SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

DIAMOND FOODS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

November 25, 2014

To our stockholders:

You are cordially invited to attend the Diamond Foods, Inc. 2015 annual meeting of stockholders (“Annual Meeting”) to be held at the Le Meridien hotel, 333 Battery Street, San Francisco, CA 94111 on Tuesday, January 13, 2015 at 8:30 a.m., Pacific Time.

The matters to be acted upon at the Annual Meeting are described in detail in the accompanying notice of the Annual Meeting and the proxy statement. The Annual Meeting materials include the notice, proxy statement, our annual report and proxy card, all of which are enclosed.

Please use this opportunity to contribute to our company by voting on the matters to come before this Annual Meeting. Stockholders who hold shares in their own name through our transfer agent, Computershare, or who hold physical stock certificates can cast their vote online or by telephone. To vote online or by telephone, follow the instructions for online voting contained within your Annual Meeting materials. If you do not wish to vote online or by telephone, please complete, date, sign and promptly return the enclosed proxy card in the enclosed postage-paid envelope so that your shares will be represented at the Annual Meeting. Voting online, by telephone or by returning the proxy card does not deprive you of your right to attend the Annual Meeting and to vote your shares in person. If you do attend the Annual Meeting and wish to vote your shares personally, you may revoke your proxy at or prior to the Annual Meeting.

| Sincerely, |

|

|

| Brian J. Driscoll |

| President and Chief Executive Officer |

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on January 13, 2015

| Time and Date: |

Tuesday, January 13, 2015 at 8:30 a.m., Pacific Time. | |

| Place: |

Le Meridien hotel, 333 Battery Street, San Francisco, CA 94111 | |

| Items of Business: |

1. Elect Alison Davis, Brian J. Driscoll and Nigel A. Rees as the Class I members of the Board of Directors to hold office until the 2018 annual meeting of stockholders.

2. Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015.

3. Approve, on an advisory basis, the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote).

4. Approve Diamond’s 2015 Equity Incentive Plan.

5. Transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. | |

| Record Date: |

Only stockholders of record at the close of business on November 21, 2014 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. | |

| Proxy Voting: |

Whether or not you plan to attend the Annual Meeting in person, please either cast your vote online, by telephone, or by completing, dating, signing and returning the enclosed proxy card in the enclosed postage-paid envelope before the Annual Meeting so that your shares will be represented.

Please vote at your earliest convenience. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option. | |

This notice of annual meeting, proxy statement and form of proxy are being distributed and made available on or about December 2, 2014.

Important Notice Regarding the Availability of Proxy materials for the Stockholder Meeting to Be Held on January 13, 2015: Our proxy statement and annual report on Form 10-K are available at www.diamondfoods.com.

| By order of the Board of Directors

|

| Brian Driscoll |

| President and Chief Executive Officer |

Proxy Summary

Annual Meeting of Stockholders

| Time and Date: |

Tuesday, January 13, 2015 at 8:30 a.m., Pacific Time. | |

| Place: |

Le Meridien hotel, 333 Battery Street, San Francisco, CA 94111 | |

| Items of Business: |

1. Elect Alison Davis, Brian J. Driscoll and Nigel A. Rees as the Class I members of the Board of Directors to hold office until the 2018 annual meeting of stockholders.

2. Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015.

3. Approve, on an advisory basis, the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote).

4. Approve Diamond’s 2015 Equity Incentive Plan.

5. Transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. | |

| Record Date: |

Close of market on November 21, 2014 | |

| Voting: |

Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for election of directors and one vote for each of the proposals to be voted on. | |

Voting Matters and Recommendations

| Voting Matter |

Board Recommendation | |

| Election of Alison Davis, Brian J. Driscoll and Nigel A. Rees as Class I members of our Board of Directors. | FOR each of the nominees | |

| Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015. | FOR | |

| Approval, on an advisory basis, of the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote). | FOR | |

| Approval of Diamond’s 2015 Equity Incentive Plan. | FOR | |

Executive Compensation

Fiscal 2014 marked the second year of a multi-year turnaround at Diamond. We made significant progress on our strategic initiatives, resulting in expansion in market share and gross margin in the Snack segment, stabilized walnut supply and a refinanced balance sheet providing financial flexibility to further our growth strategy. However, we did not meet our original financial plan. Our results reflected significant increases in tree

i

nut commodity costs, which resulted in lower gross margin in the Nuts segment and adversely impacted overall company performance. Diamond’s Annual Incentive Plan compensation reflected this financial performance in the components of gross profit, which increased 1.3 percent and adjusted EBITDA, which increased 3.3 percent, both of which were below the target level set by the Board of Directors entering the fiscal year. This performance was reflected in executive compensation in line with Diamond’s compensation policies.

| • | Base salaries: For fiscal 2014, our CEO, COO, CFO and Chief Sales Officer did not receive an increase to their base salaries given their levels as compared to our peer group and survey data, and with respect to our CFO, given that he joined Diamond in the fourth quarter of fiscal 2013. Our EVP, General Counsel and Chief Legal and Compliance Officer and our EVP, Chief Strategy and People Officer both received an increase to their salaries in September 2013 after review of market comparables for their positions, in addition to being promoted to these positions in April 2014 and awarded an increase in base salary in connection with their promotions from SVP, General Counsel and SVP, Corporate Strategy and HR, respectively. |

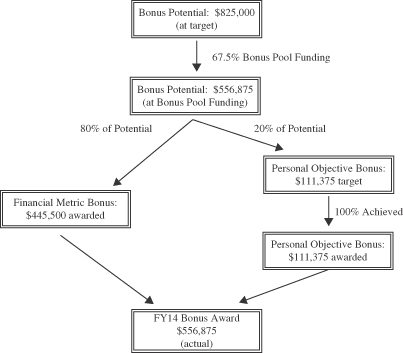

| • | Annual Cash Incentives: In fiscal 2014, Diamond did not meet its target adjusted EBITDA and gross profit metrics for bonus purposes, but did exceed the minimum performance threshold of 90% of target for each metric. As a result, the bonus pool available for payment was funded at 67.5% of target, which resulted in lower bonus payments to the named executive officers as compared to fiscal 2013. In association with their promotions to EVP in April 2014, our EVP, General Counsel and Chief Legal and Compliance Officer and our EVP, Chief Strategy and People Officer both received an increase in bonus target to 70 percent of their respective base salaries, in line with the target for EVP level. |

| • | CEO Equity Grant: Mr. Driscoll received a $1.8 million annual equity grant for fiscal 2014 in October 2013 in line with the 50th percentile of Diamond’s peer group survey data and general industry survey data for companies with revenue of less than or equal to $2.0 billion. |

| • | Equity Grants to Other Officers: Annual grants made to the other executive officers employed at Diamond in October 2013 were well below grants received in fiscal 2013, due to Diamond’s adjustment in compensation philosophy to align equity for fiscal 2014 generally with the 50th percentile of Diamond’s peer group survey data and general industry survey data for companies with revenue of less than or equal to $2.0 billion. Other factors were used to determine size of awards, including evaluating their past contributions to Diamond, the importance of their positions and the effort required to execute on the company’s strategic priorities. |

| • | Clawback: During fiscal 2014, we adopted a clawback policy applicable to our executive officers. |

