SHAREHOLDER RIGHTS PLAN AGREEMENT

ENDEAVOUR SILVER CORP.

(the "Corporation")

AND

COMPUTERSHARE INVESTOR SERVICES INC.

(the "Rights Agent")

June 29, 2011

i

i ii

iiSHAREHOLDER RIGHTS PLAN AGREEMENT

|

|

THIS SHAREHOLDER RIGHTS PLAN AGREEMENT made as of June 29, 2011.

|

BETWEEN:

|

|

ENDEAVOUR SILVER CORP., a corporation incorporated pursuant to the laws of British Columbia and having its registered office at 19th Floor, 885 West Georgia Street, Vancouver, British Columbia, Canada, V6C 3H4

|

(the "Corporation")

|

|

OF THE FIRST PART

|

AND:

|

|

COMPUTERSHARE INVESTOR SERVICES INC., a company incorporated under the laws of Canada and having an office at 3rd floor, 510 Burrard Street, Vancouver, British Columbia, Canada, V6C 3B9

|

(the "Rights Agent")

|

|

OF THE SECOND PART

|

WHEREAS:

|

A.

|

The Board of Directors of the Corporation has determined that it is in the best interests of the Corporation to adopt a shareholder rights plan to ensure, to the extent possible, that all shareholders of the Corporation are treated fairly in connection with any take-over bid for the Corporation.

|

|

B.

|

In order to implement the adoption of a shareholder rights plan as established by this Agreement the Board of Directors of the Corporation has:

|

|

|

(1)

|

authorized the issuance, effective at 12:01 a.m. (Vancouver time) on the Effective Date, of one Right in respect of each Common Share outstanding as of 12:01 a.m. (Vancouver time) on the Effective Date (the "Record Time"); and

|

|

|

(2)

|

authorized the issue of one Right in respect of each Common Share issued after the Record Time and prior to the earlier of the Separation Time and the Expiration Time.

|

|

C.

|

Each Right entitles the holder thereof, after the Separation Time, to purchase securities of the Corporation pursuant to the terms and subject to the conditions set forth in this Agreement.

|

|

D.

|

The Corporation wishes to appoint the Rights Agent to act on behalf of the Corporation and the holders of Rights, and the Rights Agent is willing to so act, in connection with the issuance, transfer, exchange and replacement of Rights Certificates, the exercise of Rights and other matters referred to in this Agreement.

|

|

E.

|

The Board of Directors of the Corporation proposes that this Agreement be in place until the 2017 AGM (as hereinafter defined), subject to shareholder ratification as set forth herein.

|

NOW THEREFORE, in consideration of the premises and respective agreements set forth herein, the Corporation and the Rights Agent hereby agree as follows:

1. Interpretation

1.1 Definitions

In this Agreement, the following words and terms will, unless the context otherwise requires, have the following meanings:

|

|

(a)

|

"Acquiring Person" means any Person who is or becomes the Beneficial Owner of 20% or more of the outstanding Voting Shares, provided that the term "Acquiring Person" will not include:

|

|

|

(i)

|

the Corporation or any Subsidiary of the Corporation;

|

|

|

(ii)

|

any Person who becomes the Beneficial Owner of 20% or more of the outstanding Voting Shares as a result of one or any combination of:

|

|

|

(A)

|

a Voting Share Reduction;

|

|

|

(B)

|

Permitted Bid Acquisitions;

|

|

|

(C)

|

an Exempt Acquisition;

|

|

|

(D)

|

a Pro Rata Acquisition, or

|

|

|

(E)

|

a Convertible Security Acquisition,

|

provided that if a Person becomes the Beneficial Owner of 20% or more of the outstanding Voting Shares by reason of one or any combination of a Voting Share Reduction, Permitted Bid Acquisitions, an Exempt Acquisition, a Pro Rata Acquisition or a Convertible Security Acquisition and, thereafter, such Person becomes the Beneficial Owner of any additional Voting Shares (other than pursuant to a Voting Share Reduction, Permitted Bid Acquisitions, an Exempt Acquisition, a Pro Rata Acquisition or a Convertible Security Acquisition), then as of the date that such Person becomes the Beneficial Owner of such additional Voting Shares, such Person will become an "Acquiring Person";

|

|

(iii)

|

for a period of ten days after the Disqualification Date (as defined below), any person who becomes the Beneficial Owner of 20% or more of the outstanding Voting Shares as a result of such Person becoming disqualified from relying on section 1.1(f)(viii) solely because such Person or the Beneficial Owner of such Voting Shares has participated in, proposes or intends to make or is participating in a Take-Over Bid or any plan or proposal relating thereto or resulting therefrom, either alone or by acting jointly or in concert with any other Person. For the purposes of this definition, "Disqualification Date" means the first date of public announcement of facts indicating that any Person has participated in,

|

2

|

|

has made, proposes or intends to make or is participating in a Take-Over Bid or any plans or proposals relating thereto or resulting therefrom;

|

|

|

(iv)

|

an underwriter or member of a banking or selling group that becomes the Beneficial Owner of 20% or more of the outstanding Voting Shares in connection with a bona fide distribution to the public of securities pursuant to an underwriting agreement with the Corporation; or

|

|

|

(v)

|

a Grandfathered Person, provided that this exception will not be, and will cease to be, applicable to a Grandfathered Person in the event that such Grandfathered Person, after the Record Time, becomes the Beneficial Owner of any additional Voting Shares that increases its Beneficial Ownership of Voting Shares by more than 2% of the number of Voting Shares outstanding from time to time, other than through a Voting Share Reduction, a Permitted Bid Acquisition, an Exempt Acquisition, a Pro Rata Acquisition or a Convertible Security Acquisition or through the exercise of existing rights to acquire additional Voting Shares from the Corporation where such rights were owned by the Grandfathered Person at the Record Time.

|

|

|

(b)

|

"Affiliate" means, when used to indicate a relationship with a specified Person, a Person that, directly, or indirectly through one or more intermediaries or otherwise, controls, or is controlled by, or is under common control with, such specified Person.

|

|

|

(c)

|

"Agreement" means this shareholder rights plan agreement dated as of June 29, 2011 between the Corporation and the Rights Agent, as amended, modified or supplemented from time to time.

|

|

|

(d)

|

"annual cash dividend" means cash dividends paid at regular intervals in any financial year of the Corporation to the extent that such cash dividends do not exceed, in the aggregate, the greatest of:

|

|

|

(i)

|

200% of the aggregate amount of cash dividends declared payable by the Corporation on its Common Shares in its immediately preceding financial year;

|

|

|

(ii)

|

300% of the arithmetic average of the aggregate amount of cash dividends declared payable by the Corporation on its Common Shares in its three immediately preceding financial years; and

|

|

|

(iii)

|

100% of the aggregate consolidated net income of the Corporation, before extraordinary items, for its immediately preceding financial year.

|

|

|

(e)

|

"Associate" means, when used to indicate a relationship with a specified Person:

|

|

|

(i)

|

a corporation of which that Person owns, at law or in equity, shares or securities currently convertible into shares carrying more than 10% of the Voting Rights exercisable with respect to the election of directors under all circumstances or by reason of the occurrence of an event that has occurred and is continuing, or a currently exercisable option or right to purchase such shares or such convertible securities and with whom that Person is acting jointly or in concert;

|

3

|

|

(ii)

|

a partner of that Person acting on behalf of the partnership of which they are partners;

|

|

|

(iii)

|

a trust or estate in which that Person has a beneficial interest and with whom that Person is acting jointly or in concert or in which that Person has a beneficial interest of 50% or more or in respect of which that Person serves as a trustee or in a similar capacity provided, however, that a Person shall not be an associate of a trust by reason only of the fact that such Person serves as a trustee or any similar capacity in relation to such trust if such Person is duly licensed to carry on the business of a trust company under the laws of Canada or any province or territory thereof or if the ordinary business of such Person includes the management of investment funds for unaffiliated investors and such Person acts as trustee or in a similar capacity in relation to such trust in the ordinary course of such business; and

|

|

|

(iv)

|

a spouse of that Person, any person of the same or opposite sex with whom that person is living in a conjugal relationship outside marriage, a child of that Person or a relative of that Person if that relative has the same residence as that Person.

