UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material under §240.14a-12

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒No fee required.

☐Fee paid previously with preliminary materials.

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

2024 AT A GLANCE

$631.4M | $162.8M | $60M |

Record Revenue | Cash & Marketable Securities Balance as of Year-End 2024 | Returned to Shareholders Under Share Repurchase Program |

Healthier people. Stronger communities.

Collegium is building a leading, diversified biopharmaceutical company committed to improving the lives of people living with serious medical conditions. The Company has a leading portfolio of responsible pain management medications and recently acquired Jornay PM, a treatment for ADHD, establishing a presence in neuropsychiatry. Collegium’s strategy includes growing its commercial portfolio, with Jornay PM as the lead growth driver, and deploying capital in a disciplined manner. Collegium’s headquarters are located in Stoughton, Massachusetts. For more information, please visit the Company’s website at www.collegiumpharma.com. The information contained in, or that can be accessed through, our website is not part of this proxy statement.

Our Core Values

Dear Collegium Shareholders,

2024 was a transformational year for Collegium Pharmaceutical. We delivered on our key business and financial objectives, including expanding our product portfolio, executing on our capital deployment strategy, generating operating cash flows, and delivering strong financial results, which led to achieving record net product revenue. We are proud of these accomplishments, which advance our mission of building a leading, diversified biopharmaceutical company committed to helping improve the lives of people living with serious medical conditions.

In September 2024, we closed the acquisition of Ironshore Therapeutics, Inc. (“Ironshore”), which included Jornay PM for the treatment of attention deficit hyperactivity disorder (“ADHD”). This acquisition has established our presence in neuropsychiatry and provides an initial step towards diversifying our business beyond the chronic pain market. Jornay PM is now poised to become our lead growth driver in 2025 and beyond. In connection with the acquisition of Ironshore, we secured $646.0 million financing from funds managed by Pharmakon Advisors, LP (“Pharmakon”). The new five-year term loan was used to repay our prior term loan, reducing our interest rate by 300 basis points, and the remaining $325.0 million, along with our cash on-hand was used to fund the all-cash acquisition.

In June 2024, we redeemed the remaining $26.4 million aggregate principal amount of our 2.625% convertible senior notes due in 2026. During 2024, we also repurchased $60.0 million of Collegium shares at a weighted-average price of $31.88 per share. To date, we have returned $197.0 million in capital to shareholders at an average price per share of $24.00.

2024 was also marked by important, positive developments within our pain franchise. We secured a six-month extension of U.S. pediatric exclusivity for the Nucynta® IR and Nucynta® ER (the “Nucynta products”), extending the market exclusivity to January 3, 2027 for Nucynta IR, and December 27, 2025 for Nucynta ER. These extensions enhance the value of the Nucynta franchise and bolsters our near-term outlook. And importantly, our portfolio of pain medicines achieved record-setting sales in 2024. For the first time, annual net sales for Belbuca® exceeded $200.0 million while net sales of Xtampza® ER grew to over $190.0 million, also representing its strongest year.

More recently, in early 2025, we strengthened our Board of Directors and Executive Leadership team with the addition of accomplished industry leaders who will play a critical role as we further advance our business. Beyond achieving our business objectives, Collegium employees continued to make a positive impact in the community by driving meaningful change through our commitment to “Do Good as We Do Well.” Everything we do at Collegium is guided by our dedication to serving as responsible corporate citizens and holding ourselves accountable to the highest ethical standards. Reflecting this unwavering commitment to integrity, accountability and responsibility in all aspects of our business, we recently issued our third annual Environmental, Social and Governance report highlighting our commitment to community service, shaping the next generation of life science leaders, and reducing our environmental impact through sustainability efforts.

This is an exciting time for Collegium. The achievement of our financial commitments and the execution of our strategic priorities in 2024 position us for a new phase of growth in 2025 and beyond. Looking ahead, we are focused on driving accelerated growth for Jornay PM, maximizing our pain portfolio, and strategically deploying capital to expand our portfolio, as we did with the Ironshore acquisition, as well as opportunistically leveraging our share repurchase program and rapidly paying down debt to strengthen our financial position. Accomplishing these objectives will create long-term value for our shareholders and ensure the sustainability of our business and the health of our broader communities.

Thank you for your investment and confidence in Collegium.

Sincerely,

Vikram Karnani

President and Chief Executive Officer

100 Technology Center Drive, Suite 300 · Stoughton, MA 02072 · collegiumpharma.com · (781) 713-3699

100 Technology Center Drive, Suite 300 |

Stoughton, MA 02072 |

Notice of 2025 Annual Meeting of Shareholders of Collegium Pharmaceutical, Inc. |

| When |

|

| Record Date |

Thursday, May 15, 2025 | Only shareholders of record at the close of business on March 25, 2025 are entitled to notice of, and to vote at, the 2025 Annual Meeting of Shareholders (the “Annual Meeting”) or any adjournment thereof. | |||

| Where | |||

www.meetnow.global/MZQSZJF |

Item of Business | Board | |||

1 | To elect eight director nominees, each to serve for a one-year term extending until our 2026 Annual Meeting of Shareholders and their successors are duly elected and qualified |

| FOR each nominee | |

2 | To approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement |

| FOR | |

3 | To indicate, on an advisory basis, the preferred frequency of shareholder advisory votes on the compensation of our named executive officers |

| FOR “One Year” | |

4 | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025 |

| FOR | |

5 | To approve the Collegium Pharmaceutical, Inc. 2025 Equity Incentive Plan |

| FOR | |

6 | To transact any other business properly brought before the Annual Meeting | |||

| How to Vote | ||||

YOUR VOTE IS IMPORTANT. Even if you plan to attend the Annual Meeting, we encourage you to vote as soon as possible using one of the following methods. Have your proxy card or voting instruction form with your control number and follow the instructions. | |||||

|

|

|

| ||

Internet | Telephone | At the Annual Meeting | |||

Registered | www.envisionreports.com/COLL | Within the United States and Canada, 1-800-652-8683 (toll-free) | Return a properly executed proxy card | Attend the Annual Meeting and vote online using your control number | |

Beneficial Owners (Holders in street name) | www.envisionreports.com/COLL | Not applicable | Return a properly executed voting instruction form by mail, depending upon the method(s) your broker, bank or other nominee makes available | To attend the Annual Meeting, you will need to contact your broker, bank or other nominee to obtain your control number | |

Deadline | 11:59 p.m. Eastern Time on May 14, 2025, if you are a registered holder. If you are a beneficial owner, please refer to the information provided by your broker, bank or other nominee. | ||||

You can find more information, including with respect to each proposal, in the attached proxy statement. This year’s Annual Meeting will be held entirely online live via audio webcast. You will be able to attend and participate in the Annual Meeting online by visiting www.meetnow.global/MZQSZJF, where you will be able to listen to the Annual Meeting live, submit questions, and vote. The list of shareholders entitled to vote at the Annual Meeting will be available for examination at the Annual Meeting by shareholders for any purpose germane to the Annual Meeting, or upon request, 10 days prior to the Annual Meeting at our principal executive office, 100 Technology Center Drive, Suite 300, Stoughton, MA 02072. Please read the enclosed information carefully before submitting your proxy.

By Order of the Board of Directors, | |

/s/ DAVID DIETER | |

David Dieter | |

Executive Vice President, General Counsel and Corporate Secretary |

Stoughton, Massachusetts

March 28, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE |

Instead of mailing a printed copy of our proxy materials to all of our shareholders, we provide access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about April 2, 2025, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all shareholders of record on our books at the close of business on March 25, 2025, the record date for the Annual Meeting. Copies of this proxy statement, the form of proxy card, and the Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “2024 Form 10-K”) are available without charge at www.envisionreports.com/COLL, by telephone at 1-866-641-4276, or by notifying our Corporate Secretary, in writing, at Collegium Pharmaceutical, Inc., 100 Technology Center Drive, Suite 300, Stoughton, MA 02072. |

Forward-Looking Statements

This proxy statement contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. We may, in some cases, use terms such as “predicts,” “forecasts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Examples of forward-looking statements contained in this proxy statement include, among others, statements relating to our business plans, objectives and expected operating results. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results, performance, or achievements to differ materially from the company’s current expectations, including risks described under the heading “Risk Factors” in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q and other filings with the SEC. Any forward-looking statements that we make in this proxy statement speak only as of the date hereof. We assume no obligation to update our forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

Table of contents

-i-

2025 PROXY STATEMENT SUMMARY

This proxy statement is furnished to shareholders of Collegium Pharmaceutical, Inc. in connection with the solicitation of proxies by our board of directors (the “board”). In this proxy statement, unless expressly stated otherwise or the context otherwise requires, the use of “Collegium,” the “Company,” “our,” “we” or “us” refers to Collegium Pharmaceutical, Inc. and its subsidiaries. The Notice will first be mailed to shareholders on or about April 2, 2025. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information you should consider. You should read the entire proxy statement carefully before voting.

