Filed by the Registrant x | Filed by a Party other than the Registrant o |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under § 240.14a-12 |

x | No fee required. |

o | Fee paid previously with preliminary materials. |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2025 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

TO BE HELD ON MAY 6, 2025 |

iii | ||

Information About the Proxy Materials .............................................................. | |

Information About Voting ................................................................................. | |

Record Holders............................................................................................... | |

Beneficial Owners ........................................................................................... | |

Quorum Requirement ...................................................................................... | |

Costs of Soliciting Proxies ............................................................................... | |

Other Matters ................................................................................................. | |

Householding ................................................................................................. | |

Corporate Governance Profile ....................................................................... | |

Corporate Culture and Strategy ..................................................................... | |

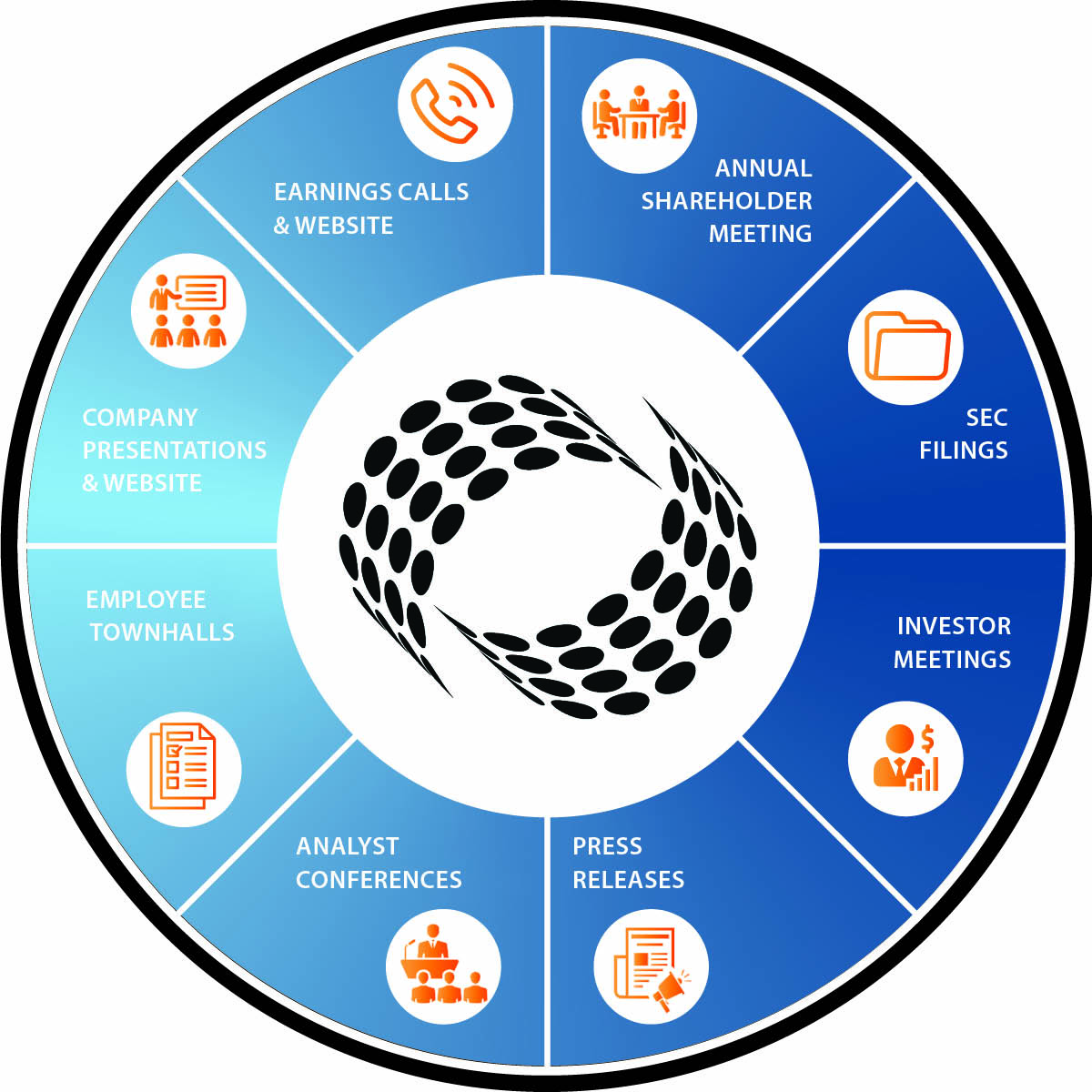

Stockholder Engagement ............................................................................. | |

Corporate Responsibility and Governance ..................................................... | |

Director Independence ................................................................................. | |

Clawback Policy .......................................................................................... | |

Equity Award Timing Policies and Practices ................................................... | |

Equity Retention Policy ................................................................................. | |

Communicating with Directors ....................................................................... | |

Selection of Director Nominees ..................................................................... | |

Audit Committee .......................................................................................... | |

Code of Ethics ............................................................................................. | |

Insider Trading Compliance Policy ................................................................. | |

Board Skills and Experience ......................................................................... | |

Board Composition ...................................................................................... | |

Our Board of Directors ................................................................................. | |

Director Compensation ................................................................................. | |

Director Compensation Table ........................................................................ | |

Equity Retention Policy ................................................................................. | |

Director Meetings Attendance ....................................................................... | |

Our Named Executive Officers ...................................................................... | |

Executive Summary ..................................................................................... | |

Funds From Operations ................................................................................ | |

Compensation Elements ............................................................................... | |

Good Governance and Best Practices ........................................................... | |

Equity Retention Policy ................................................................................. | |

Stockholder Interest Alignment ...................................................................... | |

Determination of Compensation .................................................................... | |

Executive Compensation Philosophy and Objectives ....................................... | |

Elements of Executive Compensation Program .............................................. | |

2024 Cash Target Awards and Resulting Awards Earned ................................ | |

Long-Term Equity-Based Inventive ................................................................ | |

Restricted Stock Unit Awards ........................................................................ | |

Performance-Based Restricted Stock Units .................................................... | |

