J.P. Morgan 44th Annual Healthcare Conference January 14, 2026 Jim Clemmer, President

& CEO

Forward looking statements 2 Notice Regarding Forward-Looking Statements This

presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements regarding AngioDynamics' expected future financial position, results of operations, cash flows, business

strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include the words such as "expects,"

"reaffirms," "intends," "anticipates," "plans," "believes," "seeks," "estimates," "projects," "optimistic," or variations of such words and similar expressions, are forward-looking statements. These forward-looking statements are not guarantees

of future performance and are subject to risks and uncertainties. Investors are cautioned that actual events or results may differ materially from AngioDynamics' expectations, expressed or implied. Factors that may affect the actual results

achieved by AngioDynamics include, without limitation, the scale and scope of the COVID-19 global pandemic, the ability of AngioDynamics to develop its existing and new products, technological advances and patents attained by competitors,

infringement of AngioDynamics' technology or assertions that AngioDynamics' technology infringes the technology of third parties, the ability of AngioDynamics to effectively compete against competitors that have substantially greater resources,

future actions by the FDA or other regulatory agencies, domestic and foreign health care reforms and government regulations, results of pending or future clinical trials, overall economic conditions (including inflation, tariffs, labor

shortages and supply chain challenges including the cost and availability of raw materials), the results of on-going litigation, challenges with respect to third-party distributors or joint venture partners or collaborators, the results of

sales efforts, the effects of product recalls and product liability claims, changes in key personnel, the ability of AngioDynamics to execute on strategic initiatives, the effects of economic, credit and capital market conditions, general

market conditions, market acceptance, foreign currency exchange rate fluctuations, the effects on pricing from group purchasing organizations and competition, the ability of AngioDynamics to obtain regulatory clearances or approval of its

products, or to integrate acquired businesses, as well as the risk factors listed from time to time in AngioDynamics' SEC filings, including but not limited to its Annual Report on Form 10-K for the year ended May 31, 2025. AngioDynamics does

not assume any obligation to publicly update or revise any forward-looking statements for any reason. Notice Regarding Non-GAAP Financial Measures Management uses non-GAAP measures to establish operational goals and believes that non-GAAP

measures may assist investors in analyzing the underlying trends in AngioDynamics’ business over time. Investors should consider these non-GAAP measures in addition to, not as a substitute for or as superior to, financial reporting measures

prepared in accordance with GAAP. In this presentation, AngioDynamics has reported pro forma results, adjusted EBITDA (income before interest, taxes, depreciation and amortization and stock-based compensation); adjusted net income and adjusted

earnings per share. Management uses these measures in its internal analysis and review of operational performance. Management believes that these measures provide investors with useful information in comparing AngioDynamics’ performance over

different periods. By using these non-GAAP measures, management believes that investors get a better picture of the performance of AngioDynamics’ underlying business. Management encourages investors to review AngioDynamics’ financial results

prepared in accordance with GAAP to understand AngioDynamics’ performance taking into account all relevant factors, including those that may only occur from time to time but have a material impact on AngioDynamics’ financial results. Please see

the tables that follow for a reconciliation of non-GAAP measures to measures prepared in accordance with GAAP.

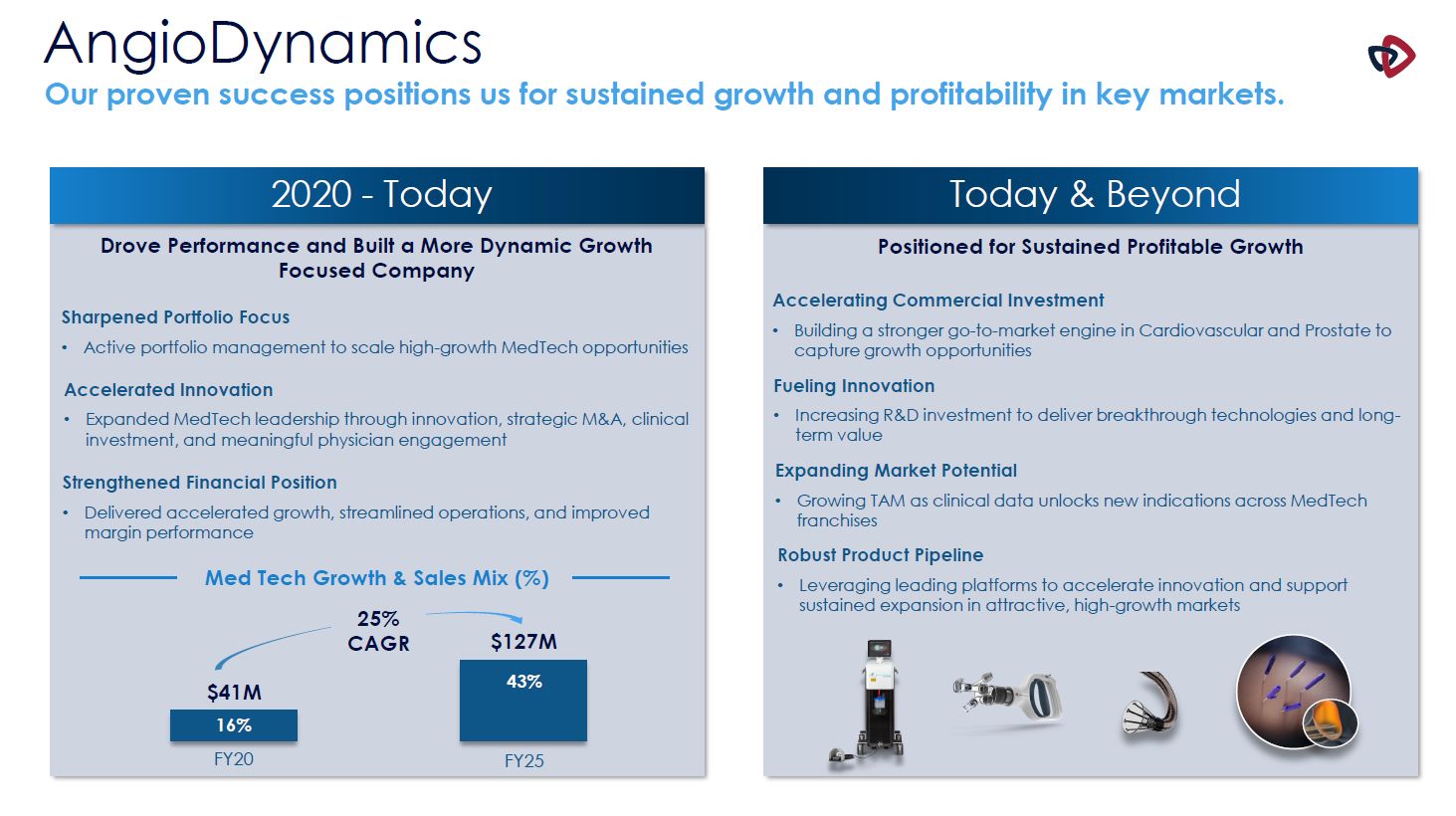

AngioDynamics Our proven success positions us for sustained growth and profitability in

key markets. 2020 - Today Today & Beyond Drove Performance and Built a More Dynamic Growth Focused Company Med Tech Growth & Sales Mix (%) 16% 43% FY20 FY25 Positioned for Sustained Profitable Growth Strengthened Financial

