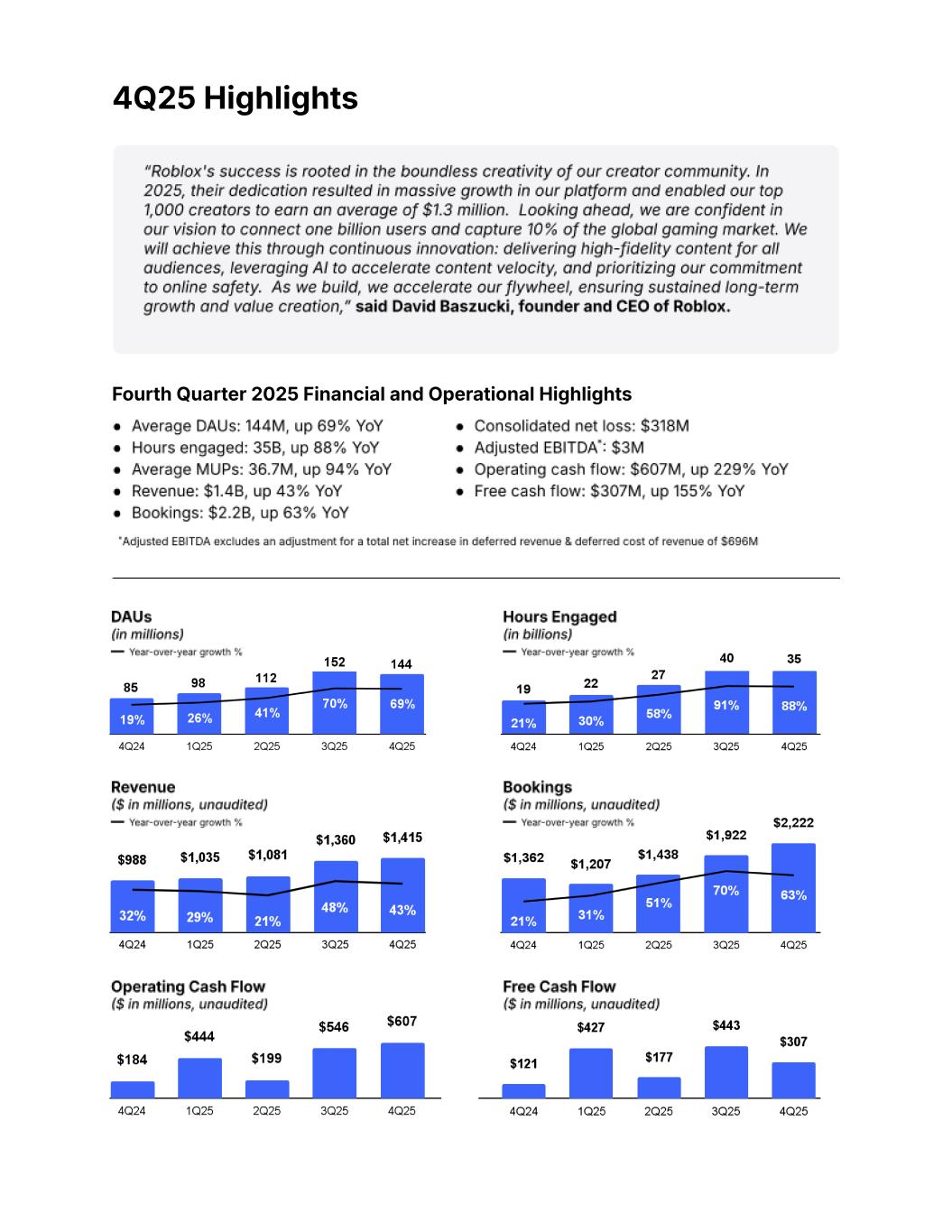

4Q25 Highlights Fourth Quarter 2025 Financial and Operational Highlights

To Our Shareholders: Fiscal 2025 was a banner year for Roblox, with results significantly exceeding both our annual guidance and our long-term targets. We reached new heights across core metrics including average daily active users (DAUs), Hours Engaged (Hours), revenue and bookings. Revenue grew 36% year-over-year to $4.9 billion, bookings grew 55% year-over-year to $6.8 billion and we generated $1.8 billion in operating cash flow. This performance was driven by the addition of approximately 60 million DAUs from Q4 2024 to Q4 2025. At the same time, increased content diversity and deeper engagement fueled the Roblox flywheel, yielding a larger economic opportunity for our creator community. At the end of 2025, Roblox accounted for 3.4% of the global gaming content market, with even deeper penetration in the U.S1. Q4 results also exceeded our expectations on both the top and bottom line. Revenue and bookings increased 43% and 63% year-over-year, respectively, driven by a combination of robust user growth and strong monetization growth across most regions. DAUs grew 69% and Hours were up 88% year-over-year. Operating cash flow was $607 million and free cash flow totaled $307 million in the quarter. We captured operating leverage as demonstrated by 155% growth in free cash flow (including a healthy capex cycle) on 63% growth in bookings year-over-year. Our long-term vision is to connect one billion users with optimism and civility. We are working towards an ambitious target of capturing 10% of the global gaming content market and winning an even greater share of the U.S. market. This scale will enable us to further expand our capabilities in communication, entertainment, commerce and advertising. In order to achieve this goal, we are focused on the following levers: 1. Novel Game Expansion to Serve All Audiences: We see an even larger opportunity than previously estimated to expand our footprint among older audiences. 2. Harnessing the Power of AI: We are innovating aggressively in AI to accelerate the creation of content, improve the safety of our platform, and fuel ongoing user engagement, discovery and monetization improvements. 3. Safety & Civility as a Strategic Advantage: We seek to make Roblox a safe place for kids on the Internet and believe there is significant value to be captured by super-serving this audience. 4. Accelerating our Flywheel: We will continue to enhance monetization, while investing in our creators and our platform to drive growth that unlocks further capacity for investment and long-term margin expansion. 1 Source: Newzoo: Global Games Market Report, November 2025 Quarterly Update. 2

The execution and financial results delivered in 2025 give us even greater conviction in the long term value creation opportunity for Roblox. Novel Game Expansion to Serve All Audiences Roblox holds a distinct position in the digital landscape and our Total Addressable Market (TAM) is larger than many peer platforms. Unlike other platforms that were created for adults, Roblox was initially created to serve the younger demographic, and today we are the largest dedicated gaming platform for users aged 13 and under (U13). Over the past two months, we began requiring users across the globe to complete an age-check in order to access chat functionality. As expected, age-checked data reveals a younger user base than self-reported data. Through January 31, 45% of DAUs have age-checked. Of those who have age-checked, 35% are U13, 38% are between the ages of 13 and 17, and 27% are over 18 (O18).2 This data reveals an even larger growth opportunity in the O18 demographic relative to self-reported data. For instance, in the U.S., Roblox currently reaches fewer than 10% of adults between the ages of 18-34 each day.3 This user cohort is growing at over 50%4—more than double the rate of U18 DAUs—and monetizes 40%5 higher. To capture value associated with the older user cohort, we are optimizing our platform to facilitate the creation of games that expand into new genres, use different gameplay mechanics, and have a different look and feel than classic Roblox games. At Roblox, we refer to these as “Novel” games. We are prioritizing some of the largest and highest-monetizing genres in the gaming market—e.g. Shooters, RPGs, and Sports & Racing. Our technology roadmap is heavily oriented to building the key functionality required to support these high-fidelity genres while leveraging the unique capabilities of the Roblox platform to scale from low end mobile devices to high performance consoles and PCs. 5 Estimate generated using the same methodology in footnote (3) for both DAUs and bookings. Measure based on a comparison for FY 2025. 4 Estimate generated using the same methodology in footnote (3). Growth based on FY 2025 data. 3 TAM based on 2025 U.S. census population estimates. Historical age distribution extrapolated from current ‘age-checked’ DAU distribution applied to ‘non age-checked’ DAU. 2 Based on the age distribution of ‘age-checked’ DAUs as of the 7 days ended January 31, 2026. 3

Toward the end of 2025, we delivered many innovations, including these three: ● SLIM (Scalable Lightweight Interactive Models): Improves performance across all hardware enabling richer, more immersive experiences, across devices, at the highest volume. We expect SLIM to drive material improvements in engagement and session length. ● Server Authority: Essential for competitive genres like Shooters, this release empowers creators to designate the server as the "source of truth." This increases fairness and security while utilizing advanced prediction and rollback technology to ensure players experience gameplay with minimal lag. ● Texture Streaming: Dramatically improves the human perception of having joined a game faster, using a texture’s size on screen, distance to the player and other signals to load the most important textures first. This dramatically improves memory utilization and CDN bandwidth, as it only loads the smallest LOD (or low cost representation) and then gradually improves the quality as the device can handle it. These technologies, along with many others such as improved memory management and rendering optimizations will give our creators the ability to build games of increased fidelity, while still performing on low end Android phones. Harnessing the Power of AI Our long term vision is to build a human co-experience platform, where a billion users come together to play, learn, work, and communicate. Rapid advancements in AI are a tailwind to this universal vision. Over the past four years we have embedded AI models in our vertically integrated stack to both accelerate content creation and enhance many facets of our platform that serves 144 million DAUs and millions of creators. We are building foundation models that will support large scale, photo-realistic, multi-player games where thousands of users (and AI powered NPCs) can come together, communicate, and compete on any device. We have unique data to train these models, including 12 billion hours of human interaction data per month— not just video, but a 3D record of all avatar movement within Roblox worlds, facial expression, billions of chat messages each day— and tens of millions of users communicating through voice each day. As we move toward our long-term vision, we have developed and deployed over 400 models on the Roblox platform to power creation, discovery, safety and social communication. 4