|

|

|

(f)

|

A Person shall be deemed the "Beneficial Owner", and to have "Beneficial Ownership" of, and to "Beneficially Own":

|

|

|

(i)

|

any securities as to which such Person or any of such Person's Affiliates is the direct or indirect owner at law or in equity and for the purposes of this section 1.1(f)(i), but without limiting the generality of the foregoing, a Person shall be deemed to be an owner at law or in equity of all securities:

|

|

|

(A)

|

owned by a partnership of which the Person is a partner;

|

|

|

(B)

|

owned by a trust in which the Person has a beneficial interest and which is acting jointly or in concert with that Person or in which the Person has a beneficial interest of 50% or more;

|

|

|

(C)

|

owned jointly or in common with others; and

|

|

|

(D)

|

of which the Person may be deemed to be the beneficial owner (whether or not of record) pursuant to the provisions of the Corporations Act, or the Securities Act (British Columbia) or pursuant to Rule 13d-3 or 13d-5 under the U.S. Exchange Act (or pursuant to any comparable or successor laws, regulations or rules enacted in relation to the provisions of the Corporations Act or the Securities Act (British Columbia) or pursuant to Rule 13d-3 or 13d-5 under the U.S. Exchange Act as in effect on the date of this Agreement);

|

|

|

(ii)

|

any securities as to which such Person or any of such Person's Affiliates or Associates has, directly or indirectly:

|

|

|

(A)

|

the right to acquire (whether such right is exercisable immediately or after the lapse or passage of time and whether or not on condition or the happening of any contingency or otherwise) pursuant to any agreement, arrangement, pledge or understanding, whether or not in writing (other

|

4

|

|

than (x) customary agreements with and between underwriters and/or banking group members and/or selling group members with respect to a bona fide public offering of securities; (y) pledges of securities in the ordinary course of business that meet all the conditions specified in Rule 13d-3(d)(3) under the U.S. Exchange Act (except for the condition in Rule 13d-3(d)(3)(ii)); and (z) pledge agreements with a registered securities dealer relating to the extension of credit for purchases of securities on margin in the ordinary course of the dealer's business), or upon the exercise of any conversion right, exchange right, share purchase right (other than the Rights), warrant or option, or otherwise; or

|

|

|

(B)

|

the right to vote such securities (whether such right is exercisable immediately or after the lapse or passage of time and whether or not on condition or the happening of any contingency or otherwise) pursuant to any agreement, arrangement, pledge (other than (y) pledges of securities in the ordinary course of business that meet all the conditions specified in Rule 13d-3(d)(3) under the U.S. Exchange Act (except for the condition in Rule 13d-3(d)(3)(ii)); and (z) pledge agreements with a registered securities dealer relating to the extension of credit for purchases of securities on margin in the ordinary course of the dealer's business) or understanding (whether or not in writing) or otherwise;

|

|

|

(iii)

|

any securities which are Beneficially Owned within the meaning of section 1.1(f)(i) or 1.1(f)(ii) by any other Person with which such Person or any of such Person's Affiliates or Associates has any agreement, arrangement or understanding, whether or not in writing (other than (y) customary agreements with and between underwriters and/or banking group members and/or selling group members with respect to a bona fide public offering of securities, (z) pledges of securities in the ordinary course of business that meet all the conditions specified in Rule 13d-3(d)(3) under the U.S. Exchange Act (except for the condition in Rule 13d-3(d)(3)(ii)) and (z) pledge agreements with a registered securities dealer relating to the extension of credit for purchases of securities on margin in the ordinary course of the dealer's business) with respect to or for the purpose of acting jointly or in concert in acquiring, holding, voting or disposing of any Voting Shares of any class; and

|

|

|

(iv)

|

any securities which are directly or indirectly owned at law or in equity by an Associate of such Person;

|

provided, however, that a Person shall not be deemed the "Beneficial Owner" of, or to have "Beneficial Ownership" of, or to "Beneficially Own", any security:

|

|

(v)

|

where such security has been or has been agreed to be deposited or tendered pursuant to a Permitted Lock-up Agreement or is otherwise deposited or tendered to any Take-over Bid made by such Person, made by any of such Person's Affiliates or Associates or made by any other Person or made by any other Person referred to in section 1.1(f)(iii) until such deposited or tendered security has been taken up or paid for, whichever shall first occur;

|

|

|

(vi)

|

where such Person, any of such Person's Affiliates or Associates or any other Person referred to in section 1.1(f)(iii), has or shares the power to vote or direct

|

5

|

|

the voting of such security pursuant to a revocable proxy given in response to a public proxy solicitation or where such Person has an agreement, arrangement or understanding with respect to a shareholder proposal or proposals or a matter or matters to come before a meeting of shareholders, including the election of directors;

|

|

|

(vii)

|

where such Person, any of such Person's Affiliates or Associates or any other Person referred to in section 1.1(f)(iii), has or shares the power to vote or direct the voting of such security in connection with or in order to participate in a public proxy solicitation or where such Person has an agreement, arrangement or understanding with respect to a shareholder proposal or proposals or a matter or matters to come before a meeting of shareholders, including the election of directors;

|

|

|

(viii)

|

where such Person, any of such Person's Affiliates or Associates or any other Person referred to in section 1.1(f)(iii), holds or exercises voting or dispositive power over such security provided that:

|

|

|

(A)

|

the ordinary business of any such Person (the "Investment Manager") includes the management of investment funds for others (which others, for greater certainty, may include or be limited to one or more employee benefit plans or pension plans) or mutual funds and such security or voting or dispositive power over such security is held by the Investment Manager in the ordinary course of such business in the performance of such Investment Manager's duties for the account of another Person (a "Client") including a non-discretionary account held on behalf of a Client by a broker or dealer appropriately registered under applicable law;

|

|

|

(B)

|

such Person (the "Trust Company") is licensed to carry on the business of a trust company under the laws of Canada or any province or territory thereof or under other applicable laws and, as such, acts as trustee or administrator or in a similar capacity in relation to the estates of deceased or incompetent Persons (each an "Estate Account") or in relation to other accounts (each an "Other Account") and holds such security or such voting or dispositive power over such security in the ordinary course of such duties for the estate of any such deceased or incompetent Person or for such Other Accounts;

|

|

|

(C)

|

such Person is established by statute for purposes that include, and a substantial portion of the ordinary business or activity of such Person (the "Statutory Body") is, the management of investment funds for employee benefit plans, pension plans, insurance plans or various public bodies and the Statutory Body holds or exercises voting or dispositive power over such securities for the purpose of its activities as such;

|

|

|

(D)

|

such Person (the "Administrator") is the administrator or trustee of one or more pension funds or plans (a “Plan”), or is a Plan, registered under the laws of Canada or any province or territory thereof or the laws of the United States of America or any State thereof; or

|

6

|

|

(E)

|

such Person (the “Crown Agent”) is a Crown agent or agency;

|

provided, in any of the above cases, that the Investment Manager, the Trust Company, the Statutory Body, the Administrator, the Plan or the Crown Agent, as the case may be, is not then making or proposing to make a Take-Over Bid, other than an Offer to Acquire Voting Shares or other securities by means of a distribution by the Corporation or by means of ordinary market transactions (including prearranged trades) executed through the facilities of a stock exchange or organized over-the-counter market, alone or by acting jointly or in concert with any other Person; or

|

|

(ix)

|

where such Person is a Client of the same Investment Manager as another Person on whose account the Investment Manager holds or exercises voting or dispositive power over such security, or by reason of such Person being an Estate Account or an Other Account of the same Trust Company as another Person on whose account the Trust Company holds or exercises voting or dispositive power over such security.

|

|

|

(g)

|

"Board of Directors" means the board of directors from time to time of the Corporation or any duly constituted and empowered committee thereof.

|

|

|

(h)

|

"Business Day" means any day other than a Saturday, Sunday or a day on which banking institutions in Vancouver are authorized or obligated by law to close.

|

|

|

(i)

|

"Canadian Dollar Equivalent" means, for any amount which is expressed in United States dollars on any date, the Canadian dollar equivalent of such amount determined by reference to the U.S.-Canadian Exchange Rate on such date.

|

|

|

(j)

|

"Canadian-U.S. Exchange Rate" means, on any date, the inverse of the U.S.-Canadian Exchange Rate.

