| Filed Pursuant to Rule 433 Registration No. 333-193197 March 2014 |

|

|

1

square 1 financial

Initial Public Offering

March 2014

Offering Disclosure

This presentation has been prepared by Square 1 Financial, Inc. (“Square 1” or the “Company”) solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of Square 1 and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of Square 1 and the data set forth in this presentation and other information provided by or on behalf of Square 1.

This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities of Square 1 by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of the securities of Square 1 or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense.

By accepting this presentation, the recipient acknowledges and agrees that (i) the recipient will not reproduce this presentation, or such other information, in whole or in part, and will use this presentation and such other information solely for purposes of evaluating Square 1 and (ii) if the recipient does not wish to pursue this matter, the recipient will promptly return this presentation and such other information, if any, to Square 1, together with any other materials relating to Square 1, which the recipient may have received from either Square 1 or its subsidiaries, or their respective affiliates, directors, officers, employees, representatives or agents, as well as any notes or written materials prepared by the recipient.

Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implications that there has been no change in the affairs of the Company after the date hereof.

Certain of the information contained herein may be derived from information provided by industry sources. Square 1 believes that such information is accurate and that the sources from which it has been obtained are reliable. Square 1 cannot guarantee the accuracy of such information, however, and has not independently verified such information.

From time to time, Square 1 may make forward-looking statements that reflect the Company’s views with respect to, among other things, future events and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Square 1 believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

Square 1 has filed a registration statement (including a prospectus), which is preliminary and subject to completion, with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and the other documents that Square 1 has filed with the Securities and Exchange Commission for more complete information about Square 1 and the offering. You may get these documents for free by visiting Edgar on the SEC web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting: Sandler O’Neill + Partners, L.P. at toll-free 1-866-805-4128 or by emailing syndicate@sandleroneill.com or Keefe, Bruyette & Woods at capitalmarketsequity@kbw.com.

2 | March 2014

square 1 financial

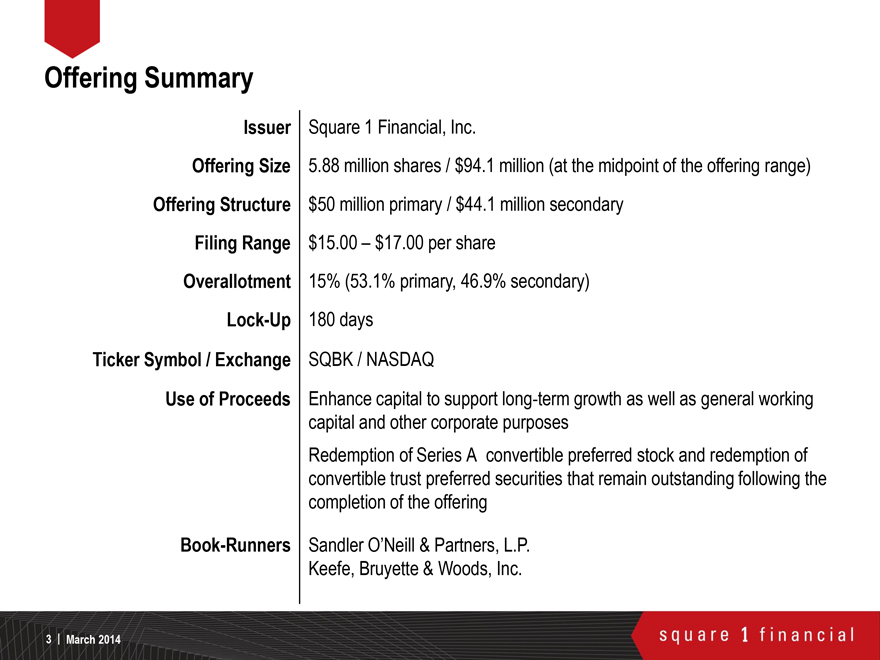

Offering Summary

Issuer

Square 1 Financial, Inc.

Offering Size

5.88 million shares / $94.1 million (at the midpoint of the offering range)

Offering Structure

$50 million primary / $44.1 million secondary

Filing Range

$15.00 – $17.00 per share

Overallotment

15% (53.1% primary, 46.9% secondary)

Lock-Up

180 days

Ticker Symbol / Exchange

SQBK / NASDAQ

Use of Proceeds

Enhance capital to support long-term growth as well as general working capital and other corporate purposes

Redemption of Series A convertible preferred stock and redemption of convertible trust preferred securities that remain outstanding following the completion of the offering

Book-Runners

Sandler O’Neill & Partners, L.P.

Keefe, Bruyette & Woods, Inc.

3 | March 2014

square 1 financial

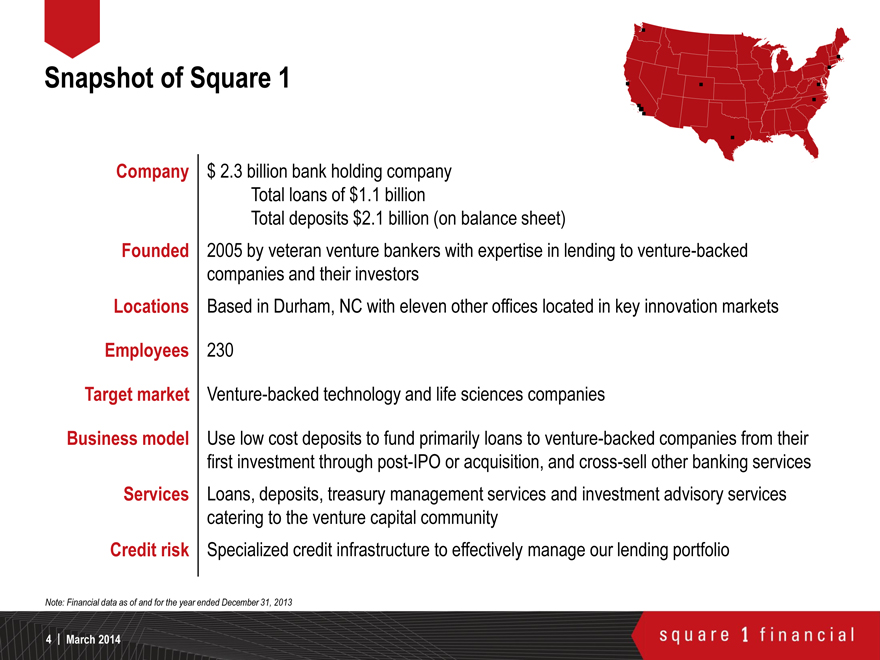

Snapshot of Square 1

Company

$ 2.3 billion bank holding company

Total loans of $1.1 billion

Total deposits $2.1 billion (on balance sheet)

