Second Quarter FY 2025 Results November 7th, 2024 Exhibit 99.2

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Safe Harbor Disclosure This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements regarding the Company’s expected financial performance, including revenues, organic revenue growth, adjusted diluted EPS, and free cash flow; the Company’s ability to execute on its brand-building strategy and to drive free cash flow and maximize shareholder value; the Company’s expected growth, including with respect to international sales; stability of the Company’s gross margin; the impact and timing of supply chain challenges; and the Company’s capital allocation strategy and optionality, including its pursuit of M&A, share buybacks and debt reduction. Words such as “continue,” “expect,” “remain,” “positioned,” “proven,” “outlook,” “will,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the ability of the Company’s manufacturing operations and third party manufacturers and logistics providers and suppliers to meet demand for its products and to avoid inflationary cost increases and disruption as a result of labor shortages; the impact of economic and business conditions; consumer trends; competitive pressures; the impact of the Company’s advertising and promotional and new product development initiatives; customer inventory management initiatives; the ability to pass along rising costs to customers without impacting sales; fluctuating foreign exchange rates; and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2024. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedule or in our November 7, 2024 earnings release in the “About Non-GAAP Financial Measures” section.

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Agenda for Today’s Discussion I. Performance Update II. Financial Overview III. FY 25 Outlook 3

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S I. Performance Update

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Strong Results in Second Quarter FY 25 Quarterly Revenue of $283.8 million, ahead of expectations Outperformance highlighted by strong International growth Continue to execute proven brand-building strategy Gross Margin performance stable Adjusted Diluted EPS(2) up slightly versus prior year Strong financial profile and resulting Free Cash Flow(2) generation Leverage of 2.7x(3) continues to enable capital allocation optionality Further debt reduction and opportunistic share repurchases in 2Q M&A, share buybacks, and debt reduction remain optimal capital allocation levers Q2 FY 25 Sales Drivers Disciplined Capital Allocation Superior Earnings and FCF 5

