| Project San Jacinto DISCUSSION MATERIALS FOR THE BOARD OF DIRECTORS OF BATTALION OIL CORPORATION SEPTEMBER 18, 2024 | CONFIDENTIAL |

| DRAFT | SUBJECT TO FURTHER REVIEW Table of Contents 2 Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 Weighted Average Cost of Capital Calculation 39 Observed Premiums Paid Analysis 42 Redeemable Convertible Preferred Stock Terms 45 Glossary of Selected Terms 48 5. Disclaimer 51 |

| Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 5. Disclaimer 51 |

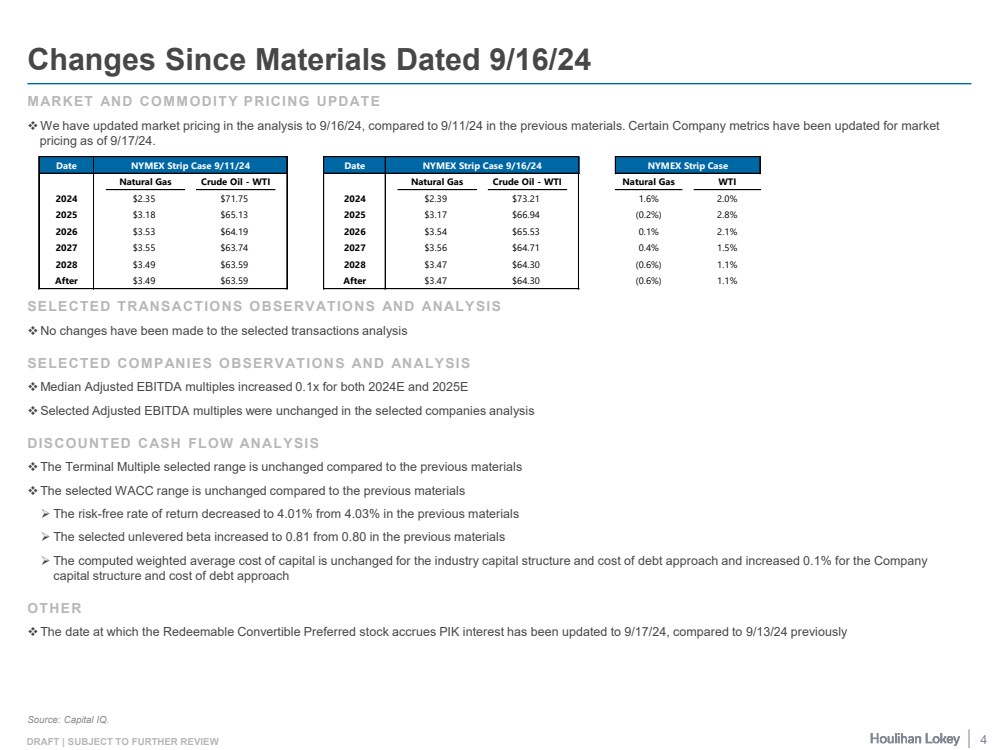

| DRAFT | SUBJECT TO FURTHER REVIEW MARKET AND COMMODITY PRICING UPDATE We have updated market pricing in the analysis to 9/16/24, compared to 9/11/24 in the previous materials. Certain Company metrics have been updated for market pricing as of 9/17/24. SELECTED TRANSACTIONS OBSERVATIONS AND ANALYSIS No changes have been made to the selected transactions analysis SELECTED COMPANIES OBSERVATIONS AND ANALYSIS Median Adjusted EBITDA multiples increased 0.1x for both 2024E and 2025E Selected Adjusted EBITDA multiples were unchanged in the selected companies analysis DISCOUNTED CASH FLOW ANALYSIS The Terminal Multiple selected range is unchanged compared to the previous materials The selected WACC range is unchanged compared to the previous materials The risk-free rate of return decreased to 4.01% from 4.03% in the previous materials The selected unlevered beta increased to 0.81 from 0.80 in the previous materials The computed weighted average cost of capital is unchanged for the industry capital structure and cost of debt approach and increased 0.1% for the Company capital structure and cost of debt approach OTHER The date at which the Redeemable Convertible Preferred stock accrues PIK interest has been updated to 9/17/24, compared to 9/13/24 previously Changes Since Materials Dated 9/16/24 Source: Capital IQ. Date NYMEX Strip Case 9/11/24 Date NYMEX Strip Case 9/16/24 NYMEX Strip Case Natural Gas Crude Oil - WTI Natural Gas Crude Oil - WTI Natural Gas WTI 2024 $2.35 $71.75 2024 $2.39 $73.21 1.6% 2.0% 2025 $3.18 $65.13 2025 $3.17 $66.94 (0.2%) 2.8% 2026 $3.53 $64.19 2026 $3.54 $65.53 0.1% 2.1% 2027 $3.55 $63.74 2027 $3.56 $64.71 0.4% 1.5% 2028 $3.49 $63.59 2028 $3.47 $64.30 (0.6%) 1.1% After $3.49 $63.59 After $3.47 $64.30 (0.6%) 1.1% 4 |

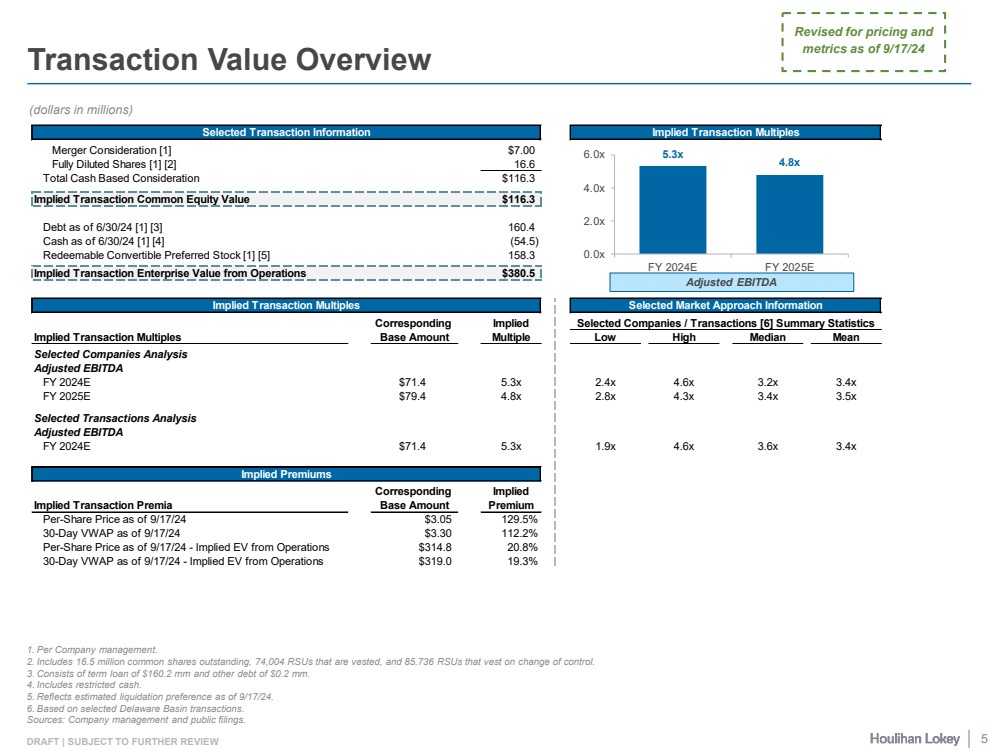

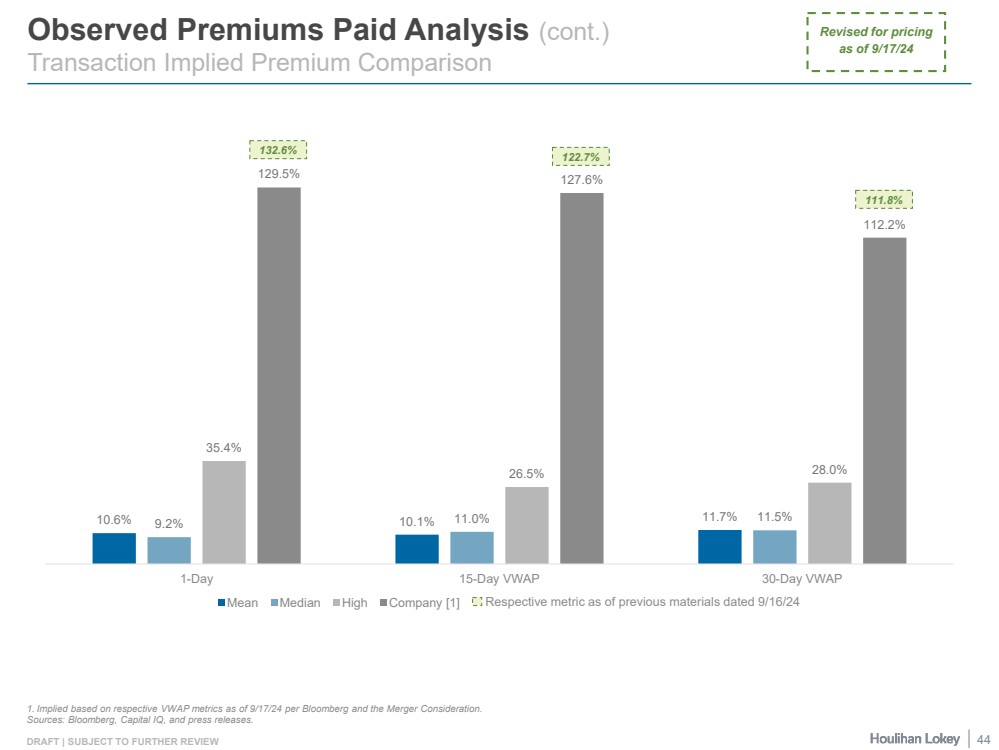

| DRAFT | SUBJECT TO FURTHER REVIEW Transaction Value Overview 1. Per Company management. 2. Includes 16.5 million common shares outstanding, 74,004 RSUs that are vested, and 85,736 RSUs that vest on change of control. 3. Consists of term loan of $160.2 mm and other debt of $0.2 mm. 4. Includes restricted cash. 5. Reflects estimated liquidation preference as of 9/17/24. 6. Based on selected Delaware Basin transactions. Sources: Company management and public filings. (dollars in millions) Revised for pricing and metrics as of 9/17/24 5 Selected Transaction Information Implied Transaction Multiples Merger Consideration [1] $7.00 Fully Diluted Shares [1] [2] 16.6 Total Cash Based Consideration $116.3 Implied Transaction Common Equity Value $116.3 Debt as of 6/30/24 [1] [3] 160.4 Cash as of 6/30/24 [1] [4] (54.5) Redeemable Convertible Preferred Stock [1] [5] 158.3 Implied Transaction Enterprise Value from Operations $380.5 Implied Transaction Multiples Selected Market Approach Information Corresponding Implied Selected Companies / Transactions [6] Summary Statistics Implied Transaction Multiples Base Amount Multiple Low High Median Mean Selected Companies Analysis Adjusted EBITDA FY 2024E $71.4 5.3x 2.4x 4.6x 3.2x 3.4x FY 2025E $79.4 4.8x 2.8x 4.3x 3.4x 3.5x Selected Transactions Analysis Adjusted EBITDA FY 2024E $71.4 5.3x 1.9x 4.6x 3.6x 3.4x Implied Premiums Corresponding Implied Implied Transaction Premia Base Amount Premium Per-Share Price as of 9/17/24 $3.05 129.5% 30-Day VWAP as of 9/17/24 $3.30 112.2% Per-Share Price as of 9/17/24 - Implied EV from Operations $314.8 20.8% 30-Day VWAP as of 9/17/24 - Implied EV from Operations $319.0 19.3% 5.3x 4.8x 0.0x 2.0x 4.0x 6.0x FY 2024E FY 2025E Adjusted EBITDA |

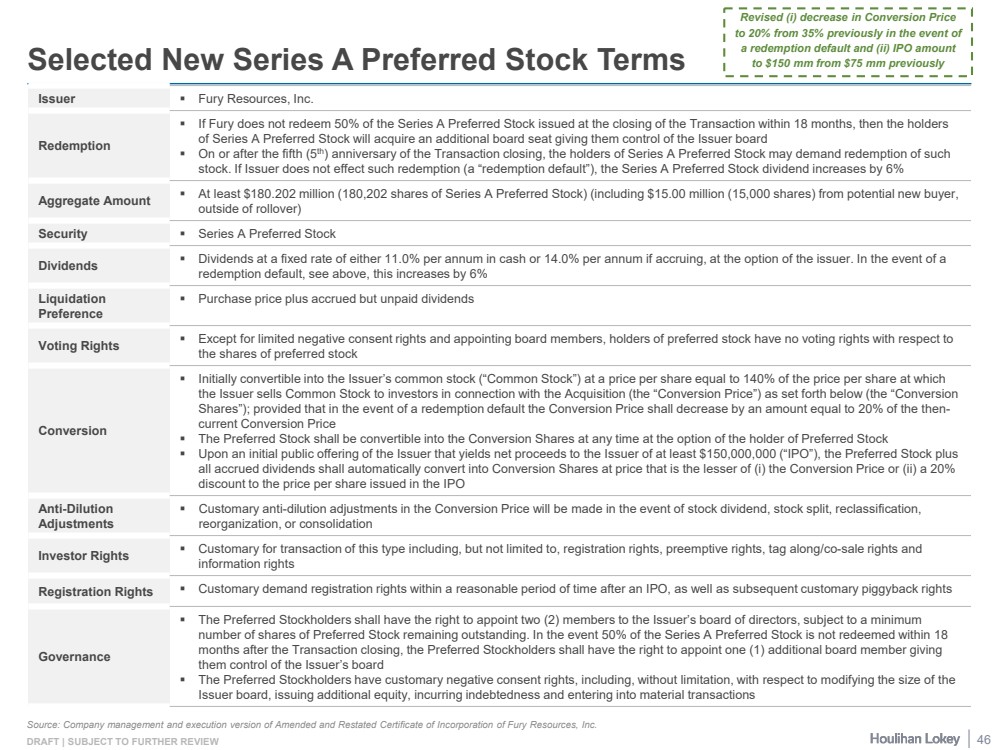

| DRAFT | SUBJECT TO FURTHER REVIEW Parties to the Transaction: Battalion Oil Corporation, a Delaware corporation (the “Company”) Fury Resources, Inc., a Delaware corporation (“Parent”) San Jacinto Merger Sub, Inc., a Delaware corporation (“Merger Sub”) Form of Transaction: Reverse Triangular merger with the Company surviving as a wholly owned subsidiary of Parent Form of Consideration: Cash Transaction Consideration: $[7.00] per share in cash (the “Merger Consideration”) Termination Fee: Company Termination Fee:2 3 $0 or $3.5 million Closing Failure Fee:4 5 $25 million or $30 million (which includes the $10 million Initial Escrow Deposit Amount as a portion of such fee) Certain Closing Conditions: HSR Approval Company Stockholder Approval The Preferred Stock Transactions shall have been consummated Representations and Warranties: Parent has delivered to the Company true and complete copies of (a) executed commitment letter(s), from Fortress Credit Corp. and AI Partners Asset Management Co., Ltd. (the “Lenders”) (the “Debt Financing Commitments”) and (b) each of the executed Purchase Agreement and Contribution Agreement Related Agreements: Certain stockholders of the Company have entered into a voting agreement (the “Voting Agreement”) Holders of all of the issued and outstanding shares of the Company Series A Preferred Stock (the “Insider Stockholders”) and certain other persons (the “Purchasers”) (i) entered into a Purchase Agreement with Parent and (ii) are entering into an amendment to such Purchase Agreement with Parent, in each case, pursuant to which the Purchasers will purchase from Parent shares of the Series A Preferred Stock of Parent (such shares, the “Parent Preferred Stock” and such transaction, the “Preferred Stock Financing”) The Insider Stockholders (i) entered into a Contribution, Rollover and Sale Agreement and (ii) are entering into an A&R Contribution, Rollover and Sale Agreement, in each case, pursuant to which the Insider Stockholders will contribute and/or sell to Parent all of the issued and outstanding shares of Preferred Stock in exchange for shares of Parent Preferred Stock (such transaction, the “Preferred Stock Contribution”) The Company will sell shares of Company Common Stock to Parent for total aggregate cash proceeds of at least $160,000,000 (the “Common Equity Investments” and, together with the Preferred Stock Financing and the Preferred Stock Contribution, the “Preferred Stock Transactions”) Other: Abraham Mirman, the chairman of Parent (the “Guarantor”) entered into (i) an A&R limited guarantee in favor of the Company pursuant to which the Guarantor has guaranteed certain obligations of each of Parent and Merger Sub under the Agreement (subject to a cap) and (ii) a limited guarantee in favor of the Company pursuant to which the Guarantor is guaranteeing certain obligations of each of Parent and Merger Sub under the Agreement (subject to a cap) in connection with the funding by Parent. 1. This summary is intended only as an overview of selected terms and is not intended to cover all terms or details of the Transaction. 2. Payable in the event (i) the Company terminates prior to obtaining the Company Stockholder Approval due to a Company Superior Proposal, (ii) Parent terminates due to a Change of Recommendation or (iii) the Company consummates a Company Superior Proposal within 1 year of termination, (iv) closing has not occurred by the Termination Date, (v) Company Stockholder Approval has not been obtained, or (vi) a breach by Company causes conditions to closing to not be satisfied by the earlier of the Termination Date and 30 Business Days from receipt of Parent’s written notice to terminate. 3. Company Termination Fee of $0 shall increase to $3.5 million if Parent has consummated the Full Escrow Funding. 4. Total fee payable in the event (i) the Company terminates due to a breach by Parent or Merger Sub causing conditions to closing to not be satisfied and such breach is not curable (or has not been cured) by the earlier of the Termination Date and 30 Business Days from receipt of Company’s written notice to terminate or due to the Closing not having occurred prior to the Termination Date and not at the fault of the Company or (ii) either the Company or Parent terminate due to the Closing not having occurred prior to the Termination Date and not at the fault of the terminating party or (iii) Parent fails to deliver all of the Qualifying Additional Financing Documents to the Company on or before 5:00 PM Central Time on April 26, 2024 or (iv) Parent fails to deliver, at least 7 days prior to Closing, Evidence of Funding and other evidence reasonably acceptable to the Company demonstrating that Parent and Merger Sub have financial resources available to them that are sufficient for Parent and Merger Sub to consummate the Merger upon the terms contemplated by the Agreement and pay all related fees and expenses or (v) Company terminates at any time prior to the delivery of Evidence of Funding by Parent. The Company shall be entitled to the Initial Escrow Deposit Amount if the Agreement is terminated for any reason other than those contemplated in the immediately preceding sentence or when the Company Termination Fee is payable to Parent as described in note 2. 5. Initial Closing Failure Fee of $25 million shall increase to $30 million if Parent delivers to Company Qualifying Additional Financing Documents. Source: Agreement and Plan of Merger, dated as of December 14, 2023, as amended by that certain First Amendment to the Agreement and Plan of Merger, dated as of January 23, 2024, that certain Second Amendment to the Agreement and Plan of Merger, dated as of February 6, 2024, that certain Third Amendment to the Agreement and Plan of Merger, dated as of February 16, 2024, that certain Fourth Amendment to the Agreement and Plan of Merger, dated as of April 16, 2024, that certain Fifth Amendment to the Agreement and Plan of Merger, dated as of June 10, 2024 and that certain Sixth Amendment to the Agreement and Plan of Merger, dated as of September 11, 2024 (as amended, the "Agreement"), and Company management. Summary of Selected Transaction Terms1 6 |

