Q3 2025 Update 1

Highlights 03 Financial Summary 04 Operational Summary 06 Automotive 07 Core Technology 08 Energy & Services and Other 09 Outlook 10 Photos & Charts 11 Key Metrics 20 Financial Statements 22 Additional Information 28 2

S U M M A R YH I G H L I G H T S (1) Excludes SBC (stock-based compensation) & Digital assets gains and losses, net of tax; (2) Free cash flow = operating cash flow less capex; (3) Includes cash, cash equivalents and investments; Note: all information herein refers to the current quarter unless otherwise noted. Profitability $1.6B GAAP operating income $1.4B GAAP net income $1.8B non-GAAP net income1 In Q3, the Tesla team achieved record vehicle deliveries globally, showing strength and growth across all regions, while also achieving record energy storage deployments across the residential, industrial and utility sectors. This strong performance resulted in both record revenue and free cash flow generation in the quarter. We continue to launch new products that excite our customers across automotive and energy. We launched the Model YL and Model Y Performance and further expanded our vehicle offering with the Model 3 and Model Y Standard, our most affordable vehicles. We also unveiled the Megapack 3 and Megablock, which will further simplify large battery installations by reducing cost and time to deploy. We believe our scale and cost structure will enable us to navigate the shifting market dynamics across the globe more effectively than our peers, with advances in AI making our products the most compelling in the market. Our focus remains on scaling our core hardware business by maximizing our deliveries and deployments, as these products will deliver increasing value to our customers over time via services powered by AI. Every Tesla vehicle delivered today is designed for autonomy while every Tesla energy storage product is capable of being enhanced and optimized by our virtual power plant or Autobidder functionality. We continue to deliver a fleet of products that brings AI into the real world as we pursue a future of sustainable abundance as outlined in our Master Plan Part IV. While we face near-term uncertainty from shifting trade, tariff and fiscal policy, we are focused on long-term growth and value creation. We are prudently making the necessary investments in our business, including future business lines, that we believe will drive incredible value for Tesla and the world across transport, energy and robotics. Cash Operating cash flow of $6.2B Record Free cash flow2 of nearly $4.0B $4.9B increase in our cash and investments3 to $41.6B Operations Launched ride-hailing service in the Bay Area using Robotaxi technology Record energy storage deployments Record vehicle deliveries 3

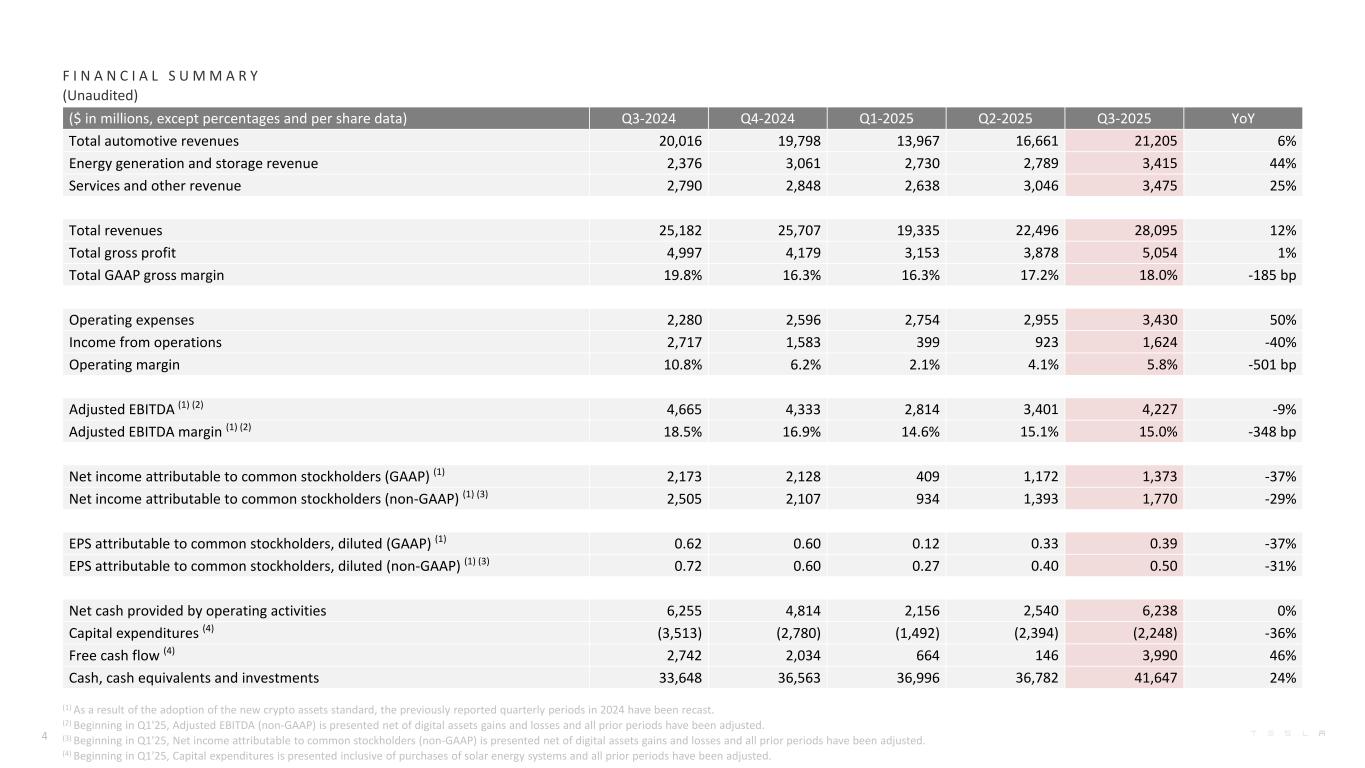

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) Q3-2024 Q4-2024 Q1-2025 Q2-2025 Q3-2025 YoY Total automotive revenues 20,016 19,798 13,967 16,661 21,205 6% Energy generation and storage revenue 2,376 3,061 2,730 2,789 3,415 44% Services and other revenue 2,790 2,848 2,638 3,046 3,475 25% Total revenues 25,182 25,707 19,335 22,496 28,095 12% Total gross profit 4,997 4,179 3,153 3,878 5,054 1% Total GAAP gross margin 19.8% 16.3% 16.3% 17.2% 18.0% -185 bp Operating expenses 2,280 2,596 2,754 2,955 3,430 50% Income from operations 2,717 1,583 399 923 1,624 -40% Operating margin 10.8% 6.2% 2.1% 4.1% 5.8% -501 bp Adjusted EBITDA (1) (2) 4,665 4,333 2,814 3,401 4,227 -9% Adjusted EBITDA margin (1) (2) 18.5% 16.9% 14.6% 15.1% 15.0% -348 bp Net income attributable to common stockholders (GAAP) (1) 2,173 2,128 409 1,172 1,373 -37% Net income attributable to common stockholders (non-GAAP) (1) (3) 2,505 2,107 934 1,393 1,770 -29% EPS attributable to common stockholders, diluted (GAAP) (1) 0.62 0.60 0.12 0.33 0.39 -37% EPS attributable to common stockholders, diluted (non-GAAP) (1) (3) 0.72 0.60 0.27 0.40 0.50 -31% Net cash provided by operating activities 6,255 4,814 2,156 2,540 6,238 0% Capital expenditures (4) (3,513) (2,780) (1,492) (2,394) (2,248) -36% Free cash flow (4) 2,742 2,034 664 146 3,990 46% Cash, cash equivalents and investments 33,648 36,563 36,996 36,782 41,647 24% 4 (1) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast. (2) Beginning in Q1'25, Adjusted EBITDA (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted. (3) Beginning in Q1'25, Net income attributable to common stockholders (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted. (4) Beginning in Q1'25, Capital expenditures is presented inclusive of purchases of solar energy systems and all prior periods have been adjusted.

