SYMPROIC while you are breastfeeding may cause opioid withdrawal symptoms in your baby. You and your healthcare provider should decide if you will take SYMPROIC or breastfeed. You should not do both – The most common side effects of SYMPROIC include stomach (abdomen) pain, diarrhea, nausea and vomiting (gastroenteritis) – Tell your healthcare provider if you have any side effect that bothers you or that does not go away. These are not all the possible side effects of SYMPROIC. Call your doctor for medical advice about side effects. You may report side effects to FDA at 1-800-FDA-1088 See full prescribing Information and other serious risks at Symproic.com/#isi. 43 SYMPROIC (naldemedine) tablets |

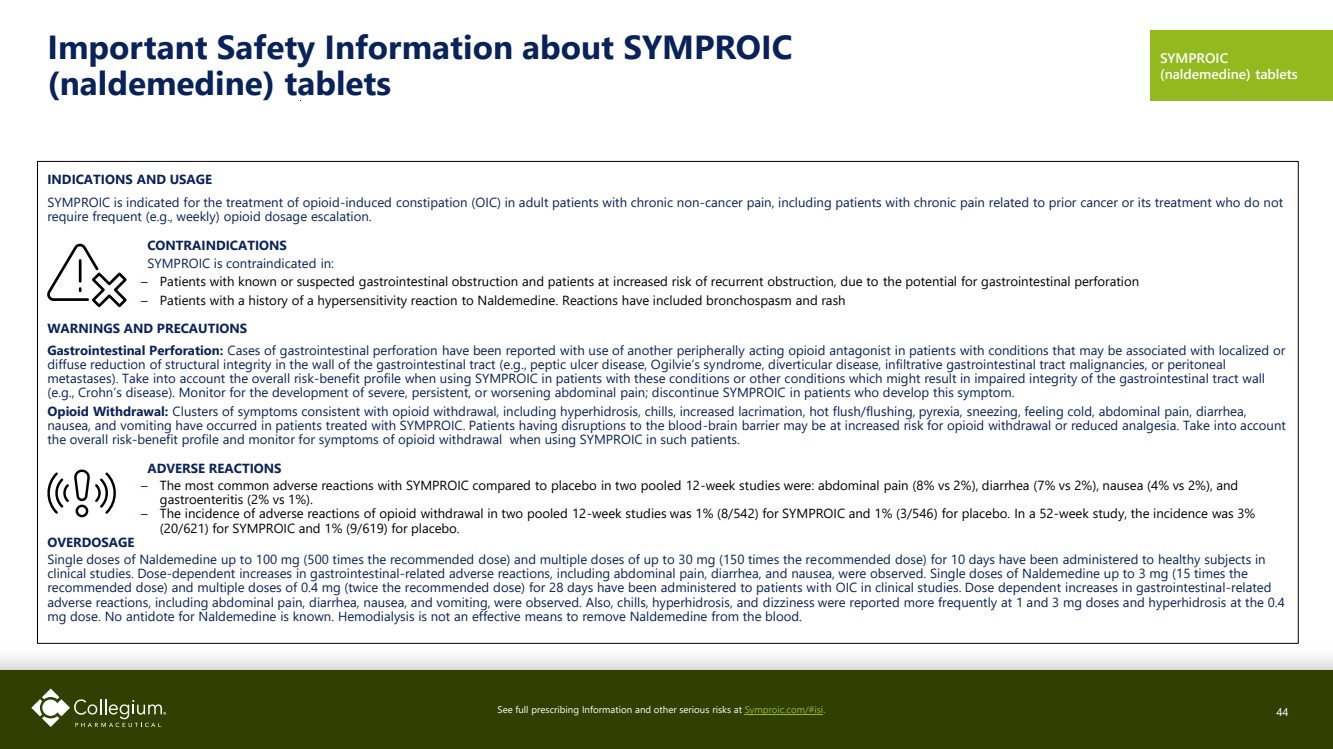

| Important Safety Information about SYMPROIC (naldemedine) tablets INDICATIONS AND USAGE SYMPROIC is indicated for the treatment of opioid-induced constipation (OIC) in adult patients with chronic non-cancer pain, including patients with chronic pain related to prior cancer or its treatment who do not require frequent (e.g., weekly) opioid dosage escalation. CONTRAINDICATIONS SYMPROIC is contraindicated in: – Patients with known or suspected gastrointestinal obstruction and patients at increased risk of recurrent obstruction, due to the potential for gastrointestinal perforation – Patients with a history of a hypersensitivity reaction to Naldemedine. Reactions have included bronchospasm and rash WARNINGS AND PRECAUTIONS Gastrointestinal Perforation: Cases of gastrointestinal perforation have been reported with use of another peripherally acting opioid antagonist in patients with conditions that may be associated with localized or diffuse reduction of structural integrity in the wall of the gastrointestinal tract (e.g., peptic ulcer disease, Ogilvie’s syndrome, diverticular disease, infiltrative gastrointestinal tract malignancies, or peritoneal metastases). Take into account the overall risk-benefit profile when using SYMPROIC in patients with these conditions or other conditions which might result in impaired integrity of the gastrointestinal tract wall (e.g., Crohn’s disease). Monitor for the development of