Corporate Governance at Diamond

| • | In October 2014, we adopted majority voting in uncontested director elections and amended our Bylaws accordingly. |

| • | In October 2014, we terminated our “poison pill” by terminating our Rights Agreement and eliminating our Series A Junior Preferred Stock. |

| • | In October 2014, we adopted Corporate Governance Guidelines. |

| • | In November 2014, we increased our stock ownership guideline applicable to our executive vice presidents to shares worth 300% of base salary. |

| • | We separate the CEO and Board Chair roles and have appointed an independent director as Chair. |

| • | Our independent directors meet in executive session at every regularly scheduled Board meeting without management present. |

| • | We hold an advisory vote on executive compensation on an annual basis. |

ii

| • | Trading in Diamond securities by our CEO or CFO requires pre-clearance by Board Chair or Compensation Committee Chair. |

| • | Each of our standing Board committees is composed entirely of independent directors. |

| • | We continue to reach out to stockholders regarding governance and executive compensation matters. |

| • | Our Compensation Committee has retained Exequity as its independent executive compensation consultant. |

2016 Annual Meeting

| • | Stockholder proposals submitted for inclusion in our 2016 Proxy Statement pursuant to SEC Rule 14a-8 must be delivered to us by August 4, 2015. |

| • | Notice of stockholder proposals and director nominees to be raised from the floor of the 2016 Annual Meeting of Stockholders outside of SEC Rule 14a-8 must be delivered to us no earlier than September 30, 2015 and no later than October 30, 2015. |

Special Note about Forward Looking Statements

This Proxy Statement contains forward-looking statements regarding our plans, objectives, expectations, intentions, future financial performance, future financial condition, and other statements that are not historical facts. These statements can be identified by our use of the future tense, or by forward-looking words such as “may,” “will,” “expect,” “anticipate,” “believe,” “intend,” “estimate,” “continue” and other similar words and phrases. These forward-looking statements involve many risks and uncertainties, as described in the section titled “Risk Factors,” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”). The occurrence of any of these risks and uncertainties may cause our actual results to differ materially from those anticipated in our forward-looking statements, which could have a material adverse effect on our business, results of operations, and financial condition. All forward-looking statements included in this report are based on information available to us as of the date of this report. We undertake no obligation to revise or update any such forward-looking statements for any reason.

iii

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 7 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 29 | ||||

| 36 | ||||

| 39 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| Appendix A—Reconciliation of GAAP Net Loss to Adjusted EBITDA (non-GAAP) |

A-1 | |||

| B-1 | ||||

iv

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

PROXY STATEMENT

November 21, 2014

Information about the Annual Meeting

The accompanying proxy is solicited on behalf of the Board of Directors (“Board”) of Diamond Foods, Inc., a Delaware corporation (“Diamond Foods”, “Diamond” or “Company”), for use at the 2015 annual meeting of stockholders (“Annual Meeting”). The Annual Meeting will be held at the Le Meridien hotel, 333 Battery Street, San Francisco, CA 94111 on Tuesday, January 13, 2015 at 8:30 a.m., Pacific Time. This proxy statement and the accompanying form of proxy card will be first mailed to stockholders on or about December 2, 2014. Our Annual Report to Stockholders is enclosed with this proxy statement.

Record Date; Quorum

Only holders of record of “Diamond” common stock as of the close of business on November 21, 2014, the record date, will be entitled to vote at the Annual Meeting. At the close of business on the record date, we had 31,416,024 shares of common stock outstanding and entitled to vote. A majority of the shares outstanding on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

Purpose of the Annual Meeting

You are receiving this proxy statement because the Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (“SEC”) and is designed to assist you in voting your shares. You will be voting on the following matters at the Annual Meeting:

| • | The election of Alison Davis, Brian J. Driscoll and Nigel A. Rees as Class I members of our Board; |

| • | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015; |

| • | The approval, on an advisory basis, of the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote); |

| • | The approval of Diamond’s 2015 Equity Incentive Plan; and |

| • | The transaction of any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

Recommendation of the Board

Our Board recommends that you vote:

| • | “FOR” the election of each of Alison Davis, Brian J. Driscoll and Nigel A. Rees as Class I members of our Board; |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015; |

| • | “FOR” the approval, on an advisory basis, of the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote); and |

| • | “FOR” the approval of Diamond’s 2015 Equity Incentive Plan. |

1

Effect of Abstentions and Broker Discretionary Voting

Shares held by a stockholder who indicates on the proxy card that he or she wishes to abstain from voting on a proposal will not be taken into account in determining the outcome of that proposal. However, those shares are considered present and entitled to vote at the Annual Meeting and will count toward determining whether or not a quorum is present. On routine matters, such as the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, brokers are entitled to vote shares held for beneficial holders without voting instructions from the beneficial holders of those shares. On the other hand, brokers may not be entitled to vote shares held for beneficial holders on non-routine items, such as the election of directors, absent voting instructions from the beneficial holders of such shares. Consequently, if you do not submit any voting instructions to your broker, your shares will not be voted in connection with the election of directors, the Say-on-Pay vote or the 2015 Equity Incentive Plan and will not be counted in determining the number of shares necessary for approval of these matters, although they will count for purposes of determining whether a quorum is present.

Voting Rights; Required Vote

| • | Stockholders are entitled to one vote for each share of common stock held as of the record date. |

| • | For Proposal 1, the election of each of Alison Davis, Brian J. Driscoll and Nigel A. Rees as Class I members of our Board, a nominee will be elected if the number of votes cast “For” that nominee exceeds the number of votes cast “Against” that nominee. Abstentions and broker non-votes will have no effect. Stockholders do not have the right to cumulate their votes in the election of directors. |

| • | Proposal 2, ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015, requires the affirmative vote of the holders of a majority of the shares represented and voting on such matter at the Annual Meeting, either in person or by proxy. Abstentions and broker non-votes will have no effect. |

| • | Proposal 3, approval, on an advisory basis, of the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote) is only advisory in nature and has no binding effect on Diamond or our Board of Directors. Our Board of Directors will consider Proposal 3 approved upon the affirmative vote of the holders of a majority of the shares represented and voting on such matter at the Annual Meeting, either in person or by proxy. Abstentions and broker non-votes will have no effect. |

| • | Proposal 4, approval of Diamond’s 2015 Equity Incentive Plan, requires the affirmative vote of the holders of a majority of the shares represented and voting on such matter at the Annual Meeting, either in person or by proxy. Abstentions and broker non-votes will have no effect. |

| • | The inspector of elections appointed for the Annual Meeting will separately tabulate the relevant affirmative and negative votes, abstentions and broker non-votes for each proposal. |

Voting of Proxies

Most stockholders have the option of submitting their votes by Internet, telephone or mail. If you have Internet access, you may submit your proxy by following the “Vote by Internet” instructions on the proxy card. If you live in the United States or Canada, you may submit your proxy by following the “Vote by Telephone” instructions on the proxy card. If you complete and properly sign the proxy card you receive and return it to us in the prepaid envelope, your shares will be voted in accordance with the specifications made on the proxy card. If no specification is made on a signed and returned proxy card, the shares represented by the proxy will be voted:

| • | “FOR” the election of each of nominees to serve as Class I members of our Board; |

| • | “FOR” the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015; |

| • | “FOR” the approval, on an advisory basis, of the compensation of Diamond’s named executive officers (the “Say-on-Pay” vote); |

2

| • | “FOR” the approval of Diamond’s 2015 Equity Incentive Plan; and |

| • | In the discretion of the proxy holders or in accordance with the recommendations of our Board in the absence of a proxy holder on any other matter that may be properly brought before the Annual Meeting. |

Stockholders who attend the Annual Meeting may vote in person, and any previously submitted votes will be superseded by the vote cast at the Annual Meeting.

