Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Under §240.14a-12 |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check all boxes that apply): | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 1 | |

| |||

We are pleased with our fiscal 2025 results, continuing our long-term track record of  consistent revenue and earnings growth. Executing this strategy is an entire organization that continues to operate at the highest level of excellence thanks to our guiding principles of Leadership, Trust, Change, and Execution.  Ronald M. Lombardi President, Chief Executive Officer and Chair of the Board | |||

2 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| When Tuesday, August 5, 2025 10:00 a.m. (Eastern Daylight Time) |  | Where At the Company’s offices 660 White Plains Road Tarrytown, New York 10591 |  | Who Only stockholders of record at the close of business on June 10, 2025 will be entitled to vote at the Annual Meeting. |

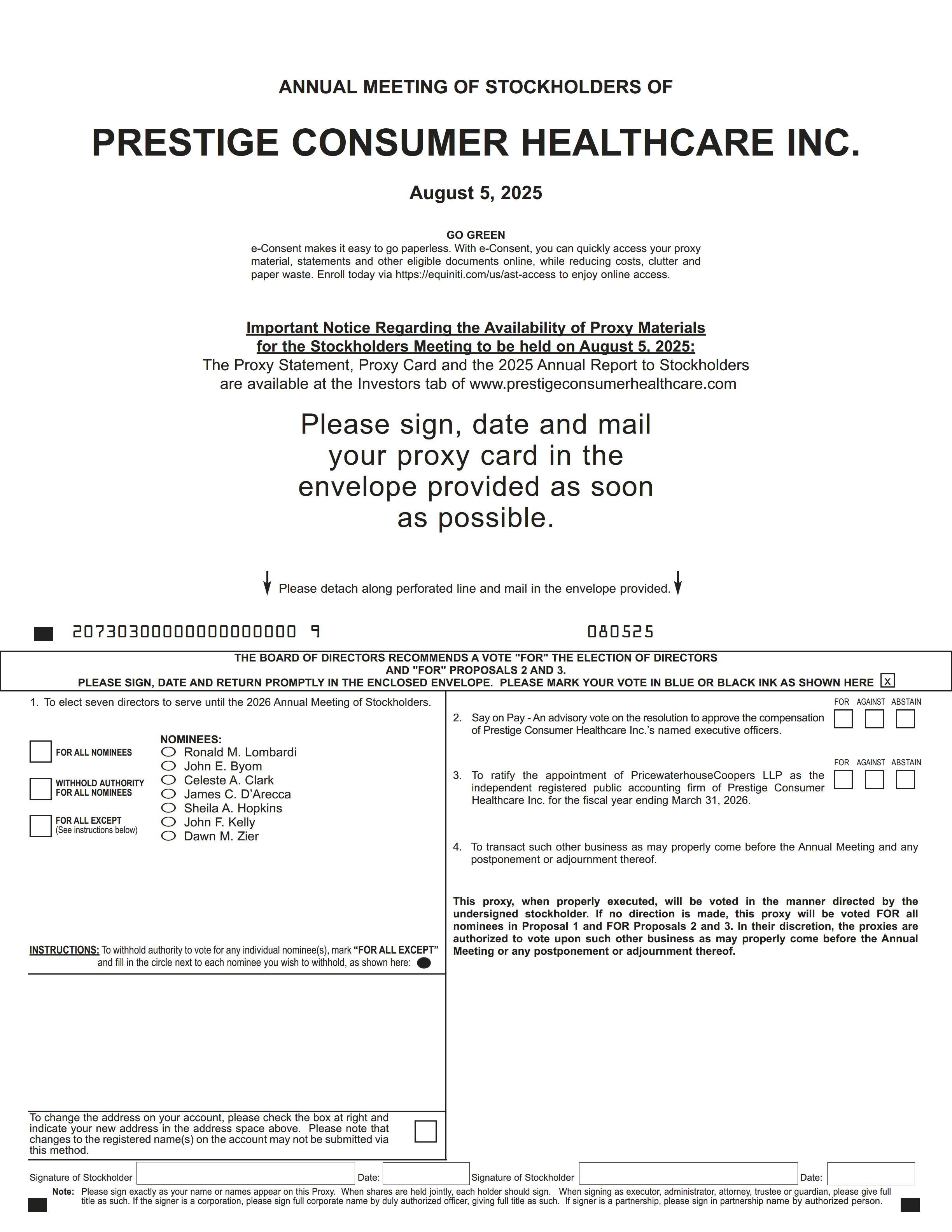

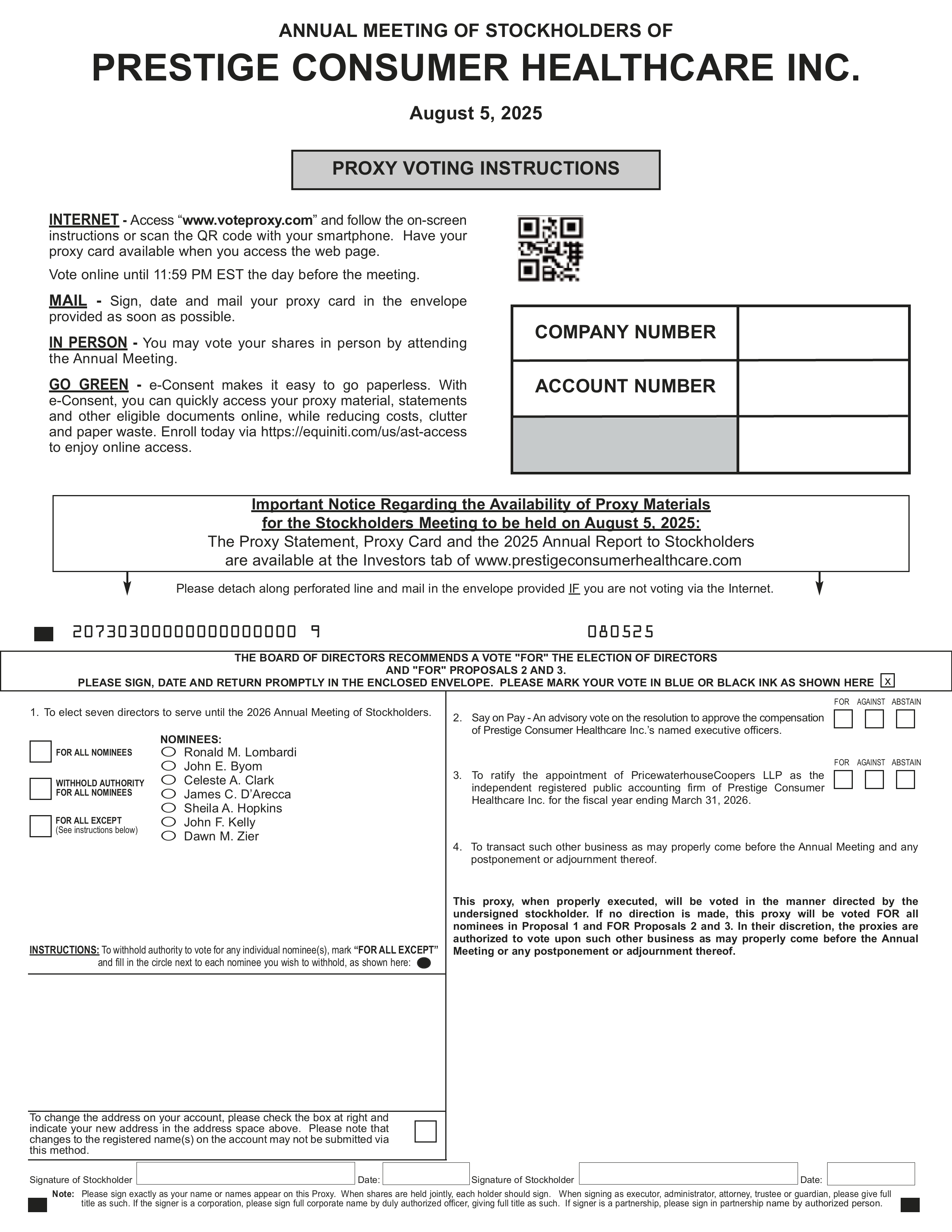

Proposal | Board’s Recommendation | See Page | |

1 | Elect the seven directors nominated by the Board of Directors and named in the accompanying Proxy Statement to serve until the 2026 Annual Meeting of Stockholders or until their earlier death, removal or resignation | FOR each  director nominee | |

2 | Conduct an advisory vote to approve the compensation of our named executive officers | FOR  | |

3 | Ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Prestige Consumer Healthcare Inc. for the fiscal year ending March 31, 2026 | FOR  | |

| By Internet Visit, 24/7, access www.voteproxy.com and follow the on-screen instructions or scan the QR code with your smartphone |  |

| By Mail Complete, date and sign your proxy card and send by mail in the enclosed postage-paid envelope | |

| In Person Attend the Annual Meeting and cast your ballot | |

Beneficial Owners If your shares are held in “street name,” your bank or brokerage firm forwarded these proxy materials, as well as a voting instruction card, to you. Please follow the instructions on the voting instruction card to vote your shares. Beneficial owners who hold shares in “street name” and who wish to vote in person at the Annual Meeting must bring a power of attorney or legal proxy from their bank, broker or other nominee. | ||||

This Proxy Statement and the proxy card are first being mailed or given to stockholders on or about June 30, 2025. | ||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 3 | |

Whether or not you expect to attend the Annual Meeting in person, please promptly complete, sign, date and mail the enclosed proxy card, or vote by the internet according to the instructions on your proxy card. A self-addressed postage paid return envelope is enclosed for your convenience. No postage is required if mailed in the United States. If you do attend the Annual Meeting, you may withdraw your proxy should you wish to vote in person. You may revoke your proxy by following the instructions on page 75 of the proxy statement. If you own shares in a brokerage account, your bank or brokerage firm forwarded these proxy materials, as well as a voting instruction card, to you. Please follow the instructions on the voting instruction card to vote your shares. Your broker cannot vote your shares for proposals regarding the election of our directors and approval of the compensation of our named executive officers unless you provide voting instructions to your broker. Therefore, it is very important that you exercise your right as a stockholder and vote on all proposals. | ||

4 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| |||||

| |||||

| |||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD ON AUGUST 5, 2025: This Proxy Statement, the Proxy Card and the 2025 Annual Report to Stockholders are available at the “Investors” tab of www.prestigeconsumerhealthcare.com, our internet website. You can submit a request for a copy of the proxy statement, annual report and form of proxy for any future stockholder meetings (including the meeting of stockholders to be held on August 5, 2025) to 1-800-831-7105, (Attention: Investor Relations), proxy@prestigebrands.com or the “contact us” tab at www.prestigeconsumerhealthcare.com. You can also contact us at the phone number, e-mail address and website set forth above to request directions to the location of the Annual Meeting of Stockholders so that you may attend the meeting and vote in person. | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 5 | |

|  |  |  |  |

|  |  |  |  |

|  |  |  |  |

|  |  |  |  |

Proven Ability to Execute Value Creation Strategy | ||||||

1 Investing for Growth with Proven Brand-Building Playbook | 2 Superior Business Attributes Drive Strong Free Cash Flow | 3 Scalable & Efficient Platform Enables Capital Allocation Optionality | Revenue +3.4% 5-Yr CAGR | |||

