Fourth-Quarter 2025 Supplemental Presentation February 12, 2026 2 This presentation contains forward-looking statements within the meaning of Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "prospects," or "continue." These statements involve known or unknown risks and uncertainties that may cause actual results to differ significantly from what we expect. More information about factors that could affect Morningstar's business and financial results are in our filings with the SEC, including our most recent Forms 8-K, 10-K, and 10-Q. Morningstar undertakes no obligation to publicly update any forward-looking statements as a result of new information, future events, or otherwise, except as required by law. 3 This presentation includes references to the non-GAAP financial measures listed below (including percentage growth or decline of those numbers). These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is provided in the appendix to this presentation and in our filings with the SEC, including our most recent Forms 8-K, 10-K, and 10-Q. "Organic Revenue" is consolidated revenue before (1) acquisitions and divestitures, (2) adoption of new accounting standards or revisions to accounting practices (accounting changes), and (3) the effect of foreign currency translations. "Adjusted Operating Income (Loss)" is consolidated operating income (loss) excluding (1) intangible amortization expense, (2) the impact of merger, acquisition, and divestiture-related activity which, when applicable, may include certain non-recurring expenses such as pre-deal due diligence, transaction costs, contingent consideration, severance, and post-close integration costs (M&A-related expenses), and (3) certain other one-time, non-recurring items which management does not consider when evaluating ongoing performance (other non-recurring items). "Adjusted Operating Margin" is operating margin excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. "Adjusted Operating Expense" is operating expenses excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. "Free Cash Flow" is cash provided by or used for operating activities less capital expenditures. 4 Table of Contents Q4 25 Results Summary 5 Q4 25 Segment Detail 15 Appendix A: Additional Segment Detail 33 Appendix B: Reconciliations 43 Appendix C: Additional Information 55

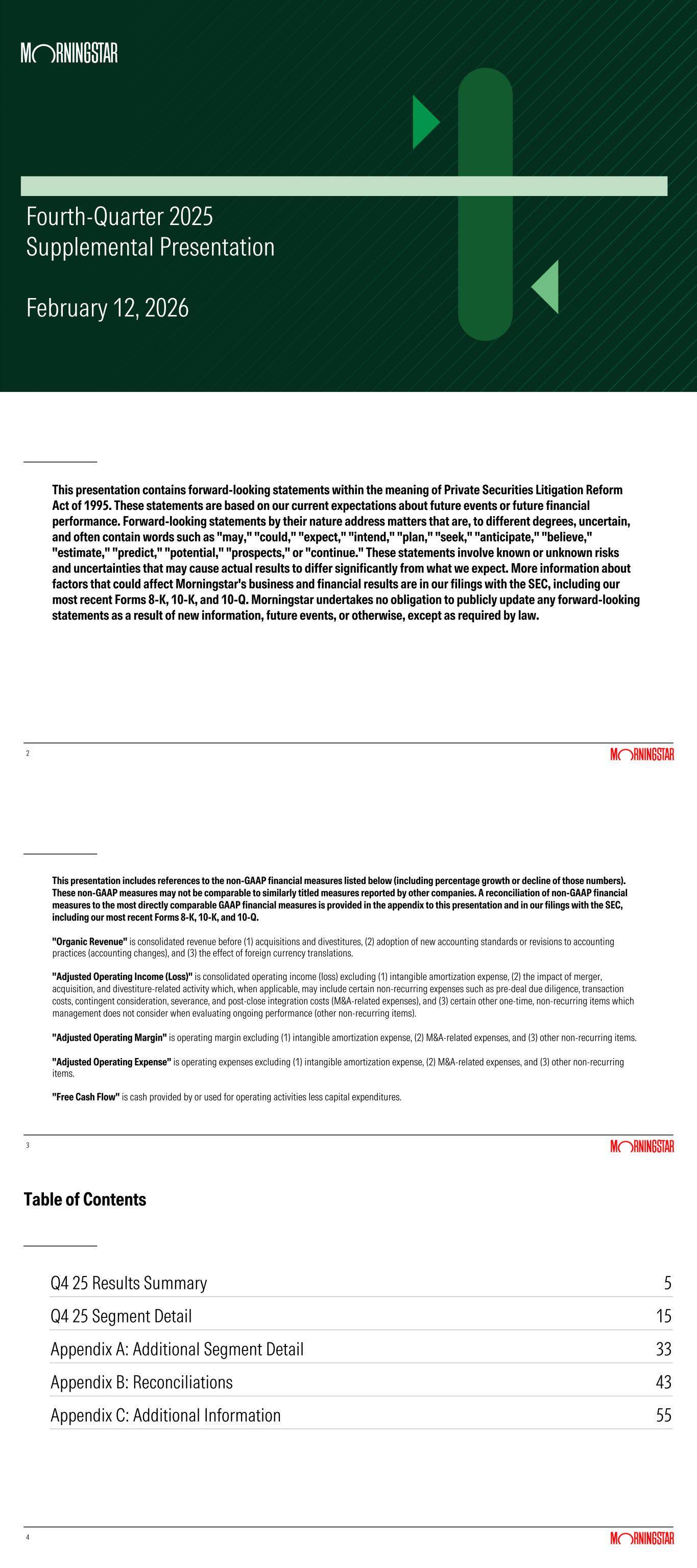

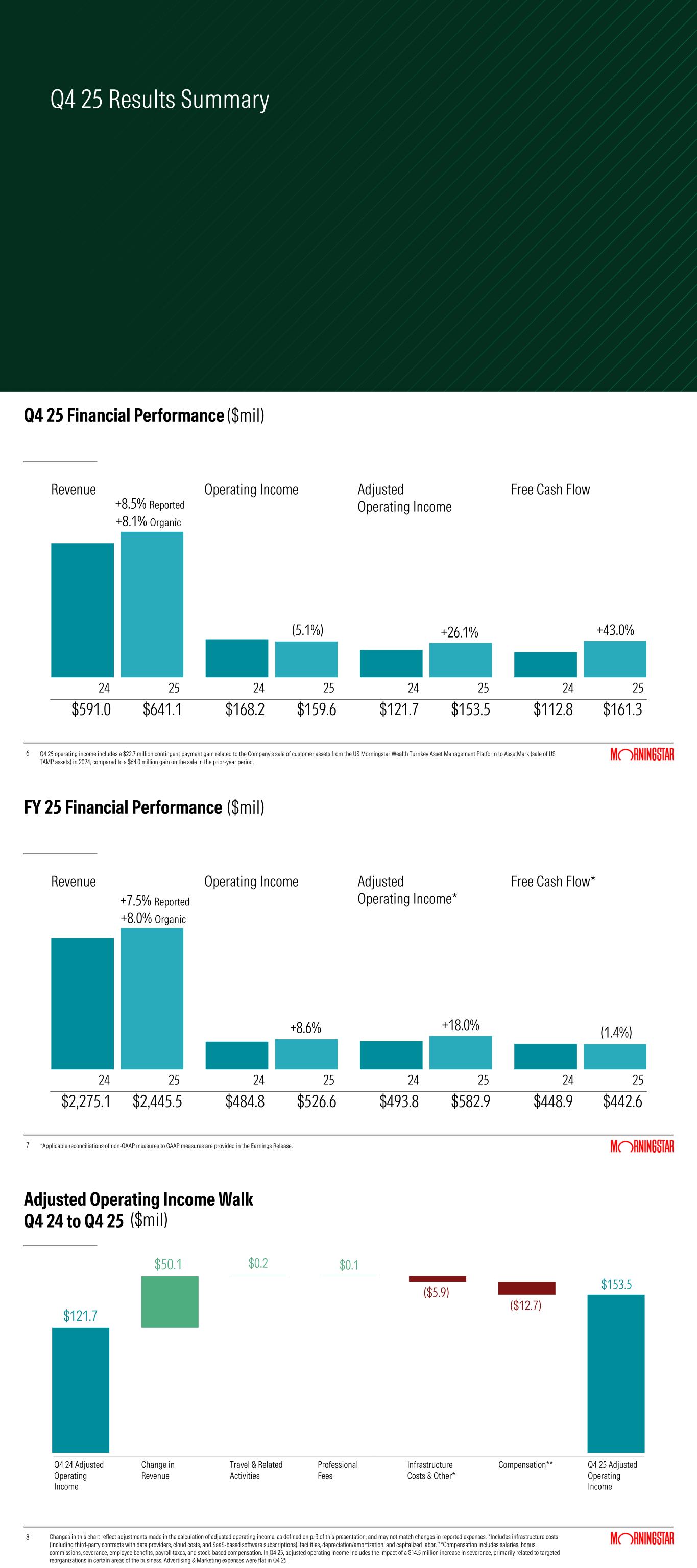

Q4 25 Results Summary 6 Q4 25 Financial Performance +8.5% Reported +8.1% Organic +26.1% +43.0%(5.1%) $591.0 $641.1 $168.2 $159.6 $121.7 $153.5 $112.8 $161.3 Revenue Operating Income Adjusted Operating Income Free Cash Flow ($mil) 24 25 24 25 24 25 24 25 Q4 25 operating income includes a $22.7 million contingent payment gain related to the Company's sale of customer assets from the US Morningstar Wealth Turnkey Asset Management Platform to AssetMark (sale of US TAMP assets) in 2024, compared to a $64.0 million gain on the sale in the prior-year period. 7 FY 25 Financial Performance +7.5% Reported +8.0% Organic +18.0% (1.4%)+8.6% $2,275.1 $2,445.5 $484.8 $526.6 $493.8 $582.9 $448.9 $442.6 Revenue Operating Income Adjusted Operating Income* Free Cash Flow* ($mil) 24 25 24 25 24 25 24 25 *Applicable reconciliations of non‑GAAP measures to GAAP measures are provided in the Earnings Release. 8 Adjusted Operating Income Walk Q4 24 to Q4 25 Q4 24 Adjusted Operating Income Change in Revenue Travel & Related Activities Professional Fees Infrastructure Costs & Other* Compensation** Q4 25 Adjusted Operating Income Changes in this chart reflect adjustments made in the calculation of adjusted operating income, as defined on p. 3 of this presentation, and may not match changes in reported expenses. *Includes infrastructure costs (including third-party contracts with data providers, cloud costs, and SaaS-based software subscriptions), facilities, depreciation/amortization, and capitalized labor. **Compensation includes salaries, bonus, commissions, severance, employee benefits, payroll taxes, and stock-based compensation. In Q4 25, adjusted operating income includes the impact of a $14.5 million increase in severance, primarily related to targeted reorganizations in certain areas of the business. Advertising & Marketing expenses were flat in Q4 25. ($mil) $121.7 $50.1 ($5.9) $0.1 ($12.7) $0.2 $153.5

