MANAGEMENT'S DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2020This Management Discussion and Analysis ("MD&A") should be read in conjunction with the consolidated financial statements of Endeavour Silver Corp. ("Endeavour" or "the Company") for the year ended December 31, 2020 and the related notes contained therein, which were prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). The Company uses certain non-IFRS financial measures in this MD&A as described under "Non-IFRS Measures". Additional information relating to the Company, including the most recent Annual Information Form (the "Annual Information Form"), is available on SEDAR at www.sedar.com, and the Company's most recent annual report on Form 40-F has been filed with the U.S. Securities and Exchange Commission (the "SEC"). This MD&A contains "forward-looking statements" that are subject to risk factors set out in a cautionary note contained herein. All dollar ($) amounts are expressed in United States ("$.") dollars and tabular amounts are expressed in thousands of U.S. dollars unless Canadian dollars (CAN$) are indicated otherwise indicated. This MD&A is dated as of February 25, 2021 and all information contained is current as of February 25, 2021 unless otherwise stated.

Cautionary Note to U.S. Investors Regarding Mineral Reserves and Resources

This Management Discussion and Analysis has been prepared in accordance with the requirements of Canadian provincial securities laws, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral reserve and mineral resource estimates included have been prepared in accordance with Canadian National Instrument 43-101- Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. NI 43-101 is an instrument developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These definitions differ from the definitions in requirements under United States securities laws adopted by the United States Securities and Exchange Commission.

Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. An "inferred mineral resource" is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

Investors are cautioned not to assume that all or any part of mineral reserves and mineral resources determined in accordance with NI 43-101 and CIM standards will qualify as, or be identical to, mineral reserves and mineral resources estimated under the standards of the SEC applicable to U.S. companies. The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC's new rules and will continue to provide disclosure under NI 43-101 and the CIM standards. If the Company ceases to be a foreign private issuer or lose its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to the SEC's new rules, which differ from the requirements of NI 43-101 and the CIM standards.

Accordingly, information contained in this Management Discussion and Analysis that contain descriptions of the Corporation's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Forward-Looking Statements

This MD&A contains "forward-looking statements" within the meaning of the U.S. Securities Litigation Reform Act of 1995, as amended and "forward-looking information" within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information include, but are not limited to, statements regarding Endeavour's anticipated performance in 2021, including silver and gold production, financial results, timing and expenditures to develop new silver mines and mineralized zones, silver and gold grades and recoveries, cash costs per ounce, capital expenditures and sustaining capital and the impact of the COVID 19 pandemic on operations. Forward-looking statements are frequently characterized by words such as "plan", "expect", "forecast", "project", "intend", "believe", "anticipate", "outlook" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward- looking statements are based on the opinions and estimates of management at the dates the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements.

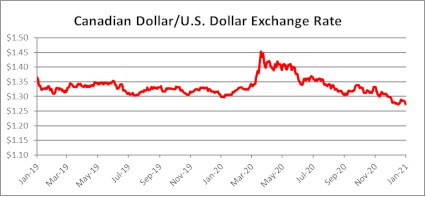

The Company does not intend to, and does not assume any obligation to, update such forward-looking statements or information, other than as required by applicable law. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors and are based on assumptions that may cause the actual results, level of activity, performance or achievements of the Company and its operations to be materially different from those expressed or implied by such statements. Such factors and assumptions include, among others: the ultimate impact of the COVID 19 pandemic on operations and results, fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Mexican peso, Chilean peso, Canadian dollar and U.S. dollar); changes in national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining (including, but not limited to environmental hazards, industrial accidents, unusual or unexpected geological conditions, pressures, cave-ins and flooding); inadequate insurance, or inability to obtain insurance; availability of and costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, diminishing quantities or grades of mineral reserves as properties are mined; the ability to successfully integrate acquisitions; risks in obtaining necessary licenses and permits, and challenges to the Company's title to properties; as well as those factors described under "Risk Factors" in the Company's Annual Information Form. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Qualified Person

The scientific and technical information contained in this MD&A relating to the Company's mines and mineral projects has been reviewed and approved by Dale Mah, B.Sc., P.Geo., Vice President Corporate Development of Endeavour, a Qualified Person within the meaning of NI 43-101.

