DEED OF Amendment and Restatement | |

DATED 10 MAY 2006 | |

Between UPC BROADBAND HOLDING B.V. and UPC FINANCING PARTNERSHIP as Borrowers and THE COMPANIES LISTED IN Schedule 1 as Guarantors and The Senior Hedging Banks with TORONTO DOMINION (TEXAS) LLC as Facility Agent relating to a FACILITY AGREEMENT originally dated 16 January 2004 and relating to a SECURITY DEED originally dated 16 January 2004 TD BANK EUROPE LIMITED as Existing Security Agent | |

1. | Interpretation 1 |

2. | Amendments 2 |

3. | Representations and Warranties 2 |

4. | Accession of Senior Hedging Banks 2 |

5. | Miscellaneous 3 |

6. | Counterparts 3 |

7. | Governing Law 3 |

1. | Guarantors 4 |

2. | Restated New Facility Agreement 6 |

3. | Restated New Security Deed 7 |

(1) | UPC BROADBAND HOLDING B.V. (UPC Broadband) and UPC FINANCING PARTNERSHIP (the US Borrower) as Borrowers; |

(2) | THE COMPANIES whose names and addresses are set out in Schedule 1 (Guarantors) as Guarantors; |

(3) | TORONTO DOMINION (TEXAS) LLC as Facility Agent; |

(4) | TD BANK EUROPE LIMITED in as Security Agent; and |

(5) | THE SENIOR HEDGING BANKS who are a party to this Deed from time to time. |

(A) | This Deed is supplemental to and amends a credit agreement originally dated 16 January 2004 (the New Facility Agreement), and a security deed originally dated 16 January 2004 (the New Security Deed), both as amended from time to time, between, among others, the Borrowers, the Guarantors, the Facility Agent and the Security Agent. |

(B) | The Majority Lenders (as defined in the New Facility Agreement) have consented to the amendments to the New Facility Agreement and the New Security Deed contemplated by this Deed. Accordingly, the Facility Agent and the Security Agent is authorised to execute this Deed on behalf of the Finance Parties. |

1. | INTERPRETATION |

1.1 | Definitions |

1.2 | Construction |

(a) | Capitalised terms defined in the New Facility Agreement or the New Security Deed (each as amended and restated pursuant to this Deed) have, unless expressly defined in this Deed, the same meaning in this Deed. |

(b) | The provisions of Clause 1.2 (Construction) of the New Facility Agreement apply to this Deed as though they were set out in full in this Deed except that references to the New Facility Agreement are to be construed as references to this Deed. |

(c) | Reference is made to Clause 1.3 of the New Facility Agreement. References in any of the Finance Documents to the Existing Facility Agreement and the Existing Security Deed shall be references to the Existing Facility Agreement and the Existing Security Agreement as amended by a deed of amendment and restatement dated on or about the date of this Deed. |

2. | AMENDMENTS |

(a) | The New Facility Agreement will be amended, with effect from the Amendment Effective Date, so that it reads as if it were restated in the form set out in Schedule 2 (Restated New Facility Agreement). |

(b) | The New Security Deed will be amended, with effect from the Amendment Effective Date, so that it reads as if it were restated in the form set out in Schedule 3 (Restated New Security Deed). |

(c) | The amendments to be made to the New Facility Agreement and the New Security Deed by this Deed shall take effect on the date (the Amendment Effective Date) on which the Facility Agent notifies UPC Broadband and the Lenders that it has received in form and substance satisfactory to it (acting reasonably): |

(i) | evidence of the due authorisation and execution of this Deed by each Obligor; and |

(ii) | legal opinions in respect of Dutch, English and New York law from Allen & Overy LLP, English, Dutch and New York legal advisers to the Facility Agent, addressed to the Finance Parties. |

3. | REPRESENTATIONS AND WARRANTIES |

(a) | The representations and warranties set out in clause 15 (Representations and Warranties) of the New Facility Agreement (as amended and restated in Schedule 2 (Restated New Facility Agreement) to this Deed) (with the exception of clauses 15.6(a) (Consents), 15.10 (Financial condition), 15.12 (Security Interests), 15.13(b) (Litigation and insolvency proceedings), 15.14 (Business Plan), 15.15 (Tax liabilities), 15.16 (Ownership of assets), 15.18 (Works councils), 15.19 (Borrower Group Structure), 15.20 (ERISA) and 15.24 (UPC Financing)) are true and correct as if made on the date of this Deed, with reference to the facts and circumstances then existing, and as if each reference to (i) the Finance Documents includes a reference to this Deed, (ii) the New Facility Agreement is a reference to the New Facility Agreement as amended and restated by this Deed and (iii) the New Security Deed is a reference to the New Security Deed as amended and restated by this Deed. |

(b) | UPC Broadband represents and warrants to each Finance Party that there has been no material adverse change in the consolidated financial position of the Borrower Group (taken as a whole) since the date of the financial statements most recently provided under clause 16.2(a) (Financial Information) of the New Facility Agreement which would or is reasonably likely to have a Material Adverse Effect. |

4. | ACCESSION OF SENIOR HEDGING BANKS |

(a) | As of the Amendment Effective Date, each Senior Hedging Bank agrees that it shall become a party to the New Security Deed in its capacity as a Senior Hedging Bank and shall observe, perform and be bound by the terms and provisions of and be entitled to exercise all the rights set out in the New Security Deed in the capacity of a Senior Hedging Bank. |

(b) | Paragraph (a) above constitutes a Senior Hedging Bank's Deed of Accession in respect of each Senior Hedging Bank for the purposes of clause 9.7 (Assignment and/or transfer by Senior Hedging Banks) of the New Security Deed. |

(c) | For the purposes of clause 14.1 (Mechanics) of the New Security Deed, the address and facsimile number of each Senior Hedging Bank will be notified by each Senior Hedging Bank to the Security Agent prior to the Amendment Effective Date. |

5. | MISCELLANEOUS |

(a) | Each of this Deed, the New Facility Agreement, as amended and restated by this Deed and the New Security Deed, as amended and restated by this Deed, is a Finance Document. |

(b) | Subject to the terms of this Deed, the New Facility Agreement and the New Security Deed will remain in full force and effect. |

(c) | Each Obligor confirms: |

(i) | that the Security Interests granted to the Beneficiaries pursuant to the Security Documents and its obligations under the Finance Documents shall continue and remain unaffected by the entry into this Deed; |

(ii) | in accordance with Article 1278 of the Belgian Civil Code, its duties and obligations under the share pledge listed in paragraph (i) of Schedule 7 (Security Documents) of the New Facility Agreement shall not be affected or impaired by the entry into of this Agreement and that this Deed does not constitute a novation. |

6. | COUNTERPARTS |

7. | GOVERNING LAW |

Name | Address |

UPC Financing Partnership | 4643 South Ulster Street Suite 1300 Denver, Co 80237 United States |

UPC Broadband Holding B.V. (previously called UPC Distribution Holding B.V.) | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Holding II B.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Holding B.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC France Holding B.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Scandinavia Holding B.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Austria Holding B.V. (previously called Cable Network Austria Holding B.V.) | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Central Europe Holding B.V. (previously called Stipdon Investments B.V.) | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Nederland B.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Poland Holding B.V. (previously called UPC Telecom B.V.) | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Broadband N.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

UPC Broadband Ireland B.V. | Boeing Avenue 53 1119 PE Schiphol Rijk Amsterdam The Netherlands |

SENIOR SECURED CREDIT FACILITY AGREEMENT |

Dated 16th January 2004 as amended and restated pursuant to a Deed of Amendment and Restatement dated 10 May 2006 For UPC BROADBAND HOLDING B.V. as Borrower with TORONTO DOMINION (TEXAS) LLC acting as Facility Agent |

