2nd Quarter Earnings July 18, 2025 Exhibit 99.3

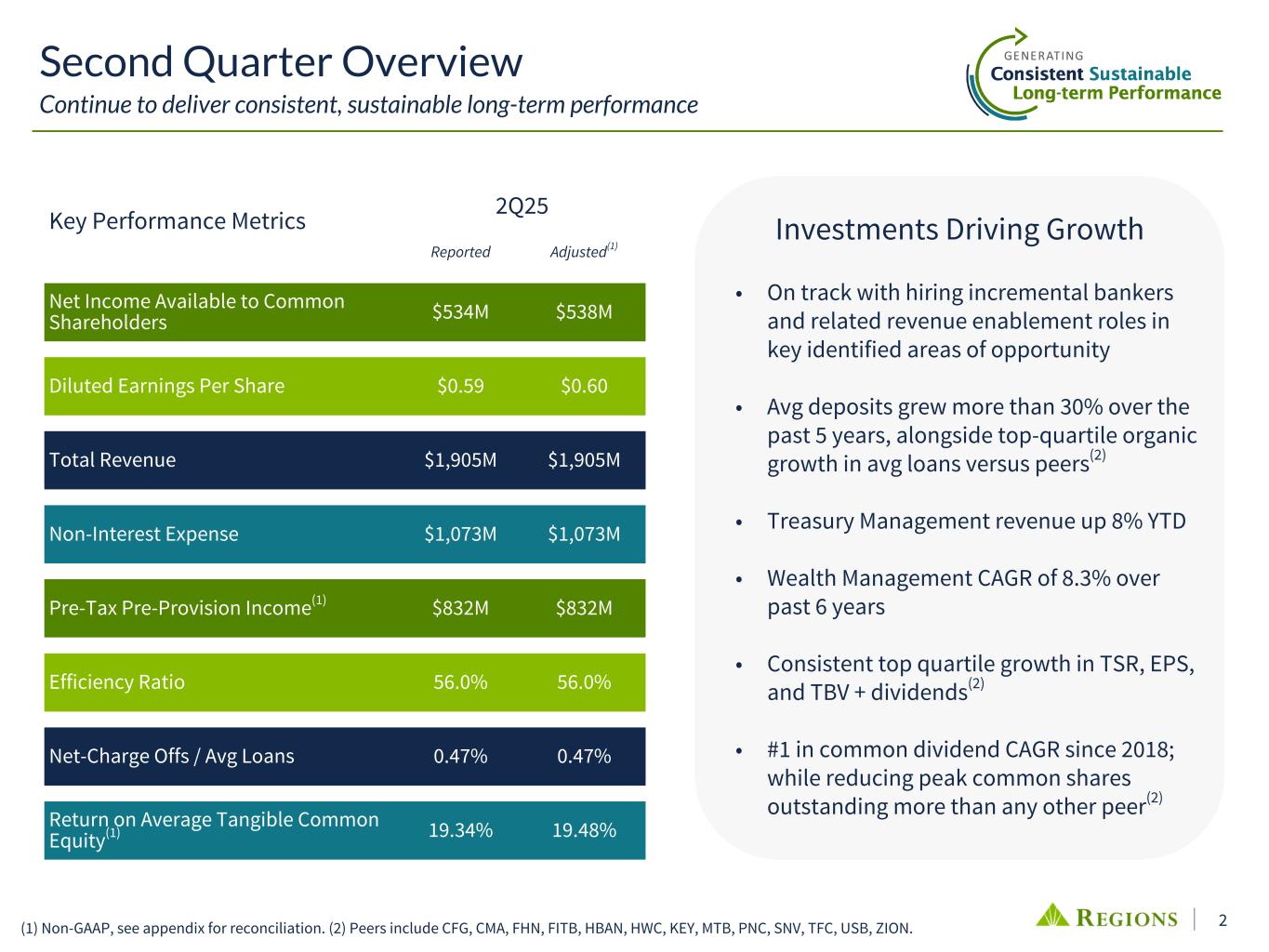

2 Second Quarter Overview Continue to deliver consistent, sustainable long-term performance (1) Non-GAAP, see appendix for reconciliation. (2) Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. Key Performance Metrics 2Q25 Reported Adjusted(1) Net Income Available to Common Shareholders $534M $538M Diluted Earnings Per Share $0.59 $0.60 Total Revenue $1,905M $1,905M Non-Interest Expense $1,073M $1,073M Pre-Tax Pre-Provision Income(1) $832M $832M Efficiency Ratio 56.0% 56.0% Net-Charge Offs / Avg Loans 0.47% 0.47% Return on Average Tangible Common Equity(1) 19.34% 19.48% Investments Driving Growth • On track with hiring incremental bankers and related revenue enablement roles in key identified areas of opportunity • Avg deposits grew more than 30% over the past 5 years, alongside top-quartile organic growth in avg loans versus peers(2) • Treasury Management revenue up 8% YTD • Wealth Management CAGR of 8.3% over past 6 years • Consistent top quartile growth in TSR, EPS, and TBV + dividends(2) • #1 in common dividend CAGR since 2018; while reducing peak common shares outstanding more than any other peer(2)

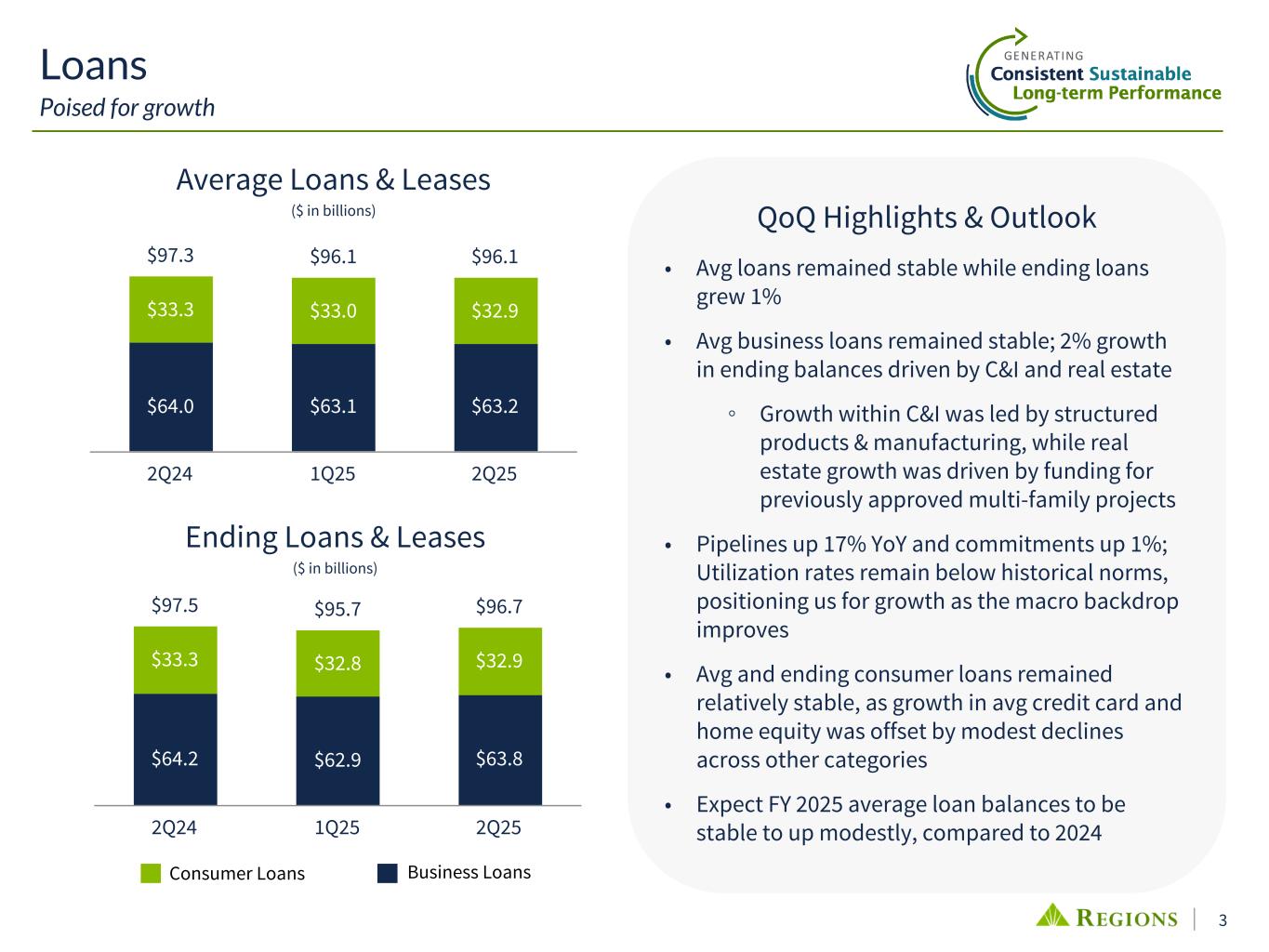

3 QoQ Highlights & Outlook • Avg loans remained stable while ending loans grew 1% • Avg business loans remained stable; 2% growth in ending balances driven by C&I and real estate ◦ Growth within C&I was led by structured products & manufacturing, while real estate growth was driven by funding for previously approved multi-family projects • Pipelines up 17% YoY and commitments up 1%; Utilization rates remain below historical norms, positioning us for growth as the macro backdrop improves • Avg and ending consumer loans remained relatively stable, as growth in avg credit card and home equity was offset by modest declines across other categories • Expect FY 2025 average loan balances to be stable to up modestly, compared to 2024 $97.5 $95.7 $96.7 $64.2 $62.9 $63.8 $33.3 $32.8 $32.9 2Q24 1Q25 2Q25 $97.3 $96.1 $96.1 $64.0 $63.1 $63.2 $33.3 $33.0 $32.9 2Q24 1Q25 2Q25 Average Loans & Leases ($ in billions) Business LoansConsumer Loans Ending Loans & Leases ($ in billions) Loans Poised for growth

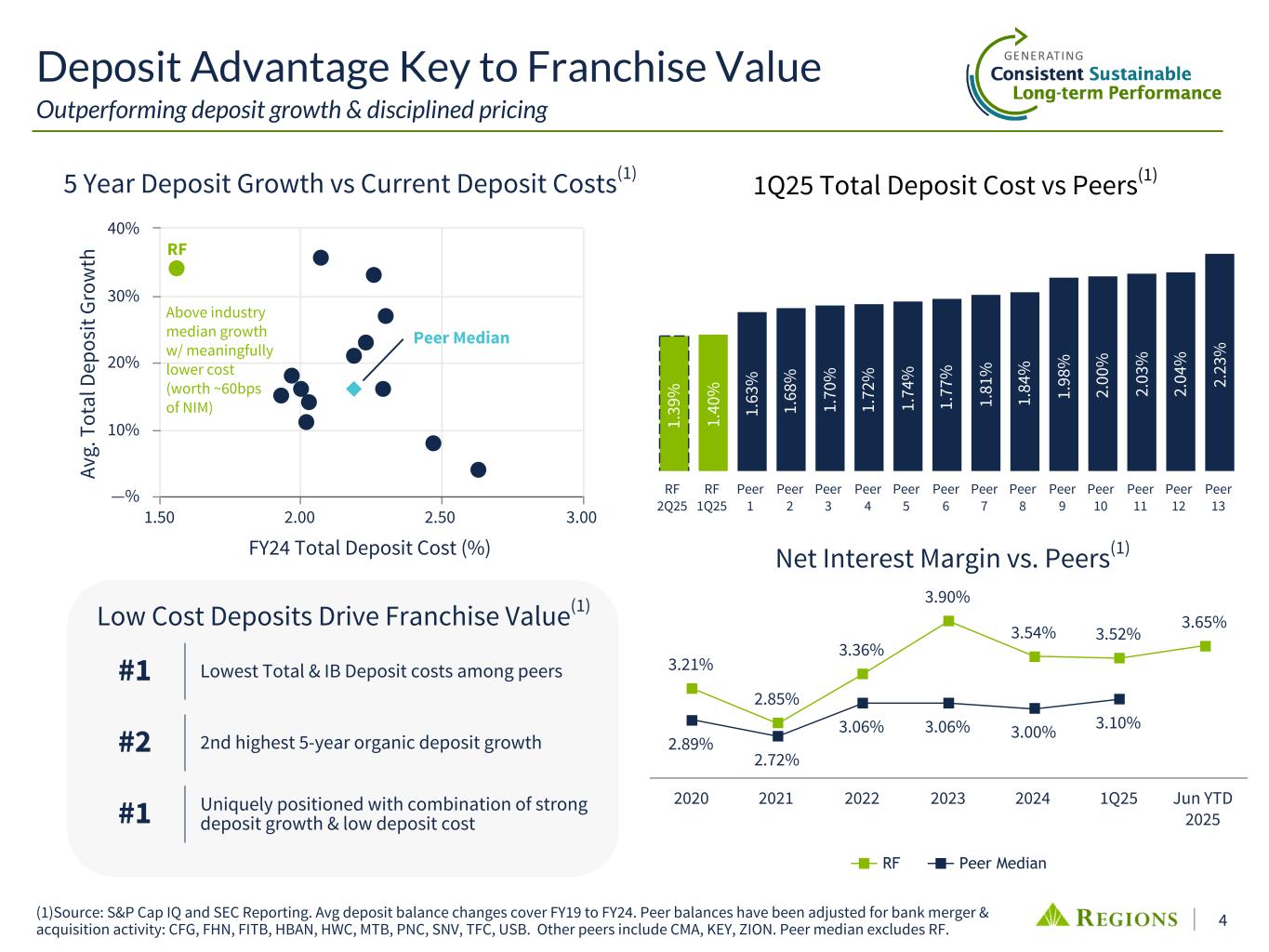

4 Deposit Advantage Key to Franchise Value Outperforming deposit growth & disciplined pricing FY24 Total Deposit Cost (%) Av g. T ot al D ep os it Gr ow th 1.50 2.00 2.50 3.00 —% 10% 20% 30% 40% RF Peer Median 5 Year Deposit Growth vs Current Deposit Costs(1) Above industry median growth w/ meaningfully lower cost (worth ~60bps of NIM) 1. 39 % 1. 40 % 1. 63 % 1. 68 % 1. 70 % 1. 72 % 1. 74 % 1. 77 % 1. 81 % 1. 84 % 1. 98 % 2. 00 % 2. 03 % 2. 04 % 2. 23 % RF 2Q25 RF 1Q25 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 1Q25 Total Deposit Cost vs Peers(1) (1)Source: S&P Cap IQ and SEC Reporting. Avg deposit balance changes cover FY19 to FY24. Peer balances have been adjusted for bank merger & acquisition activity: CFG, FHN, FITB, HBAN, HWC, MTB, PNC, SNV, TFC, USB. Other peers include CMA, KEY, ZION. Peer median excludes RF. 3.21% 2.85% 3.36% 3.90% 3.54% 3.52% 3.65% 2.89% 2.72% 3.06% 3.06% 3.00% 3.10% RF Peer Median 2020 2021 2022 2023 2024 1Q25 Jun YTD 2025 Net Interest Margin vs. Peers(1) Low Cost Deposits Drive Franchise Value(1) #1 Lowest Total & IB Deposit costs among peers #2 2nd highest 5-year organic deposit growth #1 Uniquely positioned with combination of strong deposit growth & low deposit cost

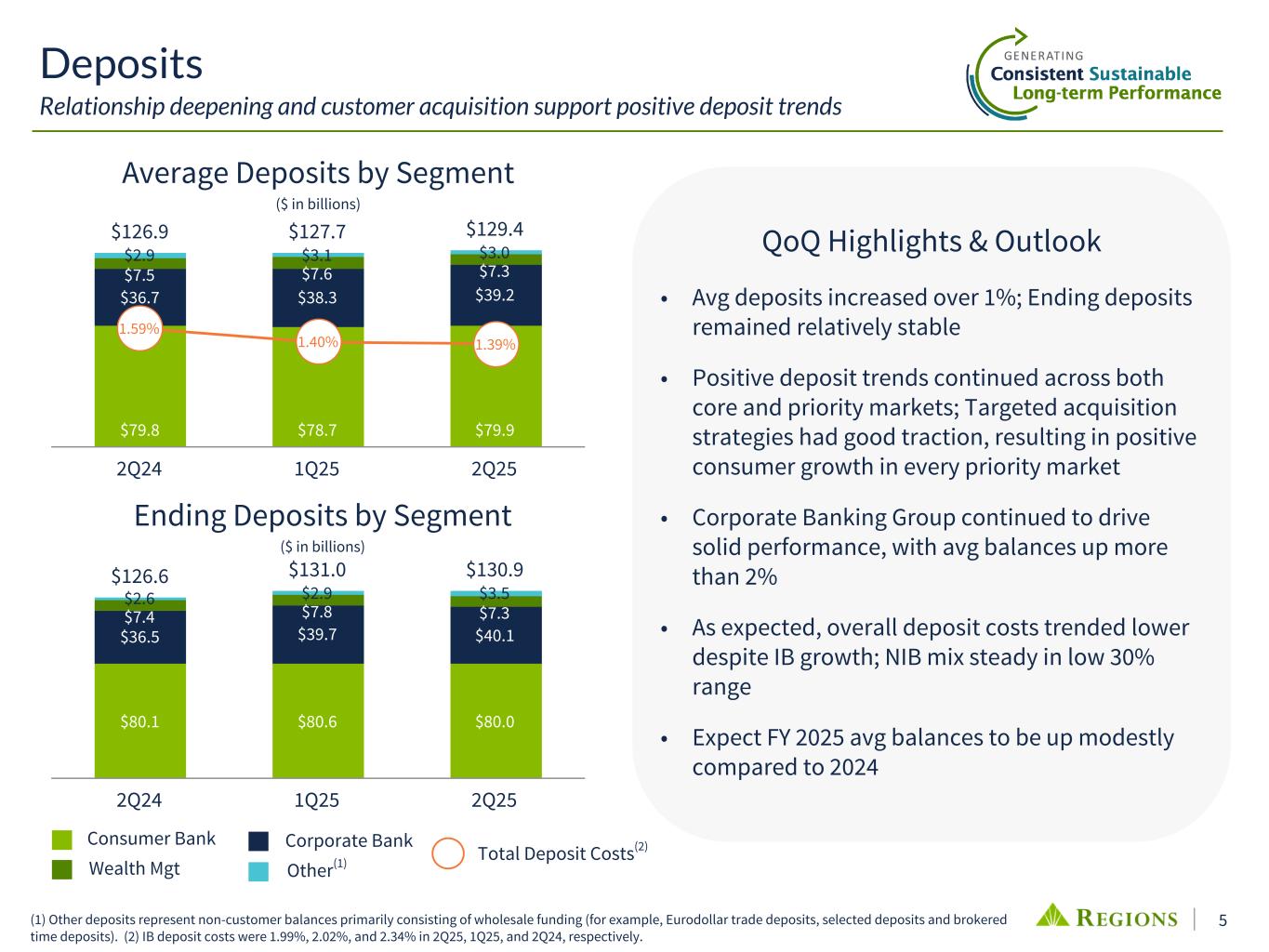

5 QoQ Highlights & Outlook • Avg deposits increased over 1%; Ending deposits remained relatively stable • Positive deposit trends continued across both core and priority markets; Targeted acquisition strategies had good traction, resulting in positive consumer growth in every priority market • Corporate Banking Group continued to drive solid performance, with avg balances up more than 2% • As expected, overall deposit costs trended lower despite IB growth; NIB mix steady in low 30% range • Expect FY 2025 avg balances to be up modestly compared to 2024 $126.6 $131.0 $130.9 $80.1 $80.6 $80.0 $36.5 $39.7 $40.1 $7.4 $7.8 $7.3 $2.6 $2.9 $3.5 2Q24 1Q25 2Q25 $126.9 $127.7 $129.4 $79.8 $78.7 $79.9 $36.7 $38.3 $39.2 $7.5 $7.6 $7.3 $2.9 $3.1 $3.0 1.59% 1.40% 1.39% 2Q24 1Q25 2Q25 (1) Other deposits represent non-customer balances primarily consisting of wholesale funding (for example, Eurodollar trade deposits, selected deposits and brokered time deposits). (2) IB deposit costs were 1.99%, 2.02%, and 2.34% in 2Q25, 1Q25, and 2Q24, respectively. Average Deposits by Segment ($ in billions) Deposits Relationship deepening and customer acquisition support positive deposit trends Wealth Mgt Other(1) Consumer Bank Corporate Bank Ending Deposits by Segment ($ in billions) Total Deposit Costs(2)

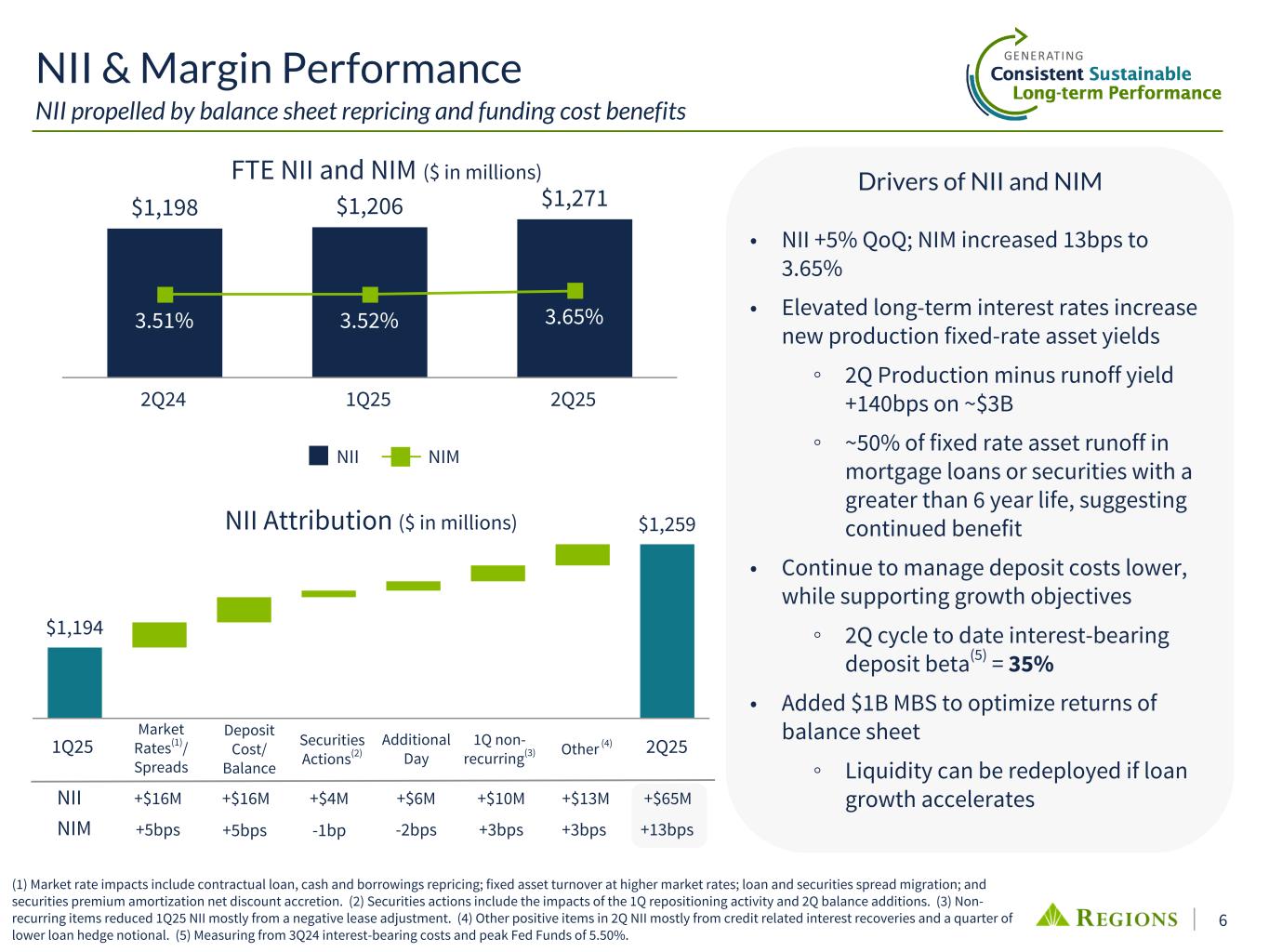

6 NII & Margin Performance NII propelled by balance sheet repricing and funding cost benefits (1) Market rate impacts include contractual loan, cash and borrowings repricing; fixed asset turnover at higher market rates; loan and securities spread migration; and securities premium amortization net discount accretion. (2) Securities actions include the impacts of the 1Q repositioning activity and 2Q balance additions. (3) Non- recurring items reduced 1Q25 NII mostly from a negative lease adjustment. (4) Other positive items in 2Q NII mostly from credit related interest recoveries and a quarter of lower loan hedge notional. (5) Measuring from 3Q24 interest-bearing costs and peak Fed Funds of 5.50%. $1,194 $1,259 Securities Actions(2) Additional Day Market Rates(1)/ Spreads 2Q25 1Q25 -1bp +3bps+5bps +$4M +$10M+$16MNII NIM +$6M -2bps $1,198 $1,206 $1,271 3.51% 3.52% 3.65% 2Q24 1Q25 2Q25 NII NIM +$65M Deposit Cost/ Balance FTE NII and NIM ($ in millions) NII Attribution ($ in millions) +5bps +$16M +$13M +3bps +13bps Other (4)1Q non- recurring(3) Drivers of NII and NIM • NII +5% QoQ; NIM increased 13bps to 3.65% • Elevated long-term interest rates increase new production fixed-rate asset yields ◦ 2Q Production minus runoff yield +140bps on ~$3B ◦ ~50% of fixed rate asset runoff in mortgage loans or securities with a greater than 6 year life, suggesting continued benefit • Continue to manage deposit costs lower, while supporting growth objectives ◦ 2Q cycle to date interest-bearing deposit beta(5) = 35% • Added $1B MBS to optimize returns of balance sheet ◦ Liquidity can be redeployed if loan growth accelerates

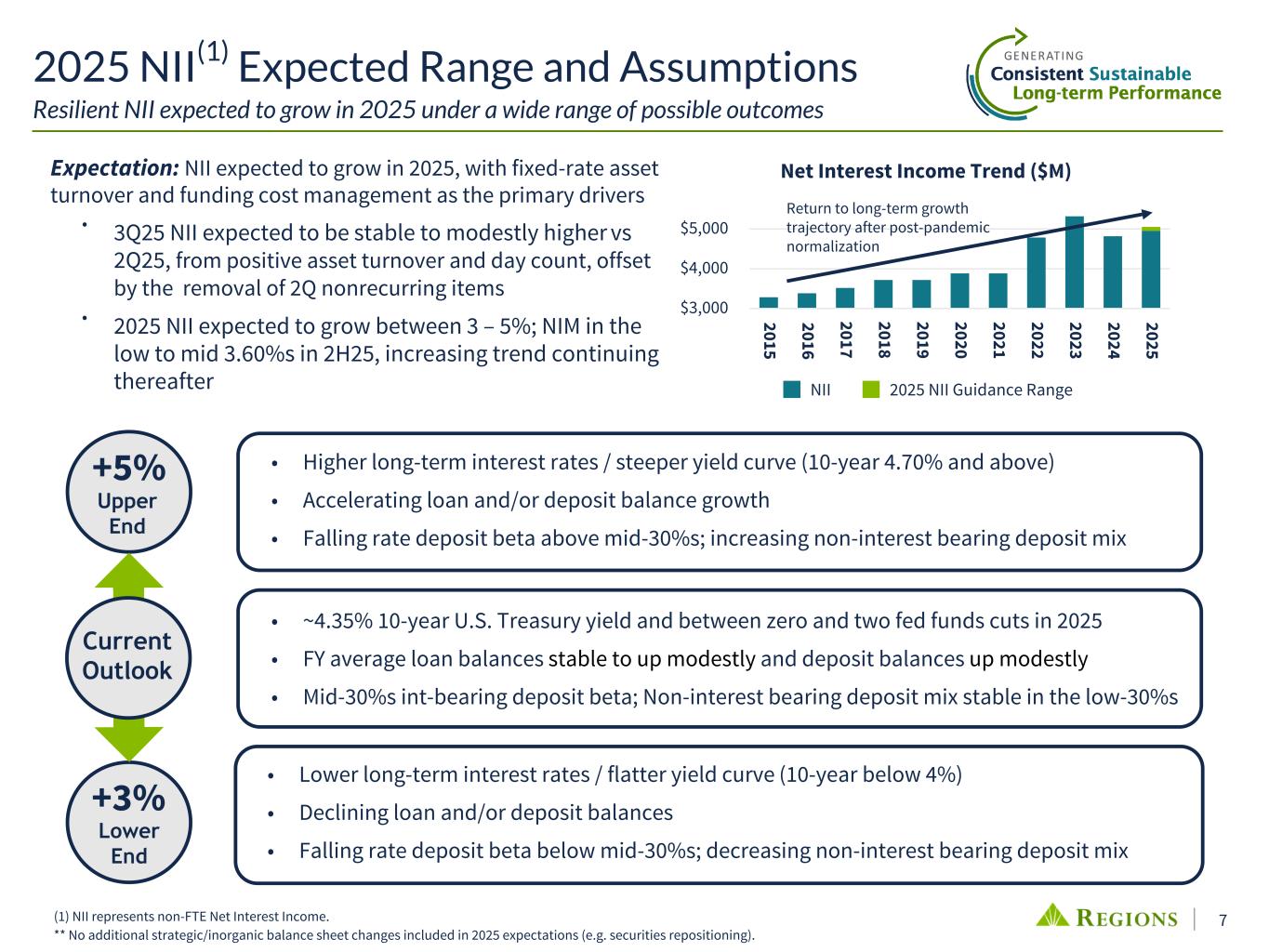

7 Expectation: NII expected to grow in 2025, with fixed-rate asset turnover and funding cost management as the primary drivers • 3Q25 NII expected to be stable to modestly higher vs 2Q25, from positive asset turnover and day count, offset by the removal of 2Q nonrecurring items • 2025 NII expected to grow between 3 – 5%; NIM in the low to mid 3.60%s in 2H25, increasing trend continuing thereafter 2025 NII(1) Expected Range and Assumptions Resilient NII expected to grow in 2025 under a wide range of possible outcomes (1) NII represents non-FTE Net Interest Income. ** No additional strategic/inorganic balance sheet changes included in 2025 expectations (e.g. securities repositioning). +5% +3% • Lower long-term interest rates / flatter yield curve (10-year below 4%) • Declining loan and/or deposit balances • Falling rate deposit beta below mid-30%s; decreasing non-interest bearing deposit mix Current Outlook Upper End Lower End • ~4.35% 10-year U.S. Treasury yield and between zero and two fed funds cuts in 2025 • FY average loan balances stable to up modestly and deposit balances up modestly • Mid-30%s int-bearing deposit beta; Non-interest bearing deposit mix stable in the low-30%s • Higher long-term interest rates / steeper yield curve (10-year 4.70% and above) • Accelerating loan and/or deposit balance growth • Falling rate deposit beta above mid-30%s; increasing non-interest bearing deposit mix Net Interest Income Trend ($M) NII 2025 NII Guidance Range 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 $3,000 $4,000 $5,000 Return to long-term growth trajectory after post-pandemic normalization