Adjournment of Annual Meeting

If the persons present or represented by proxy at the Annual Meeting constitute the holders of less than a majority of the outstanding shares of common stock as of the record date, the meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

Expenses of Soliciting Proxies

We will pay the expenses of assembling proxy materials and soliciting proxies for the Annual Meeting. After the original mailing of the proxy cards and other proxy materials, our directors, officers and employee also may solicit proxies by mail, telephone, facsimile or email, without receiving any additional compensation for such solicitation activities. After the original mailing of the proxy cards and other soliciting materials, we will request that brokers, banks, custodians, nominees and other record holders of our common stock forward copies of the proxy cards and other proxy materials to persons for whom they hold shares and request authority for the exercise of proxies. We will reimburse the record holders for their reasonable expenses if they ask us to do so. We have also retained the services of Georgeson Inc. in connection with soliciting proxies for the Annual Meeting for a fee of approximately $15,000, plus appropriate out-of-pocket expenses.

Additional Copy of the Proxy Materials

We will deliver a single copy of the proxy materials to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. Each stockholder will continue to be able to access and receive separate proxy cards. Upon written request, we will deliver promptly a separate copy of the proxy materials to any stockholder at a shared address to which we delivered a single copy of the proxy materials. To receive a separate copy of the proxy materials or an additional copy of the annual report on Form 10-K, stockholders may write or call us at the following address and phone number:

Investor Relations

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, CA 94111

Telephone: (415) 230-7952

Stockholders who hold shares through a broker, bank, trustee or nominee may contact their brokerage firm, bank, broker-dealer, or other similar organization to request additional copy of the proxy materials.

Revocability of Proxies

Any person signing a proxy card in the form accompanying this proxy statement has the power to revoke it at any time before it is voted. Registered holders may revoke a proxy by signing and returning a proxy card with a later date, by delivering a written notice of revocation to Computershare, our transfer agent, by mail at P.O. Box 30170, College Station, TX 77842-3170 or via overnight correspondence to Computershare at 211 Quality Circle, Suite 210 College Station, TX 77845, that the proxy is revoked or by attending the Annual Meeting and voting in person. The mere presence at the Annual Meeting of a stockholder who has previously

3

appointed a proxy will not revoke the appointment. Please note, however, that if a stockholder’s shares are held of record by a broker, bank, trustee or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank, trustee or other nominee confirming the stockholder’s beneficial ownership of the shares and that the broker, bank, trustee or other nominee is not voting the shares at the Annual Meeting. In the event of multiple online or telephone votes by a stockholder, each vote will supersede the previous vote and the last vote cast will be deemed to be the final vote of the stockholder unless such vote is revoked in person at the Annual Meeting.

Electronic Delivery of Stockholder Communications

We encourage you to help us conserve natural resources, as well as significantly reduce printing and mailing costs, by signing up to receive your stockholder communications electronically via e-mail. With electronic delivery, you will be notified via e-mail as soon as future Annual Reports and proxy statements are available on the Internet, and you can submit your stockholder votes online. Electronic delivery also can eliminate duplicate mailings and reduce the amount of bulky paper documents you maintain in your personal files. To sign up for electronic delivery:

Registered Owner (you hold our common stock in your own name through our transfer agent, Computershare, or you are in possession of stock certificates): visit www.computershare.com/investor to enroll.

Beneficial Owner (your shares are held by a brokerage firm, a bank, a trustee or a nominee): If you hold shares beneficially, please follow the instructions provided to you by your broker, bank, trustee, or nominee.

Your electronic delivery enrollment will be effective until you cancel it. Stockholders who are record owners of shares of our common stock may call Computershare, our transfer agent, at (800) 733-5001 or visit www-us.computershare.com/investor/Contact with questions about electronic delivery.

Corporate Governance at Diamond

We are committed to maintaining high standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders well and maintaining our integrity in the marketplace. We have adopted a code of conduct and ethics for our directors, officers and employees, known as the Diamond Code of Conduct. Our certificate of incorporation, bylaws, committee charters, Corporate Governance Guidelines and Diamond Code of Conduct form our corporate governance framework.

Notably, as part of our ongoing commitment to governance, in October 2014, we:

| • | Adopted majority voting in uncontested director elections; |

| • | Terminated our “poison pill” by terminating our Rights Agreement and eliminating our Series A Participating Preferred Stock; and |

| • | Adopted Corporate Governance Guidelines, to set forth the principles of governance by which our Board manages its affairs. |

In July 2014, Dr. Celeste A. Clark joined our Board of Directors, increasing the percentage of our Board that is independent to 70%.

In addition, we have continued to maintain a number of practices that we believe are important aspects of our governance structure, including:

| • | The Chairman of our Board of Directors is an independent director. |

4

| • | Independent directors regularly meet outside the presence of management as part of all regularly scheduled Board meetings. |

| • | We make arrangements for our Board members to attend education programs designed for public company Board members. |

| • | An independent consulting service conducts an annual analysis of our internal controls. |

| • | Our Compensation Committee engages an independent consultant to conduct an analysis of our executive compensation and recommend improvements. |

Our Corporate Governance Guidelines, the Diamond Code of Conduct and the charters governing the responsibilities and duties of each of the Audit Committee, Compensation Committee and Nominating and Governance Committee are available through the investor relations page at our website: www.diamondfoods.com. We will post on this website any updated versions of the Diamond Code of Conduct and, if applicable, any waivers under the Code granted to our Chief Executive Officer, Chief Financial Officer, principal accounting officer (if different), controller or persons performing similar functions.

Composition of Board of Directors

Our Board currently consists of ten directors. The Board is divided into three classes for purposes of election (i.e., Class I, Class II and Class III), with Class I and III each having three members and Class II having four members. At each annual meeting of stockholders, the successors to directors whose terms have expired are elected to serve until the third annual meeting following their election.

Board Independence

We believe that having a Board comprised predominantly of independent directors is critical to the effective governance of Diamond. The Board has determined that each of Mr. Blechschmidt, Ms. Davis, Mr. Hollis, Mr. Rees, Mr. Wilson, Mr. Zollars and Dr. Clark is an “independent director” under applicable NASDAQ rules, a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934 (“Exchange Act”), and an “outside director” as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986 (“IRC”). The non-independent Board members are Mr. Driscoll, our CEO, and two directors, Mr. Lea and Mr. Tos, who are affiliated with growers from whom we purchase walnuts.

Leadership Structure

In February 2012, the Board decided to have an independent director serve as the Chairman of the Board, and at that time, Mr. Zollars was appointed to that role. In deciding to separate the roles and to have an independent director serve as Chairman, the Board considered Diamond’s corporate governance requirements and anticipated time commitments required from the Board distinct from requirements of the CEO. Our Corporate Governance Guidelines adopted in October 2014 provide that the Chairman shall be an independent director. The Board periodically considers the appropriate leadership structure for the Company and may revise our Corporate Governance Guidelines and adjust our leadership structure in the future as circumstance require.

Mr. Driscoll, our Chief Executive Officer, serves on the Board and is a bridge between management and the Board so that both groups act with a common purpose. The CEO’s membership on the Board enhances his ability to provide insight and direction on important strategic initiatives to both management and the non-employee directors. We believe Mr. Driscoll, our CEO, and Mr. Zollars have an excellent working relationship.

Risk Oversight

Our Board has responsibility, directly and through its committees, for the oversight of risk management, and our officers are responsible for the day-to-day management of the material risks we face. In its oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by

5

management are adequate and functioning as designed. The involvement of the Board in setting our annual operating plan and reviewing the key assumptions and strategies proposed by management is a key part of its oversight of risk management, as is its assessment of management’s appetite for risk and its determination of what constitutes an appropriate level of risk for Diamond. The Board regularly receives updates from management and outside advisors regarding certain risks we face, including litigation and various operating risks.