Position Delivered accelerated growth, streamlined operations, and improved margin performance Sharpened Portfolio Focus Active portfolio management to scale high-growth MedTech opportunities Accelerated Innovation Expanded MedTech

leadership through innovation, strategic M&A, clinical investment, and meaningful physician engagement $41M $127M 25% CAGR Accelerating Commercial Investment Building a stronger go-to-market engine in Cardiovascular and Prostate to

capture growth opportunities Fueling Innovation Increasing R&D investment to deliver breakthrough technologies and long-term value Expanding Market Potential Growing TAM as clinical data unlocks new indications across MedTech

franchises Robust Product Pipeline Leveraging leading platforms to accelerate innovation and support sustained expansion in attractive, high-growth markets

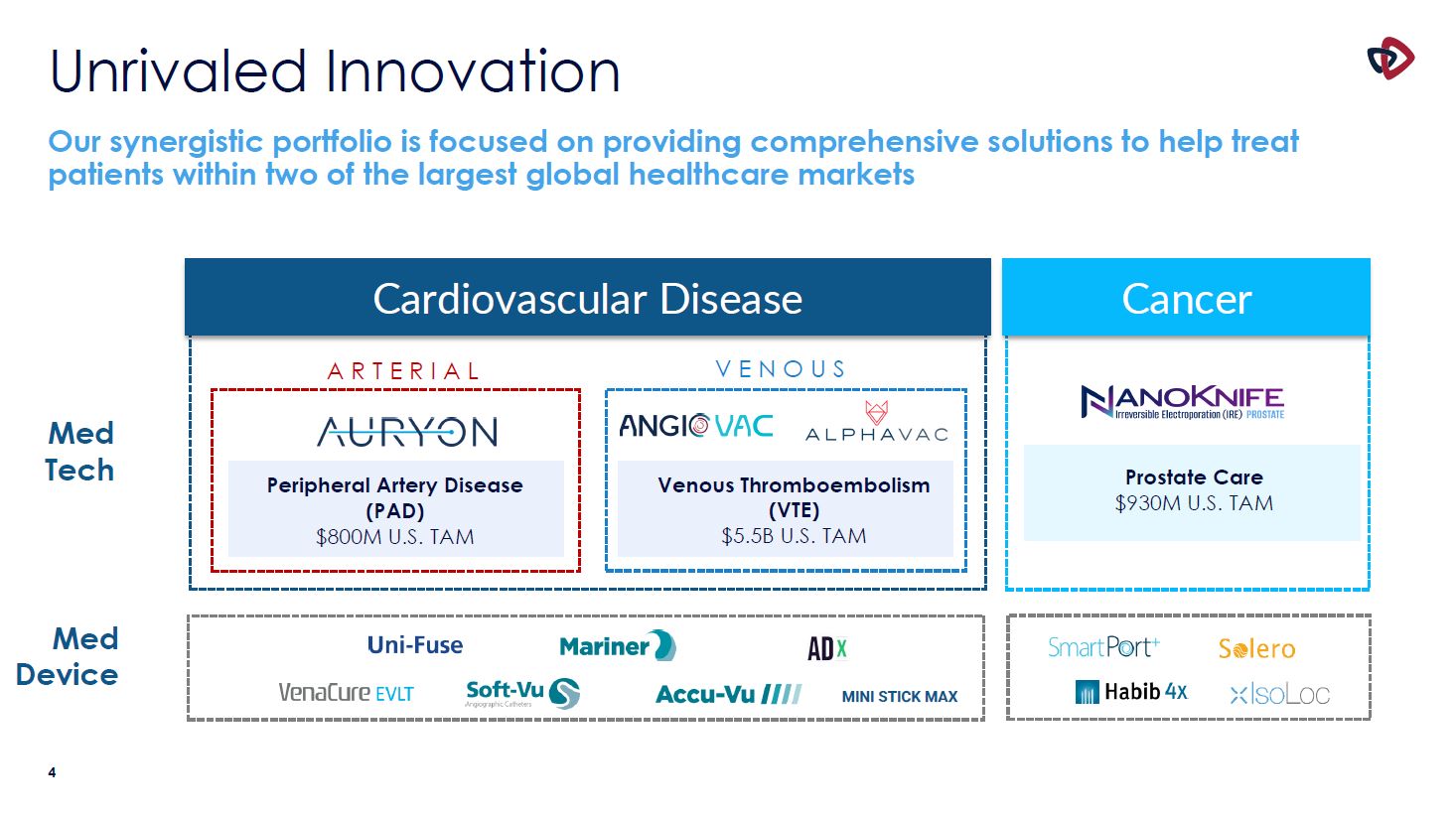

Unrivaled Innovation Our synergistic portfolio is focused on providing comprehensive

solutions to help treat patients within two of the largest global healthcare markets MINI STICK MAX Prostate Care $930M U.S. TAM Med Tech Med Device Peripheral Artery Disease (PAD) $800M U.S. TAM Venous Thromboembolism (VTE) $5.5B