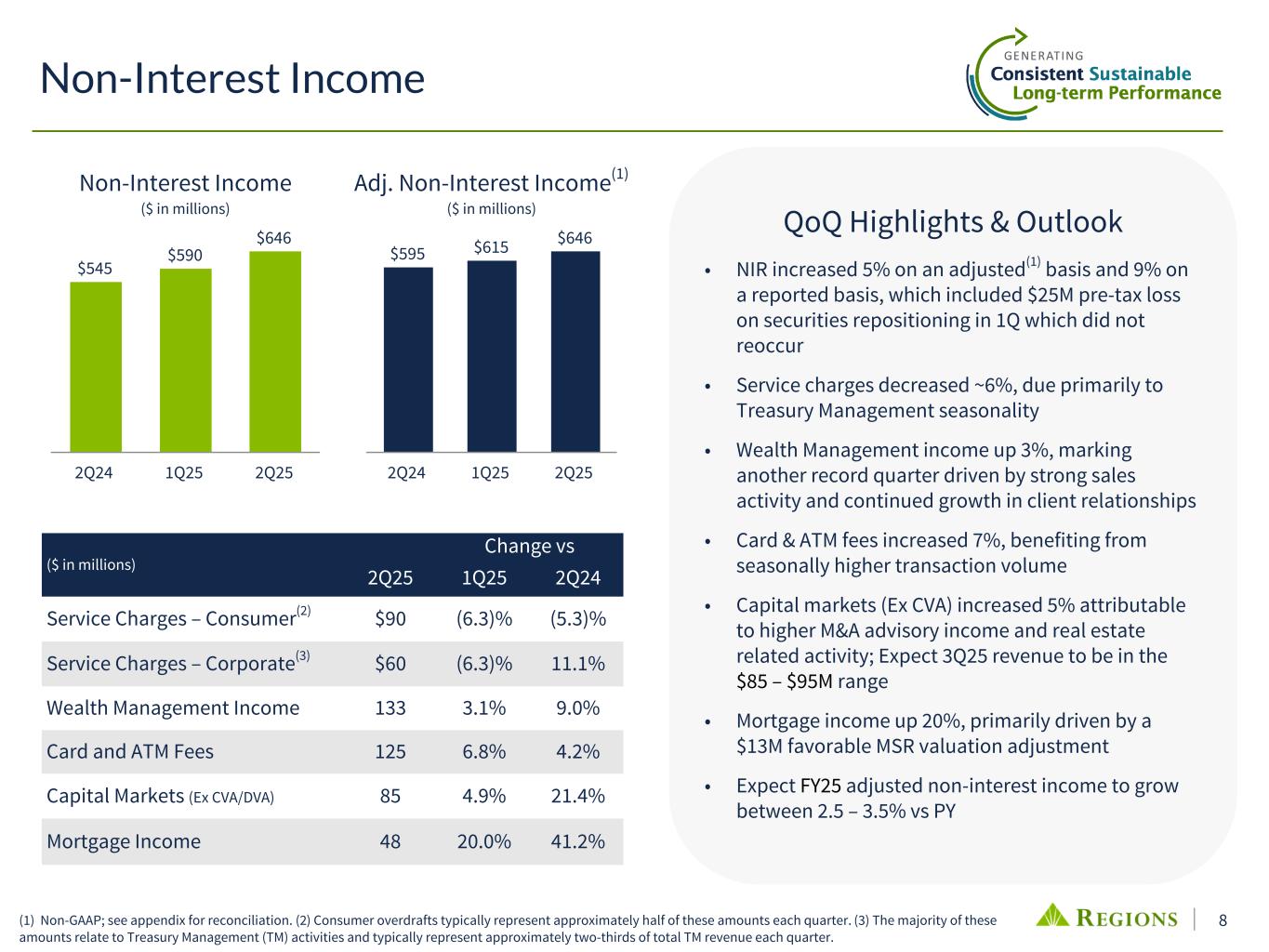

8 QoQ Highlights & Outlook • NIR increased 5% on an adjusted(1) basis and 9% on a reported basis, which included $25M pre-tax loss on securities repositioning in 1Q which did not reoccur • Service charges decreased ~6%, due primarily to Treasury Management seasonality • Wealth Management income up 3%, marking another record quarter driven by strong sales activity and continued growth in client relationships • Card & ATM fees increased 7%, benefiting from seasonally higher transaction volume • Capital markets (Ex CVA) increased 5% attributable to higher M&A advisory income and real estate related activity; Expect 3Q25 revenue to be in the $85 – $95M range • Mortgage income up 20%, primarily driven by a $13M favorable MSR valuation adjustment • Expect FY25 adjusted non-interest income to grow between 2.5 – 3.5% vs PY $595 $615 $646 2Q24 1Q25 2Q25 ($ in millions) Change vs 2Q25 1Q25 2Q24 Service Charges – Consumer(2) $90 (6.3)% (5.3)% Service Charges – Corporate(3) $60 (6.3)% 11.1% Wealth Management Income 133 3.1% 9.0% Card and ATM Fees 125 6.8% 4.2% Capital Markets (Ex CVA/DVA) 85 4.9% 21.4% Mortgage Income 48 20.0% 41.2% Non-Interest Income (1) Non-GAAP; see appendix for reconciliation. (2) Consumer overdrafts typically represent approximately half of these amounts each quarter. (3) The majority of these amounts relate to Treasury Management (TM) activities and typically represent approximately two-thirds of total TM revenue each quarter. $545 $590 $646 2Q24 1Q25 2Q25 Non-Interest Income ($ in millions) Adj. Non-Interest Income(1) ($ in millions)

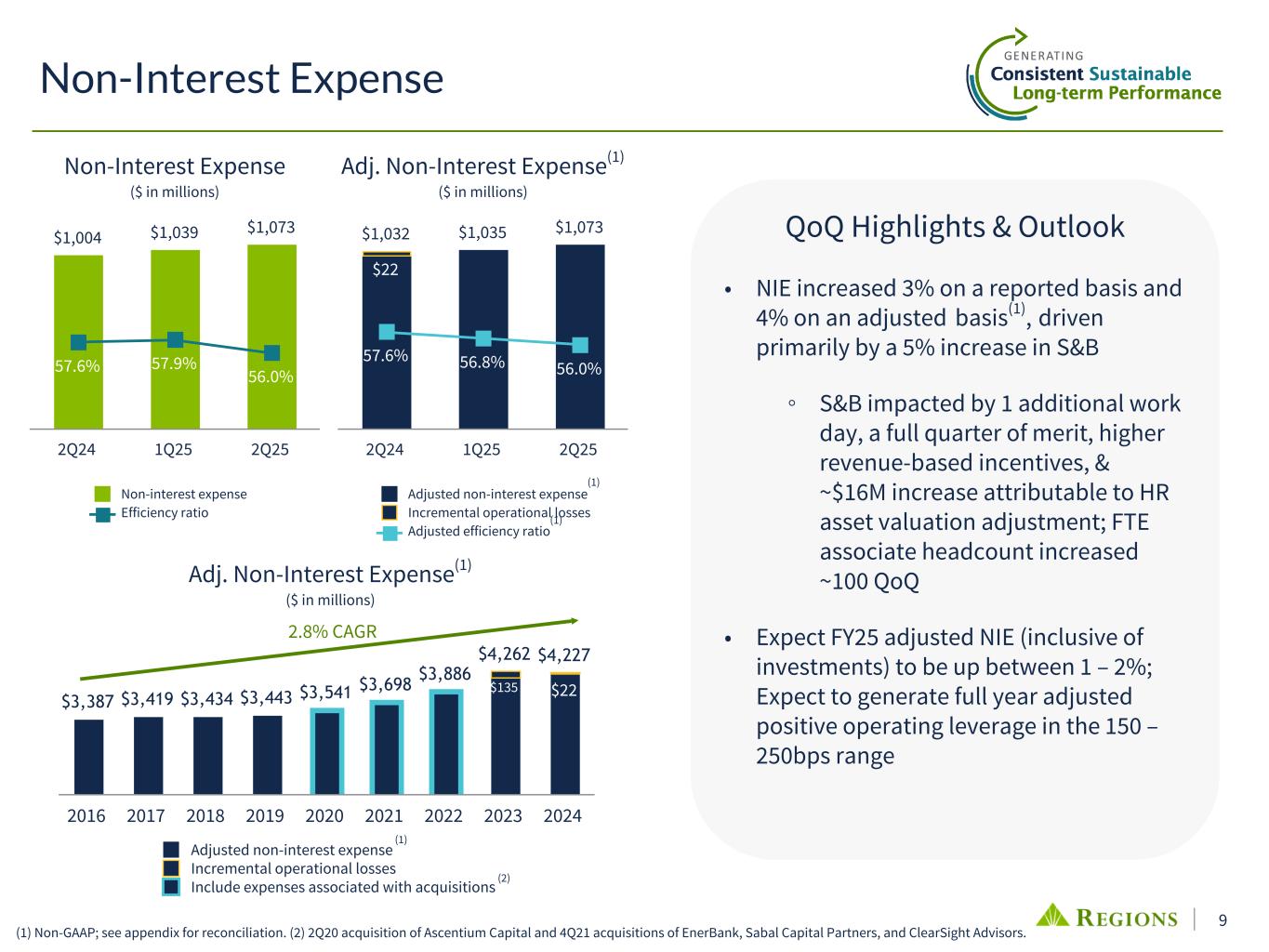

9 $1,004 $1,039 $1,073 57.6% 57.9% 56.0% Non-interest expense Efficiency ratio 2Q24 1Q25 2Q25 QoQ Highlights & Outlook • NIE increased 3% on a reported basis and 4% on an adjusted basis(1), driven primarily by a 5% increase in S&B ◦ S&B impacted by 1 additional work day, a full quarter of merit, higher revenue-based incentives, & ~$16M increase attributable to HR asset valuation adjustment; FTE associate headcount increased ~100 QoQ • Expect FY25 adjusted NIE (inclusive of investments) to be up between 1 – 2%; Expect to generate full year adjusted positive operating leverage in the 150 – 250bps range $1,032 $1,035 $1,073 $22 $— 57.6% 56.8% 56.0% Adjusted non-interest expense Incremental operational losses Adjusted efficiency ratio 2Q24 1Q25 2Q25 Non-Interest Expense (1) (1) Non-Interest Expense ($ in millions) Adj. Non-Interest Expense(1) ($ in millions) $3,387 $3,419 $3,434 $3,443 $3,541 $3,698 $3,886 $4,262 $4,227 $135 $22 Adjusted non-interest expense Incremental operational losses Include expenses associated with acquisitions 2016 2017 2018 2019 2020 2021 2022 2023 2024 2.8% CAGR Adj. Non-Interest Expense(1) ($ in millions) (1) (2) (1) Non-GAAP; see appendix for reconciliation. (2) 2Q20 acquisition of Ascentium Capital and 4Q21 acquisitions of EnerBank, Sabal Capital Partners, and ClearSight Advisors.

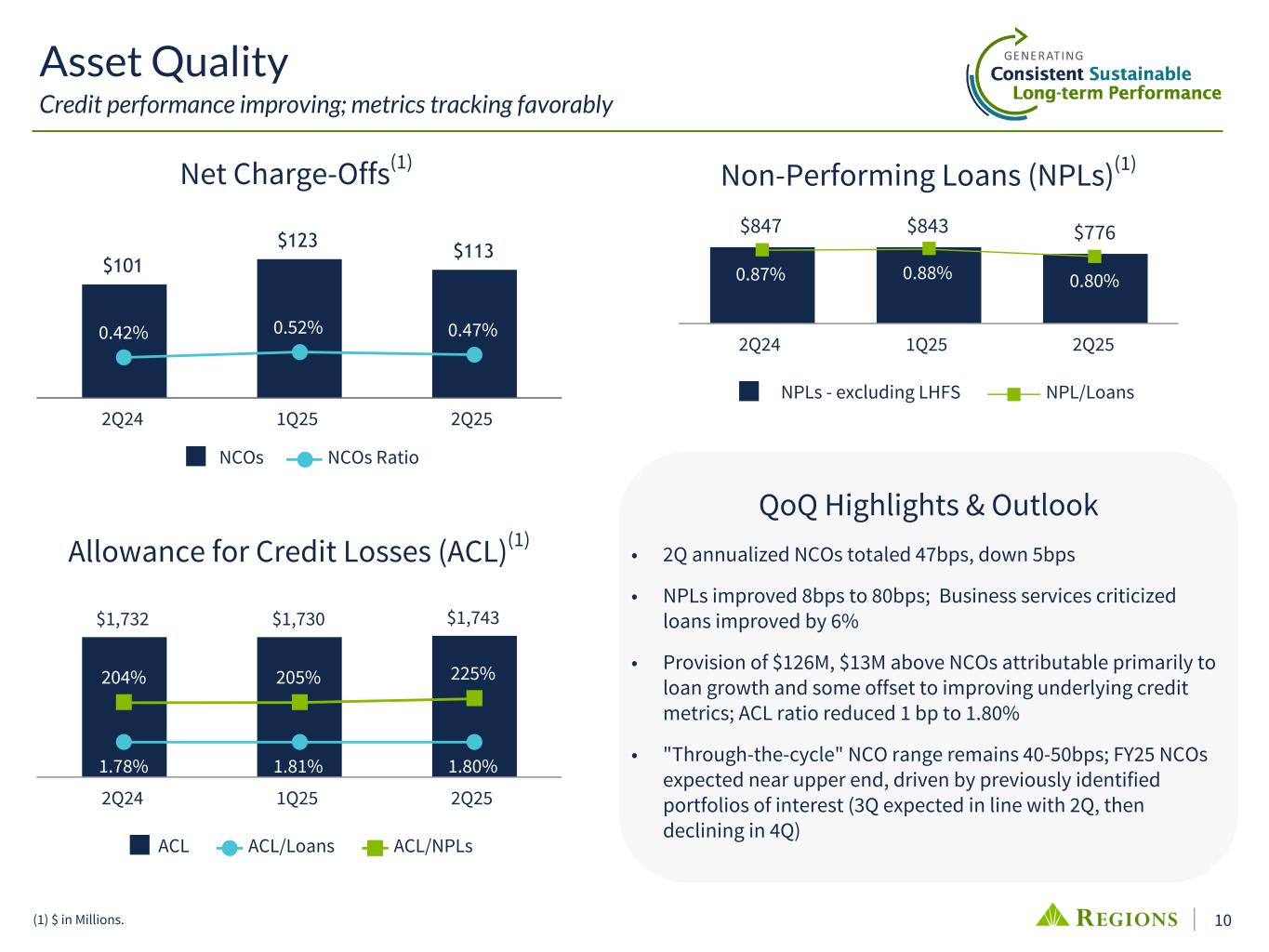

10 QoQ Highlights & Outlook • 2Q annualized NCOs totaled 47bps, down 5bps • NPLs improved 8bps to 80bps; Business services criticized loans improved by 6% • Provision of $126M, $13M above NCOs attributable primarily to loan growth and some offset to improving underlying credit metrics; ACL ratio reduced 1 bp to 1.80% • "Through-the-cycle" NCO range remains 40-50bps; FY25 NCOs expected near upper end, driven by previously identified portfolios of interest (3Q expected in line with 2Q, then declining in 4Q) Asset Quality Credit performance improving; metrics tracking favorably $1,732 $1,730 $1,743 1.78% 1.81% 1.80% 204% 205% 225% ACL ACL/Loans ACL/NPLs 2Q24 1Q25 2Q25 $101 $123 $113 0.42% 0.52% 0.47% NCOs NCOs Ratio 2Q24 1Q25 2Q25 $847 $843 $776 0.87% 0.88% 0.80% NPLs - excluding LHFS NPL/Loans 2Q24 1Q25 2Q25 (1) $ in Millions. Net Charge-Offs(1) Allowance for Credit Losses (ACL)(1) Non-Performing Loans (NPLs)(1)

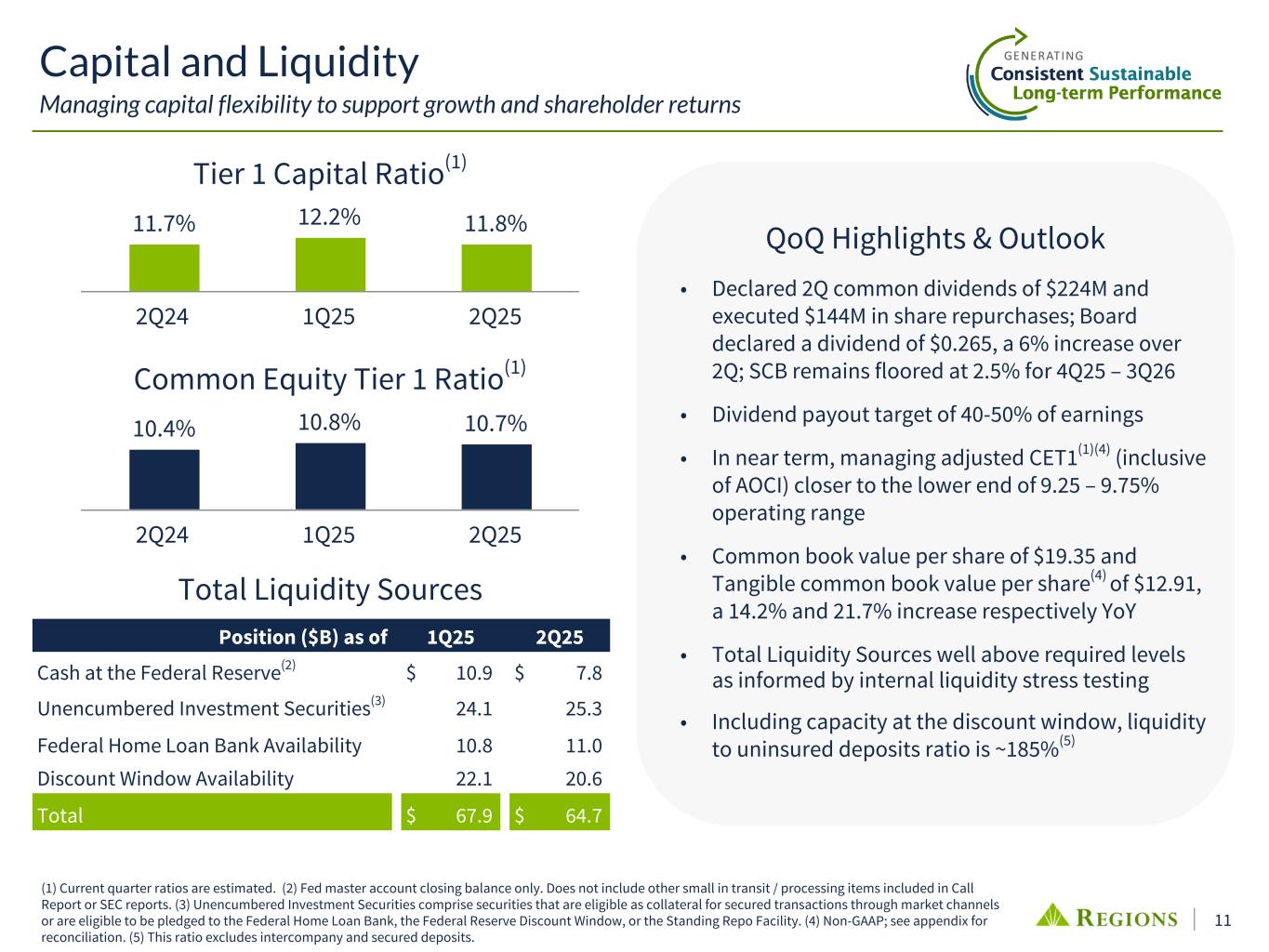

11 QoQ Highlights & Outlook • Declared 2Q common dividends of $224M and executed $144M in share repurchases; Board declared a dividend of $0.265, a 6% increase over 2Q; SCB remains floored at 2.5% for 4Q25 – 3Q26 • Dividend payout target of 40-50% of earnings • In near term, managing adjusted CET1(1)(4) (inclusive of AOCI) closer to the lower end of 9.25 – 9.75% operating range • Common book value per share of $19.35 and Tangible common book value per share(4) of $12.91, a 14.2% and 21.7% increase respectively YoY • Total Liquidity Sources well above required levels as informed by internal liquidity stress testing • Including capacity at the discount window, liquidity to uninsured deposits ratio is ~185%(5) 10.4% 10.8% 10.7% 2Q24 1Q25 2Q25 Capital and Liquidity Managing capital flexibility to support growth and shareholder returns 11.7% 12.2% 11.8% 2Q24 1Q25 2Q25 Tier 1 Capital Ratio(1) Common Equity Tier 1 Ratio(1) Position ($B) as of 1Q25 2Q25 Cash at the Federal Reserve(2) $ 10.9 $ 7.8 Unencumbered Investment Securities(3) 24.1 25.3 Federal Home Loan Bank Availability 10.8 11.0 Discount Window Availability 22.1 20.6 Total $ 67.9 $ 64.7 (1) Current quarter ratios are estimated. (2) Fed master account closing balance only. Does not include other small in transit / processing items included in Call Report or SEC reports. (3) Unencumbered Investment Securities comprise securities that are eligible as collateral for secured transactions through market channels or are eligible to be pledged to the Federal Home Loan Bank, the Federal Reserve Discount Window, or the Standing Repo Facility. (4) Non-GAAP; see appendix for reconciliation. (5) This ratio excludes intercompany and secured deposits. Total Liquidity Sources

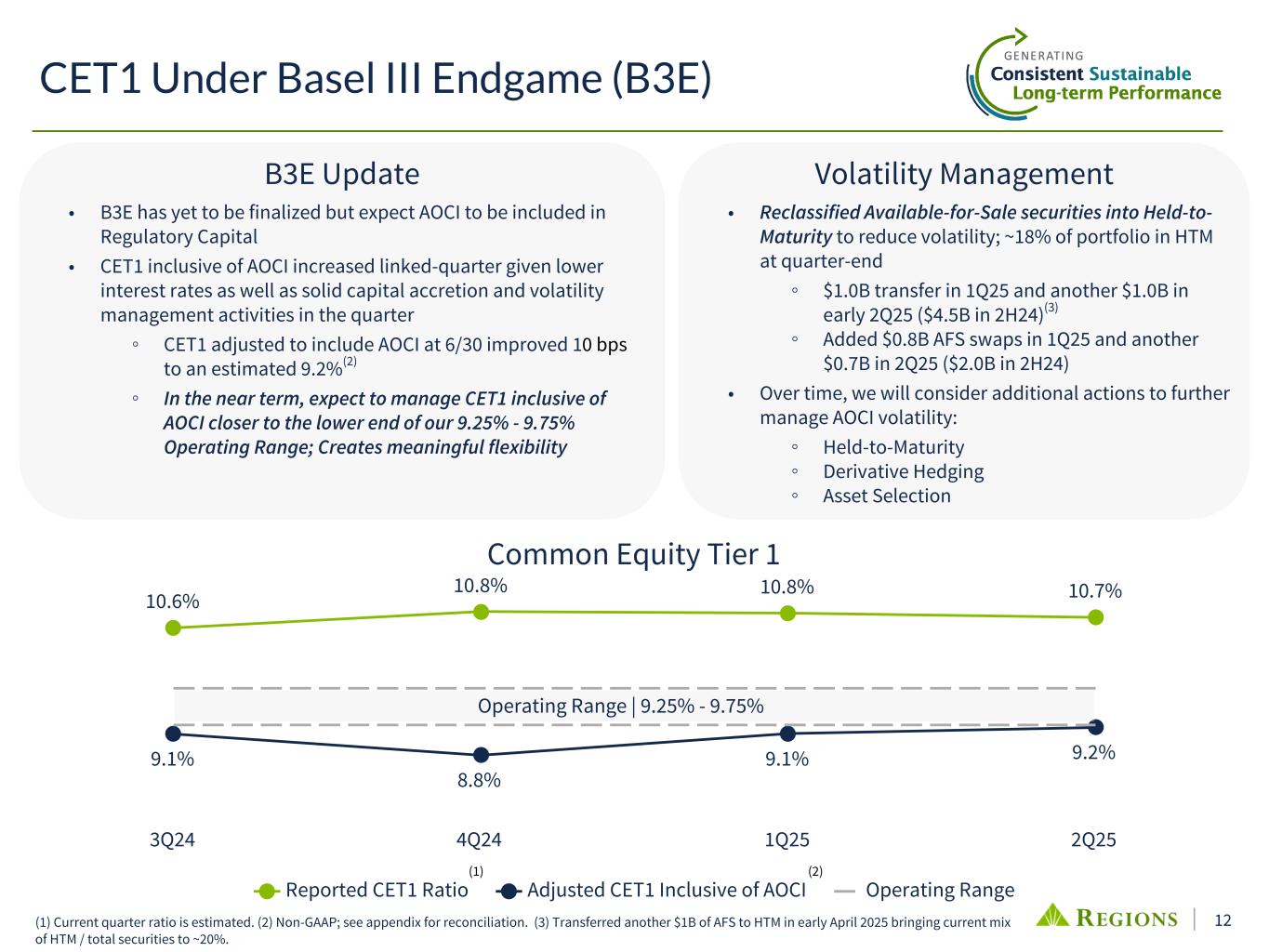

12 Common Equity Tier 1 10.6% 10.8% 10.8% 10.7% 9.1% 8.8% 9.1% 9.2% Reported CET1 Ratio Adjusted CET1 Inclusive of AOCI Operating Range 3Q24 4Q24 1Q25 2Q25 CET1 Under Basel III Endgame (B3E) B3E Update • B3E has yet to be finalized but expect AOCI to be included in Regulatory Capital • CET1 inclusive of AOCI increased linked-quarter given lower interest rates as well as solid capital accretion and volatility management activities in the quarter ◦ CET1 adjusted to include AOCI at 6/30 improved 10 bps to an estimated 9.2%(2) ◦ In the near term, expect to manage CET1 inclusive of AOCI closer to the lower end of our 9.25% - 9.75% Operating Range; Creates meaningful flexibility Volatility Management • Reclassified Available-for-Sale securities into Held-to- Maturity to reduce volatility; ~18% of portfolio in HTM at quarter-end ◦ $1.0B transfer in 1Q25 and another $1.0B in early 2Q25 ($4.5B in 2H24)(3) ◦ Added $0.8B AFS swaps in 1Q25 and another $0.7B in 2Q25 ($2.0B in 2H24) • Over time, we will consider additional actions to further manage AOCI volatility: ◦ Held-to-Maturity ◦ Derivative Hedging ◦ Asset Selection (1) (1) Current quarter ratio is estimated. (2) Non-GAAP; see appendix for reconciliation. (3) Transferred another $1B of AFS to HTM in early April 2025 bringing current mix of HTM / total securities to ~20%. (2) Operating Range | 9.25% - 9.75%