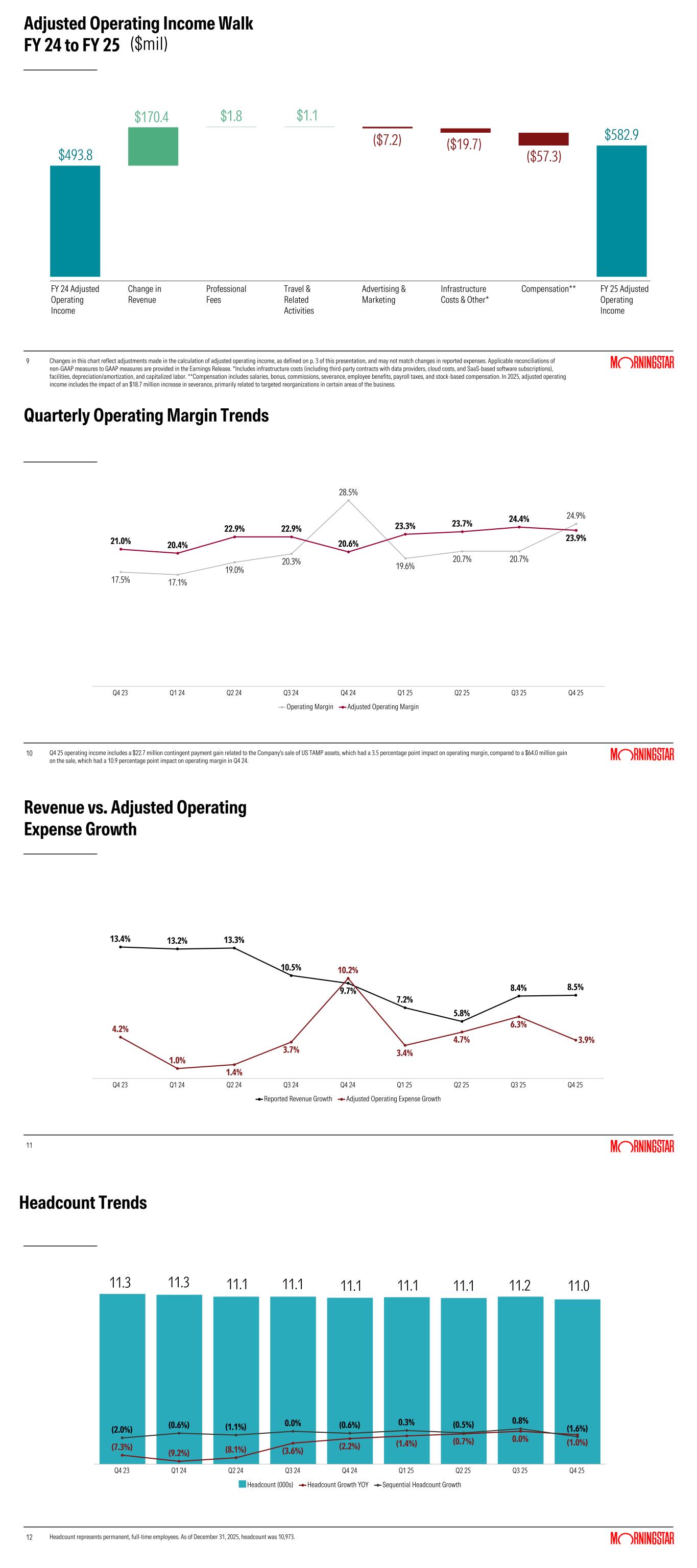

9 Adjusted Operating Income Walk FY 24 to FY 25 FY 24 Adjusted Operating Income Change in Revenue Professional Fees Travel & Related Activities Advertising & Marketing Infrastructure Costs & Other* Compensation** FY 25 Adjusted Operating Income Changes in this chart reflect adjustments made in the calculation of adjusted operating income, as defined on p. 3 of this presentation, and may not match changes in reported expenses. Applicable reconciliations of non‑GAAP measures to GAAP measures are provided in the Earnings Release. *Includes infrastructure costs (including third-party contracts with data providers, cloud costs, and SaaS-based software subscriptions), facilities, depreciation/amortization, and capitalized labor. **Compensation includes salaries, bonus, commissions, severance, employee benefits, payroll taxes, and stock-based compensation. In 2025, adjusted operating income includes the impact of an $18.7 million increase in severance, primarily related to targeted reorganizations in certain areas of the business. ($mil) $493.8 $170.4 ($7.2) ($19.7) $1.1 ($57.3) $1.8 $582.9 10 Quarterly Operating Margin Trends 17.5% 17.1% 19.0% 20.3% 28.5% 19.6% 20.7% 20.7% 24.9% 21.0% 20.4% 22.9% 22.9% 20.6% 23.3% 23.7% 24.4% 23.9% Operating Margin Adjusted Operating Margin Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Q4 25 operating income includes a $22.7 million contingent payment gain related to the Company's sale of US TAMP assets, which had a 3.5 percentage point impact on operating margin, compared to a $64.0 million gain on the sale, which had a 10.9 percentage point impact on operating margin in Q4 24. 11 Revenue vs. Adjusted Operating Expense Growth 13.4% 13.2% 13.3% 10.5% 9.7% 7.2% 5.8% 8.4% 8.5% 4.2% 1.0% 1.4% 3.7% 10.2% 3.4% 4.7% 6.3% 3.9% Reported Revenue Growth Adjusted Operating Expense Growth Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 12 Headcount Trends Headcount represents permanent, full-time employees. As of December 31, 2025, headcount was 10,973. (7.3%) (9.2%) (8.1%) (3.6%) (2.2%) (1.4%) (0.7%) 0.0% (1.0%) (2.0%) (0.6%) (1.1%) 0.0% (0.6%) 0.3% (0.5%) 0.8% (1.6%) Headcount (000s) Headcount Growth YOY Sequential Headcount Growth Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 11.3 11.3 11.1 11.1 11.1 11.1 11.1 11.2 11.0

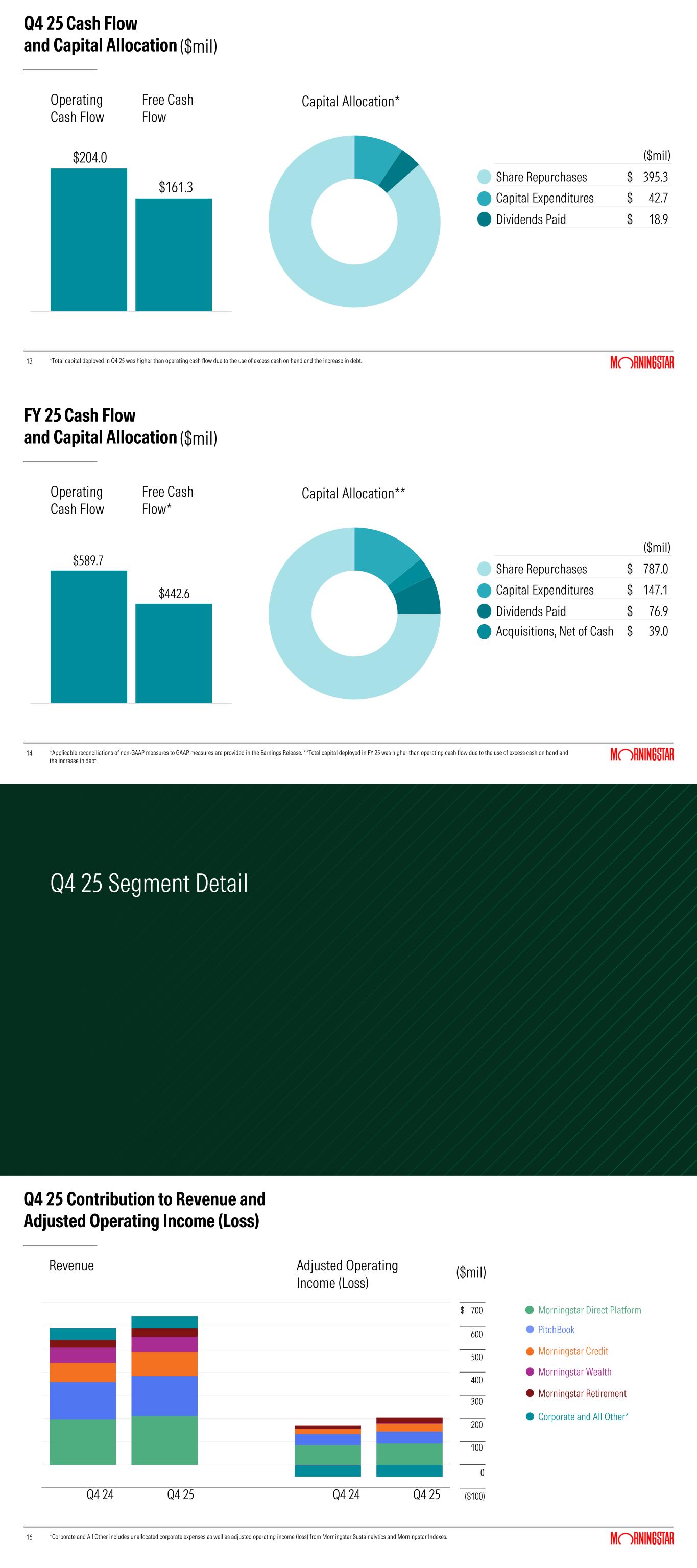

13 Q4 25 Cash Flow and Capital Allocation 13 ($mil) Operating Cash Flow Free Cash Flow *Total capital deployed in Q4 25 was higher than operating cash flow due to the use of excess cash on hand and the increase in debt. Capital Allocation* $204.0 $161.3 ($mil) Share Repurchases $ 395.3 Capital Expenditures $ 42.7 Dividends Paid $ 18.9 14 FY 25 Cash Flow and Capital Allocation 14 ($mil) Operating Cash Flow Free Cash Flow* ($mil) Share Repurchases $ 787.0 Capital Expenditures $ 147.1 Dividends Paid $ 76.9 Acquisitions, Net of Cash $ 39.0 *Applicable reconciliations of non‑GAAP measures to GAAP measures are provided in the Earnings Release. **Total capital deployed in FY 25 was higher than operating cash flow due to the use of excess cash on hand and the increase in debt. Capital Allocation** $589.7 $442.6 Q4 25 Segment Detail 16 Q4 25 Contribution to Revenue and Adjusted Operating Income (Loss) 16 Morningstar Direct Platform Revenue Adjusted Operating Income (Loss) *Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Q4 24 Q4 25 Q4 24 Q4 25 $ 700 600 500 400 300 200 100 0 ($100) PitchBook Morningstar Credit Morningstar Wealth Morningstar Retirement Corporate and All Other* ($mil)