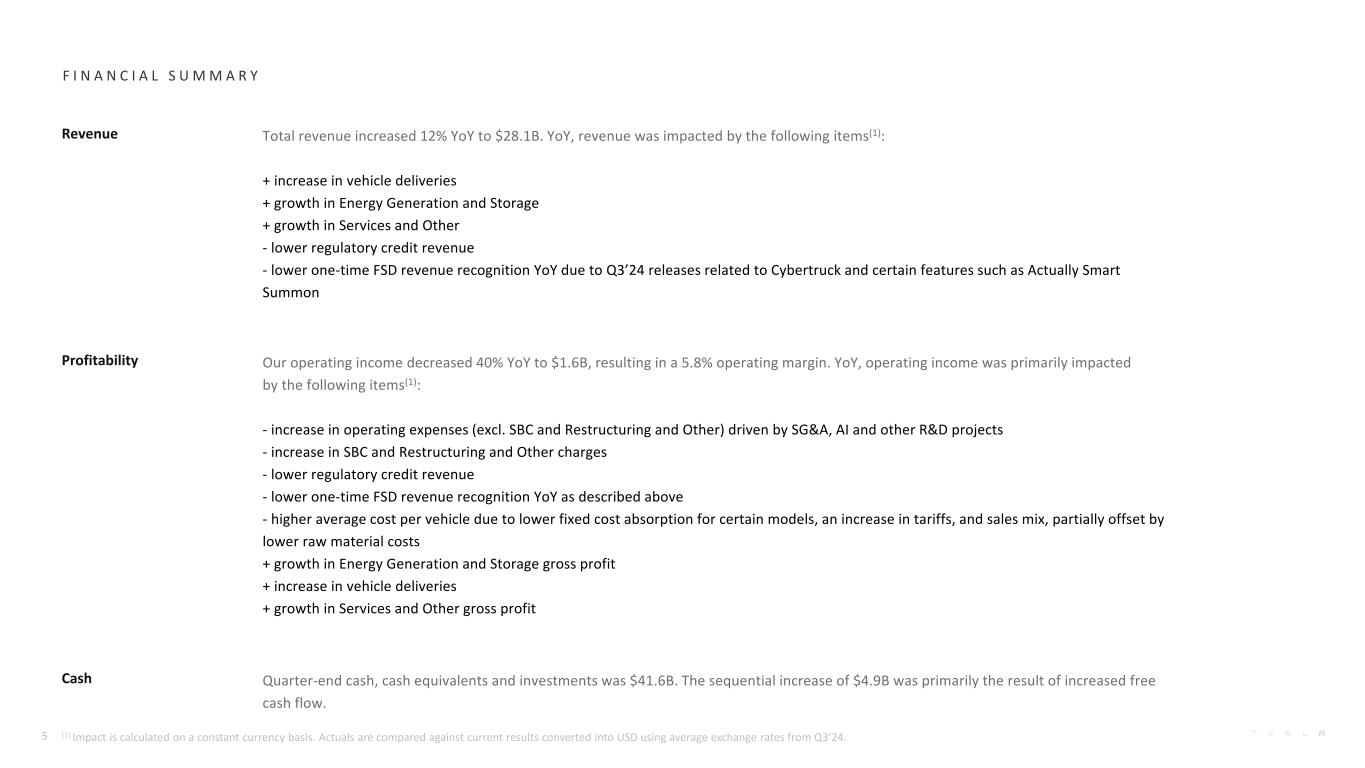

F I N A N C I A L S U M M A R Y Revenue Total revenue increased 12% YoY to $28.1B. YoY, revenue was impacted by the following items(1): + increase in vehicle deliveries + growth in Energy Generation and Storage + growth in Services and Other - lower regulatory credit revenue - lower one-time FSD revenue recognition YoY due to Q3’24 releases related to Cybertruck and certain features such as Actually Smart Summon Profitability Our operating income decreased 40% YoY to $1.6B, resulting in a 5.8% operating margin. YoY, operating income was primarily impacted by the following items(1): - increase in operating expenses (excl. SBC and Restructuring and Other) driven by SG&A, AI and other R&D projects - increase in SBC and Restructuring and Other charges - lower regulatory credit revenue - lower one-time FSD revenue recognition YoY as described above - higher average cost per vehicle due to lower fixed cost absorption for certain models, an increase in tariffs, and sales mix, partially offset by lower raw material costs + growth in Energy Generation and Storage gross profit + increase in vehicle deliveries + growth in Services and Other gross profit Cash Quarter-end cash, cash equivalents and investments was $41.6B. The sequential increase of $4.9B was primarily the result of increased free cash flow. 5 (1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q3’24.

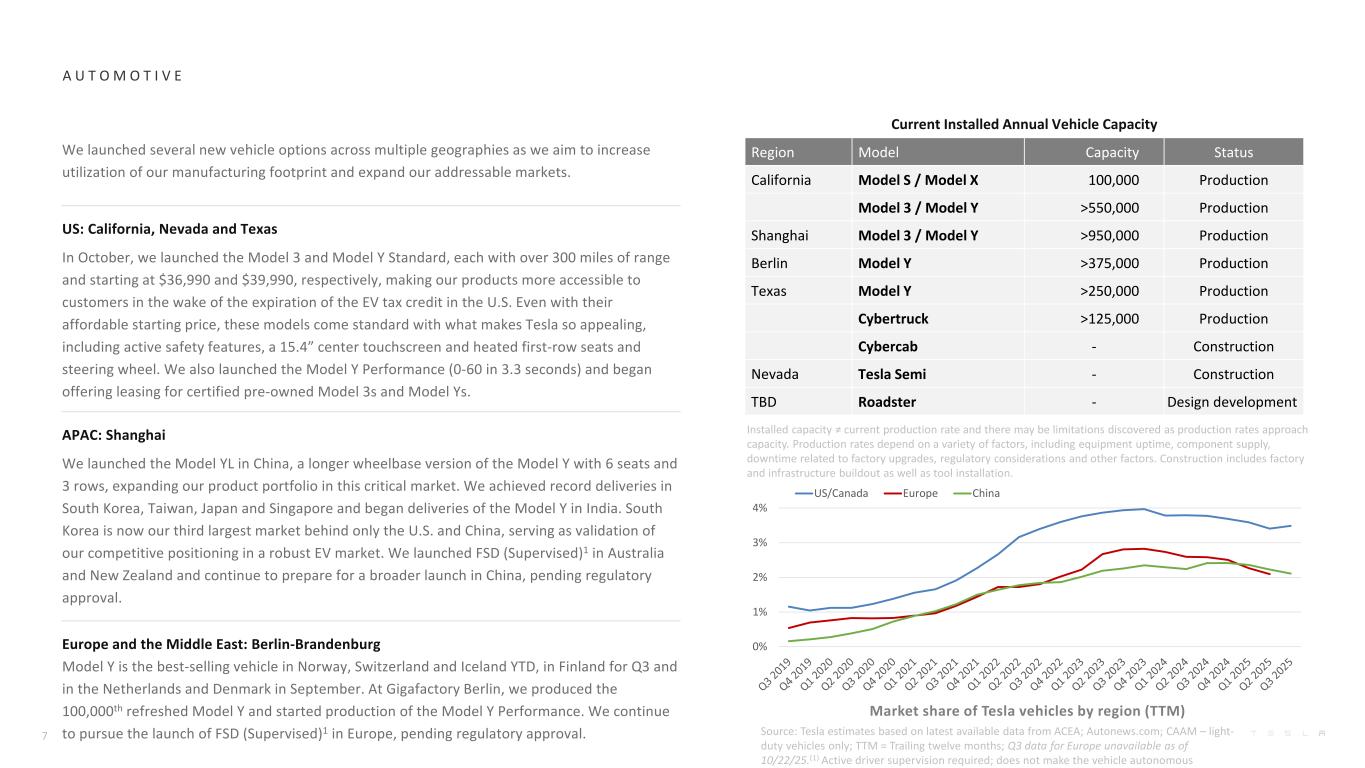

Q3-2024 Q4-2024 Q1-2025 Q2-2025 Q3-2025 YoY Model 3/Y production 443,668 436,718 345,454 396,835 435,826 -2% Other models production 26,128 22,727 17,161 13,409 11,624 -56% Total production 469,796 459,445 362,615 410,244 447,450 -5% Model 3/Y deliveries 439,975 471,930 323,800 373,728 481,166 9% Other models deliveries 22,915 23,640 12,881 10,394 15,933 -30% Total deliveries 462,890 495,570 336,681 384,122 497,099 7% of which subject to operating lease accounting 14,449 26,962 13,721 6,670 10,230 -29% Total end of quarter operating lease vehicle count 168,867 180,523 179,930 172,882 170,017 1% Global vehicle inventory (days of supply)(1) 19 12 22 24 10 -47% Storage deployed (GWh) 6.9 11.0 10.4 9.6 12.5 81% Tesla locations 1,306 1,359 1,390 1,454 1,498 15% Mobile service fleet 1,933 1,895 1,799 1,684 1,699 -12% Supercharger stations 6,706 6,975 7,131 7,377 7,753 16% Supercharger connectors 62,421 65,495 67,316 70,228 73,817 18% (1) Days of supply is calculated by dividing new vehicle ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). O P E R A T I O N A L S U M M A R Y (Unaudited) 6