1. | Interpretation 4 |

2. | The Facilities 33 |

3. | Purpose 35 |

4. | Conditions Precedent 36 |

5. | Advances 37 |

6. | Repayment 38 |

7. | Cancellation and Prepayment 40 |

8. | Interest 45 |

9. | Payments 46 |

10. | Tax Gross-up and Indemnities 48 |

11. | Market Disruption 51 |

12. | Increased Costs 53 |

13. | Illegality and Mitigation 54 |

14. | Guarantee 54 |

15. | Representations and Warranties 58 |

16. | Undertakings 65 |

17. | Financial Covenants 87 |

18. | Default 93 |

19. | Facility Agent, Security Agent and Lenders 100 |

20. | Fees 104 |

21. | Expenses 105 |

22. | Stamp Duties 105 |

23. | Indemnities 105 |

24. | Evidence and Calculations 107 |

25. | Amendments and Waivers 107 |

26. | Changes to the Parties 109 |

27. | Disclosure of Information 115 |

28. | Set-off 116 |

29. | Pro Rata Sharing 116 |

30. | Severability 117 |

31. | Counterparts 117 |

32. | Notices 118 |

33. | Language 119 |

34. | Jurisdiction 119 |

35. | Waiver of Immunity 120 |

36. | Waiver of Trial by Jury 121 |

37. | Governing Law 121 |

1. | Original Parties 122 |

Part 1 | Original Guarantors 122 |

2. | Conditions Precedent Documents 124 |

Part 1 | To be Delivered before the First Advance 124 |

Part 2 | To be Delivered by an Additional Obligor 127 |

3. | Mandatory Cost Formulae 130 |

4. | Form of Request and Cancellation Notice 132 |

Part 1 | Form of Request 132 |

Part 2 | Form of Cancellation and/or Prepayment Notice 133 |

5. | Forms of Accession Documents 134 |

Part 1 | Novation Certificate 134 |

Part 2 | Obligor Accession Agreement 136 |

Part 3 | Additional Facility Accession Agreement 137 |

6. | Form of Confidentiality Undertaking 140 |

Part 1 | Form of LMA Confidentiality Undertaking 140 |

Part 2 | Form of LSTA Confidentiality Undertaking 145 |

7. | Security Documents 150 |

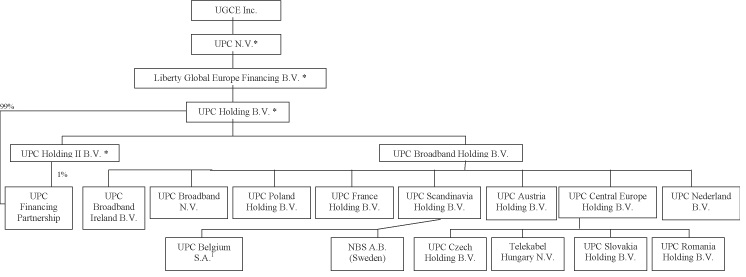

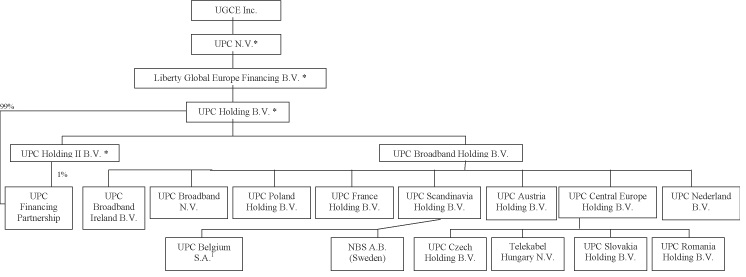

8. | Borrower Group Structure 152 |

9. | Shareholders' Agreements 153 |

(1) | UPC BROADBAND HOLDING B.V. (previously called UPC Distribution Holding B.V.) (UPC Broadband); |

(2) | THE COMPANIES identified as guarantors in Schedule 1 (Original Guarantors) (the Original Guarantors); |

(3) | TORONTO DOMINION (TEXAS) LLC as facility agent (the Facility Agent); and |

(4) | TD BANK EUROPE LIMITED as security agent for the Finance Parties (in this capacity, the Security Agent). |

1. | INTERPRETATION |

1.3 | Definitions |

(a) | the value at the time of completion of the Acquisition of any consideration to be paid or delivered after the time of completion of the Acquisition will be determined in accordance with GAAP; |

(b) | if the entity acquired becomes a member of the Borrower Group as a result of the Acquisition, the aggregate principal amount of Financial Indebtedness of any entity acquired outstanding at the time of completion of the Acquisition (including without limitation any Lending Transaction (as defined in Clause 16.14(f) (Loans and guarantees) made by a member of the Borrower Group in connection with the relevant Acquisition) will be counted as part of the consideration for that Acquisition; |

(c) | if the entity acquired does not become a member of the Borrower Group as a result of the Acquisition, the aggregate principal amount of Financial Indebtedness of the entity acquired at the time of completion of the Acquisition will be counted as part of the consideration for that Acquisition to the extent of the aggregate principal amount of the payment and repayment obligations in respect of such Financial Indebtedness assumed or guaranteed by any member of the Borrower Group; and |

(d) | subject to paragraphs (a), (b) and (c) above, the value at the time of completion of the Acquisition of any non-cash consideration will be determined in accordance with GAAP, |

(a) | an Initial Additional Facility Lender the amount in euros, US Dollars or relevant Additional Currency set out as the Additional Facility Commitment of a Lender in the relevant Additional Facility Accession Agreement and the amount of any other Additional Facility Commitment transferred to it under this Agreement; and |

(b) | any other Lender, the amount in euros, US Dollars or relevant Additional Currency (as applicable) transferred to it in accordance with this Agreement, |

(a) | a Subsidiary of UPC Broadband; and |

(b) | any UPC Broadband Holdco (other than UPC Holding), |

(a) | Executive Order No. 13224 of 23 September 2001 - Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism (the Executive Order); |

(b) | the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56 (commonly known as the USA Patriot Act); |

(c) | the Money Laundering Control Act of 1986, Public Law 99-570; and |

(d) | any similar law enacted in the United States of America subsequent to the date of this Agreement. |

(a) | any other person which is directly or indirectly Controlled by, under common Control with or Controlling such person; or |

(b) | any other person owning beneficially and/or legally directly or indirectly 10 per cent. or more of the equity interest in such person or 10 per cent. of whose equity is owned beneficially and/or legally directly or indirectly by such person. |

(a) | UPC Broadband and its Subsidiaries from time to time excluding Unrestricted Subsidiaries; and |

(b) | UPC Financing. |

(a) | the amount of interest (excluding the Margin and any Mandatory Costs) which a Lender should have received for the period from the date of receipt of all or any part of its participation in an Advance or Unpaid Sum to the last day of the current Interest Period in respect of that Advance or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period, |

(b) | the amount of interest which that Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank in the London interbank market for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period. |

(a) | that consists of the upgrade, construction, creation, development, marketing, acquisition (to the extent permitted under this Agreement), operation, utilisation and maintenance of networks that use existing or future technology for the transmission, reception and delivery of voice, video and/or other data (including networks that transmit, receive and/or deliver services such as multi-channel television and radio, programming, telephony, Internet services and content, high speed data transmission, video, multi-media and related activities); or |

(b) | that supports, is incidental to or is related to any such business; or |

(c) | that comprises being a Holding Company of one or more persons engaged in such business, |

(a) | a day (other than a Saturday or Sunday) on which banks are open for general business in: |

(i) | London and Amsterdam; |

(ii) | in relation to a transaction involving US Dollars, New York; and |

(iii) | in relation to a transaction involving an Additional Currency, the principal financial centre of the country of that currency; or |

(b) | in relation to a rate fixing day or a payment date for euros, a TARGET Day. |

(a) | minus Capital Expenditure of or relating to the Target for such period; |

(b) | minus all Taxes actually paid and/or falling due for payment by or in respect of the Target during such period; |

(c) | minus the amount of all dividends, redemptions and other distributions payable by the Target during such period on, or in respect of any of its share capital not held by a member of the Borrower Group; |

(d) | minus any increase or plus any decrease in working capital of or in respect of the Target for such |

(e) | minus the aggregate of (i) Interest payable by or in respect of the Target during such period and (ii) an amount equal to the Interest that would have been payable in respect of an Advance made during such period in an amount equal to the principal amount of Financial Indebtedness incurred in connection with the Acquisition of the Target, and plus any Interest that was received by the Target during such period; and |

(f) | minus all extraordinary or exceptional items (including one off restructuring costs) which were paid by the Target during such period on (net of any cash proceeds of insurance or warranty claims which relate to such items) and plus all extraordinary or exceptional items which were received by or in respect of the Target during such period. |

(a) | by means of the holding of shares or the possession of voting power in or in relation to any other person; or |

(b) | by virtue of any powers conferred by the articles of association or other documents regulating any other person, |

(a) | in the Annex to the Executive Order; |

(b) | on the "Specially Designated Nationals and Blocked Persons" list maintained by the Office of Foreign Assets Control of the United States Department of the Treasury; or |