|

|

|

(k)

|

"close of business" means, on any given date, the time on such date (or, if such date is not a Business Day, the time on the next succeeding Business Day) at which the principal transfer office in Vancouver, British Columbia of the transfer agent for the Common Shares of the Corporation (or, after the Separation Time, the principal transfer office in Vancouver of the Rights Agent) closes to the public.

|

|

|

(l)

|

"Common Shares" means the common shares without par value in the capital of the Corporation as presently constituted, as such shares may be subdivided, consolidated, reclassified or otherwise changed from time to time.

|

|

|

(m)

|

"Competing Permitted Bid" means a Take-Over Bid made while a Permitted Bid is in existence and that satisfies all of the provisions of a Permitted Bid except that the condition set forth in section 1.1(ll)(ii) may provide that the Voting Shares that are the subject of the Take-Over Bid may be taken up or paid for on a date which is not earlier than the later of 21 days after the date of the Take-Over Bid or the earliest date on which Voting Shares may be taken up or paid for under any other Permitted Bid that is in existence for the Voting Shares.

|

|

|

(n)

|

"controlled": a corporation shall be deemed to be "controlled" by another Person or two or more Persons if:

|

7

|

|

(i)

|

securities entitled to vote in the election of directors carrying more than 50% of the votes for the election of directors are held, directly or indirectly, by or for the benefit of the other Person or Persons; and

|

|

|

(ii)

|

the votes carried by such securities are entitled, if exercised, to elect a majority of the Board of Directors of such corporation.

|

|

|

(o)

|

"Convertible Securities" shall mean, at any time:

|

|

|

(i)

|

any right (contractual or otherwise, regardless of whether it would be considered a security); or

|

|

|

(ii)

|

any securities issued by the Corporation (including rights, warrants and options but not including the Rights) carrying any purchase, exercise, conversion or exchange right,

|

pursuant to which the holder thereof may acquire Voting Shares or other securities convertible into or exercisable or exchangeable for Voting Shares (in each case, whether such right is exercisable immediately or after a specified period and whether or not on condition or the happening of any contingency);

|

|

(p)

|

"Convertible Security Acquisition" means the acquisition of Voting Shares from the Corporation upon the exercise or pursuant to the terms and conditions of any Convertible Securities acquired by a Person pursuant to a Permitted Bid Acquisition, an Exempt Acquisition or a Pro Rata Acquisition;

|

|

|

(q)

|

"Co-Rights Agents" means a Co-Rights Agent appointed pursuant to section 4.1(a).

|

|

|

(r)

|

"Corporations Act" means the Business Corporations Act (British Columbia), S.B.C. 2002, c. 57, as amended, and the regulations thereunder, as now in effect or as the same may from time to time be amended, re-enacted or replaced.

|

|

|

(s)

|

"Corporation" means Endeavour Silver Corp.

|

|

|

(t)

|

"Disposition Date" has the meaning ascribed thereto in section 5.1(h).

|

|

|

(u)

|

"Dividend Reinvestment Acquisition" shall mean an acquisition of Voting Shares pursuant to a Dividend Reinvestment Plan.

|

|

|

(v)

|

"Dividend Reinvestment Plan" means a regular dividend reinvestment or other plan of the Corporation made available by the Corporation to holders of its securities or to holders of securities of a Subsidiary of the Corporation where such plan permits the holder to direct that some or all of:

|

|

|

(i)

|

dividends paid in respect of shares of any class of the Corporation or a Subsidiary of the Corporation;

|

|

|

(ii)

|

proceeds of redemption of shares of the Corporation or a Subsidiary of the Corporation;

|

8

|

|

(iii)

|

interest paid on evidence of indebtedness of the Corporation or a Subsidiary of the Corporation; or

|

|

|

(iv)

|

optional cash payments;

|

be applied to the purchase from the Corporation of Voting Shares.

|

|

(w)

|

"Effective Date" means June 29, 2011.

|

|

|

(x)

|

"Election to Exercise" has the meaning ascribed thereto in section 2.2(d)(ii).

|

|

|

(y)

|

"Exempt Acquisition" means an acquisition of Voting Shares or Convertible Securities (1) in respect of which the Board of Directors has waived the application of section 3.1 pursuant to the provisions of section 5.1(a), (h) or (j); or (2) pursuant to a distribution of Voting Shares or Convertible Securities made by the Corporation pursuant to a prospectus or a securities exchange take-over bid, by way of a private placement (provided that such private placement has received the approval of the Board of Directors and all applicable securities regulatory authorities) or pursuant to an amalgamation, merger, plan of arrangement or other statutory procedure requiring shareholder approval.

|

|

|

(z)

|

"Exercise Price" means, as of any date, the price at which a holder of a Right may purchase the securities issuable upon exercise of one whole Right which, until adjusted in accordance with the terms hereof, will be an amount equal to three times the Market Price per Common Share determined at the Separation Time.

|

|

|

(aa)

|

"Expansion Factor" shall have the meaning ascribed thereto in section 2.3(a)\.

|

|

|

(bb)

|

"Expiration Time" means the earlier of (i) the Termination Time and (ii) the close of the annual general meeting of the shareholders of the Corporation held in 2014 (the “2014 AGM”) or, if this Agreement is reconfirmed at the 2014 AGM pursuant to section 5.16, the close of the annual general meeting of the shareholders of the Corporation held in 2017 (the “2017 AGM”).

|

|

|

(cc)

|

"Flip-in Event" means a transaction or event in or pursuant to which a Person becomes an Acquiring Person.

|

|

|

(dd)

|

"Grandfathered Person" means a Person who is the Beneficial Owner of 20% or more of the outstanding Voting Shares of the Corporation determined as at the Record Time.

|

|

|

(ee)

|

"holder" shall have the meaning ascribed thereto in section 2.8.

|

|

|

(ff)

|

"Independent Shareholders" means holders of outstanding Voting Shares, other than:

|

|

|

(i)

|

any Acquiring Person;

|

|

|

(ii)

|

any Offeror (other than any Person who, by virtue of section 1.1(f)(viii), is not deemed to Beneficially Own the Voting Shares held by such Person);

|

|

|

(iii)

|

any Affiliate or Associate of any Acquiring Person or Offeror;

|

|

|

(iv)

|

any Person acting jointly or in concert with any Acquiring Person or Offeror, or with any Affiliate or Associate of any Acquiring Person or Offeror; and

|

9

|

|

(v)

|

any employee benefit plan, deferred profit-sharing plan, stock participation plan and any other similar plan or trust for the benefit of employees of the Corporation or a Subsidiary of the Corporation unless the beneficiaries of the plan or trust direct the manner in which the Voting Shares are to be voted or withheld from voting or direct whether the Voting Shares are to be tendered to a Take-Over Bid.

|

|

|

(gg)

|

"Market Price" per share of any securities on any date means the average daily Closing Price per Share of such securities on each of the 20 consecutive Trading Days through and including the Trading Day immediately preceding such date provided, however, that if an event of a type analogous to any of the events described in section 2.3 hereof shall have caused the closing prices used to determine the Market Price on any Trading Day not to be fully comparable with the closing price on such date (or, if such date is not a Trading Day, on the immediately preceding Trading Day), each such closing price so used shall be appropriately adjusted in a manner analogous to the applicable adjustment provided for in section 2.3 hereof in order to make it fully comparable with the closing price on such date or, if such date is not a Trading Day, on the immediately preceding Trading Day. The closing price per share ("Closing Price per Share") of any securities on any date shall be:

|

|

|

(i)

|

the closing board lot sale price or, in case no sale takes place on such date, the average of the closing bid and asked prices per security, as reported by the principal Canadian stock exchange on which such securities are listed and posted for trading;

|

|

|

(ii)

|

if for any reason none of such prices is available on such day or the securities are not listed or posted for trading on a Canadian stock exchange, the last sale price or, in case no such sale takes place on such date, the average of the closing bid and asked prices for each of such securities as reported by the principal United Stated securities exchange on which such securities are listed or admitted to trading;

|

|

|

(iii)

|

if for any reason none of such prices is available on such date or the securities are not listed or posted or admitted to trading on a Canadian stock exchange or a United States securities exchange, the last sale price or, in case no sale takes place on such date, the average of the high bid and low ask prices for each of such securities in the over-the-counter market, as quoted by any recognized reporting system then in use (as determined by the Board of Directors); or

|

|

|

(iv)

|

if for any reason none of such prices is available on such date or the securities are not listed or posted or admitted to trading on a Canadian stock exchange or a United States securities exchange or quoted by any such reporting system, the average of the closing bid and ask prices as furnished by a professional marketmaker making a market in the securities selected in good faith by the Board of Directors;

|

provided, however, that if for any reason none of such prices is available on such day, the Closing Price per Share of such securities on such a date means the fair value per share of such securities on such date as determined a nationally recognized investment dealer or investment banker selected by the Board of Directors. The Market Price shall be expressed in Canadian dollars. Provided further that if an event of a type analogous to any of the events described in section 2.3 hereof shall have caused any price used