OPERATING HIGHLIGHTS

|

Three Months Ended December 31 |

2020 Highlights |

Year Ended December 31 | ||||

|

2020 |

2019 |

% Change |

2020 |

2019 | % Change | |

| Production | ||||||

|

1,117,289 |

939,511 |

19% |

Silver ounces produced |

3,513,767 |

4,018,735 |

(13%) |

|

12,586 |

9,578 |

31% |

Gold ounces produced |

37,139 |

38,907 |

(5%) |

|

1,108,848 |

923,540 |

20% |

Payable silver ounces produced |

3,482,094 |

3,951,923 |

(12%) |

|

12,314 |

9,397 |

31% |

Payable gold ounces produced |

36,392 |

38,003 |

(4%) |

|

2,124,169 |

1,705,751 |

25% |

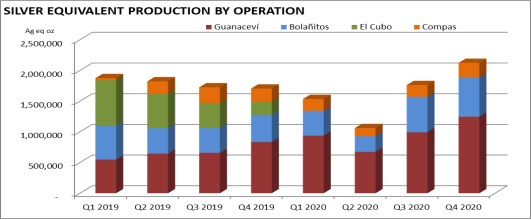

Silver equivalent ounces produced(1) |

6,484,887 |

7,131,295 |

(9%) |

|

6.83 |

13.63 |

(50%) |

Cash costs per silver ounce(2)(3) |

5.55 |

12.85 |

(57%) |

|

14.58 |

20.43 |

(29%) |

Total production costs per ounce(2)(4) |

14.01 |

20.73 |

(32%) |

|

18.52 |

23.20 |

(20%) |

All-in sustaining costs per ounce(2)(5) |

17.59 |

21.19 |

(17%) |

|

237,389 |

236,531 |

0% |

Processed tonnes |

757,160 |

954,886 |

(21%) |

|

105.07 |

110.64 |

(5%) |

Direct operating costs per tonne(2)(6) |

101.17 |

107.96 |

(6%) |

|

129.66 |

113.47 |

14% |

Direct costs per tonne(2)(6) |

114.57 |

110.09 |

4% |

|

14.83 |

15.19 |

(2%) |

Silver co-product cash costs(7) |

12.97 |

14.18 |

(9%) |

|

1,129 |

1,312 |

(14%) |

Gold co-product cash costs(7) |

1,109 |

1,238 |

(10%) |

|

Financial |

|

|

|

|||

|

60.7 |

33.5 |

81% |

Revenue(11) ($ millions) |

138.4 |

117.4 |

18% |

|

1,419,037 |

1,050,157 |

35% |

Silver ounces sold |

3,460,638 |

4,054,652 |

(15%) |

|

13,850 |

10,803 |

28% |

Gold ounces sold |

35,519 |

39,151 |

(9%) |

|

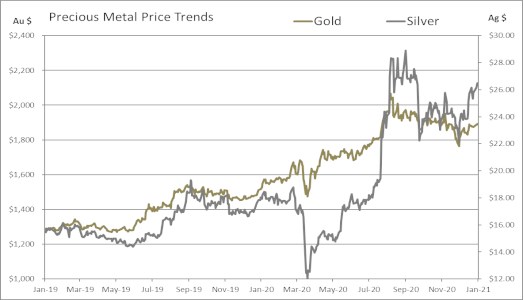

24.76 |

17.45 |

42% |

Realized silver price per ounce |

21.60 |

16.29 |

33% |

|

1,885 |

1,507 |

25% |

Realized gold price per ounce |

1,846 |

1,422 |

30% |

|

19.9 |

(17.9) |

211% |

Net earnings (loss) ($ millions) |

1.2 |

(48.1) |

102% |

|

20.8 |

(3.8) |

649% |

Mine operating earnings (loss) ($ millions) |

27.3 |

(17.4) |

257% |

|

30.2 |

4.9 |

519% |

Mine operating cash flow ($ millions)(8) |

56.2 |

14.9 |

277% |

|

21.6 |

(7.9) |

375% |

Operating cash flow before working capital changes(9) |

28.8 |

(8.9) |

424% |

|

24.3 |

(4.8) |

603% |

Earnings before ITDA(10 ) ($ millions) |

29.4 |

(11.1) |

364% |

|

70.4 |

38.4 |

83% |

Working capital ($ millions) |

70.4 |

38.4 |

83% |

|

Shareholders |

|

|

|

|||

|

0.13 |

(0.13) |

199% |

Earnings (loss) per share – basic |

0.01 |

(0.36) |

103% |

|

0.14 |

(0.06) |

250% |

Operating cash flow before working capital changes per share(9) |

0.19 |

(0.07) |

600% |

|

157,536,658 |

140,054,885 |

12% |

Weighted average shares outstanding |

150,901,598 |

135,367,129 |

11% |

(1) Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

(2) The Company reports non-IFRS measures which include cash costs net of by-product revenue on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce, direct production costs per tonne, silver co-product cash costs and gold co-product cash costs in order to manage and evaluate operating performance at each of the Company's mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliations to IFRS beginning on page 20.

(3) Cash costs net of by-product revenue per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on pages 21 & 23.

(4) Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites net of by product revenues. See Reconciliation to IFRS on pages 21 & 22.

(5) All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. See Reconciliation to IFRS on pages 23 & 24.

(6) Direct operating costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. Direct cost per tonne include all direct operating costs, royalties and special mining duty. See Reconciliation to IFRS on pages 21 & 22.

(7) Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on pages 24 and 25.

(8) Mine operating cash flow is calculated by adding back amortization, depletion, inventory write-downs and share-based compensation to mine operating earnings. Mine operating earnings and mine operating cash flow are before taxes. See Reconciliation to IFRS on page 20.

(9) See Reconciliation to IFRS on pages 20 and 21 for the reconciliation of operating cash flow before working capital changes and for the operating cash flow before working capital changes per share.

(10) See Reconciliation of Earnings before interest, taxes, depreciation and amortization on page 21.

(11) The Company changed its presentation of concentrate treatment and refining costs of sales to presenting as a reduction in revenue effective Q1 2020. The prior period revenue has been reclassified.

The above highlights are key measures used by management, however they should not be the sole measures used in determining the performance of the Company's operations.

HISTORY AND STRATEGY

The Company is engaged in silver mining in Mexico and related activities including property acquisition, exploration, development, mineral extraction, processing, refining and reclamation. The Company is also engaged in exploration activities in Chile. Since 2002, the Company's business strategy has been to focus on acquiring advanced-stage silver mining properties in Mexico. Mexico, despite its long and prolific history of metal production, appears to be relatively under-explored using modern exploration techniques and offers promising geological potential for precious metals exploration and production.

The Company's Guanaceví and Bolañitos mines acquired in 2004 and 2007, respectively, demonstrate its business model of acquiring fully built and permitted silver mines that were about to close for lack of ore. By bringing the money and expertise needed to find new silver ore-bodies, the Company successfully re-opened and expanded these mines to develop their full potential. The benefit of acquiring fully built and permitted mining and milling infrastructure is that, if new exploration efforts are successful, the mine development cycle from discovery to production only takes a matter of months instead of the several years normally required in the traditional mining business model.

In addition to operating the Guanaceví and Bolañitos mines, the Company commissioned the El Compas mine in March 2019. The Company is advancing the Terronera development project and several exploration projects in order to achieve its goal to become a premier senior producer in the silver mining sector. In 2012, the Company acquired the El Cubo silver-gold mine located in Guanajuato, Mexico, which operated until November 2019.

The Company has historically funded its acquisition, exploration and development activities through equity financings, debt facilities and convertible debentures. In recent years, the Company has financed most of its acquisition, exploration, development and operating activities from production cash flows, treasury and equity financings. The Company may choose to undertake equity, debt, convertible debt or other financings, on an as-needed basis, in order to facilitate its growth.

On March 31, 2020, the Mexican government declared a national health emergency with extraordinary measures due to the COVID-19 pandemic. Numerous health precautions were decreed, including the suspension of non-essential businesses, with only essential services to remain open. At March 31, 2020, mining did not qualify as an essential service so for the protection of the Company's staff, employees, contractors and communities, the Company suspended its three mining operations in Mexico as of April 1, 2020 as mandated by the Mexican government. The Company retained essential personnel at each mine site during the suspension period to maintain safety protocols, environmental monitoring, security measures and equipment maintenance. Essential personnel followed the Company's strict COVID-19 safety protocols and non-essential employees were sent home to self-isolate and stay healthy, while continuing to receive their base pay. The suspension of activities ceased in May 2020 as mining was declared an essential business.

The Company implemented measures to minimize the risks of the COVID-19 virus, both to employees and to the business. At each site, the Company is following government health protocols and is closely monitoring the pandemic with local health authorities. The Company has posted health advisories to educate employees about the COVID-19 symptoms, best practices to avoid contracting and spreading the virus, and procedures to follow if symptoms are experienced.

As the COVID-19 global pandemic is dynamic and, given that the ultimate duration and severity of the pandemic remains uncertain, the impact on the Company's 2021 production and costs has greater uncertainty. Globally, and in Mexico, positive COVID-19 continues to spread at a significant rate, while the duration of vaccine distributions remain uncertain. A local outbreak, an impediment to supply or market logistics or change in government health orders remains a significant risk.

The Company's long-term business could be significantly adversely affected by the on-going effects the COVID-19 pandemic. The Company cannot accurately predict the impact COVID-19 will have on third parties' ability to meet their obligations with the Company, including due to uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, the duration of vaccine distribution and the length of travel and quarantine restrictions imposed by governments of affected countries.

In particular, the continued spread of COVID-19 globally could materially and adversely impact the Company's business including without limitation, employee health, limitations on travel, the availability of industry experts and personnel, on-going restrictions to mining and processing operations and drill programs, and other factors that will depend on future developments beyond the Company's control. In addition, the COVID 19 pandemic could adversely affect the economies and financial markets of many countries (including those in which the Company operates), resulting in an economic downturn that could negatively impact the Company's operating results and ability to raise capital.

As of December 31, 2020, the Company held $61.1 million in cash and $70.4 million in working capital. Management believes there is sufficient working capital to meet the Company's current obligations, however the ultimate duration and severity of the COVID pandemic remains uncertain and could impact the financial liquidity of the Company.