U.S. TAM Cardiovascular Disease Cancer A R T E R I A L V E N O U S 4

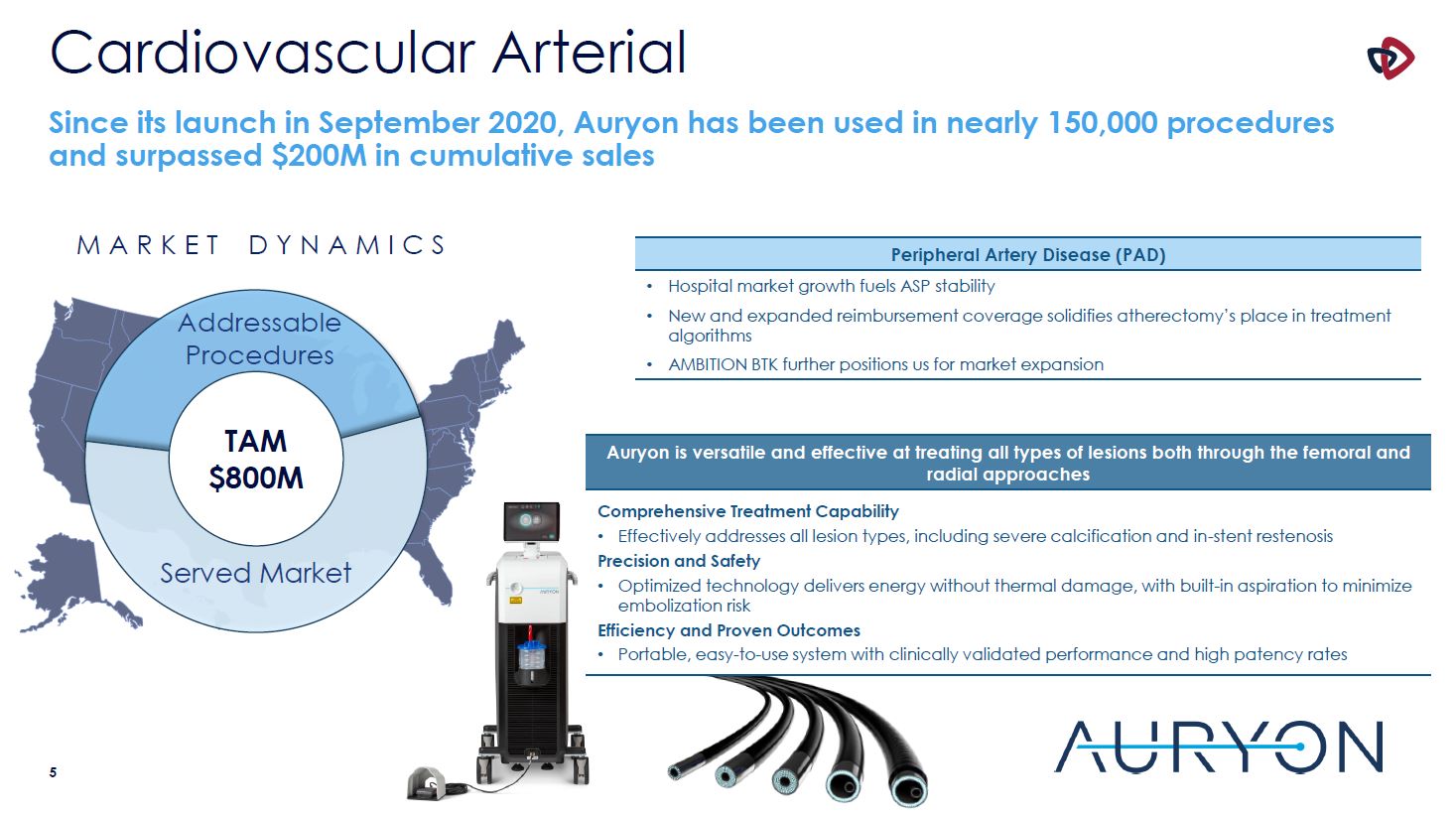

Cardiovascular Arterial Peripheral Artery Disease (PAD) Hospital market growth fuels ASP

stability New and expanded reimbursement coverage solidifies atherectomy’s place in treatment algorithms AMBITION BTK further positions us for market expansion Since its launch in September 2020, Auryon has been used in nearly 150,000

procedures and surpassed $200M in cumulative sales M A R K E T D Y N A M I C S Addressable Procedures TAM $800M Served Market Auryon is versatile and effective at treating all types of lesions both through the femoral and radial

approaches Comprehensive Treatment Capability Effectively addresses all lesion types, including severe calcification and in-stent restenosis Precision and Safety Optimized technology delivers energy without thermal damage, with built-in

aspiration to minimize embolization risk Efficiency and Proven Outcomes Portable, easy-to-use system with clinically validated performance and high patency rates 4

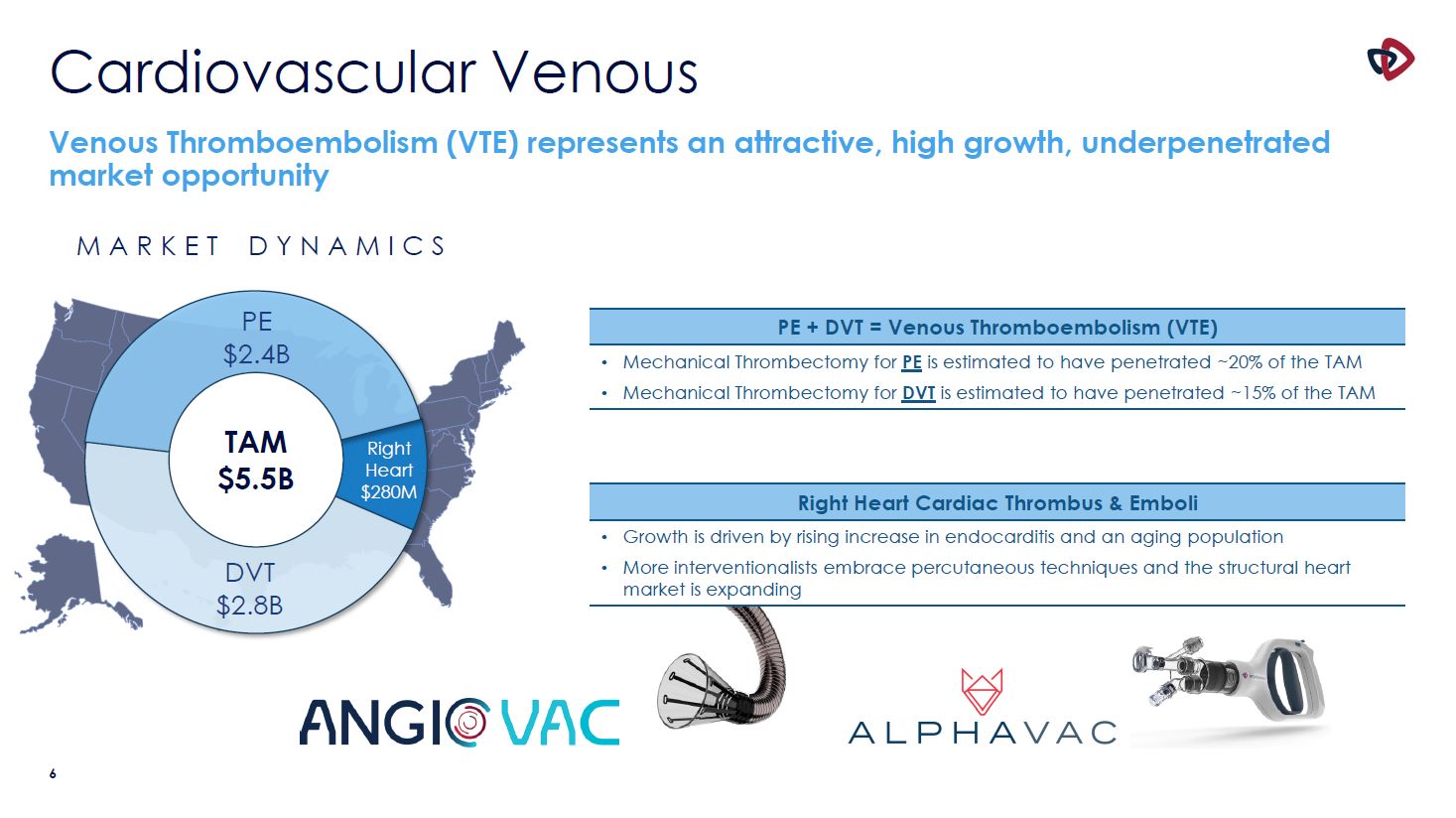

Cardiovascular Venous TAM $5.5B DVT $2.8B Right Heart $280M Venous Thromboembolism

(VTE) represents an attractive, high growth, underpenetrated market opportunity M A R K E T D Y N A M I C S PE $2.4B PE + DVT = Venous Thromboembolism (VTE) Mechanical Thrombectomy for PE is estimated to have penetrated ~20% of the

TAM Mechanical Thrombectomy for DVT is estimated to have penetrated ~15% of the TAM Right Heart Cardiac Thrombus & Emboli Growth is driven by rising increase in endocarditis and an aging population More interventionalists embrace