2025 Annual Meeting

| When |

|

| Record Date |

Thursday, May 15, 2025 | Only shareholders of record at the close of business on March 25, 2025 are entitled to notice of, and to vote at, the 2025 Annual Meeting of Shareholders (the “Annual Meeting”) or any adjournment thereof. | |||

| Where | |||

www.meetnow.global/MZQSZJF |

Item of Business | Board Recommendation | See Page | ||

1 | To elect eight director nominees, each to serve for a one-year term extending until our 2025 Annual Meeting of Shareholders and their successors are duly elected and qualified |

| FOR each nominee | 13 |

2 | To approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement |

| FOR | 41 |

3 | To indicate, on an advisory basis, the preferred frequency of shareholder advisory votes on the compensation of our named executive officers |

| FOR “One Year” | 84 |

4 | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025 |

| FOR | 85 |

5 | To approve the Collegium Pharmaceutical, Inc. 2025 Equity Incentive Plan |

| FOR | 88 |

6 | To transact any other business properly brought before the Annual Meeting | |||

1

About Collegium

Record Date Shares Outstanding | 32,131,798 shares | Exchange | Nasdaq Global Select Market | |

Stock Symbol | COLL | Transfer Agent | Computershare Trust Company, N.A. |

Our Mission

Collegium Pharmaceutical is building a leading, diversified biopharmaceutical company committed to improving the lives of people living with serious medical conditions.

Our Values

2024 Business Performance

| • | Product revenues, net for the year ended December 31, 2024 (FY 2024) were $631.4 million, up 11% year-over-year from 2023 |

| • | Grew full-year Jornay PM prescriptions 31% year-over-year and Belbuca prescriptions 3.8% year-over-year |

| • | Closed Ironshore Acquisition and completed integration of Ironshore operations, establishing presence in neuropsychiatry (ADHD) |

| • | Secured a $646.0 million financing and used proceeds to repay prior term loan, reducing interest rate by 300 basis points, and the remaining proceeds, along with cash on-hand, to fund the acquisition of Ironshore |

| • | Appointed Vikram Karnani as President and Chief Executive Officer |

2

| • | Returned $60.0 million in capital to shareholders in 2024 under the share repurchase program authorized by our board of directors in January 2024 |

| • | Called and redeemed all $26.4 million aggregate principal amount of 2.625% Convertible Senior Notes due in 2026 |

| • | Entered into an authorized generic agreement with Hikma Pharmaceuticals USA Inc. (“Hikma”), under which Hikma has the exclusive right to sell the authorized generic versions of the Nucynta products in the United States |

| • | Ended the year with over $162.0 million in cash and marketable securities. |

Corporate Governance Highlights

Corporate Governance Best Practices | |

✓ 8 of our 9 current directors are independent, including all committee members | ✓ Annual director self-evaluation and committee assessment to ensure Board effectiveness |

✓ Regular executive sessions of independent directors | ✓ All directors attended at least 75% of 2024 meetings |

✓ Lead Independent Director | ✓ Robust risk oversight, including separate compliance committee |

✓ Ongoing Board refreshment and balance of new and experienced directors | ✓ Code of Business Conduct and Ethics |

✓ No over-boarding | ✓ Active shareholder engagement |

✓ Majority vote director resignation policy | ✓ Commitment to ESG |

3

Environmental, Social, Governance Highlights

Our commitment to serving as a responsible corporate citizen is rooted in our longstanding history of advancing our mission, executing our commercial strategy, governing our business to drive efficiency and value creation, and supporting our communities. As we strive to make an impact through our business and initiatives to “Do Good as We Do Well,” we have prioritized corporate governance and risk mitigation; employee development and culture; our environmental footprint; and giving back to our communities. Our 2024 corporate scorecard included environmental stewardship objectives, focusing on sustainability and environmental impact.

In February 2025, we published our third annual ESG report on our corporate website highlighting our ESG accomplishments to date. The information contained in our ESG report is not a part of, nor is it incorporated by reference into, this proxy statement.

4

Board of Directors Overview

Collegium Board Committees | ||||||||

Age | Director | Independent(1) | Total | Audit | Nominating and Corporate Governance | Compensation | Compliance | |

Michael Heffernan, | 60 | 2003 |

| 4 | ||||

Vikram Karnani | 50 | 2024 | 1 | |||||

Rita Balice-Gordon, Ph.D. | 64 | 2020 |

| 1 |

| |||

Garen Bohlin | 77 | 2015 |

| 2 |

|

| ||

John Fallon, M.D. | 77 | 2016 |

| 1 |

|

|

| |

John Freund, M.D. | 71 | 2014 |

| 3 |

|

| ||

Nancy Lurker(3) | 67 | 2025 |

| 3 | ||||

Gwen Melincoff (4) | 73 | 2017 |

| 3 |

| |||

Gino Santini | 68 | 2012 |

| 2 |

|

| ||

Meetings in 2024 | Board: 9 | 8 | 2 | 5 | 3 | |||

| (1) | Independence under Nasdaq criteria. |

| (2) | Mr. Heffernan will not stand for re-election at the Annual Meeting. |

| (3) | Ms. Lurker joined our board in February 2025. |

| (4) | Ms. Melincoff will not stand for re-election at the Annual Meeting. |

| Committee Chair |

| Committee Member |

| Board Chairman |

| Lead Independent Director |

| Audit Committee Financial Expert |

5

Board Attributes

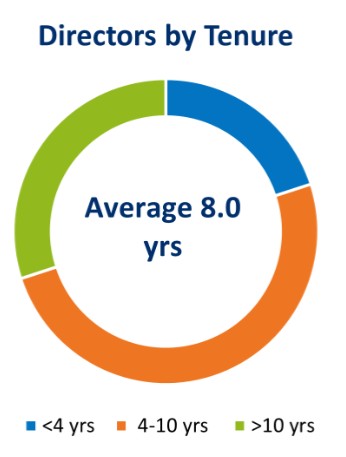

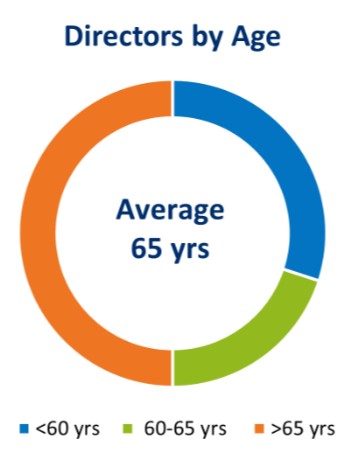

Board Independence, Tenure and Age as of the Record Date

8 of 9

board members are independent

Board Skills and Experience Matrix

The matrix below displays the top areas of the skills and experience of each of our directors and director nominees. The absence of a check mark below does not mean the director does not possess that skill or experience, instead these are the skills and experience most considered by the nominating and corporate

6

governance committee and the Board in making nomination decisions and as part of the board succession planning process.

|

|

|

|

|

|

|

| |

Director | Senior | Finance and Accounting | Business | Human | Operations, | Other | Commercial Pharma | Drug Development & Regulatory |