REVIEW OF OPERATING RESULTS

The Company operates the Guanaceví, Bolañitos and El Compas mine, the last of which attained commercial production in March 2019. The Company suspended mining operations at the El Cubo mine on November 30, 2019 due to exhaustion of reserves.

Consolidated Production Results for the Three Months and Years Ended December 31, 2020 and 2019

|

Three Months Ended December 31 |

CONSOLIDATED |

Year Ended December 31 |

||||

|

2020 |

2019 |

% Change |

|

2020 |

2019 |

% Change |

|

237,389 |

236,531 |

0% |

Ore tonnes processed |

757,160 |

954,886 |

(21%) |

|

169 |

140 |

21% |

Average silver grade (gpt) |

167 |

149 |

12% |

|

86.8 |

88.3 |

(2%) |

Silver recovery (%) |

86.5 |

88.0 |

(2%) |

|

1,117,289 |

939,511 |

19% |

Total silver ounces produced |

3,513,767 |

4,018,735 |

(13%) |

|

1,108,848 |

923,540 |

20% |

Payable silver ounces produced |

3,482,094 |

3,951,923 |

(12%) |

|

1.90 |

1.53 |

24% |

Average gold grade (gpt) |

1.78 |

1.50 |

18% |

|

87.0 |

82.2 |

6% |

Gold recovery (%) |

85.9 |

84.7 |

1% |

|

12,586 |

9,578 |

31% |

Total gold ounces produced |

37,139 |

38,907 |

(5%) |

|

12,314 |

9,397 |

31% |

Payable gold ounces produced |

36,392 |

38,003 |

(4%) |

|

2,124,169 |

1,705,751 |

25% |

Silver equivalent ounces produced(1) |

6,484,887 |

7,131,295 |

(9%) |

|

6.83 |

13.63 |

(50%) |

Cash costs per silver ounce(2)(3) |

5.55 |

12.85 |

(57%) |

|

14.58 |

20.43 |

(29%) |

Total production costs per ounce(2)(4) |

14.01 |

20.73 |

(32%) |

|

18.52 |

23.20 |

(20%) |

All in sustaining cost per ounce (2)(5) |

17.59 |

21.19 |

(17%) |

|

105.07 |

110.64 |

(5%) |

Direct operating costs per tonne(2)(6) |

101.17 |

107.96 |

(6%) |

|

129.66 |

113.47 |

14% |

Direct costs per tonne(2)(6) |

114.57 |

110.09 |

4% |

|

14.83 |

15.19 |

(2%) |

Silver co-product cash costs(7) |

12.97 |

14.18 |

(9%) |

|

1,129 |

1,312 |

(14%) |

Gold co-product cash costs(7) |

1,109 |

1,238 |

(10%) |

(1) Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

(2) The Company reports non-IFRS measures which include cash costs net of by-product revenue on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce, direct production costs per tonne, silver co-product cash costs and gold co-product cash costs in order to manage and evaluate operating performance at each of the Company's mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliations to IFRS on page 20.

(3) Cash costs net of by-product revenue per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on pages 21 & 23.

(4) Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites net of by product revenues. See Reconciliation to IFRS on pages 21 & 23.

(5) All-in sustaining costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. See Reconciliation to IFRS on pages 23 & 24.

(6) Direct operating costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. Direct cost per tonne include all direct operating costs, royalties and special mining duty. See Reconciliation to IFRS on pages 21 & 22.

(7) Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on pages 24 & 25.

(1) Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

Consolidated Production

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Consolidated silver production during Q4, 2020 was 1,117,289 ounces (oz), an increase of 19% compared to 939,511 oz in Q4, 2019, and gold production was 12,586 oz, an increase of 31% compared to 9,578 oz in Q4, 2019. Plant throughput was 237,389 tonnes at average grades of 169 grams per tonne (gpt) silver and 1.90 gpt gold, with the throughput tonnes similar to 236,531 tonnes grading 140 gpt silver and 1.53 gpt gold in Q4, 2019. Consolidated silver production in Q4, 2020 was significantly higher than Q4, 2019 due to the higher ore grades primarily from the Guanaceví mine, partially offset by lower in silver grade ore at Bolañitos. Mining the new, higher grade orebodies at Guanaceví resulted in higher mine output and higher ore grades.

Excluding El Cubo, which ceased operations in Q4, 2019, Q4, 2020 production increased significantly due to the improved plant throughput and ore grades at Guanaceví and improved throughput at Bolañitos.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Consolidated silver production during 2020 was 3,513,767 oz, a decrease of 13% compared to 4,018,735 oz in 2019, and gold production was 37,139 oz, a decrease of 5% compared to 38,907 oz. Plant throughput was 757,160 tonnes at average grades of 167 gpt silver and 1.78 gpt gold, a 21% reduction compared to 954,886 tonnes grading 149 gpt silver and 1.50 gpt gold in 2019. Consolidated silver and gold production were lower than 2019 due to the suspension of mining activities in April and part of May due to the COVID-19 pandemic and the suspension of operations at the El Cubo mine, related to lack of ore, in November 2019.

Excluding El Cubo, 2020 production was higher despite the suspension of activities. Improved performance at Guanaceví and production from El Compas, which declared commercial production in late March 2019, were partially offset by the lower silver production from Bolañitos.

The Company's 2020 full year production met original guidance notwithstanding the government mandated two-month suspension of operations due to the pandemic. The Company withdrew its 2020 production guidance in early April due to the COVID-19 pandemic and the temporary shutdown mandated by the Mexican government and chose not to issue revised guidance when production was resumed at the end of May due to continued uncertainty caused by the ongoing pandemic. Despite the temporary shutdown in Q2, 2020, annual silver production exceeded the high range of original guidance by 1%, gold production missed the low range by 2% and silver equivalent production achieved the mid-point of the original 2020 production guidance.

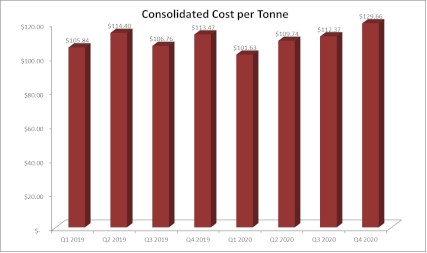

Consolidated Operating Costs

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Direct production costs per tonne in Q4, 2020 increased 14%, to $129.66 compared with Q4, 2019 despite improved productivity at Guanaceví and Bolañitos. Costs on a per tonne basis increased due to higher royalty and purchased toll ore at the Guanaceví operation offset by lower costs incurred at the Bolanitos and El Compas operations. Direct operating costs per tonne, which excludes royalties and special mining duties was $105.07 per tonne compared to $110.64 in Q4, 2019.

Consolidated cash costs per oz, net of by-product credits (a non-IFRS measure and a standard of the Silver Institute) decreased 50% to $6.83. The cash cost decrease was driven by higher ore grades, a higher proportion of gold production, and rising gold price, which increased 25% compared to the same period ended in 2019. Royalties and special mining duty amounted to $5.27 per consolidated ounce, compared to $0.72 per consolidated ounce in Q4, 2019.

On a co-product cash costs basis silver cost per ounce was relatively flat compared to the Q4, 2019. Silver co-product cash costs fell 2% to $14.83 per ounce, while gold co-product costs fell 14% to $1,129 per ounce. The 2020 productivity improvements and higher ore grades were offset by higher royalty and special mining duty costs primarily at the Guanaceví mine. Gold co-product cash costs decreased to a greater extent as gold ore grades increased 24% and gold recoveries improved 6%.