percutaneous techniques and the structural heart market is expanding 4

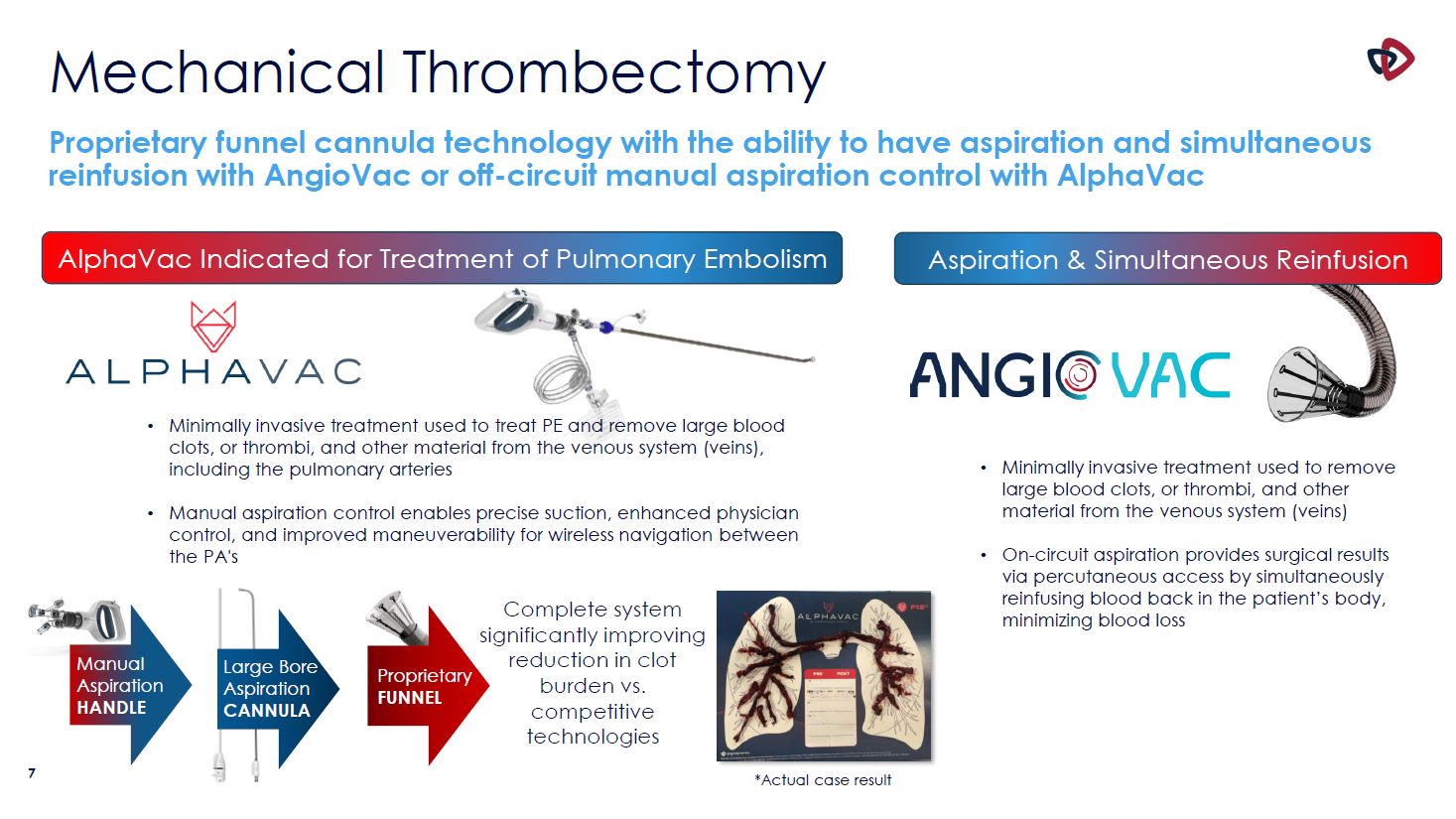

7 Mechanical Thrombectomy Proprietary funnel cannula technology with the ability to have

aspiration and simultaneous reinfusion with AngioVac or off-circuit manual aspiration control with AlphaVac AlphaVac Indicated for Treatment of Pulmonary Embolism Aspiration & Simultaneous Reinfusion Minimally invasive treatment used to

remove large blood clots, or thrombi, and other material from the venous system (veins) On-circuit aspiration provides surgical results via percutaneous access by simultaneously reinfusing blood back in the patient’s body, minimizing blood

loss Proprietary FUNNEL Manual Aspiration HANDLE Large Bore Aspiration CANNULA Complete system significantly improving reduction in clot burden vs. competitive technologies *Actual case result Minimally invasive treatment used to treat

PE and remove large blood clots, or thrombi, and other material from the venous system (veins), including the pulmonary arteries Manual aspiration control enables precise suction, enhanced physician control, and improved maneuverability for

wireless navigation between the PA's

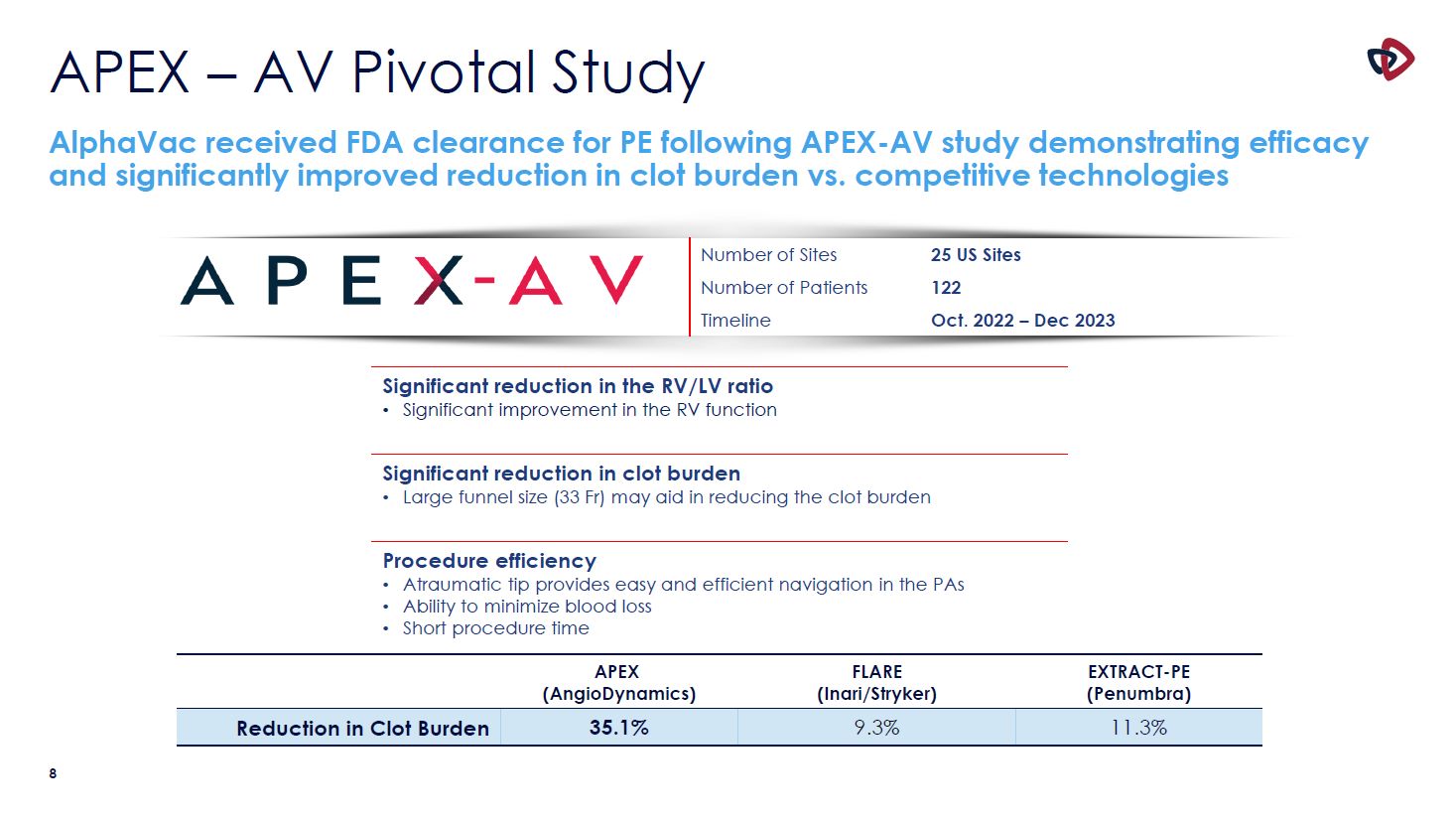

APEX – AV Pivotal Study AlphaVac received FDA clearance for PE following APEX-AV study

demonstrating efficacy and significantly improved reduction in clot burden vs. competitive technologies Number of Sites 25 US Sites Number of Patients 122 Timeline Oct. 2022 – Dec 2023 Significant reduction in the RV/LV

ratio Significant improvement in the RV function Significant reduction in clot burden Large funnel size (33 Fr) may aid in reducing the clot burden Procedure efficiency Atraumatic tip provides easy and efficient navigation in the