Time-Based Restricted Stock Units ............................................................... | |

2022 Performance-Based Restricted Stock Unit Vesting .................................. | |

Other Elements of Compensation .................................................................. | |

Severance and Change in Control-Based Compensation ................................. | |

Tax and Accounting Considerations ............................................................... | |

Fiscal 2025 Compensation Decisions ............................................................ | |

Grants of Plan-Based Awards in 2024 ........................................................... | |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table .............................................................. | |

Outstanding Equity Awards at 2024 Year-End ................................................ | |

Stock Vested in 2024 ................................................................................... | |

Potential Payments Upon Termination or Change in Control ............................ | |

RSU Award Agreements ............................................................................... | |

CEO Pay Ratio Disclosure ............................................................................ | |

STOCK OWNERSHIP ..................................................................................... | |

STOCKHOLDER PROPOSALS ...................................................................... | |

A1 |

1 | ||

2 | ||

| MAIL: if you received a hard copy proxy card, you may complete and return it as instructed on the proxy card. If you received a Notice, you may request a proxy card at any time by following the instructions on the Notice. You may then complete the proxy card and return it by mail as instructed on the proxy card in the pre-addressed postage paid envelope provided. If mailed, your completed and signed proxy card must be received by May 5, 2025; |

| |

TELEPHONE: dial 1-800-690-6903 any time prior to 11:59 p.m. Eastern Time on May 5, 2025, with your Notice in hand and follow the instructions; or | |

| |

INTERNET: go to www.proxyvote.com any time prior to 11:59 p.m. Eastern Time on May 5, 2025, with your Notice in hand and follow the instructions to obtain your records and to create an electronic voting instruction form. | |

3 | ||

1 | PROPOSAL NO. 1: Election of eight directors, to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualify. A plurality of all the votes cast at the Annual Meeting shall be sufficient to elect a director. Each share may be voted for as many individuals as there are directors to be elected and for whose election the holder is entitled to vote. The Board unanimously recommends a vote FOR each of the nominees for director. | ||

2 | PROPOSAL NO. 2: Ratification of the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2025. A majority of the votes cast at the Annual Meeting shall be sufficient to approve Proposal No. 2. The Board unanimously recommends a vote FOR the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2025. | ||

3 | PROPOSAL NO. 3: Approval, on a non-binding advisory basis, of a resolution approving the compensation of our named executive officers as disclosed in this proxy statement pursuant to the SEC’s compensation disclosure rules (“say-on-pay”). A majority of the votes cast at the Annual Meeting shall be sufficient to approve Proposal No. 3. The Board unanimously recommends a vote FOR the approval on a non-binding, advisory basis, of a resolution approving the compensation of our named executive officers as disclosed herein pursuant to the SEC’s compensation disclosure rules. | ||

4 | ||

5 | ||

6 | ||

7 | ||

8 | ||

9 | ||

OUR COMPANY | |

ESG Strategy | •Annual reporting of our performance on environmental, social and governance (ESG) matters to our Board, with reporting by management to be done annually on strategy and performance to the Board, or more often as deemed appropriate. |

•Membership and participation in industry organizations focusing on sustainability including GRESB and the National Association of Real Estate Investment Trusts (“Nareit”). | |

Highlights | •Continue to strategically execute on the 5-year goals stated in our ESG Report. |

•InvenTrust has been involved with the GRESB Real Estate Assessment since 2013. | |

•InvenTrust has continued to expand on implementing the key principles of ESG and has an ongoing commitment to maximize value for its stakeholders in the long-term while conducting business in a socially, ethical and environmentally friendly manner. | |

•Conducted ESG training for all employees to stay current with industry trends. | |

ENVIRONMENTAL | |

Principle | •We focus on promoting sustainable culture practices through education, awareness, and opportunity in order to preserve our communities’ valuable resources for future generations. |

Highlights | •We set measurable 5-year reduction targets for energy, water, waste and greenhouse gas emissions. |

•20 properties received IREM Certified Sustainable Property designation. | |

•InvenTrust named a Green Lease Leader (Gold Level), fairly aligning financial and environmental benefits of sustainability initiatives for both InvenTrust and its tenants. | |

•Enlisted an independent third-party to perform limited assurance verification of property energy, water, waste and greenhouse gas data. | |

SOCIAL | |

Principle | •Our people give us a competitive advantage – we strive to hire and retain the best in real estate. |

Highlights | •We invest in our people through offering tuition reimbursement, continuing education, and training programs. |

•Superior benefits - our program focuses on our employees’ health and well-being, financial security, and work-life balance. | |

•InvenTrust named a Top Chicago Workplace in 2024 by The Chicago Tribune for the third year in a row. | |

•100% employee participation in volunteerism and/or charitable giving in 2024. | |

•100% employee participation in our Ethics, Anti-Harassment, Cyber security, and other corporate level trainings. | |

GOVERNANCE | |

Principle | •The structure and practices of our Board is committed to independence, education, and transparency. |

Highlights | •88% of our directors are independent. |

•50% of our independent directors are women and 50% are men. | |

•The Board conducts a robust annual review of all its governing documents to ensure that the Company is current and relevant regarding governance trends. | |

•Each new director goes through an on-boarding process to integrate them into the Company, its practices, and its people. | |

10 | ||

11 | ||

COVERED PERSON | MULTIPLE OF SALARY / RETAINER | ||

Non-Employee Director | 5x | ||

Chief Executive Officer | 5x | ||

Chief Financial Officer | 3x | ||

Chief Operating Officer | 3x |

12 | ||

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | |

MEMBERS**: Scott A. Nelson (Chairperson) Thomas F. Glavin Paula J. Saban Smita N. Shah | The nominating and corporate governance committee is responsible for, among other things: •identifying individuals qualified to become members of our Board, including conducting inquiries into the background and qualifications of any candidate, and recommending candidates for election to the Board at annual meetings of stockholders (or special meetings of stockholders at which directors are to be elected); •reviewing periodically the committee composition and structure of the Board and recommending to the Board the number and function of board committees and directors to serve as members of each committee of the Board; •reviewing periodically the Board leadership structure and recommending any proposed changes to the Board; •developing and recommending to the Board a set of corporate governance guidelines and, from time to time, reviewing such guidelines and the Company’s code of ethics and business conduct and recommending changes to the Board for approval as necessary; •overseeing and monitoring the Company’s sustainability, environmental and corporate social responsibility activities; and •overseeing the annual evaluations of the Board. |