All-in sustaining costs decreased 20% to $18.52 per oz in Q4, 2020 as a result of lower operating costs offset by higher corporate general and administrative costs and increased capital expenditures to accelerate mine development to improve daily mine output. General and administrative costs increased due to mark to market effects of deferred share units.

A Company-wide review of operations in 2019 identified several deficiencies in the operating performance. As a result, management initiated multiple remedial measures including changes of mine-site management and mining contractors, changes to shift and contractor supervision, renting used mining equipment, leasing new mining equipment and reducing the work force.

The goal of these remedial actions was to improve safety, improve productivity, reduce operating costs and generate free cash flow. Management notes that the remedial actions had a positive impact on mine operating performance with the benefit of these initiatives realized in 2020. The results of these improvements were moderated by increased health protocols and new government restrictions related to the COVID 19 global pandemic. Additionally, the increased precious metal prices increased royalty costs in Q4, 2020, muting the positive impact these initiatives have had on costs. The consolidated royalty expense increased $3.5 million and special mining duty increased $1.7 million compared to Q4, 2019.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

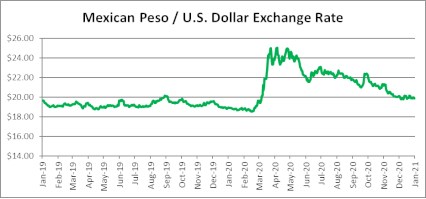

Direct production costs per tonne in 2020 increased 4%, to $114.57 compared with 2019 due to higher royalties, special mining duties and toll ore purchases offset by improved productivity at the Guanaceví and Bolañitos operation, the depreciation of the Mexican Peso and the exclusion of the El Cubo operation, which suspended activities in Q4, 2019. Direct operating costs per tonne, which excludes royalties and special mining duties was $101.17 per tonne compared to $108.49 in 2019.

Consolidated cash costs per oz, net of by-product credits decreased 57% to $5.55 primarily due to higher ore grades and higher a realized gold price that increased the by-product credit compared to 2019. All-in sustaining cost decreased 17% to $17.59 per oz in 2020 as a result of lower operating costs offset by higher corporate general and administrative costs and increased capital expenditures to accelerate mine development. The cash portion of general and administrative costs increased $3.0 million primarily due to a $3.6 million expense related the mark to market of deferred share units.

On a co-product cash costs basis, both silver and gold cost per ounce improved compared to 2019. Silver co-product cash costs fell 9%, while gold co-product costs fell 10% to $12.97 per ounce and $1,109 per ounce respectively. The improvement was driven by items as described for direct production costs and the higher grade ore.

The Company retained essential personnel at its operations during the suspension period to maintain safety protocols, environmental monitoring, security measures and day-to-day maintenance. Non-essential employees were sent home to self-isolate and continued to receive their base pay. From April 1st until the May re-starts, $2.2 million of costs were incurred related to the suspension of operations and were allocated to care and maintenance expenses and excluded from mine operating costs or the corresponding metrics.

A Company-wide review of operations in 2019 identified several deficiencies in the operating performance. As a result, management initiated multiple remedial measures including changes of mine-site management and mining contractors, changes to shift and contractor supervision, renting used mining equipment, leasing new mining equipment and reducing the work force.

The goal of these remedial actions was to improve safety, improve productivity, reduce operating costs and generate free cash flow. Management notes that the remedial actions had a positive impact on mine operating performance with the benefit of these initiatives realized in 2020. The results of these improvements were moderated by the additional costs and inefficiencies from suspension and the re-start of mining activities in Q2, 2020 as well as increased health protocols and new government restrictions related to the COVID 19 global pandemic. Additionally, the increased precious metal prices increased royalty costs in 2020, muting the positive impact these initiatives have had on cost metrics. At Guanaceví, the royalty costs increased $6.0 million and special mining duty increased $1.6 million compared to 2019.

GUANACEVÍ OPERATIONS

The Guanaceví operation is currently producing from three underground silver-gold mines along a five kilometre length of the prolific Santa Cruz vein. Guanaceví provides steady employment to over 500 people and engages over 400 contractors. Guanaceví mine production operated below plant capacity due to the operational issues in 2019. The development of two new orebodies, Milache and SCS and the acquisition of the Ocampo concession rights have provided sufficient ore and flexibility to increase mine output and to reach designed plant capacity. The Company successfully drilled the projected extensions of the previously mined Porvenir Cuatro and Porvenir ore bodies onto the Ocampo concessions. The Company commenced mining from the Porvenir Cuatro extension (P4E) and the Porvenir extension (PNE) late in 2019 and has steadily increased mine output throughout 2020.

During 2019, the Company acquired a 10 year right to explore and exploit the El Porvenir and El Curso concessions from Ocampo Mining SA de CV ("Ocampo"), a subsidiary of Grupo Frisco. The Company agreed to meet certain minimum production targets from the properties, subject to various terms and conditions and pay Ocampo a $12 fixed per tonne production payment plus a floating net smelter return royalty based on the spot silver price. The Company pays a 4% royalty on sales below $15.00 per ounce, 9% above $15.00 per ounce 13% above $20.00 per silver ounce, and a maximum 16% above $25 per silver ounce, based on then current realized prices.

Production Results for the Three Months and Years Ended December 31, 2020 and 2019

|

Three Months Ended December 31 |

GUANACEVÍ |

Year Ended December 31 |

||||

|

2020 |

2019 |

% Change |

|

2020 |

2019 |

% Change |

|

106,425 |

92,323 |

15% |

Ore tonnes processed |

346,679 |

322,988 |

7% |

|

331 |

252 |

31% |

Average silver grade (g/ t) |

314 |

234 |

34% |

|

87.6 |

90.0 |

(3%) |

Silver recovery (%) |

87.7 |

90.6 |

(3%) |

|

991,697 |

673,559 |

47% |

Total silver ounces produced |

3,071,075 |

2,202,592 |

39% |

|

988,722 |

671,051 |

47% |

Payable silver ounces produced |

3,061,982 |

2,196,475 |

39% |

|

1.01 |

0.75 |

35% |

Average gold grade (g/ t) |

0.96 |

0.65 |

48% |

|

92.5 |

91.0 |

2% |

Gold recovery (%) |

91.7 |

90.2 |

2% |

|

3,198 |

2,025 |

58% |

Total gold ounces produced |

9,814 |

6,087 |

61% |

|

3,188 |

2,027 |

57% |

Payable gold ounces produced |

9,786 |

6,081 |

61% |

|

1,247,537 |

835,559 |

49% |

Silver equivalent ounces produced(1) |

3,856,195 |

2,689,552 |

43% |

|

13.21 |

13.54 |

(2%) |

Cash costs per silver ounce(2)(3) |

10.44 |

15.87 |

(34%) |

|

15.52 |

16.83 |

(8%) |

Total production costs per ounce(2)(4) |

13.36 |

22.15 |

(40%) |

|

19.67 |

19.48 |

1% |

All in sustaining cost per ounce (2)(5) |

17.14 |

22.86 |

(25%) |

|

129.91 |

123.70 |

5% |

Direct operating costs per tonne(2)(6) |

117.38 |

130.78 |

(10%) |

|

179.34 |

131.56 |

36% |

Direct costs per tonne(2)(6) |

143.46 |

135.14 |

6% |

|

15.45 |

14.32 |

8% |

Silver co-product cash costs(7) |

12.72 |

15.97 |

(20%) |

|

1,176 |

1,236 |

(5%) |

Gold co-product cash costs(7) |

1,087 |

1,394 |

(22%) |

(1) Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

(2) The Company reports non-IFRS measures which include cash costs net of by-product revenue on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company's mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20.

