Please wait

.2

____

.

Forward-Looking Statements

These earnings supplemental materials contain forward-looking statements including, but not limited to, statements about management’s plans, goals, expectations, and guidance and assumptions with respect to future financial performance of the Company. Any statements in these supplemental materials that are not statements of historical facts are forward-looking statements. When used in these supplemental materials, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will,” “positions,” “confidence,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. Forward-looking statements relate to our future plans, objectives, expectations, and intentions and are not historical facts and accordingly involve known and unknown risks and uncertainties and other factors that may cause the actual results or performance to be materially different from future results or performance expressed or implied by these forward-looking statements. The following factors, among others, could cause actual results to differ materially from those contained in forward-looking statements made in these supplemental materials and in oral statements made by our authorized officers:

•the impact of fluctuations in the amount of fuel purchased and sold by our customers and retail partners, respectively, fuel price volatility, and the actual price of fuel, including fuel spreads in the Company’s international markets, and the resulting impact on the Company’s results, including margins, revenues, and net income;

•the effects of general economic conditions and the amount of business activity in the economies in which we operate, particularly in the U.S., Europe, and the United Kingdom, including, but not limited to, conditions resulting from market volatility, an economic recession, the impact of tariffs or international trade wars, increasing unemployment, and declining consumer confidence, which may lead to, among other things, a decline or stagnation in demand for fuel, corporate payment services, travel related services, or employee benefits related products and services;

•the failure to meet the applicable requirements or commitments under Mastercard or Visa contracts and rules;

•the extent to which unpredictable events in the locations in which the Company or the Company’s customers operate or elsewhere may adversely affect the Company’s employees, ability to conduct business, results of operations and financial condition;

•the impact and size of credit losses, including fraud losses, and other adverse effects if the Company fails to adequately assess and monitor credit risk or fraudulent use of our payment cards or systems;

•the impact of changes to the Company’s credit standards;

•limitations on, or compression of, interchange fees, including as a result of regulatory changes;

•the effect of adverse financial conditions affecting the banking system;

•failure to implement new technologies and products;

•the failure to realize or sustain the expected benefits from investments in our capabilities and other initiatives;

•the failure to compete effectively in order to maintain or renew key customer and partner agreements and relationships, to maintain volumes under such agreements or to favorably differentiate ourselves from our competitors;

•the ability to attract and retain employees;

•the ability to execute the Company’s business expansion and acquisition efforts and realize the benefits of acquisitions we have completed;

•the failure to achieve commercial and financial benefits as a result of our strategic minority equity investments;

•the impact of foreign currency exchange rates on the Company’s operations, revenue and income and other risks associated with our operations outside the United States;

•the failure to adequately safeguard custodial HSA assets;

•the incurrence of impairment charges if the Company’s assessment of the fair value of certain of its reporting units or assets changes;

•the uncertainties of investigations and litigation;

•the ability of the Company to protect its intellectual property and other proprietary rights;

•the impact of actions of activist investors including costs and expenses incurred to address activism-related matters and the distraction of management from business operations in responding to those actions, including any proposals or proxy contest for the election of directors at our annual meeting of stockholders;

•the impact of market volatility, regulatory capital requirements and other regulatory requirements on the operations of WEX Bank or its ability to make payments to WEX Inc.;

•the impact of the Company’s debt instruments on the Company’s operations;

•the impact of increased leverage on the Company’s operations, results or borrowing capacity generally;

•our ability to achieve our capital allocation priorities;

•changes in interest rates, including those which we must pay for our deposits, those which we earn on our investment securities, and the resultant potential impacts to our debt securities subject to early call provisions;

•the ability to refinance certain indebtedness or obtain additional financing;

•the actions of regulatory bodies, including tax, banking and securities regulators, or possible changes in tax, banking or financial regulations impacting the Company’s industrial bank, the Company as the corporate parent or other subsidiaries or affiliates;

•the failure to comply with the Treasury Regulations applicable to non-bank custodians;

•the impact from breaches of, or other issues with, the Company’s technology systems or those of its third-party service providers and any resulting negative impact on the Company’s reputation, liabilities or relationships with customers or merchants;

•the impact of regulatory developments with respect to privacy and data protection;

•the impact of any disruption to the technology and electronic communications networks we rely on;

•the ability to adopt, implement and use artificial intelligence technologies across our business successfully and ethically;

•the ability to maintain effective systems of internal controls;

•the failure to repurchase shares at favorable prices, if at all;

•the impact of provisions in our charter documents, Delaware law and applicable banking laws that may delay or prevent our acquisition by a third party; as well as

•other risks and uncertainties identified in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the Securities and Exchange Commission on February 20, 2025, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, filed with the SEC on May 1, 2025 and subsequent filings with the SEC.

The forward-looking statements speak only as of the date of the initial filing of these earnings supplemental materials and undue reliance should not be placed on these statements. The Company disclaims any obligation to update any forward-looking statements as a result of new information, future events, or otherwise.

Non-GAAP Information:

For additional important information and disclosure regarding our use of non-GAAP metrics, specifically, adjusted net income, adjusted net income per diluted share, total segment adjusted operating income and margin, adjusted operating income and margin, and adjusted free cash flow, please see our most recent earnings release issued on February 4, 2026. In addition, see Exhibit 1 to this earnings supplement for an explanation and reconciliation of (i) GAAP operating income to non-GAAP total segment adjusted operating income and adjusted operating income, (ii) GAAP net income to non-GAAP adjusted net income, (iii) GAAP net income per diluted share to non-GAAP adjusted net income per diluted share, and (iv) GAAP operating cash flow to non-GAAP adjusted free cash flow.

Note:

The Company rounds amounts to millions within tables and text (unless otherwise specified), and calculates all percentages and per-share data from underlying whole-dollar amounts. As a result, certain amounts may not foot, crossfoot, or recalculate based on reported numbers due to rounding. Within the tables below, we present the impact of FX and PPG changes on various financial metrics. To determine the estimated earnings impact of FX on revenue and expenses from entities whose functional currency is not denominated in U.S. dollars, as well as revenue and variable expenses from purchase volume transacted in non-U.S. denominated currencies, amounts were translated using the weighted average exchange rates for the same period in the prior year, net of tax, exclusive of revenue and expenses derived from acquisitions for one year following the acquisition dates. To determine the estimated earnings impact of PPG, revenue and certain variable expenses impacted by changes in fuel prices were adjusted based on the average retail price of fuel for the same period in the prior year for the portion of our business that earns revenue based on a percentage of fuel spend, net of applicable taxes, exclusive of revenue and expenses derived from acquisitions for one year following the acquisition dates. For the portions of our business that earn revenue based on margin spreads, revenue was adjusted to the comparable margin from the prior year, net of non-controlling interests and applicable taxes.

Financial Results

•Total revenue for Q4 2025 increased $36.3 million, or 5.7%, compared to Q4 2024, including a net $3.3 million favorable impact from fuel prices and spreads and a $4.2 million favorable impact from foreign exchange rates. Q4 net income was $2.41 per diluted share, an increase of 50.6% compared to the prior year. Q4 adjusted net income was $4.11 per diluted share, an increase of 15.1% compared to the prior year.

•Q4 2025 results were better than previous guidance, largely due to higher-than-anticipated fuel prices and a strong quarter in the Benefits segment. Fuel prices trended higher than the guidance assumption, which increased revenue above the top end of the guidance range. The higher fuel prices also pushed adjusted EPS above the guidance range. When accounting for the impact of fuel prices and FX noted in the table below, revenue growth was up 4.5% during the quarter compared with the prior year, while adjusted earnings per share grew 12.1% on the same basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended | | For the twelve months ended |

| (in millions except per share amounts) | 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | 12/31/23 | 12/31/24 | 12/31/25 |

| Revenues | $ | 663.3 | | $ | 652.7 | | $ | 673.5 | | $ | 665.5 | | $ | 636.5 | | $ | 636.6 | | $ | 659.6 | | $ | 691.8 | | $ | 672.9 | | | $ | 2,548.0 | | $ | 2,628.1 | | $ | 2,660.8 | |

| | | | | | | | | | | | | |

| Y/Y Change | 7.2 | % | 6.7 | % | 8.4 | % | 2.2 | % | (4.0) | % | (2.5) | % | (2.1) | % | 3.9 | % | 5.7 | % | | 8.4 | % | 3.1 | % | 1.2 | % |

| FX Impact vs Prior Year1 | $ | (0.3) | | $ | (0.7) | | $ | 0.8 | | $ | (2.2) | | $ | 1.3 | | $ | 2.5 | | $ | (1.9) | | $ | (2.7) | | $ | (4.2) | | | $ | (1.7) | | $ | (0.8) | | $ | (6.2) | |

PPG Impact vs Prior Year1 | $ | 24.9 | | $ | 20.5 | | $ | 5.4 | | $ | 21.2 | | $ | 26.6 | | $ | 8.5 | | $ | 15.9 | | $ | 6.0 | | $ | (3.3) | | | $ | 108.4 | | $ | 73.8 | | $ | 27.0 | |

| PPG and FX % Impact on Revenue vs Prior Year | (4.0) | % | (3.2) | % | (1.0) | % | (2.9) | % | (4.2) | % | (1.7) | % | (2.1) | % | (0.5) | % | 1.2 | % | | (4.5) | % | (2.9) | % | (0.8) | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

GAAP Income per Diluted Share2 | $ | 1.98 | | $ | 1.55 | | $ | 1.83 | | $ | 2.52 | | $ | 1.60 | | $ | 1.81 | | $ | 1.98 | | $ | 2.30 | | $ | 2.41 | | | $ | 6.16 | | $ | 7.50 | | $ | 8.47 | |

| Y/Y Change3 | (2.0) | % | (0.6) | % | (16.8) | % | NM | (19.2) | % | 16.8 | % | 8.2 | % | (8.7) | % | 50.6 | % | | 36.9 | % | 21.8 | % | 12.9 | % |

| | | | | | | | | | | | | |

ANI per Diluted Share2 | $ | 3.82 | | $ | 3.46 | | $ | 3.91 | | $ | 4.35 | | $ | 3.57 | | $ | 3.51 | | $ | 3.95 | | $ | 4.59 | | $ | 4.11 | | | $ | 14.81 | | $ | 15.28 | | $ | 16.10 | |

| | | | | | | | | | | | | |

| Y/Y Change | 11.0 | % | 4.5 | % | 7.7 | % | 7.4 | % | (6.5) | % | 1.4 | % | 1.0 | % | 5.5 | % | 15.1 | % | | 9.5 | % | 3.2 | % | 5.4 | % |

FX Impact per Share vs Prior Year1 | $ | 0.04 | | $ | — | | $ | — | | $ | (0.05) | | $ | 0.01 | | $ | — | | $ | (0.03) | | $ | (0.03) | | $ | (0.04) | | | $ | — | | $ | (0.04) | | $ | (0.11) | |

PPG Impact per Share vs Prior Year1 | $ | 0.39 | | $ | 0.33 | | $ | 0.09 | | $ | 0.33 | | $ | 0.44 | | $ | 0.13 | | $ | 0.29 | | $ | 0.11 | | $ | (0.07) | | | $ | 1.62 | | $ | 1.19 | | $ | 0.46 | |

| PPG and FX % Impact on Adjusted Earnings Per Share vs Prior Year | (12.5) | % | (10.0) | % | (2.5) | % | (6.9) | % | (11.8) | % | (3.7) | % | (6.7) | % | (1.6) | % | 3.1 | % | | (12.0) | % | (7.8) | % | (2.3) | % |

| | | | | | | | | | | | | |

(1) Favorable impacts are shown in these tables as negatives, while unfavorable impacts are shown as positive figures.

