Third-Quarter 2025 Supplemental Presentation October 29, 2025 2 This presentation contains forward-looking statements within the meaning of Private Securities Litigation Reform Act of 1995. These statements are based on Morningstar's current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "prospects," or "continue." These statements involve known or unknown risks and uncertainties that may cause actual results to differ significantly from what Morningstar expects. More information about factors that could affect Morningstar's business and financial results are in its filings with the SEC, including its most recent Forms 8-K, 10-K, and 10-Q. Morningstar undertakes no obligation to publicly update any forward-looking statements as a result of new information, future events, or otherwise, except as required by law. 3 This presentation includes references to the non-GAAP financial measures listed below (including percentage growth or decline of those numbers). These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is provided in the appendix to this presentation and in the Company's filings with the SEC, including its most recent Forms 8-K, 10-K, and 10-Q. "Organic Revenue" is consolidated revenue before (1) acquisitions and divestitures, (2) adoption of new accounting standards or revisions to accounting practices (accounting changes), and (3) the effect of foreign currency translations. "Adjusted Operating Income (Loss)" is consolidated operating income (loss) excluding (1) intangible amortization expense, (2) the impact of merger, acquisition, and divestiture-related activity which, when applicable, may include certain non-recurring expenses such as pre-deal due diligence, transaction costs, contingent consideration, severance, and post-close integration costs (M&A-related expenses), and (3) certain other one-time, non-recurring items which management does not consider when evaluating ongoing performance (other non-recurring items). "Adjusted Operating Margin" is operating margin excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. "Adjusted Operating Expense" is operating expenses excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. "Free Cash Flow" is cash provided by or used for operating activities less capital expenditures. 4 Table of Contents Q3 25 Results Summary 5 Q3 25 Segment Detail 12 Appendix A: Additional Segment Detail 27 Appendix B: Reconciliations 37 Appendix C: Additional Information 49

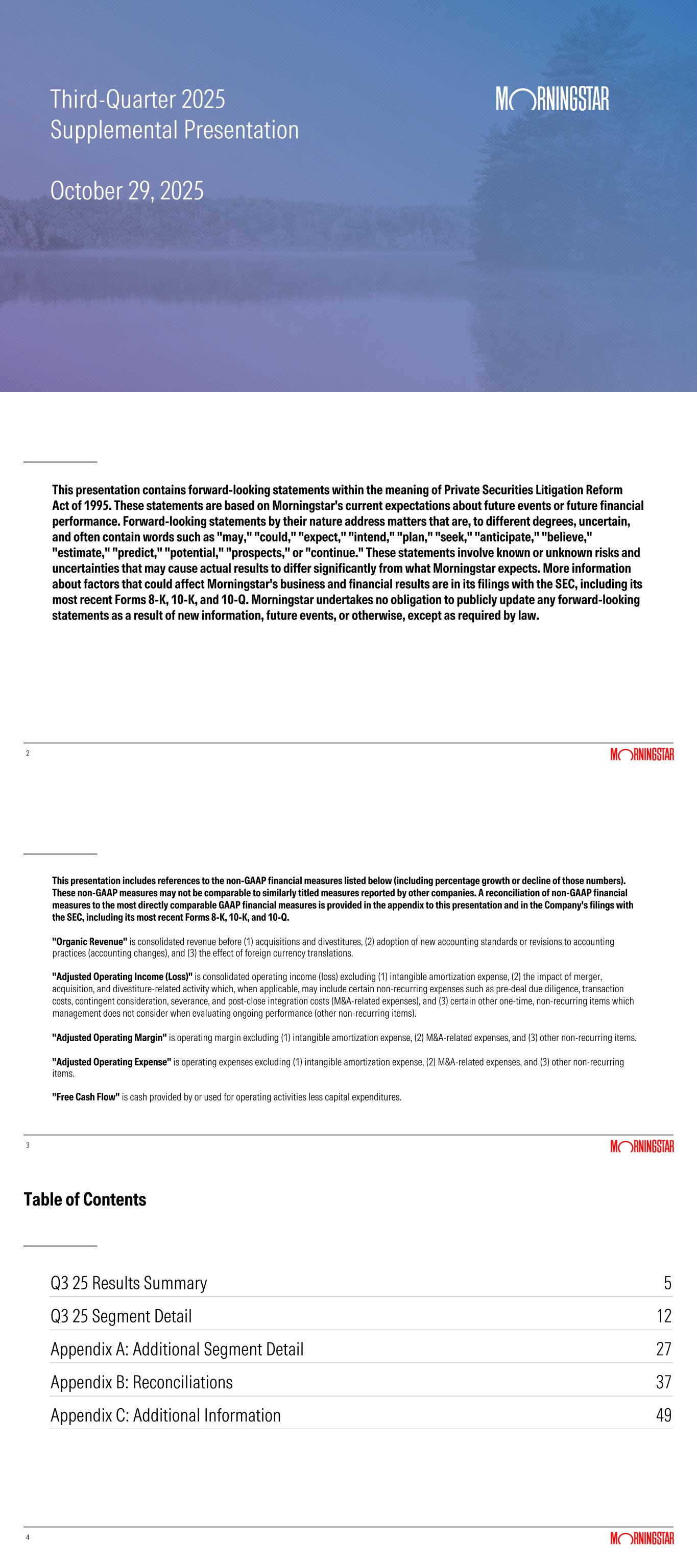

Q3 25 Results Summary 6 Q3 25 Financial Performance +8.4% Reported +9.0% Organic +15.6% +2.8%+10.6% $569.4 $617.4 $115.5 $127.8 $130.3 $150.6 $155.8 $160.1 Revenue Operating Income Adjusted Operating Income Free Cash Flow ($mil) 24 25 24 25 24 25 24 25 7 Adjusted Operating Income Walk Q3 24 to Q3 25 Q3 24 Adjusted Operating Income Change in Revenue Professional Fees Travel & Related Activities Advertising & Marketing Infrastructure Costs & Other* Compensation** Q3 25 Adjusted Operating Income Changes in this chart reflect adjustments made in the calculation of adjusted operating income, as defined on p. 3 of this presentation, and may not match changes in reported expenses. *Includes infrastructure costs (including third-party contracts with data providers, cloud costs, and SaaS-based software subscriptions), facilities, depreciation/amortization, and capitalized labor.**Compensation includes salaries, bonus, commissions, severance, employee benefits, payroll taxes, and stock-based compensation. ($mil) $130.3 $48.0 ($1.3) ($5.5) $0.8 ($23.5) $1.8 $150.6 8 Quarterly Operating Margin Trends 13.6% 17.5% 17.1% 19.0% 20.3% 28.5% 19.6% 20.7% 20.7%17.8% 21.0% 20.4% 22.9% 22.9% 20.6% 23.3% 23.7% 24.4% Operating Margin Adjusted Operating Margin Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 During Q4 24, operating income included a $64.0 million gain on the sale of US Turnkey Asset Management Platform (US TAMP) assets, which had a 10.9 percentage point impact on operating margin.