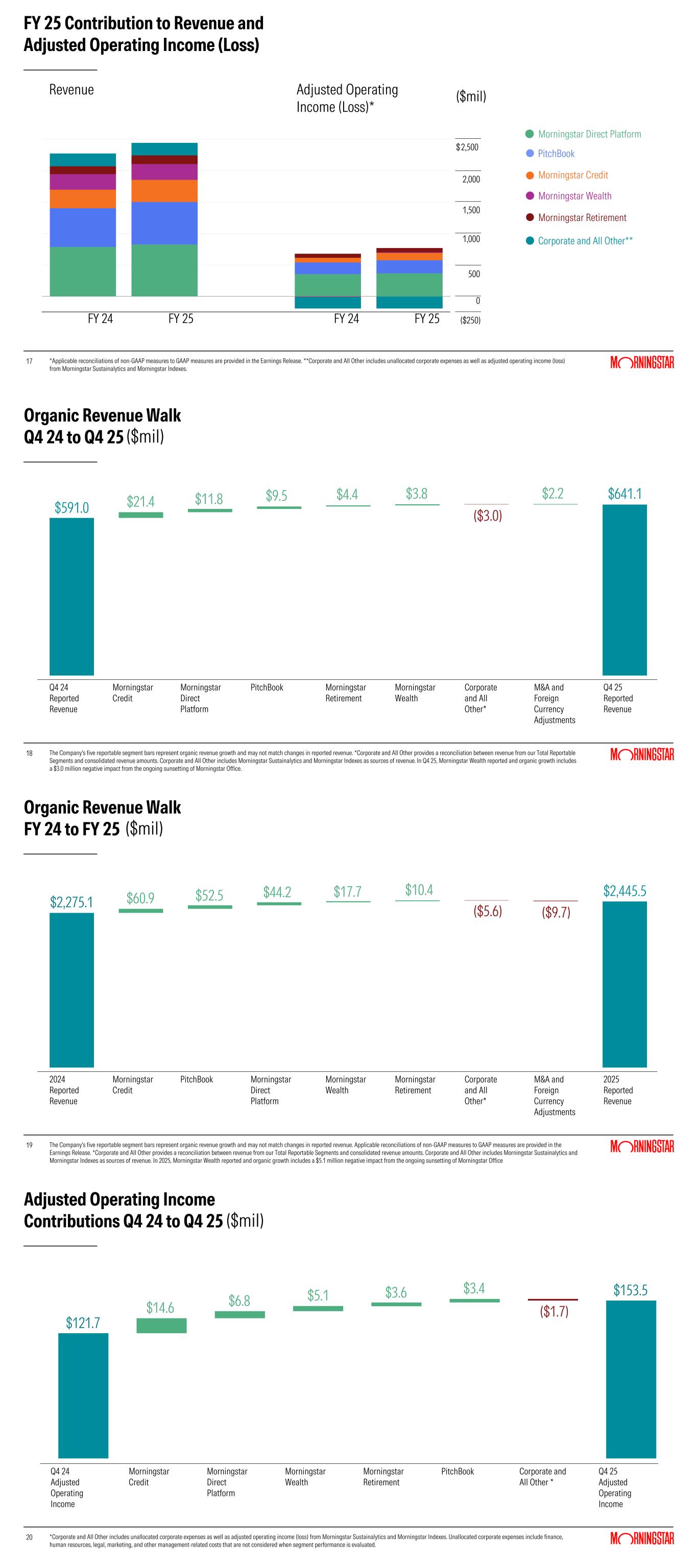

17 FY 25 Contribution to Revenue and Adjusted Operating Income (Loss) 17 Revenue Adjusted Operating Income (Loss)* *Applicable reconciliations of non‑GAAP measures to GAAP measures are provided in the Earnings Release. **Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. FY 24 FY 25 FY 24 FY 25 $ 2,500 2,000 1,500 1,000 500 0 ($250) ($mil) Morningstar Direct Platform PitchBook Morningstar Credit Morningstar Wealth Morningstar Retirement Corporate and All Other** 18 Organic Revenue Walk Q4 24 to Q4 25 Q4 24 Reported Revenue Morningstar Credit Morningstar Direct Platform PitchBook Morningstar Retirement Morningstar Wealth Corporate and All Other* M&A and Foreign Currency Adjustments Q4 25 Reported Revenue ($mil) The Company's five reportable segment bars represent organic revenue growth and may not match changes in reported revenue. *Corporate and All Other provides a reconciliation between revenue from our Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenue. In Q4 25, Morningstar Wealth reported and organic growth includes a $3.0 million negative impact from the ongoing sunsetting of Morningstar Office. $591.0 $9.5 $4.4 $3.8$21.4 $11.8 ($3.0) $2.2 $641.1 19 Organic Revenue Walk FY 24 to FY 25 2024 Reported Revenue Morningstar Credit PitchBook Morningstar Direct Platform Morningstar Wealth Morningstar Retirement Corporate and All Other* M&A and Foreign Currency Adjustments 2025 Reported Revenue ($mil) The Company's five reportable segment bars represent organic revenue growth and may not match changes in reported revenue. Applicable reconciliations of non‑GAAP measures to GAAP measures are provided in the Earnings Release. *Corporate and All Other provides a reconciliation between revenue from our Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenue. In 2025, Morningstar Wealth reported and organic growth includes a $5.1 million negative impact from the ongoing sunsetting of Morningstar Office $2,275.1 $44.2 $17.7 $10.4$60.9 $52.5 ($5.6) ($9.7) $2,445.5 20 Adjusted Operating Income Contributions Q4 24 to Q4 25 Q4 24 Adjusted Operating Income Morningstar Credit Morningstar Direct Platform Morningstar Wealth Morningstar Retirement PitchBook Corporate and All Other * Q4 25 Adjusted Operating Income *Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include finance, human resources, legal, marketing, and other management-related costs that are not considered when segment performance is evaluated. ($mil) $121.7 $6.8 $3.6$5.1 $3.4 $14.6 ($1.7) $153.5