NUMBER OF MEETINGS IN 2024: 4 | Each member of the nominating and corporate governance committee is independent as that term is defined in the rules and regulations of the SEC and the rules of the NYSE. |

13 | ||

14 | ||

AUDIT COMMITTEE | |

MEMBERS**: Amanda E. Black (Chairperson)* Thomas F. Glavin* Smita N. Shah Michael A. Stein* | The audit committee assists the Board in fulfilling its oversight responsibility relating to: •the integrity of our financial statements; •our compliance with legal and regulatory requirements; •the qualifications and independence of the independent registered public accounting firm; and •the performance of our internal audit function and independent auditors. |

NUMBER OF MEETINGS IN 2024: 4 *Our Board determined that each of Messrs. Glavin and Stein and Ms. Black qualifies as an “audit committee financial expert” as that term is defined in the rules of the SEC. | The audit committee is also responsible for, among other things: •appointing, or replacing the independent auditors and retaining, compensating, evaluating and overseeing the work of the independent auditors and any other registered public accounting firm engaged for the purpose of preparing or issuing an audit report; •preparing the audit committee report required by SEC regulations to be included in our annual report and proxy statement; •reviewing and discussing our annual and quarterly financial statements with management and the independent auditor; •reviewing and discussing with management, our independent auditors and the head of the internal audit team the adequacy of the Company’s internal audit function; •discussing our guidelines and policies with respect to risk assessment and risk management, and our major financial risk exposures and the steps management takes to monitor and control such exposures; •considering and discussing with management and our independent auditor our Code of Ethics and Business Conduct, and procedures in place to enforce such code, and, if appropriate, granting any requested waivers; •reviewing, and if need be proposing and recommending changes to, the Company’s Whistleblower Policy; •establishing procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters; •reviewing and approving related person transactions pursuant to our written policy described below under “Related Person Transaction Policy and Procedures;” and •reviewing and providing oversight of management’s cybersecurity risk management program. Each member of the audit committee is independent as that term is defined in the rules and regulations of the SEC and the rules of the NYSE. |

15 | ||

COMPENSATION COMMITTEE | |

MEMBERS**: Stuart W. Aiken (Chairperson) Paula J. Saban Michael A. Stein Julian E. Whitehurst NUMBER OF MEETINGS IN 2024: 4 | The compensation committee oversees the discharge of the responsibilities of the Board related to determining the compensation that we pay to our named executive officers, including our chief executive officer, and directors and oversees the evaluation of our management. |

The compensation committee is also responsible for, among other things: •periodically reviewing the human capital practices and compensation philosophy of the Company; •reviewing and approving the corporate goals and objectives with respect to the compensation of our CEO, evaluating the performance of our CEO and determining and approving the compensation of our CEO; •reviewing and setting, or making recommendations to the Board regarding, the compensation for all of our other “executive officers” (as such term is defined in Rule 16a-1 under the Exchange Act) other than our CEO; •reviewing and approving any employment and severance agreement for executive officers; •reviewing and making recommendations to the Board regarding director compensation; •reviewing and approving, or making recommendations to the Board regarding, the Company’s incentive compensation and equity-based plans and arrangements; •establishing, overseeing and/or reviewing all other executive compensation policies, plans and arrangements of the Company; •reviewing our incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk taking; •administering and overseeing compliance with the compensation recovery policy required by applicable SEC and NYSE rules; •reviewing the Company’s equity retention and ownership policy for named executive officers and the Board; and •overseeing and annually reviewing the Company’s human capital programs, including culture, inclusion and engagement, talent management, training and organizational health and wellness. | |

Consistent with the requirements of Rule 10C-1 of the Exchange Act and any other applicable listing requirements and rules and regulations of the NYSE, the committee: •has the sole and exclusive authority, as it deems appropriate to retain and/or replace, as needed, any independent counsel, compensation and benefits consultants and other outside experts or advisors as the committee believes to be necessary or appropriate (the “compensation advisors”); •has the direct responsibility to compensate and oversee any and all compensation advisors retained by the compensation committee; and •has the authority to also utilize the services of the Company’s regular legal counsel or other advisors to the Company. | |

Each member of the compensation committee is independent and meets the additional standards for the independence of compensation committee members set forth in Section 303A.02 of the NYSE Listed Company Manual, and each is a “non-employee director,” as defined by Section 16 of the Exchange Act. | |

16 | ||

17 | ||

18 | ||

Stuart W. Aitken | Amanda E. Black | Daniel J. Busch | Scott A. Nelson | Paula J. Saban | Smita N. Shah | Julie M. Swinehart | Julian E. Whitehurst | |||

Current or Former C-Suite | Contributes to an understanding of how our business, standards and performance are essential to protecting and increasing the value of the Company | • | • | • | • | • | • | |||

REITs or Real Estate | Provides an understanding of owning, managing, selling or leasing real estate and its affect on the business | • | • | • | • | • | ||||

Retail | Contributes to an understanding of the of how tenant mix affects the value and attractiveness of a center and the overall strategy of the Company | • | • | • | • | • | ||||

Finance & Accounting Expertise | Supports the oversight of our financial statements and strategy and financial reporting to investors and other stakeholders | • | • | • | • | • | • | |||

Legal Expertise | Provides an understanding and proficiency in legal principles, with the ability to analyze complex legal issues and provide informed advice | • | ||||||||

Public Company Expertise | Demonstrates a practical understanding of organizations, processes, governance and oversight of strategy, risk management and growth from the perspective of the Board and management | • | • | • | • | • | ||||

Technology | Contributes to an understanding of information technology capabilities, cloud computing, scalable data analytics and risks associated with cybersecurity matters | • |