(2) Diluted earnings per share includes the impact of convertible securities under the “if-converted” method if the effect of such securities would be dilutive and includes the assumed exercise of dilutive options, the assumed issuance of unvested RSUs, performance-based awards for which the performance condition has been met as of the date of determination, and contingently issuable shares that would be issuable if the end of the reporting period was the end of the contingency period, using the treasury stock method unless the effect is anti-dilutive. On August 11, 2023, the Company repurchased all of the outstanding Convertible Notes.

(3) Due to the relative volatility in our GAAP net income per share, many of the changes are not meaningful to the reader and have been marked "NM".

The following table summarizes our financial results by segment for the most recent quarter and for the twelve months ended December 31, 2025, in millions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended 12/31/25 | | For the twelve months ended 12/31/25 |

| Mobility | Benefits | Corporate

Payments | WEX Inc. | | Mobility | Benefits | Corporate Payments | WEX Inc. |

| Revenues | $ | 345.1 | | $ | 204.9 | | $ | 122.9 | | $ | 672.9 | | | $ | 1,386.0 | | $ | 797.4 | | $ | 477.4 | | $ | 2,660.8 | |

| Segment Revenue % of Total | 51.3 | % | 30.5 | % | 18.3 | % | | | 52.1 | % | 30.0 | % | 17.9 | % | |

| Y/Y Change | — | % | 9.6 | % | 17.8 | % | 5.7 | % | | (1.1) | % | 7.8 | % | (2.1) | % | 1.2 | % |

| | | | | | | | | |

| Operating Income (GAAP) | $ | 88.4 | | $ | 58.9 | | $ | 48.8 | | $ | 166.3 | | | $ | 400.4 | | $ | 225.8 | | $ | 166.0 | | $ | 663.9 | |

| Operating Income (GAAP) Margin | 25.6 | % | 28.7 | % | 39.7 | % | 24.7 | % | | 28.9 | % | 28.3 | % | 34.8 | % | 25.0 | % |

| | | | | | | | | |

| Adjusted Operating Income * | $ | 128.9 | | $ | 83.1 | | $ | 59.5 | | $ | 247.1 | | | $ | 541.1 | | $ | 341.6 | | $ | 213.3 | | $ | 997.5 | |

| Adjusted Operating Income Margin * | 37.3 | % | 40.6 | % | 48.4 | % | 36.7 | % | | 39.0 | % | 42.8 | % | 44.7 | % | 37.5 | % |

* Amounts presented within the Mobility, Benefits, and Corporate Payments columns represent Segment Adjusted Operating Income or Segment Adjusted Operating Income Margin, as applicable, while amounts presented within the WEX Inc. columns represent Adjusted Operating Income or Adjusted Operating Income Margin, as applicable. For related definitions, see Acronyms and Abbreviations later in this supplement.

Within our Mobility segment, operating through North American, Over-the-Road, and International business units, WEX is a leader in fleet payment solutions, transaction processing, and information management. We serve diverse fleet needs globally, from Over-the-Road to locally operated fleets. Our proprietary closed-loop payments network in the U.S. covers more than 90% of fueling locations and offers broad acceptance at EV charging locations. Our differentiated network offers enhanced data capture, custom controls, and tailored economics between fleets and merchants, creating customer value. Beyond fuel cards, our portfolio includes SaaS solutions for field service management, telematics, reporting and analytics, cash flow management, and mixed-energy fleets. Powered by payment intelligence and workflow optimization, these solutions deliver transformative value to operators, fleet managers, and business managers. Our solutions simplify our customers' businesses by optimizing costs, streamlining operations, and improving driver and fleet manager satisfaction while advancing sustainability and driving business growth.

Revenue in this segment is derived primarily from payment processing, based on transaction volume or fixed fees, as well as account servicing fees, finance charges, and other ancillary services.

•Mobility segment revenue for the quarter was flat compared to the same period a year ago, including a 1.4% benefit due to higher fuel prices and foreign exchange rates. The Q4 average domestic fuel price of $3.29 was 20 cents higher than our prior guidance, increasing revenue by approximately $10 million relative to guidance. Compared to the same period in 2024, the $0.04 increase in domestic fuel prices increased revenue by approximately $3 million, which also includes the impact of European fuel price spreads.

•Payment processing transactions decreased 4.3% in Q4 2025 compared to Q4 2024. Local fleets in North America were down 4.4%, while Over-the-Road truck fleets were down 1.1%.

•The net interchange rate in the Mobility segment was 1.33%, stable relative to Q3 2025. The benefits from pricing initiatives and favorable portfolio mix were offset by the decline in interest rates compared to the same quarter in the prior year.

•The net late fee rate decreased 1 basis point year-over-year, while finance fee revenue increased 3.1% to $81.7 million.

•Credit losses increased by $5.2 million versus the same period last year, coming in at 15 basis points of spend volume, which was in line with our guidance range of 14-19 basis points and compares to 11 basis points for the same quarter last year.

•Operating income margin for the segment was 25.6%, compared to 33.1% in the same prior-year period. The segment adjusted operating income margin for the quarter was 37.3%, down 5.0% compared to the same prior-year period. This decrease was primarily driven by the impact of higher credit losses and expense increases for sales and marketing and product development.

The following table reflects segment results and select other metrics within Mobility. All amounts are in millions, except for per gallon data:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended | | For the twelve months ended |

| 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | 12/31/23 | 12/31/24 | 12/31/25 |

| Revenues | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Revenues | $ | 350.1 | | $ | 339.0 | | $ | 359.6 | | $ | 357.2 | | $ | 345.2 | | $ | 333.8 | | $ | 346.2 | | $ | 360.8 | | $ | 345.1 | | | $ | 1,382.7 | | $ | 1,400.8 | | $ | 1,386.0 | |

| | | | | | | | | | | | | |

| Y/Y Change | (4.7) | % | (1.0) | % | 5.7 | % | 2.0 | % | (1.4) | % | (1.5) | % | (3.7) | % | 1.0 | % | — | % | | (4.2) | % | 1.3 | % | (1.1) | % |

| FX Impact4 | $ | (0.9) | | $ | 0.1 | | $ | 0.4 | | $ | (0.5) | | $ | 0.1 | | $ | 1.3 | | $ | (0.8) | | $ | (0.9) | | $ | (1.5) | | | $ | 1.7 | | $ | — | | $ | (1.9) | |

PPG Impact5 | $ | 24.9 | | $ | 20.5 | | $ | 5.4 | | $ | 21.2 | | $ | 26.6 | | $ | 8.5 | | $ | 15.9 | | $ | 6.0 | | $ | (3.3) | | | $ | 108.4 | | $ | 73.8 | | $ | 27.0 | |

| PPG and FX % Impact on Revenue | (6.5) | % | (6.0) | % | (1.7) | % | (5.9) | % | (7.6) | % | (2.9) | % | (4.2) | % | (1.4) | % | 1.4 | % | | (7.6) | % | (5.3) | % | (1.8) | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Operating Income (GAAP) | $ | 117.3 | | $ | 99.3 | | $ | 119.2 | | $ | 136.5 | | $ | 114.1 | | $ | 99.4 | | $ | 101.1 | | $ | 111.5 | | $ | 88.4 | | | $ | 472.8 | | $ | 469.1 | | $ | 400.4 | |

| Operating Income (GAAP) Margin | 33.5 | % | 29.3 | % | 33.1 | % | 38.2 | % | 33.1 | % | 29.8 | % | 29.2 | % | 30.9 | % | 25.6 | % | | 34.2 | % | 33.5 | % | 28.9 | % |

| Segment Adjusted Operating Income | $ | 150.7 | | $ | 131.0 | | $ | 154.3 | | $ | 167.1 | | $ | 146.1 | | $ | 131.4 | | $ | 134.0 | | $ | 146.7 | | $ | 128.9 | | | $ | 599.4 | | $ | 598.5 | | $ | 541.1 | |

| Segment Adjusted Operating Income Margin5 | 43.0 | % | 38.6 | % | 42.9 | % | 46.8 | % | 42.3 | % | 39.4 | % | 38.7 | % | 40.7 | % | 37.3 | % | | 43.3 | % | 42.7 | % | 39.0 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Select Other Metrics | | | | | | | | | | | | | |

| Total Volume | $ | 21,057 | | $ | 19,943 | | $ | 20,849 | | $ | 20,137 | | $ | 18,610 | | $ | 18,751 | | $ | 18,833 | | $ | 19,684 | | $ | 18,637 | | | $ | 84,721 | | $ | 79,539 | | $ | 75,905 | |

| Y/Y Change | (12.2) | % | (6.0) | % | 3.1 | % | (9.4) | % | (11.6) | % | (6.0) | % | (9.7) | % | (2.3) | % | 0.1 | % | | (14.3) | % | (6.1) | % | (4.6) | % |

| Payment Processing Transactions | 138.1 | | 136.9 | | 144.9 | | 146.5 | | 138.5 | | 134.5 | | 139.2 | | 140.0 | | 132.5 | | 562.6 | | 566.8 | | 546.1 | |

| Y/Y Change | (0.8) | % | (0.4) | % | 1.8 | % | 1.3 | % | 0.3 | % | (1.8) | % | (3.9) | % | (4.5) | % | (4.3) | % | | 0.4 | % | 0.7 | % | (3.6) | % |

| Payment Processing $ of Fuel | $ | 13,814 | | $ | 13,061 | | $ | 13,729 | | $ | 13,227 | | $ | 12,003 | | $ | 12,018 | | $ | 12,216 | | $ | 12,641 | | $ | 11,859 | | | $ | 56,684 | | $ | 52,021 | | $ | 48,735 | |

| Y/Y Change | (13.3) | % | (7.7) | % | (0.4) | % | (11.5) | % | (13.1) | % | (8.0) | % | (11.0) | % | (4.4) | % | (1.2) | % | | (14.3) | % | (8.2) | % | (6.3) | % |

| Average U.S. Fuel Price | $ | 3.76 | | $ | 3.56 | | $ | 3.62 | | $ | 3.45 | | $ | 3.25 | | $ | 3.32 | | $ | 3.28 | | $ | 3.38 | | $ | 3.29 | | | $ | 3.82 | | $ | 3.47 | | $ | 3.32 | |

| Y/Y Change | (13.4) | % | (7.8) | % | (1.6) | % | (13.1) | % | (13.6) | % | (6.7) | % | (9.5) | % | (2.1) | % | 1.1 | % | | (14.3) | % | (9.2) | % | (4.4) | % |

| Payment Processing Gallons | 3,579 | | 3,568 | | 3,694 | | 3,731 | | 3,601 | | 3,528 | | 3,625 | | 3,640 | | 3,497 | | | 14,507 | | 14,593 | | 14,289 | |

| Y/Y Change | (0.9) | % | (0.3) | % | 0.8 | % | 1.2 | % | 0.6 | % | (1.1) | % | (1.9) | % | (2.4) | % | (2.9) | % | | (0.5) | % | 0.6 | % | (2.1) | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Payment Processing Rate | 1.26 | % | 1.31 | % | 1.29 | % | 1.38 | % | 1.36 | % | 1.30 | % | 1.31 | % | 1.33 | % | 1.33 | % | | 1.23 | % | 1.34 | % | 1.32 | % |

| Net Late Fee Revenue | $69.0 | $60.4 | $67.3 | $59.0 | $68.4 | $63.7 | $65.9 | $67.2 | $66.7 | | $271.8 | $255.1 | $263.5 |

| Y/Y Change | (23.3) | % | (14.0) | % | 1.5 | % | (11.1) | % | (0.9) | % | 5.5 | % | (2.0) | % | 13.9 | % | (2.5) | % | | (11.5) | % | (6.1) | % | 3.3 | % |

| Net Late Fee Rate | 0.50 | % | 0.46 | % | 0.49 | % | 0.45 | % | 0.57 | % | 0.53 | % | 0.54 | % | 0.53 | % | 0.56 | % | | 0.48 | % | 0.49 | % | 0.54 | % |

| Credit Losses, in Basis Points | 8 | 15 | 14 | 6 | 11 | 12 | 14 | 12 | 15 | | 15 | 12 | 13 |

(4) Favorable impacts are shown in these tables as negatives, while unfavorable impacts are shown as positive figures.