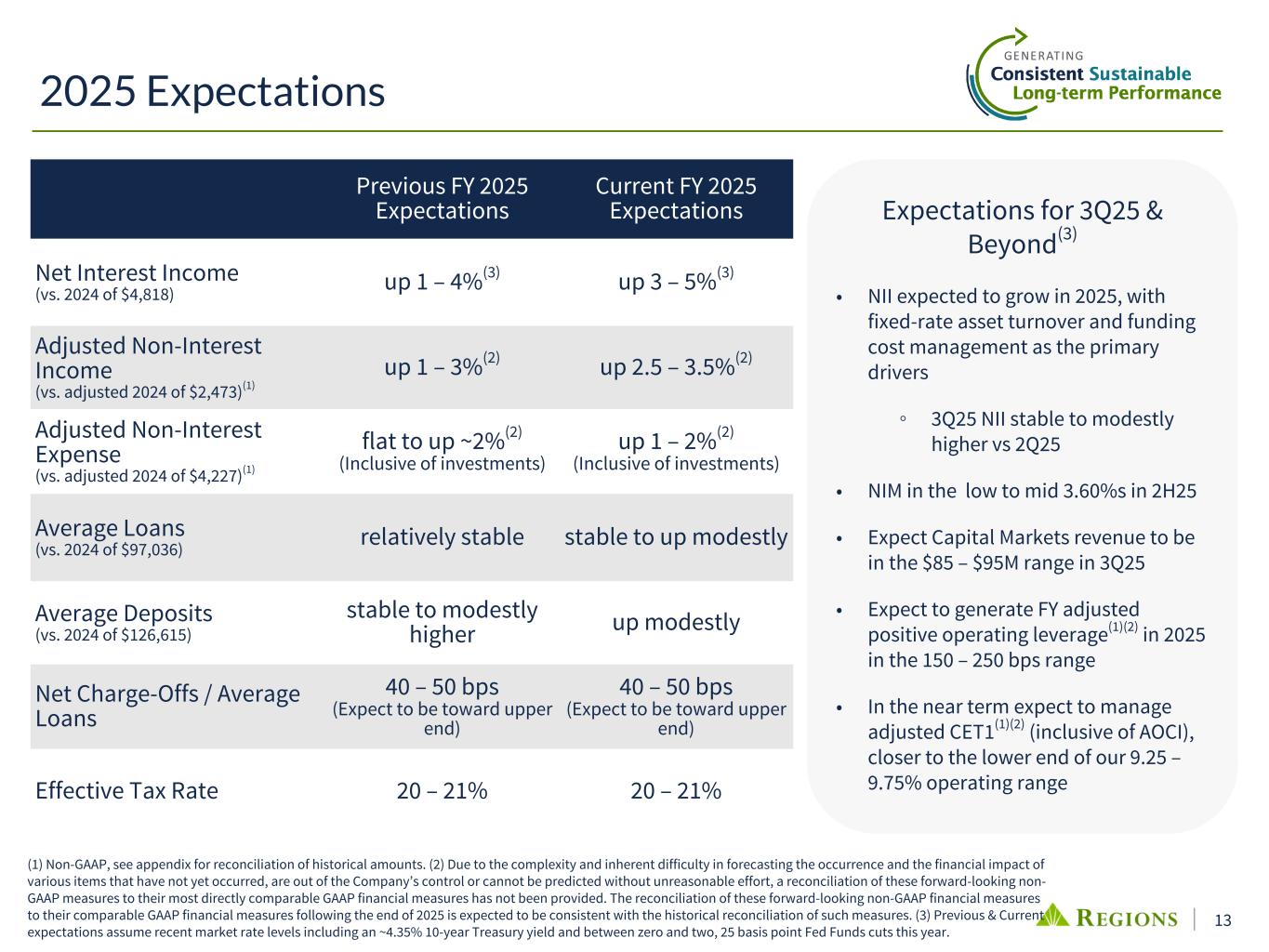

13 Expectations for 3Q25 & Beyond(3) • NII expected to grow in 2025, with fixed-rate asset turnover and funding cost management as the primary drivers ◦ 3Q25 NII stable to modestly higher vs 2Q25 • NIM in the low to mid 3.60%s in 2H25 • Expect Capital Markets revenue to be in the $85 – $95M range in 3Q25 • Expect to generate FY adjusted positive operating leverage(1)(2) in 2025 in the 150 – 250 bps range • In the near term expect to manage adjusted CET1(1)(2) (inclusive of AOCI), closer to the lower end of our 9.25 – 9.75% operating range 2025 Expectations (1) Non-GAAP, see appendix for reconciliation of historical amounts. (2) Due to the complexity and inherent difficulty in forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Company’s control or cannot be predicted without unreasonable effort, a reconciliation of these forward-looking non- GAAP measures to their most directly comparable GAAP financial measures has not been provided. The reconciliation of these forward-looking non-GAAP financial measures to their comparable GAAP financial measures following the end of 2025 is expected to be consistent with the historical reconciliation of such measures. (3) Previous & Current expectations assume recent market rate levels including an ~4.35% 10-year Treasury yield and between zero and two, 25 basis point Fed Funds cuts this year. Previous FY 2025 Expectations Current FY 2025 Expectations Net Interest Income (vs. 2024 of $4,818) up 1 – 4%(3) up 3 – 5%(3) Adjusted Non-Interest Income (vs. adjusted 2024 of $2,473)(1) up 1 – 3%(2) up 2.5 – 3.5%(2) Adjusted Non-Interest Expense (vs. adjusted 2024 of $4,227)(1) flat to up ~2%(2) (Inclusive of investments) up 1 – 2%(2) (Inclusive of investments) Average Loans (vs. 2024 of $97,036) relatively stable stable to up modestly Average Deposits (vs. 2024 of $126,615) stable to modestly higher up modestly Net Charge-Offs / Average Loans 40 – 50 bps (Expect to be toward upper end) 40 – 50 bps (Expect to be toward upper end) Effective Tax Rate 20 – 21% 20 – 21%

Appendix

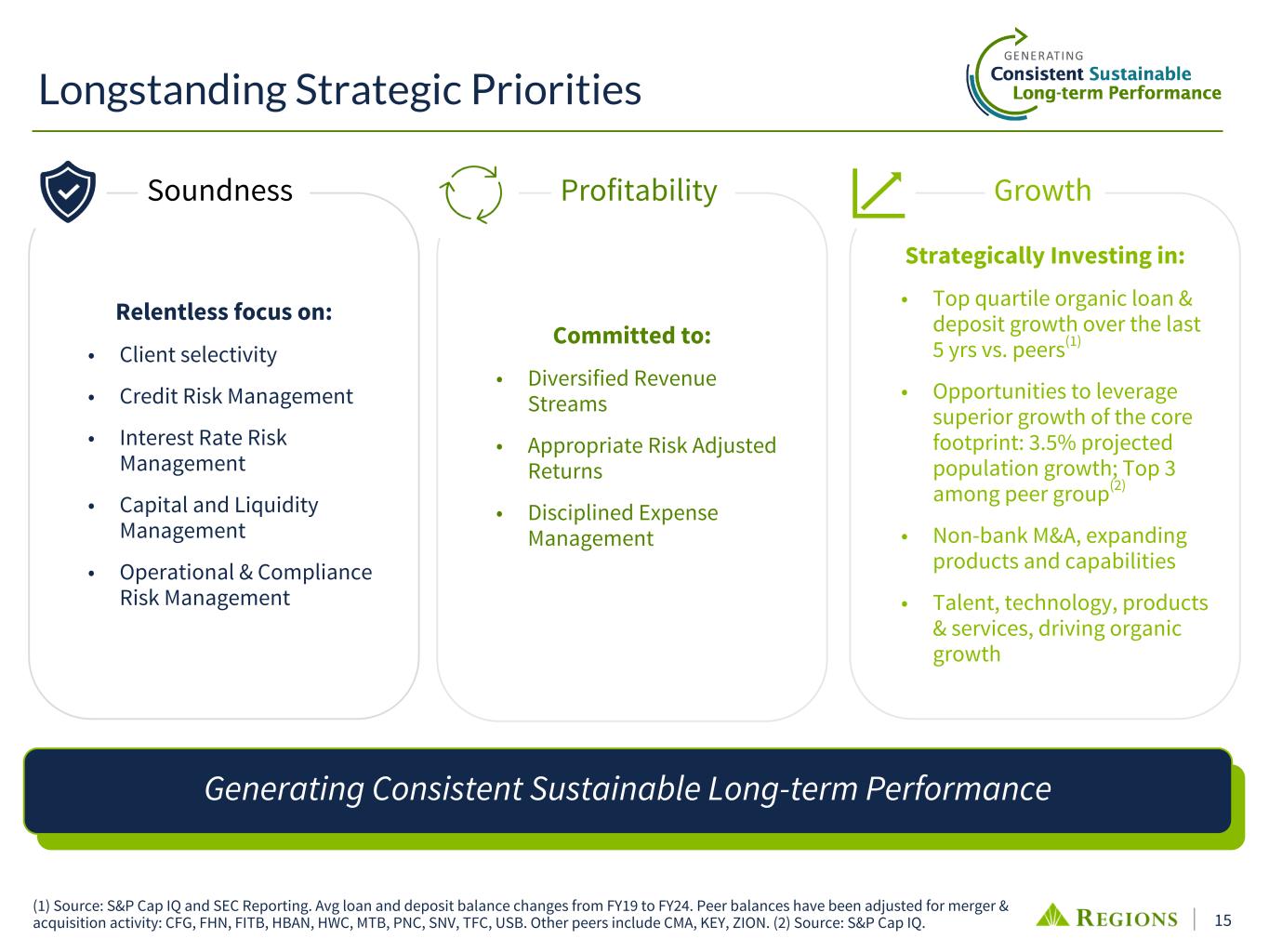

15 Longstanding Strategic Priorities Committed to: • Diversified Revenue Streams • Appropriate Risk Adjusted Returns • Disciplined Expense Management Profitability Strategically Investing in: • Top quartile organic loan & deposit growth over the last 5 yrs vs. peers(1) • Opportunities to leverage superior growth of the core footprint: 3.5% projected population growth; Top 3 among peer group(2) • Non-bank M&A, expanding products and capabilities • Talent, technology, products & services, driving organic growth Growth Relentless focus on: • Client selectivity • Credit Risk Management • Interest Rate Risk Management • Capital and Liquidity Management • Operational & Compliance Risk Management Soundness (1) Source: S&P Cap IQ and SEC Reporting. Avg loan and deposit balance changes from FY19 to FY24. Peer balances have been adjusted for merger & acquisition activity: CFG, FHN, FITB, HBAN, HWC, MTB, PNC, SNV, TFC, USB. Other peers include CMA, KEY, ZION. (2) Source: S&P Cap IQ. Generating Consistent Sustainable Long-term Performance

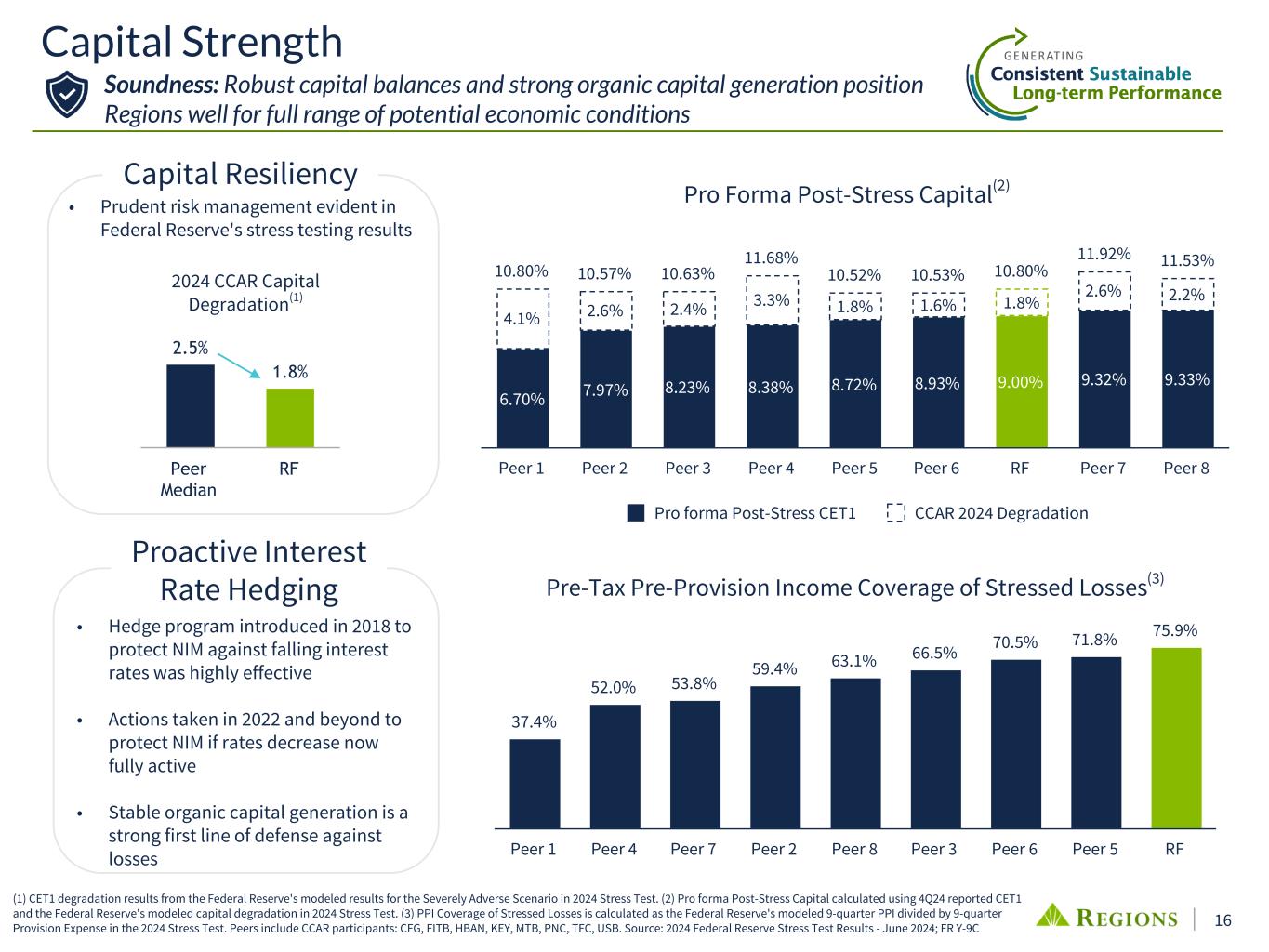

16 2.5% 1.8% Peer Median RF • Hedge program introduced in 2018 to protect NIM against falling interest rates was highly effective • Actions taken in 2022 and beyond to protect NIM if rates decrease now fully active • Stable organic capital generation is a strong first line of defense against losses 2024 CCAR Capital Degradation(1) Proactive Interest Rate Hedging Capital Resiliency (1) CET1 degradation results from the Federal Reserve's modeled results for the Severely Adverse Scenario in 2024 Stress Test. (2) Pro forma Post-Stress Capital calculated using 4Q24 reported CET1 and the Federal Reserve's modeled capital degradation in 2024 Stress Test. (3) PPI Coverage of Stressed Losses is calculated as the Federal Reserve's modeled 9-quarter PPI divided by 9-quarter Provision Expense in the 2024 Stress Test. Peers include CCAR participants: CFG, FITB, HBAN, KEY, MTB, PNC, TFC, USB. Source: 2024 Federal Reserve Stress Test Results - June 2024; FR Y-9C 10.80% 10.57% 10.63% 11.68% 10.52% 10.53% 10.80% 11.92% 11.53% 6.70% 7.97% 8.23% 8.38% 8.72% 8.93% 9.00% 9.32% 9.33% 4.1% 2.6% 2.4% 3.3% 1.8% 1.6% 1.8% 2.6% 2.2% Pro forma Post-Stress CET1 CCAR 2024 Degradation Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 RF Peer 7 Peer 8 37.4% 52.0% 53.8% 59.4% 63.1% 66.5% 70.5% 71.8% 75.9% Peer 1 Peer 4 Peer 7 Peer 2 Peer 8 Peer 3 Peer 6 Peer 5 RF • Prudent risk management evident in Federal Reserve's stress testing results Pro Forma Post-Stress Capital(2) Pre-Tax Pre-Provision Income Coverage of Stressed Losses(3) Capital Strength Soundness: Robust capital balances and strong organic capital generation position Regions well for full range of potential economic conditions

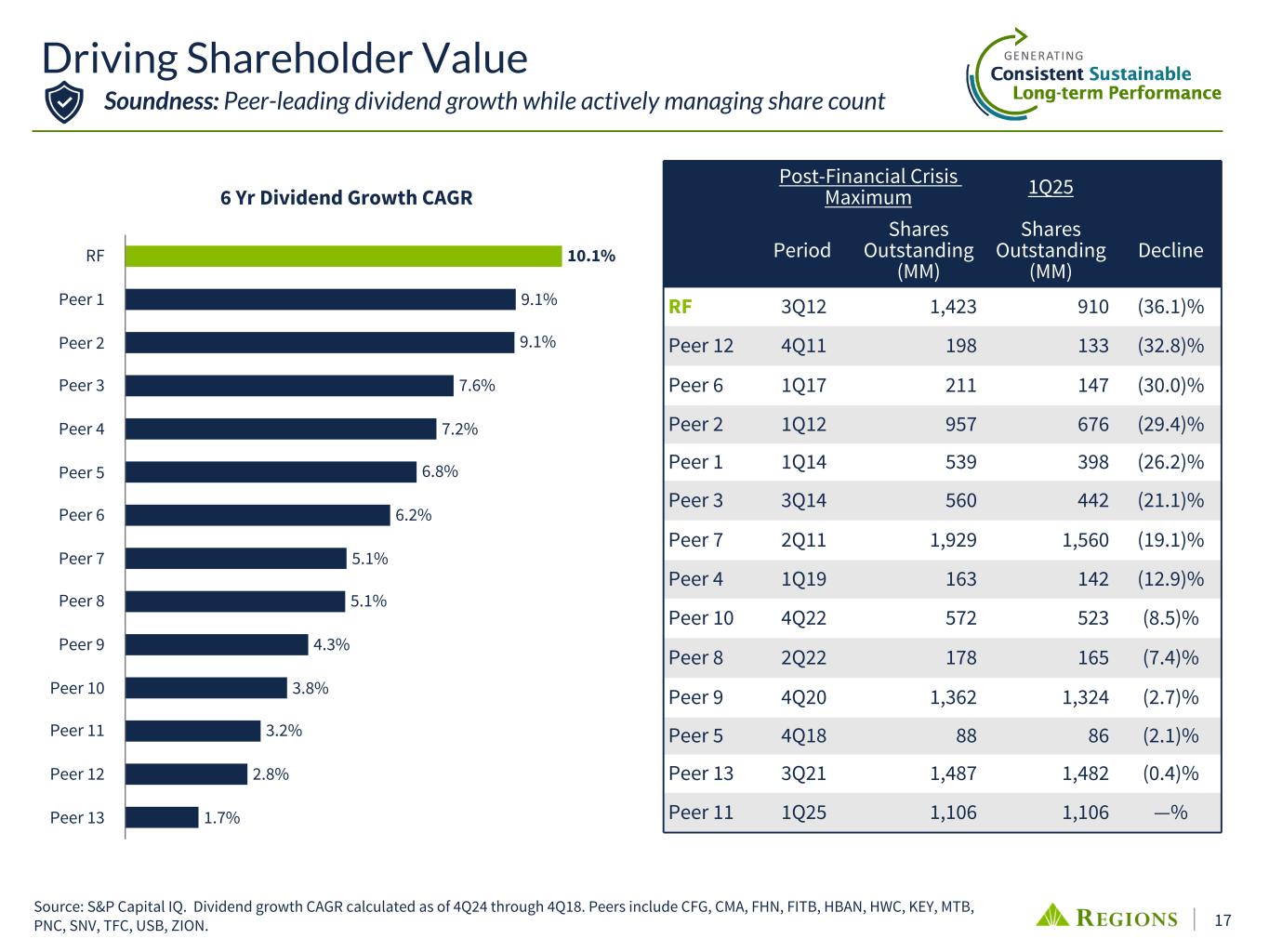

17 Driving Shareholder Value Soundness: Peer-leading dividend growth while actively managing share count Post-Financial Crisis Maximum 1Q25 Period Shares Outstanding (MM) Shares Outstanding (MM) Decline RF 3Q12 1,423 910 (36.1)% Peer 12 4Q11 198 133 (32.8)% Peer 6 1Q17 211 147 (30.0)% Peer 2 1Q12 957 676 (29.4)% Peer 1 1Q14 539 398 (26.2)% Peer 3 3Q14 560 442 (21.1)% Peer 7 2Q11 1,929 1,560 (19.1)% Peer 4 1Q19 163 142 (12.9)% Peer 10 4Q22 572 523 (8.5)% Peer 8 2Q22 178 165 (7.4)% Peer 9 4Q20 1,362 1,324 (2.7)% Peer 5 4Q18 88 86 (2.1)% Peer 13 3Q21 1,487 1,482 (0.4)% Peer 11 1Q25 1,106 1,106 —% 6 Yr Dividend Growth CAGR 10.1% 9.1% 9.1% 7.6% 7.2% 6.8% 6.2% 5.1% 5.1% 4.3% 3.8% 3.2% 2.8% 1.7% RF Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Source: S&P Capital IQ. Dividend growth CAGR calculated as of 4Q24 through 4Q18. Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION.

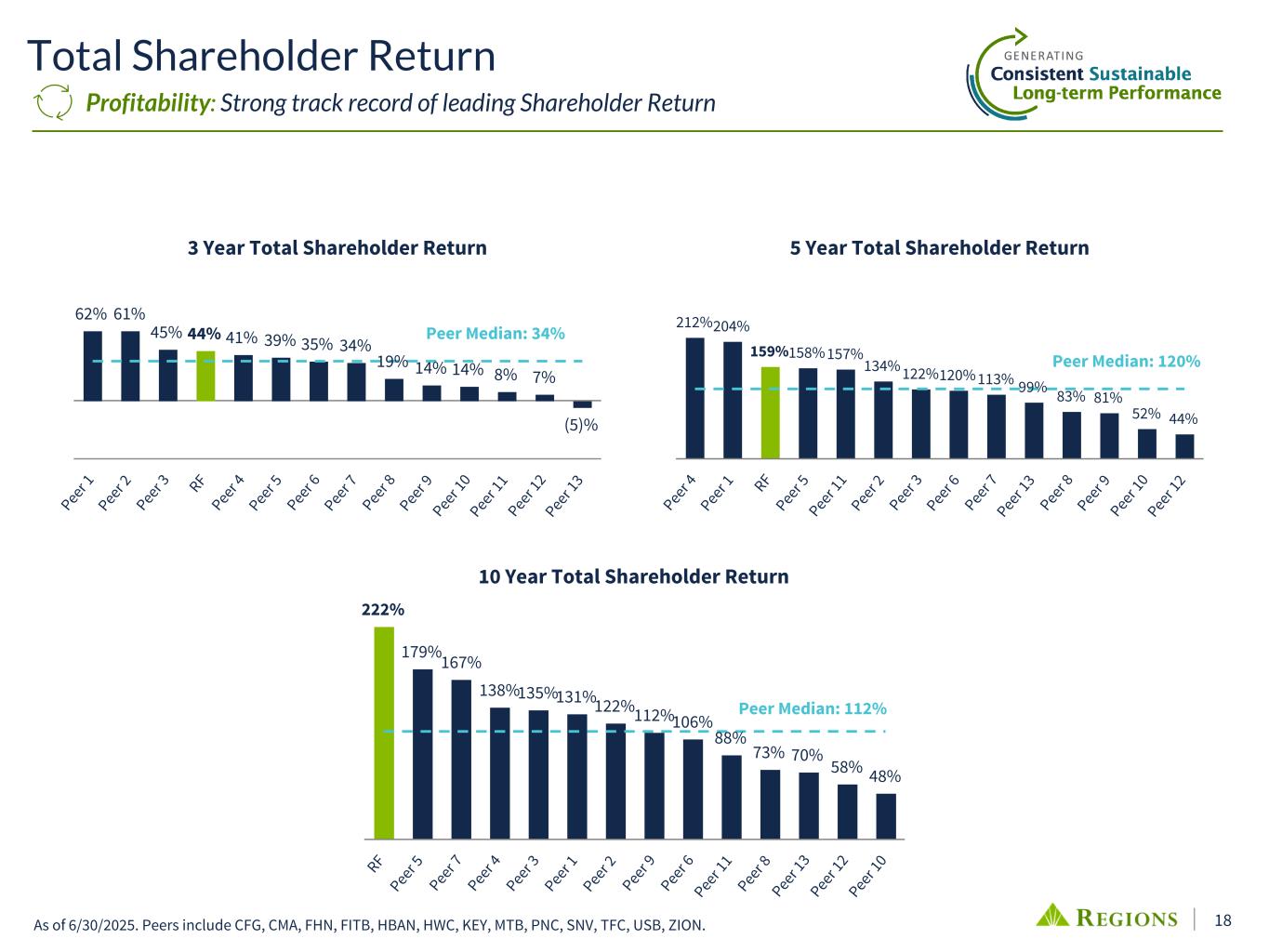

18 3 Year Total Shareholder Return 62% 61% 45% 44% 41% 39% 35% 34% 19% 14% 14% 8% 7% (5)% Peer 1 Peer 2 Peer 3 RF Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 1 0 Peer 1 1 Peer 1 2 Peer 1 3 5 Year Total Shareholder Return 212%204% 159%158% 157% 134% 122%120% 113% 99% 83% 81% 52% 44% Peer 4 Peer 1 RF Peer 5 Peer 1 1 Peer 2 Peer 3 Peer 6 Peer 7 Peer 1 3 Peer 8 Peer 9 Peer 1 0 Peer 1 2 Total Shareholder Return 10 Year Total Shareholder Return 222% 179%167% 138%135%131%122%112%106% 88% 73% 70% 58% 48% RF Peer 5 Peer 7 Peer 4 Peer 3 Peer 1 Peer 2 Peer 9 Peer 6 Peer 1 1 Peer 8 Peer 1 3 Peer 1 2 Peer 1 0 Peer Median: 34% Peer Median: 120% Peer Median: 112% As of 6/30/2025. Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. Profitability: Strong track record of leading Shareholder Return

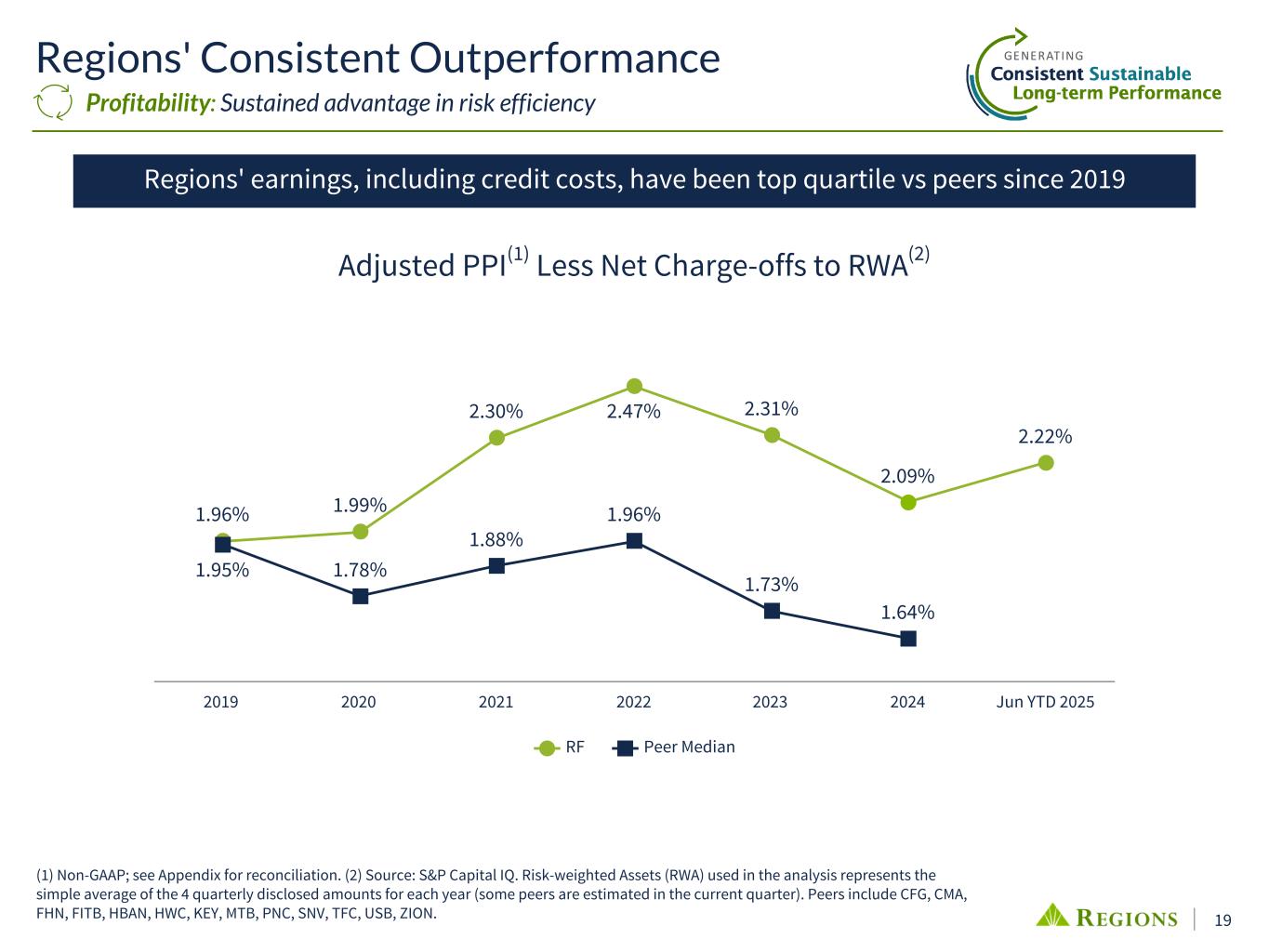

19 Regions' Consistent Outperformance Adjusted PPI(1) Less Net Charge-offs to RWA(2) Regions' earnings, including credit costs, have been top quartile vs peers since 2019 1.96% 1.99% 2.30% 2.47% 2.31% 2.09% 2.22% 1.95% 1.78% 1.88% 1.96% 1.73% 1.64% RF Peer Median 2019 2020 2021 2022 2023 2024 Jun YTD 2025 (1) Non-GAAP; see Appendix for reconciliation. (2) Source: S&P Capital IQ. Risk-weighted Assets (RWA) used in the analysis represents the simple average of the 4 quarterly disclosed amounts for each year (some peers are estimated in the current quarter). Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. Profitability: Sustained advantage in risk efficiency