19 | ||

Average Tenure | Average Age | Female Directors | Male Directors | Independent Directors | ||||||||

8 YEARS | 57 | 50% | 50% | 88% |

20 | ||

STUART W. AITKEN | Director Qualifications | Skills & Qualifications | |

Mr. Aitken is a seasoned technology and marketing executive who currently serves as President and Chief Executive Officer of Circana. He previously served as Chief Merchant and Marketing Officer of The Kroger Co. and as Chief Executive Officer of 84.51°, a wholly owned data analytics subsidiary of The Kroger Co. Prior to joining Kroger, Mr. Aitken served as the chief executive officer of dunnhumby USA, LLC from July 2010 to June 2015. Prior to that, he served as Executive Vice President and Chief Marketing Officer for arts-and-crafts retailer Michael’s Stores. Previously, he led marketing strategies, loyalty marketing, data analytics, innovation and category management at Safeway, Inc. for nearly a decade. Mr. Aitken received his Bachelor of Arts and Master of Science degrees in Information Management from Queen Margaret University and University of Strathclyde, respectively, both located in Scotland. | Current or Former C-Suite | ||

Retail | |||

Finance & Accounting Expertise | |||

Public Company Experience | |||

Director Since: 2017 Age: 53 | Technology | ||

Committees | |||

Compensation (Chair) | |||

AMANDA E. BLACK | Director Qualifications | Skills & Qualifications | |

Ms. Black served as the Managing Director and Global Chief Investment Officer of JLP Asset Management, where she oversees all investments globally for the firm. Prior to joining NWS in 2014, Ms. Black served as a Senior Vice President and Portfolio Manager at Ascent Investment Advisors from 2011 to 2014, where she co- managed a global REIT mutual fund and hedge fund. She has 20+ years of experience as an investor across a diverse set of investment firms and strategies with a specialization in real estate. Ms. Black holds an MBA from Saint Louis University and a B.S. from Southern Illinois University. She was a licensed CPA from 2001 to approximately 2004 and earned her CFA designation in 2005. | Current or Former C-Suite | ||

REITs or Real Estate | |||

Finance & Accounting Expertise | |||

Director Since: 2018 Age: 49 | |||

Committees | |||

Audit (Chair) | |||

21 | ||

DANIEL J. BUSCH | Director Qualifications | Skills & Qualifications | |

Mr. Busch serves as our President and Chief Executive Officer. Mr. Busch was appointed to the position of CEO & Director of InvenTrust in August 2021 and President of InvenTrust in February 2021. Mr. Busch joined InvenTrust in September 2019, and served as our Executive Vice President, Chief Financial Officer and Treasurer until August 2021, providing oversight to our financial and accounting practices, and ensuring the financial viability of the Company’s strategy. Prior to that, Mr. Busch served as Managing Director, Retail at Green Street Advisors, an independent research and advisory firm for commercial real estate industry in North America and Europe, where he conducted independent research on the shopping center, regional mall, and net lease sectors. Previously, Mr. Busch served as an equity research analyst at Telsey Advisory Group. He is a member of the Urban Land Institute, contributing as an active member on the Commercial and Retail Development Council. Mr. Busch received a B.S. in Applied Economics and Management from Cornell University and an MBA with specializations in general finance, financial instruments and markets from New York University. | Current or Former C-Suite | ||

REITs or Real Estate | |||

Retail | |||

Finance & Accounting Expertise | |||

Director Since: 2021 Age: 43 | Public Company Experience | ||

SCOTT A. NELSON | Director Qualifications | Skills & Qualifications | |

Mr. Nelson is Principal of SAN Prop Advisors, a retail real estate advisory firm that he started in early 2016. Clients of SAN Prop Advisors have included major retailers and shopping center developers. Most recently, he served in various senior-level real estate positions at Target Corporation including Senior Vice President Target Properties Canada from 2015 to 2016; Senior Vice President, Target Properties - U.S. in 2014; Senior Vice President, Target Real Estate from 2007 to 2014; and Vice President of Real Estate from 2000 to 2007. In these roles, he was instrumental in the acquisition, development, and optimization of Target’s retail real estate portfolio. He joined the Target real estate department in 1995. Previously, Mr. Nelson spent 10 years at Mervyn’s, a West Coast department store chain, where he served in various positions including Director of Real Estate. He is a member of the International Council of Shopping Centers and served as a Trustee and Executive Committee member of the organization. Since 2009, Mr. Nelson has served as a board member of Heart of America, a non-profit focused on volunteering and improving learning environments in public schools. He is a real estate development and REIT guest speaker at Florida Gulf Coast University. | REITs or Real Estate | ||

Retail | |||

Public Company Experience | |||

Director Since: 2016 Age: 69 | |||

Committees | |||

Nominating and Corporate Governance (Chair) | |||

22 | ||

PAULA J. SABAN | Director Qualifications | Skills & Qualifications | |

Ms. Saban has worked in the financial services and banking industry for over 25 years. She began her career in 1978 with Continental Bank, which later merged into Bank of America. From 1978 to 1990, Ms. Saban held various consultative sales roles in treasury management and traditional lending areas. She also managed client service teams and developed numerous client satisfaction programs. In 1990, Ms. Saban began designing and implementing various financial solutions for clients with Bank of America’s Private Bank and Banc of America Investment Services, Inc. Her clients included top management of publicly held companies and entrepreneurs. In addition to managing a diverse client portfolio, Ms. Saban was responsible for client management and overall client satisfaction. She retired from Bank of America in 2006 as a Senior Vice President/Private Client Manager. In 1994, Ms. Saban and her husband started a construction products company, Newport Distribution, Inc., of which she was secretary and treasurer, and a principal shareholder. The business was sold to a strategic buyer in 2021. Ms. Saban currently serves as a project-based development director of Interim Execs, a placement firm for interim CXO’s. Ms. Saban received her bachelor’s degree from MacMurray College, Jacksonville, Illinois, and her Master of Business Administration degree from DePaul University, Chicago, Illinois. She is a former president of the Fairview Elementary School PTA and a former trustee of both the Goodman Theatre and Urban Gateways. Ms. Saban served as the legislative chair of Illinois PTA District 37 and as liaison to the No Child Left Behind Task Force of School District 54. Ms. Saban previously served on the Board of Hands On Suburban Chicago, a not-for-profit organization that matches community and corporate volunteers of all ages and skills with opportunities to connect and serve. Ms. Saban is Co- Chair for Women Build, an initiative of Habitat for Humanity of Northern Fox Valley Illinois. Ms. Saban is a volunteer with the Naples Cancer Advisors. Ms. Saban is a member of the Private Directors Association of Chicago and Madame Chair. | Finance & Accounting Expertise | ||