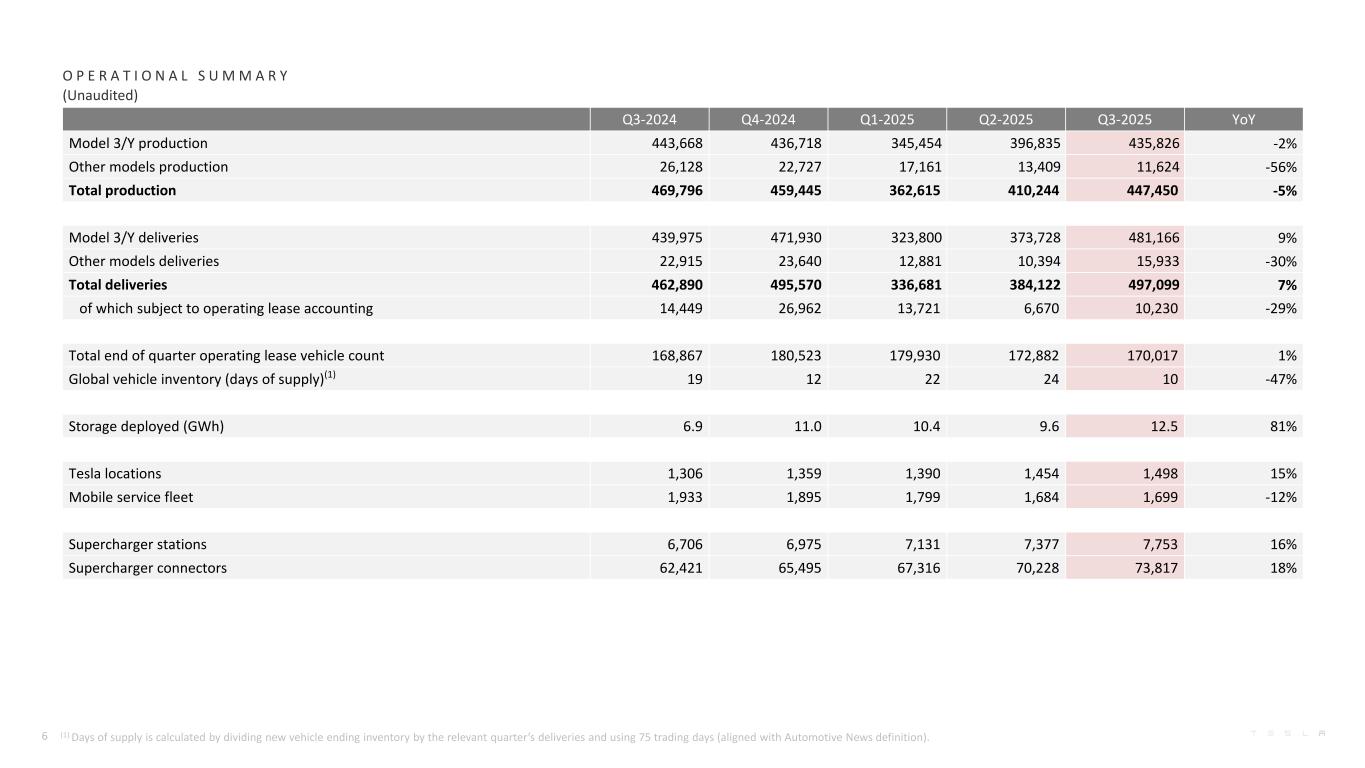

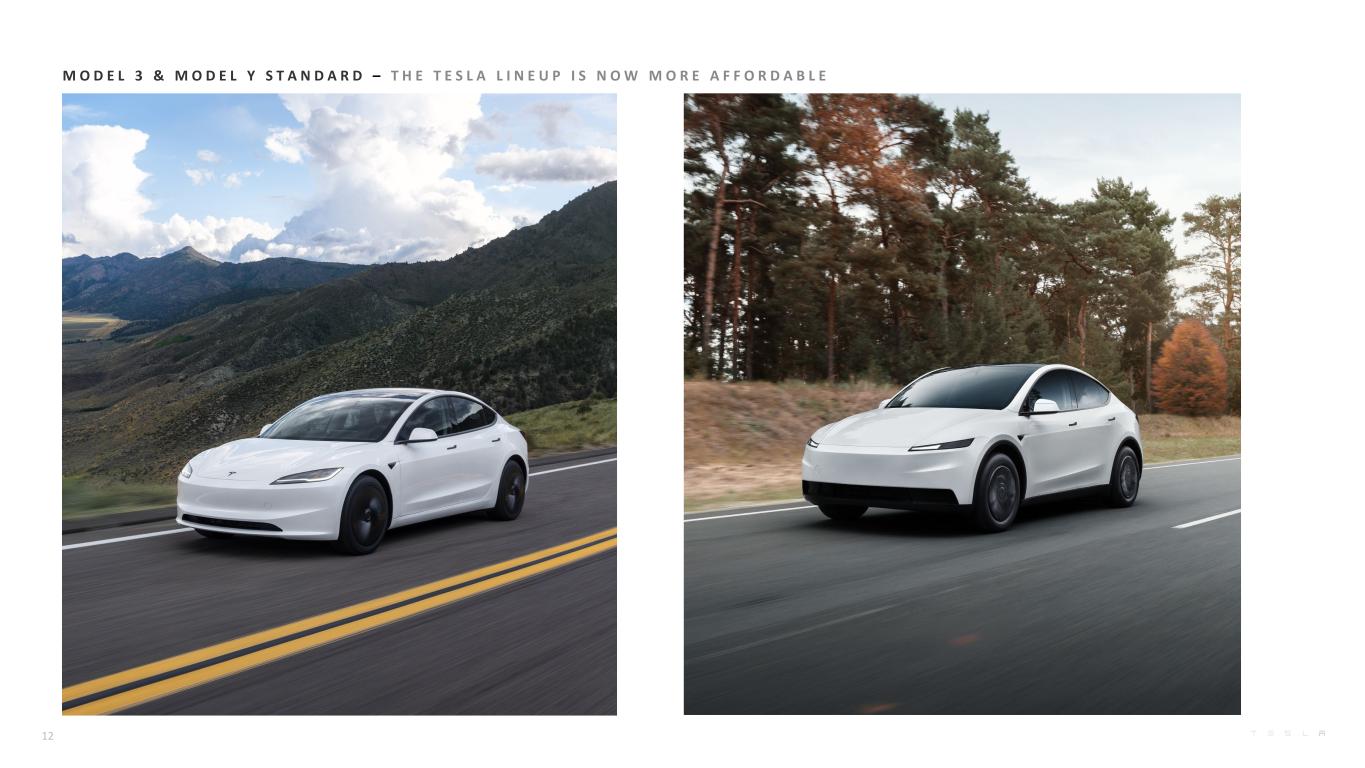

A U T O M O T I V E Current Installed Annual Vehicle Capacity Region Model Capacity Status California Model S / Model X 100,000 Production Model 3 / Model Y >550,000 Production Shanghai Model 3 / Model Y >950,000 Production Berlin Model Y >375,000 Production Texas Model Y >250,000 Production Cybertruck >125,000 Production Cybercab - Construction Nevada Tesla Semi - Construction TBD Roadster - Design development Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Construction includes factory and infrastructure buildout as well as tool installation. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on latest available data from ACEA; Autonews.com; CAAM – light- duty vehicles only; TTM = Trailing twelve months; Q3 data for Europe unavailable as of 10/22/25.(1) Active driver supervision required; does not make the vehicle autonomous We launched several new vehicle options across multiple geographies as we aim to increase utilization of our manufacturing footprint and expand our addressable markets. US: California, Nevada and Texas In October, we launched the Model 3 and Model Y Standard, each with over 300 miles of range and starting at $36,990 and $39,990, respectively, making our products more accessible to customers in the wake of the expiration of the EV tax credit in the U.S. Even with their affordable starting price, these models come standard with what makes Tesla so appealing, including active safety features, a 15.4” center touchscreen and heated first-row seats and steering wheel. We also launched the Model Y Performance (0-60 in 3.3 seconds) and began offering leasing for certified pre-owned Model 3s and Model Ys. APAC: Shanghai We launched the Model YL in China, a longer wheelbase version of the Model Y with 6 seats and 3 rows, expanding our product portfolio in this critical market. We achieved record deliveries in South Korea, Taiwan, Japan and Singapore and began deliveries of the Model Y in India. South Korea is now our third largest market behind only the U.S. and China, serving as validation of our competitive positioning in a robust EV market. We launched FSD (Supervised)1 in Australia and New Zealand and continue to prepare for a broader launch in China, pending regulatory approval. Europe and the Middle East: Berlin-Brandenburg Model Y is the best-selling vehicle in Norway, Switzerland and Iceland YTD, in Finland for Q3 and in the Netherlands and Denmark in September. At Gigafactory Berlin, we produced the 100,000th refreshed Model Y and started production of the Model Y Performance. We continue to pursue the launch of FSD (Supervised)1 in Europe, pending regulatory approval.7 0% 1% 2% 3% 4% US/Canada Europe China