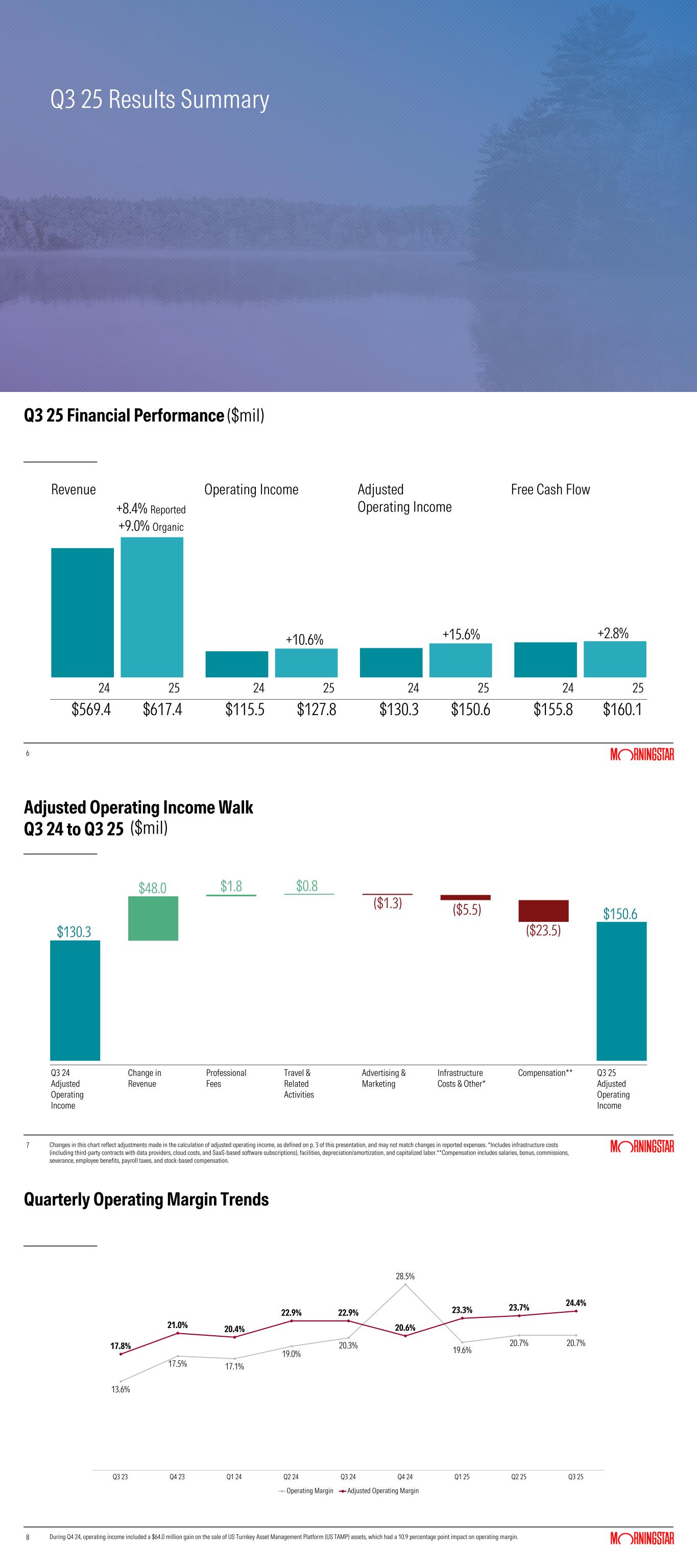

9 Revenue vs. Adjusted Operating Expense Growth 10.1% 13.4% 13.2% 13.3% 10.5% 9.7% 7.2% 5.8% 8.4% 8.1% 4.2% 1.0% 1.4% 3.7% 10.2% 3.4% 4.7% 6.3% Reported Revenue Growth Adjusted Operating Expense Growth Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 10 Headcount Trends Headcount represents permanent, full-time employees. As of September 30, 2025, headcount was 11,154. (1.3%) (7.3%) (9.2%) (8.1%) (3.6%) (2.2%) (1.4%) (0.7%) 0.0% (4.6%) (2.0%) (0.6%) (1.1%) 0.0% (0.6%) 0.3% (0.5%) 0.8% Headcount (000s) Headcount Growth YOY Sequential Headcount Growth Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 11.6 11.3 11.3 11.1 11.1 11.1 11.1 11.1 11.2 11 Q3 25 Cash Flow and Capital Allocation 11 ($mil) Operating Cash Flow Free Cash Flow ($mil) Share Repurchases $ 170.1 Capital Expenditures $ 35.6 Dividends Paid $ 19.2 *Total capital deployed in Q3 25 was higher than operating cash flow due to use of excess cash on hand and the increase in debt. The Company's debt increased by $10.0 million, net in Q3 25. Capital Allocation* $195.7 $160.1 Q3 25 Segment Detail

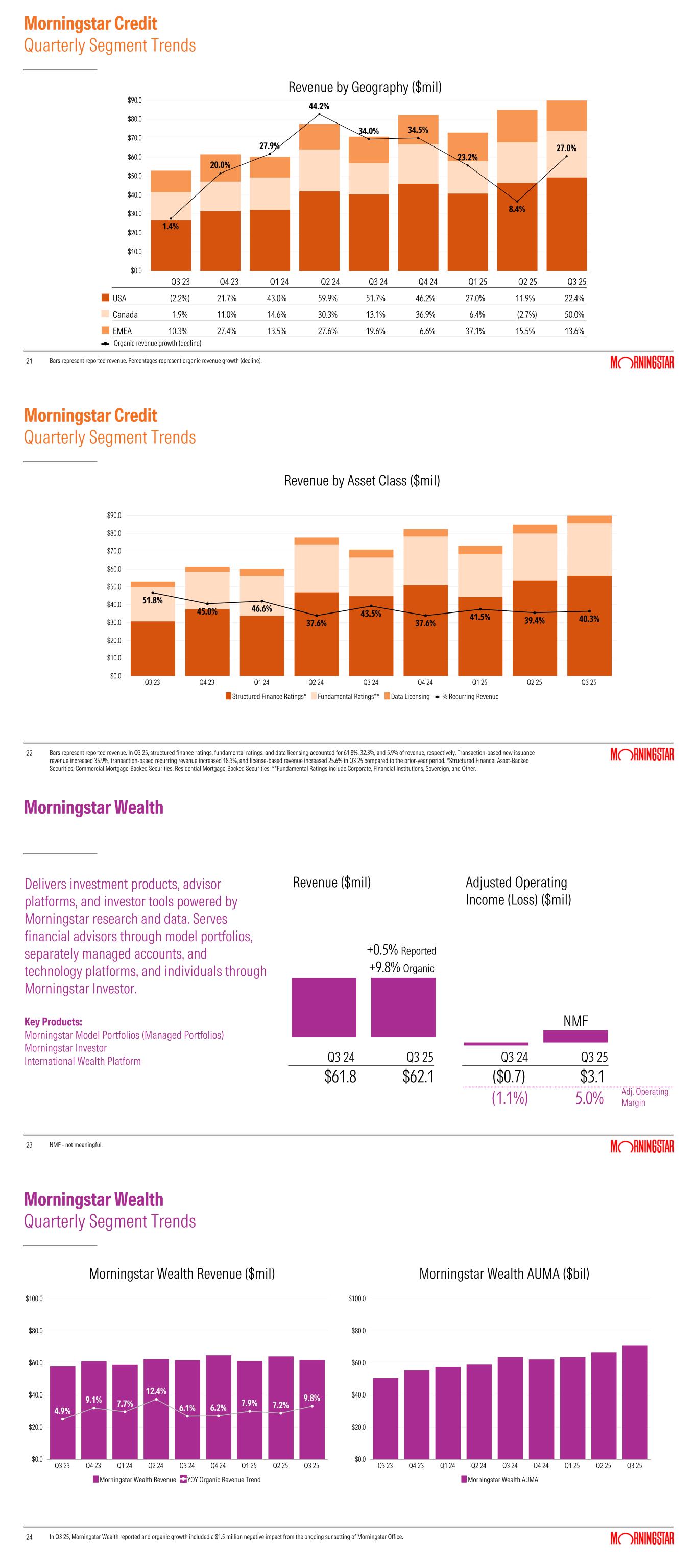

13 Q3 25 Contribution to Revenue and Adjusted Operating Income (Loss) 13 Morningstar Direct Platform Revenue Adjusted Operating Income (Loss) *Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Q3 24 Q3 25 Q3 24 Q3 25 $ 600 450 300 150 0 ($150) PitchBook Morningstar Credit Morningstar Wealth Morningstar Retirement Corporate and All Other* ($mil) 14 Organic Revenue Walk Q3 24 to Q3 25 Q3 24 Reported Revenue Morningstar Credit Morningstar Direct Platform PitchBook Morningstar Wealth Morningstar Retirement Corporate and All Other* M&A and Foreign Currency Adjustments Q3 25 Reported Revenue ($mil) The Company's five reportable segment bars represent organic revenue growth and may not match changes in reported revenue. *Corporate and All Other provides a reconciliation between revenue from its Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenues. $569.4 $12.0$19.2 $12.1 $2.4$5.6 ($1.0) ($2.3) $617.4 15 Adjusted Operating Income Contributions Q3 24 to Q3 25 Q3 24 Adjusted Operating Income Morningstar Credit Morningstar Wealth PitchBook Morningstar Direct Platform Morningstar Retirement Corporate and All Other * Q3 25 Adjusted Operating Income *Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include finance, human resources, legal, marketing, and other management-related costs that are not considered when segment performance is evaluated. ($mil) $130.3 $3.8 $2.3$2.5 $0.0 $12.9 ($1.2) $150.6 16 Morningstar Direct Platform 16 +6.3% Reported +6.2% Organic +2.5% $198.5 $211.1 $91.4 $93.7 46.0 % 44.4 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Beginning with Q1 25 reporting, Morningstar Data and Analytics was renamed Morningstar Direct Platform. Q3 24 Q3 25 Q3 24 Q3 25 Provides investors comprehensive data, research and insights, and investment analysis to empower investment decision- making. Key Products: Morningstar Data Morningstar Direct Morningstar Advisor Workstation

