Investor Questions and Answers: September 26, 2025 We encourage current shareholders, potential shareholders, and other interested parties to send questions to us in writing and we make written responses available on a periodic basis. The following answers respond to selected questions received through August 31, 2025. We retain the discretion to combine answers for duplicate or similar questions into one comprehensive response. If you would like to submit a question, please send an e-mail to investors@morningstar.com or write us at the following address: Morningstar, Inc. Investor Relations 22 W. Washington St. Chicago, IL 60602 Use of Non-GAAP Measures These Investor Questions and Answers reference non-GAAP financial measures, including but not limited to, adjusted operating income and free cash flow. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. Reconciliation of non-GAAP financial measures can be found at https://shareholders.morningstar.com/financials- stock-info/key-financials/default.aspx. Management Transitions 1. Is there any more insight you can provide re: the pending departure of James Rhodes, President of Direct Platform, disclosed in your 8K filing on August 29, 2025? Was there any disagreement with the company leading to his departure? Will there be a formal process to find his replacement? After a successful career with Morningstar, James Rhodes, President of Direct Platform, left the company effective Sept. 12, 2025, to pursue other interests. James joined Morningstar in 2016 and prior to being named President of Direct Platform, he served as our Chief Technology Officer and Chief Data Officer. James was a pivotal contributor to the company, driving innovation and delivering value across the firm. When we announced his departure on Aug. 29, 2025, we also shared that Frannie Besztery, Chief Operating Officer of Direct Platform, would serve as interim head until a permanent successor is appointed. We have retained Russell Reynolds, an executive search firm, to formally assist us with the search process to secure our next President of Direct Platform. We are actively considering both internal and external candidates. Margin and Expense Trends 2. The management team has begun to prioritize profitability over the past couple of years. Is the cost focus mainly driven by desire to protect EPS in a weaker demand environment? Or can we expect similar cost discipline even if demand stabilizes or slightly improves? Is there any more low-hanging fruit from a cost optimization perspective, e.g. unused office space, unnecessary T&E, duplicate positions, etc.? Our management team is focused on creating value. As our Chief Financial Officer Michael Holt noted at our annual shareholders’ meeting in May, we believe a company’s ultimate value is a function of the free cash flow that it generates. We view adjusted operating income (AOI) as a good proxy for that. To achieve long-term AOI growth, we are focused on growing revenue at a faster pace than adjusted operating expense over time, which requires us to balance investment in the business to support growth with careful attention to expenses. We will continue to drive for profitable growth. 3. Into which products are you investing incremental S&M and R&D? We continue to invest across multiple areas of the business. Investments include the following priorities: - Development of Morningstar Credit’s ratings and licensed data products. - Platform and operational enhancements for PitchBook to streamline workflows and help clients more quickly access data and insights, including new AI-powered tools. - Modernizing interfaces for our other major products, including Direct Platform, to remove friction from client workflows, while leveraging AI-powered tools. - Scaling our Morningstar Indexes business with the recently announced acquisition of the Center for Research in Security Prices (CRSP). - Database expansion and investment in research and analytics to create intellectual property built around our data, including tools that span public and private investments. Cash Flows 4. Working capital has been a bigger drag on CFO YTD 2025 than in prior periods. Is there anything different about the cash flow dynamics of the TAMP business/AssetMark relationship that we should consider when thinking about working capital or CFO going forward? Cash provided by operating activities declined 22.9% to $190.0 million in H1 25, compared to the prior-year period, while free cash flow decreased 32.8% to $121.2 million. There were two specific items which largely drove the decline: - Cash paid for income tax payments, which increased by $49.6 million in H1 25 compared to the prior-year period. Please see our response to a related question in an 8-K from August 2025 for more detail. - Higher bonus payments, which