6 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

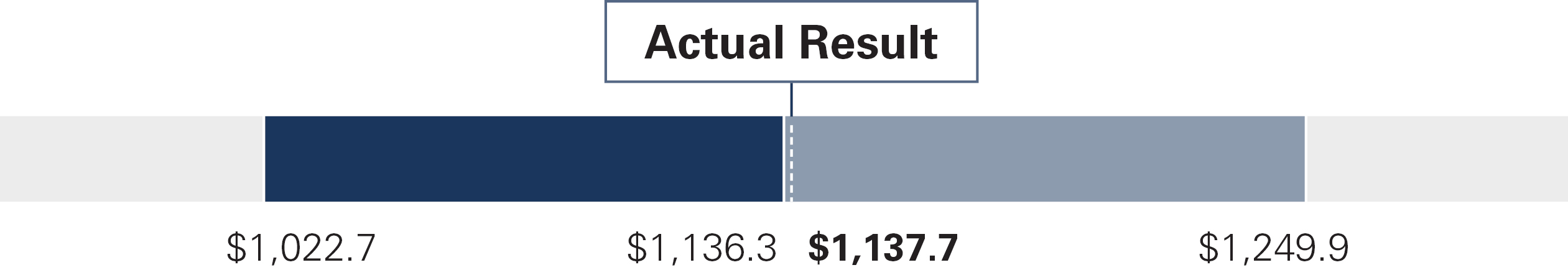

Top Line Trends •Revenue of $1,138M •Organic revenue growth of 1.2% •Continued strong growth in International OTC segment | EPS •Adjusted Diluted EPS of $4.52 •Adjusted EPS growth of 7.3% •Strong financial profile leading to sustained profitability | Free Cash Flow & Allocation •Free Cash Flow of approximately $243M •Reduced debt to lowest level in Company history, enabling value-creating capital allocation | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 7 | |

| Our People Our people are critical to our Company’s success. We trust them every day to maintain safety and performance excellence, uphold integrity in manufacturing and marketing, and adhere to our Company’s four guiding principles. | |

Our Community & Consumers Prestige’s commitment to responsible corporate citizenship extends beyond our employees and into the lives of our communities and consumers. | ||

Our Planet & Partners In line with our goal to continuously innovate and provide quality products to our consumers, we aim to assess, reduce, and report on our environmental impacts. | ||

8 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 9 | |

1 | 2 | 3 | |||

To elect the seven directors nominated by the Board of Directors and named in this Proxy Statement to serve until the 2026 Annual Meeting of Stockholders or until their earlier death, removal or resignation | To vote on a non-binding resolution to approve the compensation of our named executive officers as disclosed in our Proxy Statement | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Prestige Consumer Healthcare Inc. for the fiscal year ending March 31, 2026 | |||

•Ronald M. Lombardi •John E. Byom •Celeste A. Clark •James C. D’Arecca | •Sheila A. Hopkins •John F. Kelly •Dawn M. Zier | ||||

Name Age Director Since | Primary (or Former) Occupation | Independence | Committee Assignments | |

| Ronald M. Lombardi, 61 June 2015 | Chair of the Board, President and Chief Executive Officer of Prestige Consumer Healthcare Inc. | ||

| John E. Byom, 71 January 2006 | (Former) Chief Executive Officer of Classic Provisions Inc: (former) Chief Financial Officer of International Multifoods Corporation |  | Audit & Finance, Compensation & Talent Management |

| Celeste A. Clark, Ph.D. 72 February 2021 | (Former) Senior Vice President, Global Policy and External Affairs and Chief Sustainability Officer of Kellogg Company |  | Compensation & Talent Management, Nominating & Corporate Governance (Chair) |

| James C. D’Arecca, 54 August 2023 | Executive Vice President, Chief Financial Officer of Haemonetics Corporation. |  | Audit & Finance (Chair), Nominating & Corporate Governance |

| Sheila A. Hopkins, 69 August 2015 | (Former) Interim Chief Executive Officer of Cutera, Inc; (Former) President, Global Vision Care and Executive Vice President of Bausch + Lomb |  | Audit & Finance, Nominating & Corporate Governance |

| John F. Kelly, 64 May 2024 | (Former) Vice President, Quality Operations and Environment, Health & Safety of Pfizer Inc. |  | Compensation & Talent Management, Nominating & Corporate Governance |

| Dawn M. Zier, 60 May 2020 | Chair of The Hain Celestial Group, Inc; (Former) President and CEO of Nutrisystem |  | Audit & Finance, Compensation & Talent Management (Chair) |

10 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Some Knowledge | Deep Knowledge | ||

| Leadership Experience |  | |

| Finance Experience |  |  |

| Consumer Products Experience |  |  |

| Marketing Experience |  |  |

| Sustainability & Corporate Governance |  |  |

| Supply Chain Experience |  |  |

| Board Accountability |

| Director Independence |

| Board Leadership |

| Director Engagement |

| Board Diversity |

| Continuous Board Education |

| Regular Executive Sessions |

| Board and Committee Self-Evaluations |

| No Overboarding |

| Director Access and Resources |

| Stockholder Rights |

| Regular Review of Key Governance Documents |

| Compensation Best Practices |

| Robust Code of Conduct and Ethics |

| Robust Risk Management Oversight |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 11 | |

