6031 Connection Drive

Suite 400

Irving, TX 75039

Phone: 214.880.3500

6031 Connection Drive

Suite 400

Irving, TX 75039

Phone: 214.880.3500

October 22, 2024

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Trade & Services

Attn: Suying Li and Angela Lumley

Re: Builders FirstSource, Inc.

Form 10-K for Fiscal Year Ended December 31, 2023

Item 2.02 Form 8-K dated August 6, 2024

File No. 001-40620

This letter sets forth the response of Builders FirstSource, Inc. (the “Company”) to the comment letter dated October 15, 2024 from the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) regarding the Staff’s review of the Company’s annual report on Form 10-K for the year ended December 31, 2023 and the Company’s current report on Form 8-K dated August 6, 2024 and the earnings release included as exhibit 99.1 thereto (the “Prior Earnings Release”). For your convenience, each of the Staff’s comments has been repeated below in its entirety in bold italicized font, with the Company’s response to each such comment set out immediately underneath it.

Please note that we are filing this response letter via EDGAR submission.

Item 2.02 Form 8-K dated August 6, 2024

Exhibit 99.1

Second Quarter 2024 Highlights, page 1

Response: We respectfully acknowledge the Staff’s comment. In future earnings releases, when we discuss a change in a non-GAAP measure, including adjusted EBITDA margin, we will include a discussion of the change in the most directly comparable GAAP measure, including, in this instance, net income as a percentage of net sales. An example of our proposed revised disclosure based on the Prior Earnings Release is as follows:

Under the heading “Second Quarter 2024 Highlights” we will include a revised disclosure by adding the underlined sentence below:

Under the heading “Second Quarter 2024 Highlights” we will add the following new bullet below under the subheading “Net Income”

Reconciliation of Adjusted Non-GAAP Financial Measures to their GAAP Equivalents, page 4