Creation. We are helping our creators build faster and with higher fidelity through tools like Roblox Assistant, which automates repetitive coding and creation tasks, Avatar Auto-Setup, which streamlines character creation, and Cube, our proprietary 3D foundation model. We recently enhanced the Cube model with the ability to add the 4th dimension to objects: interactivity. This technology significantly reduces the time and effort to create functional 3D assets that players can immediately interact with. For example, a user can create their own unique car with a text prompt, and then get in it and race it through a racing game. In our research labs, we’re working on what we call “real-time dreaming”, the ability to let users create fully interactive lifelike worlds in any style from an image or prompt, and continue to shape that world with additional prompts and user inputs. Safety. We have developed and open sourced several state-of-the-art safety models, including a voice classifier for real time detection of toxicity in voice communications, Roblox Sentinel for real-time child endangerment detection, Roblox Guard for Large Language Model (LLM) moderation, and a PII Classifier that helps detect when players attempt to solicit personal information. These open source models, along with other proprietary and third party models such as the technology we use for facial age estimation, allow us to enforce our community standards faster, more accurately and at a massive scale. Discovery. We are focused on efficiently matching users with the content they love. In 2025, improvements in search and discovery stimulated the entire ecosystem— facilitating new viral hits while expanding engagement in the “torso and the tail”. On average, users engaged with over 24 unique experiences per month in 2025, up double-digit percentages from 2024, and in Q4, improvements to the "Recommended for You" algorithm drove another double-digit increase in the number of unique experiences surfaced per 1 million recommendations. Social Communication. We use AI to improve the social interaction on our platform. AI-driven matchmaking - enabled by our recent age-check initiative - improves the quality of social interactions grouping players together in game servers to maximize communication affinity and encourage an age-appropriate play experience. Auto-translation of text chat into 17 different languages and our upcoming Real-Time Voice Chat Translation effectively remove language barriers supporting an even more vibrant Roblox community. Not long ago, people talked about game development budgets in the billions of dollars and timelines of years. But in September 2025, thanks to the power of the Roblox platform, Steal a Brainrot, a game launched in 4 months by a group of young developers, reached an all time record of 25 million concurrent users. We believe our AI roadmap will create more opportunities for this kind of success. 5

Safety & Civility as a Strategic Advantage Roblox remains steadfast in its commitment to define and execute on our vision to be the gold standard for online safety. In late Q4, we began our rollout of mandatory age-checks for access to communication features in Australia, New Zealand, and the Netherlands, and we completed a global rollout in early January 2026. Adoption has been strong with approximately 60% of DAUs in our first three markets already age-checked and as of January 31, we have achieved 45% penetration of our global DAUs. As anticipated, and as may be the case for many other digital platforms, our initial age-checked data revealed a younger user base than indicated by self-reported data. Of DAUs who have age-checked to date, 35% are U13, 38% are between the ages of 13 and 17, and 27% are O18. This mix may evolve further as more users age-check. Going forward, we intend to provide quarterly data on the distribution of our age-checked cohorts, including disclosure on our O18 cohort, providing greater transparency into this growing audience on Roblox. Thus far, our age-check rollout has created some expected short-term friction— a mid-single-digit headwind to engagement growth and a low-single-digit headwind to bookings growth— as the lost Hours have largely come from less engaged users. However, the strategic upside is significant. Accurate age data unlocks a long-term opportunity to tailor features and content, increasing safety and civility, which in turn drives organic engagement growth. We are rapidly deploying enhancements designed to further incentivize users to age-check with the goal of accelerating engagement beyond our pre-rollout levels. Last week, we released enhanced matchmaking which clusters users based on their age and skill level. Over the coming months, we have more products launching, including next generation text filters, real time multi-modal moderation and continuous age estimation which is the next iteration of facial age estimation, and uses additional signals, such as play patterns, social graphs, and economic activity to estimate users’ ages. As we learn more, we are more confident that over time, these enhancements can enable even higher levels of engagement than what we saw prior to the age-check rollout. We view our scale with young users as a valuable strategic asset. This position drives our commitment to being the industry leader in safety. The fact that we generated nearly $7 billion in bookings from our user base in fiscal 2025 demonstrates our ability to engage and monetize a young user base, without significant reliance on advertising. 6

Accelerating our Flywheel Roblox builds scale by investing in monetization, creators, tech innovation (i.e. our people), and our platform. We operate with the principle of growing bookings faster than fixed costs while capturing leverage in distribution and infrastructure expenses over time. Our flywheel gives us the ability to reinvest this operating leverage in further growth while also delivering long-term margin expansion. Pricing Optimization. Our automated price tuning technology is supporting bookings growth. In 2025, regional pricing and pricing optimization tools expanded both the geographical diversity of our payer base and monetization per user. For the full year, average Bookings per DAU (ABPDAU) increased year-over-year and was up double-digits in the U.S. and Canada, and average monthly unique payers (MUP) grew over 65%. Advertising. Advertisers continue to seek access to our highly engaged user base. Late last year we made our Rewarded Video product widely available. For over 1,000 brands, Rewarded Video is delivering performance comparable to industry standards with completion rates of over 90% and viewability rates of 95%. We continue to work closely with creators to expand Rewarded Video supply, though we expect this will take some time to scale. Last month, we launched our new ad format, Homepage Feature. While advertising revenue currently remains modest, our expanded portfolio of ad products, together with our growing age-checked user base makes us bullish about the long-term potential for mass market advertising on Roblox. Our offerings for native advertisers are also expanding. In 2025, we overhauled our Ads Manager solution to help creators reach and retain users on the platform. These changes resulted in a greater than 40% reduction in cost-per-play versus Q1 2025. As our products evolve, the number of experiences using traffic-driving ads has increased over 75% year-over-year. Creator Economics. We believe increasing creator economics leads to greater creator engagement, which drives content quality and diversity. In September, we increased our DexEx rate by 8.5%. In 2025, we also launched our Creator Rewards program which provides additional financial incentives for creators who drive high-value behaviors such as retention and engagement. For the full year, our top 1,000 creators earned an average of $1.3 million, up over 50% compared to a year ago. Over the long term, we expect to further increase DevEx rates, which we view as one of our highest-yielding investments. Lowering Distribution Costs. In Q4 and 2025, we made tangible progress in reducing payment processing fees by moving more of our business to first-party distribution channels. As app store policies continue to evolve, we have modified our "Buy Robux" user experience to steer more 7

traffic to lower-cost channels. We plan to apply these modifications to additional platforms and regions which suggests a multi-year opportunity to improve operating leverage. Infrastructure Investment. We are building the infrastructure to support rapid AI adoption and the growth of our user base while lowering Cost-to-Serve (CtS) over the long term. In Q4, we began to make targeted infrastructure investments and are seeing compelling returns, including a 10x efficiency improvement for certain AI workloads related to safety moderation, discovery and content generation. In 2026, we will continue to migrate AI inference workloads from third-party cloud providers to our own GPU-equipped data centers. We are also expanding the resiliency of our core data centers by adding a third core data center location to our footprint. Simultaneously, we continue to expand our edge data centers to reduce latency, support new genres, and improve performance in our fastest-growing international markets. Key Metrics and Financials: Q4 2025 In Q4 we delivered strong results capping off a record year: Users & Engagement. DAUs grew 69% year-over-year to 144 million. We saw diversification of Roblox's geographic footprint as DAUs outside of the U.S. and Canada grew 79%, while U.S. and Canada DAUs grew 32% year-over-year. The combination of user growth and increasing content diversity resulted in significant engagement growth. Hours grew 88% year-over-year to 35 billion. Similar to user growth trends, Hours growth was strongest in APAC but also included robust 41% growth in the U.S. and Canada. Content Diversity. Q4 saw significant engagement and bookings growth without large new viral experiences. While top experiences like Grow a Garden, Steal a Brainrot, and 99 Nights in the Forest continued to attract large volumes of DAUs and Hours, we’ve also seen growth in tenured experiences such as AdoptMe! and RIVALS. The long tail of content shows continued strength: experiences outside the top 10 saw 68% growth in engagement and 53% growth in Robux spending— both an acceleration relative to Q3. In fact, experiences outside the top 10 accounted for more than half of the growth in Robux spending this quarter. While we welcome and expect future viral hits, our results in Q4 give us confidence in Roblox’s long-term growth potential despite the unpredictability of viral experiences. Monetization. Rapid growth in DAUs and Hours, together with measurable gains in ABPDAU in each region and growth in payer penetration translated to significantly better-than-expected revenue and bookings performance. MUPs increased to 36.7 million, close to double a year ago, with year-over-year growth accelerating for the fourth quarter in a row. While payer growth was particularly strong in international markets, the U.S. and Canada saw healthy 34% growth in the 8