Founded

2005 by veteran venture bankers with expertise in lending to venture-backed companies and their investors

Locations

Based in Durham, NC with eleven other offices located in key innovation markets

Employees

230

Target market

Venture-backed technology and life sciences companies

Business model

Use low cost deposits to fund primarily loans to venture-backed companies from their first investment through post-IPO or acquisition, and cross-sell other banking services

Services

Loans, deposits, treasury management services and investment advisory services catering to the venture capital community

Credit risk

Specialized credit infrastructure to effectively manage our lending portfolio

Note: Financial data as of and for the year ended December 31, 2013

4 | March 2014

square 1 financial

Why Invest in Square 1

1

Differentiated business model

n Pure play venture bank, focused on innovation sector nationwide (source of new potential clients)

n Expertise in lending to venture-backed companies, known for high-touch client service

n Seasoned management team, extensive networks, proven track records

Consistent growth

n Average loan growth – 22% CAGR 2009 – 2013 n Average deposit growth – 15% CAGR 2009 – 2013

n Strong and diversified noninterest income growth – Reflects overall increase in balance sheet

Diversified balance sheet and strong liquidity position

n Loan portfolio diversified across industry, stage, size and geography

n Low cost, core deposits – Current average cost of deposits is 4 basis points

n Benefit from rising interest rates – 93% of loans are variable rate; investment portfolio duration is 2.8 years

Strong Profitability

n Return on average assets – 1.06%¹

n Profitability – Net operating income growth of 52%²

n Efficient, scalable platform – Efficiency ratio of 53%¹

n Net Interest Margin – Consistently above 3.90% for the years ended 2009 through 2013

(1) As of and for the year ended December 31, 2013

(2) From 2012 to 2013. Net operating income and efficiency ratio are non-GAAP financial measures. See Non-GAAP Financial Measures in Appendix for reconciliation. Note: Data as of December 31, 2013

5 | March 2014

square 1 financial

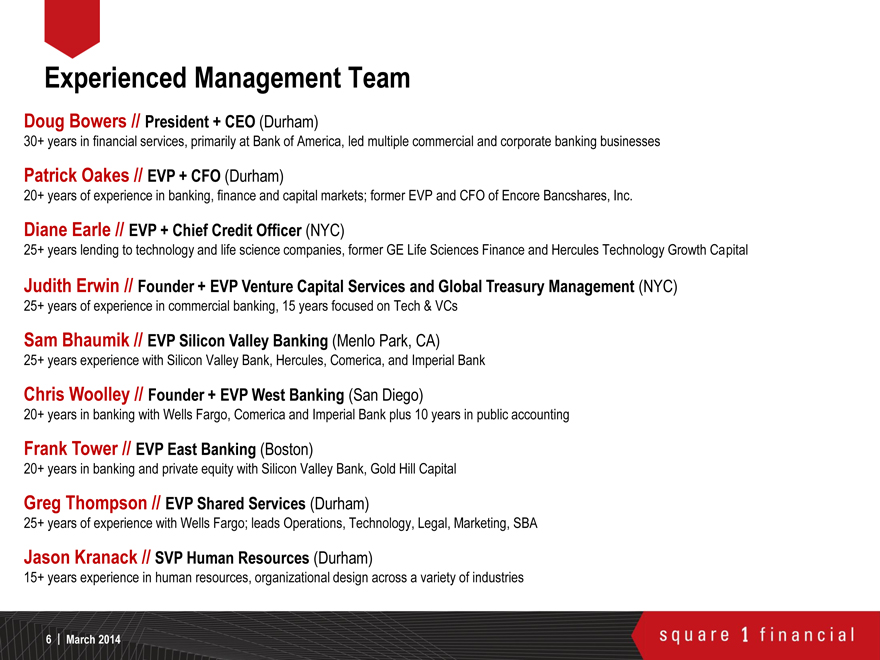

Experienced Management Team

Doug Bowers // President + CEO (Durham)

30+ years in financial services, primarily at Bank of America, led multiple commercial and corporate banking businesses

Patrick Oakes // EVP + CFO (Durham)

20+ years of experience in banking, finance and capital markets; former EVP and CFO of Encore Bancshares, Inc.

Diane Earle // EVP + Chief Credit Officer (NYC)

25+ years lending to technology and life science companies, former GE Life Sciences Finance and Hercules Technology Growth Capital

Judith Erwin // Founder + EVP Venture Capital Services and Global Treasury Management (NYC)

25+ years of experience in commercial banking, 15 years focused on Tech & VCs

Sam Bhaumik // EVP Silicon Valley Banking (Menlo Park, CA)

25+ years experience with Silicon Valley Bank, Hercules, Comerica, and Imperial Bank

Chris Woolley // Founder + EVP West Banking (San Diego)

20+ years in banking with Wells Fargo, Comerica and Imperial Bank plus 10 years in public accounting

Frank Tower // EVP East Banking (Boston)

20+ years in banking and private equity with Silicon Valley Bank, Gold Hill Capital

Greg Thompson // EVP Shared Services (Durham)

25+ years of experience with Wells Fargo; leads Operations, Technology, Legal, Marketing, SBA

Jason Kranack // SVP Human Resources (Durham)

15+ years experience in human resources, organizational design across a variety of industries

6 | March 2014

square 1 financial

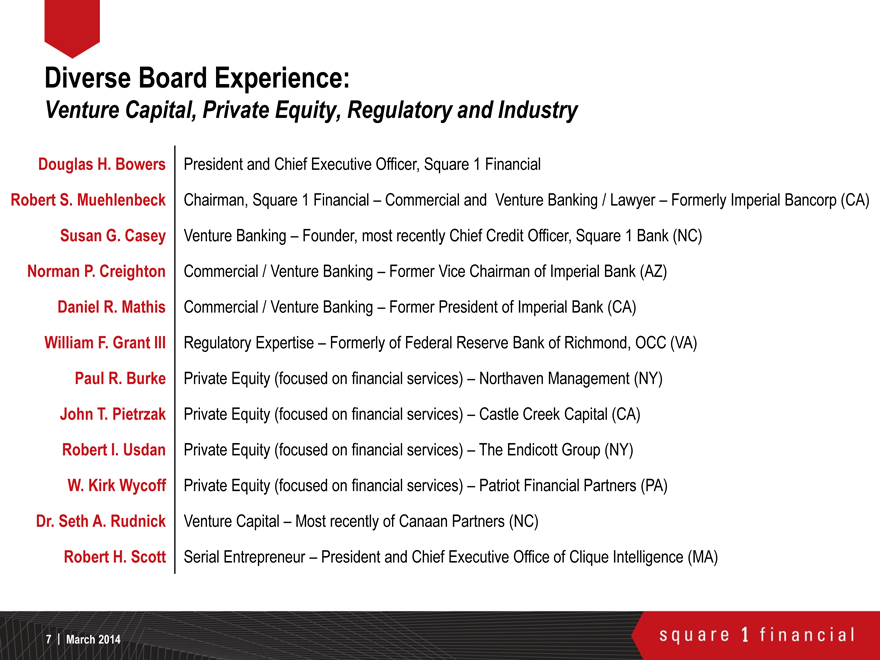

Diverse Board Experience:

Venture Capital, Private Equity, Regulatory and Industry

Douglas H. Bowers

President and Chief Executive Officer, Square 1 Financial

Robert S. Muehlenbeck

Chairman, Square 1 Financial – Commercial and Venture Banking / Lawyer – Formerly Imperial Bancorp (CA)

Susan G. Casey

Venture Banking – Founder, most recently Chief Credit Officer, Square 1 Bank (NC)

Norman P. Creighton

Commercial / Venture Banking – Former Vice Chairman of Imperial Bank (AZ)

Daniel R. Mathis

Commercial / Venture Banking – Former President of Imperial Bank (CA)

William F. Grant III

Regulatory Expertise – Formerly of Federal Reserve Bank of Richmond, OCC (VA)

Paul R. Burke

Private Equity (focused on financial services) – Northaven Management (NY)

John T. Pietrzak

Private Equity (focused on financial services) – Castle Creek Capital (CA)

Robert I. Usdan

Private Equity (focused on financial services) – The Endicott Group (NY)

W. Kirk Wycoff

Private Equity (focused on financial services) – Patriot Financial Partners (PA)

Dr. Seth A. Rudnick

Venture Capital – Most recently of Canaan Partners (NC)

Robert H. Scott

Serial Entrepreneur – President and Chief Executive Office of Clique Intelligence (MA)

7 | March 2014

square 1 financial

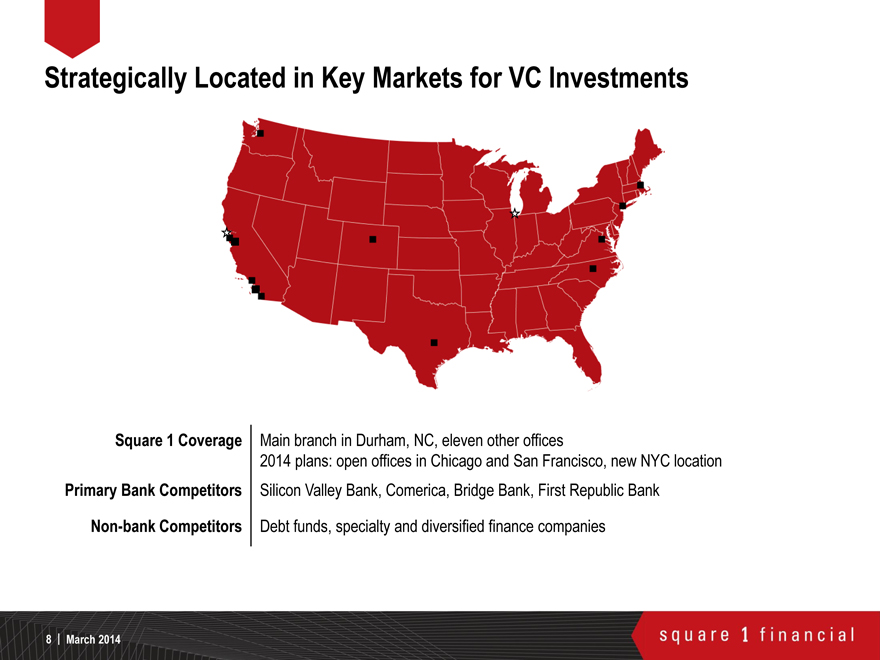

Strategically Located in Key Markets for VC Investments

Square 1 Coverage

Primary Bank Competitors

Non-bank Competitors

Main branch in Durham, NC, eleven other offices

2014 plans: open offices in Chicago and San Francisco, new NYC location

Silicon Valley Bank, Comerica, Bridge Bank, First Republic Bank

Debt funds, specialty and diversified finance companies

8 | March 2014

square 1 financial

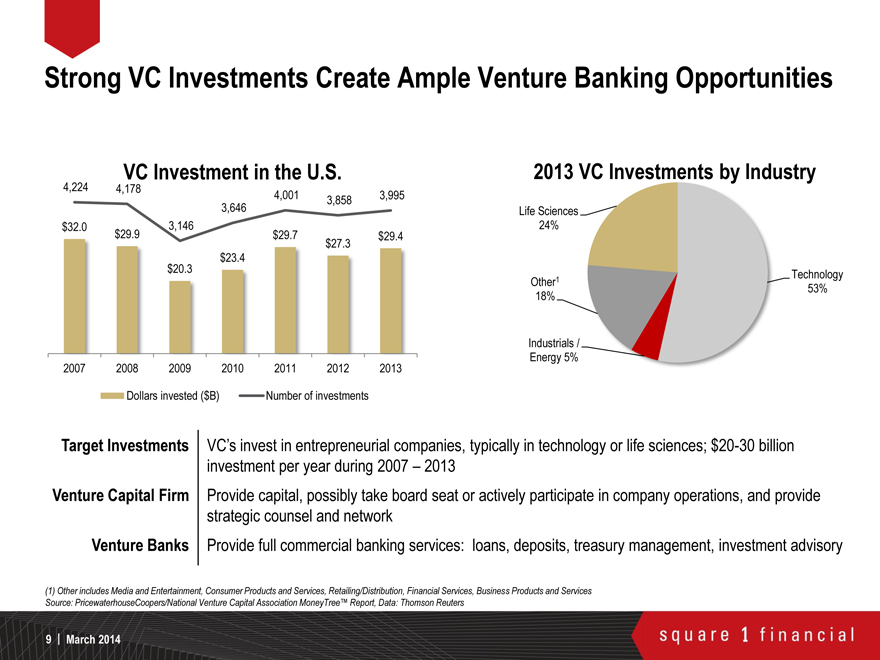

Strong VC Investments Create Ample Venture Banking Opportunities

VC Investment in the U.S.