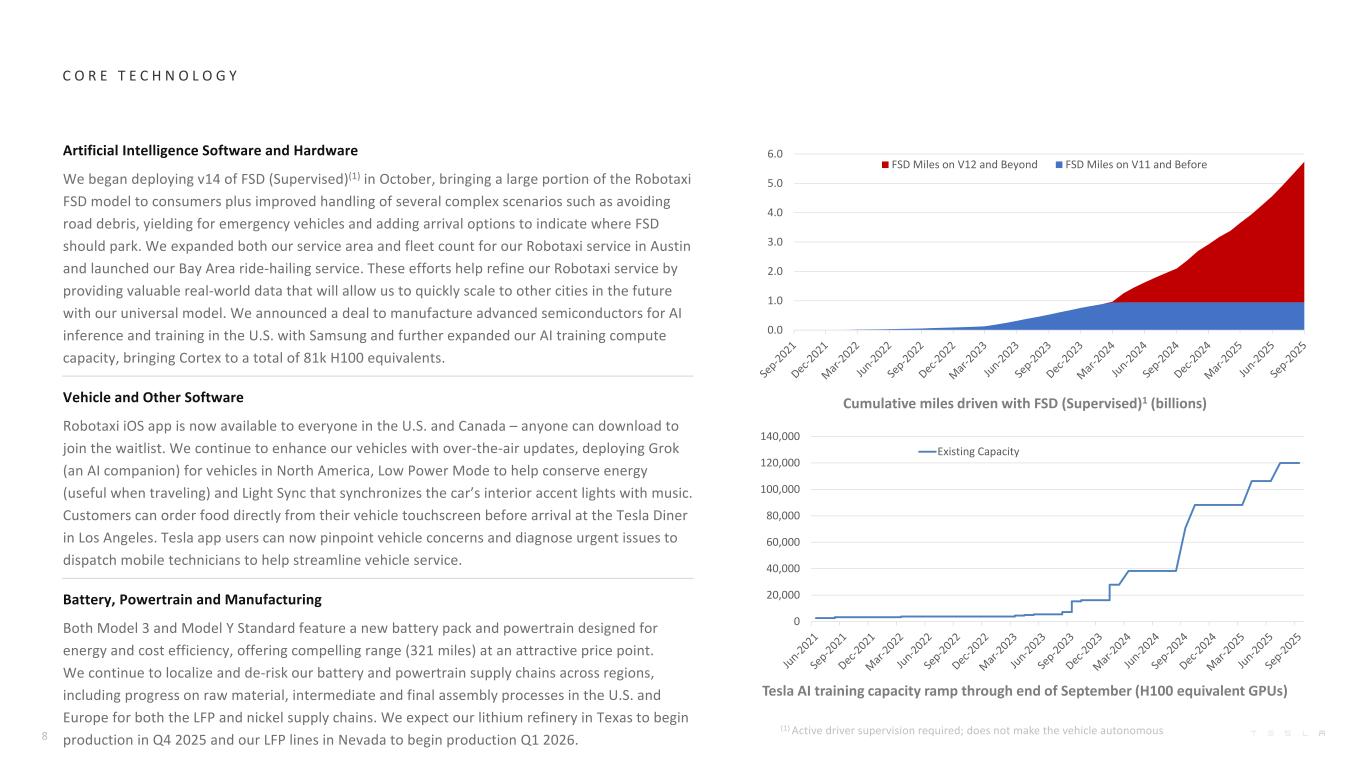

Tesla AI training capacity ramp through end of September (H100 equivalent GPUs) C O R E T E C H N O L O G Y Cumulative miles driven with FSD (Supervised)1 (billions) Artificial Intelligence Software and Hardware We began deploying v14 of FSD (Supervised)(1) in October, bringing a large portion of the Robotaxi FSD model to consumers plus improved handling of several complex scenarios such as avoiding road debris, yielding for emergency vehicles and adding arrival options to indicate where FSD should park. We expanded both our service area and fleet count for our Robotaxi service in Austin and launched our Bay Area ride-hailing service. These efforts help refine our Robotaxi service by providing valuable real-world data that will allow us to quickly scale to other cities in the future with our universal model. We announced a deal to manufacture advanced semiconductors for AI inference and training in the U.S. with Samsung and further expanded our AI training compute capacity, bringing Cortex to a total of 81k H100 equivalents. Vehicle and Other Software Robotaxi iOS app is now available to everyone in the U.S. and Canada – anyone can download to join the waitlist. We continue to enhance our vehicles with over-the-air updates, deploying Grok (an AI companion) for vehicles in North America, Low Power Mode to help conserve energy (useful when traveling) and Light Sync that synchronizes the car’s interior accent lights with music. Customers can order food directly from their vehicle touchscreen before arrival at the Tesla Diner in Los Angeles. Tesla app users can now pinpoint vehicle concerns and diagnose urgent issues to dispatch mobile technicians to help streamline vehicle service. Battery, Powertrain and Manufacturing Both Model 3 and Model Y Standard feature a new battery pack and powertrain designed for energy and cost efficiency, offering compelling range (321 miles) at an attractive price point. We continue to localize and de-risk our battery and powertrain supply chains across regions, including progress on raw material, intermediate and final assembly processes in the U.S. and Europe for both the LFP and nickel supply chains. We expect our lithium refinery in Texas to begin production in Q4 2025 and our LFP lines in Nevada to begin production Q1 2026.8 (1) Active driver supervision required; does not make the vehicle autonomous 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 Existing Capacity 0.0 1.0 2.0 3.0 4.0 5.0 6.0 FSD Miles on V12 and Beyond FSD Miles on V11 and Before

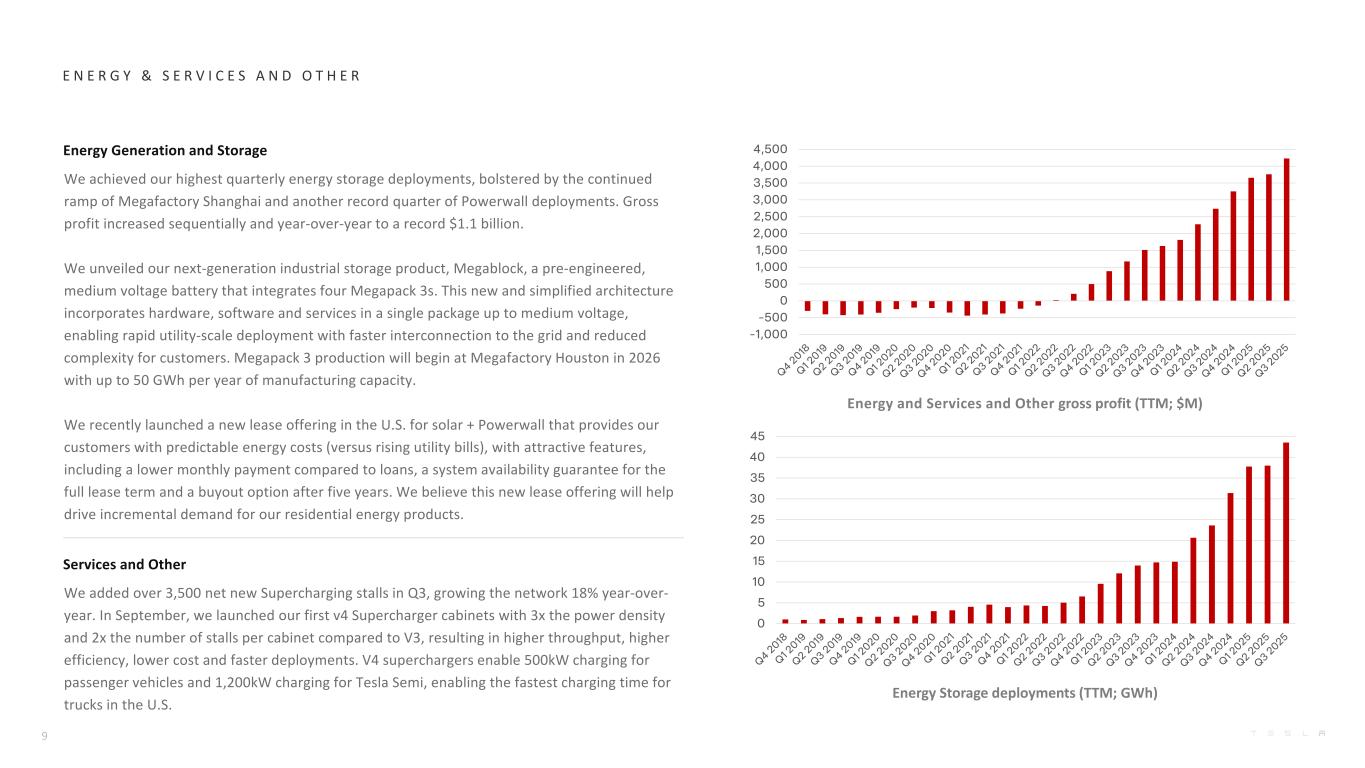

E N E R G Y & S E R V I C E S A N D O T H E R Energy Storage deployments (TTM; GWh) Energy and Services and Other gross profit (TTM; $M) Energy Generation and Storage We achieved our highest quarterly energy storage deployments, bolstered by the continued ramp of Megafactory Shanghai and another record quarter of Powerwall deployments. Gross profit increased sequentially and year-over-year to a record $1.1 billion. We unveiled our next-generation industrial storage product, Megablock, a pre-engineered, medium voltage battery that integrates four Megapack 3s. This new and simplified architecture incorporates hardware, software and services in a single package up to medium voltage, enabling rapid utility-scale deployment with faster interconnection to the grid and reduced complexity for customers. Megapack 3 production will begin at Megafactory Houston in 2026 with up to 50 GWh per year of manufacturing capacity. We recently launched a new lease offering in the U.S. for solar + Powerwall that provides our customers with predictable energy costs (versus rising utility bills), with attractive features, including a lower monthly payment compared to loans, a system availability guarantee for the full lease term and a buyout option after five years. We believe this new lease offering will help drive incremental demand for our residential energy products. Services and Other We added over 3,500 net new Supercharging stalls in Q3, growing the network 18% year-over- year. In September, we launched our first v4 Supercharger cabinets with 3x the power density and 2x the number of stalls per cabinet compared to V3, resulting in higher throughput, higher efficiency, lower cost and faster deployments. V4 superchargers enable 500kW charging for passenger vehicles and 1,200kW charging for Tesla Semi, enabling the fastest charging time for trucks in the U.S. 9 0 5 10 15 20 25 30 35 40 45 -1,000 -500 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500

O U T L O O K Volume It is difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains, our cost structure and demand for durable goods and related services. While we are making prudent investments that will set up our vehicle, energy and other future businesses for growth, the actual results will depend on a variety of factors, including the broader macroeconomic environment, the rate of acceleration of our autonomy efforts and production ramp at our factories. Cash We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during periods of uncertainty. Profit While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware- related profits to be accompanied by an acceleration of AI, software and fleet-based profits. Product We continue to evolve and augment our product lineup with a focus on cost, scale and future monetization opportunities via services powered by our AI software. We remain focused on growing our sales volumes through a differentiated and efficiently managed product portfolio, which includes leveraging and optimizing our existing production capacity before building new factories and production lines. Cybercab, Tesla Semi and Megapack 3 are on schedule for volume production starting in 2026. First generation production lines for Optimus are being installed in anticipation of volume production. 10