(c) | in any successor list to either of the foregoing. |

(a) | the business of upgrading, constructing, creating, developing, acquiring, operating, owning, leasing and maintaining cable television networks (including for avoidance of doubt master antenna television, satellite master antenna television, single and multi-channel microwave single or multi-point distribution systems and direct-to-home satellite systems) for the transmission, reception and/or delivery of multi-channel television and radio programming, telephony and internet and/or data services to the residential markets; or |

(b) | any business which is incidental to or related to and, in either case, material to such business. |

(a) | all or any part of the share capital or equivalent of a person or company (including, without limitation any partnership or joint venture) incorporated or carrying on a material part of its business in Eastern Europe; or |

(b) | any asset or assets constituting a business or separate line of business, a material part of which is being carried on in Eastern Europe, |

(a) | in respect of any loss or liability suffered or incurred by that person as a result of or in connection with any violation of Environmental Law; or |

(b) | that arises as a result of or in connection with Environmental Contamination and that could give rise to any remedy or penalty (whether interim or final) that may be enforced or assessed by private or public legal action or administrative order or proceedings including, without limitation, any such claim that arises from injury to persons or property. |

(a) | any release, emission, leakage or spillage of any Dangerous Substance at or from any site owned or occupied by any member of the Borrower Group into any part of the Environment; or |

(b) | any accident, fire, explosion or sudden event at any site owned or occupied by any member of the Borrower Group which is directly caused by or attributable to any Dangerous Substance; or |

(c) | any other pollution of the Environment arising at or from any site owned or occupied by any member of the Borrower Group. |

(a) | the applicable Screen Rate for deposits in the currency of the relevant Advance or Unpaid Sum for a period equal or comparable to the required period at or about 11.00 a.m. (Brussels time) on the applicable Rate Fixing Day; or |

(b) | if the rate cannot be determined under paragraph (a) above, the arithmetic mean (rounded upwards, if necessary, to the nearest four decimal places) of the respective rates, as supplied to the Facility Agent at its request, quoted by the Reference Banks to leading banks for the offering of deposits in euros for the required period in the London interbank market at or about 11.00 a.m. on the Rate Fixing Day for such period, |

(a) | less: |

(i) | any interest and other charges in respect of Financial Indebtedness of the Borrower Group paid during such financial year; |

(ii) | repayments and/or prepayments of any Financial Indebtedness of the Borrower Group paid during such financial year; and |

(iii) | capital expenditure of the Borrower Group incurred during such financial year; and |

(b) | either (i) plus any amount by which Net Working Capital at the commencement of such financial year exceeds Net Working Capital at the close of such financial year or, as appropriate, (ii) minus any amount by which Net Working Capital at the end of such financial year exceeds Net Working Capital at the beginning of such financial year. |

(a) | the Security Documents as defined in paragraph (a) of the definition of Security Documents in the Existing Facility Agreement; and |

(b) | any other Security Documents as defined in paragraph (b) of the definition of Security Documents in the Existing Facility Agreement provided that the Security Interest(s) granted under any such Security Document are simultaneously granted on the same terms (save for variations directly attributable to the identity of the parties and the loan amounts) to the Security Agent on behalf of Beneficiaries to secure the Secured Obligations (as defined in the Security Deed). |

(a) | on or before the date it becomes a Lender; or |

(b) | by not less than five Business Days' notice, |

(a) | money borrowed or raised and debit balances at banks; |

(b) | any bond, note, loan stock, debenture or similar debt instrument; |

(c) | acceptance or documentary credit facilities; |

(d) | receivables sold or discounted (otherwise than on a non-recourse basis and other than in the normal course of business for collection); |

(e) | payments for assets acquired or services supplied deferred for a period of over 180 days (or 360 days if such deferral is in accordance with the terms pursuant to which the relevant assets were or are to be acquired or services were or are to be supplied) after the relevant assets were or are to be acquired or the relevant services were or are to be supplied; |

(f) | finance leases and hire purchase contracts to the extent that they constitute capital leases within the meaning of GAAP, provided that indebtedness in respect of network leases shall only be included in this paragraph (f) for the purposes of the definition of Excess Cash Flow and Clause 18.5 (Cross default); |

(g) | any other transaction (including without limitation forward sale or purchase agreements) having the commercial effect of a borrowing or raising of money or any of (b) to (f) above; |

(h) | (for the purposes of Clause 18.5 (Cross default) only) any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked-to-market value shall be taken into account); and |

(i) | guarantees in respect of indebtedness of any person falling within any of paragraphs (a) to (g) above (including for the avoidance of doubt, without double counting, guarantees given by a member of the Borrower Group for the indebtedness of the type falling within (a) to (g) above of another member of the Borrower Group), |

(a) | an Initial Additional Facility Lender; and |

(b) | any person which has become a New Lender (as defined in Clause 26.2 (Transfers by Lenders) under an Additional Facility in accordance with Clause 26 (Changes to the Parties), |

(a) | the applicable Screen Rate for deposits in the currency of the relevant Advance or Unpaid Sum for a period equal or comparable to the required period at or about 11.00 a.m. on the applicable Rate Fixing Day; or |

(b) | (if no Screen Rate is available for the required currency or required period of that Advance or Unpaid Sum) the arithmetic mean (rounded upwards, if necessary, to the nearest four decimal places) of the respective rates, as supplied to the Facility Agent at its request, quoted by the Reference Banks to leading banks for the offering of deposits in the required currency and for the required period in the London interbank market at or about 11.00 a.m. on the Rate Fixing Day for such period, |

(a) | the Interconnect Agreements; |

(b) | the Priority Pledge; |

(c) | the Shareholders' Agreements as from time to time amended, varied, restated or replaced, in each case in a manner that does not constitute an Event of Default under Clause 18.18 (Material Contracts); and |

(d) | each other agreement agreed as such by the Facility Agent and UPC Broadband. |

(a) | includes the assignment or transfer of the right to receive an amount of principal and interest under this Agreement; and |

(b) | is made on a day other than the last day of an Interest Period. |

(a) | the principal amount of an Advance (as applicable) denominated in euros; or |

(b) | the principal amount of an Advance denominated in US Dollars or an Additional Currency translated into euros on the basis of the Agent's Spot Rate of Exchange on the date of receipt by the Facility Agent of the Request for the relevant Advance. |

(a) | any Acquisition of a member of the Borrower Group by any other member of the Borrower Group as part of the solvent reorganisation of the Borrower Group; |

(b) | any Acquisition where, upon completion of the Acquisition, the person acquired will be a Subsidiary of UPC Broadband or where UPC Broadband or one of its Subsidiaries which is a member of the Borrower Group will own directly or indirectly greater than a 50 per cent. interest in the asset or assets constituting the acquired business (a Majority Acquisition) and where: |

(i) | the business of the acquired entity or the business acquired, as the case may be, is of the same nature as the business of the Borrower Group as at the Effective Date and is carried out principally in Europe (other than Great Britain or Germany); |

(ii) | in the case of any Majority Acquisition where the Acquisition Cost is ε40,000,000 or greater, UPC Broadband delivers to the Facility Agent: |

(A) | a Borrower Group Business Plan which must: |

I. | contain cash flow projections which show that the sum of the undrawn Total Facility A Commitments (as defined under the Existing Facility Agreement), any undrawn Additional Facility Commitments that are available to be drawn for the general corporate and working capital purposes of the Borrower Group, and Unrestricted Cash, taking into account the proposed Majority Acquisition, is projected to be greater than ε100,000,000 on the date on which financial covenants relating to the eleventh quarterly Accounting Period after the quarterly Accounting Period in which the Acquisition is made are tested under Clause 17 (Financial Covenants); and |

II. | contain financial projections which demonstrate that the Borrowers will be in compliance with the undertakings set out in Clause 17 (Financial Covenants) for the period from completion of the Acquisition (taking into account the Acquisition Cost of such Acquisition) to the Final Maturity Date; and |

(B) | an Acquisition Business Plan; |

(iii) | UPC Broadband delivers to the Facility Agent the most recent six-months management accounts of or relating to the Target, together with a certificate signed by two managing directors or the sole managing director, as the case may be, of UPC Broadband certifying the amount of the Cash Flow of the Target for the most recent six months and setting out the supporting calculations; |

(iv) | no Default has occurred and is continuing or would be caused by the Majority Acquisition; and |