4,224

4,178

4,001

3,995

3,646

3,858

$32.0

3,146

$29.9

$29.7

$29.4

$27.3

$23.4

$20.3

2007 2008 2009 2010 2011 2012 2013

Dollars invested ($B)

Number of investments

2013 VC Investments by Industry

Life Sciences

24%

Technology

Other1

53%

18%

Industrials / Energy 5%

Target Investments

Venture Capital Firm

Venture Banks

VC’s invest in entrepreneurial companies, typically in technology or life sciences; $20-30 billion

investment per year during 2007 – 2013

Provide capital, possibly take board seat or actively participate in company operations, and provide

strategic counsel and network

Provide full commercial banking services: loans, deposits, treasury management, investment advisory

(1) Other includes Media and Entertainment, Consumer Products and Services, Retailing/Distribution, Financial Services, Business Products and Services Source: PricewaterhouseCoopers/National Venture Capital Association MoneyTreeTM Report, Data: Thomson Reuters

9 | March 2014

square 1 financial

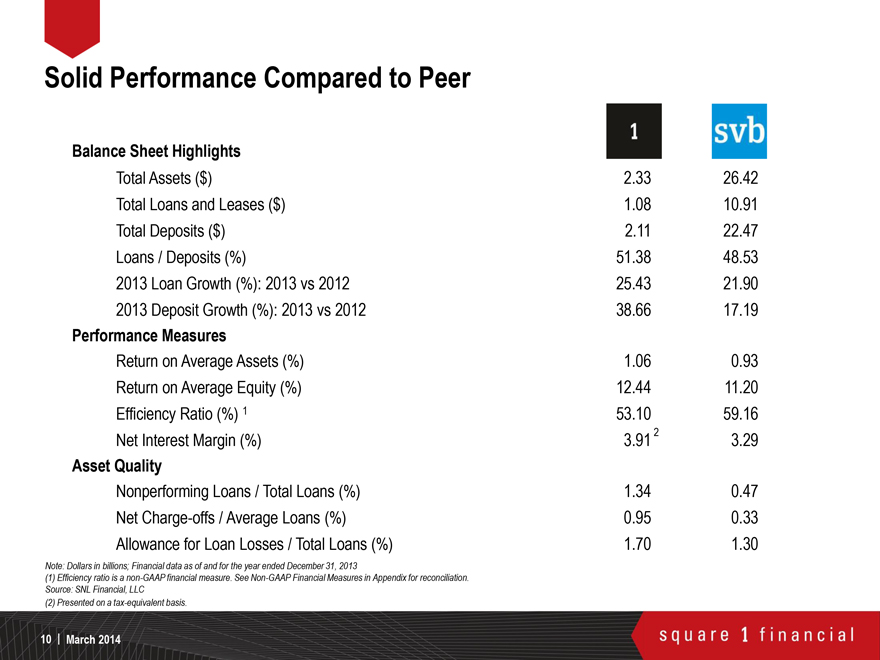

Solid Performance Compared to Peer

Balance Sheet Highlights

1 svb

Total Assets ($)

2.33 26.42

Total Loans and Leases ($)

1.08 10.91

Total Deposits ($)

2.11 22.47

Loans / Deposits (%)

51.38 48.53

2013 Loan Growth (%): 2013 vs 2012

25.43 21.90

2013 Deposit Growth (%): 2013 vs 2012

38.66 17.19

Performance Measures

Return on Average Assets (%)

1.06 0.93

Return on Average Equity (%)

12.44 11.20

Efficiency Ratio (%) 1

53.10 59.16

Net Interest Margin (%)

3.912 3.29

Asset Quality

Nonperforming Loans / Total Loans (%)

1.34 0.47

Net Charge-offs / Average Loans (%)

0.95 0.33

Allowance for Loan Losses / Total Loans (%)

1.70 1.30

Note: Dollars in billions; Financial data as of and for the year ended December 31, 2013

(1) Efficiency ratio is a non-GAAP financial measure. See Non-GAAP Financial Measures in Appendix for reconciliation. Source: SNL Financial, LLC

(2) Presented on a tax-equivalent basis.

10 | March 2014

square 1 financial

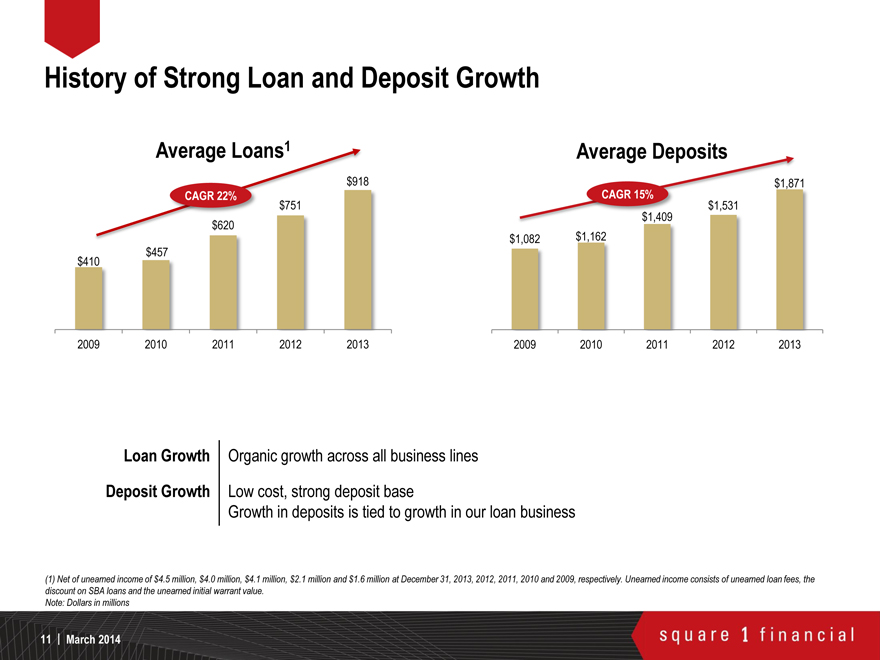

History of Strong Loan and Deposit Growth

Average Loans 1

CAGR 22%

$918

$457

$620

$751

$410

2009 2010 2011 2012 2013

Average Deposits

CAGR 15%

$1,082

$1,162

$1,409

$1,531

$1,871

2009 2010 2011 2012 2013

Loan Growth

Deposit Growth

Organic growth across all business lines

Low cost, strong deposit base

Growth in deposits is tied to growth in our loan business

(1) Net of unearned income of $4.5 million, $4.0 million, $4.1 million, $2.1 million and $1.6 million at December 31, 2013, 2012, 2011, 2010 and 2009, respectively. Unearned income consists of unearned loan fees, the discount on SBA loans and the unearned initial warrant value.