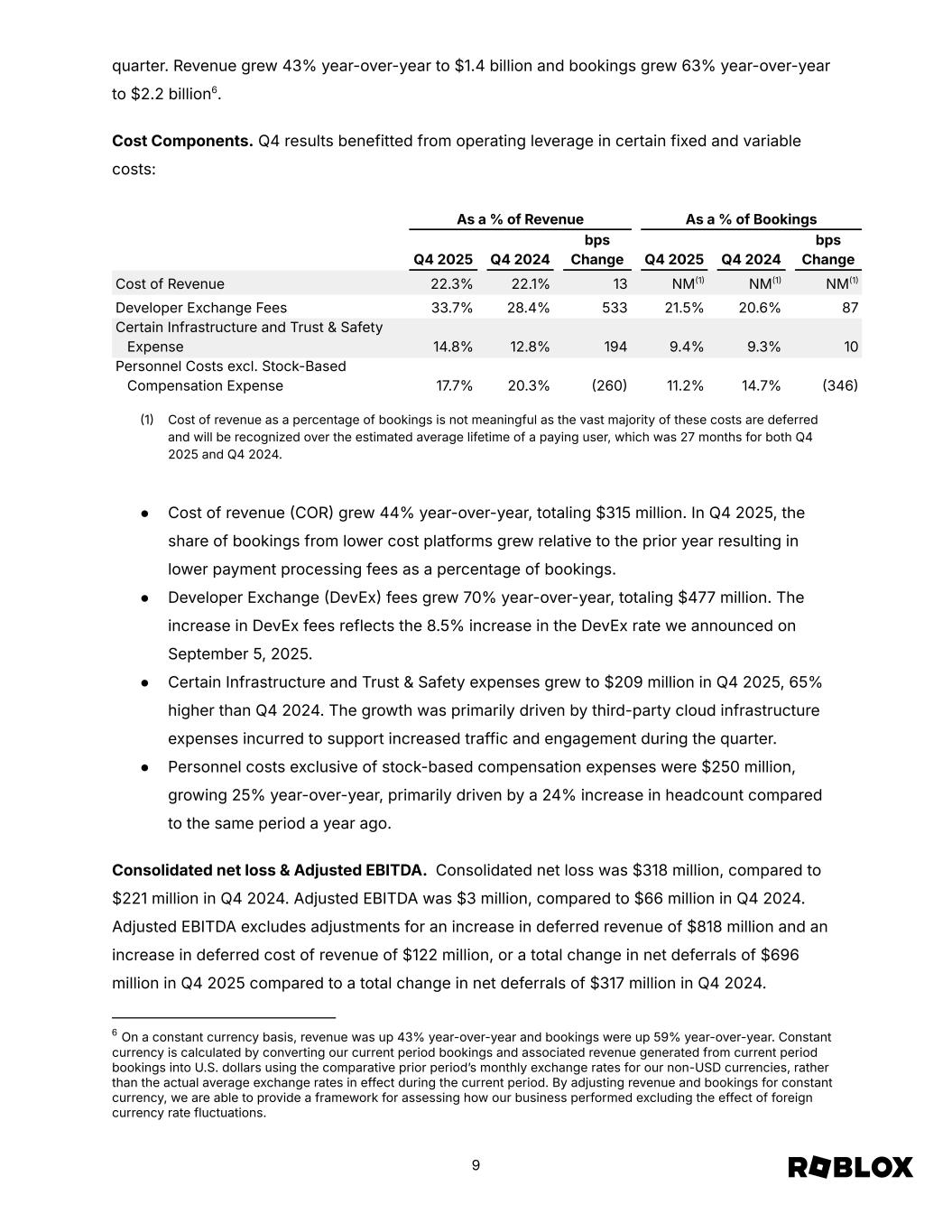

quarter. Revenue grew 43% year-over-year to $1.4 billion and bookings grew 63% year-over-year to $2.2 billion6. Cost Components. Q4 results benefitted from operating leverage in certain fixed and variable costs: As a % of Revenue As a % of Bookings Q4 2025 Q4 2024 bps Change Q4 2025 Q4 2024 bps Change Cost of Revenue 22.3% 22.1% 13 NM(1) NM(1) NM(1) Developer Exchange Fees 33.7% 28.4% 533 21.5% 20.6% 87 Certain Infrastructure and Trust & Safety Expense 14.8% 12.8% 194 9.4% 9.3% 10 Personnel Costs excl. Stock-Based Compensation Expense 17.7% 20.3% (260) 11.2% 14.7% (346) (1) Cost of revenue as a percentage of bookings is not meaningful as the vast majority of these costs are deferred and will be recognized over the estimated average lifetime of a paying user, which was 27 months for both Q4 2025 and Q4 2024. ● Cost of revenue (COR) grew 44% year-over-year, totaling $315 million. In Q4 2025, the share of bookings from lower cost platforms grew relative to the prior year resulting in lower payment processing fees as a percentage of bookings. ● Developer Exchange (DevEx) fees grew 70% year-over-year, totaling $477 million. The increase in DevEx fees reflects the 8.5% increase in the DevEx rate we announced on September 5, 2025. ● Certain Infrastructure and Trust & Safety expenses grew to $209 million in Q4 2025, 65% higher than Q4 2024. The growth was primarily driven by third-party cloud infrastructure expenses incurred to support increased traffic and engagement during the quarter. ● Personnel costs exclusive of stock-based compensation expenses were $250 million, growing 25% year-over-year, primarily driven by a 24% increase in headcount compared to the same period a year ago. Consolidated net loss & Adjusted EBITDA. Consolidated net loss was $318 million, compared to $221 million in Q4 2024. Adjusted EBITDA was $3 million, compared to $66 million in Q4 2024. Adjusted EBITDA excludes adjustments for an increase in deferred revenue of $818 million and an increase in deferred cost of revenue of $122 million, or a total change in net deferrals of $696 million in Q4 2025 compared to a total change in net deferrals of $317 million in Q4 2024. 6 On a constant currency basis, revenue was up 43% year-over-year and bookings were up 59% year-over-year. Constant currency is calculated by converting our current period bookings and associated revenue generated from current period bookings into U.S. dollars using the comparative prior period’s monthly exchange rates for our non-USD currencies, rather than the actual average exchange rates in effect during the current period. By adjusting revenue and bookings for constant currency, we are able to provide a framework for assessing how our business performed excluding the effect of foreign currency rate fluctuations. 9

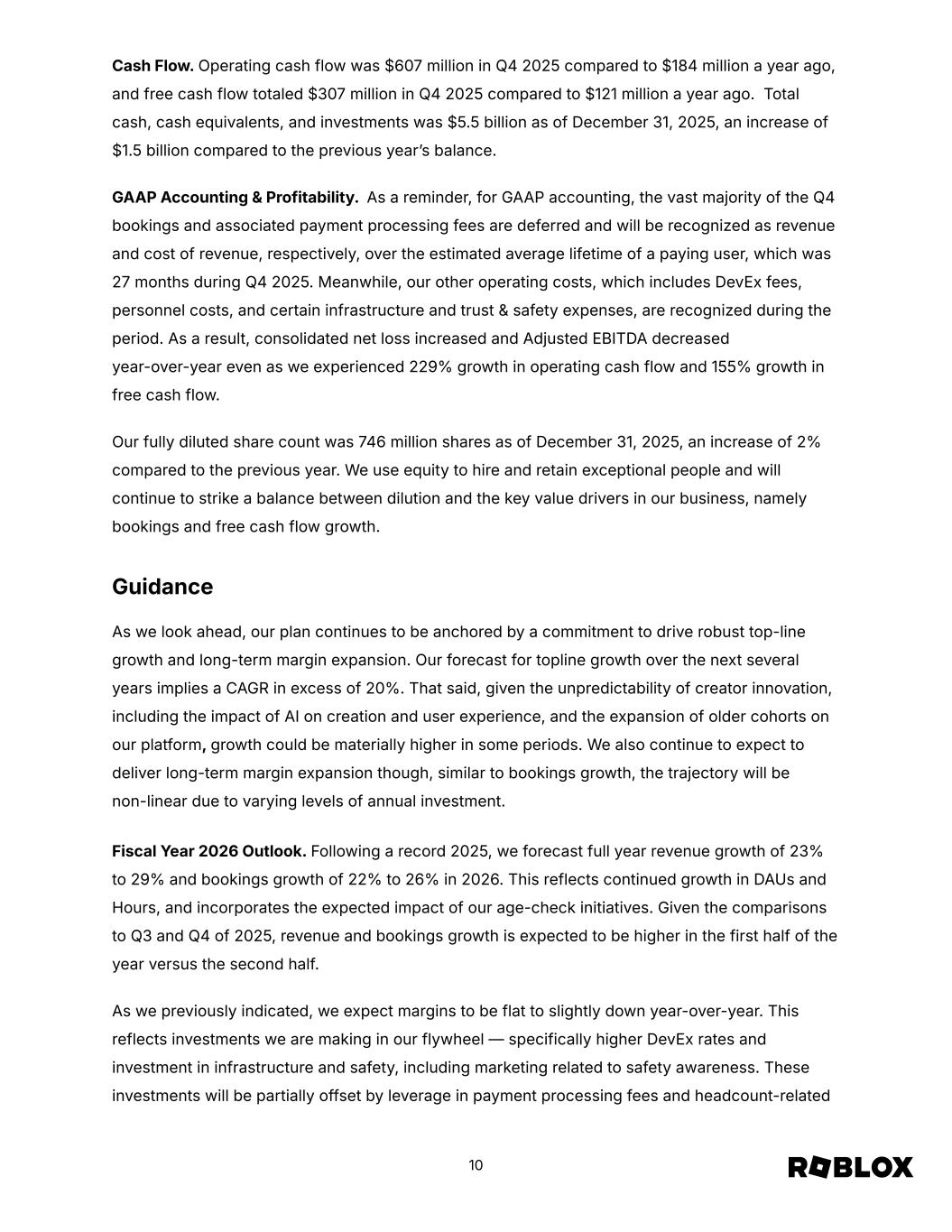

Cash Flow. Operating cash flow was $607 million in Q4 2025 compared to $184 million a year ago, and free cash flow totaled $307 million in Q4 2025 compared to $121 million a year ago. Total cash, cash equivalents, and investments was $5.5 billion as of December 31, 2025, an increase of $1.5 billion compared to the previous year’s balance. GAAP Accounting & Profitability. As a reminder, for GAAP accounting, the vast majority of the Q4 bookings and associated payment processing fees are deferred and will be recognized as revenue and cost of revenue, respectively, over the estimated average lifetime of a paying user, which was 27 months during Q4 2025. Meanwhile, our other operating costs, which includes DevEx fees, personnel costs, and certain infrastructure and trust & safety expenses, are recognized during the period. As a result, consolidated net loss increased and Adjusted EBITDA decreased year-over-year even as we experienced 229% growth in operating cash flow and 155% growth in free cash flow. Our fully diluted share count was 746 million shares as of December 31, 2025, an increase of 2% compared to the previous year. We use equity to hire and retain exceptional people and will continue to strike a balance between dilution and the key value drivers in our business, namely bookings and free cash flow growth. Guidance As we look ahead, our plan continues to be anchored by a commitment to drive robust top-line growth and long-term margin expansion. Our forecast for topline growth over the next several years implies a CAGR in excess of 20%. That said, given the unpredictability of creator innovation, including the impact of AI on creation and user experience, and the expansion of older cohorts on our platform, growth could be materially higher in some periods. We also continue to expect to deliver long-term margin expansion though, similar to bookings growth, the trajectory will be non-linear due to varying levels of annual investment. Fiscal Year 2026 Outlook. Following a record 2025, we forecast full year revenue growth of 23% to 29% and bookings growth of 22% to 26% in 2026. This reflects continued growth in DAUs and Hours, and incorporates the expected impact of our age-check initiatives. Given the comparisons to Q3 and Q4 of 2025, revenue and bookings growth is expected to be higher in the first half of the year versus the second half. As we previously indicated, we expect margins to be flat to slightly down year-over-year. This reflects investments we are making in our flywheel — specifically higher DevEx rates and investment in infrastructure and safety, including marketing related to safety awareness. These investments will be partially offset by leverage in payment processing fees and headcount-related 10