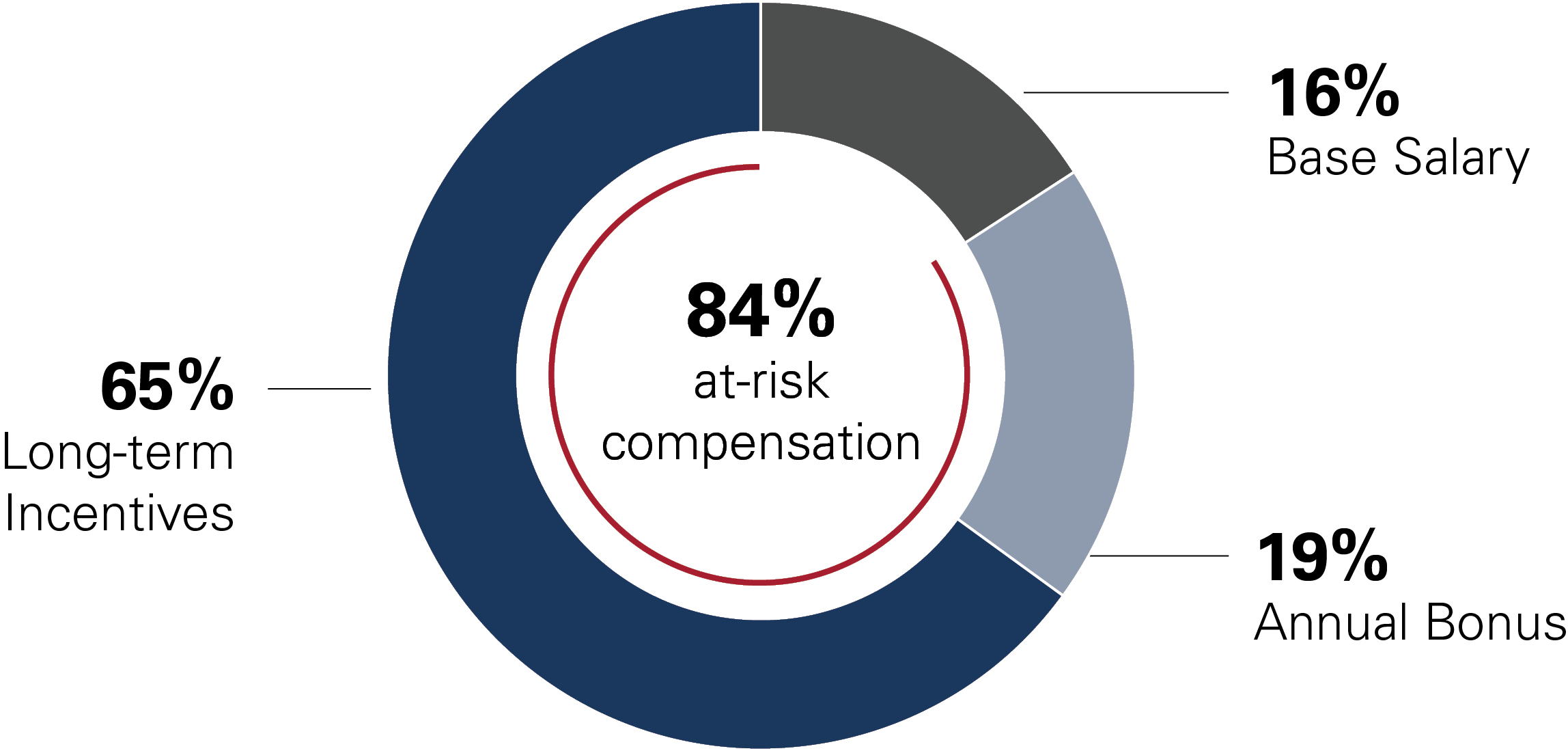

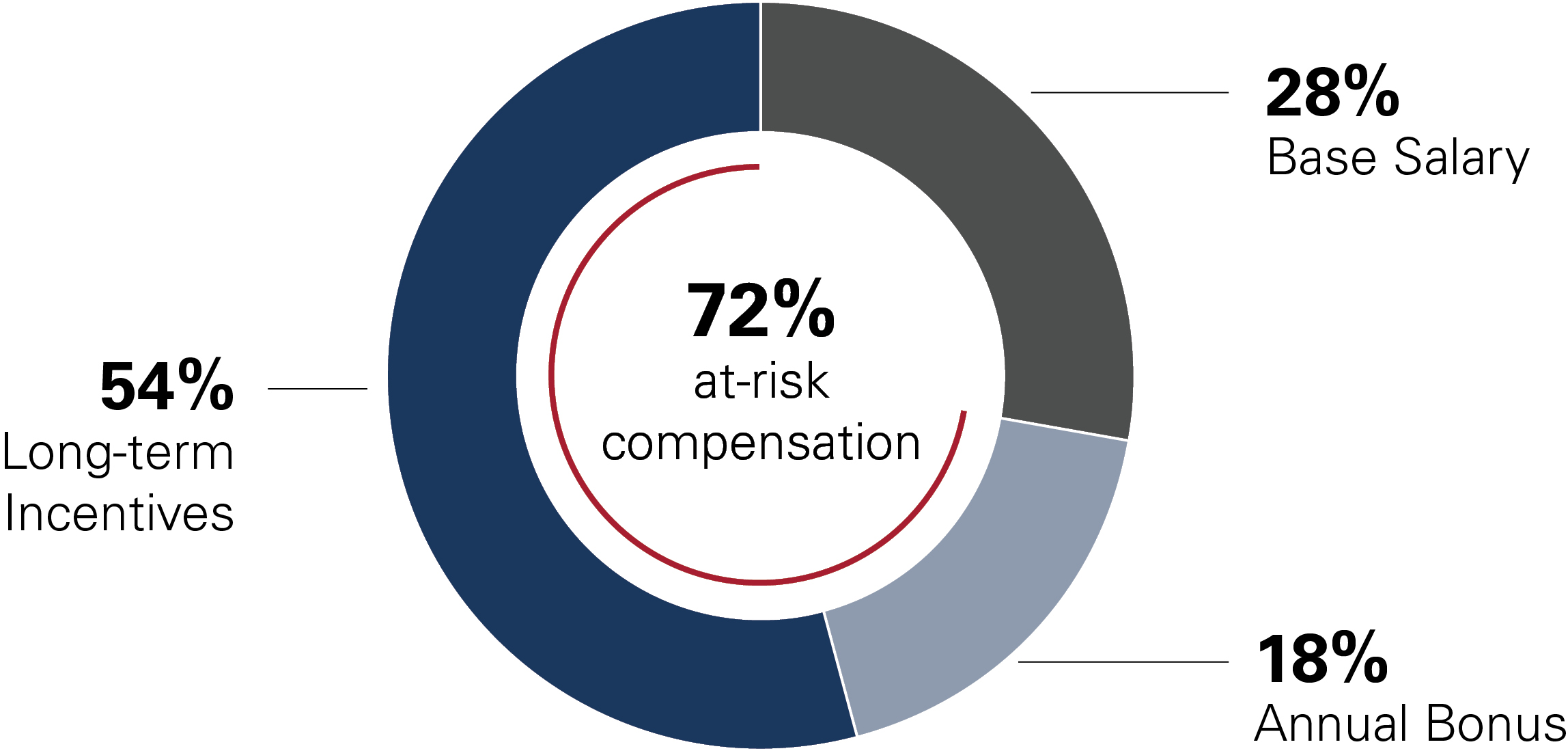

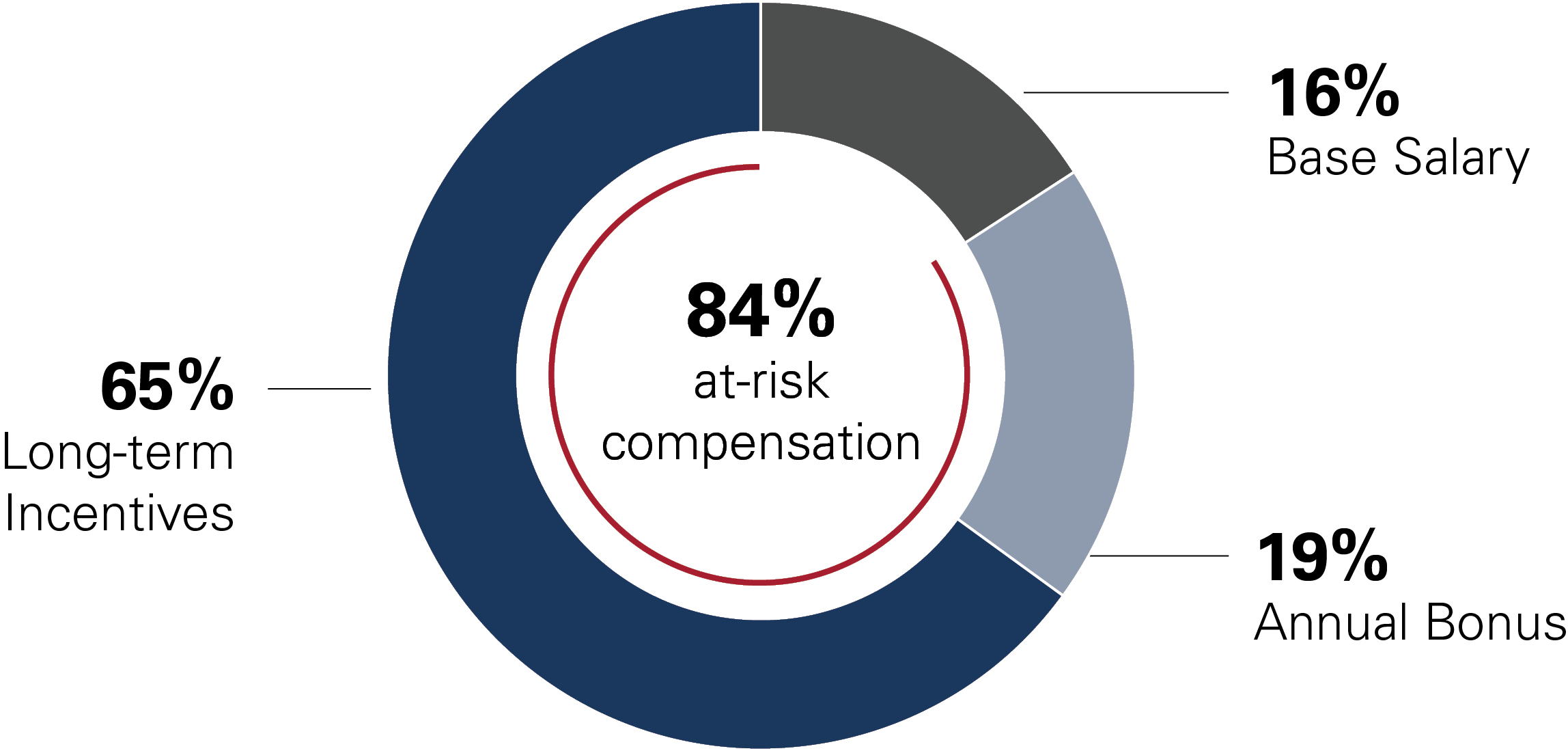

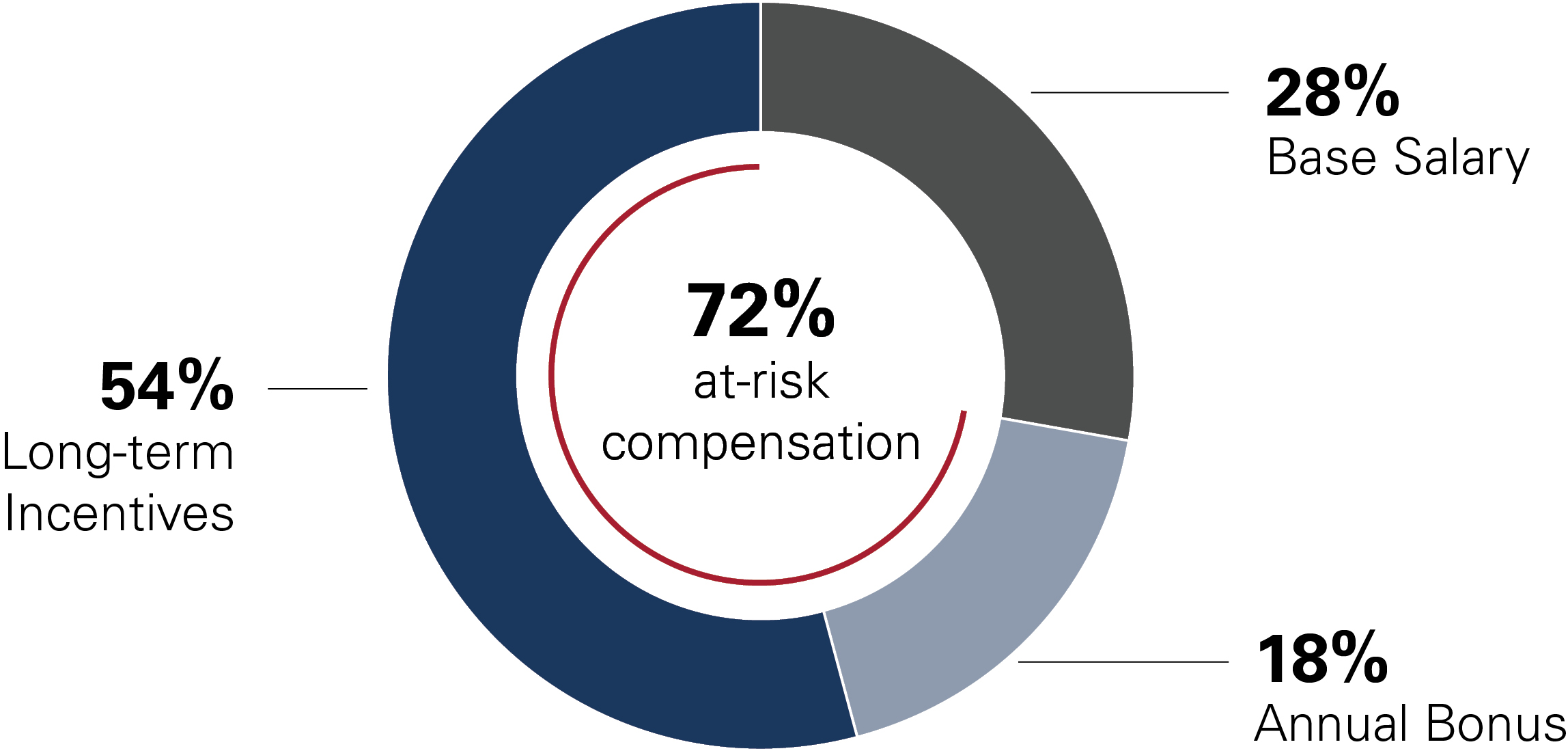

Pay Element | Objective | Purpose of the Pay Element | |||

| Base Salary | •Skills, experience, competence, performance, responsibility, leadership and contribution to the Company. | •Recognize the level of job scope and complexity, and the skills, experience, leadership and sustained performance required by the executive. | ||

| Annual Cash Incentive (“AIP”) | •Efforts to achieve annual target revenue and profitability. | •Reward the achievement of annual performance targets. •Ensures compensation is properly aligned to financial performance, including being completely at risk for failure to meet annual financial threshold targets. | ||

Long-Term Incentive Awards (Performance Stock Units, Restricted Stock Units) | •Efforts to achieve long-term revenue growth and profitability over the three year vesting period. •Ability to increase and maintain stock price. •Achievement of adjusted cumulative EBITDA and cumulative revenue goals. •Continued employment with the Company during the three-year vesting period. | •Reward achievement of long-term financial performance and strategic corporate initiatives. •Provide a competitive mix of incentives to attract and retain top talent and to further reinforce alignment between the interests of management and stockholders. | |||

12 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| What We Do |  | What We Don’t Do | |||||||

Clawback Policy.  Minimum vesting requirements.  Limitation on non-employee  director compensation. Robust Stock  Ownership Guidelines. | No evergreen provision in our  equity plan. No repricing of stock options.  No dividends on  unearned awards. No excessive perks.  | No liberal share  recycling provisions. No single-trigger change of  control vesting. No gross-ups.  No hedging.  | ||||||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 13 | |

PROPOSAL 1: Election of Directors | |

How many directors are stockholders being asked to elect and for what term? The number of directors on the Board of Directors is fixed from time to time by resolution adopted by the affirmative vote of a majority of the total number of directors then in office. Currently, the Board of Directors is fixed at seven directors. If elected, each nominee would hold office until the 2026 Annual Meeting of Stockholders and until his or her respective successor is elected and qualified or until his or her earlier death, removal or resignation. What if a nominee is unable to stand for election? If a nominee is unable to stand for election, the Board may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have voted “Withhold” with respect to the original nominee. How many votes are needed to elect directors? The affirmative vote of a plurality of the votes of shares present, in person or represented by proxy, at the Annual Meeting and entitled to vote in the election of directors is necessary for the election of directors. This means that the seven director nominees with the most votes will be elected. You may vote in favor of all nominees, withhold your vote as to all nominees, or withhold your vote as to specific nominees. | |

| The Board Recommends You Vote for the Election of the Nominees for Director Named Above. |

14 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| Leadership Experience We believe that directors with experience in significant leadership positions over an extended period, especially chief executive officer positions, chief financial officers and other senior executives, provide the Company with valuable insights and strategic thinking. These individuals generally possess extraordinary leadership qualities and the ability to identify and develop those qualities in others. They demonstrate a practical understanding of organizations, processes, strategy, risk management and the methods to drive change and growth. | ||

| Finance Experience We believe that an understanding of finance and the financial reporting process is important for our directors. We measure our operating and strategic performance by reference to financial targets. In addition, accurate financial reporting and robust auditing are critical to our success and developing stockholders’ confidence in our reporting processes under the Sarbanes-Oxley Act of 2002. We expect all of our directors to be financially literate. | ||

| Consumer Products Experience As a marketer and distributor of brand name personal healthcare products throughout the U.S. and Canada, Australia, and in certain other international markets, we seek directors with experience as executives managing consumer products businesses. | ||

| Marketing Experience The Company seeks to grow organically by identifying and developing opportunities for expanding distribution of its existing product offerings through traditional and digital marketing, while also developing and launching new products to sell into the market. We seek directors with a strong marketing background. | ||

| Sustainability & Corporate Governance As a global corporate citizen, we believe that sustainable operations are both financially and operationally beneficial to our business, and critical to the health of our employees and the communities in which we operate. We seek directors with experience in building strong environmental, labor, health & safety, corporate governance and ethical practices. | ||

| Supply Chain Experience The Company relies on both third party manufacturers and its own manufacturing facilities to fulfill its manufacturing needs. As a result, we seek to have directors with experience in supply chain management, quality and compliance with the various regulations that govern the manufacturing, packaging, labeling, distribution, and importation of our products. | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 15 | |

|  |  |  |  |  |  | Total Experience | |||

Some Knowledge | Deep Knowledge | |||||||||

| Leadership Experience |  |  |  |  |  |  |  |  | |

| Finance Experience |  |  |  |  |  |  |  |  |  |

| Consumer Products Experience |  |  |  |  |  |  |  |  |  |

| Marketing Experience |  |  |  |  |  |  |  |  |  |

| Sustainability & Corporate Governance |  |  |  |  |  |  |  |  |  |

| Supply Chain Experience |  |  |  |  |  |  |  |  |  |

| Deep Knowledge or Experience |  | Some Knowledge or Experience |

16 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| John E. Byom Independent Lead Director |      | ||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||