(5) Segment adjusted operating income margin is derived by dividing segment adjusted operating income by the revenue of the corresponding segment.

WEX's Benefits segment simplifies employee benefit plan administration through SaaS software integrated with payment solutions. We deliver diverse product offerings including Benefits Administration, Health Savings Accounts, Flexible Spending Accounts, Health Reimbursement Arrangements, COBRA & Direct Billing, and compliance administration. These solutions empower administrators, employers, and participants to make optimal benefits decisions. Our platform's flexibility supports multiple plan types and customizable designs, adapting to market changes. Our solutions streamline processes, reduce costs, and empower employees with greater choice and control. WEX combines healthcare expertise with payment intelligence and workflow optimization to deliver secure, customer-centric solutions. This simplifies daily administration, provides personalized tools, and offers proactive support, ultimately driving better business outcomes through healthier, more engaged employees.

Revenue in this segment is derived from per-participant fees, HSA deposit interest, and debit card interchange. Our business experiences annual seasonality, with Q1 peaking for new account sign-ups and transactions. WEX Inc. also serves as an IRS-designated non-bank custodian, while WEX Bank provides HSA depository services.

•Benefits segment revenue for the quarter was $204.9 million, an increase of 9.6% over the prior year, driven by continued strong revenue growth in SaaS accounts and custodial revenue.

•Average SaaS accounts for Q4 increased 6.0% year-over-year to 21.6 million. HSA account growth specifically, including partner channel accounts, was 7% compared to market growth of 6% according to the Devenir Research 2025 Midyear HSA Market Statistics & Trends report.

•Benefits purchase volume increased by 7.1% compared to the prior-year quarter. While our interchange revenues in this segment are a relatively small piece of the total, they generate a steady revenue stream and a strong flow-through to operating income.

•Account servicing revenue in Q4 was $114.2 million, an increase of 4.2% versus last year, due to an increase in SaaS accounts.

•Average custodial cash assets for the quarter totaled $4.9 billion, an increase of 11.6% compared to the prior year, and generated $61.0 million in revenue—up from $53.4 million last year—earned at WEX Bank and third-party banks. The interest yield earned on these investments increased 11 basis points year-over-year to 5.00%.

•Operating income margin for the segment was 28.7%, compared to 26.1% in the same prior-year period. The segment adjusted operating income margin for the quarter was 40.6%, compared to 41.7% in the same prior-year period.

The following table reflects segment results and select other metrics within Benefits. All amounts are in millions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended | | For the twelve months ended |

| 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | 12/31/23 | 12/31/24 | 12/31/25 |

| Revenues | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Revenues | $ | 178.2 | | $ | 191.2 | | $ | 179.8 | | $ | 181.5 | | $ | 186.9 | | $ | 199.3 | | $ | 195.1 | | $ | 198.1 | | $ | 204.9 | | | $ | 668.4 | | $ | 739.5 | | $ | 797.4 | |

| | | | | | | | | | | | | |

| Y/Y Change | 26.7 | % | 15.9 | % | 12.9 | % | 9.3 | % | 4.9 | % | 4.2 | % | 8.5 | % | 9.2 | % | 9.6 | % | | 32.5 | % | 10.6 | % | 7.8 | % |

| | | | | | | | | | | | | |

| Operating Income (GAAP) | $ | 19.0 | | $ | 46.7 | | $ | 32.5 | | $ | 45.2 | | $ | 48.8 | | $ | 56.5 | | $ | 53.5 | | $ | 56.9 | | $ | 58.9 | | | $ | 114.8 | | $ | 173.3 | | $ | 225.8 | |

| Operating Income (GAAP) Margin | 10.7 | % | 24.4 | % | 18.1 | % | 24.9 | % | 26.1 | % | 28.3 | % | 27.4 | % | 28.7 | % | 28.7 | % | | 17.2 | % | 23.4 | % | 28.3 | % |

| Segment Adjusted Operating Income | $ | 59.2 | | $ | 79.4 | | $ | 71.1 | | $ | 78.4 | | $ | 78.0 | | $ | 86.9 | | $ | 84.9 | | $ | 86.7 | | $ | 83.1 | | | $ | 241.8 | | $ | 307.0 | | $ | 341.6 | |

| Segment Adjusted Operating Income Margin6 | 33.2 | % | 41.5 | % | 39.6 | % | 43.2 | % | 41.7 | % | 43.6 | % | 43.5 | % | 43.8 | % | 40.6 | % | | 36.2 | % | 41.5 | % | 42.8 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Select Other Metrics | | | | | | | | | | | | | |

| Average SaaS Accounts | 19.9 | | 20.3 | | 20.0 | | 20.3 | | 20.4 | | 21.5 | | 21.2 | | 21.5 | | 21.6 | | | 19.9 | | 20.3 | | 21.5 | |

| Y/Y Change | 7.6 | % | — | % | 2.6 | % | 2.0 | % | 2.5 | % | 6.1 | % | 6.0 | % | 6.0 | % | 6.0 | % | | 10.6 | % | 2.0 | % | 6.0 | % |

| Total volume | $ | 2,823 | | $ | 3,840 | | $ | 3,496 | | $ | 3,129 | | $ | 3,135 | | $ | 4,196 | | $ | 3,729 | | $ | 3,276 | | $ | 2,882 | | | $12,442 | $13,600 | $14,083 |

| Y/Y Change | 8.7 | % | 9.7 | % | 8.0 | % | 8.6 | % | 11.1 | % | 9.3 | % | 6.7 | % | 4.7 | % | (8.1) | % | | 11.0 | % | 9.3 | % | 3.5 | % |

| Purchase volume | $ | 1,510 | | $ | 2,115 | | $ | 1,865 | | $ | 1,646 | | $ | 1,617 | | $ | 2,330 | | $ | 2,003 | | $ | 1,771 | | $ | 1,732 | | | $6,656 | $7,243 | $7,836 |

| Y/Y Change | 9.9 | % | 9.6 | % | 8.7 | % | 9.7 | % | 7.1 | % | 10.2 | % | 7.4 | % | 7.6 | % | 7.1 | % | | 13.4 | % | 8.8 | % | 8.2 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Average HSA Custodial Cash Assets | $ | 3,925 | | $ | 4,209 | | $ | 4,231 | | $ | 4,315 | | $ | 4,366 | | $ | 4,609 | | $ | 4,705 | | $ | 4,808 | | $ | 4,874 | | | $3,869 | $4,280 | $4,749 |

| Y/Y Change | 13.1 | % | 11.8 | % | 9.1 | % | 10.4 | % | 11.2 | % | 9.5 | % | 11.2 | % | 11.4 | % | 11.6 | % | | 21.8 | % | 10.6 | % | 11.0 | % |

| Custodial Investment Revenue - in Other Revenue7 | $ | 32.2 | | $ | 37.5 | | $ | 40.0 | | $ | 41.2 | | $ | 44.3 | | $ | 44.6 | | $ | 48.2 | | $ | 51.5 | | $ | 51.8 | | | $ | 109.0 | | $ | 163.0 | | $ | 196.1 | |

| Custodial Investment Revenue - in Account Servicing Revenue8 | $ | 13.1 | | $ | 13.0 | | $ | 11.9 | | $ | 12.5 | | $ | 9.1 | | $ | 11.3 | | $ | 9.6 | | $ | 10.2 | | $ | 9.2 | | | $ | 59.4 | | $ | 46.5 | | $ | 40.3 | |

| Custodial Investment Revenue - Total | $ | 45.3 | | $ | 50.5 | | $ | 51.9 | | $ | 53.7 | | $ | 53.4 | | $ | 55.8 | | $ | 57.8 | | $ | 61.7 | | $ | 61.0 | | | $ | 168.5 | | $ | 209.5 | | $ | 236.4 | |

| Y/Y Change | 77.0 | % | 35.8 | % | 23.6 | % | 22.0 | % | 17.9 | % | 10.6 | % | 11.4 | % | 14.9 | % | 14.2 | % | | 175.8 | % | 24.3 | % | 12.8 | % |

| HSA Yield9 | 4.62 | % | 4.80 | % | 4.91 | % | 4.98 | % | 4.89 | % | 4.85 | % | 4.92 | % | 5.13 | % | 5.00 | % | | 4.36 | % | 4.90 | % | 4.98 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(6) Segment adjusted operating income margin is derived by dividing segment adjusted operating income by the revenue of the corresponding segment.

(7) Represents income earned on available-for-sale securities held and managed by WEX Bank. These amounts are recorded within Other Revenue on our consolidated statement of operations.

(8) Represents income earned for custodial deposits held at third-party banks. These amounts are recorded within Account Servicing Revenue on our consolidated statement of operations.

(9) We calculate HSA yield by dividing Custodial Investment Revenue - Total by Average HSA Custodial Cash Assets.

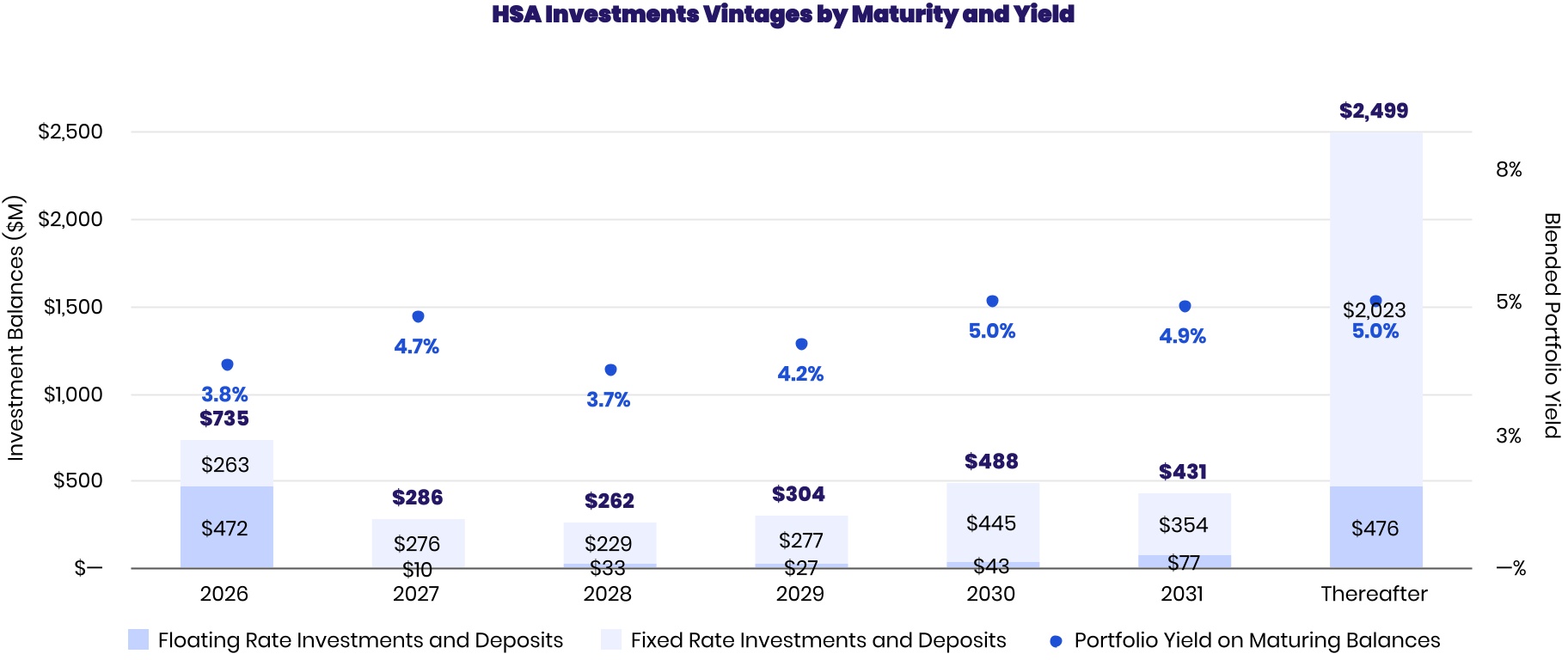

The following chart shows the maturity profile of the investment securities and deposits as of December 31, 2025. The blended portfolio yield shown is the return earned on the balances maturing each year as of December 31, 2025.