Michael Heffernan, R.Ph. |

|

|

|

|

|

|

| |

Vikram Karnani |

|

|

|

|

|

| ||

Rita Balice-Gordon, Ph.D. |

|

|

| |||||

Garen Bohlin |

|

|

|

|

|

| ||

John Fallon, M.D. |

|

|

|

| ||||

John Freund, M.D. |

|

|

|

|

| |||

Nancy Lurker |

|

|

|

|

| |||

Gwen Melincoff |

|

|

|

|

|

| ||

Carlos Paya, M.D., Ph.D. |

|

|

|

|

|

| ||

Gino Santini |

|

|

|

|

|

| ||

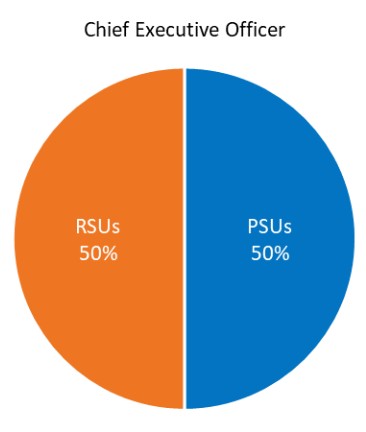

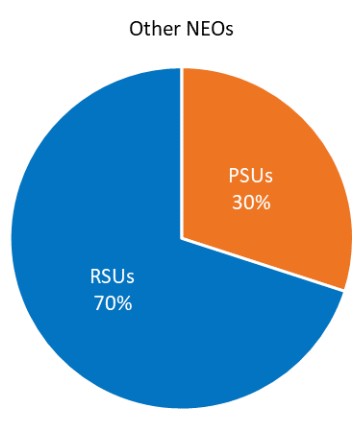

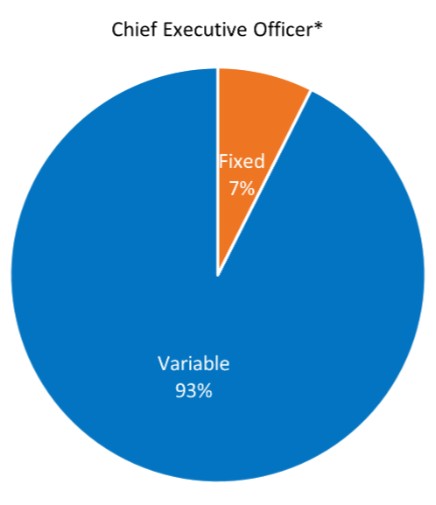

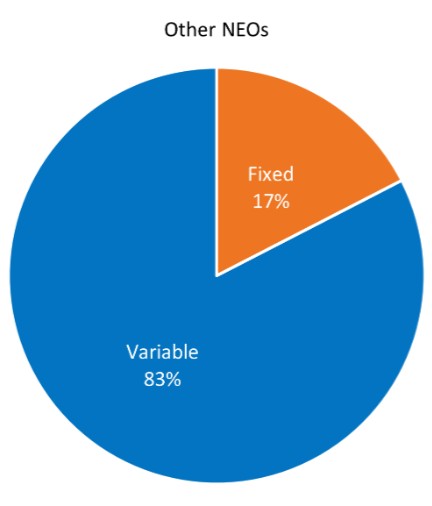

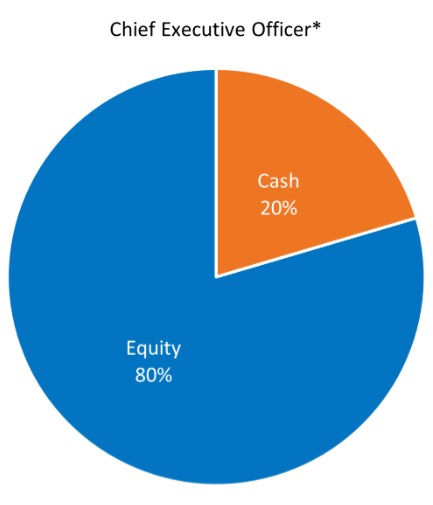

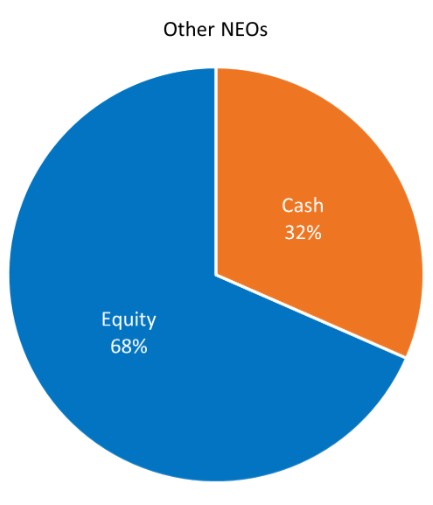

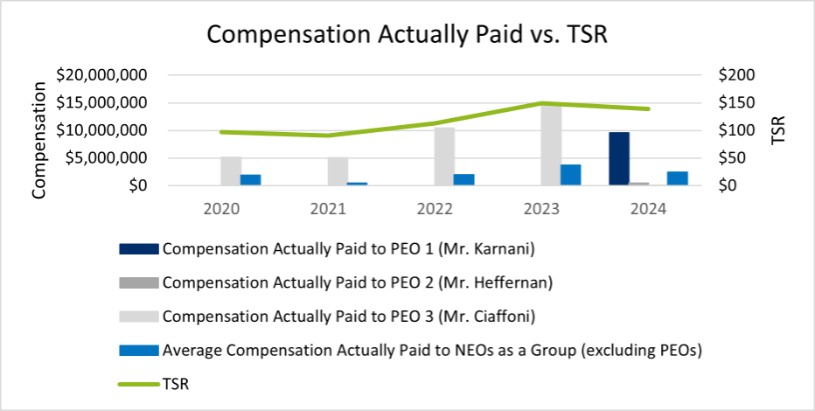

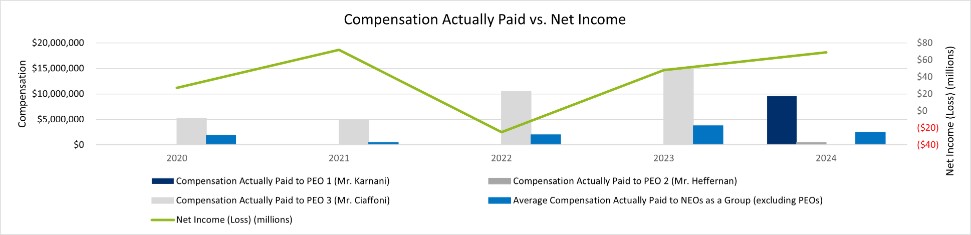

Executive Compensation Highlights

We have designed our executive compensation program to motivate our management team to create long-term value for our shareholders through the achievement of strategic business objectives, while effectively managing the risks and challenges inherent to a growing specialty pharmaceutical company. Specifically, our executive compensation program is designed to promote the achievement of key strategic objectives by linking executives’ short- and long-term cash and equity incentives to the achievement of measurable performance goals.

Compensation Policies and Practices

Things We Do | Things We Don’t Do |

✓ Independent compensation committee that approves all compensation for our named executive officers other than our Chief Executive Officer, whose compensation is approved by the Board ✓ Independent compensation consultant ✓ Annual say-on-pay vote ✓ Compensation committee assesses compensation practices to eliminate excessive risk ✓ Maintain a recoupment policy which requires us to seek the repayment of performance-based compensation in the event of a restatement of our financial results ✓ Pay-for-performance philosophy | × No excise tax gross-ups in the event of a change of control × No pensions or any other enhanced benefit programs beyond those typically available to all employees × Limited perquisites × No hedging or pledging of company stock × No option repricing |

7

✓ Maintain stock ownership guidelines |

Say-on-Pay Advisory Vote The compensation committee believes that our recent say-on-pay votes affirm our shareholders’ support of our approach to executive compensation. In 2024, the annual say-on-pay vote reflected overwhelming support of our executive compensation program, with approximately 99% of votes cast supporting such program. We look forward to continuing to receive feedback from our shareholders through the annual say-on-pay advisory vote and to incorporating the feedback we receive as we evolve our executive compensation program. |

|

2024 Compensation Highlights

| • | In recent years we have continued to work to align our executive compensation programs with shareholder interests as compensation earned under these programs is substantially linked to the achievement of our corporate performance goals. |

| • | Consistent with our pay-for-performance philosophy, in 2024 our executive compensation programs reflected a heavy emphasis on performance-based compensation, with the performance measures of our variable compensation components – our target annual cash incentive and long-term equity incentives – being primarily based on the achievement of our 2024 corporate performance goals and our relative total shareholder return. |

| • | Reflective of our continued commitment to ESG, our 2024 corporate scorecard included environmental stewardship objectives, focusing on sustainability and environmental impact. |

General Information about the Meeting

Proxy Solicitation

Our Board is soliciting your vote on matters that will be presented at the Annual Meeting and at any adjournment or postponement thereof and we have retained Innisfree M&A Incorporated (“Innisfree”) to assist us in soliciting proxies. This proxy statement contains information on these matters to assist you in voting your shares.