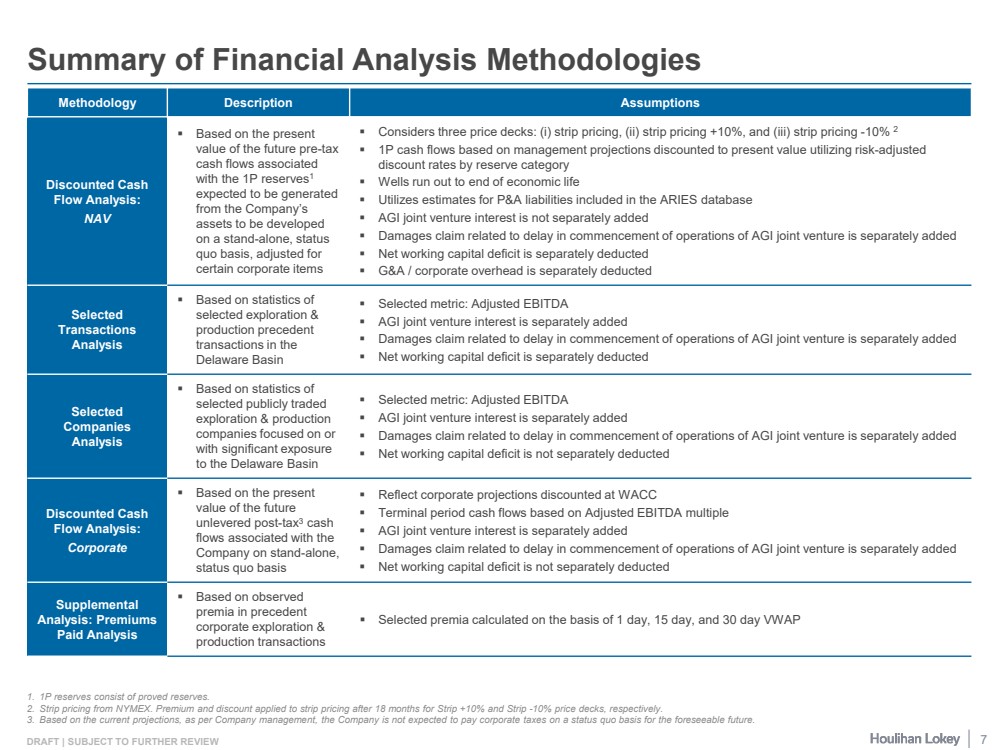

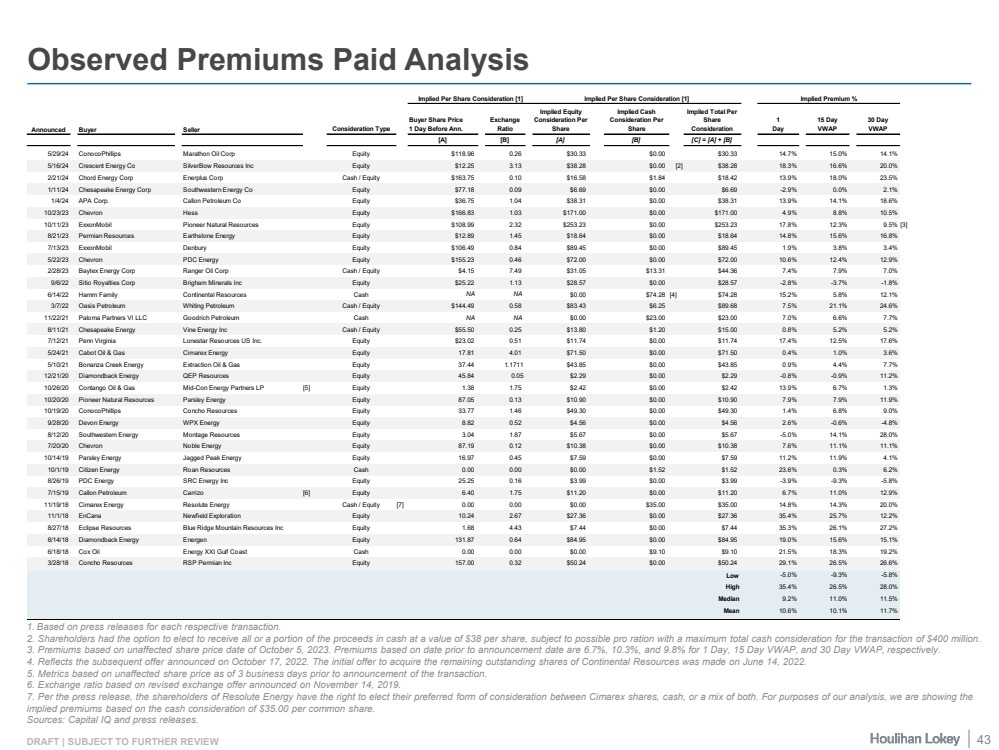

| DRAFT | SUBJECT TO FURTHER REVIEW Summary of Financial Analysis Methodologies Methodology Description Assumptions Discounted Cash Flow Analysis: NAV Based on the present value of the future pre-tax cash flows associated with the 1P reserves1 expected to be generated from the Company’s assets to be developed on a stand-alone, status quo basis, adjusted for certain corporate items Considers three price decks: (i) strip pricing, (ii) strip pricing +10%, and (iii) strip pricing -10% 2 1P cash flows based on management projections discounted to present value utilizing risk-adjusted discount rates by reserve category Wells run out to end of economic life Utilizes estimates for P&A liabilities included in the ARIES database AGI joint venture interest is not separately added Damages claim related to delay in commencement of operations of AGI joint venture is separately added Net working capital deficit is separately deducted G&A / corporate overhead is separately deducted Selected Transactions Analysis Based on statistics of selected exploration & production precedent transactions in the Delaware Basin Selected metric: Adjusted EBITDA AGI joint venture interest is separately added Damages claim related to delay in commencement of operations of AGI joint venture is separately added Net working capital deficit is separately deducted Selected Companies Analysis Based on statistics of selected publicly traded exploration & production companies focused on or with significant exposure to the Delaware Basin Selected metric: Adjusted EBITDA AGI joint venture interest is separately added Damages claim related to delay in commencement of operations of AGI joint venture is separately added Net working capital deficit is not separately deducted Discounted Cash Flow Analysis: Corporate Based on the present value of the future unlevered post-tax3 cash flows associated with the Company on stand-alone, status quo basis Reflect corporate projections discounted at WACC Terminal period cash flows based on Adjusted EBITDA multiple AGI joint venture interest is separately added Damages claim related to delay in commencement of operations of AGI joint venture is separately added Net working capital deficit is not separately deducted Supplemental Analysis: Premiums Paid Analysis Based on observed premia in precedent corporate exploration & production transactions Selected premia calculated on the basis of 1 day, 15 day, and 30 day VWAP 1. 1P reserves consist of proved reserves. 2. Strip pricing from NYMEX. Premium and discount applied to strip pricing after 18 months for Strip +10% and Strip -10% price decks, respectively. 3. Based on the current projections, as per Company management, the Company is not expected to pay corporate taxes on a status quo basis for the foreseeable future. 7 |

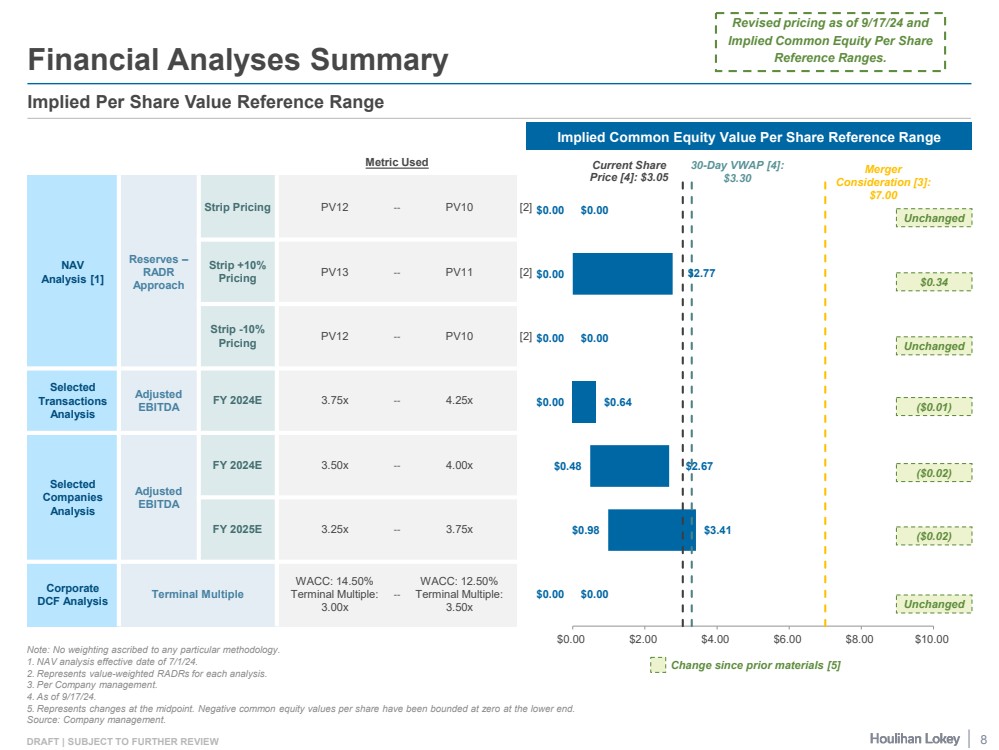

| DRAFT | SUBJECT TO FURTHER REVIEW Note: No weighting ascribed to any particular methodology. 1. NAV analysis effective date of 7/1/24. 2. Represents value-weighted RADRs for each analysis. 3. Per Company management. 4. As of 9/17/24. 5. Represents changes at the midpoint. Negative common equity values per share have been bounded at zero at the lower end. Source: Company management. Financial Analyses Summary Implied Per Share Value Reference Range Metric Used NAV Analysis [1] Reserves – RADR Approach Strip Pricing PV12 -- PV10 [2] Strip +10% Pricing PV13 -- PV11 [2] Strip -10% Pricing PV12 -- PV10 [2] Selected Transactions Analysis Adjusted EBITDA FY 2024E 3.75x -- 4.25x Selected Companies Analysis Adjusted EBITDA FY 2024E 3.50x -- 4.00x FY 2025E 3.25x -- 3.75x Corporate DCF Analysis Terminal Multiple WACC: 14.50% Terminal Multiple: 3.00x -- WACC: 12.50% Terminal Multiple: 3.50x Implied Common Equity Value Per Share Reference Range Unchanged $0.34 ($0.02) ($0.01) Unchanged ($0.02) Unchanged Revised pricing as of 9/17/24 and Implied Common Equity Per Share Reference Ranges. Change since prior materials [5] 8 $0.00 $0.98 $0.48 $0.00 $0.00 $0.00 $0.00 $0.00 $3.41 $2.67 $0.64 $0.00 $2.77 $0.00 Merger Consideration [3]: $7.00 Current Share Price [4]: $3.05 30-Day VWAP [4]: $3.30 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 |

| Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 5. Disclaimer 51 |

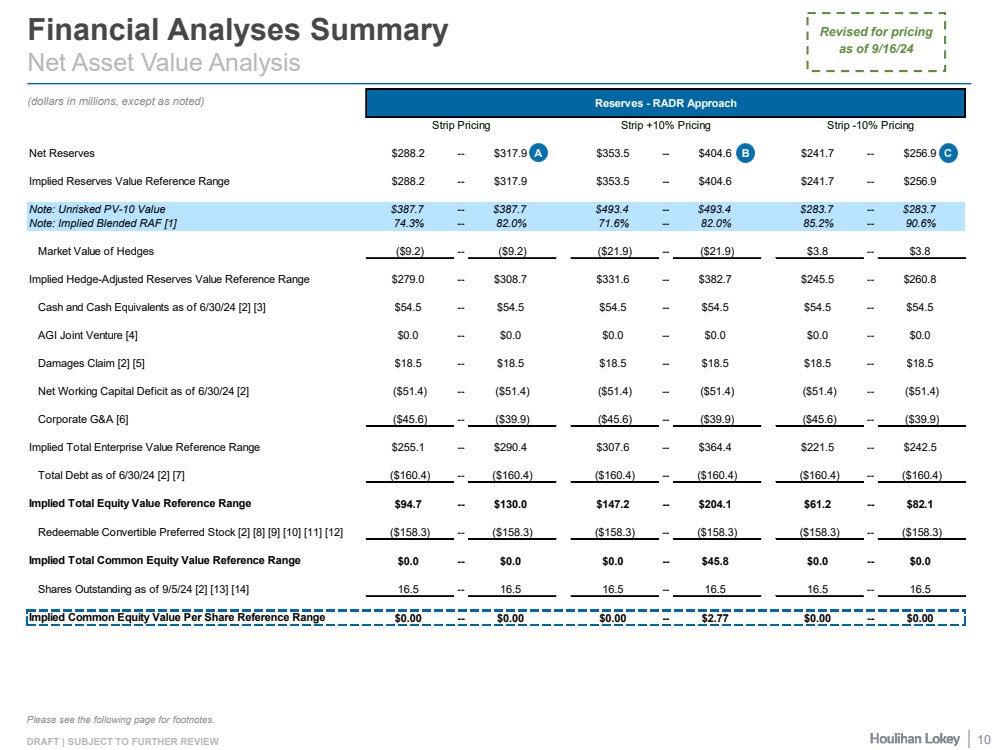

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary Net Asset Value Analysis Please see the following page for footnotes. (dollars in millions, except as noted) Revised for pricing as of 9/16/24 Reserves - RADR Approach Strip Pricing Strip +10% Pricing Strip -10% Pricing Net Reserves $288.2 -- $317.9 $353.5 -- $404.6 $241.7 -- $256.9 Implied Reserves Value Reference Range $288.2 -- $317.9 $353.5 -- $404.6 $241.7 -- $256.9 Note: Unrisked PV-10 Value $387.7 -- $387.7 $493.4 -- $493.4 $283.7 -- $283.7 Note: Implied Blended RAF [1] 74.3% -- 82.0% 71.6% -- 82.0% 85.2% -- 90.6% Market Value of Hedges ($9.2) -- ($9.2) ($21.9) -- ($21.9) $3.8 -- $3.8 Implied Hedge-Adjusted Reserves Value Reference Range $279.0 -- $308.7 $331.6 -- $382.7 $245.5 -- $260.8 Cash and Cash Equivalents as of 6/30/24 [2] [3] $54.5 -- $54.5 $54.5 -- $54.5 $54.5 -- $54.5 AGI Joint Venture [4] $0.0 -- $0.0 $0.0 -- $0.0 $0.0 -- $0.0 Damages Claim [2] [5] $18.5 -- $18.5 $18.5 -- $18.5 $18.5 -- $18.5 Net Working Capital Deficit as of 6/30/24 [2] ($51.4) -- ($51.4) ($51.4) -- ($51.4) ($51.4) -- ($51.4) Corporate G&A [6] ($45.6) -- ($39.9) ($45.6) -- ($39.9) ($45.6) -- ($39.9) Implied Total Enterprise Value Reference Range $255.1 -- $290.4 $307.6 -- $364.4 $221.5 -- $242.5 Total Debt as of 6/30/24 [2] [7] ($160.4) -- ($160.4) ($160.4) -- ($160.4) ($160.4) -- ($160.4) Implied Total Equity Value Reference Range $94.7 -- $130.0 $147.2 -- $204.1 $61.2 -- $82.1 Redeemable Convertible Preferred Stock [2] [8] [9] [10] [11] [12] ($158.3) -- ($158.3) ($158.3) -- ($158.3) ($158.3) -- ($158.3) Implied Total Common Equity Value Reference Range $0.0 -- $0.0 $0.0 -- $45.8 $0.0 -- $0.0 Shares Outstanding as of 9/5/24 [2] [13] [14] 16.5 -- 16.5 16.5 -- 16.5 16.5 -- 16.5 Implied Common Equity Value Per Share Reference Range $0.00 -- $0.00 $0.00 -- $2.77 $0.00 -- $0.00 A B C 10 |

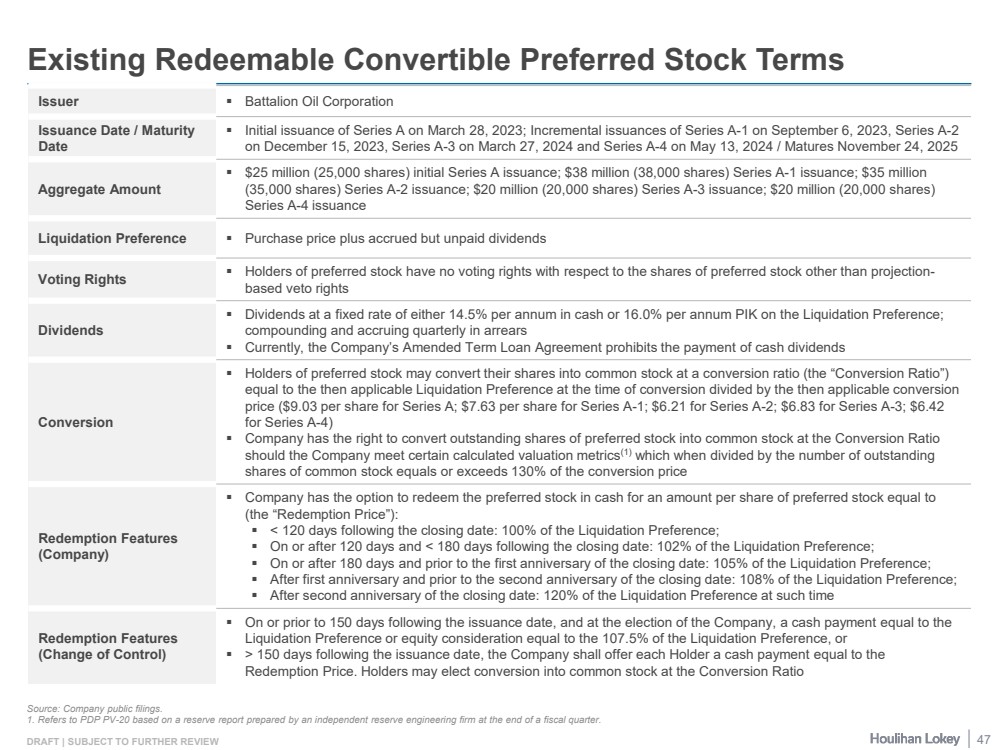

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary Net Asset Value Analysis (cont.) 1. Represents value-weighted RAFs for each analysis as applicable. 2. Per Company management. 3. Includes restricted cash. 4. Economic benefit of Company's 5% interest in AGI Joint Venture reflected in reserve cash flows as an offset to certain expenses. 5. Estimated damages claim due to delay in commencement of operations of the AGI Joint Venture. 6. 2024E G&A capitalized at 4.00x at the low end and 3.50x at the high end. 7. Consists of term loan of $160.2 mm and other debt of $0.2 mm. 8. Includes Series A preferred equity issued by the Company on 3/28/23, which converts into ~3.5 mm shares based on a liquidation preference of $31.5 mm and conversion price of $9.03 per share. 9. Includes Series A-1 preferred equity issued by the Company on 9/6/23, which converts into ~5.9 mm shares based on a liquidation preference of $44.7 mm and conversion price of $7.63 per share. 10. Includes Series A-2 preferred equity issued by the Company on 12/15/23, which converts into ~6.3 mm shares based on a liquidation preference of $39.4 mm and conversion price of $6.21 per share. 11. Includes Series A-3 preferred equity issued by the Company on 3/27/24, which converts into ~3.2 mm shares based on a liquidation preference of $21.6 mm and conversion price of $6.83 per share. 12. Includes Series A-4 preferred equity issued by the Company on 5/13/24, which converts into ~3.3 mm shares based on a liquidation preference of $21.1 mm and conversion price of $6.42 per share. 13. Includes 16.5 million common shares outstanding and 74,004 RSUs that are vested. Excludes performance shares that vest under change of control. 14. The Company has 132,822 options outstanding (three equal tranches at exercise prices of $18.91, $28.23 and $37.83). Source: Company management. 11 |

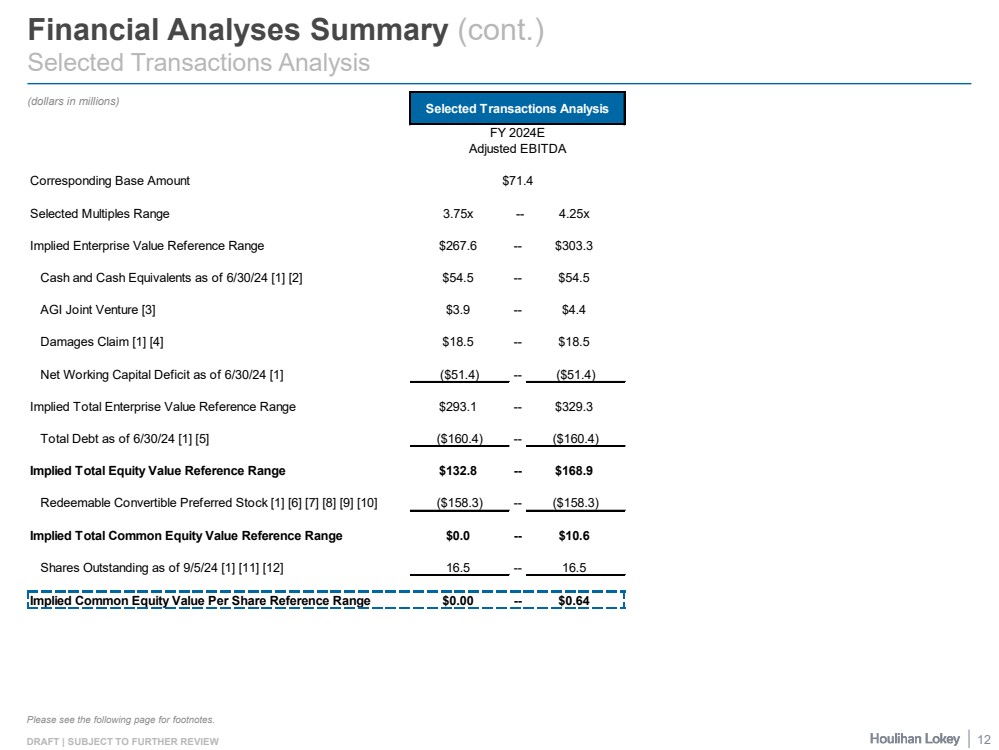

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary (cont.) Selected Transactions Analysis (dollars in millions) Please see the following page for footnotes. Selected Transactions Analysis FY 2024E Adjusted EBITDA Corresponding Base Amount $71.4 Selected Multiples Range 3.75x -- 4.25x Implied Enterprise Value Reference Range $267.6 -- $303.3 Cash and Cash Equivalents as of 6/30/24 [1] [2] $54.5 -- $54.5 AGI Joint Venture [3] $3.9 -- $4.4 Damages Claim [1] [4] $18.5 -- $18.5 Net Working Capital Deficit as of 6/30/24 [1] ($51.4) -- ($51.4) Implied Total Enterprise Value Reference Range $293.1 -- $329.3 Total Debt as of 6/30/24 [1] [5] ($160.4) -- ($160.4) Implied Total Equity Value Reference Range $132.8 -- $168.9 Redeemable Convertible Preferred Stock [1] [6] [7] [8] [9] [10] ($158.3) -- ($158.3) Implied Total Common Equity Value Reference Range $0.0 -- $10.6 Shares Outstanding as of 9/5/24 [1] [11] [12] 16.5 -- 16.5 Implied Common Equity Value Per Share Reference Range $0.00 -- $0.64 12 |