P H O T O S & C H A R T S

M O D E L 3 & M O D E L Y S T A N D A R D – T H E T E S L A L I N E U P I S N O W M O R E A F F O R D A B L E 12

M O D E L Y P E R F O R M A N C E – 0 - 6 0 M P H I N 3 . 3 S E C O N D S 13

M O D E L Y L – T H E E X T E N D E D W H E E L B A S E , T H R E E - R O W O P T I O N 14

M O D E L Y L – T H E E X T E N D E D W H E E L B A S E , T H R E E - R O W O P T I O N 15

G I G A F A C T O R Y T E X A S – 5 0 0 K V E H I C L E S P R O D U C E D 16

O P T I M U S – A T T H E T R O N A R E S P R E M I E R E 17

L A S M E G A S – M E G A P A C K 3 L A U N C H E V E N T 18

L A S M E G A S – M E G A P A C K 3 L A U N C H T E A M 19

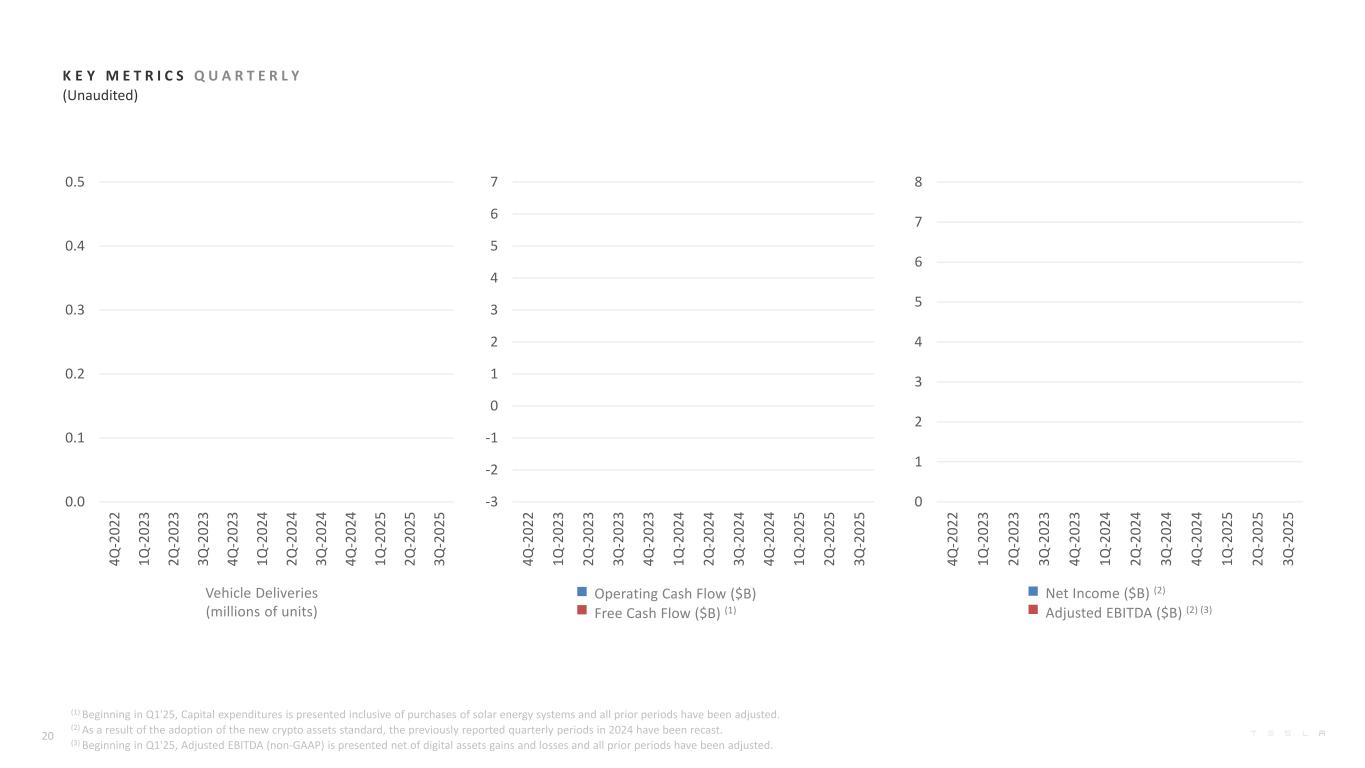

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) (1) Net Income ($B) (2) Adjusted EBITDA ($B) (2) (3) 20 (1) Beginning in Q1'25, Capital expenditures is presented inclusive of purchases of solar energy systems and all prior periods have been adjusted. (2) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast. (3) Beginning in Q1'25, Adjusted EBITDA (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted. 0.0 0.1 0.2 0.3 0.4 0.5 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 1Q -2 02 5 2Q -2 02 5 3Q -2 02 5 -3 -2 -1 0 1 2 3 4 5 6 7 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 1Q -2 02 5 2Q -2 02 5 3Q -2 02 5 0 1 2 3 4 5 6 7 8 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 1Q -2 02 5 2Q -2 02 5 3Q -2 02 5

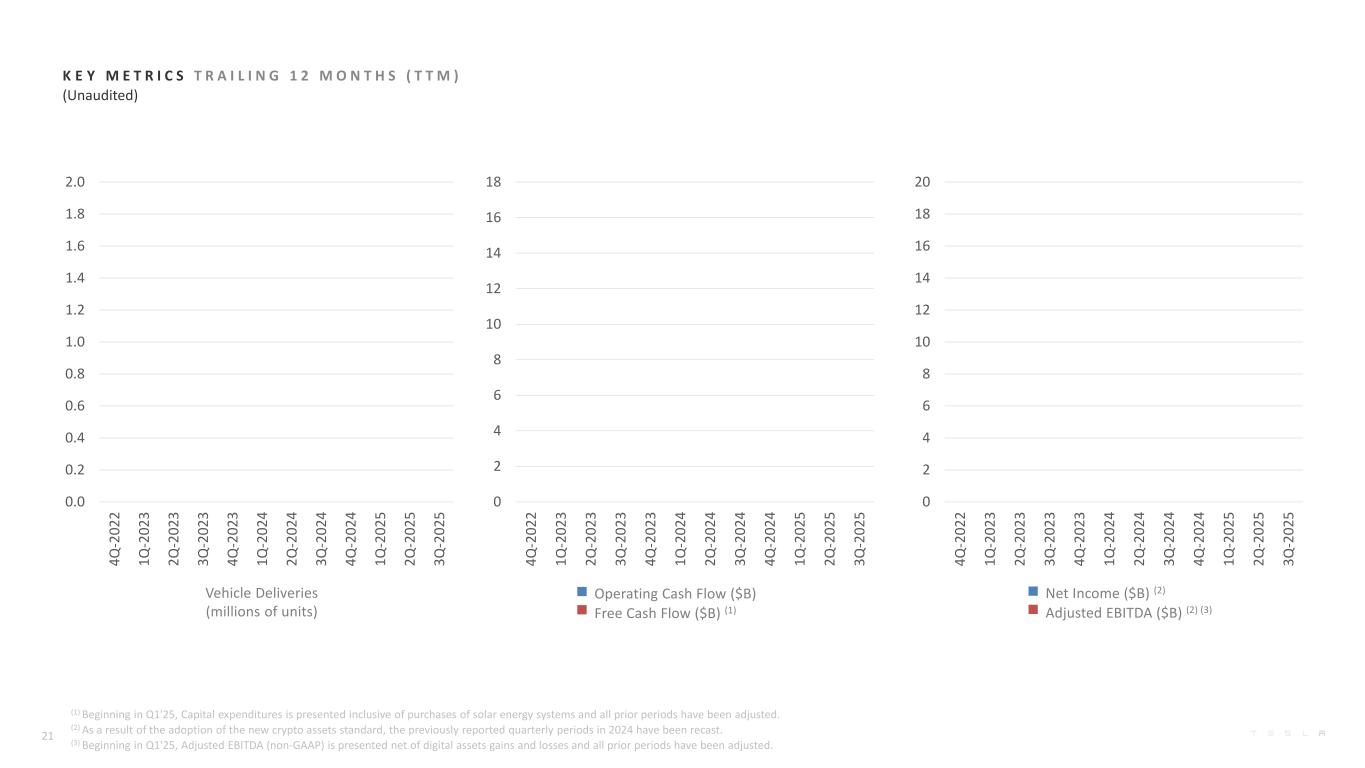

Operating Cash Flow ($B) Free Cash Flow ($B) (1) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) (2) Adjusted EBITDA ($B) (2) (3) Vehicle Deliveries (millions of units) 21 (1) Beginning in Q1'25, Capital expenditures is presented inclusive of purchases of solar energy systems and all prior periods have been adjusted. (2) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast. (3) Beginning in Q1'25, Adjusted EBITDA (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted. 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 1Q -2 02 5 2Q -2 02 5 3Q -2 02 5 0 2 4 6 8 10 12 14 16 18 20 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 1Q -2 02 5 2Q -2 02 5 3Q -2 02 5 0 2 4 6 8 10 12 14 16 18 4Q -2 02 2 1Q -2 02 3 2Q -2 02 3 3Q -2 02 3 4Q -2 02 3 1Q -2 02 4 2Q -2 02 4 3Q -2 02 4 4Q -2 02 4 1Q -2 02 5 2Q -2 02 5 3Q -2 02 5

