PROSPECTUS |

|

2,035,000 Shares

Common Stock

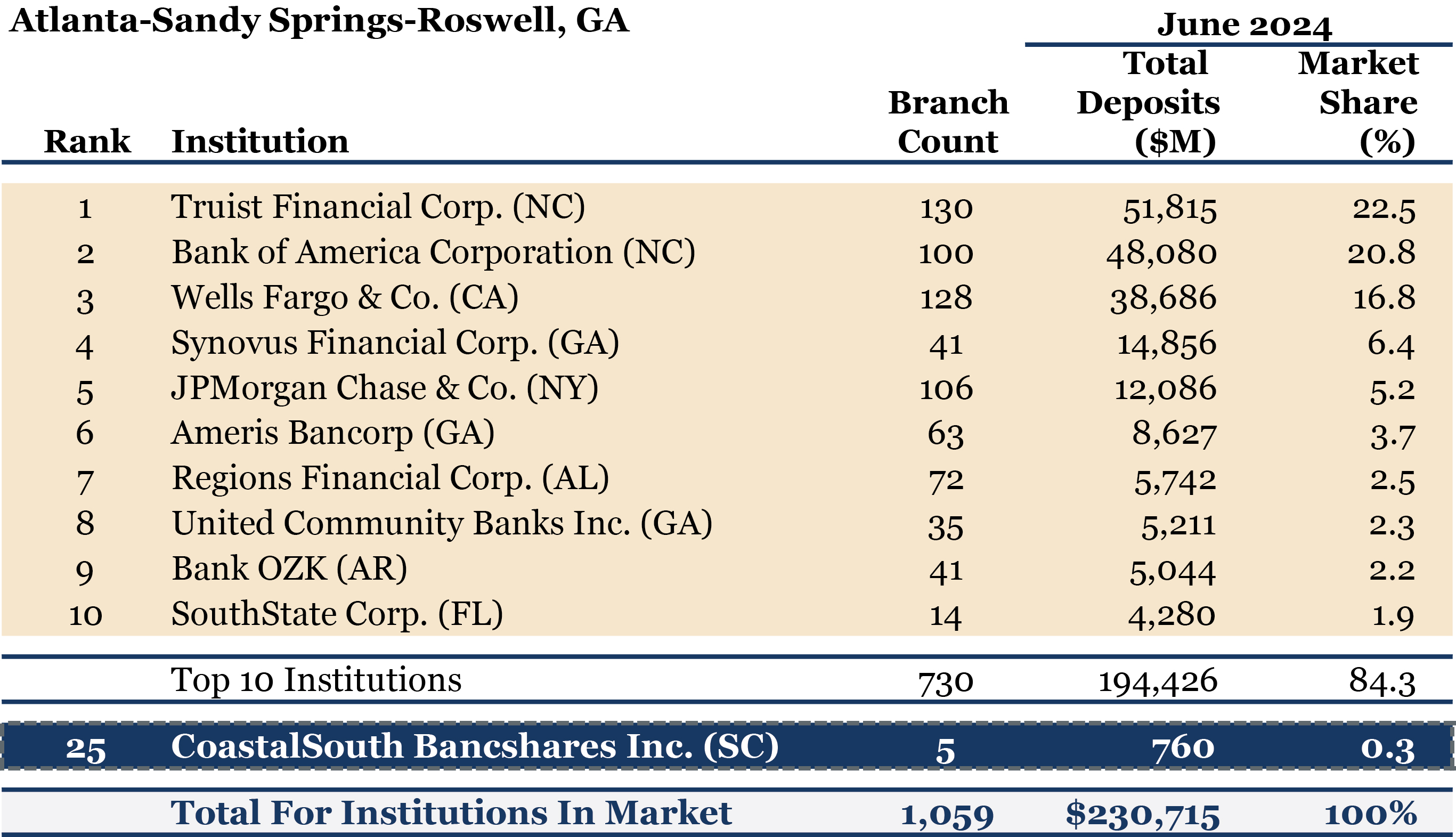

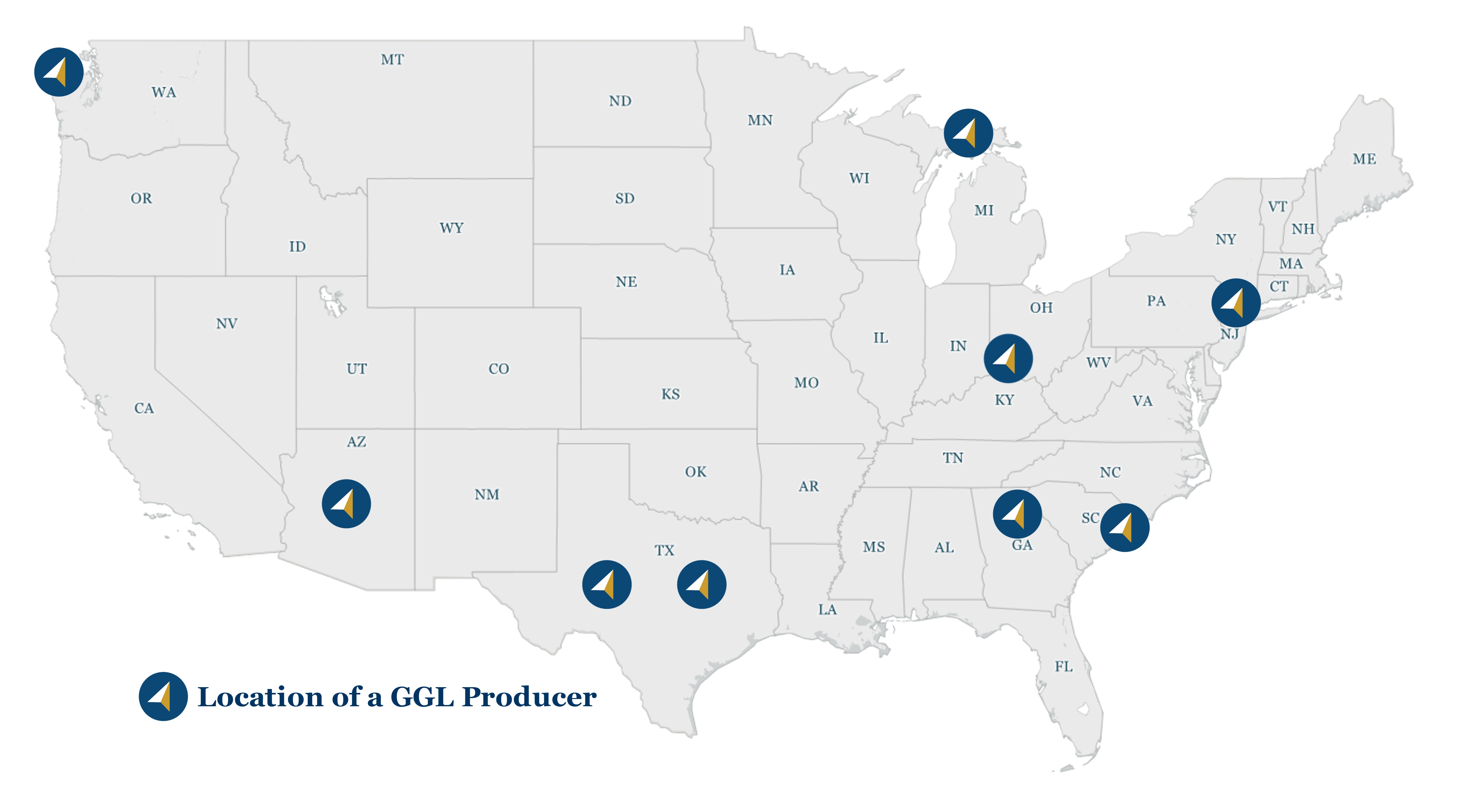

This is the initial public offering of CoastalSouth Bancshares, Inc. We are offering 1,700,000 shares of our voting common stock (our “common stock” or “voting common stock”) and the selling shareholders identified in this prospectus are offering an additional 335,000 shares of our common stock. We and the selling shareholders will be selling the shares of our common stock at the same fixed price. We will not receive any proceeds from the sale of shares of our common stock by the selling shareholders.

Our common stock is presently quoted on the OTC Market Group's OTCQX Best Market under the symbol “COSO.” On June 30, 2025, the last reported sale price of our common stock was $21.29 per share. The initial public offering price of our common stock is $21.50 per share. We have been approved to list our common stock on the New York Stock Exchange (“NYSE”) under the symbol “COSO.”

|

Investing in our common stock involves risk. See “Risk Factors” beginning on page 32 to read about factors you should consider before investing in our common stock.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, the Federal Deposit Insurance Corporation (the “FDIC”), the Board of Governors of the Federal Reserve System nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