•None | •MGP Ingredients Inc. | |||||||||

Career Highlights: •Has served as a director since January 2006 •Was Chief Executive Officer of Classic Provisions Inc., a specialty foods distribution company, from October 2007 until the business was sold and he retired in June 2019 •Was previously the Chief Financial Officer of International Multifoods Corporation. He left International Multifoods Corporation in March 2005 after 26 years, including four years as Vice President Finance and Chief Financial Officer from March 2000 to June 2004 •Was President of Multifoods Foodservice and Bakery Products from June 2004 until March 2005 after the sale of International Multifoods Corporation to The J.M. Smucker Company in June 2004 | •Was President of U.S. Manufacturing from July 1999 to March 2000, and Vice President Finance and IT for the North American Foods Division from 1993 to 1999, prior to his time as Chief Financial Officer and as President of Multifoods Foodservice and Bakery Products •Prior to 1993, held various positions in finance and was an internal auditor for International Multifoods Corporation from 1979 to 1981 Education: Mr. Byom earned his B.A. in Accounting from Luther College. | |||||||||

| Celeste A. Clark, Ph.D. Director |     | ||||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||||

•The Hain Celestial Group, Inc. (Better For Your CPG Products) (Nominating & Governance Committee Chair) •Darling Ingredients Inc. (Sustainability Committee Chair) •Wells Fargo & Company | •Mead Johnson Nutrition Company, Inc. •Diamond Foods, Inc. •AdvancePierre Foods Holdings, Inc. •Omega Protein Corporation, Inc. | |||||||||||

Career Highlights: •Has served as a director since February 2021 •Has been the principal of Abraham Clark Consulting, LLC, a consulting firm, since November 2011 and consults on nutrition and health policy, regulatory affairs and leadership development •Has been an adjunct professor in the Department of Food Science and Human Nutrition at Michigan State University since January 2012 •Serves as a trustee of the W.K. Kellogg Foundation •Served as Senior Vice President, Global Policy and External Affairs of Kellogg Company, a food manufacturing company, and was the Chief Sustainability Officer until she retired in 2011 •Was a member of the Global Executive Management Team and had an accomplished career spanning nearly 35 years at Kellogg Company, in which time, she was responsible for the development and implementation of global health, nutrition and regulatory science initiatives. In addition, she led global corporate communications, public affairs, philanthropy and several administrative functions | Recognition & Certifications: •Recognized as a Director 100 by the National Association of Corporate Directors in 2023 •She brings significant industry experience in various nutrition, consumer productions, public policy, risk management, governance and sustainability matters to the Board. Education: Dr. Clark earned her Ph.D. from Michigan State University in Food Science and Nutrition and in 2021, she was bestowed an honorary Ph.D. in Humanities. | |||||||||||

| Leadership Experience |  | Finance Experience |  | Consumer Products Experience |  | Marketing Experience |  | Sustainability & Corporate Governance |  | Supply Chain Experience | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 17 | |

| James C. D’Arecca Director |   | ||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||

•None | •None | |||||||||

Career Highlights: •Has served as a director since August 2023 •Has been Executive Vice President, Chief Financial Officer of Haemonetics Corporation, a medical technology company, since April 2022 •Previously served as Chief Financial Officer of TherapeuticsMD, Inc., a women’s healthcare company, from June 2020 to April 2022 •Served as the Senior Vice President and Chief Accounting Officer of Allergen plc (formerly known as Actavis plc), a global pharmaceutical company, from August 2013 until its merger with AbbVie Inc. in May 2020, prior to joining TherapeuticsMD, Inc. •Served as Chief Accounting Officer at Bausch & Lomb prior to joining Actavis plc | •Held finance and business development positions of increasing responsibility at Merck & Co., Inc. and Schering-Plough Corporation earlier in his career •Began his career at PricewaterhouseCoopers LLP from 1992 to 2005, where he had an industry focus on pharmaceuticals, medical devices, and consumer products Education: Mr. D’Arecca earned a Bachelor of Science in Accounting from Rutgers University and a Master of Business Administration from Columbia University. He is a Certified Public Accountant. | |||||||||

| Sheila A. Hopkins Director |     | ||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||

•None | •Cutera, Inc. •Warnaco, Inc. | |||||||||

Career Highlights: •Has served as a director since August 2015 •Formerly served as the Interim Chief Executive Officer of Cutera, Inc., an energy based and aesthetic devices company, from April 2023 to August 2023. Cutera, Inc. filed Chapter 11 Bankruptcy in March 2025 •Previously served as President, Global Vision Care and Executive Vice President of Bausch + Lomb, a healthcare company, from September 2011 until her retirement in August 2013 •Worked at Colgate-Palmolive, a leading consumer products company, where she held several senior executive positions including Vice President and General Manager, Personal Care, Vice President, Global Business Development and Vice President and General Manager, Professional Oral Care, from September 1997 to August 2011 •Held significant marketing and sales positions at Procter & Gamble, American Cyanamid, and Tambrands, prior to joining Colgate- Palmolive | •Served on the boards of the Consumer Healthcare Products Association and the American Dental Association Foundation Recognition & Certifications: •Certified in Cyber-Risk Oversight by the NACD - National Association of Corporate Directors Education: Ms. Hopkins earned a B.A. in History from Wellesley College. | |||||||||

| Leadership Experience |  | Finance Experience |  | Consumer Products Experience |  | Marketing Experience |  | Sustainability & Corporate Governance |  | Supply Chain Experience | ||

18 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| John F. Kelly Director |    | ||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||

•None | •None | |||||||||

Career Highlights: •Appointed to the Board in May 2024 •Is Chair of the Board of Trustees of Wakeman Boys & Girls Club, and a member of the Worcester Polytechnic Institute Engineering Dean’s Advisory Board •Retired in June 2022 after a 40-year career at Pfizer Inc., a biopharmaceutical company, where he was a member of the Pfizer Global Supply Leadership Team and a member of the Pfizer PAC Board of Directors •Held multiple positions in his career with Pfizer starting in August 1982 and finishing as the Vice President, Quality Operations and Environment, Health & Safety. At Pfizer, Mr. Kelly’s responsibilities included pharmaceutical and consumer product operations, manufacturing strategy, business development, quality and EHS | •Served as Chair of the Board of Directors of Zydus Cadila Oncology Private Limited, a 50/50 joint venture between Pfizer and Zydus Cadila, between March 2019 and June 2022, and prior to that he was a director of same between December 2015 and March 2019 •Was a member of the Board of Directors of The Patterson Club, Fairfield, CT and co-President of the Fairfield College Preparatory School Father’s Club Education: Mr. Kelly earned a degree in Chemical Engineering from Worcester Polytechnic Institute and an M.B.A. in Operations Management from Pace University. | |||||||||

| Ronald M. Lombardi Chair of the Board, CEO and President |    | ||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||

•ACCO Brands Corporation (Audit Committee Chair) | •None | |||||||||

Career Highlights: •Elected Chair of the Board in May 2017 and has served as a director and as President and Chief Executive Officer of the Company since June 2015 •Served as Chief Financial Officer of the Company from December 2010 until November 2015 •Employed by Medtech Group Holdings, a components and contract medical device manufacturer, as Chief Financial Officer, prior to joining the Company, from October 2010 to December 2010 •Served as the Chief Financial Officer of Waterbury International Holdings, a specialty chemical and pest control business, from October 2009 to October 2010 •Employed by Cannondale Sports Group, a sporting goods and apparel manufacturing company, as Chief Operating Officer from August 2008 to October 2009 and as Senior Vice President and Chief Financial Officer from March 2004 to August 2008 | •Served in various roles at Gerber Scientific Inc., including Vice President and Chief Financial Officer of Gerber Scientific Inc.’s Gerber Coburn Optical Division and Director of Financial Planning and Analysis from 2000 to 2004 •Previously employed by Emerson Electric, Scovill Fasteners, Inc. and Go/Dan Industries Education: Mr. Lombardi earned a B.S. from Springfield College and an M.B.A. from American International College and has been a licensed CPA. | |||||||||

| Leadership Experience |  | Finance Experience |  | Consumer Products Experience |  | Marketing Experience |  | Sustainability & Corporate Governance |  | Supply Chain Experience | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 19 | |

| Dawn M. Zier Director |      | ||||||||

Current Public Company Directorships | Previous Public Company Directorships | |||||||||

•The Hain Celestial Group, Inc. (Better For You CPG Products) (Board Chair) | •Spirit Airlines, Inc. •Purple Innovation, Inc. •Tivity Health, Inc. | |||||||||

Career Highlights: •Has served as a director since May 2020 •Has been the principal of Aurora Business Consulting, LLC, which advises public and private companies on business transformation, digital/marketing acceleration, and high-performance teams, since February 2020 •Serves as an executive mentor/advisor to Fortune 500 leaders, through her work with the ExCo Group •Was formerly the President and CEO and a director of Nutrisystem, an innovative provider of weight loss programs and digital tools, from November 2012 until its March 2019 acquisition by Tivity Health, Inc., a leading provider of fitness and social engagement solutions •Joined Tivity Health serving as President and Chief Operating Officer and a member of its Board of Directors, to help with the integration efforts through December 2019 | •Served in a variety of executive positions at Reader’s Digest Association (now Trusted Media Brands), a global media and data marketing company, including President of International from 2011-2012, President of Europe from 2009-2011, President of Global Consumer Marketing from 2008-2009 and President of North America Consumer Marketing from 2005-2008, prior to November 2012 Recognition & Certifications: •Earned a certificate from MIT, Artificial Intelligence: Implications for Business Strategy in March 2025 •Recognized as a Director 100 by the National Association of Corporate Directors in 2022 •Received a Corporate Director Certification from Harvard Business School in 2020 Education: Ms. Zier earned an M.B.A. and Master of Science in Engineering from the Massachusetts Institute of Technology. | |||||||||

| Leadership Experience |  | Finance Experience |  | Consumer Products Experience |  | Marketing Experience |  | Sustainability & Corporate Governance |  | Supply Chain Experience | ||

20 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 21 | |

|  |  | |||||||||||||

01 | 02 | 03 | |||||||||||||

Board and Nominating and Corporate Governance Committee determine desired criteria, including skills and diversity of experience of director candidates | Director candidates identified by search firm, Board members, executive officers and stockholders | Nominating and Corporate Governance Committee evaluates candidates of interest against selection criteria, individual characteristics and qualifications | |||||||||||||

|  |  | |||||||||||||

06 | 05 | 04 | |||||||||||||

The Board votes to appoint director candidate based on an assessment of his or her qualifications and potential contributions to the Board | Nominating and Corporate Governance Committee discusses each director candidate, evaluates potential contributions to the Board as a whole and recommends the potential candidate to the Board | Nominating and Corporate Governance Committee Chair, the Independent Lead Director and the Chair conduct interviews and gather information; other Board members may also meet with candidates | |||||||||||||