(3) Cash costs net of by-product revenue per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on pages 21 & 22.

(4) Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites net of by product revenues. See Reconciliation to IFRS on pages 21 & 22.

(5) All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. See Reconciliation to IFRS on pages 23 & 25.

(6) Direct operating costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. Direct cost per tonne include all direct operating costs, royalties and special mining duty. See Reconciliation to IFRS on pages 21 & 22.

(7) Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on pages 21 & 22.

Guanaceví Production Results

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Silver production at the Guanaceví mine during Q4, 2020 was 991,697 oz, an increase of 47% compared to 673,559 oz in Q4, 2019, and gold production was 3,198 oz, an increase of 58% compared to 2,025 oz in Q4, 2019. Plant throughput was 106,425 tonnes at average grades of 331 gpt silver and 1.01 gpt gold, compared to 92,323 tonnes grading 252 gpt silver and 0.75 gpt gold in Q4, 2019, a 15% increase in plant throughput. Mining the new, higher grade El Curso, Milache and SCS orebodies resulted in higher mine output, higher ore grades and ultimately, significantly higher silver and gold production compared to Q4, 2019.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Silver production at the Guanaceví mine for year ended December 31, 2020 was 3,071,075 oz, an increase of 39% compared to 2,202,592 oz and gold production was 9,814 oz, an increase of 61% compared to 6,087 oz in 2019, despite the operations being temporarily suspended for April and part of May. Plant throughput was 346,679 tonnes at average grades of 314 gpt silver and 0.96 gpt gold, compared to 322,988 tonnes grading 234 gpt silver and 0.65 gpt gold for 2019. Metal production increased compared to 2019 primarily due to higher ore grades and 7% increase in throughput. Mine output and ore grades increased as a result of operational changes and increased access to the higher grade ores in the Milache, SCS and Porvenir Cuatro Extension (P4E) orebodies. These areas replaced production from the lower grade Porvenir Norte and Santa Cruz orebodies, which are now closed.

Management guided 2020 production at the Guanaceví mine to range from 2.4 to 2.7 million oz silver and 6,000 to 7,000 oz gold prior to the withdrawal of guidance on April 2, 2020. The Company withdrew its 2020 production guidance in early April due to the COVID-19 pandemic and the temporary shutdown mandated by the Mexican government and chose not to issue revised guidance when production was resumed at the end of May due to continued uncertainty caused by the ongoing pandemic. The Guanacevi mine significantly exceeded the withdrawn guidance notwithstanding the government mandated two-month suspension of operations due to the pandemic. Higher grade ores compared to plan in the SCS and P4E orebodies was the primary factor for exceeding original guidance.

Guanaceví Operating Costs

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Direct production costs per tonne for the three months ended December 31, 2020 increased 36% to $179.34 compared with the same period in 2019. Mining, processing and indirect costs improved on per tonne basis compared to prior year, however royalties paid for ore mined from the Porvenir Cuatro extension increased substantially, a higher proportion of third party ore was purchased and improved profitability resulted in special mining duties paid to the government. Increased production from the Porvenir Cuatro extension with rising precious metal prices resulted in $4.2 million of royalty costs, a $3.5 million increase compared to the same period in 2019. The higher price environment has resulted in increased ore available for purchase from toll miners within the district. During Q4, 2020 15% of tonnes processed were purchased from local miners at total cost of $2.0 million. At current prices, the ore purchased is more expensive than ore mined by the Company, however numerous peripheral benefits resulted in the decision to purchase a higher proportion of local ore, with the excess mined ore stockpiled in the quarter. The improved profitability of the operations resulted in $1.1 million Mexico special mining duty during Q4, 2020 compared to nil in Q4, 2019 which are included in cost per tonne and ounce metrics. Direct operating costs per tonne, which excludes royalties and special mining duties was $129.91 per tonne compared to $123.70 in Q4, 2019.

Cash costs per oz, net of by-product credits (a non-IFRS measure and a standard of the Silver Institute) were $13.21, 2% lower due to higher metal grades and a higher gold credit, offset by the higher costs per tonne described above. Similarly, all-in sustaining cost was relatively flat, increasing 1% to $19.67 per oz for the three months ended December 31, 2020. Lower operating costs on a per ounce basis were offset by higher general and administration costs and capital expenditures compared to the same period in 2019. On an absolute basis, capital expenditures increased as new ore bodies continued to be developed, and higher allocation of increased general and administrative costs further offset the operational gains. General and administrative costs increased due to the effect of the mark to market of deferred share units.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Direct production costs per tonne for the year ended December 31, 2020 increased 6% compared with 2019. Operating costs improved on per tonne basis compared to prior year, however royalties paid for ore mined from the Porvenir Cuatro extension increased substantially, a higher proportion of third party ore was purchased and improved profitability resulted in special mining duties paid to the government. Increased production from the Porvenir Cuatro extension with rising precious metal prices resulted in $7.4 million of royalty costs, a $6.0 million increase compared to the same period in 2019. The higher price environment has resulted in increased ore available for purchase from toll miners within the district. During 2020 12% of tonnes processed were purchased from local miners compared to 6% in 2019.

At current prices, the ore purchased is more expensive than ore mined by the Company, however numerous peripheral benefits resulted in the decision to purchase a higher proportion of local ore, with the excess mined ore stockpiled. The improved profitability of the operations resulted in $1.6 million Mexico special mining duty during 2020 compared to nil in 2019 which are included in cost per tonne and ounce metrics. Direct operating costs per tonne, which excludes royalties and special mining duties was $117.38 per tonne compared to $130.78 in Q4, 2019.

Cash costs per oz, net of by-product credits were $10.44, 34% lower 2019, despite the higher direct cost per tonne, as significantly higher metal grades and higher gold credit reduced this cost metric. Similarly, all-in sustaining costs fell 25% to $17.14 per oz for 2020. The decrease in cash costs per ounce was the primary driver of the lower all in sustaining costs, which were offset by a larger allocation of increased general and administration expenses compared to the same period in 2019. Consolidated general and administrative costs increased $3.0 million primarily due to a $3.6 million mark to market expense of deferred share units, amounting to a $2.2 million allocation increase to Guanacevi production costs.

The Company retained essential personnel at Guanaceví during the suspension period to maintain safety protocols, environmental monitoring, security measures and day-to-day maintenance. Non-essential employees were sent home to self-isolate and continued to receive their base pay. These costs incurred from April 1st to early May totaled $0.9 million and were allocated to care and maintenance expenses and excluded from mine operating costs and the corresponding metrics.

BOLAÑITOS OPERATIONS

The Bolañitos operation encompasses three underground silver-gold mines and a flotation plant. Bolañitos provides steady employment for over 360 people and engages over 260 contractors.