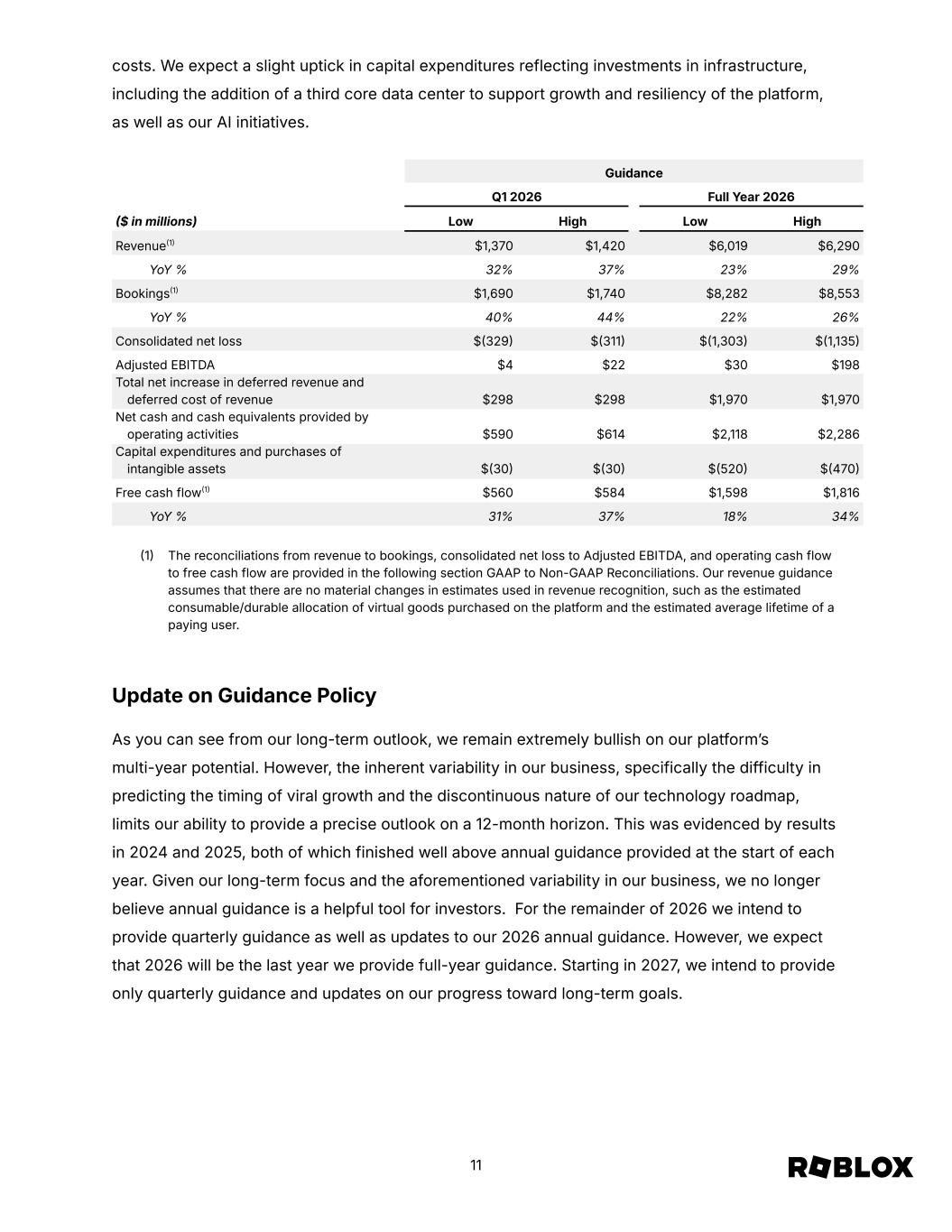

costs. We expect a slight uptick in capital expenditures reflecting investments in infrastructure, including the addition of a third core data center to support growth and resiliency of the platform, as well as our AI initiatives. Guidance Q1 2026 Full Year 2026 ($ in millions) Low High Low High Revenue(1) $1,370 $1,420 $6,019 $6,290 YoY % 32% 37% 23% 29% Bookings(1) $1,690 $1,740 $8,282 $8,553 YoY % 40% 44% 22% 26% Consolidated net loss $(329) $(311) $(1,303) $(1,135) Adjusted EBITDA $4 $22 $30 $198 Total net increase in deferred revenue and deferred cost of revenue $298 $298 $1,970 $1,970 Net cash and cash equivalents provided by operating activities $590 $614 $2,118 $2,286 Capital expenditures and purchases of intangible assets $(30) $(30) $(520) $(470) Free cash flow(1) $560 $584 $1,598 $1,816 YoY % 31% 37% 18% 34% (1) The reconciliations from revenue to bookings, consolidated net loss to Adjusted EBITDA, and operating cash flow to free cash flow are provided in the following section GAAP to Non-GAAP Reconciliations. Our revenue guidance assumes that there are no material changes in estimates used in revenue recognition, such as the estimated consumable/durable allocation of virtual goods purchased on the platform and the estimated average lifetime of a paying user. Update on Guidance Policy As you can see from our long-term outlook, we remain extremely bullish on our platform’s multi-year potential. However, the inherent variability in our business, specifically the difficulty in predicting the timing of viral growth and the discontinuous nature of our technology roadmap, limits our ability to provide a precise outlook on a 12-month horizon. This was evidenced by results in 2024 and 2025, both of which finished well above annual guidance provided at the start of each year. Given our long-term focus and the aforementioned variability in our business, we no longer believe annual guidance is a helpful tool for investors. For the remainder of 2026 we intend to provide quarterly guidance as well as updates to our 2026 annual guidance. However, we expect that 2026 will be the last year we provide full-year guidance. Starting in 2027, we intend to provide only quarterly guidance and updates on our progress toward long-term goals. 11

Expected Guidance Provided on Future Earnings Calls Reporting Period: Q1 2026 Q2 2026 Q3 2026 Q4 2026 Outlook Provided: Q2 2026 & update to FY2026 Q3 2026 & update to FY2026 Q4 2026 & update to FY2026 Q1 2027 EARNINGS Q&A SESSION We will host a live Q&A session to answer questions regarding our fourth quarter and full year 2025 results on Thursday, February 5, 2026 at 1:30 p.m. Pacific Time/ 4:30 p.m. Eastern Time. The live webcast and Q&A session will be open to the public at ir.roblox.com and we invite you to join us and to visit our investor relations website at ir.roblox.com to review supplemental information. 12