Director Since: 2004 Age: 71 | |||

Committees | |||

Audit Compensation Nominating & Corporate Governance | |||

23 | ||

SMITA N. SHAH | Director Qualifications | Skills & Qualifications | |

Ms. Shah is the founder and Chief Executive Officer of SPAAN Tech, Inc., an architecture, engineering, and project management firm with 20+ years expertise in public and private infrastructure projects including transportation, aviation, facilities, and telecommunications systems. She has an extensive business and technical background, earning her Bachelor of Science from Northwestern University, a Master of Science in Civil and Environmental Engineering from M.I.T., and a Post Graduate Certificate in Management Studies from Oxford University. In recognition of Ms. Shah’s leadership and commitment to the community, she was appointed by President Biden to the President’s Commission on Asian Americans, Native Hawaiians and Pacific Islanders. Her additional civic engagement includes Board Member of the Museum of Science and Industry, Trustee of the Lincoln Academy of Illinois, Visiting Committee for MIT Department of Civil and Environmental Engineering, Environmental Law and Policy Center, and Harris School Council at University of Chicago. She was the recent past Vice Chairman of Chicago Plan Commission, supporting the development of the Chicago of Chicago for the past 14 years. Ms. Shah serves on the board of MacLean Fogg Company and is a member of the audit committee. She is a Co-Chair of Young President’s Organization (YPO) Chicago, and a member of the Economic Club and Commercial Club of Chicago. Ms. Shah also served as a U.S. delegate for the APEC Women and the Economy Forum (WEF) and is a recipient of the congressionally recognized Ellis Island Medal of Honor. | Current or Former C-Suite | ||

Director Since: 2022 Age: 51 | |||

Committees | |||

Audit Nominating & Corporate Governance | |||

24 | ||

JULIAN E. WHITEHURST | Director Qualifications | Skills & Qualifications | |

Mr. Whitehurst served as a director and as Chief Executive Officer of National Retail Properties, Inc. from 2017 to 2022. He joined National Retail Properties in 2003 and subsequently served in various executive roles, including General Counsel, Chief Operating Officer and President prior to being appointed Chief Executive Officer. He retired as Chief Executive Officer and resigned from the board of directors of National Retail Properties, Inc. in April 2022. Prior to joining National Retail Properties in 2003, Mr. Whitehurst was a partner at the Lowndes Law Firm. Mr. Whitehurst has served in leadership and service roles in various charitable and education related non-profits, as well as industry associations Nareit and ICSC. | Current or Former C-Suite | ||

REITs or Real Estate | |||

Retail | |||

Finance & Accounting Expertise | |||

Legal Expertise | |||

Director Since: 2016 Chairperson Since: 2024 Age: 67 | Public Company Experience | ||

Committees | |||

Compensation | |||

JULIE M. SWINEHART | Director Qualifications | Skills & Qualifications | |

Ms. Swinehart currently serves as the Executive Vice President, Chief Financial Officer of Fenway Sports Group, a global sports, marketing, media, entertainment and real estate company, since July 2022. Prior to this position, Ms. Swinehart held the position of Executive Vice President, Chief Financial Officer & Treasurer at Retail Properties of America, Inc. (“RPAI”), until its merger with Kite Realty Group Trust in 2021. During her thirteen years with RPAI, Ms. Swinehart held various accounting and financial reporting positions including the role of Chief Accounting Officer, prior to her appointment as CFO in 2018. Earlier in her career, Ms. Swinehart was a Manager of External Reporting at Equity Office Properties Trust for two years, and she spent eight years in public accounting in the audit practices of Arthur Andersen LLP and Deloitte & Touche LLP. Ms. Swinehart received her B.S. in accountancy from the University of Illinois at Urbana-Champaign and is a Certified Public Accountant. | Current or Former C-Suite | ||

REITs or Real Estate | |||

Retail | |||

Finance & Accounting Expertise | |||

Director Since: 2025 Age: 49 | Public Company Experience | ||

Committees | |||

Audit Compensation | |||

25 | ||

ANNUAL INDEPENDENT DIRECTOR COMPENSATION |

ADDITIONAL CASH COMPENSATION | |||

CHAIR | MEMBER | ||

Independent Chairperson | $50,000 | - | |

Audit Committee | $25,000 | $12,500 | |

Compensation Committee | $20,000 | $10,000 | |

Nominating & Corporate Governance Committee | $20,000 | $10,000 | |

26 | ||

NAME (1) | FEES EARNED OR PAID IN CASH ($) (2) | STOCK AWARDS ($) (3) (4) | TOTAL ($) |

Stuart W. Aitken | $88,125 | $120,000 | $208,125 |

Amanda E. Black | $89,375 | $120,000 | $209,375 |

Thomas F. Glavin(5) | $90,625 | $120,000 | $210,625 |

Scott A. Nelson | $82,500 | $120,000 | $202,500 |

Paula J. Saban | $95,000 | $120,000 | $215,000 |

Smita N. Shah | $85,000 | $120,000 | $205,000 |

Michael A. Stein(5) | $87,500 | $120,000 | $207,500 |

Julian E. Whitehurst | $115,000 | $120,000 | $235,000 |

27 | ||

28 | ||

29 | ||

30 | ||

31 | ||

32 | ||

33 | ||

TOTAL COMPENSATION | |||

Compensation Component | Component Element | Component Objective | |

Fixed | Base Salary | To compensate ongoing performance of job responsibilities and provide a fixed minimum income level as a necessary tool in attracting and retaining executives. | |