10

to determine the Market Price on any Trading Day not to be fully comparable with the price as so determined on the Trading Day immediately preceding such date of determination, each such price so used shall be appropriately adjusted in a manner analogous to the applicable adjustment provided for in section 2.3 hereof in order to make it fully comparable with the price on the Trading Day immediately preceding such date of determination. If any relevant amount used in calculating the Market Price happens to be in United States dollars, such amount shall be translated into Canadian dollars on that date at the Canadian Dollar Equivalent thereof.

|

|

(hh)

|

"Nominee" has the meaning ascribed thereto in section 2.2(c).

|

|

|

(ii)

|

"Offer to Acquire" includes:

|

|

|

(i)

|

an offer to purchase or a solicitation of an offer to sell Voting Shares; and

|

|

|

(ii)

|

an acceptance of an offer to sell Voting Shares, whether or not such offer to sell has been solicited;

|

or any combination thereof, and the Person accepting an offer to sell shall be deemed to be making an Offer to Acquire to the Person that made the offer to sell.

|

|

(jj)

|

"Offeror" means a Person who has announced, and has not withdrawn, an intention to make or who has made, and has not withdrawn, a Take-over Bid, other than a Person who has completed a Permitted Bid, a Competing Permitted Bid or an Exempt Acquisition.

|

|

|

(kk)

|

"Offeror's Securities" means the aggregate of all Voting Shares Beneficially Owned by the Offeror on the date of an Offer to Acquire.

|

|

|

(ll)

|

"Permitted Bid" means a Take-Over Bid made by an Offeror by way of a takeover bid circular which also complies with the following additional provisions:

|

|

|

(i)

|

the Take-Over Bid is made for all outstanding Voting Shares and to all holders of Voting Shares as registered on the books of the Corporation, other than the Offeror. The Take-Over Bid shall expressly state that Common Shares issued on the exercise of share purchase warrants, options and other securities convertible into Common Shares shall, subject to compliance with the procedures applicable generally to the tendering of Voting Shares of the Take-Over Bid, be eligible to be tendered under the Take-Over Bid;

|

|

|

(ii)

|

the Take-Over Bid contains, and the take-up and payment for securities tendered or deposited is subject to, an irrevocable and unqualified provision that no Voting Shares will be taken up or paid for pursuant to the Take-Over Bid prior to the close of business on the date which is not less than 60 days following the date of the Take-Over Bid and only if at such date more than 50% of the Voting Shares held by Independent Shareholders shall have been deposited or tendered pursuant to the Take-Over Bid and not withdrawn;

|

|

|

(iii)

|

unless the Take-over Bid is withdrawn, the Take-Over Bid contains an irrevocable and unqualified provision that Voting Shares may be deposited pursuant to such Take-Over Bid at any time during the period of time described

|

11

|

|

in section 1.1(ll)(ii) and that any Voting Shares deposited pursuant to the Take-Over Bid may be withdrawn until taken up and paid for; and

|

|

|

(iv)

|

unless the Take-over Bid is withdrawn, the Take-Over Bid contains an irrevocable and unqualified provision that in the event that the deposit condition set forth in section 1.1(ll)(ii) is satisfied the Offeror will make a public announcement of that fact and the Take-Over Bid will remain open for deposits and tenders of Voting Shares for not less than ten Business Days from the date of such public announcement,

|

provided always that a Permitted Bid will cease to be a Permitted Bid at any time when such bid ceases to meet any of the provisions of this definition and provided that, at such time, any acquisition of Voting Shares made pursuant to such Permitted Bid, including any acquisitions of Voting Shares theretofore made, will cease to be a Permitted Bid Acquisition.

|

|

(mm)

|

"Permitted Bid Acquisition" means an acquisition of Voting Shares made pursuant to a Permitted Bid or a Competing Permitted Bid.

|

|

|

(nn)

|

“Permitted Lock-up Agreement” means an agreement between an Offeror, any of its Affiliates or Associates or any other Person acting jointly or in concert with the Offeror and a Person (the "Locked-up Person") who is not an Affiliate or Associate of the Offeror or a Person acting jointly or in concert with the Offeror (the terms of which agreement are publicly disclosed and a copy of which is made available to the public (including the Corporation) not later than the date the Lock-up Bid (as defined below) is publicly announced or if the Lock-up Bid has been made prior to the date on which such agreement is entered into, forthwith, and in any event not later than the date following the date of such agreement) whereby the Locked-up Person agrees to deposit or tender the Voting Shares held by the Locked-up Person to the Offeror's Take-over Bid or to any Take-over Bid made by any of the Offerer's Affiliates or Associates or made by any other Person acting jointly or in concert with the Offeror (the "Lock-up Bid") provided such agreement:

|

|

|

(i)

|

permits the Locked-up Person to withdraw the Voting Shares from the agreement in order to tender or deposit the Voting Shares to another Take-over Bid or to support another transaction (whether by way of merger, amalgamation, arrangement, reorganization or other transaction) (the "Superior Offer Consideration") that in either case will provide a greater cash equivalent value per Voting Share to the holders of Voting Shares than the Locked-up Person otherwise would have received to pay under the Lock-up Bid (the "Lock-up Bid Consideration"). Notwithstanding the above, the Permitted Lock-Up Agreement may require that the Superior Offer Consideration must exceed the Lock-up Bid Consideration by a specified percentage before such withdrawal right takes effect, provided such specified percentage is not greater than 7%;

|

(and, for greater clarity, such agreement may contain a right of first refusal or require a period of delay to give an Offeror an opportunity to match a higher price in another Take-over Bid or transaction and may provide for any other similar limitation on a Locked-up Person's right to withdraw Voting Shares from the agreement, as long as the limitation does not preclude the exercise by the Locked-up Person of the right to

12

withdraw Voting Shares during the period of the other Take-over Bid or other transaction); and

|

|

(ii)

|

does not provide for any "break-up" fees, "top-up" fees, penalties, expenses or other amounts that exceed in the aggregate the greater of:

|

|

|

(A)

|

the cash equivalent of 2.5% of the price or value payable under the Lock-up Bid to a Locked-Up Person; and

|

|

|

(B)

|

50% of the amount by which the price or value payable under another Take-over Bid or transaction exceeds the price or value of the consideration that such Locked-up Person would have received under the Lock-up Bid;

|

being payable or forfeited by a Locked-up Person pursuant to the agreement in the event a Locked-up Person fails to deposit or tender Voting Shares to the Lock-up Bid, withdraws Voting Shares previously tendered thereto to another Take-over Bid or supports another transaction.

|

|

(oo)

|

"Person" includes an individual, body corporate, partnership, syndicate or other form of unincorporated association, a government and its agencies or instrumentalities, any entity or group (as such term is used in Rule 13d-5 under the U.S. Exchange Act as in effect on the date hereof) whether or not having legal personality and any of the foregoing acting in any derivative, representative or fiduciary capacity.

|

|

|

(pp)

|

"Pro-Rata Acquisition" means an acquisition by a Person of Voting Shares or Convertible Securities pursuant to:

|

|

|

(i)

|

a Dividend Reinvestment Acquisition;

|

|

|

(ii)

|

a stock dividend, stock split or other event in respect of securities of the Corporation pursuant to which such Person becomes a Beneficial Owner of Voting Shares on the same pro-rata basis as all other holders of securities of the particular class, classes or series;

|

|

|

(iii)

|

the acquisition or the exercise by the Person of only those rights to purchase Voting Shares distributed by the Corporation to that Person in the course of a distribution to all holders of securities of the Corporation of one or more particular classes or series pursuant to a rights offering or pursuant to a prospectus, provided that the Person does not thereby acquire a greater percentage of such Voting Shares, or securities convertible into or exchangeable for Voting Shares, so offered than the Person's percentage of Voting Shares Beneficially Owned immediately prior to such acquisition and that such rights are acquired directly from the Corporation and not from any other Person; or

|

|

|

(iv)

|

a distribution of Voting Shares, or securities convertible into or exchangeable for Voting Shares (and the conversion or exchange of such convertible or exchangeable securities), by the Corporation, provided that the Person does not thereby acquire a greater percentage of such Voting Shares, or securities convertible into or exchangeable for Voting Shares, so offered in the distribution

|

13

|

|

than the Person's percentage of Voting Shares beneficially owned immediately prior to such acquisition.