severe, persistent, or worsening abdominal pain; discontinue SYMPROIC in patients who develop this symptom. Opioid Withdrawal: Clusters of symptoms consistent with opioid withdrawal, including hyperhidrosis, chills, increased lacrimation, hot flush/flushing, pyrexia, sneezing, feeling cold, abdominal pain, diarrhea, nausea, and vomiting have occurred in patients treated with SYMPROIC. Patients having disruptions to the blood-brain barrier may be at increased risk for opioid withdrawal or reduced analgesia. Take into account the overall risk-benefit profile and monitor for symptoms of opioid withdrawal when using SYMPROIC in such patients. ADVERSE REACTIONS – The most common adverse reactions with SYMPROIC compared to placebo in two pooled 12-week studies were: abdominal pain (8% vs 2%), diarrhea (7% vs 2%), nausea (4% vs 2%), and gastroenteritis (2% vs 1%). – The incidence of adverse reactions of opioid withdrawal in two pooled 12-week studies was 1% (8/542) for SYMPROIC and 1% (3/546) for placebo. In a 52-week study, the incidence was 3% (20/621) for SYMPROIC and 1% (9/619) for placebo. OVERDOSAGE Single doses of Naldemedine up to 100 mg (500 times the recommended dose) and multiple doses of up to 30 mg (150 times the recommended dose) for 10 days have been administered to healthy subjects in clinical studies. Dose-dependent increases in gastrointestinal-related adverse reactions, including abdominal pain, diarrhea, and nausea, were observed. Single doses of Naldemedine up to 3 mg (15 times the recommended dose) and multiple doses of 0.4 mg (twice the recommended dose) for 28 days have been administered to patients with OIC in clinical studies. Dose dependent increases in gastrointestinal-related adverse reactions, including abdominal pain, diarrhea, nausea, and vomiting, were observed. Also, chills, hyperhidrosis, and dizziness were reported more frequently at 1 and 3 mg doses and hyperhidrosis at the 0.4 mg dose. No antidote for Naldemedine is known. Hemodialysis is not an effective means to remove Naldemedine from the blood. See full prescribing Information and other serious risks at Symproic.com/#isi. 44 SYMPROIC (naldemedine) tablets |