increased by $39.6 million in H1 25 compared to the prior-year period. The bonus payments reflected strong company performance compared to targets in 2024. The sale of customer assets from the US Morningstar Wealth Turnkey Asset Management Platform did not have a meaningful impact on cash flow from operations. Morningstar Direct Platform 5. Sales of Morningstar Direct improved this quarter. Can you give some commentary on the state of the end market clients here, and explain what drove the improvement in revenues? What’s the strategy to accelerate growth in Morningstar Direct? In Q2 25, Morningstar Direct revenue, which includes Morningstar Direct as well as Morningstar Direct Reporting Solutions, increased 6.0% on a reported and 4.5% on an organic basis compared to the prior-year period. Reported revenue increased 2.9% sequentially compared to Q1 25, a higher sequential growth rate than we have seen in recent prior quarters. The primary driver of the improvement in the sequential growth rate was the timing of renewals and related catch-up revenue that can cause some lumpiness quarter-to- quarter. The two primary client segments for this business are asset managers and wealth managers including advisors: - We continue to see trends in the asset management industry consistent with what our CEO Kunal Kapoor shared at the 2025 annual shareholders’ meeting. Margin pressure has led to some defensiveness, although we would note that we are observing higher cost sensitivity in the US asset management market, compared to EMEA and APAC where we have seen stronger performance. That said, asset managers are also increasingly thinking about how to better position themselves to take advantage of new trends including the convergence of public-private markets. They are also seeing good growth dynamics in managed product solutions. In recent years, many have also built out data science teams. This creates new use cases for our product which we have supported with product enhancements including Analytics Lab. - Wealth managers and advisors face an ever-growing number of investment opportunities available to meet their clients’ personalized needs. Morningstar Direct Platform combines data, research, and tools to guide the investment process, support investment selection aligned with individual client preferences, and provide reporting solutions informed by our independent research. Enhancing and growing our databases alongside the convergence of public-private markets can help us grow with these clients. 6. Morningstar Direct has managed to grow organic revenue by 9% in 2023 and 11% in 2024 despite only 1% license growth. Can you break down the high single-digit revenue per license growth over the past couple years? How much is driven by pricing and how much is driven by more add-on features? We have seen revenue growth decelerating from high single-digit/low double-digit rates to ~5% in the most recent quarters while license growth remained relatively stable at ~1%. What is the main driver behind this deceleration? Is this all pricing? The revenue growth trend relative to license growth that you note for Morningstar Direct for 2023, 2024 and H1 25 was due to the following factors: - We implemented larger-than-typical price increases for Morningstar Direct starting in Q1 23, which contributed to growth through H1 24. Since then, price increases have been more in line with those implemented in prior years. - A number of clients entered multi-year contracts as we implemented the price increases, leaving us with fewer opportunities for expansion in 2024. - In addition, Morningstar Direct growth rates in H2 23 and H1 24 benefited from a new capability that we introduced in 2023 that allowed users to download data from Morningstar Direct. The associated revenue was initially booked to Morningstar Direct, but, starting with new and renewed contracts signed in Q3 24, we started reporting related revenue in Morningstar Data. Please note that we updated the composition of the Morningstar Direct product area to include Morningstar Direct Reporting Solutions starting in Q1 25. 7. Given structural challenges in public asset management, what avenues does Direct have to grow licenses? What’s the strategy to accelerate growth in Morningstar Direct? As we see the industry evolving, we continue to enhance our databases beyond traditional mutual funds with a specific focus on semiliquid structures (including interval funds, tender offer funds, and business development companies), collective investment trusts, model portfolios, separately managed accounts and exchange-traded products. We believe that these additional datasets will unlock new capabilities and experiences in Direct to grow our user base in adjacent user segments. In addition, we continue to invest in modern user experiences which are more workflow oriented and leverage AI to achieve desired analyses and outputs quicker. We expect that these more tailored experiences will attract a broader range of users, including those focused on specific tasks in addition to the typical current user who is a heavy user with broad familiarity with Direct’s capabilities. As addressed in a related question this month, we are observing higher cost sensitivity in the US asset management market, compared to EMEA and APAC where we have seen stronger performance. 