17 Morningstar Direct Platform Quarterly Segment Trends 17 7.0% 8.1% 8.9% 6.2% 4.7% 3.6% 4.2% 6.3% 6.2% Morningstar Direct Platform Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 Morningstar Direct Platform Revenue ($mil) 18 PitchBook 18 +7.9% Reported +7.7% Organic +5.0% $156.6 $169.0 $50.4 $52.9 32.2 % 31.3 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Q3 24 Q3 25 Q3 24 Q3 25 Provides investors with access to a broad collection of data and research covering the private capital markets, including venture capital, private equity, private credit and bank loans, and merger and acquisition (M&A) activities. Investors can also access Morningstar’s data and research on public equities. Key Products: PitchBook Platform Direct Data 19 PitchBook Quarterly Segment Trends 19 14.4% 13.1% 12.6% 10.9% 12.2% 12.7% 11.1% 9.6% 7.7% PitchBook Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 PitchBook Revenue ($mil) 20 Morningstar Credit 20 +28.5% Reported +27.0% Organic +84.9% $70.9 $91.1 $15.2 $28.1 21.4 % 30.8 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Q3 24 Q3 25 Q3 24 Q3 25 Provides investors with credit ratings, research, data, and credit analytics solutions that contribute to the transparency of international and domestic credit markets. Key Products: Morningstar DBRS Morningstar Credit (Credit Data and Analytics)

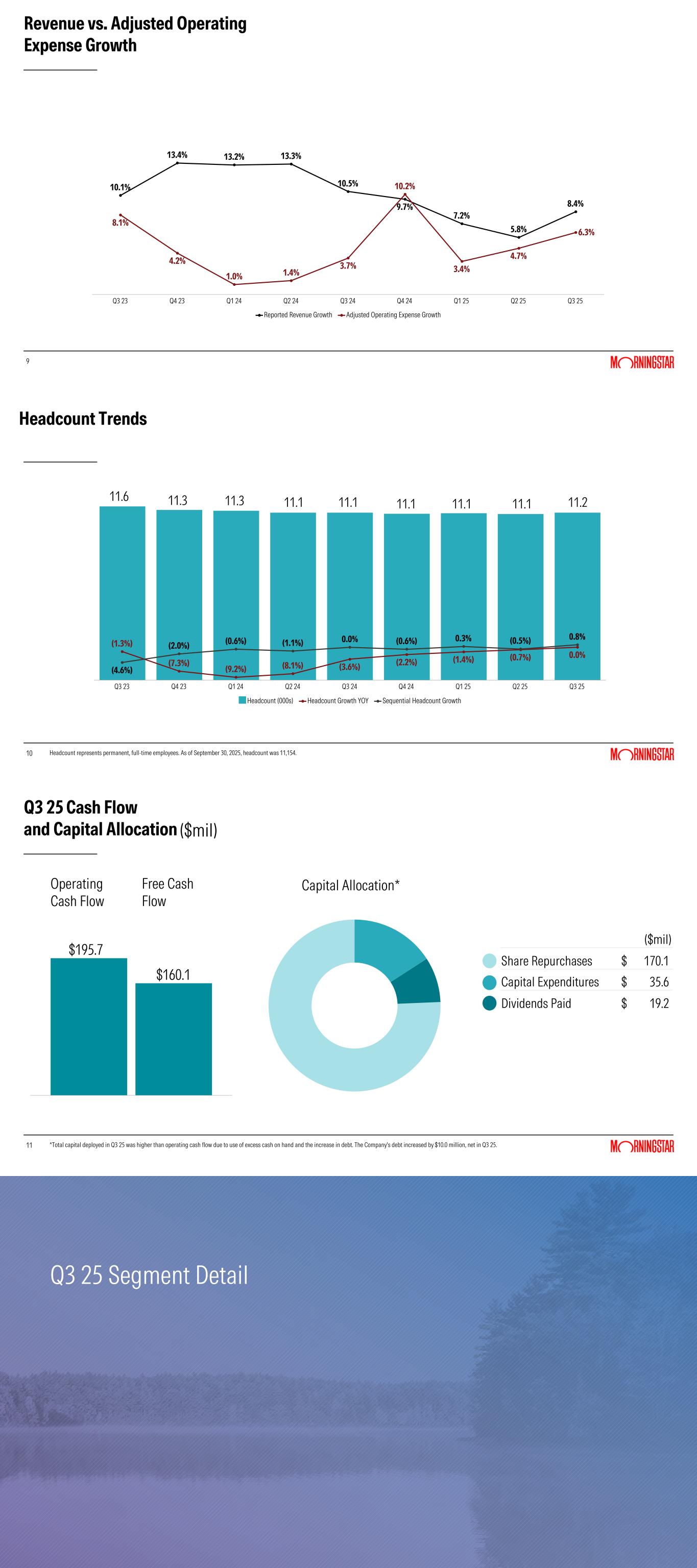

21 Morningstar Credit Quarterly Segment Trends 21 Bars represent reported revenue. Percentages represent organic revenue growth (decline). 1.4% 20.0% 27.9% 44.2% 34.0% 34.5% 23.2% 8.4% 27.0% $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Revenue by Geography ($mil) Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 USA (2.2%) 21.7% 43.0% 59.9% 51.7% 46.2% 27.0% 11.9% 22.4% Canada 1.9% 11.0% 14.6% 30.3% 13.1% 36.9% 6.4% (2.7%) 50.0% EMEA 10.3% 27.4% 13.5% 27.6% 19.6% 6.6% 37.1% 15.5% 13.6% Organic revenue growth (decline) 22 Morningstar Credit Quarterly Segment Trends 22 Bars represent reported revenue. In Q3 25, structured finance ratings, fundamental ratings, and data licensing accounted for 61.8%, 32.3%, and 5.9% of revenue, respectively. Transaction-based new issuance revenue increased 35.9%, transaction-based recurring revenue increased 18.3%, and license-based revenue increased 25.6% in Q3 25 compared to the prior-year period. *Structured Finance: Asset-Backed Securities, Commercial Mortgage-Backed Securities, Residential Mortgage-Backed Securities. **Fundamental Ratings include Corporate, Financial Institutions, Sovereign, and Other. 51.8% 45.0% 46.6% 37.6% 43.5% 37.6% 41.5% 39.4% 40.3% Structured Finance Ratings* Fundamental Ratings** Data Licensing % Recurring Revenue Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Revenue by Asset Class ($mil) 23 Morningstar Wealth 23 +0.5% Reported +9.8% Organic NMF $61.8 $62.1 ($0.7) $3.1 (1.1%) 5.0% Adj. Operating Margin Revenue ($mil) Adjusted Operating Income (Loss) ($mil) NMF - not meaningful. Q3 24 Q3 25 Q3 24 Q3 25 Delivers investment products, advisor platforms, and investor tools powered by Morningstar research and data. Serves financial advisors through model portfolios, separately managed accounts, and technology platforms, and individuals through Morningstar Investor. Key Products: Morningstar Model Portfolios (Managed Portfolios) Morningstar Investor International Wealth Platform 24 Morningstar Wealth Quarterly Segment Trends 24 4.9% 9.1% 7.7% 12.4% 6.1% 6.2% 7.9% 7.2% 9.8% Morningstar Wealth Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Morningstar Wealth AUMA Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Morningstar Wealth Revenue ($mil) Morningstar Wealth AUMA ($bil) In Q3 25, Morningstar Wealth reported and organic growth included a $1.5 million negative impact from the ongoing sunsetting of Morningstar Office.