|

|

|

(qq)

|

"Record Time" means 12:01 a.m. (Vancouver time) on the Effective Date.

|

|

|

(rr)

|

"Redemption Price" has the meaning ascribed thereto in section 5.1(b).

|

|

|

(ss)

|

"Right" means a right to purchase Common Shares on and subject to the terms and conditions of this Agreement.

|

|

|

(tt)

|

"Rights Agent" means Computershare Investor Services Inc. and any successor rights agent hereunder.

|

|

|

(uu)

|

"Rights Certificate" means a certificate representing Rights after the Separation Time, which shall be substantially in the form of Schedule A attached hereto or such other form as the Corporation and the Rights Agent may agree.

|

|

|

(vv)

|

"Rights Register" shall have the meaning ascribed thereto in section 2.6(a).

|

|

|

(ww)

|

"Securities Act (British Columbia)” means the Securities Act, RSBC 1996, c.418, as amended, and the Securities Rules thereunder, as now in effect or as the same may from time to time be amended, re-enacted or replaced.

|

|

|

(xx)

|

"Separation Time" means the close of business on the tenth Business Day after the earliest of:

|

|

|

(i)

|

the Share Acquisition Date; and

|

|

|

(ii)

|

the date of the commencement of or first public announcement of the intent of any Person (other than the Corporation or any Subsidiary of the Corporation) to commence a Take-Over Bid (other than a Permitted Bid or a Competing Permitted Bid), and

|

|

|

(iii)

|

the date on which a Permitted Bid or Competing Permitted Bid ceases to be such;

|

or such later time as may be determined by the Board of Directors, and provided that, if any Take-over Bid referred to in section 1.1(xx)(ii) or Permitted Bid or Competing Permitted Bid referred to in section 1.1(xx)(iii) expires, is not made, is cancelled, terminated or otherwise withdrawn prior to the Separation Time, such Take-over Bid, Permitted Bid or Competing Permitted Bid, as applicable, shall be deemed, for the purposes of this definition, never to have been commenced, made or announced.

|

|

(yy)

|

"Share Acquisition Date" means the first date of a public announcement or disclosure (which, for purposes of this definition, shall include, without limitation, a report filed pursuant to section 5.2 of Multilateral Instrument 62-104 or section 102.1 of the Securities Act (Ontario) (R.S.O. 1990, c.s.5, as amended), as any of the aforementioned legislation may be amended or substituted from time to time) by the Corporation or an Acquiring Person indicating that a Person has become an Acquiring Person.

|

14

|

|

(zz)

|

"Subsidiary": a corporation shall be deemed to be a subsidiary of another corporation if:

|

|

|

(i)

|

it is controlled by:

|

|

|

(A)

|

that other; or

|

|

|

(B)

|

that other and one or more corporations, each of which is controlled by that other; or

|

|

|

(C)

|

two or more corporations, each of which is controlled by that other; or

|

|

|

(ii)

|

it is a Subsidiary of a corporation that is that other's Subsidiary.

|

|

|

(aaa)

|

"Take-Over Bid" means an Offer to Acquire Voting Shares, or Convertible Securities if, assuming that the Voting Shares or Convertible Securities subject to the Offer to Acquire are acquired and are Beneficially Owned at the date of such Offer to Acquire by the Person making such Offer to Acquire, such Voting Shares (including Voting Shares that may be acquired upon conversion, exchange or exercise of the rights under such Convertible Securities into Voting Shares) together with the Offeror's Securities, constitute in the aggregate 20% or more of the outstanding Voting Shares at the date of the Offer to Acquire.

|

|

|

(bbb)

|

"Termination Time" means the time at which the right to exercise Rights shall terminate pursuant to section 5.1(e).

|

|

|

(ccc)

|

"Trading Day" means, when used with respect to any securities, a day on which the principal Canadian stock exchange on which such securities are listed or posted for trading is open for the transaction of business or, if the securities are not listed or posted for trading on any Canadian stock exchange, a Business Day.

|

|

|

(ddd)

|

"U.S.-Canadian Exchange Rate" means, on any date:

|

|

|

(i)

|

if on such date the Bank of Canada sets an average noon spot rate of exchange for the conversion of one United States dollar into Canadian dollars, such rate; and

|

|

|

(ii)

|

in any other case, the rate for such date for the conversion of one United States dollar into Canadian dollars calculated in the manner determined by the Board of Directors from time to time acting in good faith.

|

|

|

(eee)

|

"U.S. Dollar Equivalent" means, for any amount which is expressed in Canadian dollars on any date, the United States dollar equivalent of such amount determined by reference to the Canadian-U.S. Exchange Rate on such date.

|

|

|

(fff)

|

"U.S. Exchange Act" means the United States Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, as now in effect or as the same may from time to time be amended, re-enacted or repealed.

|

|

|

(ggg)

|

"U.S. Securities Act" means the United States Securities Act of 1933, as amended, and the rules and regulations thereunder, as now in effect or as the same may from time to time be amended, re-enacted or replaced.

|

15

|

|

(hhh)

|

"Voting Share Reduction" means an acquisition or redemption by the Corporation of outstanding Voting Shares which, by reducing the number of Voting Shares outstanding, increases the percentage of Voting Shares Beneficially Owned by a Person to 20% or more of the Voting Shares then outstanding.

|

|

|

(iii)

|

"Voting Shares" means the Common Shares and any other shares of the Corporation entitled to vote generally and at all times for the election of directors of the Corporation.

|

1.2 Currency

All sums of money which are referred to in this Agreement are expressed in lawful money of Canada, unless otherwise specified.