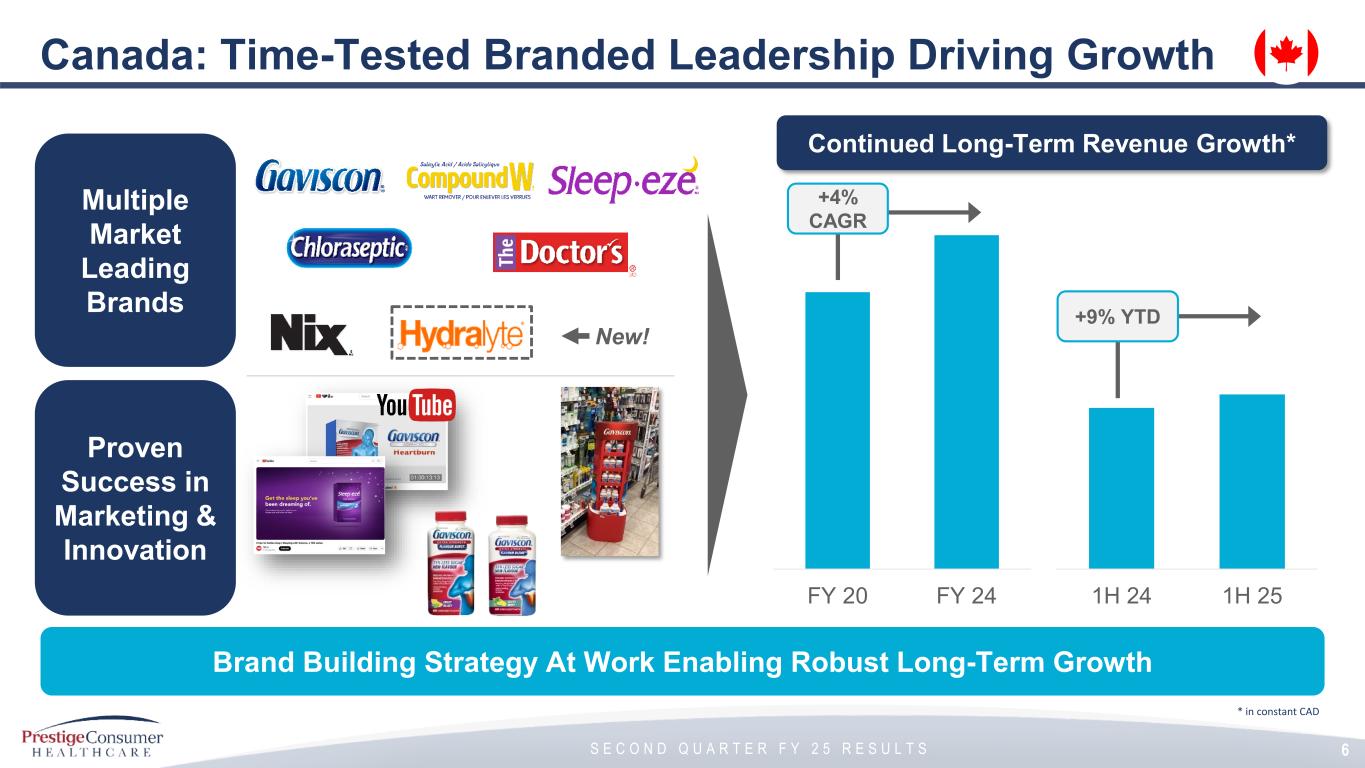

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S 1H 24 1H 25 Canada: Time-Tested Branded Leadership Driving Growth Continued Long-Term Revenue Growth* * in constant CAD FY 20 FY 24 +9% YTD +4% CAGR Proven Success in Marketing & Innovation Multiple Market Leading Brands New! Brand Building Strategy At Work Enabling Robust Long-Term Growth 6