22 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 23 | |

WHAT IS CORPORATE GOVERNANCE AND HOW DOES THE COMPANY IMPLEMENT IT? Corporate governance is a set of guidelines and policies established by the Company to ensure that our directors and all employees conduct the Company’s business in a legal, impartial and ethical manner. Your Board has a strong commitment to sound and effective corporate governance practices. The Company’s management and the Board have reviewed and continue to monitor our corporate governance practices considering Delaware law, U.S. federal securities laws, the listing requirements of the NYSE and best practices. | ||

Board Accountability. All directors stand for election each year subject to a resignation policy if they do not receive a majority. | ||

Director Independence. 6 of 7 director nominees are independent and all members of each committee are independent. | ||

Board Leadership. Annual assessment of Board leadership structure and strong Lead Independent Director role appointed each year. | ||

Director Engagement. Robust attendance for Board and committee meetings in 2025; all directors attended more than 75% of the meetings of the Board and the committees on which they served. | ||

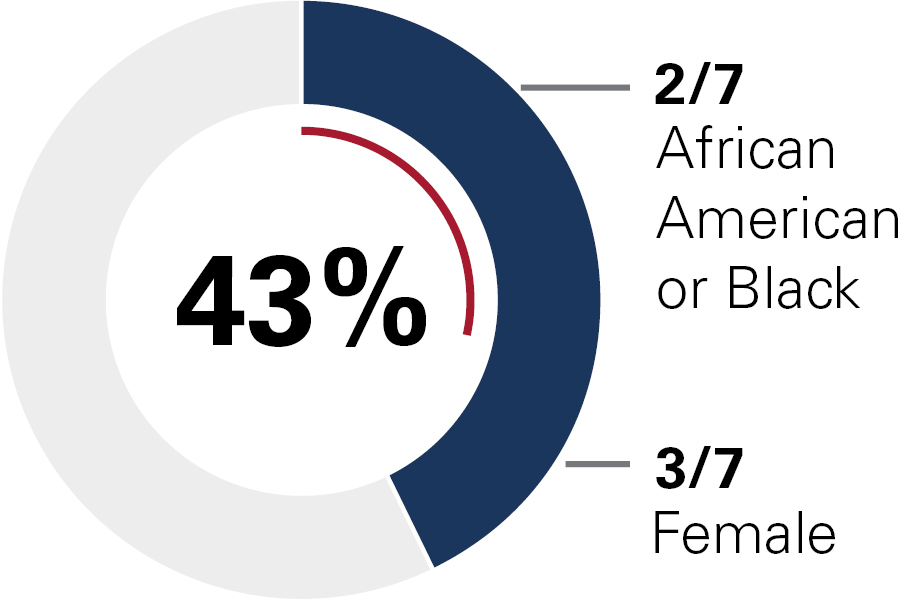

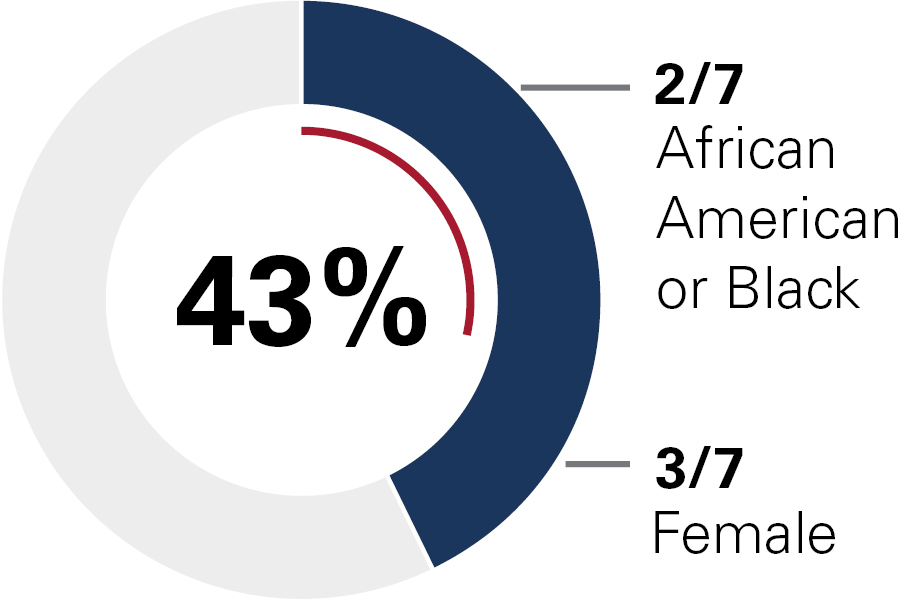

Board Diversity of Experience. Diverse and experienced Board comprised of individuals with different backgrounds, relevant experiences, ages, gender and ethnic diversity. | ||

Regular Executive Sessions. All regularly scheduled Board and committee meetings provide an opportunity for the directors to meet without management present. | ||

Board and Committee Self-Evaluations. The Board and each of its committees conducts a self- evaluation of its performance on an annual basis, with individual assignment and follow-up for any items identified as a part of continuous improvement efforts. | ||

No Overboarding. Non-employee directors are limited to no more than four public company boards in addition to the Company, and the CEO is limited to one board in addition to the Company. | ||

Director Access and Resources. Board members have significant interaction with and direct access to senior business leaders and outside experts. | ||

Stockholder Rights. Stockholders may act by written consent. | ||

Regular Review of Key Governance Documents. Annual review of Committee Charters, Corporate Governance Guidelines and Code of Conduct and Ethics. | ||

Robust Code of Conduct and Ethics. Code of Conduct and Ethics promotes honest and ethical conduct throughout the Company and all employees receive | ||

Robust Risk Management Oversight. The Board and designated committees exercise oversight of management’s risk assessment and management processes and findings and oversee the Corporate Responsibility strategy and initiatives. | ||

24 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| Annual Election of Directors. All directors stand for election on an annual basis. |

| Majority Voting Uncontested Director Elections. Any director nominee must resign if they do not receive an affirmative vote of a majority of votes cast in an uncontested election. The Board will then determine whether to accept the resignation and disclose any decision not to accept the resignation. |

| Director Independence. 6 out of 7 director nominees are independent (all directors are independent other than the CEO; fully independent Audit and Finance Committee, Compensation and Talent Management Committee and Nominating and Corporate Governance Committee). |

| Independent Board Leadership. Our Board of Directors maintains a Lead Independent Director who meets regularly with our independent members in executive session. |

| Board Refreshment. 4 of our 6 independent Board nominees have joined in the last 6 years and have expanded the Board’s scope of experience. |

| Financial Literacy for Audit Committee. Three current Audit and Finance Committee members are “audit committee financial experts” under SEC rules. |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 25 | |

| Ronald M. Lombardi Chair of the Board, President and Chief Executive Officer | ||||

The Board of Directors believes the most effective leadership structure for the Company at this time is one with a combined Chair and CEO, coupled with an independent Lead Director. Key responsibilities of the Chair include: •set meeting agendas and Board schedules in coordination with the Lead Director; •prepare meeting materials and ensures that key issues and recommendations are brought to the attention of the Board and management; •identify and lead Board discussions on important matters related to our business operations and related risk; •promotes a cohesive vision and strategy for the Company enhancing effective execution; •provide in-depth knowledge of strategic priorities and operations; and •facilitate effective communication between management and the Board. | |||||

| John E. Byom Lead Independent Director | ||||

The Lead Independent Director acts in a leadership capacity with respect to the Board of Directors and consults with the Chair of the Board between meetings of the Board of Directors. The Board created the Lead Independent Director role as an integral part of a leadership structure that promotes strong, independent oversight of the Company’s management and affairs. Key responsibilities of the Lead Independent Director include: •assist the Board, the Chief Executive Officer and other members of management in promoting compliance with and implementation of the Corporate Governance Guidelines; •preside at the executive sessions of the independent directors and have the authority to call additional executive sessions or meetings of the independent directors; •preside at Board meetings in the Chair’s absence; •review and approve information sent to the Board; •review and approve meeting agendas for the Board and approve meeting schedules to ensure sufficient time for discussion of all agenda items; •facilitate communications between employees, stockholders and others with the independent directors; •be available for consultation and direct communication with major stockholders if requested; and •monitor and evaluate, along with the members of the Compensation and Talent Management Committee and the other independent directors, the performance of the Chief Executive Officer. | |||||

26 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

100% | As required by the NYSE, all members of the Audit and Finance, Compensation and Talent Management and Nominating and Corporate Governance Committees are independent directors. | ||||

Audit and Finance Committee | Meetings in 2025: 5 |

|  |  |  |

James C. D’Arecca (Chair) | John E. Byom | Sheila A. Hopkins | Dawn M. Zier |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 27 | |

Compensation and Talent Management Committee | Meetings in 2025: 5 |

|  |  |  |

Dawn M. Zier (Chair) | John E. Byom | Celeste A. Clark | John F. Kelly |

28 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Nominating and Corporate Governance Committee | Meetings in 2025: 5 |

|  |  |  |

Celeste A. Clark (Chair) | James C. D’Arecca | Sheila A. Hopkins | John F. Kelly |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 29 | |

| ||||||||||||

The Board is committed to oversight of the Company’s business strategy and strategic planning, including work embedded in the Board committees, regular Board meetings and a dedicated meeting each year to focus on strategy. | This ongoing effort enables the Board to focus on Company performance over the short, intermediate and long term, as well as the quality of operations. In addition to financial and operational performance, non- financial measures, including sustainability goals, are discussed regularly by the Board and Board committees. | |||||||||||

|  | |||||||||||

|  |  |  | |||||||||

Holds a two-day strategy session, including presentations from, and engagement with, the Senior Leadership Team and other senior executives across the Company | Routinely engages with senior management on critical business matters that tie to the Company's overall strategy | Periodically travels to the Company’s facilities to obtain a first-hand look at the Company’s operations | Regularly meets with the next generation of leadership to ensure the pipeline remains diverse and inclusive | |||||||||

30 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Board Oversight | |||||||||||||

The Board implements its risk oversight function both as a whole and through its committees. Throughout the year, the Board, including through executive session, and the committees to which it has delegated responsibility, conduct risk assessments and discuss identified risks and how to mitigate such risks. The Board reviews risks to the Company strategy and operations. | |||||||||||||

Committees | |||||||||||||

Audit & Finance •Overall risk exposures and enterprise risk management process; •Risks related to financial statements and the financial reporting process; •Accounting, legal, ethics and compliance matters; •Internal audit and the risk control organization including any significant changes to corporate risk control policies; •Risks related to information technology systems, artificial intelligence, privacy and cyber security management (including annual review of the structure and sufficiency of cyber security mitigation efforts, including cyber risk insurance); •Financial risk related to environmental, health and safety matters; and •Risks related to liquidity and capital allocation. | Compensation & Talent Management •Risks associated with the Company’s compensation philosophy and programs; •Engages an independent consultant to support the Compensation Committee in reviewing compensation programs and policies to encourage appropriate risk taking; •Talent acquisition and retention risks; and •Human capital management and issues related to employment practices. | Nominating & Corporate Governance •Risks related to corporate governance, including the Corporate Governance Guidelines; •Along with the Audit and Finance Committee, the Company’s Code of Conduct and Ethics; •Corporate responsibility, sustainability and environmental, health and safety related risks and opportunities; and •Succession planning for the Board and CEO. | |||||||||||

Role of Management | |||||||||||||

Prestige Consumer Healthcare’s management has day-to-day responsibility for: •Identifying risks and assessing them in relation to Company strategies and objectives; •Implementing suitable risk mitigation plans, processes and controls; and •Appropriately managing risks in a manner that serves the best interests of Prestige Consumer Healthcare, its stockholders and other stakeholders. Management regularly reports to the Board on its risk assessments and risk mitigation strategies for the major risks of our business. Senior management and other employees also report to the Board and its committees from time to time on risk-related issues. | |||||||||||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 31 | |