F I N A N C I A L S T A T E M E N T S

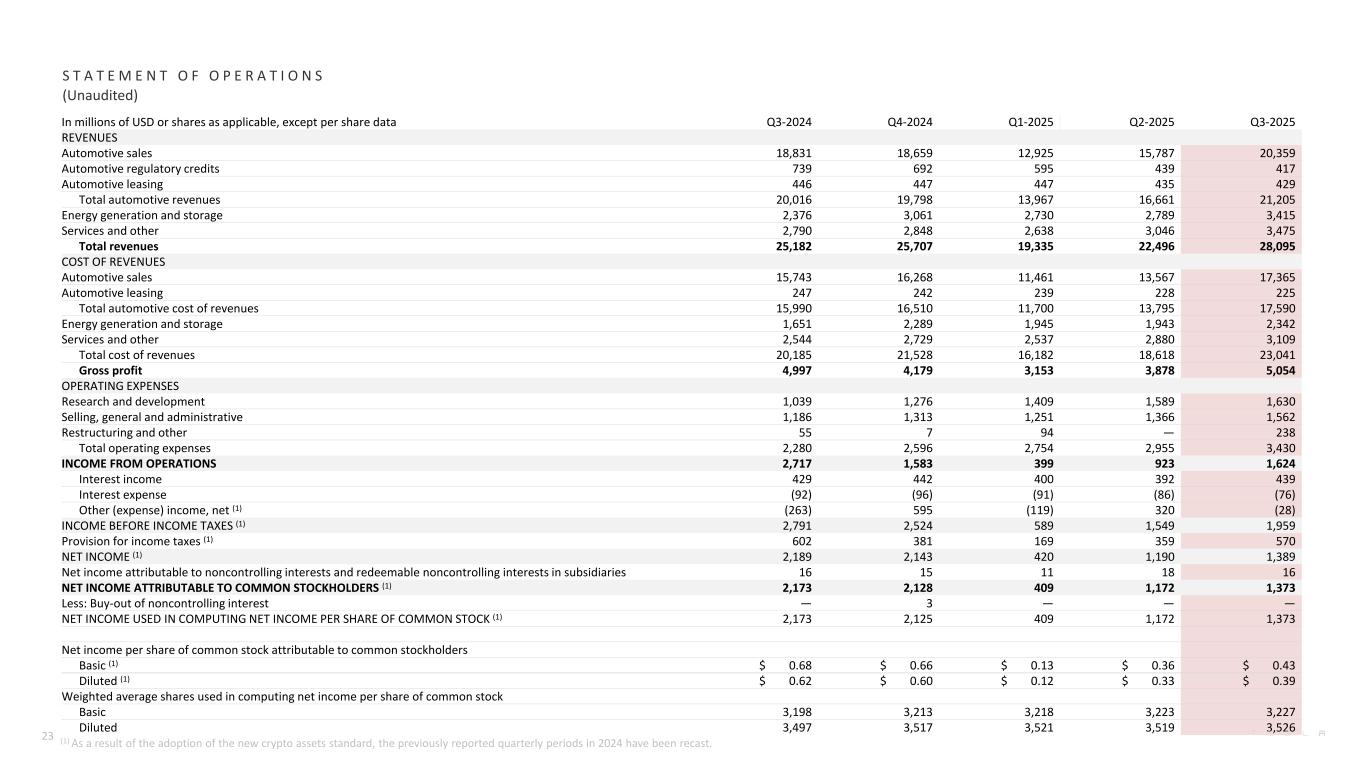

In millions of USD or shares as applicable, except per share data Q3-2024 Q4-2024 Q1-2025 Q2-2025 Q3-2025 REVENUES Automotive sales 18,831 18,659 12,925 15,787 20,359 Automotive regulatory credits 739 692 595 439 417 Automotive leasing 446 447 447 435 429 Total automotive revenues 20,016 19,798 13,967 16,661 21,205 Energy generation and storage 2,376 3,061 2,730 2,789 3,415 Services and other 2,790 2,848 2,638 3,046 3,475 Total revenues 25,182 25,707 19,335 22,496 28,095 COST OF REVENUES Automotive sales 15,743 16,268 11,461 13,567 17,365 Automotive leasing 247 242 239 228 225 Total automotive cost of revenues 15,990 16,510 11,700 13,795 17,590 Energy generation and storage 1,651 2,289 1,945 1,943 2,342 Services and other 2,544 2,729 2,537 2,880 3,109 Total cost of revenues 20,185 21,528 16,182 18,618 23,041 Gross profit 4,997 4,179 3,153 3,878 5,054 OPERATING EXPENSES Research and development 1,039 1,276 1,409 1,589 1,630 Selling, general and administrative 1,186 1,313 1,251 1,366 1,562 Restructuring and other 55 7 94 — 238 Total operating expenses 2,280 2,596 2,754 2,955 3,430 INCOME FROM OPERATIONS 2,717 1,583 399 923 1,624 Interest income 429 442 400 392 439 Interest expense (92) (96) (91) (86) (76) Other (expense) income, net (1) (263) 595 (119) 320 (28) INCOME BEFORE INCOME TAXES (1) 2,791 2,524 589 1,549 1,959 Provision for income taxes (1) 602 381 169 359 570 NET INCOME (1) 2,189 2,143 420 1,190 1,389 Net income attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries 16 15 11 18 16 NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS (1) 2,173 2,128 409 1,172 1,373 Less: Buy-out of noncontrolling interest — 3 — — — NET INCOME USED IN COMPUTING NET INCOME PER SHARE OF COMMON STOCK (1) 2,173 2,125 409 1,172 1,373 Net income per share of common stock attributable to common stockholders Basic (1) $ 0.68 $ 0.66 $ 0.13 $ 0.36 $ 0.43 Diluted (1) $ 0.62 $ 0.60 $ 0.12 $ 0.33 $ 0.39 Weighted average shares used in computing net income per share of common stock Basic 3,198 3,213 3,218 3,223 3,227 Diluted 3,497 3,517 3,521 3,519 3,526 S T A T E M E N T O F O P E R A T I O N S (Unaudited) 23 (1) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast.

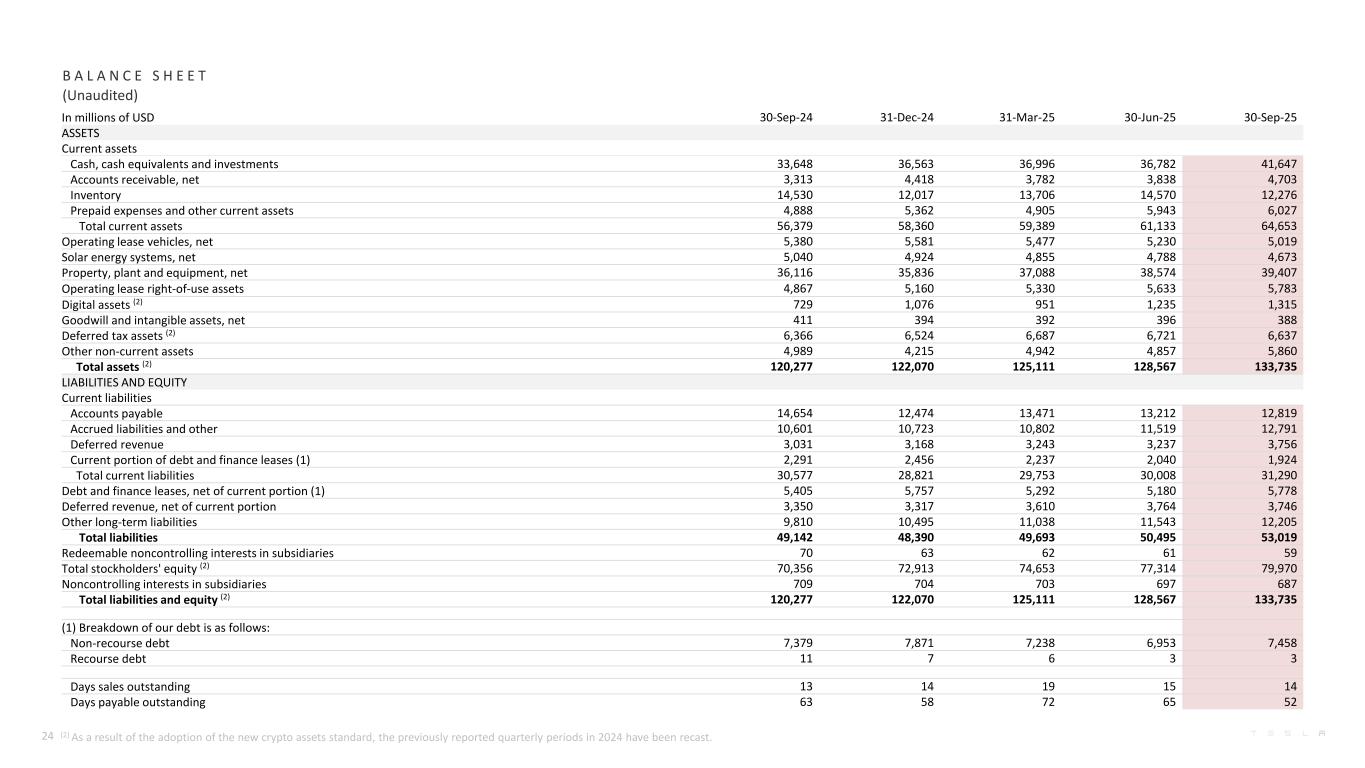

B A L A N C E S H E E T (Unaudited) In millions of USD 30-Sep-24 31-Dec-24 31-Mar-25 30-Jun-25 30-Sep-25 ASSETS Current assets Cash, cash equivalents and investments 33,648 36,563 36,996 36,782 41,647 Accounts receivable, net 3,313 4,418 3,782 3,838 4,703 Inventory 14,530 12,017 13,706 14,570 12,276 Prepaid expenses and other current assets 4,888 5,362 4,905 5,943 6,027 Total current assets 56,379 58,360 59,389 61,133 64,653 Operating lease vehicles, net 5,380 5,581 5,477 5,230 5,019 Solar energy systems, net 5,040 4,924 4,855 4,788 4,673 Property, plant and equipment, net 36,116 35,836 37,088 38,574 39,407 Operating lease right-of-use assets 4,867 5,160 5,330 5,633 5,783 Digital assets (2) 729 1,076 951 1,235 1,315 Goodwill and intangible assets, net 411 394 392 396 388 Deferred tax assets (2) 6,366 6,524 6,687 6,721 6,637 Other non-current assets 4,989 4,215 4,942 4,857 5,860 Total assets (2) 120,277 122,070 125,111 128,567 133,735 LIABILITIES AND EQUITY Current liabilities Accounts payable 14,654 12,474 13,471 13,212 12,819 Accrued liabilities and other 10,601 10,723 10,802 11,519 12,791 Deferred revenue 3,031 3,168 3,243 3,237 3,756 Current portion of debt and finance leases (1) 2,291 2,456 2,237 2,040 1,924 Total current liabilities 30,577 28,821 29,753 30,008 31,290 Debt and finance leases, net of current portion (1) 5,405 5,757 5,292 5,180 5,778 Deferred revenue, net of current portion 3,350 3,317 3,610 3,764 3,746 Other long-term liabilities 9,810 10,495 11,038 11,543 12,205 Total liabilities 49,142 48,390 49,693 50,495 53,019 Redeemable noncontrolling interests in subsidiaries 70 63 62 61 59 Total stockholders' equity (2) 70,356 72,913 74,653 77,314 79,970 Noncontrolling interests in subsidiaries 709 704 703 697 687 Total liabilities and equity (2) 120,277 122,070 125,111 128,567 133,735 (1) Breakdown of our debt is as follows: Non-recourse debt 7,379 7,871 7,238 6,953 7,458 Recourse debt 11 7 6 3 3 Days sales outstanding 13 14 19 15 14 Days payable outstanding 63 58 72 65 52 24 (2) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast.