In addition, our Board committees each oversee certain aspects of risk management. For example, our Audit Committee is responsible for overseeing risk management of financial matters, financial reporting, the adequacy of our risk-related internal controls, and internal investigations; our Compensation Committee oversees risks related to compensation policies and practices as well as management succession planning; and our Nominating and Governance Committee oversees governance related risks, such as Board independence, adherence to governance policies and requirements and conflicts of interest.

Senior management attends Board and Board committee meetings at the invitation of the Board or its committees and is available to address any questions or concerns raised by the Board on risk management-related and any other matters. The Board holds strategic planning sessions with senior management periodically to discuss strategies, key challenges, and risks and opportunities for the Company.

Consideration of Director Nominees

Director Qualifications. The goal of the Nominating and Governance Committee is to ensure that the members of our Board have a variety of perspectives and skills derived from high-quality business and professional experience. The Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on our Board. To this end, the committee seeks nominees with high professional and personal integrity, an understanding of our business lines and industry, diversity of background and perspective, broad-based business acumen and the ability to think strategically. In addition, the committee considers the level of the candidate’s commitment to active participation as a director, both at Board and committee meetings and otherwise. Although the committee uses these and other criteria to evaluate potential nominees, we have not established a formal diversity policy or any particular minimum criteria for nominees. When appropriate, the committee may retain executive recruitment firms to assist in identifying suitable candidates. Additionally, the Nominating and Governance Committee will consider stockholder recommendations for director candidates. To recommend a prospective nominee for the Nominating and Governance Committee’s consideration, submit the candidate’s name and qualifications to the Company’s Secretary in writing to the following address: Diamond Foods, Inc., Attn: Secretary, 600 Montgomery Street, 13th Floor, San Francisco, California 94111. After its evaluation of potential nominees, the committee submits nominees to the Board for approval. The committee does not use different standards to evaluate nominees depending on whether they are recommended by our directors and management or by our stockholders.

Stockholder Nominees.

| • | To nominate a director candidate for possible election at the next annual meeting of stockholders, a stockholder must deliver notice of such nomination to our Corporate Secretary at our principal executive offices no later than the close of business on the 75th day and no earlier than the close of business on the 105th day prior to the anniversary date of the previous year’s annual meeting of stockholders. |

| • | However, if the next annual meeting of stockholders occurs on a date more than 30 days earlier or more than 60 days later than the anniversary of the prior year’s annual meeting of stockholders, then nominations must be received no earlier than close of business on the 105th day prior to the annual meeting and not later than close of business on the later to occur of (i) the 75th day prior to the annual meeting or (ii) the 10th day after the date we first publicly announced the date of the annual meeting. |

| • | Nominations for candidates must also be accompanied by the information required by Section 1.11(a)(ii) of our Bylaws. |

6

| • | A stockholder nominating a candidate may be asked to submit additional information as determined by our Corporate Secretary and as necessary to satisfy the rules of the SEC or The NASDAQ Stock Market. |

| • | If a stockholder’s nomination is received within the applicable time period and the stockholder has met the criteria above, the Nominating and Governance Committee will evaluate such candidate, along with the other candidates being evaluated by the committee, in accordance with the committee’s charter. |

Oaktree Designee. Oaktree Capital Management, L.P. (“Oaktree”) has the right to nominate one member to the Board (“Oaktree Designee”) who qualifies as an independent director under applicable NASDAQ rules. No Oaktree Designee may serve as a director or executive officer of a direct competitor of Diamond. Mr. Wilson is currently the Oaktree Designee.

Oaktree’s right to appoint an Oaktree Designee terminates upon the first to occur of: (i) such time as Oaktree or its affiliates, collectively, do not own at least 10% of Diamond’s outstanding common stock, (ii) Diamond sells all or substantially all of its assets, (iii) Diamond participates in any merger, consolidation or similar transaction following the consummation of which, the stockholders of Diamond immediately prior to the consummation of such transaction hold less than 50% of all of the outstanding common stock or other securities entitled to vote for the election of directors of the surviving or resulting entity in such transaction or (iv) Oaktree irrevocably waives and terminates all of their Board designation rights.

Communication with the Board

You may contact the Board by sending a letter addressed to:

Board of Directors

c/o Corporate Secretary

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor,

San Francisco, California 94111

An employee will forward these letters directly to the Board, except for spam, junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. We may forward correspondence, such as product-related inquiries, elsewhere within Diamond for review and possible response. We reserve the right not to forward to the Board any abusive, threatening or otherwise inappropriate materials.

Our Board of Directors has ten members, divided into three classes for purposes of election (i.e., Class I, Class II and Class III). We ask that our stockholders approve Proposal 1 and elect Alison Davis, Brian J. Driscoll and Nigel A. Rees as Class I members of the Board. Each of these nominees has confirmed that she or he is willing to serve on the Board if elected. Each of the nominees for election as a Class I director is currently a director of the Company. Ms. Davis and Mr. Rees have been members of the Board since their appointment in March 2012; Mr. Driscoll has been a member since his appointment in May 2012. The nominees were evaluated and recommended by the Nominating and Governance Committee in accordance with the process for nominating directors as found below in “Corporate Governance Matters—Board of Directors Meetings and Committees.”

If elected as Class I directors, Ms. Davis, Mr. Driscoll and Mr. Rees will hold office until the annual meeting in 2018 or until their earlier death, resignation or retirement. If a nominee is unavailable for election, proxy holders will vote for another nominee proposed by the board or, as an alternative, the board may reduce the number of directors to be elected at the meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for a substitute nominee selected by the proxy holder.

7

The election of directors at the Annual Meeting is an uncontested election. Therefore, for Proposal 1, election of Alison Davis, Brian J. Driscoll and Nigel A. Rees as Class I members of the Board, a nominee will be elected if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Abstentions and broker non-votes will have no effect.

Additionally, since the election of directors at the Annual Meeting is an uncontested election, each of Ms. Davis, Mr. Driscoll and Mr. Rees has submitted an irrevocable resignation from our Board of Directors as set forth under our Corporate Governance Guidelines. Each such resignation will be effective only if such incumbent director is not re-elected at the Annual Meeting, in which event it will be effective upon the earlier of (i) the date 90 days after the certification of the Annual Meeting vote and (ii) the date on which such director’s seat on the Board has been filled by the Board of Directors, in accordance with our Corporate Governance Guidelines.

If an incumbent director fails to receive the required vote for re-election at the Annual Meeting, the Nominating and Governance Committee will determine whether to appoint a new director, re-appoint the incumbent director or allow the seat to remain vacant and will submit such recommendation for prompt consideration by our Board of Directors. Within 90 days following the certification of the Annual Meeting Vote, our Board of Directors will publicly disclose its decision in a Form 8-K furnished to the Securities and Exchange Commission.

Class I Director Nominees

| Name |

Age | Principal Occupation |

Director Since | |||

| Alison Davis |

53 | Managing Partner, Fifth Era | 2012 | |||

| Brian J. Driscoll |

55 | President and Chief Executive Officer of Diamond Foods, Inc. | 2012 | |||

| Nigel A. Rees |

68 | Vice President and Controller, McKesson Corporation | 2012 |

Alison Davis is the Managing Partner of Fifth Era, which invests in and incubates early stage companies. She is the former Managing Partner of Belvedere Capital, a private equity firm and regulated bank holding company focused on investments in the financial services sector, where she worked from 2004 to December 2010. From 2000 to 2003, Ms. Davis was the Chief Financial Officer and a member of the Global Management Committee of Barclays Global Investors, an institutional asset manager with $1.5 trillion of assets under management. From 1984 to 2000, Ms. Davis worked as a strategy consultant and advisor to Fortune 500 CEOs, boards and executive teams with A.T. Kearney and McKinsey & Company. Ms. Davis has extensive experience serving on the boards of directors of public companies and currently serves on the boards of the Royal Bank of Scotland, Unisys and Fiserv, Inc. She also served on the board of City National Bank from June 2010 to July 2011 and the board of Xoom Corporation from March 2010 to November 2014. Ms. Davis received a B.A. degree and M.A. degree in Economics from Cambridge University and an M.B.A. from the Stanford Graduate School of Business. With her experience in global financial services and her roles as a senior executive and as a consultant, Ms. Davis brings valuable expertise in corporate strategy, governance and financial management to our Board and to the Audit and Compensation Committees.