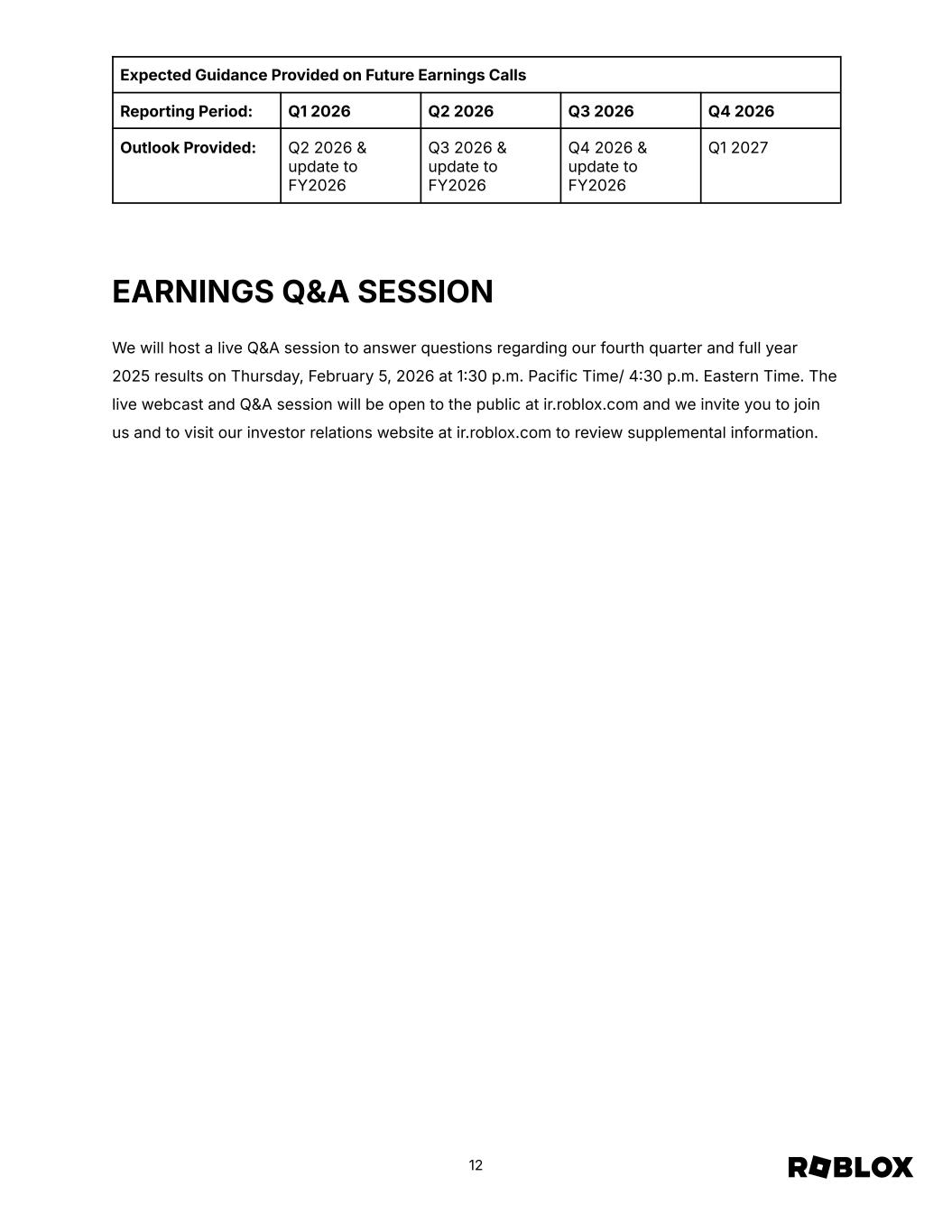

Roblox Corporation Unaudited Financial Statements ROBLOX CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS Unaudited (in thousands) As of December 31, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 1,205,319 $ 711,683 Short-term investments 1,849,823 1,697,862 Accounts receivable—net of allowances 900,646 614,838 Prepaid expenses and other current assets 109,294 75,415 Deferred cost of revenue, current portion 832,941 628,232 Total current assets 4,898,023 3,728,030 Long-term investments 2,492,593 1,610,215 Property and equipment—net 884,776 659,589 Operating lease right-of-use assets 651,055 665,885 Deferred cost of revenue, long-term 448,169 321,824 Intangible assets, net 18,234 34,153 Goodwill 142,624 141,688 Other assets 21,644 13,619 Total assets $ 9,557,118 $ 7,175,003 Liabilities and Stockholders’ equity Current liabilities: Accounts payable $ 64,948 $ 42,885 Accrued expenses and other current liabilities 396,451 275,754 Developer exchange liability 496,020 339,600 Deferred revenue—current portion 4,168,971 3,004,969 Total current liabilities 5,126,390 3,663,208 Deferred revenue—net of current portion 2,336,959 1,567,007 Operating lease liabilities 643,356 670,051 Long-term debt, net 993,098 1,006,371 Other long-term liabilities 82,335 59,712 Total liabilities 9,182,138 6,966,349 Stockholders' equity: Common stock 64 62 Additional paid-in capital 5,438,559 4,220,916 Accumulated other comprehensive income/(loss) 16,555 (3,895) Accumulated deficit (5,060,694) (3,995,637) Total Roblox Corporation stockholders' equity 394,484 221,446 Noncontrolling interest (19,504) (12,792) Total stockholders' equity 374,980 208,654 Total liabilities and stockholders' equity $ 9,557,118 $ 7,175,003 13

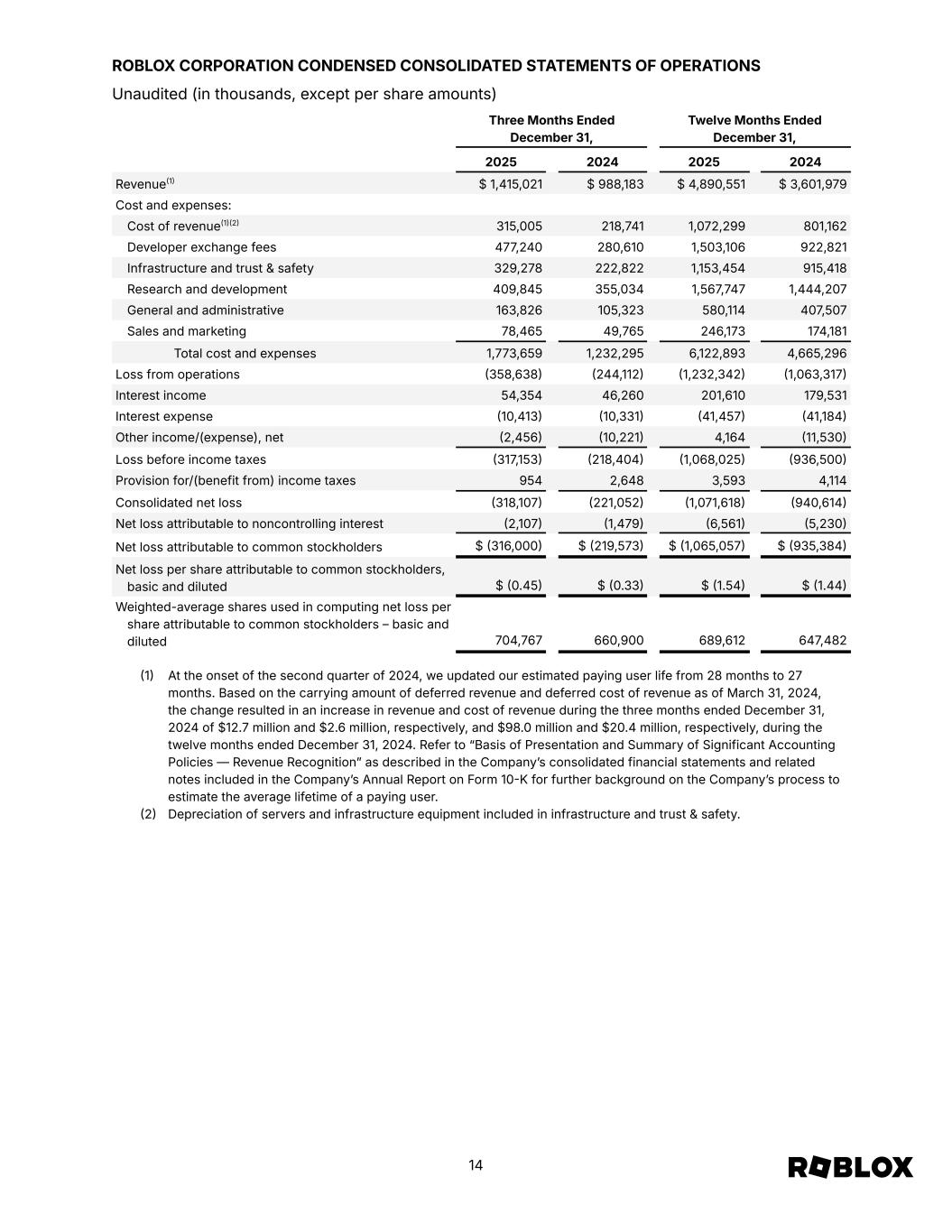

ROBLOX CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Unaudited (in thousands, except per share amounts) Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Revenue(1) $ 1,415,021 $ 988,183 $ 4,890,551 $ 3,601,979 Cost and expenses: Cost of revenue(1)(2) 315,005 218,741 1,072,299 801,162 Developer exchange fees 477,240 280,610 1,503,106 922,821 Infrastructure and trust & safety 329,278 222,822 1,153,454 915,418 Research and development 409,845 355,034 1,567,747 1,444,207 General and administrative 163,826 105,323 580,114 407,507 Sales and marketing 78,465 49,765 246,173 174,181 Total cost and expenses 1,773,659 1,232,295 6,122,893 4,665,296 Loss from operations (358,638) (244,112) (1,232,342) (1,063,317) Interest income 54,354 46,260 201,610 179,531 Interest expense (10,413) (10,331) (41,457) (41,184) Other income/(expense), net (2,456) (10,221) 4,164 (11,530) Loss before income taxes (317,153) (218,404) (1,068,025) (936,500) Provision for/(benefit from) income taxes 954 2,648 3,593 4,114 Consolidated net loss (318,107) (221,052) (1,071,618) (940,614) Net loss attributable to noncontrolling interest (2,107) (1,479) (6,561) (5,230) Net loss attributable to common stockholders $ (316,000) $ (219,573) $ (1,065,057) $ (935,384) Net loss per share attributable to common stockholders, basic and diluted $ (0.45) $ (0.33) $ (1.54) $ (1.44) Weighted-average shares used in computing net loss per share attributable to common stockholders – basic and diluted 704,767 660,900 689,612 647,482 (1) At the onset of the second quarter of 2024, we updated our estimated paying user life from 28 months to 27 months. Based on the carrying amount of deferred revenue and deferred cost of revenue as of March 31, 2024, the change resulted in an increase in revenue and cost of revenue during the three months ended December 31, 2024 of $12.7 million and $2.6 million, respectively, and $98.0 million and $20.4 million, respectively, during the twelve months ended December 31, 2024. Refer to “Basis of Presentation and Summary of Significant Accounting Policies — Revenue Recognition” as described in the Company’s consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for further background on the Company’s process to estimate the average lifetime of a paying user. (2) Depreciation of servers and infrastructure equipment included in infrastructure and trust & safety. 14

