The following is an article which was published by Forbes on February 28, 2022.

MoneyGram’s Post-Acquisition Plans: CEO Alex Holmes On Digital, Crypto And Beyond

|

Daniel Webber Contributor | |

| Fintech | ||

| I write about international payments. |

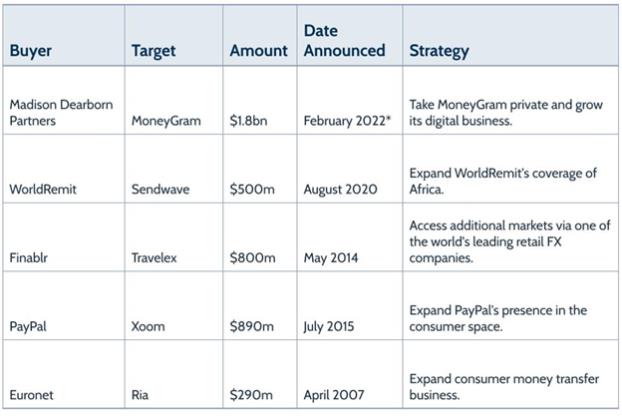

Earlier this month, remittance major MoneyGram announced that it had entered into an agreement to be acquired by private equity firm Madison Dearborn Partners, in a deal that values the company at around $1.1bn ($1.8bn including the assumed debt). Assuming that there isn’t another bid before the 30-day ‘go-shop’ period ends on March 16, this will see MoneyGram become privately traded, with its leadership, branding and headquarters remaining the same.

The deal is the biggest acquisition ever in the remittance industry, and is an unexpected move in that it comes at a time when large numbers of other players in the money transfers space are looking to go public. However, for CEO Alex Holmes, it’s an opportunity to accelerate its future development without the constraints that come with making quarterly reports to the markets.

“The opportunity to execute on our strategy and to continue to push the company forward into digital, into a broader set of financial services, without the quarterly piece is going to be beneficial to us,” he says.

“There is a bit of that short-termism in the markets, and the ability to shift away from that for a period of time is good.”

Time away will give MoneyGram the space to innovate and experiment without the need to produce instant results, and in a period of transition for remittances it could prove immensely beneficial for the company. But where does it plan to focus its efforts?

“Taking that noise away enables us to do what the company is really designed to do, which is execute our strategy and grow the cross-border platform,” explained Holmes.

“We’re also going to be doing a lot more in digital assets and crypto and blockchain over the next several years, and some people are favorable on that and some people aren’t. So taking away that volatility will be helpful for the company as well as we bridge that world and begin to look at what that strategy can be down the road.”