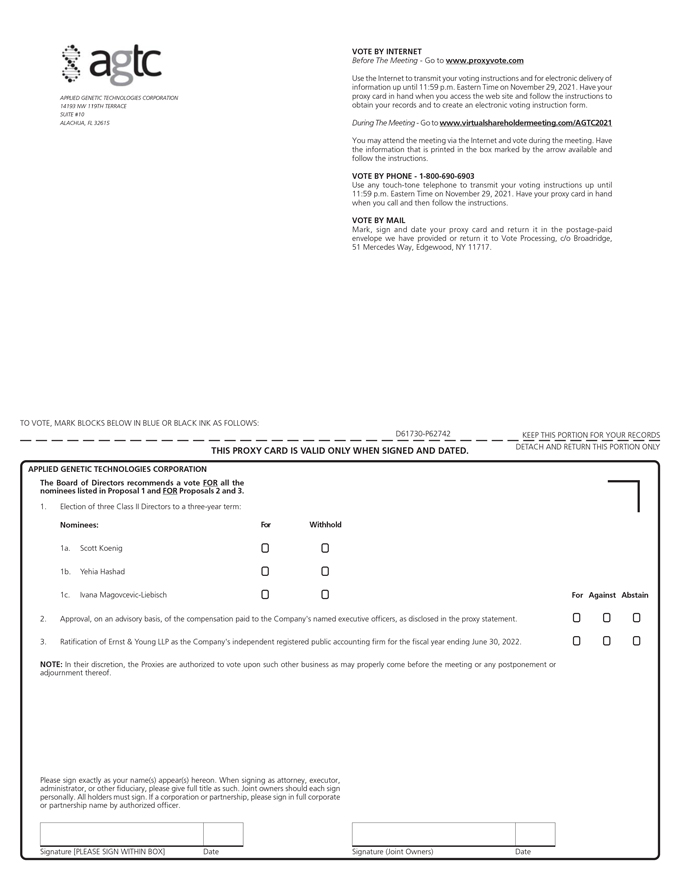

APPLIED GENETIC TECHNOLOGIES CORPORATION 14193 NW 119TH TERRACE SUITE #10 ALACHUA, FL 32615 VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on November 29, 2021. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/AGTC2021 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on November 29, 2021. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D61730-P62742 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY APPLIED GENETIC TECHNOLOGIES CORPORATION The Board of Directors recommends a vote FOR all the nominees listed in Proposal 1 and FOR Proposals 2 and 3. 1. Election of three Class II Directors to a three-year term: Nominees: For Withhold 1a. Scott Koenig 1b. Yehia Hashad 1c. Ivana Magovcevic-Liebisch For Against Abstain 2. Approval, on an advisory basis, of the compensation paid to the Company’s named executive officers, as disclosed in the proxy statement. 3. Ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022. NOTE: In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any postponement or adjournment thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date