Performance Based | Annual Cash Bonus | To incentivize the attainment of annual financial, operational and personal objectives and individual contributions to the achievement of those objectives. | |

Long-Term Equity Incentive Compensation | To provide incentives that are linked directly to increases in value of the Company as a result of the execution of our long-term plans. | ||

Benefits | Retirement savings - 401(k) plan | To provide retirement savings in a tax-efficient manner. | |

Health and Welfare Benefits | To provide typical protections from health, dental, death and disability risks. | ||

34 | ||

35 | ||

NAME | 2024 ANNUAL BASE SALARY | |

Daniel J. Busch | $900,000 | |

Christy L. David | $550,000 | |

Michael D. Phillips | $500,000 | |

36 | ||

NAME | THRESHOLD | TARGET | MAXIMUM | |

(% of annual base salary) | (% of annual base salary) | (% of annual base salary) | ||

Daniel J. Busch | 86.25% | 150% | 213.75% | |

Christy L. David | 66.13% | 115% | 163.88% | |

Michael D. Phillips | 66.13% | 115% | 163.88% | |

37 | ||

2024 Company Performance Target: Same Property NOI (2023 - 2024) | ||||

Threshold 0.5X | Target 1.0X | Maximum 1.5X | 2024 Results | Performance to Target Achieved 1 |

2.3% | 2.8% | 3.3% | 5.0% | 1.50X |

Why is this metric important? | ||||

We evaluate the performance of our retail properties based on NOI, which excludes general and administrative expenses, depreciation and amortization, other income and expense, net, gains (losses) from sales of properties, gains (losses) on extinguishment of debt, impairment of real estate assets, interest expense, net, equity in earnings (losses) from unconsolidated entities, lease termination income and expense, and GAAP rent adjustments such as amortization of market lease intangibles, amortization of lease incentives, and straight-line rent adjustments. We use Same Property NOI as an input to our compensation plan to determine cash bonuses and measure the achievement of certain performance-based equity awards. | ||||

Target | ||||

The 2024 Company Performance Target for Same Property NOI growth was 2.8%. The target level was set based on the Company’s expectations for the year. | ||||

Performance | ||||

Actual Same Property NOI, performance was 5.0%, resulting in an achievement of 150% of target. | ||||

2024 Company Performance Target: Core FFO Per Diluted Share | ||||

Threshold 0.5X | Target 1.0X | Maximum 1.5X | 2024 Results | Performance to Target Achieved 1 |

$1.65 | $1.68 | $1.71 | $1.73 | 1.50X |

Why is this metric important? | ||||

Core FFO provides an additional measure to compare the operating performance of different REITs without having to account for certain remaining amortization assumptions within Nareit FFO and other unique revenue and expense items which are not pertinent to measuring a particular company’s on-going operating performance. We use Core FFO as an input to our compensation plan to determine cash bonuses and measure the achievement of certain performance- based equity awards. | ||||

Target | ||||

The 2024 Company Performance Target for Core FFO per diluted share was $1.68 per share. The target level was set based on the Company’s expectations for the year. | ||||

Performance | ||||

Actual Core FFO per diluted share was $1.73, resulting in an achievement of 150% of target. | ||||

38 | ||

NAME | 2024 BASE SALARY | TARGET BONUS AS % OF SALARY | TARGET BONUS POTENTIAL | ACTUAL 2024 ANNUAL BONUS | COMBINED ACHIEVEMENT FACTOR AS A PERCENTAGE OF TARGET | |

Daniel J. Busch | $900,000 | 150% | $1,350,000 | $1,923,750 | 143% | |

Christy L. David | $550,000 | 115% | $632,500 | $901,313 | 143% | |

Michael D. Phillips | $500,000 | 115% | $575,000 | $805,000 | 140% | |

NAME | NUMBER OF RSUs1 |

Daniel J. Busch | 178,293 |

Christy L. David | 83,533 |

Michael D. Phillips | 75,940 |

INCOME AWARD GRANTS | 67% | 3-Year Performance Based LTI Award | Three year cliff vesting based on total shareholder return relative to NAREIT shopping center index (“NAREIT SCI”) |

33% | 3-Year Time Based LTI Award | Annual vesting of one-third award, subject to continued employment | |

39 | ||

LEVEL TYPE | INDEX RELATIVE PERFORMANCE | RELATIVE TSR PERFORMANCE VESTING PERCENTAGE |

≤ 25th Percentile | 0% | |

“Threshold Level” | > 25th Percentile | 25% |

“Target Level” | > 50th Percentile | 50% |

“Maximum Level” | > 75th Percentile | 100% |

40 | ||

41 | ||

42 | ||

NAME (1) | 2025 ANNUAL BASE SALARY |

Daniel J. Busch | $950,000 |

Christy L. David | $575,000 |

Michael D. Phillips | $525,000 |

43 | ||

NAME AND PRINCIPAL POSITION | YEAR | SALARY($) | BONUS($) | STOCK AWARDS ($) (1) | NON-EQUITY INCENTIVE PLAN COMPENSATION ($) (2) | ALL OTHER COMPENSATION ($)(3) | TOTAL($) |

Daniel J. Busch | 2024 | 900,000 | - | 3,264,391 | 1,923,750 | 7,508 | 6,095,649 |

President and Chief Executive Officer | 2023 | 850,000 | - | 3,158,279 | 1,581,000 | 11,712 | 5,600,991 |

2022 | 800,000 | - | 2,834,988 | 1,479,600 | 7,160 | 5,121,748 | |

Christy L. David | 2024 | 550,000 | - | 1,529,423 | 901,313 | 7,392 | 2,988,128 |

Executive Vice President, Chief Operating Officer, General Counsel and Secretary | 2023 | 525,000 | - | 1,495,554 | 748,650 | 11,450 | 2,780,654 |

2022 | 500,000 | - | 1,358,420 | 708,975 | 7,158 | 2,574,553 | |

Michael D. Phillips | 2024 | 500,000 | - | 1,390,397 | 805,000 | 7,337 | 2,702,734 |