PAs Ability to minimize blood loss Short procedure time APEX (AngioDynamics) FLARE (Inari/Stryker) EXTRACT-PE (Penumbra) Reduction in Clot Burden 35.1% 9.3% 11.3% 10

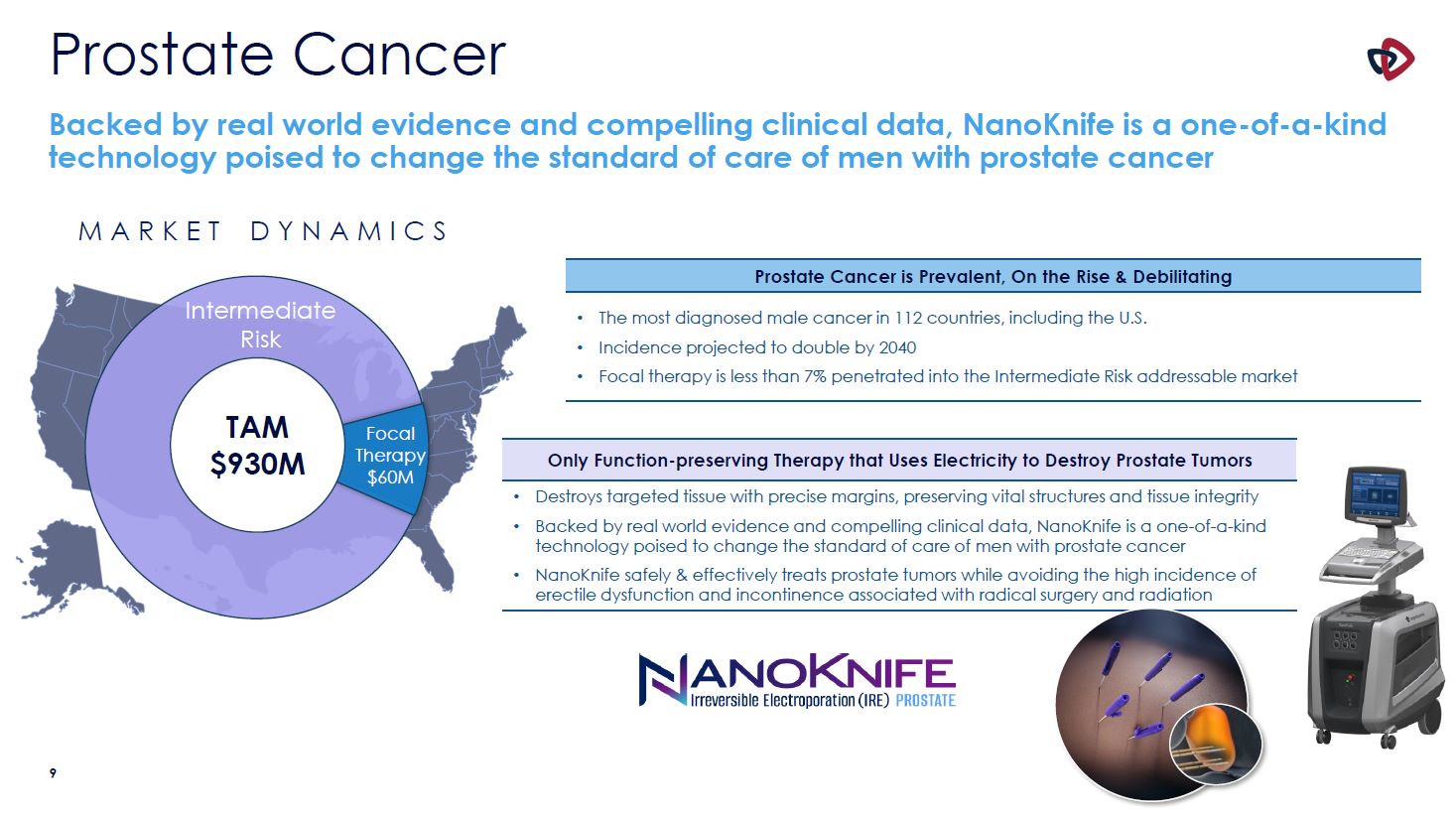

Prostate Cancer Backed by real world evidence and compelling clinical data, NanoKnife is

a one-of-a-kind technology poised to change the standard of care of men with prostate cancer M A R K E T D Y N A M I C S Intermediate Risk Prostate Cancer is Prevalent, On the Rise & Debilitating The most diagnosed male cancer in 112

countries, including the U.S. Incidence projected to double by 2040 Focal therapy is less than 7% penetrated into the Intermediate Risk addressable market Only Function-preserving Therapy that Uses Electricity to Destroy Prostate

Tumors Destroys targeted tissue with precise margins, preserving vital structures and tissue integrity Backed by real world evidence and compelling clinical data, NanoKnife is a one-of-a-kind technology poised to change the standard of care

of men with prostate cancer NanoKnife safely & effectively treats prostate tumors while avoiding the high incidence of erectile dysfunction and incontinence associated with radical surgery and radiation Focal

