0 Stock Option Exchange Program Employee Meetings July 2016 Exhibit (a)(1)(I) Confidential and Proprietary. © 2014 Bazaarvoice, Inc. |

0 Stock Option Exchange Program Employee Meetings July 2016 Exhibit (a)(1)(I) Confidential and Proprietary. © 2014 Bazaarvoice, Inc. |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

1 Agenda • Why Are We Making This Offer? • What Is the Stock Option Exchange Program? • Which Grants Are Eligible to be Exchanged? • How Many New Options Will I Receive? • When Will I Receive the New Options? • What Are the Tax Implications? • What Should I Consider In Making My Decision? • How Do I Make My Election? • What Happens Following the Close of the Offer? • What If I Have Questions? • Demo of Offer Website 1 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

2 Why Are We Making This Offer? • Bazaarvoice’s Stock Price has declined significantly since the IPO • We believe that the decline was influenced in part by declines in the valuation of similarly-situated companies, the PowerReviews antitrust decision, sales of common stock by our former affiliates and adverse conditions in the United States & global economies • As a result of the decline in our stock price, a significant portion of our

stock options are underwater

• Primary purpose of the exchange program is to restore the intended retention and incentive value of our equity awards in order to promote long-term stockholder value 2 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

3 What is the Stock Option Exchange Program? • An offer to exchange certain underwater stock options for a lesser number

of new options with an exercise price per share equal to the fair market

value on the new option grant date, and subject to a new vesting

schedule •

Bazaarvoice stockholders approved program at June 2016 Special Meeting • Offer is filed with the U.S. Securities and Exchange Commission as part of

a tender offer statement on Schedule TO available at

www.sec.gov • Offer is open July 5, 2016 – August 2, 2016 at 11 p.m. Central Time • Participation is voluntary 3 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

4 Which Grants Are Eligible to be Exchanged? • Stock options that meet all of the following criteria are eligible: • Held by an eligible option holder • Exercise price greater than $6.11 • Remain unexercised as of the offer expiration date • Eligible option holders include • Employees of Bazaarvoice (or any subsidiary or successor) in the U.S. or the U.K. as of the start date of the offer who remain employees in the U.S. or U.K. through the

expiration of the offer

• Our executive officers and members of the board are not eligible to participate in the

offer • Employees may elect to participate on a grant-by-grant basis • If a grant is included all vested and unvested outstanding option shares under such