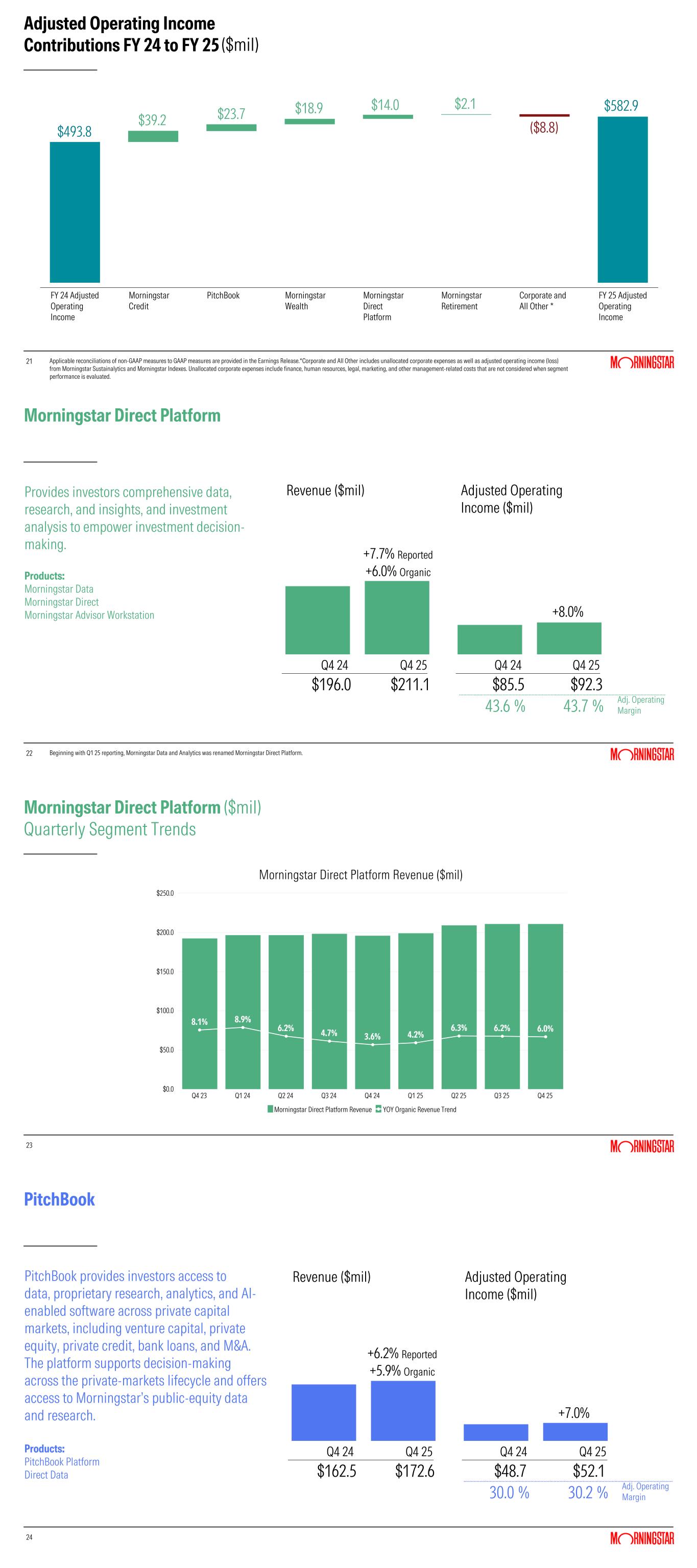

21 Adjusted Operating Income Contributions FY 24 to FY 25 FY 24 Adjusted Operating Income Morningstar Credit PitchBook Morningstar Wealth Morningstar Direct Platform Morningstar Retirement Corporate and All Other * FY 25 Adjusted Operating Income Applicable reconciliations of non‑GAAP measures to GAAP measures are provided in the Earnings Release.*Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include finance, human resources, legal, marketing, and other management-related costs that are not considered when segment performance is evaluated. ($mil) $493.8 $23.7 $14.0$18.9 $2.1 $39.2 ($8.8) $582.9 22 Morningstar Direct Platform 22 +7.7% Reported +6.0% Organic +8.0% $196.0 $211.1 $85.5 $92.3 43.6 % 43.7 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Beginning with Q1 25 reporting, Morningstar Data and Analytics was renamed Morningstar Direct Platform. Q4 24 Q4 25 Q4 24 Q4 25 Provides investors comprehensive data, research, and insights, and investment analysis to empower investment decision- making. Products: Morningstar Data Morningstar Direct Morningstar Advisor Workstation 23 Morningstar Direct Platform ($mil) Quarterly Segment Trends 23 8.1% 8.9% 6.2% 4.7% 3.6% 4.2% 6.3% 6.2% 6.0% Morningstar Direct Platform Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 Morningstar Direct Platform Revenue ($mil) 24 PitchBook 24 +6.2% Reported +5.9% Organic +7.0% $162.5 $172.6 $48.7 $52.1 30.0 % 30.2 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Q4 24 Q4 25 Q4 24 Q4 25 PitchBook provides investors access to data, proprietary research, analytics, and AI- enabled software across private capital markets, including venture capital, private equity, private credit, bank loans, and M&A. The platform supports decision-making across the private-markets lifecycle and offers access to Morningstar’s public-equity data and research. Products: PitchBook Platform Direct Data

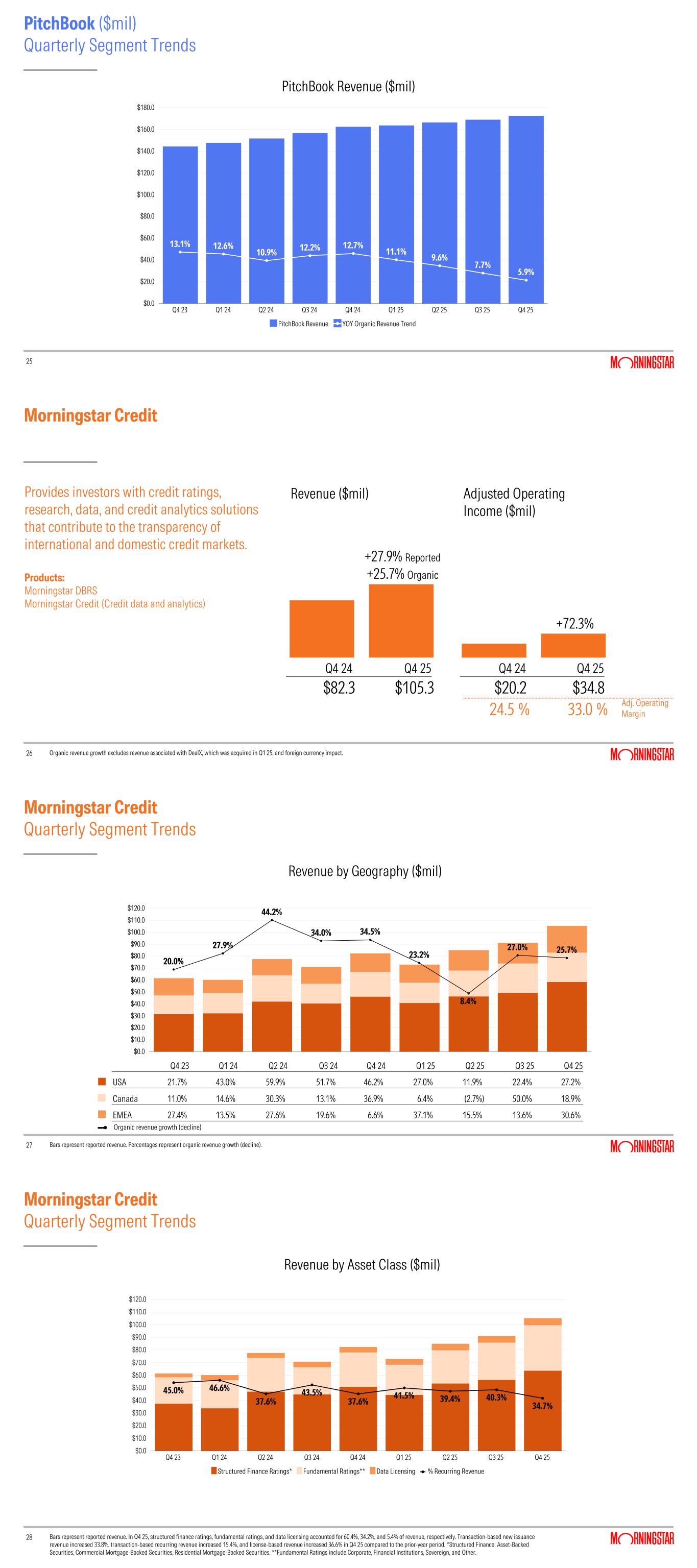

25 PitchBook ($mil) Quarterly Segment Trends 25 13.1% 12.6% 10.9% 12.2% 12.7% 11.1% 9.6% 7.7% 5.9% PitchBook Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 PitchBook Revenue ($mil) 26 Morningstar Credit 26 +27.9% Reported +25.7% Organic +72.3% $82.3 $105.3 $20.2 $34.8 24.5 % 33.0 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Q4 24 Q4 25 Q4 24 Q4 25 Provides investors with credit ratings, research, data, and credit analytics solutions that contribute to the transparency of international and domestic credit markets. Products: Morningstar DBRS Morningstar Credit (Credit data and analytics) Organic revenue growth excludes revenue associated with DealX, which was acquired in Q1 25, and foreign currency impact. 27 Morningstar Credit Quarterly Segment Trends 27 Bars represent reported revenue. Percentages represent organic revenue growth (decline). 20.0% 27.9% 44.2% 34.0% 34.5% 23.2% 8.4% 27.0% 25.7% $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 $110.0 $120.0 Revenue by Geography ($mil) Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 USA 21.7% 43.0% 59.9% 51.7% 46.2% 27.0% 11.9% 22.4% 27.2% Canada 11.0% 14.6% 30.3% 13.1% 36.9% 6.4% (2.7%) 50.0% 18.9% EMEA 27.4% 13.5% 27.6% 19.6% 6.6% 37.1% 15.5% 13.6% 30.6% Organic revenue growth (decline) 28 Morningstar Credit Quarterly Segment Trends 28 Bars represent reported revenue. In Q4 25, structured finance ratings, fundamental ratings, and data licensing accounted for 60.4%, 34.2%, and 5.4% of revenue, respectively. Transaction-based new issuance revenue increased 33.8%, transaction-based recurring revenue increased 15.4%, and license-based revenue increased 36.6% in Q4 25 compared to the prior-year period. *Structured Finance: Asset-Backed Securities, Commercial Mortgage-Backed Securities, Residential Mortgage-Backed Securities. **Fundamental Ratings include Corporate, Financial Institutions, Sovereign, and Other. 45.0% 46.6% 37.6% 43.5% 37.6% 41.5% 39.4% 40.3% 34.7% Structured Finance Ratings* Fundamental Ratings** Data Licensing % Recurring Revenue Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 $110.0 $120.0 Revenue by Asset Class ($mil)