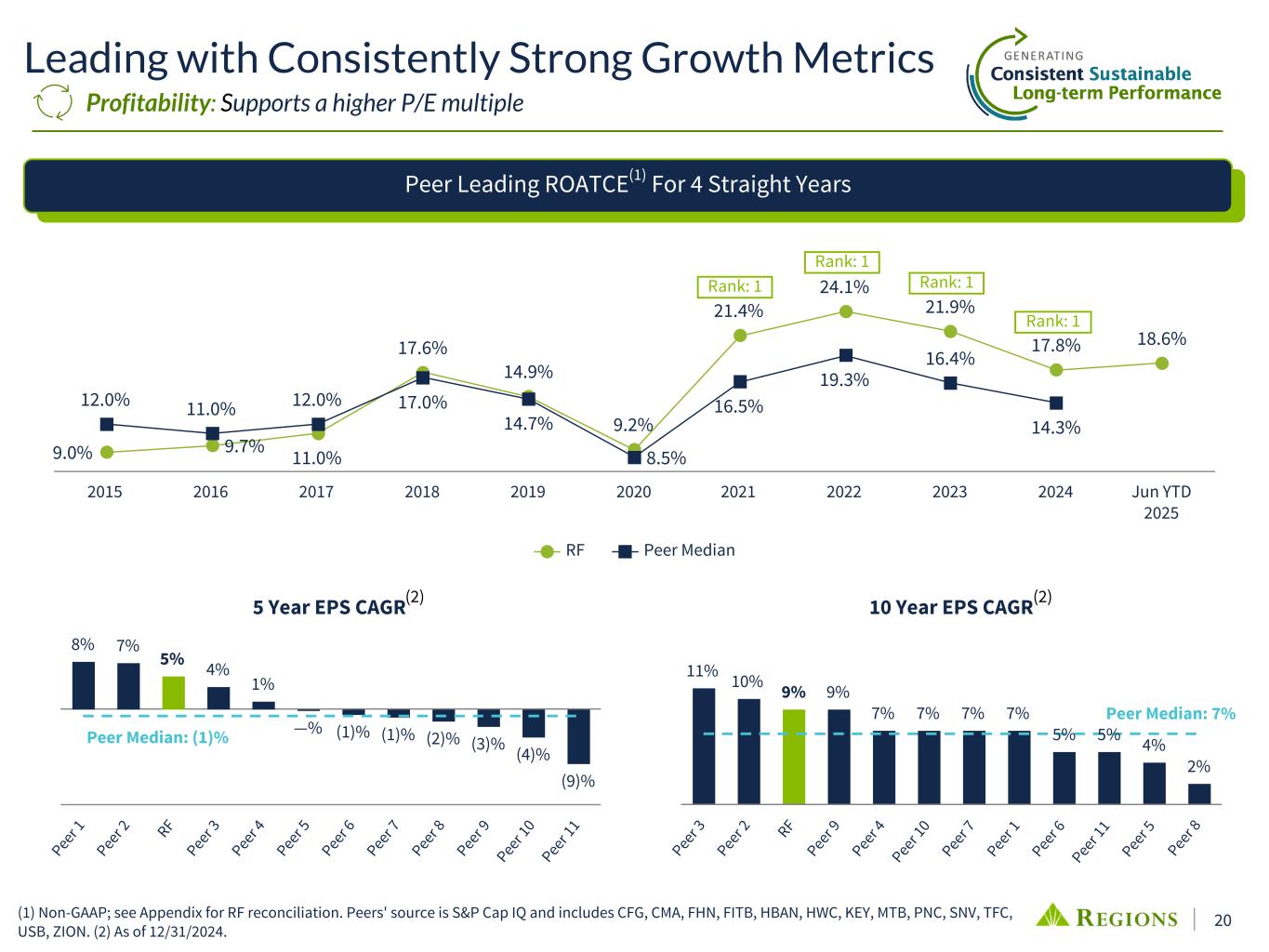

20 9.0% 9.7% 11.0% 17.6% 14.9% 9.2% 21.4% 24.1% 21.9% 17.8% 18.6% 12.0% 11.0% 12.0% 17.0% 14.7% 8.5% 16.5% 19.3% 16.4% 14.3% RF Peer Median 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Jun YTD 2025 (1) Non-GAAP; see Appendix for RF reconciliation. Peers' source is S&P Cap IQ and includes CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. (2) As of 12/31/2024. Rank: 1 Rank: 1 Rank: 1Rank: 1 5 Year EPS CAGR 8% 7% 5% 4% 1% —% (1)% (1)% (2)% (3)% (4)% (9)% Peer 1 Peer 2 RF Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 1 0 Peer 1 1 10 Year EPS CAGR 11% 10% 9% 9% 7% 7% 7% 7% 5% 5% 4% 2% Peer 3 Peer 2 RF Peer 9 Peer 4 Peer 1 0 Peer 7 Peer 1 Peer 6 Peer 1 1 Peer 5 Peer 8 Peer Leading ROATCE(1) For 4 Straight Years Peer Median: (1)% Peer Median: 7% (2) (2) Leading with Consistently Strong Growth Metrics Profitability: Supports a higher P/E multiple

21 Tangible Book Value Growth plus Dividends 3 Yr CAGR of TBV + Dividends 20.4% 18.7% 16.7% 16.2% 15.2% 14.2% 12.9% 12.8% 12.2% 12.2% 11.9% 11.6% 9.3% 6.9% Peer 1 RF Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 5 Yr CAGR of TBV + Dividends 15.3% 14.9% 14.8% 14.6% 14.2% 13.9% 13.4% 13.2% 12.8% 12.6% 12.0% 11.9% 11.6% 10.4% Peer 1 Peer 7 RF Peer 2 Peer 6 Peer 9 Peer 4 Peer 8 Peer 5 Peer 11 Peer 10 Peer 13 Peer 3 Peer 12 As of 12/31/2024. Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION. Profitability: 3 and 5 yr CAGR excluding AOCI

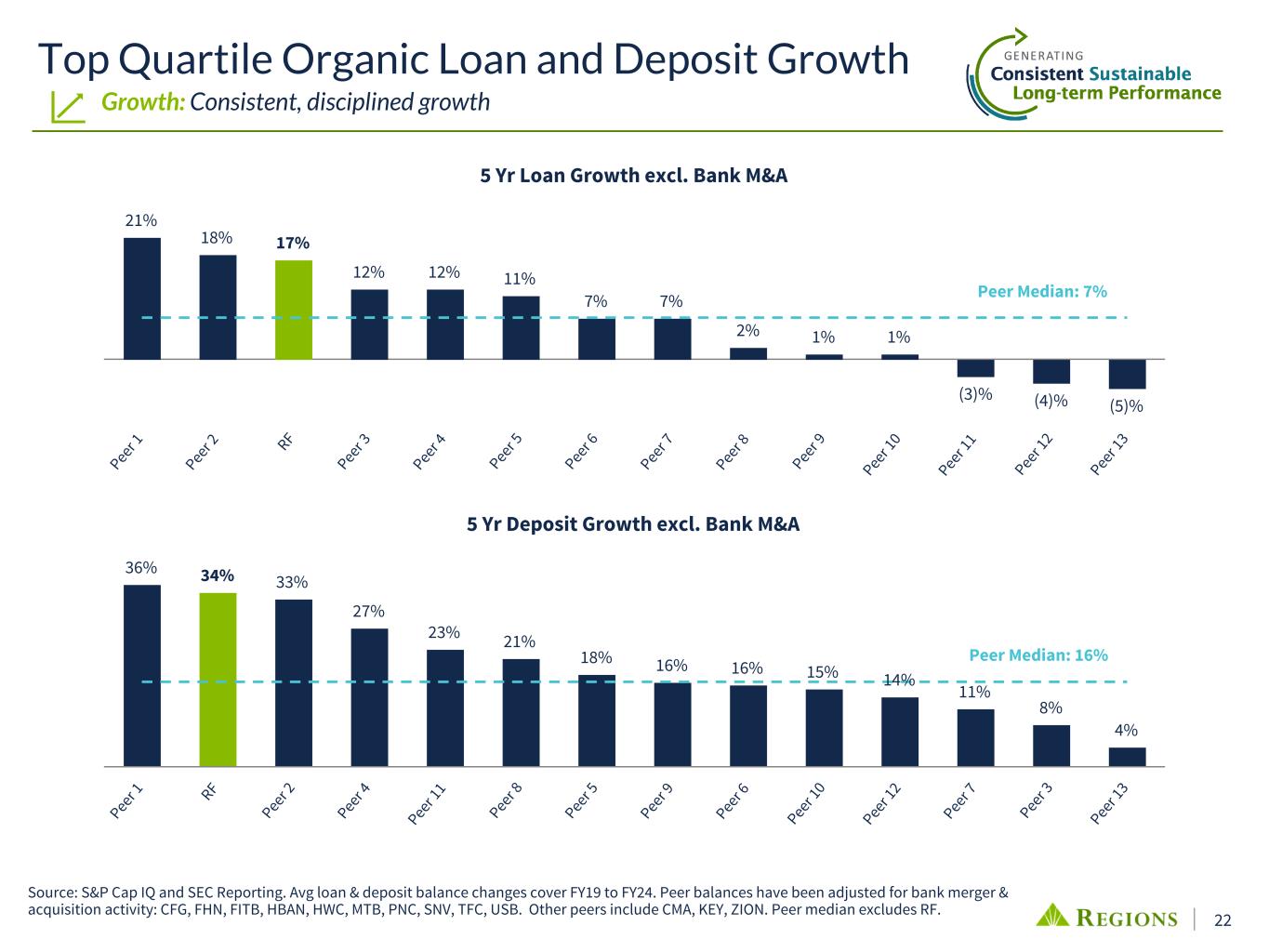

22 Top Quartile Organic Loan and Deposit Growth Growth: Consistent, disciplined growth 5 Yr Loan Growth excl. Bank M&A 21% 18% 17% 12% 12% 11% 7% 7% 2% 1% 1% (3)% (4)% (5)% Peer 1 Peer 2 RF Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 1 0 Peer 1 1 Peer 1 2 Peer 1 3 Source: S&P Cap IQ and SEC Reporting. Avg loan & deposit balance changes cover FY19 to FY24. Peer balances have been adjusted for bank merger & acquisition activity: CFG, FHN, FITB, HBAN, HWC, MTB, PNC, SNV, TFC, USB. Other peers include CMA, KEY, ZION. Peer median excludes RF. Peer Median: 7% 5 Yr Deposit Growth excl. Bank M&A 36% 34% 33% 27% 23% 21% 18% 16% 16% 15% 14% 11% 8% 4% Peer 1 RF Peer 2 Peer 4 Peer 1 1 Peer 8 Peer 5 Peer 9 Peer 6 Peer 1 0 Peer 1 2 Peer 7 Peer 3 Peer 1 3 Peer Median: 16%

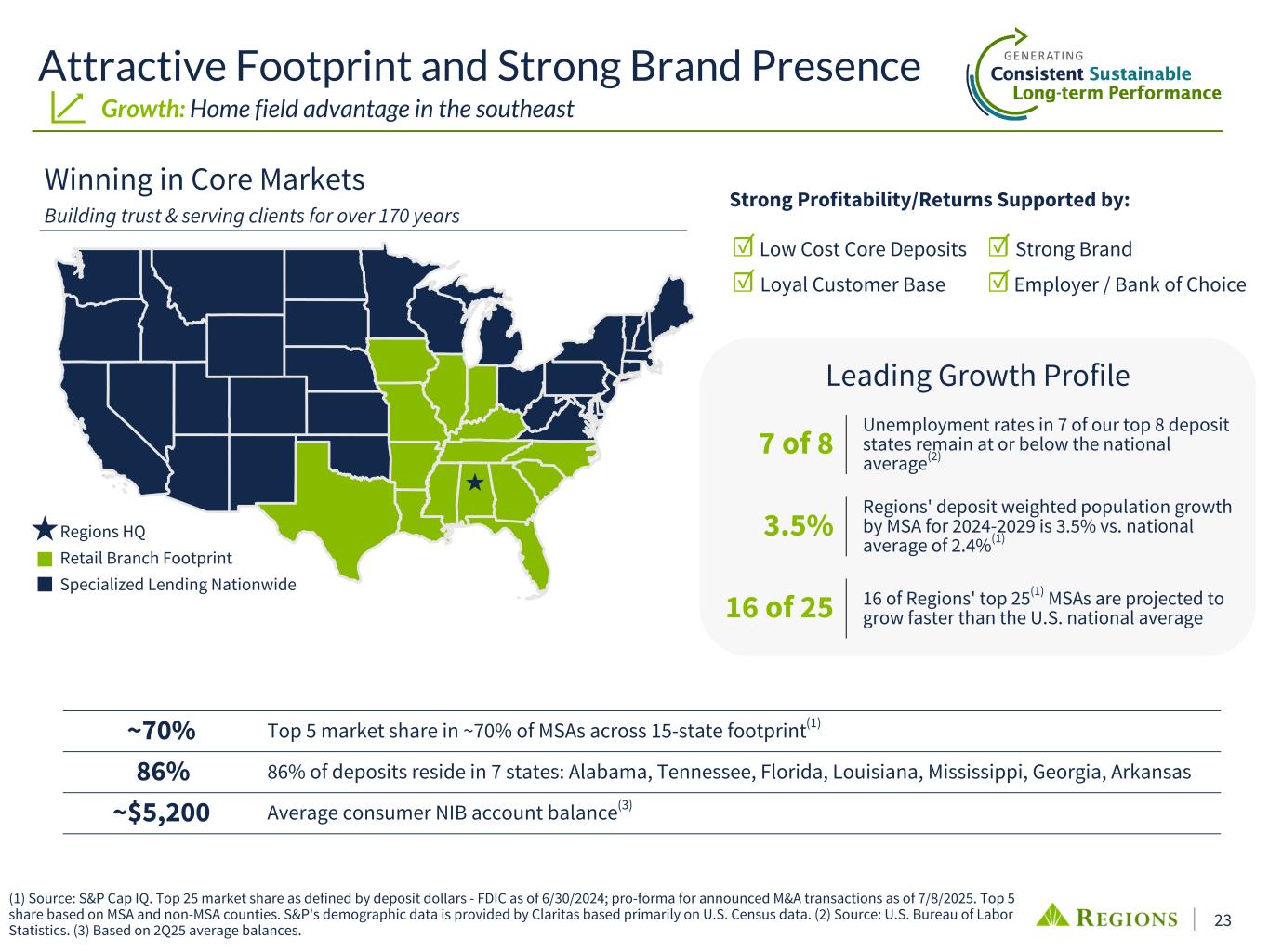

23 Leading Growth Profile Attractive Footprint and Strong Brand Presence Growth: Home field advantage in the southeast Regions HQ Retail Branch Footprint Specialized Lending Nationwide Winning in Core Markets Building trust & serving clients for over 170 years Strong Profitability/Returns Supported by: ☑ Low Cost Core Deposits ☑ Strong Brand ☑ Loyal Customer Base ☑ Employer / Bank of Choice ~70% Top 5 market share in ~70% of MSAs across 15-state footprint(1) 86% 86% of deposits reside in 7 states: Alabama, Tennessee, Florida, Louisiana, Mississippi, Georgia, Arkansas ~$5,200 Average consumer NIB account balance(3) 7 of 8 Unemployment rates in 7 of our top 8 deposit states remain at or below the national average(2) 3.5% Regions' deposit weighted population growth by MSA for 2024-2029 is 3.5% vs. national average of 2.4%(1) 16 of 25 16 of Regions' top 25(1) MSAs are projected to grow faster than the U.S. national average (1) Source: S&P Cap IQ. Top 25 market share as defined by deposit dollars - FDIC as of 6/30/2024; pro-forma for announced M&A transactions as of 7/8/2025. Top 5 share based on MSA and non-MSA counties. S&P's demographic data is provided by Claritas based primarily on U.S. Census data. (2) Source: U.S. Bureau of Labor Statistics. (3) Based on 2Q25 average balances.

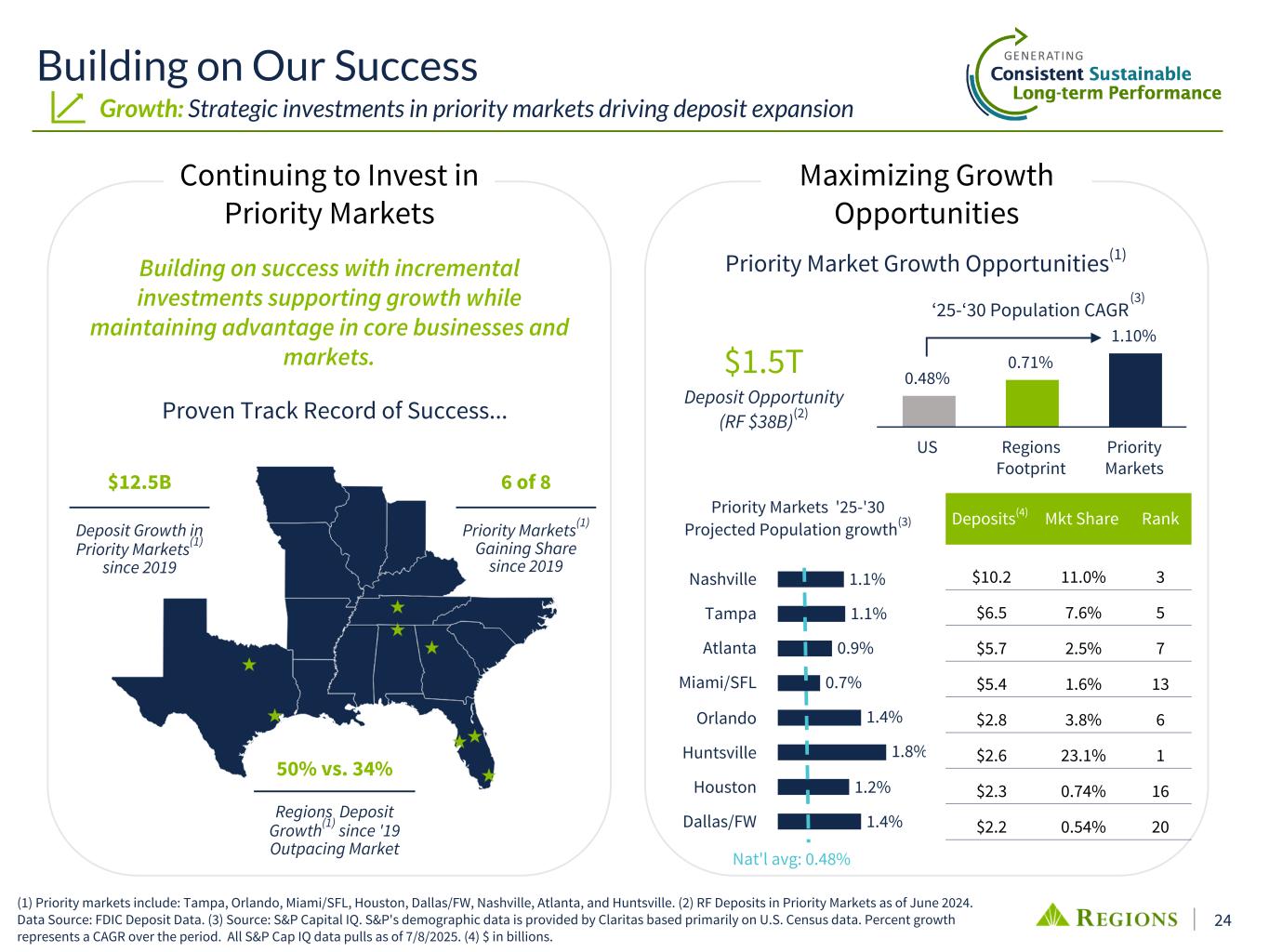

24 ‘25-‘30 Population CAGR 0.48% 0.71% 1.10% US Regions Footprint Priority Markets Priority Market Growth Opportunities(1) 1.1% 1.1% 0.9% 0.7% 1.4% 1.8% 1.2% 1.4% Nashville Tampa Atlanta Miami/SFL Orlando Huntsville Houston Dallas/FW Building on Our Success Growth: Strategic investments in priority markets driving deposit expansion (1) Priority markets include: Tampa, Orlando, Miami/SFL, Houston, Dallas/FW, Nashville, Atlanta, and Huntsville. (2) RF Deposits in Priority Markets as of June 2024. Data Source: FDIC Deposit Data. (3) Source: S&P Capital IQ. S&P's demographic data is provided by Claritas based primarily on U.S. Census data. Percent growth represents a CAGR over the period. All S&P Cap IQ data pulls as of 7/8/2025. (4) $ in billions. Nat'l avg: 0.48% Priority Markets '25-'30 Projected Population growth(3) 50% vs. 34% Regions Deposit Growth(1) since '19 Outpacing Market Continuing to Invest in Priority Markets Proven Track Record of Success... Maximizing Growth Opportunities (3) $1.5T Deposit Opportunity (RF $38B)(2) Building on success with incremental investments supporting growth while maintaining advantage in core businesses and markets. 6 of 8 Priority Markets(1) Gaining Share since 2019 $12.5B Deposit Growth in Priority Markets(1) since 2019 Deposits(4) Mkt Share Rank $10.2 11.0% 3 $6.5 7.6% 5 $5.7 2.5% 7 $5.4 1.6% 13 $2.8 3.8% 6 $2.6 23.1% 1 $2.3 0.74% 16 $2.2 0.54% 20

25 Over the next 3 years, will invest in Talent across the Footprint in key areas of opportunity: By hiring and converting skilled Bankers with local market expertise Commercial and Middle Market Associates ~90 Increase in Middle Market, Small Business Relationship Managers, & TM Bankers Consumer and Wealth ~300 Reskilling Branch Sales Bankers to Focus on Small Business Opportunities ~300 Reallocating Branch Bankers to Optimized Markets with Greatest Growth Potential ~50 Incremental Mortgage Loan Originators ~30 Incremental Wealth Associates Revenue Enablement ~100 Incremental Revenue Enablement roles supporting existing Bankers, including bankers above. Note - Hiring initiatives remain on track: ~40 incremental bankers and revenue enablement roles have been added through 6/30/2025; ~70% complete with reskilling and reallocating Branch Bankers Investing in Banker Expansion (1) Provides bill payment, accounts payable and receivable, and invoice generation – streamlining all the tools needed to run a business. (2) Provides real-time cash management analysis for clients. (3) Identifies personalized solutions for small business owners. (4) Insights for mortgage lending officers. (5) Small Business defined as companies with $0M-$5M in annual revenue. Growth represents average deposit FY19 through FY24. (6) Dunn & Bradstreet. Priority markets include: Tampa, Orlando, Miami/SFL, Houston, Dallas/FW, Nashville, Atlanta, and Huntsville. (7) As of June 30, 2025. Investing in People and Technology Growth: Expanding talent and capabilities in markets with greatest opportunity ☐ Core Modernization ☐ Commercial Loan System ☐ Deposit System ☐ General Ledger ☐ New Native Mobile App (Roll-out in progress) ☐ Small Business Digital Origination Platform Investments in Technology Personalization Powered by AI ☑ CashFlowIQ(1) ☑ CashFlow Advisor(2) ☑ SmallBusinessIQ(3) ☑ Mortgage Analytics Pro(4) Small Business Opportunity ~12M Small Business Companies in Regions' Footprint (~400k RF customers today driving $2.6B or 30% avg. deposit growth since '19; $1.1B or 41% within priority growth markets)(5)(6) ~5M in priority markets

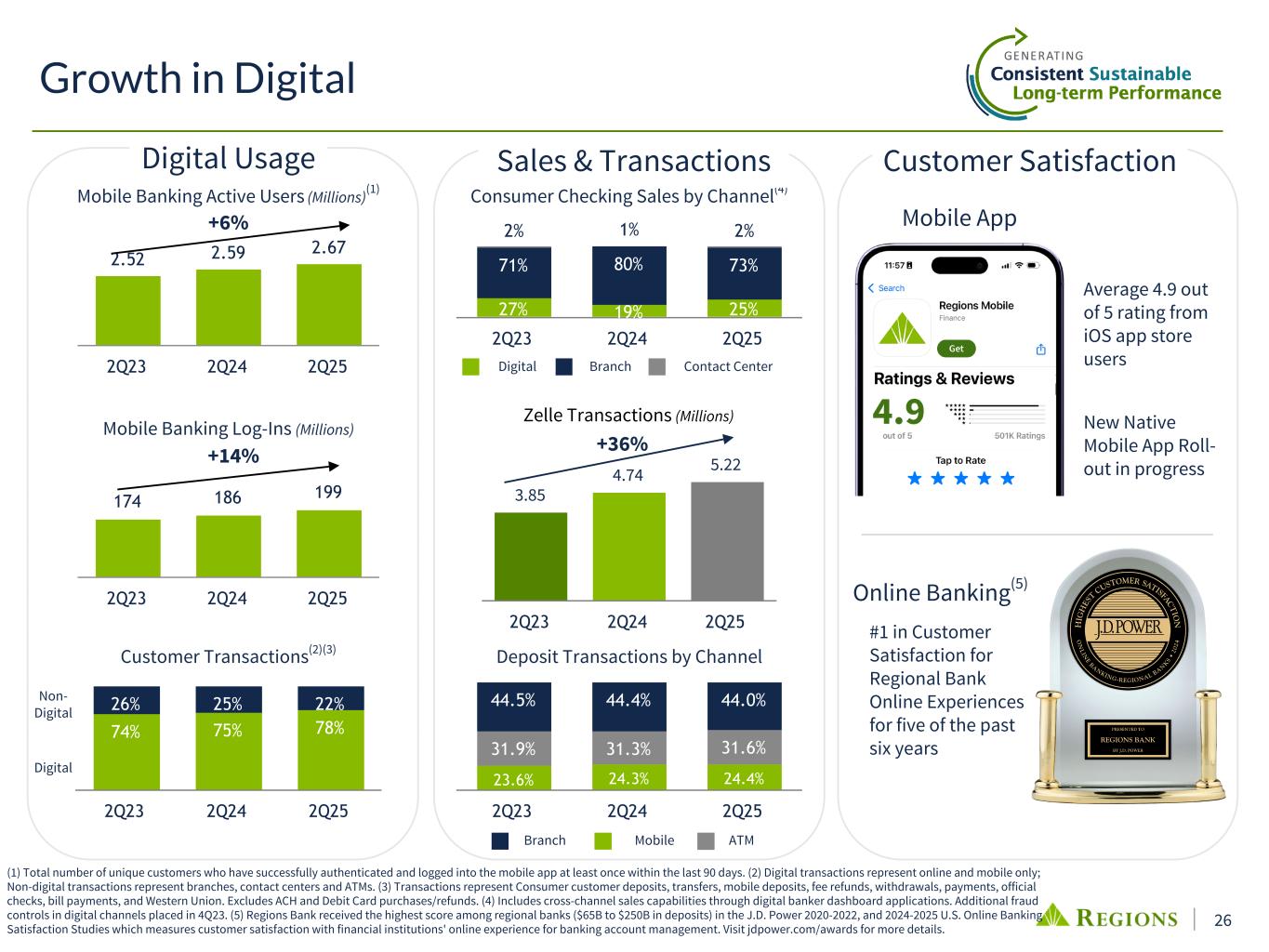

26 2.52 2.59 2.67 2Q23 2Q24 2Q25 3.85 4.74 5.22 2Q23 2Q24 2Q25 174 186 199 2Q23 2Q24 2Q25 23.6% 24.3% 24.4% 31.9% 31.3% 31.6% 44.5% 44.4% 44.0% 2Q23 2Q24 2Q25 74% 75% 78% 26% 25% 22% 2Q23 2Q24 2Q25 Growth in Digital Mobile Banking Log-Ins (Millions) Customer Transactions(2)(3) Deposit Transactions by Channel Mobile Banking Active Users (Millions)(1) Digital Non- Digital Mobile ATMBranch +36%+14% 27% 19% 25% 71% 80% 73% 2% 1% 2% 2Q23 2Q24 2Q25 Digital Branch Contact Center Consumer Checking Sales by Channel(4) Customer Satisfaction Zelle Transactions (Millions) Sales & TransactionsDigital Usage +6% (1) Total number of unique customers who have successfully authenticated and logged into the mobile app at least once within the last 90 days. (2) Digital transactions represent online and mobile only; Non-digital transactions represent branches, contact centers and ATMs. (3) Transactions represent Consumer customer deposits, transfers, mobile deposits, fee refunds, withdrawals, payments, official checks, bill payments, and Western Union. Excludes ACH and Debit Card purchases/refunds. (4) Includes cross-channel sales capabilities through digital banker dashboard applications. Additional fraud controls in digital channels placed in 4Q23. (5) Regions Bank received the highest score among regional banks ($65B to $250B in deposits) in the J.D. Power 2020-2022, and 2024-2025 U.S. Online Banking Satisfaction Studies which measures customer satisfaction with financial institutions' online experience for banking account management. Visit jdpower.com/awards for more details. Mobile App Online Banking(5) #1 in Customer Satisfaction for Regional Bank Online Experiences for five of the past six years Average 4.9 out of 5 rating from iOS app store users New Native Mobile App Roll- out in progress

27 • Record 2Q25 NIR, up 1.2% QoQ • Relationship growth of 8.3%(2) • Investing in our Associates through our Next Level Advisor Development Program • Completion of new cloud-based portal to improve infrastructure of existing and future WM applications • Leveraging new tools to drive enhancements to Advisor CRMs leading to improvements in both experience and efficiency • Fully launched social media program for client-facing associates to deliver compliant content through LinkedIn • New head of Regions Investment Services named; Brandon Greve Investments in Our Businesses Investments in talent, technology and strategic acquisitions continue to pay off • Driving growth in our priority and core markets by adding resources within Treasury Management and Commercial Banking • Treasury Management revenue increased 8.1% YTD, driven by client base growth of 10.2%(1) • Capital Markets income up 4% QoQ driven by higher M&A activity and RECM originations • Ascentium Capital 1H25 loan production is up 12% YoY, contributing to growth are transactions originated through cross-marketing relationships with the Commercial Bank & Branch network • Leveraging advanced technology including Natural Language Processing to efficiently screen public filings to evaluate 18K+ product opportunities for large corporate clients Corporate • Growing and retaining primary relationships by reskilling ~300 bankers to focus on small business opportunities and reallocating ~300 bankers to align talent depth with highest opportunity across key customer segments • Delivering on localized strategies leveraging key sponsorships and campus activations including conducting ~6k financial education workshops in 2Q25 • Digital channel YTD checking growth of 10% from digital funnel improvements • Mobile App mobile users increased 2% YoY; New Mobile App launch in progress • Saved over 200k hours from centralizing processes so bankers can focus more on serving customers Consumer Wealth (1) Represents increase from May '24 to May '25 (2) Total Wealth Management Relationships as of May '24 from May '25.