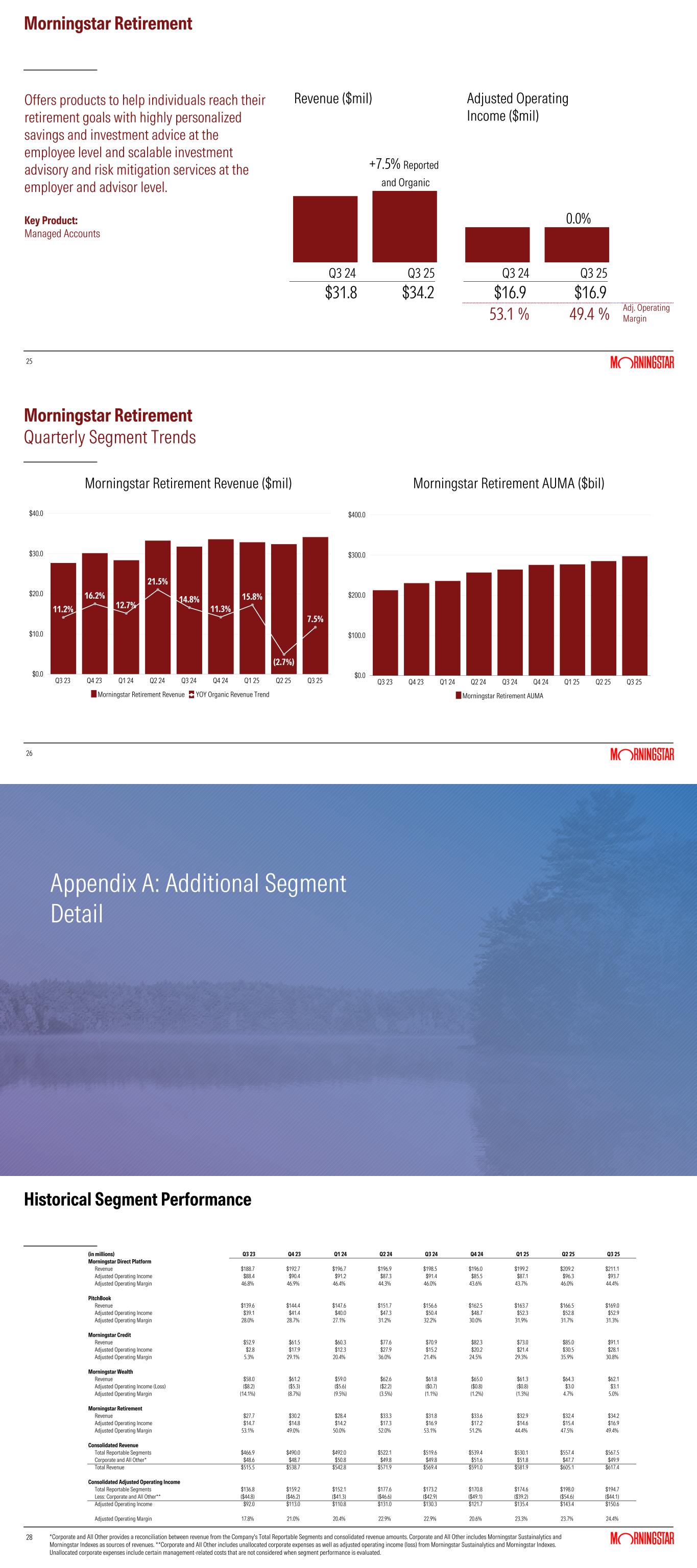

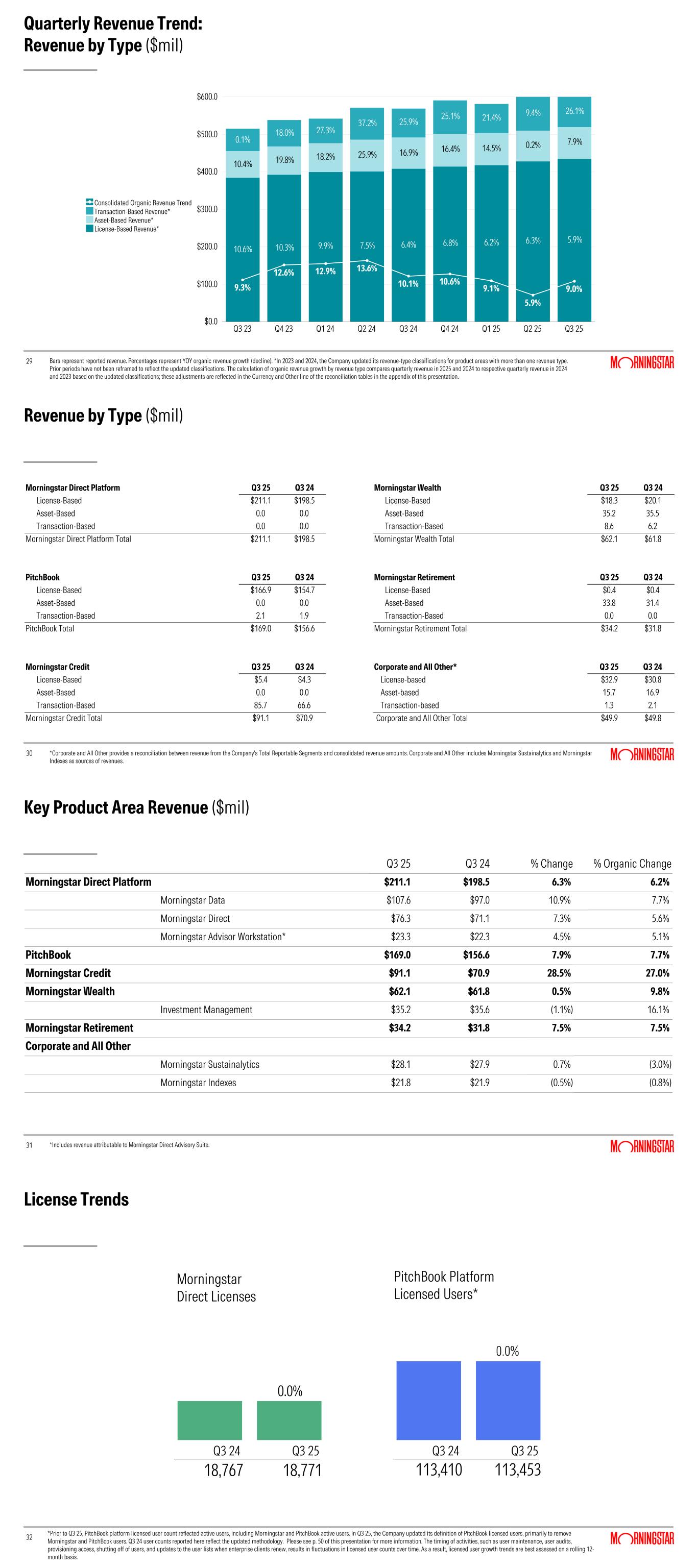

25 Morningstar Retirement 25 +7.5% Reported and Organic 0.0% $31.8 $34.2 $16.9 $16.9 53.1 % 49.4 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Q3 24 Q3 25 Q3 24 Q3 25 Offers products to help individuals reach their retirement goals with highly personalized savings and investment advice at the employee level and scalable investment advisory and risk mitigation services at the employer and advisor level. Key Product: Managed Accounts 26 Morningstar Retirement Quarterly Segment Trends 26 11.2% 16.2% 12.7% 21.5% 14.8% 11.3% 15.8% (2.7%) 7.5% Morningstar Retirement Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $10.0 $20.0 $30.0 $40.0 Morningstar Retirement AUMA Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $100.0 $200.0 $300.0 $400.0 Morningstar Retirement Revenue ($mil) Morningstar Retirement AUMA ($bil) Appendix A: Additional Segment Detail 28 Historical Segment Performance *Corporate and All Other provides a reconciliation between revenue from the Company's Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenues. **Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include certain management-related costs that are not considered when segment performance is evaluated. (in millions) Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Morningstar Direct Platform Revenue $188.7 $192.7 $196.7 $196.9 $198.5 $196.0 $199.2 $209.2 $211.1 Adjusted Operating Income $88.4 $90.4 $91.2 $87.3 $91.4 $85.5 $87.1 $96.3 $93.7 Adjusted Operating Margin 46.8% 46.9% 46.4% 44.3% 46.0% 43.6% 43.7% 46.0% 44.4% PitchBook Revenue $139.6 $144.4 $147.6 $151.7 $156.6 $162.5 $163.7 $166.5 $169.0 Adjusted Operating Income $39.1 $41.4 $40.0 $47.3 $50.4 $48.7 $52.3 $52.8 $52.9 Adjusted Operating Margin 28.0% 28.7% 27.1% 31.2% 32.2% 30.0% 31.9% 31.7% 31.3% Morningstar Credit Revenue $52.9 $61.5 $60.3 $77.6 $70.9 $82.3 $73.0 $85.0 $91.1 Adjusted Operating Income $2.8 $17.9 $12.3 $27.9 $15.2 $20.2 $21.4 $30.5 $28.1 Adjusted Operating Margin 5.3% 29.1% 20.4% 36.0% 21.4% 24.5% 29.3% 35.9% 30.8% Morningstar Wealth Revenue $58.0 $61.2 $59.0 $62.6 $61.8 $65.0 $61.3 $64.3 $62.1 Adjusted Operating Income (Loss) ($8.2) ($5.3) ($5.6) ($2.2) ($0.7) ($0.8) ($0.8) $3.0 $3.1 Adjusted Operating Margin (14.1%) (8.7%) (9.5%) (3.5%) (1.1%) (1.2%) (1.3%) 4.7% 5.0% Morningstar Retirement Revenue $27.7 $30.2 $28.4 $33.3 $31.8 $33.6 $32.9 $32.4 $34.2 Adjusted Operating Income $14.7 $14.8 $14.2 $17.3 $16.9 $17.2 $14.6 $15.4 $16.9 Adjusted Operating Margin 53.1% 49.0% 50.0% 52.0% 53.1% 51.2% 44.4% 47.5% 49.4% Consolidated Revenue Total Reportable Segments $466.9 $490.0 $492.0 $522.1 $519.6 $539.4 $530.1 $557.4 $567.5 Corporate and All Other* $48.6 $48.7 $50.8 $49.8 $49.8 $51.6 $51.8 $47.7 $49.9 Total Revenue $515.5 $538.7 $542.8 $571.9 $569.4 $591.0 $581.9 $605.1 $617.4 Consolidated Adjusted Operating Income Total Reportable Segments $136.8 $159.2 $152.1 $177.6 $173.2 $170.8 $174.6 $198.0 $194.7 Less: Corporate and All Other** ($44.8) ($46.2) ($41.3) ($46.6) ($42.9) ($49.1) ($39.2) ($54.6) ($44.1) Adjusted Operating Income $92.0 $113.0 $110.8 $131.0 $130.3 $121.7 $135.4 $143.4 $150.6 Adjusted Operating Margin 17.8% 21.0% 20.4% 22.9% 22.9% 20.6% 23.3% 23.7% 24.4%