8. How does active to passive and the increasing number of actively managed ETFs impact or benefit Morningstar Direct? We believe that the ongoing evolution of the asset management industry, including the increased prominence of both passively and actively managed exchange-traded products, presents growth opportunities for Morningstar broadly and Morningstar Direct in particular. As we expand and enhance our datasets and capabilities covering exchange-traded products, we feel well-positioned to reach new users and expand existing client engagement. Today, Morningstar Direct offers comprehensive coverage of the global exchange-traded fund (ETF) universe, with coverage growing by roughly 16% for the year-to-date through August, reflecting the high volume of product launches. Meanwhile, we are investing in and expanding user workflows aimed at delivering insights that align with these investment vehicles. Recent enhancements include new classification datapoints to help clients better screen and understand an ETF's objective and composition. For example, we have introduced tags that identify active, defined-outcome, and single-stock ETFs, as well as ETF dashboards with liquidity and tracking metrics to support investment selection and ongoing monitoring processes. Morningstar Direct’s analytical capabilities are designed to support our clients in meeting research and regulatory requirements regardless of whether they are constructing portfolios with active or passive vehicles or a combination of both. So, for example, an investor might use a passive ETF as a core strategic holding in a portfolio, potentially alongside active investments, or use an ETF to implement tactical bets. Our intellectual property, including the Morningstar Medalist Ratings, Morningstar Portfolio Risk Score, and Morningstar Style Box, supports the decision of whether to use an active or passive investment to fill a particular role in a portfolio and allows clients to easily compare investments. Clients also use Morningstar Direct to understand potential risk and return contributions from active and passive investments in a portfolio. Finally, our proprietary strategy data links investments that follow the same approach across investment vehicles and domiciles, helping investors identify an option to meet their needs. 9. The pricing comment from your annual report seems to suggest you do not charge for add-ons for Morningstar Direct licenses. Does everyone pay the same price? Our checks suggest you have taken a more proactive approach to Morningstar Direct pricing during Covid driven by both inflation and better capturing report redistribution fees. How should we think about pricing strategy going forward? How much do you raise prices in a typical year? You have made a number of enhancements to the Direct Platform over the past 12-18 months. Is there room to further close price to value gap or should we expect pricing to converge with CPI going forward? You are correct that we follow a simplified licensing model with Morningstar Direct pricing based on the number of licenses purchased. That said, we will charge additional fees on top of that license for specific use cases such as distribution or publication. So, for example, we charge separately for report distribution leveraging our data, research and analytics in reports as part of our Direct Reporting Solutions product. We review prices regularly and make adjustments based on the added value provided and input costs. Starting in 2023, we introduced a larger-than-usual price increase with our annual renewals, reflecting significant enhancements to the product, including new data sets, additional Morningstar IP, and the introduction of Analytics Lab. Since mid-2024, price increases have been more in line with prior years. We do not comment on future price increases. 