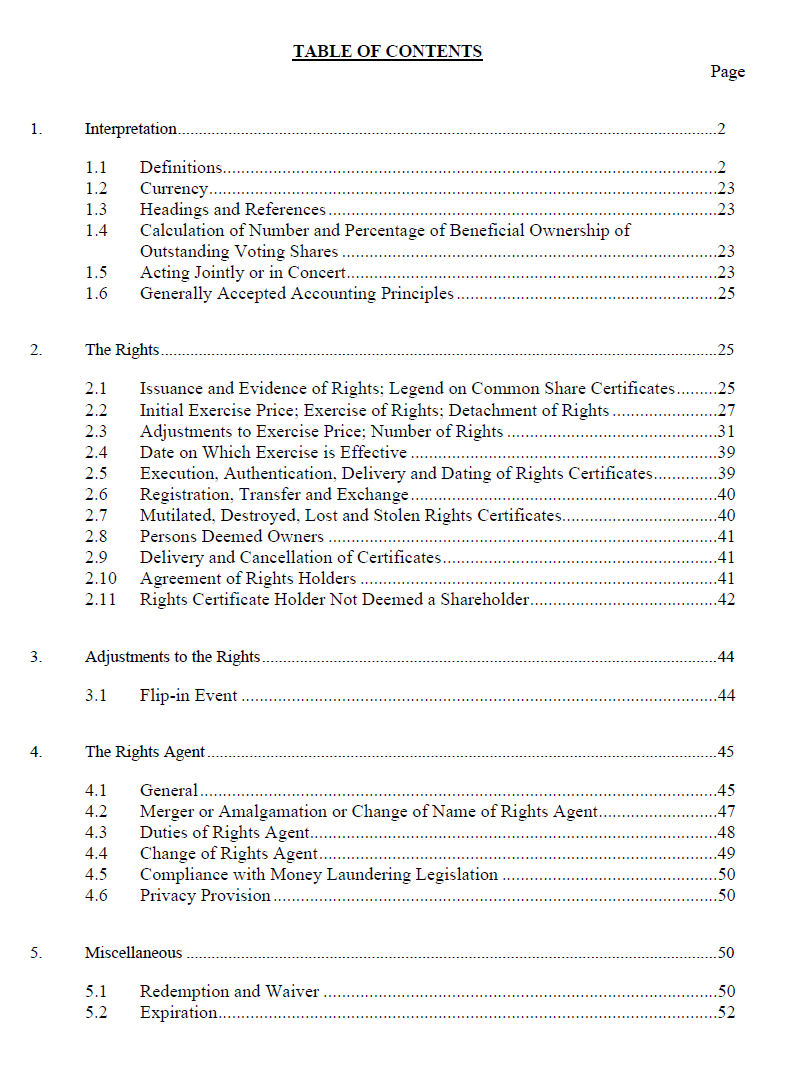

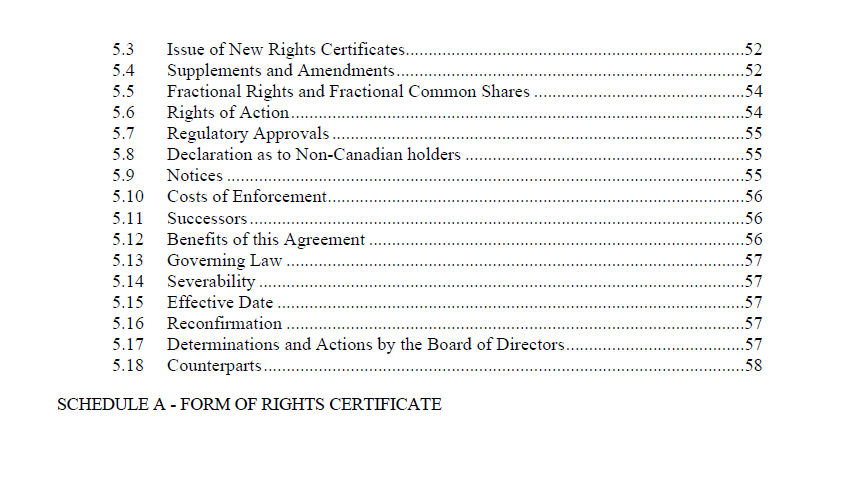

1.3 Headings and References

The headings of the sections of this Agreement and the table of contents are inserted for convenience of reference only and shall not affect the construction or interpretation of this Agreement. All references to sections are to sections, subsections, clauses and paragraphs of this Agreement. The words "hereto", "herein", "hereof', "hereunder", "this Agreement", "the Rights Agreement" and similar expressions refer to this Agreement including the schedule attached hereto as a whole, as the same may be amended, modified or supplemented at any time or from time to time.

|

1.4

|

Calculation of Number and Percentage of Beneficial Ownership of Outstanding Voting Shares

|

For purposes of this Agreement, the percentage of Voting Shares of any class Beneficially Owned by any Person, will be and be deemed to be the product (expressed as a percentage) determined by the formula:

100 x A/B

where:

|

|

A

|

=

|

the number of votes for the election of all directors generally attaching to the Voting Shares of the particular class Beneficially Owned by such Person; and

|

|

|

B

|

=

|

the number of votes for the election of all directors generally attaching to all outstanding Voting Shares of the particular class.

|

Where any Person is deemed to Beneficially Own unissued Voting Shares such Voting Shares will be deemed to be outstanding for the purpose of calculating the percentage of Voting Shares of the particular class Beneficially Owned by such Person.

1.5 Acting Jointly or in Concert

For the purposes of this Agreement, a Person is acting jointly or in concert with every Person who is a party to any agreement, commitment or understanding (whether formal or informal and whether or not in writing) with the first Person (the "First Person") or any Associate or Affiliate thereof or any other Person acting jointly or in concert with the First Person, to acquire or offer to acquire Voting Shares (other than customary agreements (i) with and between underwriters or banking group members or selling group members with respect to a public offering or private

16

placement of securities or pledges of securities in the ordinary course of business, and (ii) among shareholders of the Company for legitimate corporate governance activities)

1.6 Generally Accepted Accounting Principles

Wherever in this Agreement reference is made to generally accepted accounting principles, such reference shall be deemed to be the recommendations at the relevant time of the Canadian Institute of Chartered Accountants, or any successor institute, applicable on a consolidated basis (unless otherwise specifically provided herein to be applicable on an unconsolidated basis) as of the date on which a calculation is made or required to be made in accordance with generally accepted accounting principles. Where the character or amount of an asset or liability or item of revenue or expense is required to be determined, or any consolidation or other accounting computation is required to be made for the purpose of this Agreement or any document, such determination or calculation shall, to the extent applicable and except as otherwise specified herein or as otherwise agreed in writing by the parties, be made in accordance with generally accepted accounting principles applied on a consistent basis.

2. The Rights

2.1 Issuance and Evidence of Rights; Legend on Common Share Certificates

|

|

(a)

|

The Corporation shall issue one Right in respect of each Common Share outstanding at the Record Time and one Right in respect of each Common Share which may be issued after the Record Time and prior to the earlier of the Separation Time and the Expiration Time in accordance with the terms hereof.

|

|

|

(b)

|

Certificates representing Common Shares which are issued after the Record Time but prior to the earlier of the Separation Time and the Expiration Time, will evidence one Right for each Common Share represented thereby and shall have impressed, printed or written thereon or otherwise affixed thereto the following legend:

|

"Until the Separation Time (as such term is defined in the Shareholder Rights Agreement referred to below), this certificate also evidences and entitles the holder hereof to certain rights as set forth in the shareholder rights agreement (the "Shareholder Rights Agreement") dated as of June 29, 2011 between ENDEAVOUR SILVER CORP. (the "Corporation") and COMPUTERSHARE INVESTOR SERVICES INC., as Rights Agent, the terms of which are hereby incorporated herein by reference and a copy of which is on file and may be inspected during normal business hours at the principal executive office of the Corporation. Under certain circumstances as set forth in the Shareholder Rights Agreement, such Rights may be amended, redeemed or exchanged, may expire, may lapse, may become void (if, in certain circumstances, they are "Beneficially Owned" by a person who is or becomes an "Acquiring Person", as such terms are defined in the Shareholder Rights Agreement, or a transferee thereof) or may be evidenced by separate certificates and may no longer be evidenced by this certificate. The Corporation will mail or arrange for the mailing of a copy of the Shareholder Rights Agreement to the holder of this certificate without charge as soon as practicable after the receipt of a written request therefor."

Certificates representing Common Shares that are issued and outstanding at the Record Time will also evidence one Right for each one Common Share evidenced thereby,

17

notwithstanding the absence of the foregoing legend, until the close of business on the earlier of the Separation Time and the Expiration Time.

Registered holders of Common Shares who have not received a share certificate and are entitled to do so on the earlier of the Separation Time and Expiration Time shall be entitled to Rights as if such certificates had been issued and such Rights shall for all purposes hereof be evidenced by the corresponding entries on the Corporation's securities register for Common Shares.

2.2 Initial Exercise Price; Exercise of Rights; Detachment of Rights

|

|

(a)

|

Exercise Terms: Subject to section 3.1(a) and adjustment as herein set forth, each Right will entitle the holder thereof, from and after the Separation Time and prior to the Expiration Time, to purchase one Common Share for the Exercise Price (and the Exercise Price and number of Common Shares are subject to adjustment as set forth below). Notwithstanding any other provision of this Agreement, any Rights held by the Corporation or any of its Subsidiaries will be void.

|

|

|

(b)

|

No Exercise Prior to Separation Time: Until the Separation Time:

|

|

|

(i)

|

the Rights will not be exercisable and no Right may be exercised; and

|

|

|

(ii)

|

each Right shall be evidenced by the certificate for the associated Common Share registered in the name of the holder thereof (which certificate shall also be deemed to represent a Rights Certificate) and shall be transferable only together with, and shall be transferred by a transfer of, such associated Common Share.

|

|

|

(c)

|

Exercise After Separation Time: From and after the Separation Time and prior to the Expiration Time:

|

|

|

(i)

|

the Rights are exercisable; and

|

|

|

(ii)

|

the registration and transfer of Rights will be separate from and independent of Common Shares.