Note: Dollars in millions

11 | March 2014

square 1 financial

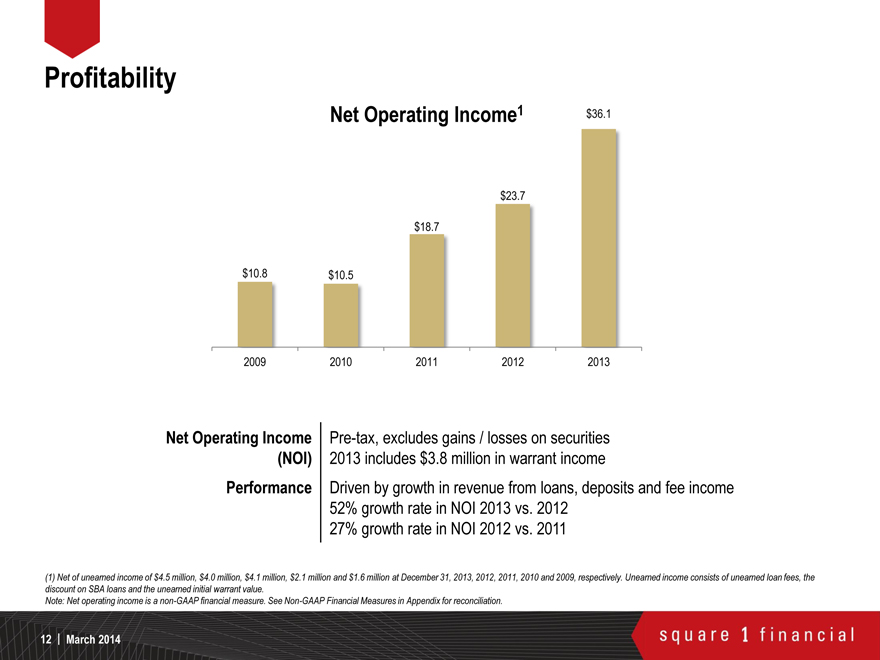

Profitability

Net

Operating

Income1

$36.1

$23.7

$18.7

$10.8

$10.5

2009 2010 2011 2012 2013

Net Operating Income

(NOI)

Performance

Pre-tax, excludes gains / losses on securities

2013 includes $3.8 million in warrant income

Driven by growth in revenue from loans, deposits and fee income

52% growth rate in NOI 2013 vs. 2012

27% growth rate in NOI 2012 vs. 2011

(1) Net of unearned income of $4.5 million, $4.0 million, $4.1 million, $2.1 million and $1.6 million at December 31, 2013, 2012, 2011, 2010 and 2009, respectively. Unearned income consists of unearned loan fees, the discount on SBA loans and the unearned initial warrant value.

Note: Net operating income is a non-GAAP financial measure. See Non-GAAP Financial Measures in Appendix for reconciliation.

12 | March 2014

square 1 financial

Diversified Loan Portfolio

SBA and USDA 5%

Venture firms 13%

Credit cards 1%

Venture banking 81%

Industry Concentrations Within the Venture Banking Portfolio

Software 20%

Other industries 15%

Healthcare services 9%

Hardware 9%

Media and telecom 8%

IT services 8%

Medical devices and equipment 7%

Consumer products and services 6%

Financial services 6%

Biotech 6%

Business products and services 6%

Total Loans (annual average)

Loan Yield

Venture Banking Portfolio

Interest Rate Type

Diversification

$918 million

6.34%

Includes technology and life sciences, and asset-based loans

93% of outstanding loans are variable rate loans

Loan outstandings diversified by industry, stage, size and geography

Note: Financial data as of and for the year ended December 31, 2013

13 | March 2014

square 1 financial

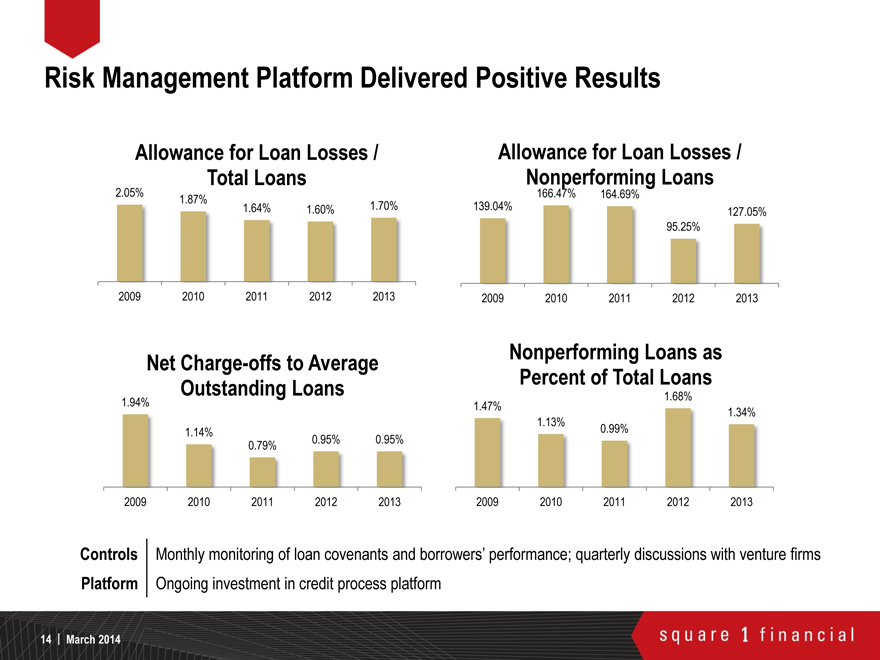

Risk Management Platform Delivered Positive Results

Allowance for Loan Losses / Total Loans

2.05%

1.87%

1.64%

1.60%

1.70%

2009 2010 2011 2012 2013

Net Charge-offs to Average Outstanding Loans

1.94%

1.14%

0.79%

0.95%

0.95%

2009 2010 2011 2012 2013

Allowance for Loan Losses / Nonperforming Loans

139.04%

166.47%

164.69%

95.25%

127.05%

2009 2010 2011 2012 2013

Nonperforming Loans as Percent of Total Loans

1.47%

1.13%

0.99%

1.68%

1.34%

2009 2010 2011 2012 2013

Controls

Platform

Monthly monitoring of loan covenants and borrowers’ performance; quarterly discussions with venture firms