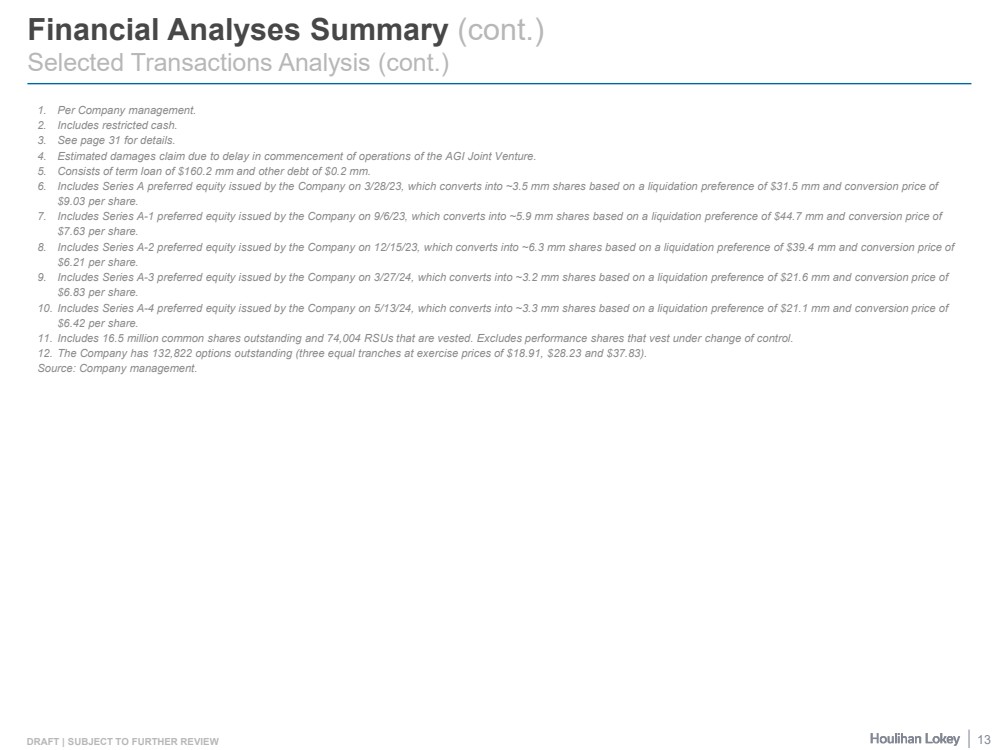

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary (cont.) Selected Transactions Analysis (cont.) 1. Per Company management. 2. Includes restricted cash. 3. See page 31 for details. 4. Estimated damages claim due to delay in commencement of operations of the AGI Joint Venture. 5. Consists of term loan of $160.2 mm and other debt of $0.2 mm. 6. Includes Series A preferred equity issued by the Company on 3/28/23, which converts into ~3.5 mm shares based on a liquidation preference of $31.5 mm and conversion price of $9.03 per share. 7. Includes Series A-1 preferred equity issued by the Company on 9/6/23, which converts into ~5.9 mm shares based on a liquidation preference of $44.7 mm and conversion price of $7.63 per share. 8. Includes Series A-2 preferred equity issued by the Company on 12/15/23, which converts into ~6.3 mm shares based on a liquidation preference of $39.4 mm and conversion price of $6.21 per share. 9. Includes Series A-3 preferred equity issued by the Company on 3/27/24, which converts into ~3.2 mm shares based on a liquidation preference of $21.6 mm and conversion price of $6.83 per share. 10. Includes Series A-4 preferred equity issued by the Company on 5/13/24, which converts into ~3.3 mm shares based on a liquidation preference of $21.1 mm and conversion price of $6.42 per share. 11. Includes 16.5 million common shares outstanding and 74,004 RSUs that are vested. Excludes performance shares that vest under change of control. 12. The Company has 132,822 options outstanding (three equal tranches at exercise prices of $18.91, $28.23 and $37.83). Source: Company management. 13 |

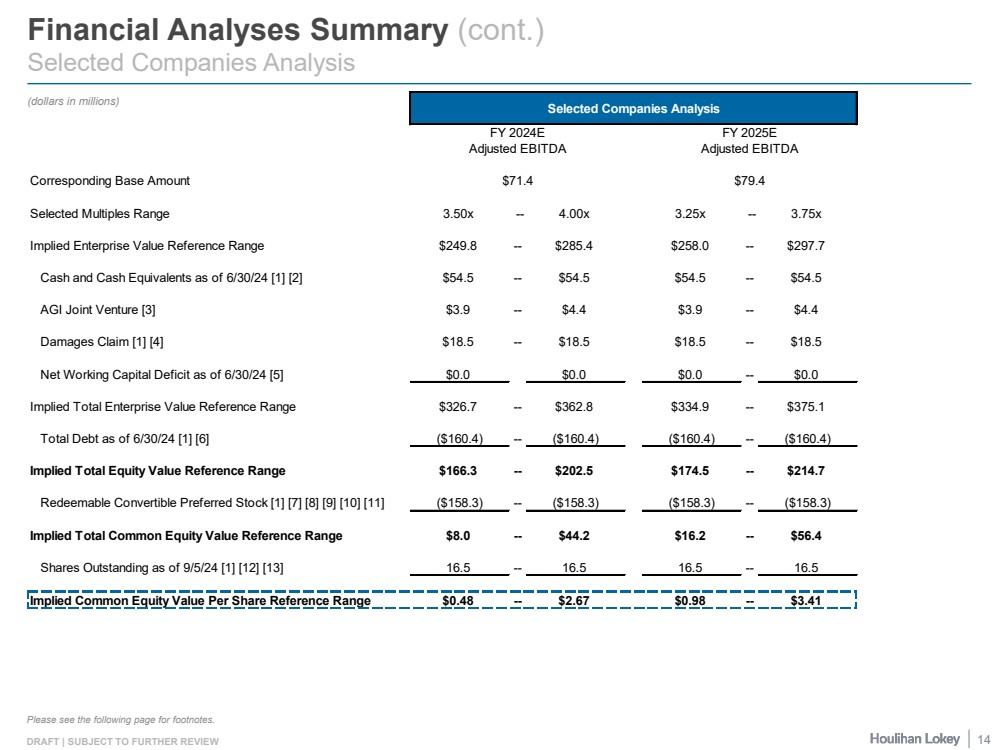

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary (cont.) Selected Companies Analysis (dollars in millions) Please see the following page for footnotes. Selected Companies Analysis FY 2024E FY 2025E Adjusted EBITDA Adjusted EBITDA Corresponding Base Amount $71.4 $79.4 Selected Multiples Range 3.50x -- 4.00x 3.25x -- 3.75x Implied Enterprise Value Reference Range $249.8 -- $285.4 $258.0 -- $297.7 Cash and Cash Equivalents as of 6/30/24 [1] [2] $54.5 -- $54.5 $54.5 -- $54.5 AGI Joint Venture [3] $3.9 -- $4.4 $3.9 -- $4.4 Damages Claim [1] [4] $18.5 -- $18.5 $18.5 -- $18.5 Net Working Capital Deficit as of 6/30/24 [5] $0.0 $0.0 $0.0 -- $0.0 Implied Total Enterprise Value Reference Range $326.7 -- $362.8 $334.9 -- $375.1 Total Debt as of 6/30/24 [1] [6] ($160.4) -- ($160.4) ($160.4) -- ($160.4) Implied Total Equity Value Reference Range $166.3 -- $202.5 $174.5 -- $214.7 Redeemable Convertible Preferred Stock [1] [7] [8] [9] [10] [11] ($158.3) -- ($158.3) ($158.3) -- ($158.3) Implied Total Common Equity Value Reference Range $8.0 -- $44.2 $16.2 -- $56.4 Shares Outstanding as of 9/5/24 [1] [12] [13] 16.5 -- 16.5 16.5 -- 16.5 Implied Common Equity Value Per Share Reference Range $0.48 -- $2.67 $0.98 -- $3.41 14 |

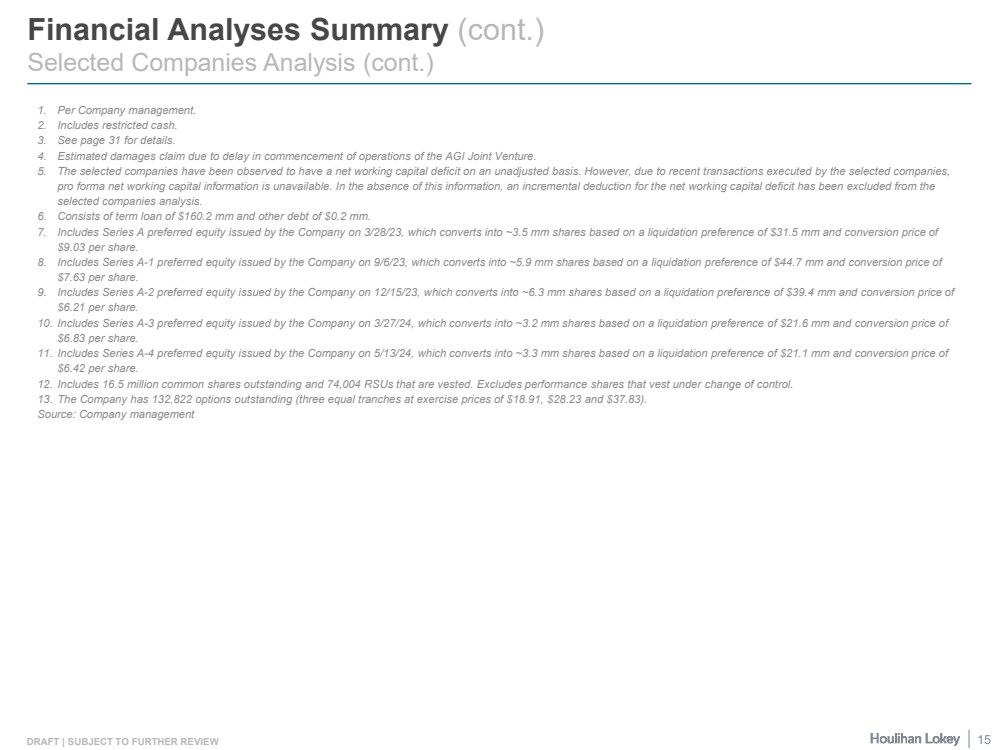

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary (cont.) Selected Companies Analysis (cont.) 1. Per Company management. 2. Includes restricted cash. 3. See page 31 for details. 4. Estimated damages claim due to delay in commencement of operations of the AGI Joint Venture. 5. The selected companies have been observed to have a net working capital deficit on an unadjusted basis. However, due to recent transactions executed by the selected companies, pro forma net working capital information is unavailable. In the absence of this information, an incremental deduction for the net working capital deficit has been excluded from the selected companies analysis. 6. Consists of term loan of $160.2 mm and other debt of $0.2 mm. 7. Includes Series A preferred equity issued by the Company on 3/28/23, which converts into ~3.5 mm shares based on a liquidation preference of $31.5 mm and conversion price of $9.03 per share. 8. Includes Series A-1 preferred equity issued by the Company on 9/6/23, which converts into ~5.9 mm shares based on a liquidation preference of $44.7 mm and conversion price of $7.63 per share. 9. Includes Series A-2 preferred equity issued by the Company on 12/15/23, which converts into ~6.3 mm shares based on a liquidation preference of $39.4 mm and conversion price of $6.21 per share. 10. Includes Series A-3 preferred equity issued by the Company on 3/27/24, which converts into ~3.2 mm shares based on a liquidation preference of $21.6 mm and conversion price of $6.83 per share. 11. Includes Series A-4 preferred equity issued by the Company on 5/13/24, which converts into ~3.3 mm shares based on a liquidation preference of $21.1 mm and conversion price of $6.42 per share. 12. Includes 16.5 million common shares outstanding and 74,004 RSUs that are vested. Excludes performance shares that vest under change of control. 13. The Company has 132,822 options outstanding (three equal tranches at exercise prices of $18.91, $28.23 and $37.83). Source: Company management 15 |

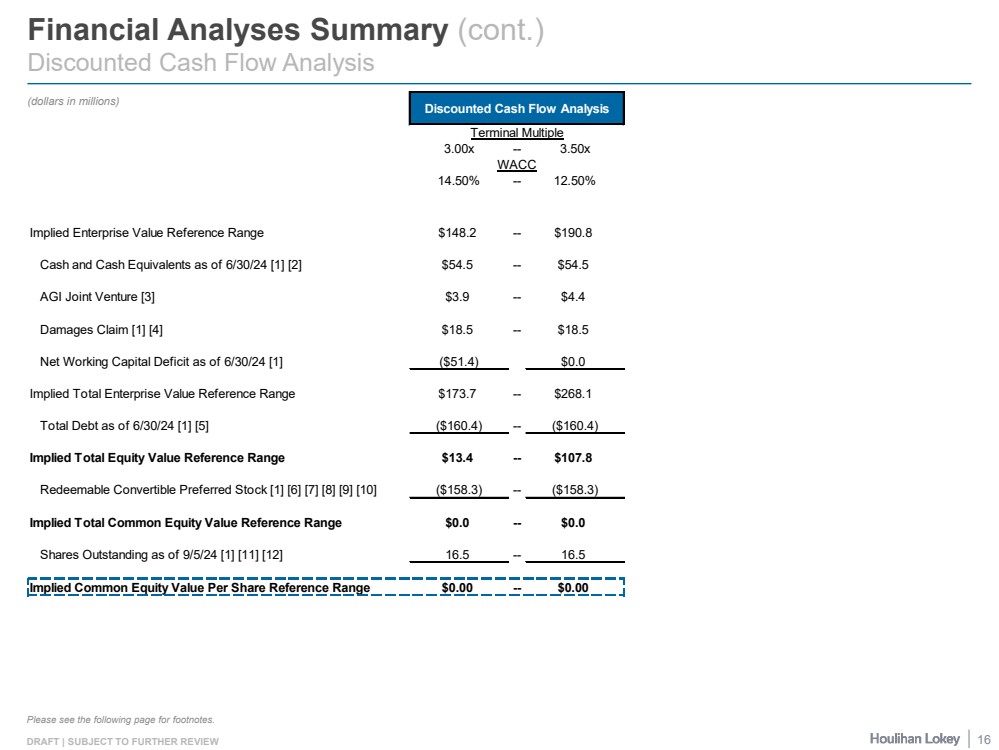

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary (cont.) Discounted Cash Flow Analysis (dollars in millions) Please see the following page for footnotes. Discounted Cash Flow Analysis Terminal Multiple 3.00x -- 3.50x WACC 14.50% -- 12.50% Implied Enterprise Value Reference Range $148.2 -- $190.8 Cash and Cash Equivalents as of 6/30/24 [1] [2] $54.5 -- $54.5 AGI Joint Venture [3] $3.9 -- $4.4 Damages Claim [1] [4] $18.5 -- $18.5 Net Working Capital Deficit as of 6/30/24 [1] ($51.4) $0.0 Implied Total Enterprise Value Reference Range $173.7 -- $268.1 Total Debt as of 6/30/24 [1] [5] ($160.4) -- ($160.4) Implied Total Equity Value Reference Range $13.4 -- $107.8 Redeemable Convertible Preferred Stock [1] [6] [7] [8] [9] [10] ($158.3) -- ($158.3) Implied Total Common Equity Value Reference Range $0.0 -- $0.0 Shares Outstanding as of 9/5/24 [1] [11] [12] 16.5 -- 16.5 Implied Common Equity Value Per Share Reference Range $0.00 -- $0.00 16 |

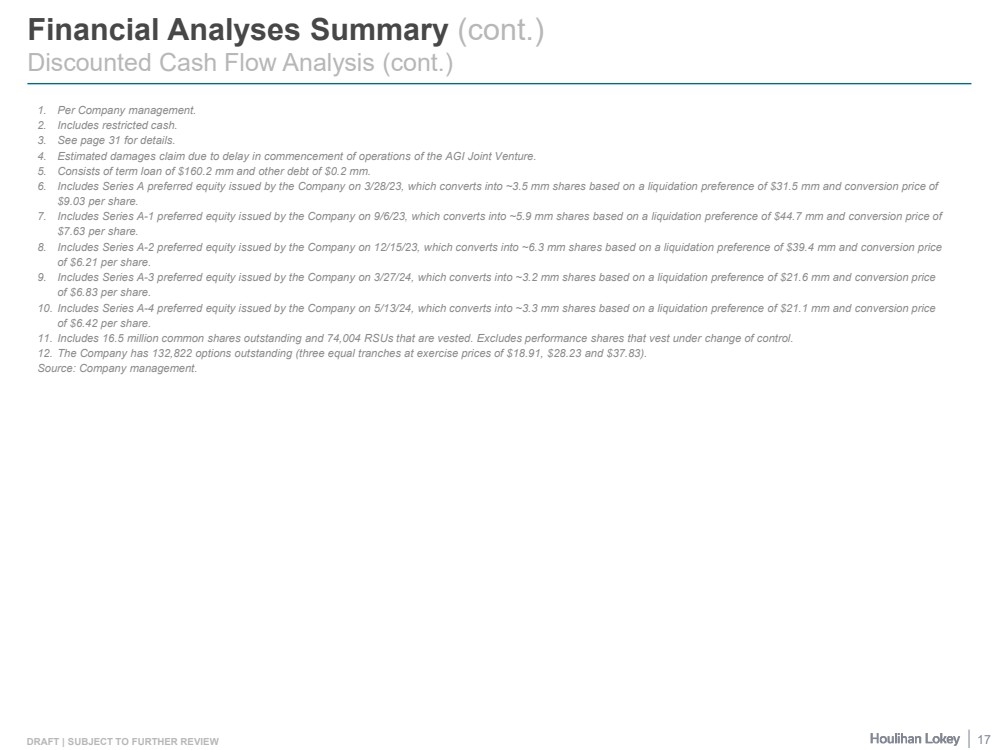

| DRAFT | SUBJECT TO FURTHER REVIEW Financial Analyses Summary (cont.) Discounted Cash Flow Analysis (cont.) 1. Per Company management. 2. Includes restricted cash. 3. See page 31 for details. 4. Estimated damages claim due to delay in commencement of operations of the AGI Joint Venture. 5. Consists of term loan of $160.2 mm and other debt of $0.2 mm. 6. Includes Series A preferred equity issued by the Company on 3/28/23, which converts into ~3.5 mm shares based on a liquidation preference of $31.5 mm and conversion price of $9.03 per share. 7. Includes Series A-1 preferred equity issued by the Company on 9/6/23, which converts into ~5.9 mm shares based on a liquidation preference of $44.7 mm and conversion price of $7.63 per share. 8. Includes Series A-2 preferred equity issued by the Company on 12/15/23, which converts into ~6.3 mm shares based on a liquidation preference of $39.4 mm and conversion price of $6.21 per share. 9. Includes Series A-3 preferred equity issued by the Company on 3/27/24, which converts into ~3.2 mm shares based on a liquidation preference of $21.6 mm and conversion price of $6.83 per share. 10. Includes Series A-4 preferred equity issued by the Company on 5/13/24, which converts into ~3.3 mm shares based on a liquidation preference of $21.1 mm and conversion price of $6.42 per share. 11. Includes 16.5 million common shares outstanding and 74,004 RSUs that are vested. Excludes performance shares that vest under change of control. 12. The Company has 132,822 options outstanding (three equal tranches at exercise prices of $18.91, $28.23 and $37.83). Source: Company management. 17 |