10. Morningstar released an update to its Advisor Workstation products. Organic revenue growth in this product has been negative in Q1 and Q2 despite the product refresh. Why are revenues still weak despite the refresh? What are the product delays described in the latest 8K release? In H1 25 Morningstar Advisor Workstation revenue was essentially flat with reported growth of -0.6% and organic growth of -0.3% compared to the prior-year period, as our teams were focused on transitioning our clients to our refreshed advisor solution, Direct Advisory Suite. We would expect that revenue associated with Direct Advisory Suite would be recognized in H2 25 and 2026 as more accounts are upgraded, consistent with contract renewals that are on a one-to-three-year cycle. The product delays described in the June 2025 8-K response to investor questions were specific to 2024 delays related to the legacy solution, Advisor Workstation, which had an impact on prior-year sales and H1 25 revenue. We are on track with the planned enhancements and rollout for Direct Advisory Suite. 11. Based on your prior revenue disclosure for Direct Platform, redistribution partners seem to account for ~30% of MORN Data revenue in 2024. How does this compare vs prior years? How much Data growth is driven by alliance and redistribution channels? With data feeds becoming increasingly popular over the past few years, have you seen any major changes in new use cases or increasing growth from any particular customer group over the past couple years? Do you see MORN Data business potentially benefit from increasing AI start-ups / LLMs? You are correct that alliances and redistributors are one of Morningstar Data’s major client segments, accounting for a little less than 30% of revenue in 2024. Our business with redistributors has been an important contributor to Morningstar Data growth, growing at a faster pace than the overall product area. We are actively evaluating opportunities with AI start-ups and large language models and believe that Morningstar Data offers tremendous value to platforms in this space.

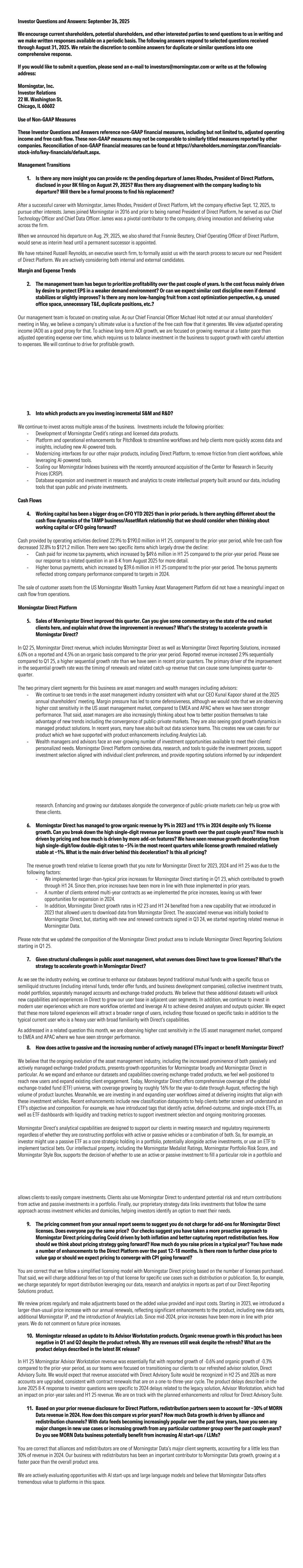

PitchBook 12. What are PitchBook’s key moats, including to prevent others from accessing the underlying data in PitchBook without a subscription? What steps is PitchBook taking to defend its moat given the proliferation of AI tools? How do you collect private company information? Do PE, VC, and private credit funds self-contribute data to PitchBook? Of the data sources you use for PitchBook, what percentage would you describe as being publicly accessible on the internet versus coming from elsewhere? Are you seeing threats to PitchBook from AI being used by investors to diligence private companies, or to otherwise “scrape” public sources for data that they would have otherwise sourced through PitchBook? If you had to rank on a spectrum from -5 (large potential for disruption by AI) to 5 (large potential beneficiary from AI), where would you place PitchBook overall? PitchBook has been a leader in data collection and innovation since its founding. Our competitive advantage is twofold: - First, our network effects and trusted relationships across the private markets enable us to source non-public, hard-to- access information directly from market participants through rigorous primary research and self-reported processes. - Second, we have a long history of adopting and innovating with technology—starting with our early adoption of machine learning and now leveraging the latest AI-powered tools for data ingestion, classification, and entity resolution. PitchBook’s data moat is built on years of investment in proprietary infrastructure, analyst expertise, and rigorous verification processes. Providers that rely on public source data scraping can surface information, but we do not believe that they can replicate our depth, context, or actionable insights. PitchBook’s stickiness in client workflows is another key differentiator. Our platform is deeply embedded in the daily operations of private market professionals, supporting use cases from deal sourcing and due diligence to benchmarking and portfolio monitoring. While the rise of AI, like other technology shifts, poses a threat for some client use cases, we are focused on harnessing it to deepen our competitive advantage. PitchBook is actively innovating across three dimensions: - Data collection technology: Scaling and refining our AI/ML-powered ingestion engines to improve coverage, accuracy, and speed. - Customer-facing features: Embedding AI into client workflows to enhance productivity and insight generation. We continue to launch AI-powered features—such as Company Profile Summaries, Transcript Summaries, and predictive analytics—that accelerate decision-making and seamlessly integrate into client workflows. - Strategic partnerships: Integrating PitchBook data into third-party platforms while maintaining control and data security. We have entered into agreements with leading large language model (LLM) providers including Anthropic, Perplexity, and Rogo to further expand our reach, allowing clients to access PitchBook’s institutional-grade data securely through the tools they already use while maintaining control and data security. 