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S II. Financial Overview

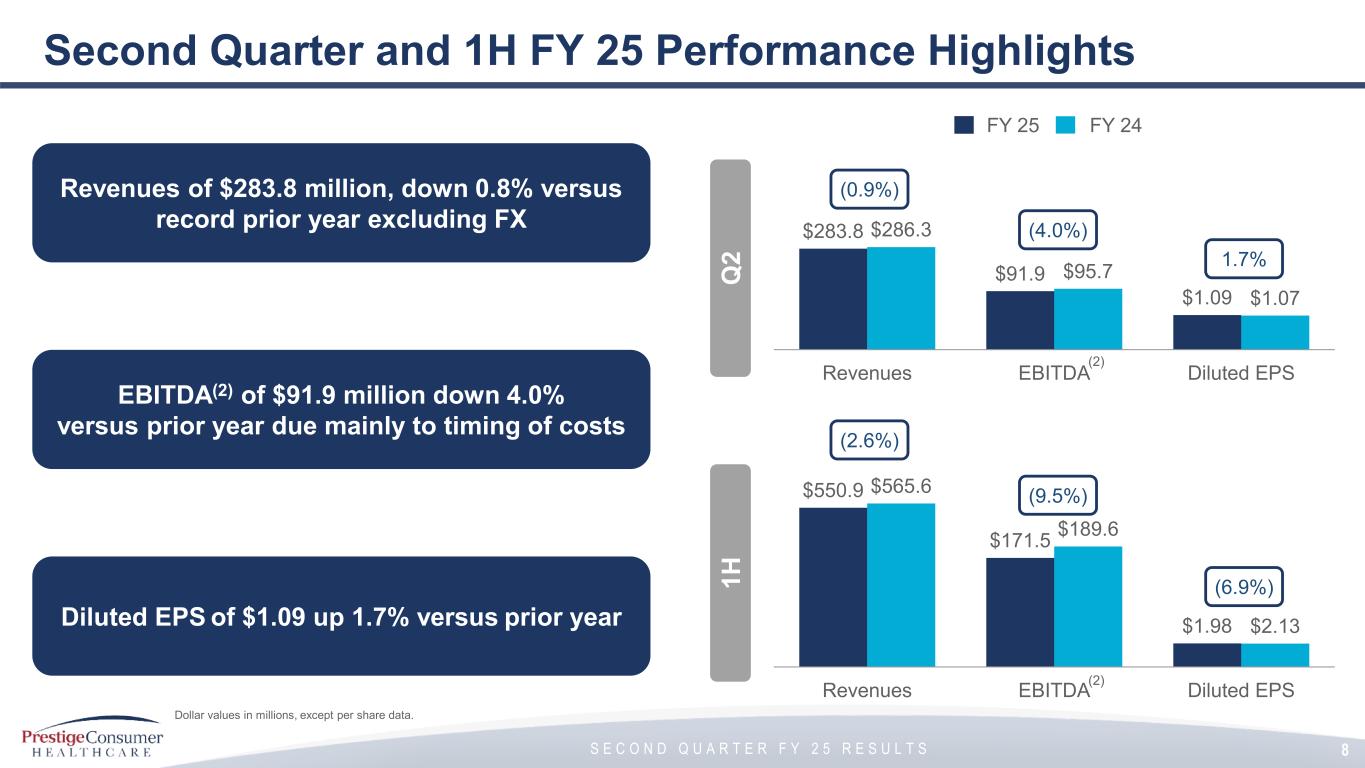

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Second Quarter and 1H FY 25 Performance Highlights FY 25 FY 24 Dollar values in millions, except per share data. $283.8 $91.9 $1.09 $286.3 $95.7 $1.07 Revenues EBITDA Diluted EPS (0.9%) (4.0%) 1.7% 8 Q 2 $550.9 $171.5 $1.98 $565.6 $189.6 $2.13 Revenues EBITDA Diluted EPS (2.6%) (9.5%) (6.9%) Revenues of $283.8 million, down 0.8% versus record prior year excluding FX Diluted EPS of $1.09 up 1.7% versus prior year EBITDA(2) of $91.9 million down 4.0% versus prior year due mainly to timing of costs 1H (2) (2)