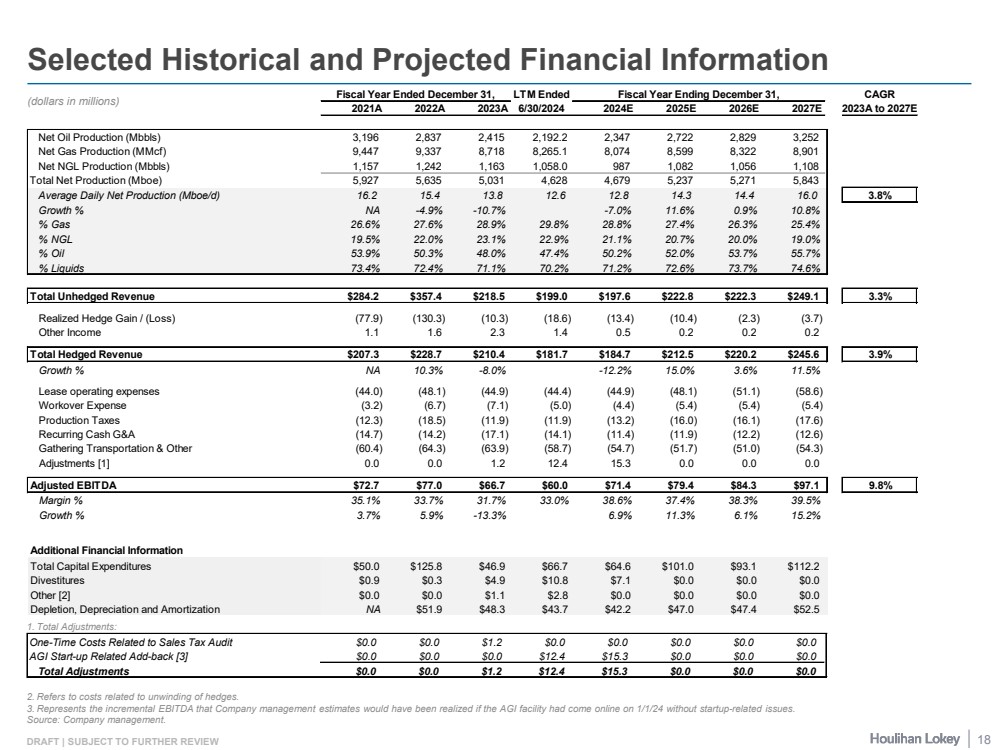

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Historical and Projected Financial Information 1. Total Adjustments: 2. Refers to costs related to unwinding of hedges. 3. Represents the incremental EBITDA that Company management estimates would have been realized if the AGI facility had come online on 1/1/24 without startup-related issues. Source: Company management. (dollars in millions) Fiscal Year Ended December 31, LTM Ended Fiscal Year Ending December 31, CAGR 2021A 2022A 2023A 6/30/2024 2024E 2025E 2026E 2027E 2023A to 2027E Net Oil Production (Mbbls) 3,196 2,837 2,415 2,192.2 2,347 2,722 2,829 3,252 Net Gas Production (MMcf) 9,447 9,337 8,718 8,265.1 8,074 8,599 8,322 8,901 Net NGL Production (Mbbls) 1,157 1,242 1,163 1,058.0 987 1,082 1,056 1,108 Total Net Production (Mboe) 5,927 5,635 5,031 4,628 4,679 5,237 5,271 5,843 Average Daily Net Production (Mboe/d) 16.2 15.4 13.8 12.6 12.8 14.3 14.4 16.0 3.8% Growth % NA -4.9% -10.7% -7.0% 11.6% 0.9% 10.8% % Gas 26.6% 27.6% 28.9% 29.8% 28.8% 27.4% 26.3% 25.4% % NGL 19.5% 22.0% 23.1% 22.9% 21.1% 20.7% 20.0% 19.0% % Oil 53.9% 50.3% 48.0% 47.4% 50.2% 52.0% 53.7% 55.7% % Liquids 73.4% 72.4% 71.1% 70.2% 71.2% 72.6% 73.7% 74.6% Total Unhedged Revenue $284.2 $357.4 $218.5 $199.0 $197.6 $222.8 $222.3 $249.1 3.3% Realized Hedge Gain / (Loss) (77.9) (130.3) (10.3) (18.6) (13.4) (10.4) (2.3) (3.7) Other Income 1.1 1.6 2.3 1.4 0.5 0.2 0.2 0.2 Total Hedged Revenue $207.3 $228.7 $210.4 $181.7 $184.7 $212.5 $220.2 $245.6 3.9% Growth % NA 10.3% -8.0% -12.2% 15.0% 3.6% 11.5% Lease operating expenses (44.0) (48.1) (44.9) (44.4) (44.9) (48.1) (51.1) (58.6) Workover Expense (3.2) (6.7) (7.1) (5.0) (4.4) (5.4) (5.4) (5.4) Production Taxes (12.3) (18.5) (11.9) (11.9) (13.2) (16.0) (16.1) (17.6) Recurring Cash G&A (14.7) (14.2) (17.1) (14.1) (11.4) (11.9) (12.2) (12.6) Gathering Transportation & Other (60.4) (64.3) (63.9) (58.7) (54.7) (51.7) (51.0) (54.3) Adjustments [1] 0.0 0.0 1.2 12.4 15.3 0.0 0.0 0.0 Adjusted EBITDA $72.7 $77.0 $66.7 $60.0 $71.4 $79.4 $84.3 $97.1 9.8% Margin % 35.1% 33.7% 31.7% 33.0% 38.6% 37.4% 38.3% 39.5% Growth % 3.7% 5.9% -13.3% 6.9% 11.3% 6.1% 15.2% Additional Financial Information Total Capital Expenditures $50.0 $125.8 $46.9 $66.7 $64.6 $101.0 $93.1 $112.2 Divestitures $0.9 $0.3 $4.9 $10.8 $7.1 $0.0 $0.0 $0.0 Other [2] $0.0 $0.0 $1.1 $2.8 $0.0 $0.0 $0.0 $0.0 Depletion, Depreciation and Amortization NA $51.9 $48.3 $43.7 $42.2 $47.0 $47.4 $52.5 One-Time Costs Related to Sales Tax Audit $0.0 $0.0 $1.2 $0.0 $0.0 $0.0 $0.0 $0.0 AGI Start-up Related Add-back [3] $0.0 $0.0 $0.0 $12.4 $15.3 $0.0 $0.0 $0.0 Total Adjustments $0.0 $0.0 $1.2 $12.4 $15.3 $0.0 $0.0 $0.0 18 |

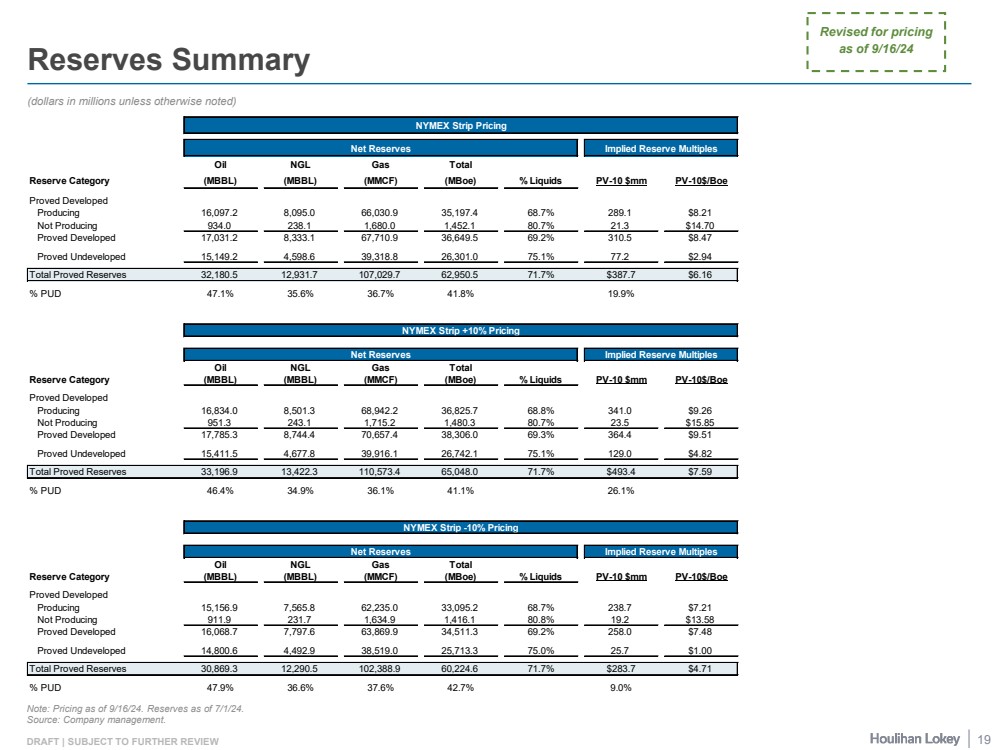

| DRAFT | SUBJECT TO FURTHER REVIEW Reserves Summary (dollars in millions unless otherwise noted) Note: Pricing as of 9/16/24. Reserves as of 7/1/24. Source: Company management. Revised for pricing as of 9/16/24 NYMEX Strip Pricing Net Reserves Implied Reserve Multiples Oil NGL Gas Total Reserve Category (MBBL) (MBBL) (MMCF) (MBoe) % Liquids PV-10 $mm PV-10$/Boe Proved Developed Producing 16,097.2 8,095.0 66,030.9 35,197.4 68.7% 289.1 $8.21 Not Producing 934.0 238.1 1,680.0 1,452.1 80.7% 21.3 $14.70 Proved Developed 17,031.2 8,333.1 67,710.9 36,649.5 69.2% 310.5 $8.47 Proved Undeveloped 15,149.2 4,598.6 39,318.8 26,301.0 75.1% 77.2 $2.94 Total Proved Reserves 32,180.5 12,931.7 107,029.7 62,950.5 71.7% $387.7 $6.16 % PUD 47.1% 35.6% 36.7% 41.8% 19.9% NYMEX Strip +10% Pricing Net Reserves Implied Reserve Multiples Oil NGL Gas Total Reserve Category (MBBL) (MBBL) (MMCF) (MBoe) % Liquids PV-10 $mm PV-10$/Boe Proved Developed Producing 16,834.0 8,501.3 68,942.2 36,825.7 68.8% 341.0 $9.26 Not Producing 951.3 243.1 1,715.2 1,480.3 80.7% 23.5 $15.85 Proved Developed 17,785.3 8,744.4 70,657.4 38,306.0 69.3% 364.4 $9.51 Proved Undeveloped 15,411.5 4,677.8 39,916.1 26,742.1 75.1% 129.0 $4.82 Total Proved Reserves 33,196.9 13,422.3 110,573.4 65,048.0 71.7% $493.4 $7.59 % PUD 46.4% 34.9% 36.1% 41.1% 26.1% NYMEX Strip -10% Pricing Net Reserves Implied Reserve Multiples Oil NGL Gas Total Reserve Category (MBBL) (MBBL) (MMCF) (MBoe) % Liquids PV-10 $mm PV-10$/Boe Proved Developed Producing 15,156.9 7,565.8 62,235.0 33,095.2 68.7% 238.7 $7.21 Not Producing 911.9 231.7 1,634.9 1,416.1 80.8% 19.2 $13.58 Proved Developed 16,068.7 7,797.6 63,869.9 34,511.3 69.2% 258.0 $7.48 Proved Undeveloped 14,800.6 4,492.9 38,519.0 25,713.3 75.0% 25.7 $1.00 Total Proved Reserves 30,869.3 12,290.5 102,388.9 60,224.6 71.7% $283.7 $4.71 % PUD 47.9% 36.6% 37.6% 42.7% 9.0% 19 |

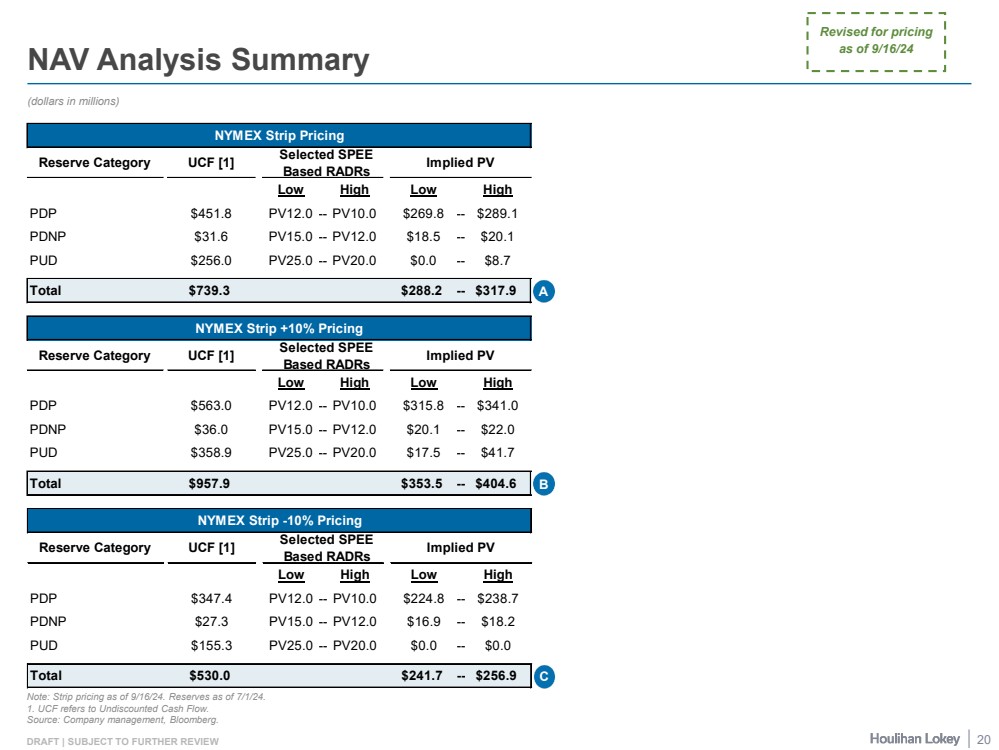

| DRAFT | SUBJECT TO FURTHER REVIEW NAV Analysis Summary (dollars in millions) Note: Strip pricing as of 9/16/24. Reserves as of 7/1/24. 1. UCF refers to Undiscounted Cash Flow. Source: Company management, Bloomberg. Revised for pricing as of 9/16/24 NYMEX Strip Pricing Reserve Category UCF [1] Selected SPEE Based RADRs Implied PV Low High Low High PDP $451.8 PV12.0 -- PV10.0 $269.8 -- $289.1 PDNP $31.6 PV15.0 -- PV12.0 $18.5 -- $20.1 PUD $256.0 PV25.0 -- PV20.0 $0.0 -- $8.7 Total $739.3 $288.2 -- $317.9 A NYMEX Strip +10% Pricing Reserve Category UCF [1] Selected SPEE Based RADRs Implied PV Low High Low High PDP $563.0 PV12.0 -- PV10.0 $315.8 -- $341.0 PDNP $36.0 PV15.0 -- PV12.0 $20.1 -- $22.0 PUD $358.9 PV25.0 -- PV20.0 $17.5 -- $41.7 Total $957.9 $353.5 -- $404.6 B NYMEX Strip -10% Pricing Reserve Category UCF [1] Selected SPEE Based RADRs Implied PV Low High Low High PDP $347.4 PV12.0 -- PV10.0 $224.8 -- $238.7 PDNP $27.3 PV15.0 -- PV12.0 $16.9 -- $18.2 PUD $155.3 PV25.0 -- PV20.0 $0.0 -- $0.0 Total $530.0 $241.7 -- $256.9 C 20 |

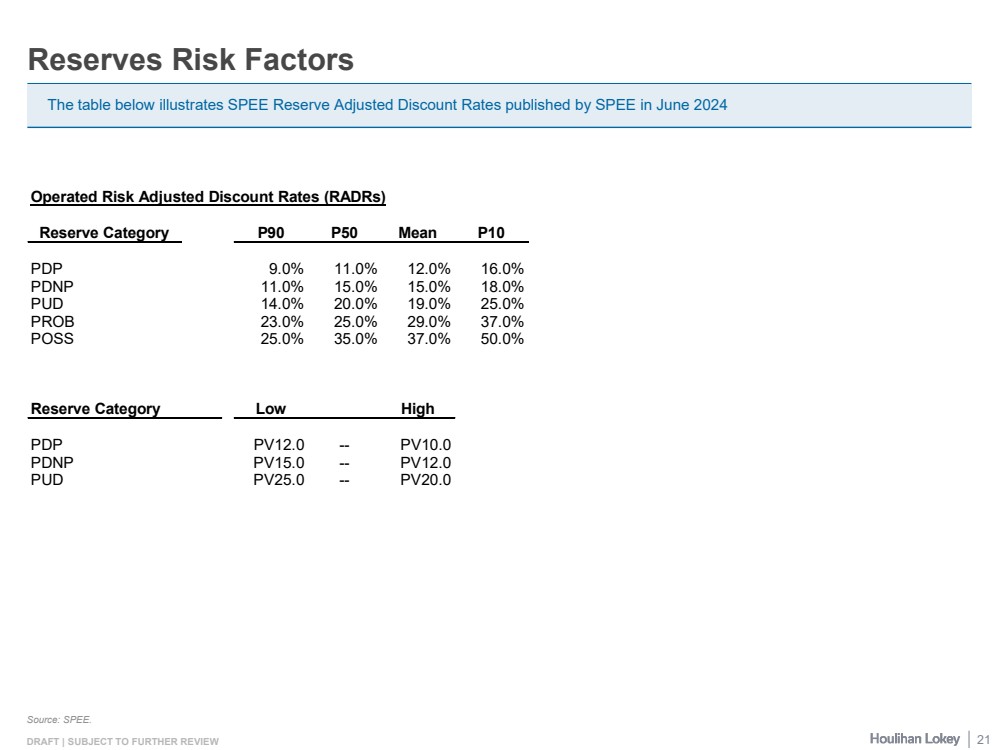

| DRAFT | SUBJECT TO FURTHER REVIEW Reserves Risk Factors Source: SPEE. The table below illustrates SPEE Reserve Adjusted Discount Rates published by SPEE in June 2024 Operated Risk Adjusted Discount Rates (RADRs) Reserve Category P90 P50 Mean P10 PDP 9.0% 11.0% 12.0% 16.0% PDNP 11.0% 15.0% 15.0% 18.0% PUD 14.0% 20.0% 19.0% 25.0% PROB 23.0% 25.0% 29.0% 37.0% POSS 25.0% 35.0% 37.0% 50.0% Reserve Category Low High PDP PV12.0 -- PV10.0 PDNP PV15.0 -- PV12.0 PUD PV25.0 -- PV20.0 21 |