Ongoing investment in credit process platform

14 | March 2014

square 1 financial

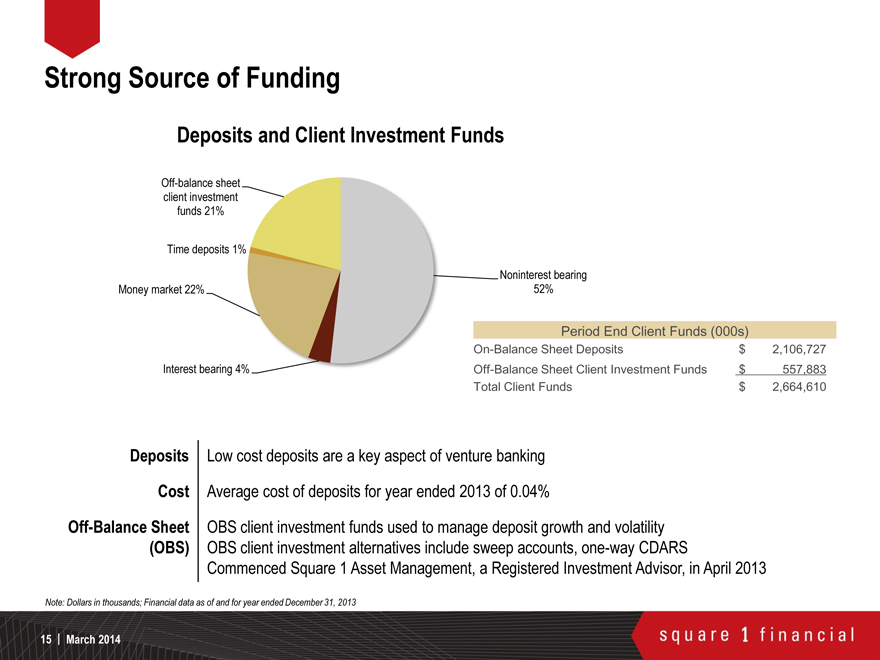

Strong Source of Funding

Deposits and Client Investment Funds

Off-balance sheet

client investment funds 21%

Time deposits 1%

Noninterest bearing

Money market 22%

52%

Interest bearing 4%

Period End Client Funds (000s)

On-Balance Sheet Deposits

Off-Balance Sheet Client Investment Funds

Total Client Funds

$2,106,727

$557,883

$2,664,610

Deposits

Cost

Off-Balance Sheet

(OBS)

Low cost deposits are a key aspect of venture banking

Average cost of deposits for year ended 2013 of 0.04%

OBS client investment funds used to manage deposit growth and volatility

OBS client investment alternatives include sweep accounts, one-way CDARS

Commenced Square 1 Asset Management, a Registered Investment Advisor, in April 2013

Note: Dollars in thousands; Financial data as of and for year ended December 31, 2013

15 | March 2014

square 1 financial

Diversified Securities Portfolio

Total book value (millions)

Corporates

Municipal Bonds

UST/Agency direct/Other

SBA pools

Non-agency mortgage-backed

securities

Agency mortgage-backed securities

Yield1

$867

$1,085

$832

$719

7%

3%

9%

14%

12%

18%

18%

12%

4%

21%

19%

5%

3%

12%

5%

67%

72%

50%

43%

2010 2011 2012 2013

2.90% 2.37% 2.29% 2.28%

Diversification

NAMBS

Duration

Reduced exposure to fixed-rate agency mortgage-backed securities; increased investment grade

municipal and corporate bonds (primarily variable rate)

Significantly reduced our exposure to legacy non-agency mortgage-backed securities purchased prior to

2008 ($20.9 million or 2% of securities portfolio at December 31, 2013)

Available for sale securities portfolio: 2.1 years; overall investment securities portfolio: 2.8 years at

December 31, 2013

(1) Annualized tax-equivalent yield

16 | March 2014

square 1 financial

Profitability

Net

Income

(Loss) Available to Common Shareholders

$22.1

$14.1

$5.1

$2.4

2009

2010

2011

2012

2013

-$12.9

Income

2010

Strong Growth

Consistent income growth over last three years

Incurred losses primarily resulting from sale and impairment of non-agency mortgage-backed

securities purchased prior to 2008

57% net income growth 2013 vs. 2012

Note: Dollars in millions

17 | March 2014

square 1 financial

Well Positioned for Rising Interest Rates

Change in Net Interest Income

17.1%

13.7%

8.3%

6.1%

4.7%

2.5%

up 300 bps

up 200 bps

up 100 bps

Year 1

Year 2

Scenario

Variable-rate loans

Deposit mix

Based on parallel shift in rates over a 12 month period, flat balance sheet

93% of loans are variable rate

66% of on-balance sheet deposits held in noninterest bearing demand deposit accounts

Note: Financial data as of December 31, 2013 and sets forth an approximation of net interest income sensitivity exposure for the 12-month periods ending December 31, 2014 and 2015

18 | March 2014

square 1 financial

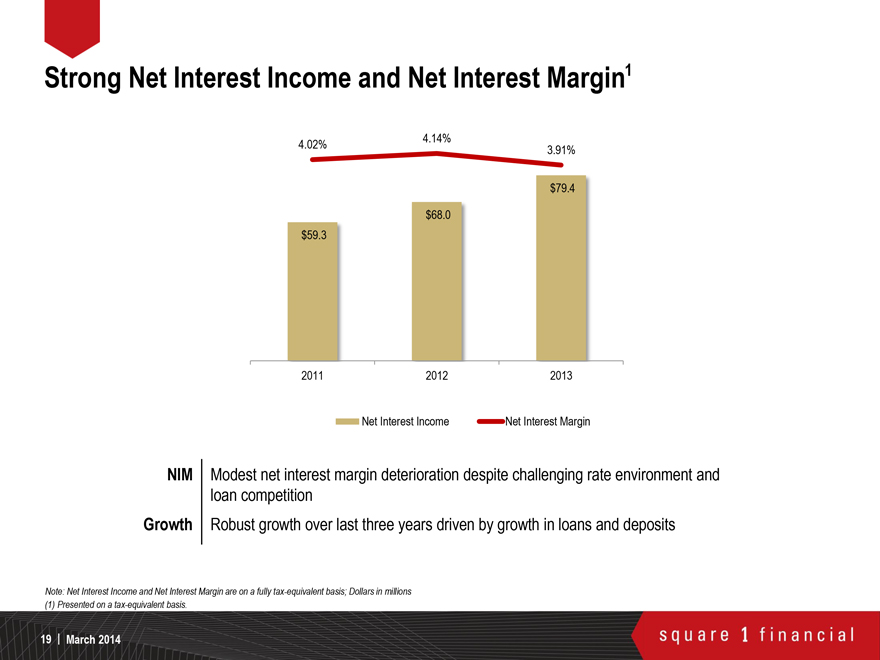

Strong Net Interest Income and Net Interest Margin1

4.02%

4.14%

3.91%

$79.4

$68.0

$59.3

2011

2012

2013

Net Interest Income

Net Interest Margin

NIM

Growth

Modest net interest margin deterioration despite challenging rate environment and

loan competition

Robust growth over last three years driven by growth in loans and deposits

Note: Net Interest Income and Net Interest Margin are on a fully tax-equivalent basis; Dollars in millions

(1) Presented on a tax-equivalent basis.