| | | | | |

| Corporate Payments Segment |

WEX's Corporate Payments segment delivers global B2B payment solutions, powered by payment intelligence and workflow optimization, that enhance security, simplify processes, and drive revenue. Our Direct to Corporate solution automates Accounts Payable (AP) by integrating with Enterprise Resource Planning systems and accounting workflows to maximize virtual payment usage. Our customizable Embedded Payments solution seamlessly integrates virtual payment capabilities into existing workflows, whether payments are core to the business, part of critical operations, or an added customer offering. This versatile solution empowers a broad range of industries, including online travel. We also offer white-label partnerships with financial institutions. Leveraging scale, network incentives, global expertise, and our supplier enablement team, we seek to optimize revenue for our customers.

Revenue in this segment is primarily derived from net interchange, with additional contributions from licensing fees.

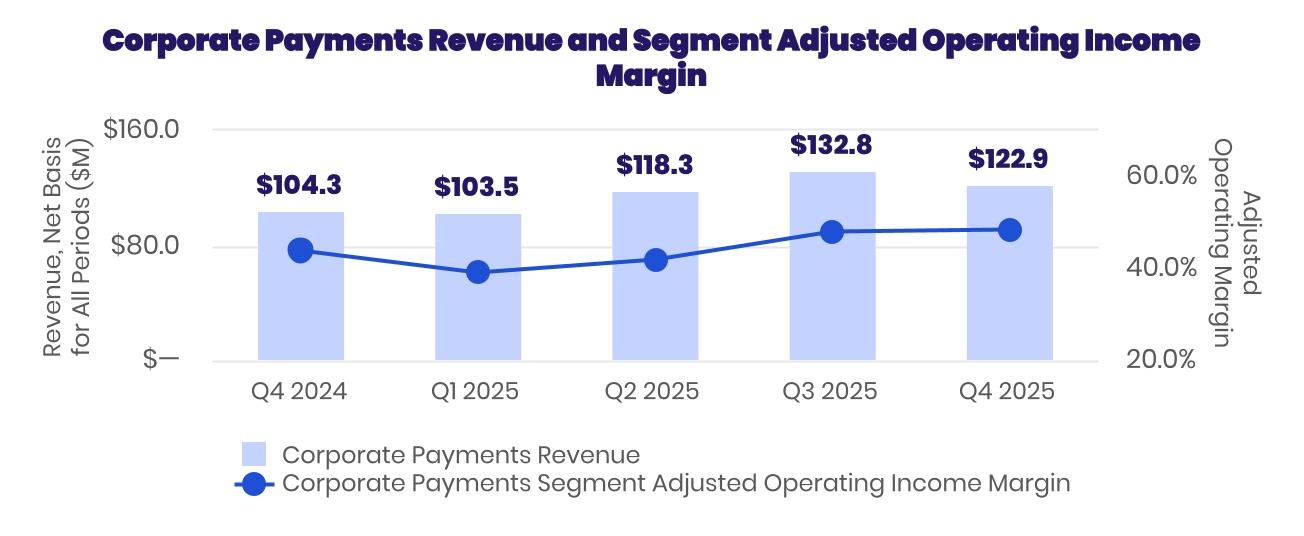

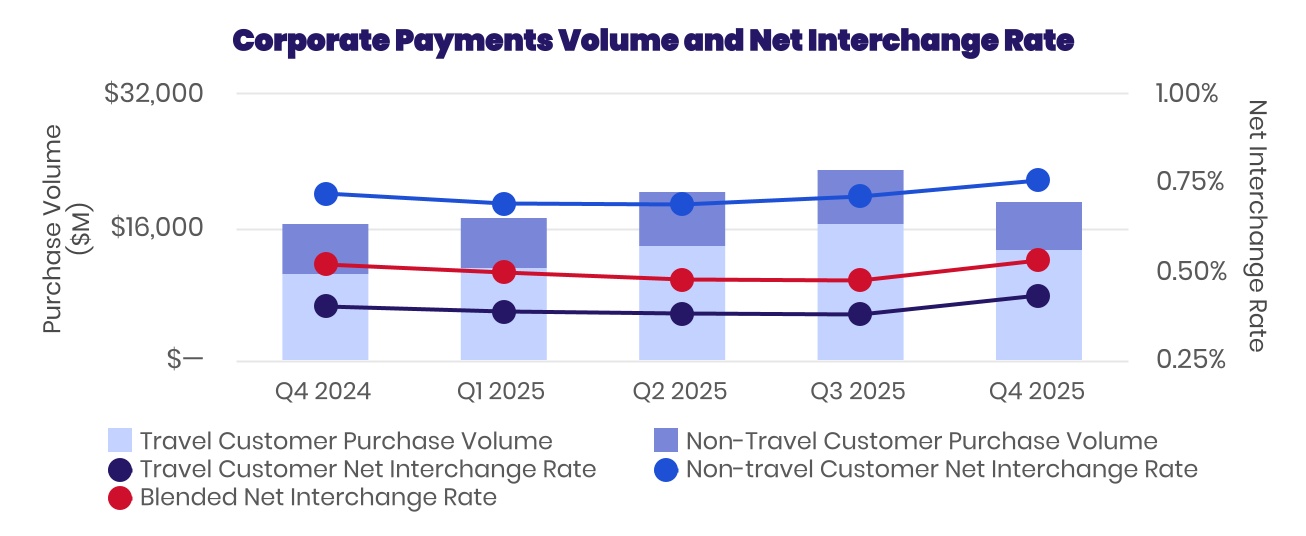

•Corporate Payments segment revenue for the quarter increased 17.8% to $122.9 million. The revenue increase was driven primarily by an 18.3% increase in the total volume. Foreign exchange rates were also favorable, increasing revenue by $2.6 million compared to the prior year.

•Purchase volumes issued by WEX for the quarter increased 16.9% compared to the same period last year, a notable sequential improvement. The improvement was primarily attributable to an increase in travel-related customers.

•The net interchange rate was up 6 basis points sequentially. The net interchange rate for travel customers was up 5 basis points while the non-travel customer rate was up 4 basis points compared with Q3 2025. The sequential increases are due primarily to the recognition of incentives received from our primary scheme.

•Direct Accounts Payable purchase volume for the quarter increased by more than 15%. This book of business currently generates approximately 20% of annual segment revenue. Because of the strong potential growth opportunity in our Direct Accounts Payable business, we intend to continue to invest in new product capabilities and additional sales and marketing resources.

•Operating income margin for the segment was 39.7%, compared to 33.9% in the same prior-year period. The segment adjusted operating income margin for the quarter was 48.4%, up from 43.9% in the same prior-year period, due primarily to the growth in purchase volume and recognition of network incentives.

The following table reflects segment results and select other metrics within Corporate Payments. All amounts are in millions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended | | For the twelve months ended |

| 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | 12/31/23 | 12/31/24 | 12/31/25 |

| Revenues | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Revenues | $ | 135.0 | | $ | 122.5 | | $ | 134.1 | | $ | 126.9 | | $ | 104.3 | | $ | 103.5 | | $ | 118.3 | | $ | 132.8 | | $ | 122.9 | | | $ | 496.9 | | $ | 487.8 | | $ | 477.4 | |

| | | | | | | | | | | | | |

| Y/Y Change | 22.0 | % | 16.9 | % | 10.0 | % | (6.1) | % | (22.7) | % | (15.5) | % | (11.8) | % | 4.7 | % | 17.8 | % | | 23.5 | % | (1.8) | % | (2.1) | % |

| FX Impact10 | $ | 0.6 | | $ | (0.9) | | $ | 0.5 | | $ | (1.7) | | $ | 1.3 | | $ | 1.3 | | $ | (1.1) | | $ | (1.9) | | $ | (2.6) | | | $ | (3.3) | | $ | (0.9) | | $ | (4.3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Operating Income (GAAP) | $ | 60.9 | | $ | 51.1 | | $ | 61.0 | | $ | 56.1 | | $ | 35.4 | | $ | 27.2 | | $ | 38.0 | | $ | 52.0 | | $ | 48.8 | | | $ | 219.1 | | $ | 203.5 | | $ | 166.0 | |

| Operating Income (GAAP) Margin | 45.1 | % | 41.7 | % | 45.5 | % | 44.2 | % | 33.9 | % | 26.3 | % | 32.1 | % | 39.1 | % | 39.7 | % | | 44.1 | % | 41.7 | % | 34.8 | % |

| Segment Adjusted Operating Income | $ | 78.8 | | $ | 64.6 | | $ | 74.4 | | $ | 71.5 | | $ | 45.7 | | $ | 40.5 | | $ | 49.5 | | $ | 63.8 | | $ | 59.5 | | | $ | 277.2 | | $ | 256.2 | | $ | 213.3 | |

| Segment Adjusted Operating Income Margin11 | 58.4 | % | 52.7 | % | 55.5 | % | 56.4 | % | 43.9 | % | 39.1 | % | 41.9 | % | 48.0 | % | 48.4 | % | | 55.8 | % | 52.5 | % | 44.7 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Select Other Metrics | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Volume | $ | 31,971 | | $ | 33,026 | | $ | 35,792 | | $ | 39,056 | | $ | 30,833 | | $ | 31,109 | | $ | 36,939 | | $ | 43,272 | | $ | 36,466 | | | $ | 128,168 | | $ | 138,707 | | $ | 147,786 | |

| Y/Y Change | 22.0 | % | 19.7 | % | 12.5 | % | 6.2 | % | (3.6) | % | (5.8) | % | 3.2 | % | 10.8 | % | 18.3 | % | | 26.1 | % | 8.2 | % | 6.5 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Purchase Volume | $ | 22,801 | | $ | 23,948 | | $ | 25,756 | | $ | 23,394 | | $ | 16,541 | | $ | 17,285 | | $ | 20,497 | | $ | 23,177 | | $ | 19,342 | | | $ | 92,197 | | $ | 89,640 | | $ | 80,300 | |

| Y/Y Change | 33.5 | % | 28.5 | % | 12.5 | % | (16.0) | % | (27.5) | % | (27.8) | % | (20.4) | % | (0.9) | % | 16.9 | % | | 38.3 | % | (2.8) | % | (10.4) | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Interchange Rate | 0.52 | % | 0.43 | % | 0.45 | % | 0.45 | % | 0.52 | % | 0.50 | % | 0.48 | % | 0.47 | % | 0.53 | % | | 0.46 | % | 0.46 | % | 0.49 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(10) Favorable impacts are shown as negatives, while unfavorable impacts are shown as positive figures.

(11) Segment adjusted operating income margin is derived by dividing segment adjusted operating income by the revenue of the corresponding segment.