Brian J. Driscoll has served as President and Chief Executive Officer of Diamond and as a member of our Board since May 2012. Prior to joining Diamond, Mr. Driscoll was Chief Executive Officer of Hostess Brands from June 2010 to March 2012, which filed for Chapter 11 bankruptcy protection in January 2012. From 2002 to June 2010, he held senior management positions at Kraft Foods, Inc., including as President, Sales, Customer Service and Logistics, Kraft North America from 2007 to June 2010. Mr. Driscoll joined Kraft Foods, Inc. as a result of Kraft’s acquisition of Nabisco Biscuits and Snacks, where he worked from 1995 to 2002, first as President of Sales and Integrated Logistics and later as the Senior Vice President, Biscuit Sales and Customer Service. Earlier in his career, Mr. Driscoll held sales and sales management positions of increasing responsibility at Nestlé USA and Procter & Gamble Company. Mr. Driscoll holds a B.S. degree from St. John’s University. Mr. Driscoll brings to the Board extensive experience is the food and consumer packaged goods industries as well as a background in general management, sales and logistics.

8

Nigel A. Rees joined McKesson Corporation, a healthcare services and technology company, in 2001 and he serves as its Vice President and Controller. Prior to joining McKesson Corporation, Mr. Rees was Senior Vice President of Finance from 1998 to 2001 for Adecco, SA, a global staffing and professional services company. From 1995 to 1998, he served as Director of Internal Audit for Tandem Computers, Inc., from 1993 to 1994, he served as the Chief Financial Officer for International Microcomputer Software, Inc., and from 1991 to 1993, he served as Vice President of Finance and Administration for Challenge Dairy Products, Inc. Mr. Rees is a C.P.A. and began his career in public accounting with Deloitte & Touche LLP. He holds an M.B.A. from the University of Washington and a B.A. from Whitman College. Mr. Rees brings to Diamond deep expertise in financial reporting, accounting and compliance.

Class II Directors (term to expire in 2016)

| Name |

Age | Principal Occupation |

Director Since | |||

| Robert M. Lea |

71 | Founder and Owner, Law Offices of Robert Lea | 2005 | |||

| Matthew C. Wilson |

39 | Managing Director, Oaktree Capital Management, L.P. | 2012 | |||

| William L. Tos, Jr. |

56 | Co-owner, Tos Farms, Inc. | 2012 | |||

| Dr. Celeste A. Clark |

61 | Principal, Abraham Clark Consulting, LLC | 2014 |

Robert M. Lea served as a member of the board of directors of our predecessor company, Diamond Walnut Growers, from 1993 to 2005. Mr. Lea has practiced law as a solo practitioner with the Law Offices of Robert Lea, since 2004. From 1984 to 2003, Mr. Lea was a partner of the law firm Lea & Arruti. Mr. Lea holds a B.A. from the University of California, Davis and a J.D. from the University of California, Berkeley, School of Law (Boalt Hall). Mr. Lea brings to Diamond extensive legal experience handling complex civil cases, business experience generally, a long-term perspective on Diamond as a result of his service on the board of directors of Diamond Walnut Growers, and his insights on the walnut industry, tree-nut commodity markets and general economic conditions affecting Diamond.

Matthew C. Wilson has been a Managing Director with Oaktree Capital Management, L.P., an investment management firm, since November 2007 and leads the firm’s principal investments in the consumer products, food and beverage and retail sectors. Mr. Wilson worked at H.I.G. Capital, LLC from 2003 to 2007, where Mr. Wilson was a founding member of Bayside Capital, Inc., a fund focused on special situations and credit oriented investments. From 1999 to 2001 he worked at J.H. Whitney & Co in their middle market buyout group. Mr. Wilson began his career in the Investment Banking division of Merrill Lynch & Co., where he worked from 1997 to 1999. He currently serves as Chairman of Agro Merchants Group, LLC and on the boards of Billabong International Ltd., The Bridge Direct, Inc., Glam Squad, Inc., and AdvancePierre Foods, for which he chairs the Compensation Committee and serves on the Audit Committee. He is also the Chairman of the Board of Trustees of The Children’s Bureau of Los Angeles. Mr. Wilson earned a B.A. degrees in Economics and History from the University of Virginia and an M.B.A. from the Harvard Business School. Mr. Wilson is the Board designee for Oaktree Capital Management, which has the right to designate one member to the Board in connection with its investment in Diamond. Mr. Wilson brings to Diamond transactional and finance expertise as well as investment experience in consumer packaged goods companies.

William L. Tos, Jr., is a third-generation Northern California family farmer, co-owner of Tos Farms, Inc. and Tos Land Co. Inc., and a partner with the Tos Farming Company, a farm management company. Tos Farms harvests peaches, plums, nectarines, cherries, table grapes, corn, alfalfa, walnuts and almonds. Mr. Tos presently serves as a member and Chairman of the California Walnut Commission and as an alternate member of the Walnut Marketing Board. From 1991 to 2005 he served as a director of Diamond Walnut Growers, Inc., the co-operative predecessor to Diamond. Mr. Tos received a B.S. degree from California Polytechnic State University. Mr. Tos brings to Diamond deep experience in agribusiness and the walnut industry, and he has a long-term perspective on Diamond as a result of his service on the board of directors of Diamond Walnut Growers.

9

Dr. Celeste A. Clark is the principal of Abraham Clark Consulting, LLC and consults on nutrition/health policy, brand reputation, crisis communications, and leadership development. She is also an adjunct professor at Michigan State University in the Department of Food Science and Human Nutrition. Dr. Clark was in senior management positions at Kellogg Company, including Senior Vice President of Global Public Policy and External Affairs from 2010 to 2011, Chief Sustainability Officer from 2008 to 2011, and Senior Vice President, Global Nutrition and Corporate Affairs and President, Kellogg Corporate Citizenship Fund from 2003 forward. Dr. Clark serves on the board of Mead Johnson Nutrition Company and is a trustee of the W.K. Kellogg Foundation. She also serves on several local and state boards including the Auto Club of Michigan. Dr. Clark received a B.S. in Food and Nutrition from Southern University, a M.S. in Nutrition from Iowa State University and completed her Ph.D. in Food Science at Michigan State University. Dr. Clark brings to the Board extensive experience in the food and consumer packaged goods industries as well as an extensive background in food science, regulatory affairs, nutrition, and health policy. She also has experience in board governance, risk management and compliance.