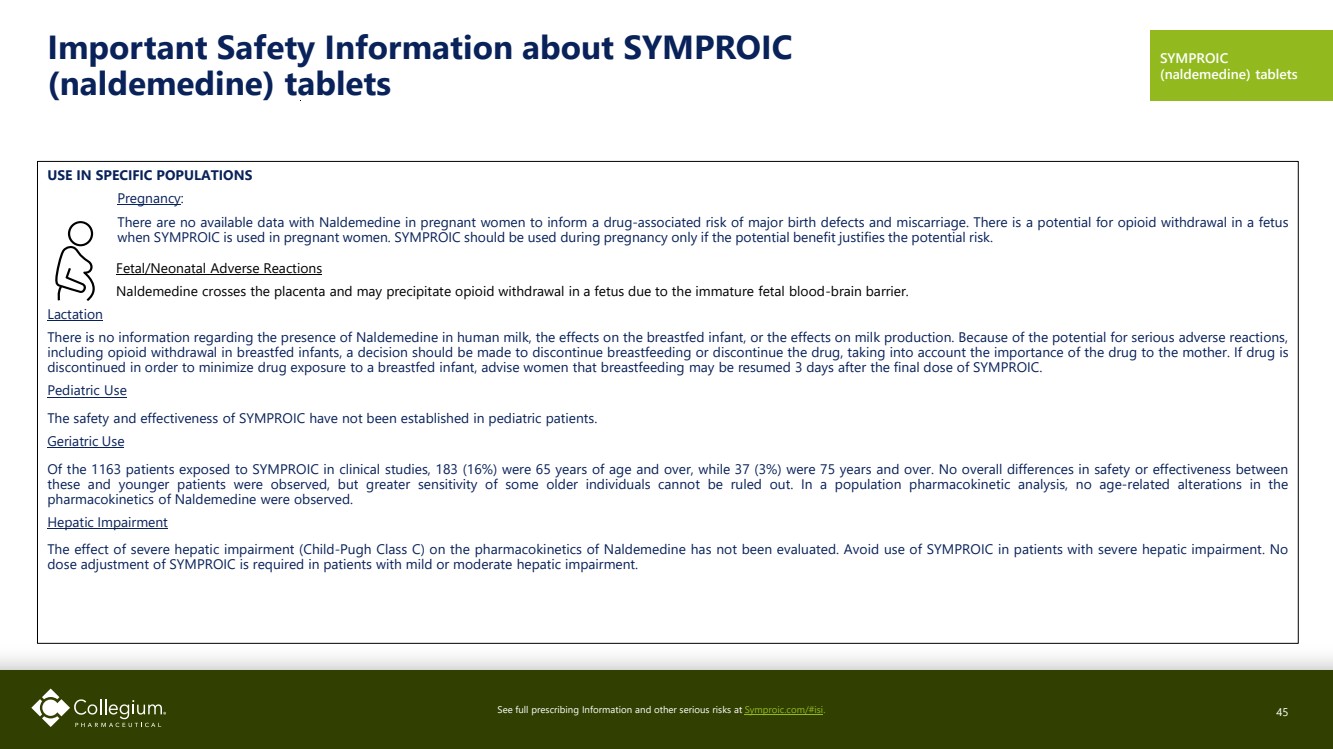

| Important Safety Information about SYMPROIC (naldemedine) tablets USE IN SPECIFIC POPULATIONS Pregnancy: There are no available data with Naldemedine in pregnant women to inform a drug-associated risk of major birth defects and miscarriage. There is a potential for opioid withdrawal in a fetus when SYMPROIC is used in pregnant women. SYMPROIC should be used during pregnancy only if the potential benefit justifies the potential risk. Fetal/Neonatal Adverse Reactions Naldemedine crosses the placenta and may precipitate opioid withdrawal in a fetus due to the immature fetal blood-brain barrier. Lactation There is no information regarding the presence of Naldemedine in human milk, the effects on the breastfed infant, or the effects on milk production. Because of the potential for serious adverse reactions, including opioid withdrawal in breastfed infants, a decision should be made to discontinue breastfeeding or discontinue the drug, taking into account the importance of the drug to the mother. If drug is discontinued in order to minimize drug exposure to a breastfed infant, advise women that breastfeeding may be resumed 3 days after the final dose of SYMPROIC. Pediatric Use The safety and effectiveness of SYMPROIC have not been established in pediatric patients. Geriatric Use Of the 1163 patients exposed to SYMPROIC in clinical studies, 183 (16%) were 65 years of age and over, while 37 (3%) were 75 years and over. No overall differences in safety or effectiveness between these and younger patients were observed, but greater sensitivity of some older individuals cannot be ruled out. In a population pharmacokinetic analysis, no age-related alterations in the pharmacokinetics of Naldemedine were observed. Hepatic Impairment The effect of severe hepatic impairment (Child-Pugh Class C) on the pharmacokinetics of Naldemedine has not been evaluated. Avoid use of SYMPROIC in patients with severe hepatic impairment. No dose adjustment of SYMPROIC is required in patients with mild or moderate hepatic impairment. See full prescribing Information and other serious risks at Symproic.com/#isi. 45 SYMPROIC (naldemedine) tablets |