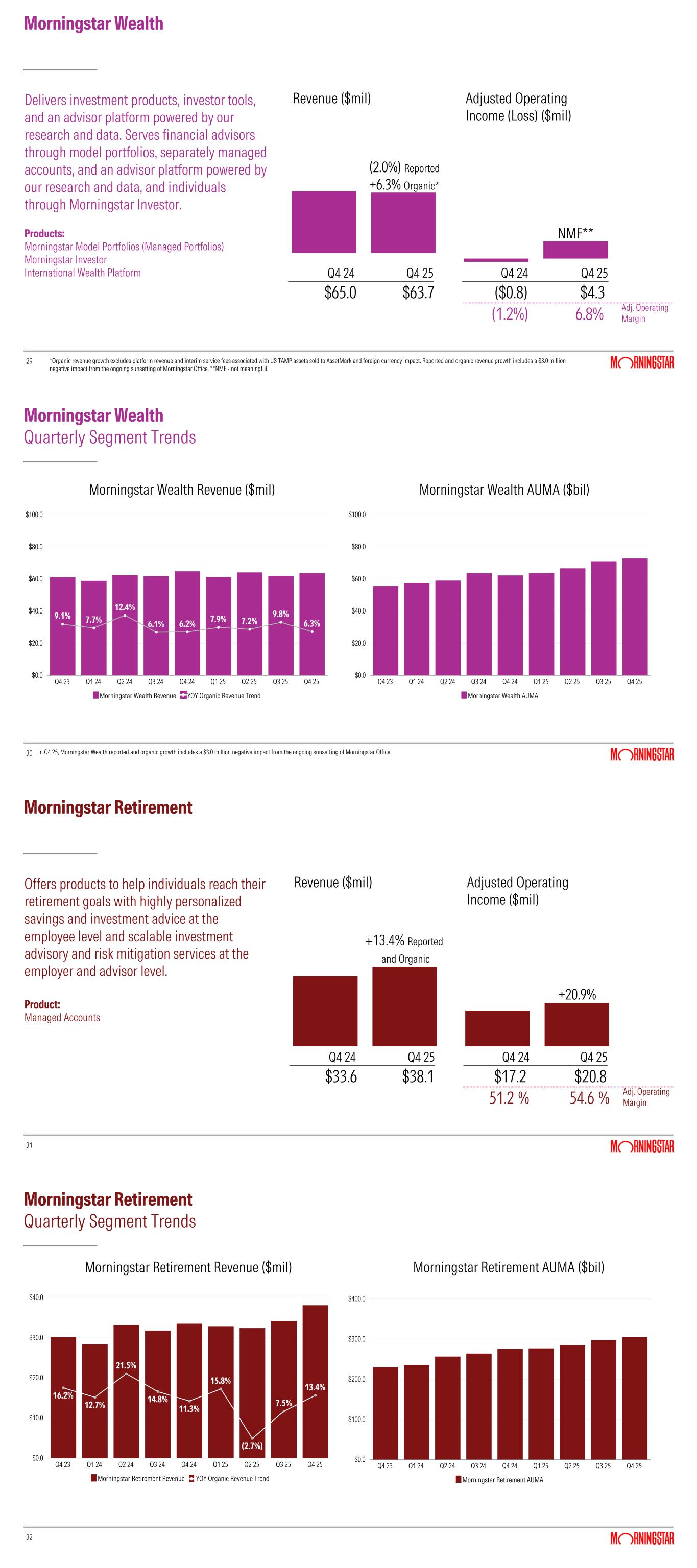

29 Morningstar Wealth 29 (2.0%) Reported +6.3% Organic* NMF** $65.0 $63.7 ($0.8) $4.3 (1.2%) 6.8% Adj. Operating Margin Revenue ($mil) Adjusted Operating Income (Loss) ($mil) *Organic revenue growth excludes platform revenue and interim service fees associated with US TAMP assets sold to AssetMark and foreign currency impact. Reported and organic revenue growth includes a $3.0 million negative impact from the ongoing sunsetting of Morningstar Office. **NMF - not meaningful. Q4 24 Q4 25 Q4 24 Q4 25 Delivers investment products, investor tools, and an advisor platform powered by our research and data. Serves financial advisors through model portfolios, separately managed accounts, and an advisor platform powered by our research and data, and individuals through Morningstar Investor. Products: Morningstar Model Portfolios (Managed Portfolios) Morningstar Investor International Wealth Platform 30 Morningstar Wealth Quarterly Segment Trends 30 9.1% 7.7% 12.4% 6.1% 6.2% 7.9% 7.2% 9.8% 6.3% Morningstar Wealth Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Morningstar Wealth AUMA Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Morningstar Wealth Revenue ($mil) Morningstar Wealth AUMA ($bil) In Q4 25, Morningstar Wealth reported and organic growth includes a $3.0 million negative impact from the ongoing sunsetting of Morningstar Office. 31 Morningstar Retirement 31 +13.4% Reported and Organic +20.9% $33.6 $38.1 $17.2 $20.8 51.2 % 54.6 % Adj. Operating Margin Revenue ($mil) Adjusted Operating Income ($mil) Q4 24 Q4 25 Q4 24 Q4 25 Offers products to help individuals reach their retirement goals with highly personalized savings and investment advice at the employee level and scalable investment advisory and risk mitigation services at the employer and advisor level. Product: Managed Accounts 32 Morningstar Retirement Quarterly Segment Trends 32 16.2% 12.7% 21.5% 14.8% 11.3% 15.8% (2.7%) 7.5% 13.4% Morningstar Retirement Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $10.0 $20.0 $30.0 $40.0 Morningstar Retirement AUMA Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $100.0 $200.0 $300.0 $400.0 Morningstar Retirement Revenue ($mil) Morningstar Retirement AUMA ($bil)

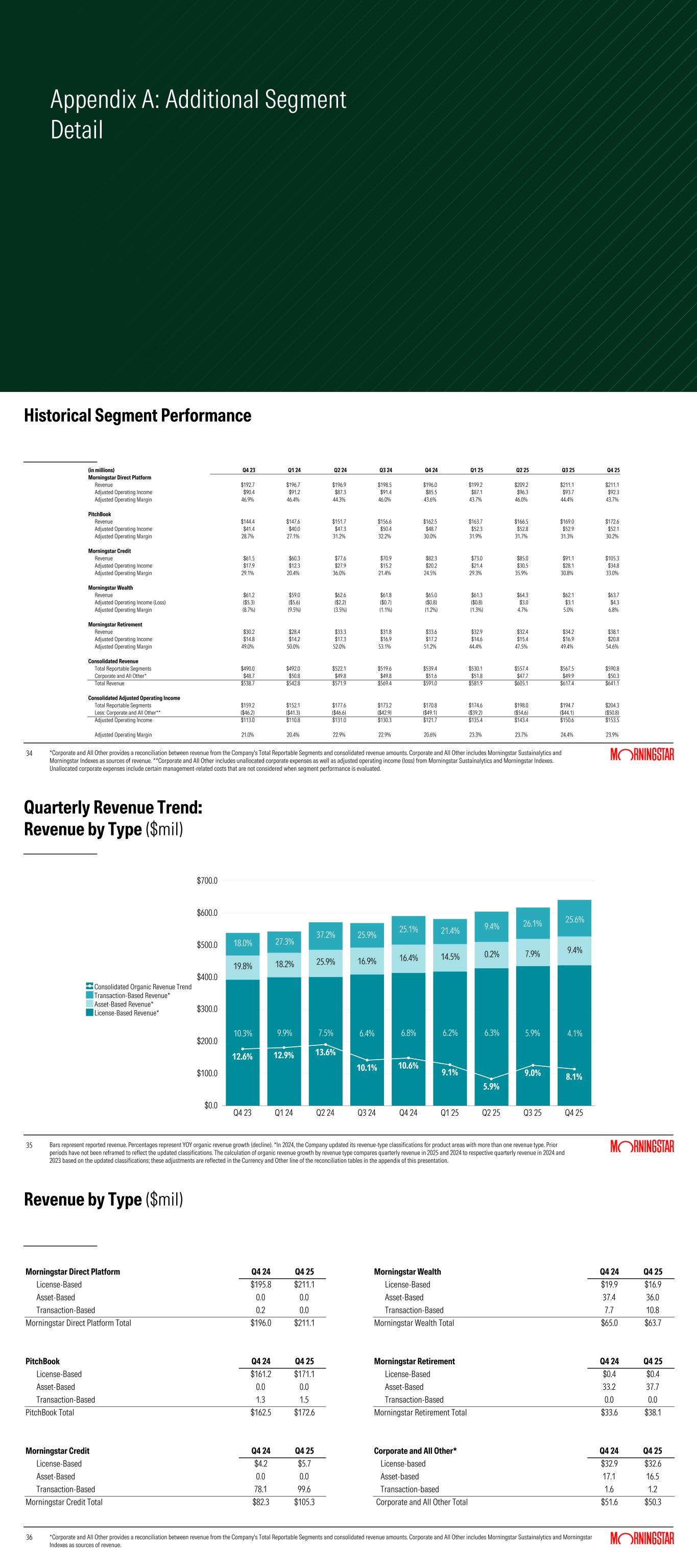

Appendix A: Additional Segment Detail 34 Historical Segment Performance *Corporate and All Other provides a reconciliation between revenue from the Company's Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenue. **Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include certain management-related costs that are not considered when segment performance is evaluated. (in millions) Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Morningstar Direct Platform Revenue $192.7 $196.7 $196.9 $198.5 $196.0 $199.2 $209.2 $211.1 $211.1 Adjusted Operating Income $90.4 $91.2 $87.3 $91.4 $85.5 $87.1 $96.3 $93.7 $92.3 Adjusted Operating Margin 46.9% 46.4% 44.3% 46.0% 43.6% 43.7% 46.0% 44.4% 43.7% PitchBook Revenue $144.4 $147.6 $151.7 $156.6 $162.5 $163.7 $166.5 $169.0 $172.6 Adjusted Operating Income $41.4 $40.0 $47.3 $50.4 $48.7 $52.3 $52.8 $52.9 $52.1 Adjusted Operating Margin 28.7% 27.1% 31.2% 32.2% 30.0% 31.9% 31.7% 31.3% 30.2% Morningstar Credit Revenue $61.5 $60.3 $77.6 $70.9 $82.3 $73.0 $85.0 $91.1 $105.3 Adjusted Operating Income $17.9 $12.3 $27.9 $15.2 $20.2 $21.4 $30.5 $28.1 $34.8 Adjusted Operating Margin 29.1% 20.4% 36.0% 21.4% 24.5% 29.3% 35.9% 30.8% 33.0% Morningstar Wealth Revenue $61.2 $59.0 $62.6 $61.8 $65.0 $61.3 $64.3 $62.1 $63.7 Adjusted Operating Income (Loss) ($5.3) ($5.6) ($2.2) ($0.7) ($0.8) ($0.8) $3.0 $3.1 $4.3 Adjusted Operating Margin (8.7%) (9.5%) (3.5%) (1.1%) (1.2%) (1.3%) 4.7% 5.0% 6.8% Morningstar Retirement Revenue $30.2 $28.4 $33.3 $31.8 $33.6 $32.9 $32.4 $34.2 $38.1 Adjusted Operating Income $14.8 $14.2 $17.3 $16.9 $17.2 $14.6 $15.4 $16.9 $20.8 Adjusted Operating Margin 49.0% 50.0% 52.0% 53.1% 51.2% 44.4% 47.5% 49.4% 54.6% Consolidated Revenue Total Reportable Segments $490.0 $492.0 $522.1 $519.6 $539.4 $530.1 $557.4 $567.5 $590.8 Corporate and All Other* $48.7 $50.8 $49.8 $49.8 $51.6 $51.8 $47.7 $49.9 $50.3 Total Revenue $538.7 $542.8 $571.9 $569.4 $591.0 $581.9 $605.1 $617.4 $641.1 Consolidated Adjusted Operating Income Total Reportable Segments $159.2 $152.1 $177.6 $173.2 $170.8 $174.6 $198.0 $194.7 $204.3 Less: Corporate and All Other** ($46.2) ($41.3) ($46.6) ($42.9) ($49.1) ($39.2) ($54.6) ($44.1) ($50.8) Adjusted Operating Income $113.0 $110.8 $131.0 $130.3 $121.7 $135.4 $143.4 $150.6 $153.5 Adjusted Operating Margin 21.0% 20.4% 22.9% 22.9% 20.6% 23.3% 23.7% 24.4% 23.9% 35 Quarterly Revenue Trend: Revenue by Type ($mil) 12.6% 12.9% 13.6% 10.1% 10.6% 9.1% 5.9% 9.0% 8.1% Consolidated Organic Revenue Trend Transaction-Based Revenue* Asset-Based Revenue* License-Based Revenue* Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 18.0% 19.8% 10.3% 27.3% 18.2% 9.9% 37.2% 25.9% 7.5% 25.9% 16.9% 6.4% 25.1% 16.4% 6.8% 21.4% 14.5% 6.2% 9.4% 0.2% 6.3% 26.1% 7.9% 5.9% 25.6% 9.4% 4.1% Bars represent reported revenue. Percentages represent YOY organic revenue growth (decline). *In 2024, the Company updated its revenue-type classifications for product areas with more than one revenue type. Prior periods have not been reframed to reflect the updated classifications. The calculation of organic revenue growth by revenue type compares quarterly revenue in 2025 and 2024 to respective quarterly revenue in 2024 and 2023 based on the updated classifications; these adjustments are reflected in the Currency and Other line of the reconciliation tables in the appendix of this presentation. 36 Revenue by Type ($mil) *Corporate and All Other provides a reconciliation between revenue from the Company's Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenue. Morningstar Direct Platform Q4 24 Q4 25 Morningstar Wealth Q4 24 Q4 25 License-Based $195.8 $211.1 License-Based $19.9 $16.9 Asset-Based 0.0 0.0 Asset-Based 37.4 36.0 Transaction-Based 0.2 0.0 Transaction-Based 7.7 10.8 Morningstar Direct Platform Total $196.0 $211.1 Morningstar Wealth Total $65.0 $63.7 PitchBook Q4 24 Q4 25 Morningstar Retirement Q4 24 Q4 25 License-Based $161.2 $171.1 License-Based $0.4 $0.4 Asset-Based 0.0 0.0 Asset-Based 33.2 37.7 Transaction-Based 1.3 1.5 Transaction-Based 0.0 0.0 PitchBook Total $162.5 $172.6 Morningstar Retirement Total $33.6 $38.1 Morningstar Credit Q4 24 Q4 25 Corporate and All Other* Q4 24 Q4 25 License-Based $4.2 $5.7 License-based $32.9 $32.6 Asset-Based 0.0 0.0 Asset-based 17.1 16.5 Transaction-Based 78.1 99.6 Transaction-based 1.6 1.2 Morningstar Credit Total $82.3 $105.3 Corporate and All Other Total $51.6 $50.3