Executive Vice President, Chief Financial Officer and Treasurer | 2023 | 475,000 | - | 1,353,125 | 677,350 | 11,256 | 2,516,731 |

2022 | 450,000 | - | 1,222,604 | 638,078 | 7,095 | 2,317,777 | |

NAME | COMPANY CONTRIBUTIONS TO 401(K) PLAN ($) | LIFE INSURANCE PREMIUMS ($) | TOTAL ($) |

Daniel J. Busch | 6,000 | 1,508 | 7,508 |

Christy L. David | 6,000 | 1,392 | 7,392 |

Michael D. Phillips | 6,000 | 1,337 | 7,337 |

44 | ||

NAME | GRANT DATE | ESTIMATED FUTURE PAYOUT UNDER NON-EQUITY INCENTIVE PLAN AWARDS (1) | ESTIMATED FUTURE PAYOUT UNDER EQUITY INCENTIVE PLAN AWARDS (2) | ALL OTHER STOCK AWARDS: NUMBER OF STOCK OR SHARE UNIT (#)(3) | GRANT DATE FAIR VALUE OF STOCK AWARDS ($) (4) | ||||

THRESHOLD ($) | TARGET ($) | MAX ($) | THRESHOLD (#) | TARGET (#) | MAX (#) | ||||

Daniel J. Busch | N/A | 776,250 | 1,350,000 | 1,923,750 | - | - | - | - | - |

2/21/2024 | - | - | - | - | - | - | 35,231 | 890,992 | |

2/21/2024 | - | - | - | 35,766 | 71,531 | 143,062 | - | 2,373,399 | |

Christy L. David | N/A | 363,688 | 632,500 | 901,313 | - | - | - | - | - |

2/21/2024 | - | - | - | - | - | - | 16,507 | 417,462 | |

2/21/2024 | - | - | - | 16,757 | 33,513 | 67,026 | - | 1,111,961 | |

Michael D. Phillips | N/A | 330,625 | 575,000 | 819,375 | - | - | - | - | - |

2/21/2024 | - | - | - | - | - | - | 15,006 | 379,502 | |

2/21/2024 | - | - | - | 15,234 | 30,467 | 60,934 | - | 1,010,895 | |

45 | ||

NAME | GRANT DATE | NUMBER OF RSUs THAT HAVE NOT VESTED (#) | MARKET VALUE OF RSUs THAT HAVE NOT VESTED ($)(1) | NUMBER OF UNEARNED RSUs THAT HAVE NOT VESTED (#) | MARKET VALUE OF UNEARNED RSUs THAT HAVE NOT VESTED ($)(1) |

Daniel J. Busch | February 23, 2022(2) | 62,248 | 1,875,532 | — | — |

February 22, 2023(3) | 11,736 | 353,606 | — | — | |

February 22, 2023(4) | — | — | 140,156 | 4,222,900 | |

February 21, 2024 (5) | 23,605 | 711,219 | — | — | |

February 21, 2024 (6) | — | — | 143,062 | 4,310,458 | |

Christy L. David | February 23, 2022(2) | 29,827 | 898,688 | — | — |

February 22, 2023(3) | 5,557 | 167,432 | — | — | |

February 22, 2023(4) | — | — | 66,368 | 1,999,668 | |

February 21, 2024 (5) | 11,060 | 333,238 | — | — | |

February 21, 2024 (6) | — | — | 67,026 | 2,019,493 | |

Michael D. Phillips | February 23, 2022(2) | 26,845 | 808,840 | — | — |

February 22, 2023(3) | 5,028 | 151,494 | — | — | |

February 22, 2023(4) | — | — | 60,048 | 1,809,246 | |

February 21, 2024 (5) | 10,054 | 302,927 | — | — | |

February 21, 2024 (6) | — | — | 60,934 | 1,835,941 | |

46 | ||

NAME | NUMBER OF SHARES ACQUIRED ON VESTING (#) | VALUES REALIZED ON VESTING ($)(1) |

Daniel J. Busch | 67,264 | 1,850,603 |

Christy L. David | 35,489 | 968,495 |

Michael D. Phillips | 21,891 | 617,331 |

47 | ||

48 | ||

NAME | BENEFIT | CHANGE OF CONTROL (NO TERMINATION) ($) (1) | TERMINATION UPON DEATH OR DISABILITY (NO CHANGE IN CONTROL) ($) (2) | TERMINATION WITHOUT CAUSE OR FOR GOOD REASON (NO CHANGE IN CONTROL) ($) | TERMINATION WITHOUT CAUSE OR FOR GOOD REASON (CHANGE IN CONTROL ) ($) (3) |

Cash Severance (4) | — | — | 4,500,000 | 6,750,000 | |

Daniel J. | Accelerated Vesting of RSU Awards (5) | 9,331,291 | 6,833,243 | 5,768,419 | 10,396,115 |

Busch | Company-Paid COBRA Premiums (6) | — | — | 56,670 | 56,670 |

Total | 9,331,291 | 6,833,243 | 10,325,089 | 17,202,785 | |

Cash Severance (4) | — | — | 1,773,750 | 2,956,250 | |

Christy L. | Accelerated Vesting of RSU Awards (5) | 4,412,990 | 3,237,348 | 2,736,678 | 4,913,661 |

David | Company-Paid COBRA Premiums (6) | — | — | 56,670 | 56,670 |

Total | 4,412,990 | 3,237,348 | 4,567,098 | 7,926,581 | |

Cash Severance (4) | — | — | 1,612,500 | 2,687,500 | |

Michael D. | Accelerated Vesting of RSU Awards (5) | 3,995,057 | 2,928,425 | 2,474,004 | 4,449,478 |

Phillips | Company-Paid COBRA Premiums (6) | — | — | 56,670 | 56,670 |

Total | 3,995,057 | 2,928,425 | 4,143,174 | 7,193,648 |

49 | ||

50 | ||

SUMMARY COMPENSATION TABLE TOTAL | COMPENSATION ACTUALLY PAID TO (a) (b): | AVERAGE SUMMARY COMPENSATION TABLE TOTAL FOR NON-PEO NEOS ($) | AVERAGE COMPENSATION ACTUALLY PAID TO NON-PEO NEOS ($) (a) (b) | VALUE OF INITIAL FIXED $100 INVESTMENT BASED ON (C): | ||||||