|

Promptly following the Separation Time, the Corporation will prepare and the Rights Agent will mail to each holder of record of Common Shares as of the Separation Time (other than an Acquiring Person and, in respect of any Rights Beneficially Owned by such Acquiring Person which are not held of record by such Acquiring Person, the holder of such Rights (a "Nominee")), at such holder's address as shown by the records of the Corporation (the Corporation hereby agreeing to furnish copies of such records to the Rights Agent for this purpose):

|

|

(iii)

|

a Rights Certificate appropriately completed, representing the number of Rights held by such holder at the Separation Time and having such marks of identification or designation and such legends, summaries or endorsements printed thereon as the Corporation may deem appropriate and as are not inconsistent with the provisions of this Agreement, or as may be required to comply with any law, rule or regulation or with any rule or regulation of any self-regulatory organization, stock exchange or "system" on which the Rights may from time to time be listed or traded, or to conform to usage; and

|

18

|

|

(iv)

|

a disclosure statement describing the Rights;

|

provided that a Nominee shall be sent the materials provided for in (iii) and (iv) in respect of all Common Shares of the Corporation held of record by it which are not Beneficially Owned by an Acquiring Person.

|

|

(d)

|

Manner of Exercise: Rights may be exercised, in whole or in part, on any Business Day after the Separation Time and prior to the Expiration Time by submitting to the Rights Agent:

|

|

|

(i)

|

the Rights Certificate evidencing such Right;

|

|

|

(ii)

|

an election to exercise such Rights (an "Election to Exercise") substantially in the form attached to the Rights Certificate appropriately completed and executed by the holder or his executors or administrators or other personal representatives or his or their legal attorney duly appointed by instrument in writing in form and executed in a manner satisfactory to the Rights Agent; and

|

|

|

(iii)

|

payment by certified cheque, banker's draft or money order payable to the order of the Corporation, in a sum equal to the Exercise Price multiplied by the number of Rights being exercised and a sum sufficient to cover any transfer tax or charge which may be payable in respect of any transfer involved and the transfer or delivery of Rights Certificates or the issuance or delivery of certificates of Common Shares in a name other than that of the holder of the Rights being exercised.

|

|

|

(e)

|

Issue of Common Shares: Upon receipt of a Rights Certificate, together with a completed Election to Exercise executed in accordance with section 2.2(d)(ii) which does not indicate that such Right is null and void as provided by section 3.1(b), and payment as set forth in section 2.2(d)(iii), the Rights Agent (unless otherwise instructed by the Corporation in the event that the Corporation is of the opinion that the Rights cannot be exercised in accordance with this Agreement) will thereupon promptly:

|

|

|

(i)

|

requisition from the transfer agent certificates representing the number of Common Shares to be purchased (the Corporation hereby irrevocably authorizing its transfer agent to comply with all such requisitions);

|

|

|

(ii)

|

when appropriate, requisition from the Corporation the amount of cash to be paid in lieu of issuing fractional Common Shares;

|

|

|

(iii)

|

after receipt of the certificates referred to in section 2.2(e)(i), deliver the same to or upon the order of the registered holder of such Rights Certificates, registered in such name or names as may be designated by such holder;

|

|

|

(iv)

|

when appropriate, after receipt, deliver the cash referred to in section 2.2(e)(ii) to or to the order of the registered holder of such Rights Certificate; and

|

|

|

(v)

|

tender to the Corporation all payments received on exercise of Rights.

|

|

|

(f)

|

Partial Exercise: In case the holder of any Rights shall exercise less than all of the Rights evidenced by the Rights Certificate of such holder, a new Rights Certificate evidencing

|

19

|

|

the Rights remaining unexercised (subject to the provisions of section 5.5(a)) will be issued by the Rights Agent to such holder or to such holder's authorized assigns.

|

|

|

(g)

|

Covenants: The Corporation covenants and agrees to:

|

|

|

(i)

|

take all such action as may be necessary on its part and within its powers to ensure that all Common Shares delivered upon exercise of Rights shall, at the time of delivery of the certificates evidencing such Common Shares (subject to payment of the Exercise Price), be validly authorized, executed, issued and delivered and be fully paid and non-assessable;

|

|

|

(ii)

|

take all such action as may be necessary and within its power to comply with any applicable requirements of the Corporations Act, the Securities Act (British Columbia), the U.S. Securities Act, the U.S. Exchange Act and the securities laws or comparable legislation of each of the other provinces and territories of Canada and states of the United States, and any other applicable law, rule or regulation thereof, in connection with the issue and delivery of the Rights Certificates and the issuance of the Common Shares upon exercise of Rights;

|

|

|

(iii)

|

use reasonable efforts to cause all Common Shares issued upon exercise of Rights to be listed upon the stock exchanges upon which the Common Shares were traded immediately prior to the Share Acquisition Date;

|

|

|

(iv)

|

cause to be reserved and kept available out of the authorized and unissued Common Shares, the number of Common Shares that, as provided in this Agreement, will from time to time be sufficient to permit the exercise in full of all outstanding Rights;

|

|

|

(v)

|

pay when due and payable, if applicable, any and all federal, provincial and municipal transfer taxes and charges (not including any income or capital taxes of the holder or exercising holder or any liability of the Corporation to withhold tax) which may be payable in respect of the original issuance or delivery of the Rights Certificates, or certificates for the Common Shares to be issued upon exercise of any Rights, provided that the Corporation shall not be required to pay any transfer tax or charge which may be payable in respect of any transfer involved in the transfer or delivery of Rights Certificates or the issuance or delivery of certificates for Common Shares in a name other than that of the holder of the Rights being transferred or exercised; and

|

|

|

(vi)

|

after the Separation Time, except as permitted by section 5.1, not take (or permit any Subsidiary of the Corporation to take) any action if at the time such action is taken it is reasonably foreseeable that such action will diminish substantially or otherwise eliminate the benefits intended to be afforded by the Rights.

|

2.3 Adjustments to Exercise Price; Number of Rights

The Exercise Price, the number and kind of securities subject to purchase upon exercise of each Right and the number of Rights outstanding are subject to adjustment from time to time as provided in this section 2.3, as well as in section 3.

20

(a) Share Reorganization: If the Corporation shall at any time after the date of this Agreement:

|

|

(i)

|

declare or pay a dividend on Common Shares payable in Common Shares (or other securities exchangeable for or convertible into or giving a right to acquire Common Shares or other securities of the Corporation) other than pursuant to any optional stock dividend program;

|

|

|

(ii)

|

subdivide or change the then outstanding Common Shares into a greater number of Common Shares;

|

|

|

(iii)

|

consolidate or change the then outstanding Common Shares into a smaller number of Common Shares; or

|

|

|

(iv)

|

issue any Common Shares for other securities exchangeable for or convertible into or giving a right to acquire Common Shares or other securities of the Corporation or in respect of, in lieu of or in exchange for existing Common Shares, except as otherwise provided in this section 2.3.

|

the Exercise Price and the number of Rights outstanding, or, if the payment or effective date therefor shall occur after the Separation Time, the securities purchasable upon exercise of Rights shall be adjusted as of the payment or effective date in the manner set forth below.

If the Exercise Price and number of Rights outstanding are to be adjusted:

|

|

(1)

|

the Exercise Price in effect after such adjustment will be equal to the Exercise Price in effect immediately prior to such adjustment divided by the number of Common Shares (or other capital stock) (the "Expansion Factor") that a holder of one Common Share immediately prior to such dividend, subdivision, change, consolidation or issuance would hold thereafter as a result thereof; and

|

|

|

(2)

|

each Right held prior to such adjustment will become that number of Rights as results from the application of the Expansion Factor,

|

and the adjusted number of Rights will be deemed to be distributed among the Common Shares with respect to which the original Rights were associated (if they remain outstanding) and the shares issued in respect of such dividend, subdivision, change, consolidation or issuance, so that each such Common Share (or other capital stock) will have exactly one Right associated with it in effect following the payment or effective date of the event referred to in section 2.3(a)(i), (ii), (iii) or (iv), as the case may be.

For greater certainty, if the securities purchasable upon exercise of Rights are to be adjusted, the securities purchasable upon exercise of each Right after such adjustment will be the securities that a holder of the securities purchasable upon exercise of one Right immediately prior to such dividend, subdivision, change, consolidation or issuance would hold thereafter as a result of such dividend, subdivision, change, consolidation or issuance.