(v) | UPC Broadband delivers to the Facility Agent a certificate signed by two managing directors or the sole managing director of UPC Broadband which certifies that, if the ratio of Senior Debt to Annualised EBITDA of the Borrower Group was re-calculated for the most recent Ratio Period ending prior to the date of the Acquisition for which financial statements have been delivered pursuant to Clause 16.2(a) or (b) (Financial information) (the Relevant Ratio Period) but adding to the: |

(A) | amount of Senior Debt used in such calculation any net increase in the Senior Debt of the Borrower Group since the end of the Relevant Ratio Period or subtracting from the amount of Senior Debt used in such calculation any net deduction in the Senior Debt of the Borrower Group (in each case taking into account the amount of Senior Debt used to fund the Acquisition Cost); and |

(B) | Annualised EBITDA of the Borrower Group, the Annualised EBITDA of the |

II. | the ratio of Senior Debt to Annualised EBITDA of the Borrower Group for the Relevant Ratio Period; or |

(c) | any Acquisition by a member of the Borrower Group for the purposes of a solvent reorganisation of the Borrower Group where the Acquisition is of share capital or equivalent of a company which: |

(i) | has not traded and does not own any assets; or |

(ii) | is a dormant Subsidiary of Liberty Global, Inc. and, |

(a) | any Acquisition referred to in paragraph (a) of the definition of "Permitted Acquisition" and any Acquisition as a result of a reorganisation of a person that is not a Subsidiary of UPC Broadband but in which a member of the Borrower Group has an interest, provided that such reorganisation does not result in an overall increase in the value of the Borrower Group's interest in that person, other than adjustments to the basis of any member of the Borrower Group's interest in accordance with GAAP; or |

(b) | any Acquisition where, upon completion of the Acquisition, the person acquired will not be a Subsidiary of UPC Broadband or where UPC Broadband or one of its Subsidiaries which is a member of the Borrower Group will own directly or indirectly no more than a 50 per cent. interest in the asset or assets constituting the acquired business (a JV Minority Acquisition) and where: |

(i) | the business of the acquired entity or the business acquired, as the case may be, is of the same nature as the business of the Borrower Group as at the Effective Date and is carried out principally in Europe (other than Great Britain or Germany); |

(ii) | in the case of any JV Minority Acquisition where the Acquisition Cost is ε40,000,000 or greater, UPC Broadband delivers to the Facility Agent: |

(A) | a Borrower Group Business Plan which in relation to any JV Minority Acquisition must: |

I. | contain cash flow projection which show that the sum of the undrawn Total Facility A Commitments (as defined in the Existing Facility Agreement), any undrawn Additional Facility Commitments that are available to be drawn for the general corporate and working capital purposes of the Borrower Group, and Unrestricted Cash, taking into account the proposed JV Minority Acquisition, is projected to be greater than ε100,000,000 on the date on which financial covenants relating to the eleventh quarterly Accounting Period after the quarterly Accounting Period in which the Acquisition is made are tested under Clause 17 (Financial Covenants); and |

II. | contain financial projections which demonstrate that the Borrowers will be in compliance with the undertakings set out in Clause 17 (Financial Covenants) for the period from completion of the Acquisition (taking into account the Acquisition Cost of such Acquisition) to the Final Maturity Date; and |

(iii) | UPC Broadband delivers to the Facility Agent the most recent six months management accounts of or relating to the Target, together with a certificate signed by two managing directors or the sole managing director, as the case may be, of UPC Broadband certifying the amount of the Cash Flow of the Target for the most recent six months and setting out the supporting calculations; |

(iv) | no Default has occurred and is continuing or would be caused by the JV Minority Acquisition; and |

(v) | UPC Broadband delivers to the Facility Agent a certificate signed by two managing directors or the sole managing director of UPC Broadband which certifies that, if the ratio of Senior Debt to Annualised EBITDA of the Borrower Group was re-calculated for the most recent Ratio Period ending prior to the date of the Acquisition for which financial statements have been delivered pursuant to Clause 16.2(a) or (b) (Financial information) (the Relevant Ratio Period) but adding to the: |

(A) | amount of Senior Debt used in such calculation any net increase in the Senior Debt of the Borrower Group since the end of the Relevant Ratio Period or subtracting from the amount of Senior Debt used in such calculation any net deduction in the Senior Debt of the Borrower Group since the end of the Relevant Ratio Period (in each case taking into account the amount of Senior Debt used to fund the Acquisition Cost); and |

(B) | Annualised EBITDA of the Borrower Group the Annualised EBITDA of the Target for the Relevant Ratio Period, |

(1) | 4.0:1; and |

(2) | the ratio of Senior Debt to Annualised EBITDA of the Borrower Group for the Relevant Ratio Period. |

(a) | any Security Interest arising hereunder or under any Security Document; |

(b) | any Security Interest arising under any Existing Security Document; |

(c) | any liens arising in the ordinary course of business by way of contract which secure indebtedness under any agreement for the supply of goods or services in respect of which payment is not deferred for more than 180 days (or 360 days if such deferral is in accordance with the terms pursuant to which the relevant goods were acquired or services were provided); |

(d) | any Security Interest imposed by any taxation or governmental authority in respect of amounts which are being contested in good faith and not yet payable and for which adequate reserves have been set aside in the books of the Borrower Group (or, as the case may be, UPC Broadband Holdco) in respect of the same in accordance with GAAP; |

(e) | any Security Interests approved in writing by the Agent (acting on the instructions of the Majority Lenders); |

(f) | any Security Interest in favour of any bank incurred in relation to any cash management arrangements; |

(g) | rights of set-off arising in the ordinary course of business; |

(h) | any Security Interest securing any Financial Indebtedness referred to in Clause 16.12(b)(xi) (Restrictions on Financial Indebtedness), provided that (A) such Security Interest was not created in contemplation of the acquisition of such company, (B) the debt secured by such Security Interest is not increased beyond that secured at the date the company in question is acquired and such Security Interest secures only that debt and (C) such Encumbrance is discharged within 12 months of completion of the relevant acquisition; |

(i) | any Security Interest over non-Distribution Business Assets referred to in Clause 16.12(b)(xii) (Restrictions on Financial Indebtedness), securing Financial Indebtedness described therein or any other obligation in respect of such non-Distribution Business Assets; |

(j) | Security Interests arising under agreements entered into in the ordinary course of business relating to (i) network leases or (ii) the leasing of (A) building; (B) cars; and (C) other operational equipment; |

(k) | any Security Interest securing Financial Indebtedness arising under the Permitted Borrower Group Revolving Credit Facility or the Permitted Borrower Group Guarantee Facilities provided that any such Security Interest will constitute a Security Interest over assets that are not secured or required to be secured as at the date of the Amendment Agreement under the Finance Documents or the Existing Finance Documents; and |

(l) | any Security Interests not falling within paragraphs (a) to (k) above and securing indebtedness (other than indebtedness in relation to an Acquisition) not exceeding ε15,000,000 (or its equivalent). |

(a) | UPC Poland Holding B.V. (previously called UPC Telecom NV); and |

(b) | if the entity referred to in (a) above: |

(i) | consolidates with or merges with or is acquired by any other person or persons; or |

(ii) | directly or indirectly, sells, leases, conveys or transfers all or substantially all of its assets to any other person or persons, |

(a) | the second Business Day before the Utilisation Date of an Advance denominated in US Dollars; or |

(b) | the second TARGET Day before the Utilisation Date of an Advance denominated in euros, |

(a) | convertible preference shares that cannot in accordance with their terms be redeemed for cash: |

(i) | before the date on which all amounts outstanding under the Finance Documents and the Existing Finance Documents have been repaid or prepaid in full; or |

(ii) | (if they can be redeemed for cash before that date) until the ratio of Senior Debt to Annualised EBITDA (i) is 3.5:1 or less for the two immediately preceding consecutive Ratio Periods and (ii) will be less than 3.5:1 immediately after such cash redemption; and |

(b) | convertible preference shares issued by a member of the UGCE Borrower Group and subscribed for by a member of the Wider Group. |

(a) | an event specified as such in section 4043 of ERISA or any regulation promulgated thereunder, with respect to a Plan that is subject to Title IV of ERISA, other than an event in relation to which the requirement to give 30 days notice of that event is waived by any regulation; or |

(b) | a failure to meet the minimum funding standard under section 412 of the Code or section 302 of |