Production Results for the Three Months and Years Ended December 31, 2020 and 2019

|

Three Months Ended December 31 |

BOLAÑITOS |

Year Ended December 31 |

||||

|

2020 |

2019 |

% Change |

|

2020 |

2019 |

% Change |

|

107,332 |

82,147 |

31% |

Ore tonnes processed |

331,174 |

316,708 |

5% |

|

34 |

51 |

(33%) |

Average silver grade (g/ t) |

40 |

73 |

(45%) |

|

84.7 |

81.6 |

4% |

Silver recovery (%) |

83.0 |

84.1 |

(1%) |

|

99,417 |

109,963 |

(10%) |

Total silver ounces produced |

353,318 |

624,942 |

(43%) |

|

94,526 |

103,348 |

(9%) |

Payable silver ounces produced |

333,293 |

603,903 |

(45%) |

|

2.22 |

1.81 |

23% |

Average gold grade (g/ t) |

2.02 |

1.69 |

20% |

|

88.2 |

85.5 |

3% |

Gold recovery (%) |

88.2 |

85.9 |

3% |

|

6,754 |

4,088 |

65% |

Total gold ounces produced |

18,963 |

14,779 |

28% |

|

6,551 |

4,008 |

63% |

Payable gold ounces produced |

18,429 |

14,380 |

28% |

|

639,737 |

437,003 |

46% |

Silver equivalent ounces produced (1) |

1,870,358 |

1,807,262 |

3% |

|

(44.56) |

4.82 |

(1,025%) |

Cash costs per silver ounce(2)(3) |

(32.11) |

6.72 |

(578%) |

|

(15.50) |

14.44 |

(207%) |

Total production costs per ounce(2)(4) |

(4.76) |

12.78 |

(137%) |

|

16.98 |

38.38 |

(56%) |

All in sustaining cost per ounce (2)(5) |

23.53 |

25.11 |

(6%) |

|

71.88 |

79.89 |

(10%) |

Direct operating costs per tonne(2)(6) |

70.11 |

77.31 |

(9%) |

|

75.82 |

80.66 |

(6%) |

Direct costs per tonne(2)(6) |

71.78 |

77.88 |

(8%) |

|

13.26 |

14.31 |

(7%) |

Silver co-product cash costs(7) |

12.04 |

12.88 |

(7%) |

|

1,010 |

1,236 |

(18%) |

Gold co-product cash costs(7) |

1,029 |

1,124 |

(8%) |

(1) Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

(2) The Company reports non-IFRS measures which include cash costs net of by-product revenue on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company's mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20.

(3) Cash costs net of by-product revenue per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on pages 21 & 22.

(4) Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites net of by product revenues. See Reconciliation to IFRS on pages 21 & 22.

(5) All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. See Reconciliation to IFRS on pages 23 & 25.

(6) Direct operating costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. Direct cost per tonne include all direct operating costs, royalties and special mining duty. See Reconciliation to IFRS on pages 21 & 22.

(7) Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on pages 24 & 25.

Bolañitos Production Results

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Silver production at the Bolañitos mine was 99,417 oz in Q4, 2020, a decrease of 10% compared to 109,963 oz in Q4, 2019, and gold production was 6,754 oz in Q4, 2020, an increase of 65% compared to 4,088 oz in Q4, 2019. Plant throughput in Q4, 2020 was 107,332 tonnes at average grades of 34 gpt silver and 2.22 gpt gold, compared to 82,147 tonnes grading 51 gpt silver and 1.81 gpt gold in Q4, 2019. Since 2019, management has focused to increase mine development, replaced its mining fleet and increased workforce training to improve throughput to expected capacity of the operation. These initiatives resulted in the improved throughput compared to Q4, 2019. Normal variations of the ore body have resulted in ore with higher gold grade and lower silver grade compared to Q4, 2019.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Silver production at the Bolañitos mine was 353,318 oz for 2020, a decrease of 43% compared to 624,942 oz in 2019, and gold production was 18,963 oz for 2020, an increase of 28% compared to 14,779 oz in 2019. Plant throughput was 331,174 tonnes at average grades of 40 gpt silver and 2.02 gpt gold, compared to 316,708 tonnes grading 73 gpt silver and 1.69 gpt gold for the same period in 2019. Throughput was higher compared to 2019 despite the suspension of mining activities under the Mexican health decree. Since 2019, mine management has focused to increase mine development, replaced its mining fleet and increased workforce training to improve throughput to expected capacity of the operation. These initiatives resulted in a gradual improvement of daily throughput over fiscal 2020 and exceeded plan in Q4, 2020. Ore was mined in areas with lower silver grades compared to historical grades, while gold grades are similar to historical grades and plan. The development of the San Miguel vein, which was behind plan, was expected to provide higher silver grade material during 2020. Production from the San Miguel vein is expected to increase in 2021.

Management guided 2020 production at the Bolañitos mine to range from 0.5 to 0.6 million oz silver and 22,000 to 25,000 oz gold prior to the withdrawal of guidance on April 2, 2020. The Company withdrew its 2020 production guidance in early April due to the COVID-19 pandemic and the temporary shutdown mandated by the Mexican government and chose not to issue revised guidance when production was resumed at the end of May due to continued uncertainty caused by the ongoing pandemic. On a pro-rated basis, the Bolañitos mine throughput was slightly below plan, while gold production would have met the low range of the guided production. Silver production would have missed the low range of the guided production due to the lower silver grades mined than anticipated.

Bolañitos Operating Costs

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Direct production costs per tonne in the three month period ended December 31, 2020 decreased 6% to $75.82 per tonne due to operational improvements, including lower costs gained from new mobile equipment offset by increased special mining duties. The significantly lower silver grades resulted in lower silver production, while cash costs net of by-product credits (which is a non-IFRS measure and a standard of the Silver Institute), were negative $44.56 per oz of payable silver in Q4, 2020 compared to positive $4.82 per oz in Q4, 2019. The higher proportion of gold production, and rising gold price which increased 41% compared to the same period 2019, were the primary drivers in the lower cash cost metric.

On a co-product cash costs basis, both silver and gold cost per ounce improved compared to Q4, 2019. Silver co-product cash costs fell 7%, while gold co-product costs fell 18% to $13.26 per ounce and $1,010 per ounce respectively. The improvement was primarily driven by the lower direct costs per tonne, the variation in ore grades and improved recoveries.

All-in sustaining costs (also a non-IFRS measure) decreased in Q4, 2020 to $16.98 per oz due to the improved operating costs. The improved operating costs were partially offset by higher capital expenditures and higher general and administrative costs in Q4, 2020 compared to Q4, 2019. The Company continues to focus on mine development to improve stope access and provide flexibility for future periods. General and administrative costs increased due to mark to market deferred share units.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Direct production costs per tonne for 2020 decreased 8% to $71.78 per tonne due to operational improvements, including lower maintenance costs incurred from new mobile equipment offset by the additional costs required for the re-start of operating activities in May. Silver cash costs net of by-product credits (which is a non-IFRS measure and a standard of the Silver Institute), were negative $32.11 per oz of payable silver in 2020 compared to positive $6.72 per oz in 2019. The higher proportion of gold production, and rising gold price which increased 27% compared to 2019, were the primary drivers in the lower cash cost net of by-product credits metric.

On a co-product cash costs basis, silver cost per ounce improved compared to 2019. Silver co-product cash costs fell 7% to $12.04 as lower direct costs per tonne were offset by lower silver grade ore compared to prior period. Gold co-product costs decreased 8% to $1,029 per ounce primarily due to the lower direct costs per tonne and a 20% increase of ore gold grade.