YEAR | PEO 1($) | PEO 2($) | PEO 1($) | PEO 2($) | TOTAL SHAREHOLDER RETURN ($) (c) | PEER GROUP TOTAL SHAREHOLDER RETURN ($) (d) | NET INCOME / (LOSS) (e) | CORE FFO PER DILUTED SHARE ($) (f) | ||

2024 | N/A | N/A | ||||||||

2023 | N/A | N/A | ||||||||

2022 | N/A | N/A | ||||||||

2021 | ( | |||||||||

2020 | N/A | N/A | N/A | N/A | ( | |||||

YEAR | PEO 1 | PEO 2 | NON-PEO NEOS |

2024 | Christy L. David Michael D. Phillips | ||

2023 | Christy L. David Michael D. Phillips | ||

2022 | Christy L. David Michael D. Phillips | ||

2021 | Christy L. David Michael D. Phillips | ||

2020 | Daniel J. Busch Christy L. David Ivy Z. Greaner |

51 | ||

2024 | ||

ADJUSTMENTS | PEO 1($) | AVERAGE NON-PEO NEOS ($) |

Total reported in Summary Compensation Table (SCT) | ||

Deduction for value of stock awards reported in SCT | ( | ( |

Increase for ASC 718 fair value of awards granted during the covered fiscal year that remain unvested and outstanding as of the end of the covered fiscal year | ||

Increase for ASC 718 fair value of awards granted and vested in the covered fiscal year | ||

Increase for change in ASC 718 fair value of awards granted in prior fiscal years that remain unvested and outstanding as of the covered fiscal year | ||

Increase for change in ASC 718 fair value of awards granted in prior fiscal years that vested in the covered fiscal year | ||

Deduction for ASC 718 fair value of awards granted in prior fiscal years that were forfeited during the covered fiscal year | ( | ( |

Increase for dividends or other earnings paid during the covered fiscal year prior to vesting date | ||

Total adjustments | ||

Compensation Actually Paid | ||

52 | ||

53 | ||

54 | ||

NAME & ADDRESS (WHERE REQUIRED) OF BENEFICIAL OWNER | AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP (1) | % OF SHARES OUTSTANDING (9) |

5% OWNERS | ||

The Vanguard Group (2) | 9,496,613 | 12.3% |

100 Vanguard Blvd., Malvern, PA 19355 | ||

BlackRock, Inc. (3) | 6,989,087 | 9.0% |

50 Hudson Yards, New York, NY 10001 | ||

Principal Real Estate Investors, LLC (4) | 3,992,211 | 5.2% |

801 Grand Avenue, Des Moines, IA 50392 | ||

DIRECTORS AND NEOS: | ||

Daniel J. Busch, President & Chief Executive Officer, Director (5) | 106,858 | * |

Christy L. David, Executive Vice President, Chief Operating Officer, General Counsel & Secretary | 71,249 | * |

Michael D. Phillips, Executive Vice President, Chief Financial Officer & Treasurer | 36,442 | * |

Julian E. Whitehurst, Chairperson of the Board (6) | 30,180 | * |

Stuart W. Aitken, Director (6) | 24,513 | * |

Amanda E. Black, Director (6) | 22,546 | * |

Thomas F. Glavin, Director (6)(7) | 34,725 | * |

Scott A. Nelson, Director (6) | 28,178 | * |

Paula J. Saban, Director (6)(8) | 30,777 | * |

Smita N. Shah, Director (6) | 12,072 | * |

Michael A. Stein, Director (6) | 27,719 | * |

All Executive Officers and Directors as a Group | 425,259 |

55 | ||

56 | ||

57 | ||

NAME | YEAR ENDED DECEMBER 31, | |

2024 | 2023 | |

Audit fees (1) | $1,300,000 | $1,080,000 |

Audit-related fees | — | — |

Tax fees (2)(3) | 69,237 | 87,252 |

All other fees | — | — |

Total | $1,369,237 | $1,167,252 |

58 | ||

59 | ||

60 | ||

61 | ||

A 1 | ||

A 2 | ||

YEAR ENDED DECEMBER 31, | |||||

2024 | 2023 | 2022 | |||

Net income | $13,658 | $5,269 | $52,233 | ||

Depreciation and amortization related to investment properties | 113,055 | 112,578 | 94,142 | ||

Impairment of real estate assets | 3,854 | — | — | ||

Gain on sale of investment properties, net | (3,857) | (2,691) | (38,249) | ||

Unconsolidated joint venture adjusting items (a) | — | 342 | 3,850 | ||

Nareit FFO Applicable to Common Shares and Dilutive Securities | 126,710 | 115,498 | 111,976 | ||

Amortization of market-lease intangibles and inducements, net | (2,804) | (3,343) | (5,589) | ||

Straight-line rent adjustments, net | (3,400) | (3,349) | (3,815) | ||

Amortization of debt discounts and financing costs | 2,403 | 4,113 | 2,816 | ||

Depreciation and amortization of corporate assets | 893 | 852 | 810 | ||

Non-operating income and expense, net (b) | (1,033) | (1,821) | (828) | ||

Unconsolidated joint venture adjusting items, net (c) | — | (92) | 582 | ||

Core FFO Applicable to Common Shares and Dilutive Securities | $122,769 | $111,858 | $105,952 | ||

Weighted average common shares outstanding - basic | 70,394,448 | 67,531,898 | 67,406,233 | ||

Dilutive effect of unvested restricted shares (d) | 616,120 | 281,282 | 119,702 | ||

Weighted average common shares outstanding - diluted | 71,010,568 | 67,813,180 | 67,525,935 | ||

Net income per diluted share | $0.19 | $0.08 | $0.77 | ||

Nareit FFO per diluted share | $1.78 | $1.70 | $1.66 | ||

Core FFO per diluted share | $1.73 | $1.65 | $1.57 | ||