29 Quarterly Revenue Trend: Revenue by Type ($mil) 9.3% 12.6% 12.9% 13.6% 10.1% 10.6% 9.1% 5.9% 9.0% Consolidated Organic Revenue Trend Transaction-Based Revenue* Asset-Based Revenue* License-Based Revenue* Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 0.1% 10.4% 10.6% 18.0% 19.8% 10.3% 27.3% 18.2% 9.9% 37.2% 25.9% 7.5% 25.9% 16.9% 6.4% 25.1% 16.4% 6.8% 21.4% 14.5% 6.2% 9.4% 0.2% 6.3% 26.1% 7.9% 5.9% Bars represent reported revenue. Percentages represent YOY organic revenue growth (decline). *In 2023 and 2024, the Company updated its revenue-type classifications for product areas with more than one revenue type. Prior periods have not been reframed to reflect the updated classifications. The calculation of organic revenue growth by revenue type compares quarterly revenue in 2025 and 2024 to respective quarterly revenue in 2024 and 2023 based on the updated classifications; these adjustments are reflected in the Currency and Other line of the reconciliation tables in the appendix of this presentation. 30 Revenue by Type ($mil) *Corporate and All Other provides a reconciliation between revenue from the Company's Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenues. Morningstar Direct Platform Q3 25 Q3 24 Morningstar Wealth Q3 25 Q3 24 License-Based $211.1 $198.5 License-Based $18.3 $20.1 Asset-Based 0.0 0.0 Asset-Based 35.2 35.5 Transaction-Based 0.0 0.0 Transaction-Based 8.6 6.2 Morningstar Direct Platform Total $211.1 $198.5 Morningstar Wealth Total $62.1 $61.8 PitchBook Q3 25 Q3 24 Morningstar Retirement Q3 25 Q3 24 License-Based $166.9 $154.7 License-Based $0.4 $0.4 Asset-Based 0.0 0.0 Asset-Based 33.8 31.4 Transaction-Based 2.1 1.9 Transaction-Based 0.0 0.0 PitchBook Total $169.0 $156.6 Morningstar Retirement Total $34.2 $31.8 Morningstar Credit Q3 25 Q3 24 Corporate and All Other* Q3 25 Q3 24 License-Based $5.4 $4.3 License-based $32.9 $30.8 Asset-Based 0.0 0.0 Asset-based 15.7 16.9 Transaction-Based 85.7 66.6 Transaction-based 1.3 2.1 Morningstar Credit Total $91.1 $70.9 Corporate and All Other Total $49.9 $49.8 31 Key Product Area Revenue ($mil) *Includes revenue attributable to Morningstar Direct Advisory Suite. Q3 25 Q3 24 % Change % Organic Change Morningstar Direct Platform $211.1 $198.5 6.3% 6.2% Morningstar Data $107.6 $97.0 10.9% 7.7% Morningstar Direct $76.3 $71.1 7.3% 5.6% Morningstar Advisor Workstation* $23.3 $22.3 4.5% 5.1% PitchBook $169.0 $156.6 7.9% 7.7% Morningstar Credit $91.1 $70.9 28.5% 27.0% Morningstar Wealth $62.1 $61.8 0.5% 9.8% Investment Management $35.2 $35.6 (1.1%) 16.1% Morningstar Retirement $34.2 $31.8 7.5% 7.5% Corporate and All Other Morningstar Sustainalytics $28.1 $27.9 0.7% (3.0%) Morningstar Indexes $21.8 $21.9 (0.5%) (0.8%) 32 License Trends 32 *Prior to Q3 25, PitchBook platform licensed user count reflected active users, including Morningstar and PitchBook active users. In Q3 25, the Company updated its definition of PitchBook licensed users, primarily to remove Morningstar and PitchBook users. Q3 24 user counts reported here reflect the updated methodology. Please see p. 50 of this presentation for more information. The timing of activities, such as user maintenance, user audits, provisioning access, shutting off of users, and updates to the user lists when enterprise clients renew, results in fluctuations in licensed user counts over time. As a result, licensed user growth trends are best assessed on a rolling 12- month basis. 0.0% 18,767 18,771 Morningstar Direct Licenses Q3 24 Q3 25 0.0% 113,410 113,453 PitchBook Platform Licensed Users* Q3 24 Q3 25

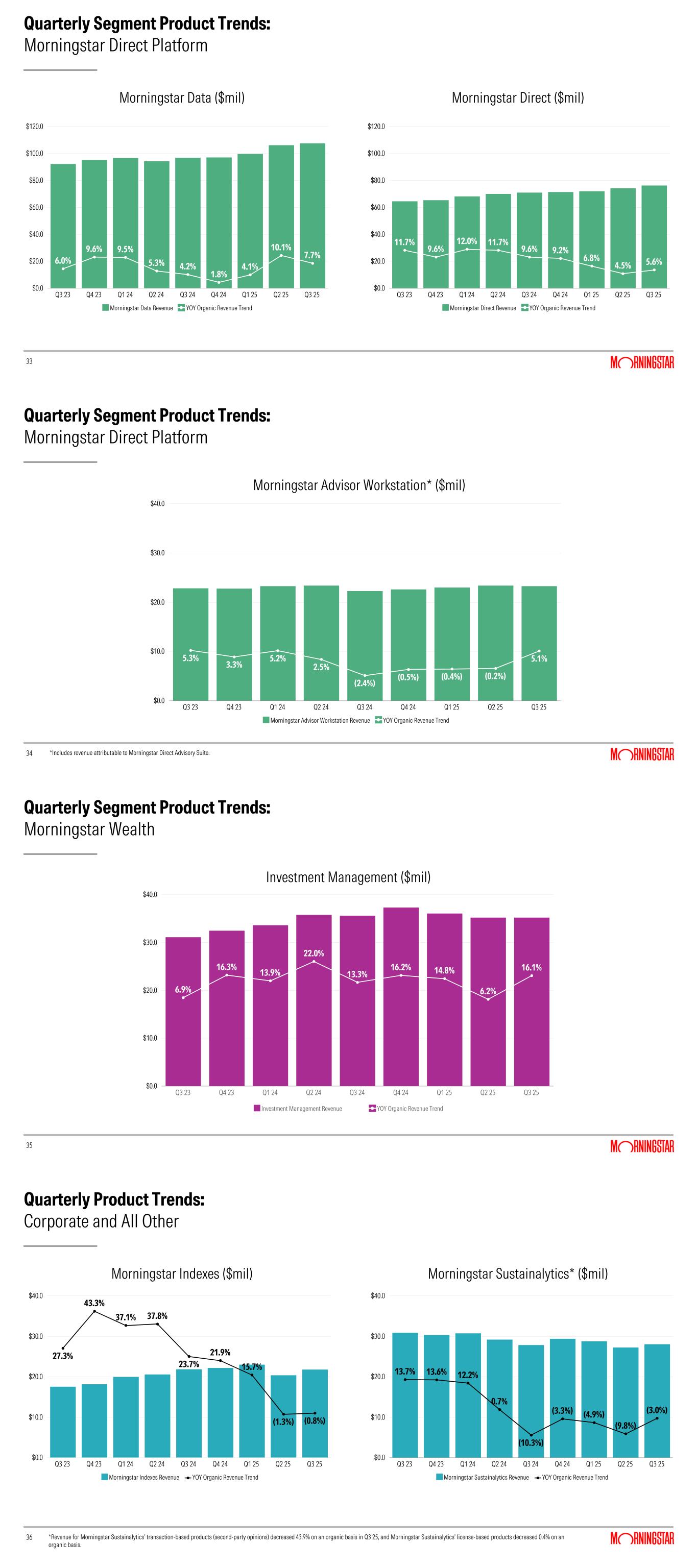

33 Quarterly Segment Product Trends: Morningstar Direct Platform 33 11.7% 9.6% 12.0% 11.7% 9.6% 9.2% 6.8% 4.5% 5.6% Morningstar Direct Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 6.0% 9.6% 9.5% 5.3% 4.2% 1.8% 4.1% 10.1% 7.7% Morningstar Data Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 Morningstar Data ($mil) Morningstar Direct ($mil) 34 Quarterly Segment Product Trends: Morningstar Direct Platform 34 5.3% 3.3% 5.2% 2.5% (2.4%) (0.5%) (0.4%) (0.2%) 5.1% Morningstar Advisor Workstation Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $10.0 $20.0 $30.0 $40.0 *Includes revenue attributable to Morningstar Direct Advisory Suite. Morningstar Advisor Workstation* ($mil) 35 Quarterly Segment Product Trends: Morningstar Wealth 35 6.9% 16.3% 13.9% 22.0% 13.3% 16.2% 14.8% 6.2% 16.1% Investment Management Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $10.0 $20.0 $30.0 $40.0 Investment Management ($mil) 36 Quarterly Product Trends: Corporate and All Other 36 27.3% 43.3% 37.1% 37.8% 23.7% 21.9% 15.7% (1.3%) (0.8%) Morningstar Indexes Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $10.0 $20.0 $30.0 $40.0 13.7% 13.6% 12.2% 0.7% (10.3%) (3.3%) (4.9%) (9.8%) (3.0%) Morningstar Sustainalytics Revenue YOY Organic Revenue Trend Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $0.0 $10.0 $20.0 $30.0 $40.0 *Revenue for Morningstar Sustainalytics’ transaction-based products (second-party opinions) decreased 43.9% on an organic basis in Q3 25, and Morningstar Sustainalytics’ license-based products decreased 0.4% on an organic basis. Morningstar Indexes ($mil) Morningstar Sustainalytics* ($mil)