On or about April 2, 2025, we will begin mailing the Notice to all shareholders of record on our books at the close of business on March 25, 2025, the record date for the Annual Meeting. Copies of this proxy statement, the form of proxy card, and the 2024 Form 10-K are available without charge at www.envisionreports.com/COLL, by telephone at 1-866-641-4276, or by notifying our Corporate Secretary, in writing, at Collegium Pharmaceutical, Inc., 100 Technology Center Drive, Suite 300, Stoughton, MA 02072.

8

We have filed the 2024 Form 10-K with the SEC, and it is available free of charge at the SEC’s website at www.sec.gov and on our website at ir.collegiumpharma.com/sec-filings.

Shareholders Entitled to Vote

All shareholders of record of our common stock at the close of business on March 25, 2025, or the Record Date, are entitled to receive notice of and to vote their shares at the Annual Meeting. As of that date, 32,131,798 shares of our common stock were outstanding. Each share is entitled to one vote on each matter properly brought to the meeting.

Voting Methods

You may cast your vote in any of the following ways:

|

|

|

| |

Internet | Telephone | At the Annual Meeting | ||

Registered Holders | www.envisionreports.com/COLL | Within the United States and Canada, 1-800-652-8683 (toll-free) | Return a properly executed proxy card | Attend the Annual Meeting and vote online using your control number |

Beneficial Owners (Holders in street name) | www.envisionreports.com/COLL | Not applicable | Return a properly executed voting instruction form by mail, depending upon the method(s) your broker, bank or other nominee makes available | To attend the Annual Meeting, you will need to contact your broker, bank or other nominee to obtain your control number |

Deadline | 11:59 p.m. Eastern Time on May 14, 2025, if you are a registered holder. If you are a beneficial owner, please refer to the information provided by your broker, bank or other nominee. | |||

How Your Shares Will be Voted

In each case, your shares will be voted as you instruct. If you return a signed card, but do not provide voting instructions, your shares will be voted “FOR” each of the proposals. If you are the record holder of your shares, you may revoke or change your vote any time before the proxy is exercised. To do so, you must do one of the following:

| • | Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. You may not revoke or change your vote over the Internet or by telephone after 11:59 p.m., Eastern Time, on May 14, 2025. |

9

| • | Sign a new proxy and submit it by mail to Computershare Investor Services, PO BOX 43101, Providence, RI 02040-5067, Attention: Proxy Tabulation, who must receive the proxy card no later than May 14, 2025. Only your latest dated proxy will be counted. |

| • | Attend the Annual Meeting and vote as instructed above. Attending the Annual Meeting alone will not revoke your Internet vote, telephone vote or proxy submitted by mail, as the case may be. |

| • | Give our Corporate Secretary written notice before or at the meeting that you want to revoke your proxy. If your shares are held in “street name,” you should contact your broker, bank or nominee for information on how to change your voting instructions. You may also vote in person at the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a “legal proxy” from your broker, bank or nominee. |

If your shares are held by your broker, bank or other holder of record as a nominee or agent (i.e., the shares are held in “street name”), you should follow the instructions provided by your broker, bank or other holder of record.

If you have any questions or require any assistance in voting your shares, please call Innisfree at 877-800-518.

Deadline for Voting

The deadline for voting by telephone or Internet, other than by virtually attending the Annual Meeting, is 11:59 p.m. Eastern Time on May 14, 2025. If you are a registered shareholder and virtually attend the Annual Meeting, you may deliver your vote online during the Annual Meeting. “Street name” shareholders who wish to vote at the Annual Meeting will need to obtain a proxy form from the institution that holds their shares.

Broker Voting and Votes Required for Each Proposal

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. This proxy statement has been forwarded to you by your broker, bank or other holder of record who is considered the shareholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction form included in the materials made available or by following their instructions for voting on the Internet.

A broker non-vote occurs when a broker or other nominee that holds shares for a beneficial owner does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the beneficial owner of the shares. The following table summarizes the

10

voting matters, votes required, how broker non-votes and abstentions are treated with respect to our proposals, and broker discretionary voting authority:

VOTING MATTERS | VOTES REQUIRED | TREATMENT OF | BROKER |

PROPOSAL 1: To elect eight director nominees, each to serve for a one-year term extending until our 2026 Annual Meeting of Shareholders and their successors are duly elected and qualified | Majority of the votes cast | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No |

PROPOSAL 2: To approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement | Majority of the votes cast | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No |

PROPOSAL 3: To indicate, on an advisory basis, the preferred frequency of shareholder advisory votes on the compensation of our named executive officers | Majority of the votes cast | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No |

PROPOSAL 4: To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025 | Majority of the votes cast | Abstentions and broker non-votes, if any, will not be taken into account in determining the outcome of the proposal | Yes |

PROPOSAL 5: To approve the Collegium Pharmaceutical, Inc. 2025 Equity Incentive Plan | Majority of the votes cast | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No |

Quorum

The holders of a majority of the 32,131,798 shares of common stock outstanding as of the Record Date, either present in person or represented by proxy, constitute a quorum. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will

11

be considered part of the quorum. Broker non-votes and abstentions will be counted as present for the purpose of establishing a quorum. If a quorum is not present by attendance or represented by proxy at the Annual Meeting, the shareholders present by attendance at the meeting or by proxy may adjourn the Annual Meeting until a quorum is present.

Participating in the Annual Meeting

Our Annual Meeting will be a completely virtual meeting conducted via live webcast. There will be no physical meeting location. We have adopted a virtual format for the Annual Meeting to make participation accessible for shareholders from any geographic location with Internet connectivity. We have worked to offer the same participation opportunities as would be provided at an in-person meeting while further enhancing the online experience available to all shareholders regardless of their location.

To participate in the virtual meeting, visit www.meetnow.global/MZQSZJF. You will need to enter the 15-digit control number included on your Notice or on your proxy card. The meeting will begin promptly at 8:30 a.m. ET on May 15, 2025. We encourage you to access the meeting prior to the start time leaving ample time for the check in.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong wifi connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in prior to the start of the meeting.

This year’s shareholders question and answer session will include questions submitted in advance of, and questions submitted live during, the Annual Meeting. Questions may be submitted through www.meetnow.global/MZQSZJF. We will post questions and answers if applicable to our business on our website, www.collegiumpharma.com, under the “Investors” section shortly after the meeting.

If you are a registered holder and wish to vote at the meeting, you will need the 15-digit control number provided on your proxy card. If you hold your shares through a broker, bank or other nominee and wish to vote at the meeting, you will need to register in advance to attend the Annual Meeting online and you may not vote your shares at the Annual Meeting unless you obtain a “legal proxy” from the bank, broker or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. To register to attend the Annual Meeting online, you must submit proof of your legal proxy reflecting your holdings along with your name and email address to Computershare Trust Company, N.A. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. (Eastern Time) on May 14, 2025. You will receive confirmation of your registration by email after we receive your registration materials. Requests for registration should be directed by (i) email to legalproxy@computershare.com, with a forward of the email from your broker or attachment of an image of your legal proxy, or (ii) by mail to Computershare Trust Company, N.A., Collegium Pharmaceutical, Inc. Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001.

Proxy Solicitation Costs

We pay the cost of soliciting proxies. We have retained Innisfree to assist us in soliciting proxies, for which we will pay Innisfree a fee of approximately $30,000 plus out-of-pocket expenses. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We will furnish

12

copies of solicitation material to such brokerage firms and other representatives. Proxies may also be solicited on behalf of the Board by mail, telephone, and other electronic means or in person. Directors and employees will not be paid any additional compensation for soliciting proxies.

1. Corporate Governance and Board Matters Proposal | |

Election of Directors

Board Composition

Board Refreshment

Our Board is committed to thoughtful board refreshment and ongoing succession planning. Our Board currently consists of nine members. In February 2025, we appointed Nancy Lurker, an independent director, to our Board. In addition, our Board is nominating distinguished industry leader Carlos Paya M.D., Ph.D. to stand for election to our Board as an independent director at the Annual Meeting. In connection therewith, in March 2025, Mr. Heffernan and Ms. Melincoff notified our Board that they will not stand for re-election at the Annual Meeting and will be retiring from the Board at that time.

Mr. Heffernan’s retirement follows 22 years of distinguished service to the Company as founder, Chairman of the Board and Chief Executive Officer (until 2018). Mr. Heffernan also served as interim Chief Executive Officer in 2024, leading the Company through a Chief Executive Officer transition and the Ironshore Acquisition. Ms. Melicoff has served as a director of the Company since 2017. We thank Mr. Heffernan and Ms. Melincoff for their combined 30 years of service to our Company, our board, and our shareholders.