(a) | UPC, LGEF, UPC Holding, UPC Broadband and UPC Broadband Operations B.V. (previously called UPC Operations B.V.); |

(b) | UPC, LGEF, UPC Holding and UGC Europe Services B.V. (previously called UPC Services B.V.); |

(c) | UPC, LGEF, UPC Holding, UPC Broadband and UPC Broadband Holding Services B.V. (previously called UPC Holding Services B.V.); and |

(d) | UPC, LGEF, UPC Holding, UPC Broadband and UPC Services Ltd. |

(a) | in relation to LIBOR, the British Bankers Association Interest Settlement Rate for the relevant currency and period; and |

(b) | in relation to EURIBOR, the percentage rate per annum determined by the Banking Federation of the European Union for the relevant period, |

(a) | the documents listed in Schedule 7 (Security Documents); and |

(b) | such other security documents as may from time to time be entered into in favour of any Beneficiary pursuant to any of the Finance Documents (including without limitation any other Obligor Pledge of Shareholder Loans or Pledge of Subordinated Shareholder Loans, any security document referred to in Clause 16.22 (UPC Broadband Pledged Account), Clause 16.23 (Share security) or Clause 16.25 (Further security over receivables) and any security document provided to the Security Agent in connection with the accession of an Additional Obligor pursuant to Clause 26.4 (Additional Obligors) and Part 2 of Schedule 2 (Conditions Precedent Documents) or otherwise. |

(a) | UnitedGlobalCom, Inc. a corporation incorporated in the State of Delaware, United States and, as of the Signing Date, having its business office at 4643 South Ulster Street, Suite 1300, Denver, Colorado 80237 U.S.A.; and |

(b) | if the entity referred to in (a) above: |

(i) | consolidates with or merges with any other person or persons; or |

(ii) | directly or indirectly, sells, leases, conveys or transfers all or substantially all of its assets to any other person or persons, |

(a) | UGCE Inc.; |

(b) | any other company of which UPC Broadband is a Subsidiary and which is a Subsidiary of UGCE Inc.; and |

(c) | UPC Holding II. |

(a) | UGC Europe Inc. a company organised under the laws of the State of Delaware; and |

(b) | if the entity referred to in (a) above: |

(i) | consolidates with or merges with any other person or persons; or |

(ii) | directly or indirectly, sells, leases, conveys or transfers all or substantially all of its assets to any other person or persons, |

(a) | any corporation, association or other business entity (other than a partnership, joint venture, limited liability company or similar entity) of which more than 50 per cent. of the total ordinary voting power of shares of Capital Stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof (or persons performing similar functions); or |

(b) | any partnership, joint venture limited liability company or similar entity of which more than 50 per cent. of the capital accounts, distribution rights, total equity and voting interests or general or limited partnership interests, as applicable, is, in the case of clauses (a) and (b), at the time owned or controlled, directly indirectly, by: |

(i) | UGCE Inc; |

(ii) | UGCE Inc. and one or more UGCE Inc. Subsidiaries; or |

(iii) | one or more UGCE Inc. Subsidiaries. |

1.4 | Construction |

(a) | In this Agreement, unless the contrary intention appears, a reference to: |

(i) | a document being in the agreed form means a document (A) in a form previously agreed in writing by or on behalf of the Facility Agent and UPC Broadband, or (B) in a form substantially as set out in any Schedule to any Finance Document, or (C) (if not falling within (A) or (B) above) in form and substance satisfactory to the Lenders and initialled by or on behalf of the Facility Agent and UPC Broadband for the purposes of identification; |

(A) | a provision of a law is a reference to that provision as amended, re-enacted or extended; |

(B) | a Clause or a Schedule is a reference to a clause of or a schedule to this Agreement; |

(C) | a person includes its successors, transferees and assigns; |

(D) | (or to any specified provision of) this Agreement or any other document shall be construed, save where expressly provided to the contrary in this Agreement, as a reference to this Agreement, that provision or that document as in force for the time being and as from time to time amended in accordance with its terms, or, as the case may be, with the agreement of the relevant parties and (where such consent is, by the terms of this Agreement or the relevant document, required to be obtained as a condition to such amendment being permitted) the prior written consent of the Facility Agent, all of the Lenders or the Majority Lenders (as the case may be); |

(E) | other than in the definition of EURIBOR in Clause 1.1 (Definitions), a time of day is a reference to London time; and |

(F) | words importing the plural include the singular and vice versa. |

(b) | Unless the contrary intention appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

(c) | The index to and the headings in this Agreement are for convenience only and are to be ignored in construing this Agreement. |

(d) | Unless expressly provided to the contrary in a Finance Document, a person who is not a party to a Finance Document may not enforce any of its terms under the Contracts (Rights of Third Parties) Act 1999. |

(e) | Notwithstanding any term of any Finance Document, the consent of any third party is not required for any variation (including any release or compromise of any liability under) or termination of that Finance Document. |

1.5 | Existing Facility Agreement |

(a) | Unless expressly stated to the contrary, and subject to paragraph (b), references in any of the Finance Documents to the Existing Finance Documents and to terms defined in, and provisions of, any of the Existing Finance Documents, shall be references to the relevant Existing Finance Document and such terms and provisions as at the Effective Date, as the same may be amended with the prior written approval of the Facility Agent (acting on the instructions of the Majority Lenders) from time to time. |

(b) | References in any of the Finance Documents to any Finance Party (as defined in the Existing Facility Agreement) shall include such Finance Party's permitted successors, transferees or assigns from time to time. |

2. | THE FACILITIES |

2.2 | [Intentionally left blank] |

2.3 | Additional Facilities |

(a) | Any person may, subject to the terms of this Agreement, become a Lender by delivering to the Facility Agent an Additional Facility Accession Agreement in each case duly completed and executed by that person, , UPC Broadband and, if the Additional Facility is to be granted to an Additional Borrower, the relevant Additional Borrower. If, on the date the Additional Facility Accession Agreement becomes effective, it is a requirement under Dutch law that a Lender needs to be qualified as a Professional Market Party, such Lender must make the declaration and representation set out in paragraph 4 of the Additional Facility Accession Agreement. That person shall become a Lender on the date specified in the Additional Facility Accession Agreement. |

(b) | Upon the relevant person becoming a Lender, the Total Commitments shall be increased by the amount set out in the relevant Additional Facility Accession Agreement as that Lender's Additional Facility Commitment. |

(c) | Each Lender will grant to the relevant Borrower a term loan facility in the amount specified in the relevant Additional Facility Accession Agreement in euros, US Dollars or an Additional Currency (as applicable) during the Additional Facility Availability Period specified in the Additional Facility Accession Agreement, subject to the terms of this Agreement. |

(d) | The execution by UPC Broadband and the relevant Borrower of an Additional Facility Accession Agreement constitutes confirmation by each Guarantor that its obligations under Clause 14 (Guarantee) shall continue unaffected except that those obligations shall extend to the Total Commitments as increased by the addition of the relevant Lender's Commitment and shall be owed to each Finance Party including the relevant Lender. |

2.4 | Overall facility limits |

(a) | The aggregate amount of all outstanding Advances under an Additional Facility shall not at any time exceed the relevant Total Additional Facility Commitments for that Additional Facility. |

(b) | The aggregate amount of the participations of a Lender in Advances under an Additional Facility shall not at any time exceed that Lender's Additional Facility Commitment for that Additional Facility at that time. |

2.5 | Number of Requests and Advances |

(a) | No more than one Request may be made under each Additional Facility unless an Additional Facility Accession Agreement specifies otherwise, in which case the maximum number of requests for Advances under that Additional Facility will be as set out in that Additional Facility Accession Agreement. |

(b) | Unless the Facility Agent agrees otherwise, no more than five Advances may be outstanding at any one time under each Additional Facility (other than Additional Facilities that can be redrawn) and no more than ten Advances may be outstanding at any one time under each Additional Facility that can be redrawn. |

2.6 | Nature of a Finance Party's rights and obligations |

(a) | The obligations of a Finance Party under the Finance Documents are several. Failure of a Finance Party to carry out those obligations does not relieve any other Party of its obligations under the Finance Documents. No Finance Party is responsible for the obligations of any other Finance Party under the Finance Documents. |

(b) | The rights of a Finance Party under the Finance Documents are divided rights. A Finance Party may, except as otherwise stated in the Finance Documents, separately enforce those rights. |