19 | March 2014

square 1 financial

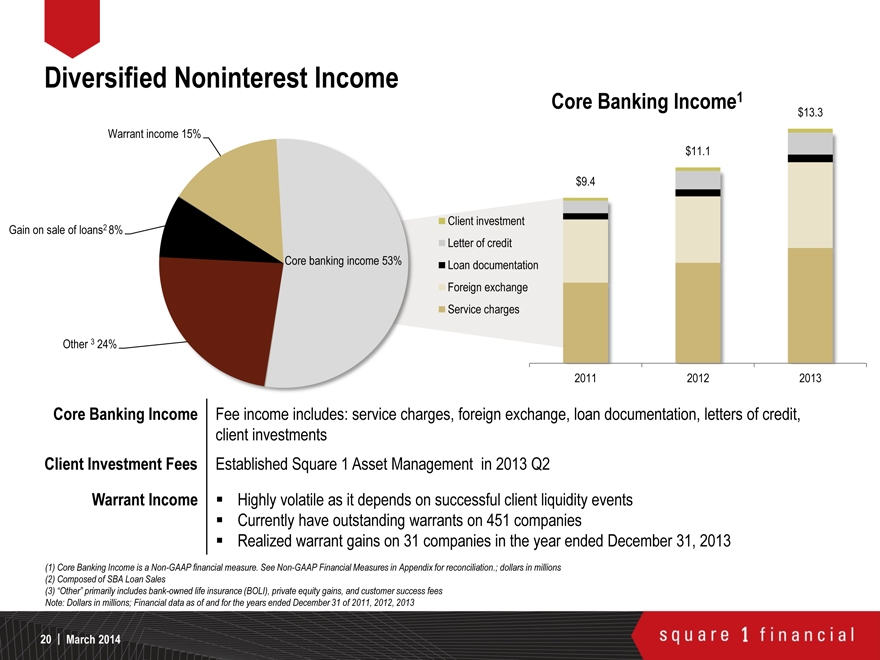

Diversified Noninterest Income

Warrant income 15%

Gain on sale of loans2 8%

Other 3 24%

Core banking income 53%

Client investment

Letter of credit

Loan documentation

Foreign exchange

Service charges

Core Banking Income1

$13.3

$11.1

$9.4

2011

2012

2013

Core Banking Income

Client Investment Fees

Warrant Income

Fee income includes: service charges, foreign exchange, loan documentation, letters of credit,

client investments

Established Square 1 Asset Management in 2013 Q2

Highly volatile as it depends on successful client liquidity events

Currently have outstanding warrants on 451 companies

Realized warrant gains on 31 companies in the year ended December 31, 2013

(1) Core Banking Income is a Non-GAAP financial measure. See Non-GAAP Financial Measures in Appendix for reconciliation.; dollars in millions (2) Composed of SBA Loan Sales (3) “Other” primarily includes bank-owned life insurance (BOLI), private equity gains, and customer success fees Note: Dollars in millions; Financial data as of and for the years ended December 31 of 2011, 2012, 2013

20 | March 2014

square 1 financial

Improving Efficiency Ratio; 2014 Investment Outlook

Expenses and Efficiency Ratio1

65%

73%

65%

61%

53%

$37.7

$43.1

$49.2

$51.1

$55.9

2009

2010

2011

2012

2013

Expense ($ millions)

Efficiency Ratio (%)

Efficiency Ratio

Investing in Key Platforms, Talent and Locations in 2014

Improvements since 2010

Estimated 20% increase in expenses:

Update online banking platform, introduce new services

Upgrade loan platform; additional controls and monitoring

Continue to recruit bankers

2014 planned offices: San Francisco, Chicago, NYC (new location)

Sand Hill Finance acquisition: factoring business, $11.9 million in loans, seven employees, office located in Campbell, CA (acquisition closed December 31, 2013)

(1) Efficiency ratio is a non-GAAP financial measure. See Non-GAAP Financial Measures in Appendix for reconciliation. Note: Dollars in millions, total expenses

21 | March 2014

square 1 financial

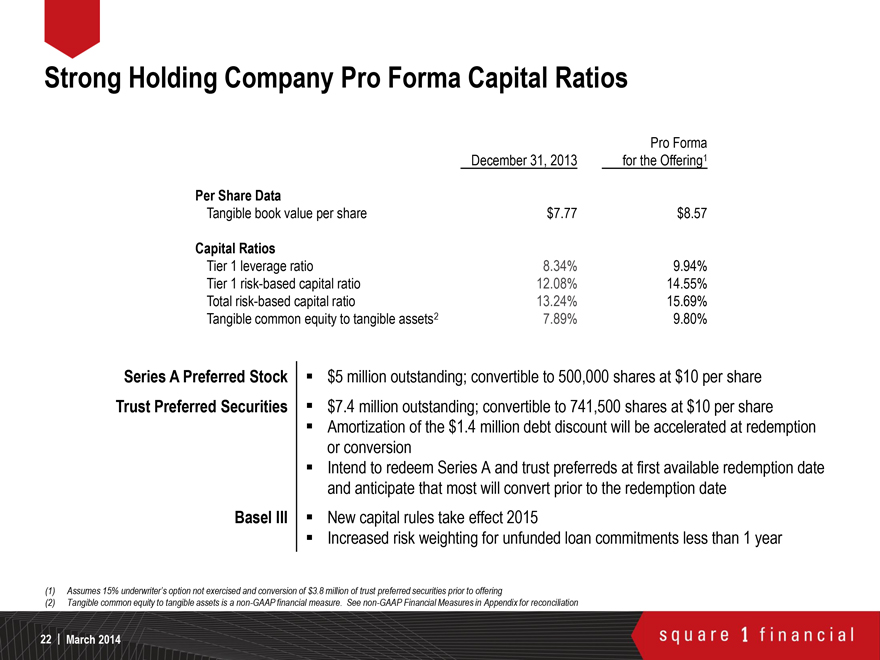

Strong Holding Company Pro Forma Capital Ratios

Pro Forma

December 31, 2013 for the Offering1

Per Share Data

Tangible book value per share $7.77 $8.57

Capital Ratios

Tier 1 leverage ratio 8.34% 9.94%

Tier 1 risk-based capital ratio 12.08% 14.55%

Total risk-based capital ratio 13.24% 15.69%

Tangible common equity to tangible assets2 7.89% 9.80%

Series A Preferred Stock

Trust Preferred Securities

Basel III

$5 million outstanding; convertible to 500,000 shares at $10 per share

$7.4 million outstanding; convertible to 741,500 shares at $10 per share

Amortization of the $1.4 million debt discount will be accelerated at redemption or conversion

Intend to redeem Series A and trust preferreds at first available redemption date anticipate that most will convert prior to the redemption data

New capital rules take effect 2015

Increased risk weighting for unfunded loan commitments less than 1 year

(1) Assumes 15% underwriter’s option not exercised and conversion of $3.8 million of trust preferred securities prior to offering