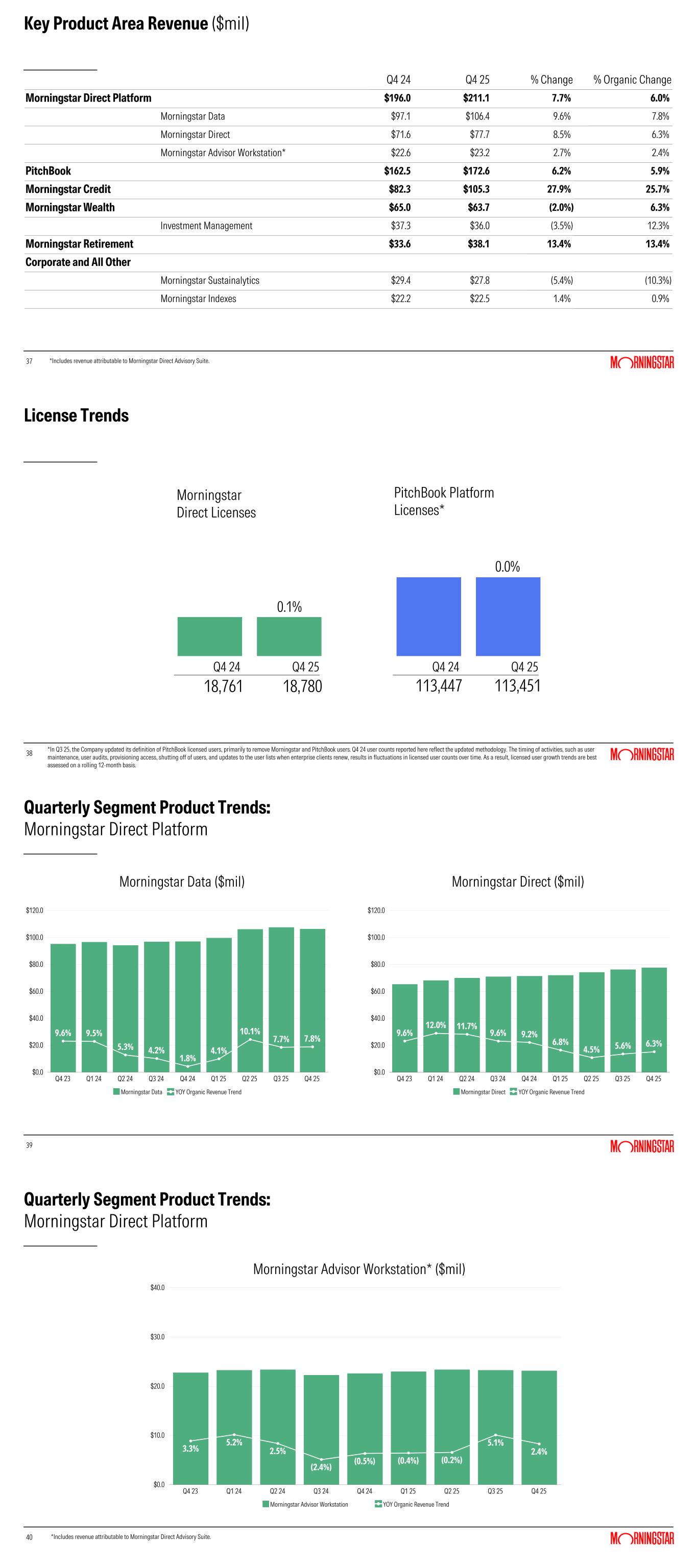

37 Key Product Area Revenue ($mil) *Includes revenue attributable to Morningstar Direct Advisory Suite. Q4 24 Q4 25 % Change % Organic Change Morningstar Direct Platform $196.0 $211.1 7.7% 6.0% Morningstar Data $97.1 $106.4 9.6% 7.8% Morningstar Direct $71.6 $77.7 8.5% 6.3% Morningstar Advisor Workstation* $22.6 $23.2 2.7% 2.4% PitchBook $162.5 $172.6 6.2% 5.9% Morningstar Credit $82.3 $105.3 27.9% 25.7% Morningstar Wealth $65.0 $63.7 (2.0%) 6.3% Investment Management $37.3 $36.0 (3.5%) 12.3% Morningstar Retirement $33.6 $38.1 13.4% 13.4% Corporate and All Other Morningstar Sustainalytics $29.4 $27.8 (5.4%) (10.3%) Morningstar Indexes $22.2 $22.5 1.4% 0.9% 38 License Trends 38 0.1% 18,761 18,780 Morningstar Direct Licenses Q4 24 Q4 25 0.0% 113,447 113,451 PitchBook Platform Licenses* Q4 24 Q4 25 *In Q3 25, the Company updated its definition of PitchBook licensed users, primarily to remove Morningstar and PitchBook users. Q4 24 user counts reported here reflect the updated methodology. The timing of activities, such as user maintenance, user audits, provisioning access, shutting off of users, and updates to the user lists when enterprise clients renew, results in fluctuations in licensed user counts over time. As a result, licensed user growth trends are best assessed on a rolling 12-month basis. 39 Quarterly Segment Product Trends: Morningstar Direct Platform 39 9.6% 12.0% 11.7% 9.6% 9.2% 6.8% 4.5% 5.6% 6.3% Morningstar Direct YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 9.6% 9.5% 5.3% 4.2% 1.8% 4.1% 10.1% 7.7% 7.8% Morningstar Data YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 Morningstar Data ($mil) Morningstar Direct ($mil) 40 Quarterly Segment Product Trends: Morningstar Direct Platform 40 3.3% 5.2% 2.5% (2.4%) (0.5%) (0.4%) (0.2%) 5.1% 2.4% Morningstar Advisor Workstation YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $10.0 $20.0 $30.0 $40.0 *Includes revenue attributable to Morningstar Direct Advisory Suite. Morningstar Advisor Workstation* ($mil)

41 Quarterly Segment Product Trends: Morningstar Wealth 41 16.3% 13.9% 22.0% 13.3% 16.2% 14.8% 6.2% 16.1% 12.3% Investment Management Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $10.0 $20.0 $30.0 $40.0 Investment Management ($mil) 42 Quarterly Product Trends: Corporate and All Other 42 43.3% 37.1% 37.8% 23.7% 21.9% 15.7% (1.3%) (0.8%) 0.9% Morningstar Indexes Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $10.0 $20.0 $30.0 $40.0 13.6% 12.2% 0.7% (10.3%) (3.3%) (4.9%) (9.8%) (3.0%) (10.3%) Morningstar Sustainalytics Revenue YOY Organic Revenue Trend Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 $0.0 $10.0 $20.0 $30.0 $40.0 *In Q4 25, revenue for Morningstar Sustainalytics’ transaction-based products (second-party opinions) decreased 30.0% on an organic basis and Morningstar Sustainalytics’ license-based products decreased 9.2% on an organic basis. Morningstar Indexes ($mil) Morningstar Sustainalytics* ($mil) Appendix B: Reconciliations 44 Reconciliation from Reported to Organic Revenue Change by Revenue Type Consolidated Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 13.4% 13.2% 13.3% 10.5% 9.7% 7.2% 5.8% 8.4% 8.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.8% 0.9% 1.0% 1.2% 0.9% Effect of foreign currency transactions (0.8%) (0.3%) 0.3% (0.4%) 0.1% 1.0% (0.9%) (0.6%) (1.3%) Organic Change in Revenue 12.6% 12.9% 13.6% 10.1% 10.6% 9.1% 5.9% 9.0% 8.1% License-Based Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 12.4% 9.9% 6.8% 6.3% 5.4% 4.4% 6.6% 6.4% 5.6% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.9% 0.8% 0.6% 0.3% (0.1%) Effect of foreign currency transactions (2.1%) 0.0% 0.7% 0.1% 0.5% 1.0% (0.9%) (0.8%) (1.4%) Organic Change in Revenue 10.3% 9.9% 7.5% 6.4% 6.8% 6.2% 6.3% 5.9% 4.1%