If, after the Record Time and prior to the Expiration Time, the Corporation shall issue any shares of capital stock other than Common Shares in a transaction of a type described in section 2.3(a)(i) or (iv), shares of such capital stock shall be treated herein as nearly equivalent to Common Shares as may be practicable and appropriate under the

21

circumstances and the Corporation and the Rights Agent agree to amend this Agreement in order to effect such treatment. If an event occurs which would require an adjustment under both this section 2.3 and section 3.1(a) hereof, the adjustment provided for in this section 2.3 shall be in addition to and shall be made prior to any adjustment required pursuant to section 3.1(a) hereof. Adjustments pursuant to this section 2.3(a) shall be made successively, whenever an event referred to in this section 2.3(a) occurs.

In the event the Corporation shall at any time after the Record Time and prior to the Separation Time issue any Common Shares otherwise than in a transaction referred to in this section 2.3(a), each such Common Share so issued shall automatically have one new Right associated with it, which Right shall be evidenced by the certificate representing such associated Common Share.

|

|

(b)

|

Rights Offering: If the Corporation shall at any time after the Record Time and prior to the Separation Time fix a record date for the issuance of rights, options or warrants to all holders of Common Shares entitling them (for a period expiring within 21 calendar days after such record date) to subscribe for or purchase Common Shares (or securities convertible into or exchangeable for or carrying a right to purchase Common Shares) at a price per Common Share (or, if a security convertible into or exchangeable for or carrying a right to purchase or subscribe for Common Shares, having a conversion, exchange or exercise price, including the price required to be paid to purchase such convertible or exchangeable security or right per share) less than the Market Price per Common Share on such record date, the Exercise Price to be in effect after such record date shall be determined by multiplying the Exercise Price in effect immediately prior to such record date by a fraction:

|

|

|

(i)

|

the numerator of which shall be the number of Common Shares outstanding on such record date, plus the number of Common Shares that the aggregate offering price of the total number of Common Shares so to be offered (and/or the aggregate initial conversion, exchange or exercise price of the convertible or exchangeable securities or rights so to be offered, including the price required to be paid to purchase such convertible or exchangeable securities or rights) would purchase at such Market Price per Common Share; and

|

|

|

(ii)

|

the denominator of which shall be the number of Common Shares outstanding on such record date, plus the number of additional Common Shares to be offered for subscription or purchase (or into which the convertible or exchangeable securities or rights so to be offered are initially convertible, exchangeable or exercisable).

|

In case such subscription price may be paid by delivery of consideration, part or all of which may be in a form other than cash, the value of such consideration shall be as determined in good faith by the Board of Directors, whose determination shall be described in a statement filed with the Rights Agent and shall be binding on the Rights Agent and the holders of Rights. Such adjustment shall be made successively whenever such a record date is fixed, and in the event that such rights, options or warrants are not so issued, or if issued, are not exercised prior to the expiration thereof, the Exercise Price shall be readjusted to the Exercise Price which would then be in effect if such record date had not been fixed, or to the Exercise Price which would be in effect based upon the number of Common Shares (or securities convertible into, or exchangeable or exercisable for Common Shares) actually issued upon the exercise of such rights, options or warrants, as the case may be.

22

For purposes of this Agreement, the granting of the right to purchase Common Shares (whether from treasury or otherwise) pursuant to the Dividend Reinvestment Plan or any employee benefit stock option or similar plans shall be deemed not to constitute an issue of rights, options or warrants by the Corporation; provided, however, that, in all such cases, the right to purchase Common Shares is at a price per share of not less than 95% of the current market price per share (determined as provided in such plans) of the Common Shares.

|

|

(c)

|

Special Distribution: If the Corporation shall at any time after the Record Time and prior to the Separation Time fix a record date for the making of a distribution to all holders of Common Shares (including any such distribution made in connection with a merger or amalgamation) of evidences of indebtedness, cash (other than an annual cash dividend or a dividend paid in Common Shares, but including any dividend payable in securities other than Common Shares), assets or rights, options or warrants (excluding those referred to in section 2.3(b)), the Exercise Price to be in effect after such record date shall be determined by multiplying the Exercise Price in effect immediately prior to such record date by a fraction:

|

|

|

(i)

|

the numerator of which shall be the Market Price per Common Share on such record date, less the fair market value (as determined in good faith by the Board of Directors, whose determination shall be described in a statement filed with the Rights Agent and shall be binding on the Rights Agent and the holders of Rights), on a per share basis, of the portion of the cash, assets, evidences of indebtedness, rights, options or warrants so to be distributed; and

|

|

|

(ii)

|

the denominator of which shall be such Market Price per Common Share.

|

Such adjustments shall be made successively whenever such a record date is fixed, and in the event that such a distribution is not so made, the Exercise Price shall be adjusted to be the Exercise Price which would have been in effect if such record date had not been fixed.

|

|

(d)

|

Minimum Adjustments: Notwithstanding anything herein to the contrary, no adjustment in the Exercise Price shall be required unless such adjustment would require an increase or decrease of at least one per cent in the Exercise Price; provided, however, that any adjustments which by reason of this section 2.3(d) are not required to be made shall be carried forward and taken into account in many subsequent adjustment. All calculations under section 2.3 shall be made to the nearest cent or to the nearest ten-thousandth of a share. Notwithstanding the first sentence of this section 2.3(d), any adjustment required by section 2.3 shall be made no later than the earlier of:

|

|

|

(i)

|

three years from the date of the transaction which gives rise to such adjustment; and

|

|

|

(ii)

|

the Expiration Date.

|

|

|

(e)

|

Discretionary Adjustment: If the Corporation shall at any time after the Record Time and prior to the Separation Time issue any shares of capital stock (other than Common Shares), or rights, options or warrants to subscribe for or purchase any such capital stock, or securities convertible into or exchangeable for any such capital stock, in a transaction referred to in section 2.3(a)(i) or (iv), if the Board of Directors acting in good faith determines that the adjustments contemplated by sections 2.3(a), 2.3(b) and 2.3(c) in connection with such transaction will not appropriately protect the interests of the holders

|

23

|

|

of Rights, the Board of Directors may determine what other adjustments to the Exercise Price, number of Rights and/or securities purchasable upon exercise of Rights would be appropriate and, notwithstanding sections 2.3(a), 2.3(b) and 2.3(c), such adjustments, rather than the adjustments contemplated by sections 2.3(a), 2.3(b) and 2.3(c), shall be made. Subject to the prior consent of the holders of Voting Shares or Rights obtained as set forth in section 5.4(b) or (c), the Corporation and the Rights Agent shall have authority to amend this Agreement as appropriate to provide for such adjustments.

|

|

|

(f)

|

Benefit of Adjustments: Each Right originally issued by the Corporation subsequent to any adjustment made to the Exercise Price hereunder shall evidence the right to purchase, at the adjusted Exercise Price, the number of Common Shares purchasable from time to time hereunder upon exercise of a Right immediately prior to such issue, all subject to further adjustment as provided herein.

|

|

|

(g)

|

No Change of Certificates: Irrespective of any adjustment or change in the Exercise Price or the number of Common Shares issuable upon the exercise of the Rights, the Rights Certificates theretofore and thereafter issued may continue to express the Exercise Price per Common Share and the number of Common Shares which were expressed in the initial Rights Certificates issued hereunder.

|

|

|

(h)

|

Timing of Issuance: In any case in which this section 2.3 shall require that an adjustment in the Exercise Price be made effective as of a record date for a specified event, the Corporation may elect to defer until the occurrence of such event the issuance to the holder of any Right exercised after such record date the number of Common Shares and other securities of the Corporation, if any, issuable upon such exercise over and above the number of Common Shares and other securities of the Corporation, if any, issuable upon such exercise on the basis of the Exercise Price in effect prior to such adjustment; provided, however, that the Corporation shall deliver to such holder an appropriate instrument evidencing such holder's right to receive such additional shares (fractional or otherwise) or other securities upon the occurrence of the event requiring such adjustment.

|

|

|

(i)

|

Adjustments Regarding Tax: Notwithstanding anything contained in this section 2.3 to the contrary, the Corporation shall be entitled to make such reductions in the Exercise Price, in addition to those adjustments expressly required by this section 2.3, as and to the extent that in their good faith judgment the Board of Directors shall determine to be advisable, in order that any:

|

|

|

(i)

|