Class III Directors (term to expire in 2017)

| Name |

Age | Principal Occupation |

Director Since | |||

| Edward A. Blechschmidt |

62 | Retired; former Chief Executive Officer Novelis Corp. and current member of two public company boards | 2008 | |||

| R. Dean Hollis |

54 | Retired; former President and Chief Operating Officer, ConAgra Foods, Inc. Consumer Foods and International Division | 2012 | |||

| Robert J. Zollars |

57 | Chairman of Vocera Communications, Inc. | 2005 |

Edward A. Blechschmidt is a retired corporate executive. He was Chief Executive Officer of Novelis Corp. from 2006 until its sale to the Birla Group in 2007. Mr. Blechschmidt was Chairman, Chief Executive Officer and President of Gentiva Health Services, Inc., a leading provider of specialty pharmaceutical and home health care services, from 2000 to 2002. From 1999 to 2000, Mr. Blechschmidt served as Chief Executive Officer and a director of Olsten Corporation, the conglomerate from which Gentiva Health Services was split off and taken public. He served as President of Olsten from 1998 to 1999. Mr. Blechschmidt also served as President and Chief Executive Officer of Siemens Nixdorf America and Siemens Pyramid Technologies from 1996 to 1998. Prior to Siemens, he spent more than 20 years with Unisys Corporation, including serving as its Chief Financial Officer. Mr. Blechschmidt serves as a member of the board of directors of Lionbridge Technologies, Inc. and VWR Corporation. In addition, he served on the board of directors of Healthsouth Corp. from 2004 to 2012 and Colombia Labs from 2004 to 2014. He has a B.S. in Business Administration from Arizona State University and is a National Association of Corporate Directors (NACD) Board Leadership Fellow. Mr. Blechschmidt brings to the Board his extensive background in executive management, mergers and acquisitions, and his financial and accounting expertise.

R. Dean Hollis is a retired corporate executive. He was President and Chief Operating Officer of the Consumer Foods and International Division of ConAgra Foods, Inc. and served in that role from 2005 to July 2008. Mr. Hollis had management responsibility for ConAgra’s consumer and customer branded businesses consisting of over 40 global brands in 110 countries. During Mr. Hollis’ 21 years with ConAgra, he had a broad array of responsibilities, including Executive Vice President, Retail Products; President, Frozen Foods; President, Grocery Foods; President, Specialty Foods; and President, Gilardi Foods. Currently, Mr. Hollis is a Senior Advisor for Oaktree Capital Management, L.P. He also serves on the board of directors for AdvancePierre Foods, an Oaktree portfolio company, for which he is Chairman of the board of directors, Landec Corporation, for which he chairs the Compensation Committee and Boulder Brands, Inc., for which he serves as the lead independent director and as a member of the Audit Committee. Mr. Hollis is a graduate of Stetson University where he currently serves on the board of trustees. With over 20 years of experience in the food industry, Mr. Hollis provides the Board with significant expertise in marketing and sales of packaged foods, overall strategy development for food products and in-depth general management expertise for investing in food companies.

10

Robert J. Zollars has served as Chairman of Vocera Communications, Inc., a provider of instant wireless communications solutions, since July 2014 and as an Operating Partner of Frazier Healthcare, a provider of growth equity and venture capital to emerging health care companies, since October 2014. From June 2013 to June 2014 he served as Executive Chairman of Vocera. From 2007 until June 2013, he served as Chairman and Chief Executive Officer of Vocera Communications. From 2006 to 2007, Mr. Zollars was President and Chief Executive Officer of Wound Care Solutions, LLC, a holding company that operates chronic wound care centers in partnership with hospitals in the U.S. From 1999 to 2006, Mr. Zollars was Chairman of the Board of Directors and Chief Executive Officer of Neoforma, Inc., a provider of supply chain management solutions for the healthcare industry. From 1997 to 1999, Mr. Zollars served as Executive Vice President and Group President of Cardinal Health, Inc., a healthcare products and services company. Earlier in his career, while employed at Baxter International, a healthcare products and services company, Mr. Zollars served as President of a dietary products joint venture between Baxter International and Kraft General Foods. Mr. Zollars serves as a member of the board of directors of Five9, Inc. and VWR Corporation. Mr. Zollars holds a B.S. from Arizona State University and an M.B.A. from John F. Kennedy University. Mr. Zollars brings to the Board his experience in serving as the chief executive of public companies and running businesses from $100 million to over $5 billion in revenue, and his expertise in general management, corporate strategy, and mergers and acquisitions.

Board of Directors Meetings and Committees

Each member of the Board is expected to attend all regularly scheduled meetings of the Board and of any committees on which the director serves, and our annual meeting of stockholders. Each director is expected to attend all special Board and committee meetings to the extent possible. During fiscal 2014, our Board met 11 times. No director attended fewer than 75% of the aggregate of the number of Board and committee meetings on which the director served during fiscal 2014. All members of the Board attended our January 2014 annual meeting of stockholders, with the exception of Dr. Clark who joined the Board in July 2014.

The Board has three standing committees: Audit Committee, Compensation Committee, and Nominating and Governance Committee. The membership and authority of each committee is described below, and the committee charters are available on our website at www.diamondfoods.com or upon written request to Diamond Foods, Inc., 600 Montgomery Street, 13th Floor, San Francisco, CA 94111, attention: Investor Relations. Each of these Board committees has the authority and right, at the expense of the Company, to retain legal and other consultants, experts and advisers of its choice to assist the committee in connection with its functions.

| Director |

Independent Director |

Audit | Compensation | Nominating & Governance |

||||||||||||

| Edward A. Blechschmidt |

X | X | X | |||||||||||||

| Alison Davis |

X | X | X | |||||||||||||

| Brian J. Driscoll |

||||||||||||||||

| R. Dean Hollis |

X | X | X | |||||||||||||

| Robert M. Lea |

||||||||||||||||

| Nigel A. Rees |

X | X | ||||||||||||||

| William L. Tos, Jr. |

||||||||||||||||

| Matthew C. Wilson |

X | |||||||||||||||

| Robert J. Zollars |

X | X | X | |||||||||||||

| Dr. Celeste A. Clark |

X | X | ||||||||||||||

Audit Committee

The principal functions of the Audit Committee are:

| • | overseeing the integrity of our accounting and financial reporting processes and the audits of our financial statements; |

11

| • | monitoring the periodic reviews of the adequacy of the accounting and financial reporting processes and systems of internal control that are conducted by our independent auditors and Diamond financial and senior management; |

| • | reviewing and evaluating the independence and performance of our independent auditors; |

| • | evaluating and monitoring areas of major financial risk exposure; and |

| • | facilitating communication among our independent auditors, our financial and senior management and the Board. |

The Audit Committee, which met eight times during fiscal 2014, is currently comprised of Ms. Davis, Mr. Hollis and Mr. Rees, with Mr. Rees serving as Chair of the committee. The Board has determined that each of our Audit Committee members qualifies as an “audit committee financial expert” as defined by SEC rules. All of the members of the Audit Committee are independent directors under applicable NASDAQ rules.

Compensation Committee

The principal functions of the Compensation Committee are:

| • | reviewing and making recommendations to the full Board as to compensation for our CEO and Board members; |

| • | reviewing and determining the compensation of our non-CEO executive officers; |

| • | commissioning compensation studies from an independent compensation consultant to provide the committee with benchmarks regarding base salary, bonus, and long-term equity incentives for executive officers; |

| • | overseeing our equity compensation and employee benefits plans; |

| • | reviewing and establishing general policies relating to compensation and benefits; and |

| • | overseeing risks related to our compensation programs. |

The Compensation Committee, which met six times during fiscal 2014, is currently comprised of Ms. Davis, Mr. Zollars and Mr. Blechschmidt, with Ms. Davis serving as Chair of the committee. All of the members of the Compensation Committee are independent directors under applicable NASDAQ rules.