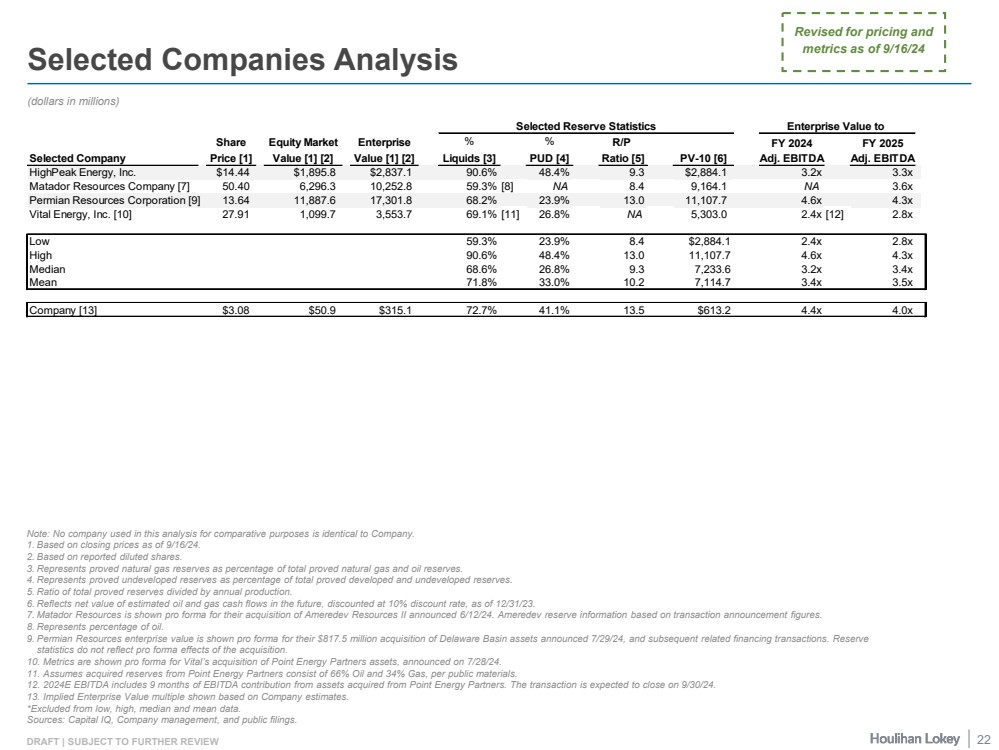

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Companies Analysis (dollars in millions) Note: No company used in this analysis for comparative purposes is identical to Company. 1. Based on closing prices as of 9/16/24. 2. Based on reported diluted shares. 3. Represents proved natural gas reserves as percentage of total proved natural gas and oil reserves. 4. Represents proved undeveloped reserves as percentage of total proved developed and undeveloped reserves. 5. Ratio of total proved reserves divided by annual production. 6. Reflects net value of estimated oil and gas cash flows in the future, discounted at 10% discount rate, as of 12/31/23. 7. Matador Resources is shown pro forma for their acquisition of Ameredev Resources II announced 6/12/24. Ameredev reserve information based on transaction announcement figures. 8. Represents percentage of oil. 9. Permian Resources enterprise value is shown pro forma for their $817.5 million acquisition of Delaware Basin assets announced 7/29/24, and subsequent related financing transactions. Reserve statistics do not reflect pro forma effects of the acquisition. 10. Metrics are shown pro forma for Vital’s acquisition of Point Energy Partners assets, announced on 7/28/24. 11. Assumes acquired reserves from Point Energy Partners consist of 66% Oil and 34% Gas, per public materials. 12. 2024E EBITDA includes 9 months of EBITDA contribution from assets acquired from Point Energy Partners. The transaction is expected to close on 9/30/24. 13. Implied Enterprise Value multiple shown based on Company estimates. *Excluded from low, high, median and mean data. Sources: Capital IQ, Company management, and public filings. Revised for pricing and metrics as of 9/16/24 Selected Reserve Statistics Enterprise Value to Share Equity Market Enterprise % % R/P FY 2024 FY 2025 Selected Company Price [1] Value [1] [2] Value [1] [2] Liquids [3] PUD [4] Ratio [5] PV-10 [6] Adj. EBITDA Adj. EBITDA HighPeak Energy, Inc. $14.44 $1,895.8 $2,837.1 90.6% 48.4% 9.3 $2,884.1 3.2x 3.3x Matador Resources Company [7] 50.40 6,296.3 10,252.8 59.3% [8] NA 8.4 9,164.1 NA 3.6x Permian Resources Corporation [9] 13.64 11,887.6 17,301.8 68.2% 23.9% 13.0 11,107.7 4.6x 4.3x Vital Energy, Inc. [10] 27.91 1,099.7 3,553.7 69.1% [11] 26.8% NA 5,303.0 2.4x [12] 2.8x Low 59.3% 23.9% 8.4 $2,884.1 2.4x 2.8x High 90.6% 48.4% 13.0 11,107.7 4.6x 4.3x Median 68.6% 26.8% 9.3 7,233.6 3.2x 3.4x Mean 71.8% 33.0% 10.2 7,114.7 3.4x 3.5x Company [13] $3.08 $50.9 $315.1 72.7% 41.1% 13.5 $613.2 4.4x 4.0x 22 |

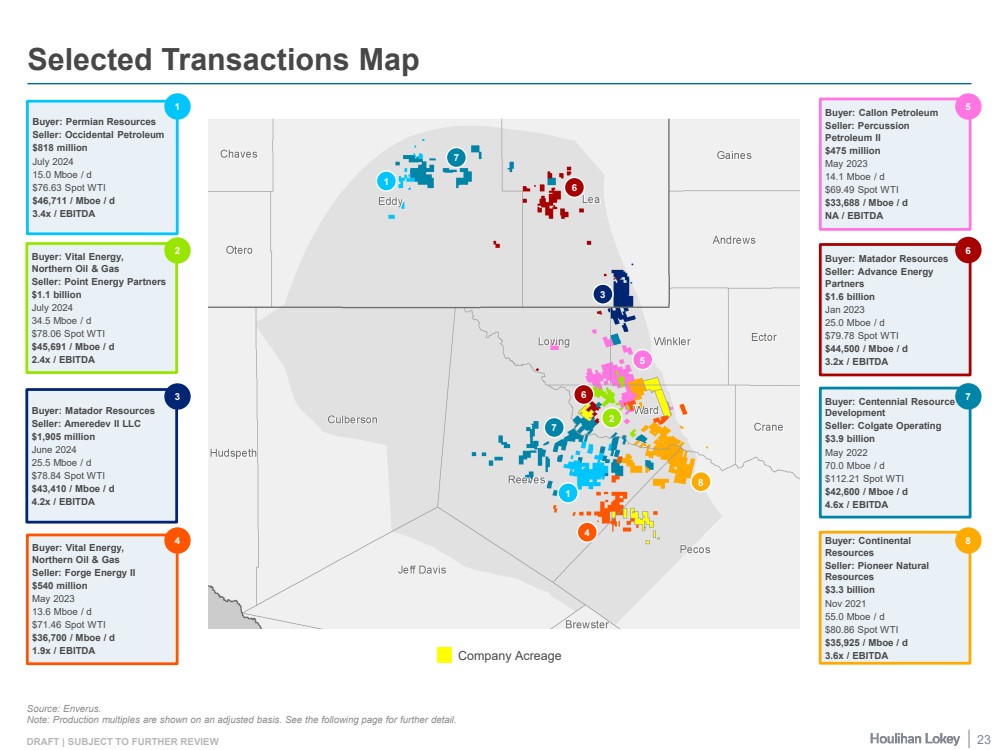

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Transactions Map Buyer: Continental Resources Seller: Pioneer Natural Resources $3.3 billion Nov 2021 55.0 Mboe / d $80.86 Spot WTI $35,925 / Mboe / d 3.6x / EBITDA 8 Buyer: Matador Resources Seller: Advance Energy Partners $1.6 billion Jan 2023 25.0 Mboe / d $79.78 Spot WTI $44,500 / Mboe / d 3.2x / EBITDA 6 Buyer: Vital Energy, Northern Oil & Gas Seller: Forge Energy II $540 million May 2023 13.6 Mboe / d $71.46 Spot WTI $36,700 / Mboe / d 1.9x / EBITDA 4 Buyer: Centennial Resource Development Seller: Colgate Operating $3.9 billion May 2022 70.0 Mboe / d $112.21 Spot WTI $42,600 / Mboe / d 4.6x / EBITDA 7 Company Acreage 6 8 2 Buyer: Callon Petroleum Seller: Percussion Petroleum II $475 million May 2023 14.1 Mboe / d $69.49 Spot WTI $33,688 / Mboe / d NA / EBITDA 5 Buyer: Vital Energy, Northern Oil & Gas Seller: Point Energy Partners $1.1 billion July 2024 34.5 Mboe / d $78.06 Spot WTI $45,691 / Mboe / d 2.4x / EBITDA 2 Buyer: Permian Resources Seller: Occidental Petroleum $818 million July 2024 15.0 Mboe / d $76.63 Spot WTI $46,711 / Mboe / d 3.4x / EBITDA 1 3 Buyer: Matador Resources Seller: Ameredev II LLC $1,905 million June 2024 25.5 Mboe / d $78.84 Spot WTI $43,410 / Mboe / d 4.2x / EBITDA 3 4 Source: Enverus. Note: Production multiples are shown on an adjusted basis. See the following page for further detail. 5 1 7 6 7 1 23 |

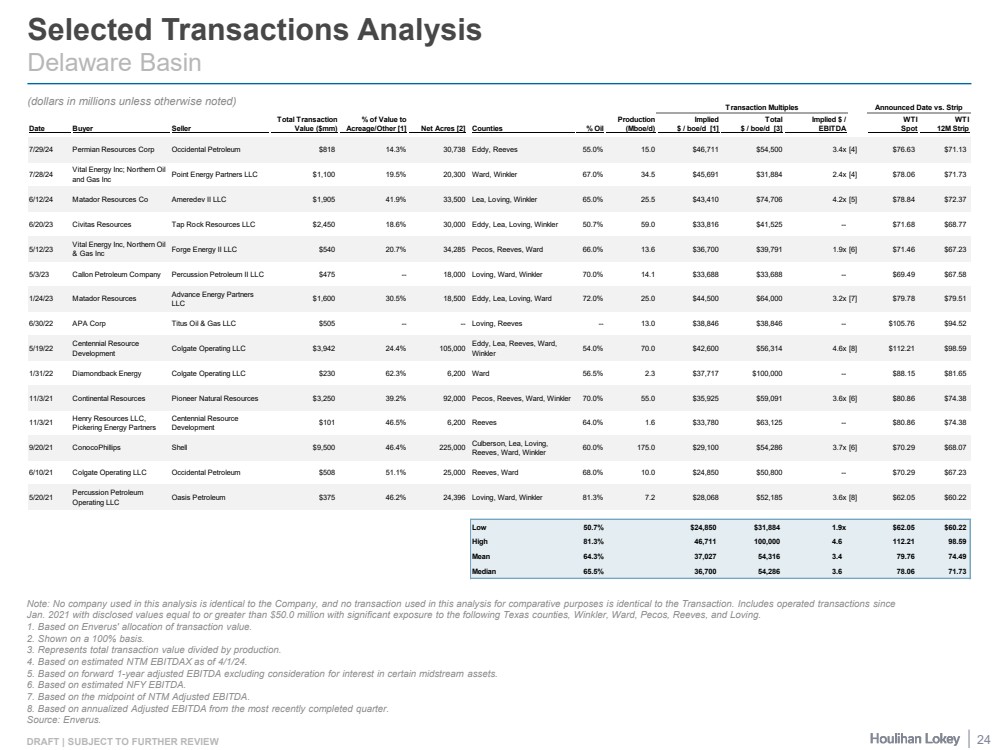

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Transactions Analysis Delaware Basin Note: No company used in this analysis is identical to the Company, and no transaction used in this analysis for comparative purposes is identical to the Transaction. Includes operated transactions since Jan. 2021 with disclosed values equal to or greater than $50.0 million with significant exposure to the following Texas counties, Winkler, Ward, Pecos, Reeves, and Loving. 1. Based on Enverus' allocation of transaction value. 2. Shown on a 100% basis. 3. Represents total transaction value divided by production. 4. Based on estimated NTM EBITDAX as of 4/1/24. 5. Based on forward 1-year adjusted EBITDA excluding consideration for interest in certain midstream assets. 6. Based on estimated NFY EBITDA. 7. Based on the midpoint of NTM Adjusted EBITDA. 8. Based on annualized Adjusted EBITDA from the most recently completed quarter. Source: Enverus. (dollars in millions unless otherwise noted) Transaction Multiples Announced Date vs. Strip Total Transaction % of Value to Production Implied Total Implied $ / WTI WTI Date Buyer Seller Value ($mm) Acreage/Other [1] Net Acres [2] Counties % Oil (Mboe/d) $ / boe/d [1] $ / boe/d [3] EBITDA Spot 12M Strip 7/29/24 Permian Resources Corp Occidental Petroleum $818 14.3% 30,738 Eddy, Reeves 55.0% 15.0 $46,711 $54,500 3.4x [4] $76.63 $71.13 7/28/24 Vital Energy Inc; Northern Oil and Gas Inc Point Energy Partners LLC $1,100 19.5% 20,300 Ward, Winkler 67.0% 34.5 $45,691 $31,884 2.4x [4] $78.06 $71.73 6/12/24 Matador Resources Co Ameredev II LLC $1,905 41.9% 33,500 Lea, Loving, Winkler 65.0% 25.5 $43,410 $74,706 4.2x [5] $78.84 $72.37 6/20/23 Civitas Resources Tap Rock Resources LLC $2,450 18.6% 30,000 Eddy, Lea, Loving, Winkler 50.7% 59.0 $33,816 $41,525 -- $71.68 $68.77 5/12/23 Vital Energy Inc, Northern Oil & Gas Inc Forge Energy II LLC $540 20.7% 34,285 Pecos, Reeves, Ward 66.0% 13.6 $36,700 $39,791 1.9x [6] $71.46 $67.23 5/3/23 Callon Petroleum Company Percussion Petroleum II LLC $475 -- 18,000 Loving, Ward, Winkler 70.0% 14.1 $33,688 $33,688 -- $69.49 $67.58 1/24/23 Matador Resources Advance Energy Partners LLC $1,600 30.5% 18,500 Eddy, Lea, Loving, Ward 72.0% 25.0 $44,500 $64,000 3.2x [7] $79.78 $79.51 6/30/22 APA Corp Titus Oil & Gas LLC $505 -- -- Loving, Reeves -- 13.0 $38,846 $38,846 -- $105.76 $94.52 5/19/22 Centennial Resource Development Colgate Operating LLC $3,942 24.4% 105,000 Eddy, Lea, Reeves, Ward, Winkler 54.0% 70.0 $42,600 $56,314 4.6x [8] $112.21 $98.59 1/31/22 Diamondback Energy Colgate Operating LLC $230 62.3% 6,200 Ward 56.5% 2.3 $37,717 $100,000 -- $88.15 $81.65 11/3/21 Continental Resources Pioneer Natural Resources $3,250 39.2% 92,000 Pecos, Reeves, Ward, Winkler 70.0% 55.0 $35,925 $59,091 3.6x [6] $80.86 $74.38 11/3/21 Henry Resources LLC, Pickering Energy Partners Centennial Resource Development $101 46.5% 6,200 Reeves 64.0% 1.6 $33,780 $63,125 -- $80.86 $74.38 9/20/21 ConocoPhillips Shell $9,500 46.4% 225,000 Culberson, Lea, Loving, Reeves, Ward, Winkler 60.0% 175.0 $29,100 $54,286 3.7x [6] $70.29 $68.07 6/10/21 Colgate Operating LLC Occidental Petroleum $508 51.1% 25,000 Reeves, Ward 68.0% 10.0 $24,850 $50,800 -- $70.29 $67.23 5/20/21 Percussion Petroleum Operating LLC Oasis Petroleum $375 46.2% 24,396 Loving, Ward, Winkler 81.3% 7.2 $28,068 $52,185 3.6x [8] $62.05 $60.22 Low 50.7% $24,850 $31,884 1.9x $62.05 $60.22 High 81.3% 46,711 100,000 4.6 112.21 98.59 Mean 64.3% 37,027 54,316 3.4 79.76 74.49 Median 65.5% 36,700 54,286 3.6 78.06 71.73 24 |

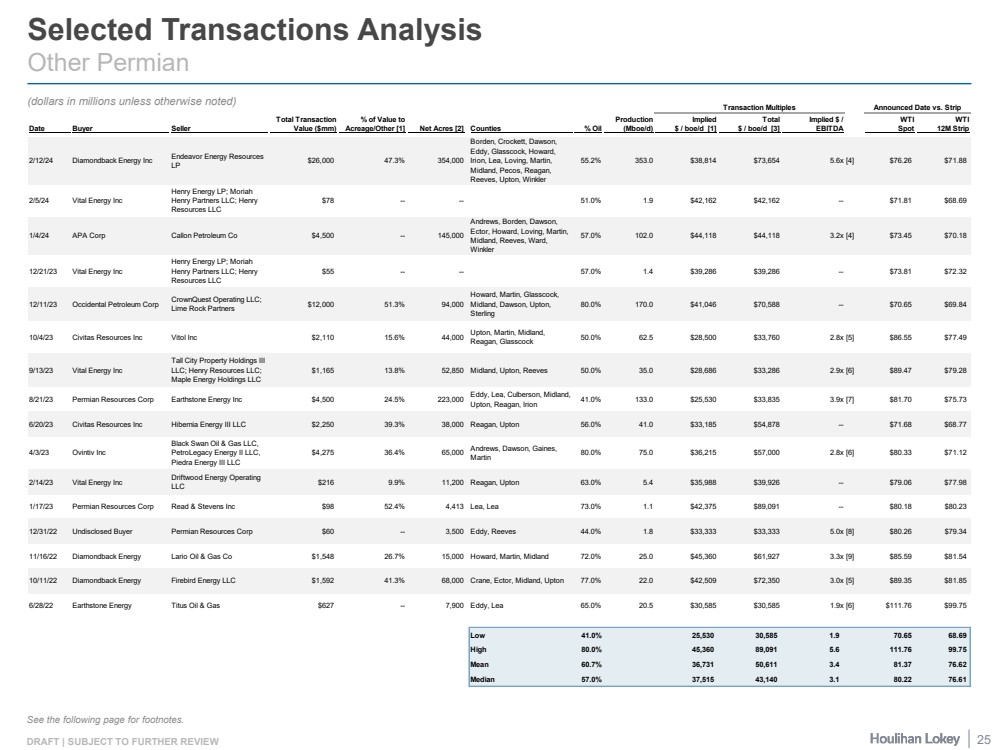

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Transactions Analysis Other Permian (dollars in millions unless otherwise noted) See the following page for footnotes. Transaction Multiples Announced Date vs. Strip Total Transaction % of Value to Production Implied Total Implied $ / WTI WTI Date Buyer Seller Value ($mm) Acreage/Other [1] Net Acres [2] Counties % Oil (Mboe/d) $ / boe/d [1] $ / boe/d [3] EBITDA Spot 12M Strip 2/12/24 Diamondback Energy Inc Endeavor Energy Resources LP $26,000 47.3% 354,000 Borden, Crockett, Dawson, Eddy, Glasscock, Howard, Irion, Lea, Loving, Martin, Midland, Pecos, Reagan, Reeves, Upton, Winkler 55.2% 353.0 $38,814 $73,654 5.6x [4] $76.26 $71.88 2/5/24 Vital Energy Inc Henry Energy LP; Moriah Henry Partners LLC; Henry Resources LLC $78 -- -- 51.0% 1.9 $42,162 $42,162 -- $71.81 $68.69 1/4/24 APA Corp Callon Petroleum Co $4,500 -- 145,000 Andrews, Borden, Dawson, Ector, Howard, Loving, Martin, Midland, Reeves, Ward, Winkler 57.0% 102.0 $44,118 $44,118 3.2x [4] $73.45 $70.18 12/21/23 Vital Energy Inc Henry Energy LP; Moriah Henry Partners LLC; Henry Resources LLC $55 -- -- 57.0% 1.4 $39,286 $39,286 -- $73.81 $72.32 12/11/23 Occidental Petroleum Corp CrownQuest Operating LLC; Lime Rock Partners $12,000 51.3% 94,000 Howard, Martin, Glasscock, Midland, Dawson, Upton, Sterling 80.0% 170.0 $41,046 $70,588 -- $70.65 $69.84 10/4/23 Civitas Resources Inc Vitol Inc $2,110 15.6% 44,000 Upton, Martin, Midland, Reagan, Glasscock 50.0% 62.5 $28,500 $33,760 2.8x [5] $86.55 $77.49 9/13/23 Vital Energy Inc Tall City Property Holdings III LLC; Henry Resources LLC; Maple Energy Holdings LLC $1,165 13.8% 52,850 Midland, Upton, Reeves 50.0% 35.0 $28,686 $33,286 2.9x [6] $89.47 $79.28 8/21/23 Permian Resources Corp Earthstone Energy Inc $4,500 24.5% 223,000 Eddy, Lea, Culberson, Midland, Upton, Reagan, Irion 41.0% 133.0 $25,530 $33,835 3.9x [7] $81.70 $75.73 6/20/23 Civitas Resources Inc Hibernia Energy III LLC $2,250 39.3% 38,000 Reagan, Upton 56.0% 41.0 $33,185 $54,878 -- $71.68 $68.77 4/3/23 Ovintiv Inc Black Swan Oil & Gas LLC, PetroLegacy Energy II LLC, Piedra Energy III LLC $4,275 36.4% 65,000 Andrews, Dawson, Gaines, Martin 80.0% 75.0 $36,215 $57,000 2.8x [6] $80.33 $71.12 2/14/23 Vital Energy Inc Driftwood Energy Operating LLC $216 9.9% 11,200 Reagan, Upton 63.0% 5.4 $35,988 $39,926 -- $79.06 $77.98 1/17/23 Permian Resources Corp Read & Stevens Inc $98 52.4% 4,413 Lea, Lea 73.0% 1.1 $42,375 $89,091 -- $80.18 $80.23 12/31/22 Undisclosed Buyer Permian Resources Corp $60 -- 3,500 Eddy, Reeves 44.0% 1.8 $33,333 $33,333 5.0x [8] $80.26 $79.34 11/16/22 Diamondback Energy Lario Oil & Gas Co $1,548 26.7% 15,000 Howard, Martin, Midland 72.0% 25.0 $45,360 $61,927 3.3x [9] $85.59 $81.54 10/11/22 Diamondback Energy Firebird Energy LLC $1,592 41.3% 68,000 Crane, Ector, Midland, Upton 77.0% 22.0 $42,509 $72,350 3.0x [5] $89.35 $81.85 6/28/22 Earthstone Energy Titus Oil & Gas $627 -- 7,900 Eddy, Lea 65.0% 20.5 $30,585 $30,585 1.9x [6] $111.76 $99.75 Low 41.0% 25,530 30,585 1.9 70.65 68.69 High 80.0% 45,360 89,091 5.6 111.76 99.75 Mean 60.7% 36,731 50,611 3.4 81.37 76.62 Median 57.0% 37,515 43,140 3.1 80.22 76.61 25 |