| Non-GAAP Reconciliations |

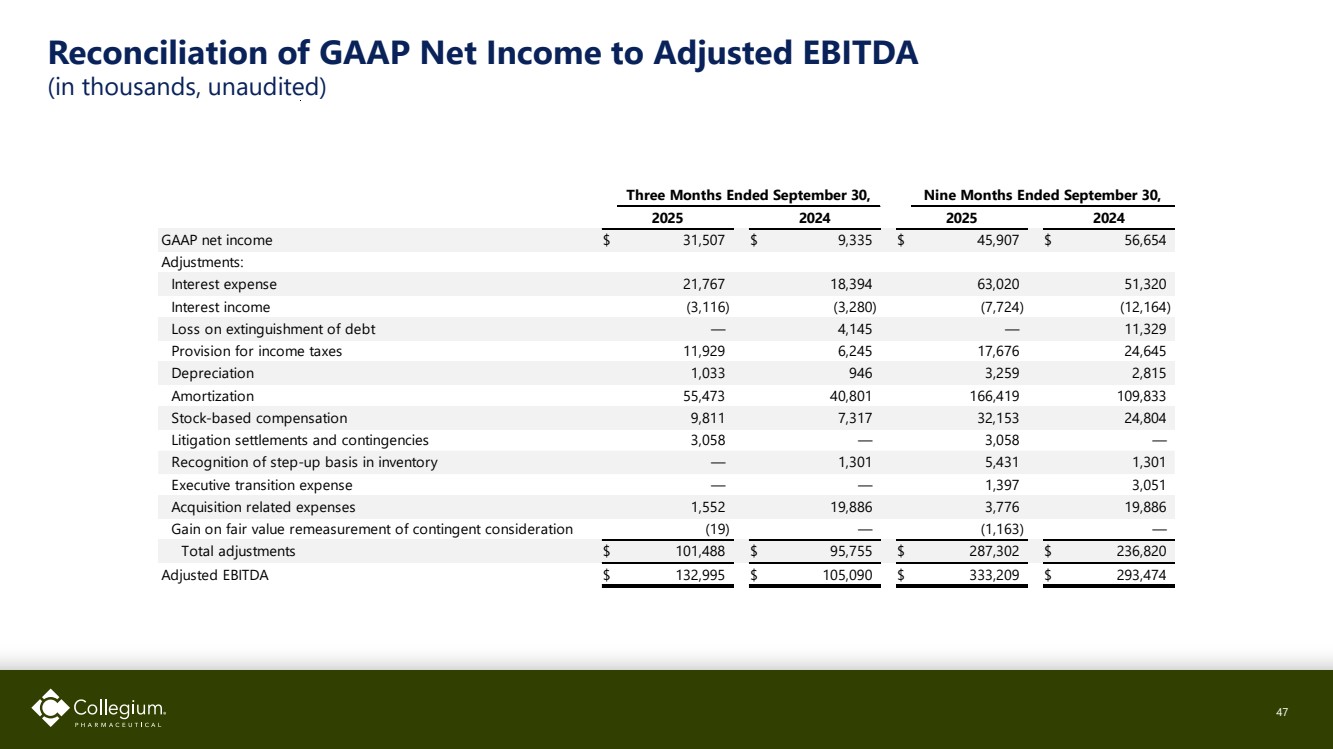

| Reconciliation of GAAP Net Income to Adjusted EBITDA (in thousands, unaudited) 47 GAAP net income $ 31,507 $ 9,335 $ 45,907 $ 56,654 Adjustments: Interest expense 21,767 18,394 63,020 51,320 Interest income (3,116) (3,280) (7,724) (12,164) Loss on extinguishment of debt — 4,145 — 11,329 Provision for income taxes 11,929 6,245 17,676 24,645 Depreciation 1,033 946 3,259 2,815 Amortization 55,473 40,801 166,419 109,833 Stock-based compensation 9,811 7,317 32,153 24,804 Litigation settlements and contingencies 3,058 — 3,058 — Recognition of step-up basis in inventory — 1,301 5,431 1,301 Executive transition expense — — 1,397 3,051 Acquisition related expenses 1,552 19,886 3,776 19,886 Gain on fair value remeasurement of contingent consideration (19) — (1,163) — Total adjustments $ 101,488 $ 95,755 $ 287,302 $ 236,820 Adjusted EBITDA $ 132,995 $ 105,090 $ 333,209 $ 293,474 2025 Three Months Ended September 30, 2024 Nine Months Ended September 30, 2025 2024 |