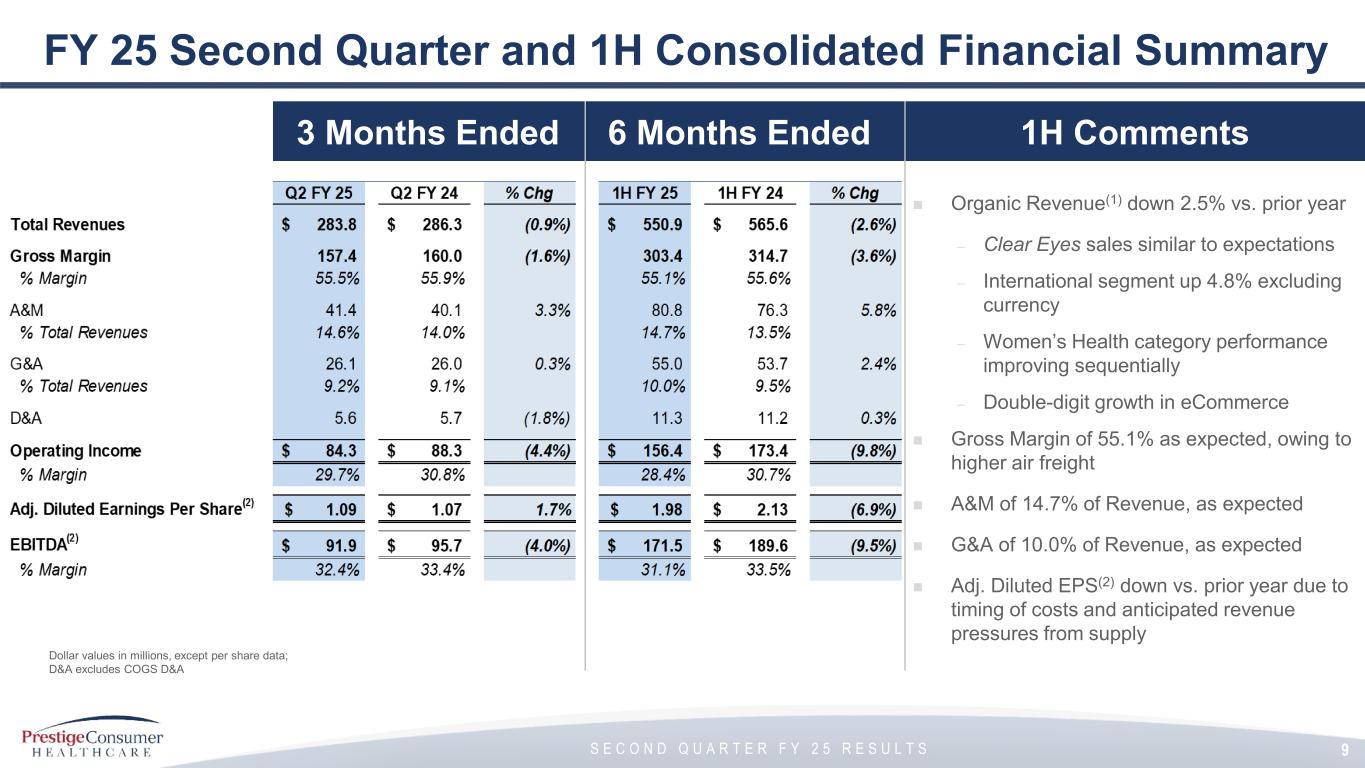

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S 3 Months Ended 1H Comments FY 25 Second Quarter and 1H Consolidated Financial Summary Organic Revenue(1) down 2.5% vs. prior year – Clear Eyes sales similar to expectations – International segment up 4.8% excluding currency – Women’s Health category performance improving sequentially – Double-digit growth in eCommerce Gross Margin of 55.1% as expected, owing to higher air freight A&M of 14.7% of Revenue, as expected G&A of 10.0% of Revenue, as expected Adj. Diluted EPS(2) down vs. prior year due to timing of costs and anticipated revenue pressures from supply Dollar values in millions, except per share data; D&A excludes COGS D&A 9 6 Months Ended