Risk Assessment. The Compensation Committee considers whether our compensation programs encourage unnecessary or excessive risk taking. Based on the committee’s most recent review in June 2014, we believe that our compensation programs do not encourage unnecessary or excessive risk taking. In particular, the executive compensation program is intended to reflect a balanced approach to compensation and uses both quantitative and qualitative assessments of performance to avoid undue emphasis on any single performance measure or time period of performance.

| • | Base salaries are fixed and, for executive officers, reviewed each year by the Compensation Committee. Since our compensation programs balance fixed and variable pay and because base salaries for executives do not vary unless the Compensation Committee approves an adjustment in its discretion, we do not believe that salaries encourage unnecessary or excessive risk taking. |

| • | Our annual cash incentive plan focuses on achievement of key financial measures to fund the plan each year, and then awards individual bonus based on the financial measures and accomplishment of individual objectives. Management and the Compensation Committee believe this approach to bonus compensation appropriately balances risk and the desire to focus employees on specific annual goals that we believe are important to our success. Since our annual cash incentive plan represents only a portion of employees’ total compensation opportunities, the measures and objectives are designed to be consistent with our overall business plan and strategy, as approved by the Board, award opportunities |

12

| are capped and the Compensation Committee retains ultimate discretion to evaluate performance and determine payouts, we believe that the annual cash incentive program does not encourage unnecessary or excessive risk taking. |

| • | The majority of our equity grants to employees are in restricted stock units,, which we believe provide long-term incentives and align our employees’ (and particularly our executives’) interests with those of stockholders. Since grants are subject to long-term vesting schedules, we believe the grants help ensure that executives have significant value tied to long-term stock price performance. Historically, including during fiscal 2014, our practice has been to grant executives a mixture of stock options, which only have value if the stock price increases after the option is granted, and restricted stock, which provides increased value as our stock price rises. In fiscal 2015, for our executives, we shifted to a mixture of restricted stock units and performance share units, which vest or are forfeited based on Relative Total Shareholder Return performance. We believe equity awards also serve as a retention tool in keeping executive-level talent as a result of the vesting schedule. Each year, the Compensation Committee has discretion to determine whether to use equity awards, and whether to use a mix of different forms of equity grants or a single type of equity award. We also maintain stock ownership guidelines and a clawback policy to help mitigate the potential for risky behavior. |

Independent Compensation Consultant. The Compensation Committee retained Exequity to advise the committee on marketplace trends in executive compensation, management proposals for compensation programs, and executive officer and director compensation decisions. Exequity also evaluates equity and bonus compensation programs generally. Exequity is directly accountable to the Compensation Committee. To maintain the independence of the firm’s advice, Exequity does not provide any services for Diamond other than those described above. In addition, the Compensation Committee conducted a conflict of interest assessment by using the factors applicable to compensation consultants under SEC rules, and no conflict of interest was identified.

From time to time, Fenwick and West LLP, which currently advises the Company regarding various corporate and other matters, may advise the Compensation Committee. In connection with the engagement of Fenwick and West LLP, the Compensation Committee considered their independence and potential conflicts of interest.

Nominating and Governance Committee

The principal functions of the Nominating and Governance Committee are:

| • | make recommendations regarding the structure and composition of the Board and committees of the Board; |

| • | determine on an on-going basis the desired qualifications and expertise of the Board; |

| • | identify, evaluate and nominate candidates for appointment or election as members of the Board; and |

| • | develop, recommend and oversee a code of conduct and ethics, insider trading policy and other governance policies applicable to Diamond. |

The Nominating and Governance Committee, which met two times during fiscal 2014, is currently comprised of Mr. Hollis, Dr. Clark, Mr. Blechschmidt and Mr. Zollars, with Mr. Blechschmidt serving as Chair of the committee. Dr. Clark joined the Nominating and Governance Committee in July 2014, in conjunction with her appointment to the Board. All of the members of the Nominating and Governance Committee are independent directors under applicable NASDAQ rules.

13

Stock Ownership of Principal Stockholders and Management

The following table presents information regarding the beneficial ownership of our common stock as of November 21, 2014, by each of our directors, each of our named executive officers (as set forth in “Compensation Discussion and Analysis” below), all of our current directors and executive officers as a group and each stockholder known to us owning more than 5% of our common stock. The percentage of beneficial ownership for the table is based on 31,416,024 shares of our common stock outstanding as of November 21, 2014. To our knowledge, except under community property laws or as otherwise noted, the persons and entities named in the table have sole voting and sole investment power over their shares.

The number of shares beneficially owned by each stockholder is determined under the rules of the SEC and is not necessarily indicative of ownership for any other purpose. Under these rules, beneficial ownership includes those shares over which the stockholder has or shares voting or investment control and includes those shares that the stockholder has the right to acquire within 60 days after November 21, 2014 through the exercise of any stock option. The “Percentage of Common Stock” column treats as outstanding all shares underlying such options held by the named stockholder, but not shares underlying options held by other stockholders.

Stock Ownership Guidelines. Under our guidelines, our Board members and executive officers are required to hold shares as follows:

| • | Board members: shares worth $250,000 |

| • | Chief Executive Officer: shares worth 500% of base salary |

| • | Executive Vice Presidents: shares worth 300% of base salary |

Shares that count toward satisfaction of these stock ownership guidelines include:

| • | shares beneficially owned by the executive or director, or by any of his or her immediate family members residing in the same household, regardless of how such shares were acquired; |

| • | shares beneficially owned through any business entity controlled by such individual; shares held in trust for the benefit of the executive or director or his or her family; and |

| • | vested and unvested shares of restricted stock or restricted stock units and vested performance share units granted under our equity incentive plans. |

Board members and executive officers are expected to meet these ownership guidelines within the later of (i) five years after being appointed or elected a member of the Board or appointed to an executive position, as applicable, or (ii) five years from the adoption of the guidelines. The foregoing description of our stock ownership guidelines reflect changes adopted in October and November 2014 to increase the guidelines for executive officers, change the guidelines for directors to a dollar value, and exclude all options from shares that count toward satisfaction of our guidelines. All of our executive officers hold shares as required under our guidelines, except Ms. Jones who joined Diamond in October 2014.

In addition, pursuant to our insider trading compliance policy, our CEO and CFO are required to pre-clear all trading activity in Diamond securities with our Board Chair or Compensation Committee Chair. Furthermore, our executive officers and Board members may not purchase Diamond securities on margin, borrow against any account in which Diamond securities are held, or pledge Diamond securities as collateral for a loan without the express written consent of Diamond’s insider trading compliance officer, which may be provided in the compliance officer’s discretion.

14

| Name of Beneficial Owner |

Number of Shares of Common Stock |

% of Common Stock |

||||||

| Current Directors and Named Executive Officers: |

||||||||

| Brian J. Driscoll(1) |

424,229 | 1.3 | % | |||||

| Raymond P. Silcock(2) |

76,921 | * | ||||||

| David J. Colo(3) |

91,932 | * | ||||||

| Lloyd J. Johnson(4) |

213,080 | * | ||||||

| Linda B. Segre(5) |

93,915 | * | ||||||

| Stephen Kim(6) |

65,354 | * | ||||||

| Edward A. Blechschmidt(7) |

66,241 | * | ||||||

| Alison Davis(8) |

21,659 | * | ||||||

| R. Dean Hollis(8) |

25,417 | * | ||||||

| Robert M. Lea(9) |

126,322 | * | ||||||

| Nigel A. Rees(8) |

24,977 | * | ||||||

| William L. Tos, Jr.(10) |

173,670 | * | ||||||

| Matthew C. Wilson(11) |

— | * | ||||||

| Robert J. Zollars(9)(12) |

99,394 | * | ||||||

| Dr. Celeste A. Clark |

4,325 | * | ||||||

| All current directors and executive officers as a group (15 persons)(13) |

1,482,019 | 4.6 | % | |||||

| Other 5% Stockholders: |

||||||||

| Blackrock, Inc.(14) |

2,029,117 | 6.5 | % | |||||

| Entities affiliated with Oaktree Capital Group Holdings GP, LLP(15) |

4,420,859 | 14.1 | % | |||||

| * | Less than one percent. |

| (1) | Includes 229,587 shares that may be acquired upon exercises of stock options. |