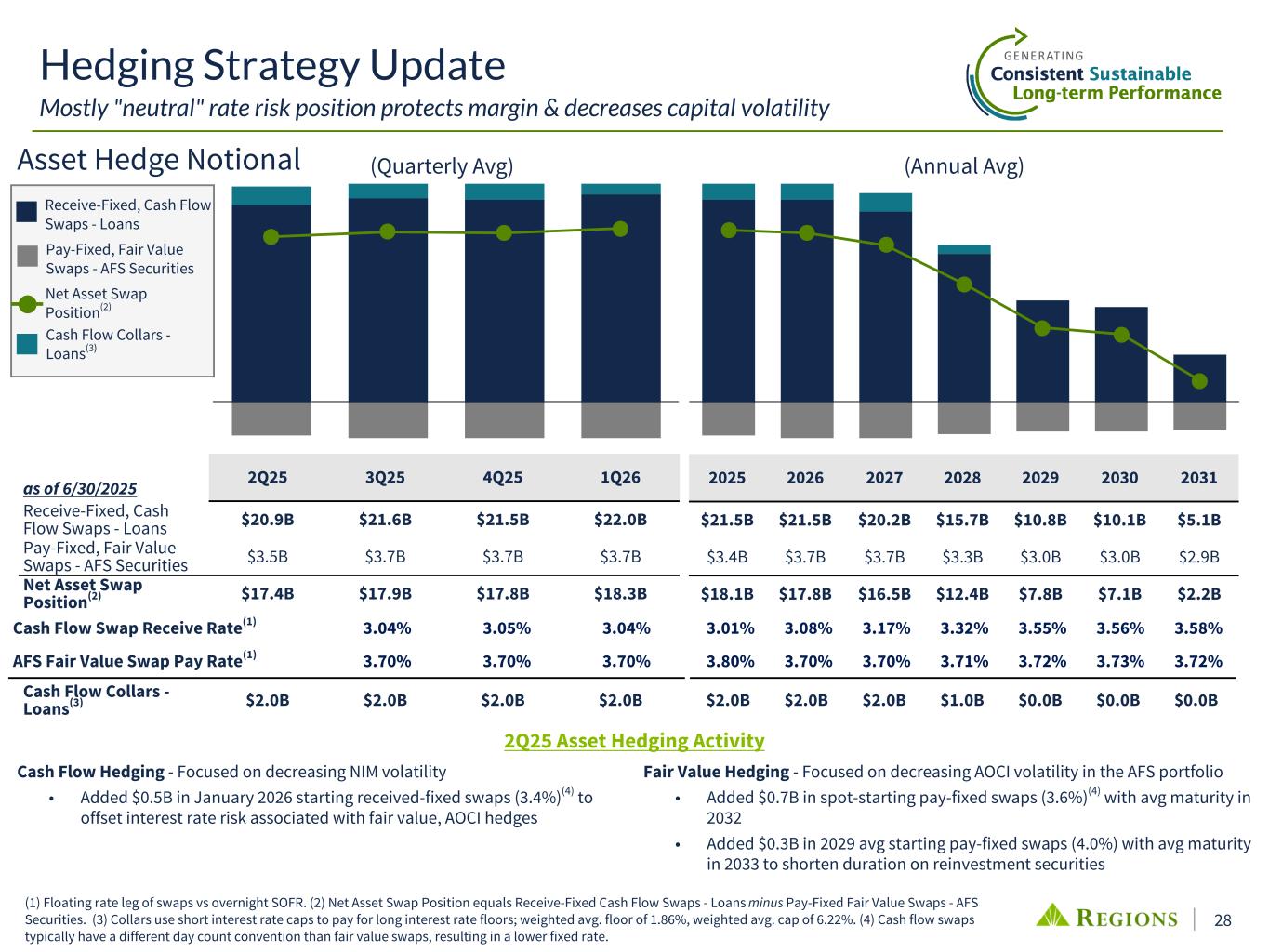

28 Asset Hedge Notional (1) Floating rate leg of swaps vs overnight SOFR. (2) Net Asset Swap Position equals Receive-Fixed Cash Flow Swaps - Loans minus Pay-Fixed Fair Value Swaps - AFS Securities. (3) Collars use short interest rate caps to pay for long interest rate floors; weighted avg. floor of 1.86%, weighted avg. cap of 6.22%. (4) Cash flow swaps typically have a different day count convention than fair value swaps, resulting in a lower fixed rate. (Quarterly Avg) 3.01% 3.08% 3.17% 3.32% 3.55% 3.56% 3.58% 3.80% 3.70% 3.70% 3.71% 3.72% 3.73% 3.72% 2025 2026 2027 2028 2029 2030 2031 $21.5B $21.5B $20.2B $15.7B $10.8B $10.1B $5.1B $3.4B $3.7B $3.7B $3.3B $3.0B $3.0B $2.9B $18.1B $17.8B $16.5B $12.4B $7.8B $7.1B $2.2B (Annual Avg) as of 6/30/2025 2Q25 3Q25 4Q25 1Q26 Receive-Fixed, Cash Flow Swaps - Loans $20.9B $21.6B $21.5B $22.0B Pay-Fixed, Fair Value Swaps - AFS Securities $3.5B $3.7B $3.7B $3.7B Net Asset Swap Position(2) $17.4B $17.9B $17.8B $18.3B Receive-Fixed, Cash Flow Swaps - Loans Cash Flow Swap Receive Rate(1) 3.04% 3.05% 3.04% AFS Fair Value Swap Pay Rate(1) 3.70% 3.70% 3.70% $2.0B $2.0B $2.0B $1.0B $0.0B $0.0B $0.0BCash Flow Collars - Loans(3) $2.0B $2.0B $2.0B $2.0B Cash Flow Collars - Loans(3) Hedging Strategy Update Mostly "neutral" rate risk position protects margin & decreases capital volatility Cash Flow Hedging - Focused on decreasing NIM volatility • Added $0.5B in January 2026 starting received-fixed swaps (3.4%)(4) to offset interest rate risk associated with fair value, AOCI hedges Pay-Fixed, Fair Value Swaps - AFS Securities Net Asset Swap Position(2) 2Q25 Asset Hedging Activity Fair Value Hedging - Focused on decreasing AOCI volatility in the AFS portfolio • Added $0.7B in spot-starting pay-fixed swaps (3.6%)(4) with avg maturity in 2032 • Added $0.3B in 2029 avg starting pay-fixed swaps (4.0%) with avg maturity in 2033 to shorten duration on reinvestment securities

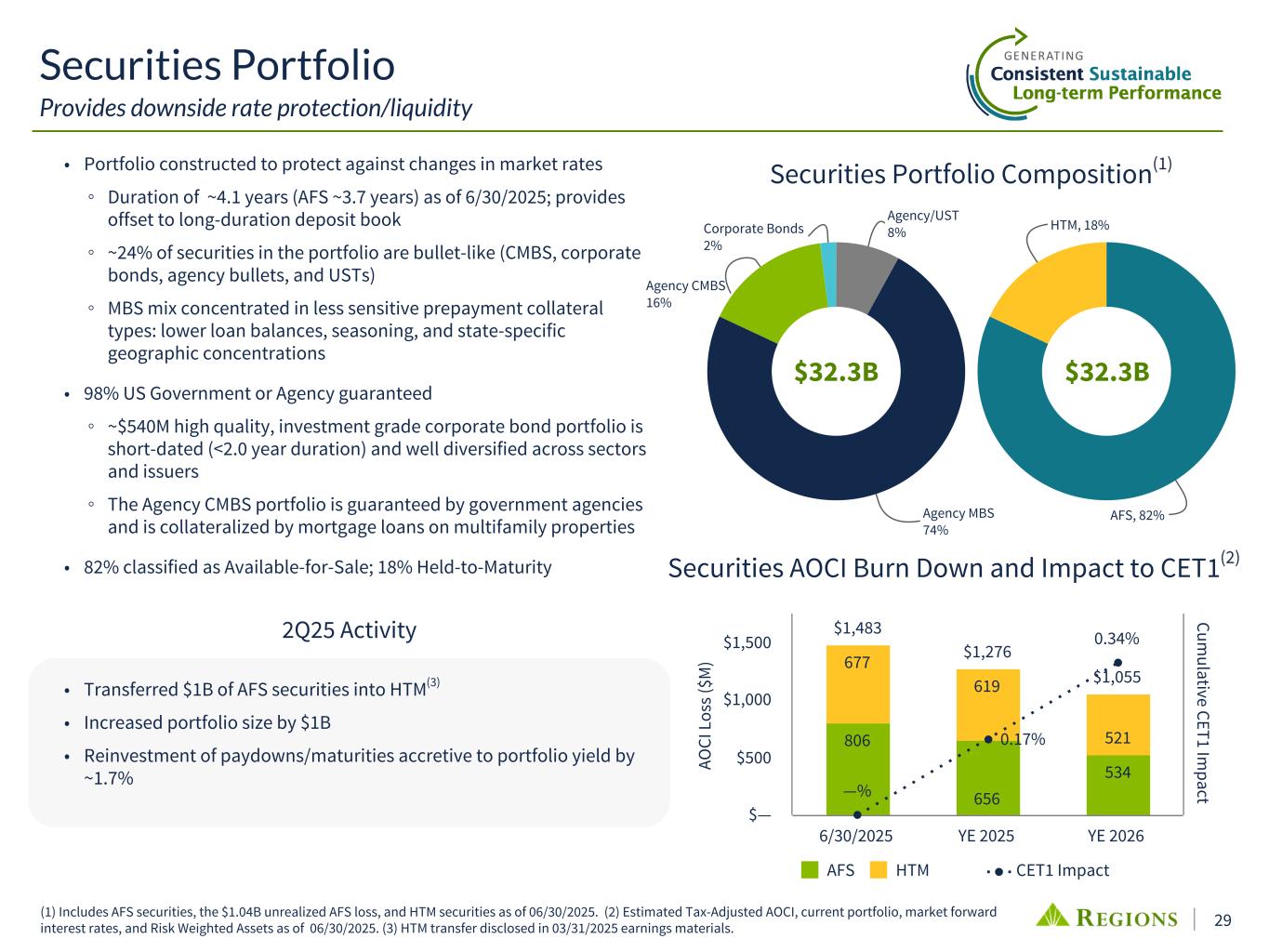

29 • Portfolio constructed to protect against changes in market rates ◦ Duration of ~4.1 years (AFS ~3.7 years) as of 6/30/2025; provides offset to long-duration deposit book ◦ ~24% of securities in the portfolio are bullet-like (CMBS, corporate bonds, agency bullets, and USTs) ◦ MBS mix concentrated in less sensitive prepayment collateral types: lower loan balances, seasoning, and state-specific geographic concentrations • 98% US Government or Agency guaranteed ◦ ~$540M high quality, investment grade corporate bond portfolio is short-dated (<2.0 year duration) and well diversified across sectors and issuers ◦ The Agency CMBS portfolio is guaranteed by government agencies and is collateralized by mortgage loans on multifamily properties • 82% classified as Available-for-Sale; 18% Held-to-Maturity • Transferred $1B of AFS securities into HTM(3) • Increased portfolio size by $1B • Reinvestment of paydowns/maturities accretive to portfolio yield by ~1.7% Agency/UST 8% Agency MBS 74% Agency CMBS 16% Corporate Bonds 2% Securities Portfolio Provides downside rate protection/liquidity Securities Portfolio Composition(1) $32.3B Securities AOCI Burn Down and Impact to CET1(2) AO CI L os s ( $M ) Cum ulative CET1 Im pact 806 656 534 677 619 521 $1,483 $1,276 $1,055 —% 0.17% 0.34% AFS HTM CET1 Impact 6/30/2025 YE 2025 YE 2026 $— $500 $1,000 $1,5002Q25 Activity AFS, 82% HTM, 18% (1) Includes AFS securities, the $1.04B unrealized AFS loss, and HTM securities as of 06/30/2025. (2) Estimated Tax-Adjusted AOCI, current portfolio, market forward interest rates, and Risk Weighted Assets as of 06/30/2025. (3) HTM transfer disclosed in 03/31/2025 earnings materials. $32.3B

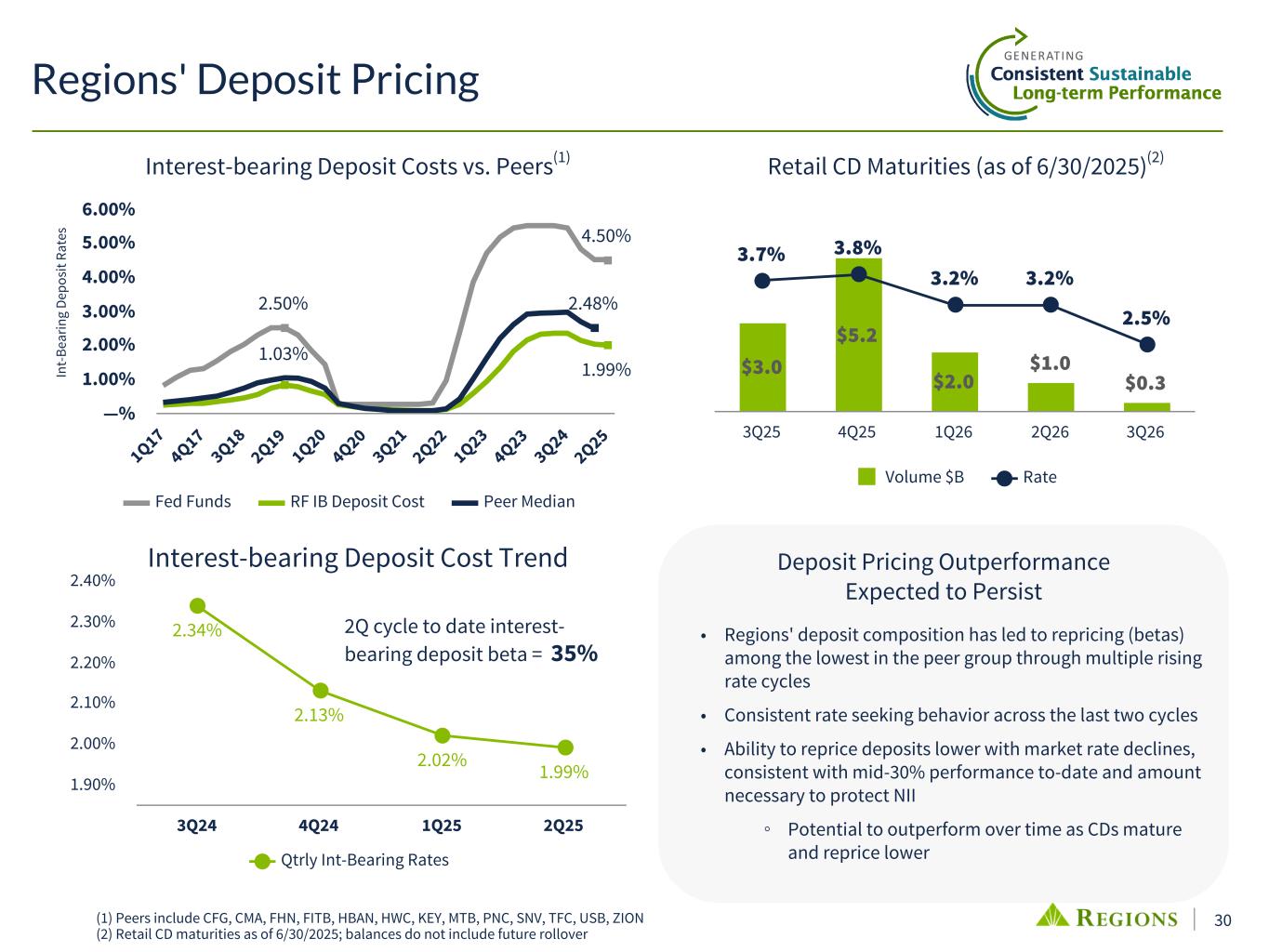

30 2.50% 4.50% 1.99% 1.03% 2.48% Fed Funds RF IB Deposit Cost Peer Median 1Q17 4Q17 3Q18 2Q19 1Q20 4Q20 3Q21 2Q22 1Q23 4Q23 3Q24 2Q25 —% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% (1) Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, TFC, USB, ZION (2) Retail CD maturities as of 6/30/2025; balances do not include future rollover Interest-bearing Deposit Costs vs. Peers(1) In t- Be ar in g De po si t R at es Regions' Deposit Pricing Deposit Pricing Outperformance Expected to Persist • Regions' deposit composition has led to repricing (betas) among the lowest in the peer group through multiple rising rate cycles • Consistent rate seeking behavior across the last two cycles • Ability to reprice deposits lower with market rate declines, consistent with mid-30% performance to-date and amount necessary to protect NII ◦ Potential to outperform over time as CDs mature and reprice lower $3.0 $5.2 $2.0 $1.0 $0.3 3.7% 3.8% 3.2% 3.2% 2.5% Volume $B Rate 3Q25 4Q25 1Q26 2Q26 3Q26 Retail CD Maturities (as of 6/30/2025)(2) 2.34% 2.13% 2.02% 1.99% Qtrly Int-Bearing Rates 3Q24 4Q24 1Q25 2Q25 1.90% 2.00% 2.10% 2.20% 2.30% 2.40% 2Q cycle to date interest- bearing deposit beta = 35% Interest-bearing Deposit Cost Trend

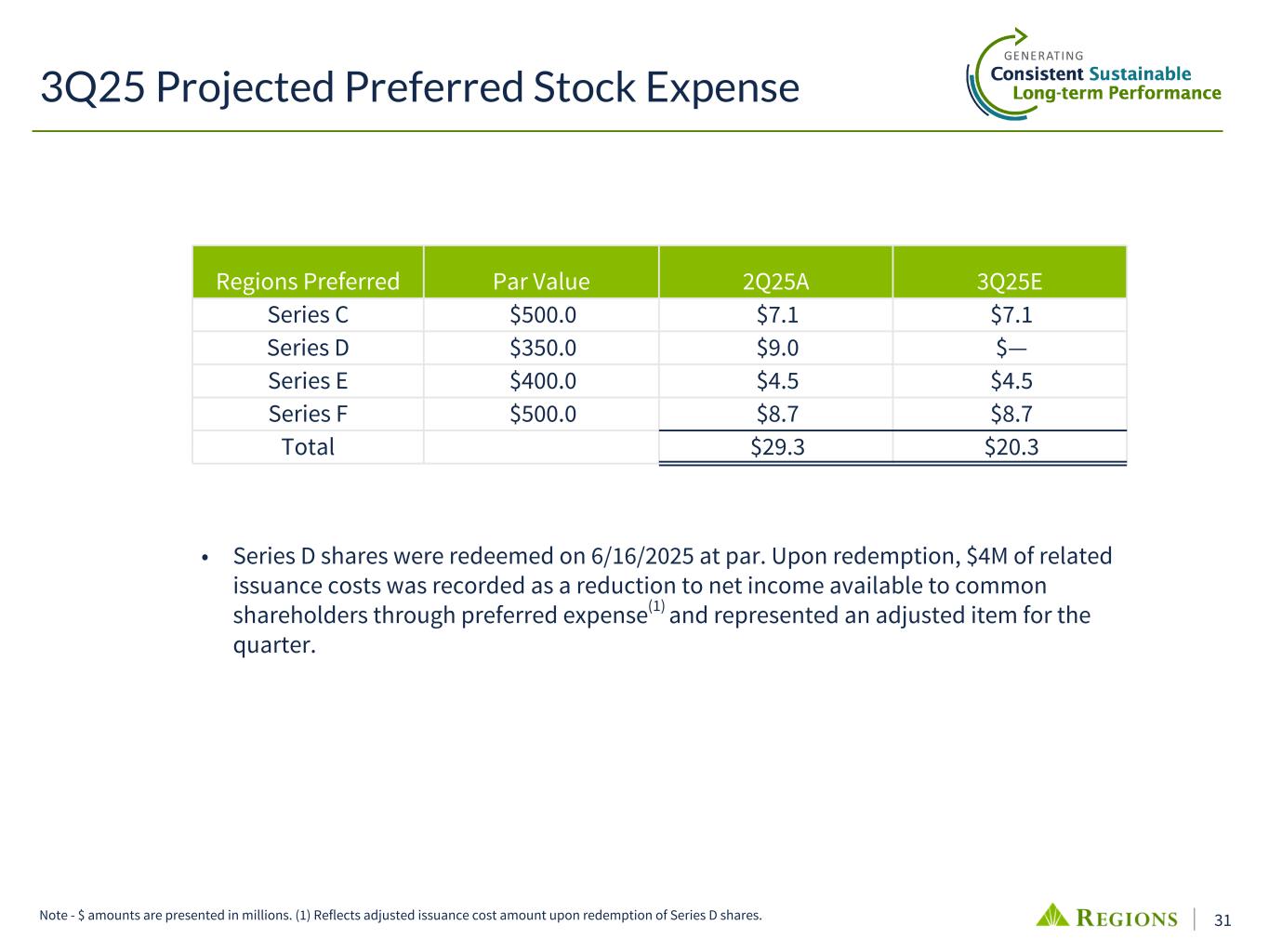

31 3Q25 Projected Preferred Stock Expense Regions Preferred Par Value 2Q25A 3Q25E Series C $500.0 $7.1 $7.1 Series D $350.0 $9.0 $— Series E $400.0 $4.5 $4.5 Series F $500.0 $8.7 $8.7 Total $29.3 $20.3 • Series D shares were redeemed on 6/16/2025 at par. Upon redemption, $4M of related issuance costs was recorded as a reduction to net income available to common shareholders through preferred expense(1) and represented an adjusted item for the quarter. Note - $ amounts are presented in millions. (1) Reflects adjusted issuance cost amount upon redemption of Series D shares.

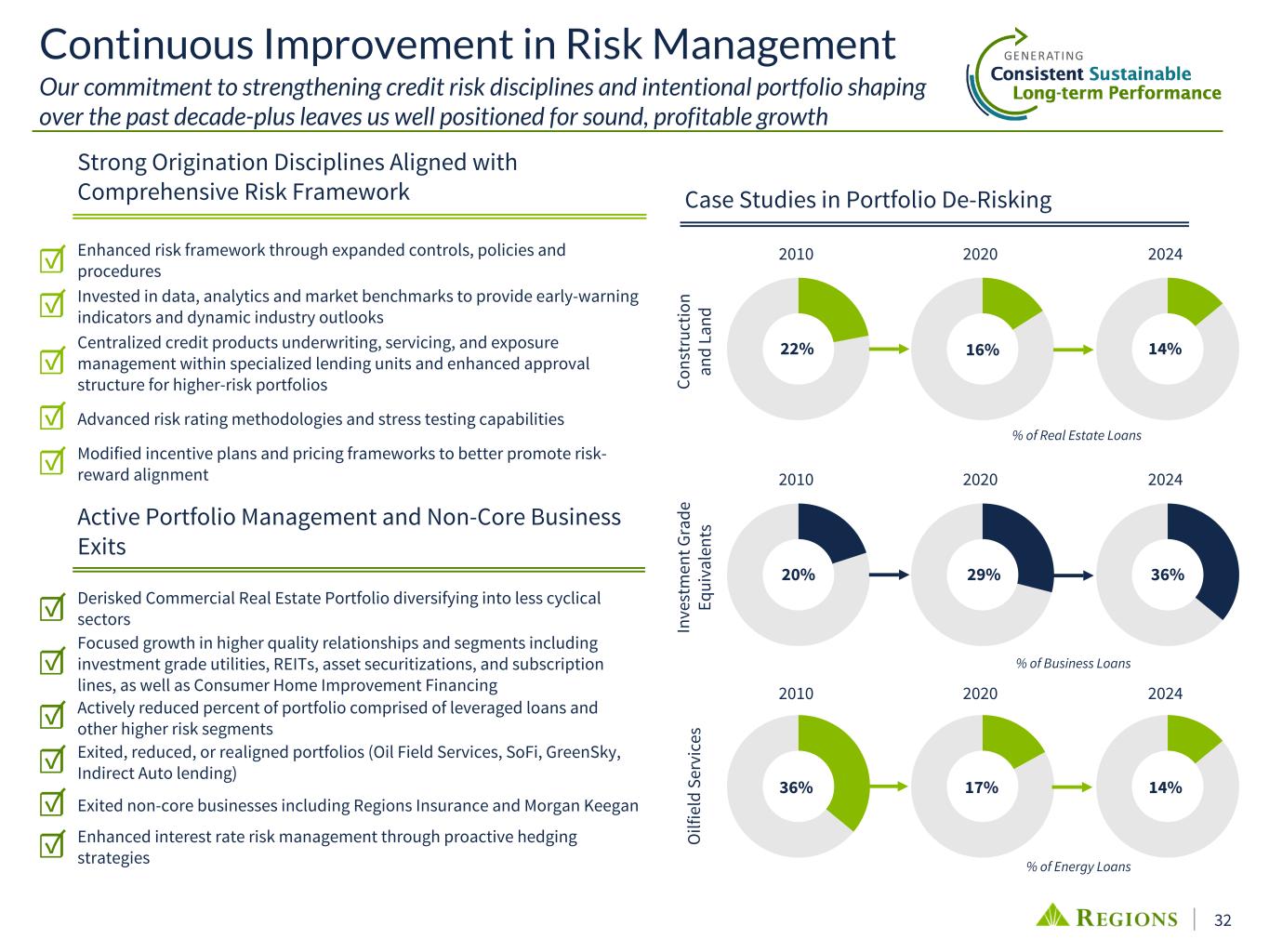

32 Continuous Improvement in Risk Management Our commitment to strengthening credit risk disciplines and intentional portfolio shaping over the past decade-plus leaves us well positioned for sound, profitable growth Strong Origination Disciplines Aligned with Comprehensive Risk Framework ☑ Enhanced risk framework through expanded controls, policies and procedures ☑ Invested in data, analytics and market benchmarks to provide early-warning indicators and dynamic industry outlooks ☑ Centralized credit products underwriting, servicing, and exposure management within specialized lending units and enhanced approval structure for higher-risk portfolios ☑ Advanced risk rating methodologies and stress testing capabilities ☑ Modified incentive plans and pricing frameworks to better promote risk- reward alignment Active Portfolio Management and Non-Core Business Exits ☑ Derisked Commercial Real Estate Portfolio diversifying into less cyclical sectors ☑ Focused growth in higher quality relationships and segments including investment grade utilities, REITs, asset securitizations, and subscription lines, as well as Consumer Home Improvement Financing ☑ Actively reduced percent of portfolio comprised of leveraged loans and other higher risk segments ☑ Exited, reduced, or realigned portfolios (Oil Field Services, SoFi, GreenSky, Indirect Auto lending) ☑ Exited non-core businesses including Regions Insurance and Morgan Keegan ☑ Enhanced interest rate risk management through proactive hedging strategies Case Studies in Portfolio De-Risking 22% 16% 14% Co ns tr uc tio n an d La nd 2010 2020 2024 2010 2020 2024 In ve st m en t G ra de Eq ui va le nt s O ilf ie ld S er vi ce s 20% 29% 36% 36% 17% 14% % of Real Estate Loans % of Business Loans % of Energy Loans 2010 2020 2024

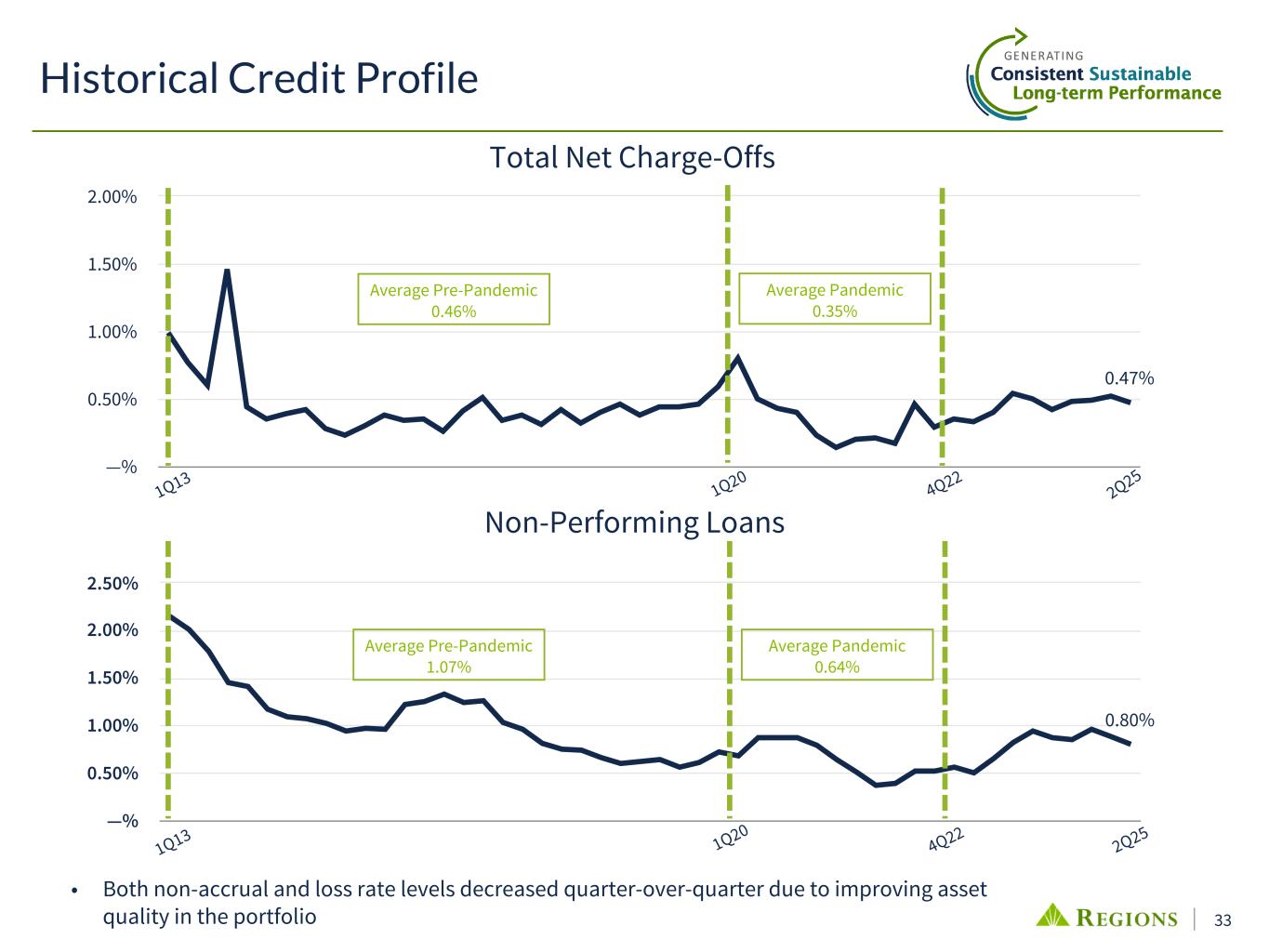

33 0.80% —% 0.50% 1.00% 1.50% 2.00% 2.50% 0.47% —% 0.50% 1.00% 1.50% 2.00% Historical Credit Profile Non-Performing Loans Total Net Charge-Offs 1Q20 2Q25 4Q221Q20 4Q22 2Q25 • Both non-accrual and loss rate levels decreased quarter-over-quarter due to improving asset quality in the portfolio Average Pre-Pandemic 0.46% Average Pandemic 0.35% Average Pre-Pandemic 1.07% Average Pandemic 0.64% 1Q13 1Q13