All-in sustaining costs (also a non-IFRS measure) were $23.53 per oz, a 6% decrease compared to 2019. The lower operating costs were partially offset by increased capital expenditures and higher general and administration cost allocation in 2020 compared to 2019. The Company invested in new mine equipment to improve fleet operating costs and equipment availability and increase mine development in 2020 to improve stope access and provide operating flexibility. Consolidated general and administrative costs increased $3.0 million primarily due to a $3.6 million mark to market expense of deferred share units, amounting to a $1.0 million allocation increase to Bolanitos production costs.

The Company retained essential personnel at Bolañitos during the suspension period to maintain safety protocols, environmental monitoring, security measures and day-to-day maintenance. Non-essential employees were sent home to self-isolate and continued to receive their base pay. These costs incurred from April 1st to late May totaled $0.8 million and were allocated to care and maintenance expenses and not included in operating costs or the corresponding metrics.

EL COMPAS OPERATIONS

The El Compas operation is a small but high grade, permitted gold-silver mine with a small leased flotation plant in the historic silver mining district of Zacatecas, with good exploration potential to expand resources and scale up production. There is also potential for the Company to acquire other properties in the area to consolidate resources and exploration targets in the district. El Compas has a nominal plant capacity of 250 tonnes per day.

El Compas currently employs close to 200 people and engages over 50 contractors and achieved commercial production during Q1, 2019. The current resource is sufficient to support mining until mid-2021, and brownfields exploration has returned encouraging results on the Calicanto property. Management is reviewing alternative mine plans to ensure positive free cash flow in 2021.

Production Results for the Three Months and Years Ended December 31, 2020 and 2019

|

Three Months Ended December 31 |

El Compas |

Year Ended December 31 |

||||

|

2020 |

2019 |

% Change |

|

2020 |

2019 |

% Change |

|

23,632 |

22,855 |

3% |

Ore tonnes processed |

79,307 |

69,772 |

14% |

|

50 |

65 |

(23%) |

Average silver grade (g/ t) |

53 |

75 |

(29%) |

|

68.9 |

70.2 |

(2%) |

Silver recovery (%) |

66.1 |

62.0 |

7% |

|

26,175 |

33,518 |

(22%) |

Total silver ounces produced |

89,374 |

104,377 |

(14%) |

|

25,600 |

31,941 |

(20%) |

Payable silver ounces produced |

86,819 |

100,243 |

(13%) |

|

4.41 |

4.33 |

2% |

Average gold grade (g/ t) |

4.32 |

4.37 |

(1%) |

|

78.6 |

72.2 |

9% |

Gold recovery (%) |

75.9 |

77.3 |

(2%) |

|

2,634 |

2,298 |

15% |

Total gold ounces produced |

8,362 |

7,577 |

10% |

|

2,575 |

2,193 |

17% |

Payable gold ounces produced |

8,177 |

7,342 |

11% |

|

236,895 |

217,358 |

9% |

Silver equivalent ounces produced(1) |

758,334 |

710,537 |

7% |

|

(50.04) |

10.90 |

(559%) |

Cash costs per silver ounce(2)(3) |

(22.51) |

(7.74) |

(191%) |

|

89.45 |

52.82 |

69% |

Total production costs per ounce(2)(4) |

109.10 |

58.70 |

86% |

|

(20.19) |

47.68 |

(142%) |

All in sustaining cost per ounce (2)(5) |

10.98 |

27.49 |

(60%) |

|

143.96 |

154.58 |

(7%) |

Direct operating costs per tonne(2)(6) |

160.04 |

139.53 |

15% |

|

150.52 |

160.01 |

(6%) |

Direct costs per tonne(2)(6) |

166.97 |

143.70 |

16% |

|

15.69 |

15.76 |

(0%) |

Silver co-product cash costs(7) |

16.47 |

13.09 |

26% |

|

1,194 |

1,361 |

(12%) |

Gold co-product cash costs(7) |

1,408 |

1,143 |

23% |

(1) Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

(2) The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company's mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20.

(3) Cash costs net of by-product revenue per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on pages 21 & 22.

(4) Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites net of by product revenues. See Reconciliation to IFRS on pages 21 & 22.

(5) All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. See Reconciliation to IFRS on pages 23 & 24.

(6) Direct operating costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. Direct cost per tonne include all direct operating costs, royalties and special mining duty. See Reconciliation to IFRS on pages 21 & 22.

(7) Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on pages 24 & 25.

El Compas Production Results

Three months ended December 31, 2020 (compared to the three months ended December 31, 2019)

Silver production at the El Compas mine was 26,175 oz in Q4, 2020, a decrease of 22% compared to 33,518 oz in Q4, 2019 and gold production was 2,634 oz in Q4, 2020, an increase of 15% compared to 2,298 in Q4, 2019. Plant throughput in Q4, 2020 was 23,632 tonnes at average grades of 50 gpt silver and 4.41 gpt gold compared to 22,855 tonnes at average grades of 65 gpt silver and 4.33 gpt gold. El Compas silver grades were lower than Q4, 2019 due to variations in the ore body.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Silver production at the El Compas mine was 89,374 oz and gold production was 8,362 oz in 2020. Plant throughput in 2020 was 79,307 tonnes at average grades of 53 gpt silver and 4.32 gpt gold.

As commercial production was declared March 15, 2019, the 2019 comparative period does not include a full year of production. During the period from March 15, 2019 to December 31, 2019 silver production at the El Compas mine was 104,377 oz and gold production was 7,577 oz with plant throughput of 69,772 tonnes at average grades of 75 gpt silver and 4.37 gpt gold during this period in 2019. Similarly, due to the Mexican health decree 2020 does not include a full year of production. Throughput was lower than planned due to the suspension of mining activities under the Mexican health decree. El Compas production was close to plan prior to the suspension with higher throughput offset by lower grades. Management replaced the mining contractor with new mine employees in March 2020 and adjusted the mining methods to reduce dilution and costs going forward. Management finished replacing the mining contractor with new employees in June 2020, but dilution remains a continuing focus for improvement.

Management guided 2020 production at the El Compas mine to range from 0.1 to 0.2 million oz silver and 10,000 to 12,000 oz gold prior to the withdrawal of guidance on April 2, 2020. The Company withdrew its 2020 production guidance in early April due to the COVID-19 pandemic and the temporary shutdown mandated by the Mexican government and chose not to issue revised guidance when production was resumed at the end of May due to continued uncertainty caused by the ongoing pandemic. On a pro-rated basis, the El Compas mine throughput was slightly above plan, while metal production would have met the low range of the guided production.

El Compas Operating Costs

Three months ended December 31, 2019

Direct production costs were $150.52 per tonne in Q4, 2020, a 6% decrease from Q4, 2019. On re-start of the mine in May, the Company invested in employee training to improve dilution and grade control. Silver cash costs net of by-product credits (which is a non-IFRS measure and a standard of the Silver Institute), were negative $50.04 per oz of payable silver in Q4, 2020 compared to $10.90 per oz in Q4, 2019. The lower costs per tonne and rising gold prices which increased 41% were the primary drivers in the lower cash cost metric offset by lower silver grades compared to 2019.