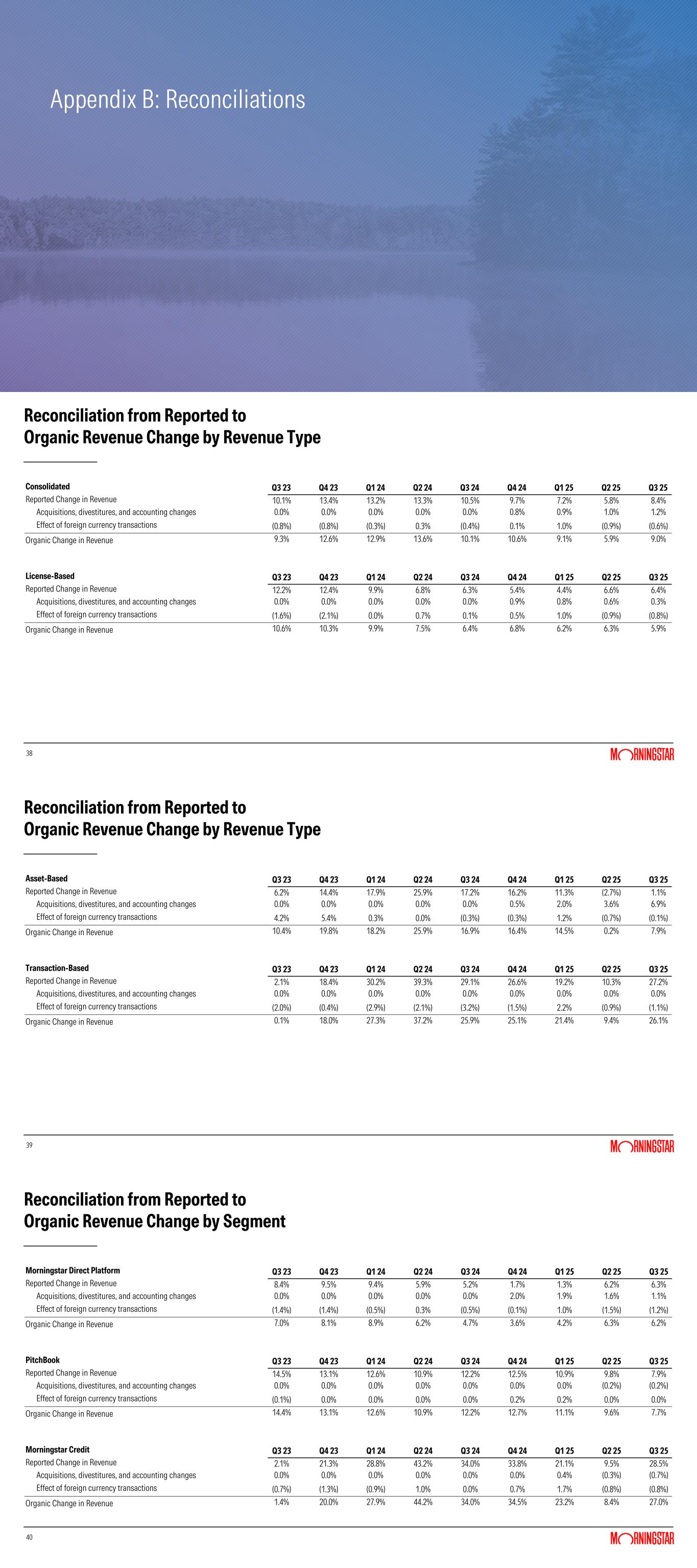

Appendix B: Reconciliations 38 Reconciliation from Reported to Organic Revenue Change by Revenue Type Consolidated Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 10.1% 13.4% 13.2% 13.3% 10.5% 9.7% 7.2% 5.8% 8.4% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.8% 0.9% 1.0% 1.2% Effect of foreign currency transactions (0.8%) (0.8%) (0.3%) 0.3% (0.4%) 0.1% 1.0% (0.9%) (0.6%) Organic Change in Revenue 9.3% 12.6% 12.9% 13.6% 10.1% 10.6% 9.1% 5.9% 9.0% License-Based Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 12.2% 12.4% 9.9% 6.8% 6.3% 5.4% 4.4% 6.6% 6.4% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.9% 0.8% 0.6% 0.3% Effect of foreign currency transactions (1.6%) (2.1%) 0.0% 0.7% 0.1% 0.5% 1.0% (0.9%) (0.8%) Organic Change in Revenue 10.6% 10.3% 9.9% 7.5% 6.4% 6.8% 6.2% 6.3% 5.9% 39 Reconciliation from Reported to Organic Revenue Change by Revenue Type Asset-Based Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 6.2% 14.4% 17.9% 25.9% 17.2% 16.2% 11.3% (2.7%) 1.1% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.5% 2.0% 3.6% 6.9% Effect of foreign currency transactions 4.2% 5.4% 0.3% 0.0% (0.3%) (0.3%) 1.2% (0.7%) (0.1%) Organic Change in Revenue 10.4% 19.8% 18.2% 25.9% 16.9% 16.4% 14.5% 0.2% 7.9% Transaction-Based Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 2.1% 18.4% 30.2% 39.3% 29.1% 26.6% 19.2% 10.3% 27.2% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (2.0%) (0.4%) (2.9%) (2.1%) (3.2%) (1.5%) 2.2% (0.9%) (1.1%) Organic Change in Revenue 0.1% 18.0% 27.3% 37.2% 25.9% 25.1% 21.4% 9.4% 26.1% 40 Reconciliation from Reported to Organic Revenue Change by Segment Morningstar Direct Platform Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 8.4% 9.5% 9.4% 5.9% 5.2% 1.7% 1.3% 6.2% 6.3% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 2.0% 1.9% 1.6% 1.1% Effect of foreign currency transactions (1.4%) (1.4%) (0.5%) 0.3% (0.5%) (0.1%) 1.0% (1.5%) (1.2%) Organic Change in Revenue 7.0% 8.1% 8.9% 6.2% 4.7% 3.6% 4.2% 6.3% 6.2% PitchBook Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 14.5% 13.1% 12.6% 10.9% 12.2% 12.5% 10.9% 9.8% 7.9% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% (0.2%) (0.2%) Effect of foreign currency transactions (0.1%) 0.0% 0.0% 0.0% 0.0% 0.2% 0.2% 0.0% 0.0% Organic Change in Revenue 14.4% 13.1% 12.6% 10.9% 12.2% 12.7% 11.1% 9.6% 7.7% Morningstar Credit Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 2.1% 21.3% 28.8% 43.2% 34.0% 33.8% 21.1% 9.5% 28.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.4% (0.3%) (0.7%) Effect of foreign currency transactions (0.7%) (1.3%) (0.9%) 1.0% 0.0% 0.7% 1.7% (0.8%) (0.8%) Organic Change in Revenue 1.4% 20.0% 27.9% 44.2% 34.0% 34.5% 23.2% 8.4% 27.0%