13. Does the PitchBook team still operate independently, or have you made further integration to allow for more cost synergies and potential cross-sell opportunities? As we noted in a response to a related question in August 2025, we follow an integrated coverage model for clients who are purchasing multiple products from Morningstar across segments. We partner a lead strategic account executive with product sales specialists from our different solution areas who contribute expertise on specific products. This would include representatives from the PitchBook sales team as appropriate. The lead account executive is responsible for growing strategically with the client while account planning is integrated across our different segments, driving opportunity identification and relationship management. That said, we run our firm in a decentralized manner and the PitchBook segment, like others at Morningstar, operates with relative independence. 14. How much do you raise prices in a typical year for PitchBook? As we noted in response to a related question in August 2025, PitchBook seeks price increases at renewal where appropriate, consistent with our historical approach. We do not disclose the exact magnitude of the increases in a typical year. 15. Why is PitchBook organic revenue growth slowing despite the capital markets seemingly improving? How meaningful of a driver is private markets fundraising to organic revenue growth at PitchBook? If it is one, how long is the typical lag between a change in the fundraising environment and the downstream effect on PitchBook revenue growth? What types of fundraising (PE, private credit, VC, etc.) are most relevant here? To the extent that private markets fundraising continues to skew to larger players versus smaller ones, how much of a headwind would this be for growth in this business? We are seeing commentary from private market participants (such as PE firms and M&A banks) indicate a better environment for deal-making in H2 of 2025. Given that, should we expect a better sales environment, and ultimately better license growth for Pitchbook? Among the factors that have contributed to slower organic revenue growth at PitchBook year to date, how much of these would you describe as being more unique to this moment in time versus ones we should be considering on an ongoing basis for the business? For a comprehensive overview of the factors influencing PitchBook’s recent revenue trends, please refer to the response to a related question in August 2025. There, we provide more detail on the interplay between current market conditions and business performance. As we have noted previously, private market fundraising and deal activity have been drivers of activity for PitchBook. While we have seen early signs of stabilization in deal flow so far in Q3 25, particularly in M&A and private equity, we don’t yet see broad-based improvement. We continue to observe uncertainty in the policy, macroeconomic, and technology environments contributing to hesitancy and caution among our clients. In the past, firms have often waited for several quarters of sustained momentum before re-accelerating investments in tools, and licenses. We believe the majority of the pressure is short-term and cyclical, while we are proactively positioning the business to capture long-term opportunities as the private markets expand and evolve. 16. What have been the key drivers of the growth slowdown among PitchBook’s corporate clients you have called out? The slowdown among corporate clients is primarily tied to weakness in the broader dealmaking environment. In stronger markets, corporates rely on PitchBook for use cases like deal sourcing, execution, and business development, which drive adoption and expansion. In weaker markets, those activities slow, and budgets tighten, which, in our experience, directly impacts new client acquisition and seat growth. We continue to believe that corporates view PitchBook as highly valuable, but the timing of their spend is more cyclical and sensitive to deal flow compared to our financial sponsor and advisor segments. 