(2) Tangible common equity to tangible assets is a non-GAAP financial measure. See non-GAAP Financial Measures in Appendix for reconciliation

22 | March 2014

square 1 financial

Summary

1 Consistent growth – loans, deposits, net operating income, noninterest income

Strong profitability – profitable, efficient and scalable platform

Attractive market niche – innovation economy is source of potential new clients in all key markets

Asset-sensitive – both loan and investment securities portfolios

Consistent credit performance – strong controls and risk metrics

Liquidity and capital ratios

Ongoing investments in scalable platform – bankers, online treasury management and risk platforms

Seasoned bankers, accelerating brand

23 | March 2014

square 1 financial

Appendix

24 | March 2014

square 1 financial

Non-GAAP Financial Measures

For the Years Ended December 31,

Efficiency Ratio 2013 2012 2011 2010 2009

Noninterest expense $55,921 $51,148 $49,163 $43,091 $37,705

Net interest taxable equivalent income 79,404 67,950 59,325 50,974 44,009

Noninterest taxable equivalent income (loss) 25,886 15,900 6,858 (22,724) 10,319

Less loss on sale of securities (24) (358) (8,956) (30,410) (3,433)

Adjusted operating revenue $105,314 $84,208 $75,139 $58,660 $57,761

Efficiency ratio 53.10% 60.74% 65.43% 73.46% 65.28%

Note: Dollars in thousands

25 | March 2014

square 1 financial

Non-GAAP Financial Measures

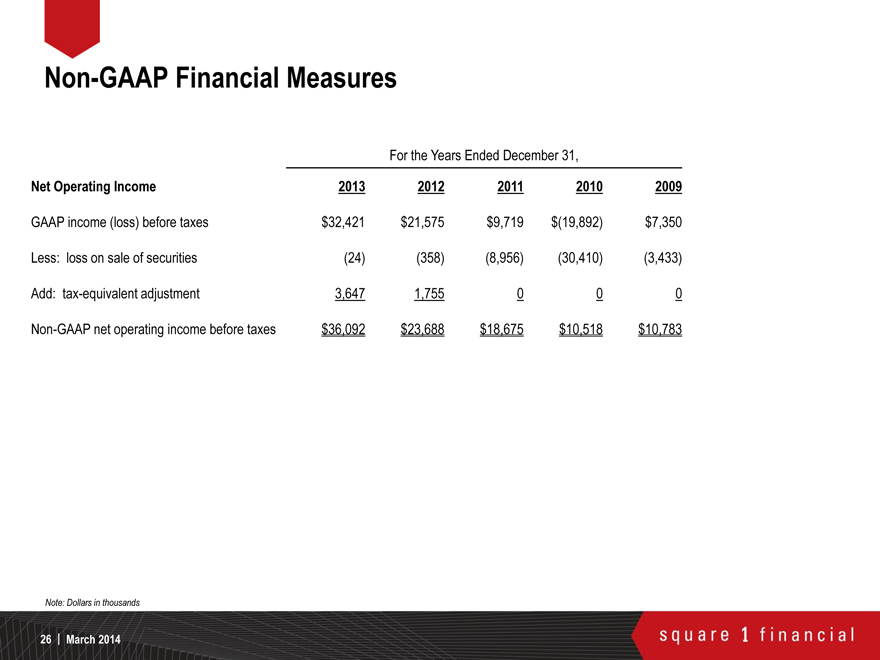

For the Years Ended December 31,

Net Operating Income 2013 2012 2011 2010 2009

GAAP income (loss) before taxes $32,421 $21,575 $9,719 $(19,892) $7,350

Less: loss on sale of securities (24) (358) (8,956) (30,410) (3,433)

Add: tax-equivalent adjustment 3,647 1,755 0 0 0

Non-GAAP net operating income before taxes $36,092 $23,688 $18,675 $10,518 $10,783

Note: Dollars in thousands

26 | March 2014

square 1 financial

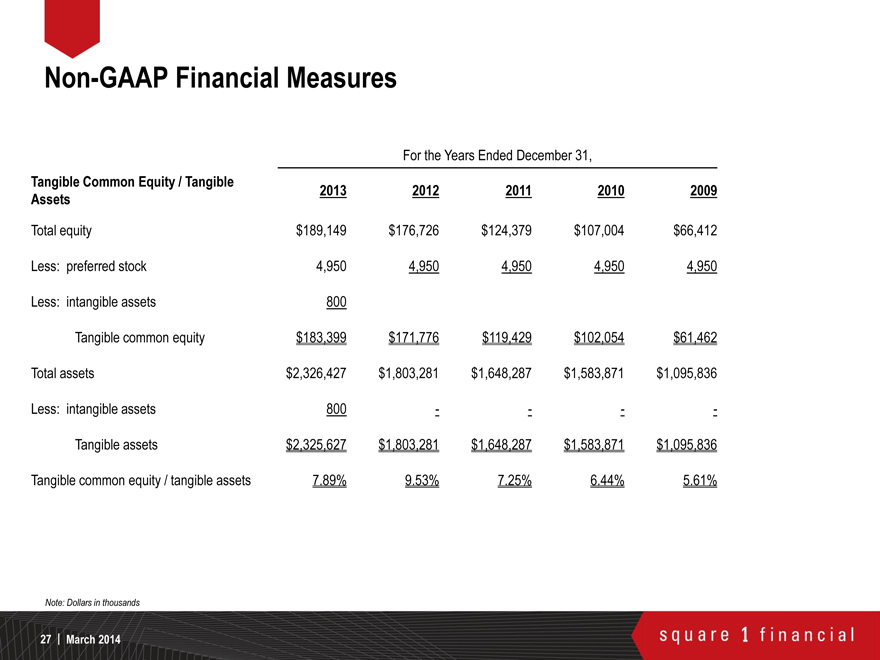

Non-GAAP Financial Measures

For the Years Ended December 31,

Tangible Common Equity / Tangible 2013 2012 2011 2010 2009

Assets

Total equity $189,149 $176,726 $124,379 $107,004 $66,412

Less: preferred stock 4,950 4,950 4,950 4,950 4,950

Less: intangible assets 800

Tangible common equity $183,399 $171,776 $119,429 $102,054 $61,462

Total assets $2,326,427 $1,803,281 $1,648,287 $1,583,871 $1,095,836

Less: intangible assets 800 — — — —

Tangible assets $2,325,627 $1,803,281 $1,648,287 $1,583,871 $1,095,836

Tangible common equity / tangible assets 7.89% 9.53% 7.25% 6.44% 5.61%

Note: Dollars in thousands

27 | March 2014

square 1 financial