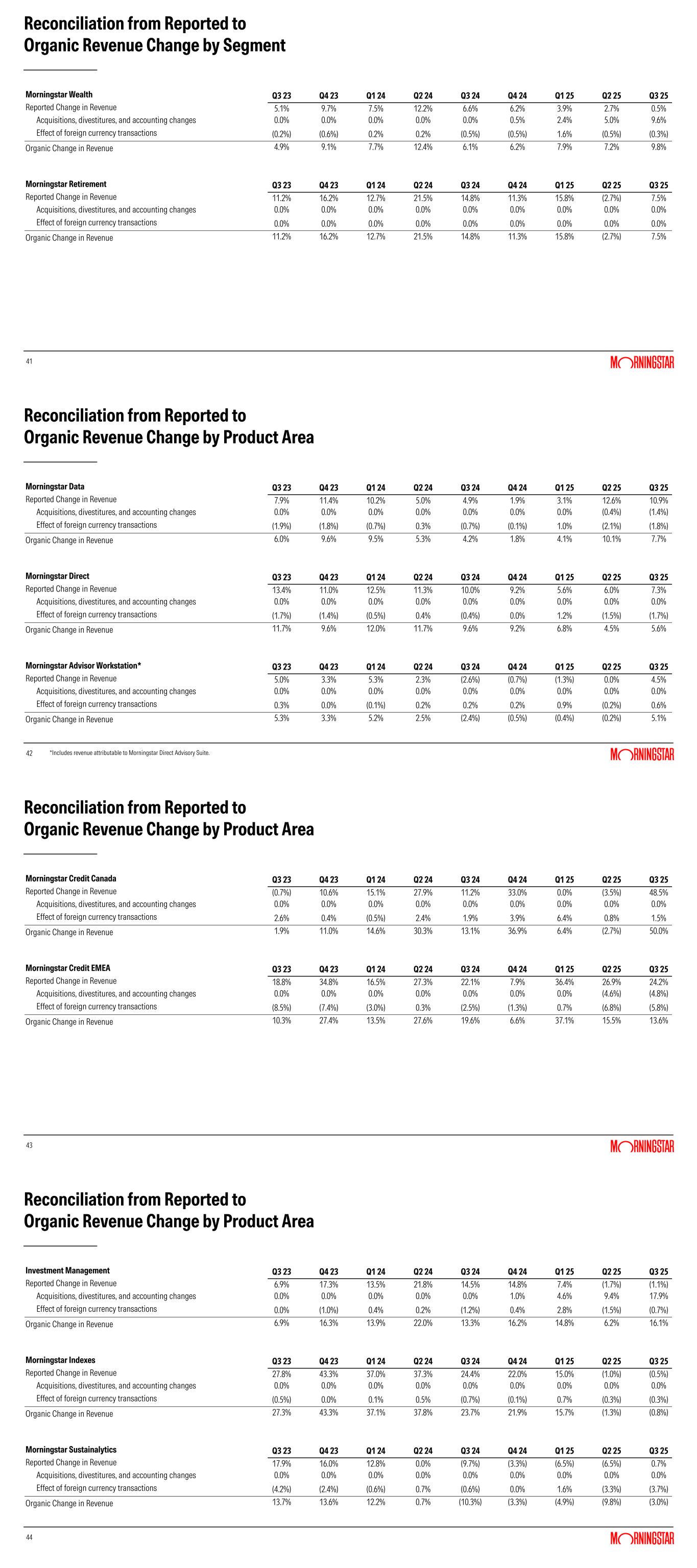

41 Reconciliation from Reported to Organic Revenue Change by Segment Morningstar Wealth Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 5.1% 9.7% 7.5% 12.2% 6.6% 6.2% 3.9% 2.7% 0.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.5% 2.4% 5.0% 9.6% Effect of foreign currency transactions (0.2%) (0.6%) 0.2% 0.2% (0.5%) (0.5%) 1.6% (0.5%) (0.3%) Organic Change in Revenue 4.9% 9.1% 7.7% 12.4% 6.1% 6.2% 7.9% 7.2% 9.8% Morningstar Retirement Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 11.2% 16.2% 12.7% 21.5% 14.8% 11.3% 15.8% (2.7%) 7.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Organic Change in Revenue 11.2% 16.2% 12.7% 21.5% 14.8% 11.3% 15.8% (2.7%) 7.5% 42 Reconciliation from Reported to Organic Revenue Change by Product Area Morningstar Data Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 7.9% 11.4% 10.2% 5.0% 4.9% 1.9% 3.1% 12.6% 10.9% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% (0.4%) (1.4%) Effect of foreign currency transactions (1.9%) (1.8%) (0.7%) 0.3% (0.7%) (0.1%) 1.0% (2.1%) (1.8%) Organic Change in Revenue 6.0% 9.6% 9.5% 5.3% 4.2% 1.8% 4.1% 10.1% 7.7% Morningstar Direct Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 13.4% 11.0% 12.5% 11.3% 10.0% 9.2% 5.6% 6.0% 7.3% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (1.7%) (1.4%) (0.5%) 0.4% (0.4%) 0.0% 1.2% (1.5%) (1.7%) Organic Change in Revenue 11.7% 9.6% 12.0% 11.7% 9.6% 9.2% 6.8% 4.5% 5.6% Morningstar Advisor Workstation* Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 5.0% 3.3% 5.3% 2.3% (2.6%) (0.7%) (1.3%) 0.0% 4.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 0.3% 0.0% (0.1%) 0.2% 0.2% 0.2% 0.9% (0.2%) 0.6% Organic Change in Revenue 5.3% 3.3% 5.2% 2.5% (2.4%) (0.5%) (0.4%) (0.2%) 5.1% *Includes revenue attributable to Morningstar Direct Advisory Suite. 43 Reconciliation from Reported to Organic Revenue Change by Product Area Morningstar Credit Canada Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue (0.7%) 10.6% 15.1% 27.9% 11.2% 33.0% 0.0% (3.5%) 48.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 2.6% 0.4% (0.5%) 2.4% 1.9% 3.9% 6.4% 0.8% 1.5% Organic Change in Revenue 1.9% 11.0% 14.6% 30.3% 13.1% 36.9% 6.4% (2.7%) 50.0% Morningstar Credit EMEA Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 18.8% 34.8% 16.5% 27.3% 22.1% 7.9% 36.4% 26.9% 24.2% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% (4.6%) (4.8%) Effect of foreign currency transactions (8.5%) (7.4%) (3.0%) 0.3% (2.5%) (1.3%) 0.7% (6.8%) (5.8%) Organic Change in Revenue 10.3% 27.4% 13.5% 27.6% 19.6% 6.6% 37.1% 15.5% 13.6% 44 Reconciliation from Reported to Organic Revenue Change by Product Area Investment Management Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 6.9% 17.3% 13.5% 21.8% 14.5% 14.8% 7.4% (1.7%) (1.1%) Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 1.0% 4.6% 9.4% 17.9% Effect of foreign currency transactions 0.0% (1.0%) 0.4% 0.2% (1.2%) 0.4% 2.8% (1.5%) (0.7%) Organic Change in Revenue 6.9% 16.3% 13.9% 22.0% 13.3% 16.2% 14.8% 6.2% 16.1% Morningstar Indexes Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 27.8% 43.3% 37.0% 37.3% 24.4% 22.0% 15.0% (1.0%) (0.5%) Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (0.5%) 0.0% 0.1% 0.5% (0.7%) (0.1%) 0.7% (0.3%) (0.3%) Organic Change in Revenue 27.3% 43.3% 37.1% 37.8% 23.7% 21.9% 15.7% (1.3%) (0.8%) Morningstar Sustainalytics Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Reported Change in Revenue 17.9% 16.0% 12.8% 0.0% (9.7%) (3.3%) (6.5%) (6.5%) 0.7% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (4.2%) (2.4%) (0.6%) 0.7% (0.6%) 0.0% 1.6% (3.3%) (3.7%) Organic Change in Revenue 13.7% 13.6% 12.2% 0.7% (10.3%) (3.3%) (4.9%) (9.8%) (3.0%)