Our Board has elected to reduce the size of the Board from nine to eight directors, effective as of the date of the Annual Meeting. In addition, effective as of the Annual Meeting, Mr. Santini, Lead Independent Director of the Board, will succeed Mr. Heffernan as Chairman of the Board.

Director Nominees

Upon the recommendation of the nominating and corporate governance committee, each of the following directors has been nominated for election at our 2025 Annual Meeting of Shareholders, and each has agreed to stand for election:

• Vikram Karnani | • John Fallon, M.D. |

• Rita Balice-Gordon, Ph.D. | • Nancy Lurker |

• Garen Bohlin | • Carlos Paya, M.D., Ph.D. |

• John Freund, M.D. | • Gino Santini |

If the director nominees are elected at the Annual Meeting, then each nominee will serve for a one-year term expiring at the 2026 Annual Meeting of Shareholders and until his or her successor is duly elected and qualified.

13

Elected directors hold office until their death, resignation or removal or their successors are duly elected and qualified. In accordance with our articles of incorporation and bylaws, our directors may fill existing vacancies on our Board (including vacancies resulting from an increase in the number of directors) by appointment. Pursuant to the Virginia Stock Corporation Act, the term of office of a director elected by our Board to fill a vacancy expires at the next shareholders’ meeting at which directors are elected.

Vote Required

Our directors are elected by a majority of the votes cast. Pursuant to our bylaws, a majority of votes cast means that if the votes cast “FOR” such nominee’s election exceed the votes cast “AGAINST” such nominee’s election, such nominee is elected. Abstentions and broker non-votes will not be counted as votes cast either “FOR” or “AGAINST” a director’s election and will have no impact on the outcome of the election of directors.

| The Board of Directors recommends voting FOR the election of each director nominee. |

If a choice is specified on the proxy card by a shareholder, the shares will be voted as specified. If no contrary indication is made, proxies are to be voted “FOR” each of the nominees, or, if any such individual is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), proxies are to be voted “FOR” any nominee who is designated by our Board to fill the vacancy.

14

Nominees for Election

The following table sets forth certain information, as of April 2, 2025, with respect to each of our director nominees.

VIKRAM KARNANI | |||

Age: 50 Director Since: 2024 | Committee Memberships: None | Other Public Directorships: None | |

Mr. Karnani has served as our President and Chief Executive Officer, and a director, since November 2024. Mr. Karnani previously served as Executive Vice President and President, Global Commercial Operations and Medical Affairs at Amgen Inc. (“Amgen”), a global biotechnology company. Mr. Karnani joined Amgen in October 2023 through Amgen’s acquisition of Horizon Therapeutics plc (“Horizon”). Mr. Karnani joined Horizon in 2014, holding numerous leadership positions including Executive Vice President and President, International, from August 2020 until October 2023; Executive Vice President and Chief Commercial Officer from March 2018 to August 2020; Senior Vice President, Rheumatology Business Unit from February 2017 to March 2018; and General Manager, Specialty Business Unit from July 2014 until February 2017. Prior to joining Horizon, Mr. Karnani was with Fresenius Kabi AG (“Fresenius Kabi”), a global health care company, where he served as Vice President of the therapeutics and cell therapy business from October 2011 to July 2014. Mr. Karnani also held various positions in business development, corporate strategy and strategic marketing within Fenwal Inc., a global blood technology company that was acquired by Fresenius Kabi, from November 2008 to October 2011. Mr. Karnani has a master’s degree from the Kellogg School of Management at Northwestern University, a master’s degree in electrical engineering from Case Western Reserve University and a bachelor of science degree in electrical engineering from University of Bombay, India. | |||

Skills & Qualifications: We believe that Mr. Karnani’s perspective as our Chief Executive Officer and extensive experience as a senior executive in the pharmaceutical and biotechnology industry provide him with the qualifications and skills to serve as a director. | |||

15

RITA BALICE-GORDON, PH.D. | |||

Age: 64 Director Since: 2020 | Committee Memberships: Nominating and Corporate Governance | Other Public Directorships: None | |

Dr. Balice-Gordon has served as a member of our Board since September 2020. Dr. Balice-Gordon is the Chief Executive Officer of Muna Therapeutics (“Muna”), a biotech company focused on developing novel therapeutics for patients with neurodegenerative diseases, since July 2021. She was the founding Chief Scientific Officer of Muna from May 2020 to July 2021, and was an entrepreneur-in-residence at Novo Holdings / Novo Seeds from August 2020 through July 2021. Previously, Dr. Balice-Gordon served in senior leadership roles at Sanofi, Inc. (“Sanofi”) from May 2016 through May 2020, most recently as Global Head of Rare and Neurological Diseases. Prior to joining Sanofi, Dr. Balice-Gordon led the psychiatry and pain drug discovery portfolios as Vice President in the Neuroscience and Pain Research Unit at Pfizer, Inc. Earlier in her career, Dr. Balice-Gordon was Professor of Neuroscience and Chair of the Neuroscience Graduate Group at the University of Pennsylvania Perelman School of Medicine, where she currently holds an appointment as Adjunct Professor in the Department of Neuroscience. Dr. Balice-Gordon has authored more than 100 scientific papers, received numerous accolades for her work in the field of neuroscience, including election as a Fellow of the American Association for the Advancement of Science, and has chaired or served on many National Institutes of Health, national and international committees. She received her B.A. degree in Biological Sciences from Northwestern University, her Ph.D. in Neurobiology from the University of Texas at Austin and completed a postdoctoral fellowship at Washington University School of Medicine in St. Louis. | |||

Skills & Qualifications: We believe that Dr. Balice-Gordon’s scientific expertise and industry experience, including in the neurology and pain therapeutic areas, provide her with the qualifications and skills to serve as a director. | |||

16

GAREN BOHLIN | ||

Age: 77 Director Since: 2015 | Committee Memberships: Audit (Chair), Compensation | Other Public Directorships: Karyopharm Therapeutics, Inc. |

Mr. Bohlin has served as a member of our Board since January 2015. Mr. Bohlin has almost 30 years of experience serving in executive roles at several biotechnology companies, including Constellation Pharmaceuticals, Inc., where he served as an Executive Vice President from January 2010 to his retirement in April 2012. Prior to that, Mr. Bohlin served as Chief Operating Officer at Sirtris Pharmaceuticals, Inc. (“Sirtris”), which was acquired by GlaxoSmithKline plc. Prior to joining Sirtris, Mr. Bohlin served as President and Chief Executive Officer of Syntonix Pharmaceuticals, Inc. (“Syntonix”), which was acquired by Biogen Idec. Prior to Syntonix, Mr. Bohlin spent 14 years in executive management at Genetics Institute, Inc. (“Genetics Institute”), which was acquired by Wyeth. Prior to Mr. Bohlin’s tenure at Genetics Institute, he was a partner at Arthur Andersen & Co., where he spent 13 years. Mr. Bohlin has served on the board of directors of several companies. Mr. Bohlin currently serves on the board of directors of Karyopharm Therapeutics, Inc. (NASDAQ GS: KPTI) (2013 to present) and Curadel Surgical Innovations, Inc, a privately held company (2020 to present). Previously, he served on the board of directors of Acusphere, Inc. (OTC: ACUS) (2005 to 2015), Tetraphase Pharmaceuticals, Inc. (NASDAQ: TTPH) (2010 to 2020), Proteon Therapeutics, Inc. (NASDAQ: PRTO) (2014 to 2020) and several other publicly traded and privately held biotechnology companies. Mr. Bohlin graduated from the University of Illinois with a B.S. in Accounting and Finance in 1970. | ||

Skills & Qualifications: We believe that Mr. Bohlin’s perspective and experience as a senior executive in our industry, as well as his board and audit committee experience with publicly traded and privately held biotechnology companies, provide him with the qualifications and skills to serve as a director. | ||

17

JOHN FALLON, M.D. | ||

Age: 77 Director Since: 2016 | Committee Memberships: Audit, Nominating and Corporate Governance Committee (Chair), Compliance | Other Public Directorships: None |