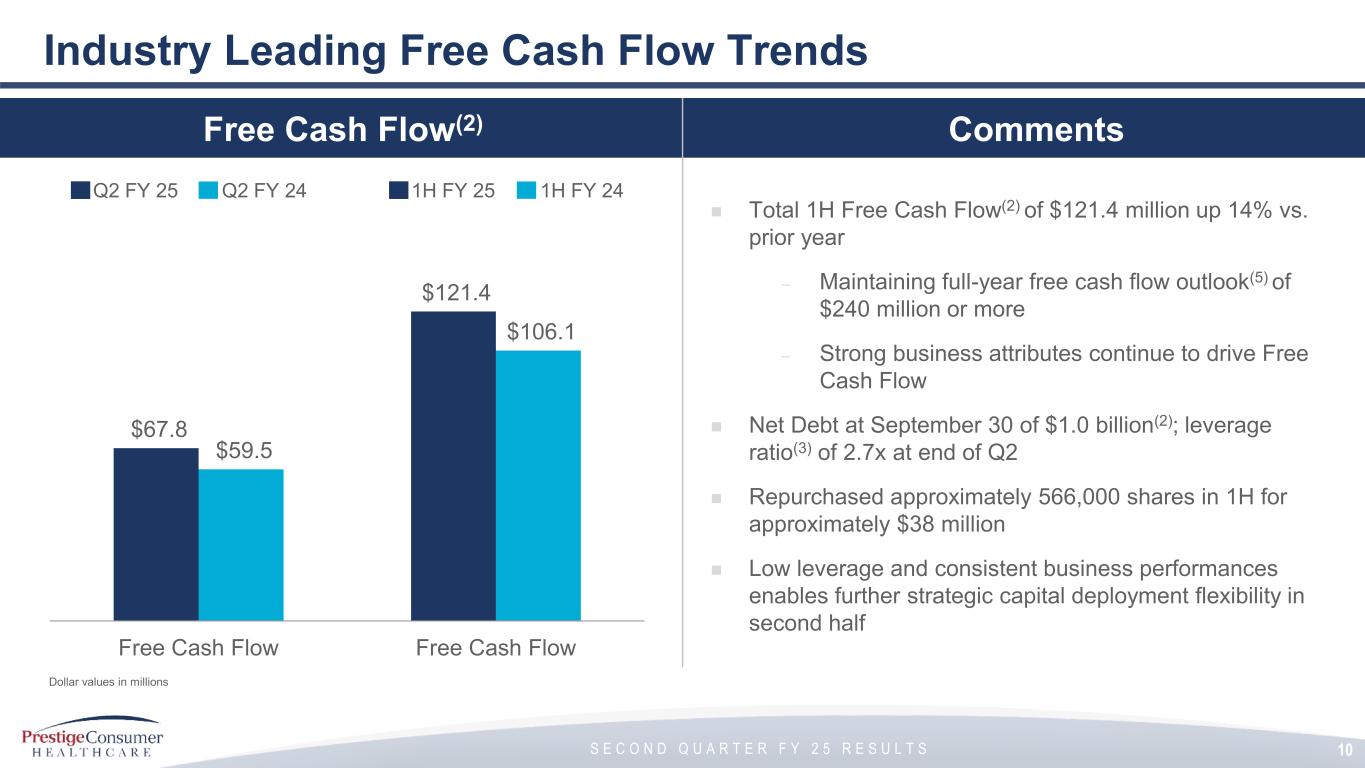

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Free Cash Flow(2) Comments Total 1H Free Cash Flow(2) of $121.4 million up 14% vs. prior year – Maintaining full-year free cash flow outlook(5) of $240 million or more – Strong business attributes continue to drive Free Cash Flow Net Debt at September 30 of $1.0 billion(2); leverage ratio(3) of 2.7x at end of Q2 Repurchased approximately 566,000 shares in 1H for approximately $38 million Low leverage and consistent business performances enables further strategic capital deployment flexibility in second half Industry Leading Free Cash Flow Trends Dollar values in millions 10 $67.8 $121.4 $59.5 $106.1 Free Cash Flow Free Cash Flow Q2 FY 25 Q2 FY 24 1H FY 25 1H FY 24