17. What's the best way to think about PitchBook TAM and penetration? Our channel checks seem to suggest most big logo companies / funds are already PitchBook customers. Are there any major greenfield opportunities left? Is most of the growth going to be coming from existing customers or do you still see new logos being a meaningful growth contributor over the medium term? Morningstar currently estimates PitchBook’s TAM at $11.1 billion in 2025, reflecting both the expansion of private markets globally and the growing demand for integrated data solutions across corporates, service providers, and financial sponsors. While penetration is highest in our core segments like PE, VC, and investment banks, we continue to see opportunities in corporates, commercial banks, and international markets. We expect future growth to come from a combination of new logo acquisition and expansion with existing customers. Even at large firms where PitchBook is well-penetrated, our footprint often covers only certain teams or geographies. We believe there is a meaningful opportunity to broaden adoption across functions, business units, regions, and asset classes (including private credit), as well as to expand usage through new products, data sets, and AI-driven workflows. At the same time, we continue to see new logo opportunities across segments, particularly in underpenetrated corporate and international markets. In short, new logos remain an important driver, but expansion at existing clients, especially large global firms, also represents a substantial and durable growth opportunity. Morningstar Credit (DBRS) 18. What area are you gaining more market share? Are you winning more share in private credit ratings due to your PitchBook database? Morningstar Credit continues to increase market coverage in areas where we are investing, including in private credit ratings sectors such as aviation and data center transactions. More broadly, we would note that according to the SEC’s January 2025 Staff Report on Nationally Recognized Statistical Rating Organizations (NRSROs), taken together smaller and medium sized credit ratings agencies have picked up roughly 1% of addressable market coverage per year over the past five years through 2023. The growth of our licensed data product, which grew at a rate of roughly 25% in 2024 compared to the prior year, is also a positive indicator of our increased market acceptance. 19. Regarding Morningstar Credit’s $80m of transaction-based revenues, are there any one-offs? Does Morningstar recognize surveillance/recurring revenues as licensed based or transaction based? In a previous 8-K MORN provided the split of revenues between traditional ratings, surveillance and data but that is as of 2024 and not dynamic i.e. we don’t know what is growing/shrinking. Your annual report mentioned about a quarter of credit revenue is in private- market ratings. Is this referring to private credit? Is the right way to think about revenue mix here as 61% structured finance, 25% private credit, 9% corporates, and 5% data licensing? Morningstar Credit revenue is comprised of transaction-based recurring revenue and transaction-based new issuance revenue, which are both included in transaction-based revenue reported for the segment, as well as license-based revenue related to our data licensing product. Transaction-based revenue is comprised of structured finance and fundamental ratings revenue. Please see our response to a related question in August 2025 for more detail on the composition of our transaction-based new issuance revenue. In Q2 25, we disclosed that recurring revenue, which is derived primarily from surveillance, research, and other transaction-related services, represented 39.4% of total Morningstar Credit revenue. Recurring revenue included license-based revenue of $5.0 million, and $28.5 million of recurring revenue included within Morningstar Credit's total transaction-based revenue. We plan to provide a breakdown of transaction-based new issuances, transaction-based recurring, and license-based revenue for Morningstar Credit starting with our Q3 25 reporting. We have provided these figures for H1 25 compared to H1 24 below for your reference: Morningstar Credit Revenue by Fee Type* H1 25 H1 24 Transaction-Based: New Issuance 94.2 80.6 Transaction-Based: Recurring 54.2 49.4 License-Based 9.6 7.9 Total 158.0 137.9 * amounts in $millions We also provide a breakdown of Morningstar Credit transaction-based revenue by asset class in our quarterly supplemental presentation. (Please see slide 22 in our Q2 25 presentation available at shareholders.morningstar.com/financials-stock-info/key- financials/default.aspx.) In Q2 25, structured finance ratings revenue, which includes ratings revenue for asset-backed securities, commercial mortgage-backed securities, and residential mortgage backed-securities accounted for 62.9% of Morningstar Credit revenue. Fundamental ratings revenue, including corporate, financial institutions, sovereign, and other, accounted for 31.1%, and data licensing revenue accounted for 6.0%. Please refer to the 2024 Morningstar Credit revenue diversification as referenced in slide 105 of our 2025 annual shareholder's meeting presentation (available at https://shareholders.morningstar.com/shareholder- meeting/default.aspx) for more detail on the composition of our revenue in 2024. Finally, private credit ratings accounted for roughly a quarter of Morningstar Credit’s