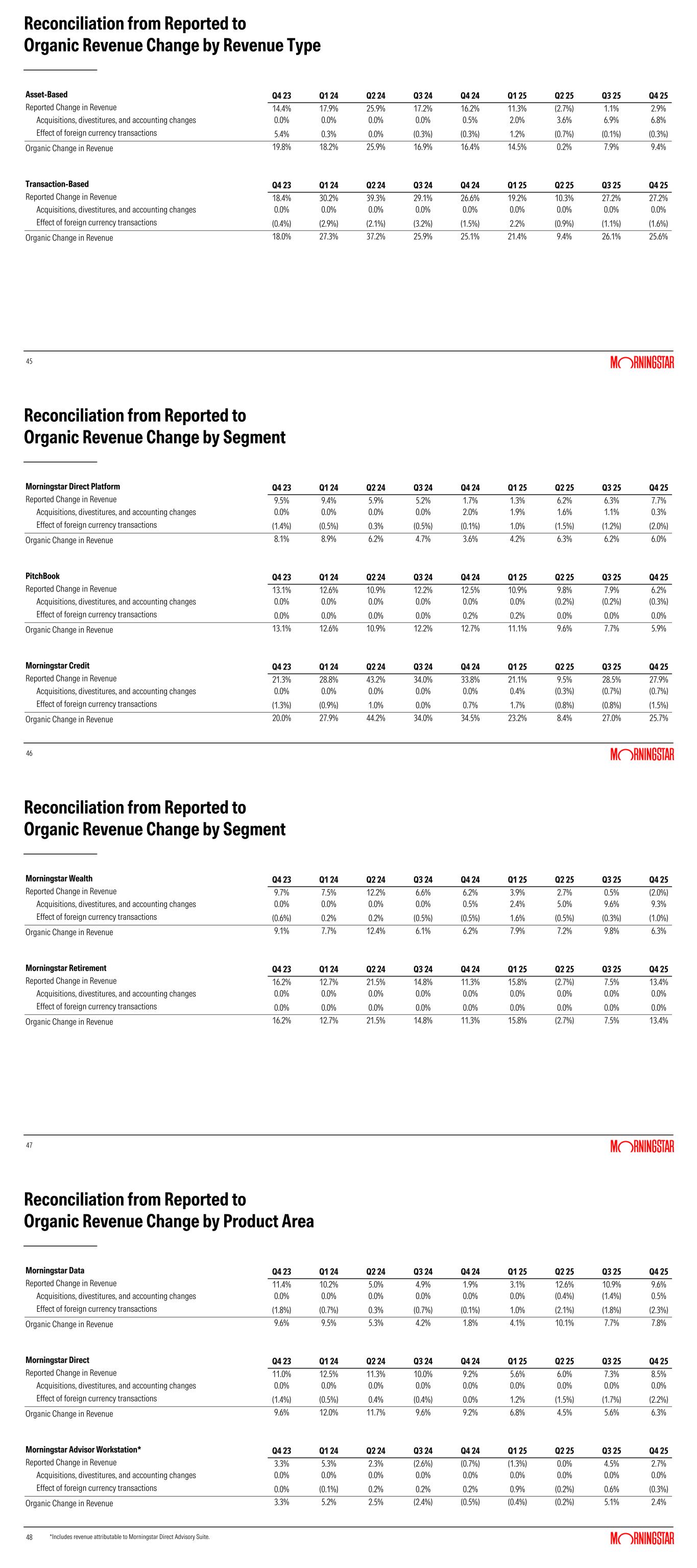

45 Reconciliation from Reported to Organic Revenue Change by Revenue Type Asset-Based Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 14.4% 17.9% 25.9% 17.2% 16.2% 11.3% (2.7%) 1.1% 2.9% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.5% 2.0% 3.6% 6.9% 6.8% Effect of foreign currency transactions 5.4% 0.3% 0.0% (0.3%) (0.3%) 1.2% (0.7%) (0.1%) (0.3%) Organic Change in Revenue 19.8% 18.2% 25.9% 16.9% 16.4% 14.5% 0.2% 7.9% 9.4% Transaction-Based Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 18.4% 30.2% 39.3% 29.1% 26.6% 19.2% 10.3% 27.2% 27.2% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (0.4%) (2.9%) (2.1%) (3.2%) (1.5%) 2.2% (0.9%) (1.1%) (1.6%) Organic Change in Revenue 18.0% 27.3% 37.2% 25.9% 25.1% 21.4% 9.4% 26.1% 25.6% 46 Reconciliation from Reported to Organic Revenue Change by Segment Morningstar Direct Platform Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 9.5% 9.4% 5.9% 5.2% 1.7% 1.3% 6.2% 6.3% 7.7% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 2.0% 1.9% 1.6% 1.1% 0.3% Effect of foreign currency transactions (1.4%) (0.5%) 0.3% (0.5%) (0.1%) 1.0% (1.5%) (1.2%) (2.0%) Organic Change in Revenue 8.1% 8.9% 6.2% 4.7% 3.6% 4.2% 6.3% 6.2% 6.0% PitchBook Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 13.1% 12.6% 10.9% 12.2% 12.5% 10.9% 9.8% 7.9% 6.2% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% (0.2%) (0.2%) (0.3%) Effect of foreign currency transactions 0.0% 0.0% 0.0% 0.0% 0.2% 0.2% 0.0% 0.0% 0.0% Organic Change in Revenue 13.1% 12.6% 10.9% 12.2% 12.7% 11.1% 9.6% 7.7% 5.9% Morningstar Credit Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 21.3% 28.8% 43.2% 34.0% 33.8% 21.1% 9.5% 28.5% 27.9% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.4% (0.3%) (0.7%) (0.7%) Effect of foreign currency transactions (1.3%) (0.9%) 1.0% 0.0% 0.7% 1.7% (0.8%) (0.8%) (1.5%) Organic Change in Revenue 20.0% 27.9% 44.2% 34.0% 34.5% 23.2% 8.4% 27.0% 25.7% 47 Reconciliation from Reported to Organic Revenue Change by Segment Morningstar Wealth Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 9.7% 7.5% 12.2% 6.6% 6.2% 3.9% 2.7% 0.5% (2.0%) Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.5% 2.4% 5.0% 9.6% 9.3% Effect of foreign currency transactions (0.6%) 0.2% 0.2% (0.5%) (0.5%) 1.6% (0.5%) (0.3%) (1.0%) Organic Change in Revenue 9.1% 7.7% 12.4% 6.1% 6.2% 7.9% 7.2% 9.8% 6.3% Morningstar Retirement Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 16.2% 12.7% 21.5% 14.8% 11.3% 15.8% (2.7%) 7.5% 13.4% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Organic Change in Revenue 16.2% 12.7% 21.5% 14.8% 11.3% 15.8% (2.7%) 7.5% 13.4% 48 Reconciliation from Reported to Organic Revenue Change by Product Area Morningstar Data Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 11.4% 10.2% 5.0% 4.9% 1.9% 3.1% 12.6% 10.9% 9.6% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% (0.4%) (1.4%) 0.5% Effect of foreign currency transactions (1.8%) (0.7%) 0.3% (0.7%) (0.1%) 1.0% (2.1%) (1.8%) (2.3%) Organic Change in Revenue 9.6% 9.5% 5.3% 4.2% 1.8% 4.1% 10.1% 7.7% 7.8% Morningstar Direct Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 11.0% 12.5% 11.3% 10.0% 9.2% 5.6% 6.0% 7.3% 8.5% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (1.4%) (0.5%) 0.4% (0.4%) 0.0% 1.2% (1.5%) (1.7%) (2.2%) Organic Change in Revenue 9.6% 12.0% 11.7% 9.6% 9.2% 6.8% 4.5% 5.6% 6.3% Morningstar Advisor Workstation* Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 3.3% 5.3% 2.3% (2.6%) (0.7%) (1.3%) 0.0% 4.5% 2.7% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 0.0% (0.1%) 0.2% 0.2% 0.2% 0.9% (0.2%) 0.6% (0.3%) Organic Change in Revenue 3.3% 5.2% 2.5% (2.4%) (0.5%) (0.4%) (0.2%) 5.1% 2.4% *Includes revenue attributable to Morningstar Direct Advisory Suite.