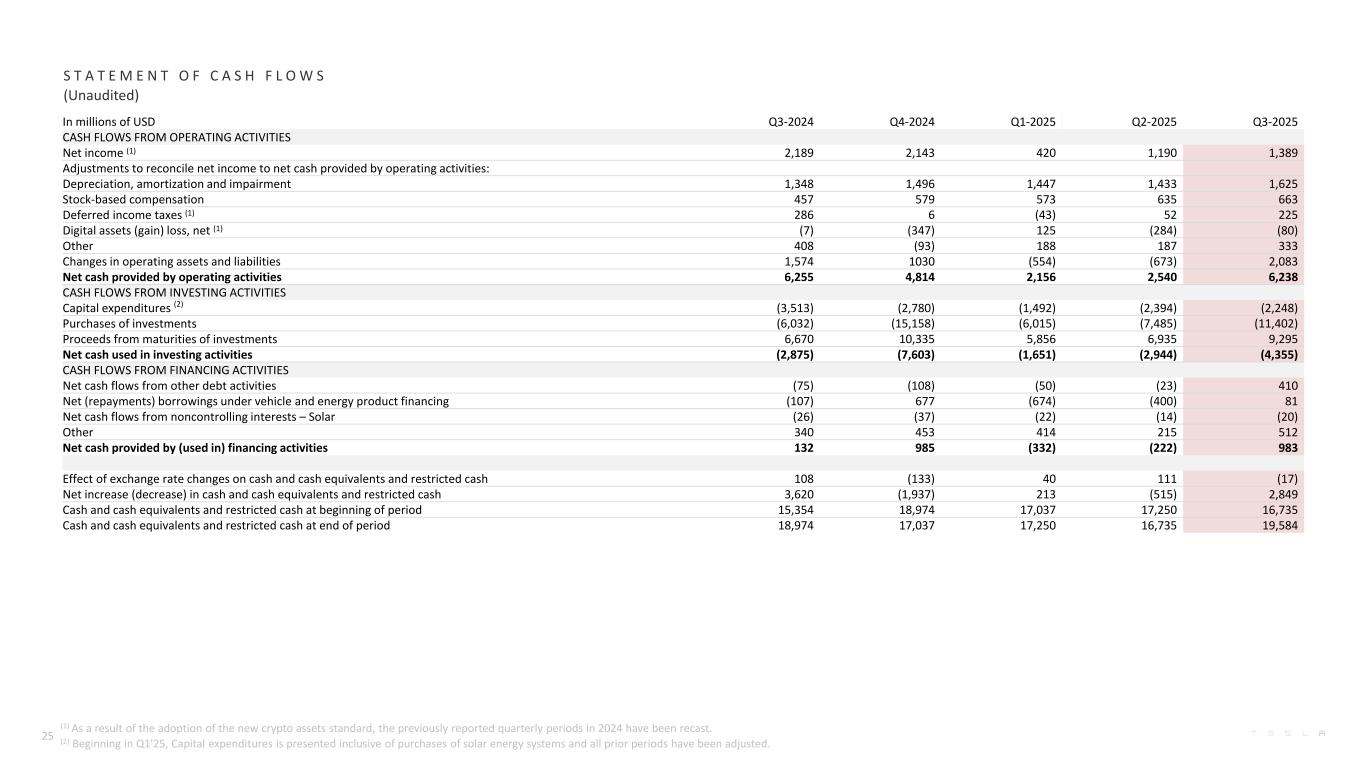

In millions of USD Q3-2024 Q4-2024 Q1-2025 Q2-2025 Q3-2025 CASH FLOWS FROM OPERATING ACTIVITIES Net income (1) 2,189 2,143 420 1,190 1,389 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and impairment 1,348 1,496 1,447 1,433 1,625 Stock-based compensation 457 579 573 635 663 Deferred income taxes (1) 286 6 (43) 52 225 Digital assets (gain) loss, net (1) (7) (347) 125 (284) (80) Other 408 (93) 188 187 333 Changes in operating assets and liabilities 1,574 1030 (554) (673) 2,083 Net cash provided by operating activities 6,255 4,814 2,156 2,540 6,238 CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures (2) (3,513) (2,780) (1,492) (2,394) (2,248) Purchases of investments (6,032) (15,158) (6,015) (7,485) (11,402) Proceeds from maturities of investments 6,670 10,335 5,856 6,935 9,295 Net cash used in investing activities (2,875) (7,603) (1,651) (2,944) (4,355) CASH FLOWS FROM FINANCING ACTIVITIES Net cash flows from other debt activities (75) (108) (50) (23) 410 Net (repayments) borrowings under vehicle and energy product financing (107) 677 (674) (400) 81 Net cash flows from noncontrolling interests – Solar (26) (37) (22) (14) (20) Other 340 453 414 215 512 Net cash provided by (used in) financing activities 132 985 (332) (222) 983 Effect of exchange rate changes on cash and cash equivalents and restricted cash 108 (133) 40 111 (17) Net increase (decrease) in cash and cash equivalents and restricted cash 3,620 (1,937) 213 (515) 2,849 Cash and cash equivalents and restricted cash at beginning of period 15,354 18,974 17,037 17,250 16,735 Cash and cash equivalents and restricted cash at end of period 18,974 17,037 17,250 16,735 19,584 S T A T E M E N T O F C A S H F L O W S (Unaudited) 25 (1) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast. (2) Beginning in Q1'25, Capital expenditures is presented inclusive of purchases of solar energy systems and all prior periods have been adjusted.

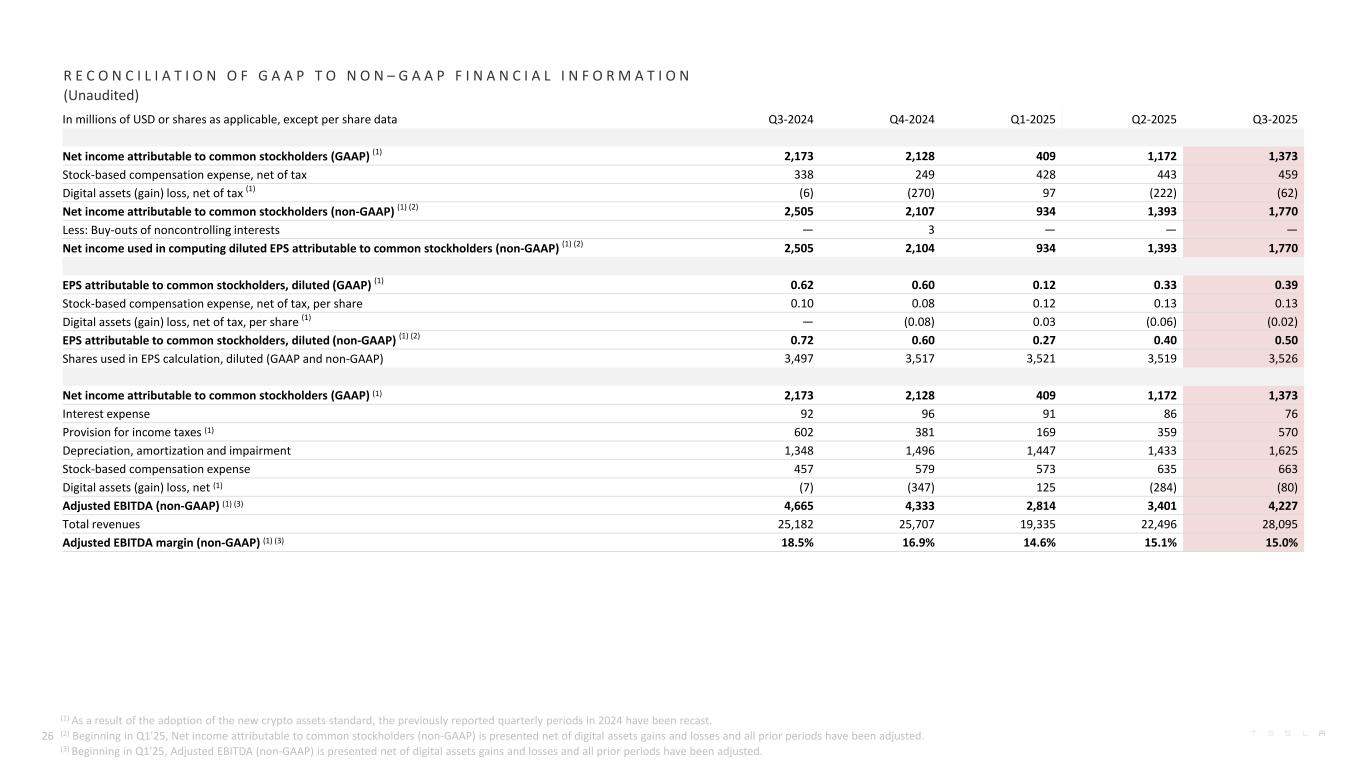

In millions of USD or shares as applicable, except per share data Q3-2024 Q4-2024 Q1-2025 Q2-2025 Q3-2025 Net income attributable to common stockholders (GAAP) (1) 2,173 2,128 409 1,172 1,373 Stock-based compensation expense, net of tax 338 249 428 443 459 Digital assets (gain) loss, net of tax (1) (6) (270) 97 (222) (62) Net income attributable to common stockholders (non-GAAP) (1) (2) 2,505 2,107 934 1,393 1,770 Less: Buy-outs of noncontrolling interests — 3 — — — Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) (1) (2) 2,505 2,104 934 1,393 1,770 EPS attributable to common stockholders, diluted (GAAP) (1) 0.62 0.60 0.12 0.33 0.39 Stock-based compensation expense, net of tax, per share 0.10 0.08 0.12 0.13 0.13 Digital assets (gain) loss, net of tax, per share (1) — (0.08) 0.03 (0.06) (0.02) EPS attributable to common stockholders, diluted (non-GAAP) (1) (2) 0.72 0.60 0.27 0.40 0.50 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 3,497 3,517 3,521 3,519 3,526 Net income attributable to common stockholders (GAAP) (1) 2,173 2,128 409 1,172 1,373 Interest expense 92 96 91 86 76 Provision for income taxes (1) 602 381 169 359 570 Depreciation, amortization and impairment 1,348 1,496 1,447 1,433 1,625 Stock-based compensation expense 457 579 573 635 663 Digital assets (gain) loss, net (1) (7) (347) 125 (284) (80) Adjusted EBITDA (non-GAAP) (1) (3) 4,665 4,333 2,814 3,401 4,227 Total revenues 25,182 25,707 19,335 22,496 28,095 Adjusted EBITDA margin (non-GAAP) (1) (3) 18.5% 16.9% 14.6% 15.1% 15.0% R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) 26 (1) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast. (2) Beginning in Q1'25, Net income attributable to common stockholders (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted. (3) Beginning in Q1'25, Adjusted EBITDA (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted.