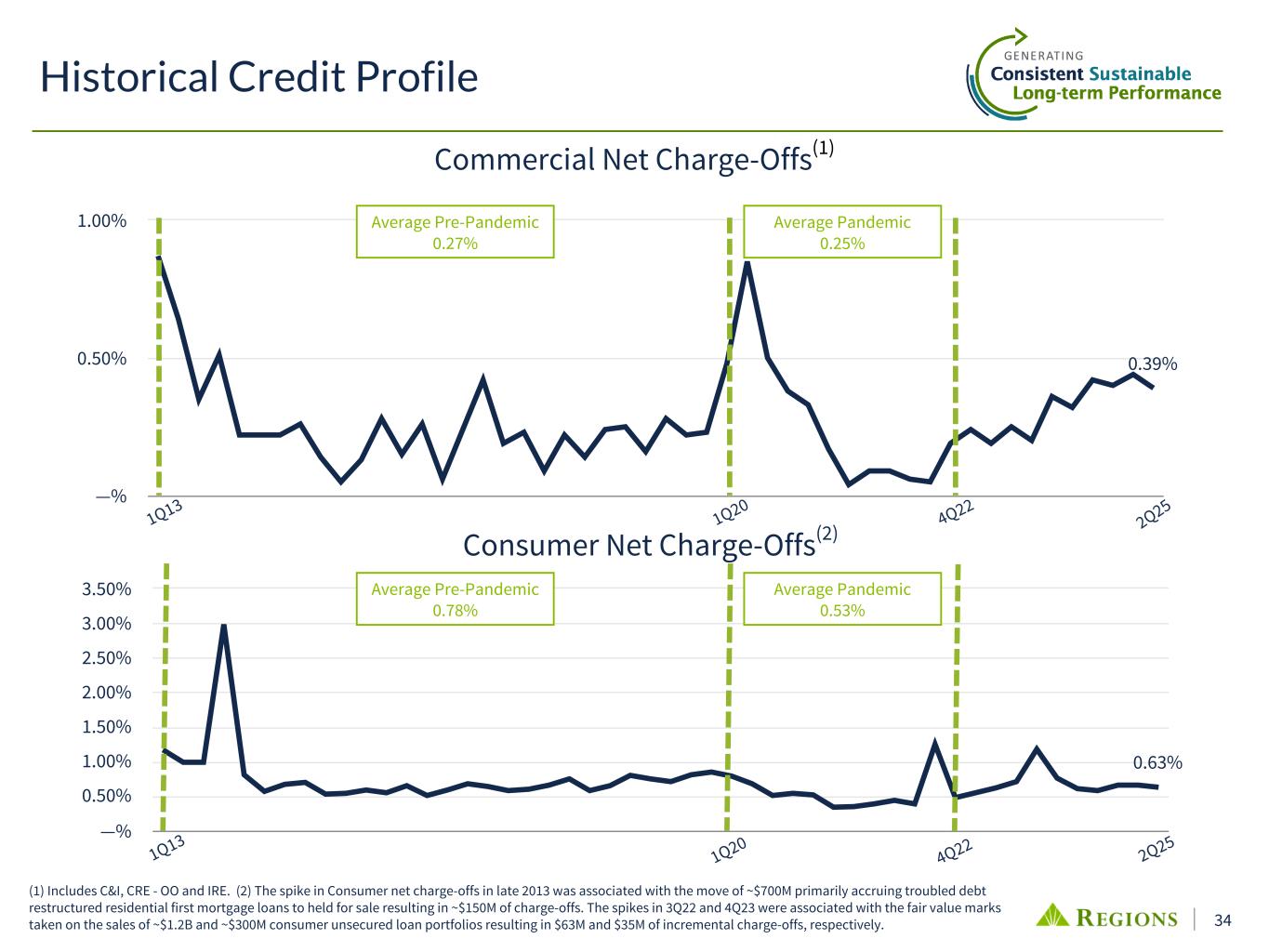

34 0.63% —% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 0.39% —% 0.50% 1.00% Consumer Net Charge-Offs(2) Commercial Net Charge-Offs(1) 1Q20 2Q25 4Q22 1Q20 4Q22 2Q25 (1) Includes C&I, CRE - OO and IRE. (2) The spike in Consumer net charge-offs in late 2013 was associated with the move of ~$700M primarily accruing troubled debt restructured residential first mortgage loans to held for sale resulting in ~$150M of charge-offs. The spikes in 3Q22 and 4Q23 were associated with the fair value marks taken on the sales of ~$1.2B and ~$300M consumer unsecured loan portfolios resulting in $63M and $35M of incremental charge-offs, respectively. Average Pre-Pandemic 0.27% Average Pandemic 0.25% Average Pre-Pandemic 0.78% Average Pandemic 0.53% 1Q13 1Q13 Historical Credit Profile

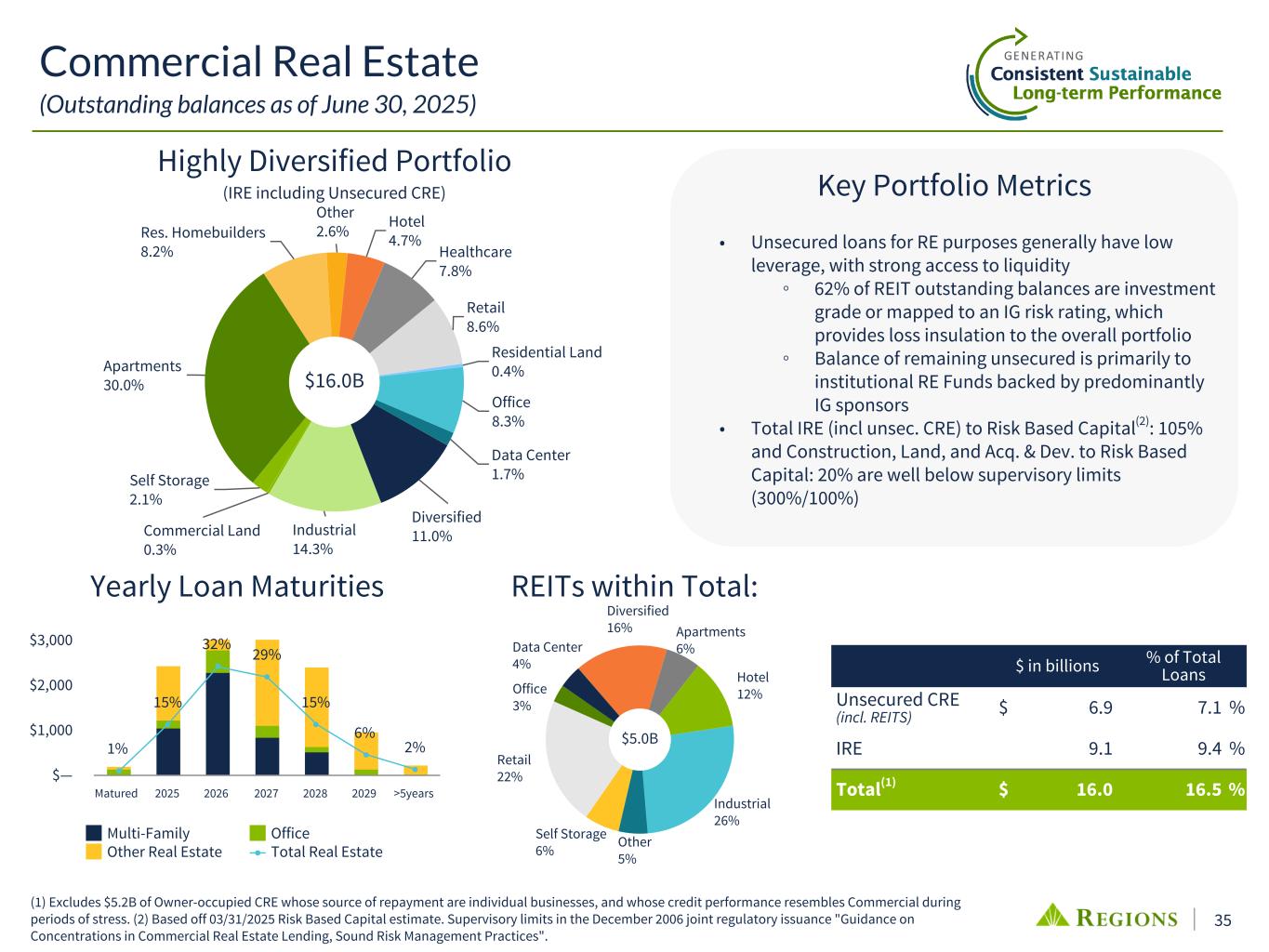

35 Commercial Real Estate (Outstanding balances as of June 30, 2025) Highly Diversified Portfolio (IRE including Unsecured CRE) (1) Excludes $5.2B of Owner-occupied CRE whose source of repayment are individual businesses, and whose credit performance resembles Commercial during periods of stress. (2) Based off 03/31/2025 Risk Based Capital estimate. Supervisory limits in the December 2006 joint regulatory issuance "Guidance on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices". Res. Homebuilders 8.2% Other 2.6% Hotel 4.7% Healthcare 7.8% Retail 8.6% Residential Land 0.4% Office 8.3% Data Center 1.7% Diversified 11.0%Industrial 14.3% Commercial Land 0.3% Self Storage 2.1% Apartments 30.0% $16.0B $ in billions % of Total Loans Unsecured CRE (incl. REITS) $ 6.9 7.1 % IRE 9.1 9.4 % Total(1) $ 16.0 16.5 % Yearly Loan Maturities 1% 15% 32% 29% 15% 6% 2% Multi-Family Office Other Real Estate Total Real Estate Matured 2025 2026 2027 2028 2029 >5years $— $1,000 $2,000 $3,000 Office 3% Data Center 4% Diversified 16% Apartments 6% Hotel 12% Industrial 26% Other 5% Self Storage 6% Retail 22% REITs within Total: $5.0B • Unsecured loans for RE purposes generally have low leverage, with strong access to liquidity ◦ 62% of REIT outstanding balances are investment grade or mapped to an IG risk rating, which provides loss insulation to the overall portfolio ◦ Balance of remaining unsecured is primarily to institutional RE Funds backed by predominantly IG sponsors • Total IRE (incl unsec. CRE) to Risk Based Capital(2): 105% and Construction, Land, and Acq. & Dev. to Risk Based Capital: 20% are well below supervisory limits (300%/100%) Key Portfolio Metrics

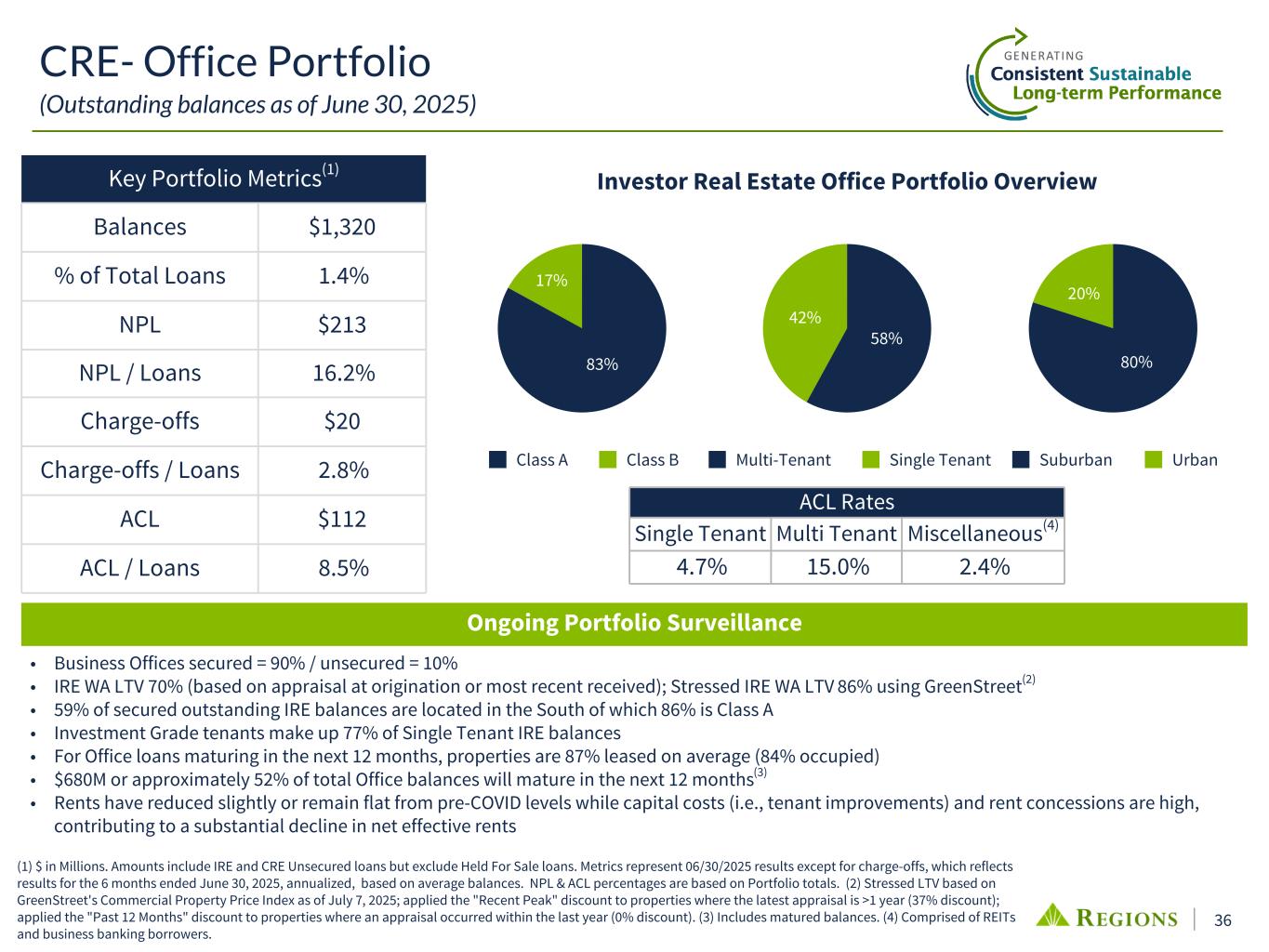

36 CRE- Office Portfolio (Outstanding balances as of June 30, 2025) (1) $ in Millions. Amounts include IRE and CRE Unsecured loans but exclude Held For Sale loans. Metrics represent 06/30/2025 results except for charge-offs, which reflects results for the 6 months ended June 30, 2025, annualized, based on average balances. NPL & ACL percentages are based on Portfolio totals. (2) Stressed LTV based on GreenStreet's Commercial Property Price Index as of July 7, 2025; applied the "Recent Peak" discount to properties where the latest appraisal is >1 year (37% discount); applied the "Past 12 Months" discount to properties where an appraisal occurred within the last year (0% discount). (3) Includes matured balances. (4) Comprised of REITs and business banking borrowers. • Business Offices secured = 90% / unsecured = 10% • IRE WA LTV 70% (based on appraisal at origination or most recent received); Stressed IRE WA LTV 86% using GreenStreet(2) • 59% of secured outstanding IRE balances are located in the South of which 86% is Class A • Investment Grade tenants make up 77% of Single Tenant IRE balances • For Office loans maturing in the next 12 months, properties are 87% leased on average (84% occupied) • $680M or approximately 52% of total Office balances will mature in the next 12 months(3) • Rents have reduced slightly or remain flat from pre-COVID levels while capital costs (i.e., tenant improvements) and rent concessions are high, contributing to a substantial decline in net effective rents Key Portfolio Metrics(1) Balances $1,320 % of Total Loans 1.4% NPL $213 NPL / Loans 16.2% Charge-offs $20 Charge-offs / Loans 2.8% ACL $112 ACL / Loans 8.5% Ongoing Portfolio Surveillance 58% 42% Multi-Tenant Single Tenant 83% 17% Class A Class B Investor Real Estate Office Portfolio Overview 80% 20% Suburban Urban ACL Rates Single Tenant Multi Tenant Miscellaneous(4) 4.7% 15.0% 2.4%

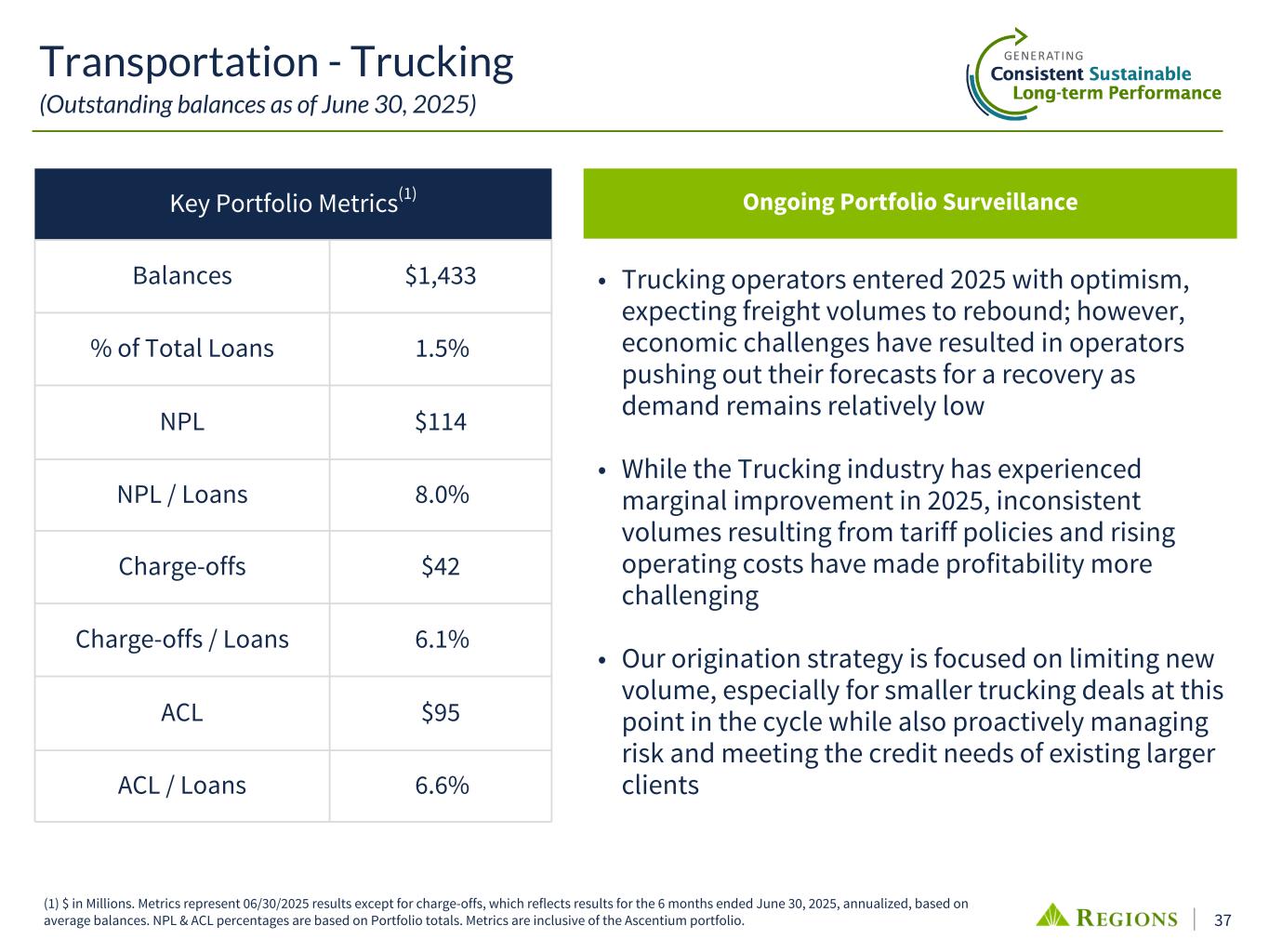

37 Transportation - Trucking (Outstanding balances as of June 30, 2025) (1) $ in Millions. Metrics represent 06/30/2025 results except for charge-offs, which reflects results for the 6 months ended June 30, 2025, annualized, based on average balances. NPL & ACL percentages are based on Portfolio totals. Metrics are inclusive of the Ascentium portfolio. Key Portfolio Metrics(1) Balances $1,433 % of Total Loans 1.5% NPL $114 NPL / Loans 8.0% Charge-offs $42 Charge-offs / Loans 6.1% ACL $95 ACL / Loans 6.6% • Trucking operators entered 2025 with optimism, expecting freight volumes to rebound; however, economic challenges have resulted in operators pushing out their forecasts for a recovery as demand remains relatively low • While the Trucking industry has experienced marginal improvement in 2025, inconsistent volumes resulting from tariff policies and rising operating costs have made profitability more challenging • Our origination strategy is focused on limiting new volume, especially for smaller trucking deals at this point in the cycle while also proactively managing risk and meeting the credit needs of existing larger clients Ongoing Portfolio Surveillance

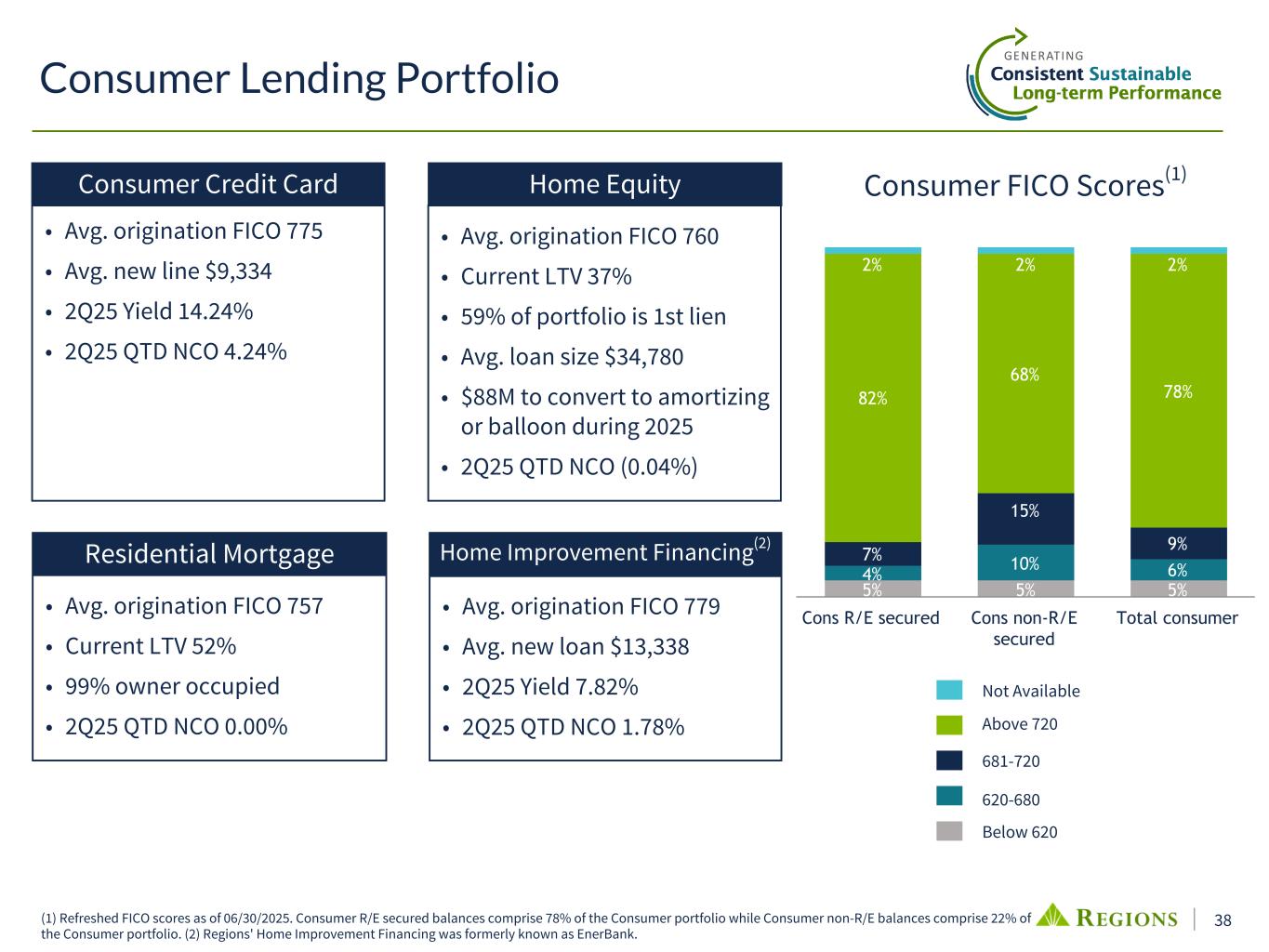

38 Consumer Lending Portfolio • Avg. origination FICO 757 • Current LTV 52% • 99% owner occupied • 2Q25 QTD NCO 0.00% • Avg. origination FICO 760 • Current LTV 37% • 59% of portfolio is 1st lien • Avg. loan size $34,780 • $88M to convert to amortizing or balloon during 2025 • 2Q25 QTD NCO (0.04%) • Avg. origination FICO 779 • Avg. new loan $13,338 • 2Q25 Yield 7.82% • 2Q25 QTD NCO 1.78% • • Avg. origination FICO 775 • Avg. new line $9,334 • 2Q25 Yield 14.24% • 2Q25 QTD NCO 4.24% 5% 5% 5% 4% 10% 6% 7% 15% 9% 82% 68% 78% 2% 2% 2% Cons R/E secured Cons non-R/E secured Total consumer Not Available Above 720 620-680 Below 620 681-720 Consumer FICO Scores(1) (1) Refreshed FICO scores as of 06/30/2025. Consumer R/E secured balances comprise 78% of the Consumer portfolio while Consumer non-R/E balances comprise 22% of the Consumer portfolio. (2) Regions' Home Improvement Financing was formerly known as EnerBank. Residential Mortgage Consumer Credit Card Home Equity Home Improvement Financing(2)

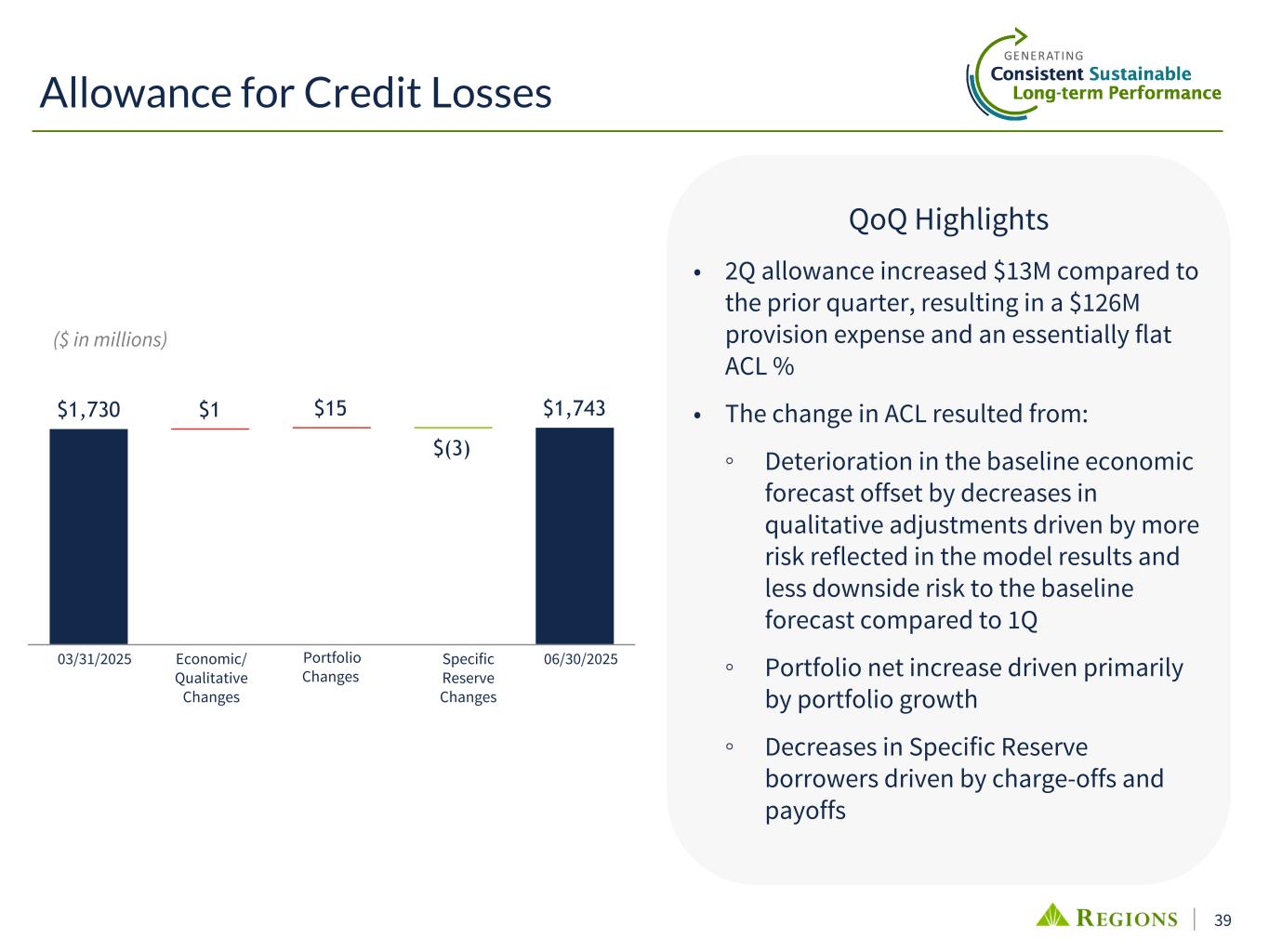

39 QoQ Highlights • 2Q allowance increased $13M compared to the prior quarter, resulting in a $126M provision expense and an essentially flat ACL % • The change in ACL resulted from: ◦ Deterioration in the baseline economic forecast offset by decreases in qualitative adjustments driven by more risk reflected in the model results and less downside risk to the baseline forecast compared to 1Q ◦ Portfolio net increase driven primarily by portfolio growth ◦ Decreases in Specific Reserve borrowers driven by charge-offs and payoffs $1,730 $1 $15 $(3) $1,743 Allowance for Credit Losses 06/30/2025 ($ in millions) 03/31/2025 Portfolio Changes Specific Reserve Changes Economic/ Qualitative Changes