Oversight of Enterprise Risk Management Management administers an annual detailed Enterprise Risk Management assessment to identify and rank the most significant risks that affect our Company, including consideration of a large number of risks associated with companies in the consumer products industry. Formal alignment of the most significant risks occurs between the Board and executive management every year and as changes in the risk environment necessitate. The assessed risks encompass, among others, economic, industry, enterprise, operational, cybersecurity, compliance and financial risks. Our Chief Executive Officer assigns a manager to lead the management of each of those risks identified as among the most significant. As part of the risk management process, management (with the assistance of our third-party internal auditor) annually prepares a project plan under which it reviews activities directed to mitigate business and financial related risks. This plan is reviewed with the Audit and Finance Committee annually and throughout the year as updates occur. Our third-party internal auditor reports directly to the Audit and Finance Committee and advises the committee on a quarterly basis regarding management’s risk assessment process and the progress of mitigation activities designed to facilitate the maintenance of risk within acceptable levels. |

Oversight of Cybersecurity and Privacy Risk Management Our Board considers cybersecurity risk as part of its risk oversight function and has delegated to the Audit and Finance Committee oversight of cybersecurity and other information technology risks. The Audit and Finance Committee oversees management’s implementation of our cybersecurity risk management strategy, including reviewing risk assessments from management with respect to our information technology systems and procedures, and overseeing our cybersecurity risk management strategy. The Audit and Finance Committee, which is tasked with oversight of certain risk issues, including cybersecurity, receives regular reports from the Chief Financial Officer and the Vice President, Information Technology and Chief Information Security Officer (“CISO”). At least annually, the Audit and Finance Committee receives updates on the strategy and about the results of exercises and response readiness assessments led by outside advisors who provide a third-party independent assessment of our technical program and our internal response preparedness. The Audit and Finance Committee also receives periodic briefings regarding our information security programs and cyber threats in order to enhance our directors’ literacy on cyber issues. In addition, management will update the Audit and Finance Committee, as necessary, regarding cybersecurity incidents that we may experience. Our CISO and Chief Financial Officer are responsible for assessing and managing our material risks from cybersecurity threats. The cyber security risk management team, which includes personnel with Certified Information Systems Security Professional ("CISSP") certification from ISC2, has primary responsibility for our overall cybersecurity risk management program and oversees both our internal cybersecurity personnel and our retained external cybersecurity consultants. Our cyber security risk management team is led by our CISO, who has significant experience across digital innovation and technology-enabled growth, information security, infrastructure, operations and compliance. Our management team supervises efforts to prevent, detect, mitigate, and remediate cybersecurity risks and incidents through various means, which include briefings from internal personnel; threat intelligence and other information obtained from governmental, public or private sources, including external consultants engaged by us; and alerts and reports produced by security tools deployed in the IT environment. |

32 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| Board of Directors |  | |||||||||||||||

| |||||||||||||||||

Nominating and Corporate Governance Committee | Compensation and Talent Management Committee | Audit and Finance Committee | |||||||||||||||

Corporate Management Social Responsibility Committee Senior Vice President, General Counsel & Corporate Secretary; Vice President, Investor Relations & Treasury; Vice President, Human Resources; Vice President, Manufacturing & Operations | |||||||||||||||||

| |||||||||||||||||

Environmental Health & Safety Manager | |||||||||||||||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 33 | |

≥75% ATTENDANCE Each of our directors attended 75% or more of the total number of meetings of the Board of Directors and those committees on which he or she served during the last fiscal year. |

Review of Process The Nominating & Corporate Governance Committee annually reviews the self-assessment process | Self-Assessment Questionnaire Provides director feedback on the Board and each of the committees | Results Analyzed Results of the self- assessment analyzed by the Chair of the Nominating & Corporate Governance Committee and discussed with such committee | Individual Discussions The Chair of the Nominating & Corporate Governance Committee engages with individual directors as appropriate | |||||||||||||||||||||||||||||||||

|  |  | ||||||||||||||||||||||||||||||||||

|  | |||||||||||||||||||||||||||||||||||

Feedback Incorporated Policies and practices updated as appropriate as a result of the annual self-assessment and ongoing feedback | Ongoing Feedback Directors are encouraged to provide ongoing feedback in addition to the annual self-assessment | Summary of Results Summary of Board and committee self-assessment results provided to full Board | ||||||||||||||||||||||||||||||||||

|  | |||||||||||||||||||||||||||||||||||

34 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

|  | ||

On Our Corporate Website www.prestigeconsumerhealthcare.com | By Writing To Prestige Consumer Healthcare Inc. Attention: Corporate Secretary 660 White Plains Road, Tarrytown, New York 10591 |

| We want to hear from you Stockholders and other interested parties may send communications to the Board of Directors or any committee thereof or any individual director by writing to the Board of Directors, such committee or such individual director at Prestige Consumer Healthcare Inc., 660 White Plains Road, Tarrytown, New York 10591, Attention: Corporate Secretary. The Corporate Secretary will distribute all stockholder and other interested party communications to the intended recipients and/or to the entire Board of Directors, as appropriate. | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 35 | |

Position | 2025 Additional Annual Fee ($) |

Chair of the Audit and Finance Committee | 20,000 |

Chair of the Compensation and Talent Management Committee | 20,000 |

Chair of the Nominating and Corporate Governance Committee | 15,000 |

Lead Independent Director | 30,000 |

36 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

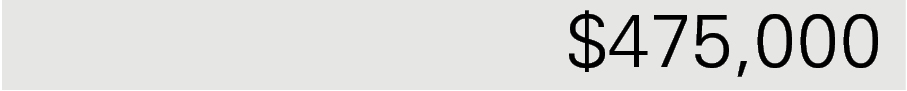

Each director must maintain ownership of shares ≥5X the amount of their annual cash retainer, currently $475,000 (5 X $95,000 retainer). | ||

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) |

Mr. Byom | 125,000 | 150,022 | 275,022 |

Ms. Clark | 110,000 | 150,022 | 260,022 |

Mr. D’Arecca | 115,000 | 150,022 | 265,022 |

Ms. Hopkins | 95,000 | 150,022 | 245,022 |

Mr. Kelly | 39,584 | 187,529 | 227,113 |

Ms. Zier | 115,000 | 150,022 | 265,022 |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 37 | |

| Ronald M. Lombardi Chair of the Board, President and Chief Executive Officer | |||||

Age: 61 | ||||||

Career Highlights: Ronald M. Lombardi was elected Chair of the Board in May 2017 and has served as a director and as President and Chief Executive Officer of the Company since June 2015. He served as Chief Financial Officer of the Company from December 2010 until November 2015. Prior to joining the Company, from October 2010 to December 2010, Mr. Lombardi was employed by Medtech Group Holdings, a components and contract medical device manufacturer, as Chief Financial Officer. From October 2009 to October 2010, Mr. Lombardi served as the Chief Financial Officer of Waterbury International Holdings, a specialty chemical and pest control business. Mr. Lombardi was employed by Cannondale Sports Group, a sporting goods and apparel manufacturing company, as Chief Operating Officer from August 2008 to October 2009 and as Senior Vice President and Chief Financial Officer from March 2004 to August 2008. From 2000 to 2004, Mr. Lombardi served in various roles at Gerber Scientific Inc., including Vice President and Chief Financial Officer of Gerber Scientific Inc.’s Gerber Coburn Optical Division and Director of Financial Planning and Analysis. Mr. Lombardi was also previously employed by Emerson Electric, Scovill Fasteners, Inc. and Go/Dan Industries. Mr. Lombardi currently serves as Chair of the Audit Committee on the board of ACCO Brands Corporation. Mr. Lombardi received a B.S. from Springfield College and an M.B.A. from American International College and has been a licensed CPA. | ||||||

| Christine Sacco Chief Financial Officer/Chief Operating Officer | |||||

Age: 50 | ||||||

Career Highlights: Christine Sacco was appointed to the position of Chief Financial Officer and Chief Operating Officer for the Company in January 2025. She served as the Chief Financial Officer of the Company from September 2016 until January 2025. Ms. Sacco joined the Company from Boulder Brands, Inc., a health and wellness food manufacturer, where she served as the Chief Financial Officer and Treasurer from January 2012 to January 2016 and Vice President and Controller from January 2008 to January 2012, including Principal Accounting Officer from January 2011 to March 2012. From October 2002 until January 2008, she held positions of increasing financial responsibility with Alpharma, Inc., a global specialty pharma company, where she last held the position of Vice President, Treasurer. Ms. Sacco began her career with Ernst & Young and worked for five years in the Audit and Assurance group. She holds a B.S. in accounting from St. Thomas Aquinas College and has been a licensed CPA. | ||||||

38 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| William C. P’Pool Senior Vice President, General Counsel and Corporate Secretary | |||||

Age: 59 | ||||||

Career Highlights: William C. P’Pool was appointed to the position of Senior Vice President, General Counsel and Corporate Secretary for the Company in November 2016. From June 2004 to April 2015, Mr. P’Pool served in progressive leadership roles at Mead Johnson Nutrition Company, a nutritional products company, the last being Senior Vice President, General Counsel and Corporate Secretary. From May 2001 to June 2004, Mr. P’Pool served as a Senior Counsel and Director of Legal Services at Yum! Brands, Inc. From 1991 to 2001, he served in legal roles of increasing responsibility at GrafTech International and Service Merchandise Company, among others. He earned a B.S. in business from Murray State University and a J.D. from the University of Kentucky. | ||||||

| Adel Mekhail Executive Vice President, Marketing & Sales | |||||

Age: 64 | ||||||

Career Highlights: Adel Mekhail was appointed to the position of Executive Vice President of Marketing & Sales for the Company in May 2019. From April 2017 to July 2018, Mr. Mekhail served as Vice President, Americas at Edgewell Personal Care Company, a personal care products company, and from July 2015 to April 2017 he served as Vice President and General Manager, Private Brands Group and Vice President, Latin America. From November 2013 to July 2015, Mr. Mekhail served as Vice President, Asia Pacific at Energizer. He held other increasingly responsible marketing roles at Energizer from 2003 to 2013. Mr. Mekhail also served in sales and marketing roles for Pfizer and Warner Lambert from 1996 to 2003. In 2000, he moved from Australia to the United States for Pfizer. Mr. Mekhail earned his B.S. in Pharmaceutical Sciences from Tanta University in Egypt and his M.B.A. from RMIT University in Melbourne, Australia. | ||||||

| Jeffrey Zerillo Executive Vice President, Operations | |||||

Age: 64 | ||||||

Career Highlights: Jeffrey Zerillo was appointed to the position of Senior Vice President, Operations for the Company in April 2018. Mr. Zerillo joined the Company from Teva Pharmaceuticals, a pharmaceutical company, where he served as Vice President, Supply Chain Management for the America’s Region from 2016 to 2018. He brings experience managing complex supply chains in pharmaceuticals, biologics and medical devices from companies including Actavis/Allergan, a pharmaceutical company, from 2014 to 2016, Purdue Pharma from 1995 to 2013, Tura L.P. from 1994 to 1995 and Instrumentation Laboratories from 1988 to 1994. He earned a B.S. in Business Management - Production Operations from York College of Pennsylvania and an Executive Certificate from Sloan School of Business. | ||||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 39 | |