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Transactions Analysis Other Permian Note: No company used in this analysis is identical to the Company, and no transaction used in this analysis for comparative purposes is identical to the Transaction. Includes operated Permian transactions since Jan. 2021 with disclosed values equal to or greater than $50.0 million. 1. Based on Enverus' allocation of transaction value. 2. Shown on a 100% basis. 3. Represents total transaction value divided by production. 4. Based on NFY EBITDA. 5. Based on NFY+1 EBITDA. 6. Based on NTM EBITDA. 7. Based on consensus NFY EBITDA as of the announcement date. 8. Multiple basis undisclosed. 9. Based on NFY+1 cash flow. Source: Enverus, Capital IQ. 26 |

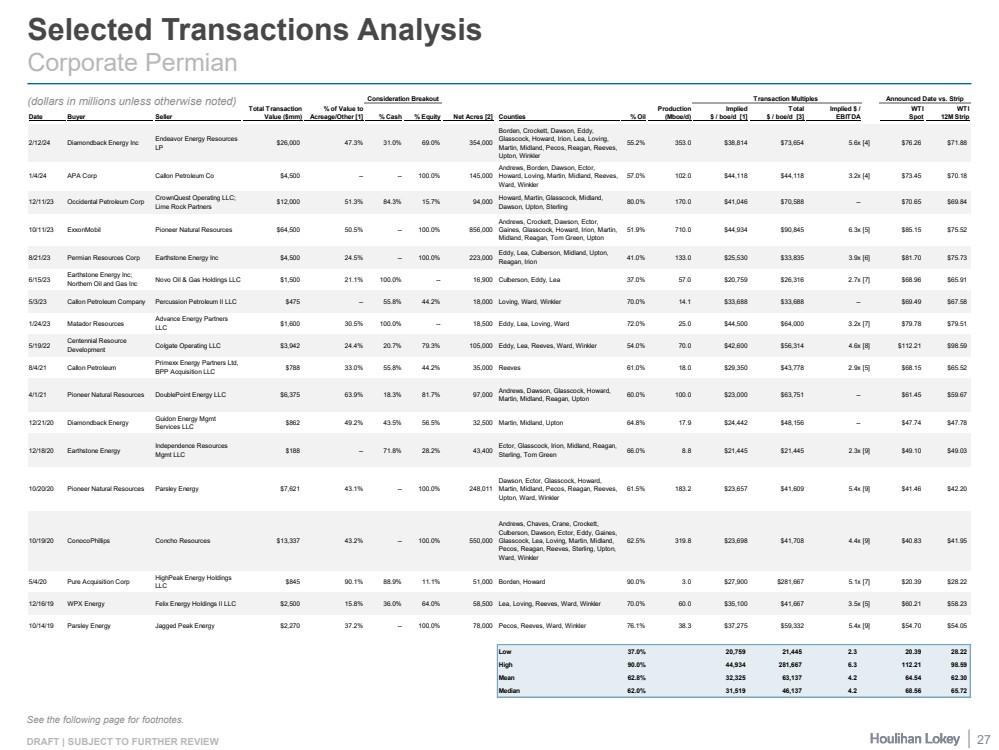

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Transactions Analysis Corporate Permian (dollars in millions unless otherwise noted) See the following page for footnotes. Consideration Breakout Transaction Multiples Announced Date vs. Strip Total Transaction % of Value to Production Implied Total Implied $ / WTI WTI Date Buyer Seller Value ($mm) Acreage/Other [1] % Cash % Equity Net Acres [2] Counties % Oil (Mboe/d) $ / boe/d [1] $ / boe/d [3] EBITDA Spot 12M Strip 2/12/24 Diamondback Energy Inc Endeavor Energy Resources LP $26,000 47.3% 31.0% 69.0% 354,000 Borden, Crockett, Dawson, Eddy, Glasscock, Howard, Irion, Lea, Loving, Martin, Midland, Pecos, Reagan, Reeves, Upton, Winkler 55.2% 353.0 $38,814 $73,654 5.6x [4] $76.26 $71.88 1/4/24 APA Corp Callon Petroleum Co $4,500 -- -- 100.0% 145,000 Andrews, Borden, Dawson, Ector, Howard, Loving, Martin, Midland, Reeves, Ward, Winkler 57.0% 102.0 $44,118 $44,118 3.2x [4] $73.45 $70.18 12/11/23 Occidental Petroleum Corp CrownQuest Operating LLC; Lime Rock Partners $12,000 51.3% 84.3% 15.7% 94,000 Howard, Martin, Glasscock, Midland, Dawson, Upton, Sterling 80.0% 170.0 $41,046 $70,588 -- $70.65 $69.84 10/11/23 ExxonMobil Pioneer Natural Resources $64,500 50.5% -- 100.0% 856,000 Andrews, Crockett, Dawson, Ector, Gaines, Glasscock, Howard, Irion, Martin, Midland, Reagan, Tom Green, Upton 51.9% 710.0 $44,934 $90,845 6.3x [5] $85.15 $75.52 8/21/23 Permian Resources Corp Earthstone Energy Inc $4,500 24.5% -- 100.0% 223,000 Eddy, Lea, Culberson, Midland, Upton, Reagan, Irion 41.0% 133.0 $25,530 $33,835 3.9x [6] $81.70 $75.73 6/15/23 Earthstone Energy Inc; Northern Oil and Gas Inc Novo Oil & Gas Holdings LLC $1,500 21.1% 100.0% -- 16,900 Culberson, Eddy, Lea 37.0% 57.0 $20,759 $26,316 2.7x [7] $68.96 $65.91 5/3/23 Callon Petroleum Company Percussion Petroleum II LLC $475 -- 55.8% 44.2% 18,000 Loving, Ward, Winkler 70.0% 14.1 $33,688 $33,688 -- $69.49 $67.58 1/24/23 Matador Resources Advance Energy Partners LLC $1,600 30.5% 100.0% -- 18,500 Eddy, Lea, Loving, Ward 72.0% 25.0 $44,500 $64,000 3.2x [7] $79.78 $79.51 5/19/22 Centennial Resource Development Colgate Operating LLC $3,942 24.4% 20.7% 79.3% 105,000 Eddy, Lea, Reeves, Ward, Winkler 54.0% 70.0 $42,600 $56,314 4.6x [8] $112.21 $98.59 8/4/21 Callon Petroleum Primexx Energy Partners Ltd, BPP Acquisition LLC $788 33.0% 55.8% 44.2% 35,000 Reeves 61.0% 18.0 $29,350 $43,778 2.9x [5] $68.15 $65.52 4/1/21 Pioneer Natural Resources DoublePoint Energy LLC $6,375 63.9% 18.3% 81.7% 97,000 Andrews, Dawson, Glasscock, Howard, Martin, Midland, Reagan, Upton 60.0% 100.0 $23,000 $63,751 -- $61.45 $59.67 12/21/20 Diamondback Energy Guidon Energy Mgmt Services LLC $862 49.2% 43.5% 56.5% 32,500 Martin, Midland, Upton 64.8% 17.9 $24,442 $48,156 -- $47.74 $47.78 12/18/20 Earthstone Energy Independence Resources Mgmt LLC $188 -- 71.8% 28.2% 43,400 Ector, Glasscock, Irion, Midland, Reagan, Sterling, Tom Green 66.0% 8.8 $21,445 $21,445 2.3x [9] $49.10 $49.03 10/20/20 Pioneer Natural Resources Parsley Energy $7,621 43.1% -- 100.0% 248,011 Dawson, Ector, Glasscock, Howard, Martin, Midland, Pecos, Reagan, Reeves, Upton, Ward, Winkler 61.5% 183.2 $23,657 $41,609 5.4x [9] $41.46 $42.20 10/19/20 ConocoPhillips Concho Resources $13,337 43.2% -- 100.0% 550,000 Andrews, Chaves, Crane, Crockett, Culberson, Dawson, Ector, Eddy, Gaines, Glasscock, Lea, Loving, Martin, Midland, Pecos, Reagan, Reeves, Sterling, Upton, Ward, Winkler 62.5% 319.8 $23,698 $41,708 4.4x [9] $40.83 $41.95 5/4/20 Pure Acquisition Corp HighPeak Energy Holdings LLC $845 90.1% 88.9% 11.1% 51,000 Borden, Howard 90.0% 3.0 $27,900 $281,667 5.1x [7] $20.39 $28.22 12/16/19 WPX Energy Felix Energy Holdings II LLC $2,500 15.8% 36.0% 64.0% 58,500 Lea, Loving, Reeves, Ward, Winkler 70.0% 60.0 $35,100 $41,667 3.5x [5] $60.21 $58.23 10/14/19 Parsley Energy Jagged Peak Energy $2,270 37.2% -- 100.0% 78,000 Pecos, Reeves, Ward, Winkler 76.1% 38.3 $37,275 $59,332 5.4x [9] $54.70 $54.05 Low 37.0% 20,759 21,445 2.3 20.39 28.22 High 90.0% 44,934 281,667 6.3 112.21 98.59 Mean 62.8% 32,325 63,137 4.2 64.54 62.30 Median 62.0% 31,519 46,137 4.2 68.56 65.72 27 |

| DRAFT | SUBJECT TO FURTHER REVIEW Selected Transactions Analysis Corporate Permian Note: No company used in this analysis is identical to the Company, and no transaction used in this analysis for comparative purposes is identical to the Transaction. Includes corporate Permian transactions since Oct. 2019 with disclosed values equal to or greater than $50.0 million. 1. Based on Enverus' allocation of transaction value. 2. Shown on a 100% basis. 3. Represents total transaction value divided by production. 4. Based on NFY EBITDA. 5. Based on NFY+1 EBITDA. 6. Based on consensus NFY EBITDA as of the announcement date. 7. Based on NTM EBITDA. 8. Based on last quarter annualized EBITDA. 9. Based on LTM EBITDA. Source: Enverus, Capital IQ. 28 |

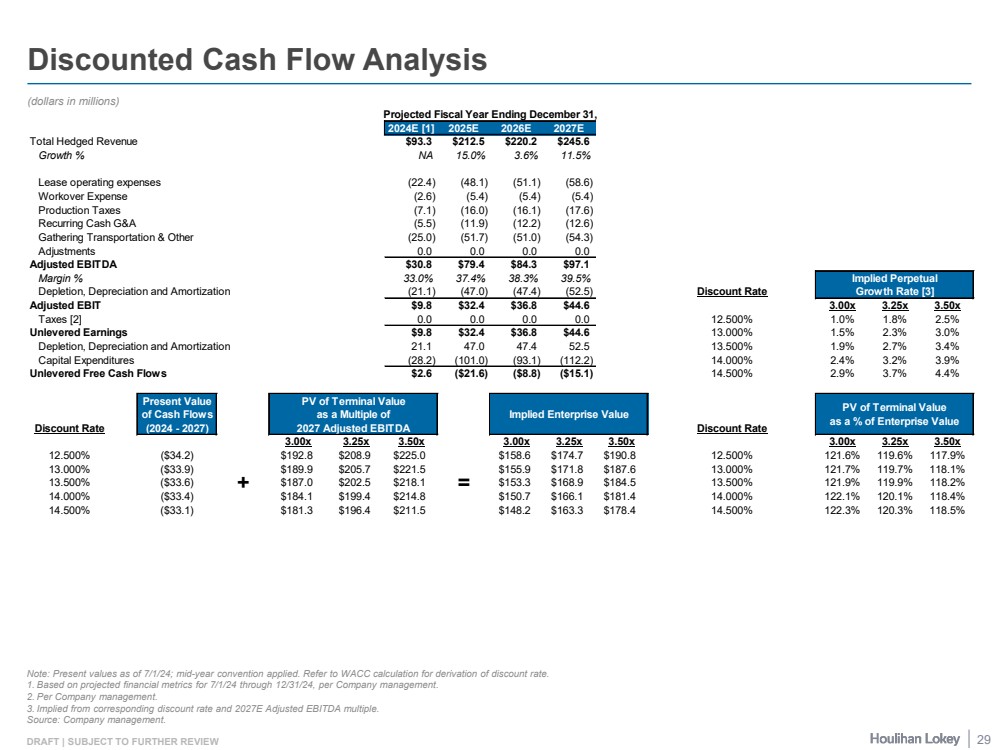

| DRAFT | SUBJECT TO FURTHER REVIEW Discounted Cash Flow Analysis (dollars in millions) Note: Present values as of 7/1/24; mid-year convention applied. Refer to WACC calculation for derivation of discount rate. 1. Based on projected financial metrics for 7/1/24 through 12/31/24, per Company management. 2. Per Company management. 3. Implied from corresponding discount rate and 2027E Adjusted EBITDA multiple. Source: Company management. Projected Fiscal Year Ending December 31, 2024E [1] 2025E 2026E 2027E Total Hedged Revenue $93.3 $212.5 $220.2 $245.6 Growth % NA 15.0% 3.6% 11.5% Lease operating expenses (22.4) (48.1) (51.1) (58.6) Workover Expense (2.6) (5.4) (5.4) (5.4) Production Taxes (7.1) (16.0) (16.1) (17.6) Recurring Cash G&A (5.5) (11.9) (12.2) (12.6) Gathering Transportation & Other (25.0) (51.7) (51.0) (54.3) Adjustments 0.0 0.0 0.0 0.0 Adjusted EBITDA $30.8 $79.4 $84.3 $97.1 Margin % 33.0% 37.4% 38.3% 39.5% Implied Perpetual Depletion, Depreciation and Amortization (21.1) (47.0) (47.4) (52.5) Discount Rate Growth Rate [3] Adjusted EBIT $9.8 $32.4 $36.8 $44.6 3.00x 3.25x 3.50x Taxes [2] 0.0 0.0 0.0 0.0 12.500% 1.0% 1.8% 2.5% Unlevered Earnings $9.8 $32.4 $36.8 $44.6 13.000% 1.5% 2.3% 3.0% Depletion, Depreciation and Amortization 21.1 47.0 47.4 52.5 13.500% 1.9% 2.7% 3.4% Capital Expenditures (28.2) (101.0) (93.1) (112.2) 14.000% 2.4% 3.2% 3.9% Unlevered Free Cash Flows $2.6 ($21.6) ($8.8) ($15.1) 14.500% 2.9% 3.7% 4.4% Present Value PV of Terminal Value of Cash Flows as a Multiple of Discount Rate (2024 - 2027) 2027 Adjusted EBITDA Discount Rate 3.00x 3.25x 3.50x 3.00x 3.25x 3.50x 3.00x 3.25x 3.50x 12.500% ($34.2) $192.8 $208.9 $225.0 $158.6 $174.7 $190.8 12.500% 121.6% 119.6% 117.9% 13.000% ($33.9) $189.9 $205.7 $221.5 $155.9 $171.8 $187.6 13.000% 121.7% 119.7% 118.1% 13.500% ($33.6) + $187.0 $202.5 $218.1 = $153.3 $168.9 $184.5 13.500% 121.9% 119.9% 118.2% 14.000% ($33.4) $184.1 $199.4 $214.8 $150.7 $166.1 $181.4 14.000% 122.1% 120.1% 118.4% 14.500% ($33.1) $181.3 $196.4 $211.5 $148.2 $163.3 $178.4 14.500% 122.3% 120.3% 118.5% PV of Terminal Value as a % of Enterprise Value Implied Enterprise Value 29 |

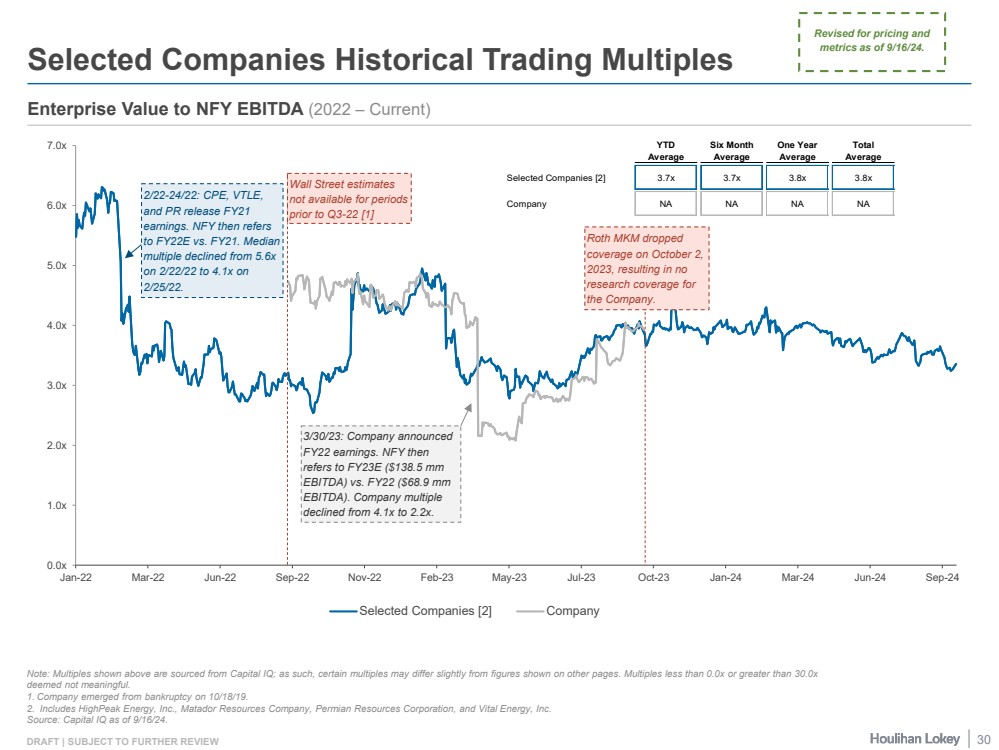

| DRAFT | SUBJECT TO FURTHER REVIEW 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x Jan-22 Mar-22 Jun-22 Sep-22 Nov-22 Feb-23 May-23 Jul-23 Oct-23 Jan-24 Mar-24 Jun-24 Sep-24 Selected Companies [2] Company Selected Companies Historical Trading Multiples Note: Multiples shown above are sourced from Capital IQ; as such, certain multiples may differ slightly from figures shown on other pages. Multiples less than 0.0x or greater than 30.0x deemed not meaningful. 1. Company emerged from bankruptcy on 10/18/19. 2. Includes HighPeak Energy, Inc., Matador Resources Company, Permian Resources Corporation, and Vital Energy, Inc. Source: Capital IQ as of 9/16/24. Enterprise Value to NFY EBITDA (2022 – Current) 2/22-24/22: CPE, VTLE, and PR release FY21 earnings. NFY then refers to FY22E vs. FY21. Median multiple declined from 5.6x on 2/22/22 to 4.1x on 2/25/22. Wall Street estimates not available for periods prior to Q3-22 [1] 3/30/23: Company announced FY22 earnings. NFY then refers to FY23E ($138.5 mm EBITDA) vs. FY22 ($68.9 mm EBITDA). Company multiple declined from 4.1x to 2.2x. Roth MKM dropped coverage on October 2, 2023, resulting in no research coverage for the Company. YTD Six Month One Year Total Average Average Average Average Selected Companies [2] 3.7x 3.7x 3.8x 3.8x Company NA NA NA NA Revised for pricing and metrics as of 9/16/24. 30 |