| (2) | Includes 32,866 shares that maybe acquired upon exercises of stock options. |

| (3) | Includes 44,954 shares that may be acquired upon exercise of stock options. |

| (4) | Includes 117,130 shares that may be acquired upon exercise of stock options. |

| (5) | Includes 51,782 shares that may be acquired upon exercise of stock options. |

| (6) | Mr. Kim left the Company in October 2014. |

| (7) | Includes 60,000 shares that may be acquired upon exercise of stock options. |

| (8) | Includes 20,000 shares that may be acquired upon exercise of stock options. |

| (9) | Includes 90,000 shares that may be acquired upon exercise of stock options. |

| (10) | Includes 143,529 shares in the name of Tos Farms, Inc., in which Mr. Tos is a co-owner. Also includes 20,000 shares that may be acquired upon exercise of stock options. |

| (11) | Mr. Wilson is a Managing Director of Oaktree Capital Management, L.P., an affiliate of Oaktree Capital Group Holdings GP, LLC. Mr. Wilson does not have or share voting or investment control over the shares owned by Oaktree Capital Management GP, LLC, and disclaims beneficial ownership of any such shares. See footnote 15. |

| (12) | Shares indicated above are beneficially owned by Mr. Zollars’ family limited partnership. |

| (13) | Includes (i) 143,529 shares of common stock and (ii) an aggregate of 796,319 shares that may be acquired upon exercise of stock options, in each case beneficially owned by the directors and executive officers as reflected in footnotes 1 through 5 and footnotes 7 through 12. |

| (14) | Consists of shares held by various subsidiaries of Blackrock, Inc. Blackrock, Inc. has sole dispositive power over 2,029,117 of the shares and sole voting power over 1,940,876 shares. Based on Schedule 13G filed on January 28, 2014 by Blackrock, Inc. The address for Blackrock, Inc. is 40 East 52nd Street, New York, New York 10022. |

| (15) | Consists of shares of common stock held directly by OCM PF/FF Adamantine Holdings, LTD. Oaktree Principal Fund V, L.P., Oaktree Principal Fund V (Parallel), L.P., and Oaktree FF Investment Fund, L.P.—Class A, the shareholders of OCM PF/FF Adamantine Holdings, LTD, Oaktree Capital Management, L.P, the director of OCM PF/FF Adamantine Holdings, Ltd., Oaktree FF Investment Fund GP Ltd. and Oaktree Principal Fund V GP Ltd. and the investment manager of Oaktree Principal Fund V, L.P., Oaktree Principal Fund V (Parallel), L.P. and Oaktree FF Investment Fund, L.P.—Class A, Oaktree Holdings, Inc., |

15

| the general partner of Oaktree Capital Management, L.P., Oaktree Principal Fund V GP, L.P., the general partner of Oaktree Principal Fund V, L.P. and Oaktree Principal Fund V (Parallel), L.P., Oaktree Principal Fund V GP, Ltd, the general partner of Oaktree Principal Fund V GP, L.P., Oaktree FF Investment Fund GP, L.P., the general partner of Oaktree FF Investment Fund, L.P.—Class A, Oaktree FF Investment Fund GP, Ltd., the general partner of Oaktree FF Investment Fund GP, L.P., Oaktree Fund GP I, L.P., the sole shareholder of Oaktree Principal Fund V GP, Ltd and Oaktree FF Investment Fund GP, Ltd., Oaktree Capital I, L.P., the general partner of Oaktree Fund GP I, L.P., OCM Holdings I, LLC, the general partner of Oaktree Capital I, L.P., Oaktree Holdings, LLC, the managing member of OCM Holdings I, LLC, Oaktree Capital Group, LLC, the managing member of Oaktree Holdings, LLC and the soles shareholder of Oaktree Holdings, Inc., Oaktree Capital Group Holdings GP, LLC, the manager of Oaktree Capital Group, LLC (collectively, the “Oaktree Entities”), may be deemed to share beneficial ownership of the shares held directly by OCM PF/FF Adamantine Holdings, LTD. Based on Schedule 13D filed on February 20, 2014 by Oaktree Capital Group Holdings GP, LLC (“Oaktree Group”), 333 South Grand Avenue, 28th Floor, Los Angeles, California 90071. Mr. Wilson, who is a Managing Director of Oaktree Capital Management L.P., an affiliate of Oaktree Group, does not have or share voting or investment control over the shares owned by Oaktree Capital Management GP, LLC, and disclaims beneficial ownership of such shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Exchange Act requires our directors and officers, and persons who own shares representing more than 10% of our common stock, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. The SEC regulations also require these persons to furnish us with a copy of all Section 16(a) forms they file. Based solely on our review of the copies of the forms furnished to us and written representations from our executive officers and directors, we believe that all Section 16(a) filing requirements were met during fiscal 2014.

16

The following individuals are our executive officers:

| Name |

Age | Position | ||||

| Brian J. Driscoll |

55 | President, Chief Executive Officer and Director | ||||

| Raymond P. Silcock |

64 | EVP, Chief Financial Officer | ||||

| Lloyd J. Johnson |

52 | EVP, Chief Sales Officer | ||||

| David J. Colo |

52 | EVP, Chief Operating Officer | ||||

| Linda B. Segre |

54 | EVP, Chief Strategy and People Officer | ||||

| Isobel A. Jones |

47 | EVP, General Counsel and Secretary | ||||

Brian J. Driscoll has served as President and Chief Executive Officer of Diamond and as a member of our Board since May 2012. Prior to joining Diamond, Mr. Driscoll was Chief Executive Officer of Hostess Brands from June 2010 to March 2012, which filed for Chapter 11 bankruptcy protection in January 2012. From 2002 to June 2010, he held senior management positions at Kraft Foods, Inc., including as President, Sales, Customer Service and Logistics, Kraft North America from 2007 to June 2010. Mr. Driscoll joined Kraft Foods, Inc. as a result of Kraft’s acquisition of Nabisco Biscuits and Snacks, where he worked from 1995 to 2002, first as President of Sales and Integrated Logistics and later as the Senior Vice President, Biscuit Sales and Customer Service. Earlier in his career, Mr. Driscoll held sales and sales management positions of increasing responsibility at Nestlé USA and Procter & Gamble Company. Mr. Driscoll holds a B.S. degree from St. John’s University.

Raymond P. Silcock has served as our Executive Vice President and Chief Financial Officer since June 2013. Prior to joining Diamond, Mr. Silcock was Senior Vice President & Chief Financial Officer of the Great Atlantic & Pacific Tea Company (A&P) from its emergence from bankruptcy in March 2012 until February 2013 and previously was the Head of Finance from December 2011 to March 2012. He was an independent management consultant with clients including A&P and Palm Ventures LLC from December 2009 to December 2011 and from September 2009 to December 2009 was Executive Vice President & Chief Financial Officer of KB Home. Prior to that Mr. Silcock served as Senior Vice President & Chief Financial Officer of UST Inc. from July 2007 to April 2009 when it was acquired by Altria. Before joining UST he was Executive Vice President and Chief Financial Officer of Swift and Company from 2006 to 2007 when the company was sold. Prior to that he was Executive Vice President & Chief Financial Officer of Cott Corporation from 1998 until 2005, where he oversaw the restructuring and turnaround of that business. Earlier in his career, Mr. Silcock held a variety of progressively more responsible roles at Campbell Soup Company where he worked from 1979-1997. Mr. Silcock is a member of the Board of Directors of Pinnacle Foods Inc and is an Advisory Partner for Alliance Consumer Growth, a private equity company. He holds an M.B.A. from the Wharton School of the University of Pennsylvania and is a Fellow of the Chartered Institute of Cost & Management Accountants (UK).