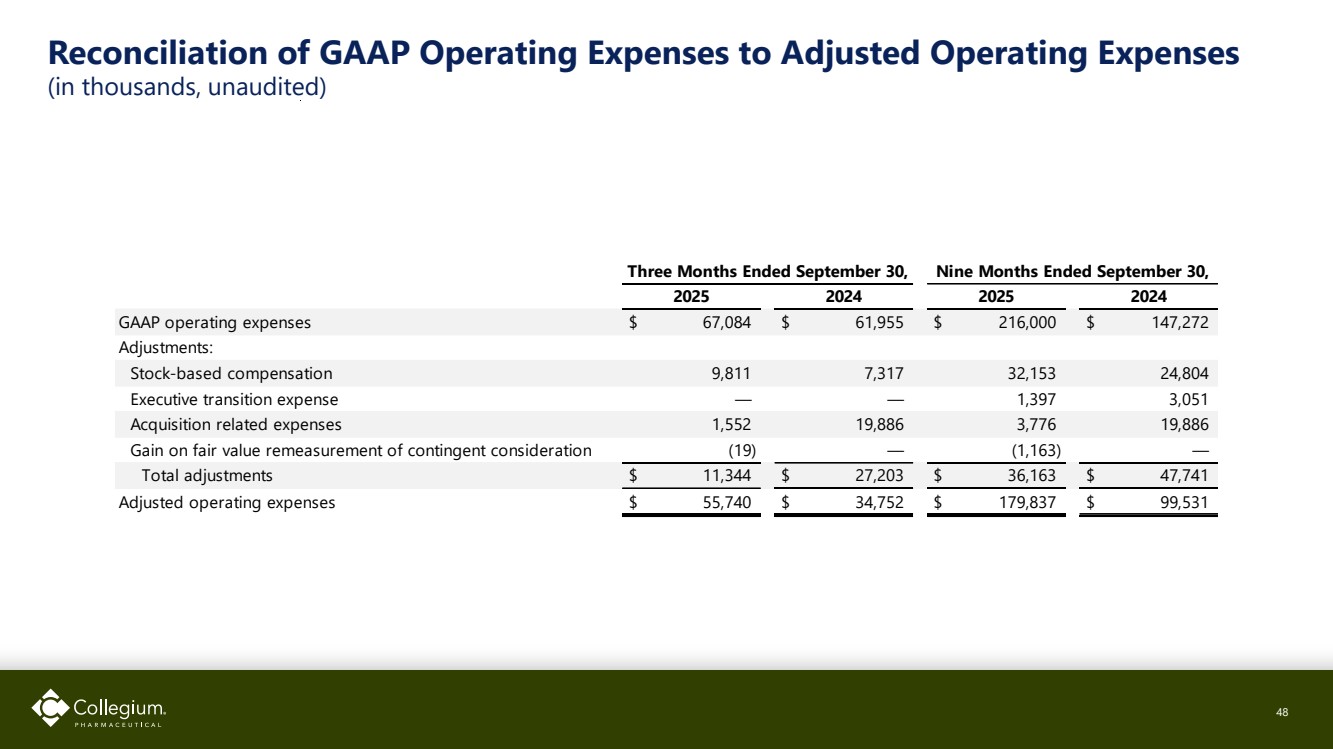

| Reconciliation of GAAP Operating Expenses to Adjusted Operating Expenses (in thousands, unaudited) 48 GAAP operating expenses $ 67,084 $ 61,955 $ 216,000 $ 147,272 Adjustments: Stock-based compensation 9,811 7,317 32,153 24,804 Executive transition expense — — 1,397 3,051 Acquisition related expenses 1,552 19,886 3,776 19,886 Gain on fair value remeasurement of contingent consideration (19) — (1,163) — Total adjustments $ 11,344 $ 27,203 $ 36,163 $ 47,741 Adjusted operating expenses $ 55,740 $ 34,752 $ 179,837 $ 99,531 2025 2024 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 |