grant must be exchanged

4 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

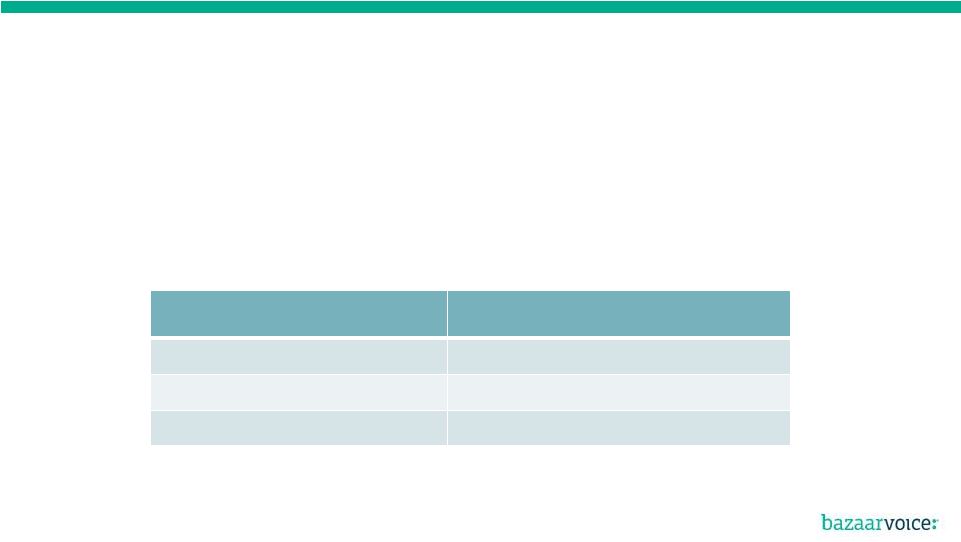

5 How Many New Options Will I Receive? • For each eligible option grant, you will have the choice of exchanging these

options for a lesser number of new options

• Number of new options you are eligible to receive is determined by an exchange ratio • Exchange ratio is based on the exercise price of your eligible options as follows: • Exercise price of new options will equal the closing price of our common stock

on the new grant date

5 If the exercise price of your eligible option is: If you elect to participate, you will receive: $6.11 to $6.99 1 new option for every 1.5 exchanged options $7.00 to $9.99 1 new option for every 2. 5 exchanged options $10.00 to $18.99 1 new option for every 6.0 exchanged options |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

6 When Will I Receive the New Options? • Grant date for new stock options is August 2, 2016 (unless offer is extended) • New option agreements will be distributed through E-Trade as soon as

reasonably practical after the expiration of the offer

• Each new option grant will have a new vesting schedule: • 1/2 of the shares subject to the new option will vest on the first anniversary of

the option grant date

• 1/2 of the shares subject to the new option will vest on the second anniversary

of the option grant date

• Vesting is conditioned on your continued employment through the applicable

vesting date • Each new stock option grant will have a contractual life of 7 years 6 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

7 What Are the Tax Implications? Please carefully review the tax disclosures included in the Offer to Exchange document • Employees in the U.S. and the U.K. will generally not be subject to tax as

a result of the exchange of eligible options for new options

• All new options will be non-statutory stock options • You should consult with your tax advisor to determine the personal tax consequences to you of participating in this offer. If you are a resident of or subject to the tax laws in more than one country, you should be aware

that there may be additional or different tax and social insurance

consequences that may apply to you

7 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

8 What Should I Consider In Making My Decision? • Potential value of your eligible options vs. new options • Based on your assumptions about future BV stock price • You can model scenarios on the offer website • Your risk tolerance • Vesting schedules • Carefully review the information provided in the Offer to Exchange and supplemental documents • Bazaarvoice is not making any recommendations as to whether or not you should participate 8 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

9 How Do I Make My Election? • Log-on to the offer website at https://www.equitytool.com/ispadvisors/bazaarvoice • Enter your password • Use your Bazaarvoice email address and the temporary password that was e-mailed to you on July 5 by optionexchange@Bazaarvoice.com • If you do not know your password, you may follow the link at the bottom of the login

page or contact us at

optionexchange@bazaarvoice.com

• Review the offer materials and view your eligible option holdings • Make your election decision online via the website • Model the potential gains for your eligible options versus the new options

• May withdraw or change you election at any time prior to the offer close

• All final elections must be submitted and received no later than August 2, 2016

at 11 p.m. Central Time

9 th |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

10 What Happens Following the Close Of the Offer? • All properly submitted elections will be accepted and processed • Exchanged stock options will be cancelled upon the expiration of the offer

– August 2, 2016 unless extended • New stock options will be granted on August 2, 2016 following the close of the offer, unless extended • The option exercise price will the be closing price of BV common stock on

the grant date

• New option agreements will be distributed through E-Trade as soon as

reasonably practical after the expiration of the offer

10 |

Confidential and Proprietary. © 2014 Bazaarvoice, Inc.

11 What If I Have Questions? • Refer to the offer materials available via www.sec.gov

or at https://www.equitytool.com/ispadvisors/bazaarvoice • Contact: Kin Gill, Chief Legal Officer, General Counsel and Secretary Bazaarvoice, Inc. 10901 Stonelake Blvd. Austin, Texas 78759 Phone: (512) 551-6094 E-mail: optionexchange@bazaarvoice.com 11 |