On a co-product cash costs basis, both silver and gold cost per ounce improved compared to the Q4, 2019. Silver co-product cash costs decreased minimally, while gold co-product costs fell 12% to $15.69 per ounce and $1,194 per ounce respectively. The improved costs were driven by the lower operating costs on a per tonne basis, offset by the lower silver grade ore.

All-in sustaining costs (also a non-IFRS measure) decreased in Q4, 2020 to negative $20.19 per oz due compared to $47.68 per ounce over the same period ended in 2019. The lower all-in sustaining costs is a function of the lower operating costs and lower capital expenditures on mine development compared to 2019.

The Company retained essential personnel at El Compas during the suspension period to maintain safety protocols, environmental monitoring, security measures and day-to-day maintenance.

Non-essential employees were sent home to self-isolate and continued to receive their base pay. These costs incurred from April 1st to late May totalled $0.5 million and were allocated to care and maintenance expenses and excluded from mine operating costs or the corresponding metrics.

Year ended December 31, 2020 (compared to the year ended December 31, 2019)

Direct production costs were $166.97 per tonne in 2020, an increase from 2019 due to inefficiencies during the transition from replacing mine contractors with employees and expensed development expenditures in 2020. Silver cash costs net of by-product credits (which is a non-IFRS measure and a standard of the Silver Institute), were negative $22.51 per oz of payable silver in 2020 compared to negative $7.74 per oz in 2019. The higher operating costs and lower silver grades were offset by a gold credit from the higher realized gold price, which increased by 27% compared to 2019.

Similarly, on a co-product cash costs basis, silver and gold cash cost per ounce increased compared to 2019. Silver co-product cash costs increased 26% due to the higher direct costs per tonne and lower silver grade ore partially offset by improved silver recoveries. Gold co-product cash costs increased 23% primarily due to the higher direct costs per tonne.

All-in sustaining costs (also a non-IFRS measure) decreased in 2020 to $10.98 per oz primarily due to the reduced capital expenditures offset by increased brownfield exploration expenditures to extend mine life and higher general and administrative costs in 2020 compared to 2019. Consolidated general and administrative costs increased $3.0 million primarily due to a $3.6 million mark to market expense of deferred share units, amounting to a $0.4 million allocation increase to El Compas production costs.

EL CUBO OPERATIONS

The El Cubo operation includes two previously operating underground silver-gold mines and a flotation plant. which employed over 350 people and engaged over 200 contractors until the suspension of operations at the end of November 2019 as the mineral reserves had been exhausted. The mine, plant and tailings facilities are on care and maintenance.

Company management and contract personnel continue to maintain the security of the mine, plant and tailings facilities. For the year ended December 31, 2020 the Company incurred $2.4 million in legal, administrative and care and maintenance expenses with an additional $0.4 million in severance costs and $0.2 million in building and office depreciation.

The Company maintains a security team, administrative staff, maintenance group and environmental staff. In Q4, 2020 the Company incurred $0.4 million in costs. During the second half of the year, there was a significant increase of illegal mining activity within the area requiring additional security and legal costs.

On December 15, 2020, the Company signed a binding letter agreement to sell its El Cubo mine and related assets to VanGold Mining Corp. ("VanGold") for $15.0 million in cash and share payments plus additional contingency payments.

VanGold has also agreed to pay the Company up to an additional $3.0 million in contingent payments based on the following events:

Closing of the sale is subject to satisfaction of certain conditions including final due diligence by VanGold, financing and receipt of all requisite third party and regulatory approvals, including the acceptance of the TSXV on or before March 17, 2021, failing which either VanGold or the Company may terminate the agreement. If the tax lien on the assets is not removed on or before closing, VanGold shall be entitled to withhold from the purchase price an amount sufficient to remove the tax lien.

DEVELOPMENT ACTIVITIES

Terronera Project

The Terronera project, located 40 kilometres northeast of Puerto Vallarta in the state of Jalisco, Mexico, features a high-grade silver-gold mineral resource in the Terronera vein, which is now over 1,400 metres long, 400 metres deep, 3 to 16 metres thick, and remains open along strike to the southeast and down dip.

In 2020, the Company engaged an external consultant to update a previous Preliminary Feasibility Study based on updated information gathered in 2019 and 2020. In Q3, 2020 the Company completed an updated summary of the project's economics and published the NI 43-101 Technical Report ("2020 PFS").

The 2020 PFS included significant changes to the operations plan, capital and operating costs compared to the previous study and, as a result, project economics improved with higher certainty on a number of assumptions. The external consultant reviewed all aspects of the previous studies, while further cost-benefit initiatives will continue to be evaluated.

The 2020 PFS base case assumes a two-year trailing average silver price of $15.97 per oz and a gold price of $1,419 per oz. At base case prices, the improved economics estimates a net present value (NPV) of $137 million at a 5% discount rate, internal rate of return (IRR) of 30.0%, and payback period of 2.7 years. Initial capital expenditures are estimated to be $99 million with life of mine capital expenditures estimated to be $60 million. The 10 year life of mine is estimated to produce an average of 3 million silver oz and 32,800 gold ounces per year generating $315 million pre-tax, $217 million after-tax, free cash flow over the life of the project.

Endeavour plans to complete a Feasibility Study in 2021 at an estimated cost of $1.8 million. During the completion of the Feasibility Study, the Company will evaluate a number of opportunities to further enhance the value of the project, including exploration drilling to expand the known resources and to test multiple veins within the district. Additionally, the Company has defined an engineering, procurement and construction strategy and is strategizing commencement of various early work items. An engineering team is being assembled and a $7.3 million budget has been approved for sourcing equipment and machinery and early work items, including camp construction and known earthworks.

In Q4, 2020 the Company expanded the footprint of the project, to 20,128 hectares through the acquisition of two adjacent groups of mineral concessions, La Sanguijuela and Cerro Gordo, covering multiple mineralized vein structures. The mineralized vein structures on these properties are highly prospective and have never been previously drilled.

EXPLORATION RESULTS

In 2020, the Company initially planned to spend $5.4 million drilling 18,500 metres of core on brownfields projects, greenfields exploration and development engineering across its portfolio of mines and properties. At the three operating mines, 10,500 metres of core drilling were planned at a cost of $2.0 million to replace reserves and expand resources. During Q3, 2020 management approved an additional 9,500 drill metres to follow up on positive results at all three operations for an estimated cost of $1.7 million.

On the exploration and development projects, expenditures of $3.4 million were planned to fund 8,000 metres of core drilling, advance engineering studies at Terronera and Parral, and drill the Paloma gold project in Chile, where initial exploration results were positive. During the government suspension of activities, staff continued with mapping, sampling and interpretations across the Company project portfolio, with drill programs re-starting in September. Management approved an additional $1.0 million for 6,500 drill metres to test a prospective target adjacent to the Terronera project. The programs are expected to be completed in Q1, 2021.

At Guanaceví the Company drilled 7,240 metres in 22 holes to test the extension of the Porvenir Cuatro and Milache ore bodies. Drilling confirmed expectations and intersected significant mineralization with similar ore grades and vein widths as the 2019 intersections.

At Bolañitos the Company drilled 10,505 metres in 37 holes to target the Melladito vein and vein splays. The Company intersected significant mineralization with ore grades over mineable widths, located about 300 metres from current and historic mine workings. Management has planned further drilling and commenced the development of a crosscut to the newly discovered zones.