Dr. Fallon has served as a member of our Board since June 2016. Dr. Fallon served as Senior Vice President and Chief Physician Executive at Blue Cross Blue Shield of Massachusetts (“BCBS”), a health insurance company, from 2004 through 2015. Prior to his role at BCBS, Dr. Fallon served as Chief Executive Officer for clinical affairs at the State University of New York Downstate Medical Center, including University Hospital of Brooklyn and the clinical faculty practice plan. His professional experience also includes the Partners Healthcare System, where he was Chairman of the physician network. Dr. Fallon was also the Chief Executive Officer of Charter Professional Services Corporation and the founder and Chief Executive Officer of North Shore Health System, a large physician-hospital organization in Massachusetts. He served on the boards of directors of Insulet Corporation (NASDAQ:PODD) (2012 to 2021), a medical devices company, and AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG), a specialty pharmaceutical company 2014 to November 2020 when the company was acquired. Dr. Fallon was formerly the Chairman of the board of directors of NEHI (Network for Excellence in Health Innovation). In the past, he also served as a member the board of directors of Exact Sciences Corporation (NASDAQ: EXAS) (2016 to 2019), a molecular diagnostics company, as well as several not-for-profit boards, including: Alliance for Healthcare Improvement, Massachusetts Health Quality Partners, Massachusetts E-Health Collaborative and Neighborhood Health Plan. He also co-chaired, with the Massachusetts Secretary of Health and Human Services, the Massachusetts Patient Centered Medical Home Initiative. Dr. Fallon practiced internal medicine for more than 20 years, fulfilled his residency at Boston City Hospital, and is Board Certified in Internal Medicine. He received a B.A. from the College of the Holy Cross, an MBA from the University of South Florida and a Doctor of Medicine from Tufts University School of Medicine. | ||

Skills & Qualifications: We believe that Dr. Fallon’s perspective and experience as an executive and board member in the life sciences industry, as well as his strong medical and scientific background, provide him with the qualifications and skills to serve as a director. | ||

18

JOHN FREUND, M.D. | ||

Age: 71 Director Since: 2014 | Committee Memberships: Compensation (Chair), Audit | Other Public Directorships: Sutro Biopharma, Inc. SI-Bone, Inc. |

Dr. Freund has served as a member of our Board since February 2014. Dr. Freund co-founded Skyline Ventures (“Skyline”), a venture capital firm, in 1997 and served as Managing Director at Skyline until 2023. Prior to joining Skyline, Dr. Freund served as Managing Director in the private equity group of Chancellor Capital Management, LLC. In 1995, Dr. Freund co-founded Intuitive Surgical, Inc. and served on its board of directors until 2000. From 1988 to 1994, Dr. Freund served in various positions at Acuson Corporation (“Acuson”), most recently as Executive Vice President. Prior to joining Acuson, Dr. Freund was a General Partner of Morgan Stanley Venture Partners from 1987 to 1988. From 1982 to 1988, Dr. Freund worked at Morgan Stanley & Co., where he co-founded the Healthcare Group in the Corporate Finance Department in 1983. In 2016, Dr. Freund co-founded and was Chief Executive Officer of Arixa Pharmaceuticals, an antibiotic company, which was acquired by Pfizer in 2020. Dr. Freund currently serves on the board of directors of Sutro Biopharma, Inc. (NASDAQ: STRO) (2014 to present), and SI-Bone, Inc. (NASDAQ: SIBN) (2013 to present). Dr. Freund also serves on the board of directors of fourteen U.S. registered investment funds managed by The Capital Group Companies. He previously served on the board of directors of several publicly traded companies, including, Proteon Therapeutics, Inc. (NASDAQ: PRTO) (2014 to 2020), Tetraphase Pharmaceuticals, Inc. (NASDAQ: TTPH) (2012 to 2020), XenoPort, Inc. (NASDAQ: XNPT) (1999 to 2016), where he was Chairman, Concert Pharmaceuticals, Inc. (NASDAQ: CNCE) (2014 to 2015), MAP Pharmaceuticals, Inc. (NASDAQ: MAPP) (2004 to 2011), and MAKO Surgical Corp. (NASDAQ: MAKO) (2008 to 2013). Dr. Freund is a member of the Advisory Board for the Harvard Business School Healthcare Initiative. Dr. Freund graduated from Harvard College with a B.A. in History in 1975, received an M.D. from Harvard Medical School in 1980 and an M.B.A. from Harvard Business School in 1982. | ||

Skills & Qualifications: We believe that Dr. Freund’s extensive finance and investment experience, his experience as an executive, and his service on the board of directors of numerous public and privately held companies in our industry provide him with the qualifications and skills to serve as a director. | ||

19

NANCY LURKER | ||

Age: 67 Director Since: 2025 | Committee Memberships: None | Other Public Directorships: EyePoint Pharmaceuticals, Inc. Alkermes plc |

Ms. Lurker has served as a member of our board since February 2025. Ms. Lurker served as President and Chief Executive Officer of EyePoint Pharmaceuticals, Inc. (“EyePoint”) from November 2016 to July 2023. Prior to EyePoint, Ms. Lurker served as President and Chief Executive Officer and a director of PDI, Inc. (now Interpace Diagnostics Group, Inc.), a publicly-traded healthcare commercialization company, and as Senior Vice President and Chief Marketing Officer of Novartis Pharmaceuticals Corporation, the U.S. subsidiary of Novartis AG. Prior to that, Ms. Lurker held various senior positions at other leading pharmaceutical companies including Pharmacia Corporation (now a part of Pfizer, Inc.), ImpactRx and Bristol-Myers Squibb Company. Ms. Lurker currently serves as the Vice Chair of the board of directors of EyePoint (NASDAQ: EYPT) and serves on the board of directors of Alkermes plc (Nasdaq: ALKS), Altasciences, LLC, a private contract research organization and National Sanitation Foundation, a not-for-profit organization dedicated to improving human health through quality standards. She previously served on the boards of directors of the Cancer Treatment Centers of America, Aquestive Therapeutics, Inc., X4 Pharmaceuticals, Inc., Auxilium Pharmaceuticals, Inc., Mallinckrodt plc, Elan Corporation, plc, and ConjuChem Biotechnologies. Ms. Lurker holds a B.S. in Biology from Seattle Pacific University and an M.B.A. from the University of Evansville. | ||

Skills & Qualifications: We believe that Ms. Lurker’s broad ranging experience in the pharmaceutical industry and years of experience as a senior executive provide her with the qualifications and skills to serve as a director. | ||

20

CARLOS PAYA, M.D., PH. D. | ||

Age: 66 | Other Public Directorships: Vaxcyte, Inc. | |

Dr. Paya has served as a Venture Partner at Abingworth LLP (acquired by The Carlyle Group Inc. in August 2022) since January 2020. Dr. Paya has also served as Chairman of the board of directors of Vaxcyte, Inc. (NASDAQ: PCVX) since October 2021 and has served as Chairman of the board of directors of Highlight Therapeutics S.L, a privately held immuno-oncology company, since January 2020. Additionally, Dr. Paya serves as a Senior Advisor to Ysios Capital, a privately held life sciences investor, and Launch Therapeutics, a privately held clinical development company. Dr. Paya previously served as a member of the boards of directors of Standard BioTools, Inc. (NASDAQ: LAB) from March 2017 to January 2024, where he also served as Chairman from May 2020 to January 2024 when it merged with SomaLogic, Inc. (NASDAQ: SLGC), and of Mallinckrodt Pharmaceuticals plc (NYSE: MNK) from May 2019 to June 2022. Dr. Paya also served as President, Chief Executive Officer and director of Immune Design Corp, from May 2011 to May 2019 when it was acquired by Merck & Co., Inc. and previously served as President of Elan Corporation (which was acquired by Perrigo Company (NYSE: PRGO)), from November 2008 to April 2011. Before joining Elan Corporation, Dr. Paya served as Vice President of the Lilly Research Laboratories at Eli Lilly & Company (NYSE: LLY) from September 2001 to November 2008. From January 1991 to August 2001, Dr. Paya was Professor of Medicine, Immunology, and Pathology, and Vice Dean of the clinical investigation program at the Mayo Clinic in Rochester, Minnesota. Dr. Paya holds M.D. and Ph.D. degrees from the University of Madrid and underwent postdoctoral training at the Institute Pasteur, Paris, France. | ||

Skills & Qualifications: We believe that Dr. Paya’s perspective and experience as a senior executive in the life sciences industry provide him with the qualifications and skills to serve as a director. | ||

21

GINO SANTINI | ||

Age: 68 Director Since: 2012 | Committee Memberships: Compliance (Chair); Compensation | Other Public Directorships: Compass Pathways PLC |

