UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

JANUS HENDERSON

GROUP PLC

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

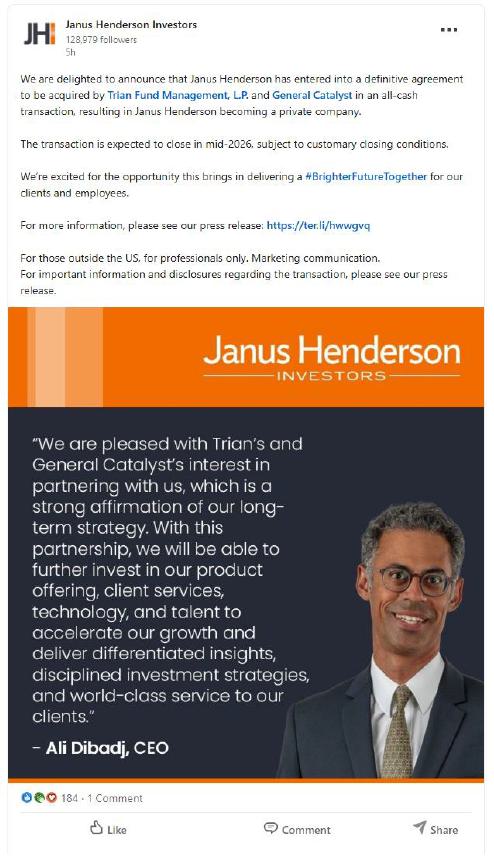

The following is a LinkedIn post made by Janus Henderson Group, plc on December 22, 2025.

Forward Looking Statements

Certain statements in this communication not based on historical facts are “forward-looking statements” within the meaning of the federal securities laws. Such forward-looking statements involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance or achievements to differ materially from those discussed. These include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects or future events, including with respect to the timing and anticipated benefits of pending and recently completed transactions and strategic partnerships, and expectations regarding opportunities that align with our strategy. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

Various risks, uncertainties, assumptions and factors that could cause our future results to differ materially from those expressed by the forward-looking statements included in this press release include, but are not limited to, Janus Henderson’s ability to obtain the regulatory, shareholder and other approvals required to consummate the proposed transaction and the timing of the closing of the proposed transaction, including the risks that a condition to closing would not be satisfied within the expected timeframe or at all or that the closing of the proposed transaction would not occur, the outcome of any legal proceedings that may be instituted against the parties and others related to the merger agreement, that shareholder litigation in connection with the proposed transaction may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability, unanticipated difficulties or expenditures relating to the proposed transaction, including the impact of the transaction on Janus Henderson’s business, that the Merger generally may involve unexpected costs, liabilities or delays, that the business of the Company may suffer as a result of uncertainty surrounding the Merger or the identity of the purchaser, that the Company may be adversely affected by other economic, business, and/or competitive factors, including the net asset value of assets in certain of the Company’s funds, and/or potential difficulties in employee retention as a result of the announcement and pendency of the proposed transaction, changes in interest rates and inflation, changes in trade policies (including the imposition of new or increased tariffs), volatility or disruption in financial markets, our investment performance as compared to third-party benchmarks or competitive products, redemptions, and other risks, uncertainties, assumptions, and factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2024, and in other filings or furnishings made by Janus Henderson with the SEC from time to time.

Important Information and Where to Find It

In connection with the proposed transaction, Janus Henderson Group plc (“Janus Henderson”) will file with the U.S. Securities and Exchange Commission (the “SEC”) a proxy statement, the definitive version of which will be sent or provided to Janus Henderson’s shareholders. Janus Henderson and affiliates of Janus Henderson intend to jointly file a transaction statement on Schedule 13E-3. Janus Henderson may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for the proxy statement, the Schedule 13E-3 or any other document that may be filed by Janus Henderson with the SEC. INVESTORS AND SECURITY HOLDERS OF JANUS HENDERSON ARE URGED TO READ THE PROXY STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain the proxy statement and the Schedule 13E-3 (in each case, when available) and other documents that are filed with the SEC by Janus Henderson free of charge from the SEC’s website at https://www.sec.gov or through the investor relations section of Janus Henderson’s website at https://ir.janushenderson.com.

Participants in the Solicitation

Janus Henderson and its directors and certain of its executive officers and other employees may be deemed to be participants in the solicitation of proxies from Janus Henderson’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of Janus Henderson and their ownership of Janus Henderson common shares is contained in the definitive proxy statement for Janus Henderson’s 2025 annual meeting of shareholders (the “Annual Meeting Proxy Statement”), which was filed with the SEC on March 21, 2025, including under the headings “Proposal 1: Election of Directors,” “Corporate Governance,” “Board Compensation,” “Proposal 2: Advisory Say-on-Pay Vote on Executive Compensation,” “Executive Compensation,” “Executive Compensation Tables,” “Securities Ownership of Certain Beneficial Owners and Management” and “Our Executive Officers.” Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the shareholders of Janus Henderson in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement relating to the proposed transaction when it is filed with the SEC. To the extent holdings of securities by potential participants (or the identity of such participants) have changed since the information printed in the Annual Meeting Proxy Statement, such information has been or will be reflected on the Statements of Change in Ownership of Janus Henderson on Forms 3 and 4 filed with the SEC. Free copies of the proxy statement relating to the proposed transaction and free copies of the other SEC filings to which reference is made in this paragraph may be obtained from the SEC’s website at https://www.sec.gov or through the investor relations section of Janus Henderson’s website at https://ir.janushenderson.com.