The following charts present Corporate Payments segment revenue, adjusted operating income margin, volume, and net interchange rate:

Key Balance Sheet and Liquidity Metrics

The following table shows key balance sheet and liquidity metrics as well as key operating metrics relevant to our balance sheet:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except for leverage ratio) | 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 |

| | | | | | | | | |

| Cash and Cash Equivalents | $ | 976 | | $ | 780 | | $ | 683 | | $ | 535 | | $ | 599 | | $ | 610 | | $ | 773 | | $ | 813 | | $ | 906 | |

| | | | | | | | | |

| Accounts Receivable | $3,429 | $3,857 | $3,966 | $3,770 | $3,023 | $3,768 | $3,925 | $3,816 | $3,363 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

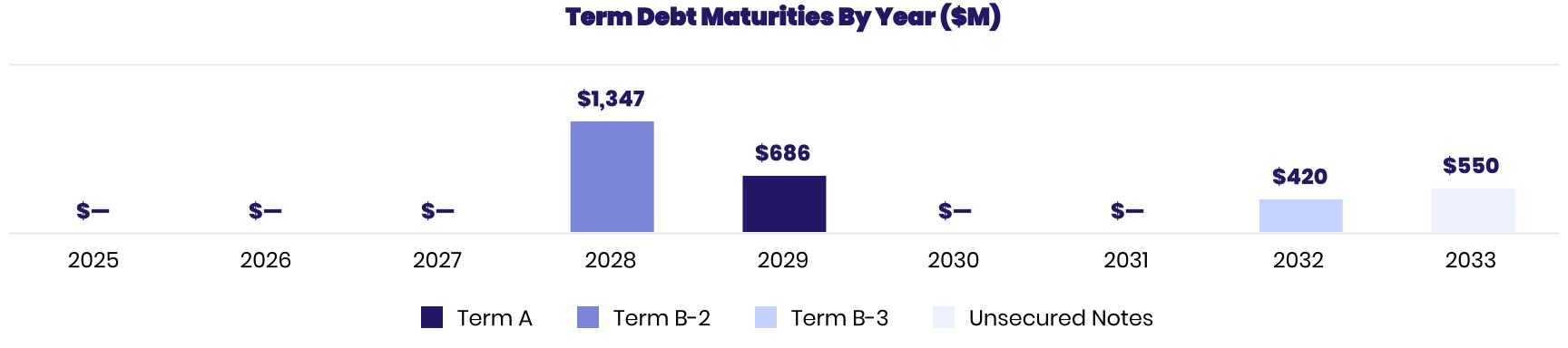

| Long-Term Debt, Net | $2,828 | $3,082 | $2,960 | $3,143 | $3,082 | $4,100 | $3,909 | $3,719 | $3,532 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Corporate Cash | $ | 172 | | $ | 176 | | $ | 143 | | $ | 123 | | $ | 80 | | $ | 163 | | $ | 134 | | $ | 128 | | $ | 122 | |

| Available Liquidity | $ | 903 | | $ | 639 | | $ | 947 | | $ | 729 | | $ | 735 | | $ | 770 | | $ | 916 | | $ | 1,082 | | $ | 1,249 | |

| Leverage Ratio12 | 2.5x | 2.6x | 2.5x | 2.6x | 2.6x | 3.5x | 3.4x | 3.25x | 3.1 |

| | | | | | | | | |

| Investment Securities at Cost13 | $ | 3,102 | | $ | 3,411 | | $ | 3,438 | | $ | 3,734 | | $ | 3,875 | | $ | 3,891 | | $ | 4,180 | | $ | 4,134 | | $ | 4,329 | |

| | | | | | | | | |

We currently remain in a healthy financial position and ended the year with $1.25 billion of available liquidity that includes our available corporate cash and capacity to borrow under our revolving Credit Agreement. Our leverage ratio, as defined in the Credit Agreement, as of December 31, 2025, stands at 3.1 times, and remains within our long-term target range of 2.5 times to 3.5 times.

The following table summarizes the Company's long-term debt maturities14, excluding our revolver and nominal scheduled principal payments on our term loans:

We have maintained ample access to debt markets and strategically review our debt composition and maturity schedule to align with our long-term objectives. We currently have a runway of more than two years before our next maturity, which we believe provides us with an appropriate cushion to remain opportunistic in the market.

(12) As defined in the Credit Agreement.

(13) Our available-for-sale debt securities are measured and reported at fair value on the face of the balance sheet. We have additionally included the cost basis of these investments to provide greater clarity on the nature and extent of our investing activities.

(14) The maturity date of the Term A debt is the earlier of (i) May 10, 2029 and (ii) the date that is 91 days prior to the maturity of the Term B-2 Loans. We have presented Term A within 2029 in the table above with the expectation that the Term B-2 debt will be refinanced prior to maturity.

Cash Flow

The following table15 presents our operating cash flow and adjusted free cash flow metric:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | | For the three months ended | | | For the twelve months ended |

| (In millions) | | | | | 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | | 12/31/23 | 12/31/24 | 12/31/25 |

| Operating Cash Flow, as reported | | | | | $ | 761.9 | | $ | (153.3) | | $ | (7.0) | | $ | 3.3 | | $ | 638.4 | | $ | (481.6) | | $ | 264.6 | | $ | 376.6 | | $ | 294.7 | | | | $ | 907.9 | | $ | 481.4 | | $ | 454.3 | |

| | | | | | | | | | | | | | | | | | |

| Changes in WEX Bank Cash Balances | | | | | $ | (23.6) | | $ | 188.9 | | $ | 69.6 | | $ | 125.3 | | $ | (104.7) | | $ | 67.7 | | $ | (182.5) | | $ | (47.5) | | $ | (95.0) | | | | $ | (82.4) | | $ | 279.1 | | $ | (257.3) | |

| Other | | | | | $ | (50.0) | | $ | 67.1 | | $ | — | | $ | — | | $ | (33.1) | | $ | 58.8 | | $ | 1.6 | | $ | 1.5 | | $ | 0.3 | | | | $ | (48.5) | | $ | 34.0 | | $ | 62.2 | |

| | | | | | | | | | | | | | | | | | |

| Net Funding Activity | | | | | $ | (214.4) | | $ | 205.0 | | $ | 214.8 | | $ | 372.2 | | $ | (139.3) | | $ | 375.5 | | $ | 495.6 | | $ | (178.1) | | $ | 290.8 | | | | $ | 1,438.2 | | $ | 652.7 | | $ | 983.8 | |

| Less: Purchases of Current Investment Securities, Net of Sales and Maturities | | | | | $ | (256.8) | | $ | (282.9) | | $ | (25.6) | | $ | (276.3) | | $ | (153.2) | | $ | 28.3 | | $ | (350.3) | | $ | 48.7 | | $ | (191.1) | | | | $ | (1,561.0) | | $ | (738.0) | | $ | (464.4) | |

| Less: Capital Expenditures | | | | | $ | (41.9) | | $ | (34.0) | | $ | (39.6) | | $ | (35.0) | | $ | (38.7) | | $ | (32.6) | | $ | (34.6) | | $ | (35.0) | | $ | (38.4) | | | | $ | (143.6) | | $ | (147.3) | | $ | (140.6) | |

| Adjusted Free Cash Flow | | | | | $ | 175.2 | | $ | (9.2) | | $ | 212.2 | | $ | 189.5 | | $ | 169.5 | | $ | 16.2 | | $ | 194.3 | | $ | 166.2 | | $ | 261.3 | | | | $ | 510.6 | | $ | 562.0 | | $ | 638.0 | |

| | | | | | | | | | | | | | | | | | |

| Trailing Twelve Month Adjusted Free Cash Flows | | | | | $ | 510.6 | | $ | 605.0 | | $ | 543.0 | | $ | 567.8 | | $ | 562.0 | | $ | 587.4 | | $ | 569.5 | | $ | 546.2 | | $ | 638.0 | | | | | | |

WEX has historically generated a significant amount of cash each year although absolute levels can vary based upon macroeconomic factors, operational investments, and overall business performance. We utilize an adjusted free cash flow metric, which is prepared on a non-GAAP basis, to describe the cash flow we consider available for investment. The purpose of the adjusted calculation is to remove impacts of funding accounts receivable in the normal course of business and other cash activity at WEX Bank, which is excluded from and does not impact the amount of cash available at the parent company level. Using our definition, Q4 2025 adjusted free cash flow was $261 million. Over the trailing twelve months ended December 31, 2025, we generated $638 million, converting a substantial portion of our ANI into adjusted free cash flow. We are able to leverage this strong adjusted free cash flow generation to deliver on our disciplined capital allocation strategy, including ongoing investments in our business.

(15) See "Reconciliation of GAAP Operating Cash Flow to Adjusted Free Cash Flow" in Exhibit 1 for a more detailed discussion of these metrics.

Capital Allocation

The following table presents our uses of cash over the preceding quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended |

| (In millions) | 12/31/23 | 3/31/24 | 6/30/24 | 9/30/2416 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 |

| Capital Expenditures | $ | 41.9 | | $ | 34.0 | | $ | 39.6 | | $ | 35.0 | | $ | 38.7 | | $ | 32.6 | | $ | 34.6 | | $ | 35.0 | | $ | 38.4 | |

| Acquisitions17 | $ | 246.3 | | $ | 86.6 | | $ | 5.1 | | $ | 7.1 | | $ | — | | $ | 91.2 | | $ | — | | $ | — | | $ | 58.6 | |

Share Repurchases16 | $ | 150.0 | | $ | 73.6 | | $ | 100.0 | | $ | 370.0 | | $ | 106.0 | | $ | 790.0 | | $ | — | | $ | — | | $ | — | |

| Capital Deployed | $ | 438.2 | | $ | 194.2 | | $ | 144.7 | | $ | 412.1 | | $ | 144.7 | | $ | 913.8 | | $ | 34.6 | | $ | 35.0 | | $ | 97.0 | |

Note: The Q4 2025 acquisition amount relates primarily to the purchase of the BP portfolio.

WEX strategically allocates capital through a disciplined and rigorous analytical process, prioritizing investments that we expect will deliver strong long-term returns. Our primary uses of cash include growth-focused initiatives, such as investments in technology and customer experience, strategic M&A, and returning capital to shareholders via share repurchases. Our capex investments are central to strengthening our competitive edge and delivering greater value to our customers.

The following table presents cash spent on share buybacks and ending undiluted shares outstanding for each of the preceding quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except per share amounts) | For the three months ended |

| 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/2416 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 |

| Cash Spent Repurchasing Shares | $ | 150.0 | | $ | 73.6 | | $ | 100.0 | | $ | 370.0 | | $ | 106.0 | | $ | 790.0 | | $ | — | | $ | — | | $ | — | |

| Cumulative Cash Spent | $ | 586.2 | | $ | 659.8 | | $ | 759.8 | | $ | 1,129.8 | | $ | 1,235.8 | | $ | 2,025.8 | | $ | 2,025.8 | | $ | 2,025.8 | | $ | 2,025.8 | |

| Share Repurchased | 0.87 | | 0.35 | | 0.47 | | 1.72 | | 0.77 | | 5.10 | | — | | — | | — | |

| Cumulative Shares Repurchased Since 2022 | 3.58 | | 3.93 | | 4.39 | | 6.12 | | 6.89 | | 11.99 | | 11.99 | | 11.99 | | 11.99 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

On February 26, 2025, the Company commenced a modified “Dutch auction” tender offer to repurchase up to $750.0 million worth of its common stock (the “Tender Offer”). On March 31, 2025, the Company completed the Tender Offer and accepted for purchase a total of approximately 4.9 million shares of its common stock at a purchase price of $154 per share. The Company paid $750.0 million in cash to complete the Tender Offer, excluding related costs and fees. The Company incurred approximately $4.2 million of costs and fees related to the Tender Offer, which are recorded along with the cost of the shares repurchased as treasury stock.