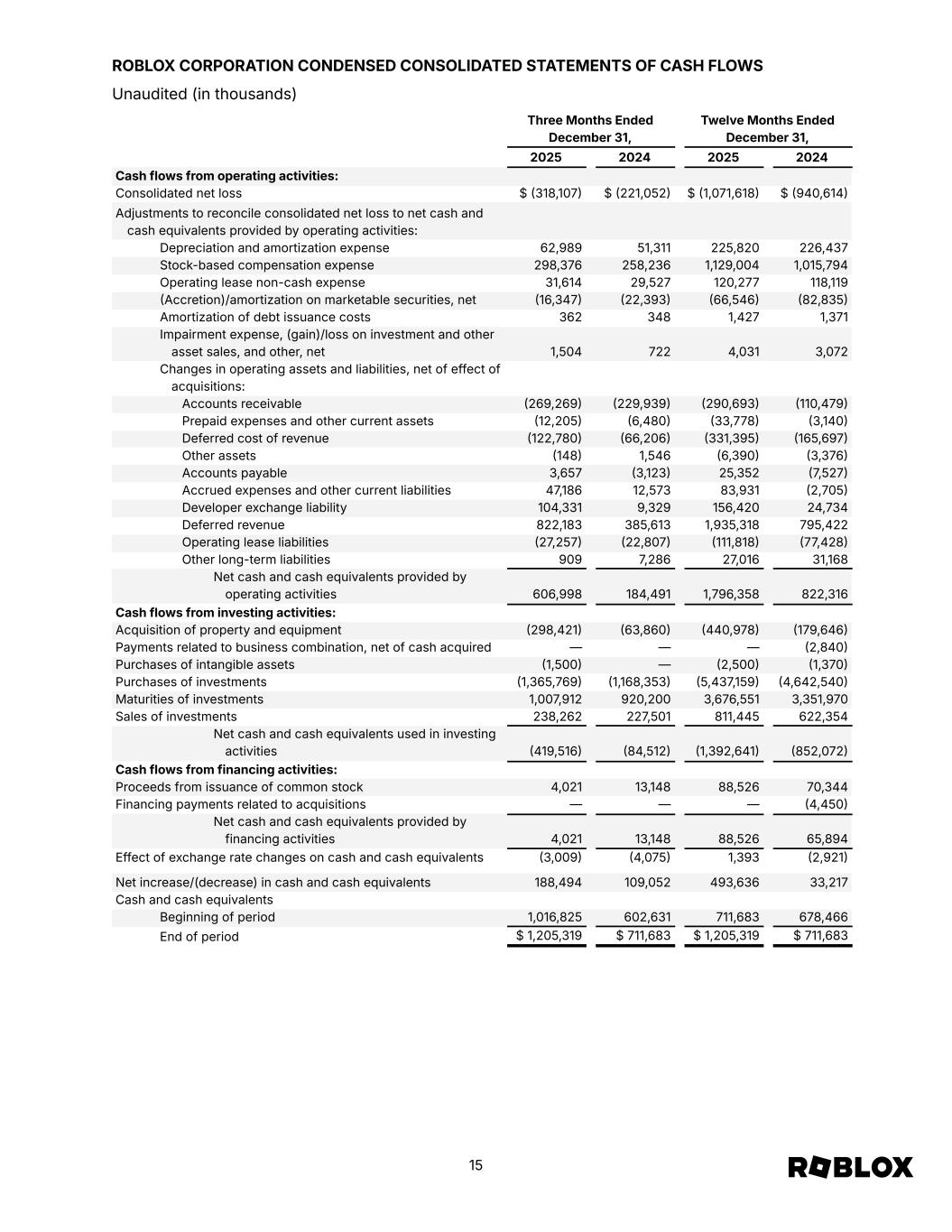

ROBLOX CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Unaudited (in thousands) Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Cash flows from operating activities: Consolidated net loss $ (318,107) $ (221,052) $ (1,071,618) $ (940,614) Adjustments to reconcile consolidated net loss to net cash and cash equivalents provided by operating activities: Depreciation and amortization expense 62,989 51,311 225,820 226,437 Stock-based compensation expense 298,376 258,236 1,129,004 1,015,794 Operating lease non-cash expense 31,614 29,527 120,277 118,119 (Accretion)/amortization on marketable securities, net (16,347) (22,393) (66,546) (82,835) Amortization of debt issuance costs 362 348 1,427 1,371 Impairment expense, (gain)/loss on investment and other asset sales, and other, net 1,504 722 4,031 3,072 Changes in operating assets and liabilities, net of effect of acquisitions: Accounts receivable (269,269) (229,939) (290,693) (110,479) Prepaid expenses and other current assets (12,205) (6,480) (33,778) (3,140) Deferred cost of revenue (122,780) (66,206) (331,395) (165,697) Other assets (148) 1,546 (6,390) (3,376) Accounts payable 3,657 (3,123) 25,352 (7,527) Accrued expenses and other current liabilities 47,186 12,573 83,931 (2,705) Developer exchange liability 104,331 9,329 156,420 24,734 Deferred revenue 822,183 385,613 1,935,318 795,422 Operating lease liabilities (27,257) (22,807) (111,818) (77,428) Other long-term liabilities 909 7,286 27,016 31,168 Net cash and cash equivalents provided by operating activities 606,998 184,491 1,796,358 822,316 Cash flows from investing activities: Acquisition of property and equipment (298,421) (63,860) (440,978) (179,646) Payments related to business combination, net of cash acquired — — — (2,840) Purchases of intangible assets (1,500) — (2,500) (1,370) Purchases of investments (1,365,769) (1,168,353) (5,437,159) (4,642,540) Maturities of investments 1,007,912 920,200 3,676,551 3,351,970 Sales of investments 238,262 227,501 811,445 622,354 Net cash and cash equivalents used in investing activities (419,516) (84,512) (1,392,641) (852,072) Cash flows from financing activities: Proceeds from issuance of common stock 4,021 13,148 88,526 70,344 Financing payments related to acquisitions — — — (4,450) Net cash and cash equivalents provided by financing activities 4,021 13,148 88,526 65,894 Effect of exchange rate changes on cash and cash equivalents (3,009) (4,075) 1,393 (2,921) Net increase/(decrease) in cash and cash equivalents 188,494 109,052 493,636 33,217 Cash and cash equivalents Beginning of period 1,016,825 602,631 711,683 678,466 End of period $ 1,205,319 $ 711,683 $ 1,205,319 $ 711,683 15

Forward-Looking Statements This letter and the live webcast and Q&A session which will be held at 1:30 p.m. Pacific Time/4:30 p.m. Eastern Time on Thursday, February 5, 2026 contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our vision to connect one billion users with optimism and civility, our vision to reach 10% of the global gaming content market, the amount of expected earnings for the creator community, our efforts to improve the Roblox Platform, including Novel game expansion and technological innovations such as SLIM, server authority, and texture streaming, our trust and safety efforts, including our efforts to expand and report on age-checking of users who access voice or text-based chat on platform, our investments in AI-powered initiatives, including those related to creation, safety, discovery, and social interaction, our infrastructure and capital expenditure plans, including our deployment of GPUs in our data centers, our efforts toward scaled advertising on the platform, including our existing partnerships and expansion of content integrations with new partners, our improvements to our creator economics, including our expansion of regional pricing, pricing optimization tools, and other investments in our creator community, our recent and anticipated product launches, our business, product, strategy, and user growth, our investment strategy, including with respect to people and opportunities for and expectations of improvements in financial and operating metrics, including operating leverage, margin, free cash flow, operating expenses, and capital expenditures and cost-to-serve, our expectation of successfully executing such strategies and plans, disclosures regarding the seasonality of our business and future growth rates, including with respect to our user demographics, changes to our estimated average lifetime of a paying user and the resulting effect on revenue, cost of revenue, deferred revenue, and deferred cost of revenue, our expectations of future net losses and net cash and cash equivalents provided by operating activities, payments to our creators, statements by our Chief Executive Officer and Chief Financial Officer, our outlook and guidance for the first quarter and full year 2026, and our expectations regarding no longer providing annual guidance starting in 2027. These forward-looking statements are made as of the date they were first issued and were based on current plans, expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Words such as “expect,” “vision,” “envision,” “evolving,” “drive,” “anticipate,” “intend,” “maintain,” “should,” “believe,” “continue,” “plan,” “goal,” “opportunity,” “estimate,” “predict,” “may,” “will,” “could,” “hope,” “target,” “project,” “potential,” “might,” “shall,” “contemplate,” and “would,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to risks detailed in our filings with the Securities and Exchange Commission (the “SEC”), including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, and other filings and reports we make with the SEC from time to time. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: our ability to successfully execute our business and growth strategy; the sufficiency of our cash and cash equivalents and investments to meet our liquidity needs, including the repayment of our senior notes; the demand for our platform in general; our ability to sustain virality of experiences on our platform; the seasonality of our business and the impact of viral experiences; our ability to retain and increase our number of users and creators, while adequately scaling our infrastructure as engagement increases; changes in the average lifetime of a paying user; the impact of inflation, tariffs, and 16

global economic conditions on our operations; the impact of changing legal and regulatory requirements on our business, including the use of verified parental consent; our ability to develop enhancements to our platform, and bring them to market in a timely manner; our ability to develop and protect our brand; any misuse of user data or other undesirable activity by third parties on our platform; our ability to maintain the security and availability of our platform; our ability to detect and minimize unauthorized use of our platform; the impact of our trust and safety efforts on our ability to attract and retain users and creators; and the impact of AI on our platform, users, and creators. Additional information regarding these and other risks and uncertainties that could cause actual results to differ materially from our expectations is included in the reports we have filed or will file with the SEC, including our annual reports on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements included in this letter represent our views as of the date of this letter. We anticipate that subsequent events and developments will cause our views to change. However, we undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this letter. Special Note Regarding Operating Metrics Additional information regarding our core financial and operating metrics disclosed above is included in the reports we have filed or will file with the SEC, including our annual reports on Form 10-K and our quarterly reports on Form 10-Q and our supplemental materials, available at ir.roblox.com. We encourage investors and others to review these materials in their entirety. Special Note Regarding Age-Check We are currently transitioning from self-reported age data to ‘age-checked’ data. All age-checked metrics included herein are estimates derived from limited information and evolving methodologies and are not directly comparable to historical self-reported data. Additionally, certain demographic data presented are estimates based on extrapolation from data on users who have undergone age-checks, which may not be representative of actual age demographics on the platform. Specifically, we have applied the demographic distribution of our current 'age-checked' DAUs to our 'non-age-checked' DAUs to estimate penetration and monetization rates for 18-34 year olds in the U.S. Extrapolated results may not fairly represent the actual demographic split or engagement and monetization levels of the ‘non-age-checked’ DAUs. As we transition to age-checked metrics, we will not be reporting age demographic data for the fourth quarter of 2025. 17

Non-GAAP Financial Measures This letter contains the following non-GAAP financial measures: bookings, Adjusted EBITDA, and free cash flow. We use this non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial information may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial information as a tool for comparison. As a result, our non-GAAP financial information is presented for supplemental informational purposes only and should not be considered in isolation from, or as a substitute for financial information presented in accordance with GAAP. Reconciliation tables of the most comparable GAAP financial measure to each non-GAAP financial measure used in this letter are included at the end of this letter. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view these non-GAAP measures in conjunction with the most directly comparable GAAP financial measures. Bookings represent the sales activity in a given period without giving effect to certain non-cash adjustments, as detailed below. Substantially all of our bookings are generated from sales of virtual currency, which can ultimately be converted to virtual items on the Roblox platform. Sales of virtual currency reflected as bookings include one-time purchases or monthly subscriptions purchased via payment processors or through prepaid cards. Bookings are initially recorded in deferred revenue and recognized as revenues over the estimated period of time the virtual items purchased with the virtual currency are available on the Roblox platform (estimated to be the average lifetime of a paying user) or as the virtual items purchased with the virtual currency are consumed. Bookings also include an insignificant amount from advertising and licensing arrangements. We believe bookings provide a timelier indication of trends in our operating results that are not necessarily reflected in our revenue as a result of the fact that we recognize the majority of revenue over the estimated average lifetime of a paying user. The change in deferred revenue constitutes the vast majority of the reconciling difference from revenue to bookings. By removing these non-cash adjustments, we are able to measure and monitor our business performance based on the timing of actual transactions with our users and the cash that is generated from these transactions. Over the long-term, the factors impacting our revenue and bookings trends are the same. However, in the short-term, there are factors that may cause revenue and bookings trends to differ. 18