(c) | Each of the Obligors and each of the Finance Parties agrees that the Security Agent shall be the joint and several creditor (hoofdelijk crediteur) of each and every obligation of any Obligor towards each of the Finance Parties under any Finance Document, and that accordingly the Security Agent will have its own independent claim as creditor and not as agent against each Obligor to demand performance by the relevant Obligor of those obligations. However, any discharge of any such obligation to either of the Security Agent or the relevant Finance Party shall, to the same extent, discharge the corresponding obligation owing to the other. |

(d) | Without limiting or affecting the Security Agent's rights against any Obligor (whether under this paragraph or under any other provision of the Finance Documents), the Security Agent agrees with each other Finance Party (on a several and divided basis) that, subject as set out in the next sentence, it will not exercise its rights as a joint and several creditor with a Finance Party except with the prior written consent of the relevant Finance Party. However, for the avoidance of doubt, nothing in the previous sentence shall in any way limit the Agent's right to act in the protection or preservation of rights under or to enforce any Security Document or the Security Deed as contemplated by the Finance Documents (or to do any act reasonably incidental to any of the foregoing). |

2.7 | UPC Broadband as Obligors' agent |

(a) | irrevocably authorises and instructs UPC Broadband to give and receive as agent on its behalf all notices (including Requests) and sign all documents in connection with the Finance Documents |

(b) | confirms that it will be bound by any action taken by UPC Broadband under or in connection with the Finance Documents. |

2.8 | Actions of UPC Broadband as Obligors' agent |

(a) | any irregularity (or purported irregularity) in any act done by or any failure (or purported failure) by UPC Broadband; |

(b) | UPC Broadband acting (or purporting to act) in any respect outside any authority conferred upon it by any Obligor; or |

(c) | the failure (or purported failure) by or inability (or purported inability) of UPC Broadband to inform any Obligor of receipt by it of any notification under this Agreement or any other Finance Document. |

3. | PURPOSE |

3.2 | Purpose |

3.3 | Lender's declarations and representations as Professional Market Party |

(a) | Each Lender under an Additional Facility made available to a Dutch Borrower makes the following declarations and representations to those relevant Dutch Borrowers: |

(i) | it is a Professional Market Party; and |

(ii) | it acknowledges that as a consequence it has no benefit from the (creditor) protection under the Dutch Banking Act for non-Professional Market Parties. |

(b) | Each declaration and representation set out in paragraph (a) above is made by each relevant Lender on the 2006 Amendment Effective Date and on each date that this Agreement is amended, restated or supplemented. |

(c) | If on the date on which a Dutch Borrower accedes to this Agreement, it is a requirement under Dutch law that a Lender needs to be qualified as a Professional Market Party in respect of Advances to be made to that Dutch Borrower, each then current Lender under an Existing Facility or an Additional Facility to which that Dutch Borrower is a Borrower shall make the declaration and representation set out under paragraph (a) above to such Dutch Borrower. |

3.4 | No monitoring |

4. | CONDITIONS PRECEDENT |

4.2 | Documentary conditions precedent |

(a) | This Agreement will take effect on the day falling no less than five Business Days after the Signing Date (the Effective Date) on which the Facility Agent notifies UPC Broadband and the Lenders that it has received written confirmation from the Existing Facility Agents that the conditions precedent in Clause 2(b) of the amendment and restatement agreement dated on or about the date of this Agreement between, inter alia, UPC Broadband and the Existing Facility Agents amending and restating the Existing Facility Agreement have been either satisfied or waived and that such agreement is effective. |

(b) | No Borrower may draw an Advance under this Agreement until the Facility Agent has notified UPC Broadband and the Lenders that it has received all of the documents set out in Part 1 of Schedule 2 (Conditions Precedent Documents) in form and substance satisfactory to the Facility Agent. |

(c) | The Facility Agent will confirm to UPC Broadband and to the Existing Facility Agents that it has received the documents referred to in paragraph (b) above as soon as practicable upon receiving all of them in form and substance satisfactory to it. |

4.3 | Further conditions precedent |

(a) | on the date of the Request for that Advance and on the proposed Utilisation Date the representations and warranties in Clause 15 (Representations and Warranties) to be repeated on those dates are and will be immediately after the relevant Advance is drawn down correct in all material respects; |

(b) | on the date of the Request for that Advance and on the proposed Utilisation Date no Default is outstanding or would result from the proposed Advance; |

(c) | on the date of the Request for that Advance and on the proposed Utilisation Date no Change of Control has occurred where the event has not been waived by the Majority Lenders; and |

(d) | the relevant Borrower confirms to the Facility Agent in the Request that the proceeds of such Advance are only to be applied in accordance with Clause 3.1 (Purpose) and specifies the relevant purpose of the proposed Advance in such Request. |

4.4 | Pro forma covenant compliance |

4.5 | Deferred Acquisition Costs |

(a) | where the Acquisition Cost of the acquisition was greater than ε100,000,000 and no more than ε150,000,000, a certificate signed by two managing directors or the sole managing director, as the case may be, of UPC Broadband and certifying; or |

(b) | where the Acquisition Cost of the acquisition was greater than ε150,000,000, financial projections based on assumptions which are no more aggressive (when taken as a whole) than those used in the preparation of the Business Plan which demonstrate, |

5. | ADVANCES |

5.2 | Delivery of Request |

5.3 | Form of Request |

(a) | the relevant Facility and the corresponding Utilisation Date which shall be a Business Day falling during the relevant Additional Facility Availability Period; |

(b) | the currency of the proposed Advance (which must be euros, US Dollars or an Additional Currency (in each case as specified in the relevant Additional Facility Accession Agreement)); |

(c) | the principal amount of the proposed Advance which: |

(i) | for an Advance denominated in euros, shall be a minimum amount of ε10,000,000; |

(ii) | for an Advance denominated in US Dollars, shall be a minimum amount of US |

(iii) | for an Advance denominated in any Additional Currency, shall be a minimum amount equivalent to €10,000,000 (in each case using the Agent's Spot Rate of Exchange on the date of receipt by the Agent of the Request and rounded up to the nearest million units in the relevant Additional Currency); |

(d) | the Interest Period of the Advance, which must be a period complying with Clause 8 (Interest); and |

(e) | unless previously notified to the Facility Agent in writing and not revoked the details of the bank and account to which the proceeds of the proposed Advance are to be made available, which must comply with Clause 9 (Payments). |

5.4 | Notification to the Lenders |

5.5 | Participations in Advances |

(a) | Subject to the terms of this Agreement, each Lender shall, on the date specified in any Request for an Advance, make available to the Facility Agent for the account of the relevant Borrower the amount of its participation in that Advance. All such amounts shall be made available to the Facility Agent in accordance with Clause 9.2 (Funds) for disbursement to or to the order of the relevant Borrower in accordance with the provisions of this Agreement. |

(b) | The amount of a Lender's participation in an Advance will be the proportion (applied to the amount set out in the Request) which its relevant Additional Facility Commitment bears to the relevant Total Additional Facility Commitments. |

(c) | Advances denominated in euro will only be made available in the euro unit. |

6. | REPAYMENT |

6.1 | Repayment of Advances |

(a) | Each Borrower must repay the Advances made to it in accordance with the provisions of the relevant Additional Facility Accession Agreement, which shall provide, subject to paragraph (b) below, for repayment of the relevant Additional Facility to be made: |

(i) | in full on the relevant Final Maturity Date; or |

(ii) | by payment of instalments (each a Repayment Instalment) on any date or dates up to and including the relevant Final Maturity Date. Each Repayment Instalment shall be in the amount and on the date or dates set out in or calculated in accordance with the relevant Additional Facility Accession Agreement. |

(b) | (i) The aggregate Original Euro Amount of each: |

(A) | Repayment Instalment; and |

(B) | amount of any Facility A Advances (as defined in the Existing Facility Agreement) repaid or prepaid pursuant to clause 6.1(a) (Repayment of Advances) of the Existing Facility Agreement, |

(ii) | (iii) the cumulative amount in euros set out in column (2) below opposite the current repayment date set out in column (1) below which immediately precedes that Relevant Date, minus |

(A) | the aggregate Original Euro Amount of each amount referred to in paragraphs (b)(i)(A) and (b)(i)(B) above repaid or prepaid on any date during the period from 2 December 2004 to (but excluding) that Relevant Date. |