These securities are not deposits, savings accounts or other obligations of any bank or savings association and are not insured or guaranteed by the FDIC or any other governmental agency and are subject to investment risks, including the possible loss of the entire amount you invest.

We are an “emerging growth company” and a “smaller reporting company” as defined under the U.S. federal securities laws and are subject to reduced public company reporting requirements.

|

|

Per share |

|

|

|

Total |

|

||||

Initial public offering price of our common stock |

|

$ |

|

21.50 |

|

|

|

$ |

|

43,752,500 |

|

Underwriting discounts and commissions (1) |

|

$ |

|

1.49 |

|

|

|

$ |

|

3,025,150 |

|

Proceeds to us, before expenses |

|

$ |

|

20.01 |

|

|

|

$ |

|

34,017,000 |

|

Proceeds to selling shareholders, before expenses |

|

$ |

|

20.01 |

|

|

|

$ |

|

6,703,350 |

|

(1) See “Underwriting” for additional disclosure regarding underwriting compensation and discounts.

This is a firm commitment underwritten offering. The selling shareholders have granted the underwriters an option to purchase up to an additional 305,250 shares of common stock from them at the initial public offering price less the underwriting discount within 30 days from the date of this prospectus.

The underwriters expect to deliver the shares to purchasers on or about July 3, 2025.

|

Sole Bookrunner |

Piper Sandler |

|

Lead Manager |

Stephens Inc. |

Prospectus dated July 1, 2025