Adjusted EBITDA represents our GAAP consolidated net loss, excluding interest income, interest expense, other (income)/expense, net, provision for/(benefit from) income taxes, depreciation and amortization expense, stock-based compensation expense, and certain other nonrecurring adjustments. We believe that, when considered together with reported GAAP amounts, Adjusted EBITDA is useful to investors and management in understanding our ongoing operations and ongoing operating trends. Our definition of Adjusted EBITDA may differ from the definition used by other companies and therefore comparability may be limited. Free cash flow represents the net cash and cash equivalents provided by operating activities, less purchases of property and equipment and intangible assets acquired through asset acquisitions. We believe that free cash flow is a useful indicator of our unit economics and liquidity that provides information to management and investors about the amount of cash and cash equivalents generated from our core operations that, after the purchases of property and equipment, and intangible assets acquired through asset acquisitions, can be used for strategic initiatives. 19

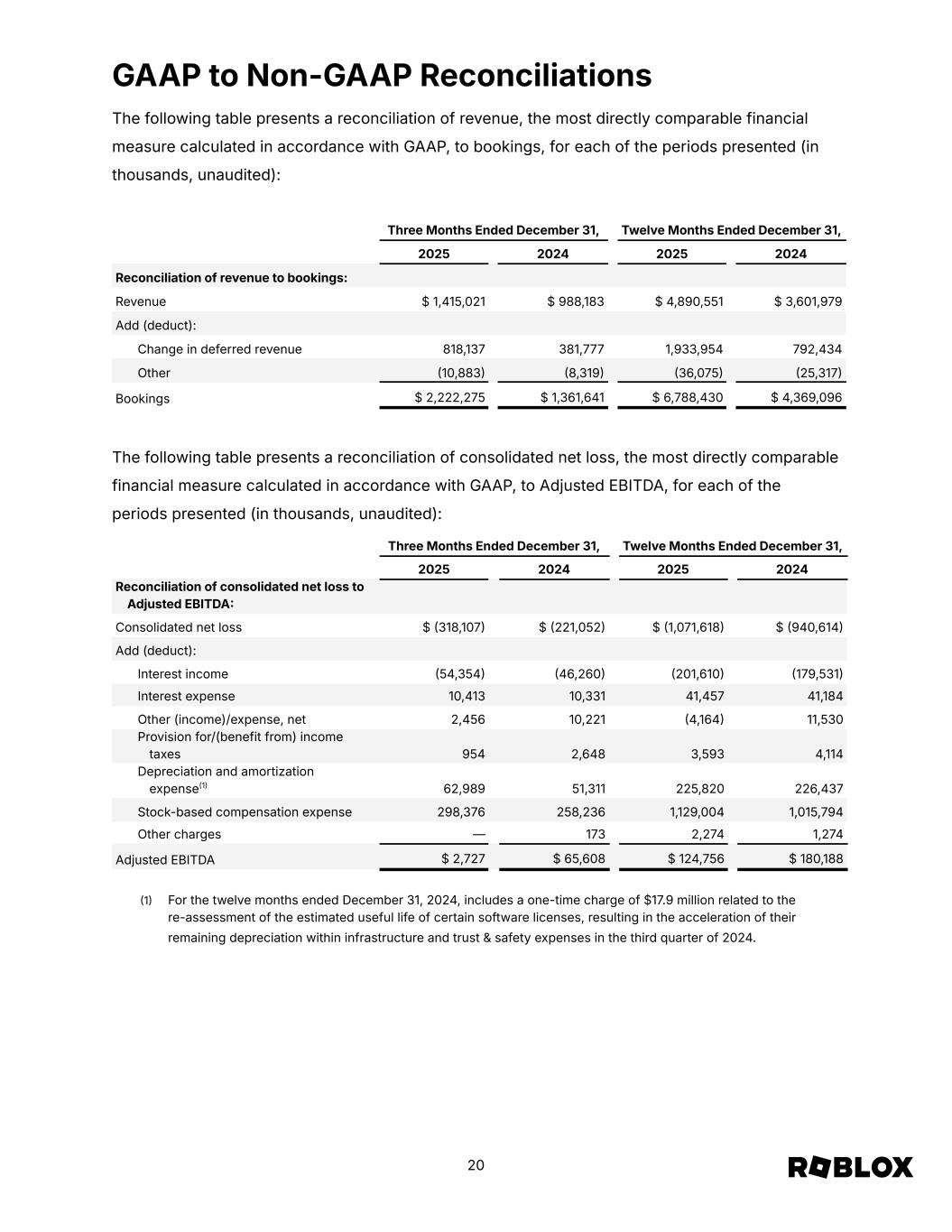

GAAP to Non-GAAP Reconciliations The following table presents a reconciliation of revenue, the most directly comparable financial measure calculated in accordance with GAAP, to bookings, for each of the periods presented (in thousands, unaudited): Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Reconciliation of revenue to bookings: Revenue $ 1,415,021 $ 988,183 $ 4,890,551 $ 3,601,979 Add (deduct): Change in deferred revenue 818,137 381,777 1,933,954 792,434 Other (10,883) (8,319) (36,075) (25,317) Bookings $ 2,222,275 $ 1,361,641 $ 6,788,430 $ 4,369,096 The following table presents a reconciliation of consolidated net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted EBITDA, for each of the periods presented (in thousands, unaudited): Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Reconciliation of consolidated net loss to Adjusted EBITDA: Consolidated net loss $ (318,107) $ (221,052) $ (1,071,618) $ (940,614) Add (deduct): Interest income (54,354) (46,260) (201,610) (179,531) Interest expense 10,413 10,331 41,457 41,184 Other (income)/expense, net 2,456 10,221 (4,164) 11,530 Provision for/(benefit from) income taxes 954 2,648 3,593 4,114 Depreciation and amortization expense(1) 62,989 51,311 225,820 226,437 Stock-based compensation expense 298,376 258,236 1,129,004 1,015,794 Other charges — 173 2,274 1,274 Adjusted EBITDA $ 2,727 $ 65,608 $ 124,756 $ 180,188 (1) For the twelve months ended December 31, 2024, includes a one-time charge of $17.9 million related to the re-assessment of the estimated useful life of certain software licenses, resulting in the acceleration of their remaining depreciation within infrastructure and trust & safety expenses in the third quarter of 2024. 20

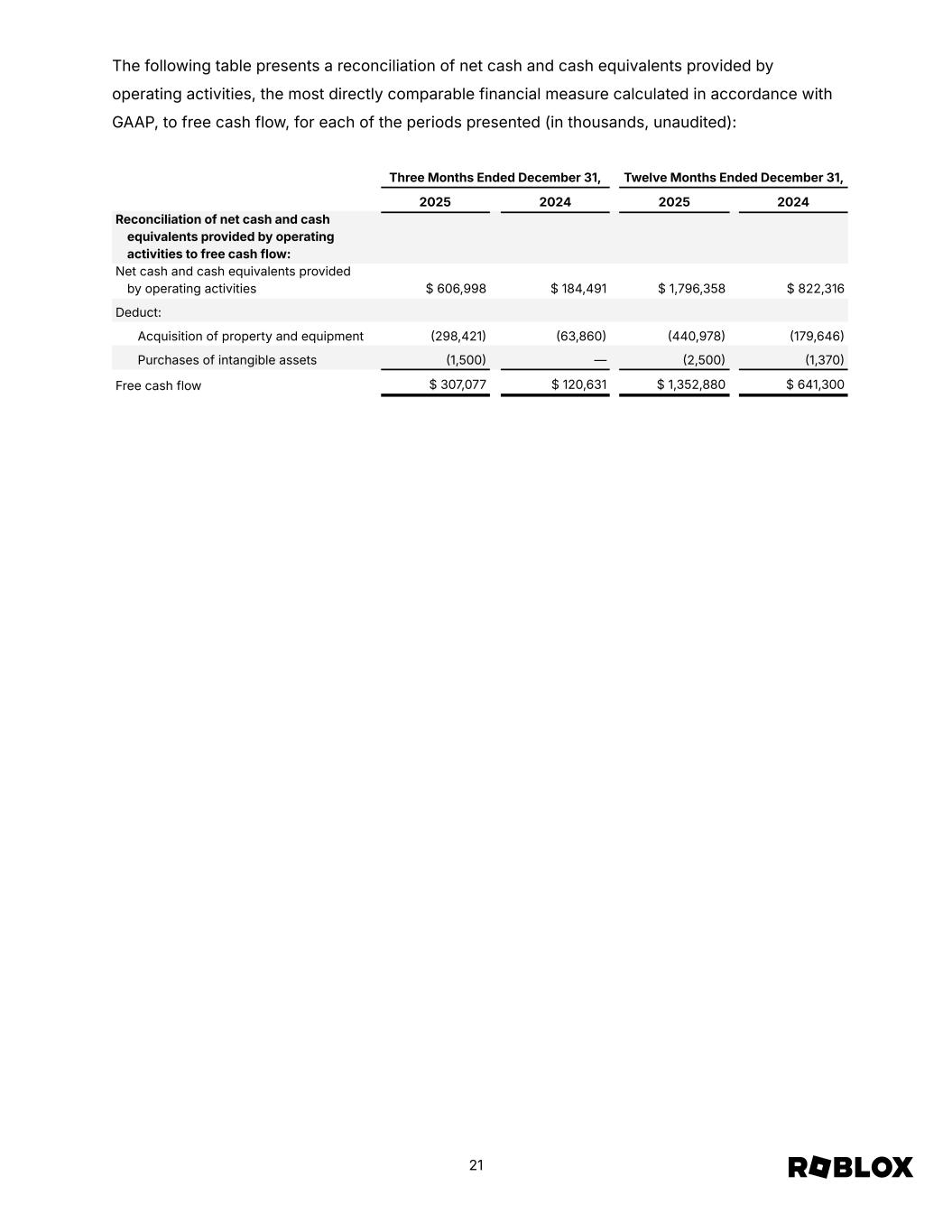

The following table presents a reconciliation of net cash and cash equivalents provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, to free cash flow, for each of the periods presented (in thousands, unaudited): Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Reconciliation of net cash and cash equivalents provided by operating activities to free cash flow: Net cash and cash equivalents provided by operating activities $ 606,998 $ 184,491 $ 1,796,358 $ 822,316 Deduct: Acquisition of property and equipment (298,421) (63,860) (440,978) (179,646) Purchases of intangible assets (1,500) — (2,500) (1,370) Free cash flow $ 307,077 $ 120,631 $ 1,352,880 $ 641,300 21