(1) | (2) |

current repayment dates | cumulative amount |

June 30, 2005 | €4,017,079 |

December 31, 2005 | €6,025,618 |

June 30, 2006 | €215,174,782 |

December 31, 2006 | €596,336,446 |

June 30, 2007 | €944,235,611 |

December 31, 2007 | €1,208,734,775 |

June 30, 2008 | €2,038,469,660 |

December 31, 2008 | €2,134,879,545 |

June 30, 2009 | €3,156,732,530 |

6.2 | Notification |

7. | CANCELLATION AND PREPAYMENT |

7.1 | Automatic Cancellation of the Commitments |

7.2 | Voluntary cancellation |

7.3 | Voluntary prepayment |

(a) | UPC Broadband may, by delivering to the Facility Agent a duly completed Cancellation Notice not less than five Business Days prior to the due date of prepayment, prepay the whole or any part, (but if in part in an aggregate minimum Original Euro Amount of ε10,000,000) of the outstanding Advances made to a Borrower under any Additional Facility. |

(b) | Any voluntary prepayment made under paragraph (a) above will be applied against the Additional Facilities in such proportion as may be specified by UPC Broadband in the notice of prepayment and: |

(i) | (in the case of any Additional Facility which may be redrawn following prepayment) against all outstanding Advances under such Additional Facility pro rata or against such Advances as UPC Broadband may designate in the Cancellation Notice; and |

(ii) | (in the case of any other Additional Facility) against all the outstanding Advances made under the relevant Additional Facility pro rata (and, if applicable, against the Repayment Instalments for the relevant Additional Facility or Additional Facilities in such order as may be specified by UPC Broadband). |

7.4 | Change of Control |

(a) | If: |

(i) | UGC ceases: |

(A) | directly or indirectly to own more than 50 per cent. of the issued share capital of UGCE Inc.; and |

(B) | to Control UGCE Inc.; or |

(ii) | UGCE Inc. does not or ceases to own, directly or indirectly through one or more of its Subsidiaries or other persons Controlled by it, the legal and beneficial interest in more than 50 per cent. of the voting and economic rights attaching to the issued share capital of, or otherwise ceases to Control, UPC Broadband Holdco, (except as a result of a merger or consolidation of UPC Broadband Holdco with or into a Shareholder, provided that such merger or consolidation is in accordance with paragraph (b) below); or |

(iii) | in accordance with the terms of any share pledge in favour of the Security Agent over the issued share capital of UPC Broadband Holdco and UPC Holding II, UPC Broadband Holdco does not or ceases to own directly (or indirectly through one or more of its Subsidiaries or other persons Controlled by it, subject to such Subsidiary or person complying with Clause 26.4(a) (Additional Obligors)) the legal and beneficial interest in 100 per cent. of the issued share capital of UPC Broadband and UPC Holding II or otherwise ceases to Control UPC Broadband and UPC Holding II; or |

(iv) | in accordance with the terms of the share pledges in favour of the Security Agent over the issued share capital of each of the Obligors (other than UPC Broadband Holdco, UPC Holding II, UPC Financing and UPC Broadband), UPC Broadband does not or ceases to own directly or indirectly through one or more of its Subsidiaries or other persons Controlled by it, the legal and beneficial |

(v) | UPC Broadband Holdco and UPC Holding II do not or cease to own, in accordance with the terms of the pledge referred to in paragraph 2 of Schedule 7 (Security Documents), the legal and beneficial interest in 100 per cent. of the partnership interests and economic rights attaching to the partnership interests of, or otherwise ceases to Control, UPC Financing, |

(A) | UPC Broadband shall promptly notify the Facility Agent upon becoming aware of a Change of Control; and |

(B) | if the Majority Lenders so require, the Facility Agent shall, by not less than 20 Business Days' notice to UPC Broadband, cancel each Additional Facility and declare all outstanding Advances, together with accrued interest and all other relevant amounts accrued under the Finance Documents immediately due and payable, whereupon each Additional Facility will be cancelled and all such outstanding amounts will become immediately due and payable. |

(b) | UPC Broadband Holdco shall not enter into a merger or consolidation with or into a Shareholder (the resulting entity being the UPC Merged Entity) unless: |

(i) | reasonable details of the proposed merger concerning the matters set out in paragraphs (ii) and (iii) below are provided to the Facility Agent at least 10 days before the merger is to be entered into; |

(ii) | the UPC Merged Entity will be liable for the obligations of UPC Broadband Holdco (including the obligations under the Finance Documents), which obligations will continue in full force and effect after the merger, and entitled to the benefit of all rights of UPC Broadband Holdco; and |

(iii) | the UPC Merged Entity has entered into Security Documents (if applicable) which provide security over the same assets of at least an equivalent nature and ranking to the security provided by UPC Broadband Holdco pursuant to any Security Documents entered into by it and such Security Documents are the legal, valid and binding obligations of the UPC Merged Entity enforceable in accordance with their terms subject (to the extent applicable) to substantially similar qualifications to those made in the legal opinions referred to in Schedule 2 (Conditions Precedent Documents). |

7.5 | Mandatory prepayment from Excess Cash Flow and Relevant Convertible Preference Shares |

(a) | Subject to paragraph (b) below and Clause 7.7 (Date for prepayment), within 10 Business Days of the delivery of the Borrower Group's audited consolidated financial statements which relate to any financial year of the Borrower Group (starting with the annual Accounting Period ending 31 December 2004) under Clause 16.2 (Financial information) the Borrowers (unless otherwise agreed in writing by the Facility Agent acting on the instructions of the Majority Lenders) shall prepay, or procure that there is prepaid, an amount of the Facilities equal to 50 per cent. of the Excess Cash Flow for such financial year. |

(b) | The Borrowers shall not be required to make any prepayments under (a) above: |

(i) | after the date on which the Facility Agent receives financial statements delivered under Clause |

(ii) | if the amount of Excess Cash Flow in respect of the relevant financial year is less than ε5,000,000. |

(c) | Subject to paragraph (d) below and Clause 7.7 (Date for prepayment) UPC Broadband shall, within ten Business Days of receipt by or for the account of a member of the UGCE Borrower Group of the proceeds of an issue of Relevant Convertible Preference Shares, prepay or procure that there is prepaid an amount of the Facilities equal to 40 per cent. of the balance of the proceeds of the Relevant Convertible Preference Shares. Such amount shall be applied pro rata against all outstanding Advances in accordance with Clause 7.8 (Order of application). |

(d) | UPC Broadband shall not be required to make any prepayments under paragraph (c) above provided that the most recently delivered financial statements provided to the Facility Agent under Clause 16.2(b) (Financial information) show that, for the two most recent Ratio Periods, the applicable ratio for the purposes of Clause 17.2(a) (Financial ratios) is 3.5:1 or less. |

7.6 | Mandatory prepayment from disposal proceeds |

(a) | Other than as provided in paragraphs (b) and (c) below, on a Permitted Disposal (other than a disposal in accordance with paragraphs (b)(i) to (xiii) of Clause 16.10 (Disposals)), the Borrowers shall immediately prepay, or procure that there is prepaid, an amount of the Additional Facilities equal to four times Annualised EBITDA (calculated in accordance with Clause 16.10(c) (Disposals)) of the person or asset that is being disposed of for the Ratio Period which ends on the most recent quarterly Accounting Period end date for which financial information has been delivered to the Facility Agent under Clause 16.2 (Financial information). Such amount shall be applied against the Additional Facilities in accordance with Clause 7.8 (Order of application). |

(b) | No prepayment in accordance with paragraph (a) above is required where the amount of any such prepayment would be less than €100,000,000. |

(c) | The Facility Agent may, with the approval of the Majority Lenders, waive the requirement for the Borrowers to make a prepayment in accordance with paragraph (a). Notwithstanding any such waiver, the Borrowers shall in any event be required to prepay an amount of the Additional Facilities to ensure that the financial ratios set out in Clause 17.2 (Financial ratios) for the Latest Ratio Period (as defined in Clause 16.10(b)(xiv) (Disposals)) in respect of the relevant disposal would not be breached if such financial ratios were tested for that Latest Ratio Period taking into account (on a pro forma basis) all disposals made since the last day of that Latest Ratio Period and the amount of such prepayment. |

7.7 | Date for prepayment |

7.8 | Order of application |

(a) | The amount of each prepayment of the Facilities made under Clauses 7.5(a) and (c) (Mandatory prepayment from Excess Cash Flow and Relevant Convertible Preference Shares) shall be applied, subject to any requirements described in this Agreement first to apply amounts in prepayment of the Existing Facilities: |