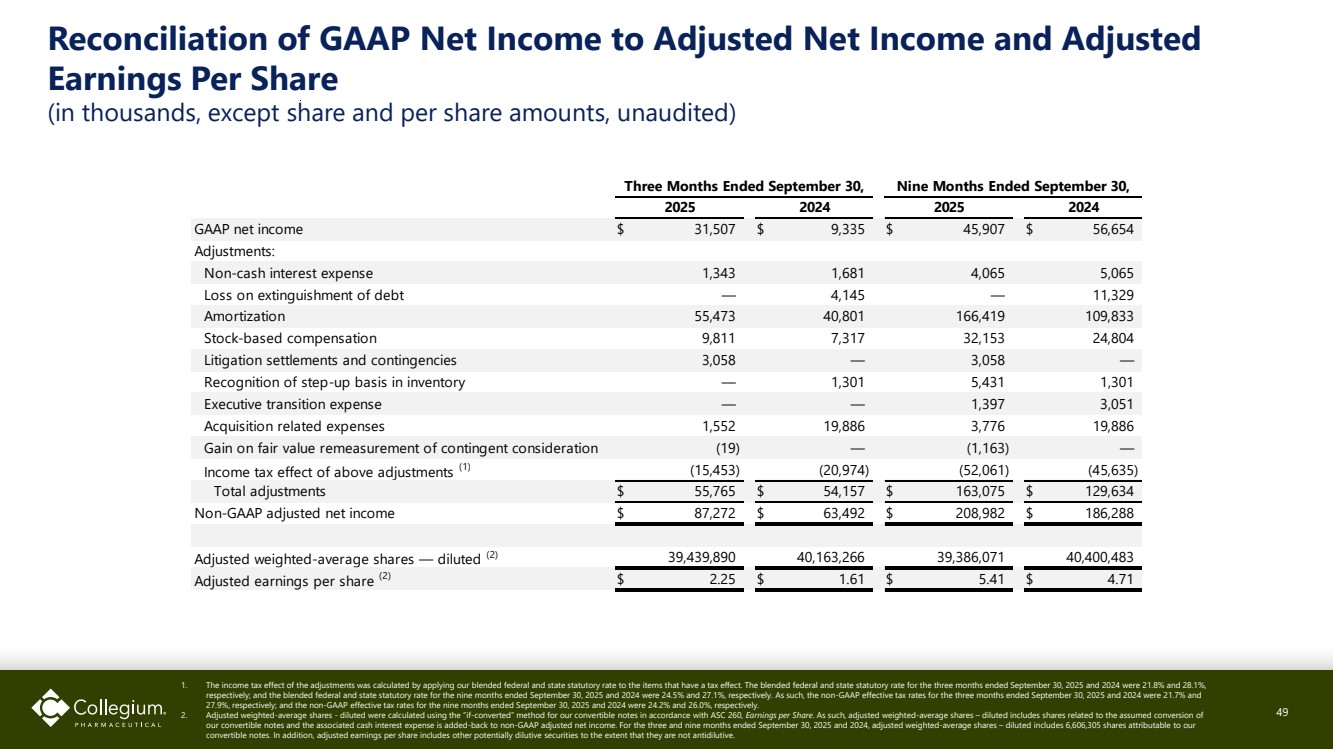

| Reconciliation of GAAP Net Income to Adjusted Net Income and Adjusted Earnings Per Share (in thousands, except share and per share amounts, unaudited) 49 1. The income tax effect of the adjustments was calculated by applying our blended federal and state statutory rate to the items that have a tax effect. The blended federal and state statutory rate for the three months ended September 30, 2025 and 2024 were 21.8% and 28.1%, respectively; and the blended federal and state statutory rate for the nine months ended September 30, 2025 and 2024 were 24.5% and 27.1%, respectively. As such, the non-GAAP effective tax rates for the three months ended September 30, 2025 and 2024 were 21.7% and 27.9%, respectively; and the non-GAAP effective tax rates for the nine months ended September 30, 2025 and 2024 were 24.2% and 26.0%, respectively. 2. Adjusted weighted-average shares - diluted were calculated using the “if-converted” method for our convertible notes in accordance with ASC 260, Earnings per Share. As such, adjusted weighted-average shares – diluted includes shares related to the assumed conversion of our convertible notes and the associated cash interest expense is added-back to non-GAAP adjusted net income. For the three and nine months ended September 30, 2025 and 2024, adjusted weighted-average shares – diluted includes 6,606,305 shares attributable to our convertible notes. In addition, adjusted earnings per share includes other potentially dilutive securities to the extent that they are not antidilutive. GAAP net income $ 31,507 $ 9,335 $ 45,907 $ 56,654 Adjustments: Non-cash interest expense 1,343 1,681 4,065 5,065 Loss on extinguishment of debt — 4,145 — 11,329 Amortization 55,473 40,801 166,419 109,833 Stock-based compensation 9,811 7,317 32,153 24,804 Litigation settlements and contingencies 3,058 — 3,058 — Recognition of step-up basis in inventory — 1,301 5,431 1,301 Executive transition expense — — 1,397 3,051 Acquisition related expenses 1,552 19,886 3,776 19,886 Gain on fair value remeasurement of contingent consideration (19) — (1,163) — Income tax effect of above adjustments (1) (15,453) (20,974) (52,061) (45,635) Total adjustments $ 55,765 $ 54,157 $ 163,075 $ 129,634 Non-GAAP adjusted net income $ 87,272 $ 63,492 $ 208,982 $ 186,288 Adjusted weighted-average shares — diluted (2) 39,439,890 40,163,266 39,386,071 40,400,483 Adjusted earnings per share (2) $ 2.25 $ 1.61 $ 5.41 $ 4.71 Three Months Ended September 30, 2025 2024 Nine Months Ended September 30, 2025 2024 |