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S III. FY 25 Outlook

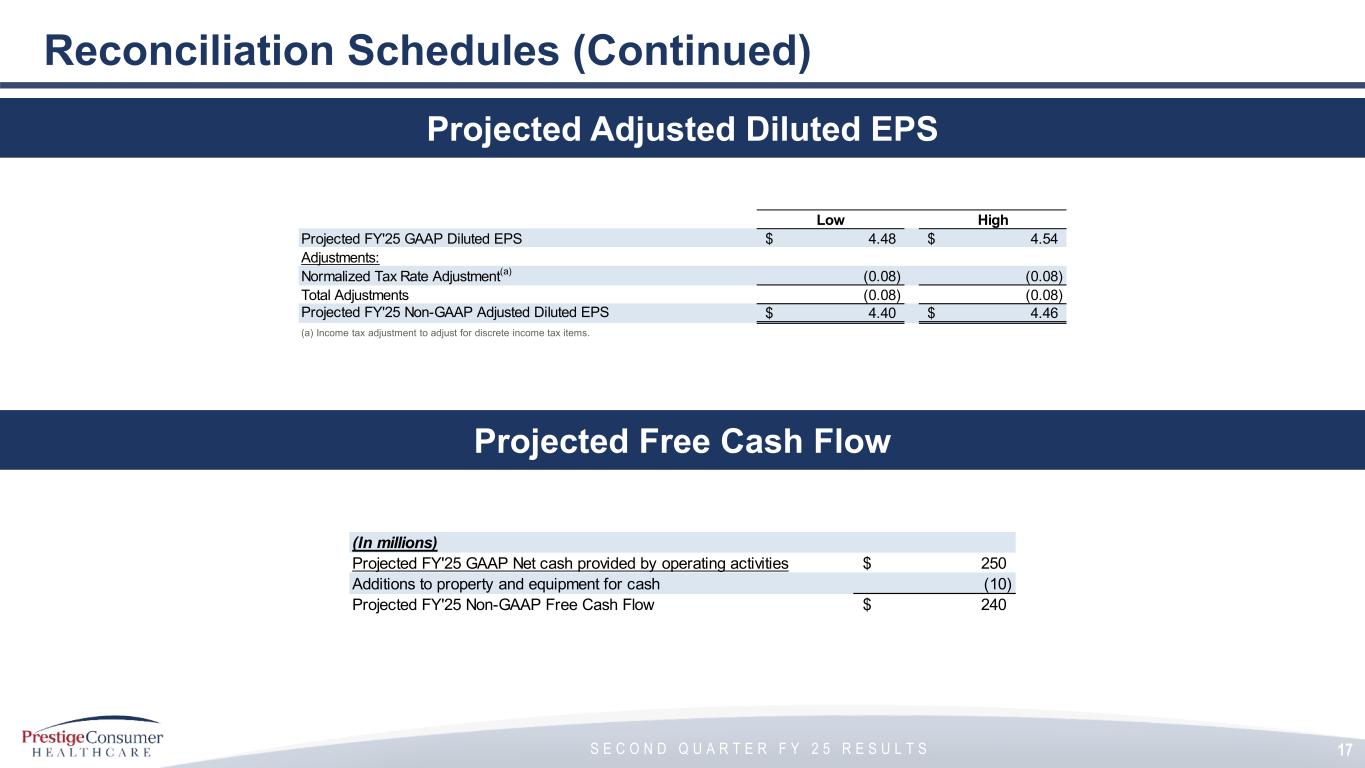

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S FY 25 Outlook Unchanged Remain well-positioned in dynamic macro environment Continue to emphasize brand-building on leading brands Revenues of $1,125 to $1,140 million — Organic growth of approximately 1% ex-FX Adjusted Diluted EPS(4) of $4.40 to $4.46 Expect earnings growth to accelerate as supply challenges subside Free Cash Flow(5) of $240 million or more Capital allocation decisions focused on maximizing shareholder value Top Line Trends Free Cash Flow & Allocation EPS 12

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Q&A

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S Appendix (1) Organic Revenue is a Non-GAAP financial measure and is reconciled to the most closely related GAAP financial measures in the attached Reconciliation Schedules and / or our earnings release dated November 7, 2024 in the “About Non-GAAP Financial Measures” section. (2) EBITDA & EBITDA Margin, Adjusted Diluted EPS, Free Cash Flow, and Net Debt are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in the attached Reconciliation Schedules and / or in our earnings release dated November 7, 2024 in the “About Non GAAP Financial Measures” section. (3) Leverage ratio reflects covenant defined Net Debt / EBITDA. (4) Adjusted Diluted EPS for FY 25 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Diluted EPS in the attached Reconciliation Schedules and/or in our earnings release dated November 7, 2024 in the “About Non-GAAP Financial Measures” section and is calculated based on projected GAAP Diluted EPS adjusted for certain discrete tax items. (5) Free Cash Flow for FY 25 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in the attached Reconciliation Schedules and / or in our earnings release dated November 7, 2024 in the “About Non-GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities less projected capital expenditures. 14