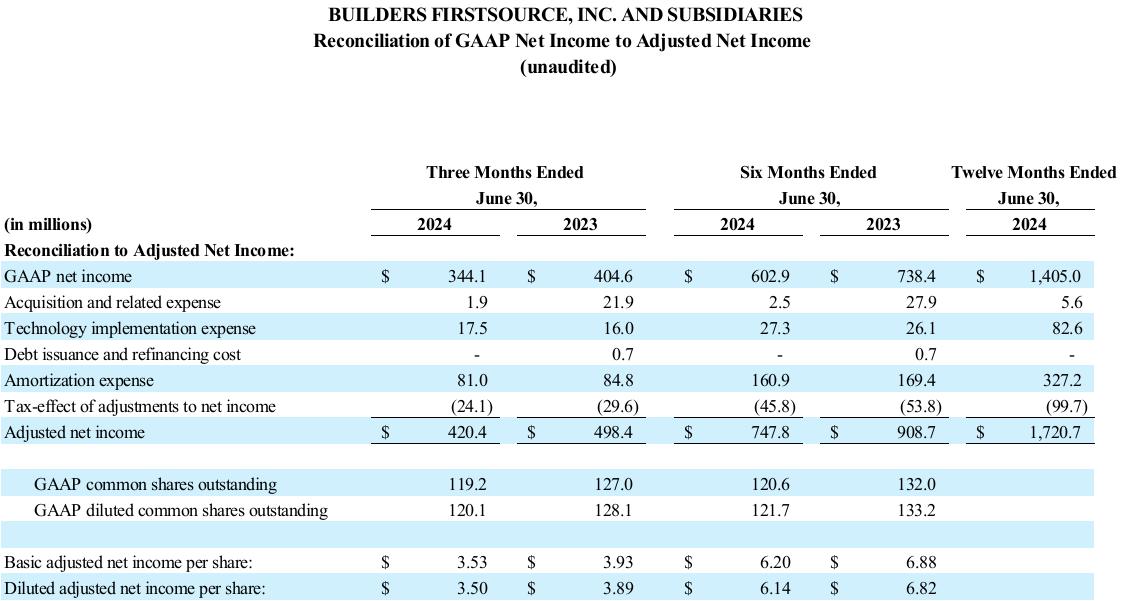

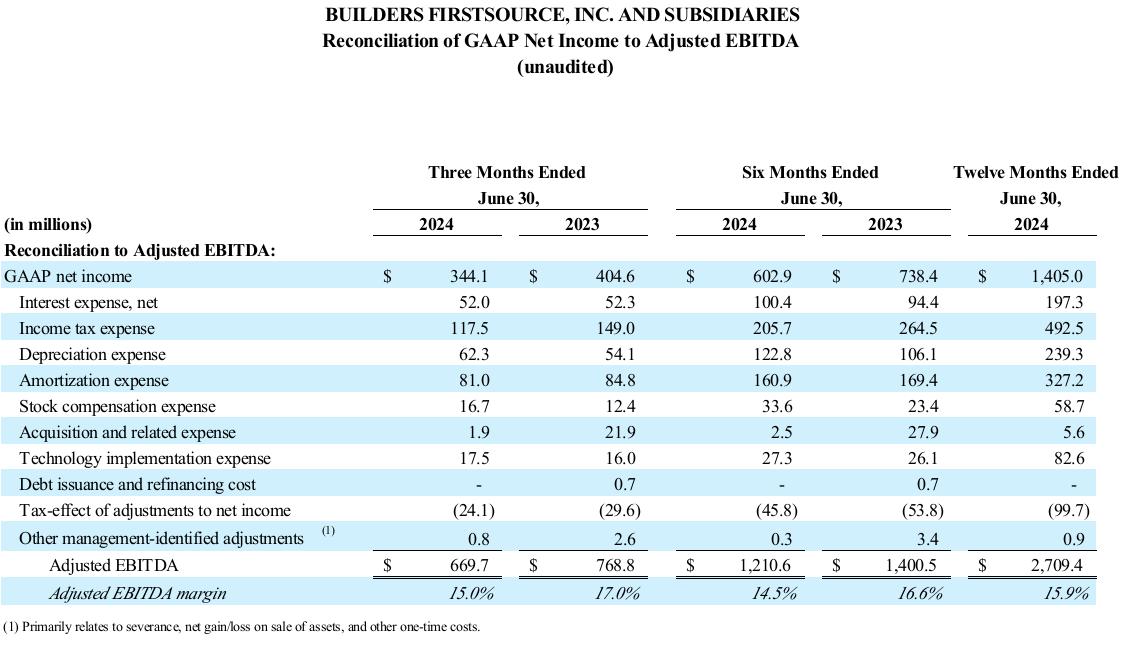

Response: We respectfully acknowledge the Staff’s comment. In future earnings releases, we will present separate reconciliations of GAAP net income to adjusted net income and of GAAP net income to adjusted EBITDA. An example of our proposed revised disclosure based on the Prior Earnings Release is set forth below. The proposed revised disclosure removes the subtotal, weighted average diluted common shares, and diluted adjusted net income per share from the reconciliation to Adjusted EBITDA and only presents it as part of the reconciliation of GAAP net income to adjusted net income as follows:

Reconciliation of GAAP Net Income to Adjusted Net Income

Reconciliation of GAAP Net Income to Adjusted EBITDA

Financial Data, page 4

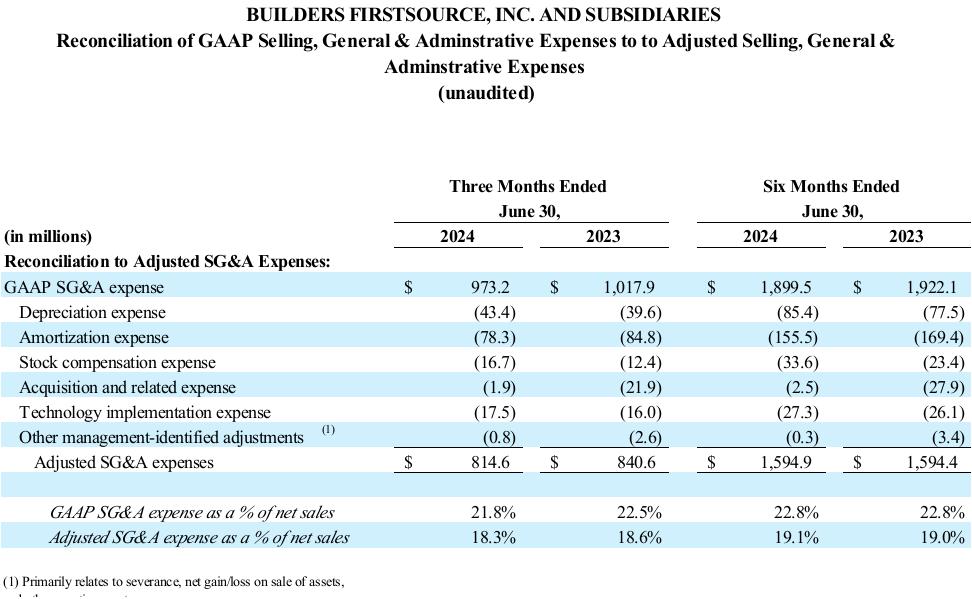

Response: We respectfully acknowledge the Staff’s comment. In future earnings releases, we will present a reconciliation of GAAP SG&A expenses to adjusted SG&A expenses, including a presentation of the non-GAAP financial measure Adjusted SG&A expense as a percentage of sales.

An example of our proposed revised disclosure based on the Prior Earnings Release is as follows:

Reconciliation of GAAP Selling, General & Administrative Expenses to Adjusted Selling, General & Administrative Expenses

Response: We respectfully acknowledge the Staff’s comment. In future earnings releases, we will present separate reconciliations of GAAP net income to adjusted net income and of GAAP net income to adjusted EBITDA as illustrated in the response to comment number 2 above.