PROPOSAL 2: Advisory Vote to Approve Named Executive Officer Compensation | |

Why are we submitting this matter to you? We are required by Section 14A of the Exchange Act and by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) to provide our stockholders with the opportunity to approve, on an advisory, non-binding basis, the compensation of our named executive officers (“NEOs”) contained in this Proxy Statement. This proposal, commonly known as a “Say-on-Pay” proposal, gives our stockholders the opportunity to express their views on our executive compensation as described in this Proxy Statement. Our executive compensation program is described in the Compensation Discussion and Analysis (“CD&A”), executive compensation tables and other narrative executive compensation disclosures required by the disclosure rules of the SEC, all of which are found in this Proxy Statement. In particular, the CD&A, beginning on page 40 of this Proxy Statement, describes the Company’s executive compensation program in detail, and we encourage you to review it. At the 2023 Annual Meeting of Stockholders, our stockholders expressed a preference that advisory votes on executive compensation be held on an annual basis. The Board of Directors has determined, in line with the vote of the Company’s stockholders, to have an annual advisory vote on the compensation of our named executive officers. Accordingly, the next advisory vote on executive compensation will occur at this Annual Meeting of Stockholders. What are you being asked to vote on? Stockholders are being asked to vote either for or against the following non-binding resolution: RESOLVED, that the stockholders of Prestige Consumer Healthcare Inc. approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and other narrative executive compensation disclosures included in this Proxy Statement. Is this vote binding? No. As provided by the Dodd-Frank Act, this vote will not be binding on the Board of Directors or the Compensation and Talent Management Committee and may not be construed as overruling a decision by the Board of Directors or the Compensation and Talent Management Committee or creating or implying any additional fiduciary duty for the Board. Further, it will not affect any compensation paid or awarded to any executive officer. The Compensation and Talent Management Committee and the Board will, however, take into account the outcome of the vote when considering future executive compensation arrangements. What vote is required for approval of the Say-on-Pay proposal? The approval of this non-binding resolution requires the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the proposal. If this proposal is not approved by the required vote, the Board and the Compensation and Talent Management Committee will take into account the result of the vote when determining future executive compensation arrangements, particularly if the votes cast against the resolution exceed the number of votes cast in favor of the resolution. What Does the Board Recommend? | |

| For all of the reasons discussed in our CD&A beginning on Page 40 of this Proxy Statement, the Board of Directors recommends that you vote for the approval of the compensation of our Named Executive Officers as described in this Proxy Statement. |

40 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

|  |  |  |  |

Ronald M. Lombardi President and Chief Executive Officer | Christine Sacco Chief Financial Officer & Chief Operating Officer | Adel Mekhail Executive Vice President, Sales and Marketing | William C. P’Pool Senior Vice President, General Counsel and Corporate Secretary | Jeffrey Zerillo Senior Vice President, Operations |

Table of Contents | ||||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 41 | |

Stable Revenue | Sustained Profitability | Strong Free Cash Flow | Low Year-End Leverage | ||

Record Revenue of to $1,138 Million | Adjusted EPS of $4.52 | Up 2% from 2024 to $243 Million | 2.4x Leverage Lowest in Company History | ||

|  |  | ||||||||

Motivate our business leaders to deliver a high degree of business performance and ensure that their interests are closely aligned with those of our stockholders; | Attract and retain highly qualified senior leaders who can drive a successful global enterprise in today’s competitive marketplace and represent the diversity of our employees and the customers we serve; | Establish executive compensation that is competitive with the compensation offered by similarly situated companies; | ||||||||

|  |  | ||||||||

Focus management on both the Company’s short-term and long-term strategy, performance and success; | Maintain practices that support good governance; and | Structure programs that mitigate any incentives to take excessive risks. | ||||||||

42 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| The executive’s level of responsibility and function within the Company; |  | Executive compensation offered to similarly situated executives at peer companies; and | |

| The overall performance and profitability of the Company; |  | Good governance practices. | |

| The executive’s performance within the Company; |

Base Salary | Annual Cash Incentive Awards | Long-term Equity Awards | ||||||||||||||

•Attract, Retain & Motivate •Maintain Good Governance | •Attract, Retain & Motivate •Support Company Objectives •Reinforce Strategy •Maintain Good Governance | •Attract, Retain & Motivate •Support Company Objectives •Reinforce Strategy •Maintain Good Governance | ||||||||||||||

Long-term Incentive (LTI) Vehicle | Target LTI NEOs Other Than CEO | Target LTI Value CEO |

Performance Stock Units | 60% | 75% |

Service-based Restricted Stock Units | 40% | 25% |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 43 | |

44 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Pay Element | Objective | Purpose of the Pay Element | |||

| Base Salary | •Skills, experience, competence, performance, responsibility, leadership and contribution to the Company. | •Recognize the level of job scope and complexity, and the skills, experience, leadership and sustained performance required by the executive. | ||

| Annual Cash Incentive (“AIP”) | •Efforts to achieve annual target revenue and profitability. | •Reward the achievement of annual performance targets. •Ensures compensation is properly aligned to financial performance, including being completely at risk for failure to meet annual financial threshold targets. | ||

Long-Term Incentive Awards (Performance Stock Units, Restricted Stock Units) | •Efforts to achieve long-term revenue growth and profitability over the three year vesting period. •Ability to increase and maintain stock price. •Achievement of adjusted cumulative EBITDA and cumulative Revenue goals. •Continued employment with the Company during the three-year vesting period. | •Reward achievement of long-term financial term performance and strategic corporate initiatives. •Provide a competitive mix of incentives to attract and retain top talent and to further reinforce alignment between the interests of management and shareholders. | |||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 45 | |

The Committee is composed solely of independent directors. | The Committee conducts an annual review of our compensation-related risk profile to ensure that compensation-related risks are not reasonably likely to have a material adverse effect on the Company. |

The Committee’s independent compensation consultant, CAP, is retained directly by the Compensation and Talent Management Committee and performs no other consulting or other services for us. | The Committee regularly reviews succession and talent management. |

46 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

| No Evergreen Provision. The Company’s 2020 Long-Term Incentive Plan (“2020 LTIP”) does not contain an “evergreen” feature pursuant to which the shares authorized for issuance under the 2020 LTIP can be automatically replenished. |

| No Repricing of Stock Options. Without the prior approval of the Company’s stockholders, outstanding stock options cannot be repriced, directly or indirectly, nor may stock options be cancelled in exchanged for stock options with an exercise price that is less than the exercise price of the original stock options. In addition, the Company may not, without the prior approval of stockholders, repurchase an option for value from a participant if the current market value of the underlying stock is lower than the exercise price per share of the option. |

| Clawback Policy. All awards (and/or any amount received with respect to such awards) under the Annual Incentive Plan and the 2020 LTIP are subject to reduction, cancellation, forfeiture or recoupment to the extent necessary to comply with applicable law, stock exchange listing requirements, and the recoupment policy of the Company. |

| Minimum Vesting Requirements. Awards granted under the 2020 LTIP will be subject to a minimum vesting period of one year except for 5% of the pool that is available to grant with shorter vesting. |

| No Dividends on Unearned Awards. The 2020 LTIP prohibits the current payment of dividends or dividend equivalent rights on unearned awards. |

| No Excessive Perqs. We do not provide excessive perquisites. |

| No Liberal Share Recycling Provisions. Shares retained by or delivered to the Company to pay the exercise price of a stock option or to satisfy tax withholding obligations in connection with the exercise, vesting or settlement of an award count against the number of shares remaining available under the 2020 LTIP. |

| No Single-trigger Change of Control Vesting. If awards granted under the 2020 LTIP are assumed by the successor entity in connection with a change of control of the Company, such awards will not automatically vest and pay out upon the change of control. |

| Limitation on Non-employee Director Compensation. The 2020 LTIP provides that, with respect to any one fiscal year, the aggregate compensation that may be granted or awarded to any one non-employee director, including all stock awards and cash payments shall not exceed $600,000, or $900,000 in the case of a nonemployee Chair of the Board or Lead Director. |

| No Gross-Ups. Our executive severance plan does not contain a Section 280G excise tax “gross-up” provision. |

| Robust Stock Ownership Guidelines. We maintain robust stock ownership guidelines for both officers and directors, which are described later in this CD&A. |

| No Hedging. We prohibit hedging and limit pledging by the Company’s directors, executive officers and employees. |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 47 | |

Role of Compensation and Talent Management Committee | |||||

The Compensation and Talent Management Committee and the Board of Directors are responsible for establishing the CEO’s compensation package. | |||||

Role of Independent Consultant •CAP assisted in reviewing the competitive landscape for executive talent and structuring the types and levels of executive compensation for review by the Compensation and Talent Management Committee. •CAP was consulted by the Compensation and Talent Management Committee in determining the compensation to be awarded to Mr. Lombardi in 2025, and in determining his compensation program for 2026. | Role of Management Mr. Lombardi, our Chair, President and Chief Executive Officer, with the assistance of certain members of senior management, participated in discussions with, and made recommendations to, the Compensation and Talent Management Committee regarding the setting of base salaries and cash and equity incentive plan compensation for the other executive officers. Mr. Lombardi was assisted by certain members of senior management and CAP in reviewing the competitive landscape for executive talent and structuring the types and levels of executive compensation for review by the Compensation and Talent Management Committee. | ||||

48 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

2025 Peer Group | |

•Amphastar Pharmaceuticals •B&G Foods Holdings Corp. •Church & Dwight Co. •Energizer Holdings, Inc. •Helen of Troy Limited •Vista Outdoor Inc. •USANA Health Sciences, Inc. •Utz Brands | •Pacira BioSciences, Inc. •Calavo Growers Inc. •Edgewell Personal Care Company •Hain Celestial Group, Inc. •Jazz Pharmaceuticals plc •Primo Water Corporation •Corcept Therapeutics Incorporated |

Name | FY2025 Salary | FY2026 Salary | % Increase Effective April 1, 2025* | ||

Mr. Lombardi | $1,000,000 | $1,000,000 | 0% | ||

Ms. Sacco | $700,000 | $715,000 | 2.1% | ||

Mr. Mekhail | $528,000 | $544,000 | 3% | ||

Mr. P’Pool | $546,000 | $562,000 | 3% | ||

Mr. Zerillo | $370,000 | $381,000 | 3% | ||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 49 | |

Metric | Definition | Rationale for Selection | ||

AIP net sales | Total revenues. | Drive consistent top-line growth. | ||

AIP Adjusted EBITDA | Net income plus depreciation and amortization, interest expense, integration, transition, purchase accounting, legal and various other costs associated with acquisitions and divestitures, tradename impairment and certain tax adjustments. | Drive stockholder value creation in terms of growth of earnings per share and free cash flow. | ||

Base Salary | Company Performance Factor (0% to 200%) | Individual Performance Factor (+/-20%) | AIP Payout | ||||||