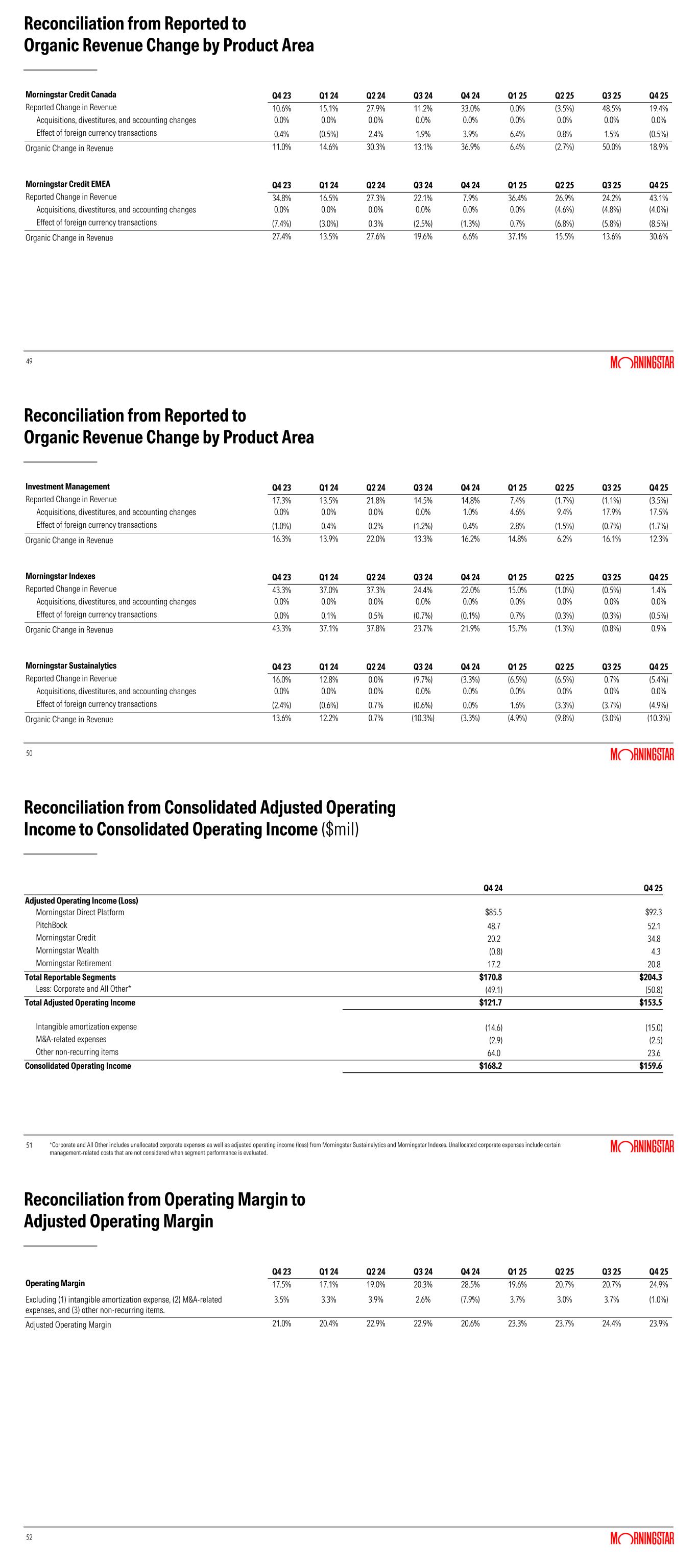

49 Reconciliation from Reported to Organic Revenue Change by Product Area Morningstar Credit Canada Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 10.6% 15.1% 27.9% 11.2% 33.0% 0.0% (3.5%) 48.5% 19.4% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 0.4% (0.5%) 2.4% 1.9% 3.9% 6.4% 0.8% 1.5% (0.5%) Organic Change in Revenue 11.0% 14.6% 30.3% 13.1% 36.9% 6.4% (2.7%) 50.0% 18.9% Morningstar Credit EMEA Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 34.8% 16.5% 27.3% 22.1% 7.9% 36.4% 26.9% 24.2% 43.1% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% (4.6%) (4.8%) (4.0%) Effect of foreign currency transactions (7.4%) (3.0%) 0.3% (2.5%) (1.3%) 0.7% (6.8%) (5.8%) (8.5%) Organic Change in Revenue 27.4% 13.5% 27.6% 19.6% 6.6% 37.1% 15.5% 13.6% 30.6% 50 Reconciliation from Reported to Organic Revenue Change by Product Area Investment Management Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 17.3% 13.5% 21.8% 14.5% 14.8% 7.4% (1.7%) (1.1%) (3.5%) Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 1.0% 4.6% 9.4% 17.9% 17.5% Effect of foreign currency transactions (1.0%) 0.4% 0.2% (1.2%) 0.4% 2.8% (1.5%) (0.7%) (1.7%) Organic Change in Revenue 16.3% 13.9% 22.0% 13.3% 16.2% 14.8% 6.2% 16.1% 12.3% Morningstar Indexes Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 43.3% 37.0% 37.3% 24.4% 22.0% 15.0% (1.0%) (0.5%) 1.4% Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions 0.0% 0.1% 0.5% (0.7%) (0.1%) 0.7% (0.3%) (0.3%) (0.5%) Organic Change in Revenue 43.3% 37.1% 37.8% 23.7% 21.9% 15.7% (1.3%) (0.8%) 0.9% Morningstar Sustainalytics Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Reported Change in Revenue 16.0% 12.8% 0.0% (9.7%) (3.3%) (6.5%) (6.5%) 0.7% (5.4%) Acquisitions, divestitures, and accounting changes 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Effect of foreign currency transactions (2.4%) (0.6%) 0.7% (0.6%) 0.0% 1.6% (3.3%) (3.7%) (4.9%) Organic Change in Revenue 13.6% 12.2% 0.7% (10.3%) (3.3%) (4.9%) (9.8%) (3.0%) (10.3%) 51 Reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income ($mil) *Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include certain management-related costs that are not considered when segment performance is evaluated. Q4 24 Q4 25 Adjusted Operating Income (Loss) Morningstar Direct Platform $85.5 $92.3 PitchBook 48.7 52.1 Morningstar Credit 20.2 34.8 Morningstar Wealth (0.8) 4.3 Morningstar Retirement 17.2 20.8 Total Reportable Segments $170.8 $204.3 Less: Corporate and All Other* (49.1) (50.8) Total Adjusted Operating Income $121.7 $153.5 Intangible amortization expense (14.6) (15.0) M&A-related expenses (2.9) (2.5) Other non-recurring items 64.0 23.6 Consolidated Operating Income $168.2 $159.6 52 Reconciliation from Operating Margin to Adjusted Operating Margin Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Operating Margin 17.5% 17.1% 19.0% 20.3% 28.5% 19.6% 20.7% 20.7% 24.9% Excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. 3.5% 3.3% 3.9% 2.6% (7.9%) 3.7% 3.0% 3.7% (1.0%) Adjusted Operating Margin 21.0% 20.4% 22.9% 22.9% 20.6% 23.3% 23.7% 24.4% 23.9%

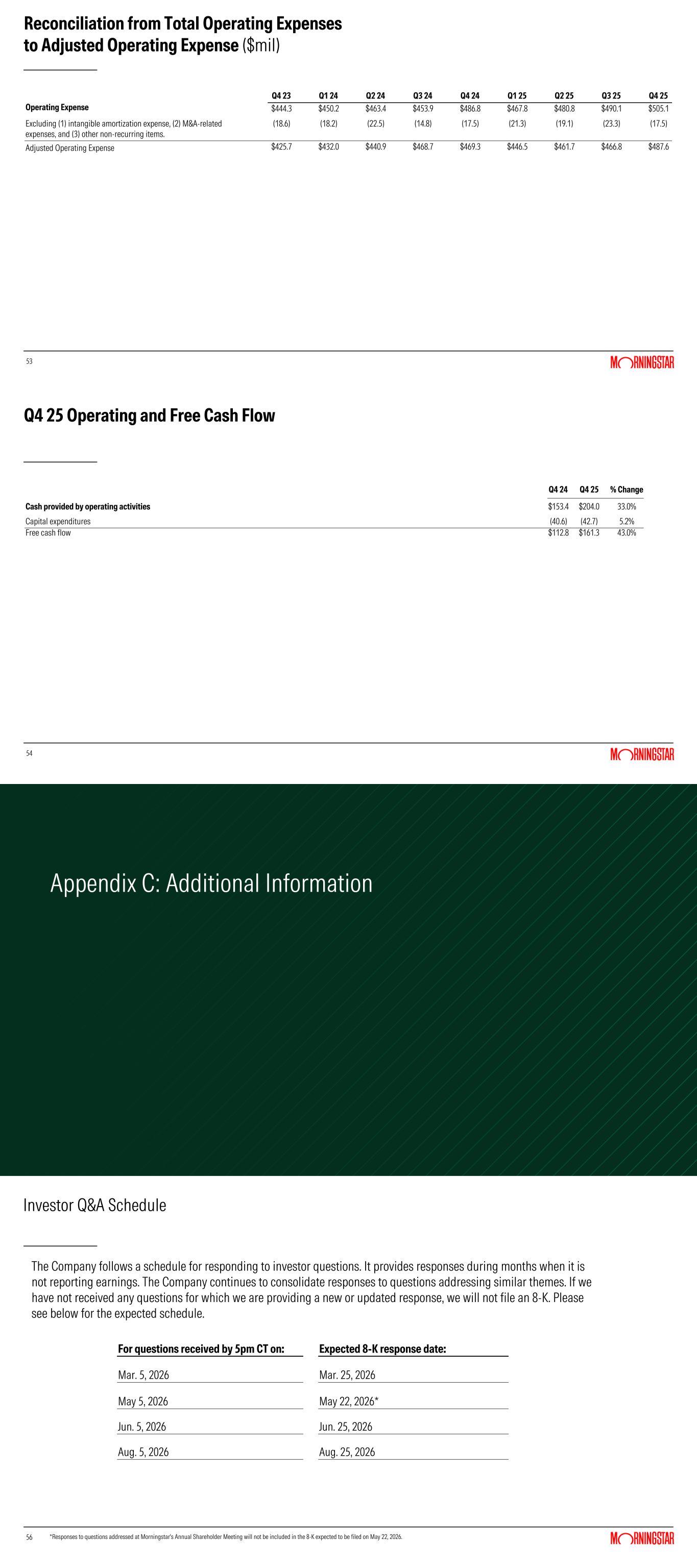

53 Reconciliation from Total Operating Expenses to Adjusted Operating Expense ($mil) Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Operating Expense $444.3 $450.2 $463.4 $453.9 $486.8 $467.8 $480.8 $490.1 $505.1 Excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items. (18.6) (18.2) (22.5) (14.8) (17.5) (21.3) (19.1) (23.3) (17.5) Adjusted Operating Expense $425.7 $432.0 $440.9 $468.7 $469.3 $446.5 $461.7 $466.8 $487.6 54 Q4 25 Operating and Free Cash Flow Q4 24 Q4 25 % Change Cash provided by operating activities $153.4 $204.0 33.0% Capital expenditures (40.6) (42.7) 5.2% Free cash flow $112.8 $161.3 43.0% Appendix C: Additional Information 56 Investor Q&A Schedule For questions received by 5pm CT on: Expected 8-K response date: Mar. 5, 2026 Mar. 25, 2026 May 5, 2026 May 22, 2026* Jun. 5, 2026 Jun. 25, 2026 Aug. 5, 2026 Aug. 25, 2026 The Company follows a schedule for responding to investor questions. It provides responses during months when it is not reporting earnings. The Company continues to consolidate responses to questions addressing similar themes. If we have not received any questions for which we are providing a new or updated response, we will not file an 8-K. Please see below for the expected schedule. *Responses to questions addressed at Morningstar's Annual Shareholder Meeting will not be included in the 8-K expected to be filed on May 22, 2026.