(16) During the third quarter of 2024, we entered into an ASR agreement with JPMorgan to repurchase an aggregate of $300.0 million of the Company’s outstanding common stock. Under the ASR, the Company made a payment of $300.0 million to JPMorgan for which we received an initial delivery of approximately 1.3 million shares of our common stock. For purposes of this table, we have included the full payment amount and the initial delivery of shares in the quarter ended September 30, 2024. During the fourth quarter of 2024, the ASR was settled, resulting in the receipt of an additional 0.2 million shares of WEX common stock, which is included in the quarter ended December 31, 2024.

(17) This line is presented on a cash basis and includes all consideration transferred in the related quarter, including deferred and contingent payments when they are paid as opposed to when the underlying transaction occurred.

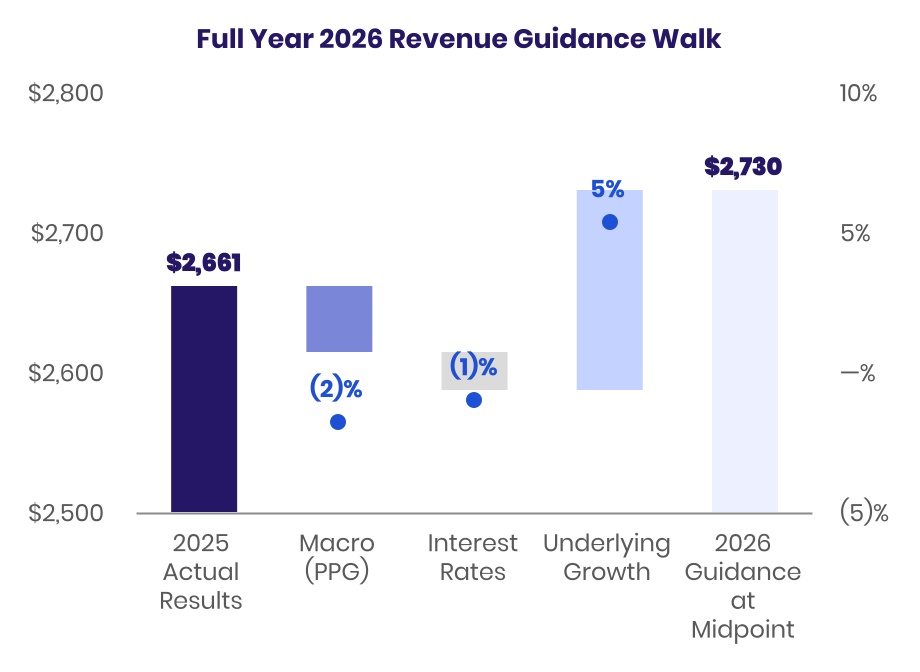

Financial Guidance

The following table presents our expectations for the first quarter and full year 2026:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Guidance | Q1'26 | | Full Year 2026 |

| Current Guidance | | Current Guidance | | Changes from FY2025 at Midpoint |

| Low | High | | Low | High | | $ Change | % Change | Fuel Price Impact |

| Net Revenue, in millions | $ | 650 | | $ | 670 | | | $ | 2,700 | | $ | 2,760 | | | $ | 69 | | 3 | % | $(47) |

| Adjusted Net Income per Diluted Share18 | $ | 3.80 | | $ | 4.00 | | | $ | 17.25 | | $ | 17.85 | | | $ | 1.45 | | 9 | % | $(0.85) |

First quarter and full year 2026 guidance is based on a number of assumptions, including:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Guidance Assumptions | Q1'26 | | Full Year 2026 |

| Current Guidance | | Current Guidance | Change From Prior Year at Midpoint | % Change |

| Average US Retail Fuel Prices per Gallon | $3.09 | | $3.10 | $(0.22) | (7)% |

| Mobility Credit Losses (bps) | 17 | - | 22 | | 12 | - | 17 | 1 | 10% |

| Diluted Shares Outstanding, in millions | 35.1 | | 35.2 | -0.7 | (2)% |

| | | | | |

2026 guidance also includes the following assumptions:

•In Mobility, excluding the impact of fuel price changes and FX, we are expecting full year revenue growth of 1-3%. This factors a decline of approximately 1% due to the impact of lower interest rates on merchant contracts that include pricing escalators. We also are assuming no improvement in the macro environment. Note that Q1 last year had a pull forward of gallons in OTR due to tariff worries, which creates a tougher comparison for Q1 this year followed by an easier comparison in Q2. Also note that the incremental BP contribution will be weighted to the second half of the year and then continue to ramp into 2027.

•In Benefits, we are expecting full year revenue growth of 5-7% including an approximately 2% reduction from lower interest rates impacting the floating rate portion of our non-bank custodian business. As a reminder, more than 75% of our portfolio is in fixed rate instruments and therefore not rate sensitive. Note that Q1 SaaS account growth is expected to be higher than the rest of 2026 as we lap the benefit of the UAW contract that began in Q2 of last year.

•In Corporate Payments, we are expecting full year revenue growth of 5-7%.

•We are investing more in innovation and product development to drive future growth. Embedded in our guidance is $50 million of cost savings actions. A portion of these savings will be reinvested in the business and a portion will drop to margins.

•The expected lower fuel prices this year impact adjusted operating margins negatively by approximately 75 basis points. As a result, for 2026, we expect adjusted operating income margin to be flat with 2025.

(18) The Company's adjusted net income guidance, which is a non-GAAP measure, excludes unrealized gains and losses on financial instruments, net foreign currency gains and losses, changes in fair value of contingent consideration, acquisition-related intangible amortization, other acquisition and divestiture related items, stock-based compensation, other costs, impairment charges, debt restructuring and debt issuance cost amortization, adjustments attributable to our non-controlling interests, and certain tax related items. We are unable to reconcile our adjusted net income guidance to the comparable GAAP measure without unreasonable effort because of the difficulty in predicting the amounts to be adjusted, including, but not limited to, foreign currency exchange rates, unrealized gains and losses on financial instruments, and acquisition and divestiture related items, which may have a significant impact on our financial results.

•We are not expecting benefits from future M&A activity or share repurchases, and last year's tender offer will continue to benefit EPS growth through Q1 before annualizing.

•Domestic fuel prices estimated at $3.09 per gallon for Q1 and $3.10 per gallon for the full year, based on NYMEX futures curve; this assumption reduced 2026 revenue and EPS guidance by approximately $47 million and $0.85 cents, respectively.

•Interest rates reductions in line with the market Fed Funds projections of two rate cuts in 2026. When combined with cuts made during 2025, we expect average rates to be 1% lower than 2025.

•Exchange rates are as of the end of January 2026.

•Adjusted net income effective tax rate of 25.0% for 2026 (all periods).

The following tables include estimated revenue and ANI per share sensitivities to changes in PPG and interest rates as of the date of this supplement. As a reminder, the impacts of these macro factors can and will change based upon various factors, including the composition of our balance sheet. We target maintaining a materially neutral ANI per share impact from 100bps adjustments to interest rates and can adjust our profile through balance sheet strategies and hedging.

| | | | | | | | | | | | | | | | | |

| Price Per Gallon | | Interest Rates |

| Sensitivities | +$0.10/Gal | -$0.10/Gal | | +100bps | -100bps |

| Impact to Net Revenue, in millions (approximate) | $ | 20 | | $ | (20) | | | $ | 30 | | $ | (30) | |

| Impact to ANI per Share (approximate)19 | $ | 0.35 | | $ | (0.35) | | | $ | (0.35) | | $ | 0.45 | |

Note: The ANI per share amounts above have been updated to reflect the share count reduction due to the Tender Offer completed at the end of March.

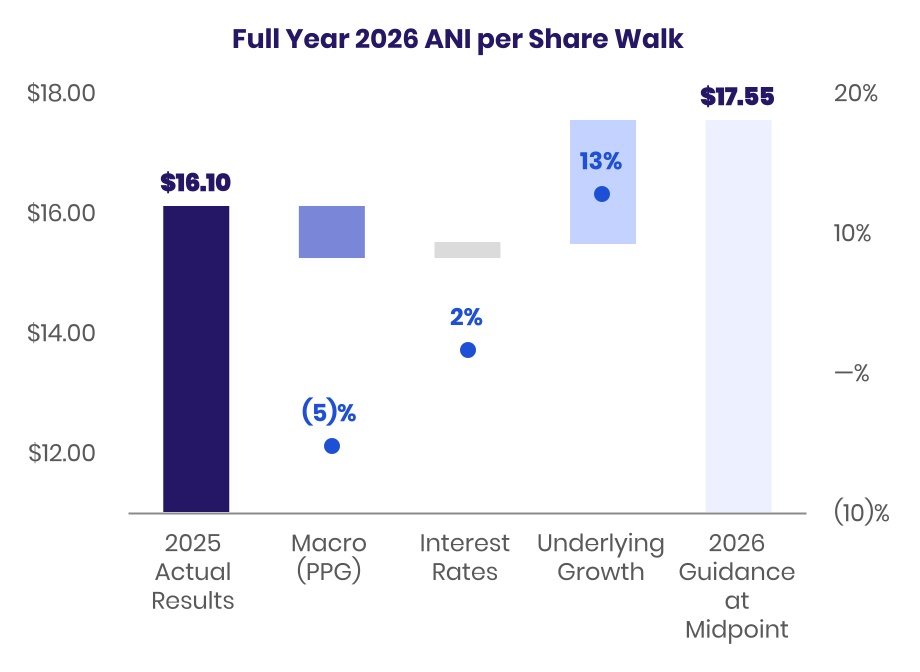

The following charts20 present our 2026 guidance on both a revenue and ANI per share basis.

(19) The Company's adjusted net income guidance, which is a non-GAAP measure, excludes unrealized gains and losses on financial instruments, net foreign currency gains and losses, changes in fair value of contingent consideration, acquisition-related intangible amortization, other acquisition and divestiture related items, stock-based compensation, other costs, impairment charges, debt restructuring and debt issuance cost amortization, adjustments attributable to our non-controlling interests and certain tax related items. We are unable to reconcile our adjusted net income guidance to the comparable GAAP measure without unreasonable effort because of the difficulty in predicting the amounts to be adjusted, including, but not limited to, foreign currency exchange rates, unrealized gains and losses on financial instruments, and acquisition and divestiture related items, which may have a significant impact on our financial results.

(20) The Macro (PPG) impacts above include a small adjustment for European fuel prices spreads.