Mr. Santini has served as a member of our Board since July 2012 and has served as our lead independent director since May 2015. Since December 2010, Mr. Santini has been a senior advisor providing financing and business consulting services to venture capital, pharmaceutical and biotechnology companies. Previously, Mr. Santini held various positions at Eli Lilly and Company (“Lilly”) from 1983 until his retirement from Lilly in December 2010, most recently as Senior Vice President of Corporate Strategy and Business Development, a position he held since 2007. Mr. Santini also served as a member of Lilly’s Executive Committee from January 2004 to his retirement and as President of U.S. Operations. He joined Lilly in 1983 as a financial planning associate in Italy. Mr. Santini has served as chairman of the board of directors of Compass Therapeutics (NASDAQ : CMPS) since September 2024. Mr. Santini currently serves as a member of the board of directors of several privately held companies. Previously, Mr. Santini served on the board of directors of Intercept Pharmaceuticals, Inc. (NASDAQ: ICPT) (2015 to 2023), as well as Horizon Therapeutics plc (NASDAQ: HZNP) (2012 to 2023), Allena Pharmaceuticals, Inc. (NASDAQ: ALNA) (2012 to 2022), AMAG Pharmaceuticals Inc. (NASDAQ: AMAG) (2012 to 2020), Vitae Pharmaceuticals, Inc. (NASDAQ GS: VTAE) (2014 to 2016) and Sorin S.p.A., a company traded on the Italian Stock Exchange (2012 to 2015). He graduated from the University of Bologna, Italy with a B.S. in Mechanical Engineering in 1981 and received an M.B.A. from the Simon School of Business at the University of Rochester in 1983. | ||

Skills & Qualifications: We believe that Mr. Santini’s perspective and experience as a senior executive at Lilly, as well as his extensive domestic and international commercial, corporate strategy, business development and transaction experience, provide him with the qualifications and skills to serve as a director. | ||

Director Nomination Process

Identification and Evaluation of Nominees for Directors

Our nominating and corporate governance committee is of the view that the continuing service of qualified incumbents promotes stability and continuity in the board room, contributing to our Board’s ability to work as a collective body, while providing us the benefit of the familiarity and insight into our affairs that our directors have accumulated during their tenure. Accordingly, our nominating and corporate governance committee recommends to our Board the re-nomination of incumbent directors for election who continue to satisfy our nominating and corporate governance committee’s criteria for membership on our Board, whom our nominating and corporate governance committee believes continue to make important contributions to our Board and who consent to continue their service on our Board. Consistent with this policy, in considering candidates for election at our annual meeting of shareholders, the nominating and corporate governance committee will first determine the incumbent directors whose terms expire at the upcoming meeting and who consent to continue their service on our Board. If our nominating and corporate governance committee determines that an incumbent director consenting to re-nomination continues to be qualified and has satisfactorily performed his or her duties as director during the preceding term, and there exist no reasons,

22

including considerations relating to the composition and functional needs of our Board as a whole, why in our nominating and corporate governance committee’s view the incumbent should not be re-nominated, the nominating and corporate governance committee will, absent special circumstances, propose the incumbent director for nomination by our Board for re-election at our annual meeting of shareholders.

If any member of our Board does not wish to continue in service or if our Board decides not to re-nominate a member for re-election, the nominating and corporate governance committee will identify a new nominee that meets the nominating and corporate governance committee’s criteria for membership on our Board. The committee may, in its sole discretion, solicit recommendations for nominees from persons that the nominating and corporate governance committee believes are likely to be familiar with qualified candidates. These persons may include members of our Board, including members of the nominating and corporate governance committee, and our management team. The nominating and corporate governance committee may, in its sole discretion, determine to engage a professional search firm to assist in identifying qualified candidates. If a search firm is engaged, the nominating and corporate governance committee will set its fees and scope of engagement. The nominating and corporate governance committee may, in its sole discretion, solicit the views of the Chief Executive Officer, other members of our senior management and other members of our Board regarding the qualifications and suitability of candidates to be nominated as directors. The nominating and corporate governance committee may, in its sole discretion, designate one or more of its members (or the entire nominating and corporate governance committee) or other members of our Board to interview any proposed candidate. Based on all available information and relevant considerations, the nominating and corporate governance committee will select a candidate who, in the view of the committee, is most suited for membership on our Board. The nominating and corporate governance committee has utilized professional search firms to identify candidates to serve on our Board, including, most recently, the identification of Nancy Lurker, who was appointed to our Board in early 2025.

In making its selection of director nominees, the nominating and corporate governance committee evaluates any candidates proposed by shareholders under criteria similar to the evaluation of other candidates and in accordance with our bylaws and as is otherwise required pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”). However, the nominating and corporate governance committee may consider, as one of the factors in its evaluation of shareholder-recommended nominees, the size and duration of the ownership by the recommending shareholder or shareholder group in our capital stock. The nominating and corporate governance committee may also consider the extent to which the recommending shareholder intends to continue holding its interest in the Company, including, in the case of nominees recommended for election at an annual meeting of shareholders, whether the recommending shareholder intends to continue holding its interest at least through the time of such annual meeting.

Shareholders wishing to suggest a candidate for director must write to our Corporate Secretary in accordance with our procedures detailed in the section below entitled “Shareholder Communications with Our Board.”

Shareholder nominations should be made according to the procedures detailed in the section below entitled “Shareholder Proposals and Director Nominations for 2026 Annual Meeting of Shareholders.” Such submissions must state the nominee’s name and address, together with information with respect to the shareholder or group of shareholders making the recommendation, including the number of shares of common stock owned by such shareholder or group of shareholders, as well as other information required by our bylaws. We may require any proposed nominee to furnish such other information as we may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director or that

23

could be material to a reasonable shareholder’s understanding of the independence, or lack thereof, of such proposed nominee.

Director Qualifications

The nominating and corporate governance committee has adopted guidelines and procedures for identifying and evaluating candidates for director that provide for a fixed set of specific minimum qualifications for its candidates for membership on our Board. Important general criteria and considerations for Board membership include:

GENERAL CRITERIA |

• Understanding of our business and relevant industries in general • Ability to regularly attend meetings of our Board and of any committees on which the director serves • Ability to review in a timely fashion and understand materials circulated to our Board regarding us or our industry • Ability to participate in meetings and decision-making processes in an objective and constructive manner • Ability to be reasonably available, upon request, to advise our officers and management |

The nominating and corporate governance committee will also consider factors such as the likelihood that he or she will be able to serve on our Board for a sustained period, global experience, experience as a director of a public company and knowledge of our industry. Consideration will be given to our Board’s overall balance of diversity of perspectives, backgrounds and experiences. The nominating and corporate governance committee considers the requirement that at least one member of our Board meet the criteria for an “audit committee financial expert” as that phrase is defined under the regulations promulgated by the SEC, and that a majority of the members of our Board be independent as required under the Nasdaq Listing Rules. Our directors’ performance and qualification criteria are reviewed periodically by the nominating and corporate governance committee.

In evaluating director nominees, the nominating and corporate governance committee will consider, among other things, the following factors:

| • | the background and qualifications of the candidate, including information concerning the candidate required to be disclosed in our proxy statement under the rules of the SEC and any relationship between the candidate and the person or persons recommending the candidate; |

| • | if the candidate satisfies certain minimum qualifications and other criteria that the committee has set for membership on our Board; |

| • | if the candidate possesses any of the specific qualities or skills that under the nominating and corporate governance policies must be possessed by one or more members of our Board; |

| • | the contribution that the candidate can be expected to make to the overall functioning of our Board; and |

| • | other factors such as independence under applicable Nasdaq Listing Rules, relationships with our shareholders, competitors, customers, suppliers or other persons with a relationship to the Company. |

24

The nominating and corporate governance committee’s goal is to assemble a Board that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. Moreover, the nominating and corporate governance committee is of the view that the composition of our Board should reflect a mix of skills and expertise that are appropriate for our company given our circumstances and that, collectively, enables our Board to perform its oversight function effectively. Nominees are not discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law.

Majority Vote Director Resignation Policy

Our Board has implemented a majority vote director resignation policy in our Corporate Governance Guidelines. Under the policy, any director nominee who does not receive more votes cast “FOR” than “AGAINST” his or her election in an uncontested election must promptly tender his or her resignation to the board following certification of the shareholder vote. The nominating and corporate governance committee will promptly consider such offer of resignation, the circumstances that led to such director’s failure to receive the required vote for re-election (if known) and make a recommendation to the Board as to whether or not to accept the resignation. The Board will act on the nominating and corporate governance committee’s recommendation within sixty (60) days following certification of the shareholder vote. The nominating and corporate governance committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s offered resignation. Thereafter, the Board will promptly disclose its decision regarding whether to accept the director’s resignation (or the reason(s) for rejecting the resignation, if applicable).