Therapy $60M TAM $930M 10

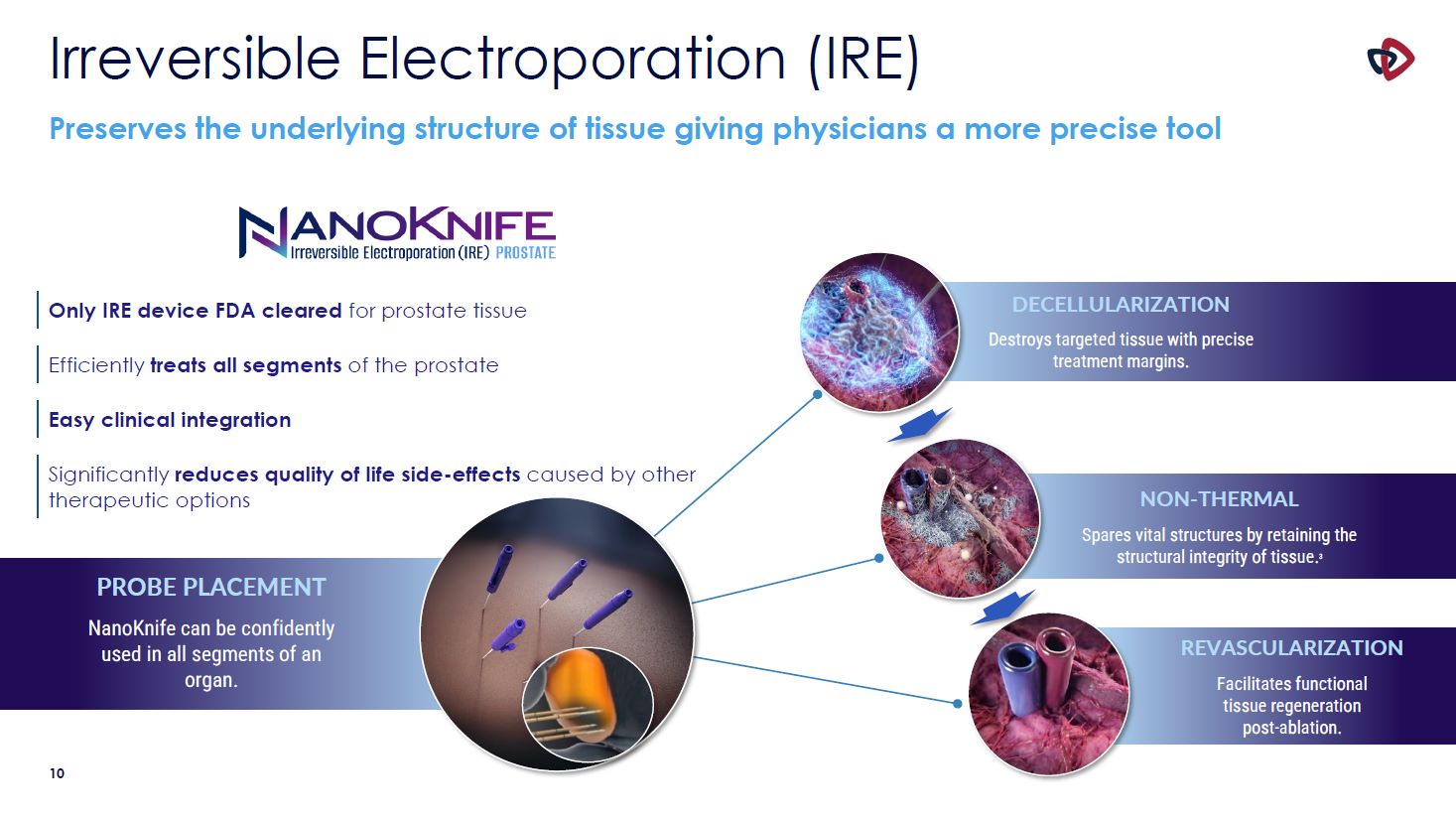

Irreversible Electroporation (IRE) Preserves the underlying structure of tissue giving

physicians a more precise tool PROBE PLACEMENT NanoKnife can be confidently used in all segments of an organ. DECELLULARIZATION Destroys targeted tissue with precise treatment margins. NON-THERMAL Spares vital structures by retaining the

structural integrity of tissue.3 REVASCULARIZATION Facilitates functional tissue regeneration post-ablation. Only IRE device FDA cleared for prostate tissue Efficiently treats all segments of the prostate Easy clinical

integration Significantly reduces quality of life side-effects caused by other therapeutic options 10

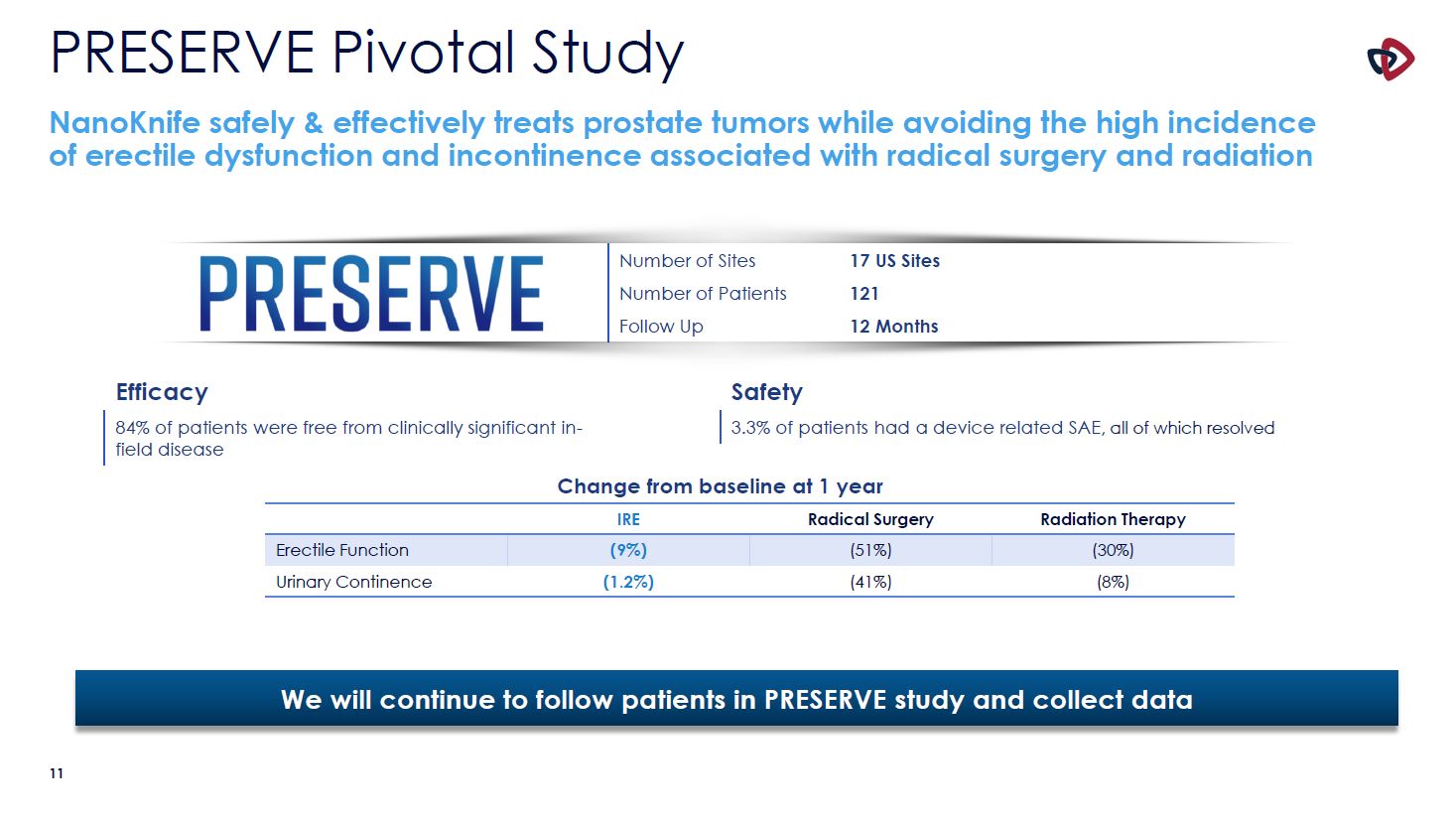

PRESERVE Pivotal Study NanoKnife safely & effectively treats prostate tumors while

avoiding the high incidence of erectile dysfunction and incontinence associated with radical surgery and radiation IRE Radical Surgery Radiation Therapy Erectile Function (9%) (51%) (30%) Urinary Continence (1.2%) (41%) (8%) Change

from baseline at 1 year Number of Sites 17 US Sites Number of Patients 121 Follow Up 12 Months Efficacy 84% of patients were free from clinically significant in- field disease Safety 3.3% of patients had a device related SAE, all of

which resolved We will continue to follow patients in PRESERVE study and collect data 10