Enterprise Strategy

The following image presents the three pillars of our strategy:

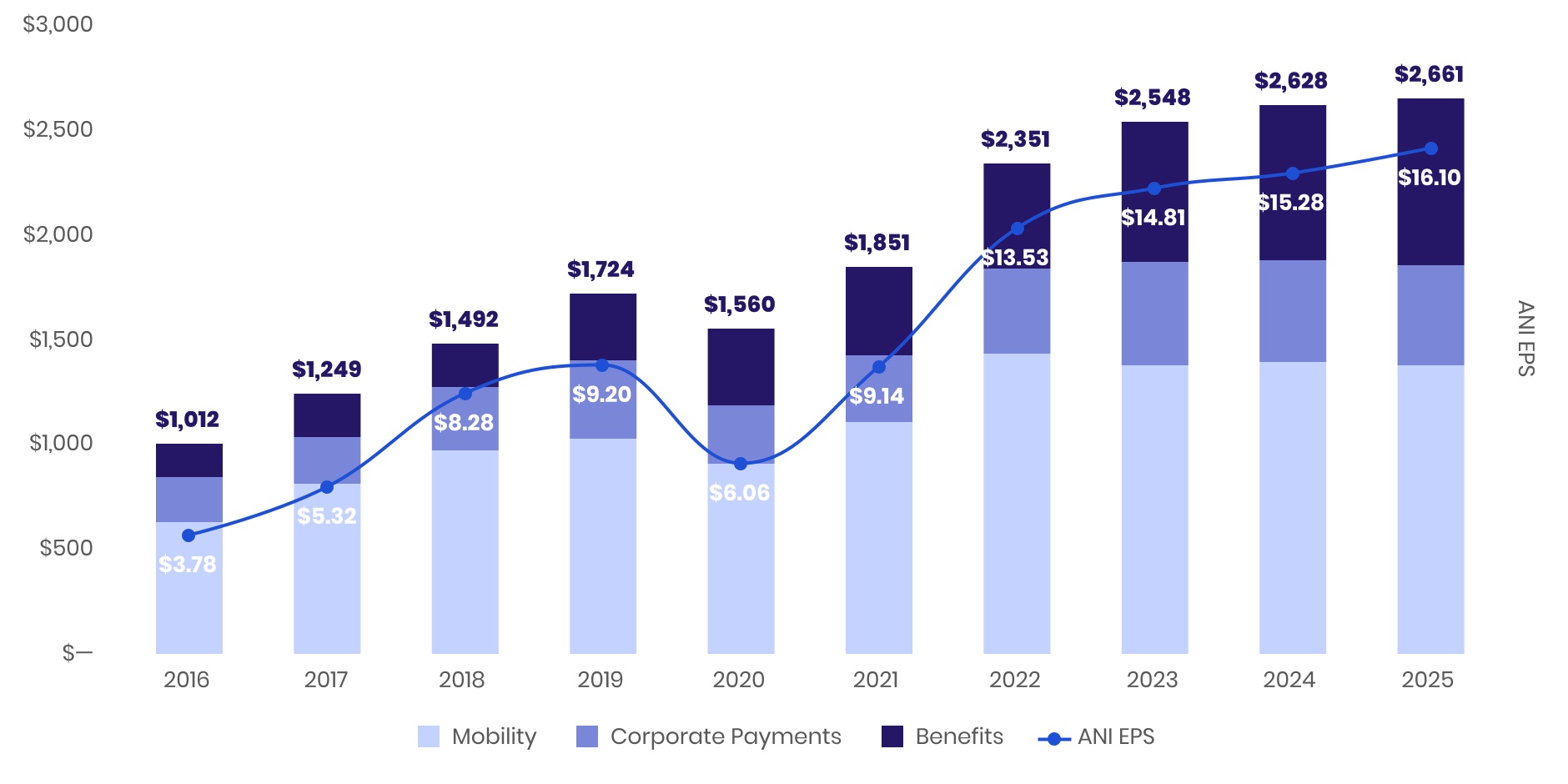

Historical Revenue Growth21

The following chart presents our revenue growth, representing a 12.0% compound annual growth rate over the past 10 years:

Reported revenue is in millions of dollars (USD).

(21) See "Reconciliation of GAAP Net Income Attributable to Shareholders per Diluted Share to Adjusted Net Income Attributable to Shareholders per Diluted Share" in Exhibit 1.

Acronyms and Abbreviations

The acronyms and abbreviations identified below are used in these supplemental materials.

| | | | | |

| Adjusted free cash flow | A non-GAAP measure calculated as cash flows from operating activities, adjusted for net purchases of current investment securities, capital expenditures, net Funding Activity, changes in WEX Bank cash balances, and certain other adjustments. |

| Adjusted net income or ANI | A non-GAAP measure that adjusts net income (loss) to exclude all items excluded in segment adjusted operating income except unallocated corporate expenses, further excluding unrealized gains and losses on financial instruments, net foreign currency gains and losses, debt issuance cost amortization, tax related items and certain other non-operating items, as applicable depending on the period presented. |

| Adjusted operating income | A non-GAAP measure that excludes acquisition-related intangible amortization, other acquisition and divestiture related items, debt restructuring costs, stock-based compensation, other costs and certain non-recurring or non-cash operating charges that are not core to our operations, as applicable depending on the period presented. |

| |

| Adjusted operating income (AOI) margin | Adjusted operating income margin is calculated by dividing adjusted operating income by total revenue. |

| ASR | Accelerated Share Repurchase |

| Average number of SaaS accounts | Represents the average number of active consumer-directed health, COBRA, and billing accounts on our SaaS platforms. HSA accounts for which WEX Inc. serves as the non-bank custodian under designation by the U.S. Department of Treasury are included in this average. |

| BTFP | The Federal Reserve Bank Term Funding Program, which provides liquidity to U.S. depository institutions. |

| Company | WEX Inc. and all entities included in the consolidated financial statements. |

| Convertible notes | Convertible senior unsecured notes due on July 15, 2027 in an aggregate principal amount of $310.0 million with a 6.5 percent interest rate, issued July 1, 2020, which were repurchased by the Company and canceled by the trustee at the instruction of the Company on August 11, 2023. |

| Corporate cash | Calculated in accordance with the terms of our consolidated leverage ratio in the Company’s Amended and Restated Credit Agreement. |

| |

| |

| Credit Agreement | Amended and Restated Credit Agreement entered into on April 1, 2021 (as amended from time to time) by and among the Company and certain of its subsidiaries, as borrowers, and Bank of America, N.A., as administrative agent on behalf of the lenders. |

| FHLB | Federal Home Loan Bank |

| |

| Funding activity | Includes the change in net deposits, net advances from the FHLB, changes in participation debt, and changes in borrowings under the BTFP and borrowed federal funds. |

| HSA | Health Savings Account |

| Net interchange rate | Represents the percentage of the dollar value of each payment processing transaction that WEX records as revenue from merchants, less certain discounts given to customers and network fees. |

| Net late fee rate | Net late fee rate represents late fee revenue as a percentage of fuel purchased by fleets that have a payment processing relationship with WEX. |

| | | | | |

| Net payment processing rate | The percentage of each payment processing $ of fuel that the Company records as revenue from merchants less certain discounts given to customers and network fees. |

| |

| Operating cash flow | Net cash provided by (used for) operating activities. |

| |

| Over-the-Road | Typically, heavy trucks traveling long distances. |

| Payment processing $ of fuel | Total dollar value of the fuel purchased by fleets that have a payment processing relationship with WEX. |

| Payment processing transactions | Total number of purchases made by fleets that have a payment processing relationship with the Company where the Company maintains the receivable for the total purchase. |

| |

| Purchase volume | Purchase volume in the Corporate Payments segment represents the total dollar value of all WEX-issued transactions that use WEX corporate card products and virtual card products. Purchase volume in the Benefits segment represents the total dollar value of all transactions where interchange is earned by WEX. |

| Revolving Credit Facility | The Company’s secured revolving credit facility under the Credit Agreement. |

| SaaS | Software-as-a-Service |

| Segment adjusted operating income (AOI) | A non-GAAP measure that adjusts operating income to exclude specified items that the Company’s management excludes in evaluating segment performance, including unallocated corporate expenses, acquisition-related intangible amortization, other acquisition and divestiture related items, debt restructuring costs, stock-based compensation, other costs and certain non-recurring or non-cash operating charges that are not core to our operations, as applicable depending on the period presented. |

| Segment adjusted operating income (AOI) margin | Segment adjusted operating income margin is calculated by dividing segment adjusted operating income by segment revenue. |

| |

| Tender Offer | The Company’s modified “Dutch auction” tender offer, that was completed on March 31, 2025, in which the Company purchased for cash $750 million in value of shares of its common stock upon the terms and subject to the conditions described in that certain Schedule TO and the exhibits thereto, that were originally filed by the Company with the SEC on February 26, 2025 and subsequently amended. |

| Total volume | Includes purchases on WEX-issued accounts as well as purchases issued by others, but using a WEX platform. |

| WEX | WEX Inc., and all of its subsidiaries that are consolidated under accounting principles generally accepted in the United States, unless otherwise indicated or required by the context. |

| |

Exhibit 1

Reconciliation of Non-GAAP Measures

(in millions, except per share data)

Reconciliation of GAAP Net Income Attributable to Shareholders to Adjusted Net Income Attributable to Shareholders

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended | | For the twelve months ended |

| 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | 12/31/23 | 12/31/24 | 12/31/25 |

| Net income attributable to shareholders | $ | 84.9 | | $ | 65.8 | | $ | 77.0 | | $ | 102.9 | | $ | 63.9 | | $ | 71.5 | | $ | 68.1 | | $ | 80.3 | | $ | 84.3 | | | $ | 266.6 | | $ | 309.6 | | $ | 304.1 | |

| Unrealized (gain) loss on financial instruments | $ | 10.3 | | $ | 0.2 | | $ | 0.2 | | $ | (0.9) | | $ | 0.8 | | $ | (0.4) | | $ | (0.1) | | $ | (0.3) | | $ | (0.1) | | | $ | 30.4 | | $ | 0.2 | | $ | (0.8) | |

| Net foreign currency (gain) loss | $ | (14.3) | | $ | 12.5 | | $ | 0.4 | | $ | (3.2) | | $ | 16.4 | | $ | 3.1 | | $ | (2.4) | | $ | 2.6 | | $ | (3.1) | | | $ | (4.9) | | $ | 26.1 | | $ | 0.2 | |

| Change in fair value of contingent consideration | $ | 2.3 | | $ | 1.7 | | $ | 1.7 | | $ | 0.1 | | $ | 3.0 | | $ | 0.8 | | $ | 0.8 | | $ | 0.7 | | $ | 0.6 | | | $ | 8.5 | | $ | 6.5 | | $ | 2.9 | |

| Acquisition-related intangible amortization | $ | 50.4 | | $ | 50.9 | | $ | 50.5 | | $ | 50.4 | | $ | 49.9 | | $ | 47.8 | | $ | 49.3 | | $ | 47.9 | | $ | 46.9 | | | $ | 184.0 | | $ | 201.8 | | $ | 191.9 | |

| Other acquisition and divestiture related items | $ | (1.0) | | $ | 3.2 | | $ | 3.8 | | $ | 2.4 | | $ | 2.8 | | $ | 2.5 | | $ | 1.9 | | $ | 5.0 | | $ | (0.3) | | | $ | 6.6 | | $ | 12.1 | | $ | 9.1 | |

| Stock-based compensation | $ | 37.1 | | $ | 26.7 | | $ | 33.3 | | $ | 29.8 | | $ | 22.1 | | $ | 13.3 | | $ | 32.4 | | $ | 34.7 | | $ | 23.1 | | | $ | 131.6 | | $ | 111.9 | | $ | 103.5 | |

| Other costs | $ | 17.0 | | $ | 5.8 | | $ | 19.4 | | $ | 12.6 | | $ | 11.1 | | $ | 14.8 | | $ | 4.5 | | $ | 3.6 | | $ | 2.5 | | | $ | 45.6 | | $ | 48.9 | | $ | 25.4 | |

| Impairment charge | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 9.9 | | | $ | — | | $ | — | | $ | 9.9 | |

| Debt restructuring and debt issuance cost amortization | $ | 5.5 | | $ | 4.5 | | $ | 3.2 | | $ | 4.3 | | $ | 3.9 | | $ | 2.2 | | $ | 1.8 | | $ | 2.3 | | $ | 2.1 | | | $ | 89.4 | | $ | 15.9 | | $ | 8.4 | |

| | | | | | | | | | | | | |

| Tax related items | $ | (28.4) | | $ | (24.7) | | $ | (25.5) | | $ | (20.9) | | $ | (31.1) | | $ | (17.2) | | $ | (20.2) | | $ | (17.1) | | $ | (22.1) | | | $ | (112.1) | | $ | (102.2) | | $ | (76.6) | |

| Adjusted net income attributable to shareholders | $ | 163.9 | | $ | 146.7 | | $ | 164.0 | | $ | 177.5 | | $ | 142.9 | | $ | 138.4 | | $ | 136.2 | | $ | 159.7 | | $ | 143.7 | | | $ | 645.8 | | $ | 631.0 | | $ | 578.0 | |

| ANI per Diluted Share | $ | 3.82 | | $ | 3.46 | | $ | 3.91 | | $ | 4.35 | | $ | 3.57 | | $ | 3.51 | | $ | 3.95 | | $ | 4.59 | | $ | 4.11 | | | $ | 14.81 | | $ | 15.28 | | $ | 16.10 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Reconciliation of GAAP Net Income Attributable to Shareholders per Diluted Share to Adjusted Net Income Attributable to Shareholders per Diluted Share