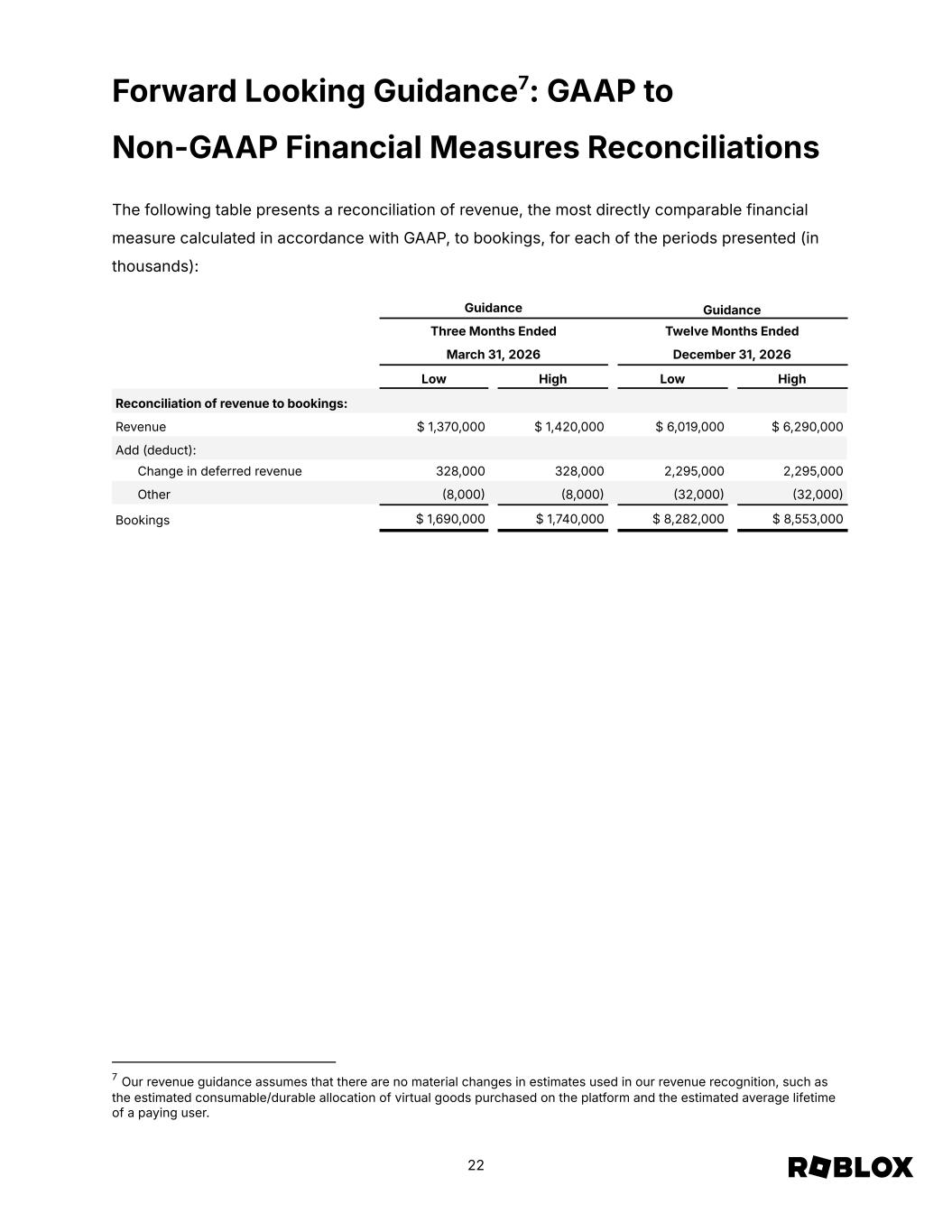

Forward Looking Guidance7: GAAP to Non-GAAP Financial Measures Reconciliations The following table presents a reconciliation of revenue, the most directly comparable financial measure calculated in accordance with GAAP, to bookings, for each of the periods presented (in thousands): Guidance Guidance Three Months Ended Twelve Months Ended March 31, 2026 December 31, 2026 Low High Low High Reconciliation of revenue to bookings: Revenue $ 1,370,000 $ 1,420,000 $ 6,019,000 $ 6,290,000 Add (deduct): Change in deferred revenue 328,000 328,000 2,295,000 2,295,000 Other (8,000) (8,000) (32,000) (32,000) Bookings $ 1,690,000 $ 1,740,000 $ 8,282,000 $ 8,553,000 7 Our revenue guidance assumes that there are no material changes in estimates used in our revenue recognition, such as the estimated consumable/durable allocation of virtual goods purchased on the platform and the estimated average lifetime of a paying user. 22

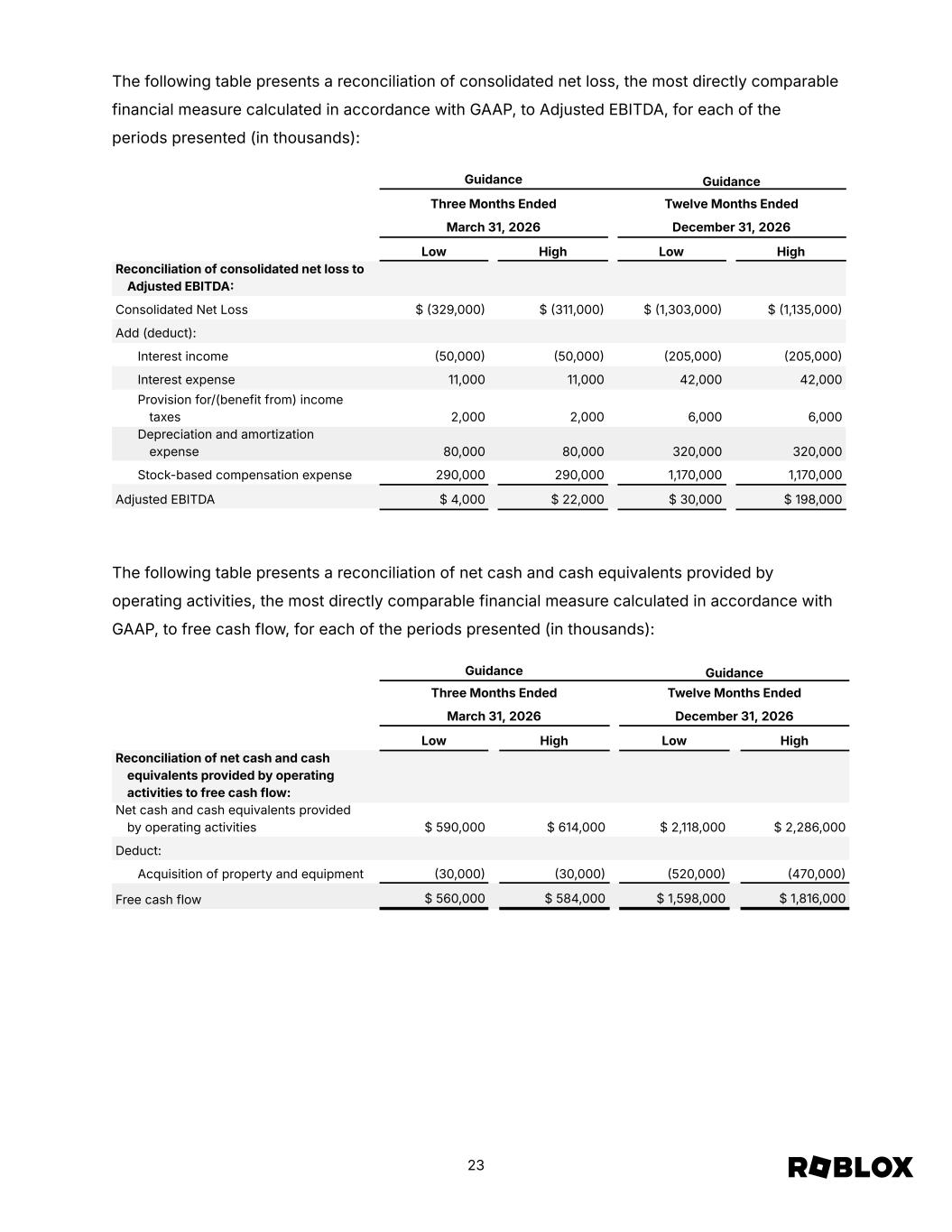

The following table presents a reconciliation of consolidated net loss, the most directly comparable financial measure calculated in accordance with GAAP, to Adjusted EBITDA, for each of the periods presented (in thousands): Guidance Guidance Three Months Ended Twelve Months Ended March 31, 2026 December 31, 2026 Low High Low High Reconciliation of consolidated net loss to Adjusted EBITDA: Consolidated Net Loss $ (329,000) $ (311,000) $ (1,303,000) $ (1,135,000) Add (deduct): Interest income (50,000) (50,000) (205,000) (205,000) Interest expense 11,000 11,000 42,000 42,000 Provision for/(benefit from) income taxes 2,000 2,000 6,000 6,000 Depreciation and amortization expense 80,000 80,000 320,000 320,000 Stock-based compensation expense 290,000 290,000 1,170,000 1,170,000 Adjusted EBITDA $ 4,000 $ 22,000 $ 30,000 $ 198,000 The following table presents a reconciliation of net cash and cash equivalents provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, to free cash flow, for each of the periods presented (in thousands): Guidance Guidance Three Months Ended Twelve Months Ended March 31, 2026 December 31, 2026 Low High Low High Reconciliation of net cash and cash equivalents provided by operating activities to free cash flow: Net cash and cash equivalents provided by operating activities $ 590,000 $ 614,000 $ 2,118,000 $ 2,286,000 Deduct: Acquisition of property and equipment (30,000) (30,000) (520,000) (470,000) Free cash flow $ 560,000 $ 584,000 $ 1,598,000 $ 1,816,000 23