transaction-based revenue in 2024. This included private credit ratings of both fundamental and structured finance transactions. Morningstar Wealth 20. Why is the Morningstar Wealth margin so low? Do you maintain a big in-house wealth advisor/consulting team to support institutional asset management or asset allocation services? What are the biggest cost items for this business? Are there any metrics you can share to help us gauge margin benefit from TAMP sale to AssetMark? Is the margin benefit fully reflected in 2Q margin profile or are there still stranded costs that can be rationalized over the coming quarters? Starting in 2024, our teams have refocused Morningstar Wealth on model portfolios distribution via third-party platforms and our International Wealth Platform, with the goals of more effectively scaling the business and supporting profitable and sustainable growth. In December 2024 we closed on the sale of customer assets on our US TAMP to AssetMark, an alliance that also launched Morningstar model portfolios on the AssetMark platform. As we noted at the time of the transaction’s announcement, we incurred certain operating costs and one-time costs through the transition of client assets to AssetMark; with the completion of the transition in Q2 25, there will be no further impact from associated expenses on Morningstar Wealth AOI starting with our Q3 25 results. In February 2025, we announced that we will be retiring Morningstar Office. We have started to see the impact of our efforts to streamline the business. Morningstar Wealth reported positive adjusted operating income of $3.0 million in Q2 25. We remain focused on improving the profitability of this segment. 21. Implied Morningstar website and software revenue (total wealth revenue less investment management revenue) increased 9% in Q2 25. This business has been in slow decline in recent years, what drove the increase in Q2? You are correct that Morningstar Wealth revenue, excluding Investment Management revenue, increased 8.6% in Q2 25 compared to the prior-year period. The increase was driven by higher advertising sales for Morningstar.com. Morningstar Retirement 22. What are the higher new investments in Retirement? When should we expect payback from those investments? In our Q2 25 earnings release, we noted that higher expenses in Morningstar Retirement were primarily due to increased marketing expenses, including costs related to campaign tracking and data management; and higher compensation costs, including the impact of increased technology and operations headcount to support growth as well as increased commissions. While we do not disclose the expected timeline on the payback period for these investments, they include marketing, sales, and operations costs to support asset growth in both traditional and advisor managed accounts in the year ahead. Morningstar Indexes 23. Why did license-based revenue decline QoQ? Shouldn't that be stable / growing on a YoY basis? You are correct that there was a sequential decline in license-based revenue for Morningstar Indexes in Q2 25 compared to Q1 25. This category is primarily comprised of licensed data but also includes our indexes services product. The decline you observe was driven by lower revenue for our index services product, due in part to the recognition of a one-time consulting-related transaction in Q1 25. Morningstar Sustainalytics 24. Please give more details on the latest re-organization. How is this different to prior reorganizations of Sustainalytics, and what is the intent of this latest reorganization? Was Morningstar Sustainalytics EBIT-positive in H1/25? How much will profitability improve because of recent restructuring efforts? As you point out, in Q2 25, we recorded severance related to a targeted reorganization in Morningstar Sustainalytics. We do not report adjusted operating income for Morningstar Sustainalytics however, we would note that this restructuring is in line with our broader effort to focus the business on areas where we believe that we can win longer term while also improving profitability. In particular, we