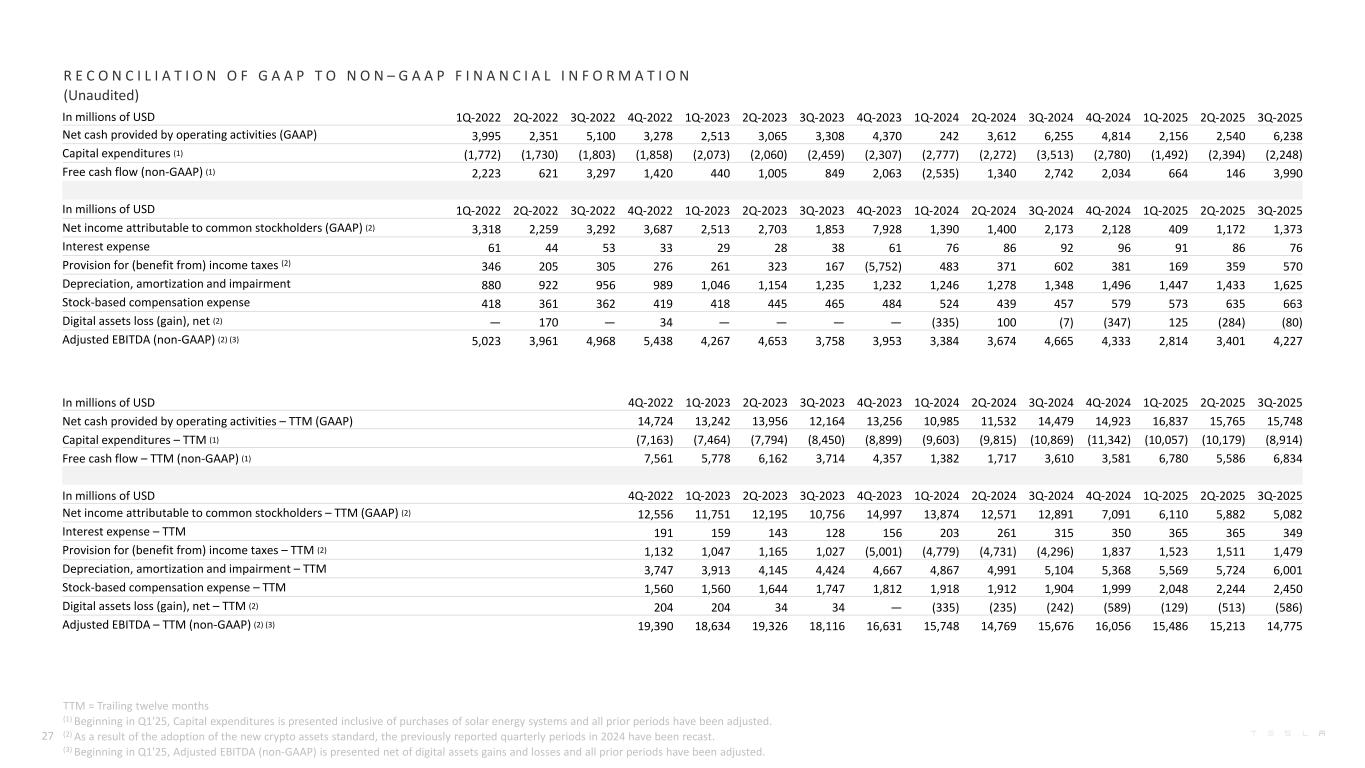

R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) In millions of USD 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 4Q-2024 1Q-2025 2Q-2025 3Q-2025 Net cash provided by operating activities – TTM (GAAP) 14,724 13,242 13,956 12,164 13,256 10,985 11,532 14,479 14,923 16,837 15,765 15,748 Capital expenditures – TTM (1) (7,163) (7,464) (7,794) (8,450) (8,899) (9,603) (9,815) (10,869) (11,342) (10,057) (10,179) (8,914) Free cash flow – TTM (non-GAAP) (1) 7,561 5,778 6,162 3,714 4,357 1,382 1,717 3,610 3,581 6,780 5,586 6,834 In millions of USD 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 4Q-2024 1Q-2025 2Q-2025 3Q-2025 Net income attributable to common stockholders – TTM (GAAP) (2) 12,556 11,751 12,195 10,756 14,997 13,874 12,571 12,891 7,091 6,110 5,882 5,082 Interest expense – TTM 191 159 143 128 156 203 261 315 350 365 365 349 Provision for (benefit from) income taxes – TTM (2) 1,132 1,047 1,165 1,027 (5,001) (4,779) (4,731) (4,296) 1,837 1,523 1,511 1,479 Depreciation, amortization and impairment – TTM 3,747 3,913 4,145 4,424 4,667 4,867 4,991 5,104 5,368 5,569 5,724 6,001 Stock-based compensation expense – TTM 1,560 1,560 1,644 1,747 1,812 1,918 1,912 1,904 1,999 2,048 2,244 2,450 Digital assets loss (gain), net – TTM (2) 204 204 34 34 — (335) (235) (242) (589) (129) (513) (586) Adjusted EBITDA – TTM (non-GAAP) (2) (3) 19,390 18,634 19,326 18,116 16,631 15,748 14,769 15,676 16,056 15,486 15,213 14,775 In millions of USD 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 4Q-2024 1Q-2025 2Q-2025 3Q-2025 Net cash provided by operating activities (GAAP) 3,995 2,351 5,100 3,278 2,513 3,065 3,308 4,370 242 3,612 6,255 4,814 2,156 2,540 6,238 Capital expenditures (1) (1,772) (1,730) (1,803) (1,858) (2,073) (2,060) (2,459) (2,307) (2,777) (2,272) (3,513) (2,780) (1,492) (2,394) (2,248) Free cash flow (non-GAAP) (1) 2,223 621 3,297 1,420 440 1,005 849 2,063 (2,535) 1,340 2,742 2,034 664 146 3,990 In millions of USD 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 4Q-2024 1Q-2025 2Q-2025 3Q-2025 Net income attributable to common stockholders (GAAP) (2) 3,318 2,259 3,292 3,687 2,513 2,703 1,853 7,928 1,390 1,400 2,173 2,128 409 1,172 1,373 Interest expense 61 44 53 33 29 28 38 61 76 86 92 96 91 86 76 Provision for (benefit from) income taxes (2) 346 205 305 276 261 323 167 (5,752) 483 371 602 381 169 359 570 Depreciation, amortization and impairment 880 922 956 989 1,046 1,154 1,235 1,232 1,246 1,278 1,348 1,496 1,447 1,433 1,625 Stock-based compensation expense 418 361 362 419 418 445 465 484 524 439 457 579 573 635 663 Digital assets loss (gain), net (2) — 170 — 34 — — — — (335) 100 (7) (347) 125 (284) (80) Adjusted EBITDA (non-GAAP) (2) (3) 5,023 3,961 4,968 5,438 4,267 4,653 3,758 3,953 3,384 3,674 4,665 4,333 2,814 3,401 4,227 27 TTM = Trailing twelve months (1) Beginning in Q1'25, Capital expenditures is presented inclusive of purchases of solar energy systems and all prior periods have been adjusted. (2) As a result of the adoption of the new crypto assets standard, the previously reported quarterly periods in 2024 have been recast. (3) Beginning in Q1'25, Adjusted EBITDA (non-GAAP) is presented net of digital assets gains and losses and all prior periods have been adjusted.

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its third quarter 2025 financial results conference call beginning at 4:30 p.m. CT on October 22, 2025 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units when installed and equipment sales at time of delivery. “Net income attributable to common stockholders (non-GAAP)" is equal to (i) net income attributable to common stockholders before (ii)(a) stock-based compensation expense, net of tax and (b) digital assets (gain) loss, net of tax. "Adjusted EBITDA (non-GAAP)" is equal to (i) net income attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment, (d) stock-based compensation expense and (e) digital assets loss (gain), net. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding operating leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant period's deliveries and using trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including, but not limited to, statements in the “Outlook” section; statements relating to the development, strategy, ramp, production and capacity, demand and market growth, cost, pricing and profitability, investment, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and services; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories and refinery are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on assumptions and management’s current expectations, involve certain risks and uncertainties, and are not guarantees. Future results may differ materially from those expressed in any forward-looking statement. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in launching and/or manufacturing our products, services and features cost-effectively; our ability to build and/or grow our products and services, sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; our ability to successfully and timely develop, introduce and scale, as well as our consumers’ demand for, products and services based on artificial intelligence, robotics and automation, electric vehicles, Autopilot and FSD (Supervised) features, and ride-hailing services generally and our vehicles and services specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international operations and expansion, including unfavorable and uncertain regulatory, political, economic, tax, tariff, export controls and labor conditions; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive, transportation and energy product and services markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 30, 2025 and subsequent quarterly reports on Form 10-Q. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise. 28