× | + | = | |||||||

NEO | Target Bonus (% of Base Salary) |

Mr. Lombardi | 115% |

Ms. Sacco | 75% |

Mr. Mekhail | 60% |

Mr. P’Pool | 50% |

Mr. Zerillo | 40% |

50 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

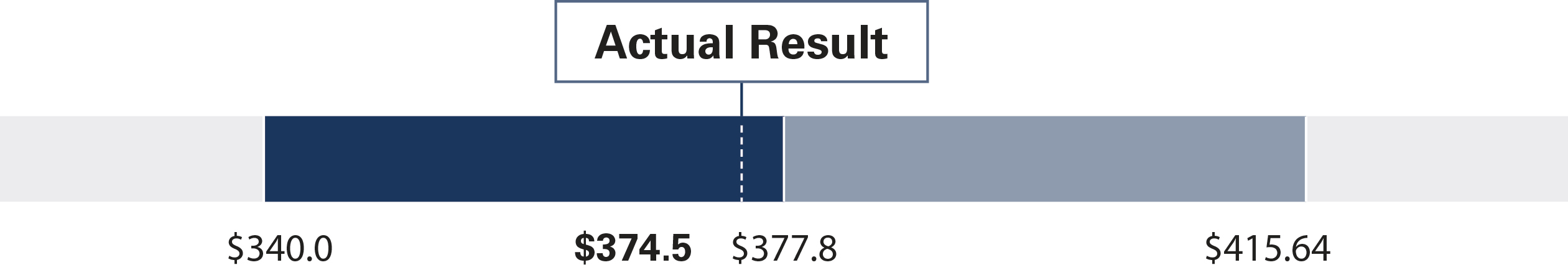

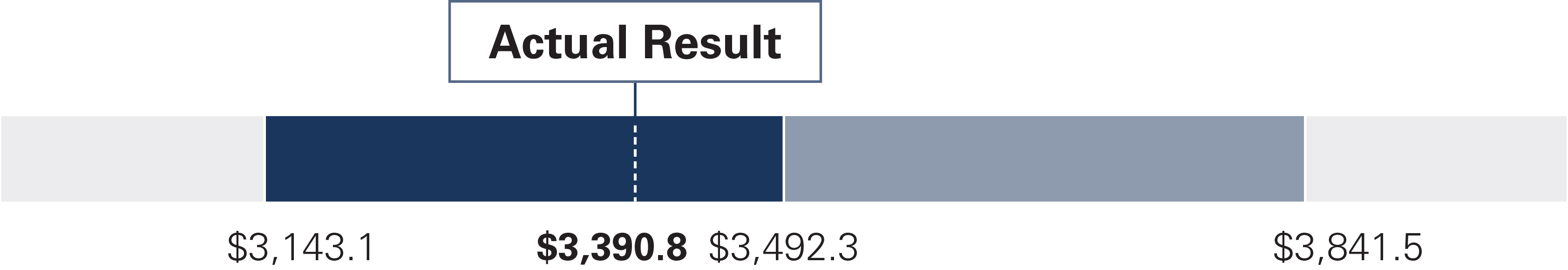

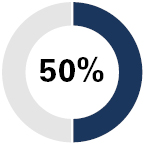

Performance Level/Payout (MIL) | ||||||

Metric | Weighting | Threshold (50%) | Target (100%) | Maximum (200%) | Payout | |

98.6% | ||||||

AIP Net Sales |  |  | ||||

AIP Adjusted EBITDA |  |  | ||||

Name | Individual Performance Highlights | Individual Adjustment |

Ronald M. Lombardi | For Mr. Lombardi, our President and Chief Executive Officer, (a) successfully lead the Company through the challenging macroeconomic environment created by significant supply chain challenges, delivering solid financial performance, (b) delivered cash flow of over $240 million despite inventory impacted by supply chain issues, (c) managed significant debt paydown with leverage below targeted level by year end, (d) made meaningful progress in customer service levels and cost reductions and (e) advanced corporate responsibility initiatives, including publication of sustainability report. | —% |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 51 | |

Name | Individual Performance Highlights | Individual Adjustment |

Christine Sacco | For Ms. Sacco, our Chief Financial Officer & Chief Operating Officer, (a) helped successfully lead the Company through the challenging macroeconomic environment created by significant supply chain challenges, delivering a solid financial performance, (b) delivered cash flow of over $240 million, (c) managed significant debt paydown with leverage below targeted level by year end, (d) worked within the finance function on maintaining and strengthening procedures and policies in support of effective controls, while helping to drive profitable growth, (e) continued enhancements in information management, technology and cybersecurity and (f) maintained strong investor relations program. | +15% |

Adel Mekhail | For Mr. Mekhail, our Executive Vice President of Marketing & Sales, (a) successfully drove North American financial performance in the challenging macroeconomic environment which included significant supply chain challenges and high inflation, (b) actively managed marketing initiatives and spend to continue to deliver strong sales and profit growth in e-commerce channels, (c) successfully lead margin improvement projects to reduce impact of inflation, and (d) successfully launched several new products extending product lines and growing revenue and profitability. | —% |

William C. P’Pool | For Mr. P’Pool, our Senior Vice President, General Counsel and Corporate Secretary, (a) strong performance in providing legal advice to the Board and senior management particularly with regard to management of operations in context of the significant supply chain challenges and challenged suppliers, (b) advanced 3-year roadmap for corporate responsibility initiatives, including publication of sustainability report, (c) strengthened the organization in terms of business conduct, compliance and control, and (d) managed the legal function to support the Company’s results in the challenging environment and secured, protected and defended the Company’s legal rights and interests. | +10% |

Jeffrey Zerillo | For Mr. Zerillo, our Senior Vice President, Operations, (a) managed the supply chain to minimize disruption to the business during challenging environment created by significant supply chain challenges and high inflation, (b) made meaningful progress in customer service levels despite multiple supply chain challenges, (c) effectively delivered productivity and savings above targeted levels despite inflationary pressures, and (d) continued evolution of the Company’s manufacturing partner network capabilities to address supply chain constraints, challenged suppliers and support business growth. | —% |

Name | Target Bonus | Company Performance Payout (98.6% of Target Bonus) | Individual Performance Adjustment | Total Payout | ||||

Mr. Lombardi | $1,150,000 | $1,134,000 | $0 | $1,134,000 | ||||

Ms. Sacco | $525,000 | $517,650 | $77,648 | $595,298 | ||||

Mr. Mekhail | $316,800 | $312,365 | $0 | $312,365 | ||||

Mr. P’Pool | $273,000 | $269,178 | $26,918 | $296,096 | ||||

Mr. Zerillo | $148,000 | $145,928 | $0 | $145,928 | ||||

52 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

|  |  | ||||||||

The use of multi-year vesting for equity awards encourages executive retention and emphasizes the attainment of long-term performance goals. | Paying a significant portion of executive compensation with long-term incentives motivates and incentivizes the executive officers to meet the long-term performance goals set by the Compensation and Talent Management Committee. | The executive officers will hold significant amounts of equity in the Company as required by the Company’s Stock Ownership Guidelines and will be motivated to increase stockholder value over the long-term. | ||||||||

Name | FY2025 Targeted Award Value | % Increase from FY2024 | |

Mr. Lombardi | $4,000,000 | 8.1 | |

Ms. Sacco | $1,575,000 | 52.9(*) | |

Mr. Mekhail | $528,000 | 2.5 | |

Mr. P’Pool | $546,000 | 1.1 | |

Mr. Zerillo | $370,000 | 2.8 | |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 53 | |

Performance Stock Units •Vest at the end of three years if company achieves pre-established goals relative to cumulative adjusted EBITDA and cumulative Net Sales (each weighted 50%). •The actual payout is determined based on the Company’s actual performance aggregated over the three-year period on a sliding-scale between the minimum (threshold) amount and the maximum amount, inclusive of the target amount. •Participants can earn up to 200% of the target number of shares with exceptional performance. •If performance is below target, but above threshold, participants can earn 50% of their award. •If performance is below threshold, participants earn 0% of their award. | ||

Restricted Stock Units •Vest ratably over three years based on service. | ||

Metric | Definition | Rationale for Selection | ||

Cumulative Net Sales  | The Company’s cumulative annual “Net Sales,” as reported in the Company’s audited financial statements for the 3-year performance period, adjusted to exclude divestitures, acquisitions, changes in accounting policy and other adjustments deemed appropriate by the Committee. | Drive consistent top-line growth over time. | ||

Cumulative EBITDA  | Company’s cumulative reported net earnings (loss) excluding earnings (loss) from discontinued operations, net of the provision (benefit) for income taxes, net of interest income and expense, net of depreciation and amortization. EBITDA for the 3-year performance period is adjusted to exclude divestitures, acquisitions, costs associated with integration, transition, purchase accounting, impairment charges, changes in accounting policy and other adjustments deemed appropriate by the Committee. | Drive stockholder value creation in terms of growth of earnings per share and free cash flow. | ||

54 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

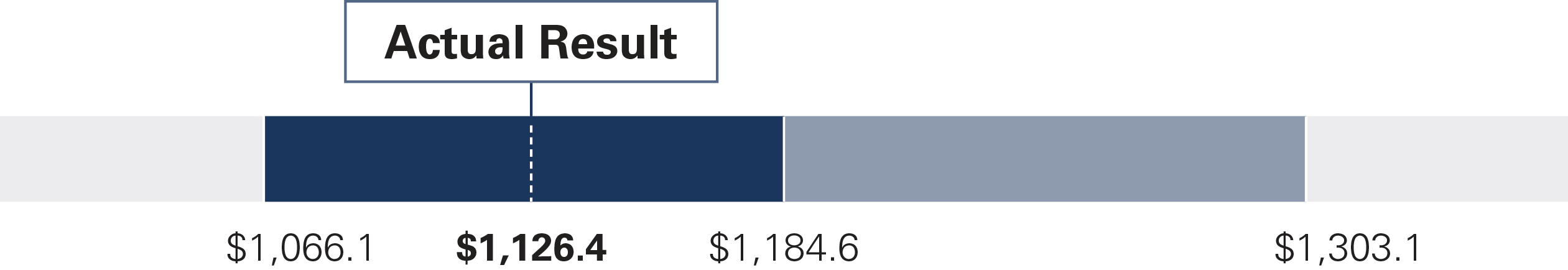

Weighting | Threshold | Target | Maximum | Performance Multiplier | ||

80.5% | ||||||

3-Year Cumulative Sales |  |  | ||||

3-Year Cumulative EBITDA |  |  | ||||

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 55 | |

Office | Value of Stockholdings Required to be Owned | |||||||

Non-Employee Director | 5x Annual Retainer |  | ||||||

Chief Executive Officer | 5x Annual Salary |  | ||||||

Chief Financial Officer | 3x Annual Salary |  | ||||||

Other NEOs | 2x Annual Salary | Varies | ||||||

What counts toward stock ownership requirement •shares of the Company purchased on the open market or in privately negotiated transactions; •shares of the Company acquired by inheritance or gift or held by immediate family members or in trust for the benefit of the employee or family member; •after-tax shares of the Company acquired through vested restricted stock units and performance stock units; •60% of vested options to the extent in-the-money — reflecting the approximate after-tax value of those shares; •60% of unvested restricted stock units and performance stock units that cliff vest, prorated to the extent full years of completed service or periods of performance, as applicable, at current projected performance multiple — reflecting the approximate after-tax value of those shares; and •100% of vested but deferred/unissued shares. | ||||||||

Compliance Status All directors and executives are in compliance with the guidelines or are within the five-year transition period. | What does not count toward stock ownership requirement •unvested restricted stock and restricted stock units, except as provided above; •unvested stock options; and •vested but not “in-the-money” stock options. | |||||||

56 | 2025 Proxy Statement | Prestige Consumer Healthcare Inc. | |

Prestige Consumer Healthcare Inc. | 2025 Proxy Statement | 57 | |

Fiscal | Salary | Bonus | Stock Awards(1) | Option Awards(2) | Non-Equity Incentive Plan Compensation(3) | All Other Compensation | Total | |||

Ronald M. Lombardi Chair, President, and Chief Executive Officer | 2025 | 1,003,564 | 4,000,008 | 0 | 1,134,000 | 55,447 | (4) | 6,193,019 | ||

2024 | 1,002,632 | 3,700,034 | 0 | 1,012,000 | 48,467 | (4) | 5,763,133 | |||

2023 | 1,002,322 | 3,600,031 | 0 | 934,000 | 46,756 | (4) | 5,583,109 | |||

Christine Sacco Chief Financial Officer and Chief Operating Officer | 2025 | 658,904 | 2,635,065 | (6) | 0 | 595,298 | 16,334 | (5) | 3,905,601 | |

2024 | 625,809 | 1,029,965 | 0 | 330,000 | 15,075 | (5) | 2,000,849 | |||

2023 | 605,809 | 666,712 | 333,327 | 339,042 | 14,062 | (5) | 1,958,952 | |||

Adel Mekhail Executive Vice President, Sales and Marketing | 2025 | 533,499 | 528,047 | — | 312,365 | 15,693 | (5) | 1,389,604 | ||

2024 | 516,583 | 515,013 | 0 | 271,920 | 15,018 | (5) | 1,318,534 | |||

2023 | 503,543 | 333,356 | 166,663 | 280,200 | 14,197 | (5) | 1,297,959 | |||