Director Independence

The Nasdaq Listing Rules require a majority of a listed company’s board of directors to be comprised of independent directors. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act.

Our Board undertook a review of the composition of our Board and its committees and the independence of each director. Based upon information requested from and provided by each director concerning their background, employment and affiliations, including family relationships, our Board has determined that each of our current directors and director nominees, with the exception of Mr. Karnani, is currently an “independent director” as defined under the Nasdaq Listing Rules. Mr. Heffernan was not an “independent director” under Nasdaq Listing Rules during the time that he served as our interim Chief Executive Officer during 2024. In making the independence determinations set forth above, our Board considered the relationships that each such non-employee director and nominee has with our Company and all other facts and circumstances our Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director and nominee. There are no family relationships among any of our directors, nominees or executive officers.

25

Board Leadership Structure and Role in Risk Oversight

Leadership Structure

In 2018, we separated the positions of Chief Executive Officer and Chairman of the Board and maintained a Lead Independent Director. Up until May 2024, Joseph Ciaffoni served as Chief Executive Officer and Mr. Heffernan served as Chairman of the Board, with Mr. Santini serving as Lead Independent Director. Our Board believes that the separation of the positions of Chief Executive Officer and Chairman of the Board, combined with a strong Lead Independent Director reinforces the independence of the Board from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of our Board as a whole. In 2024, Mr. Heffernan temporarily served as Chairman of the Board and interim Chief Executive Officer from late May until mid-November following the departure of Mr. Ciaffoni, while we searched for a new Chief Executive Officer. In connection with the appointment of Mr. Karnani as President and Chief Executive Officer in November, Mr. Heffernan stepped down from interim Chief Executive Officer and has continued to serve as our Chairman, until his resignation, effective at the Annual Meeting. Our Board has appointed Gino Santini to serve as Chairman, effective immediately following the Annual Meeting. Until such time, Mr. Santini will continue to serve as our Lead Independent Director. Though it does not have current plans to do so, our Board may combine the roles of Chief Executive Officer and Chairman of the Board again in the future if it believes that would be in the best interest of the Company and its shareholders.

Our Chairman presides over meetings of our Board and holds such other powers and carries out such other duties as are customarily carried out by the chairman of the board of directors of a company. Mr. Heffernan has provided valuable insight to our Board due to the perspective and experience he brings as our former Chief Executive Officer. Following the Annual Meeting, Mr. Santini will serve as our Chairman and brings meaningful perspective to the role due to his long tenure on the Board and experience as our Lead Independent Director.

Risk Management

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through our Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure and our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including adopting guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with certain legal, regulatory and cybersecurity requirements. The audit committee assesses cybersecurity-related risks, based on the likelihood of an incident occurring, impact to our organization if an incident occurred, and the level of internal control we currently have over the risk. The results are analyzed to identify vulnerabilities and then risk management/mitigation plans are designed, implemented, and evaluated for effectiveness.

Our nominating and corporate governance committee monitors the efficacy of our corporate governance practices, including whether they are successful in preventing illegal or improper liability-creating conduct, and our ESG strategy, reporting, policies and practices. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

26

Our compliance committee monitors our programs regarding compliance with laws, regulations, and industry standards that, if breached, may cause significant business, regulatory, or reputational damage.

Board Committees

Our Board has established a standing audit committee, compliance committee, compensation committee, and nominating and corporate governance committee. Each committee operates under a charter that has been approved by our Board and is annually reviewed by each committee. Each charter is available on our website, www.collegiumpharma.com, under the “Investors” section. The information contained in, or that can be accessed through, our website is not part of this proxy statement. The table below provides the membership of each of the committees as of April 2, 2025, with further discussion on each committee and its function below the table.

Collegium Board Committees | |||||

Independent(1) | Audit | Nominating and Corporate Governance | Compensation | Compliance | |

Michael Heffernan, |

| ||||

Vikram Karnani | |||||

Rita Balice-Gordon, Ph.D. |

|

| |||

Garen Bohlin |

|

|

| ||

John Fallon, M.D. |

|

|

|

| |

John Freund, M.D. |

|

|

| ||

Nancy Lurker |

| ||||

Gwen Melincoff (3) |

|

| |||

Gino Santini(4) |

|

|

| ||

Meetings in 2024 | Board: 9 | 8 | 2 | 5 | 3 |

| (1) | Independence under Nasdaq criteria. |

| (2) | Mr. Heffernan will not stand for re-election at the Annual Meeting. |

| (3) | Ms. Melincoff will not stand for re-election at the Annual Meeting. |

| (4) | Effective as of the date of the Annual Meeting, Mr. Santini will be appointed as Chairman of the Board and will no longer serve as Lead Independent Director. |

27

| Committee Chair |

| Committee Member |

| Board Chairman |

| Lead Independent Director |

| Audit Committee Financial Expert |

Following the Annual Meeting and Mr. Heffernan and Ms. Melincoff’s retirement from the Board, and contingent upon Dr. Paya’s election to the Board at the Annual Meeting, the Board has determined to reconstitute the committees as follows:

| • | Dr. Fallon, Dr. Freund and Mr. Bohlin will continue to serve on the Audit Committee, with Mr. Bohlin serving as chair; |

| • | Dr. Balice-Gordon, Dr. Fallon and Dr. Paya will serve on the Nominating and Corporate Governance Committee, with Dr. Fallon serving as chair; |

| • | Dr. Freund, Ms. Lurker and Mr. Santini will serve on the Compensation Committee, with Dr. Freund serving as chair; and |

| • | Mr. Bohlin, Dr. Fallon and Ms. Lurker will serve on the Compliance Committee, with Ms. Lurker serving as chair. |

28

THE AUDIT COMMITTEE | |

Chair: Garen Bohlin Additional Committee Members: ● John Freund, M.D. ● John Fallon, M.D. | Responsible for, among other things: ● hiring our independent registered public accounting firm and pre-approving the audit, audit related and permitted non-audit and tax services to be performed by our independent registered public accounting firm; ● reviewing and approving the planned scope of the annual audit and the results of the annual audit; ● reviewing the significant accounting and reporting principles to understand their impact on our financial statements; ● reviewing quarterly with management its assessment of the effectiveness and adequacy of our internal control structure and procedures for financial reporting and reviewing annually with our independent registered public accounting firm the attestation to and report on the assessment made by management; ● reviewing with management and our independent registered public accounting firm, as appropriate, our financial reports, earnings announcements and financial information and earnings guidance provided to analysts and other third parties; ● reviewing with our General Counsel or outside counsel any legal matters that may have a material impact on our financial statements, accounting policies and compliance policies and programs, including corporate securities trading policies; ● reviewing and assessing significant existing and emerging cybersecurity risks and material cybersecurity incidents, the impact on the Company and its shareholders of any significant cybersecurity incident and any disclosure obligations arising from any such incidents; ● establishing procedures for the treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and confidential submissions by our employees of concerns regarding questionable accounting or auditing matters; ● meeting independently with management and our independent registered public accounting firm; and ● reviewing, approving, ratifying or prohibiting material related party transactions. |

● All members are deemed “independent” and financially literate under the applicable rules and regulations of the SEC and Nasdaq. ● Garen Bohlin qualifies as an “audit committee financial expert” within the meaning of SEC regulations. ● Refer to the section entitled “Audit Committee Report.” | |

29

THE NOMINATING & CORPORATE GOVERNANCE COMMITTEE | ||

Chair: John Fallon, M.D. Additional Committee Members: ● Rita Balice-Gordon, Ph.D. ● Gwen Melincoff | Responsible for, among other things: ● assisting our Board in identifying prospective director nominees and recommending nominees for each annual meeting of shareholders to our Board; ● reviewing developments in corporate governance practices and reviewing and recommending to our board any changes to our corporate governance principles and guidelines; ● reviewing independence of our Board; ● evaluating and making recommendations as to the size and composition of the Board and each committee; ● determining qualifications for service on our board; ● reviewing the adequacy of our articles of incorporation and bylaws and recommending to our Board, as conditions dictate, amendments for consideration by our shareholders; and ● overseeing our ESG strategy, reporting, policies and practices. | |

● All members are deemed “independent” under the applicable rules and regulations of the SEC and Nasdaq. | ||

THE COMPLIANCE COMMITTEE | ||