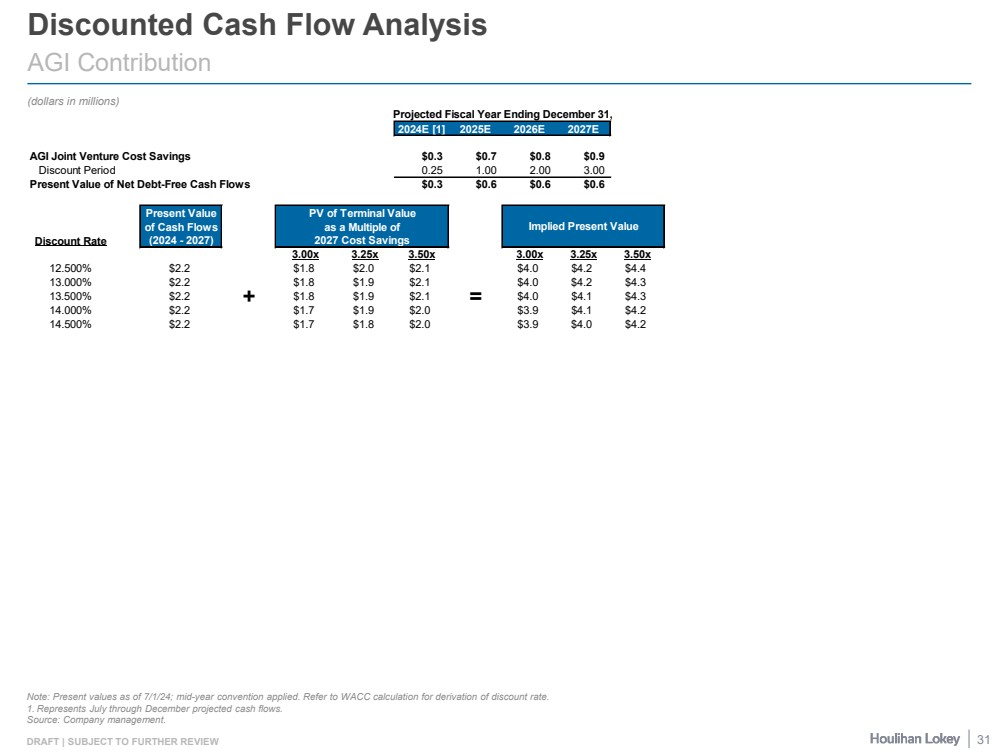

| DRAFT | SUBJECT TO FURTHER REVIEW Discounted Cash Flow Analysis AGI Contribution (dollars in millions) Note: Present values as of 7/1/24; mid-year convention applied. Refer to WACC calculation for derivation of discount rate. 1. Represents July through December projected cash flows. Source: Company management. Projected Fiscal Year Ending December 31, 2024E [1] 2025E 2026E 2027E AGI Joint Venture Cost Savings $0.3 $0.7 $0.8 $0.9 Discount Period 0.25 1.00 2.00 3.00 Present Value of Net Debt-Free Cash Flows $0.3 $0.6 $0.6 $0.6 Present Value PV of Terminal Value of Cash Flows as a Multiple of Discount Rate (2024 - 2027) 2027 Cost Savings 3.00x 3.25x 3.50x 3.00x 3.25x 3.50x 12.500% $2.2 $1.8 $2.0 $2.1 $4.0 $4.2 $4.4 13.000% $2.2 $1.8 $1.9 $2.1 $4.0 $4.2 $4.3 13.500% $2.2 + $1.8 $1.9 $2.1 = $4.0 $4.1 $4.3 14.000% $2.2 $1.7 $1.9 $2.0 $3.9 $4.1 $4.2 14.500% $2.2 $1.7 $1.8 $2.0 $3.9 $4.0 $4.2 Implied Present Value 31 |

| Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 5. Disclaimer 51 |

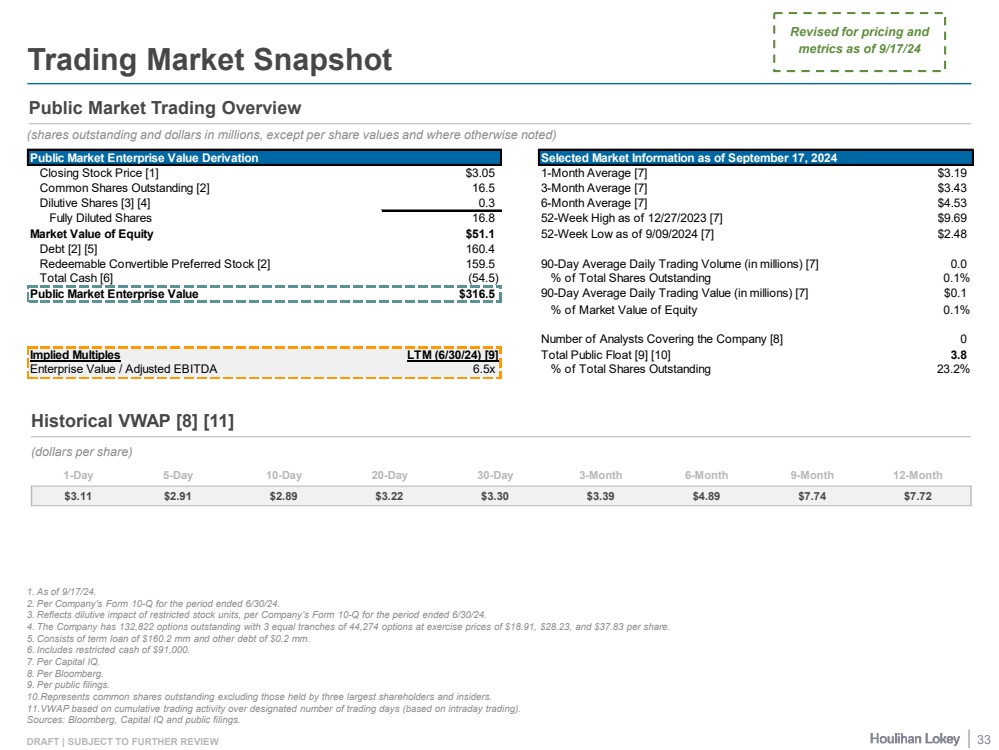

| DRAFT | SUBJECT TO FURTHER REVIEW Trading Market Snapshot Public Market Trading Overview (shares outstanding and dollars in millions, except per share values and where otherwise noted) 1. As of 9/17/24. 2. Per Company's Form 10-Q for the period ended 6/30/24. 3. Reflects dilutive impact of restricted stock units, per Company’s Form 10-Q for the period ended 6/30/24. 4. The Company has 132,822 options outstanding with 3 equal tranches of 44,274 options at exercise prices of $18.91, $28.23, and $37.83 per share. 5. Consists of term loan of $160.2 mm and other debt of $0.2 mm. 6. Includes restricted cash of $91,000. 7. Per Capital IQ. 8. Per Bloomberg. 9. Per public filings. 10.Represents common shares outstanding excluding those held by three largest shareholders and insiders. 11.VWAP based on cumulative trading activity over designated number of trading days (based on intraday trading). Sources: Bloomberg, Capital IQ and public filings. Historical VWAP [8] [11] (dollars per share) 1-Day 5-Day 10-Day 20-Day 30-Day 3-Month 6-Month 9-Month 12-Month $3.11 $2.91 $2.89 $3.22 $3.30 $3.39 $4.89 $7.74 $7.72 Revised for pricing and metrics as of 9/17/24 33 Public Market Enterprise Value Derivation Selected Market Information as of September 17, 2024 Closing Stock Price [1] $3.05 1-Month Average [7] $3.19 Common Shares Outstanding [2] 16.5 3-Month Average [7] $3.43 Dilutive Shares [3] [4] 0.3 6-Month Average [7] $4.53 Fully Diluted Shares 16.8 52-Week High as of 12/27/2023 [7] $9.69 Market Value of Equity $51.1 52-Week Low as of 9/09/2024 [7] $2.48 Debt [2] [5] 160.4 Redeemable Convertible Preferred Stock [2] 159.5 90-Day Average Daily Trading Volume (in millions) [7] 0.0 Total Cash [6] (54.5) % of Total Shares Outstanding 0.1% Public Market Enterprise Value $316.5 90-Day Average Daily Trading Value (in millions) [7] $0.1 % of Market Value of Equity 0.1% Number of Analysts Covering the Company [8] 0 Implied Multiples LTM (6/30/24) [9] Total Public Float [9] [10] 3.8 Enterprise Value / Adjusted EBITDA 6.5x % of Total Shares Outstanding 23.2% |

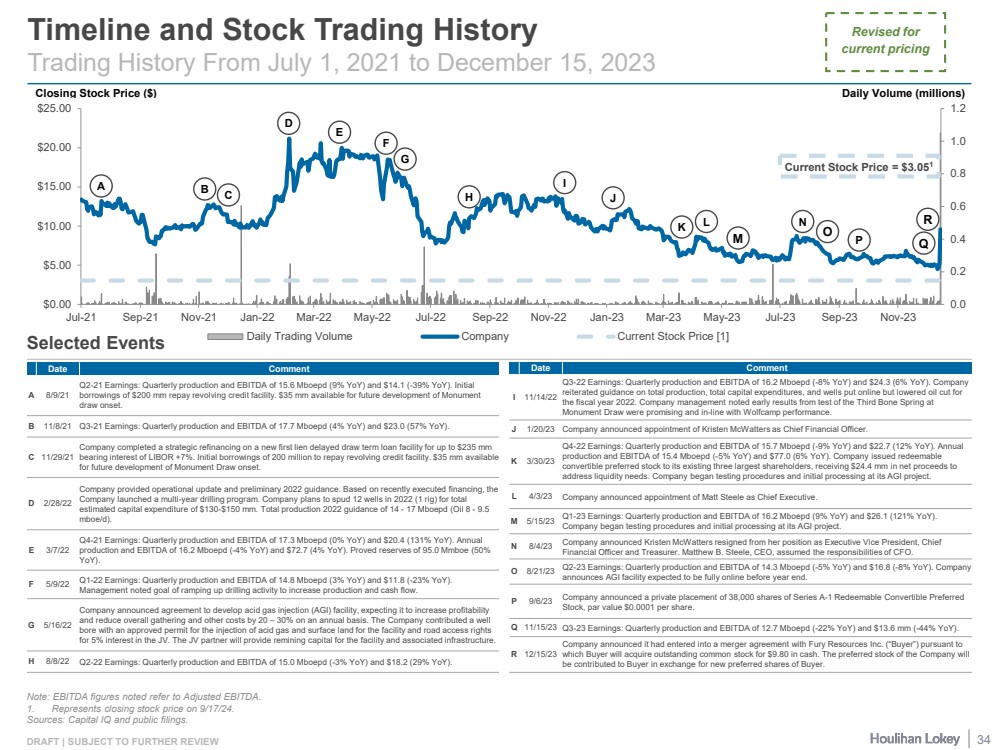

| DRAFT | SUBJECT TO FURTHER REVIEW 0.0 0.2 0.4 0.6 0.8 1.0 1.2 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 May-22 Jul-22 Sep-22 Nov-22 Jan-23 Mar-23 May-23 Jul-23 Sep-23 Nov-23 Daily Trading Volume Company Current Stock Price [1] Closing Stock Price ($) Daily Volume (millions) Timeline and Stock Trading History Trading History From July 1, 2021 to December 15, 2023 Selected Events Date Comment A 8/9/21 Q2-21 Earnings: Quarterly production and EBITDA of 15.6 Mboepd (9% YoY) and $14.1 (-39% YoY). Initial borrowings of $200 mm repay revolving credit facility. $35 mm available for future development of Monument draw onset. B 11/8/21 Q3-21 Earnings: Quarterly production and EBITDA of 17.7 Mboepd (4% YoY) and $23.0 (57% YoY). C 11/29/21 Company completed a strategic refinancing on a new first lien delayed draw term loan facility for up to $235 mm bearing interest of LIBOR +7%. Initial borrowings of 200 million to repay revolving credit facility. $35 mm available for future development of Monument Draw onset. D 2/28/22 Company provided operational update and preliminary 2022 guidance. Based on recently executed financing, the Company launched a multi-year drilling program. Company plans to spud 12 wells in 2022 (1 rig) for total estimated capital expenditure of $130-$150 mm. Total production 2022 guidance of 14 - 17 Mboepd (Oil 8 - 9.5 mboe/d). E 3/7/22 Q4-21 Earnings: Quarterly production and EBITDA of 17.3 Mboepd (0% YoY) and $20.4 (131% YoY). Annual production and EBITDA of 16.2 Mboepd (-4% YoY) and $72.7 (4% YoY). Proved reserves of 95.0 Mmboe (50% YoY). F 5/9/22 Q1-22 Earnings: Quarterly production and EBITDA of 14.8 Mboepd (3% YoY) and $11.8 (-23% YoY). Management noted goal of ramping up drilling activity to increase production and cash flow. G 5/16/22 Company announced agreement to develop acid gas injection (AGI) facility, expecting it to increase profitability and reduce overall gathering and other costs by 20 – 30% on an annual basis. The Company contributed a well bore with an approved permit for the injection of acid gas and surface land for the facility and road access rights for 5% interest in the JV. The JV partner will provide remining capital for the facility and associated infrastructure. H 8/8/22 Q2-22 Earnings: Quarterly production and EBITDA of 15.0 Mboepd (-3% YoY) and $18.2 (29% YoY). Date Comment I 11/14/22 Q3-22 Earnings: Quarterly production and EBITDA of 16.2 Mboepd (-8% YoY) and $24.3 (6% YoY). Company reiterated guidance on total production, total capital expenditures, and wells put online but lowered oil cut for the fiscal year 2022. Company management noted early results from test of the Third Bone Spring at Monument Draw were promising and in-line with Wolfcamp performance. J 1/20/23 Company announced appointment of Kristen McWatters as Chief Financial Officer. K 3/30/23 Q4-22 Earnings: Quarterly production and EBITDA of 15.7 Mboepd (-9% YoY) and $22.7 (12% YoY). Annual production and EBITDA of 15.4 Mboepd (-5% YoY) and $77.0 (6% YoY). Company issued redeemable convertible preferred stock to its existing three largest shareholders, receiving $24.4 mm in net proceeds to address liquidity needs. Company began testing procedures and initial processing at its AGI project. L 4/3/23 Company announced appointment of Matt Steele as Chief Executive. M 5/15/23 Q1-23 Earnings: Quarterly production and EBITDA of 16.2 Mboepd (9% YoY) and $26.1 (121% YoY). Company began testing procedures and initial processing at its AGI project. N 8/4/23 Company announced Kristen McWatters resigned from her position as Executive Vice President, Chief Financial Officer and Treasurer. Matthew B. Steele, CEO, assumed the responsibilities of CFO. O 8/21/23 Q2-23 Earnings: Quarterly production and EBITDA of 14.3 Mboepd (-5% YoY) and $16.8 (-8% YoY). Company announces AGI facility expected to be fully online before year end. P 9/6/23 Company announced a private placement of 38,000 shares of Series A-1 Redeemable Convertible Preferred Stock, par value $0.0001 per share. Q 11/15/23 Q3-23 Earnings: Quarterly production and EBITDA of 12.7 Mboepd (-22% YoY) and $13.6 mm (-44% YoY). R 12/15/23 Company announced it had entered into a merger agreement with Fury Resources Inc. (“Buyer”) pursuant to which Buyer will acquire outstanding common stock for $9.80 in cash. The preferred stock of the Company will be contributed to Buyer in exchange for new preferred shares of Buyer. A F G E C H J L M N O B K P D I Current Stock Price = $3.051 Q Note: EBITDA figures noted refer to Adjusted EBITDA. 1. Represents closing stock price on 9/17/24. Sources: Capital IQ and public filings. Revised for current pricing R 34 |

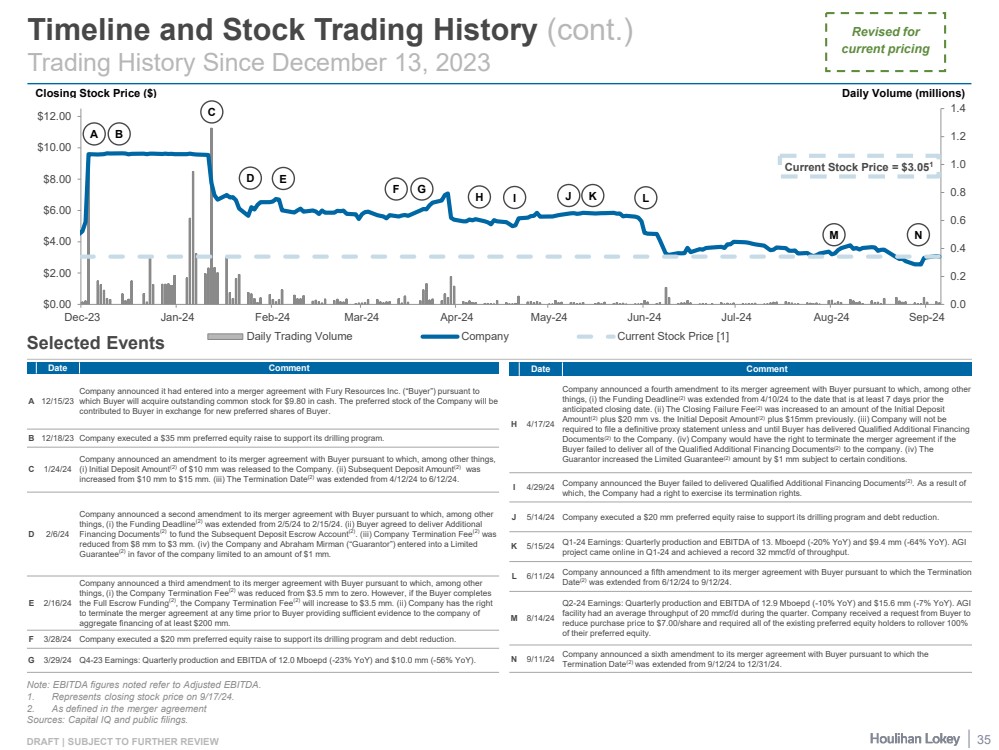

| DRAFT | SUBJECT TO FURTHER REVIEW 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Daily Trading Volume Company Current Stock Price [1] Closing Stock Price ($) Daily Volume (millions) Timeline and Stock Trading History (cont.) Trading History Since December 13, 2023 Selected Events Date Comment A 12/15/23 Company announced it had entered into a merger agreement with Fury Resources Inc. (“Buyer”) pursuant to which Buyer will acquire outstanding common stock for $9.80 in cash. The preferred stock of the Company will be contributed to Buyer in exchange for new preferred shares of Buyer. B 12/18/23 Company executed a $35 mm preferred equity raise to support its drilling program. C 1/24/24 Company announced an amendment to its merger agreement with Buyer pursuant to which, among other things, (i) Initial Deposit Amount(2) of $10 mm was released to the Company. (ii) Subsequent Deposit Amount(2) was increased from $10 mm to $15 mm. (iii) The Termination Date(2) was extended from 4/12/24 to 6/12/24. D 2/6/24 Company announced a second amendment to its merger agreement with Buyer pursuant to which, among other things, (i) the Funding Deadline(2) was extended from 2/5/24 to 2/15/24. (ii) Buyer agreed to deliver Additional Financing Documents(2) to fund the Subsequent Deposit Escrow Account(2). (iii) Company Termination Fee(2) was reduced from $8 mm to $3 mm. (iv) the Company and Abraham Mirman (“Guarantor”) entered into a Limited Guarantee(2) in favor of the company limited to an amount of $1 mm. E 2/16/24 Company announced a third amendment to its merger agreement with Buyer pursuant to which, among other things, (i) the Company Termination Fee(2) was reduced from $3.5 mm to zero. However, if the Buyer completes the Full Escrow Funding(2), the Company Termination Fee(2) will increase to $3.5 mm. (ii) Company has the right to terminate the merger agreement at any time prior to Buyer providing sufficient evidence to the company of aggregate financing of at least $200 mm. F 3/28/24 Company executed a $20 mm preferred equity raise to support its drilling program and debt reduction. G 3/29/24 Q4-23 Earnings: Quarterly production and EBITDA of 12.0 Mboepd (-23% YoY) and $10.0 mm (-56% YoY). A B Note: EBITDA figures noted refer to Adjusted EBITDA. 1. Represents closing stock price on 9/17/24. 2. As defined in the merger agreement Sources: Capital IQ and public filings. C E G H F I Date Comment H 4/17/24 Company announced a fourth amendment to its merger agreement with Buyer pursuant to which, among other things, (i) the Funding Deadline(2) was extended from 4/10/24 to the date that is at least 7 days prior the anticipated closing date. (ii) The Closing Failure Fee(2) was increased to an amount of the Initial Deposit Amount(2) plus $20 mm vs. the Initial Deposit Amount(2) plus $15mm previously. (iii) Company will not be required to file a definitive proxy statement unless and until Buyer has delivered Qualified Additional Financing Documents(2) to the Company. (iv) Company would have the right to terminate the merger agreement if the Buyer failed to deliver all of the Qualified Additional Financing Documents(2) to the company. (iv) The Guarantor increased the Limited Guarantee(2) amount by $1 mm subject to certain conditions. I 4/29/24 Company announced the Buyer failed to delivered Qualified Additional Financing Documents(2). As a result of which, the Company had a right to exercise its termination rights. J 5/14/24 Company executed a $20 mm preferred equity raise to support its drilling program and debt reduction. K 5/15/24 Q1-24 Earnings: Quarterly production and EBITDA of 13. Mboepd (-20% YoY) and $9.4 mm (-64% YoY). AGI project came online in Q1-24 and achieved a record 32 mmcf/d of throughput. L 6/11/24 Company announced a fifth amendment to its merger agreement with Buyer pursuant to which the Termination Date(2) was extended from 6/12/24 to 9/12/24. M 8/14/24 Q2-24 Earnings: Quarterly production and EBITDA of 12.9 Mboepd (-10% YoY) and $15.6 mm (-7% YoY). AGI facility had an average throughput of 20 mmcf/d during the quarter. Company received a request from Buyer to reduce purchase price to $7.00/share and required all of the existing preferred equity holders to rollover 100% of their preferred equity. N 9/11/24 Company announced a sixth amendment to its merger agreement with Buyer pursuant to which the Termination Date(2) was extended from 9/12/24 to 12/31/24. D J K L M Current Stock Price = $3.051 N Revised for current pricing 35 |