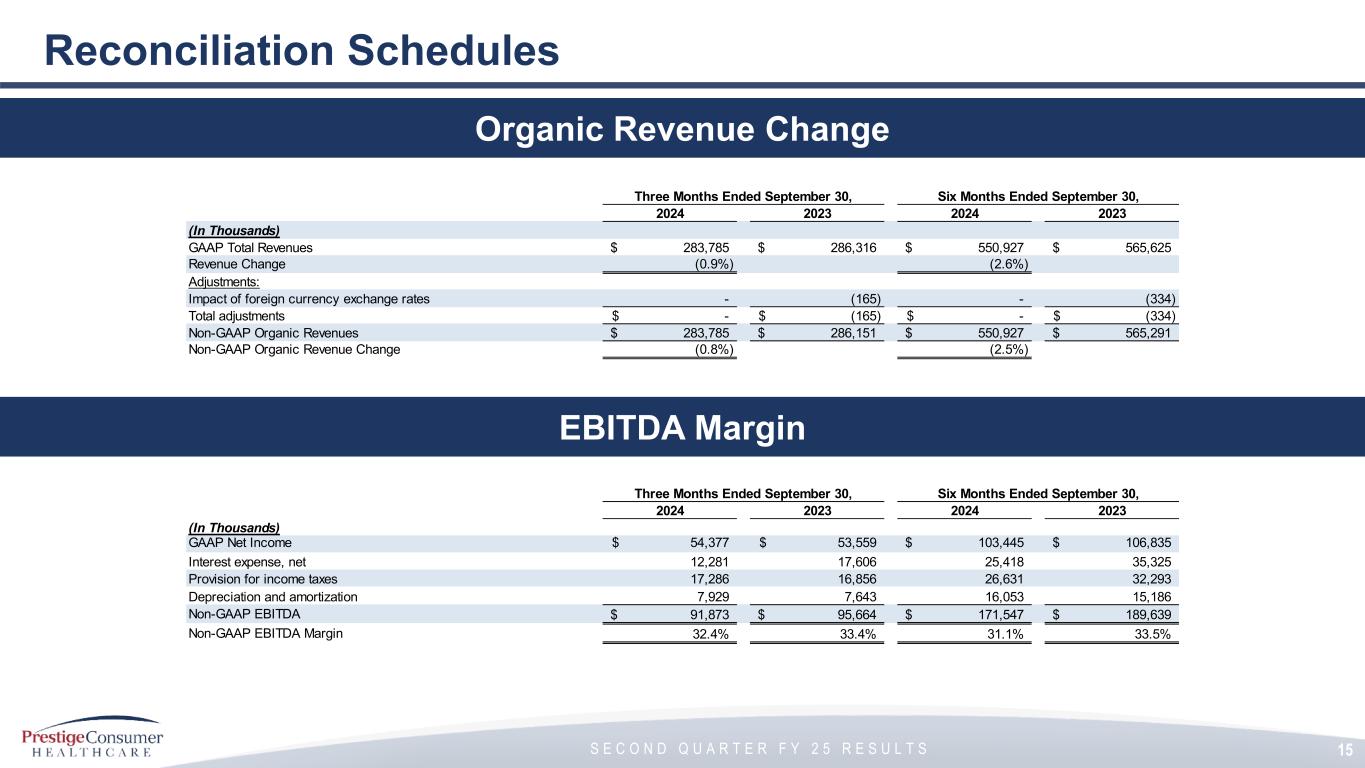

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S EBITDA Margin 15 Reconciliation Schedules Organic Revenue Change Three Months Ended September 30, Six Months Ended September 30, 2024 2023 2024 2023 (In Thousands) GAAP Total Revenues 283,785$ 286,316$ 550,927$ 565,625$ Revenue Change (0.9%) (2.6%) Adjustments: Impact of foreign currency exchange rates - (165) - (334) Total adjustments -$ (165)$ -$ (334)$ Non-GAAP Organic Revenues 283,785$ 286,151$ 550,927$ 565,291$ Non-GAAP Organic Revenue Change (0.8%) (2.5%) Three Months Ended September 30, Six Months Ended September 30, 2024 2023 2024 2023 (In Thousands) GAAP Net Income 54,377$ 53,559$ 103,445$ 106,835$ Interest expense, net 12,281 17,606 25,418 35,325 Provision for income taxes 17,286 16,856 26,631 32,293 Depreciation and amortization 7,929 7,643 16,053 15,186 Non-GAAP EBITDA 91,873$ 95,664$ 171,547$ 189,639$ Non-GAAP EBITDA Margin 32.4% 33.4% 31.1% 33.5%