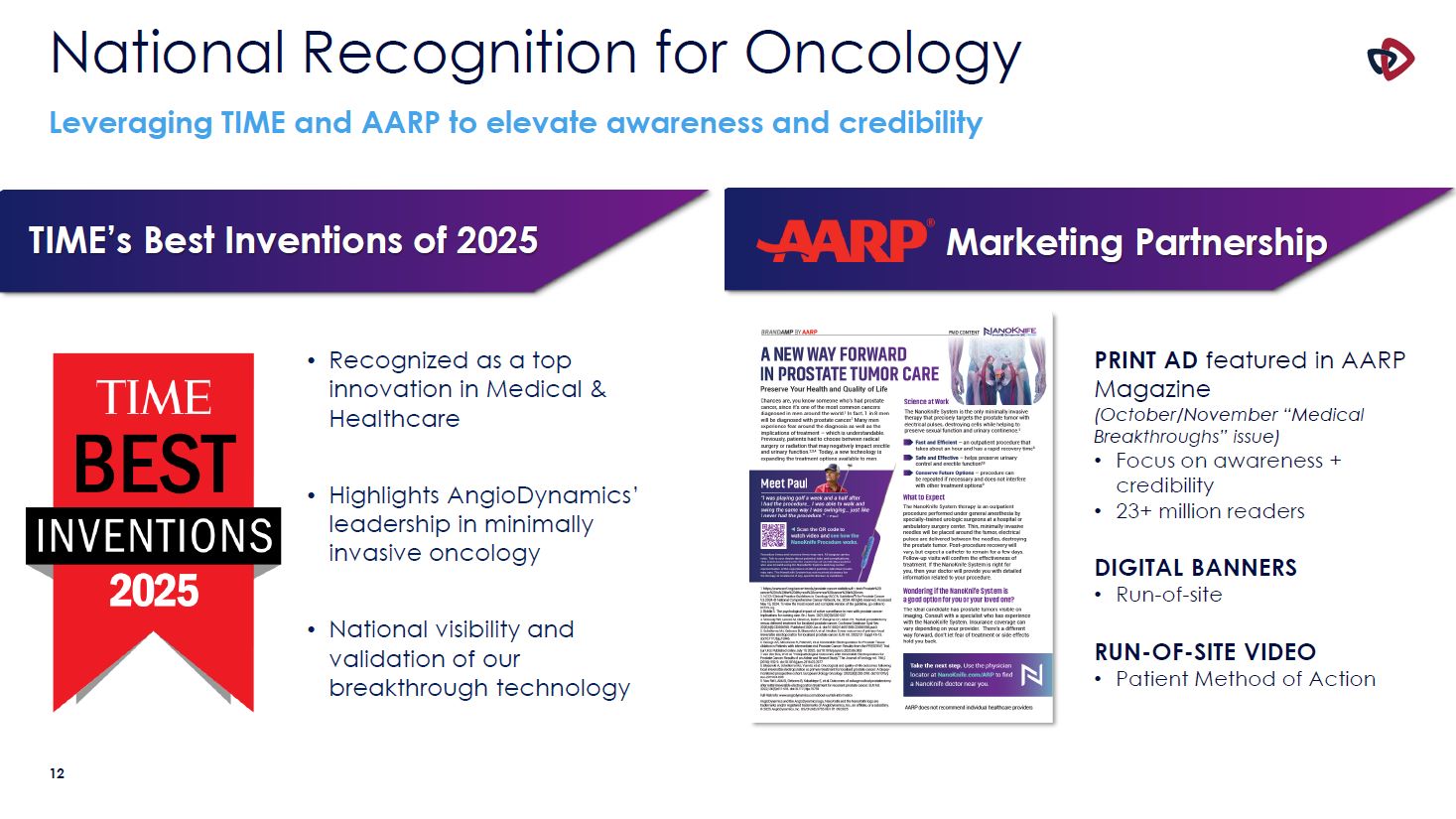

National Recognition for Oncology Leveraging TIME and AARP to elevate awareness and

credibility Recognized as a top innovation in Medical & Healthcare Highlights AngioDynamics’ leadership in minimally invasive oncology National visibility and validation of our breakthrough technology TIME’s Best Inventions of

2025 PRINT AD featured in AARP Magazine (October/November “Medical Breakthroughs” issue) Focus on awareness + credibility 23+ million readers 10 DIGITAL BANNERS Run-of-site RUN-OF-SITE VIDEO Patient Method of Action Marketing

Partnership

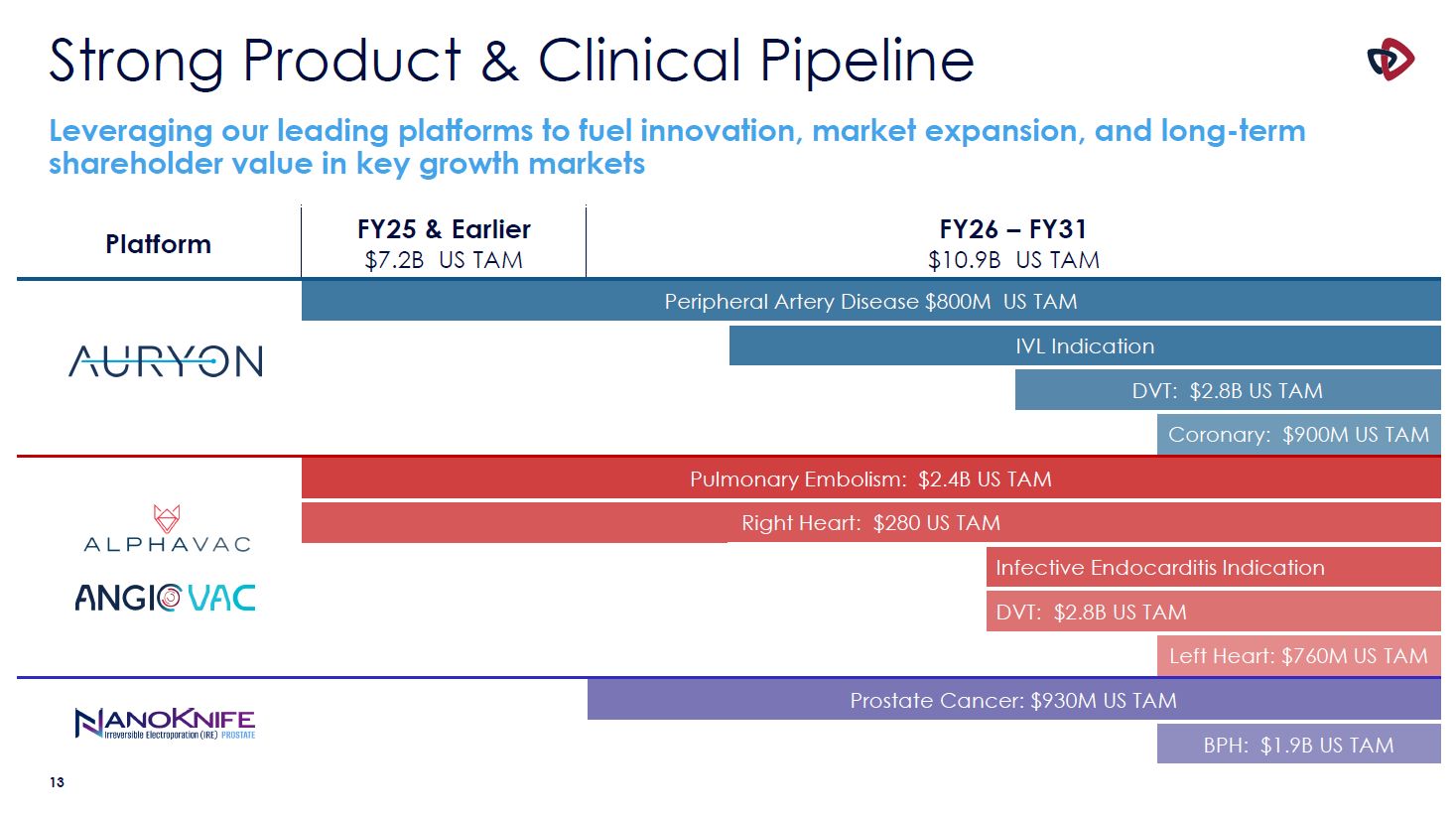

Strong Product & Clinical Pipeline Leveraging our leading platforms to fuel

innovation, market expansion, and long-term shareholder value in key growth markets Platform FY25 & Earlier $7.2B US TAM FY26 – FY31 $10.9B US TAM Peripheral Artery Disease $800M US TAM IVL Indication DVT: $2.8B US TAM Coronary:

$900M US TAM Pulmonary Embolism: $2.4B US TAM Right Heart: $280 US TAM Infective Endocarditis Indication DVT: $2.8B US TAM Left Heart: $760M US TAM Prostate Cancer: $930M US TAM BPH: $1.9B US TAM 13

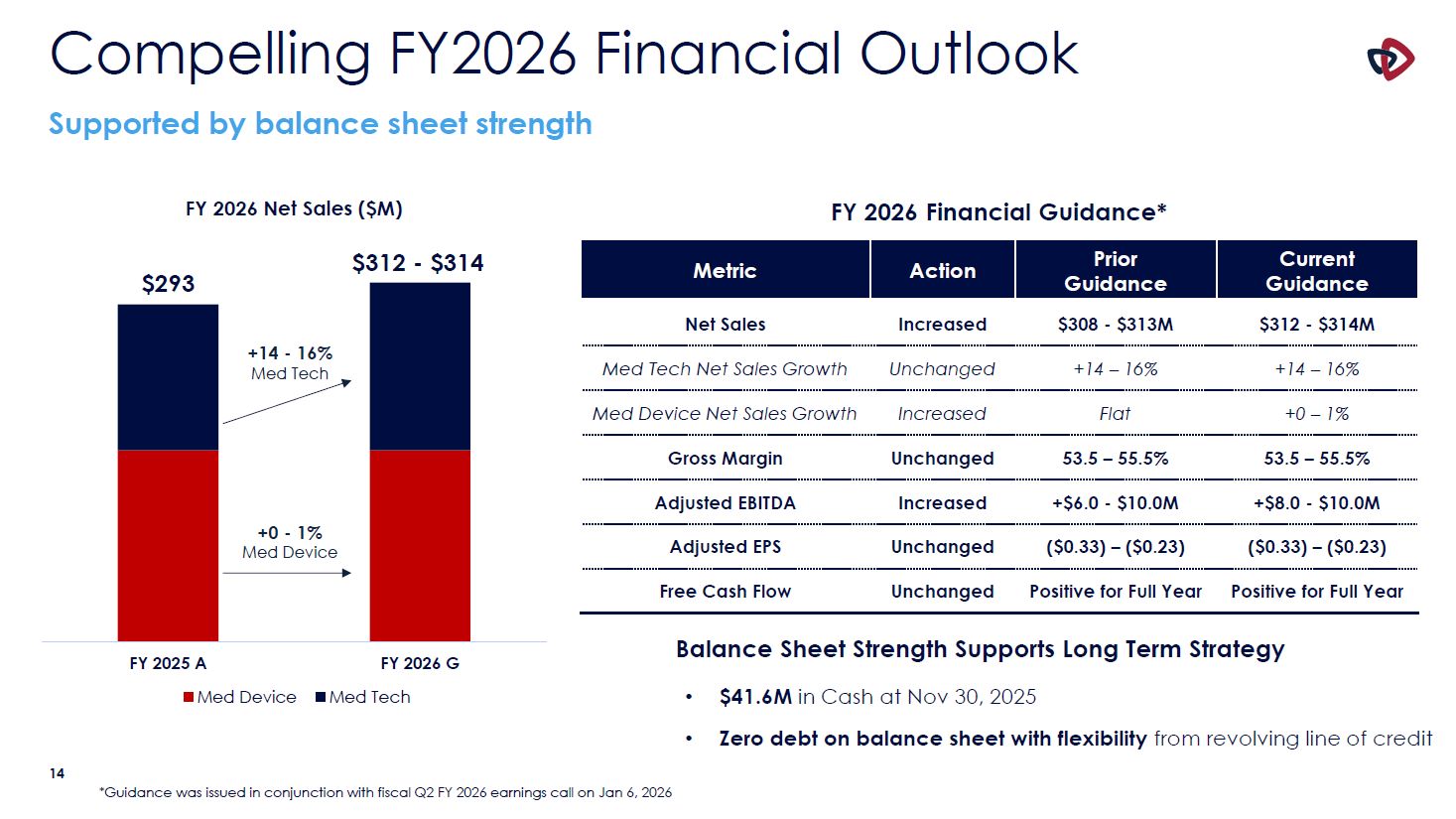

Compelling FY2026 Financial Outlook Supported by balance sheet strength $293 +14 -

16% Med Tech $312 - $314 FY 2026 G Med Tech FY 2026 Net Sales ($M) FY 2025 A Med Device Metric Action Prior Guidance Current Guidance Net Sales Increased $308 - $313M $312 - $314M Med Tech Net Sales Growth Unchanged +14 –

16% +14 – 16% Med Device Net Sales Growth Increased Flat +0 – 1% Gross Margin Unchanged 53.5 – 55.5% 53.5 – 55.5% Adjusted EBITDA Increased +$6.0 - $10.0M +$8.0 - $10.0M Adjusted EPS Unchanged ($0.33) – ($0.23) ($0.33) –

($0.23) Free Cash Flow Unchanged Positive for Full Year Positive for Full Year +0 - 1% Med Device 14 *Guidance was issued in conjunction with fiscal Q2 FY 2026 earnings call on Jan 6, 2026 Balance Sheet Strength Supports Long Term

Strategy $41.6M in Cash at Nov 30, 2025 Zero debt on balance sheet with flexibility from revolving line of credit FY 2026 Financial Guidance*

AngioDynamics Investment Summary Attractive MedTech Platforms in High-Value Markets Our

MedTech segment operates in large, growing clinical markets, supported by differentiated technologies and proven clinical outcomes. Demonstrated Execution and Portfolio Discipline We have a strong track record of active portfolio management,

disciplined R&D investment, successful clinical and regulatory expansion, and customer-centric sales and marketing execution. Self-Funded Growth Model Our Med Device segment generates cash flow that funds targeted investments to

accelerate MedTech innovation and growth. Strong, Debt-Free Balance Sheet We maintain a solid financial foundation with no debt, providing flexibility to invest, scale, and pursue strategic opportunities. Clear Path to Profitability and Cash

Generation We expect to achieve adjusted EBITDA positivity by FY2025 and cash flow positivity by FY2026, reflecting improving operating leverage and margin expansion. Positioned for Sustainable, Long-Term Value Creation With focused

strategy, financial strength, and innovation-driven growth, AngioDynamics is well positioned to deliver durable revenue growth and profitability over the long term. 15

J.P. Morgan 44th Annual Healthcare Conference January 14, 2026 Jim Clemmer, President

& CEO