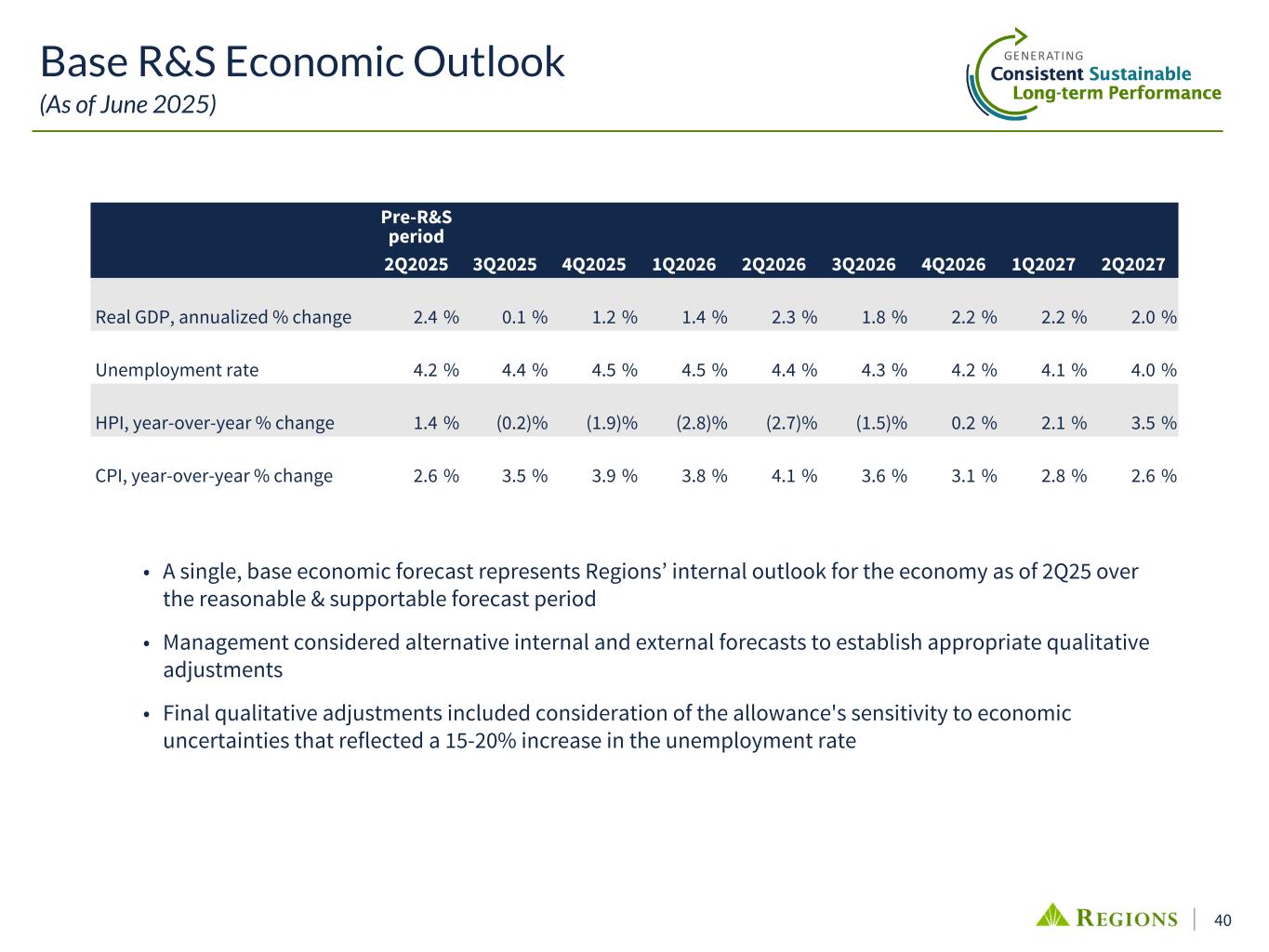

40 Pre-R&S period 2Q2025 3Q2025 4Q2025 1Q2026 2Q2026 3Q2026 4Q2026 1Q2027 2Q2027 Real GDP, annualized % change 2.4 % 0.1 % 1.2 % 1.4 % 2.3 % 1.8 % 2.2 % 2.2 % 2.0 % Unemployment rate 4.2 % 4.4 % 4.5 % 4.5 % 4.4 % 4.3 % 4.2 % 4.1 % 4.0 % HPI, year-over-year % change 1.4 % (0.2) % (1.9) % (2.8) % (2.7) % (1.5) % 0.2 % 2.1 % 3.5 % CPI, year-over-year % change 2.6 % 3.5 % 3.9 % 3.8 % 4.1 % 3.6 % 3.1 % 2.8 % 2.6 % Base R&S Economic Outlook (As of June 2025) • A single, base economic forecast represents Regions’ internal outlook for the economy as of 2Q25 over the reasonable & supportable forecast period • Management considered alternative internal and external forecasts to establish appropriate qualitative adjustments • Final qualitative adjustments included consideration of the allowance's sensitivity to economic uncertainties that reflected a 15-20% increase in the unemployment rate

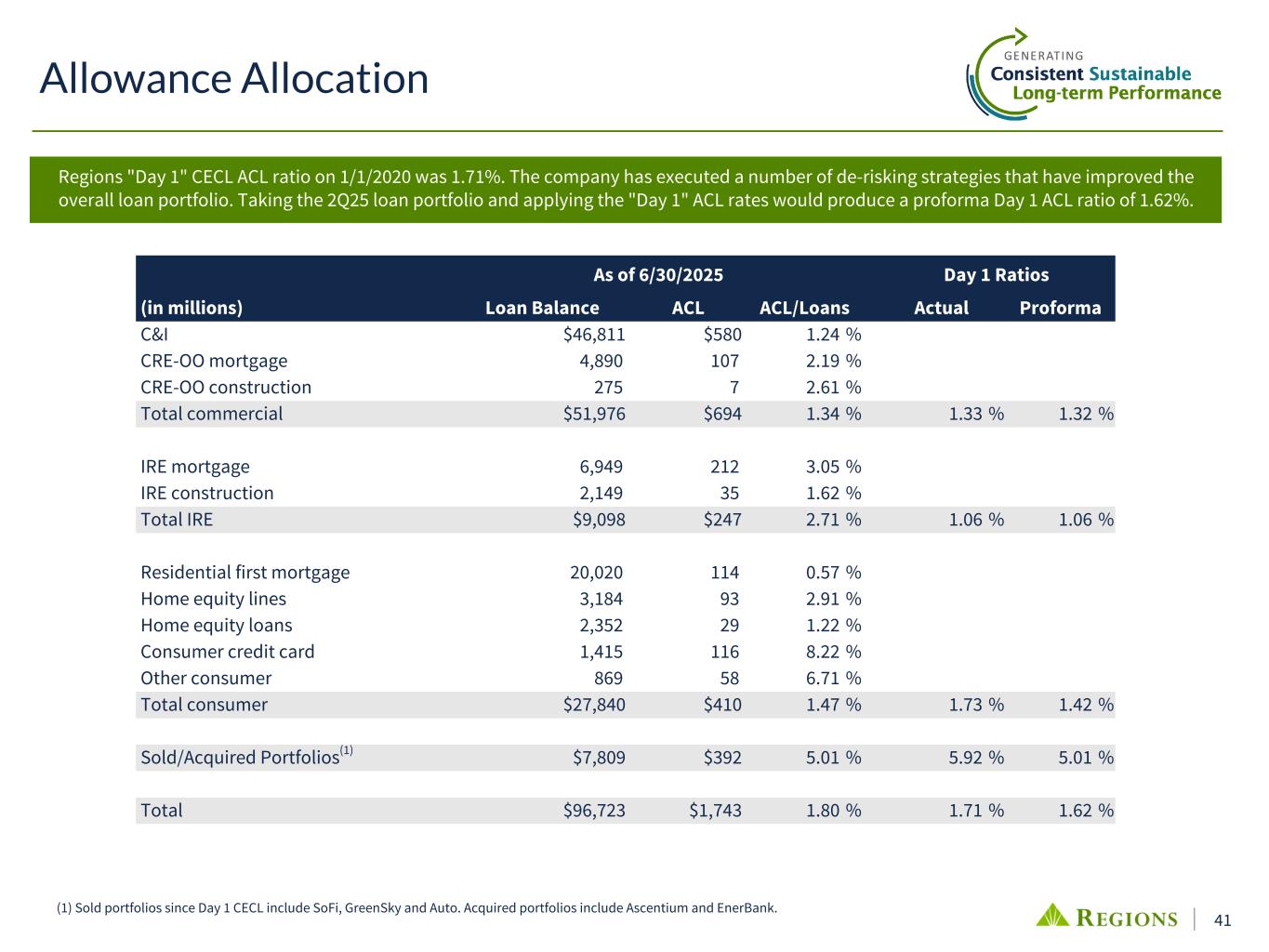

41 As of 6/30/2025 Day 1 Ratios (in millions) Loan Balance ACL ACL/Loans Actual Proforma C&I $46,811 $580 1.24 % CRE-OO mortgage 4,890 107 2.19 % CRE-OO construction 275 7 2.61 % Total commercial $51,976 $694 1.34 % 1.33 % 1.32 % IRE mortgage 6,949 212 3.05 % IRE construction 2,149 35 1.62 % Total IRE $9,098 $247 2.71 % 1.06 % 1.06 % Residential first mortgage 20,020 114 0.57 % Home equity lines 3,184 93 2.91 % Home equity loans 2,352 29 1.22 % Consumer credit card 1,415 116 8.22 % Other consumer 869 58 6.71 % Total consumer $27,840 $410 1.47 % 1.73 % 1.42 % Sold/Acquired Portfolios(1) $7,809 $392 5.01 % 5.92 % 5.01 % Total $96,723 $1,743 1.80 % 1.71 % 1.62 % Allowance Allocation Regions "Day 1" CECL ACL ratio on 1/1/2020 was 1.71%. The company has executed a number of de-risking strategies that have improved the overall loan portfolio. Taking the 2Q25 loan portfolio and applying the "Day 1" ACL rates would produce a proforma Day 1 ACL ratio of 1.62%. (1) Sold portfolios since Day 1 CECL include SoFi, GreenSky and Auto. Acquired portfolios include Ascentium and EnerBank.

42 Management uses computations of earnings and certain other financial measures, which exclude certain adjustments that are included in the financial results presented in accordance with GAAP, to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non-interest expense (non-GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Net loan charge-offs (GAAP) are presented excluding adjustments to arrive at adjusted net loan-charge offs (non-GAAP). Adjusted net loan charge-offs as a percentage of average loans (non-GAAP) are calculated as adjusted net loan charge-offs (non-GAAP) divided by average loans (GAAP) and annualized. Regions believes that the exclusion of these adjustments provides a meaningful basis for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Tangible common book value per share is calculated by dividing tangible common shareholders' equity (non·GAAP) by tangible assets (non-GAAP). The numerator for tangible book value per share (non·GAAP), tangible common shareholders' equity (non·GAAP), is calculated by excluding intangible assets and the deferred tax liability related to intangible assets from common shareholders' equity (GAAP). The denominator for tangible book value per share (non-GAAP), tangible assets (non-GAAP), is calculated by excluding intangible assets and the deferred tax liability related to intangible assets from total assets (non-GAAP). Tangible common shareholders’ equity, tangible common book value per share, and return on average tangible common shareholders' equity (ROATCE) ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common shareholders’ equity measure. Because tangible common shareholders’ equity, tangible common book value per share, and ROATCE are not formally defined by GAAP or prescribed in any amount by federal banking regulations they are currently considered to be non-GAAP financial measures and other entities may calculate them differently than Regions’ disclosed calculations. Adjustments to shareholders' equity include intangible assets and related deferred taxes and preferred stock. Additionally, adjustments to ROATCE include accumulated other comprehensive income. The Company also presents accumulated other comprehensive income excluding adjustments to arrive at adjusted accumulated other comprehensive income (non-GAAP). Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common shareholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. CET1 is a capital adequacy measure established by federal banking regulators under the Basel III framework. Banking institutions that meet requirements under the regulations are required to maintain certain minimum capital requirements, including a minimum CET1 ratio. This measure is utilized by analysts and banking regulators to assess Regions’ capital adequacy. Under the framework, Regions elected to remove the effects of certain portions of AOCI in the calculation of CET1. Adjustments to the calculation prescribed in federal banking regulations are considered to be non-GAAP financial measures. Adjustments to CET1 include certain portions of AOCI to arrive at CET1 inclusive of AOCI (non-GAAP), which is a potential impact under recent proposed rulemaking standards. Since analysts and banking regulators may assess Regions’ capital adequacy using proposed rulemaking standards, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to shareholders. Additionally, our non-GAAP financial measures may not be comparable to similar non- GAAP financial measures used by other companies and there is no certainty that we will not incur expenses in the future that are similar to those excluded in the calculations of non-GAAP financial measures presented herein. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance • Metrics for incentive compensation Non-GAAP Information

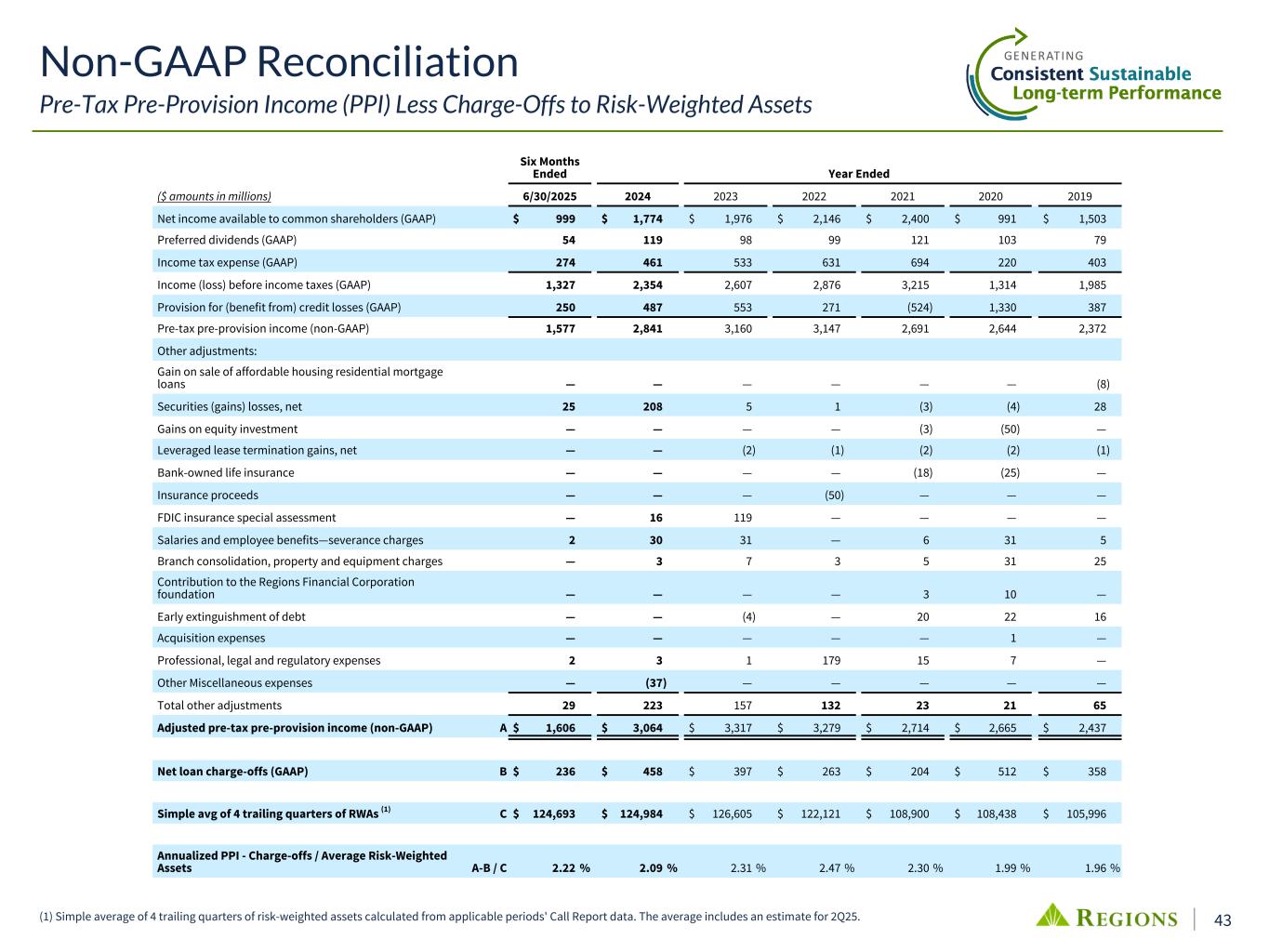

43(1) Simple average of 4 trailing quarters of risk-weighted assets calculated from applicable periods' Call Report data. The average includes an estimate for 2Q25. Six Months Ended Year Ended ($ amounts in millions) 6/30/2025 2024 2023 2022 2021 2020 2019 Net income available to common shareholders (GAAP) $ 999 $ 1,774 $ 1,976 $ 2,146 $ 2,400 $ 991 $ 1,503 Preferred dividends (GAAP) 54 119 98 99 121 103 79 Income tax expense (GAAP) 274 461 533 631 694 220 403 Income (loss) before income taxes (GAAP) 1,327 2,354 2,607 2,876 3,215 1,314 1,985 Provision for (benefit from) credit losses (GAAP) 250 487 553 271 (524) 1,330 387 Pre-tax pre-provision income (non-GAAP) 1,577 2,841 3,160 3,147 2,691 2,644 2,372 Other adjustments: Gain on sale of affordable housing residential mortgage loans — — — — — — (8) Securities (gains) losses, net 25 208 5 1 (3) (4) 28 Gains on equity investment — — — — (3) (50) — Leveraged lease termination gains, net — — (2) (1) (2) (2) (1) Bank-owned life insurance — — — — (18) (25) — Insurance proceeds — — — (50) — — — FDIC insurance special assessment — 16 119 — — — — Salaries and employee benefits—severance charges 2 30 31 — 6 31 5 Branch consolidation, property and equipment charges — 3 7 3 5 31 25 Contribution to the Regions Financial Corporation foundation — — — — 3 10 — Early extinguishment of debt — — (4) — 20 22 16 Acquisition expenses — — — — — 1 — Professional, legal and regulatory expenses 2 3 1 179 15 7 — Other Miscellaneous expenses — (37) — — — — — Total other adjustments 29 223 157 132 23 21 65 Adjusted pre-tax pre-provision income (non-GAAP) A $ 1,606 $ 3,064 $ 3,317 $ 3,279 $ 2,714 $ 2,665 $ 2,437 Net loan charge-offs (GAAP) B $ 236 $ 458 $ 397 $ 263 $ 204 $ 512 $ 358 Simple avg of 4 trailing quarters of RWAs (1) C $ 124,693 $ 124,984 $ 126,605 $ 122,121 $ 108,900 $ 108,438 $ 105,996 Annualized PPI - Charge-offs / Average Risk-Weighted Assets A-B / C 2.22 % 2.09 % 2.31 % 2.47 % 2.30 % 1.99 % 1.96 % Non-GAAP Reconciliation Pre-Tax Pre-Provision Income (PPI) Less Charge-Offs to Risk-Weighted Assets

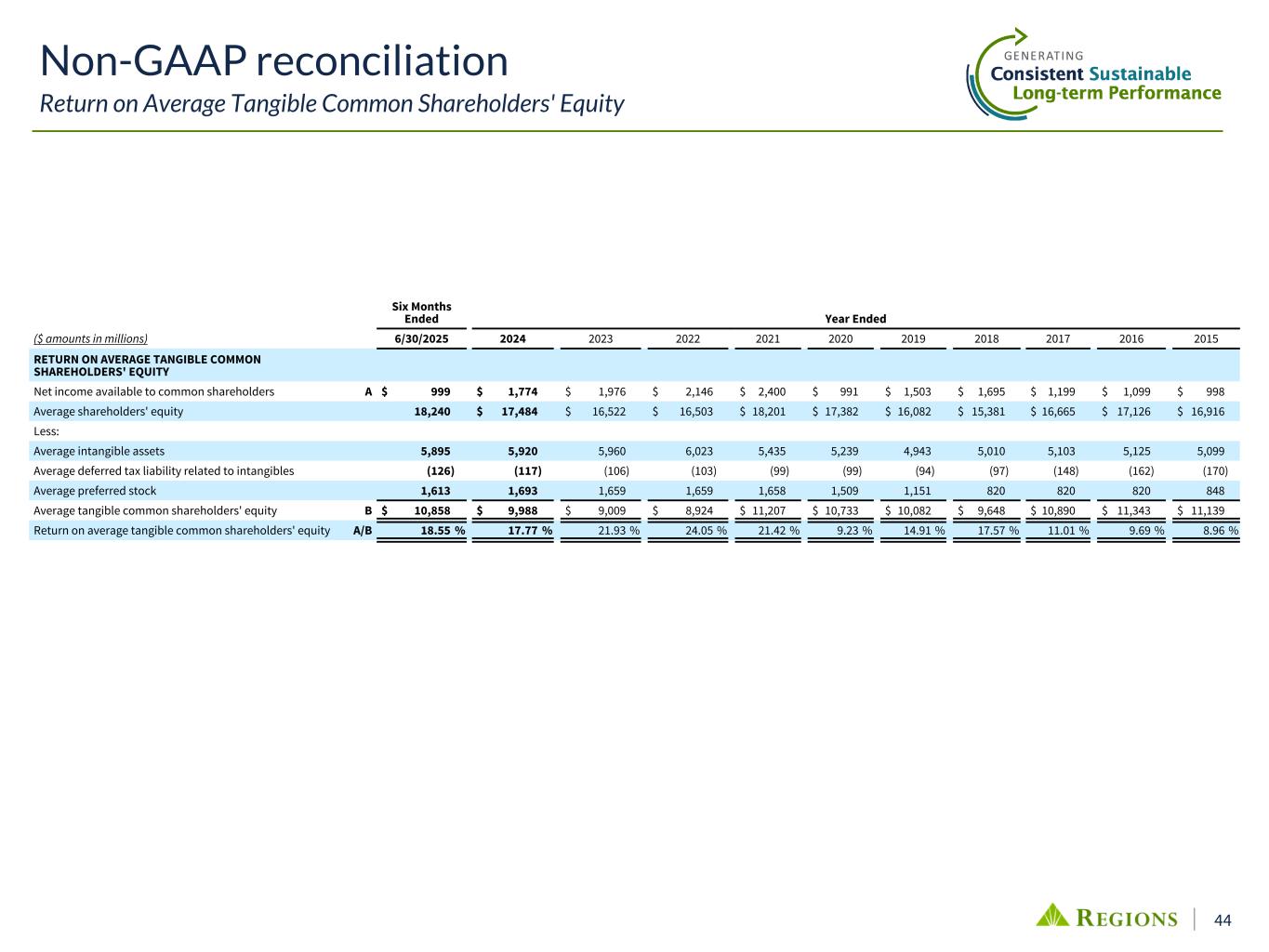

44 Non-GAAP reconciliation Return on Average Tangible Common Shareholders' Equity Six Months Ended Year Ended ($ amounts in millions) 6/30/2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 RETURN ON AVERAGE TANGIBLE COMMON SHAREHOLDERS' EQUITY Net income available to common shareholders A $ 999 $ 1,774 $ 1,976 $ 2,146 $ 2,400 $ 991 $ 1,503 $ 1,695 $ 1,199 $ 1,099 $ 998 Average shareholders' equity 18,240 $ 17,484 $ 16,522 $ 16,503 $ 18,201 $ 17,382 $ 16,082 $ 15,381 $ 16,665 $ 17,126 $ 16,916 Less: Average intangible assets 5,895 5,920 5,960 6,023 5,435 5,239 4,943 5,010 5,103 5,125 5,099 Average deferred tax liability related to intangibles (126) (117) (106) (103) (99) (99) (94) (97) (148) (162) (170) Average preferred stock 1,613 1,693 1,659 1,659 1,658 1,509 1,151 820 820 820 848 Average tangible common shareholders' equity B $ 10,858 $ 9,988 $ 9,009 $ 8,924 $ 11,207 $ 10,733 $ 10,082 $ 9,648 $ 10,890 $ 11,343 $ 11,139 Return on average tangible common shareholders' equity A/B 18.55 % 17.77 % 21.93 % 24.05 % 21.42 % 9.23 % 14.91 % 17.57 % 11.01 % 9.69 % 8.96 %

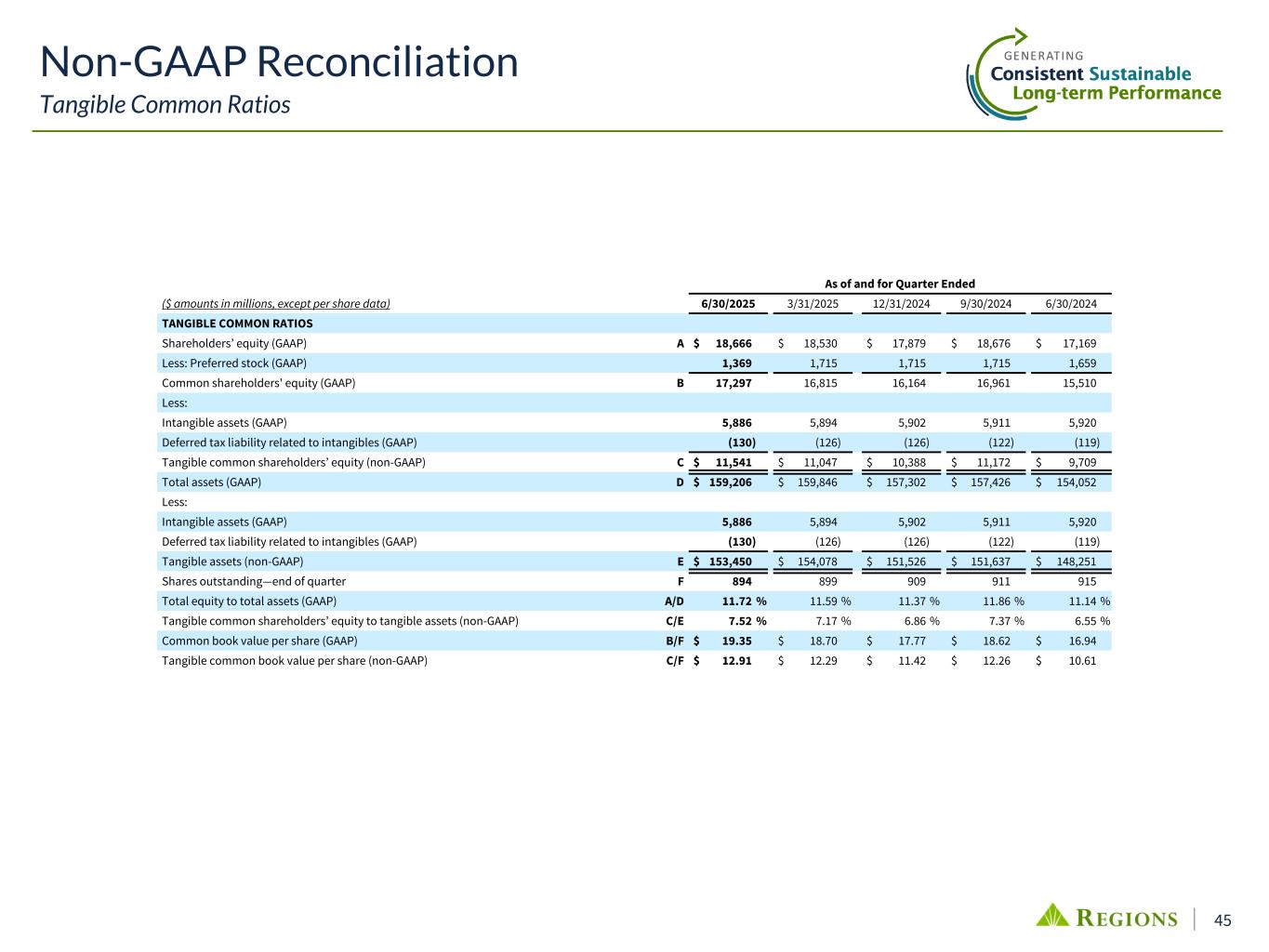

45 As of and for Quarter Ended ($ amounts in millions, except per share data) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 6/30/2024 TANGIBLE COMMON RATIOS Shareholders’ equity (GAAP) A $ 18,666 $ 18,530 $ 17,879 $ 18,676 $ 17,169 Less: Preferred stock (GAAP) 1,369 1,715 1,715 1,715 1,659 Common shareholders' equity (GAAP) B 17,297 16,815 16,164 16,961 15,510 Less: Intangible assets (GAAP) 5,886 5,894 5,902 5,911 5,920 Deferred tax liability related to intangibles (GAAP) (130) (126) (126) (122) (119) Tangible common shareholders’ equity (non-GAAP) C $ 11,541 $ 11,047 $ 10,388 $ 11,172 $ 9,709 Total assets (GAAP) D $ 159,206 $ 159,846 $ 157,302 $ 157,426 $ 154,052 Less: Intangible assets (GAAP) 5,886 5,894 5,902 5,911 5,920 Deferred tax liability related to intangibles (GAAP) (130) (126) (126) (122) (119) Tangible assets (non-GAAP) E $ 153,450 $ 154,078 $ 151,526 $ 151,637 $ 148,251 Shares outstanding—end of quarter F 894 899 909 911 915 Total equity to total assets (GAAP) A/D 11.72 % 11.59 % 11.37 % 11.86 % 11.14 % Tangible common shareholders’ equity to tangible assets (non-GAAP) C/E 7.52 % 7.17 % 6.86 % 7.37 % 6.55 % Common book value per share (GAAP) B/F $ 19.35 $ 18.70 $ 17.77 $ 18.62 $ 16.94 Tangible common book value per share (non-GAAP) C/F $ 12.91 $ 12.29 $ 11.42 $ 12.26 $ 10.61 Non-GAAP Reconciliation Tangible Common Ratios