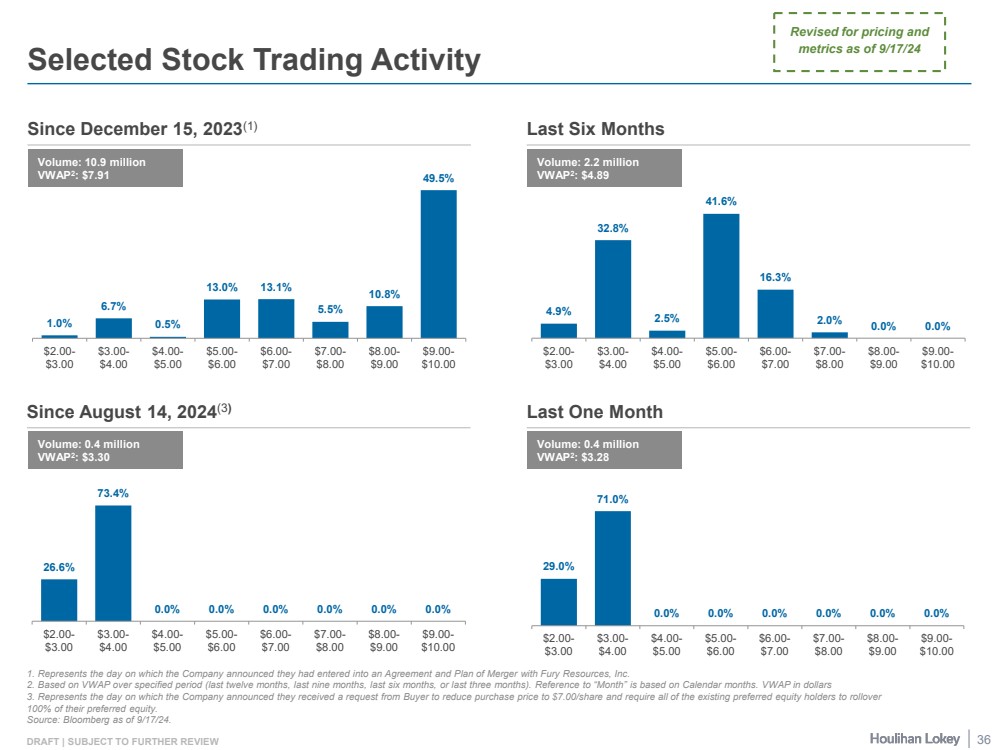

| DRAFT | SUBJECT TO FURTHER REVIEW 29.0% 71.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $2.00- $3.00 $3.00- $4.00 $4.00- $5.00 $5.00- $6.00 $6.00- $7.00 $7.00- $8.00 $8.00- $9.00 $9.00- $10.00 4.9% 32.8% 2.5% 41.6% 16.3% 2.0% 0.0% 0.0% $2.00- $3.00 $3.00- $4.00 $4.00- $5.00 $5.00- $6.00 $6.00- $7.00 $7.00- $8.00 $8.00- $9.00 $9.00- $10.00 Selected Stock Trading Activity Since December 15, 2023(1) Last Six Months Since August 14, 2024(3) Last One Month 1. Represents the day on which the Company announced they had entered into an Agreement and Plan of Merger with Fury Resources, Inc. 2. Based on VWAP over specified period (last twelve months, last nine months, last six months, or last three months). Reference to “Month” is based on Calendar months. VWAP in dollars 3. Represents the day on which the Company announced they received a request from Buyer to reduce purchase price to $7.00/share and require all of the existing preferred equity holders to rollover 100% of their preferred equity. Source: Bloomberg as of 9/17/24. Volume: 10.9 million VWAP2: $7.91 Volume: 2.2 million VWAP2: $4.89 Volume: 0.4 million VWAP2: $3.30 Volume: 0.4 million VWAP2: $3.28 36 1.0% 6.7% 0.5% 13.0% 13.1% 5.5% 10.8% 49.5% $2.00- $3.00 $3.00- $4.00 $4.00- $5.00 $5.00- $6.00 $6.00- $7.00 $7.00- $8.00 $8.00- $9.00 $9.00- $10.00 26.6% 73.4% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $2.00- $3.00 $3.00- $4.00 $4.00- $5.00 $5.00- $6.00 $6.00- $7.00 $7.00- $8.00 $8.00- $9.00 $9.00- $10.00 Revised for pricing and metrics as of 9/17/24 |

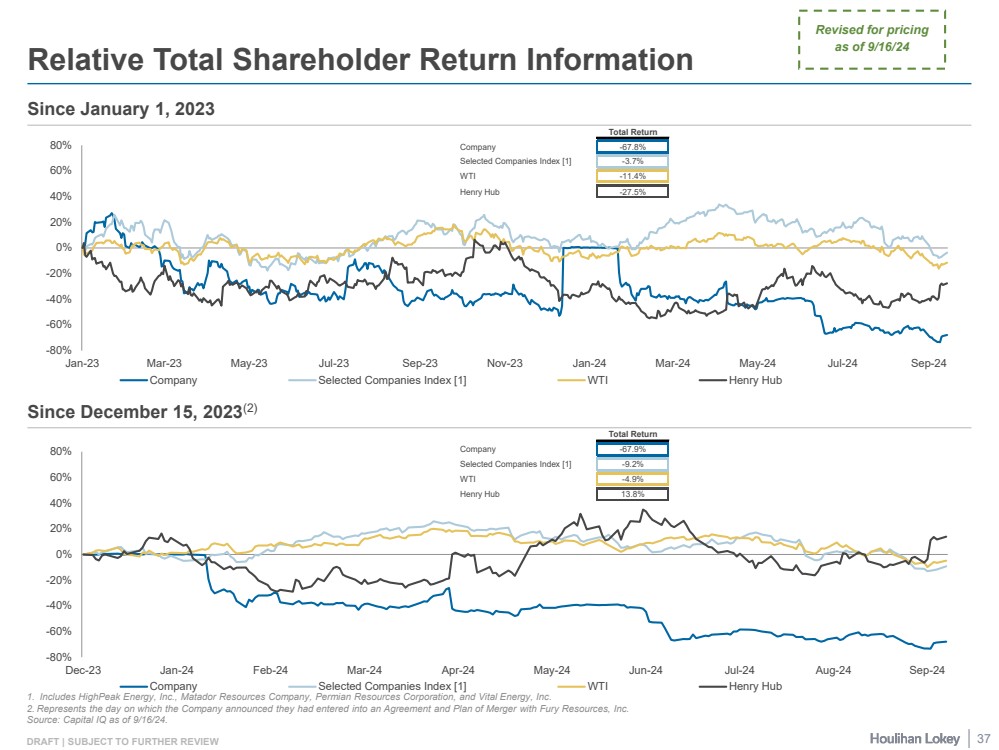

| DRAFT | SUBJECT TO FURTHER REVIEW -80% -60% -40% -20% 0% 20% 40% 60% 80% Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Company Selected Companies Index [1] WTI Henry Hub -80% -60% -40% -20% 0% 20% 40% 60% 80% Jan-23 Mar-23 May-23 Jul-23 Sep-23 Nov-23 Jan-24 Mar-24 May-24 Jul-24 Sep-24 Company Selected Companies Index [1] WTI Henry Hub Relative Total Shareholder Return Information Since January 1, 2023 1. Includes HighPeak Energy, Inc., Matador Resources Company, Permian Resources Corporation, and Vital Energy, Inc. 2. Represents the day on which the Company announced they had entered into an Agreement and Plan of Merger with Fury Resources, Inc. Source: Capital IQ as of 9/16/24. Since December 15, 2023(2) Revised for pricing as of 9/16/24 Total Return Company -67.8% Selected Companies Index [1] -3.7% WTI -11.4% Henry Hub -27.5% Total Return Company -67.9% Selected Companies Index [1] -9.2% WTI -4.9% Henry Hub 13.8% 37 |

| Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 Weighted Average Cost of Capital Calculation 39 Observed Premiums Paid Analysis 42 Redeemable Convertible Preferred Stock Terms 45 Glossary of Selected Terms 48 5. Disclaimer 51 |

| Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 Weighted Average Cost of Capital Calculation 39 Observed Premiums Paid Analysis 42 Redeemable Convertible Preferred Stock Terms 45 Glossary of Selected Terms 48 5. Disclaimer 51 |

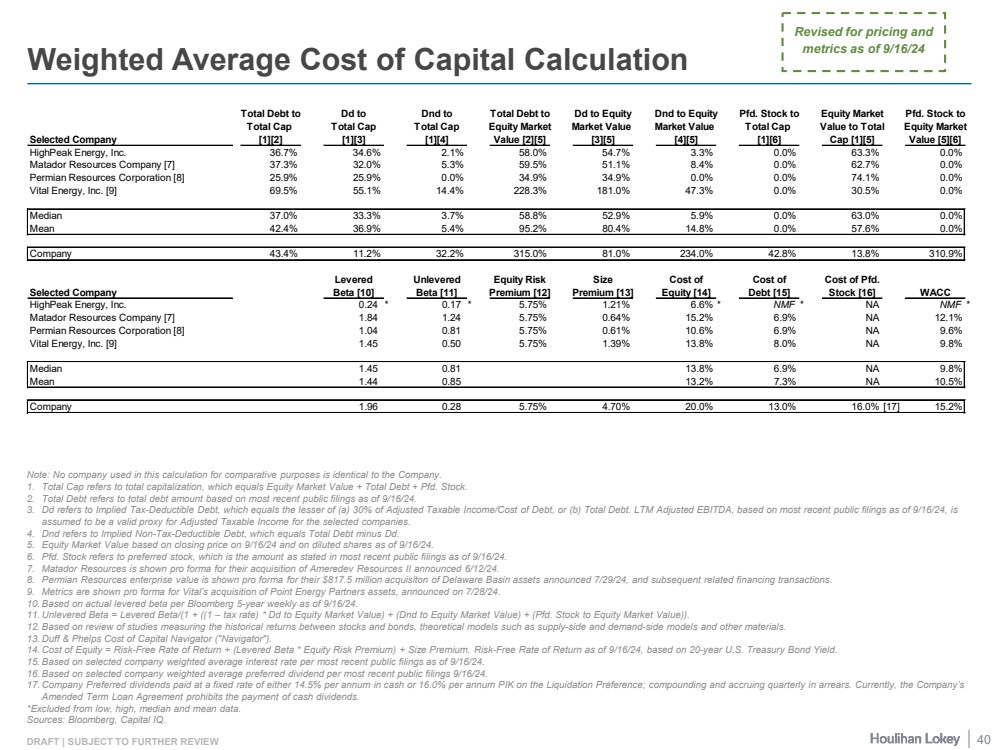

| DRAFT | SUBJECT TO FURTHER REVIEW Weighted Average Cost of Capital Calculation Note: No company used in this calculation for comparative purposes is identical to the Company. 1. Total Cap refers to total capitalization, which equals Equity Market Value + Total Debt + Pfd. Stock. 2. Total Debt refers to total debt amount based on most recent public filings as of 9/16/24. 3. Dd refers to Implied Tax-Deductible Debt, which equals the lesser of (a) 30% of Adjusted Taxable Income/Cost of Debt, or (b) Total Debt. LTM Adjusted EBITDA, based on most recent public filings as of 9/16/24, is assumed to be a valid proxy for Adjusted Taxable Income for the selected companies. 4. Dnd refers to Implied Non-Tax-Deductible Debt, which equals Total Debt minus Dd. 5. Equity Market Value based on closing price on 9/16/24 and on diluted shares as of 9/16/24. 6. Pfd. Stock refers to preferred stock, which is the amount as stated in most recent public filings as of 9/16/24. 7. Matador Resources is shown pro forma for their acquisition of Ameredev Resources II announced 6/12/24. 8. Permian Resources enterprise value is shown pro forma for their $817.5 million acquisiton of Delaware Basin assets announced 7/29/24, and subsequent related financing transactions. 9. Metrics are shown pro forma for Vital’s acquisition of Point Energy Partners assets, announced on 7/28/24. 10. Based on actual levered beta per Bloomberg 5-year weekly as of 9/16/24. 11. Unlevered Beta = Levered Beta/(1 + ((1 – tax rate) * Dd to Equity Market Value) + (Dnd to Equity Market Value) + (Pfd. Stock to Equity Market Value)). 12. Based on review of studies measuring the historical returns between stocks and bonds, theoretical models such as supply-side and demand-side models and other materials. 13. Duff & Phelps Cost of Capital Navigator ("Navigator"). 14. Cost of Equity = Risk-Free Rate of Return + (Levered Beta * Equity Risk Premium) + Size Premium. Risk-Free Rate of Return as of 9/16/24, based on 20-year U.S. Treasury Bond Yield. 15. Based on selected company weighted average interest rate per most recent public filings as of 9/16/24. 16. Based on selected company weighted average preferred dividend per most recent public filings 9/16/24. 17. Company Preferred dividends paid at a fixed rate of either 14.5% per annum in cash or 16.0% per annum PIK on the Liquidation Preference; compounding and accruing quarterly in arrears. Currently, the Company’s Amended Term Loan Agreement prohibits the payment of cash dividends. *Excluded from low, high, median and mean data. Sources: Bloomberg, Capital IQ. Revised for pricing and metrics as of 9/16/24 Total Debt to Dd to Dnd to Total Debt to Dd to Equity Dnd to Equity Pfd. Stock to Equity Market Pfd. Stock to Total Cap Total Cap Total Cap Equity Market Market Value Market Value Total Cap Value to Total Equity Market Selected Company [1][2] [1][3] [1][4] Value [2][5] [3][5] [4][5] [1][6] Cap [1][5] Value [5][6] HighPeak Energy, Inc. 36.7% ### 34.6% ### 2.1% ### 58.0% ### 54.7% ### 3.3% ### 0.0% ### 63.3% ### 0.0% ### Matador Resources Company [7] 37.3% ### 32.0% ### 5.3% ### 59.5% ### 51.1% ### 8.4% ### 0.0% ### 62.7% ### 0.0% ### Permian Resources Corporation [8] 25.9% ### 25.9% ### 0.0% ### 34.9% ### 34.9% ### 0.0% ### 0.0% ### 74.1% ### 0.0% ### Vital Energy, Inc. [9] 69.5% ### 55.1% ### 14.4% ### 228.3% ### 181.0% ### 47.3% ### 0.0% ### 30.5% ### 0.0% ### Median 37.0% 33.3% 3.7% 58.8% 52.9% 5.9% 0.0% 63.0% 0.0% Mean 42.4% 36.9% 5.4% 95.2% 80.4% 14.8% 0.0% 57.6% 0.0% Company 43.4% ### 11.2% ### 32.2% ### 315.0% ### 81.0% ### 234.0% ### 42.8% ### 13.8% ### 310.9% ### Debt Levered Unlevered Equity Risk Size Cost of Cost of Cost of Pfd. Selected Company Beta [5] Beta [10] Beta [11] Premium [12] Premium [13] Equity [14] Debt [15] Stock [16] WACC HighPeak Energy, Inc. Input 0.24 * 0.17 * 5.75% 1.21% 6.6% * NMF * NA NA NMF * Matador Resources Company [7] Input 1.84 ### 1.24 ### 5.75% 0.64% 15.2% ### 6.9% ### NA NA 12.1% ### Permian Resources Corporation [8] Input 1.04 ### 0.81 ### 5.75% 0.61% 10.6% ### 6.9% ### NA NA 9.6% ### Vital Energy, Inc. [9] Input 1.45 ### 0.50 ### 5.75% 1.39% 13.8% ### 8.0% ### NA NA 9.8% ### Median 1.45 0.81 13.8% 6.9% NA 9.8% Mean 1.44 0.85 13.2% 7.3% NA 10.5% Company Input 1.96 ### 0.28 ### 5.75% 4.70% 20.0% ### 13.0% ### 16.0% [17] 15.2% ### 40 |

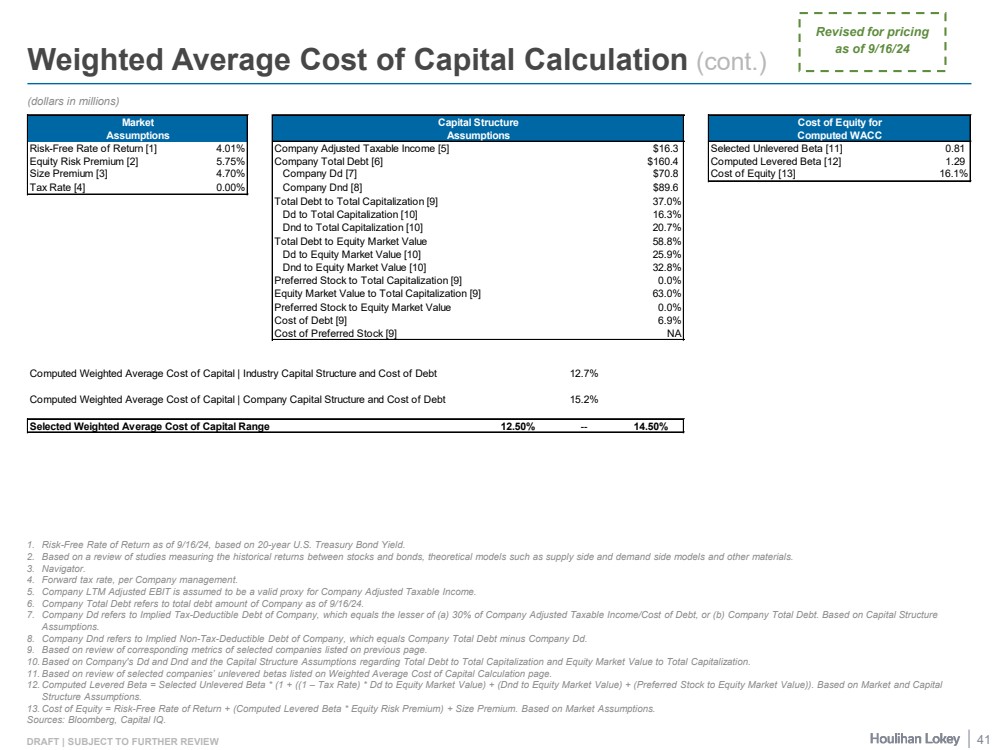

| DRAFT | SUBJECT TO FURTHER REVIEW Weighted Average Cost of Capital Calculation (cont.) 1. Risk-Free Rate of Return as of 9/16/24, based on 20-year U.S. Treasury Bond Yield. 2. Based on a review of studies measuring the historical returns between stocks and bonds, theoretical models such as supply side and demand side models and other materials. 3. Navigator. 4. Forward tax rate, per Company management. 5. Company LTM Adjusted EBIT is assumed to be a valid proxy for Company Adjusted Taxable Income. 6. Company Total Debt refers to total debt amount of Company as of 9/16/24. 7. Company Dd refers to Implied Tax-Deductible Debt of Company, which equals the lesser of (a) 30% of Company Adjusted Taxable Income/Cost of Debt, or (b) Company Total Debt. Based on Capital Structure Assumptions. 8. Company Dnd refers to Implied Non-Tax-Deductible Debt of Company, which equals Company Total Debt minus Company Dd. 9. Based on review of corresponding metrics of selected companies listed on previous page. 10. Based on Company's Dd and Dnd and the Capital Structure Assumptions regarding Total Debt to Total Capitalization and Equity Market Value to Total Capitalization. 11. Based on review of selected companies’ unlevered betas listed on Weighted Average Cost of Capital Calculation page. 12. Computed Levered Beta = Selected Unlevered Beta * (1 + ((1 – Tax Rate) * Dd to Equity Market Value) + (Dnd to Equity Market Value) + (Preferred Stock to Equity Market Value)). Based on Market and Capital Structure Assumptions. 13. Cost of Equity = Risk-Free Rate of Return + (Computed Levered Beta * Equity Risk Premium) + Size Premium. Based on Market Assumptions. Sources: Bloomberg, Capital IQ. (dollars in millions) Revised for pricing as of 9/16/24 Market Capital Structure Cost of Equity for Assumptions Assumptions Computed WACC Risk-Free Rate of Return [1] 4.01% Company Adjusted Taxable Income [5] $16.3 Selected Unlevered Beta [11] 0.81 Equity Risk Premium [2] 5.75% Company Total Debt [6] $160.4 Computed Levered Beta [12] 1.29 Size Premium [3] 4.70% Company Dd [7] $70.8 Cost of Equity [13] 16.1% Tax Rate [4] 0.00% Company Dnd [8] $89.6 Debt Beta [15] Total Debt to Total Capitalization [9] 37.0% Dd to Total Capitalization [10] 16.3% Dnd to Total Capitalization [10] 20.7% Total Debt to Equity Market Value 58.8% Dd to Equity Market Value [10] 25.9% Dnd to Equity Market Value [10] 32.8% Preferred Stock to Total Capitalization [9] 0.0% Equity Market Value to Total Capitalization [9] 63.0% Preferred Stock to Equity Market Value 0.0% Cost of Debt [9] 6.9% Cost of Preferred Stock [9] NA Computed Weighted Average Cost of Capital | Industry Capital Structure and Cost of Debt 12.7% Computed Weighted Average Cost of Capital | Company Capital Structure and Cost of Debt 15.2% Selected Weighted Average Cost of Capital Range 12.50% -- 14.50% 41 |

| Page 1. Executive Summary 3 2. Financial Analyses 9 3. Selected Public Market Observations 32 4. Appendix 38 Weighted Average Cost of Capital Calculation 39 Observed Premiums Paid Analysis 42 Redeemable Convertible Preferred Stock Terms 45 Glossary of Selected Terms 48 5. Disclaimer 51 |