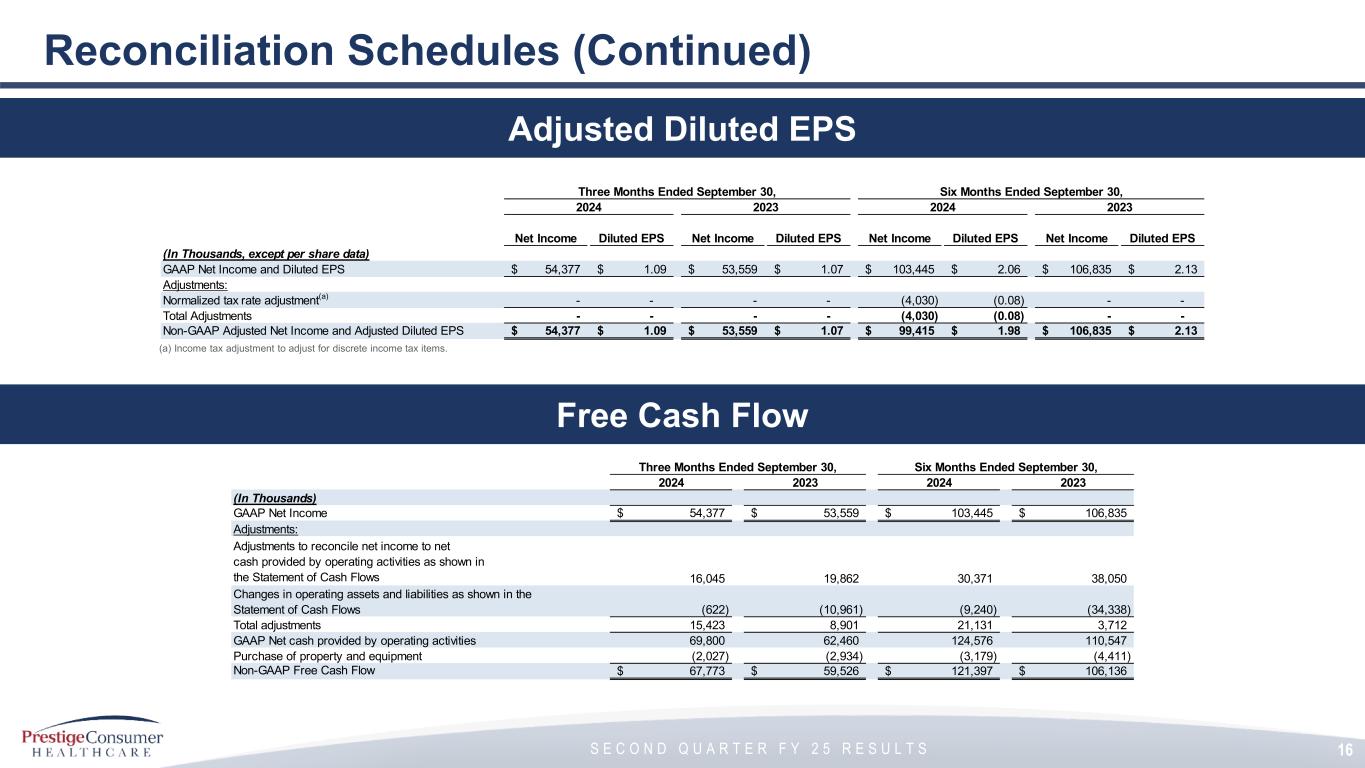

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S 16 Reconciliation Schedules (Continued) Adjusted Diluted EPS (a) Income tax adjustment to adjust for discrete income tax items. Free Cash Flow Three Months Ended September 30, Six Months Ended September 30, 2024 2023 2024 2023 Net Income Diluted EPS Net Income Diluted EPS Net Income Diluted EPS Net Income Diluted EPS (In Thousands, except per share data) GAAP Net Income and Diluted EPS 54,377$ 1.09$ 53,559$ 1.07$ 103,445$ 2.06$ 106,835$ 2.13$ Adjustments: Normalized tax rate adjustment(a) - - - - (4,030) (0.08) - - Total Adjustments - - - - (4,030) (0.08) - - Non-GAAP Adjusted Net Income and Adjusted Diluted EPS 54,377$ 1.09$ 53,559$ 1.07$ 99,415$ 1.98$ 106,835$ 2.13$ Three Months Ended September 30, Six Months Ended September 30, 2024 2023 2024 2023 (In Thousands) GAAP Net Income 54,377$ 53,559$ 103,445$ 106,835$ Adjustments: Adjustments to reconcile net income to net cash provided by operating activities as shown in the Statement of Cash Flows 16,045 19,862 30,371 38,050 Changes in operating assets and liabilities as shown in the Statement of Cash Flows (622) (10,961) (9,240) (34,338) Total adjustments 15,423 8,901 21,131 3,712 GAAP Net cash provided by operating activities 69,800 62,460 124,576 110,547 Purchase of property and equipment (2,027) (2,934) (3,179) (4,411) Non-GAAP Free Cash Flow 67,773$ 59,526$ 121,397$ 106,136$

S E C O N D Q U A R T E R F Y 2 5 R E S U L T S 17 Reconciliation Schedules (Continued) Projected Adjusted Diluted EPS Projected Free Cash Flow (a) Income tax adjustment to adjust for discrete income tax items. Low High Projected FY'25 GAAP Diluted EPS 4.48$ 4.54$ Adjustments: Normalized Tax Rate Adjustment(a) (0.08) (0.08) Total Adjustments (0.08) (0.08) Projected FY'25 Non-GAAP Adjusted Diluted EPS 4.40$ 4.46$ (In millions) Projected FY'25 GAAP Net cash provided by operating activities 250$ Additions to property and equipment for cash (10) Projected FY'25 Non-GAAP Free Cash Flow 240$