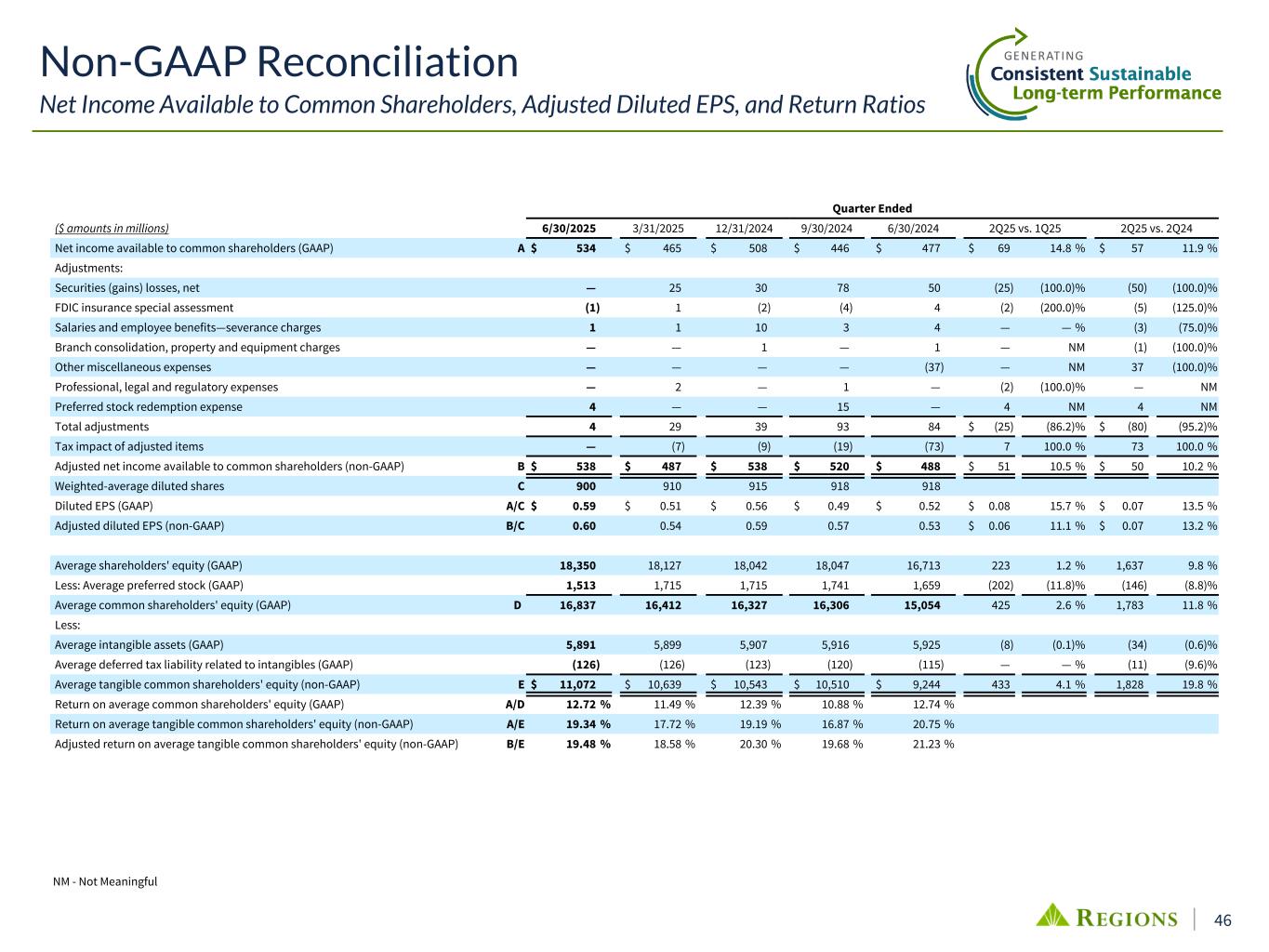

46 Non-GAAP Reconciliation Net Income Available to Common Shareholders, Adjusted Diluted EPS, and Return Ratios NM - Not Meaningful Quarter Ended ($ amounts in millions) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 6/30/2024 2Q25 vs. 1Q25 2Q25 vs. 2Q24 Net income available to common shareholders (GAAP) A $ 534 $ 465 $ 508 $ 446 $ 477 $ 69 14.8 % $ 57 11.9 % Adjustments: Securities (gains) losses, net — 25 30 78 50 (25) (100.0) % (50) (100.0) % FDIC insurance special assessment (1) 1 (2) (4) 4 (2) (200.0) % (5) (125.0) % Salaries and employee benefits—severance charges 1 1 10 3 4 — — % (3) (75.0) % Branch consolidation, property and equipment charges — — 1 — 1 — NM (1) (100.0) % Other miscellaneous expenses — — — — (37) — NM 37 (100.0) % Professional, legal and regulatory expenses — 2 — 1 — (2) (100.0) % — NM Preferred stock redemption expense 4 — — 15 — 4 NM 4 NM Total adjustments 4 29 39 93 84 $ (25) (86.2) % $ (80) (95.2) % Tax impact of adjusted items — (7) (9) (19) (73) 7 100.0 % 73 100.0 % Adjusted net income available to common shareholders (non-GAAP) B $ 538 $ 487 $ 538 $ 520 $ 488 $ 51 10.5 % $ 50 10.2 % Weighted-average diluted shares C 900 910 915 918 918 Diluted EPS (GAAP) A/C $ 0.59 $ 0.51 $ 0.56 $ 0.49 $ 0.52 $ 0.08 15.7 % $ 0.07 13.5 % Adjusted diluted EPS (non-GAAP) B/C 0.60 0.54 0.59 0.57 0.53 $ 0.06 11.1 % $ 0.07 13.2 % Average shareholders' equity (GAAP) 18,350 18,127 18,042 18,047 16,713 223 1.2 % 1,637 9.8 % Less: Average preferred stock (GAAP) 1,513 1,715 1,715 1,741 1,659 (202) (11.8) % (146) (8.8) % Average common shareholders' equity (GAAP) D 16,837 16,412 16,327 16,306 15,054 425 2.6 % 1,783 11.8 % Less: Average intangible assets (GAAP) 5,891 5,899 5,907 5,916 5,925 (8) (0.1) % (34) (0.6) % Average deferred tax liability related to intangibles (GAAP) (126) (126) (123) (120) (115) — — % (11) (9.6) % Average tangible common shareholders' equity (non-GAAP) E $ 11,072 $ 10,639 $ 10,543 $ 10,510 $ 9,244 433 4.1 % 1,828 19.8 % Return on average common shareholders' equity (GAAP) A/D 12.72 % 11.49 % 12.39 % 10.88 % 12.74 % Return on average tangible common shareholders' equity (non-GAAP) A/E 19.34 % 17.72 % 19.19 % 16.87 % 20.75 % Adjusted return on average tangible common shareholders' equity (non-GAAP) B/E 19.48 % 18.58 % 20.30 % 19.68 % 21.23 %

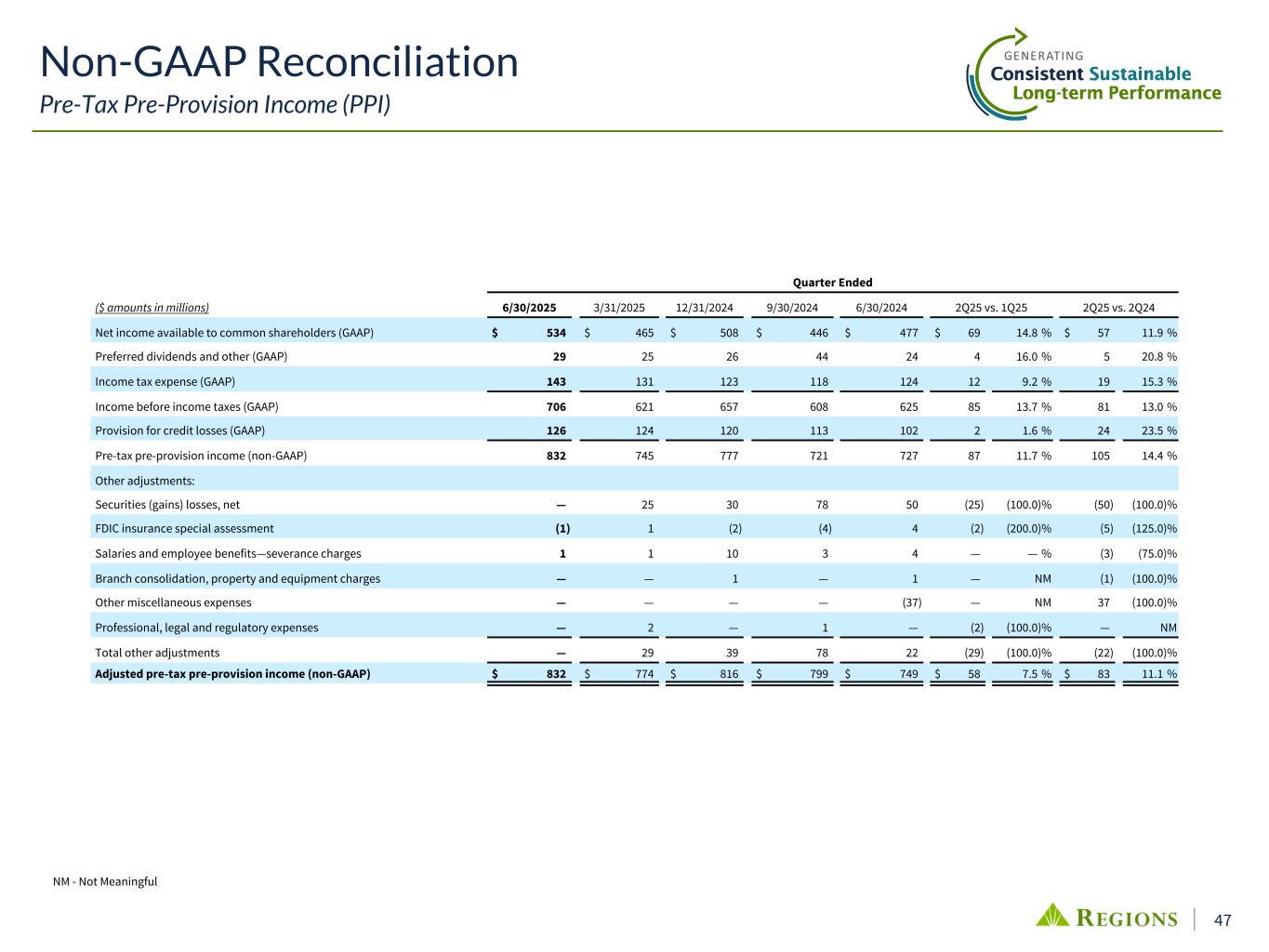

47 Non-GAAP Reconciliation Pre-Tax Pre-Provision Income (PPI) Quarter Ended ($ amounts in millions) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 6/30/2024 2Q25 vs. 1Q25 2Q25 vs. 2Q24 Net income available to common shareholders (GAAP) $ 534 $ 465 $ 508 $ 446 $ 477 $ 69 14.8 % $ 57 11.9 % Preferred dividends and other (GAAP) 29 25 26 44 24 4 16.0 % 5 20.8 % Income tax expense (GAAP) 143 131 123 118 124 12 9.2 % 19 15.3 % Income before income taxes (GAAP) 706 621 657 608 625 85 13.7 % 81 13.0 % Provision for credit losses (GAAP) 126 124 120 113 102 2 1.6 % 24 23.5 % Pre-tax pre-provision income (non-GAAP) 832 745 777 721 727 87 11.7 % 105 14.4 % Other adjustments: Securities (gains) losses, net — 25 30 78 50 (25) (100.0) % (50) (100.0) % FDIC insurance special assessment (1) 1 (2) (4) 4 (2) (200.0) % (5) (125.0) % Salaries and employee benefits—severance charges 1 1 10 3 4 — — % (3) (75.0) % Branch consolidation, property and equipment charges — — 1 — 1 — NM (1) (100.0) % Other miscellaneous expenses — — — — (37) — NM 37 (100.0) % Professional, legal and regulatory expenses — 2 — 1 — (2) (100.0) % — NM Total other adjustments — 29 39 78 22 (29) (100.0) % (22) (100.0) % Adjusted pre-tax pre-provision income (non-GAAP) $ 832 $ 774 $ 816 $ 799 $ 749 $ 58 7.5 % $ 83 11.1 % NM - Not Meaningful

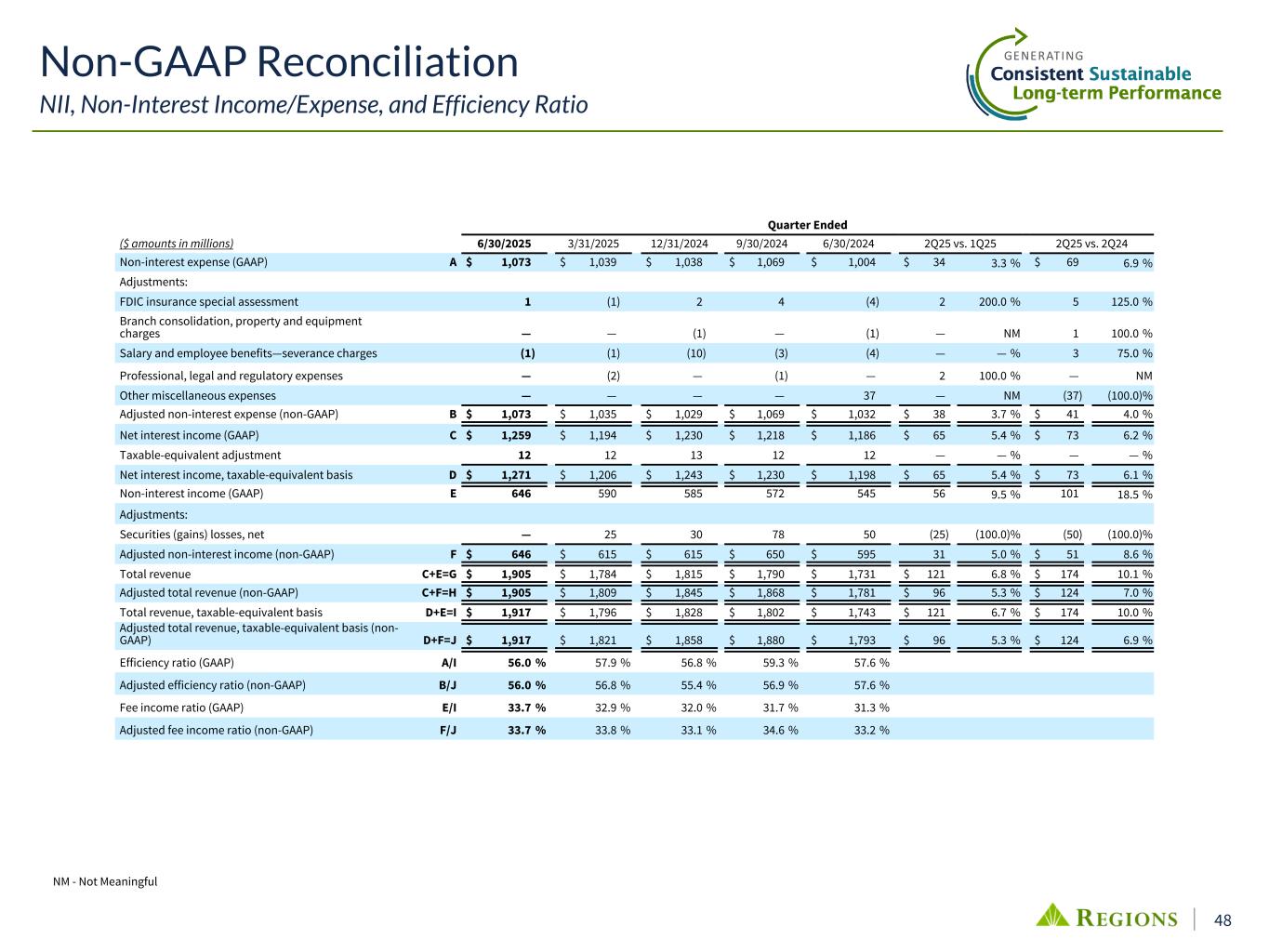

48 Non-GAAP Reconciliation NII, Non-Interest Income/Expense, and Efficiency Ratio NM - Not Meaningful Quarter Ended ($ amounts in millions) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 6/30/2024 2Q25 vs. 1Q25 2Q25 vs. 2Q24 Non-interest expense (GAAP) A $ 1,073 $ 1,039 $ 1,038 $ 1,069 $ 1,004 $ 34 3.3 % $ 69 6.9 % Adjustments: FDIC insurance special assessment 1 (1) 2 4 (4) 2 200.0 % 5 125.0 % Branch consolidation, property and equipment charges — — (1) — (1) — NM 1 100.0 % Salary and employee benefits—severance charges (1) (1) (10) (3) (4) — — % 3 75.0 % Professional, legal and regulatory expenses — (2) — (1) — 2 100.0 % — NM Other miscellaneous expenses — — — — 37 — NM (37) (100.0) % Adjusted non-interest expense (non-GAAP) B $ 1,073 $ 1,035 $ 1,029 $ 1,069 $ 1,032 $ 38 3.7 % $ 41 4.0 % Net interest income (GAAP) C $ 1,259 $ 1,194 $ 1,230 $ 1,218 $ 1,186 $ 65 5.4 % $ 73 6.2 % Taxable-equivalent adjustment 12 12 13 12 12 — — % — — % Net interest income, taxable-equivalent basis D $ 1,271 $ 1,206 $ 1,243 $ 1,230 $ 1,198 $ 65 5.4 % $ 73 6.1 % Non-interest income (GAAP) E 646 590 585 572 545 56 9.5 % 101 18.5 % Adjustments: Securities (gains) losses, net — 25 30 78 50 (25) (100.0) % (50) (100.0) % Adjusted non-interest income (non-GAAP) F $ 646 $ 615 $ 615 $ 650 $ 595 31 5.0 % $ 51 8.6 % Total revenue C+E=G $ 1,905 $ 1,784 $ 1,815 $ 1,790 $ 1,731 $ 121 6.8 % $ 174 10.1 % Adjusted total revenue (non-GAAP) C+F=H $ 1,905 $ 1,809 $ 1,845 $ 1,868 $ 1,781 $ 96 5.3 % $ 124 7.0 % Total revenue, taxable-equivalent basis D+E=I $ 1,917 $ 1,796 $ 1,828 $ 1,802 $ 1,743 $ 121 6.7 % $ 174 10.0 % Adjusted total revenue, taxable-equivalent basis (non- GAAP) D+F=J $ 1,917 $ 1,821 $ 1,858 $ 1,880 $ 1,793 $ 96 5.3 % $ 124 6.9 % Efficiency ratio (GAAP) A/I 56.0 % 57.9 % 56.8 % 59.3 % 57.6 % Adjusted efficiency ratio (non-GAAP) B/J 56.0 % 56.8 % 55.4 % 56.9 % 57.6 % Fee income ratio (GAAP) E/I 33.7 % 32.9 % 32.0 % 31.7 % 31.3 % Adjusted fee income ratio (non-GAAP) F/J 33.7 % 33.8 % 33.1 % 34.6 % 33.2 %

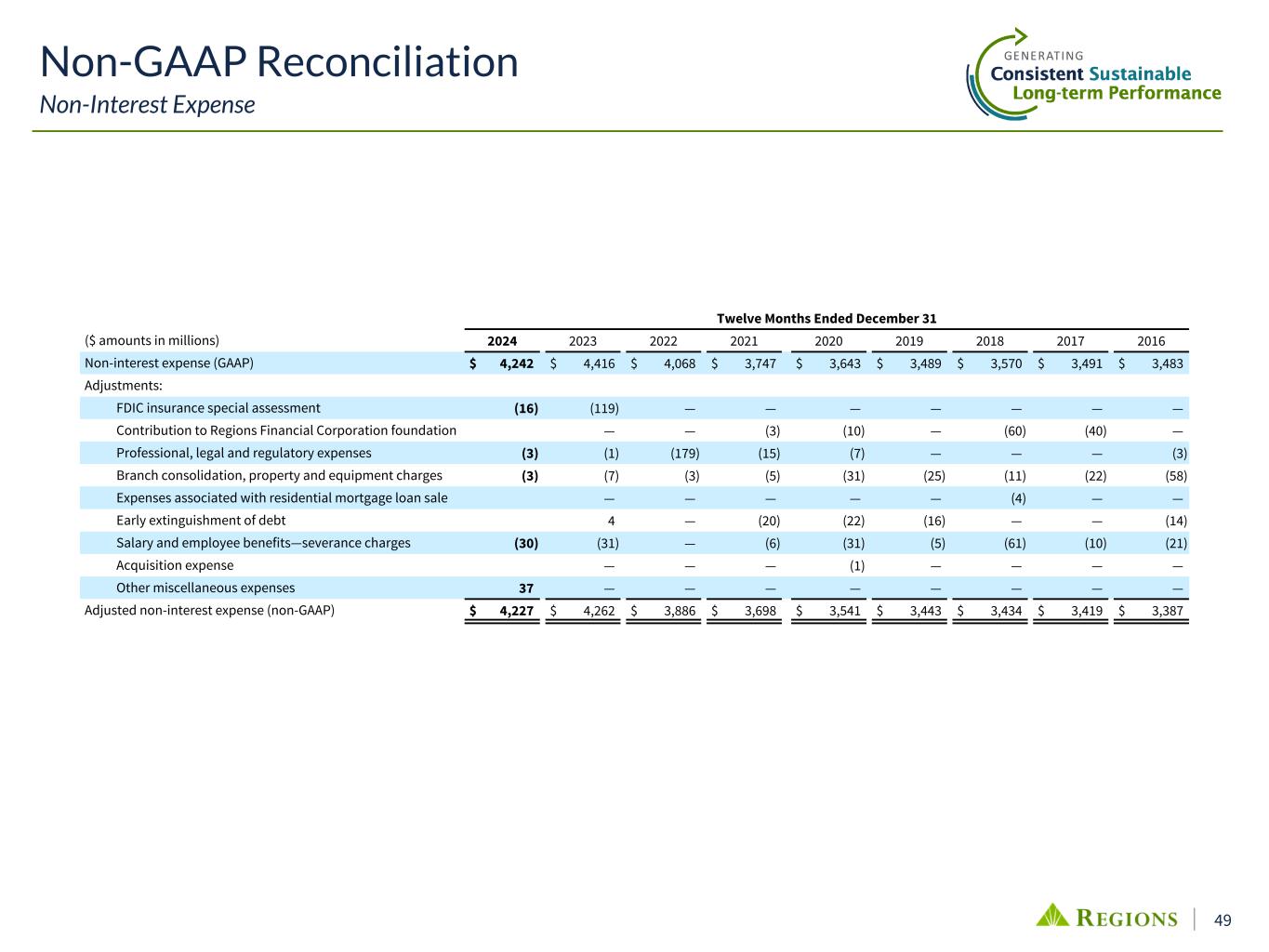

49 Non-GAAP Reconciliation Non-Interest Expense Twelve Months Ended December 31 ($ amounts in millions) 2024 2023 2022 2021 2020 2019 2018 2017 2016 Non-interest expense (GAAP) $ 4,242 $ 4,416 $ 4,068 $ 3,747 $ 3,643 $ 3,489 $ 3,570 $ 3,491 $ 3,483 Adjustments: FDIC insurance special assessment (16) (119) — — — — — — — Contribution to Regions Financial Corporation foundation — — (3) (10) — (60) (40) — Professional, legal and regulatory expenses (3) (1) (179) (15) (7) — — — (3) Branch consolidation, property and equipment charges (3) (7) (3) (5) (31) (25) (11) (22) (58) Expenses associated with residential mortgage loan sale — — — — — (4) — — Early extinguishment of debt 4 — (20) (22) (16) — — (14) Salary and employee benefits—severance charges (30) (31) — (6) (31) (5) (61) (10) (21) Acquisition expense — — — (1) — — — — Other miscellaneous expenses 37 — — — — — — — — Adjusted non-interest expense (non-GAAP) $ 4,227 $ 4,262 $ 3,886 $ 3,698 $ 3,541 $ 3,443 $ 3,434 $ 3,419 $ 3,387

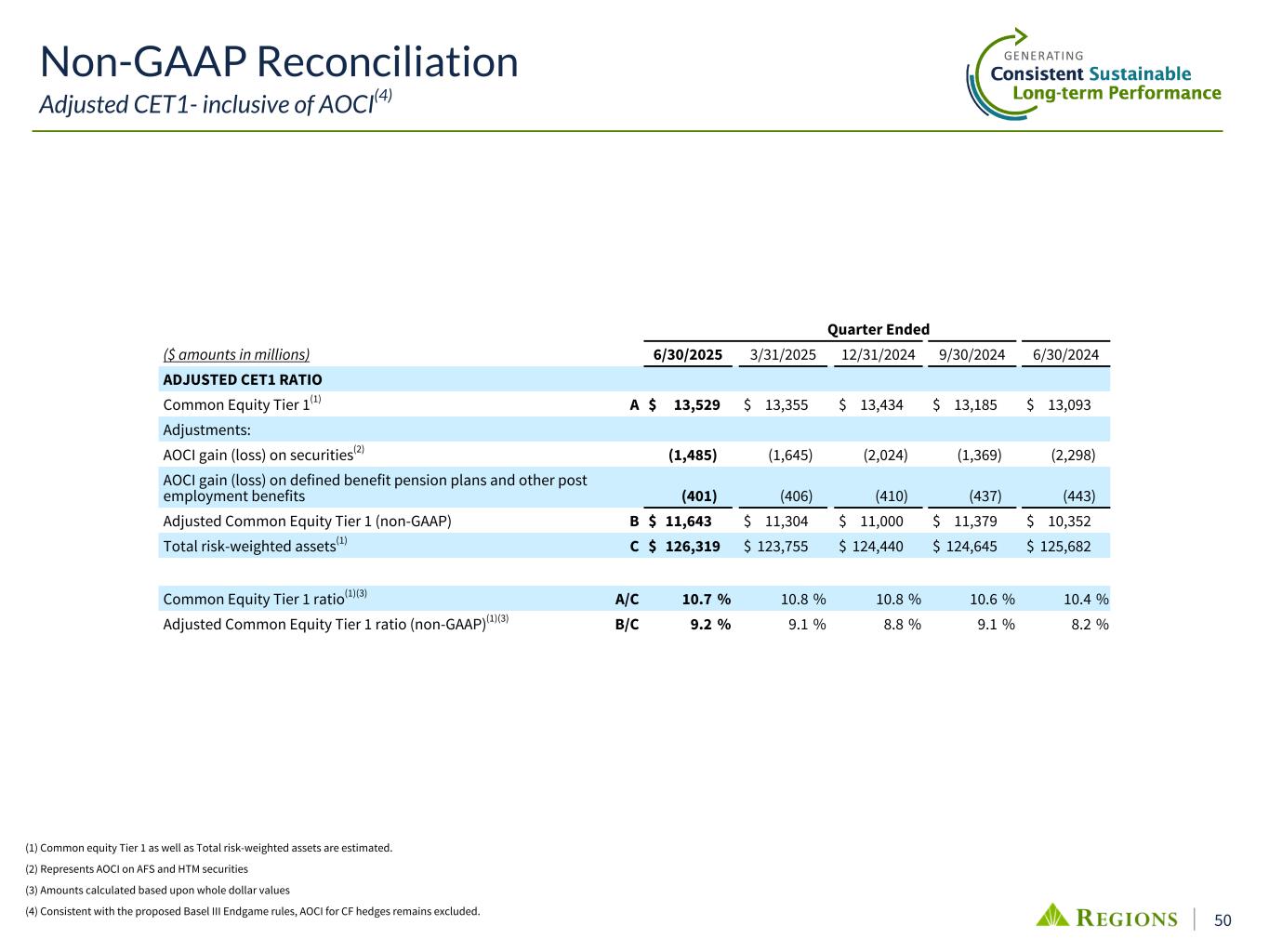

50 Quarter Ended ($ amounts in millions) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 6/30/2024 ADJUSTED CET1 RATIO Common Equity Tier 1(1) A $ 13,529 $ 13,355 $ 13,434 $ 13,185 $ 13,093 Adjustments: AOCI gain (loss) on securities(2) (1,485) (1,645) (2,024) (1,369) (2,298) AOCI gain (loss) on defined benefit pension plans and other post employment benefits (401) (406) (410) (437) (443) Adjusted Common Equity Tier 1 (non-GAAP) B $ 11,643 $ 11,304 $ 11,000 $ 11,379 $ 10,352 Total risk-weighted assets(1) C $ 126,319 $ 123,755 $ 124,440 $ 124,645 $ 125,682 Common Equity Tier 1 ratio(1)(3) A/C 10.7 % 10.8 % 10.8 % 10.6 % 10.4 % Adjusted Common Equity Tier 1 ratio (non-GAAP)(1)(3) B/C 9.2 % 9.1 % 8.8 % 9.1 % 8.2 % Non-GAAP Reconciliation Adjusted CET1- inclusive of AOCI(4) (1) Common equity Tier 1 as well as Total risk-weighted assets are estimated. (2) Represents AOCI on AFS and HTM securities (3) Amounts calculated based upon whole dollar values (4) Consistent with the proposed Basel III Endgame rules, AOCI for CF hedges remains excluded.

51 Forward-Looking Statements This presentation and the accompanying earnings call may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. In addition, the company, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. Forward-looking statements are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in interest rates and unemployment rates, inflation, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, including tariffs, which could have a material adverse effect on our businesses and our financial results and conditions. • Changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets (such as our portfolio of investment securities) and obligations, as well as the availability and cost of capital and liquidity. • Volatility and uncertainty about the direction of interest rates and the timing of any changes, which may lead to increased costs for businesses and consumers and potentially contribute to poor business and economic conditions generally. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, credit loss provisions or actual credit losses where our allowance for credit losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to declining interest rates, and the related acceleration of premium amortization on those securities. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, or the need to price interest-bearing deposits higher due to competitive forces. Either of these activities could increase our funding costs. • Possible downgrades in our credit ratings or outlook could, among other negative impacts, increase the costs of funding from capital markets. • The loss of value of our investment portfolio could negatively impact market perceptions of us. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our businesses. • The effects of social media on market perceptions of us and banks generally. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Volatility in the financial services industry (including failures or rumors of failures of other depository institutions), along with actions taken by governmental agencies to address such turmoil, could affect the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital. • Our ability to effectively compete with other traditional and non-traditional financial services companies, including fintechs, some of which possess greater financial resources than we do or are subject to different regulatory standards than we are. Forward-Looking Statements

52 • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes, including those related to the offering of digital banking and financial services, could result in losing business to competitors. • The development and use of AI presents risks and challenges that may impact our business. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and nonfinancial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses and risks related to such acquisitions, including that the expected synergies, cost savings and other financial or other benefits may not be realized within expected timeframes, or might be less than projected; and difficulties in integrating acquired businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to achieve our expense management initiatives. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair the ability of those borrowers to service any loans outstanding to them and/or reduce demand for loans in those industries. • The effects of geopolitical instability, including wars, conflicts, civil unrest, and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • Fraud, theft or other misconduct conducted by external parties, including our customers and business partners, or by our employees. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our businesses, such as credit risk and operational risk, including third-party vendors and other service providers, which inability could, among other things, result in a breach of operating or security systems as a result of a cyber-attack or similar act or failure to deliver our services effectively. • Our ability to identify and address operational risks associated with the introduction of or changes to products, services, or delivery platforms. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our businesses on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • Our ability to identify and address cyber-security risks such as data security breaches, malware, ransomware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our businesses and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, such as changes to debit card interchange fees, special FDIC assessments, any new long-term debt requirements, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, including as a result of the changes in U.S. presidential administration, control of the U.S. Congress, and changes in personnel at the bank regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our capital actions, including dividend payments, common stock repurchases, or redemptions of preferred stock, must not cause us to fall below minimum capital ratio requirements, with applicable buffers taken into account, and must comply with other requirements and restrictions under law or imposed by our regulators, which may impact our ability to return capital to shareholders. Forward-Looking Statements (continued)