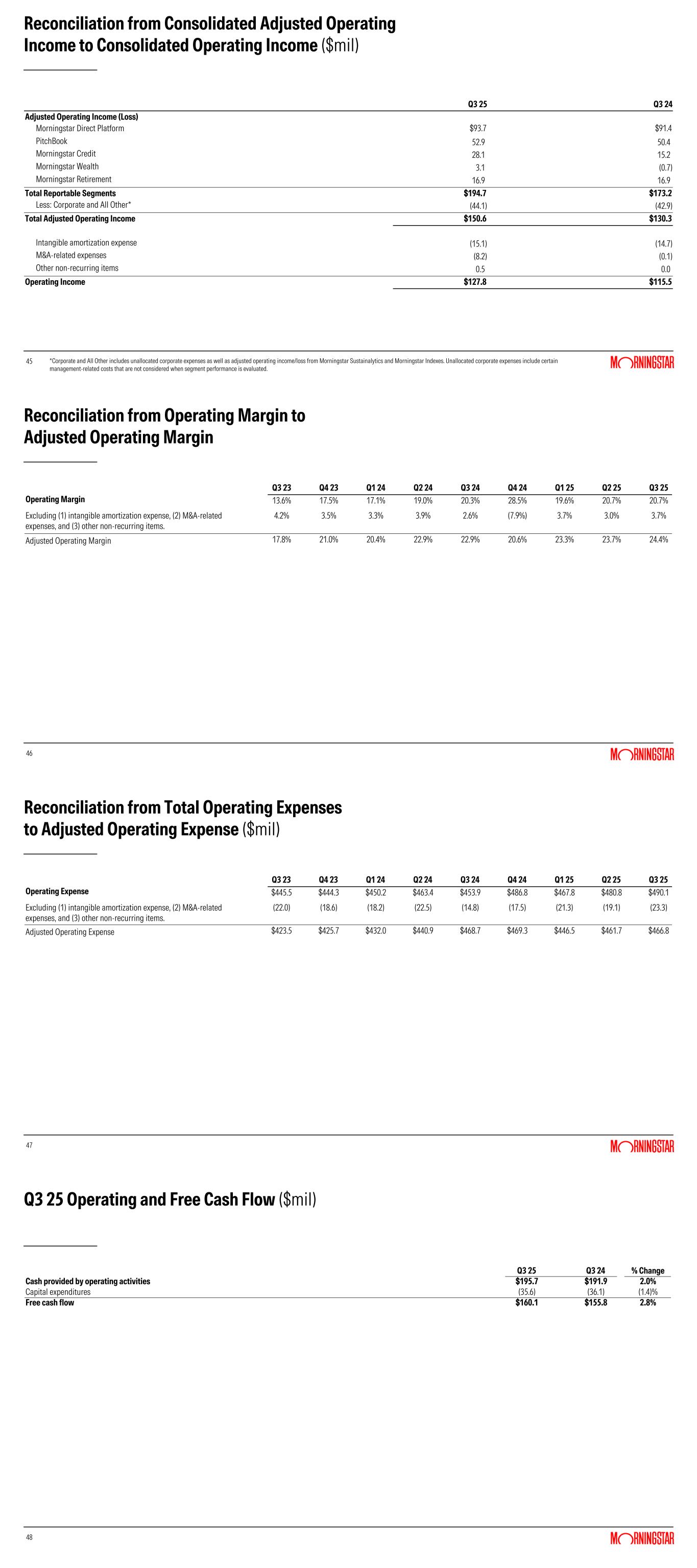

45 Reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income ($mil) *Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income/loss from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include certain management-related costs that are not considered when segment performance is evaluated. Q3 25 Q3 24 Adjusted Operating Income (Loss) Morningstar Direct Platform $93.7 $91.4 PitchBook 52.9 50.4 Morningstar Credit 28.1 15.2 Morningstar Wealth 3.1 (0.7) Morningstar Retirement 16.9 16.9 Total Reportable Segments $194.7 $173.2 Less: Corporate and All Other* (44.1) (42.9) Total Adjusted Operating Income $150.6 $130.3 Intangible amortization expense (15.1) (14.7) M&A-related expenses (8.2) (0.1) Other non-recurring items 0.5 0.0 Operating Income $127.8 $115.5 46 Reconciliation from Operating Margin to Adjusted Operating Margin Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Operating Margin 13.6% 17.5% 17.1% 19.0% 20.3% 28.5% 19.6% 20.7% 20.7% Excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. 4.2% 3.5% 3.3% 3.9% 2.6% (7.9%) 3.7% 3.0% 3.7% Adjusted Operating Margin 17.8% 21.0% 20.4% 22.9% 22.9% 20.6% 23.3% 23.7% 24.4% 47 Reconciliation from Total Operating Expenses to Adjusted Operating Expense ($mil) Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Operating Expense $445.5 $444.3 $450.2 $463.4 $453.9 $486.8 $467.8 $480.8 $490.1 Excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. (22.0) (18.6) (18.2) (22.5) (14.8) (17.5) (21.3) (19.1) (23.3) Adjusted Operating Expense $423.5 $425.7 $432.0 $440.9 $468.7 $469.3 $446.5 $461.7 $466.8 48 Q3 25 Operating and Free Cash Flow ($mil) Q3 25 Q3 24 % Change Cash provided by operating activities $195.7 $191.9 2.0% Capital expenditures (35.6) (36.1) (1.4)% Free cash flow $160.1 $155.8 2.8%

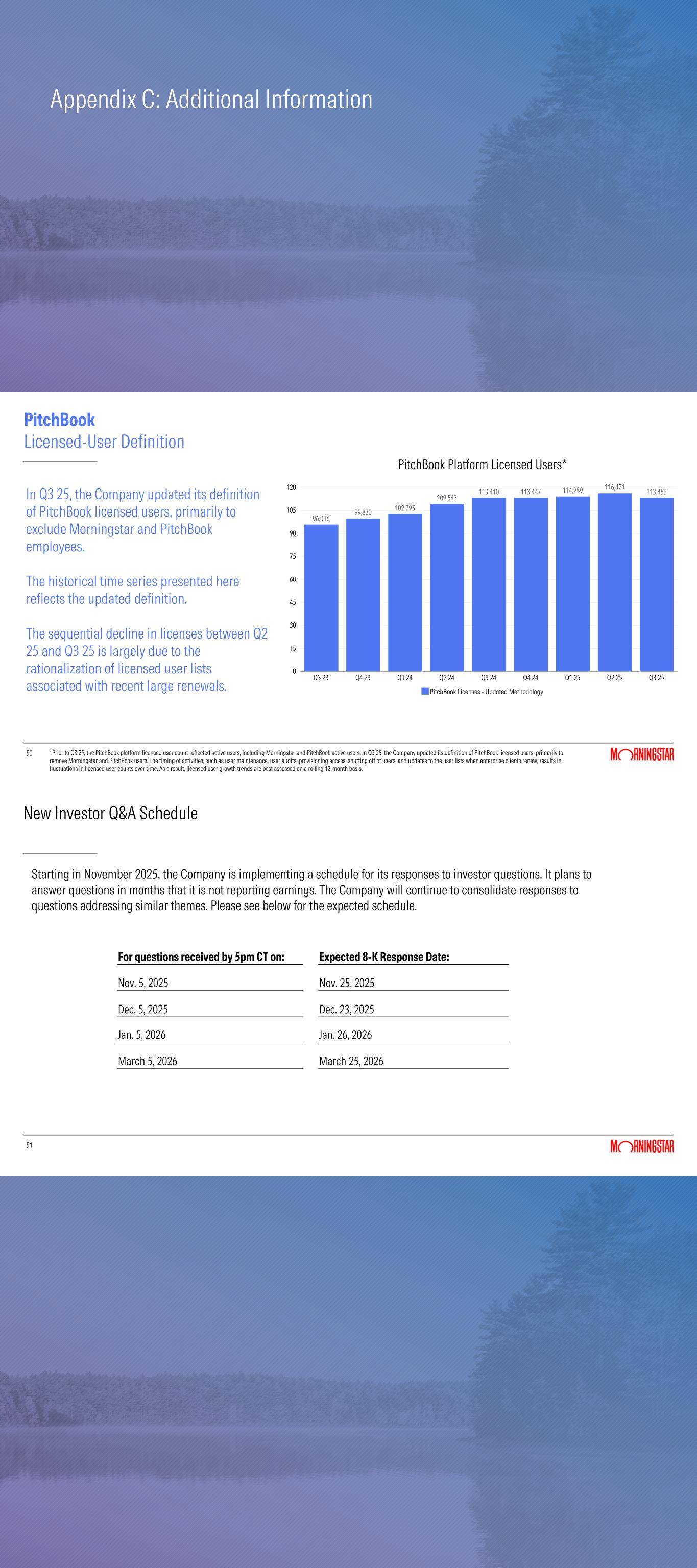

Appendix C: Additional Information 50 In Q3 25, the Company updated its definition of PitchBook licensed users, primarily to exclude Morningstar and PitchBook employees. The historical time series presented here reflects the updated definition. The sequential decline in licenses between Q2 25 and Q3 25 is largely due to the rationalization of licensed user lists associated with recent large renewals. 96,016 99,830 102,795 109,543 113,410 113,447 114,259 116,421 113,453 PitchBook Licenses - Updated Methodology Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 0 15 30 45 60 75 90 105 120 PitchBook Licensed-User Definition PitchBook Platform Licensed Users* *Prior to Q3 25, the PitchBook platform licensed user count reflected active users, including Morningstar and PitchBook active users. In Q3 25, the Company updated its definition of PitchBook licensed users, primarily to remove Morningstar and PitchBook users. The timing of activities, such as user maintenance, user audits, provisioning access, shutting off of users, and updates to the user lists when enterprise clients renew, results in fluctuations in licensed user counts over time. As a result, licensed user growth trends are best assessed on a rolling 12-month basis. 51 New Investor Q&A Schedule For questions received by 5pm CT on: Expected 8-K Response Date: Nov. 5, 2025 Nov. 25, 2025 Dec. 5, 2025 Dec. 23, 2025 Jan. 5, 2026 Jan. 26, 2026 March 5, 2026 March 25, 2026 Starting in November 2025, the Company is implementing a schedule for its responses to investor questions. It plans to answer questions in months that it is not reporting earnings. The Company will continue to consolidate responses to questions addressing similar themes. Please see below for the expected schedule.