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | | Year Ended December 31, | | |

| | | | | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | | | | |

| Net income (loss) attributable to shareholders per diluted share | | | | | $ | 0.57 | | $ | 3.71 | | $ | 3.86 | | $ | 2.26 | | $ | (5.56) | | $ | — | | $ | 4.50 | | $ | 6.16 | | $ | 7.50 | | $ | 8.47 | | | | | |

| Unrealized loss (gain) on financial instruments | | | | | $ | (0.19) | | $ | (0.03) | | $ | (0.06) | | $ | 0.79 | | $ | 0.62 | | $ | (0.86) | | $ | (1.86) | | $ | 0.70 | | $ | 0.01 | | $ | (0.02) | | | | | |

| Net foreign currency loss (gain) | | | | | $ | 0.23 | | $ | (0.73) | | $ | 0.89 | | $ | 0.02 | | $ | 0.59 | | $ | 0.27 | | $ | 0.51 | | $ | (0.11) | | $ | 0.63 | | $ | — | | | | | |

| Acquisition-related intangible amortization | | | | | $ | 2.39 | | $ | 3.57 | | $ | 3.17 | | $ | 3.64 | | $ | 3.90 | | $ | 4.01 | | $ | 3.81 | | $ | 4.25 | | $ | 4.89 | | $ | 5.34 | | | | | |

| Other acquisition and divestiture related items | | | | | $ | 1.24 | | $ | 0.12 | | $ | 0.10 | | $ | 0.86 | | $ | 1.32 | | $ | 0.81 | | $ | 0.40 | | $ | 0.15 | | $ | 0.29 | | $ | 0.25 | | | | | |

| Legal settlement | | | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 3.71 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | |

| Stock-based compensation | | | | | $ | 0.48 | | $ | 0.71 | | $ | 0.81 | | $ | 1.09 | | $ | 1.50 | | $ | 1.70 | | $ | 2.25 | | $ | 3.04 | | $ | 2.71 | | $ | 2.88 | | | | | |

| Other costs | | | | | $ | 0.34 | | $ | 0.26 | | $ | 0.31 | | $ | 0.57 | | $ | 0.31 | | $ | 0.52 | | $ | 0.86 | | $ | 1.05 | | $ | 1.19 | | $ | 0.71 | | | | | |

| Vendor settlement | | | | | $ | 0.38 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | |

| (Gain) loss on sale of subsidiary | | | | | $ | — | | $ | (0.49) | | $ | — | | $ | — | | $ | 1.06 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | |

| Impairment charges and asset write-offs | | | | | $ | — | | $ | 1.02 | | $ | 0.13 | | $ | — | | $ | 1.22 | | $ | — | | $ | 3.05 | | $ | — | | $ | — | | $ | 0.28 | | | | | |

| Debt restructuring and debt issuance cost amortization | | | | | $ | 0.31 | | $ | 0.24 | | $ | 0.32 | | $ | 0.48 | | $ | 0.91 | | $ | 0.48 | | $ | 0.39 | | $ | 2.06 | | $ | 0.39 | | $ | 0.23 | | | | | |

| Change in fair value of contingent consideration | | | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 0.88 | | $ | 3.11 | | $ | 0.20 | | $ | 0.16 | | $ | 0.08 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Non-cash adjustments related to tax receivable agreement | | | | | $ | 0.01 | | $ | (0.35) | | $ | 0.02 | | $ | (0.02) | | $ | (0.01) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | |

| ANI adjustments attributable to non-controlling interests | | | | | $ | (0.06) | | $ | (0.04) | | $ | (0.03) | | $ | 1.21 | | $ | (0.98) | | $ | 2.91 | | $ | (0.77) | | $ | — | | $ | — | | $ | — | | | | | |

| Tax related items | | | | | $ | (1.93) | | $ | (2.67) | | $ | (1.24) | | $ | (1.71) | | $ | (2.47) | | $ | (1.58) | | $ | (2.59) | | $ | (2.59) | | $ | (2.47) | | $ | (2.13) | | | | | |

| Dilutive impact of stock awards | | | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | (0.06) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | |

| Dilutive impact of convertible debt | | | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | (0.13) | | $ | (0.10) | | $ | — | | $ | — | | | | | |

| Adjusted net income attributable to shareholders per diluted share | | | | | $ | 3.78 | | $ | 5.32 | | $ | 8.28 | | $ | 9.20 | | $ | 6.06 | | $ | 9.14 | | $ | 13.53 | | $ | 14.81 | | $ | 15.28 | | $ | 16.10 | | | | | |

Reconciliation of GAAP Operating Income to Total Segment Adjusted Operating Income and Adjusted Operating Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | For the three months ended | | For the twelve months ended |

| 12/31/23 | 3/31/24 | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | 12/31/25 | | 12/31/23 | 12/31/24 | 12/31/25 |

| Operating income | $ | 158.5 | | $ | 164.5 | | $ | 168.1 | | $ | 196.4 | | $ | 157.3 | | $ | 157.3 | | $ | 156.8 | | $ | 183.6 | | $ | 166.3 | | | $ | 647.1 | | $ | 686.3 | | $ | 663.9 | |

| Unallocated corporate expenses | $ | 26.2 | | $ | 23.6 | | $ | 26.1 | | $ | 24.1 | | $ | 28.3 | | $ | 24.9 | | $ | 25.4 | | $ | 23.7 | | $ | 24.4 | | | $ | 103.0 | | $ | 102.1 | | $ | 98.5 | |

| Acquisition-related intangible amortization | $ | 50.4 | | $ | 50.9 | | $ | 50.5 | | $ | 50.4 | | $ | 49.9 | | $ | 47.8 | | $ | 49.3 | | $ | 47.9 | | $ | 46.9 | | | $ | 184.0 | | $ | 201.8 | | $ | 191.9 | |

| Other acquisition and divestiture related items | $ | (1.0) | | $ | 2.4 | | $ | 1.4 | | $ | 1.6 | | $ | 0.3 | | $ | 0.5 | | $ | 0.7 | | $ | 3.8 | | $ | (1.5) | | | $ | 6.6 | | $ | 5.7 | | $ | 3.4 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation | $ | 37.1 | | $ | 26.7 | | $ | 33.3 | | $ | 29.8 | | $ | 22.1 | | $ | 13.3 | | $ | 32.4 | | $ | 34.7 | | $ | 23.1 | | | $ | 131.6 | | $ | 111.9 | | $ | 103.5 | |

| Other costs | $ | 17.5 | | $ | 6.7 | | $ | 20.6 | | $ | 14.8 | | $ | 11.9 | | $ | 14.9 | | $ | 3.9 | | $ | 3.6 | | $ | 2.5 | | | $ | 46.1 | | $ | 53.9 | | $ | 24.8 | |

| | | | | | | | | | | | | |

Impairment charge | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 9.9 | | | $ | — | | $ | — | | $ | 9.9 | |

| Total segment adjusted operating income | $ | 288.7 | | $ | 274.9 | | $ | 299.9 | | $ | 317.1 | | $ | 269.8 | | $ | 258.7 | | $ | 268.5 | | $ | 297.2 | | $ | 271.5 | | | $ | 1,118.4 | | $ | 1,161.7 | | $ | 1,095.9 | |

| Unallocated corporate expenses | $ | (26.2) | | $ | (23.6) | | $ | (26.1) | | $ | (24.1) | | $ | (28.3) | | $ | (24.9) | | $ | (25.4) | | $ | (23.7) | | $ | (24.4) | | | $ | (103.0) | | $ | (102.1) | | $ | (98.5) | |

| Adjusted operating income | $ | 262.5 | | $ | 251.3 | | $ | 273.9 | | $ | 293.0 | | $ | 241.5 | | $ | 233.8 | | $ | 243.0 | | $ | 273.5 | | $ | 247.1 | | | $ | 1,015.4 | | $ | 1,059.7 | | $ | 997.5 | |

| | | | | | | | | | | | | |

The Company's non-GAAP adjusted operating income excludes acquisition-related intangible amortization, other acquisition and divestiture related items, debt restructuring costs, stock-based compensation, other costs and certain non-recurring or non-cash operating charges that are not core to our operations, as applicable depending on the period presented. Total segment adjusted operating income incorporates these same adjustments and further excludes unallocated corporate expenses.

The Company's non-GAAP adjusted net income, which similarly excludes the impact of all items excluded in adjusted operating income, further excludes unrealized gains and losses on financial instruments, net foreign currency gains and losses, debt issuance cost amortization, tax related items, and certain other non-operating items, as applicable depending on the period presented.

Although adjusted net income, adjusted operating income and total segment adjusted operating income are not calculated in accordance with GAAP, our management team believes these non-GAAP measures are integral to our reporting and planning processes and uses them to assess operating performance because they generally exclude financial results that are outside the normal course of our business operations or management’s control. These measures are also used to allocate capital and resources among our operating segments.

For the periods presented herein, the following items have been excluded in determining one or more non-GAAP measures for the following reasons:

•Exclusion of the non-cash, mark-to-market adjustments on financial instruments, including interest rate swap agreements and investment securities, helps management identify and assess trends in the Company’s underlying business that might otherwise be obscured due to quarterly non-cash earnings fluctuations associated with these financial instruments. Additionally, the non-cash, mark-to-market adjustments on financial instruments are difficult to forecast accurately, making comparisons across historical and future quarters difficult to evaluate;

•Net foreign currency gains and losses primarily result from the remeasurement to functional currency of cash, accounts receivable and accounts payable balances, certain intercompany transactions denominated in foreign currencies and any gain or loss on foreign currency hedges relating to these items. The exclusion of these items helps management compare changes in operating results between periods that might otherwise be obscured due to currency fluctuations;

•The change in fair value of contingent consideration, which is related to the acquisition of certain contractual rights to serve as custodian or sub-custodian to HSAs, is dependent upon changes in future interest rate assumptions and has no significant impact on the ongoing operations of the Company. Additionally, the non-cash, mark-to-market adjustments on financial instruments are difficult to forecast accurately, making comparisons across historical and future quarters difficult to evaluate;

•The Company considers certain acquisition-related costs, including certain financing costs, investment banking fees, warranty and indemnity insurance, certain integration-related expenses and amortization of acquired intangibles, as well as gains and losses from divestitures to be unpredictable, dependent on factors that may be outside of our control and unrelated to the continuing operations of the acquired or divested business or the Company. In addition, the size and complexity of an acquisition, which often drives the magnitude of acquisition-related costs, may not be indicative of such future costs. The Company believes that excluding acquisition-related costs and gains or losses on divestitures facilitates the comparison of our financial results to the Company’s historical operating results and to other companies in our industry;

•Stock-based compensation is different from other forms of compensation as it is a non-cash expense. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and the cost to the Company is based on a stock-based compensation valuation methodology and underlying assumptions that may vary over time;