(i) | first pro rata between outstanding Advances other than Advances that can be prepaid and re-borrowed (and, if applicable, against the Repayment Instalments for the relevant Additional Facility or Additional Facilities in such order as may be specified by UPC Broadband); and |

(ii) | second against outstanding Advances that can be repaid or voluntarily prepaid and re-borrowed, pro rata between such outstanding Advances, |

(b) | The amount of each prepayment of the Additional Facilities made under Clause 7.6 (Mandatory prepayment from disposal proceeds) shall be applied against the Additional Facilities in such proportion as may be specified to the Facility Agent by UPC Broadband not less than two Business Days before the date on which the prepayment is due to be made and against all the outstanding Advances made under the relevant Additional Facility pro rata (and, if applicable, against the Repayment Instalments for the relevant Additional Facility or Additional Facilities in such order as may be specified by UPC Broadband). |

(c) | If UPC Broadband does not give a notice to the Facility Agent specifying how amounts are to be applied in prepayment under Clause 7.6 (Mandatory prepayment from disposal proceeds) within the time period specified in paragraph (b) above, the amount of the relevant prepayment shall be applied in accordance with paragraph (a) above. |

7.9 | Right of prepayment and cancellation in relation to a single Lender |

(a) | If: |

(i) | any sum payable to any Lender by a Borrower is required to be increased under Clause 10.2(c) (Tax gross-up); or |

(ii) | any Lender claims indemnification from a Borrower under Clause 10.3 (Tax indemnity) or Clause 12.1 (Increased Costs), |

(b) | On receipt of a notice referred to in paragraph (a) above, the Additional Facility Commitment of that Lender shall each immediately be reduced to zero. |

(c) | On the last day of each Interest Period which ends after a Borrower has given notice under paragraph (a) |

(d) | Prepayments made pursuant to this Clause 7.9 shall be applied against the outstanding Advances and the outstanding Repayment Instalments (if applicable) pro rata. |

7.10 | Miscellaneous provisions |

(a) | Any Cancellation Notice delivered under this Agreement is irrevocable. The Facility Agent shall notify the Lenders promptly of receipt of any such notice. |

(b) | All prepayments under this Agreement shall be made together with accrued interest on the amount prepaid and any other amounts due under this Agreement in respect of that prepayment and, subject to Clause 23.4 (Break Costs), without premium or penalty. |

(c) | No prepayment or cancellation is permitted except in accordance with the express terms of this Agreement. |

(d) | The amount of an Advance prepaid by UPC Broadband in accordance with Clause 7.3 (Voluntary prepayment) may, if specified in the relevant Additional Facility Accession Agreement, be re-borrowed in accordance with the terms of this Agreement. No other amount prepaid under this Agreement may subsequently be re-borrowed. |

(e) | No amount of any Additional Facility Commitment cancelled under this Agreement may subsequently be reinstated. |

(f) | Any prepayment in part of any Advance shall be applied against the participations of the Lenders in that Advance pro rata. |

8. | INTEREST |

8.1 | Interest rate |

(a) | the applicable Margin; and |

(b) | (i) LIBOR (in the case of an Advance denominated in US Dollars or an Additional Currency); or |

(ii) | EURIBOR (in the case of an Advance denominated in euros); and |

(c) | the Mandatory Costs. |

8.2 | Selection of Interest Periods |

(a) | The Interest Period of each Advance will be the period selected in the Request for that Advance and each subsequent Interest Period will be the period selected by the Borrower by notice (a Selection Notice) to the Facility Agent received not later than the third Business Day before the end of the then current Interest Period. |

(b) | Each Interest Period shall be one month, two, three or six months or in any case such other period not exceeding six months as the relevant Borrower and the Facility Agent (acting on the instructions of all the Lenders) may agree from time to time. Each Interest Period for an Advance will commence on its Utilisation Date or in the case of each subsequent Interest Period the expiry of its preceding Interest Period. |

8.3 | Non-Business Days |

8.4 | Further Adjustments to Interest Periods |

8.5 | Other adjustments |

8.6 | Notification |

8.7 | Due dates |

8.8 | Default interest |

(a) | If an Obligor fails to pay any amount payable by it under the Finance Documents, it shall forthwith on demand by the Facility Agent pay interest on the overdue amount from the due date up to the date of actual payment, both before and after judgment, at a rate (the default rate) determined by the Facility Agent to be two per cent. per annum above the rate which would have been payable if the Unpaid Sum had, during the period of non-payment, constituted an Advance at the Margin applicable to a new Advance if it had been drawn down at such time in the currency of the Unpaid Sum for such successive Interest Periods of such duration (not being more than three months) as the Facility Agent may determine, having regard to the likely duration of the default (a Designated Term). |

(b) | The default rate will be determined on each Business Day or the first day of, or two Business Days before the first day of, the relevant Designated Term, as appropriate. |

(c) | Default interest will be compounded at the end of each Designated Term. |

8.9 | Notification of rates of interest |

9. | PAYMENTS |

9.1 | Place of Payment |

9.2 | Funds |

9.3 | Distribution |

(a) | Each payment received by the Facility Agent under this Agreement for another Party shall, except as set out in paragraph (d) below and subject to paragraphs (b) and (c) below, be made available by the Facility Agent to that Party by payment (on the date of value of receipt and in the currency and funds of receipt) to its account with such bank in the principal financial centre of the country of the relevant currency (or, in the case of euros, in the principal financial centre of such of the Participating Member States or London) as it may notify to the Facility Agent for this purpose by not less than five Business Days' prior notice. |

(b) | The Facility Agent may apply any amount received by it for an Obligor in or towards payment (on the date and in the currency and funds of receipt) of any amount due from an Obligor under this Agreement in the same currency on such date or in or towards the purchase of any amount of any currency to be so applied. |

(c) | Where a sum is to be paid under this Agreement to the Facility Agent for the account of another Party, the Facility Agent is not obliged to pay that sum to that Party until it has established that it has actually received that sum. The Facility Agent may, however, assume that the sum has been paid to it in accordance with this Agreement and, in reliance on that assumption, make available to that Party a corresponding amount. If the sum has not been made available but the Facility Agent has paid a corresponding amount to another Party, that Party shall forthwith on demand refund the corresponding amount to the Facility Agent together with interest on that amount from the date of payment to the date of receipt, calculated at a rate reasonably determined by the Facility Agent to reflect its cost of funds. |

(d) | Subject to paragraph (c) above, in the case of a Mid-Interest Period Transfer, the Facility Agent shall: |

(i) | make any interest payable in respect of the principal amount that is assigned, transferred or novated under a Mid-Interest Period Transfer, that accrues on and prior to the date on which the Mid-Interest Period Transfer becomes effective, available to the Existing Lender; and |

(ii) | make any interest payable in respect of the principal amount that is assigned, transferred or novated as a Mid-Interest Period Transfer, that accrues after the date on which the Mid-Interest Period Transfer becomes effective, available to the New Lender, |

9.4 | Currency |

(a) | A repayment or prepayment of an Advance is payable in the currency in which the Advance is denominated. |

(b) | All interest is payable in the currency in which the relevant amount in respect of which it is payable is denominated. |

(c) | Amounts payable in respect of costs, expenses, Taxes and the like are payable in the currency in which they are incurred. |

(d) | Any other amount payable under this Agreement is, except as otherwise provided in this Agreement, payable in euros. |

9.5 | Set-off and counterclaim |

9.6 | Non-Business Days |

(a) | If a payment under this Agreement is due on a day which is not a Business Day, the due date for that payment shall instead be the next Business Day in the same calendar month (if there is one) or the preceding Business Day (if there is not). |

(b) | During any extension of the due date for payment of any principal under this Agreement interest is payable on the principal at the rate payable on the original due date. |

9.7 | Partial payments |

(a) | Subject to the Security Deed, if the Facility Agent receives a payment insufficient to discharge all the amounts then due and payable by an Obligor under this Agreement, the Facility Agent shall apply that payment towards the obligations of the Obligors under this Agreement in the following order: |

(i) | first, in or towards payment pro rata of any unpaid costs, fees and expenses of the Facility Agent under this Agreement; |

(ii) | secondly, in or towards payment pro rata of any accrued fees (other than any commitment fees payable under Clause 20.1 (Commitment fee)) due but unpaid under Clause 20 (Fees); |