continue to see a wide spectrum of client needs across our target market and expect long-term demand for specialized sustainability and climate research, ratings, and data. 25. Can you quantify the impact of the business model transition to licensing ratings and data? I want to better understand how the underlying demand for Sustainalytics has trended. In H1 25, Morningstar Sustainalytics revenue declined 6.5% from the prior-year period to $56.1 million. Absent the loss of revenue associated with the transition in our licensed ratings product, which is described in more detail in a related response from July 2025, Morningstar Sustainalytics would have reported a low single-digit revenue decline. In our most recent 10-Q we also noted that ESG Risk Ratings were another source of the decline in revenue during the period; this was partially offset by growth in areas including our portfolio construction, reporting, and climate solutions as well as data that supports investor personalization (compliance solutions). Artificial Intelligence 26. If you had to rank on a spectrum from -5 (large potential for disruption by AI) to 5 (large potential beneficiary from AI), where would you place Morningstar overall? What about PitchBook? We acknowledge that AI is inherently disruptive and is changing how the world approaches technology and engages with information and believe that it will be a key factor shaping the workforce of the future. Disruptive technologies (personal computing, internet, mobile and most recently AI) tend to magnify the outcomes for both successful and unsuccessful adopters. We have a long history of leveraging advances in technology to drive growth. Today, we are investing with the goal of positioning Morningstar and PitchBook’s data, research, and intellectual property to succeed as workflows and customer preference evolve to incorporate AI. While AI will challenge older technologies, we also expect it to offer growth opportunities as we work to expand upon what we do best. In particular, our teams are focused on making our data and other capabilities AI-ready so that they can be leveraged internally and externally for AI feature development. To that end, we recently launched the Morningstar model context protocol (MCP) server, built on the Intelligence Engine. Our MCP server is designed to make it easy for our clients to connect the AI tools they are using and AI applications they are building to our AI-ready data, research and capabilities. For example, we have an integration with Anthropic to offer licensed users a convenient, conversational way to get quick answers and access our data while working within an AI environment. Meanwhile, within our product suite, we continue to introduce new AI features designed to remove friction and make our products easier to use. Earlier this year, for example, we launched AI Insights in Direct Advisory Suite, which provides quick analysis of investment lists and portfolios based on our proprietary research. For more detail specific to PitchBook and AI, please see a response to a related question this month. 27. Claude: How does the economics work on this for Morningstar and its customers? In the early days, how have initial signs been on this partnership as a customer acquisition tool for Morningstar or PitchBook? How significant do you think this could be over time? We continue to develop our relationships with AI platforms such as Claude as we iterate on models that can drive the best blend of usage and pricing. This integration is designed to complement and amplify the capabilities of Morningstar Direct and offers licensed users a convenient, conversational way to get quick answers and access our data while working within an AI environment. We have already seen opportunities to support our clients’ AI strategies through collaborations like this. We anticipate the trend will accelerate and we are exploring new ways to add value and offer access to a broader customer base, including offering trial access to AI-enabled solutions. M&A 28. Is management evaluating further divestitures or winding down other unprofitable divisions/products? Is large-scale M&A currently a capital allocation priority? Our capital allocation priorities are as follows: • We seek to preserve a strong balance sheet to maintain flexibility; • We will prioritize funding organic growth and consider acquisitions where we see opportunities to generate long-term shareholder value; • We aim to maintain and increase our dividend over time commensurate with company financial results; and • We look to repurchase shares when we have available cash and will accelerate that activity opportunistically when we believe that our shares are substantially undervalued. In the past year, we have made several important moves to better align our product portfolio, including exiting the investment platform business in the US, with the sale of customer assets in our Turnkey Asset Management Platform (TAMP) and the announcement of our intent to wind-down Morningstar Office. We also recently announced our plans to acquire the Center for Research in Security Prices (CRSP). With the transaction, we expect to acquire the CRSP Market Indexes, which are the benchmarks for more than $3 trillion in US equities, providing meaningful scale for Morningstar’s index capabilities. At this point, we believe that we have a good set of capabilities. We remain opportunistic around additional M&A, with a focus on strategic fit and reasonable prices.